Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

As we swing into the summer tourist season, a company poised to capitalise on that has raised a huge round of funding. GetYourGuide — a Berlin startup that has built a popular marketplace for people to discover and book sightseeing tours, tickets for attractions and other experiences around the world — is today announcing that it has picked up $484 million, a Series E round of funding that will catapult its valuation above the $1 billion mark.

The funding is a milestone for a couple of reasons. GetYourGuide says it is the highest-ever round of funding for a company in the area of “travel experiences” (tours and other activities) — a market estimated to be worth $150 billion this year and rising to $183 billion in 2020. And this Series E is also one of the biggest-ever growth rounds for any European startup, period.

The company has now sold 25 million tickets for tours, attractions and other experiences, with a current catalog of some 50,000 experiences on offer. That’s a sign of strong growth: in 2017 it sold 10 million tickets, and its last reported catalog number was 35,000. It will be using the funding to build more of its own “Originals” tour experiences — which have now passed the 40,000 tickets sold mark — as well as to build up more activities in Asia and the U.S., two fast-growing markets for the startup.

The funding is being led by SoftBank, via its Vision Fund, with Temasek, Lakestar, Heartcore Capital (formerly Sunstone Capital) and Swisscanto Invest among others also participating. (Swisscanto is part of Zürcher Kantonalbank: GetYourGuide was originally founded in Zurich, where the founders had studied, and it still runs some R&D operations there.) The company has now raised well over $600 million.

It’s notable how SoftBank — which is on the hunt for interesting opportunities to invest its $100 billion superfund — has been stepping up a gear in Germany to tap into some of the bigger tech players that have emerged out of that market, which today is the biggest in Europe. Other big plays have included €460 million into Auto1 and €900 million into payments provider Wirecard. Other companies it has backed, such as hotel company Oyo out of India, are using its funding to break into Europe (and buy German companies in the process).

There had been reports over the last several months that GetYouGuide was in the process of raising anywhere between $300 million and more than $500 million. In late April, we were told by sources that the round hadn’t yet closed, and that numbers published in the media up to then had been inaccurate, even as we nailed down that SoftBank was indeed involved in the round.

The valuation in this round is not being disclosed, but CEO Johannes Reck (who co-founded the app with Martin Sieber, Pascal Mathis, Tobias Rein and Tao Tao) said in an interview with TechCrunch that it was definitely “now a unicorn” — meaning that its valuation had passed the $1 billion mark. For additional context, the rumor last month was that GetYourGuide’s valuation was up to €1.6 billion ($1.78 billion), but I have not been able to get firm confirmation of that number.

GetYourGuide’s growth — and investor interest in it — has closely followed the rise of new platforms like Airbnb that have changed the face of how we travel, and what we do when we get somewhere. We have moved far beyond the days of visiting a travel agent that books everything, from flight to hotel to all your activities, as you sit on the other side of a desk from her or him. Now with the tap of a finger or the click of a mouse, we have thousands of choices.

Within that, GetYourGuide thinks that it has jumped on an interesting opportunity to rethink the activity aspect of tourism. Tour packages and other highly organized travel experiences are often associated with older people, or those with families — essentially people who need more predictability when they are not at home.

Reck noted that the earliest users of GetYourGuide in 2010 were precisely those people — or at least those who were more inclined to use digital platforms to begin with: the demographic, he said, was 40-50 year olds, most likely travelling with family.

That is one thing that has really started to change, in no small part because of GetYourGuide itself. Making the experience of booking experiences mobile-friendly, GetYourGuide has played into the culture of doing and showing, which has propelled the rise of social media.

“They want to do things, to have something to post on Instagram,” he said. The average age of a GetYourGuide user now, he said, is 25-40.

This has even evolved into what GetYourGuide provides to users. “At some point, staff in Asia had the idea of crafting a ‘GetYourGuide Instagram Tour of Bali.’ That really took off, and now this is the number-one tour booked in the region.” It has since expanded the concept to 50 destinations.

Not by coincidence, today the company is also announcing that Ameet Ranadive is joining as the company’s first chief product officer. Ranadive comes from Instagram, where he led the Well-being product team (the company’s health and safety team). He’d also been VP and GM of Revenue Product at Twitter. Nils Chrestin is also coming on as CFO, having recently been at Rocket Internet-incubated Global Fashion Group.

That has also led GetYourGuide to conclude it has a ways to go to continue developing its model and scope further, expanding into longer sightseeing excursions, beyond one or two-hour tours into day trips and even overnight experiences.

As it continues to play around with some of these offerings, it’s also increasingly taking a more direct role in the branding and the provision of the content. Initially, all tickets and tours were posted on GetYourGuide by third parties. Now, GetYourGuide is building more of what Reck calls “Originals” — which it might develop in partnership with others but ultimately handles as its own first-party content. (That Instagram tour was one of those Originals.)

It’s worth noting that others are closing in on the same “experiences” model that forms the core of GetYourGuide’s business: Airbnb, to diversify how it makes revenues and to extend its touchpoints with guests beyond basic accommodation bookings, has also started to sell experiences. Meanwhile, daily deals pioneer Groupon has also positioned itself as a destination for purchasing “experiences” as a way to offset declines in other areas of its business. Similarly, travel portals that sell plane tickets regularly default to pushing more activities on you.

Reck pointed out that the area of business where GetYourGuide is active is becoming increasingly attractive to these players as other aspects of the travel industry become increasingly commoditised. Indeed, you can visit dozens of sites to compare pricing on plane tickets, and if you are flexible, pick up even more of a bargain at the last minute. And the rise of multiple Airbnb-style platforms offering private accommodation has made competition among those supplying those platforms — as well as hotels — increasingly fierce.

All of that leaves experiences — for now at least — as the place where these companies can differentiate themselves from the pack. Reck believes that focusing on this, however, means you just do it much better than companies that have added experiences on to a platform that is not a native destination for discovering or buying that kind of content or product. (That doesn’t mean there aren’t others natively tackling “experiences” from the world of startups. Klook is one also funded by SoftBank.)

“Consumers, especially millennials, are spending an increasing portion of their disposable income on travel experiences. We believe GetYourGuide is leading this seismic shift by consolidating the fragmented global supply base of tour operators and modernizing access for travelers globally,” said Ted Fike, partner at SoftBank Investment Advisers, in a statement. “This combination creates powerful network effects for their business that is fueling their strong growth. We are excited to partner with their passionate and talented leadership team.” Fike is joining the board with this round.

Powered by WPeMatico

OpenFin, the company looking to provide the operating system for the financial services industry, has raised $17 million in funding through a Series C round led by Wells Fargo, with participation from Barclays and existing investors including Bain Capital Ventures, J.P. Morgan and Pivot Investment Partners. Previous investors in OpenFin also include DRW Venture Capital, Euclid Opportunities and NYCA Partners.

Likening itself to “the OS of finance,” OpenFin seeks to be the operating layer on which applications used by financial services companies are built and launched, akin to iOS or Android for your smartphone.

OpenFin’s operating system provides three key solutions which, while present on your mobile phone, has previously been absent in the financial services industry: easier deployment of apps to end users, fast security assurances for applications and interoperability.

Traders, analysts and other financial service employees often find themselves using several separate platforms simultaneously, as they try to source information and quickly execute multiple transactions. Yet historically, the desktop applications used by financial services firms — like trading platforms, data solutions or risk analytics — haven’t communicated with one another, with functions performed in one application not recognized or reflected in external applications.

“On my phone, I can be in my calendar app and tap an address, which opens up Google Maps. From Google Maps, maybe I book an Uber . From Uber, I’ll share my real-time location on messages with my friends. That’s four different apps working together on my phone,” OpenFin CEO and co-founder Mazy Dar explained to TechCrunch. That cross-functionality has long been missing in financial services.

As a result, employees can find themselves losing precious time — which in the world of financial services can often mean losing money — as they juggle multiple screens and perform repetitive processes across different applications.

Additionally, major banks, institutional investors and other financial firms have traditionally deployed natively installed applications in lengthy processes that can often take months, going through long vendor packaging and security reviews that ultimately don’t prevent the software from actually accessing the local system.

OpenFin CEO and co-founder Mazy Dar (Image via OpenFin)

As former analysts and traders at major financial institutions, Dar and his co-founder Chuck Doerr (now president & COO of OpenFin) recognized these major pain points and decided to build a common platform that would enable cross-functionality and instant deployment. And since apps on OpenFin are unable to access local file systems, banks can better ensure security and avoid prolonged yet ineffective security review processes.

And the value proposition offered by OpenFin seems to be quite compelling. OpenFin boasts an impressive roster of customers using its platform, including more than 1,500 major financial firms, almost 40 leading vendors and 15 of the world’s 20 largest banks.

More than 1,000 applications have been built on the OS, with OpenFin now deployed on more than 200,000 desktops — a noteworthy milestone given that the ever-popular Bloomberg Terminal, which is ubiquitously used across financial institutions and investment firms, is deployed on roughly 300,000 desktops.

Since raising their Series B in February 2017, OpenFin’s deployments have more than doubled. The company’s headcount has also doubled and its European presence has tripled. Earlier this year, OpenFin also launched it’s OpenFin Cloud Services platform, which allows financial firms to launch their own private local app stores for employees and customers without writing a single line of code.

To date, OpenFin has raised a total of $40 million in venture funding and plans to use the capital from its latest round for additional hiring and to expand its footprint onto more desktops around the world. In the long run, OpenFin hopes to become the vital operating infrastructure upon which all developers of financial applications are innovating.

“Apple and Google’s mobile operating systems and app stores have enabled more than a million apps that have fundamentally changed how we live,” said Dar. “OpenFin OS and our new app store services enable the next generation of desktop apps that are transforming how we work in financial services.”

Powered by WPeMatico

TodayTix, a mobile ticketing company that makes it easy and relatively affordable to go to Broadway shows and other live performances, is announcing a new $73 million round of funding led by private equity firm Great Hill Partners.

Founded in 2013, the company initially served as the mobile equivalent of New York’s TKTS booths for discounted, last-minute theater tickets. TodayTix says it’s now sold more than 4 million tickets, representing 8% of annual Broadway ticket sales and 4% for London’s West End.

Beyond that, co-founder and CEO Brian Fenty said that a little over 10% of the tickets sold now fall outside “theater and performing arts, narrowly defined,” covering things like comedy shows and experiential theater.

“I think to the consumer, we will be a holistic ecosystem to engage in the city’s art and experiences,” Fenty predicted. “However culture is defined … we want to be their partner in discovering those things.”

To do that, TodayTix will add more cities to its current list of 15 markets. Fenty said this expansion is driven by existing collaborations (like launching in Australia through its partnership with “Harry Potter and the Cursed Child”) and by seeing where people are already downloading the TodayTix app. His ultimate goal is to be “geographically agnostic.”

Fenty also said the company will continue investing in the TodayTix Presents program, through which the company puts on its own shows (albeit at a much smaller scale than a Broadway production).

And of course he wants to improve the app itself, introducing more personalization and curation — Fenty pointed to Netflix and Amazon as models. After all, he said TodayTix is currently offering tickets to 297 shows in New York alone, so it needs ways to “effectively guide people through that.”

“We’re actually a media company, with our own content and perspective — not on the quality of the shows, but to have a point of view on how users should and could engage with this content,” he said.

He added that those improvements will include more basic things, like the process of purchasing a ticket: “The hardest part is to complete the purchase in 30 seconds or less, as compared to the average ticketing platform, which is somewhere between 3 and 7 minutes … How we continue to squish that conversion?”

Fenty is also hoping to work more closely with show producers, providing them with data about which shows are selling, as well as helping them use data to find the most effective ways to promote themselves.

TodayTix says it’s raised a total of $90 million since it announced its Series B back in February 2016. Fenty told me the new round includes a direct investment in the company, as well as secondary purchases of TodayTix shares from previous investors.

“TodayTix is rapidly changing the way millennials and other consumers connect with live cultural experiences,” said Great Hill Managing Partner Michael Kumin in a statement. “We look forward to working with Brian, [co-founder] Merritt [Baer] and their talented management team to expand the Company’s product and service offerings and accelerate its push into new geographies.”

Powered by WPeMatico

The average enterprise today uses about 90 different software packages, with between 30-40 of them touching customers directly or indirectly. The data that comes out of those systems can prove to be very useful — to help other systems and employees work more intelligently, to help companies make better business decisions — but only if it’s put in order: now, a startup called Tealium, which has built a system precisely to do just that and works with the likes of Facebook and IBM to help manage their customer data, has raised a big round of funding to continue building out the services it provides.

Today, it is announcing a $55 million round of funding — a Series F led by Silver Lake Waterman, the firm’s late-stage capital growth fund; with ABN AMRO, Bain Capital, Declaration Partners, Georgian Partners, Industry Ventures, Parkwood and Presidio Ventures also participating.

Jeff Lunsford, Tealium’s CEO, said the company is not disclosing valuation, but he did say that it was “substantially” higher than when the company was last priced three years ago. That valuation was $305 million in 2016, according to PitchBook — a figure Lunsford didn’t dispute when I spoke with him about it, and a source close to the company says it is “more than double” this last valuation, and actually around $850 million.

He added that the company is close to profitability and is projected to make $100 million in revenues this year, and that this is being considered the company’s “final round” — presumably a sign that it will either no longer need external funding and that if it does, the next step might be either getting acquired or going public.

This brings the total raised by Tealium to $160 million.

The company’s rise over the last eight years has dovetailed with the rapid growth of big data. The movement of services to digital platforms has resulted in a sea of information. Much of that largely sits untapped, but those who are able to bring it to order can reap the rewards by gaining better insights into their organizations.

Tealium had its beginnings in amassing and ordering tags from internet traffic to help optimise marketing and so on — a business where it competes with the likes of Google and Adobe.

Over time, it has expanded and capitalised to a much wider set of data sources that range well beyond web and commerce, and one use of the funding will be to continue expanding those data sources, and also how they are used, with an emphasis on using more AI, Lunsford said.

“There are new areas that touch customers like smart home and smart office hardware, and each requires a step up in integration for a company like us,” he said. “Then once you have it all centralised you could feed machine learning algorithms to have tighter predictions.”

That vast potential is one reason for the investor interest.

“Tealium enables enterprises to solve the customer data fragmentation problem by integrating and enriching data across sources, in real-time, to create audiences while providing data governance and fidelity,” said Shawn O’Neill, managing director of Silver Lake Waterman, in a statement. “Jeff and his team have built a great platform and we are excited to support the company’s continued growth and investment in innovation.”

The rapid growth of digital services has already seen the company getting a big boost in terms of the data that is passing through its cloud-based platform: it has had a 300% year-over-year increase in visitor profiles created, with current tech customers including the likes of Facebook, IBM, Visa and others from across a variety of sectors, such as healthcare, finance and more.

“You’d be surprised how many big tech companies use Tealium,” Lunsford said. “Even they have a limited amount of bandwidth when it comes to developing their internal platforms.”

People like to say that “data is the new oil,” but these days that expression has taken on perhaps an unintended meaning: just like the overconsumption of oil and fossil fuels in general is viewed as detrimental to the long-term health of our planet, the overconsumption of data has also become a very problematic spectre in our very pervasive world of tech.

Governments — the European Union being one notable example — are taking up the challenge of that latter issue with new regulations, specifically GDPR. Interestingly, Lunsford says this has been a good thing rather than a bad thing for his company, as it gives a much clearer directive to companies about what they can use, and how it can be used.

“They want to follow the law,” he said of their clients, “and we give them the data freedom and control to do that.” It’s not the only company tackling the business opportunity of being a big-data repository at a time when data misuse is being scrutinised more than ever: InCountry, which launched weeks ago, is also banking on this gap in the market.

I’d argue that this could potentially be one more reason why Tealium is keen on expanding to areas like IoT and other sources of customer information: just like the sea, the pool of data that’s there for the tapping is nearly limitless.

Powered by WPeMatico

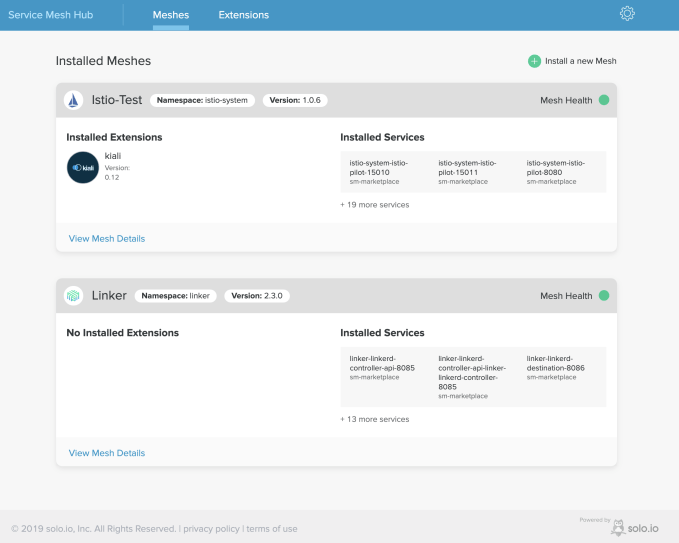

As containers and microservices have proliferated, a new kind of tool called the service mesh has developed to help manage and understand interactions between services. While Kubernetes has emerged as the clear container orchestration tool of choice, there is much less certainty in the service mesh market. Solo.io today announced a new open-source tool called Service Mesh Hub, designed to help companies manage multiple service meshes in a single interface.

It is early days for the service mesh concept, but there are already multiple offerings, including Istio, Linkerd (pronounced Linker-Dee) and Envoy. While the market sorts itself it out, it requires a new set of tools, a management layer, so that developers and operations can monitor and understand what’s happening inside the various service meshes they are running.

Idit Levine, founder and CEO at Solo, says she formed the company because she saw an opportunity to develop a set of tooling for a nascent market. Since founding the company in 2017, it has developed several open-source tools to fill that service mesh tool vacuum.

Levine says that she recognized that companies would be using multiple service meshes for multiple situations and that not every company would have the technical capabilities to manage this. That is where the idea for the Service Mesh Hub was born.

It’s a centralized place for companies to add the different service mesh tools they are using, understand the interactions happening within the mesh and add extensions to each one from a kind of extension app store. Solo wants to make adding these tools a simple matter of pointing and clicking. While it obviously still requires a certain level of knowledge about how these tools work, it removes some of the complexity around managing them.

Solo.io Service Mesh Hub (Screenshot: Solo.io)

“The reason we created this is because we believe service mesh is something big, and we want people to use it, and we feel it’s hard to adopt right now. We believe by creating that kind of framework or platform, it will make it easier for people to actually use it,” Levine told TechCrunch.

The vision is that eventually companies will be able to add extensions to the store for free, or even at some point for a fee, and it is through these paid extensions that the company will be able to make money. She recognized that some companies will be creating extensions for internal use only, and in those cases, they can add them to the hub and mark them as private and only that company can see them.

For every abstraction it seems, there is a new set of problems to solve. The service mesh is a response to the problem of managing multiple services. It solves three key issues, according to Levine. It allows a company to route the microservices, have visibility into them to see logs and metrics of the mesh and to provide security to manage which services can talk to each other.

Levine’s company is a response to the issues that have developed around understanding and managing the service meshes themselves. She says she doesn’t worry about a big company coming in and undermining her mission because she says that they are too focused on their own tools to create a set of uber-management tools like these (but that doesn’t mean the company wouldn’t be an attractive acquisition target).

So far, the company has taken more than $13 million in funding, according to Crunchbase data.

Powered by WPeMatico

A day after India’s largest wallet app Paytm entered the credit card business, local ride-hailing giant Ola is following suit. Ola has inked a deal with state-run SBI and Visa to issue as many as 10 million credit cards in the next three and a half years, it said today.

The move will help Visa and SBI (State Bank of India) acquire more customers in India, where most transactions are still bandied out over cash. For Ola, which rivals Uber in India, the foray into credit cards represents a new avenue to monetize its customers, as TechCrunch previously reported.

With about 150 million users availing more than 2 million rides on its platform each day, Ola is sitting on a mountain of data about its users’ financial power and spends. With the card, dubbed Ola Money-SBI Credit Card, the mobility firm is also offering several discounts and savings to retain its loyal customer base.

Ola, which is nearing $6 billion in valuation and counts SoftBank and Naspers among its investors, said it will offer its credit card holders “highest cashback and rewards” in the form of Ola Money that could be redeemed for Ola rides, as well as flight and hotel bookings. There will be 7% percent cashback on cab spends, 5% on flight bookings, 20% on domestic hotel bookings (6% on international hotel bookings), 20% on more than 6,000 restaurants and 1% on all other spends.

In an interview with TechCrunch, Nitin Gupta, CEO of Ola financial services, claimed that the company was offering “five times rewards to customers” in comparison to average credit card companies. “Also, the card is a first of its kind offering that can be managed digitally through the Ola App. We are committed to creating an inclusive ecosystem where mobility and financial services go hand in hand in leading growth and development,” he said. Ola said it has already rolled out the card to some users and will invite other eligible customers to avail it.

“Mobility spends form a significant wallet share for users and we see a huge opportunity to transform their payments experience with this solution. With over 150 million digital-first consumers on our platform, Ola will be a catalyst in driving India’s digital economy with cutting edge payment solutions,” Bhavish Aggarwal, co-founder and CEO of Ola, said in a statement.

Ola appears to be following the playbook of Grab and Go-Jek, two ride-hailing services in Southeast Asian markets that have ventured into a number of businesses in recent years. Both Grab and Go-Jek offer loans, remittance and insurance to their riders, while the former also maintains its own virtual credit card. Interestingly, Uber, which also offers a credit card in some markets, has no such play in India.

The move will allow Ola to look beyond ride-hailing and food delivery, two businesses that appear to have hit a saturation point in India, said Satish Meena, an analyst with research firm Forrester.

In recent years, Ola has started to explore financial services. It offers riders “micro-insurance” that covers a range of risks, including loss of baggage and medical expenses. The company said earlier this year, it has sold more than 20 million insurances to customers. Using Ola Money to facilitate cashbacks also underscores Ola’s push to increase the adoption of its mobile wallet, which, according to estimates, lags Paytm and several other wallet and UPI payment apps.

The company has also made a major push in the electric vehicles business, which it spun off as a separate company earlier this year. In March, its EV business raised $300 million from Hyundai and Kia. The company has said that it plans to offer one million EVs by 2022. Its other EV programs include a pledge to add 10,000 rickshaws for use in cities.

Powered by WPeMatico

If you thought Uber’s disastrous initial public offering last week would deter fellow venture-backed technology companies from pursuing the public markets in 2019, you thought wrong.

CrowdStrike, yet another multi-billion-dollar Silicon Valley “unicorn,” has filed to go public. The cloud-based cybersecurity platform valued at $3.3 billion in 2018 revealed its IPO prospectus Tuesday afternoon.

The company plans to trade on the Nasdaq under the ticker symbol “CRWD.” According to the filing, it intends to raise an additional $100 million, though that figure is typically a placeholder amount. To date, CrowdStrike has raised $480 million in venture capital funding from Warburg Pincus, which owns a 30.3% pre-IPO stake, Accel (20.3%) and CapitalG (11.2%).

As we’ve come to expect of these companies, CrowdStrike’s financials are a bit concerning. While its revenues are growing at an impressive rate, from $53 million in 2017 to $119 million in 2018 to $250 million in the year ending January 31, 2019, its spending is far outweighing its gross profit. Most recently, the company posted a gross profit of $163 million on total operating expenses of about $300 million.

CrowdStrike is not yet profitable. Its total losses are increasing year-over-year from $91 million in 2017, to $135 million in 2018 and $140 million in 2019.

Headquartered in Sunnyvale, the business was founded in 2011 by chief executive officer George Kurtz and chief technology officer Dmitri Alperovitch, former McAfee executives. CrowdStrike, which develops security technology that looks at changes in user behavior on networked devices and uses that information to identify potential cyber threats, has reportedly pondered an IPO for some time.

The business sells its endpoint protection software to enterprises on a subscription basis, competing with Cylance, Carbon Black and others. In its S-1, CrowdStrike makes a case for its offering based on the rise of cloud computing and the growing threat of cybersecurity breaches. It estimates a total addressable market worth $29.2 billion by 2021.

“We founded CrowdStrike in 2011 to reinvent security for the cloud era,” the company writes. “When we started the company, cyberattackers had a decided, asymmetric advantage over existing security products. We turned the tables on the adversaries by taking a fundamentally new approach that leverages the network effects of crowdsourced data applied to modern technologies such as artificial intelligence, or AI, cloud computing, and graph databases.”

Powered by WPeMatico

Innowatts, an automated toolkit for energy monitoring and management targeting utilities, has raised $18.2 million in a new round of funding from investors led by Energy Impact Partners .

Previous investors Shell Ventures, Iberdrola and Energy and Environment Investment participated along with another new investor, Evergy Ventures.

As utilities respond to new, renewable power coming online and adapt to the challenges presented by natural disasters and intermittent energy sources stressing old power grid assets, they are increasingly turning to new software toolkits to adapt.

Innowatts and its software fit squarely into that category of offering.

“Competing in today’s complex and evolving marketplace requires utility companies use data and intelligence to drive business and customer value,” said Siddhartha Sachdeva, founder and chief executive of Innowatts, in a statement.

The company’s technology is used to analyze meter data from 21 million customers globally in 13 regional energy markets.

Innowatts boasts that it’s the largest body of customer intelligence data consumed by a software company. How that data will be used is an open question.

“We invest in companies driving the transformation of the energy sector towards an increasingly decarbonized, digitized, and electrified future – solutions that our utility partners can commercialize at scale and have the greatest impact,” said Michael Donnelly, partner and chief risk officer at EIP, in a statement. “Innowatts is poised to become a key building block in the software-driven, intelligent grid of the future, and we look forward to working closely with them alongside our utility partners.”

The company uses the data it collects to predict the potential for outages or problems created by surges in energy demand so that utilities can dispatch resources to meet that demand without sacrificing reliability for customers.

“Utilities have the opportunity to deliver more value to customers, at lower costs and with greater personalization than ever before, while helping streamline the complex energy marketplace,” said Geert van de Wouw, vice president of Shell Ventures.

Powered by WPeMatico

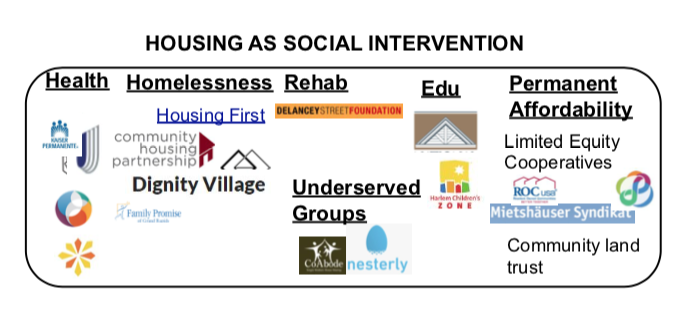

This week on Extra Crunch, I am exploring innovations in inclusive housing, looking at how 200+ companies are creating more access and affordability. Yesterday, I focused on startups trying to lower the costs of housing, from property acquisition to management and operations.

Today, I want to focus on innovations that improve housing inclusion more generally, such as efforts to pair housing with transit, small business creation, and mental rehabilitation. These include social impact-focused interventions, interventions that increase income and mobility, and ecosystem-builders in housing innovation.

Nonprofits and social enterprises lead many of these innovations. Yet because these areas are perceived to be not as lucrative, fewer technologists and other professionals have entered them. New business models and technologies have the opportunity to scale many of these alternative institutions — and create tremendous social value. Social impact is increasingly important to millennials, with brands like Patagonia having created loyal fan bases through purpose-driven leadership.

While each of these sections could be their own market map, this overall market map serves as an initial guide to each of these spaces.

These innovations address:

Powered by WPeMatico

It’s just over two years since Yext debuted on the New York Stock Exchange, and to mark the occasion, I sat down with co-founder and CEO Howard Lerman for an interview.

As Lerman noted, Yext — which allows businesses to manage their profiles and information across a wide variety of online services — actually presented onstage at the TechCrunch 50 conference back in 2009. Now, it boasts a market capitalization of nearly $2.3 billion, and it just revealed plans to take over a nine-floor building in New York’s Chelsea neighborhood, turning it into Yext’s global headquarters.

My interview with Lerman actually came before the announcement, though he managed to drop in a few veiled hints about the company making a big move in real estate.

More concretely, we talked about how Lerman’s management style has evolved from scrappy startup founder to a public company CEO — he described holding five-minute meetings with every Yext employee as “one of the best management techniques” he’s ever adopted.

Lerman also argued that as online misinformation has become a big issue, Yext has only become more important: “Our founding principle is that the ultimate authority on how many calories are in a Big Mac is McDonald’s. The ultimate authority on where Burger King is open is Burger King.”

Vowing that he will remain CEO of Yext for “as long as this board will have me,” Lerman ended our conversation with a passionate defense of the idea that “a company is the ultimate vehicle in America to effect good in the world.”

You can read a transcript of our conversation below, edited and condensed for clarity.

TechCrunch: To start with a really broad question, how do you think Yext is different now than it was two years ago?

Howard Lerman: One of the things that’s defined Yext over the years is our continuous willingness to reinvent ourselves. You started covering us in 2009 [at] TechCrunch 50, we were a launch company there.

And here we are now. One of the cool things about being public is: It’s a total gamechanger. It’s a gamechanger not just for access to capital, but it’s particularly important in global markets. And I’m not talking about capital markets, I’m talking about the markets in which we sell software. We have offices now from Berlin to Shanghai.

Powered by WPeMatico