Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Celonis, the late-stage process mining software startup, announced a $1 billion Series D investment this morning on an eye-popping $11 billion valuation, up from $2.5 billion in its Series C in 2019, quadrupling its value in just two years.

Durable Capital Partners LP and T. Rowe Price Associates co-led the round, with participation from new investors Franklin Templeton, Splunk Ventures and existing investors Arena Holdings. Other unnamed existing investors also participated.

While it was at it, the company announced it was naming experienced financial pro Carlos Kirjner as CFO. Kirjner’s most recent job was at Google, where he led finance for ads and other key product areas, according to the company.

The presence of institutional investors like T. Rowe Price and Franklin Templeton and the huge influx of capital could be a signal that this is the last private fundraise for the company before it goes public, and Celonis CEO and co-founder Alexander Rinke did not shy away from IPO talk when asked about it.

“It could be, yeah. It’s kind of tough to predict the future, but look, we’re very bullish about the growth and our prospects both as a private — and down the road — a public company, and obviously we now have backers that can invest capital in both [public and private markets],” Rinke told TechCrunch.

Rinke says what’s driving this interest is the tremendous potential of the market even beyond process mining, which he sees as just a starting point for a much larger market. “Process mining where we originated from is really just the gateway to build new processes and better processes for organizations, and as you think about that that’s a much much bigger market that we’re addressing,” he said.

The company’s processing mining software sits at the beginning of the process automation food chain, which includes robotic process automation, no-code workflow and other tools to bring more automated workflows to companies. It’s quite possible that the company could develop other pieces of this or use the new capital to buy talent and functionality, something that Rinke acknowledges is possible now with this much capital behind the company.

Celonis started by mapping out exactly how work flows through an organization, something that used to take high-priced human consultants months to figure out sitting with employees and watching how work flows. Once a company knows how work moves through an organization, it’s easier to find inefficiencies and places that are ripe for using automation tools. Speeding up that first part of the operation with technology can bring down the cost and accelerate innovation and change.

The company made a huge deal with IBM recently where IBM plans on training 10,000 consultants worldwide to use Celonis tooling. That brings the power of a company the size of IBM to one that is still relatively small in comparison — Rinke thinks they’ll reach 2,000 employees by year end — and that could be at least part of the reason investors were willing to pump so much capital into the company.

The company, which recently turned 10, currently has 1,000 enterprise customers, including Uber, Dell, Splunk (which is also an investor), L’Oréal and AstraZeneca.

Powered by WPeMatico

DealHub.io, an Austin-based platform that helps businesses manage the entire process of their sales engagements, today announced that it has raised a $20 million Series B funding round. The round was led by Israel Growth Partners, with participation from existing investor Cornerstone Venture Partners. This brings DealHub’s total funding to $24.5 million.

The company describes itself as a ‘revenue amplification’ platform (or ‘RevAmp,’ as DealHub likes to call it) that represents the next generation of existing sales and revenue operations tools. It’s meant to give businesses a more complete view of buyers and their intent, and streamline the sales processes from proposal to pricing quotes, subscription management and (electronic) signatures.

“Yesterday’s siloed sales tools no longer cut it in the new Work from Anywhere era,” said Eyal Elbahary, CEO & Co-founder of DealHub.io. “Sales has undergone the largest disruption it has ever seen. Not only have sales teams needed to adapt to more sophisticated and informed buyers, but remote selling and digital transformation have compelled them to evolve the traditional sales process into a unique human-to-human interaction.”

The platform integrates with virtually all of the standard CRM tools, including Salesforce, Microsoft Dynamics and Freshworks, as well as e-signature platforms like DocuSign.

The company didn’t share any revenue data, but it notes that the new funding round follows “continued multi-year hyper-growth.” In part, the company argues, demand for its platform has been driven by sales teams that need new tools, given that they — for the most part — can’t travel to meet their (potential) customers face-to-face.

“Revenue leaders need the agility to keep pace with today’s fast and ever-changing business environment. They cannot afford to be restrained by rigid and costly to implement tools to manage their sales processes,” said Uri Erde, General Partner at Israel Growth Partners. “RevAmp provides a simple to operate, intuitive, no-code solution that makes it possible for sales organizations to continuously adapt to the modern sales ecosystem. Furthermore, it provides sales leaders the visibility and insights they need to manage and consistently accelerate revenue growth. We’re excited to back the innovation DealHub is bringing to the world of revenue operations and help fuel its growth.”

Powered by WPeMatico

Even as remote software uptake has boomed during the pandemic, certain workflows have gotten prioritized for specialized toolsets while other team members have been left piecemealing their productivity. Employees designing the copy that directs users and encapsulates company messaging have been particularly forgotten at times, say the founders of Ditto, a young startup building software focused on finding a “single source of truth” for copy.

The startup was in Y Combinator’s winter 2020 batch (we selected it as one of our favorites from the class); now Ditto’s founders tell TechCrunch the team has raised a $1.5 million seed round from investors including Greycroft, Y Combinator, Soma Capital, Decent Capital, Twenty Two VC, Holly Liu and Scott Tong, among others.

While copy workflows are often very messy when it comes to design and implementation, even the most-organized teams are often left scouring through meandering email threads, screenshot dumps and slack DMs with disparate teams. The founders behind Ditto hope that their software can give copy teams the home they deserve to keep everything organized and synced across projects and applications, ensuring that language is actually finalized and ready to ship when the time comes.

The company’s founders Jessica Ouyang and Jolena Ma were Stanford roommates who saw a lingering opportunity to build a toolset that prioritized copy as its own vertical.

“It’s so easy to couple text with where it lives, like you may think of it as part of the design so a lot of writers have to manage it inside toolsets for design or you may already think of it as part of development so writers end up having to go into the codebase and figure out how to code or manage JSON even though they’re content designers,” Ouyang tells TechCrunch.

Out of the gate, Ditto has been built for Figma, meaning users can easily export text blocks from designs in the app and rework them inside the Ditto web app, pushing updates without having to dig through the designs themselves. The founders say they are currently working on building out integrations for Sketch and Adobe XD as well. Inside the Ditto web app users can access change logs and update the status of particular pieces of text inside a project so that approvals are always certain.

“We find there’s a lot more opportunity to integrate into all of the places where copy is being worked on,” Ma tells us. “We have a lot more we’re hoping to do with our developer integrations and just integrating to all of those places where copy lives, places like A/B testing, internationalization, localization and other workflows.”

Copy development has plenty of stakeholders and the team is looking to experiment with pricing tiers that address that. For now they split up users into editors and commenters paying $15 and $10 monthly (priced annually), respectively, on the startup’s Teams plan. Ditto has a free tier for teams of two, as well as pricing designed for larger enterprise clients.

Powered by WPeMatico

Just about every week there’s a blockbuster round coming out of South America, but in certain countries such as Ecuador, things have been more hush-hush. However, Kushki, a Quito-based fintech, is bringing attention to the region with today’s announcement of an $86 million Series B and a $600 million valuation.

“We never thought that we would return home [from the U.S.] and build a company that was more valuable in Ecuador than we had built in the U.S.,” said Aron Schwarzkopf, CEO and co-founder of Kushki.

Schwarzkopf and his business partner, Sebastián Castro, previously built and sold a fintech called Leaf in the U.S. in 2014. The two are originally from Ecuador but moved to Boston for college, where they met watching soccer.

Unlike many other fintechs in LatAm that are out to help the unbanked, Kushki works behind the scenes building the tech infrastructure that companies like Nubank use to transfer money. Some of the functionalities they build enable both local and cross-border payment players in credit and debit cards, bank transfers, digital cash, mobile wallets and other alternative payment methods.

“We realized there was a gigantic opportunity to democratize and create infrastructure to move money,” Schwarzkopf told TechCrunch.

The company, which was founded in 2017, already has operations in Mexico, Colombia, Ecuador, Peru and Chile. The Series B will be used to accelerate growth and expand to Brazil and nine other markets in Central America.

Generally, expanding to Brazil is an expensive proposition, and therefore not a path that all companies can take, even though it can be an extremely profitable move if done right. Some of the challenges include the need to translate everything into Portuguese followed by the varying financial regulations.

That’s why Kushki’s approach has to be somewhat custom in each country.

“We focus on going into the markets and we basically rebuild an entire infrastructure, so we put everything into one API,” said Schwarzkopf.

Products similar to Kushki have been successful in other regions around the world, such as in India with Pine Labs, Africa with Flutterwave and Checkout.com, which now has 15 international offices.

To build all this infrastructure, Kushki, which means “cash” in a native Andes dialect, has raised a total of $100 million from SoftBank and an undisclosed global growth equity firm, as well as previous investors including DILA Capital, Kaszek Ventures, Clocktower Ventures and Magma Partners.

“From now until 2060, people will need servers and ways to move money, and we knew that the existing payment infrastructure couldn’t support that,” said Schwarzkopf.

Powered by WPeMatico

Here in the U.S. the concept of using a driver’s data to decide the cost of auto insurance premiums is not a new one.

But in markets like Brazil, the idea is still considered relatively novel. A new startup called Justos claims it will be the first Brazilian insurer to use drivers’ data to reward those who drive safely by offering “fairer” prices.

And now Justos has raised about $2.8 million in a seed round led by Kaszek, one of the largest and most active VC firms in Latin America. Big Bets also participated in the round, along with the CEOs of seven unicorns, including Assaf Wand, CEO and co-founder of Hippo Insurance; David Vélez, founder and CEO of Nubank; Carlos Garcia, founder and CEO of Kavak; Sergio Furio, founder and CEO of Creditas; Patrick Sigrist, founder of iFood and Fritz Lanman, CEO of ClassPass. (There’s a seventh CEO who wishes to remain anonymous). Senior executives from Robinhood, Stripe, Wise, Carta and Capital One also put money in the round.

Serial entrepreneurs Dhaval Chadha, Jorge Soto Moreno and Antonio Molins co-founded Justos, having most recently worked at various Silicon Valley-based companies including ClassPass, Netflix and Airbnb.

“While we have been friends for a while, it was a coincidence that all three of us were thinking about building something new in Latin America,” Chadha said. “We spent two months studying possible paths, talking to people and investors in the United States, Brazil and Mexico, until we came up with the idea of creating an insurance company that can modernize the sector, starting with auto insurance.”

Ultimately, the trio decided that the auto insurance market would be an ideal sector considering that in Brazil, an estimated more than 70% of cars are not insured.

The process to get insurance in the country, by any accounts, is a slow one. It takes up to 72 hours to receive initial coverage and two weeks to receive the final insurance policy. Insurers also take their time in resolving claims related to car damages and loss due to accidents, the entrepreneurs say. They also charge that pricing is often not fair or transparent.

Justos aims to improve the whole auto insurance process in Brazil by measuring the way people drive to help price their insurance policies. Similar to Root here in the U.S., Justos intends to collect users’ data through their mobile phones so that it can “more accurately and assertively price different types of risk.” This way, the startup claims it can offer plans that are up to 30% cheaper than traditional plans, and grant discounts each month, according to the driving patterns of the previous month of each customer.

“We measure how safely people drive using the sensors on their cell phones,” Chadha said. “This allows us to offer cheaper insurance to users who drive well, thereby reducing biases that are inherent in the pricing models used by traditional insurance companies.”

Justos also plans to use artificial intelligence and computerized vision to analyze and process claims more quickly and machine learning for image analysis and to create bots that help accelerate claims processing.

“We are building a design-driven, mobile first and customer experience that aims to revolutionize insurance in Brazil, similar to what Nubank did with banking,” Chadha told TechCrunch. “We will be eliminating any hidden fees, a lot of the small text and insurance-specific jargon that is very confusing for customers.”

Justos will offer its product directly to its customers as well as through distribution channels like banks and brokers.

“By going direct to consumer, we are able to acquire users cheaper than our competitors and give back the savings to our users in the form of cheaper prices,” Chadha said.

Customers will be able to buy insurance through Justos’ app, website or even WhatsApp. For now, the company is only adding potential customers to a waitlist but plans to begin selling policies later this year..

During the pandemic, the auto insurance sector in Brazil declined by 1%, according to Chadha, who believes that indicates “there is latent demand raring to go once things open up again.”

Justos has a social good component as well. Justos intends to cap its profits and give any leftover revenue back to nonprofit organizations.

The company also has an ambitious goal: to help make insurance become universally accessible around the world and the roads safer in general.

“People will face everyday risks with a greater sense of safety and adventure. Road accidents will reduce drastically as a result of incentives for safer driving, and the streets will be safer,” Chadha said. “People, rather than profits, will become the focus of the insurance industry.”

Justos plans to use its new capital to set up operations, such as forming partnerships with reinsurers and an insurance company for fronting, since it is starting as an MGA (managing general agent).

It’s also working on building out its products such as apps, its back end and internal operations tools, as well as designing all its processes for underwriting, claims and finance. Justos’ data science team is also building out its own pricing model.

The startup will be focused on Brazil, with plans to eventually expand within Latin America, then Iberia and Asia.

Kaszek’s Andy Young said his firm was impressed by the team’s previous experience and passion for what they’re building.

“It’s a huge space, ripe for innovation and this is the type of team that can take it to the next level,” Young told TechCrunch. “The team has taken an approach to building an insurance platform that blends being consumer-centric and data-driven to produce something that is not only cheaper and rewards safety but as the brand implies in Portuguese, is fairer.”

Powered by WPeMatico

As AI has grown from a menagerie of research projects to include a handful of titanic, industry-powering models like GPT-3, there is a need for the sector to evolve — or so thinks Dario Amodei, former VP of research at OpenAI, who struck out on his own to create a new company a few months ago. Anthropic, as it’s called, was founded with his sister Daniela and its goal is to create “large-scale AI systems that are steerable, interpretable, and robust.”

The challenge the siblings Amodei are tackling is simply that these AI models, while incredibly powerful, are not well understood. GPT-3, which they worked on, is an astonishingly versatile language system that can produce extremely convincing text in practically any style, and on any topic.

But say you had it generate rhyming couplets with Shakespeare and Pope as examples. How does it do it? What is it “thinking”? Which knob would you tweak, which dial would you turn, to make it more melancholy, less romantic, or limit its diction and lexicon in specific ways? Certainly there are parameters to change here and there, but really no one knows exactly how this extremely convincing language sausage is being made.

It’s one thing to not know when an AI model is generating poetry, quite another when the model is watching a department store for suspicious behavior, or fetching legal precedents for a judge about to pass down a sentence. Today the general rule is: the more powerful the system, the harder it is to explain its actions. That’s not exactly a good trend.

“Large, general systems of today can have significant benefits, but can also be unpredictable, unreliable, and opaque: our goal is to make progress on these issues,” reads the company’s self-description. “For now, we’re primarily focused on research towards these goals; down the road, we foresee many opportunities for our work to create value commercially and for public benefit.”

The goal seems to be to integrate safety principles into the existing priority system of AI development that generally favors efficiency and power. Like any other industry, it’s easier and more effective to incorporate something from the beginning than to bolt it on at the end. Attempting to make some of the biggest models out there able to be picked apart and understood may be more work than building them in the first place. Anthropic seems to be starting fresh.

“Anthropic’s goal is to make the fundamental research advances that will let us build more capable, general, and reliable AI systems, then deploy these systems in a way that benefits people,” said Dario Amodei, CEO of the new venture, in a short post announcing the company and its $124 million in funding.

That funding, by the way, is as star-studded as you might expect. It was led by Skype co-founder Jaan Tallinn, and included James McClave, Dustin Moskovitz, Eric Schmidt and the Center for Emerging Risk Research, among others.

The company is a public benefit corporation, and the plan for now, as the limited information on the site suggests, is to remain heads-down on researching these fundamental questions of how to make large models more tractable and interpretable. We can expect more information later this year, perhaps, as the mission and team coalesces and initial results pan out.

The name, incidentally, is adjacent to anthropocentric, and concerns relevancy to human experience or existence. Perhaps it derives from the “Anthropic principle,” the notion that intelligent life is possible in the universe because… well, we’re here. If intelligence is inevitable under the right conditions, the company just has to create those conditions.

Powered by WPeMatico

MotoRefi has raised another $45 million in a round led by Goldman Sachs just five months after investors poured $10 million into the fintech startup to help turbocharge its auto refinancing business.

The startup developed an auto refinancing platform that handles the entire loan process, including finding the best rates, paying off the old lender and re-titling the vehicle. MotoRefi says using its platform saves consumers an average of $100 a month on their car payments, a goal achieved partly because it works directly with lending institutions. The company’s refinancing tools had seen steady growth until the COVID-19 pandemic popped into in higher gear. CEO Kevin Bennett said MotoRefi is on track to issue $1 billion in loans by the end of the year, a fivefold increase from the same period last year.

Bennett said the short timeline between rounds was driven by investor confidence in its metrics, which have continued on to grow at a fast pace, and the basic economics around the business.

“We candidly weren’t planning on raising yet, but they (Goldman Sachs) were comfortable given the relationship we have built and the track record and success of the business, to preempt the round and move that calendar up,” Bennett said.

MotoRefi’s platform is available in 46 states and Washington, DC, with plans to be live in all 50 states by the end of the year. The startup has ramped up hiring to help support that growth. By the first quarter of 2021, it had more than doubled its headcount to 187 employees from the same period last year. Its workforce has now popped to 250 employees. The company has hired several senior-level executives, opened a new headquarters and partnered with SoFi. Goldman Sach’s VP of venture capital and growth equity Jade Mandel has joined MotoRefi’s board.

And Bennett sees plenty of room to grow as consumers seek ways to rebalance their debts. The auto refinance market in the United States is $40 billion. However, overall auto loan debt is $1.3 trillion. With 40 million auto loans originated every year, MotoRefi is promised a consistent flow of potential new customers.

The fresh injection of capital, which included investor IA Capital as well as returning backers Moderne Ventures, Accomplice, Link Ventures, Motley Fool Ventures and CMFG Ventures, will be used to continue to build out its products and services and hire more people. MotoRefi has raised $60 million since its inception in 2016.

Bennett believes the company is now in self-sustaining position.

“Thankfully, we moved beyond the world where we are raising capital and then raising more capital as we run out of capital,” he said. “I think we have a great sustainable business and so we, in some sense runway is infinite, and we are building a great profitable business. That’s not to say that we won’t ever raise again, but it will be based on strategic considerations, as opposed to out of necessity.”

Powered by WPeMatico

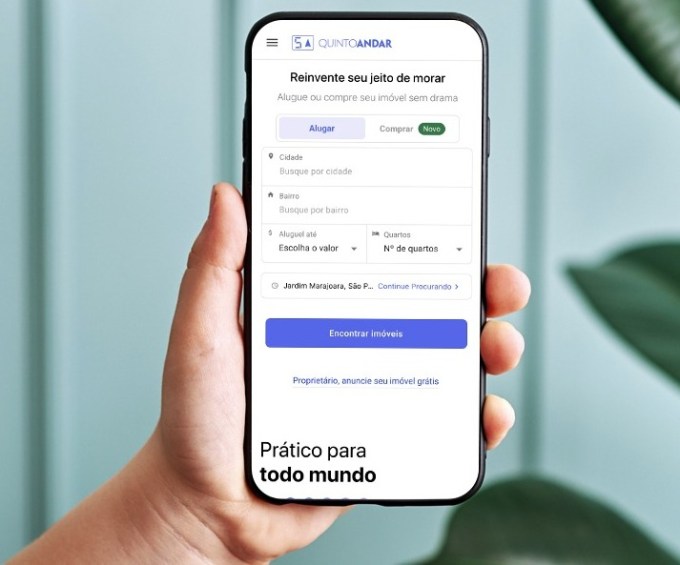

Fintech and proptech are two sectors that are seeing exploding growth in Latin America, as financial services and real estate are two categories in particular dire need of innovation in a region.

Brazil’s QuintoAndar, which has developed a real estate marketplace focused on rentals and sales, has seen impressive growth in recent years. Today, the São Paulo-based proptech has announced it has closed on $300 million in a Series E round of funding that values it at an impressive $4 billion.

The round is notable for a few reasons. For one, the valuation — high by any standards but especially for a LatAm company — represents an increase of four times from when QuintoAndar raised a $250 million Series D in September 2019.

It’s also noteworthy who is backing the company. Silicon Valley-based Ribbit Capital led its Series E financing, which also included participation from SoftBank’s LatAm-focused Innovation Fund, LTS, Maverik, Alta Park, an undisclosed U.S.-based asset manager fund with over $2 trillion in AUM, Kaszek Ventures, Dragoneer and Accel partner Kevin Efrusy.

Having backed the likes of Coinbase, Robinhood and CreditKarma, Ribbit Capital has historically focused on early-stage investments in the fintech space. Its bet on QuintoAndar represents clear faith in what the company is building, as well as its confidence in the startup’s plans to branch out from its current model into a one-stop real estate shop that also offers mortgage, title, insurance and escrow services.

The latest round brings QuintoAndar’s total raised since its 2013 inception to $635 million.

Ribbit Capital Partner Nick Huber said QuintoAndar has over the years built “a unique and trusted brand in Brazil” for those looking for a place to call home.

“Whether you are looking to buy or to rent, QuintoAndar can support customers through the entire transaction process: from browsing verified inventory to signing the final contracts,” Huber told TechCrunch. “The ability to serve customers’ needs through each phase of life and to do so from start to finish is a unique capability, both in Brazil and around the world.”

QuintoAndar describes itself as an “end-to-end solution for long-term rentals” that, among other things, connects potential tenants to landlords and vice versa. Last year, it expanded also into connecting a home buyers to sellers.

Image Credits: QuintoAndar

TechCrunch spoke with co-founder and CEO Gabriel Braga and he shared details around the growth that has attracted such a bevy of high-profile investors.

Like most other businesses around the world, QuintoAndar braced itself for the worst when the COVID-19 pandemic hit last year — especially considering one core piece of its business is to guarantee rents to the landlords on its platform.

“In the beginning, we were afraid of the implications of the crisis but we were able to honor our commitments,” Braga said. “In retrospect, the pandemic was a big test for our business model and it has validated the strength and defensibility of our business on the credit side and reinforced our value proposition to tenants and landlords. So after the initial scary moments, we actually felt even more confident in the business that we are building.”

QuintoAndar describes itself as “a distant market leader” with more than 100,000 rentals under management and about 10,000 new rentals per month. Its rental platform is live in 40 cities across Brazil, while its home-buying marketplace is live in four. Part of its plans with the new capital is to expand into new markets within Brazil, as well as in Latin America as a whole.

The startup claims that, in less than a year, QuintoAndar managed to aggregate the largest inventory among digital transactional platforms. It now offers more than 60,000 properties for sale across Sao Paulo, Rio de Janeiro, Belho Horizonte and Porto Alegre. To give greater context around the company’s growth of that side of its platform: In its first year of operation, QuintoAndar closed more than 1,000 transactions. It has now surpassed the mark of 8,000 transactions in annualized terms, growing between 50% and 100% quarter over quarter.

As for the rentals side of its business, Braga said QuintoAndar has more than 100,000 rentals under management and is closing about 10,000 new rentals per month. The company is not profitable as it’s focused on growth, although it’s unit economics are particularly favorable in certain markets such as Sao Paulo, which is financing some of its growth in other cities, according to Braga.

Now, the 2,000-person company is looking to begin its global expansion with plans to enter the Mexican market later this year. With that, Braga said QuintoAndar is looking to hire “top-tier” talent from all over.

“We want to invest a lot in our product and tech core,” he said. “So we’re trying to bring in more senior people from abroad, on a global basis.”

CEO Braga and CTO André Penha came up with the idea for QuintoAndar after receiving their MBAs at Stanford University. As many startups do, the company was founded out of Braga’s personal “nightmare” of an experience — in this case, of trying to rent an apartment in Sao Paulo.

The search process, he recalls, was difficult as there was not enough information available online and renters were forced to provide a guarantor, or co-signer, from the same city or pay rent insurance, which Braga described as “very expensive.”

“Overall, I felt it was a very inefficient and fragmented process with no transparency or tech,” Braga told me at the time of the company’s last raise. “There was all this friction and high cost involved, just real tangible problems to solve.”

The concept for QuintoAndar (which can be translated literally to “Fifth Floor” in Portuguese) was born.

“Little by little, we created a platform that consolidated supply and inventory in a uniform way,” Braga said.

The company took the search phase online for the first time, according to Braga. It also eliminated the need for tenants to provide a guarantor, thereby saving them money. On the other side, QuintoAndar also works to help protect the landlord with the guarantee that they will get their rent “on time every month,” Braga said.

It’s been interesting watching the company evolve and grow over time, just as it’s been fascinating seeing the region’s startup scene mature and shine in recent years.

Powered by WPeMatico

Orbiit, a startup that automates the interactions within an online community, has raised a $2.7 million round led by Bread and Butter Ventures, with participation from new investors High Alpha Capital, LAUNCHub Ventures and Company Ventures. Existing investors Founders Fund, which led Orbiit’s $1 million pre-seed round, Acceleprise and other angels also participated. The capital will be used to build out the Orbiit product and engineering team.

Orbiit says its platform handles the communications, matching, scheduling, feedback collection and analytics for people connecting with each other in an online community. The idea is that the communities therefore learn and network better, engage more and share more knowledge.

CEO and co-founder Bilyana Freye said: “Tailored 1:1 connections allow members to discuss difficult topics, be vulnerable and share learnings with one another. Those 1:1 connections are the hardest to execute, but when you start investing in them, with the help of Orbiit, you see engagement feeding into all other initiatives and a vibrant, active community that truly delivers on the promise to its members.”

Bread and Butter Ventures Managing Partner Mary Grove added: “This age-old question of how to leverage technology at scale to drive meaningful connections across communities both internal to an organization and across the globe is a problem we’ve been actively seeking a solution to for a decade. Orbiit brings the perfect blend of tech-enabled software with human curation to create strong connections and provide insights back to community managers.”

The platform is being used by startup communities at True Ventures, GGV and Lerer Hippeau; private networking groups such as Dreamers & Doers; and customer communities, like the CFO community run by fintech leader Spendesk.

Founders Fund Principal Delian Asparouhov said: “We see Orbiit as a key platform for peer learning within companies and communities, unlocking untapped knowledge through curated matchmaking.”

LAUNCHub Ventures participated in the round, following the recent first close of its new $70 million fund.

Powered by WPeMatico

CorrActions, a noninvasive neuroscience startup that uses sensor data to evaluate a user’s cognitive state due to drowsiness, alcohol, fatigue and other issues, today announced that it has raised a $2.7 million seed round. Early-stage fund VentureIsrael, seed fund Operator Partners and the Israeli Innovation Authority are backing the company, which is based out of OurCrowd’s Labs/02 incubator.

The idea here is to use touch sensors wherever humans may interact with machines, be that in a fighter jet’s cockpit, a car or anywhere else where knowing a user’s cognitive state could prevent potentially catastrophic errors. CorrActions promises that its proprietary algorithms can identify the user’s cognitive state and detect errors 150 milliseconds before they occur by “decoding unconscious brain signals through body motion monitoring.” For the most part, the system is use-case agnostic since it’s basically a generic platform that is independent of where it is implemented.

“Using sensors that already exist in nearly every electronic device like smartwatches, smartphones and even steering wheels and joysticks, CorrActions is the first in the world to be able to read a person’s cognitive state at any given moment by analyzing micro changes in their muscular activity,” explained Eldad Hochman, the company’s co-founder and CSO. “It is enough for the person to come in contact with an electronic device for two minutes and we can accurately quantify cognitive state and even predict a rapid deterioration, which may lead to failure or accidents. We can see this coming seconds before it occurs. This means that we can quantify the level of fatigue, intoxication, exhaustion or lack of concentration at any given moment.”

A lot of modern cars already feature sensors that can monitor your alertness, of course, and so it’s maybe no surprise that CorrActions is already working on proofs of concept with a few players in the automotive industry. In addition, it is also working on projects with the defense industry to show that its systems can assess a pilot’s performance, for example. But Hochman also believes that the company’s algorithms may be able to alert athletes or the elderly when they may be at risk of injury and falls.

The company says it will use the new funding to further develop its algorithms and support its current deployment partners, especially in the automotive industry.

“We are developing, and already seeing significant results for a technology which has the potential to save companies man-hours and money by preventing basic operational errors,” said CorrActions co-founder and CEO Zvi Ginosar. “Moreover, the application of our platform can be used to save lives, and prevent thousands of accidents and errors. In the next months we hope to be able to report more ground-breaking results and proof of concept trials, and this funding will greatly help us reach this goal.”

Powered by WPeMatico