Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

While investors are already writing big checks for meditation startups, Elevate Labs founder and CEO Jesse Pickard said that none of the existing meditation apps can replace the experience of working with a human coach.

“This experience where you have somebody that meets with you is wildly better than any digital product that’s out there,” Pickard said. “The problem is, it’s not affordable to 99% of the planet.”

So Elevate Labs is launching a new mobile app today called Balance, which is designed to replicate the experience of working with a live meditation coach.

“Even with meditation increasingly getting into the mainstream, it’s a fairly difficult practice to adhere to,” Pickard said. “We take away a lot of that indecision and present you with a path that is unique to you … People live all sorts of different lives: Some people care about stress, some people care about sleep, some people care about focus. But when you and I go into any of the other major apps, we’re getting the exact same recording.”

With Balance, on the other hand, you’re not just browsing through a library of prerecorded content. Instead, the app starts out by asking you about your goals, your meditation experience and more. You’ll then get a set of introductory meditations that may look familiar, but Pickard said that each meditation is actually “a combination of dozens and dozens of clips woven together that’s personalized to you.”

For example, I told the app that I already had experience with meditation, and that my top goal was to stay focused. As a result, my first meditation skipped most of the introductory explanations, and the main exercise was designed to help me focus on the sound of my breath.

Pickard said the app will continue to ask you questions about your experience over time, which in turn will lead to more personalization. The meditations are narrated by coach Leah Santa Cruz, who’s also involved in writing the content, and there are other meditation experts on the Balance team.

The app’s initial 10-day course is free. After that, to get access to additional meditations, you’ll need to pay $11.99 per month, $49.99 per year or $199.99 for a lifetime subscription. In addition to the meditations, Balance also includes a guided activity designed to help people sleep.

On top of launching a new app, Elevate Labs is also announcing that it has raised a $7.1 million Series B led by Keesing Media Group, with participation from Oakhouse Partners.

Under its old name MindSnacks, the company built language-learning games before shifting focus to Elevate, a “brain training” app that has supposedly been downloaded 25 million times and won Apple’s App of the Year Award in 2014. Pickard (who, thanks to the magic of Craigslist, was my roommate for about a year when I was first starting at TechCrunch) said that unlike most of the other apps that are marketed as improving your mind, Elevate focuses on trainable skills like reading, writing and math — rather than, say, improving your memory.

“We’ve been extremely careful about [not] venturing into untrainable skills — things like improving your attention span, those activities are not as provenly teachable,” he said.

It’s been a while since the company has raised outside funding — seven years since MindSnacks announced a Series A from Sequoia. Pickard said the company actually raised another bridge round in 2015, then “buckled down for a number of years and really just had to build a business that actually was sustainable.”

Apparently that’s paid off — he said Elevate Labs was cash-flow positive last year. With a total of $17.1 million in funding, the plan now is to continue supporting and growing Elevate while also launching Balance and building a whole line of related apps.

“We think there’s a really huge brand to be built around mental fitness,” Pickard said.

Powered by WPeMatico

There’s that pesky catch-22 you’ve got to get out of the way when discussing the Light Phone and its successor. There’s an inherent irony to a piece of technology created with the express purpose of weaning us off technology. But it’s 2019, and inherent irony is kind of the name of the game.

Light certainly has its share of supporters. As the company announces that it has both begun shipping the Light Phone II to Indiegogo backers and made the product more directly available through its site at $350 (via pre-order), it’s also revealing its funding for the first time. As of this writing, the company has raised $12.3 million.

The crowdfunding parts we knew about, of course. The original phone raised a solid $400,000 on Kickstarter. The Indiegogo campaign for the second version blew that out of the water at $3.5 million with an emphasis on pre-orders. Turns out VCs are getting in on the action, as well, with $8.4 million raised in seed. Hinge Capital, Bullish, White Bay Group, Able Partners, Product Co-Op and HAX have all chipped in, but the leader is the most interesting of the bunch.

Foxconn is the biggest investor of the bunch. The manufacturing giant, naturally, is also helping the company build the handsets and scale things as Light looks toward retail channels beyond its current online offering.

“They’ve been building smart phones for 20, 30 years,” co-founder Kaiwei Tang told TechCrunch. “When we came to them with the first Light Phone, it was just a simplified, voice-only device. Right after the pitch, I was talking to the sales VP who said, ‘hey Kai, I need Light Phone right now. Smartphone has ruined my life. My kids don’t talk to me.’ ”

A number of other high-profile angel investors were equally taken with the notion of a simplified device that could deliver core functionality while weaning users off of smartphone dependence. John Zimmer (Lyft), Michael Mignano and Nir Zicherman (Anchor), Tim Kendall (Moment) and Scott Belsky (Adobe) have all invested, as well.

Like the original Light Phone, the new version presents a sort of built-in paradox for its creators. If the underlying idea is stripping non-core functionality, isn’t introducing a second version with new features somewhat counter-productive?

The new model will get ridesharing (partner to be announced), music playback (likely via on-board storage for starters), turn-by-turn direction and find my phone features. Among other things, the functionality of those features will be limited by the E Ink display. The phone also finds the company making the jump from 2G to LTE. Users can pop in a SIM from AT&T, Verizon or T-Mobile.

“To use an analogy, we’re offering a beautifully designed screwdriver that does one thing well,” says Tang. “Obviously, the Light Phone being an E Ink screen and small size limits it to the users. We don’t encourage people to play videos, or watch video on it. But making a phone call, getting a taxi, listening to music (yes, there’s a headphone jack), recording a voice memo. Maybe down the road they have a calendar reminder, those are the simple tools; it has a clear goal.”

The Light Phone II is probably the least pretty device I’ve reviewed for this site. It’s small, but chunky, like a shrunken e-reader with a screen too small to actually use for e-books. It’s got just enough functionality to (hopefully) free you of your smartphone for hours at a time.

Light says it has sold “tens of thousands” of units. It shipped 15,000 of the first generation and somehow has in the neighborhood of 40,000 reservations it hasn’t filled for the device. The company is looking to push those users toward the Light Phone 2. That device, meanwhile, has around 10,000 pre-orders at present.

Powered by WPeMatico

Each unhappy startup may be unhappy in its own way, but there’s still wisdom in understanding what drives employee satisfaction and dissatisfaction across companies.

Culture Amp is just one of the companies aiming to help employees anonymously express how they feel about their place of work, but the Melbourne company is using the anonymized employee survey data from thousands of customers to help them learn from each other and chart which initiatives made a dent.

The eight-year-old startup has picked up a new bout of funding to help it extend its base of customers further.

Culture Amp just closed a sizable $82 million funding round led by Sequoia Capital China with participation from Sapphire Ventures, Felicis Ventures, Index Ventures, Blackbird Ventures, Hostplus, Skip Capital, Grok Ventures, Global Founders Capital and TDM Growth Partners.

The company’s Series E doubles the company’s total funding raised to date, which now sits at $158 million. Culture Amp closed its last major round of funding — a $40 million Series D — in July of last year.

The company’s subscription survey software gives customers all of the templates, questions and analytics that they need to track employee sentiment and visualize the data that they get back. The software can be used for things like quarterly engagement surveys, but it can also power performance reviews, goal-setting and self-reflections.

Employee surveys are certainly nothing revolutionary, but Culture Amp is trying to improve the process by helping its customers start to bring anonymous feedback to the team level so that employees can give more direct feedback to their managers.

CEO Didier Elzinga tells me the company now has 2,500 customers with a collective 3 million Culture Amp employee surveys under their belts. Elzinga tells TechCrunch that harnessing the collective intelligence of its network to predict things like employee turnover is perhaps one of its strongest value propositions.

“Once you understand the experience that people are having, once you know where you should focus, how do we actually help you act on it?” he tells TechCrunch. “A large part is bringing to bear the collective intelligence of the thousands of companies we already have so that you can learn from people that have suffered from the same sorts of problems.”

The 400-person company’s customers include McDonald’s, Salesforce, Slack and Airbnb.

Powered by WPeMatico

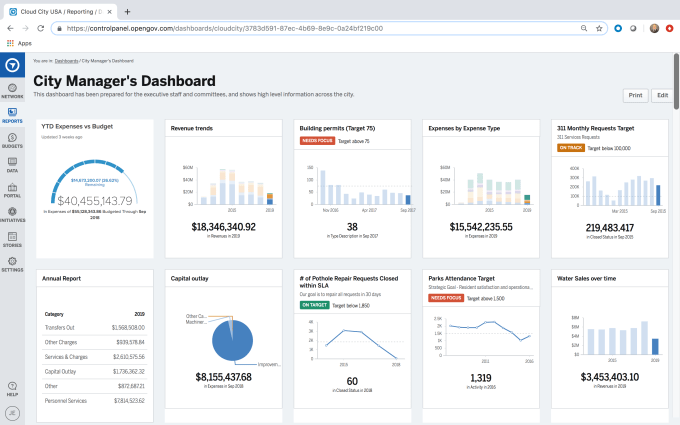

OpenGov, the firm co-founded by Palantir’s Joe Lonsdale that helps government and other civic organizations organise, analyse and present financial and other data using cloud-based architecture, has raised another big round of funding to continue expanding its business. The startup has picked up an additional $51 million in a Series D round led by Weatherford Capital and 8VC (Lonsdale’s investment firm), with participation from existing investor Andreessen Horowitz.

The funding brings the total raised by the company to $140 million, with previous investors in the firm including JC2 Ventures, Emerson Collective, Founders Fund and a number of others. The company is not disclosing its valuation — although we are asking — but for some context, PitchBook noted it was around $190 million in its last disclosed round — although that was in 2017 and has likely increased in the interim, not least because of the startup’s links in high places, and its growth.

On the first of these, the company says that its board of directors includes, in addition to Lonsdale (who is now the chairman of the company); Katherine August-deWilde, Co-Founder and Vice-Chair of First Republic Bank; John Chambers, Founder and CEO of JC2 Ventures and Former Chairman and CEO of Cisco Systems; Marc Andreessen, Co-Founder and General Partner of Andreessen Horowitz; and Zac Bookman, Co-Founder and CEO of OpenGov .

And in terms of its growth, OpenGov says today it counts more than 2,000 governments as customers, with recent additions to the list including the State of West Virginia, the State of Oklahoma, the Idaho State Controller’s Office, the City of Minneapolis MN, and Suffolk County NY. For comparison, when we wrote in 2017 about the boost the company had seen since Trump’s election (which has apparently seen a push for more transparency and security of data), the company noted 1,400 government customers.

Government data is generally associated with legacy systems and cripplingly slow bureaucratic processes, and that has spelled opportunity to some startups, who are leveraging the growth of cloud services to present solutions tailored to the needs of civic organizations and the people who work in them, from city planners to finance specialists. In the case of OpenGov, it packages its services in a platform it calls the OpenGov Cloud.

“OpenGov’s mission to power more effective and accountable government is driving innovation and transformation for the public sector at high speed,” said OpenGov CEO Zac Bookman in a statement. “This new investment validates OpenGov’s position as the leader in enterprise cloud solutions for government, and it fuels our ability to build, sell, and deploy new mission-critical technology that is the safe and trusted choice for government executives.”

It’s also, it seems, a trusted choice for government executives who have left public service and moved into investing, leveraging some of the links they still have into those who manage procurement for public services. Weatherford Capital, one of the lead investors, is led in part by managing partner Will Weatherford, who is the former Speaker of the House for the State of Florida.

“OpenGov’s innovative technology, accomplished personnel, market leadership, and mission-first approach precisely address the growing challenges inherent in public administration,” he said in a statement. “We are thrilled at the opportunity to partner with OpenGov to accelerate its growth and continue modernizing how this important sector operates.”

It will be interesting to see how and if the company uses the funding to consolidate in its particular area of enterprise technology. There are other firms like LiveStories that have also been building services to help better present civic data to the public that you could see as complementary to what OpenGov is doing. OpenGov has made acquisitions in the past, such as Ontodia to bring more open-source data and technology into its platform.

Powered by WPeMatico

Some days, it feels like there’s almost no end to the number of jobs that might be replaced altogether or in some part by smart machines, from radiologists to truck drivers to, gulp, journalists. You might be tempted to sob about it to your friendly restaurant server, but wait! It’s a robot, too!

So it may be if the 25-person, Redwood City, Calif.,-based startup Bear Robotics has its way. The two-year-old company makes “robots that help,” and specifically, it makes robots that help deliver food to restaurant customers.

It’s a market that’s seemingly poised for disruption. As Bear says in its own literature about the company, it was founded to address the “increased pressure faced by the food service industry around wages, labor supply, and cost efficiencies.”

CEO John Ha, a former Intel research scientist turned longtime technical lead at Google who also opened, then closed, his own restaurant, witnessed the struggle firsthand. As the child (and grandchild) of restaurateurs, this editor can also attest that owning and operating restaurants is a tricky proposition, given the expenses and — even more plaguing oftentimes — the turnover that goes with it.

Investors are apparently on board with the idea with robot servers. According to a new SEC filing, Bear has so far locked down at least $10.2 million from a dozen investors on its way to closing a $35.8 million round. That’s not a huge sum for many startups today, but it’s notable for a food service robot startup, one whose first model, “Penny,” spins around R2-D2-like, gliding between the kitchen and dining tables with customers’ food as it is prepared.

At least, this is what will theoretically happen once Bear begins lining up restaurants that will pay the company via a monthly subscription that includes the robot, setup and mapping of the restaurant (so Penny doesn’t collide with things), along with technical support.

In the meantime, Bear’s backers, which the startup has yet to reveal, may be taking a cue in part from Alibaba, which last year opened a highly automated restaurant in Shanghai where small robots slide down tracks to deliver patrons’ meals.

They may also be looking at the bigger picture, wherein everything inside restaurants is getting automated — from robotic chefs that fry up ingredients to table-mounted self-pay tablets — with servers one of the last pieces of the puzzle to be addressed.

That doesn’t mean Bear or other like-minded startups will take off any time soon in restaurants that aren’t offering a futuristic experience. One of the reasons that people have always headed to restaurants is for good-old human interaction. In fact, with take-out ordering on the rise, people — waiters, bartenders, restaurant owners who flit around the dining room to say hello — may prove one of the only reasons that customers show up at all.

Powered by WPeMatico

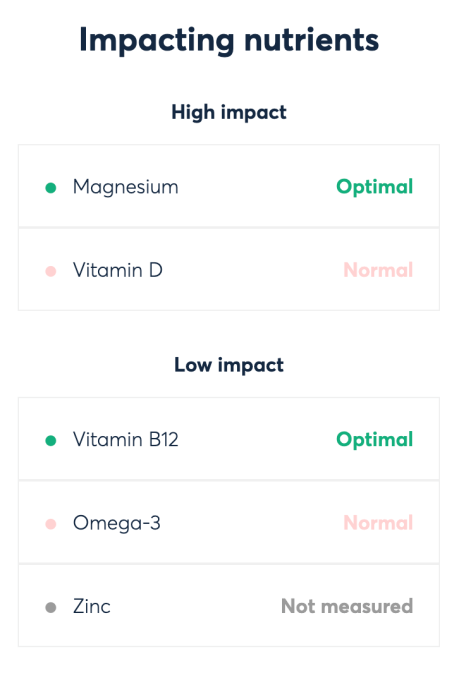

By now, the venture world is wary of blood testing startups offering health data from just a few drops of blood. However, Baze, a Swiss-based personal nutrition startup providing blood tests you can do in the convenience of your own home, collects just a smidgen of your sanguine fluid through an MIT manufactured device, which, according to the company, is in accordance with FDA regulations.

The idea is to find out (via your blood sample) which vitamins you’re missing out on and are keeping you from living your best life. That seems to resonate with folks who don’t want to go into the doctor’s office and separately head to their nearest lab for testing.

Most health professionals would agree it’s important to know if you are getting the right amount of nutrition — Vitamin D deficiency is a worldwide epidemic affecting calcium absorption, hormone regulation, energy levels and muscle weakness. An estimated 74% of the U.S. population does not get the required daily levels of Vitamin D.

“There are definitely widespread deficiencies across the population,” Baze CEO and founder Philipp Schulte tells TechCrunch. “[With the blood test] we see that we can actually close those gaps for the first time ever in the supplement industry.”

While we don’t know exactly how many people have tried out Baze just yet, Schulte says the company has seen 40% month-over-month new subscriber growth.

That has garnered the attention of supplement company Nature’s Way, which has partnered with the company and just added $6 million to the coffers to help Baze ramp up marketing efforts in the U.S.

I had the opportunity to try out the test myself. It’s pretty simple to do. You just open up a little pear-shaped device, pop it on your arm and then press it to engage and get it to start collecting your blood. After it’s done, plop it in the provided medical packaging and ship it off to a Baze-contracted lab.

I had the opportunity to try out the test myself. It’s pretty simple to do. You just open up a little pear-shaped device, pop it on your arm and then press it to engage and get it to start collecting your blood. After it’s done, plop it in the provided medical packaging and ship it off to a Baze-contracted lab.

I will say it is certainly more convenient to just pop on a little device myself — although it might be tricky if you’re at all squeamish, as you’ll see a little bubble where the blood is being sucked from your arm. For anyone who hesitates, it might be easier to just head to a lab and have another human do this for you.

The price is also nice, compared to going to a Quest Diagnostics or LabCorp, which can vary depending on which vitamins you need to test for individually. With Baze it’s just $100 a pop, plus any additional supplements you might want to buy via monthly subscription after you get your results. The first month of supplements is free with your kit.

Baze’s website will show your results within about 12 days (though Schulte tells TechCrunch the company is working on getting your results faster). It does so with a score and then displays a range of various vitamins tested.

I was told that, overall, I was getting the nutrients I require with a score of 74 out of 100. But I’m already pretty good at taking high-quality vitamins. The only thing that really stuck out was my zinc levels, which I was told was way off the charts high after running the test through twice. Though I suspect, as I am not displaying any symptoms of zinc poisoning, this was likely the result of not wiping off my zinc-based sunscreen well enough before the test began.

For those interested in conducting their own at-home test and not afraid to prick themselves in the arm with something that looks like you might have it on hand in the kitchen, you can do so by heading over to Baze and signing up.

Powered by WPeMatico

Household debt in the U.S. continues to rise and as of this year now stands at nearly $14 billion. Now, one of the startups that’s building tools to help consumers better cope with that is announcing a round of funding and plans for an IPO — signs of the demand for its services, and its success to date.

Credit Sesame — which lets consumers check their credit scores and evaluate options to rebalance existing debts and loans to improve that score and thus their overall “financial health,” in the words of CEO and founder Adrian Nazari — has raised $43 million. With the company already profitable and growing revenues 90% each year for the last five, Nazari said that this round is likely to be the last round the company raises before it goes public.

Credit Sesame is not disclosing its valuation, in part because this round is likely to have some more money added to it. But Nazari noted that it’s on track to be valued at over $1 billion when it does close in the coming months. It has now raised $110 million in total.

The round is a mixture of equity and debt, and includes both strategic and financial investors. Led by growth-stage investors ATW Partners, it also includes participation from previous investors. Past backers of Credit Sesame include Menlo Ventures, Inventus Capital, Globespan Capital, IA Capital Groups, Symantec, Capital One Ventures and Stanford University. There also will likely be new investors coming to the company when the round does expand.

The reason the startup is raising both equity and debt is worth a note: Nazari said Credit Sesame is profitable and has been “for some time,” so when it raises money now, it would prefer to do so with less dilution. The funding will be going toward continuing to work on Credit Sesame’s artificial intelligence algorithms, and to continue expanding this business, but not likely acquisitions: there are a lot of companies in the fintech arena that are working on products adjacent to what Credit Sesame does, but Nazari said that it would likely only start to work on some M&A and consolidation plays after it IPOs, using the proceeds from that to fuel that.

In addition to a number of companies building tools and products to help people manage their money better, there are direct competitors to Credit Sesame, too, including Credit Karma, NerdWallet, Experian, ClearScore, Equifax and many more. Nazari’s view is that while Credit Sesame may be targeting a similar initial function, its approach and how it helps you manage your credit score is what differentiates it.

The company has coined the term “Personal Credit Management” (as opposed to personal financial management), and has built an algorithm it calls RoboCredit, which is based on a basic score provided by TransUnion (one of the big agencies that calculates scores, alongside Equifax and Experian), but also includes other factors that it calculates to show consumers which actions they can take to improve their scores. Checking initial scores is free on Credit Sesame, as are evaluating options for how to rebalance loans and other debts to help improve the score. But users that take products referred through the engine — such as refinancing a mortgage or taking a new credit and/or transferring your existing balance — or other premium services (such as an advanced level of identity theft protection), pay fees to do so.

The credit rating industry has seen some big setbacks in the last several years — first the big breach at Equifax, and then the Consumer Financial Protection Bureau fining both Equifax and TransUnion for misrepresenting what kind of data it was providing to consumers, and for not being transparent enough in its charges. But Nazari said that in fact, this has had a positive impact on the company.

“The impact from Equifax has been net positive,” he explained. “Incidents like these create awareness and the need for consumers to watch their credit and be on top of that,” he noted. “Identity theft from breaches could happen any time.”

Indeed, online security has become a bit of an unknown variable for many of us: We can try to prepare as much as possible, but we never know what news of a new breach might come around the corner, or when one fragment of our disclosed information might be the missing piece to someone using it to steal something from us. On the other hand, the startup is giving more transparency at least to how some of the other aspects of our online financial identity work, and how it can be used by others to evaluate us as consumers.

“Credit Sesame is revolutionizing how consumers manage their credit. What once was a mystery and black box is now distilled by Credit Sesame’s PCM platform into easy to digest actionable insights that can effortlessly and meaningfully change a consumer’s credit and financial health,” said Kerry Propper, co-founder and managing partner at ATW Partners, in a statement. “We’re thrilled to open the gates to a new age of Personal Credit Management with the Credit Sesame team leading the space.”

Powered by WPeMatico

The direct-to-consumer trend in fashion has been one of the most interesting evolutions in e-commerce in the last several years, and today one of the trailblazers in the world of footwear is picking up some money from a list of illustrious backers to bring its concept to the masses.

Atoms, makers of sleek sneakers that are minimalist in style — “We will make only one shoe design a year, but we want to make that really well,” said co-founder Sidra Qasim — but not in substance — carefully crafted with comfort and durability in mind, sizes come in quarter increments and you can buy different measurements for each foot if your feet are among the millions that are not exactly the same size — has raised $8.1 million.

The company plans to use the funding to invest in further development of its shoes, and to expand its retail and marketing presence. To date, the company has been selling directly to consumers in the U.S. via its website — which at one point had a waiting list of nearly 40,000 people — and the idea will be to fold in other experiences, including selling in physical spaces in the future.

This Series A speaks to a number of interesting investors flocking to the company.

It is being led by Initialized Capital, the investment firm started by Reddit co-founder Alexis Ohanian and Garry Tan (both had first encountered Atoms and its co-founders, Qasim and CEO Waqas Ali — as mentors when the Pakistani husband and wife team were going through Y Combinator with their previous high-end shoe startup, Markhor); with other backers including Kleiner Perkins, Dollar Shave Club CEO Michael Dubin, Acumen founder and CEO Jacqueline Novogratz, LinkedIn CEO Jeff Weiner, TED curator Chris Anderson, the rapper Chamillionaire and previous backers Aatif Awan and Shrug Capital.

Investors have come to the company by way of being customers. “The thing that I love about Atoms is that it isn’t just a different look, it’s a different feel,” said Ohanian in a statement. “When I put on a pair for the first time, it was a totally unique experience. Atoms are more comfortable by an order of magnitude than any other shoe I’ve tried, and they quickly became the go-to shoe in my rotation whenever I was stepping out. That wouldn’t mean anything if the shoes didn’t look great. Luckily, that’s not a problem, I wear my Atoms all the time and even my fashion designer wife is a fan.”

Even before today’s achievement of closing a Series A, the startup has come a long way on a relative shoestring: with just around $560,000 in seed funding and some of the founders’ own savings, Atoms built a supply chain of companies that would make the materials and shoes that it wanted, and developed a gradual but strong marketing pipeline with influential people in tech, fashion and design. (That success no doubt played a big role in securing the Series A to double down and continue to build the company.)

Within the bigger trend of direct-to-consumer retail — where smaller brands are leveraging advances in e-commerce, social media and wider internet usage to build vertically integrated businesses that bypass traditional retailers and bigger e-commerce storefronts to source their customers and sales more directly — there has been a secondary trend disrupting the very products that are being sold by using technology and advances in manufacturing. Third Love is another example in this category: The company has built a huge business selling bras and other undergarments to women by completely rethinking how they are sized, and specifically by focusing on creating as wide a range of sizes as possible.

So while companies like Allbirds — which itself is very well capitalised — may look like direct competitors to Atoms, the company currently stands apart from the pack because of its own very distinctive approach to building a mass-market business, but one that aims to make its product as individualised as possible.

You might think that approaching shoe manufacturers with the idea of creating smaller-size increments and manufacturing shoes as single items rather than pairs would have been a formidable task, but as it turned out, Atoms seemed to come along at the right place and the right time.

“We thought it would be challenging, and it wasn’t unchallenging, but the good thing was that many manufacturers were already starting to think about this,” Ali said. “Think about it, there has been almost no innovation in shoe making in the last 30 or 40 years.” He said they were happy to talk to Atoms because “we were the first and only company looking at shoes this way.” That helped encourage him and Qasim, he added. “We knew we would be able to figure it all out.”

Nevertheless, the pair admit that the upfront costs have been very high (they would not say how high), but given the principle of economies of scale, the more shoes that Atoms sells, the better the economics.

Currently the shoes sell for $179 a pair, which is not cheap and puts them at the high end of the market, so it will be interesting to see how and if price points evolve as it matures as a business, and competitors big and small begin to catch onto the idea of selling their own footwear at a wider range of sizes.

My colleague Josh, who first wrote about Atoms when they launched, is our own in-house tester, and as someone who could have easily moved on to another pair of kicks after he hit publish, he remains a fan:

“My Atoms have held up incredibly well from daily wear for 14 months,” he said. “They’re still my comfiest shoes and make Nikes feel uncomfortable when I try them again. They’ve sustained a tiny bit of wear on the front of the foam sole (the toe just below the fabric) while the bottoms have worn down a little, like any shoes.

“The mesh fabric can pick up dirt or dust if you take them in the wilderness, and the sole isn’t hard enough that you won’t feel point rocks. But throwing them in the wash or a rub with a brush and they practically look new. The elastic laces are incredibly convenient.

“I’ve probably tied them 4 times since first lacing them up. And for a cleaner, more professional look you can tuck the bow of your laces behind the tongue. Their biggest problem is they’re porous and can let water through if you wear them in the rain or puddles.

“Overall, I’ve found them to be my best travel shoes because they’re so versatile. I can walk all day in them, but then go to a fancy dinner or nightclub. I can hike or even hit the gym with them if necessary, and they pack quite flat. With the quarter-sizing and different use cases, they make Allbirds look like restrictive outdoor slippers. For adults who still want to wear sneakers, the monochromatic color schemes and brandless, simple styles make Atoms feel as mature and reliable as you can get.”

Ali said that among those who buy one pair, some 85% have returned and purchased more, and that’s before it has even gone outside the U.S. Qasim said there has been a lot of interest in other regions, but for now it’s still following its original formula of keeping the organisation and business small and tight, with no plans to expand to further countries for the moment.

Powered by WPeMatico

If you think about the traditional hotel business, there hasn’t been a ton of innovation. You mostly still stand in a line to check in, and sometimes even to check out. You let the staff know about your desire for privacy with a sign on the door. Mews believes it’s time to rethink how hotels work in a more modern digital context, especially on the administrative side, and today it announced a $33 million Series B led by Battery Ventures.

When Mews founder Richard Valtr started his own hotel in Prague in 2012, he wanted to change how hotels have operated traditionally. “I really wanted to change the way that hotel systems are built to make sure that it’s more about the experience that the guest is actually having, rather than facilitating the kind of processes that hotels have built over the last hundred years,” Valtr told TechCrunch.

He said most of the innovation in this space has been in the B2C area, using Airbnb as a prime example. He wants to bring that kind of change to the way hotels operate. “That’s essentially what Mews is trying to do. [We want to shift the focus to] the fundamental things about why we love to travel and why people actually love to stay in hotels, experience hotels, and be cared for by professional staff. We are trying to do that in a way that that actually delivers a really meaningful experience and personalized experience to that one particular customer,” he explained.

For starters, Mews is a cloud-based system that automates a lot of the manual tasks, like room assignments that hotel staff at many hotels often still have to handle as part of their jobs. Valtr believes by freeing the staff from these kinds of tedious activities, it enables them to concentrate more on the guests.

It also offers ways for guests and hotels to customize their stays to get the best experience possible. Valtr says this approach brings a new level of flexibility that allows hotels to create new revenue opportunities, while letting guests choose the kind of stay they want.

From a guest perspective, they could by-pass the check-in process altogether, sharing all of their registration details ahead of time and getting a pass code sent to their phone to get into the room. The system integrates with third-party hotel booking sites like Booking.com and Expedia, as well as other services, through its open hospitality API, which offers lots of opportunities for properties to partner with local businesses.

The company is currently operating at 1,000 properties across 47 countries, but it lacks a presence in the U.S. and wants to use this round to open an office in NYC and expand into this market. “We really want to attack the U.S. market because that’s essentially where most of the decision makers for all of the major chains are. And we’re not going to change the industry if we don’t actually change the thinking of the biggest brands,” Valtr said.

Today, the company has 270 employees spread across 10 offices around the world. Headquarters are in Prague and London, but the company is in the process of opening that NYC office, and the number of employees will expand when that happens.

Powered by WPeMatico

Bestmile, a transportation software startup, has raised $16.5 million in a Series B round led by Blue Lagoon Capital and TransLink Capital.

Existing investors Road Ventures, Partech, Groupe ADP, Airbus Ventures, Serena and others also participated in the round. The company, which launched in 2014, has raised $31 million to date.

Bestmile has developed fleet management software that orchestrates the delicate balance between demand for, and supply of transportation. Managing fleets isn’t new. However, the emergence of new and varied ways for people and packages to move within cities has created new opportunities for software companies.

Bestmile is aiming to become the preferred platform for public transit operators, automakers and taxi companies that offer ride-hailing, microtransit, autonomous shuttle services and even robotaxis. While Bestmile emphasizes the ability of the platform to manage more futuristic means of travel, namely autonomous shuttles, fleet management software is designed to be agnostic. This means it will work for human-driven fleets like traditional taxi cabs as well as autonomous shuttles and, someday, robotaxis.

The startup’s investors also see opportunities for the platform that extend beyond microtransit, ride-hailing and autonomous shuttles. For instance, Airbus Ventures sees Bestmile as a key enabler for urban air mobility, according to Thomas d’Halluin, a managing partner at the Airbus’ venture arm.

The platform works by collecting real-time data such as weather, traffic, demand and vehicle telemetry. It then uses the data to squeeze the most out of the fleet. That means balancing demand from customers with the cost of operations.

The startup, which is based in Lausanne, Switzerland and has an office in San Francisco, already has a number of customers, including autonomous shuttle operators. The company’s software is managing 15 deployments globally. Bestmile announced earlier this week that it has partnered with Beep, an autonomous shuttle company in Orlando, Fla.

Blue Lagoon partners Rodney Rogers and Kevin Reid have joined Bestmile’s board. Rogers is now board chairman. The pair, which have first-hand experience as co-founders, should be able to provide the kind of insight needed to scale a company. Rogers and Reid co-founded enterprise cloud services company Virtustream, which was acquired by EMC Corporation in 2015 for $1.2 billion. The business is now part of Dell Technologies.

Powered by WPeMatico