Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

We’ve all been in a video conference, especially this year, when the neighbor started mowing the lawn or kids were playing outside your window — and it can get pretty loud. Cisco, which owns the WebEx video conferencing service, wants to do something about that, and late yesterday it announced it was going to acquire BabbleLabs, a startup that can help filter out background noise.

BabbleLabs has a very particular set of skills. It uses artificial intelligence to enhance the speaking voice, while filtering out those unwanted background noises that seem to occur whenever you happen to be in a meeting.

Interestingly enough, Cisco also sees this as a kind of privacy play by removing background conversation. Jeetu Patel, senior vice president and general manager in the Cisco Security and Applications Business Unit, says that this should go a long way toward improving the meeting experience for Cisco users.

“Their technology is going to provide our customers with yet another important innovation — automatically removing unwanted noise — to continue enabling exceptional Webex meeting experiences,” Patel, who was at Box for many years before joining Cisco, recently said in a statement.

In a blog post, BabbleLabs CEO and co-founder Chris Rowen wrote that conversations about being acquired by Cisco began just recently, and the deal came together pretty quickly. “We quickly reached a common view that merging BabbleLabs into the Cisco Collaboration team could accelerate our common vision dramatically,” he wrote.

BabbleLabs, which launched three years ago and raised $18 million, according to Crunchbase, had an interesting, but highly technical idea. That can sometimes be difficult to translate into a viable commercial product, but makes a highly attractive acquisition target for a company like Cisco.

Brent Leary, founder and principal analyst at CRM Essentials, says this acquisition could be seen as part of a broader industry consolidation. “We’re seeing consolidation taking place as the big web conferencing players are snapping up smaller players to round out their platforms,” he said.

He added, “WebEx may not be getting the attention that Zoom is, but it still has a significant presence in the enterprise, and this acquisition will allow them to keep improving their offering.”

The deal is expected to close in the current quarter after regulatory approval. Upon closing, BabbleLabs employees will become part of Cisco’s Collaboration Group.

Powered by WPeMatico

Figma for filmmakers, TikTok for English learners and a cryptocurrency twist that actually makes sense?

After 197 pitches, Y Combinator’s Demo Day for its Summer 2020 cohort has concluded. While the fanfare, run-ins and fortune cookies were missing in this virtual session, it was still exciting to see and hear founders from 26 countries pitch their passions. Of course, some opted for a more quiet route, raising millions before the two-day pitch session even kicked off.

Members of the Summer 2020 class drew attention from nearly 2,400 investors across the world. For those who didn’t tune in, no worries: here’s our write-up of the companies that presented yesterday.

Participating startups spanned a number of sectors: we saw companies in the future of work, sustainability, no-code, consumer, edtech and delivery solutions. Several entrepreneurs aimed big at e-mail, small at socks and straight at Shopify’s recent success.

While TechCrunch reporters aren’t in the business of cutting checks or predicting success, read on to learn about the 12 startups that stuck out to us for a variety of reasons (apart from their Zoom backgrounds).

CarbonChain may be the company that times the carbon market correctly. Now that the European Union and other regions are taking a serious look at penalizing businesses that fail to reduce carbon emissions, a service that provides accurate accounting for a company’s carbon footprint will be increasingly valuable.

And if the company can add marketplace and offsetting services on the back of its assessments, then its proposition becomes even more valuable. But what really makes CarbonChain stand out is the rigor with which it approaches its measurements.

The company uses independent software tools to make a digital twin of the carbon-emitting assets in a company’s business and claims that it can determine the emissions footprint of operations down to a cup of coffee (it also has models for the carbon footprint of heavy industrial equipment in the world’s most polluting industries).

For the world to address its carbon emissions, companies must understand their contribution to the problem. CarbonChain could be an invaluable tool in that effort.

Powered by WPeMatico

When Snowflake filed its S-1 ahead of an upcoming IPO yesterday, it wasn’t exactly a shock. The company which raised $1.4 billion had been valued at $12.4 billion in its last private raise in February. CEO Frank Slootman, who had taken over from Bob Muglia in May last year, didn’t hide the fact that going public was the end game.

When we spoke to him in February at the time of his mega $479 million raise, he was candid about the fact he wanted to take his company to the next level, and predicted it could happen as soon as this summer. In spite of the pandemic and the economic fallout from it, the company decided now was the time to go — as did 4 other companies yesterday including J Frog, Sumo Logic, Unity and Asana.

If you haven’t been following this company as it went through its massive private fund raising process, investors see a company taking a way to store massive amounts of data and moving it to the cloud. This concept is known as a cloud data warehouse as it it stores immense amounts of data.

While the Big 3 cloud companies all offer something similar, Snowflake has the advantage of working on any cloud, and at a time where data portability is highly valued, enables customers to shift data between clouds.

We spoke to several industry experts to get their thoughts on what this filing means for Snowflake, which after taking a blizzard of cash, has to now take a great idea and shift it into the public markets.

Big market opportunities usually require big investments to build companies that last, that typically go public, and that’s why investors were willing to pile up the dollars to help Snowflake grow. Blake Murray, a research analyst at Canalys says the pandemic is actually working in the startup’s favor as more companies are shifting workloads to the cloud.

“We know that demand for cloud services is higher than ever during this pandemic, which is an obvious positive for Snowflake. Snowflake also services multi-cloud environments, which we see in increasing adoption. Considering the speed it is growing at and the demand for its services, an IPO should help Snowflake continue its momentum,” Murray told TechCrunch.

Leyla Seka, a partner at Operator Collective, who spent many years at Salesforce agrees that the pandemic is forcing many companies to move to the cloud faster than they might have previously. “COVID is a strange motivator for enterprise SaaS. It is speeding up adoption in a way I have never seen before,” she said.

It’s clear to Seka that we’ve moved quickly past the early cloud adopters, and it’s in the mainstream now where a company like Snowflake is primed to take advantage. “Keep in mind, I was at Salesforce for years telling businesses their data was safe in the cloud. So we certainly have crossed the chasm, so to speak and are now in a rapid adoption phase,” she said.

The fact is Snowflake is in an odd position when it comes to the big cloud infrastructure vendors. It both competes with them on a product level, and as a company that stores massive amounts of data, it is also an excellent customer for all of them. It’s kind of a strange position to be in says Canalys’ Murray.

“Snowflake both relies on the infrastructure of cloud giants — AWS, Microsoft and Google — and competes with them. It will be important to keep an eye on the competitive dynamic even although Snowflake is a large customer for the giants,” he explained.

Forrester analyst Noel Yuhanna agrees, but says the IPO should help Snowflake take on these companies as they expand their own cloud data warehouse offerings. He added that in spite of that competition, Snowflake is holding its own against the big companies. In fact, he says that it’s the number one cloud data warehouse clients inquire about, other than Amazon RedShift. As he points out, Snowflake has some key advantages over the cloud vendors’ solutions.

“Based on Forrester Wave research that compared over a dozen vendors, Snowflake has been positioned as a Leader. Enterprises like Snowflake’s ease of use, low cost, scalability and performance capabilities. Unlike many cloud data warehouses, Snowflake can run on multiple clouds such as Amazon, Google or Azure, giving enterprises choices to choose their preferred provider.”

In spite of the vast sums of money the company has raised in the private market, it had decided to go public to get one final chunk of capital. Patrick Moorhead, founder and principal analyst at Moor Insight & Strategy says that if the company is going to succeed in the broader market, it needs to expand beyond pure cloud data warehousing, in spite of the huge opportunity there.

“Snowflake needs the funding as it needs to expand its product footprint to encompass more than just data warehousing. It should be focused less on niches and more on the entire data lifecycle including data ingest, engineering, database and AI,” Moorhead said.

Forrester’s Yuhanna agrees that Snowflake needs to look at new markets and the IPO will give it the the money to do that. “The IPO will help Snowflake expand it’s innovation path, especially to support new and emerging business use cases, and possibly look at new market opportunities such as expanding to on-premises to deliver hybrid-cloud capabilities,” he said.

It would make sense for the company to expand beyond its core offerings as it heads into the public markets, but the cloud data warehouse market is quite lucrative on its own. It’s a space that has required a considerable amount of investment to build a company, but as it heads towards its IPO, Snowflake is should be well positioned to be a successful company for years to come.

Powered by WPeMatico

Eden, the office management platform founded by Joe du Bey and Kyle Wilkinson, is today announcing the launch of several new enterprise software features. The company, which offers a marketplace for office managers to procure services like office cleaning, repairs, etc., is looking to offer a more comprehensive platform.

The software features include a COVID team safety tool that tracks who is coming into the office, and lets them reserve a specific desk to help ensure social distancing precautions are being taken.

“For us, the pandemic really accelerated our plans around enterprise tools,” said Joe du Bey. “We realized by talking to our clients that what they need right now isn’t services. Services are important, but what they really want in this moment is to have software so they can get back into the office.”

Eden is also introducing a service desk ticketing tool to allow workers to make requests or file a ticket for a broken piece of equipment from their own desktop, as well as a visitor management tool and a room booking tool.

The company’s acquisition of Managed By Q, its biggest competitor in the services space, also greatly accelerated its ability to deliver software. Managed By Q, which was acquired by WeWork in 2019 for $220 million, was already on the trajectory of building out software well before its acquisition by Eden, and had itself acquired companies like Hivy to offer SaaS-based tools to customers.

As Eden grows its product portfolio, competition still abounds. Envoy (with just under $60 million in funding) has been in the visitor management space since its inception and is looking to broaden its product portfolio beyond office visitors. UpKeep is charging into the service ticket space with a mobile app to make it easier for service workers within an office to do their job and move seamlessly from task to task. Meanwhile, Robin is in the mix with its own room booking platform.

The point? There is clearly a rush to build out a platform that helps folks manage the physical space of an office and the people within it. Eden, with $40 million in total funding, is well positioned to duke it out for the top spot among a variety of competitors who are angling to ‘do it all.’

“This is a board meeting question: are we fighting too many battles or is comprehensiveness our most important asset?” said du Bey. “We have a completeness to our vision. A lot of our customers are saying they want a few tools from one place versus the very fragmented experience they have today. But there are trade offs in comprehensiveness. It means that someone can can spend all day building a hundred integrations for their app that for us might not be possible. So, there are some really interesting trade offs.”

That’s not without hardship, however. Eden had to layoff about 40 percent of its workforce amid the coronavirus pandemic. And though COVID has slowed growth, du Bey says that revenue in April 2020 was still higher than it was the year prior.

Alongside trying to support marketplace partners and customers through the pandemic, Eden has also introduced new ways to search for service providers, including a way to solicit a bid from black-owned businesses in the wake of the Black Lives Matter movement.

The Eden team is 52 percent female. Black employees represent 12 percent of the workforce, and Latinx employees represent 8 percent of the workforce.

Powered by WPeMatico

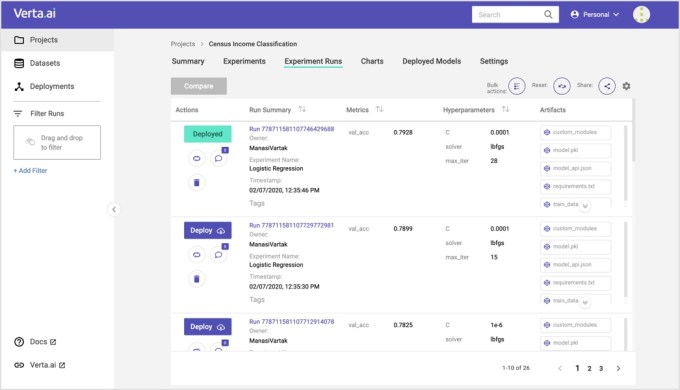

Manasi Vartak, founder and CEO of Verta, conceived of the idea of the open-source project ModelDB database as a way to track versions of machine models while she was still in grad school at MIT. After she graduated, she decided to expand on that vision to build a product that could not only track model versions, but provide a way to operationalize them — and Verta was born.

Today, that company emerged from stealth with a $10 million Series A led by Intel Capital with participation from General Catalyst, which also led the company’s $1.7 million seed round.

Beyond providing a place to track model versioning, which ModelDB gave users, Vartak wanted to build a platform for data scientists to deploy those models into production, which has been difficult to do for many companies. She also wanted to make sure that once in production, they were still accurately reflecting the current data and not working with yesterday’s playbook.

“Verta can track if models are still valid and send out alarms when model performance changes unexpectedly,” the company explained.

Image Credits: Verta

Vartak says having that open-source project helped sell the company to investors early on, and acts as a way to attract possible customers now. “So for our seed round, it was definitely different because I was raising as a solo founder, a first-time founder right out of school, and that’s where having the open-source project was a huge win,” she said.

Certainly Mark Rostick, VP and senior managing director at lead investor Intel Capital, recognized that Verta was trying to solve a fundamental problem around machine learning model production. “Verta is addressing one of the key challenges companies face when adopting AI — bridging the gap between data scientists and developers to accelerate the deployment of machine learning models,” Rostick said.

While Vartak wasn’t ready to talk about how many customers she has just yet at this early stage of the company, she did say there were companies using the platform and getting models into production much faster.

Today, the company has 9 employees, and even at this early stage, she is taking diversity very seriously. In fact, her current employee makeup includes four Indian, three Caucasian, one Latino and one Asian, for a highly diverse mix. Her goal is to continue on this path as she builds the company. She is looking at getting to 15 employees this year, then doubling that by next year.

One thing Vartak also wants to do is have a 50/50 gender split, something she was able to achieve while at MIT in her various projects, and she wants to carry on with her company. She is also working with a third party, Sweat Equity Ventures, to help with recruiting diverse candidates.

She says that she likes to work iteratively to build the platform, while experimenting with new features, even with her small team. Right now, that involves interoperability with different machine learning tools out there like Amazon SageMaker or Kubeflow, the open-source machine learning pipeline tool.

“We realized that we need to meet customers where they are at their level of maturity. So we focused a lot the last couple of quarters on building a system that was interoperable so you can pick and choose the components kind of like Lego blocks and have a system that works end to end seamlessly.”

Powered by WPeMatico

Pleasanton-based green energy startup NDB, Inc. has reached a key milestone today with the completion of two proof of concept tests of its nano diamond battery (NDB) . One of these tests took place at the Lawrence Livermore National Laboratory, and the other at the Cavendish Laboratory at Cambridge University, and both saw NDB’s battery tech manage a 40% charge, which is a big improvement over the 15% charge collection efficiency (effectively energy lossiness relative to maximum total possible charge) of standard commercial diamond.

NDB’s innovation is in creating a new, proprietary nano diamond treatment that allows for more efficient extraction of electric charge from the diamond used in the creation of the battery. Their goal is to ultimately commercialize a version of their battery that can self-charge for up to a maximum lifespan of 28,000 years, created from artificial diamond-encased carbon-14 nuclear waste.

This battery doesn’t generate any carbon emissions in operation, and only requires access to open air to work. And while they’re technically batteries, because they contain a charge which will eventually be expended, they provide their own charge for much longer than the lifetime of any specific device or individual user, making them effectively a charge-free solution.

NDB ultimately hopes to turn their battery into a viable source of power for just about anything that consumes it — including aircraft, EVs, trains and more, all the way down to smartphones, wearables and tiny industrial sensors. The company is currently now at work creating a prototype of its first commercial battery in order to make that available sometime later this year.

It has also just signed its first beta customers, who will actually be receiving and making use of those first prototypes. While it hasn’t named them specifically, it did say that one is “a leader in nuclear fuel cycle products and services,” and the other is “a leading global aerospace, defense and security manufacturing company.” Obviously, this kind of tech has appeal in just about every sector, but defense and power concerns are likely among the deepest-pocketed.

Powered by WPeMatico

Startup incubator and investment group Y Combinator today held the first of two demo days for founders in its Summer 2020 batch.

So far, this cohort contains the usual mix of bold, impressive and, at times, slightly wacky ideas young companies so often show off.

This was Y Combinator’s second online demo day, its first all-virtual class and the first time that it held live, remote pitches. The event largely went well, with founders dialing in from around the globe to share a few paragraphs of notes and a single slide. There were few technical hiccups, given the sheer number of startups presenting.

But if you are not in the mood to parse through dozens (and dozens) of entries detailing each startup that showed off its problem, solution and growth, the TechCrunch crew has collected our own favorites based on how likely a company seems to succeed and how impressed we were with the creativity of their vision. For each entry, one staffer made the call that the startup in question was among their favorites.

We’re not investors, so we’re not pretending to sort the unicorns from the goats. But if what you need is a digest of some of the day’s best companies to get a good taste of what founders are building, we have your back.

The next wave of edtech startups is entering a market that demands a better remote-learning solution for younger learners. But that’s the obvious product gap, one that is already being tackled by the biggest names in the booming category.

The non-obvious product-market deficit is how teachers, also impacted by the pandemic, are searching for new ways to interact with students. Teachers are collaborating and cross-pollinating on successful lesson plans that work across stale Zoom screens, so why not monetize that same content?

Powered by WPeMatico

Snowflake filed to go public today joining a bushel of companies making their S-1 documents public today. TechCrunch has a longer digest of all the IPO filings coming soon, but we could not wait to get into the Snowflake numbers, given the huge anticipation that the company has generated in recent quarters.

Why? Because the cloud data warehouse company has been on a fundraising tear in recent years, including a $450 million Series F in late 2018 and a $479 million Series G in February of this year. The latter round valued the mega-unicorn at around $12.5 billion. More on this later.

Snowflake is, then, one of the world’s most valuable former startups that is still private. Its public debut will make a splash. But what did its $1.4 billion in capital raised (Crunchbase data) build? Let’s take a peek at the numbers.

Even glancing at the Snowflake S-1 makes it clear what investors are excited about when it comes to the big-data storage service: Its growth. In its fiscal year ending January 31, 2019, for example, Snowflake had revenue of $96.7 million. A year later that number was $264.7 million, or growth of around 150% at scale.

More recently, the company’s growth has remained impressive. In the six months ending July 31, 2019, Snowflake’s revenue was $104.0 million. A year later, those two quarters generated revenues of $242.0 million. That’s growth of 132.7% on a year-over-year basis. Impressive, and just the sort of top line expansion that private investors want to staple their wallet to.

So, lots of growth. But how high-quality is the revenue?

Let’s take a look at the company’s gross margins over different time periods. The data will help us better understand the company’s value, and its gross margin improvement, or impairment over time. Given Snowflake’s soaring valuation over time, we are expecting to see improvements as time passes:

Et voilà ! Just like we expected, improving gross margins over time. Recall that the higher (stronger) a company’s gross margins are, the more of its revenue it gets to keep to cover its operating costs. Which is, notably, where the Snowflake story goes from super-exciting to slightly harrowing.

Let’s talk losses.

In no way does Snowflake’s operations pay for themselves. Indeed, the company is super unprofitable on both an operating and net basis.

In its fiscal year ending January 31, 2019, Snowflake lost $178.0 million on a net basis. A year later the figure swelled to $348.5 million. In the six months ending July 31, 2019, the company’s net loss was $177.2 million. In the same two quarters of this year, it was slightly lower at $171.3 million.

And that’s why the company is probably trying to go public. Now that it can point to falling net losses as its revenues grow and its gross margins improve, you can chart a path to break-even. And Snowflake’s operations are burning less cash over time. The pace was north of $50 million a quarter in the two three-month periods ending July 31, 2019, for example.

And even more, if we look inside the last two quarters, the most recent period (three months ending July 31, 2019) is larger than the one preceding it in revenue terms ($133.1 million versus $108.8 million), and its net loss is smaller ($77.6 million versus $93.6 million). This lowered the company’s net margin from -86% to -58%. Still bad! But far less bad in short order, which could cut worries about Snowflake’s enormous history of unprofitability at scale.

Since Snowflake first appeared in 2012, its ability to take the idea of a data warehouse, a concept that has existed on prem for years, and move into a cloud context had great appeal — and it attracted great investment. Imagine taking virtually all your data and having it in a single place in the cloud.

The money train started slowly at first, with $900,000 in seed money in February 2012, followed quickly by a $5 million Series A later that year. Within a few years investors would be handing the company bundles of cash and the train would be the high-speed variety, first with former Microsoft executive Bob Muglia leading the way, and more recently with former ServiceNow CEO Frank Slootman in charge.

By 2017 there were rapid-fire rounds for big money: $105 million in 2017, $263 million in January 2018, $450 million in October 2018 and finally $479 million this past February. With each chunk of money came gaudier valuations, with the most recent weighing in at an eye-popping $12.4 billion. That was triple the company’s $3.9 billion valuation in that October 2018 investment.

In February, Slootman did not shy away from the IPO question. Unlike so many startup CEOs, he actually embraced the idea of finally taking his company public, whenever the time was right, and apparently that would be now, pandemic or not.

He actually almost called the timing in a conversation with TechCrunch at the time of the $479 million round:

I think the earliest that we could actually pull that trigger is probably early- to mid-summer time frame. But whether we do that or not is a totally different question because we’re not in a hurry, and we’re not getting pressure from investors.

All money talk aside, at its core, what Snowflake offers is this ability to store vast amounts of data in the cloud without fear of locking yourself in to any particular cloud vendor. While all three cloud players have their own offerings in this space, Snowflake has the advantage of being a neutral vendor — and that has had great appeal to customers, who are concerned about vendor lock-in.

As Slootman told TechCrunch in February:

One of the key distinguishing architectural aspects of Snowflake is that once you’re on our platform, it’s extremely easy to exchange data with other Snowflake users. That’s one of the key architectural underpinnings. So content strategy induces network effect which in turn causes more people, more data to land on the platform, and that serves our business model.

When it rains it pours. Unity filed. JFrog filed. We still need to talk X-Peng. Corsair has filed as well. And there are still a host of companies that have filed privately, like Airbnb and DoorDash, that could drop a new filing at any moment. What an August!

Powered by WPeMatico

Unity, the company founded in a Copenhagen apartment in 2004, is poised for an initial public offering with numbers that look pretty strong.

Even as its main competitor, Epic Games, is in the throes of a very public fight with Apple over the fees the computer giant charges developers who sell applications (including games) on its platform (which has seen Epic’s games get the boot from the App Store), Unity has plowed ahead, narrowing its losses and maintaining its hold on over half of the game development market.

For the first six months of 2020, the company lost $54.2 million on $351.3 million in revenue. The company narrowed its losses compared to 2019, when the company lost $163.2 million on $541.8 million in revenue, and 2018 when the company lost $131.6 million on $380.8 million in revenue. As of June 30, 2020 the company had total assets of $1.29 billion and $453.2 million in cash.

Increasing revenue and narrowing losses are things that investors like to see in companies that they’re potentially going to invest in, as they point to a path to profitability. Another sign of the company’s success is the number of customers that contribute more than $100,000 in annual revenue. In the first six month of the year, Unity had 716 such customers, pointing to the health of its platform.

The company will trade on the NYSE under the single-letter ticker “U”. The NYSE only has a few single letters left to offer, although Pandora gave up the letter P when it was bought by Liberty Media back in 2018.

Unlike Epic Games, Unity has long worked with the major platforms and gaming companies to get their engine in front of as many developers and gamers as possible. In fact, the company estimates that 53% of the top 1,000 mobile games on the Apple App Store and Google Play Store and over 50% of mobile, personal computer and console games were made with Unity.

Some of the top titles that the platform claims include Nintendo’s Mario Kart: Tour, Super Mario Run and Animal Crossing: Pocket Camp; Niantic’s Pokémon GO and Activision’s recent Call of Duty: Mobile are also Unity games.

The knock against Unity is that it’s not as powerful as Epic’s Unreal rendering engine, but that hasn’t stopped the company from making forays into industries beyond gaming — something that it will need to continue doing if it’s to be successful.

Unity already has a toehold in Hollywood, where it was used to recreate the jungle environment used in Disney’s “Lion King” remake (meanwhile, much of “The Mandalorian” was created using Epic’s Unreal engine).

Of course, Unity’s numbers also reveal that the size of its business is currently a bit smaller than its biggest rival. In 2019, Epic said it had earnings of $730 million on revenue of $4.2 billion, according to VentureBeat . And the North Carolina-based game developer is now worth $17.3 billion.

Still, the games market is likely big enough for both companies to thrive. “Historically there has been substantial industry convergence in the games developer tools business, but over the past decade the number of developers has increased so much, I believe the market can support two major players,” Piers Harding-Rolls, games analyst at Ampere Analysis, told the Financial Times.

Venture investors in the Unity platform have waited a long time for this moment, and they’re certainly confident in the company’s prospects.

The last investment round valued the company at $6 billion, with the secondary sale of $525 million worth of the company’s shares.

Powered by WPeMatico

Bolt Bikes, the electric bike platform marketed to gig economy delivery workers, has a new name and a fresh injection of $11 million in capital from a Series A funding round led by Australian Clean Energy Finance Corporation.

The round also included equity from Hana Ventures and existing investors Maniv Mobility and Contrarian Ventures, together with venture debt from OneVentures and Viola Credit.

The Sydney, Australia-based startup that launched in 2017 is now called Zoomo, a change that aims to better reflect a customer base that has expanded beyond gig economy workers to include corporate clients and everyday consumers. Mina Nada, co-founder and CEO of the newly named Zoomo, also told TechCrunch that he wanted to ensure the company wouldn’t be confused by other similarly named businesses.

“When we set up Bolt back in 2017, the name was fine in Australia, but as we’ve gone international we’ve come up against at least three other companies called Bolt, two of them in the mobility space,” Nada explained. On-demand transportation company Taxify rebranded as Bolt in May 2020. Another company known as Bolt Mobility provides shared-scooter services.

Zoomo, which has operations in Australia, the U.K., New York and soon in Los Angeles, sells its electric bikes or offers them as a subscription. Its primary business has been subscriptions for commercial use, which includes the electric bike, fleet management software, financing and servicing. Subscribers get 24-hour access to the bike. A battery charger, phone holder, phone USB port, secure U-Lock and safety induction is included.

Zoomo has sales and service centers in the markets where it offers subscriptions, which includes Sydney, New York and the U.K. The company plans to use the new funding to expand its subscription footprint — which means adding physical sales and service centers — to Los Angeles and Brisbane as well as within New York.

The company’s strategy is to slowly expand where its subscription service is offered, while ramping up direct sales. The need for physical locations limits how quickly Zoomo can expand its subscription product. Selling the bikes to corporations and other users allows the company to generate more revenue, grow its geographic reach and build brand recognition as it slowly expands its more capitally intensive subscription service.

Zoomo also plans to use the funding to add new corporate categories such as parcel, mail and grocery deliveries that its bikes can be used for as well as other models better suited for individual consumers.

Powered by WPeMatico