Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Aurora Solar had one of those pitches that seemed obvious in retrospect. Instead of going to a house and measuring its roof manually for a solar panel installation, why not use aerial scans and imagery of the whole region? That smart play earned them a $20 million A round, a $50 million B round and now, only six months later, a massive $250 million C round as they aim to become the software platform on which the coming solar power expansion will be run.

The idea is simple enough to explain, but difficult to pull off. There’s lots of data out there about the topography, physical and infrastructural, of most cities. Satellite imagery, aerial lidar scans, light and power lines and usage data and, of course, where and how the sun hits a given location — this information is readily available. Aurora’s innovation wasn’t just using it, but assembling it into a cohesive system that’s simple and effective enough to be used widely by solar installers.

“Aurora’s core value proposition is the fact that you can do things remotely much faster and more accurately than if you traveled to the site,” explained co-founder and COO Sam Adeyemo.

Having developed algorithms that ingest the aforementioned data, the service they offer is a very quick turnaround on the tricky question of whether a solar installation makes sense for a potential customer, and if so what it might cost and look like, down to the size and angle of the panels.

“It’s not uncommon for the acquisition cost for a customer to be thousands of dollars,” said Adeyemo’s co-founder, CEO Chris Hopper. That’s partly because every installation is custom. He estimated that half the price tag of any setup is “soft cost” — that is, over and above the actual price of the hardware.

“If the quote is for $30K, what actually goes on your roof might be $15K, the rest is overhead, design, acquisition cost, yada yada yada,” he explained. “That’s the next frontier to make solar cost-competitive, and that’s where Aurora comes in. Every time we shave a few dollars off the price of an installation, it opens it up for new consumers.”

The company doesn’t do its own lidar flights or solar installations, so the $250 million in funding may strike some as rather high for a company making software. Though I did my best to tease out any secret skunkworks projects under way at Aurora, Adeyemo and Hopper patiently explained that enterprise-scale software isn’t cheap, and the funding is proportional to their ambitions.

“The amount we raised speaks to the opportunity ahead of us,” said Hopper. “There’s a lot more solar to put on roofs.”

Aurora has been used for evaluating about 5 million solar projects so far, about a fifth of which end up being built, Adeyemo estimated. And that’s just a fraction of a fraction. Solar makes up about 2% of the U.S.’s power infrastructure, right now, but that’s on track to increase by an order of magnitude in the next 20 years.

The new administration has thrown fuel on the fire of the industry’s optimism, and whether or not something like the Green New Deal comes to fruition, the fundamentally different approach to environmental and energy policy means there are more eyeballs directed at clean energy and consequently a lot of checks being written.

“It counts for a lot. With heightened awareness about climate change there will be more interest in ways to mitigate it,” said Adeyemo. He gave the example of Texas, which after the recent storms and blackouts had more inquiries per capita than anywhere else in the country. Renewables may be a charged issue in some ways, but solar power is bipartisan and broadly popular across the political spectrum.

The $250 million round, led by Coatue and with participation from previous investors ICONIQ, Energize Ventures and Fifth Wall, allows the company to go both broad and deep with their product.

“Historically we’ve been more of a design solution; the next phase is to broaden that into a platform that covers more of the process of going solar,” said Hopper. “We don’t believe this is going to be a niche market — going from 2 to 20% and beyond, that’s a huge endeavor.”

The co-founders would not be more specific than that scaling a SaaS company requires significant cash up front, and during the push to come they can’t be worried about whether or when they’ll need to get more capital.

“The first five years of the company were quasi-bootstrapped… we’d raised like a million bucks. So we know what it’s like to grow a company from that perspective, and now we know what it’s like to really need the capital to scale the business,” said Adeyemo. “If you want to be the platform for a significant percentage of the energy capacity of the country… you gotta tool up.”

What exactly tooling up comprises we will soon find out — the company is planning to announce more news at its upcoming summit in June.

Powered by WPeMatico

It’s hard enough to talk about your feelings to a person; Jo Aggarwal, the founder and CEO of Wysa, is hoping you’ll find it easier to confide in a robot. Or, put more specifically, “emotionally intelligent” artificial intelligence.

Wysa is an AI-powered mental health app designed by Touchkin eServices, Aggarwal’s company that currently maintains headquarters in Bangalore, Boston and London. Wysa is something like a chatbot that can respond with words of affirmation, or guide a user through one of 150 different therapeutic techniques.

Wysa is Aggarwal’s second venture. The first was an elder care company that failed to find market fit, she says. Aggarwal found herself falling into a deep depression, from which, she says, the idea of Wysa was born in 2016.

In March, Wysa became one of 17 apps in the Google Assistant Investment Program, and in May, closed a Series A funding round of $5.5 million led by Boston’s W Health Ventures, the Google Assistant Investment Program, pi Ventures and Kae Capital.

Wysa has raised a total of $9 million in funding, says Aggarwal, and the company has 60 full-time employees and about three million users.

The ultimate goal, she says, is not to diagnose mental health conditions. Wysa is largely aimed at people who just want to vent. Most Wysa users are there to improve their sleep, anxiety or relationships, she says.

“Out of the 3 million people that use Wysa, we find that only about 10% actually need a medical diagnosis,” says Aggarwal. If a user’s conversations with Wysa equate with high scores on traditional depression questionnaires like the PHQ-9 or the anxiety disorder questionnaire GAD-7, Wysa will suggest talking to a human therapist.

Naturally, you don’t need to have a clinical mental health diagnosis to benefit from therapy.

Wysa isn’t intended to be a replacement, says Aggarwal (whether users view it as a replacement remains to be seen), but an additional tool that a user can interact with on a daily basis.

“Sixty percent of the people who come and talk to Wysa need to feel heard and validated, but if they’re given techniques of self help, they can actually work on it themselves and feel better,” Aggarwal continues.

Wysa’s approach has been refined through conversations with users and through input from therapists, says Aggarwal.

For instance, while having a conversation with a user, Wysa will first categorize their statements and then assign a type of therapy, like cognitive behavioral therapy or acceptance and commitment therapy, based on those responses. It would then select a line of questioning or therapeutic technique written ahead of time by a therapist and begin to converse with the user.

Wysa, says Aggarwal, has been gleaning its own insights from more than 100 million conversations that have unfolded this way.

“Take for instance a situation where you’re angry at somebody else. Originally our therapists would come up with a technique called the empty chair technique where you’re trying to look at it from the other person’s perspective. We found that when a person felt powerless or there were trust issues, like teens and parents, the techniques the therapists were giving weren’t actually working,” she says.

“There are 10,000 people facing trust issues who are actually refusing to do the empty chair exercise. So we have to find another way of helping them. These insights have built Wysa.”

Although Wysa has been refined in the field, research institutions have played a role in Wysa’s ongoing development. Pediatricians at the University of Cincinnati helped develop a module specifically targeted toward COVID-19 anxiety. There are also ongoing studies of Wysa’s ability to help people cope with mental health consequences from chronic pain, arthritis and diabetes at The Washington University in St. Louis and The University of New Brunswick.

Still, Wysa has had several tests in the real world. In 2020, the government of Singapore licensed Wysa, and provided the service for free to help cope with the emotional fallout of the coronavirus pandemic. Wysa is also offered through the health insurance company Aetna as a supplement to Aetna’s Employee Assistance Program.

The biggest concern about mental health apps, naturally, is that they might accidentally trigger an incident, or mistake signs of self harm. To address this, the U.K.’s National Health Service (NHS) offers specific compliance standards. Wysa is compliant with the NHS’ DCB0129 standard for clinical safety, the first AI-based mental health app to earn the distinction.

To meet those guidelines, Wysa appointed a clinical safety officer, and was required to create “escalation paths” for people who show signs of self harm.

Wysa, says Aggarwal, is also designed to flag responses to self-harm, abuse, suicidal thoughts or trauma. If a user’s responses fall into those categories Wysa will prompt the user to call a crisis line.

In the U.S., the Wysa app that anyone can download, says Aggarwal, fits the FDA’s definition of a general wellness app or a “low risk device.” That’s relevant because, during the pandemic, the FDA has created guidance to accelerate distribution of these apps.

Still, Wysa may not perfectly categorize each person’s response. A 2018 BBC investigation, for instance, noted that the app didn’t appear to appreciate the severity of a proposed underage sexual encounter. Wysa responded by updating the app to handle more instances of coercive sex.

Aggarwal also notes that Wysa contains a manual list of sentences, often containing slang, that they know the AI won’t catch or accurately categorize as harmful on its own. Those are manually updated to ensure that Wysa responds appropriately. “Our rule is that [the response] can be 80%, appropriate, but 0% triggering,” she says.

In the immediate future, Aggarwal says the goal is to become a full-stack service. Rather than having to refer patients who do receive a diagnosis to Employee Assistant Programs (as the Aetna partnership might) or outside therapists, Wysa aims to build out its own network of mental health suppliers.

On the tech side they’re planning expansion into Spanish, and will start investigating a voice-based system based on guidance from the Google Assistant Investment Fund.

Powered by WPeMatico

TaniHub Group, an Indonesian startup that helps farmers get better prices and more customers for their crops, has raised a $65.5 million Series B. The funding was led by MDI Ventures, the investment arm of Telkom Group, one of Indonesia’s largest telecoms, with participation from Add Ventures, BRI Ventures, Flourish Ventures, Intudo Ventures, Openspace Ventures, Tenaya Capital, UOB Venture Management and Vertex Ventures.

Openspace and Intudo are returning investors from TaniHub’s $10 million Series A, announced in May 2019. The new funding brings its total raised to about $94 million.

Founded in 2016, TaniHub now has more than 45,000 farmers and 350,000 buyers (including businesses and consumers) in its network. The company helps farmers earn more for their crops by streamlining distribution channels so there are fewer middlemen between farms and the restaurants, grocery stores, vendors and other businesses that buy their products. It does this through three units: TaniHub, TaniSupply and TaniFund.

TaniHub is its B2B e-commerce platform, which connects farmers directly to customers. Then orders are fulfilled through TaniSupply, the company’s logistics platform, which currently operates six warehousing and processing facilities where harvests can be washed, sorted and packed within an hour, before being delivered to buyers by TaniHub’s own couriers or third-party logistics providers.

Finally, TaniFund is a fintech platform that provides loans to farmers they can use while growing crops and pay off by selling through TaniHub. Co-founder and chief executive officer Eka Pamitra told TechCrunch its credit scoring system is based on three years of performance, the company’s agriculture value chain expertise and partnerships with financial institutions.

“More than 100 data points are considered when doing the credit risk assessment. For example, for cultivation financing products, TaniFund tailors each credit scoring based on agriculture risks and market risk of each commodity, on top of the typical borrower E-KYC scoring and process,” he explained. “Beyond credit scoring, having TaniSupply and TaniHub as a standby buyer within the ecosystem also helps to mitigate risk of each loan. TaniFund aims to further boost its credit scoring system with smarter data processing and better machine learning models.”

Pamitra said TaniHub will use its new funding to build the upstream and midstream parts of its supply chain — in other words, new cultivation areas, processing, packing centers and warehouses. The company will also expand its coverage beyond Java and Bali to source and sell locally, and continue improving its supply-demand forecast model to help farmers plan crop cultivation and timing, with the goal of reducing price fluctuations and maintaining a consistent supply. Pamitra added that TaniHub will also explore precision farming technology.

Over the last couple of years, TaniHub has started exporting several types of fruits and spices to the United Arab Emirates, Singapore and South Korea. This year, it plans to focus on expanding within Indonesia because the F&B (food and beverage) market there is worth $137 billion and the Indonesian agriculture sector is still highly fragmented, Pamitra said.

Despite the COVID-19 pandemic, TaniHub says it was able to grow its revenue 600% year-on-year in 2020 as demand for online groceries increased.

“We postponed our branch expansion plan and focused on increasing the seven existing warehouses’ since there was a surge of demand on the B2C segment and the process of onboarding farmers. This benefited us since the adoption of purchasing fresh groceries online increased significantly, and the willingness of farmers to work with us became remarkably high because the local traditional markets were closed due to lockdowns,” Pamitra said. “Since COVID-19, the eagerness of provincial governments to open communications for TaniHub to work with local farmers and SMEs in their region has been quite impactful.”

TaniHub is now working with several Indonesian government agencies, including the Ministry of Trade, Ministry of Agriculture and the Ministry of Cooperatives and SMEs, to onboard more farmers, F&B businesses and increase exports.

In a press statement, MDI Ventures director of portfolio management Sandhy Widyasthana said, “TaniHub Group has an important role in transforming the agriculture sector and has proven that its presence can deliver positive impact on the quality of life of farmers. We hope our investment can help them continue their work and expand their coverage to more and more farming communities in Indonesia.”

Powered by WPeMatico

Farmers and food businesses, like restaurants, deal with the same issue: a fragmented supply chain. Secai Marche wants to streamline agricultural logistics, making fulfillment more cost-efficient and enabling food businesses to bundle products from different farmers into the same order. The company is headquartered in Japan, with operations in Malaysia, and plans to expand into Singapore, Thailand and Indonesia. This week, it announced 150 million JPY (about $1.4 million USD) in pre-Series A funding from Rakuten Ventures and Beyond Next Ventures to build a B2B logistics platform for farmers that sell to restaurants, hotels and other F&B (food and beverage) businesses.

This round brings Secai Marche’s total raised to about $3 million. The capital will be used to expand its fulfillment infrastructure, including a network of warehouses and cold chain logistics, hire more people for its engineering team and sales and marketing.

Secai Marche was founded in 2018 by Ami Sugiyama and Shusaku Hayakawa, and currently serves 130 farmers and more than 300 F&B businesses. Before launching the startup, Sugiyama spent four years working in Southeast Asia, including managing restaurants and cafes in Malaysia. During that time, she started to import green tea from Japan, intending to sell it directly to customers in Malaysia. But she realized supply chain inefficiencies not only made it hard to meet demand, but also ensure quality for all kinds of ingredients.

Meanwhile, Hayakawa was operating a farm in Japan and working on agriculture control systems that predicted weather and crop growth to help farmers maintain consistent quality.

Both Sugiyama and Hayakawa ended up at consulting firm Deloitte, researching how to create a more efficient supply chain for Japanese agricultural exports to Singaporean F&B businesses. Policies implemented by Prime Minister Yoshihide Suga’s administration aim to increase Japanese agricultural exports from 922.3 billion JPY (about $8.5 billion) in 2020 to 2 trillion JPY (about $18.5 billion) by 2025, and 5 trillion JPY (about $46.1 billion) in 2030.

Seche Marche’s goal is to make it easier for farmers to sell their crops to F&B businesses domestically or overseas.

“We found that not only farmers in Japan, but also all farmers in Southeast Asia have the same problem in terms of the current supply chain,” Sugiyama told TechCrunch. “So we left Deloitte and started our own business to connect not only farmers in Japan, but farmers in all Asian countries.”

Secai Marche’s logistics management tech is what differentiates it from other wholesaler platforms. It uses an AI-based algorithm to predict demand based on consumption trends, seasonal products and farmer recommendations, said Hayakawa. Secai Marche runs its own warehouse network, but mostly relies on third-party logistics providers for fulfillment, and its platform assigns orders to the most efficient transportation method.

This allows F&B businesses to consolidate orders from farmers, so they can order smaller batches from different places without spending more money. About 30% of Secai Marche’s products are shipped to other countries, while the rest are sold domestically.

Secai Marche is reaching out to farmers who want to increase their customer base. About 30% of its products currently come from Japanese farms, 50% from Malaysia and the rest from other ASEAN countries. Sugiyama and Hayakawa said the COVID-19 pandemic affected Secai Marche’s expansion plans because it originally planned to enter Singapore this year, but had to slow down since they were unable to travel and meet with farmers.

On the other hand, many farmers have started selling directly to consumers through social media like Instagram or Facebook, and have approached Secai Marche for help with fulfillment, logistics, repacking and quality control.

Correction: Funding amount corrected to say $1.4 million instead of $1 million.

Powered by WPeMatico

Vietnam has one of the fastest-growing e-commerce markets in Southeast Asia, but many major platforms still focus on large cities. This means people in smaller cities or rural areas need to deal with longer wait times for deliveries. Social commerce company Mio is taking advantage of that gap by building a reseller network and logistics infrastructure that can offer next-day delivery to tier 2 and 3 cities.

The startup, which currently focuses on fresh groceries and plans to expand into more categories, announced today it has raised $1 million in seed funding. The round was co-led by Venturra Discovery and Golden Gate Ventures. Other participants included iSeed SEA, DoorDash executive Gokul Rajaram and Vidit Aatrey and Sanjeev Barnwal, co-founders of Indian social commerce unicorn Meesho.

Rajaram, Aatrey and Barnwal will become advisors to Mio co-founder and chief executive officer Trung Huynh, former investment associate at IDG Ventures Vietnam. Other founders include An Pham (who also co-founded Temasek-backed logistics startup SCommerce), Tu Le and Long Pham.

Founded in June 2020, Mio now claims hundreds of agents, or resellers. They are primarily women aged 25 to 35 years old who live in smaller cities or rural areas. Most join Mio because they want to supplement their household income, which is usually below $350, Huynh and Venturra investment associate Valerie Vu told TechCrunch in an email.

The social commerce model works for them because they are part of tight-knit communities that are already used to making group orders together. On average, Mio claims that its resellers make about $200 to $300, earning a 10% commission on each order, and additional commissions based on the monthly performance of resellers they referred to the platform.

Mio is among a crop of social commerce startups across Asia that leverage the buying power of areas where major e-commerce players haven’t reached dominance yet. For example, lower-tier cities fueled Pinduoduo’s meteoric rise in China, while Meesho has built a distribution network in 5,000 Indian cities. Other examples of social commerce areas focused on smaller cities and rural areas include “hyperlocal” startup Super and KitaBeli, both in Indonesia, and Resellee in the Philippines.

Social commerce companies typically don’t require resellers to carry inventory. Instead, resellers pick which items they want to market to their buyers. In Mio’s case, most of their resellers’ customers are friends, family members and neighbors, and they promote group orders through social media platforms like Facebook, TikTok, Instagram or Zalo, Vietnam’s most popular messaging app. Then they place and manage orders through Mio’s reseller app.

To address delivery challenges, Mio is building an in-house logistics and fulfillment system, including a new distribution center in Thu Duc that can distribute goods to all of Ho Chi Minh and the surrounding five cities in Binh Dong and Dong Nai provinces. Vu and Huynh said Mio can process up to tens of thousands of daily order units at the center. Mio is also able to perform next-day deliveries for orders that are made prior to 8 p.m.

To lower logistics costs and ensure quick delivery times, Mio limits the number of products in its inventory. The company currently focuses on grocery staples, including fresh produce and poultry, and plans to add FMCG (fast-moving consumer goods) and household appliances, too, especially white-label goods that have a higher profit margin.

Mio’s new funding will be used on its distribution center, and hiring for its tech and product teams. The startup plans to add more personalization options for product categories and resellers, so they can build their own brand identities.

Powered by WPeMatico

It doesn’t feel like a week goes by at the moment that another startup doesn’t emerge armed with a huge wallet of cash to pursue a strategy of consolidating and then scaling promising brands that have built a business selling on marketplaces like Amazon’s. In the latest development, a startup called factory14 is coming out of stealth mode in Europe with $200 million in funding to snap up smaller businesses and help them grow through better economies of scale.

Along with this, factory14 is also announcing its latest acquisition to underscore its acquisition strategy: it’s acquired Pro Bike Tool, a popular D2C seller of its own-brand bike accessories and tools, for an undisclosed sum. The company, which is now fully owned by factory14, has kept the original founders on to lead the smaller company.

This is factory14’s fourth acquisition since launching earlier this year, and the company said that its focus on acquiring marketplace sellers that are already seeing success and some scale means that it is already profitable.

The startup — based in Luxembourg (with offices in Madrid, London, Shanghai and Taipei) — is describing this funding injection as a seed round, but in fact the majority of it is coming in the form of debt to acquire companies. Dmg Ventures (the VC arm of the Daily Mail Group) and DN Capital co-led the equity-based seed funding, with VentureFriends and unnamed individuals in the tech world also participating. Victory Park Capital, meanwhile, provided the credit facility and also participated in the equity consortium.

CEO Guilherme Steinbruch, an alum of Global Founders Capital (the investment firm co-founded by the Samwer brothers of Rocket Internet fame, among others), co-founded factory14 with Marcos Ramírez (COO) and Gianluca Cocco (CBO) — who have respectively worked at e-commerce giants like Amazon and Delivery Hero.

Steinbruch himself also has an interesting background. He hails from Brazil and is a member of the powerful industrial family that controls a major steel producer, a leading textile producer and a bank (Steinbruch said that factory14 has no connection to these, and is not an investor in the startup).

He said that the idea for founding factory14 in Europe came out of his interest in e-commerce and specifically the traction that Thrasio, one of the U.S. based pioneers of the roll-up space, was seeing for the model.

The Marketplace on Amazon is a massive business. One estimate puts the number of third-party sellers at 5 million, with more than 1 million sellers joining the platform in 2020 alone. Thrasio, meanwhile, has in the past estimated to me that there are probably 50,000 businesses selling on Amazon via FBA making $1 million or more per year in revenues.

It’s the latter category that is the target for factory14, Steinbruch told me. Its belief is that focusing on more successful businesses will mean a better hit rate on finding companies that have already built more solid supply chains, branding and overall quality. Being willing to pay a little more for these sellers, he said, will help it compete against what has become a very crowded field.

“There are many players, there is no denying it,” he said, adding that their research has (so far) found more than 50 roll-up players going for the same general opportunities that it is.

But in the process of planning out how factory14 might differentiate itself in that mix, Steinbruch said it found some distinct differences.

“Some are looking for volume, and are willing to buy up many companies as cheaply as possible. But we took the decision to focus only on high-quality assets,” he said. “We knew we would have to pay higher multiples for a brand growing 200% a year, but when we started targeting these we were surprised to find there was less competition for these assets rather than for the smaller ones. That was a good surprise. It means that, yes, we have competition but we’ve managed to be pretty successful anyway.”

Even among the bigger retailers selling on Amazon using the e-commerce giant’s distribution and fulfillment platform, there are reasons why the consolidators have started to circle beyond just wanting to jump on a good thing. The system has within it a lot of work that is repeatable across many different companies, specifically in areas like analytics, supply chain management, marketing and more: building a framework that could handle those processes for many at once makes sense. There is also the fact that in many cases, marketplace sellers may have found themselves sitting on successful businesses but unable to source the investment (or the will) to scale them to the next step.

All the same, the mix of competitors hoping to scoop them up is a pretty formidable one, and the point of differentiation between them all may not in itself be as distinct as factory14 (or any of them) hopes.

Just today, another ambitious player in this space, Heyday out of San Francisco, announced a further $70 million in equity funding led by General Catalyst. It, too, is raising large amounts of debt and eyeing up more innovative ways of accommodating the most interesting companies selling on Amazon in a bid for more quality and success.

“The top 1.5% of marketplace sellers are doing $1 million in revenues, and we believe there may be some that cross the $1 billion threshold eventually,” Heyday CEO and co-founder Sebastian Rymarz told me last week. To woo the best of them in the current market, as part of its ambition to become the “P&G” of the 21st century, it too is taking a very open-ended approach, he said.

“We have some come to Heyday, or we bring in our own brand managers. Sometimes it’s a matter of some ongoing participation and interest, growth equity where we buy some now and will buy more of your business over time. We are still defining that and that is fine, we are comfortable with that,” he said. “It’s about unique partnerships that we’re forming to accelerate their businesses.”

Closer to home in more ways than one, Berlin’s Razor Group — funded by Steinbruch’s former colleagues from GFC, and founded by ex-Rocket Internet people — earlier this month raised $400 million. Thrasio itself has raised very large rounds in rapid succession totaling hundreds of millions of dollars in the last year, and is also profitable. Others in the same area that have also raised huge war chests include Branded; Heroes; SellerX; Perch; Berlin Brands Group (X2); Benitago; Latin America’s Valoreo (with its backers including Razor’s CEO) and an emerging group out of Asia including Rainforest and Una Brands.

Even with all of this, there will be opportunities, these entrepreneurs believe, to bring together more disparate smaller e-commerce retailers to help them better leverage marketing, supply chains, analytics and wider business expertise to grow for the longer term, leveraging the marketplace model that has come to dominate how many shop online today.

Factory14 said it expects to have $20 million in “trailing twelve months” EBITDA by the end of 2021 and expects to double its team to 80 by that point too.

For as long as Amazon and its marketplace model remain, it seems investors will come with their checkbooks, too.

“E-commerce is undergoing structural changes which are enabling thousands of exciting new brands to be born every day,” said Manuel Lopo de Carvalho, CEO at dmg ventures, in a statement. “Factory14 can provide these brands with the tools, capital and expertise that enable them to play in the big leagues.”

Ian Marsh, principal at DN Capital, said that the VC did its homework before backing the startup, too. “We had discussions with most aggregators and were immediately impressed by factory14’s differentiated vision focused on strong consumer brands and the world-class team they have put together with top tier private equity investors combined with seasoned e-commerce executive and former Amazonians. We are excited to work with Guilherme, Marcos, Gianluca and the rest of the factory14 team to create brands that inspire consumers around the world.”

Powered by WPeMatico

Portside, an aviation startup that is building a platform for managing the backend of a corporate flight department, charter operation, government fleet and fractional ownership operation, today announced that it has raised a $17 million funding round led by Tiger Global Management, with participation from existing investors I2BF Global Ventures and SOMA Capital.

The idea behind Portside, which was founded in 2018, is that it lets business aviation companies and flight departments manage everything from flight operations to maintenance, crew and staff scheduling, expense management for crew members and staff, and financial data to help them operate more efficiently. It’s basically everything you need to run your flight department in a single solution, but it also integrates with virtually all of the existing scheduling, accounting, expense management and maintenance tools a flight department or fractional ownership operation is likely using today.

While the COVID pandemic put a halt to most forms of private aviation early on, that market saw a quick rebound. Portside says it saw its revenue grow almost 300% in 2020 and that it added more than 50 aircraft operators in multiple countries to its user base.

“This infusion of new capital will be used to accelerate investment in product innovation, support further engagement with large enterprise customers and grow our global engineering and customer success teams,” said Alek Vernitsky, co-founder and CEO of Portside. “We appreciate the strong support we have received from both our existing and new investors in this round. They have collectively demonstrated their confidence in our strategy and intentional approach to cloud-based digital transformation of the global business aviation industry.”

Portside is not alone in this market. Companies like Fl3xx, for example, offer similar solutions for flight departments and at the lower end, tools like Flight Circle offer a subset of these features for general aviation clubs and partnerships.

“Portside has progressed rapidly since inception and is entering the next stage of fulfilling its vision of becoming the undisputed leader in cloud-based solutions for business aviation,” stated John Curtius, partner at Tiger Global Management. “In our view, Portside represents the future of the industry, and we are pleased to partner with a company we believe will continue to create significant value for many years to come.”

Powered by WPeMatico

There may be billions of IoT devices in use today, but the tooling around building (and updating) the software for them still leaves a lot to be desired. Esper, which today announced that it has raised a $30 million Series B round, builds the tools to enable developers and engineers to deploy and manage fleets of Android-based edge devices. The round was led by Scale Venture Partners, with participation from Madrona Venture Group, Root Ventures, Ubiquity Ventures and Haystack.

The company argues that there are thousands of device manufacturers who are building these kinds of devices on Android alone, but that scaling and managing these deployments comes with a lot of challenges. The core idea here is that Esper brings to device development the DevOps experience that software developers now expect. The company argues that its tools allow companies to forgo building their own internal DevOps teams and instead use its tooling to scale their Android-based IoT fleets for use cases that range from digital signage and kiosks to custom solutions in healthcare, retail, logistics and more.

“The pandemic has transformed industries like connected fitness, digital health, hospitality, and food delivery, further accelerating the adoption of intelligent edge devices. But with each new use case, better software automation is required,” said Esper CEO and co-founder Yadhu Gopalan, who founded the company together with COO Shiv Sundar. “Esper’s mature cloud infrastructure incorporates the functionality cloud developers have come to expect, re-imagined for devices.”

Mobile device management (MDM) isn’t exactly a new thing, but the Esper team argues that these tools weren’t created for this kind of use case. “MDMs are the solution now in the market. They are made for devices being brought into an environment,” Gopalan said. “The DNA of these solutions is rooted in protecting the enterprise and to deploy applications to them in the network. Our customers are sending devices out into the wild. It’s an entirely different use case and model.”

To address these challenges, Esper offers a range of tools and services that includes a full development stack for developers, cloud-based services for device management and hardware emulators to get started with building custom devices.

“Esper helped us launch our Fusion-connected fitness offering on three different types of hardware in less than six months,” said Chris Merli, founder at Inspire Fitness. “Their full stack connected fitness Android platform helped us test our application on different hardware platforms, configure all our devices over the cloud, and manage our fleet exactly to our specifications. They gave us speed, Android expertise, and trust that our application would provide a delightful experience for our customers.”

The company also offers solutions for running Android on older x86 Windows devices to extend the life of this hardware, too.

“We spent about a year and a half on building out the infrastructure,” said Gopalan. “Definitely. That’s the hard part and that’s really creating a reliable, robust mechanism where customers can trust that the bits will flow to the devices. And you can also roll back if you need to.”

Esper is working with hardware partners to launch devices that come with built-in Esper-support from the get-go.

Esper says it saw 70x revenue growth in the last year, an 8x growth in paying customers and a 15x growth in devices running Esper. Since we don’t know the baseline, those numbers are meaningless, but the investors clearly believe that Esper is on to something. Current customers include the likes of CloudKitchens, Spire Health, Intelity, Ordermark, Inspire Fitness, RomTech and Uber.

Powered by WPeMatico

Trees, those deciduous entities you can occasionally see outdoors when not locked down or strapped down at a desktop ruminating on a video call, have long been the inspiration for fresh new ideas. Stories abound of how founders built companies while walking the foothills in Silicon Valley or around parks in San Francisco, and yet, we’ve managed over the past year to take movement mostly out of our remote work lives.

Chicago-based Spot Meetings wants to reinvigorate our meetings — and displace Zoom as the default meeting medium at the same time.

The product and company are just a few months old and remain in closed beta (albeit opening up a bit shortly here), and today the company is announcing $5 million in seed funding led by Ilya Fushman at Kleiner Perkins. That follows a $1.9 million pre-seed round led by Chapter One earlier this year.

CEO and co-founder Greg Caplan said that the team is looking to rebuild the meeting from the ground up for an audio-only environment. “On mobile, it needs to be abundantly simple to be very functional and understood for users so that they can actually use it on the go,” he described. In practice, that requires product development across a wide range of layers.

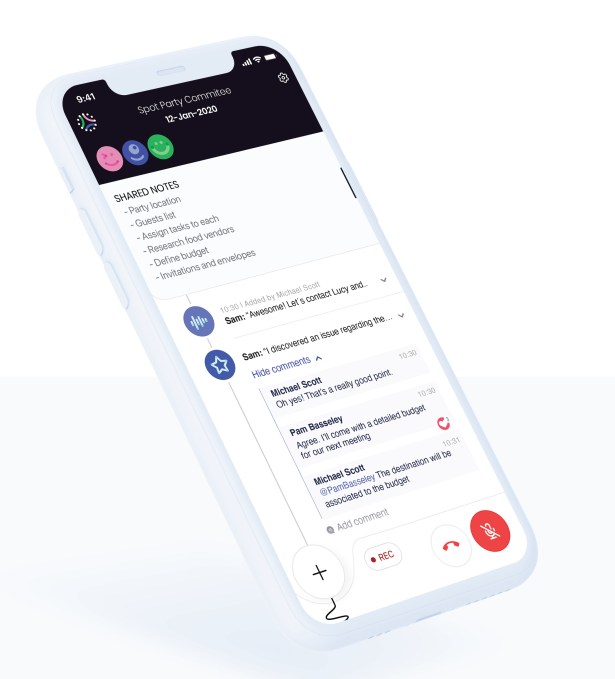

The product’s most notable feature today is that it has an assistant, aptly named Spot, which listens in on the call and which participants can direct commands to while speaking. For instance, saying “Spot Fetch” will pull the last 40 seconds of conversation, transcribe it, create a note in the meeting and save it for follow-up. That prevents the multi-hand tapping required to save a note or to-do list for follow-up with our current meeting products. You “don’t even need to take your phone out,” Caplan points out.

What gets more interesting is the collaboration layer the company has built into the product. Every audio meeting has a text-based scratch pad shared with all participants, allowing users to copy and paste snippets into the meeting as needed. Those notes and any information that Spot pulls in are saved into workspaces that can be referenced later. Spot also sends out emails to participants with follow-ups from these notes. If the same participants join another audio meeting later, Spot will pull in the notes from their last meeting so there is a running timeline of what’s been happening.

Spot’s product design emphasizes collaboration within an audio-focused experience. Image Credits: Spot Meetings

Obviously, transcription features are built-in, but Spot sees opportunities in offering edited transcripts of long calls where only a few minutes of snippets might be worth specifically following up on. So the product is a bit more deliberate in encouraging users to select the parts of a conversation that are relevant for their needs, rather than delivering a whole bolus of text that no one is ever actually going to read.

“Collaboration from now and the future is going to be primarily digital … in-person is forever going to be the exception and not the rule,” Caplan explained. Longer term, the company wants to add additional voice commands to the product and continue building an audio-first (and really, an audio-only) environment. Audio “very uniquely helps people focus on the conversation at hand,” he said, noting that video fatigue is a very real phenomenon today for workers. To that end, more audio features like smarter muting are coming. When a participant isn’t talking, their background noise will automatically melt away.

Before Spot Meetings, Caplan was the CEO and co-founder of Remote Year, a startup that was designing a service for company employees to take working trips overseas. I first covered it back in 2015, and it went on to raise some serious venture dollars before the pandemic hit last year and the company laid off 50% of its workforce. Caplan left as CEO in April last year, and the company was ultimately sold to Selina, which offers co-working spaces to travelers, in October.

Caplan’s co-founder who leads product and engineering at Spot Meetings is Hans Petter “HP” Eikemo. The duo met during the very first Remote Year cohort. “He has been a software engineer for two decades [and was] literally the first person I called,” Caplan said. The team will grow further with the new funding, and the company hopes to start opening its beta to its 6,000 waitlist users over the next 3-4 weeks.

Powered by WPeMatico

GPS is one of those science fiction technologies whose use is effortless for the end user and endlessly challenging for the engineers who design it. It’s now at the heart of modern life: everything from Amazon package deliveries to our cars and trucks to our walks through national parks are centered around a pin on a map that monitors us down to a few meters.

Yet, GPS technology is decades old, and it’s going through a much-needed modernization. The U.S., Europe, China, Japan and others have been installing a new generation of GNSS satellites (GNSS is the generic name for GPS, which is the specific name for the U.S. system) that will offer stronger signals in what is known as the L5 band (1176 MHz). That means more accurate map pinpoints compared to the original generation L1 band satellites, particularly in areas where line-of-sight can be obscured, like urban areas. L5 was “designed to meet demanding requirements for safety-of-life transportation and other high-performance applications,” as the U.S. government describes it.

It’s one thing to put satellites into orbit (that’s the easy part!), and another to build power-efficient chips that can scan for these signals and triangulate a coordinate (that’s the hard part!). So far, chipmakers have focused on creating hybrid chips that pull from the L1 and L5 bands simultaneously. For example, Broadcom recently announced the second-generation of its hybrid chip.

OneNav has a totally different opinion on product design, and it placed it right in its name. Eschewing the hybrid chip model of mixing old signals with new, it wants one chip monitoring the singular band of L5 signals to drive cost and power savings for devices. One nav to rule them all, as it were.

The company announced today that it has closed a $21 million Series B round led by Karim Faris at GV, which is solely funded by Alphabet. Other investors included Matthew Howard at Norwest and GSR Ventures, which invested in earlier rounds of the company. All together, OneNav has raised $33 million in capital and was founded about two years ago.

CEO and co-founder Steve Poizner has been in the location business a long time. His previous company, SnapTrack, built out a GPS positioning technology for mobile devices that sold to Qualcomm for $1 billion in stock in March 2000, at the height of the dot-com bubble. His co-founder and CTO at OneNav, Paul McBurney, has similarly spent decades in the GNSS space, most recently at Apple, according to his LinkedIn profile.

OneNav CEO and co-founder Steve Poizner, seen here in 2009. Image Credits: David McNew via Getty Images

They saw an opportunity to build a new navigation company as L5 band satellites have switched on in recent years. As they looked at the market and the L5 tech, they decided they wanted to go further than other companies by eliminating the legacy tech of older GPS technology and moving entirely into the future. By doing that, its design is “half the size of the old system, but much higher reliability and performance,” Poizner said. “We are aiming to get location technology into a much broader number of products.”

He differentiated between upgrading GPS from upgrading wireless signals. “With these L5 satellites, we don’t need the L1 satellites anymore [but] with 5G, you still need 4G,” he said. L5 band GPS does everything that earlier renditions did, but better, whereas with wireless technologies, they often need to complement each other to offer peak performance.

There’s one caveat here: The L5 signal is still considered “pre-operational” by the U.S. government, since the U.S. GPS system only has 16 satellites broadcasting the signal today, and is targeting 24 satellites for full deployment by later in this decade. However, other countries have also deployed L5 GNSS satellites, which means that while it may not be fully operational from the U.S. government’s perspective, it may well be good enough for consumers.

OneNav’s goal according to Poizner is to be “the Arm of the GNSS space.” What he means is that like Arm, which produces the chip designs for nearly all mobile phones globally, OneNav creates comprehensive designs for L5 band GPS chips that can be integrated as a system-on-chip into the products of other manufacturers so that they can “embed a high-performance location engine based on their silicon.”

The company today also announced that its first design customer will be In-Q-Tel, the U.S. intelligence community’s venture capital and business development organization. Poizner said that through In-Q-Tel, “we now have a development contract with a U.S. government agency.” The company is expecting that its customer evaluation units will be completed by the end of this year with the objective of potentially having OneNav’s technology in end-user devices by late 2022.

Location tracking has become a major area of investment for venture capitalists, with companies working on a variety of technologies outside of GPS to offer additional detail and functionality where GPS falls short. Poizner sees these technologies as ultimately complementary to what he and his team are building at OneNav. “The better the GPS, the less pressure on these augmentation systems,” he said, while acknowledging that, “it is the case though that in certain environments [like downtown Manhattan or underground in a subway], you will never get the GPS to work.”

For Poizner, it’s a bit of a return to entrepreneurship. Prior to starting OneNav, he had been heavily involved in California state politics. Several years after the sale of SnapTrack to Qualcomm, he unsuccessfully ran for a seat in the California State Assembly. He later was elected California’s insurance commissioner in 2007 under former Governor Arnold Schwarzenegger. He ran for governor in 2010, losing in the Republican primary against Meg Whitman, who made her name as the longtime head of eBay. He ran for his former seat of California insurance commissioner in 2018, this time as a political independent, but lost.

OneNav is based in Palo Alto and currently has more than 30 employees.

Powered by WPeMatico