Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Without good data, it’s impossible to build an accurate predictive machine learning model. Explorium, a company that has been building a solution over the last several years to help data pros find the best data for a given model, announced a $75 million Series C today — just 10 months after announcing a $31 million Series B.

Insight Partners led today’s investment with participation from existing investors Zeev Ventures, Emerge, F2 Venture Capital, 01 Advisors and Dynamic Loop Capital. The company reports it has now raised a total of $127 million. George Mathew, managing partner at Insight, and former president and COO at Alteryx, will be joining the board, giving the company someone with solid operator experience to help guide them into the next phase.

Company co-founder and CEO Maor Shlomo, says that in spite of how horrible COVID has been from a human perspective, it has been a business accelerator for his company and he saw revenue quadruple last year (although he didn’t share specific numbers beyond that). “It’s related to the nature of our business. We’re helping enterprises and data practitioners find new data sources that can help them solve business challenges,” Sholmo explained.

He says that during the pandemic, a lot of companies had to find new data sources because the old data wasn’t especially helpful for predictive models. That meant that customers required new sources to give them visibility into the shifts and movements in the market to help them adjust and make decisions during pandemic. “And given that’s basically what our platform does in its essence, we’ve seen a lot of growth [over the past year],” he says.

With the revenue growth the company has been experiencing, it has been adding employees at rapid clip. When we spoke to Explorium last July, the company had 87 people. Today that number has grown to 130 with plans to get to 200 perhaps by the end of 2021 or early 2022, depending on how the business continues to grow.

The company has offices in Tel Aviv and San Mateo, California with plans to open a new office in New York City whenever it’s possible to do so. While Shlomo wants a flexible workplace, he’s not going fully remote with plans to allow people to work two days from home and three in the office as local rules allow.

Powered by WPeMatico

In the absence of a real baseball league, it is perhaps not surprising that a simulated one should grow popular during the troubled year 2020. But even so, the absurdist horror and minimalist aesthetic of Blaseball seem an unlikely success. The text-based fantasy fantasy league has attracted hundreds of thousands of players and now $3 million in funding to build up the game and go mobile.

If you’re unfamiliar with Blaseball, feel free to go check it out now and sign up — it’s free. You’ll probably get a better idea of what the game is from 30 seconds of browsing than the next couple paragraphs.

For those of you who’d rather read, however, Blaseball is a web-based fictional baseball-esque league where players can bet in-game currency on the outcomes. But this is where things get weird. The teams aren’t the Mariners or the Mets but the Moist Talkers and the Worms; players have names like Chorby Soul and Peanutiel Duffy; their stats include things like allergies, pregame rituals and an inventory of RPG-like items.

Likewise, games — told through simple text summaries of the action like you might see in the corner of a sports site — involve hits, balls and stealing, but also incineration, shaming and secret bases. “Weather” might involve spontaneous blood transfusions between players, or birds that interfere with play.

In short, it’s totally ridiculous, utterly unpredictable and very funny. This totally unique concoction of fantasy leagues, baseball satire and cosmic horror has accrued a dedicated yet routinely puzzled fanbase over its 19-week-long seasons. And like so many hits, this one came as something of a shock to its creators.

“We’re as surprised as you are,” said Sam Rosenthal, founder and CEO of The Game Band, which developed (and is developing) the game. “Blaseball was an experimental side project for the studio — we were in the middle of a pandemic, publishers were in a spending freeze, it was a scary time. We wanted to make a game that brings people together in this really isolating time.”

The idea for it came from banter at a real baseball game, where Rosenthal and a friend speculated about a league where the rules were “different and more chaotic.” Of course the rules of real-life baseball are continually being revised, but so far there haven’t been any resurrections of players incinerated by rogue umpires, free runs for home teams or shrink rays.

While the resulting game-like product bears some resemblance to baseball, betting and fantasy leagues, it’s much too weird and random to really be considered the same thing. That’s led to some friction as players who expect a more traditional experience lose coins on a game decided by, say, a bird pecking their team’s star hitter inside an enormous peanut shell, or a guaranteed home run because the batter ate magma.

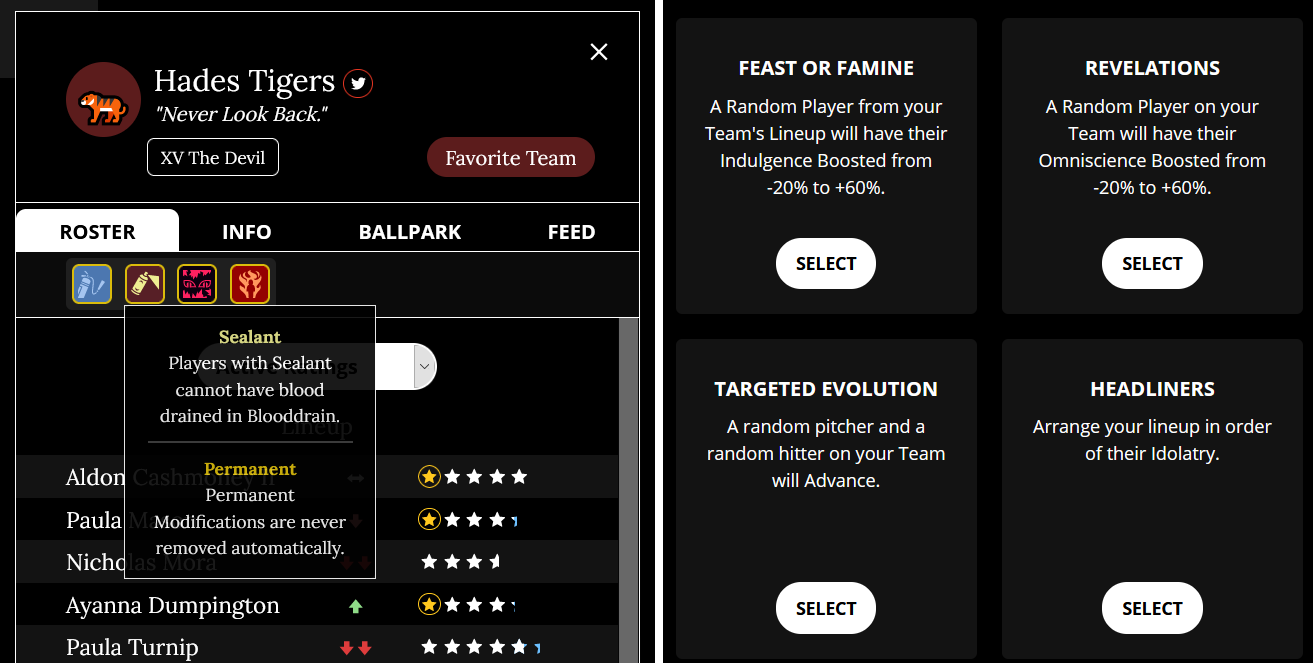

The Hades Tigers … so hot right now. The roster shows a team’s current and permanent attributes, while players can work together to create change by voting weekly. Image Credits: The Game Band

“Sometimes we have to remind the fans that this is a horror game,” Rosenthal admitted. The gameplay, as players discover in time, consists more in cooperation and guiding the league itself than in precision odds making. “This is not a game about individual success but collective success. The mechanics of the game reward organization, fans banding together with other fans of their team.”

Using those coins to buy votes to determine how the most idolized players are treated at the end of a season, for instance, could have huge repercussions on the next season. Ultimately the players are really participating in a sort of long-term alternative-reality game rather than a zany baseball sim, as the ominous announcements and events drive home now and again.

Next to the outcome of a match and the news that a player was walked to second base, you might learn that “Reality flickered in the Feedback” or see disembodied dialogue about the league or disordered cosmos.

It can be disconcerting and one may rightly wonder whether the creators have a narrative or goal in mind, or whether they’re just winging it and being weird for weirdness’s sake. I guessed the latter, but Rosenthal set me straight.

“It is going somewhere,” he assured me. “There are a lot of plans, we have a ton of lore written. We literally have a writers’ room every day, usually about 3-4 hours long. But we need to stay flexible because there’s two other creators: the simulation, since we don’t know what will happen in the games themselves, and the fans. There are things we don’t know they’ll latch onto, emergent narratives like the reincarnation of Jaylen Hotdogs. We’re always learning, and we give ourselves a lot of room to backtrack or change things quickly if needed.”

What was never clear even to the developers, however, was whether the game would live long enough to see those plans come to fruition. Blaseball, being a side project built during strange days, was never envisioned as a big money maker. For a small game developer to have a runaway success on their hands but little ability to monetize that success, the stresses of continuing development and support can overtake the benefits of popularity.

“Since we didn’t really set it up from the get-go to be profitable, we were just sort of slowly losing money,” said Rosenthal. “Fortunately our community has been really supportive through Patreon and sponsorships. But ultimately we wanted to make the game better and sustainable, and we wanted to pay our team what they deserve.”

The $3 million seed round keeps the lights on, to begin with, but also lets The Game Band staff up, so the writers don’t have to break up a meeting early because one of them is doubling as product support and the site is breaking. More importantly, however, the team plans to make a native mobile app. More than half of Blaseball‘s players (that is, the real ones, not Baby Triumphant and Wyatt Mason IV) are on mobile and Rosenthal admitted the mobile experience is “not great.”

The company comes from a mobile development background, he noted, so they know what they’re doing, but saw the web as the easiest platform to deploy on during the pandemic. Now they want to get mobile up and running, since the live, constantly shifting nature of the game fits well with the kind of updates sports and fantasy aficionados tend to sign up for. Who wouldn’t want to know right away that their favorite team has entered Party Time, or that their idolized player found a new piece of armor, or that a new non-physical law has been ratified?

Rosenthal said they resisted seeking funding to begin with due to a desire for independence, but was enthused about their choice of investor, Makers Fund, saying they actually understand Blaseball and have been partners rather than parents when it comes to moving the operation toward making money.

“They know we can’t just copy monetization from another game and put it in Blaseball, that would ruin the experience right away. They have an amazing network of people in the games industry, and at the end of the day they’re not prescriptive,” he said.

(They also gamely did not object to a line in the press release by the fictional Commissioner asserting that “Blaseball has acquired Makers Fund,” which says a lot.)

“We’re very cognizant that there are ways that free games can monetize that are detrimental to the community,” he continued. “So it will always be free to play and it will never be pay to win. Like, the Crabs are never going to run away with it because they’re the richest team. When we think about monetization we think about how it can benefit the community as a whole, not individuals.”

In the meantime the league slouches on, morphing from week to week in a live dialogue between players and developers. Don’t expect it go get any less weird, because the creators know that constant disorientation is part of the game’s charm.

Amazingly, Rosenthal even managed to suggest that Blaseball was, in the parlance of game design tropes, the Dark Souls of baseball simulators — “it [Dark Souls] gives you so little, it asks you to interpret and put a thesis together, to go linger on forums and talk with others about it. We wanted to create that kind of experience, and see how people would interpret this sort of weird, unknowable entity.”

They certainly got the weird and unknowable part right. You can try Blaseball out for yourself here.

(This story originally included the figure of $3.4 million for the round — this was an unforced error on my part and has been corrected to $3 million.)

Powered by WPeMatico

Per a recent report by Bain & Co., e-commerce is expected to grow to $28.5 billion in MENA by 2022 from a 2019 value of $8.3 billion. Egypt, one of the most active e-commerce countries in the region, is anticipated to grow 33% annually to reach $3 billion by 2022.

But for any e-commerce business to thrive, its last-mile delivery arm has to be well figured out. Bosta is one such company in Egypt helping small businesses with logistics and last-mile delivery. Today, the company is announcing it has closed a Series A investment of $6.7 million. U.S. and Middle East VC firm Silicon Badia led the round, with participation from 4DX Ventures, Plug and Play Ventures, Wealth Well VC, Khwarizmi VC, as well as other regional and global investors.

This investment comes a year after the company raised a $2.5 million round, which takes its total investment raised to $9.2 million.

Bosta was launched in 2017 by Mohamed Ezzat and Ahmed Gaber. The company offers next-day delivery to customers and handles exchange shipments, customer returns and cash collection.

The idea for Bosta came during Ezzat’s time at Lynks, his previous consumer goods startup. Lynks, the first YC-backed company from Egypt, allows people in Egypt to buy brands from the U.S., China and the U.K.

As co-founder and COO at Lynks, Ezzat was responsible for logistics, international clearance and last-mile delivery. In 2016, Egypt experienced an economic downturn coupled with the Egyptian pound devaluation and government restriction on imports. For Lynks it meant slow growth, but Ezzat was concerned about fixing the last-mile delivery bit, which, according to him, was a huge pain point.

“My nightmare was always the last mile. And at that time, you know that e-commerce is still very, very small. So it’s only 1% of the whole retail value,” he told TechCrunch. “So I was always thinking, how come if we want the e-commerce to grow, and we don’t have any strong company when it comes to last-mile because, in the end, every transaction on an e-commerce platform is a transaction on a courier platform.”

E-commerce is a fragmented sector where 80% of transactions come from small businesses selling on Facebook, Instagram and social media in general. Most of these businesses lack a strong delivery experience, and Ezzat left Lynks the following year to start Bosta.

Being in the parcel delivery industry, Bosta wants to help these companies to grow profitably. It also tries to simplify logistics and allow its customers to have full control over the delivery process.

“You can use Bosta to get anything to your doorstep. You buy in our local currency, and we buy everything, handle the shipping, customs, clearance and bring it to your doorstep,” the CEO added.

The company doesn’t own fleets of vehicles to carry out operations. Instead, it operates an Uber-like model where drivers sign up, are made contractors and make money when a delivery is completed.

Since 2017, the company has delivered more than 4 million packages to businesses, more than half since the pandemic outbreak last year. Bosta completes more than 300,000 deliveries per month, which is a 3.5x increase from when it raised its previous round, Ezzat stated. He also claims that more than 2,200 businesses use its platform daily and achieve a 95% delivery success rate.

Asides from small businesses, Bosta works with major e-commerce platforms like Souq (an Amazon company) and Jumia. Depending on the volume of goods transported, Bosta charges small businesses about 35-40 Egyptian pounds, while the big players are charged less, at 20-25 Egyptian pounds.

Speaking on the investment, Fawaz H Zu’bi said in a statement: “E-commerce has always had amazing potential in our region but was always being held back by something whether payments, logistics, market fragmentation, or customer adoption. We are excited to finally see companies like Bosta emerge to tackle some of these issues and help e-commerce realize its full promise and potential in a region that has now ‘turned on’ digitally.”

In the next two years, Bosta plans to deliver more than 15 million parcels in Egypt and serve over 20,000 businesses. The funds will be used for those causes, as well as expanding operations across Africa, MENA and the GCC.

“The investment is to dominate Egypt,” said Ezzat. “We want to make sure that we deliver the next day across Egypt, not just in Cairo, where we currently do. And to be a market leader when it comes to e-commerce on the continent and be profitable. This is the main target for us now and also to start operations in Saudi Arabia.”

Powered by WPeMatico

Amount, a company that provides technology to banks and financial institutions, has raised $99 million in a Series D funding round at a valuation of just over $1 billion.

WestCap, a growth equity firm founded by ex-Airbnb and Blackstone CFO Laurence Tosi, led the round. Hanaco Ventures, Goldman Sachs, Invus Opportunities and Barclays Principal Investments also participated.

Notably, the investment comes just over five months after Amount raised $86 million in a Series C round led by Goldman Sachs Growth at a valuation of $686 million. (The original raise was $81 million, but Barclays Principal Investments invested $5 million as part of a second close of the Series C round). And that round came just three months after the Chicago-based startup quietly raised $58 million in a Series B round in March. The latest funding brings Amount’s total capital raised to $243 million since it spun off from Avant — an online lender that has raised over $600 million in equity — in January of 2020.

So, what kind of technology does Amount provide?

In simple terms, Amount’s mission is to help financial institutions “go digital in months — not years” and thus, better compete with fintech rivals. The company formed just before the pandemic hit. But as we have all seen, demand for the type of technology Amount has developed has only increased exponentially this year and last.

CEO Adam Hughes says Amount was spun out of Avant to provide enterprise software built specifically for the banking industry. It partners with banks and financial institutions to “rapidly digitize their financial infrastructure and compete in the retail lending and buy now, pay later sectors,” Hughes told TechCrunch.

Specifically, the 400-person company has built what it describes as “battle-tested” retail banking and point-of-sale technology that it claims accelerates digital transformation for financial institutions. The goal is to give those institutions a way to offer “a secure and seamless digital customer and merchant experience” that leverages Amount’s verification and analytics capabilities.

Image Credits: Amount

HSBC, TD Bank, Regions, Banco Popular and Avant (of course) are among the 10 banks that use Amount’s technology in an effort to simplify their transition to digital financial services. Recently, Barclays US Consumer Bank became one of the first major banks to offer installment point-of-sale options, giving merchants the ability to “white label” POS payments under their own brand (using Amount’s technology).

“The pandemic dramatically accelerated banks’ interest in further digitizing the retail lending experience and offering additional buy now, pay later financing options with the rise of e-commerce,” Hughes, former president and COO at Avant, told TechCrunch. “Banks are facing significant disruption risk from fintech competitors, so an Amount partnership can deliver a world-class digital experience with significant go-to-market advantages.”

Also, he points out, consumers’ digital expectations have changed as a result of the forced digital adoption during the pandemic, with bank branches and stores closing and more banking done and more goods and services being purchased online.

Amount delivers retail banking experiences via a variety of channels and a point-of-sale financing product suite, as well as features such as fraud prevention, verification, decisioning engines and account management.

Overall, Amount clients include financial institutions collectively managing nearly $2 trillion in U.S. assets and servicing more than 50 million U.S. customers, according to the company.

Hughes declined to provide any details regarding the company’s financials, saying only that Amount “performed well” as a standalone company in 2020 and that the company is expecting “significant” year-over-year revenue growth in 2021.

Amount plans to use its new capital to further accelerate R&D by investing in its technology and products. It also will be eyeing some acquisitions.

“We see a lot of interesting technology we could layer onto our platform to unlock new asset classes, and acquisition opportunities that would allow us to bring additional features to our platform,” Hughes told TechCrunch.

Avant itself made its first acquisition earlier this year when it picked up Zero Financial, news that TechCrunch covered here.

Kevin Marcus, partner at WestCap, said his firm invested in Amount based on the belief that banks and other financial institutions have “a point-in-time opportunity to democratize access to traditional financial products by accelerating modernization efforts.”

“Amount is the market leader in powering that change,” he said. “Through its best-in-class products, Amount enables financial institutions to enhance and elevate the banking experience for their end customers and maintain a key competitive advantage in the marketplace.”

Powered by WPeMatico

French startup Ankorstore has raised a $102 million Series B funding round (€84 million). Tiger Global and Bain Capital Ventures are leading today’s funding round with existing investors Index Ventures, GFC, Alven and Aglaé also participating. This is a significant funding round, as it comes just a few months after the company raised €25 million.

If you’re not familiar with Ankorstore, the company is building a wholesale marketplace for independent shop owners. You may have noticed some highly Instagrammable shops with a selection of random items, such as household supplies, maple syrup, candles, headbands, bath salts and stationery items.

Essentially, Ankorstore helps you source those items for shop owners. It lets you buy a ton of cutesy stuff and act as a curator for your customers. Even if you’re already working with brands directly, the startup offers some advantageous terms. In addition to buying from several brands at once, Ankorstore withdraws the money from your bank account 60 days after placing an order.

On the other side of the marketplace, brands get paid upon delivery. Even if you’re just getting started, the minimum first order is €100 per brand.

And metrics have been going up and to the right. There are now 5,000 brands on Ankorstore, and 50,000 shops are buying stuff through the platform. And the best is likely ahead, as stores begin to re-open across Europe and tourism picks up again.

Ankorstore is now live across 14 different markets. The majority of the company’s revenue comes from international markets — not its home market France. The company’s co-founder Nicolas Cohen mentions the U.K., Germany, the Netherlands and Sweden as growth markets.

The total addressable market is huge, as the company has identified 800,000 independent shops across Europe that could potentially work with Ankorstore. And the success of other wholesale marketplaces, such as Faire, proves that this relatively new market is still largely untapped.

Powered by WPeMatico

Every branch of science is increasingly reliant on big data sets and analysis, which means a growing confusion of formats and platforms — more than inconvenient, this can hinder the process of peer review and replication of research. Code Ocean hopes to make it easier for scientists to collaborate by making a flexible, shareable format and platform for any and all data sets and methods, and it has raised a total of $21 million to build it out.

Certainly there’s an air of “Too many options? Try this one!” to this (and here’s the requisite relevant XKCD). But Code Ocean isn’t creating a competitor to successful tools like Jupyter or GitLab or Docker — it’s more of a small-scale container platform that lets you wrap up all the necessary components of your data and analysis in an easily shared format, whatever platform they live on natively.

The trouble appears when you need to share what you’re doing with another researcher, whether they’re on the bench next to you or at a university across the country. It’s important for replication purposes that data analysis — just like any other scientific technique — be done exactly the same way. But there’s no guarantee that your colleague will use the same structures, formats, notation, labels and so on.

That doesn’t mean it’s impossible to share your work, but it does add a lot of extra steps as would-be replicators or iterators check and double check that all the methods are the same, that the same versions of the same tools are being used in the same order, with the same settings, and so on. A tiny inconsistency can have major repercussions down the road.

Turns out this problem is similar in a way to how many cloud services are spun up. Software deployments can be as finicky as scientific experiments, and one solution to this is containers, which like tiny virtual machines include everything needed to accomplish a computing task, in a portable format compatible with many different setups. The idea is a natural one to transfer to the research world, where you can tie up all in one tidy package the data, the software used and the specific techniques and processes used to reach a given result. That, at least, is the pitch Code Ocean offers for its platform and “Compute Capsules.”

Say you’re a microbiologist looking at the effectiveness of a promising compound on certain muscle cells. You’re working in R, writing in RStudio on an Ubuntu machine, and your data are such and such collected during an in vitro observation. While you would naturally declare all this when you publish, there’s no guarantee anyone has an Ubuntu laptop with a working RStudio setup around, so even if you provide all the code, it might be for nothing.

If, however, you put it on Code Ocean, like this, it makes all the relevant code available, and capable of being inspected and run unmodified with a click, or being fiddled with if a colleague is wondering about a certain piece. It works through a single link and web app, cross platform, and can even be embedded on a webpage like a document or video. (I’m going to try to do that below, but our backend is a little finicky. The capsule itself is here.)

More than that, though, the Compute Capsule can be repurposed by others with new data and modifications. Maybe the technique you put online is a general purpose RNA sequence analysis tool that works as long as you feed it properly formatted data, and that’s something others would have had to code from scratch in order to take advantage of some platforms.

Well, they can just clone your capsule, run it with their own data and get their own results in addition to verifying your own. This can be done via the Code Ocean website or just by downloading a zip file of the whole thing and getting it running on their own computer, if they happen to have a compatible setup. A few more example capsules can be found here.

This sort of cross-pollination of research techniques is as old as science, but modern data-heavy experimentation often ends up siloed because it can’t easily be shared and verified even though the code is technically available. That means other researchers move on, build their own thing and further reinforce the silo system.

Right now there are about 2,000 public compute capsules on Code Ocean, most of which are associated with a published paper. Most have also been used by others, either to replicate or try something new, and some, like ultra-specific open source code libraries, have been used by thousands.

Naturally there are security concerns when working with proprietary or medically sensitive data, and the enterprise product allows the whole system to run on a private cloud platform. That way it would be more of an internal tool, and at major research institutions that in itself could be quite useful.

Code Ocean hopes that by being as inclusive as possible in terms of codebases, platforms, compute services and so on will make for a more collaborative environment at the cutting edge.

Clearly that ambition is shared by others, as the the company has raised $21 million so far, $6 million of which was in previously undisclosed investments and $15 million in an A round announced today. The A round was led by Battery Ventures, with Digitalis Ventures, EBSCO and Vaal Partners participating as well as numerous others.

The money will allow the company to further develop, scale and promote its platform. With luck they’ll soon find themselves among the rarefied air often breathed by this sort of savvy SaaS — necessary, deeply integrated and profitable.

Powered by WPeMatico

Merge, a startup that helps its users build customer-facing integrations with third-party tools, today announced that it has raised a $4.5 million seed round led by NEA. Additional angel investors include former MuleSoft CEO Greg Schott, Cloudflare CEO Matthew Prince, Expanse co-founders Tim Junio and Matt Kraning, and Jumpstart CEO Ben Herman.

Launched in 2020, the core focus of Merge is to give B2B companies a unified API to access data from what is currently about 40 HR, payroll, recruiting and accounting platforms, with plans for expanding to additional areas soon. But Merge co-founders Shensi Ding and Gil Feig, who have been lifelong friends and previously worked at companies like Expanse and Jumpstart, stress that the service isn’t aiming to replace workflow tools Workato or Zapier.

“What we built is more similar to Plaid than MuleSoft or other things,” Feig said. “We built a unified API, so we’re fully embedded in a customer’s product and they build one integration with us and can automatically offer all these integrations to their customers. On top of that, we offer what we call integrations management, which is a suite of tools to automatically detect issues where the customer would have to get involved — automatically detect that stuff and handle it without ever having to involve engineering again.”

When Merge’s systems detect issues with an integration, maybe because a data schema in an API response has changed without notice (which happens with some regularity), Merge’s engineers can fix that within minutes, in part because the teams also built an internal no-code tool for building and managing these integrations.

As Ding also noted, B2B buyers today also simply expect their tools to feature integrations with the service they use. “Companies, when they purchase a vendor, they expect that vendor to have integrations with all the other vendors that they own,” she said. “They don’t want to have to purchase a vendor and then purchase a workflow product and then connect those products.”

And while Merge’s focus right now is squarely on a few verticals, the plan is to expand this to far more areas shortly, likely starting with CRM. “Salesforce has a pretty large market share, so we thought that it wasn’t going to be as interesting of a market,” Ding said. “But it turns out that their API is so complex that customers would still prefer to integrate with us instead if we simplify it for them.”

Ding and Feig tell me the company, which came out of stealth about two months ago, already has about 100 organizations on its platform, varying from seed-stage companies to publicly listed enterprises. The team credits its focus on security and reliability (and its SOC II compliance) with being able to bring on some of these larger companies despite being a seed-stage company itself.

To monetize the service, Merge offers a free tier (up to 10,000 API requests per month) and charges $0.01 per API request for additional usage. Unsurprisingly, the company also offers customized enterprise plans for its larger customers.

“The time and expense associated with building and maintaining myriad API integrations is a pain point we hear about consistently from our portfolio companies across all industries,” said NEA managing general partner Scott Sandell, who will join the company’s board. “Merge is tackling this ubiquitous problem head-on via their easy-to-use, unified API platform. Their platform has broad applicability and is a massive upgrade for any software company that needs to build, manage, and maintain multiple API integrations.”

Powered by WPeMatico

Orbital imagery is in demand, and if you think having daily images of everywhere on Earth is going to be enough in a few years, you need a lesson in ambition. Alba Orbital is here to provide it with its intention to provide Earth observation at intervals of 15 minutes rather than hours or days — and it just raised $3.4 million to get its next set of satellites into orbit.

Alba attracted our attention at Y Combinator’s latest demo day; I was impressed with the startup’s accomplishment of already having six satellites in orbit, which is more than most companies with space ambition ever get. But it’s only the start for the company, which will need hundreds more to begin to offer its planned high-frequency imagery.

The Scottish company has spent the last few years in prep and R&D, pursuing the goal, which some must have thought laughable, of creating a solar-powered Earth observation satellite that weighs in at less than one kilogram. The joke’s on the skeptics, however — Alba has launched a proof of concept and is ready to send the real thing up as well.

Little more than a flying camera with a minimum of storage, communication, power and movement, the sub-kilogram Unicorn-2 is about the size of a soda can, with paperback-size solar panel wings, and costs in the neighborhood of $10,000. It should be able to capture up to 10-meter resolution, good enough to see things like buildings, ships, crops, even planes.

“People thought we were idiots. Now they’re taking it seriously,” said Tom Walkinshaw, founder and CEO of Alba. “They can see it for what it is: a unique platform for capturing data sets.”

Indeed, although the idea of daily orbital imagery like Planet’s once seemed excessive, in some situations it’s quite clearly not enough.

“The California case is probably wildfires,” said Walkinshaw (and it always helps to have a California case). “Having an image once a day of a wildfire is a bit like having a chocolate teapot… not very useful. And natural disasters like hurricanes, flooding is a big one, transportation as well.”

Walkinshaw noted that they company was bootstrapped and profitable before taking on the task of launching dozens more satellites, something the seed round will enable.

“It gets these birds in the air, gets them finished and shipped out,” he said. “Then we just need to crank up the production rate.”

When I talked to Walkinshaw via video call, 10 or so completed satellites in their launch shells were sitting on a rack behind him in the clean room, and more are in the process of assembly. Aiding in the scaling effort is new investor James Park, founder and CEO of Fitbit — definitely someone who knows a little bit about bringing hardware to market.

Interestingly, the next batch to go to orbit (perhaps as soon as in a month or two, depending on the machinations of the launch provider) will be focusing on nighttime imagery, an area Walkinshaw suggested was undervalued. But as orbital thermal imaging startup Satellite Vu has shown, there’s immense appetite for things like energy and activity monitoring, and nighttime observation is a big part of that.

The seed round will get the next few rounds of satellites into space, and after that Alba will be working on scaling manufacturing to produce hundreds more. Once those start going up it can demonstrate the high-cadence imaging it is aiming to produce — for now it’s impossible to do so, though Alba already has customers lined up to buy the imagery it does get.

The round was led by Metaplanet Holdings, with participation by Y Combinator, Liquid2, Soma, Uncommon Denominator, Zillionize and numerous angels.

As for competition, Walkinshaw welcomes it, but feels secure that he and his company have more time and work invested in this class of satellite than anyone in the world — a major obstacle for anyone who wants to do battle. It’s more likely companies will, as Alba has done, pursue a distinct product complementary to those already or in the process of being offered.

“Space is a good place to be right now,” he concluded.

Powered by WPeMatico

A year and a half’s worth of global pandemic has had a profound impact on virtually every sector of the workforce. When it comes to future automation, food prep isn’t quite at the top of the list (that distinction likely goes to warehouse fulfillment, for the time being), but it’s certainly up there. And it’s easy to see why the events of 2020 and beyond have left many kitchens looking for alternative sources of labor.

San Francisco-based Chef Robotics today announced that it has raised a combined $7.7 million pre-seed and seed round, with the goal of helping automate certain aspects of food preparation. The list of investors is pretty long on this one (with seed and pre-seed rolled up into one), including Kleiner Perkins, Promus Ventures, Construct, Bloomberg Beta, BOLD Capital Partners, Red and Blue Ventures, Gaingels, Schox VC, Stewart Alsop and Tau Ventures, among others.

The product team includes ex-employees of Cruise, Google, Verb Surgical, Zoox and Strateos. Chef’s team isn’t quite ready to show off its robot just yet (hence generic kitchen stock photo #8952 up top) — not entirely unusual for a robotics company still in the early stages. What it has outlined, thus far, is a robotics and vision system destined to increase production volume and enhance consistency, while removing some food waste from the process. Fast casual restaurants appear to be a key focus for this sort of tech.

The company describes it thusly:

Chef is designed to mimic the flexibility of humans, allowing customers to handle thousands of different kinds of food using minimal hardware changes. Chef does this using artificial intelligence that can learn how to handle more and more ingredients over time and that also improves. This allows customers to do things like change their menu often. Additionally, Chef’s modular architecture allows customers to quickly scale up just as they would by hiring more staff (but unlike humans, Chef always shows up on time and doesn’t need breaks).

More details on the underlying tech soon, no doubt.

Powered by WPeMatico

Legionfarm, the gaming platform that lets gamers play with pro players in their favorite games, has today announced the close of a $6 million Series A round. Investors in the round include SVB, Y Combinator, Scrum VC, Kevin Lin, Altair Capital, Ankur Nagpal and more.

Legionfarm launched out of Y Combinator at the beginning of last year with a mission to give pro players a way to generate income and amateur players the chance to get better by playing with a pro coach. It started out with an à la carte business model but has since added a subscription product.

It either costs $12/hour to play on an individual session basis (one hour of play) or you can pay $25 or $50/month. That gives gamers access to discounted prices for pros and unlimited sessions with pros who are brand new to the platform, which Legionfarm calls “rookies.”

The company was founded by Alex Beliankin, who is a former pro gamer and was once in the top .01% of World of Warcraft players. There are many, many pro caliber players out in the world who can’t necessarily make a living off of gaming. They either have to be signed by an org (super limited supply) or play in as many tournaments as possible (unreliable) or stream on Twitch.

Legionfarm gives these pros the opportunity to earn a living playing the games they love.

Meanwhile, gamers are always looking to get better but don’t often have the environments in a game to do so, particularly in Battle Royale games. Legionfarm, which supports a couple of the biggest BRs (Call of Duty: Warzone and Apex Legends), allows these players to team up with pros and learn from them.

The startup is also running a hardware support program, which lets pros on the platform effectively rent gear by paying for it over time in installments that come directly out of their earnings each month.

“Recently, we’ve learned that one pro player can acquire seven or more new customers to the platform if we work with the pro properly,” said Beliankin. “That’s the biggest growth point for us and the biggest challenge. We don’t need to demand in the performance channels, but through existing supply. If we manage to build some sustainable processes here, I think we’re going to skyrocket because we see some huge potential here.”

Powered by WPeMatico