Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Finmark, a member of the Summer 2020 Y Combinator cohort, is not your typical YC startup. In fact company co-founder Rami Essaid has already built Distil, a security startup, and saw it through to exit when he sold the company to Imperva last year.

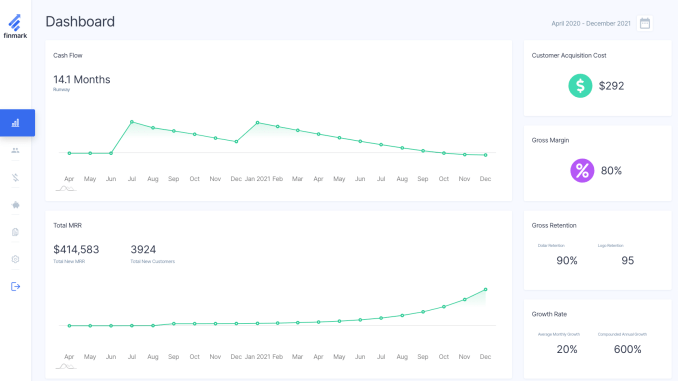

As he pondered what to do next, he took a quick turn at InsightFinder before turning his attention to a problem every startup founder faces: modeling what your financial future could look like. “Finmark is financial modeling for startups. We want to help founders understand their runway, their cash flow, their hiring plans and be able to do it in an easy way,” Essaid told TechCrunch.

It’s a problem he saw firsthand when he was co-founder at Distil. Like most startups, these projections were kind of a crapshoot in Excel. He wants to make it more precise and easy to get the big picture of your company’s finances before you can afford more sophisticated financial tracking software.

“One of the biggest pain points was always understanding where our projections were relative to what we were actually doing as a company. So many times we were running our entire business off of Excel, and so many times the forecasts of what we thought we were going to do were wrong,” he said.

He says it’s tough enough, even after you hire your first CFO and have professional rigor applied to your projections. As he sees it, the problem is you’re always looking back and always playing catchup. What’s more, because it’s done manually in Excel, he says that it introduces a lot of room for error.

Image Credits: Finmark

He admits this isn’t exactly a new idea. Companies like Anaplan and Adaptive Insights have been able to move modeling like this beyond Excel, but up until now he says that these tools have been designed for large enterprises, and he wanted to come up with a tool within reach of anyone, regardless of their size.

If you think it’s too limited a market, Essaid doesn’t agree. He sees a need and he thinks he can turn early-stage startups into paying customers, who eventually will pay significant money to have a tool like this to help them manage all of their finances in a professional manner. One way to build his customer base could be to partner with early-stage venture capitalists, whose portfolio companies could benefit from a service like this, an avenue he intends to pursue.

So why does an experienced entrepreneur join Y Combinator? Essaid candidly says that he saw the program as a good way to market the product. YC companies are his prime target audience. “Even as a repeat founder with some gray hair, I thought access to the network alone was worth the equity of YC,” he said.

But beyond the practical aspects, he says he still has plenty to learn. “Even with all of the lessons that I have learned, you don’t know everything, and they see a lot more companies than the ones that I’ve had a chance to operate, so I still find nuggets of wisdom in going through the program,” he said.

While Essaid has a company under his belt, which dedicated hundreds of thousands of dollars to scholarships for women in STEM, he admits that it’s hard to build a diverse organization and it’s something he’s still working on. He co-founded the company with two ex-Distil engineers, and he says there is a natural inclination to go back to the people he worked with before at Distil as he adds early employees, but he recognizes that he will not necessarily grow a diverse group of employees that way.

“I don’t have an answer to solving it yet. [ … ] We’ve been hiring from ex-Distilers but once we look outside of that, I think it’s really important to set up things in a way where you can look [ … ] at resumes with an unbiased lens,” he said.

For now, with 15 employees on the payroll, he’s just trying to build the company. He hinted that he is working on obtaining funding, but didn’t have anything definitive to say just yet.

Powered by WPeMatico

After yesterday’s look into the somewhat lackluster pace of investment into e-commerce-focused startups this year, a few VCs sent in notes that added useful context. So this morning let’s discuss why the pace of e-commerce startup fundraising has been so milquetoast in 2020.

The Exchange explores startups, markets and money. You can read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

To frame the oddity of e-commerce startups not raising a flood of cash during what are historic boom times, we noted Walmart’s staggering online sales growth in Q2, which TechCrunch’s Sarah Perez broke out into a separate piece. Today, for a soupçon more, Target reported its Q2 earnings. Its results are similar to Walmart’s own, if even more extreme.

The American retailer reported that its “store comparable” sales were up 10.9% in the quarter, which was rather good. But Target also reported that its “digital comparable sales grew 195%,” which is staggering. Target’s revenue mix moved from 7.3% digital in its year-ago quarter to 17.2% in its most recent.

The American retailer reported that its “store comparable” sales were up 10.9% in the quarter, which was rather good. But Target also reported that its “digital comparable sales grew 195%,” which is staggering. Target’s revenue mix moved from 7.3% digital in its year-ago quarter to 17.2% in its most recent.

Damn.

If you’ve been around the internet lately, you can’t help but trip over more data detailing this extraordinary moment in e-commerce history — there are years of change happening in just a quarter’s time. For a taste, former Andreessen denizen Benedict Evans has some great data on U.S. and U.K. e-commerce growth, and here’s yet another great chart to chew on. It goes on and on.

So the e-commerce boom is real, and the startup funding funk is as well, per the data we ingested yesterday via CB Insights. What gives? GGV’s Jeff Richards had an idea, and we chatted with Canaan’s Byron Ling as well. We’ve also done a little digging into some of the largest, recent e-commerce rounds to get some flavor on who is raising in the space. Ready?

If you recall, our thesis yesterday was that, perhaps, the kill zone theory often posited concerning Amazon meant that the e-commerce space is less investable than we’d otherwise imagine and that because some things are “sorted” to a degree, there is less green space available in the sector for startups to tackle.

Bits of that might be right.

Powered by WPeMatico

The United States is currently in the middle of an affordable housing crisis that’s putting the nation’s most economically insecure citizens at risk of becoming homeless even as a pandemic continues to spread across the country.

But one Atlanta startup called PadSplit is using the same model that Airbnb created (which ultimately drove up rental and housing prices across the country) to bring down costs for subsidized housing and provide relief for some of the people most at risk.

America’s second housing crisis

Twelve years after the last housing crisis in the United States caused a global economic meltdown, the U.S. is once again on the brink of another real estate-related economic disaster.

This time, it’s not speculators and investors that will carry the weight of the coming collapse, but low-income renters faced with still sky-high housing costs and no income thanks to historic unemployment caused by the nation’s COVID-19 epidemic, as Vox reported.

Before COVID-19 swept across the world, half of U.S. renters were spending roughly 30% of their income on apartments and homes. One-fifth of the population actually spent over half of their income on rent, and now, with roughly 10% of the country unemployed, that population faces eviction and the prospect of homelessness.

One-third of American families failed to make rent in June, and by September more than 20 million renters could be evicted by landlords.

Can an Airbnb model provide relief?

To solve the problem of housing insecurity, PadSplit borrows a page from the Airbnb playbook by creating a marketplace where homeowners can list rooms for rent for long-term stays.

Currently, the company manages 1,000 units in the Atlanta area and has expanded its presence into Maryland. The company’s renters include teachers, grocery store employees, restaurant workers — all people whose services are considered essential during the COVID-19 epidemic. “Forty percent of our population has been functionally homeless,” said company founder, Atticus LeBlanc. “The average income [for our renters] is $25,000 per year.”

The average age of an occupant in a PadSplit room is 39, but renters have been as young as 19 or as old as 77, according to the company.

A quick scan of PadSplit rates in the Atlanta area shows rents of roughly $140 to $250 per week for rooms in existing homes. “We are focused on longer-term stays for lower income,” said LeBlanc.

The company screens tenants and landlords, including criminal background checks and employment verification. “We sit between a hotel provider and a longer-term apartment,” said Leblanc. “Where we need to both be an immediate housing provider for people who are in difficult situations while also underwriting that [person].” Owners looking to rent on PadSplit also need to prove that they haven’t been convicted of a felony within the last seven years.

Image Credits: luismmolina (opens in a new window) / Getty Images

Launching PadSplit

LeBlanc, a New Orleans native turned Atlanta entrepreneur was named for Atticus Finch, the fictional lawyer whose fight for social justice in “To Kill a Mockingbird” is a staple of schoolroom lit assignments, and a model for white liberal southern gentry.

“My mother… said she wanted to give me someone to live up to,” says LeBlanc.

With a degree in architecture from Yale University, LeBlanc has run a real estate development and construction business in Atlanta for over 12 years. He launched PadSplit in 2017 after writing up the idea for the business in response to a competition from the Atlanta housing nonprofit House ATL and the nonprofit Enterprise Community Partners.

LeBlanc’s plan was selected as one of the finalists and he received a small grant from the organization and the JPMorgan Chase foundation to pursue the business.

With the help of John O’Bryan, a serial entrepreneur who had built businesses in the vacation rental industry, LeBlanc built up the marketplace that would become PadSplit, starting first in Atlanta and moving out to surrounding suburbs and into Maryland. LeBlanc later brought in Frank Furman, a Naval Academy graduate, U.S. Marine Corps veteran and former McKinsey consultant, to help grow the business.

Now the company, a Techstars accelerator graduate, has $10 million in new financing from Core Innovation Capital, Alate Partners, the Citi Impact Fund, Kapor Capital, Impact Engine and Cox Enterprises to expand PadSplit into Texas, starting with Houston, and quickly ramp up hiring.

“PadSplit provides a truly unique solution to a complicated national problem that’s becoming more dire each day,” said Arjan Schütte, founder and managing partner of Core Innovation Capital, in a statement. “We’re proud to support Atticus and the PadSplit team as they expand into new markets and introduce critical housing supply at a time when so many require affordable housing.”

Making money in affordable housing

According to LeBlanc, affordable housing is built around two things. One is the subsidy owners receive from the federal government and the second is a percentage of the cost of rentals. To convince owners that being in the affordable housing market was a good idea, LeBlanc just proved to them that they could get higher risk-adjusted returns versus other long-term rentals.

So far, that’s been proven out, he says. Through its model of fixed costs and weekly rent payments, PadSplit occupants have been able to save roughly $516 per month, according to data supplied by the company. Lowering rent has also allowed tenants to build credit, move into their own apartments and buy vehicles — or even, in some cases, houses of their own.

The company estimates it has also saved taxpayers over $203 million in subsidies by eliminating the need to build subsidized housing units. Property owners have also benefited, the company said, increasing revenues on properties by more than 60%.

And LeBlanc isn’t just the founder of PadSplit, he’s also a customer. “I rent a room downstairs in my personal home,” he said.

Ultimately, LeBlanc sees housing stability and a path to home ownership as one of the key tenets of economic equality in the United States.

“Every zoning law in America was based on a system that had no racial equity. We’re still battling those vestiges that exist in almost every jurisdiction,” he says.

And for LeBlanc the problem goes back to nearly 100 years. “If you acknowledge that racial inequality led to income stratification where it was impossible for returning Black GIs to get access to the same wealth-building opportunities that white returning GIs had… it’s no surprise that you have lower incomes by a substantial margin for African Americans as you do for whites.”

LeBlanc sees his business providing an additional revenue stream for the owners who rent properties, and an on-ramp to the financial system for people who are at risk or historically disenfranchised.

“We wanted to create a value proposition that is valuable to anyone in the housing space,” said LeBlanc.

Powered by WPeMatico

Taiwanese startup iKala, which offers an artificial intelligence-based customer acquisition and engagement platform, will expand into new Southeast Asian markets after raising a $17 million Series B. The round was led by Wistron Digital Technology Holding Company, the investment arm of the electronics manufacturer, with participation from returning investors Hotung Investment Holdings Limited and Pacific Venture Partners. It brings iKala’s total raised so far to $30.3 million.

The new funding will be used to launch in Indonesia and Malaysia, and expand in markets where iKala already operates, including Singapore, Thailand, Hong Kong, the Philippines, Vietnam and Japan. Wistron Digital Technology Holding Company, which also offers big data analytics, will serve as a strategic investor, and this also marks the Taiwanese firm’s entry into Southeast Asia.

IKala’s products are targeted toward e-commerce companies, and include KOL Radar, for influencer marketing, and Shoplus, a social commerce service focused on Southeast Asian markets.

In a statement about the funding, iKala board member Lee-feng Chien, former managing director at Google Taiwan, said, “Taiwan has an excellent reputation for having some of the best high-tech talents in both hardware and software around the region. With Wistron as a strategic partner, iKala can become a major driving force for transforming Taiwan into an AI industry and talent hub in Asia.”

While Taiwan’s technology industry is best-known for hardware, especially semiconductor manufacturers like Foxconn and TSMC, a new crop of startups are helping the country establish a reputation for AI prowess.

In addition to iKala, these include Appier, which also provides a customer analytics, and enterprise translation platform WritePath. Big American tech companies, including Amazon, Google and Microsoft, have also set up AI-focused research and development centers in Taiwan, drawing on the country’s engineering talent and government programs.

Powered by WPeMatico

Bengaluru-based Pixxel is getting ready to launch its first Earth imaging satellite later this year, with a scheduled mission aboard a Soyuz rocket. The roughly one-and-a-half-year-old company is moving quickly, and today it’s announcing a $5 million seed funding round to help it accelerate even more. The funding is led by Blume Ventures, Lightspeed India Partners, and growX ventures, while a number of angel investors participated.

This isn’t Pixxel’s first outside funding: It raised $700,000 in pre-seed money from Techstars and others last year. But this is significantly more capital to invest in the business, and the startup plans to use it to grow its team, and to continue to fund the development of its Earth observation constellation.

The goal is to fully deploy said constellation, which will be made up of 30 satellites, by 2022. Once all of the company’s small satellites are on orbit, the Pixxel network will be able to provide globe-spanning imaging capabilities on a daily basis. The startup claims that its technology will be able to provide data that’s much higher quality when compared to today’s existing Earth-imaging satellites, along with analysis driven by PIxxel’s own deep learning models, which are designed to help identify and even potentially predict large problems and phenomena that can have impact on a global scale.

Pixxel’s technology also relies on very small satellites (basically the size of a beer fridge) that nonetheless provide a very high-quality image at a cadence that even large imaging satellite networks that already exist would have trouble delivering. The startup’s founders, Awais Ahmed and Kshitij Khandelwal, created the company while still in the process of finishing up the last year of their undergraduate studies. The founding team took part in Techstars’ Starburst Space Accelerator last year in LA.

Powered by WPeMatico

In Indonesia, about half of adults are “underbanked,” meaning they don’t have access to bank accounts, credit cards and other traditional financial services. A growing list of tech companies are working on solutions, from Payfazz, which operates a network of financial agents in small towns, to digital payment services from GoJek and Grab. As a result, financial inclusion is increasing for consumers and small businesses in Southeast Asia’s largest country, but one group remains underserved: schools.

InfraDigital was founded in 2018 by chief executive officer Ian McKenna and chief operating officer Indah Maryani. Both have backgrounds in financial tech, and their platform enables parents to pay school tuition with the same digital services they use for electricity bills or online shopping. The startup currently serves about 400 schools and recently raised a Series A led by AppWorks.

Many Indonesian schools still rely on cash payments, which are often delivered by kids to their teachers.

“My kid had just started school, and one day I spotted my wife giving him an envelope full of cash for tuition. He was only three years old,” McKenna said. “That triggered my curiosity about how these financial systems work.”

To give parents an easier alternative, InfraDigital, which is registered with Indonesia’s central bank, partners with banks, convenience store chains like Indomaret, online wallets and digital payment services like GoPay to allow them to send tuition money online.

“The way you pay your electricity bill, it’s likely that your school is already there, regardless of whether you have a bank account or live in a really remote place” where many people make cash payments for services at convenience stores, McKenna said. The startup is now working on a system for schools in areas that don’t have access to convenience store chains and banks.

Before building InfraDigital’s network, McKenna and Maryani had to understand why many schools still rely on cash payments and paper ledgers to manage tuition.

“Banks have been trying to tap into the education market for a long time, 12 to 15 years probably, but no one has become the biggest bank for schools,” said Maryani. “The reason behind that is because they come in with their own products and they don’t try to resolve the issues schools are facing. Since they are focused on the consumer side, they don’t really see schools or other offline businesses as their customers, and there is a lot of customization that they need to do.”

For example, a school might have 2,000 students and charge each of them about USD $10 a month in school fees. But they also collect separate payments for books, uniforms, and building fees. InfraDigital’s founders say schools typically send out an average of about 2.5 invoices a month.

Digitizing payments also makes it easier for schools to track their finances. InfraDigital provides its clients with a backend application for accounting and enrollment management. It automatically tracks tuition payments as they come in.

“People don’t get paid that much and they are ridiculously busy taking care of thousands of kids. It’s really, really tough,” McKenna said. “When you’re giving them a solution, it’s not about features, it’s not about tools, it’s about the practicalities of their day-to-day life and how we are going to assist them with it. So you remove that burden from them.”

During the COVID-19 pandemic, which resulted in movement restriction orders in different areas of Indonesia, InfraDigital’s founders say the platform was able to forecast trends even before schools officially closed. They started surveying schools in their client base, and sent back data to help them forecast how school closures would affect their income.

“From the school’s perspective, it’s a really damaging situation, with 30% to 60% income drops. Teachers don’t get paid. If the economy goes down, parents at lower-income schools, which are a big part of our client base, won’t be able to pay,” McKenna said. “It’s built into the model, and we’ll continue seeing that however long the economic impact of COVID-19 lasts.”

Powered by WPeMatico

In recent years, China’s online shopping titans have been muscling into the prescription drug market. When JD.com, Alibaba’s archrival, realized the health market spans well beyond retail, it spun out its healthcare unit into a subsidiary last May for a potential initial public offering. That startup, JD Health, gained a staggering valuation of $7 billion fresh off its $1 billion Series A round in November.

In less than a year, another massive check is on its way as JD Health announced it has entered into a definitive agreement with private equity firm Hillhouse Capital, which plans to shell out over $830 million for the infant company’s Series B financing.

The deal with Hillhouse, an early backer in JD.com and an aggressive pursuer of opportunities in healthcare, is expected to occur in Q3 this year. JD.com will remain the majority shareholder upon the transaction.

JD Health is now a multifunctional health platform, providing everything from 30-minute pharmacy delivery, telemedicine service that saw surging usage during the COVID-19 pandemic, consumer-related health services such as genetic testing through to solutions to digitize hospital systems. The business “achieved profitability” last year, its chief executive Xin Lijun claimed.

The health unit is yet another effort from JD.com, the closest Amazon equivalent in China for its control over the supply chain, to branch out of online retail. JD.com also oversees an independent fintech subsidiary and a separate logistics business, both of which have plans to go public.

Alibaba has made a similar move into the healthcare sector with its part-owned Alibaba Health, a Hong Kong-listed firm with a current market cap of about $34 billion.

The company’s earnings report sheds some light on the breadth of its reach: annual active consumers of its online drugstore exceeded 190 million as of May, with recent growth sparked by the pandemic.

It’s unclear how many users JD Health has amassed for its online pharmacy, the “main business” of the company according to its CEO, but it has disclosed stats on other segments. Since the COVID-19 outbreak, more than 1.7 million patients have used its diagnosis service, which now sees over 100,000 inquiries every day. JD Health’s latest pledge, announced this week, is to construct an online family doctor service to target as many as 50 million Chinese families.

Powered by WPeMatico

Dutchie, a nearly three-year-old, Bend, Oregon-based software company focused on connecting consumers with cannabis dispensaries that pay it a monthly subscription fee to create and maintain their websites, process their orders and track what needs to be ready for pickup, has raised $35 million in Series B funding. The capital came both new investors Thrive Capital and Starbucks founder Howard Schultz, along with earlier backers, including Kevin Durant’s Thirty Five Ventures and the cannabis-focused fund Casa Verde Capital.

The money comes hot on the heels of Dutchie’s first major round of funding — $15 million that it closed last September — and suggests that the cannabis industry has fared better during the COVID-19 pandemic than people outside the industry might imagine.

We had a fast chat yesterday with the company’s co-founder and CEO, Ross Lipson, about the year that Dutchie is having.

TC: I’d seen recently that Dutchie has added contactless payments.

RL: Yes, when the pandemic hit, virtually all of our dispensaries shifted to a curbside pickup model. We built a solution that allows customers to select curbside at checkout, and also includes a way to notify the dispensary when they arrive and provides them information on how to locate their vehicle.

TC: A year ago, there were more than 30 states where cannabis was either medically legal or that had legalized the recreational use of marijuana. How has that changed?

RL: We now work with over 1,300 dispensaries in 32 markets. By comparison, a year ago we were only operating in 9 markets. Nationwide, 47 out of 50 states now allow some form of legal cannabis, and 2020 could bring full legalization in major markets such as New Jersey and Arizona.

TC. Can you put that into context? How many dispensaries are there in the U.S.?

RL: Dutchie processes 10% of all legal cannabis sales worldwide and powers over 25% of dispensaries. That’s more than 75,000 orders a day.

TC: You had 36 employees the last time we talked. What’s that number now?

RL: We currently have 102 employees and we aim to double our team by the end of 2021.

TC: Aside from helping dispensaries shift to a curbside model, how has the pandemic impacted your business?

RL: Virtually all states deemed cannabis dispensaries as essential businesses [once COVID took hold]. Many still had to comply with state laws and close their physical stores, though, leaving only one option for sales — online ordering. We saw dispensaries shift from about 30% of overall sales coming from Dutchie to upwards of 100%, and our business grew 600% in roughly one month.

Overall, we’ve seen a 700% surge in sales volume during the pandemic. We had to scale quickly to deal with six times the load on our technology.

TC: Think those numbers will shift around as some parts of the country open up?

RL: Dispensaries are poised to keep online ordering and e-commerce options available because it is part of what their customers now expect.

Pictured, left to right, above: Ross and Zach Lipson (Zach, Ross’s brother, is the company’s co-founder and chief product officer).

Powered by WPeMatico

The food blogging community in China is booming, and many creators have been cashing in big time by touting food products to loyal followers, a business model that has lured investors.

This week, Hong Kong-based startup DayDayCook announced that it has raised $20 million to expand its multifunctional food platform, whose users mainly come from mainland China. The company, founded by banker-turned food blogger and entrepreneur Norma Chu, offers a bit of everything: an app featuring recipes and food videos, cooking classes in upscale malls and a product line of its own branded food products sold online, which makes up 80% of its revenues.

London-based Talis Capital led the funding round, with participation from Hong Kong’s Ironfire Ventures. The eight-year-old startup has raised a total of $65 million to date from investors, including Alibaba Entrepreneurs Fund, the e-commerce giant’s not-for-profit effort to support young entrepreneurs in Hong Kong and Taiwan.

The selling point of DayDayCook products is their carefully crafted brand stories. Users first consume the content put out by the startup across social channels, and then they become customers of DayDayCook’s ready to eat or cook food packs, kitchenware and more.

“We really believe in the content-to-commerce model,” said Matus Maar, managing partner at Talis Capital .

He went on to explain that as content creation becomes easier thanks to an abundance of mobile editing tools, “even one person in rural China can make amazing content that creates a huge following.” He was referring to China’s reclusive influencer Li Ziqi who rose to stardom by posting videos on YouTube and domestic sites about her rural self-sufficiency.

“That goes hand in hand with people not wanting to see content that is super polished or comes out of mega agencies. People on the internet want to see authenticity. They want to see people doing real things,” suggested the investor.

While there is a legion of food influencers out there, not all are equipped to build a money-making venture. Matus believes DayDayCook has all the pieces in place: suppliers, distribution, logistics and shipment. By developing its private label products, the startup is also able to sell at higher margins.

Chu said her company has amassed 2.3 million registered users on its own app. Its paid users, ordering through e-commerce channels like JD.com and Alibaba’s Tmall, grew 12 times year-over-year to 2.2 million.

DayDayCook’s content has a wider reach, garnering 60 million followers across microblogging platform Weibo, TikTok’s Chinese edition Douyin, Tencent’s video site and more. That may not seem like a lot in the influencer era — Li Ziqi herself has nearly 12 million subscribers just on YouTube.

Powered by WPeMatico

Kentaro Kawamori and Jason Offerman, the co-founders of new startup Persefoni, which aims to make carbon reporting easier for large corporations, know a few things about carbon emissions.

The two men met at Chesapeake Energy Corp., an Oklahoma City-based energy company focused on oil and gas extraction that ranks as one of the biggest polluters in the world.

Kawamori, whose colorful career includes no more than two-year stints at companies including Accenture, Insight, SoftwareONE and Major League Gaming before ascending to the chief digital officer role at Chesapeake Energy, met Offerman at the energy company just as the company was helping the U.S. assume a dominant position in the oil and gas energy world.

Offerman, a longtime employee of the energy company, had spent 30 years in operations and enterprise resource planning before finding himself working under Kawamori. Together, the two men left to pursue entrepreneurial opportunities and linked up with a family office called Rice Investment Group, in late 2019.

Their timing proved to be fortuitous, as Chesapeake Energy was forced to declare bankruptcy less than a year later. But even as Chesapeake was hitting hard times, Offerman and Kawamori were ramping up their work on Persofoni, which was officially incorporated in January.

The company provides businesses with the equivalent of enterprise resource planning software to set up the scope of their carbon reporting based on established guidelines and provide a window into a company’s emissions profile.

While many companies have tried to pitch similar products in the past, they were working to overcome institutional inertia that had many companies convinced they could ignore their environmental impact. In the current business climate, that attitude is no longer acceptable to some of the major investors that companies rely on for liquidity in stock markets.

“Institutional investors are getting aggressive on requiring companies to disclose their sustainability metrics,” said Kawamori, who serves as Persefoni’s chief executive.

It’s not only institutional investors that are getting more stringent with their reporting requirements around sustainability. Kawamori expects that the European Union will pass tough regulations similar to the privacy requirements under GDPR to mandate clear reporting around emissions.

Investors backing the company include the Rice Investment Group, which led the round, with participation from Carnrite Ventures and some undisclosed angel investors. Daniel Rice, a co-founder and partner at Rice Investment Group, and a former oil and gas executive at Rice Energy, has joined the company’s board of directors.

While Persefoni uses standardized reporting metrics, the company’s software only enables reporting based on the criteria that companies establish for their metrics. These self-reporting mechanisms could obscure more than they reveal if company’s aren’t transparent about how they decide to measure their emissions profiles and what data they’re actually including in those measurements.

“Ultimately, Persefoni wants to make measuring and tracking every organization’s carbon footprint as ubiquitous as managing their financial performance,” Kawamori said in a statement. “Financial ERP systems did that for financial data decades ago and the same need to manage carbon inventories and transactions has emerged for organizations.”

Powered by WPeMatico