Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

At the beginning of 2019, Techstars Mobility turned into Techstars Detroit. At the time of the announcement, Managing Director Ted Serbinski penned “the word mobility was becoming too limiting. We knew we needed to reach a broader audience of entrepreneurs who may not label themselves as mobility but are great candidates for the program.”

I always called it Techstars Detroit anyway.

With Techstars Detroit, the program is looking for startups transforming the intersection of the physical and digital worlds that can leverage the strengths of Detroit to succeed. It’s a mouthful, but makes sense. Mobility is baked into Detroit, but Detroit is more than mobility.

Today the program took the wraps off the first class of startups under the new direction.

Techstars has operated in Detroit since 2015 and has been a critical partner in helping the city rebuild. Since its launch, Serbinski and the Techstars Mobility (now Detroit) mentors have helped bring talented engineers and founders to the city.

Serbinski summed up Detroit nicely for me, saying, “No longer is Detroit telling the world how to move. The world is telling Detroit how it wants to move.” He added the incoming class represents the new Detroit, with 60% international and 40% female founders.

Airspace Link (Detroit, MI)

Providing highways in the sky for safer drone operations.

Alpha Drive (New York, NY)

Platform for the validation of autonomous vehicle AI.

Le Car (Novi, MI)

An AI-powered personal car concierge that matches you to your perfect vehicle fit.

Octane (Fremont, CA)

Octane is a mobile app that connects car enthusiasts to automotive events and to each other out on the road.

PPAP Manager (Chihuahua, Mexico)

A platform to streamline the approval of packets of documents required in the automotive industry, known as PPAP, to validate production parts.

Ruksack (Toronto, Canada)

Connecting travelers with local travel experts to help them plan a perfect trip.

Soundtrack AI (Tel Aviv, Israel)

Acoustics-based and AI-enabled Predictive Maintenance Platform.

Teporto (Tel Aviv, Israel)

Teporto is enabling a new commute modality with its one-click smart platform for transportation companies that seamlessly adapts commuter service to commuters’ needs.

Unlimited Engineering (Barcelona, Spain)

Unlimited develops modular Light Electric Vehicles as a fun, cheap and convenient solution to last-mile trips that are overserved by cars and public transportation.

Zown (Toronto, Canada)

Open up your real estate property to the new mobility marketplace.

Powered by WPeMatico

Growing D2C brands face an interesting challenge. While they’ve eliminated much of the hassle of a physical storefront, they must still deal with all the complications involved in managing inventory and manufacturing and shipping a physical product to suppliers.

Anvyl, with a fresh $9.3 million in Series A funding, is looking to jump in and make a difference for those brands. The company, co-founded by chief executive Rodney Manzo, is today announcing the raise, led by Redpoint Ventures, with participation from existing investors First Round Capital and Company Ventures. Angel investors Kevin Ryan (MongoDB and DoubleClick), Ben Kaufman (Quirky and Camp) and Dan Rose (Facebook) also participated in the round.

Manzo hails from Apple, where with $300 million in spend to manage logistics and supply chain he was still operating in an Excel spreadsheet. He then went to Harry’s, where he shaved $10 million in cash burn in his first month. He says himself that sourcing, procurement and logistics are in his DNA.

Which brings us to Anvyl. Anvyl looks at every step in the logistics process, from manufacture to arrival at the supplier, and visualizes that migration in an easy-to-understand UI.

The difference between Anvyl and other supply chain logistics companies, such as Flexport, is that Anvyl goes all the way to the very beginning of the supply chain: the factories. The company partners with factories to set up cameras and sensors that let brands see their product actually being built.

“When I was at Apple, I traveled for two years at least once a month to China and Japan just to oversee production,” said Manzo. “To oversee production, you essentially have to be boots on the ground and eyes in the factory. None of our brands have traveled to a factory.”

On the other end of the supply chain, Anvyl lets brands manage suppliers, find new suppliers, submit RFQs, see cost breakdowns and accept quotes.

The company also looks at each step in between, including trucks, trains, boats and planes so that brands can see, in real time, their products go from being manufactured to delivery.

Anvyl charges brands a monthly fee using a typical SaaS model. On the other end, Anvyl takes a “tiny percentage” of goods being produced within the Anvyl marketplace. The company declined to share actual numbers around pricing.

This latest round brings Anvyl’s total funding to $11.8 million. The company plans to use the funding toward hiring in engineering and marketing, and grow its consumer goods customer base.

Powered by WPeMatico

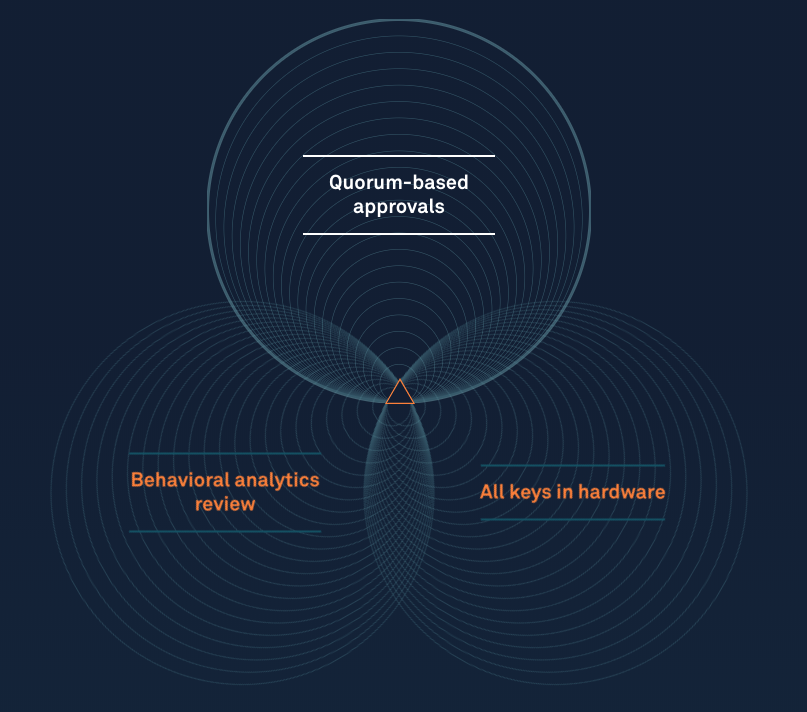

Visa and Andreessen Horowitz are betting even bigger on cryptocurrency, funding a big round for fellow Facebook Libra Association member Anchorage’s omnimetric blockchain security system. Instead of using passwords that can be stolen, Anchorage requires cryptocurrency withdrawals to be approved by a client’s other employees. Then the company uses both human and AI review of biometrics and more to validate transactions before they’re executed, while offering end-to-end insurance coverage.

This new-age approach to cryptocurrency protection has attracted a $40 million Series B for Anchorage, led by Blockchain Capital and joined by Visa and Andreessen Horowitz. The round adds to Anchorage’s $17 million Series A that Andreessen led just six months ago, demonstrating extraordinary momentum for the security startup.

“As a custodian, our work is focused on building financial plumbing that other companies depend on for their operations to run smoothly. In this regard we have always looked at Visa as a model,” Anchorage co-founder and president Diogo Mónica tells me.

“Visa was ‘fintech’ before the term existed, and has always been on the vanguard of financial infrastructure. Visa’s investment in Anchorage is helpful not only to our company but to our industry, as a validation of the entire ecosystem and a recognition that crypto will play a key role in the future of global finance.”

Cold-storage, where assets are held in computers not connected to the internet, has become a popular method of securing Bitcoin, Ether and other tokens. But the problem is that this can prevent owners from participating in governance of certain cryptocurrency where votes are based on their holdings, or earning dividends. Anchorage tells me it’s purposefully designed to permit this kind of participation, helping clients to get the most out of their assets like capturing returns from staking and inflation, or joining in on-chain governance.

As three of the 28 founding members of the Libra Association that will govern the new Facebook-incubated cryptocurrency, Anchorage, Visa and Andreessen Horowitz will be responsible for ensuring the stablecoin stays secure. While Facebook is building its own custodial wallet called Calibra for users, other Association members and companies hoping to dive into the ecosystem will need ways to protect their Libra stockpiles.

“Libra is exactly the kind of asset that Anchorage was created to hold,” Mónica wrote the day Libra was revealed. “Our custody solution enables online participation with offline assets, so that asset-holders don’t face a trade-off between security and usability.” The company believes that custodians shouldn’t dictate which coins their clients hold, so it’s working to support all types of digital assets. Anchorage tells me that will include support for securing Libra in the future.

You’ve probably already used technology secured by Anchorage’s founders, who engineered Docker’s containers that are used by Microsoft, and Square’s first encrypted card reader. Mónica was at Square when he met his future Anchorage co-founder Nathan McCauley, who’d been working on anti-reverse-engineering tech for the U.S. military. When a company that had lost the password to a $1 million cryptocurrency account asked for their help with security, they recognized the need for a more idiot-proof take on asset protection.

“Anchorage applies the best of modern security engineering for a more advanced approach: we generate and store private keys in secure hardware so they are never exposed at any point in their life cycle, and we eliminate human operations that expose assets to risk,” Mónica says. The startup competes with other crypto custody firms like Bitgo, Ledger, Coinbase and Gemini.

Last time we spoke, Anchorage was cagey about what I could reveal regarding how its transaction validation system worked. With the new funding, it’s feeling a little more secure about its market position and was willing to share more.

Last time we spoke, Anchorage was cagey about what I could reveal regarding how its transaction validation system worked. With the new funding, it’s feeling a little more secure about its market position and was willing to share more.

Anchorage ditches usernames, passwords, email addresses and phone numbers completely. That way a hacker can’t just dump your coins into their account by stealing your private key or SIM-porting your number to their phone. Instead, clients whitelist devices held by their employees, who use the Anchorage app to submit transactions. You’d propose selling $10 million worth of Bitcoin or transferring it to someone else as payment, and a minimum of two-thirds of your designated co-workers would need to concur to form a quorum that approves the transfer.

But first, Anchorage’s artificial intelligence and human staff would check for any suspicious signals that might indicate a hack in progress. It uses behavioral analysis (do you act like a real human and similar to how you have before), biometric signals (do you look like you) and network signals (is your device what and where it should be) to confirm the transaction is legitimate. The same process goes down if you try to add a new whitelisted device or change who has permission to do what.

The challenge will be scaling security to an ever-broadening range of digital assets, each with their own blockchain quirks and complex smart contracts. Even if Anchorage keeps coins safely in custody, those variables could expose assets to risk while in transit. Now with deeper pockets and the Visa vote of confidence, Anchorage could solve those problems as clients line up.

While most blockchain attention has focused on the cryptocurrencies themselves and the exchanges where you can buy and sell them, a second order of critical infrastructure startups is emerging. Companies like Anchorage could make Bitcoin, Ether, Libra and more not just objects of speculation or the domain of experts, but safely functioning elements of the new world economy.

Powered by WPeMatico

Our 14th Annual TechCrunch Summer Party is a mere two weeks away, and we’re serving up a fresh new batch of tickets to this popular Silicon Valley tradition. Jump on this opportunity, folks, because our previous releases sold out in a flash — and these babies won’t last long, either. Buy your ticket today.

Our summer soiree takes place on July 25 at Park Chalet, San Francisco’s coastal beer garden. Picture it: A cold brew, an ocean view, tasty food and relaxed conversations with other amazing members of the early-startup tech community.

TechCrunch parties have a reputation as a place where startup magic happens. And there will be plenty of magical opportunity afoot this year as heavy-hitter VCs from Merus Capital, August Capital, Battery Ventures, Cowboy Ventures, Data Collective, General Catalyst and Uncork Capital join the party.

There’s more than one way to make magic at our summer fete. If you’re serious about catching the eye of these major VCs, consider buying a Startup Demo Package, which includes four attendee tickets.

Fun fact: Box founders Aaron Levie and Dylan Smith met one of their first investors, DFJ, at a party hosted by TechCrunch founder Michael Arrington. It’s one of our favorite success stories.

Check out the party details:

No TechCrunch party is complete without a chance to win great door prizes, including TechCrunch swag, Amazon Echos and tickets to Disrupt San Francisco 2019.

Buy your ticket today and enjoy a convivial evening of connection and community in a beautiful setting. Opportunity happens, and it’s waiting for you at the TechCrunch Summer Party.

Pro Tip: If you miss out this time, sign up here and we’ll let you know when we release the next group of tickets.

Is your company interested in sponsoring or exhibiting at the TechCrunch 14th Annual Summer Party? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico

Fintech startup Bunq is announcing a handful of new features today, such as a way to track group expenses without creating a joint account, a web app and better Siri integration.

If you usually track vacation expenses and group expenses from your phone, chances are you’ve been using two different products — a mobile app like Splitwise to track group expenses with your friends, and a peer-to-peer payment app to settle up balances.

Bunq is essentially bundling these two features with Slice Groups for owners of the Bunq Travel Card. Given that the Bunq app already lists all your transactions, adding transactions to a group is easier than with your average group payment tracking app.

After adding other people to your Slice Group, each person can add expenses to the group. You get a list of your most recent Bunq transactions and you can add them to a group. You also can add manual transactions in case you paid for something using cash, for instance.

This is just a group accounting feature. When you add a transaction to a Slice Group, your money remains in your account. But you can see who has a positive balance and who has a negative balance.

When you settle up a group, people who owe money get a push notification. They can then tap on the notification and send money from their Bunq account to your friends’ Bunq accounts.

This feature will work particularly well for groups of people who all use the Bunq Travel Card. But it doesn’t fundamentally change how you manage your money with groups.

Bunq now has two tiers of users. Free users get a travel card with an account that they can top up. Paid users get a full-fledged bank account with banking information.

Multiple paid users can already create joint accounts with their roommates or partner. You can then associate your Bunq card with a joint account and spend money from that joint account directly.

So if you have a Bunq Travel Card, Slice Groups are for you. If you have a Bunq bank account, joint accounts are for you.

Revolut doesn’t try to reinvent the wheel, either, as you can only split individual card transactions with other users. It could take a while to settle all transactions after a long vacation. Revolut also lets you create Group Vaults. Those are sub-accounts to put some money aside and invite other people to contribute. But only the admin can withdraw and spend money from those vaults.

N26 has promised Shared Spaces so that you can create sub-accounts and share them with other people. But the feature isn’t live yet.

Lydia’s take on group expenses works more like Bunq’s joint accounts. You can create sub-accounts and share those accounts with other people. Everyone can then top up that account and attach a payment method, such as a payment card or a virtual card in Apple Pay or Google Pay. You also can move expenses from one sub-account to another. When you’re back from vacation, you can associate your card with your personal Lydia account again.

In addition to Slice Groups, Bunq is launching a web interface to access your bank account. It works a bit like WhatsApp’s web app. You scan a QR code with your phone and you can then control the mobile app from a desktop web browser.

Bunq should also work better with Siri. You can now send money using your voice or change card settings. Finally, the startup has also made improvements to its business accounts with a few new features. For instance, you can now automatically put money aside to pay back VAT later down the road.

Powered by WPeMatico

Mobile marketing company AppLovin is announcing that it has acquired SafeDK.

While AppLovin started out as a mobile ad business, it now bills itself as “a comprehensive mobile gaming platform,” offering tools for game developers around user acquisition, monetization, analytics and (through Lion Studios, launched last year) publishing. SafeDK, meanwhile, allows developers to manage all the different SDKs on which their apps rely.

Palo Alto-headquartered AppLovin says that by incorporating SafeDK technology, it will help its publishers ensure GDPR compliance and brand safety.

It also says SafeDK will continue to support existing customers, while its headquarters in Herzliya, Israel will become AppLovin’s first office in Israel. Co-founders Orly Shoavi and Ronnie Sternberg will remain on-board as the heads of SafeDK and general managers of AppLovin Israel.

The companies are not disclosing the financial terms of the deal, except to say that it was all-cash. According to Crunchbase, SafeDK has raised a total of $5.8 million from investors, including Samsung Next Tel Aviv, Marius Nacht, StageOne Ventures and Kaedan Capital.

“We are delighted to be working with the AppLovin team to help mobile game publishers grow their businesses,” Shoavi said in a statement. “AppLovin has been a trusted partner for the biggest mobile game studios around the world and SafeDK’s technology will strengthen that trust.”

Powered by WPeMatico

NiYO Solutions, a Bangalore-based “neo-bank” that helps salaried employees and blue-collar workers access company benefits and other financial services, has raised $35 million in a new funding round to expand its business in the nation and explore international markets for some of its products.

The four-year-old startup, which serves small and medium businesses and other salaried employees across India, raised its Series B from Horizons Ventures, Tencent and existing investor JS Capital. It has raised $49.2 million to date, with its $13.2 million Series A closing in January last year.

NiYO Solutions serves as a “neo-bank” that relies on traditional financial institutions (Yes Bank and DCB banks, in its case) and offers to customers additional features such as lending and insurance. Blue-collared employees in India (and many other markets) continue to struggle in availing crucial financial services from banks that typically reserve them for the privileged segment. With its payroll solution and other products, NiYO is trying to drive financial inclusion in the country, it said.

The startup also offers a global travel card with no mark-up fee. More than 50,000 users have already signed up for the travel card — and NiYO intends to scale that figure to 500,000 by April next year. In an interview with TechCrunch, Vinay Bagri, co-founder and CEO of NiYO, said the startup is exploring bringing the travel card to other markets — though he did not share any names.

He said the startup will also use the fresh capital to build new product offerings and in expansion of its distribution and marketing efforts. It also wants to grow its customer base from about 1 million currently to 5 million in the next three years. Bagri said NiYO is looking to acquire other startups that are a good fit for its vision.

Neo banks are increasingly becoming popular across the globe as traditional banks show little interest in addressing the needs of niche customer bases. Tide and N26 are showing remarkable growth in European markets, while Azlo in the U.S. and Tyro Payments and Volt Bank in Australia are also among the top players.

In developing regions such as India, too, this tried and tested idea is increasingly being replicated. Open, another Bangalore-based neo-bank, helps businesses automate their finances. It raised $30 million last month.

Powered by WPeMatico

HQ Trivia’s troubles continue after a failed mutiny to oust the CEO, a 92% decline in downloads since versus a year ago, and layoffs of 20% of its staff last week. Now TechCrunch has learned HQ has failed to install a new CEO after months of searching. Meanwhile, users continue to complain about delays for payouts of their prizes from the live mobile trivia game, and about being booted from the game for no reason while on the final question.

Notably, Jeopardy winner Alex Jacob claims he hasn’t been paid the $20,000 he won on HQ Trivia on June 10th. This could shake players faith in HQ and erode their incentive to compete.

Guys, I need your help. I won $20,000 on @hqtrivia on June 10 and still haven’t heard anything about payment. Sadly, I don’t think they’re going to pay.

Please RT to tell HQ they should honor their jackpots. If I’m wrong, I’ll happily delete this & give $100 to someone who RT’d! pic.twitter.com/FmpY6unK49

— Alex Jacob (@whoisalexjacob) July 8, 2019

An HQ Trivia representative tells TechCrunch that the game has paid out $6.25 million to date and that 99% of players have been eligible to cash out within 48 hours of winning, but some winners may have to wait up to 90 days for it to ensure they didn’t break the rules to win. Given Jacob’s large jackpot, it’s possible the delay could be due to the company investigating to ensure he won fairly, though he’s clearly skilled at trivia given he won Jeopardy’s Tournament Of Champions in 2015. Jacob did not respond to requests for interview.

“We strive to make a game that is fair and fun for all players. As such, we have a rigorous process of reviewing winners for eligibility to receive cash prizes. Infrequently, we disqualify players for violating HQ‘s Terms of Service and Contest Rules” HQ Trivia’s press alias anonymously reponded to our request for comment. “It may take some eligible winners up to 90 days to receive cash prizes, however 99% of players have been able to cash out within 48 hours of winning a game and we have paid out a total of $6,252,634.58 USD to winners since launch.”

It seems that HQ’s internal problems are now metastasizing into public issues. Its team being short-staffed and distracted by weak morale could lengthen payout delays, which make players worry if they’ll ever get their cash. When they share those sentiments to social media, it could discourage others from playing. That, combined with concerns that bots and cheaters are winning the games, splitting the jackpots into tiny fractions so legitimate winners get less, has hurt the perception of HQ as a game where the smartest can win big.

Back in April, TechCrunch reported that 20 of HQ’s 35 staffers were preparing a petition to the board to remove CEO and co-founder Rus Yusupov for mismanagement. Yusupov caught wind of the plot and fired two of the leaders of the movement. However, HQ’s board decided it would bring in a new CEO. Board member and Tinder CEO Elie Seidman told TechCrunch that Yusupov had accepted he would be replaced by someone with the ability fire him and that a CEO search was ongoing. The startup’s lead investor Lightspeed has pledged to provide 18 months of funding once a new CEO was hired.

However, multiple sources tell TechCrunch that a new CEO has yet to be installed. One source tells me that management had promised a new CEO by the beginning of August, but that Yusupov had stalled the process seemingly to remain in power. HQ Trivia, Yusupov, and Seidman did not respond for requests for comment regarding the CEO search.

When asked about morale at the company, a source familiar with HQ’s internal situation told me “It’s terrible.” Yusupov is said to continue to be tough to work with, making decisions without full buy-in from the rest of the company. A substantial portion of the team was allegedly unaware of plans to launch a $9.99 subscription tier for HQ’s second game HQ Words until the company tweeted out the announcement.

Hopefully HQ Trivia can find a new captain to steer this ship back into smoother waters. The game has hundreds of thousands of players and many more with fond memories of competing. There’s still hope if it can evolve the product to give new users a taste of gameplay without waiting for the next scheduled match, find new revenue in expanded brand partnerships, fight off the bots and cheaters, and get everyone paid promptly. Perhaps there’s room for television tie-ins to bring HQ to a wider audience.

But before the startup can keep quizzing the world, HQ Trivia must endure its internal tests of resolve and find a champ to lead it.

Powered by WPeMatico

In the years following the financial crisis, de novo bank activity in the US slowed to a trickle. But as memories fade, the economy expands and the potential of tech-powered financial services marches forward, entrepreneurs have once again been asking the question, “Should I start a bank?”

And by bank, I’m not referring to a neobank, which sits on top of a bank, or a fintech startup that offers an interesting banking-like service of one kind or another. I mean a bank bank.

One of those entrepreneurs is Judith Erwin, a well-known business banking executive who was part of the founding team at Square 1 Bank, which was bought in 2015. Fast forward a few years and Erwin is back, this time as CEO of the cleverly named Grasshopper Bank in New York.

With over $130 million in capital raised from investors including Patriot Financial and T. Rowe Price Associates, Grasshopper has a notable amount of heft for a banking newbie. But as Erwin and her team seek to build share in the innovation banking market, she knows that she’ll need the capital as she navigates a hotly contested niche that has benefited from a robust start-up and venture capital environment.

Gregg Schoenberg: Good to see you, Judith. To jump right in, in my opinion, you were a key part of one of the most successful de novo banks in quite some time. You were responsible for VC relationships there, right?

…My background is one where people give me broken things, I fix them and give them back.

Judith Erwin: The VC relationships and the products and services managing the balance sheet around deposits. Those were my two primary roles, but my background is one where people give me broken things, I fix them and give them back.

Schoenberg: Square 1 was purchased for about 22 times earnings and 260% of tangible book, correct?

Erwin: Sounds accurate.

Schoenberg: Plus, the bank had a phenomenal earnings trajectory. Meanwhile, PacWest, which acquired you, was a “perfectly nice bank.” Would that be a fair characterization?

Erwin: Yes.

Schoenberg: Is part of the motivation to start Grasshopper to continue on a journey that maybe ended a little bit prematurely last time?

Erwin: That’s a great insight, and I did feel like we had sold too soon. It was a great deal for the investors — which included me — and so I understood it. But absolutely, a lot of what we’re working to do here are things I had hoped to do at Square 1.

Image via Getty Images / Classen Rafael / EyeEm

Schoenberg: You’re obviously aware of the 800-pound gorilla in the room in the form of Silicon Valley Bank . You’ve also got the megabanks that play in the segment, as well as Signature Bank, First Republic, Bridge Bank and others.

Powered by WPeMatico

Technology has been used to improve many of the processes that we use to get work done. But today, a startup has raised funding to build tech to improve us, the workers.

15Five, which builds software and services to help organisations and their employees evaluate their performance, as well as set and meet goals, has closed a Series B round of $30.7 million, money that it plans to use to continue building out the functionality of its core product — self-evaluations that take “15 minutes to write, 5 minutes to read” — as well as expand into new services that will sit alongside that.

David Hassell, 15Five’s CEO and co-founder, would not elaborate on what those new services might be, but he recently started a podcast with the startup’s “chief culture officer” Shane Metcalf around the subject of “best-self” management that taps into research on organizational development and positive psychology.

At the same time that 15Five works on productizing these principles into software form, it seems that the secondary idea will be to bring in more services and coaching into the mix alongside 15Five’s existing SaaS model.

This Series B is being led by Next47, the strategic investment arm of manufacturing giant Siemens. Others in the round included Matrix Partners, PointNine Capital, Jason Calacanis’s LAUNCH Fund, Newground Ventures, Bling Capital, Chaifetz Group, and Origin Ventures (which had led 15Five’s Series A). It brings the total raised to $42.6 million, but Hassell said that while the valuation is up, the exact number is not being disclosed.

(Previous investors in the company have included David Sacks, 500 Startups and Ben Ling.)

15Five’s growth comes at a time when we are seeing a significant evolution in how companies are run internally. The digital age has made workforces more decentralised — with people using smartphones, video communications and services like Slack to stay in constant contact while otherwise working potentially hundreds of miles from their closest colleagues, or at least not sitting in one office altogether, all the time.

All well and good, but this has also had an inevitable impact on how employees are evaluated by their managers, and also how they are able to gauge how well they are doing versus those with whom they work. So while communication of one kind — getting information across from one person to another across big distances — has seen a big boost through technology, you could argue that another kind of communication — of the human kind — has been lost.

15Five’s approach is to create a focus on building an easy way for employees to think about and set goals for themselves on a regular basis.

Indeed, “regular” is the operative word here, with key thing being frequency. A lot of companies — especially large ones — already use performance management software (other players in this space include BetterWorks, Lattice, and PeopleGoal among many others), but in many cases, it’s based around self-evaluations that you might make annually, or at six-month intervals.

15Five’s focus is on providing a service that people will use much more often than that. In fact, it encourages use all the time, by way of sending praise to each other when something positive happens (it calls these “High fives” appropriately enough), as well as regular evaluations and goals set by the employees themselves.

Hassell said in an interview that this is in tune with what modern workplaces, and younger employees, expect today, partly fuelled by the rise of social media.

“Most millennials will get feedback on what they eat for breakfast more than what they do at work,” he said. “The rest of our lives exist in a real-time feedback loop, filled with continuous, positive reinforcement, but then you go into work and have an annual or maybe biannual performance review? It’s simply not enough.”

He said that he knows some millennial employees who have said that they will not work at a company if it’s not already using or planning to adopt 15Five, and since talent is the cornerstone to a company’s success this could have a significant impact.

The startup was born in San Francisco in more than one sense. It’s based there, but also, its principles seem to be uniquely a product of the kind of self-reflection and self-care/quality of life emphasis that has been associated with California culture for a while now, even amidst the relentless march that comes with being at the epicenter of the tech world.

In that regard, its newest investor, Next47, will help put 15Five to the test, both in terms of how the product will be adopted and used at a company whose holdings are as much manufacturing as technology, and in terms of sheer size: Siemens globally has around 400,000 employees, a huge jump up compared to the smaller and medium-sized businesses that form the core of 15Five’s customer base today.

Matthew Cowan, a partner at the firm, noted that while Siemens is currently not a 15Five user, the thinking behind the investment was strategic and the idea will be to incorporate it into the company’s practices for helping employees’ progress.

“It’s very representative of how the workplace is transforming,” he said

Powered by WPeMatico