Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Eric Hippeau is the founding partner at Lerer Hippeau Ventures, whose portfolio companies include the likes of Axios, BuzzFeed, Casper, Warby Parker, Allbirds, DocSend, Fundera, Everlane, Giphy, Genius and the recently acquired fitness company Mirror.

It would not be an overstatement to say that Hippeau is well-positioned to discuss startups across a wide spectrum of industries, from media to D2C to telehealth to edtech. We spoke with Hippeau for a full hour on a recent episode of Extra Crunch Live to discuss all of the above and get his tactical advice for early-stage startups looking to catch their break.

Below, you’ll find a video of the entire episode and highlights from our conversation. Enjoy!

As much as you can, in terms of timing and resources, build something. Don’t just talk about building something. Build it. It’s not gonna be perfect, and it might not work the way you might do, but build it because that will give me, as a VC, an indication of what you’re trying to accomplish. It also tells me a lot about you, and that that this is something that you really care about. You’re going to ask your family, and even ask your friends, and you’re going to get resources any way you can because it’s that important to you. And, the product that you build, while not perfect by any of stretch of the imagination, will go a long way for us to figure out what it is.

Powered by WPeMatico

You’d be hard pressed to hang out with a designer and not hear the name Figma .

The company behind the largely browser-based design tool has made a huge splash in the past few years, building a massive war chest with more than $130 million from investors like A16Z, Sequoia, Greylock, Kleiner Perkins and Index.

The company was founded in 2012 and spent several years in stealth, raising both its seed and Series A without having any public product or user metrics.

At Early Stage, we spoke with co-founder and CEO Dylan Field about the process of hiring and fundraising while in stealth and how life at the company changed following its launch in 2016. Field, who was 20 when he founded the company, also touched on the lessons he’s learned from his team about leadership. Chief among them: the importance of empowering the people you hire.

You can check out the full conversation in the video embedded below, as well as a lightly edited transcript.

I actually had approached John Lilly from Greylock in our seed round. For those who don’t know, John Lilly was the CEO of Mozilla and an amazing guy. He’s on a lot of really cool boards and has a bunch of interesting experience for Figma, with very deep roots in design. I had approached him for the seed round, and he basically said to us, “You know, I don’t think you guys know what you’re doing, but I’m very intrigued, so let’s keep in touch.” This is the famous line that you hear from every investor ever. It’s like “Yeah, let’s keep in touch, let me know if I can be helpful.” Sometimes, they actually mean it. In John’s case, he actually would follow up every few months or I would follow up with him. We’d grab coffee, and he helped me develop the strategy to a point that got us to what we are today. And that was a collaboration. I could really learn a lot from him on that one.

When we started off the idea was: Let’s have this global community around design, and you’ll be able to use the tool to post to the community and someday we’ll think about how people can pay us. Talking with John got me to the point where I realized we need to start with a business tool. We’ll build the community later. Now, we’re starting to work toward that.

At some point, John told me, “Hey, if you ever think about raising again, let me know.” A few weeks later, I told him maybe we would raise because I just wanted to work with him. We talked to a few other investors. I think it’s pretty important that there’s always a competitive dynamic in the round. But really, it was just him that we were really considering for that round. He really did us a solid. He really believed in us. At the time, it wasn’t like there were metrics to look at. He had conviction in the space, a conviction in the attack, and he had conviction in me and Evan, which I feel very, very honored by. He’s a dear mentor to this day, and he’s on our board. And it’s been a really deep relationship.

Powered by WPeMatico

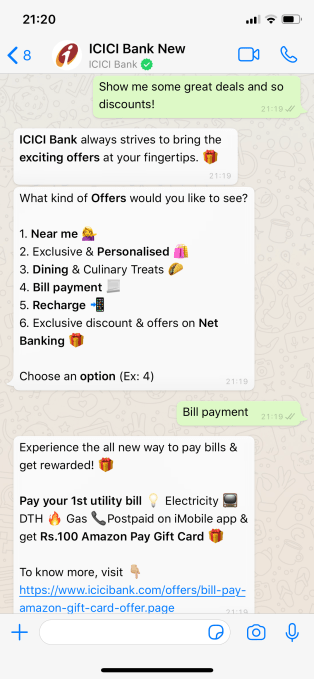

Yalochat, a five-year-old, Mexico City-based conversational commerce platform that enables customers like Coca-Cola and Walmart to upsell, collect payments and provide better service to their own customers over WhatsApp, Facebook Messenger and WeChat in China, has closed on $15 million in Series B funding led by B Capital Group.

Sierra Ventures, which led a $10 million Series A financing for the company in early 2019, also participated.

The round isn’t so surprising if Yalochat’s numbers are to be believed. It says that since the beginning of the COVID-19 pandemic, its platform has seen a tenfold increase in volume, and a 650% increase of message volume as more large enterprises — especially outside of the U.S. — use messaging apps to manage some of their sales operations and much of their customer service.

Yalochat is chasing a fast-growing market, too. According to the 10-year-old, India-based market research company MarketsandMarkets, the conversational AI software market should see $4.8 billion in revenue this year and more than triple that amount by 2025.

Certainly, having conglomerates on board is speeding along the company’s growth.

“With Coca-Cola, we started in Brazil and we helped them run their commerce when it comes to talking with small mom-and-pop shops,” says Yalochat founder and CEO Javier Mata, a Columbia University grad who studied engineering and founded three other companies beginning in 2013 before launching Yalochat.

“They had such success running their ordering process that they then took us to Mexico and Colombia, and we’re talking with [them about entering into the] Philippines and India.” Says Mata, “You try to get fast success in one market, then the conglomerate takes you into other areas of business so they can optimize their workflows around sales and customer service in other countries.”

Mata makes the process sound awfully easy, particularly considering that dozens of startups are also focused on conversational commerce and also raising funding right now.

Still, he argues that if you build your product the right way, it becomes a no-brainer for customers.

In pitching companies like Walmart, for example, he says Yalochat would “start with something super simple but high value that they could launch in a week. We’d say, ‘That process for sales that it has taken you years [to organize], we can get it out for you by Friday.’ Then we’d just do it.

“It was low stakes for them to try us out, and as soon as they saw our conversion rates, we were introduced to other [units] with the corporation.” Says Mata, “I think why a lot of other companies haven’t been successful is that [their tech] is not simple or doesn’t really work. We made ours scalable, easy to launch and capable of running smoothly without passing that complexity to end users.”

B Capital is plainly buying what Yalochat is selling. Firm co-founder Eduardo Saverin — who famously co-founded Facebook — calls Mata and his team “phenomenally strong” and suggests there’s little to stop their trajectory right now. “Yalo is an example of a Latin American business that is already today in Asia. And if you’re building a conversational commerce enablement for large enterprises that redefines the way they touch customers — [meaning] messaging applications, the most engaging medium in the world today — should that really be confined to Latin America or Asia? Absolutely not.”

Saverin compares the startup to B Capital itself, which has offices in LA, San Francisco, New York and Singapore.

The firm has already made bets in the U.S., Europe and Asia, since getting off the ground in 2015. Now, with Yalo, it has its first investment that’s principally headquartered in Latin America, as well. “For us,” says Saverin, who grew up in Brazil, “we didn’t start investing everywhere on day one. But that’s the mission.”

Powered by WPeMatico

Vertical farming technology provider iFarm has bagged a $4 million seed round, led by Gagarin Capital, an earlier investor in the startup. Other investors in the round include Matrix Capital, Impulse VC, IMI.VC and several business angels.

The Finnish startup is focused on providing software that enables others to carry out vertical farming — targeting sales at food processing companies and FMCG giants, as well as farmers, university research centers and even large corporates with their own catering needs as a result of operating large physical office footprints.

Its software as a service platform automates crop care for plants such as salad greens, cherry tomatoes and berries grown in vertical stacks. The system involves a range of technologies to monitor and automate crop care, applying computer vision and machine learning and drawing on data on “thousands” of plants collected from a distributed network of farms, per iFarm .

At this stage it’s providing technology to around 50 projects in Europe and the Middle East — covering a total of 11,000 square meters of farm. Its platform is currently able to automate care for around 120 varieties of plants, with the goal of getting to 500 by 2025 (it says 10 new crop varieties are being added each month).

“iFarm started three years ago, with three founders. The goal is to build technology… for growing tasty and healthy food that we already eat,” says co-founder and CEO Max Chizhov, who notes the business has grown to 15 employees along the way.

“We started from a greenhouse. First year just looking for technologies — which kind of technologies to use. After one year of experiments we have some pilots and now we are focused on indoor farming, vertical farming.”

Vertical farming is an urban farming technique that involves stacking plants in dense layers in a highly controlled indoor environment, using LED lighting to replace sunlight to power all-year-round agriculture.

Furthermore, iFarm notes that the fully automated approach also means there’s no need for pesticides to grow a range of edible greens, herbs, fruits, flowers and vegetables. There are some natural limits on what can be grown within such systems — taller plants and trees obviously can’t be squeezed into stacks. Deep-root vegetables also aren’t suitable, although iFarm touts baby carrots among its product portfolio.

“We focus on profitable products,” says Chizhov. “Small crops, very fast growing crops, and easy to irrigate and easy to grow in many layers. Many layers is the advantage of indoor farms.”

Photo credit: iFarm

While there are now hundreds of vertical farming startups whose business model is fixed on selling the edible produce they grow, such as to supply supermarkets and other food retailers, iFarm is purely focused on developing technologies to support automated indoor agriculture.

So it might, for instance, be eyeing the likes of Infarm, Bowery and Plenty as potential customers for its vertical farming optimization technologies.

It says its systems can be applied to vertical farms of 20 to 20,000 square meters, supporting scalability.

“Our main advantage is we know how to grow and you don’t need any special technologies to know how to grow. All of our algorithms, all of the data, is based in our software,” says Chizhov, emphasizing the software is hardware agnostic — meaning customers don’t need to use iFarm’s kit for their vertical farms but just can apply its algorithms to their own set-ups.

The company has designed various bits of vertical farm hardware it can supply, or co-develop with customers, per Chizhov, such as fertilizer units and LED lighting. But the software as a service platform isn’t locked to any specific piece of kit.

“The main thing is the software that combines optimization systems like humidity, temperature, CO2 etc; and some business separations — like why, how, when we start growing, which clients,” he says, adding: “It’s like a CRM plus an ERP system that controls all the parameters.

“In this system we use computer vision systems. We use AI for increasing taste [of the edible produce], increasing yield parameters of our growing crops. We also use drones which fly in our farms and observe all of our greens and all of our plants. We optimize all of the processes in the farm using software and some [pieces of hardware] that use the software.”

Chizhov says the seed funding will be used to gradually expand the business into new regions — with a launch into the U.S. market on the cards in two years’ time — but the main priority now is to spend on further software development.

“The main goal is [adding] new type of crops,” he notes. “Research, development, new products.”

On the competitive front, iFarm is not the only technology provider seeking to sell to the burgeoning vertical farming sector. Chizhov says there are around 10 to 15 similar agtech startups. But he contends its tech and approach has the edge over the likes of U.K.-based Intelligent Growth Solutions, Belgium’s Urban Crop Solutions, Switzerland’s Growcer, U.S. “container farms” provider Freight Farms or China’s Alesca Life, to name-check a handful of other players in the space.

“There are some companies in this market that also provide solutions but with less optimization, with less software value and with less product mix/product line,” he argues. “The main difference is the type of crops; it’s software that we provide for our clients — because you don’t need to know how to grow; you don’t need to be a specialist in your company, you just push a button. And we provide excellent services for our clients. Design, installation, operation, help to sell the final product, etc.”

Chizhov also notes iFarm has filed patents to protect some of its technologies.

Photo credit: iFarm

Mikhail Taver, GP of Gagarin Capital, who is the lead investor in iFarm’s seed round, says the startup stood out on account of having a competitive advantage in the sector. Although he also notes that the fund’s agtech strategy is focused on indoor farming rather than mainstream outdoors — which again makes iFarm a good fit.

“We do see a large potential in the sector with the [world’s] rising population. We see the increasing demand for food — it’s only going to continue. We see global warming and general sustainability issues. And iFarm seems to be able to solve most of those,” Taver told TechCrunch.

“I don’t really see much competitors able to grow things other than greens,” he added, elaborating on the competitive edge claim. “You don’t normally get proper tomatoes or edible flowers and things like that grown in vertical farms. They mainly concentrate on a couple of salads at most.

“Plus most of our competitors they focus on competing with actual farmers, whereas we’re trying to augment them. We don’t try to force them off the market — we’re trying to help them get bigger. Which is a totally different approach and it should be working better. At least that’s what I believe.”

This article was updated with a correction: We were originally given the incorrect job title for Max Chizhov; he is in fact CEO, not CBDO.

Powered by WPeMatico

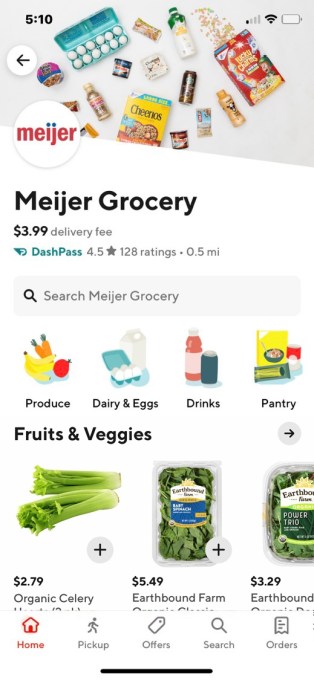

DoorDash is announcing that customers can now order groceries through the DoorDash app from partners including Smart & Final, Meijer and Fresh Thyme. Additional stores like Hy-Vee and Gristedes/D’Agnostino are supposed to be added in the next few weeks.

Through these partnerships, DoorDash says it has a delivery footprint covering 75 million Americans in markets like the San Francisco Bay Area, Los Angeles, Orange County, Sacramento, San Diego, Chicago, Cincinnati, Milwaukee, Detroit and Indianapolis.

DoorDash began delivering from a wide range of convenience stores earlier this year. Fuad Hannon, the company’s head of new verticals, also noted that a number of grocery stores are already part of the DoorDash Drive program, a white-label service where DoorDash handles last-mile delivery.

So Hannon said introducing grocery delivery into the DoorDash app itself is a “natural extension” of those efforts. And in contrast to many other grocery services, the company promises to deliver within an hour of your order.

“There’s no scheduling, no delivery slots, no day-long waits,” he said.

To achieve this, Hannon said DoorDash has created “deep partnerships and commercial relationships” with the grocery stores, coordinating on things like inventory management. “Embedded shoppers” hired from a staffing agency handle the shopping in each store, and the groceries are then delivered by DoorDash’s Dashers.

Image Credits: DoorDash

Hannon said these deliveries will be handled by “the same pool of Dashers” as restaurant delivery. Individual Dashers will decide for themselves when and if they want to take on groceries as well, but he argued that this provides a new opportunity for them, particularly between mealtimes when there’s not much demand for restaurant delivery.

Asked whether there’s any tension with grocery stores in the Drive program that may prefer bringing in customers through their own websites and apps, Hannon argued that customers in the DoorDash app represent “largely different users,” and he said the company is “philosophically agnostic” about whether customers are making purchases through the grocery store’s website/app or through DoorDash.

“DoorDash provides another convenient way for customers to get the value, selection and quality that Smart & Final offers, especially at a time when some are looking to limit trips outside their homes,” said Navin Cotton, Smart & Final’s director of digital commerce, in a statement. “DoorDash’s on-demand grocery service is a nice addition to our online shopping options and with delivery in under an hour, we know Smart & Final customers are going to appreciate it.”

Grocery prices are set by the merchant and should be the same as what you’d find in-store, Hannon said, though perhaps without buy-one-get-one-free offers and others in-store deals. These deliveries are also included in the company’s DashPass subscription, which offers free delivery and reduced service fees.

DoorDash is also offering prepared meals from a longer list of grocery partners, including Wegmans, Hy-Vee, Gelson’s, Kowalski’s, Big Y World Class Markets, Food City, Village Supermarkets, Save Mart, Lucky, Lucky California and Coborn’s.

Powered by WPeMatico

In a turn of fortune, Airbnb today announced that it has filed to go public, albeit confidentially.

The move puts the home-sharing service on a path to a public offering sooner rather than later, and comes after reports that the company was prepping an IPO filing this month. Those same reports indicated that Airbnb could go public as soon as the end of the year.

A Q3 or Q4 Airbnb offering is therefore a distinct possibility.

Airbnb has mounted a comeback since COVID-19-related shutdowns slammed the travel market, tanking its revenues at the same time. Airbnb laid off nearly 2,000 workers, and took on expensive capital from external sources.

The company promised in 2019 that it would go public in 2020, but that pledge seemed far-off in the middle of the year. Since then, Airbnb has made noise about different parts of its business coming back to life, although changed by new travel and work and vacation patterns from its users.

If Airbnb has filed, we can presume that present results are good enough to get it life, else the firm would have not filed and would have simply gone public later. The question now becomes if its Q2 numbers were good enough to get it out the door, or if the company intends to update its S-1 filing with Q3 numbers, push the filing live and go public with more recovery time in its results.

Of course, such a course of action would put its public debut perilously close to the American election. And, Airbnb’s Q2 numbers are down not only from Q1 in revenue terms, but even more sharply from its year-ago results for the same calendar period. In short, Airbnb’s growth story may not be clear until Q3 numbers are tallied, a month and a half from now.

Airbnb joins other companies that have filed privately, like DoorDash, waiting in the wings for the right moment to go public, or the right set of results.

We’ll see, but the company’s public debut is back to being impending. Now the question becomes whether Airbnb intends to go public in an IPO, as the wording of its filing appears to suggest, or if a direct listing could still be in the cards. We think it’s more likely the former and not the latter, but, hey, in 2020 you never know.

Powered by WPeMatico

Max Levchin needs little introduction in the world of tech. As an entrepreneur, he’s been the co-founder of PayPal (now public), Slide (acquired by Google) and Affirm (reportedly about to go public), some of the hottest startups to have come out of Silicon Valley. And as an investor, he’s applied his power of observation and execution also towards helping many others build huge technology businesses.

We sat down with Levchin for a recent session of Extra Crunch Live, where he spoke at length about what he sees as some of the big opportunities in fintech. Here’s an edited version of the conversation. You can watch and listen to the whole discussion — which includes stories about Levchin’s coffee and cycling habits, and how many times he’s seen “The Seven Samurai” (hint: more than once) — here, also embedded below, and you can check out the rest of the pretty cool ECL program here.

Even going as far back as PayPal I think the industry has devolved. I think fintech had the promise of really bringing simplicity, honesty and transparency to the customer. Instead, we ended up putting a really nice user interface on products that are not designed with the user’s best interest in mind. I’m a big fan of throwing shade on credit cards, because I think fundamentally, their business model is remarkably similar to that of payday loans. You are allowed to borrow some money and don’t really know exactly what the terms are. It’s all in the fine print, don’t worry about it and then you just make the minimum payments and you stay in debt. Potentially forever.

Powered by WPeMatico

We can’t help but wonder what the future of work will look like in the wake of this pandemic. That’s the timely topic of today’s interactive webinar, COVID-19’s Impact on the Startup World.

The second of three in our free series of interactive webinars — exclusively for founders exhibiting in Digital Startup Alley at Disrupt 2020 — gets underway today, August 19 at 1 p.m. PDT/4 p.m. EDT. Exhibitors, be sure to register to attend.

Still on the fence about exhibiting at Disrupt? Hop off and get to it — buy a Disrupt Digital Startup Alley Package, tune in to the remaining webinars and then get ready to reap the benefits that come with introducing your startup to a global Disrupt audience. More on those in a minute.

You’ll hear from Nicola Corzine, executive director of the Nasdaq Entrepreneurship Center and Cameron Stanfill, a VC Analyst at PitchBook. Jon Shieber, a TechCrunch editor who covers venture capital and private equity investments will moderate the discussion. No one can predict the future, but these three bring years of experience to the table, and they’ll offer a data-informed perspective, tips and advice on how startups can adapt and what they need to think about both during and after COVID-19. It’s interactive, folks — got questions? Get answers.

Exhibiting in Digital Startup Alley is opportunity on steroids. Network with thousands of Disrupt attendees from around the globe. Expose your tech and talent to influencers of every stripe across the startup ecosystem — investors, R&D teams, advisors, potential customers. Make and nurture connections that can result in exciting partnerships.

CrunchMatch, our AI-powered networking platform bridges the physical distance of a virtual conference. It helps you quickly find and connect with the people who can help take your business to the next level. The platform’s up and running right now. Once you register for Disrupt, you can reach out to attendees and start expanding your network immediately.

Ready to exhibit? Great — be sure to mark your calendar for the final exclusive webinar. Tune in on August 26 for Fundraising and Hiring Best Practices with panelists Sarah Kunst of Cleo Capital and Brett Berson of First Round Capital.

We can’t predict the future, but there’s one thing we do know. It’s going to take every opportunity and every advantage to survive and thrive in these tumultuous times.

Buy a Disrupt Digital Startup Alley Package and tune in. It’s worth it.

Is your company interested in sponsoring or exhibiting at Disrupt 2020? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico

Here’s another edition of “Dear Sophie,” the advice column that answers immigration-related questions about working at technology companies.

“Your questions are vital to the spread of knowledge that allows people all over the world to rise above borders and pursue their dreams,” says Sophie Alcorn, a Silicon Valley immigration attorney. “Whether you’re in people ops, a founder or seeking a job in Silicon Valley, I would love to answer your questions in my next column.”

“Dear Sophie” columns are accessible for Extra Crunch subscribers; use promo code ALCORN to purchase a one- or two-year subscription for 50% off.

Dear Sophie:

I’m employed at a major Silicon Valley tech company in H-1B status. I want to found a startup. How can I work at the startup?

—Enterprising in Emeryville

Hiya Enterprising,

Thanks — you’re in good company; a lot of people are inspired by amazing new ideas during the pandemic. It’s a great opportunity to seek life transitions and new adventures.

Powered by WPeMatico

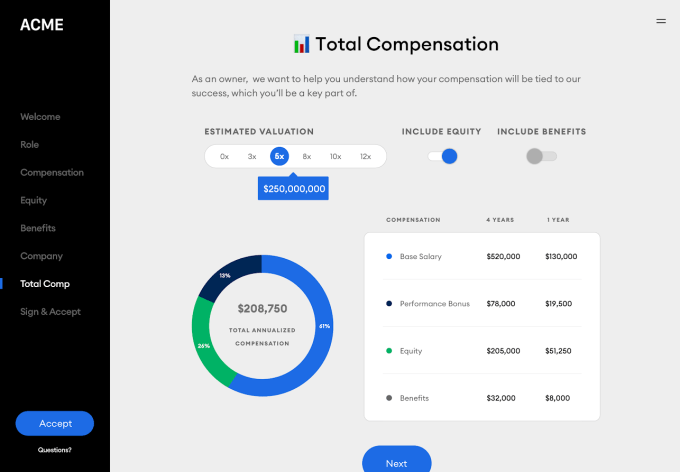

Thinking back to the last time I accepted a job, I can’t recall actually reading any of the material that was sent over. I think I skimmed some docs to make sure the numbers written down matched what I had been told over the phone, but after that it was a blur of digital signing and emailing and precisely no due diligence from myself.

Not great, really. I bet that your experience accepting new gigs has been somewhat similar. In startups, jobs are offered with exotic types of pay, chock full of startup stock options in all their 409A and vesting-period glory. Some folks might not really understand what is being offered. Like what the value of their full comp package really is, when performance pay and other sweeteners are stacked on top of base rates. With remote learning in the equation, it’s even more confusing.

This is the market space that Welcome, a startup that is announcing a $1.4 million fundraise, wants to fix. (Update: Forgot to add the capital sources, which include Ludlow Ventures, the Weekend Fund, Global Founders Capital, both Shrug and Basement, as well as a number of angels.)

The company told TechCrunch it is a “first offer management and closing platform.” Its service helps provide a clear picture of total comp to candidates, helping them accept or deny an offer that they can fully understand.

Here’s a screengrab from the candidate’s side of the employer-employee divide:

If “offer management and closing” sounds like a small niche to target, it both is and is not.

It is, in that if Welcome stayed in its current market-position forever it would have a smaller product target than most startups. But the company has plans to expand its product-set over time. For example, its co-founders Nick Gavronsky and Rick Pereira explained that Welcome wants to offer real-time salary data in the future, based on the information that will flow through its service.

Want to close an engineer in North Carolina with a high level of confidence in the offer? Welcome should be able to tell you, later on, what a comp package should look like if you want make sure the candidate will accept.

Gavronsky and Pereira have experience in product and people work, respectively, making their union at Welcome a good fit. The company’s team is currently just four folks, though the startup expects that it will double in size this year. The capital it raised in January, but is only talking about now, is making the hiring possible.

Now, the $1.4 million number is pretty dated. Normally I’d skip over a round so far from the past, but Welcome caught my eye, as I’ve recently written about another HR tech provider, Sora, and the Welcome deal felt like an illustrative event: This is how seed rounds are announced, long after the fact, which makes reporting on seed-stage trends really hard. Something to keep in mind.

Welcome is barking up a winsome tree with its product, not only because the offer/offer acceptance process is garbage today — let’s email some PDFs and hand a candidate off between departments! — but because it has seen strong early demand from potential customers. Its service is currently in a private alpha that was a bit oversubscribed, though the company is not yet charging for its service. (Welcome will be a SaaS play, priced on company size, which seems reasonable.)

Past all that, what’s exciting about Welcome is that if it can get a number of customers aboard when it makes it to beta or launch, the company will have placed itself in a position where it can expand in several directions. It could, for example, extend its feature set to help with pre-onboarding or onboarding itself, given that it already knows a new candidate and their new employer. Of course, the startup wants to talk more about what it’s building today, but it’s also fun to look ahead.

That’s enough on Welcome, we’ll chatter about them again when they formally launch, or share some neat growth metrics. Until then, good luck getting into the alpha.

Powered by WPeMatico