Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

About 18 months ago, Jenny Gyllander created an Instagram account by the name of @thingtesting.

The premise was simple. Gyllander, who was at the center of the London startup ecosystem as an investor with the British seed fund Backed.VC, would upload photos of interesting direct-to-consumer products with a caption that served as a bite-sized review. The experiment began with Birchbox, a provider of curated boxes of beauty products that rose to prominence amid the subscription box hype of yesteryear. In her short review, tailored perfectly for the Instagram generation, Gyllander admitted to being “like 10 years late to this much hyped subscription-everything party,” adding that “after two boxes and ten products, only three products were relevant to me.” Her honesty, and perhaps more importantly, her brevity, garnered her a small following of venture capitalists, founders and consumer-brand enthusiasts.

Since that first post, Gyllander has featured and reviewed more than 100 products on her Instagram account — which today counts 32,800 followers. And she quit her day job and began building an Instagram-inspired, full-fledged review business.

“I found something I am very, very passionate about,” Gyllander tells TechCrunch. “Finding the D2C niche was for me a little bit of a Holy Grail. It’s where brands and startups align for the first time in a concrete way.”

With a $300,000 pre-seed investment from angel investor and Homebrew co-founder Hunter Walk, who previously called Thingtesting “The best VC on Instagram,” early Spotify investor Shakil Khan and more, Gyllander wants to create a full-scale D2C review platform with a team of reviewers and content creators, and a portal for her loyal followers to write and submit their own reviews. She compares what she envisions for Thingtesting to that of Rotten Tomatoes. Akin to the popular website for movie and television reviews, each product review on her future website will include a Thingtesting score and an audience score. The goal is to help consumers shop smarter and filter through the D2C noise.

“People are confused right now by the sheer amount of products launching,” Gyllander said. “I want Thingtesting to be a filter for people to consume better … It’s a role department stores used to have back in the day, but nobody has really filled that role in the online world.”

Gyllander, already making money from what was once a side project, has plans in store to generate significantly more revenue. Currently, she’s capitalizing off Instagram’s Close Friends list, which the social media hub launched last year to allow users to share content to fewer people. Gyllander, like a slew of other Instagram influencers, however, quickly realized an opportunity to monetize content using the feature, a trend explained in detail in a recent report from The Atlantic.

Gyllander charges a lifetime fee of $100 to her followers hoping for a spot on her Close Friends list. Those followers are then provided exclusive content, including behind-the-scenes looks at her product review journeys. So far, 300 people have been granted access to the exclusive group as others sit on the waitlist. Gyllander explains she hasn’t green-lit every request to enter the coveted group because she wants to maintain a sense of community as the account grows in popularity. Early next year, she hopes, she will have launched a Thingtesting website and a new subscription-based membership tier targeting D2C connoisseurs, investors and anyone interested in a front-seat view of the booming D2C industry.

As Thingtesting morphs into a digital review platform and expands from the bounds of Instagram, Gyllander will have to work harder to differentiate what she’s built from other review sites and D2C blogs. Her secret weapon, she believes, is her authenticity.

“It’s my honesty,” Gyllander said. “And it’s the fact that there’s no payment involved from the brands and that I’m not being paid to review products. That’s something quite rare in the Instagram world today. There aren’t that many accounts that are just talking about new products with non-monetary incentives.”

Since launching with a review of Birchbox, Gyllander has shared her thoughts on Magic Spoon, a D2C cereal company: “one bowl kept me full for hours,” she wrote, ultimately concluding she wouldn’t continue eating the cereal. More recently, she referred to the D2C aperitif brand Haus as “stunning;” wrote a lukewarm review of the blue light-protecting eyewear brand Felix Gray; and posted a glowing summary of Dripkit, a D2C coffee brand.

To secure a spot on Gyllander’s grid, a product must bring something new to the market, as well as boast killer branding and packaging. The former VC says she tries out about 20 products a month and shares official reviews of four or five.

“The majority of people today, when it comes to modern brands, they have their first interaction through an ad or an influencer telling them about the product,” Gyllander explained. “Discovery is in a weird place right now when it comes to the general consumer.”

It’s difficult to imagine a venture-scale business within Gyllander’s vision for Thingtesting. But one should never underestimate the value of an exclusive and hyper-focused network. Gyllander, in a short time, has created a meeting place for D2C aficionados and venture capitalists and, as she’s proven, her thoughts are worth paying for.

Powered by WPeMatico

There are apps out there that help you find friends, find dates and find your distant family histories, but when it comes to “growing your professional network,” the options are shockingly bad, we’re talking LinkedIn here.

Lunchclub is a startup that’s looking to help users navigate finding new connections inside specific industries. The company has recently closed a $4 million seed round led by Andreessen Horowitz with other investments coming in from Quora’s co-founder, the Robinhood cofounders, and Flexport’s cofounders.

The app follows in the footsteps of others that aimed to be dating app-like marketplaces for growing out your professional network via 1:1 lunch and coffee meetings. Lunchclub is more focused on setting up a handful of meetings for users that have a specific goal in mind. Lunchclub is aiming to be your warm intro and connect you with other users via email that can assist you in your professional goals.

When you’re on-boarded to the service, you are asked to highlight some “objectives” that you might have and this is where the app really makes its goals clear. Options include, “raise funding,” “find a co-founder or parter,” “explore other companies,” and “brainstorm with peers.” These objectives are pretty explicit and complementary, i.e. for every “raise funding” objective, there’s an “invest” option.

There isn’t a ton being asked for on the part of the user when it comes to building up the data on their profile, Lunchclub is hoping to get most of the data that they need from the rest of the web.

“Our view is that there’s tons of data already out there,” Lunchclub CEO Vlad Novakovski told TechCrunch in an interview. “Anything that comes from the existing social networks, be in things like Twitter, be it things that are more specific to what people might be working on, like Github or Dribble or AngelList — all of those data sources are in the public domain and are fair game.”

Lunchclub’s sell is that they can learn from what matches are successful via user feedback and use that to hone further matches. Novakovski most previously was the CTO of Euclid Analytics which WeWork acquired in 2017. Previous to that, he led the machine learning team at Quora.

The web app, which currently has a lengthy-waitlist, is available for users in seven cities including the SF Bay Area, Los Angeles, New York, Boston, Austin, Seattle and London.

Co-founders Vlad Novakovski, Scott Wu and Hayley Leibson

Powered by WPeMatico

As Greta Thunberg heads back to Europe from the U.S. after radicalizing a generation, entrepreneurs are quickly realizing there is a zeitgeist to be gotten hold of here. With food production a major contributor to climate change, it’s no surprise then that on-demand food startups are appearing to cater to this new audience.

Simple Feast launched its plant-based food product in early 2017 and since then has developed a fast-food range that is catching the climate and taste fashion wave.

The company has now raised a total of $33 million in a Series B round led by U.S.-based venture capital firm 14W, with a number of other existing investors participating, including Europe’s Balderton Capital, which is increasing their investment in the business.

The company was partly self-funded in the beginning, then added Sweet Capital (London/Stockholm) and byFounders (CPH/SF) as the first VCs. Later, Balderton Capital (London) and 14W (NYC) joined in the Series A and B. The total funding to date is now north of $50 million.

The founders are Jakob Jønck and Thomas Ambus; Jønck was co-founder of Endomondo, acquired by MyFitnessPal.

Jønck says: “The future of food does not just belong to plants, but will be both plant-based and unprocessed. This movement is pivotal to save not only our planet, but also human health. With this investment, we can continue our journey and bring our products to more people, in existing as well as new markets, while also strengthening our R&D efforts in new food innovation.”

Simple Feast is ticking the climate agenda boxes, with packaging made solely by FSC-approved cardboard boxes, to the cooling element they use to keep the food fresh (frozen tap water in drinkable cartons) and their use of all-organic produce.

Alex Zubillaga from 14W commented: “Over the past year since first investing in Simple Feast, we have continued to be impressed by the caliber and deep operational experience of the management team that Jakob Jønck has built around him… We believe Simple Feast has the opportunity to become a global, category-defining brand as they expand to the U.S. early next year.”

Typical customers are meat-eating families in their 30s and 40s who are trying to cut down on their meat consumption. They are well-educated, have a middle or high income and demand high quality and transparency in the food they consume. Their main competitors are restaurants, meal-kits and take-away. The idea is not to compromise on taste or quality, nor convenience or packaging.

Powered by WPeMatico

Julo, a peer-to-peer lending platform in Indonesia, said on Wednesday it has extended its $5 million Series A raise to $15 million as it looks to scale its business in the key Southeast Asian market.

The $10 million Series A2 round for the Jakarta-headquartered startup was led by Quona Capital, with Skystar, East Ventures, Provident, Gobi Partners and Convergence participating. The two-year-old startup, which has raised about $16 million to date, is now closing the round, Adrianus Hitijahubessy, co-founder and CEO of Julo, told TechCrunch in an interview.

Through its eponymous Android app, Julo provides loans of about $300 to users at aggressively competitive rate of 3-5% per month — one of its key differentiating factors. Julo has managed to keep its interest rate low because its credit scoring system is more efficient than those of its rivals, claimed Hitijahubessy, who has amassed more than a decade of experience in credit scoring systems using alternative data from his previous stints.

“There are lots of players in this market. Not just Indonesia, but globally. But it comes down to who actually knows what they are doing. The bar is becoming higher and it is increasingly becoming difficult for digital lending companies to just launch an app and charge a high interest rate,” he said.

Julo works with banks and individuals to finance loans to customers. It says it has disbursed about $50 million to date.

Hitijahubessy said Julo will use the fresh capital to expand the team and enhance its credit score system. The startup intends to focus on growing its business in Indonesia itself.

In a statement, Ganesh Rengaswamy, co-founder and partner of Quona Capital, said, “a significant majority of JULO’s loans are used for productive purposes that can enhance the economic well-being of families and small businesses — driving financial inclusion in Indonesia, which is a cornerstone of Quona’s focus.”

Digital lending is becoming an increasingly crowded space in South Asian markets. In India, for instance, a growing number of digital mobile wallets, including Paytm and MobiKwik, have recently started to offer credits to customers.

Powered by WPeMatico

PlayVS, the platform that allows high school students to compete on varsity esports teams through their school, has today announced the close of a $50 million Series C led by existing investor NEA. Battery Ventures, Dick Costolo and Adam Bain of 01 Advisors, Sapphire Sport, Michael Zeisser, Dennis Phelps of IVP and co-founder of CAA Michael Ovitz participated.

This brings the startup’s total funding to $96 million, the vast majority of which was raised in the last 13 months.

PlayVS launched in April of 2018 under founder and CEO Delane Parnell, who believes that the opportunity of esports is fundamentally broken without high school leagues. Through an exclusive partnership with the NFHS (the NCAA of high schools), PlayVS allows schools across the country to create esports teams and participate in leagues with their neighboring schools, just like any other varsity sport.

PlayVS also partners with the game publishers, which allows the platform to pull stats directly from the PlayVS website and track players’ performance across every game.

The startup charges either the player, parent/guardian or school $64 per player to participate in “Seasons,” PlayVS’s first product. It was launched in October of 2018 in five states and expanded to eight states this spring.

Since launch, 13,000 schools have joined the waitlist to get a varsity esports team through PlayVS, which represents 68% of the country. PlayVS says that just over 14,000 high schools in the United States have a football program, marking the idea of varsity esports as a relatively popular one.

With the upcoming fall Season for 2019, all 50 states will have access to the PlayVS platform, with 15 states competing for an actual State Championship in partnership with their state association. These states include Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Georgia, Hawaii, Kentucky, Massachusetts, Mississippi, Rhode Island, Virginia and Washington D.C.

States that have not gotten an endorsement from their state association will still compete regionally for a PlayVS championship. PlayVS supports League of Legends, Rocket League and SMITE, with plans to support other games in the future.

Not only does PlayVS offer high school students the chance to play organized esports, but it also gives colleges and esports orgs a recruitment tool to scope and scoop young talent.

But what about that funding? Well, Parnell says that the new round gives the company a war chest to not only hire aggressively — the company has gone from 18 to 41 employees in the last year — but also to consider mergers and acquisitions as a means of growth.

Perhaps most importantly, the company will use the funding to explore products outside of high school, with eyes squarely focused on the collegiate market. With esports still in its infancy, there is a huge opportunity to provide the infrastructure of these leagues early on, and PlayVS is looking to capture that.

Powered by WPeMatico

It’s still early days for quantum computing, but we’re nonetheless seeing an interesting group of startups emerging that are helping the world take advantage of the new technology now. Aliro Technologies, a Harvard startup that has built a platform for developers to code more easily for quantum environments — “write once, run anywhere” is one of the startup’s mottos — is today coming out of stealth and announcing its first funding of $2.7 million to get it off the ground.

The seed round is being led Flybridge Capital Partners, with participation from Crosslink Ventures and Samsung NEXT’s Q Fund, a fund the corporate investor launched last year dedicated specifically to emerging areas like quantum computing and AI.

Aliro is wading into the market at a key moment in the development of quantum computing.

While vendors continue to build new quantum hardware to be able to tackle the kinds of complex calculations that cannot be handled by current binary-based machines, for example around medicine discovery, or multi-variabled forecasting — just today IBM announced plans for a 53-qubit device — even so, it’s widely acknowledged that the computers that have been built so far face a number of critical problems that will hamper wide adoption.

The interesting development of recent times is the emergence of startups that are tackling these specific critical problems, dovetailing that progress with that of building the hardware itself. Take the fact that quantum machines so far have been too prone to error when used for extended amounts of time: last week, I wrote about a startup called Q-CTRL that has built firmware that sits on top of the machines to identify when errors are creeping in and provide fixes to stave off crashes.

The specific area that Aliro is addressing is the fact that quantum hardware is still very fragmented: each machine has its own proprietary language and operating techniques and sometimes even purpose for which it’s been optimised. It’s a landscape that is challenging for specialists to engage in, let alone the wider world of developers.

“We’re at the early stage of the hardware, where quantum computers have no standardisation, even those based on the same technology have different qubits (the basic building block of quantum activity) and connectivity. It’s like digital computing in 1940s,” said CEO and chairman Jim Ricotta. (The company is co-founded by Harvard computational materials science professor Prineha Narang along with Michael Cubeddu and Will Finigan, who are actually still undergraduate students at the university.)

“Because it’s a different style of computing, software developers are not used to quantum circuits,” said Ricotta, and engaging with them is “not the same as using procedural languages. There is a steep on-ramp from high-performance classical computing to quantum computing.”

While Aliro is coming out of stealth, it appears that the company is not being specific with details about how its platform actually works. But the basic idea is that Aliro’s platform will essentially be an engine that will let developers work in the languages that they know, and identify problems that they would like to solve; it will then assess the code and provide a channel for how to optimise that code and put it into quantum-ready language, and suggest the best machine to process the task.

The development points to an interesting way that we may well see quantum computing develop, at least in its early stages. Today, we have a handful of companies building and working on quantum computers, but there is still a question mark over whether these kinds of machines will ever be widely deployed, or if — like cloud computing — they will exist among a smaller amount of providers that will provide access to them on-demand, SaaS-style. Such a model would seem to fit with how much computing is sold today in the form of instances, and would open the door to large cloud names like Amazon, Google and Microsoft playing a big role in how this would be disseminated.

Such questions are still theoretical, of course, given some of the underlying problems that have yet to be fixed, but the march of progress seems inevitable, with forecasts predicting that quantum computing is likely to be a $2.2 billion industry by 2025, and if this is a route that is taken, the middlemen like Aliro could play an important role.

“I have been working with the Aliro team for the past year and could not be more excited about the opportunity to help them build a foundational company in Quantum Computing software, “ said David Aronoff, general partner at Flybridge, in a statement. “Their innovative approach and unique combination of leading Quantum researchers and a world-class proven executive team, make Aliro a formidable player in this exciting new sector.

“At Samsung NEXT we are focused on what the world will look like in the future, helping to make that a reality,” said Ajay Singh, Samsung NEXT’s Q Fund, in a statement. “We were drawn to Prineha and her team by their impressive backgrounds and extent of research into quantum computing. We believe that Aliro’s unique software products will revolutionize the entire category, by speeding up the inflection point where quantum becomes as accessible as classical computing. This could have implications on anything from drug discovery, materials development or chemistry. Aliro’s ability to map quantum circuits to heterogeneous hardware in an efficient way will be truly transformative and we’re thrilled to be on this journey with them.”

Powered by WPeMatico

Automating agriculture is a complex proposition given the number and variety of tasks involved, but a number of robotics and autonomy companies are giving it their best shot. FarmWise seems to have impressed someone — it just raised $14.5 million to continue development of its autonomous weeding vehicle.

Currently in the prototype stage, these vehicles look like giant lumbering personnel carriers or the like, but are in fact precision instruments which scan the ground for invasive weeds among the crop and carefully pluck them out.

“Each day, one FarmWise robot can weed crops to feed a medium-sized city of approximately 400,000 inhabitants,” said FarmWise CEO Sebastien Boyer in a press release announcing the latest funding round. “We are now enhancing the scale and depth of our proprietary plant-detection technology to help growers with more of their processes and on more of their crops.”

Presumably the robot was developed and demonstrated with something of a specialty in one crop or another, more as a proof of concept than anything.

Well, it seems to have proved the concept. The new $14.5 million round, led by Calibrate Ventures, is likely due to the success of these early trials. This is far from an easy problem, so going from idea to nearly market-ready in under three years is pretty impressive. Farmers love tech — if it works. And tiny issues or error rates can lead to enormous problems with the vast monoculture fields that make up the majority of U.S. farms.

The company previously took in about $5.7 million in a seed round, following its debut on Alchemist Accelerator’s demo day back in 2017. Robots are expensive!

Hopefully the cash infusion will help propel FarmWise from prototype to commercialization, though it’s hard to imagine they could build more than a handful of the machines with that kind of money. Perhaps they’ll line up a couple big orders and build on that future revenue.

Meanwhile they’ll continue to develop the AI that powers the chunky, endearing vehicles.

“Looking ahead, our robots will increasingly act as specialized doctors for crops, monitoring individual health and adjusting targeted interventions according to a crop’s individual needs,” said Boyer. So not only will these lumbering platforms delicately remove weeds, but they’ll inspect for aphids and fungus and apply the necessary remedies.

With that kind of inspection they can make a data play later — what farmer wouldn’t want to be able to digitally inspect every plant in their fields?

Powered by WPeMatico

Artificial intelligence is playing an increasingly large role in enterprise software, and Boston’s DataRobot has been helping companies build, manage and deploy machine learning models for some time now. Today, the company announced a $206 million Series E investment led by Sapphire Ventures.

Other participants in this round included new investors Tiger Global Management, World Innovation Lab, Alliance Bernstein PCI and EDBI, along with existing investors DFJ Growth, Geodesic Capital, Intel Capital, Sands Capital, NEA and Meritech.

Today’s investment brings the total raised to $431 million, according to the company. It has a pre-money valuation of $1 billion, according to PitchBook. DataRobot would not confirm this number.

The company has been catching the attention of these investors by offering a machine learning platform aimed at analysts, developers and data scientists to help build predictive models much more quickly than it typically takes using traditional methodologies. Once built, the company provides a way to deliver the model in the form of an API, simplifying deployment.

The late-stage startup plans to use the money to continue building out its product line, while looking for acquisition opportunities where it makes sense. The company also announced the availability of a new product today, DataRobot MLOps, a tool to manage, monitor and deploy machine learning models across a large organization.

The company, which was founded in 2012, claims it has had triple-digit recurring revenue growth dating back to 2015, as well as one billion models built on the platform to date. Customers contributing to that number include a broad range of companies, such as Humana, United Airlines, Harvard Business School and Deloitte.

Powered by WPeMatico

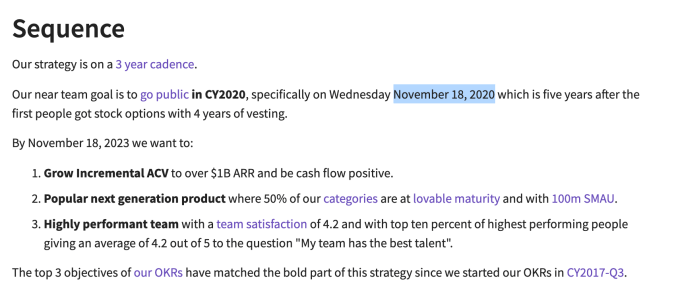

GitLab is a company that doesn’t pull any punches or try to be coy. It actually has had a page on its website for some time stating it intends to go public on November 18, 2020. You don’t see that level of transparency from late-stage startups all that often. Today, the company announced a huge $268 million Series E on a tidy $2.75 billion valuation.

Investors include Adage Capital Management, Alkeon Capital, Altimeter Capital, Capital Group, Coatue Management, D1 Capital Partners, Franklin Templeton, Light Street Capital, Tiger Management Corp. and Two Sigma Investments.

The company seems to be primed and ready for that eventual IPO. Last year, GitLab co-founder and CEO Sid Sijbrandij said that his CFO Paul Machle told him he wanted to begin planning to go public, and he would need two years in advance to prepare the company. As Sijbrandij tells it, he told him to pick a date.

“He said, I’ll pick the 16th of November because that’s the birthday of my twins. It’s also the last week before Thanksgiving, and after Thanksgiving, the stock market is less active, so that’s a good time to go out,” Sijbrandij told TechCrunch.

He said that he considered it a done deal and put the date on the GitLab Strategy page, a page that outlines the company’s plans for everything it intends to do. It turned out that he was a bit too quick on the draw. Machle had checked the date in the interim and realized that it was a Monday, which is not traditionally a great day to go out, so they decided to do it two days later. Now the target date is officially November 18, 2020.

GitLab has the date it’s planning to go public listed on its Strategy page.

As for that $268 million, it gives the company considerable runway ahead of that planned event, but Sijbrandij says it also gives him flexibility in how to take the company public. “One other consideration is that there are two options to go public. You can do an IPO or direct listing. We wanted to preserve the optionality of doing a direct listing next year. So if we do a direct listing, we’re not going to raise any additional money, and we wanted to make sure that this is enough in that case,” he explained.

Sijbrandij says that the company made a deliberate decision to be transparent early on. Being based on an open-source project, it’s sometimes tricky to make that transition to a commercial company, and sometimes that has a negative impact on the community and the number of contributions. Transparency was a way to combat that, and it seems to be working.

He reports that the community contributes 200 improvements to the GitLab open-source product every month, and that’s double the amount of just a year ago, so the community is still highly active in spite of the parent company’s commercial success.

It did not escape his notice that Microsoft acquired GitHub last year for $7.5 billion. It’s worth noting that GitLab is a similar kind of company that helps developers manage and distribute code in a DevOps environment. He claims in spite of that eye-popping number, his goal is to remain an independent company and take this through to the next phase.

“Our ambition is to stay an independent company. And that’s why we put out the ambition early to become a listed company. That’s not totally in our control as the majority of the company is owned by investors, but as long as we’re more positive about the future than the people around us, I think we can we have a shot at not getting acquired,” he said.

The company was founded in 2014 and was a member of Y Combinator in 2015. It has been on a steady growth trajectory ever since, hauling in more than $426 million. The last round before today’s announcement was a $100 million Series D last September.

Powered by WPeMatico

Automated check-out systems in supermarkets, where cashiers are replaced by barcode-readers and touchscreen interfaces for taking payments, have become a commonplace fixture in many parts of the world. But today, a startup that’s building what many believe will be the next generation of such systems — computer-vision-powered platforms that monitor what you take from the shelves and automatically tally it up as you are on the move so that you can leave without checking out — has raised funding to continue developing its product and help it connect with grocery retailers that have seen the advances of Amazon Go and also want to get in on the AI action without getting involved with Amazon itself.

Trigo, a computer vision startup out of Tel Aviv that is building check-out-free grocery purchasing systems specifically targeted at large supermarkets, has picked up a Series A round of $22 million. The funding is being led by Red Dot Capital, with previous Vertex Ventures Israel and Hetz Ventures also participating. This round brings the total raised by Trigo to $29 million.

The company is not disclosing its valuation, but says that it has a number of deals in place already with grocery chains, including an unspecified European chain and Shufersal, the largest grocer in Israel.

Shufersal already has plans to implement Trigo’s solution in 280 stores in the next five years, which speaks to the company’s ambitions and traction to date, even at this early stage in its development: The company says that it’s already piloting its camera and sensor technology in stores that are 5,000 square feet, or twice the size of a typical Amazon Go store. It’s, however, still fairly small compared to the size of a large supermarket (35,000-45,000 square feet) or even smaller challenger markets like a Trader Joe’s or a Lidl (20,000 square feet).

As with Amazon Go, Trigo works by implementing a series of cameras throughout a store to monitor shoppers and record what they are placing into their baskets. This is not just about being able to identify items: it’s also a triangulation system to ensure that people are not charged twice for items, and that items are removed from the total if they are discarded before a person leaves the store.

And it’s not just to speed things up, either. It’s to make shopping great again.

“I don’t actually think people really want grocery e-commerce,” Ran Peled, VP of marketing, said. “They do that because the supermarket experience has become worse with the years. We are very much committed to helping brick and mortar stores return to the time of a few decades ago, when it was fun to go to the supermarket. What would happen if a store could have an entirely new OS that is based on computer vision?”

Unlike Amazon Go, Trigo is not tied to any specific company that might potentially compete with the retailers that it is targeting, and the product can be implemented to work with loyalty cards, or without them.

However, given that Amazon has built one of the world’s most valuable companies by being both a simultaneous competitor and partner to businesses, I’m not sure that its competitor status will be a gating factor to the growth of Amazon Go, if it decides to productise it and sell the technology to other retailers… and neither does Trigo.

“The technology behind Amazon Go existed in the industry for about a decade before Amazon Go,” Peled said (Trigo was founded in 2018 by brothers Michael and Daniel Gabay). “But after it launched, it was a moment of realising, ‘Ah, this is really happening!’ ” Meaning, he knew now would be a fruitful period because other grocery retailers would want to get on board, and even if Amazon did roll Go out as its own service, and a service used by other retailers, there will be others who will never work with it, presenting a market opportunity to his startup.

If the endgame is bringing the time spent in the check-out phase down to zero, there are other startups working on alternative ways to reach that. Just last week, Caper raised a round of funding for a system that is based on “smart” trolleys, with sensors attached to grocery carts to take note of items and add them to your shopping bill. While the shopping cart might have the advantage of being able to more closely monitor an individual’s own shopping cart, store-wide systems like Trigo’s will potentially cost less to operate and the software might even be something that can be used on existing in-store cameras.

Interestingly, at a time when patents form one of the key ways that a company defends its intellectual property, Trigo is taking another approach. “We don’t file patents because we don’t want our technology to be public,” said Peled. “We have things that we don’t want anyone to see.” It’s an ironic, if perhaps telling, stance for a computer vision company.

In the rush to build tech solutions to all the world’s problems (and if not problems, at least all the world’s processes), there are bound to be others building further technology to bring grocery stores into the twenty-first century. Trigo presents one route to getting there, making it as much a coveted company for grocery businesses as it is for the companies that provide other services to them.

“We believe that Trigo’s world-leading computer-vision team will be the first to scale this technology globally and unlock the full potential of a true grocery-wide revolution,” said Barak Salomon, managing partner of Red Dot Capital. “The process of manually scanning barcodes for each separate item at check out is outdated and time-consuming. Trigo’s technology is going to save brick and mortar, revitalizing the in-store experience while keeping the best part of shopping alive.”

Powered by WPeMatico