Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Actor and Hollywood media mogul Will Smith surprised the TechCrunch Disrupt SF 2019 audience this afternoon by announcing he would invest $10K in a startup that pitched to him onstage as part of an “elevator pitch” contest, where the winner would get to take a selfie with the star. The company, Socionado.com, helps companies with their social media presence. However, what got Smith’s attention was their well-delivered pitch, he said.

The startups didn’t get much time to prepare, having been plucked from the Startup Alley earlier in the day.

In addition to responding well to the pitch itself, Smith also liked the concept and the business model.

“As I built out my social media team, that was the idea — I wanted to take back my storytelling,” said Smith. “I think that’s hugely important.”

“That was really the best pitch so we’re gonna rock a selfie,” Smith said, jumping up to snap a photo with the founder.

That moment when you pitch your startup to Will Smith, get a selfie and an investment of $10K. #TCDisrupt pic.twitter.com/NtDIeYrT9b

— Queenie Wong (@QWongSJ) October 2, 2019

Will smith investing https://t.co/Mwa0pnHkC9

— Talks_With_TJ (@TJ_Overall) October 2, 2019

Smith’s investment strategy isn’t usually this off-the-cuff, however.

Speaking onstage at the Disrupt conference, he also offered more details on his plans for Dreamers VC, the investment firm founded with Japanese soccer star Keisuke Honda, which was announced last year by Honda’s management firm KSK Group.

Smith noted the firm has an interest in “doing good” with its funds — pointing, in particular, to an investment in “Boring tech.” (He actually means The Boring Company, per the Dreamers VC website, where it’s listed alongside a host of others.)

He also offered a little background on how Dreamers VC came to be in the first place.

“Well, you know, I met with [Keisuke Honda] and we just hit it off immediately. And, you know, we felt like there was a beautiful intersection between being able to create businesses, but also to stay focused on solving problems of the world,” Smith explained. Honda already had banking relationships in Japan that were looking to make their way into the U.S.

“So the relationship worked out well,” he said.

Plus, Smith adds, “I had already been investing and he had already been investing and our values were in alignment. We want to solve some of the world’s problems. We want to do well by doing good.”

Powered by WPeMatico

Cloud services and the adoption of apps that rely on them continue to grow in popularity, but a persistent theme in enterprise technology has been that a lot of organizations still continue to use legacy software and architectures, for reasons of cost, migration headaches and simply because sometimes, if it ain’t broke, don’t fix it. That doesn’t mean they couldn’t benefit from a better way of integrating some of those workflows, and better leveraging the data coming out of those different apps, and today a startup that’s built a service to help them do that has raised a growth round of funding.

Snaplogic, which has built an integration platform that lets enterprises bring in and integrate both legacy and cloud apps to better monitor them and let them work together, has closed $72 million in growth financing, money that it will be using to expand its business globally. According to analysis from PitchBook, this latest funding comes at a $260 million pre-money valuation, which would work out to about $332 million post-money. We are checking with Snaplogic to see if it can confirm those numbers directly.

This latest round, which brings the total raised by Snaplogic to $208 million, is being led by growth equity VC Arrowroot Capital, with participation also from Golub Capital and existing investors. Past investors are an illustrious group that has included a mix of financial and strategic backers such as Andreessen Horowitz, Vitruvian (which led its previous round), Capital One, Ignition Parnters, Microsoft and a number of others.

The company is not disclosing how big its customer base is currently. In its last round in 2016, it had grown to 700 enterprises, adding 300 in just one year, which was an especially big amount of growth. Current customers feature a number of big names like Adobe, Verizon (which owns TechCrunch), AstraZeneca, Bristol-Myers Squibb, Emirates, Schneider Electric, Siemens, Sony and Wendy’s. It describes the bigger integration market as a $30 billion opportunity.

The defining characteristic in that list is that these are businesses that pre-date the big cloud revolution, and so they are more likely than not grappling with a mix of new and legacy apps that need to be balanced against one another, brought together in some instances to work together and harnessed in terms of their data to help in a company’s wider efforts around big data for projects in areas like application integration, data integration, API management, B2B integration and data engineering.

“This is an exciting time for SnapLogic,” said Gaurav Dhillon, CEO at Snaplogic, in a statement. “We’re extremely proud to have built a modern and innovative solution that is solving really hard problems for our enterprise customers. This latest investment is a testament to the hard work and ongoing support of our customers, partners, and employees around the world. Together, we’ll continue to chart the way forward, making integration even faster and easier so enterprises can realize their data-driven ambitions.”

There has been an interesting wave of startups that have emerged specifically to tackle the opportunity of providing tools to businesses that are still using old kit and older software to give them the ability to take advantage of new innovations in computing and how to use their bigger pool of data. Others include Workato (which itself has raised money in the last year), MuleSoft (now a part of Salesforce) and Microsoft itself, and in that context, Snaplogic has been taking a very measured approach in how it raises capital and expands.

“Our approach is to do successive up rounds with straightforward terms rather than chase a big slug with onerous terms,” Dhillon told TechCrunch once. He’s a repeat entrepreneur and has a track record of conservative but sound growth. “We built Informatica with just $13.5 million, so my approach is to raise funds as needed.”

It’s an approach that is resonating with investors. “SnapLogic is attacking a huge and surging market opportunity with a uniquely modern and powerful platform,” said Matthew Safaii, founder and managing partner at Arrowroot Capital, in a statement. “They’ve built an amazing product, work with an impressive roster of customers, and are led by an experienced executive team. As SnapLogic sets its sights on continued product leadership and global expansion, we look forward to partnering with them to help get their pioneering integration platform into the hands of even more enterprises around the globe.”

“SnapLogic is reinventing application and data integration for the modern era,” said Robert Sverbilov, director at Golub Capital, added. “We are excited to support SnapLogic’s next generation SaaS application integration platform and to help secure its footing as a leader in the iPaaS (Integration Platform as a Service) vertical.”

Powered by WPeMatico

Think Jack Dorsey’s jobs are tough? Well, Tom Chavez is running six startups. He thinks building businesses can be boiled down to science, so today he’s unveiling his laboratory for founding, funding and operating companies. He and his team have already proven they can do it themselves after selling their startups Rapt to Microsoft and Krux to Salesforce for a combined $1.2 billion. Now they’ve raised a $65 million fund for “super{set}”, an enterprise startup studio with a half-dozen companies currently in motion.

The idea is that {super}set either conceptualizes a company or brings in founders whose dream they can make a reality. The studio provides early funding and expertise while the startup works from their shared space in San Francisco, plus future ones in New York and Boston. The secret sauce is the “super{set} Code,” an execution playbook plus technological tools and building blocks that guide the strategy and eliminate redundant work. “Our belief is that we can make the companies 10x faster and increase capital efficiency by 5X,” says Chavez of his partnership with {super}set co-founders Vivek Vaidya, who acts as CTO, and Jae Lim who manages the fund.

The {super}set team (from left): Tom Chavez, Jae Lim, Jen Elena and Vivek Vaidya

Perhaps the question isn’t whether the portfolio startups can scale, but if the humans behind them can without breaking. It’s stressful running a single company, let alone six. Even with the order of operations nailed down, each encounters unique challenges and no plan is one-size-fits-all. But after delivering 17.5X returns to their past investors, Chavez et al. have proven their power to repeatedly recognize what enterprises need and build admittedly boring but bountiful products in customer data management, and advertising yield.

The studio’s playbooks cover business plan formation, pitch strategies, go to market, revenue, machine learning, management principles, HR processes, sales methods, pipeline measurement, product sequencing, finance, legal and more. There’s also shared engineering code it provides, so each startup doesn’t have to reinvent the wheel. “I don’t think you can systemize it but I do think you can accelerate and de-risk the path,” Chavez explains.

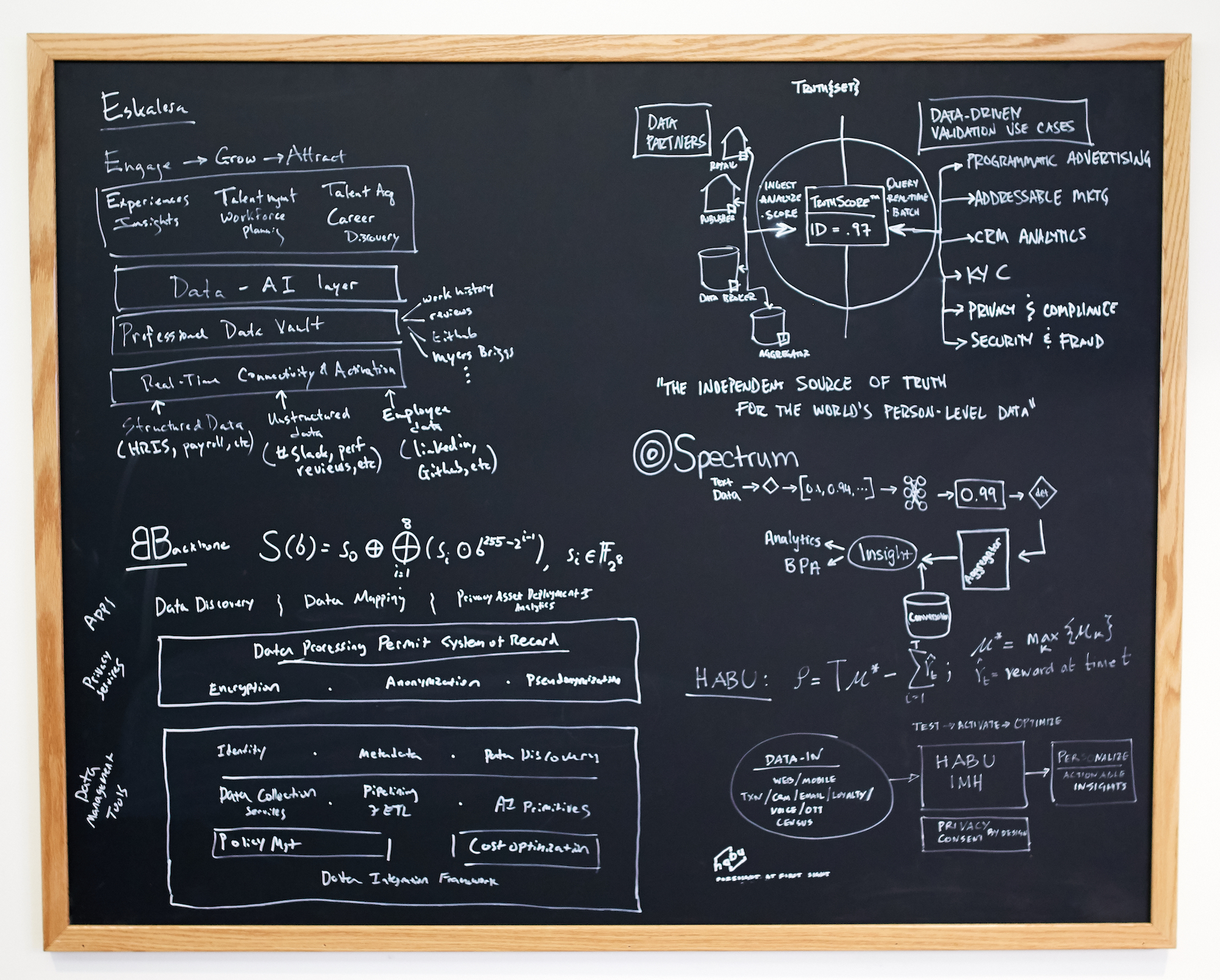

{super}set Code

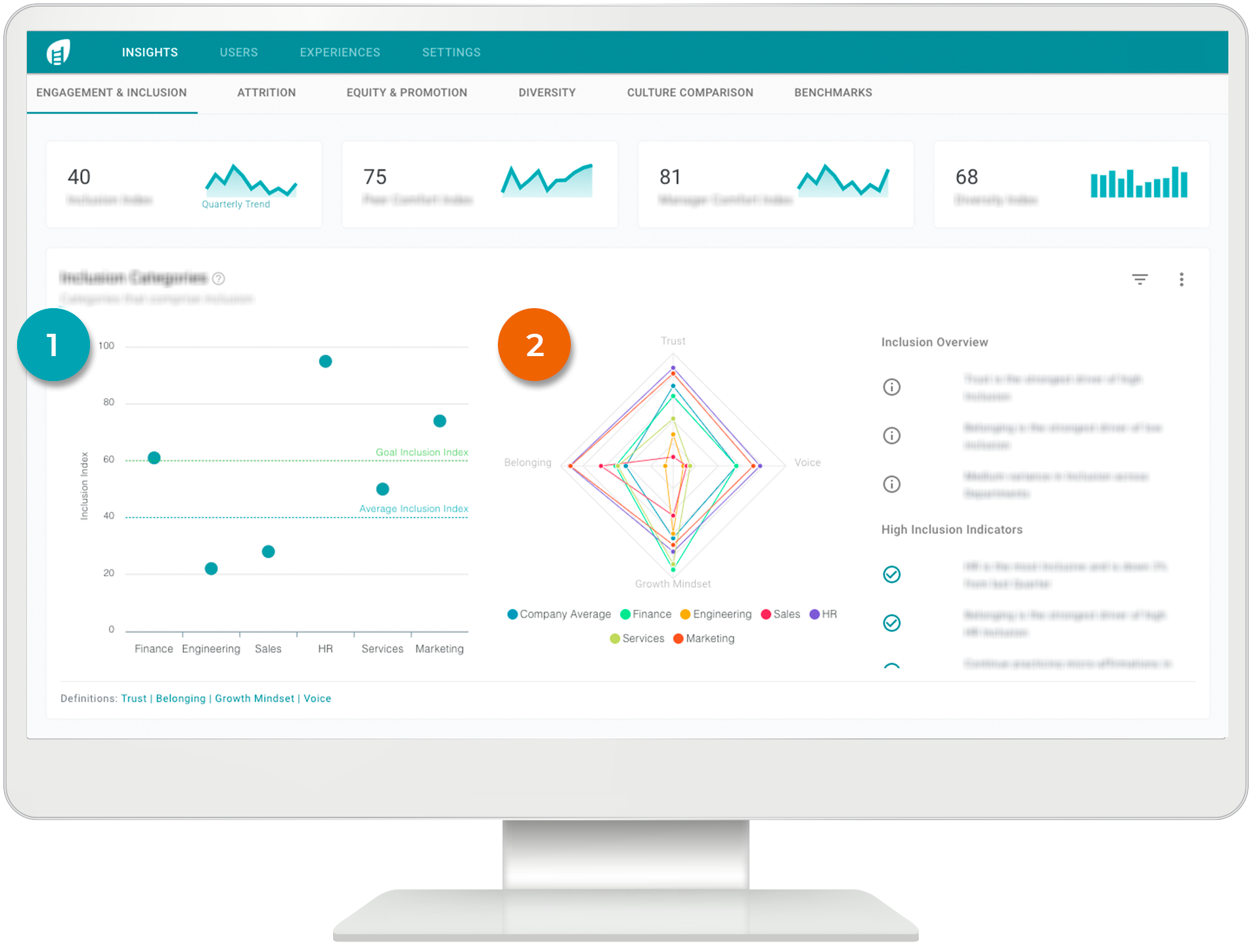

Today, the first {super}set company is coming out of stealth. Eskalera helps enterprises retain top talent by tracking diversity and inclusion stats of employees to engage them with career growth and community programs. Chavez is the CEO, but plans to install a new one shortly so he can focus more time on founding more startups. There are 55 employees across the first six companies, with two already generating revenue and most ready to emerge in the next nine months.

The funding for Eskalera and other {super}set companies comes with unique terms. Because Chavez and the team aren’t just board members you hear from once a quarter but “shoulder to shoulder with the entrepreneurs” as he repeats several times in our interview, the startups pay more equity for the cash.

The hope is having seasoned leadership aboard is worth it. “We’re product people first and foremost,” Chavez tells me. “What are you going to build? Who’s going to buy it? Why? What’s the technical moat? We’re not people doing jazz hands.” The {super}set team has plenty of skin in the game, though, given Chavez himself put in a big chunk of the $65 million, and the fund sticks to a standard management fee.

Eskalera

To supercharge the companies, {super}set brings in expert staffers in artificial intelligence, data science and more, who then align with the most relevant companies in the portfolio. They get equity grants to incentivize them to work hard on the startups’ behalf. “The worry I have about these larger funds is that they have an incentive disconnect where they work for the fees” Chavez says. His fund hopes to win through follow-on funding of its winners.

{super}set co-founder Tom Chavez

If portfolio companies hit hard times, Chavez says {super}set will stick with them. “My first company had multiple layoffs and a major pivot. We had an enterperenur that walked away. They lost conviction, but we brought that company to an $180 million exit after people said there was no effing way and that felt really good,” Chavez says of staying the course. “The good entrepreneurs have that demonic energy.” But if everyone involved agrees a project isn’t working, they’ll shutter it. “It comes back to opportunity cost of people’s time.”

Chavez has respect for studios taking different approaches, like Atomic in consumer startups, Science in e-commerce and Pioneer Square Labs, which maintains a larger fund staff. “What excites me is moving entrepreneurship a step forward. Why couldn’t we franchise this in other cities?” He hopes {super}set can attract top talent that “just want to work on cool shit” rather than getting sucked into a single company.

Can {super}set keep all the plates spinning and really lower their risk? “If we’re wrong there will be a giant orange plume streak across the sky. The early returns are promising but we have to prove it,” Chavez says. But after accruing plenty of wealth for himself, he says the thrill that keeps him in the startup game is seeing life-changing outcomes for his teams. “I have spreadsheets showing the wealth generated by employees of companies I’ve built and nothing makes me happier than seeing them pay for tuitions, property, or retiring.”

Powered by WPeMatico

Multiplayer games are more fun when you get to play with the same crew regularly. Playing with the same people means better cooperation, deeper strategies and, if all goes well, more wins.

But what if none of your friends play the game you want to play?

Rune, a company out of Y Combinator’s Winter 2019 class, wants to use AI to help you find the right people to play with, connecting you via voice chat. And they’ve just closed a $2 million seed round to get it done.

The round was led by the gaming-focused firm Makers Fund, and backed by byFounders, E14 Fund, VentureSouq and Gmail creator Paul Buchheit.

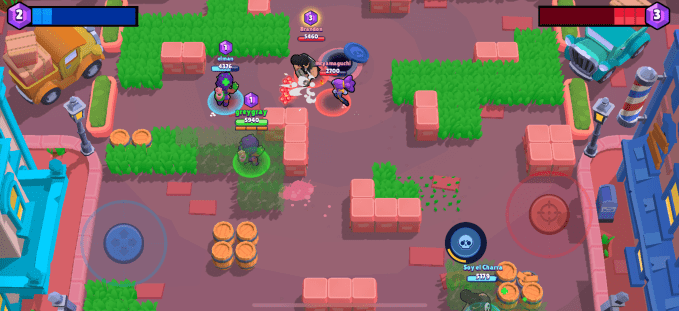

The first game they’re supporting is Brawl Stars, the popular free-to-play mobile game built by Clash of Clans creator Supercell. It’s a pretty perfect game for something like this — it’s a game where strategic teams have a solid advantage, but where building such a team from scratch can be tough. Brawl Stars will automatically match you with teammates if you’re playing alone, but in-game communication is limited and random players tend to only hang around for a game or two.

Supercell’s Brawl Stars

When you first sign up, Rune asks you a handful of questions to start tuning their matchmaking algorithm. Which language(s) do you speak? How much Brawl Stars have you played (how many “trophies” have you earned)? What sort of gameplay are you looking for right now — are you just messing around, or are you looking for nothing but wins? Push a button, and the matchmaking system starts its search.

The more you play, the better the algorithm is tuned. If you seem to have longer play sessions with certain players, for example, it can prioritize matchmaking you with players their algorithms see as similar. (For the curious: While they will tune the matchmaking algorithms based on metadata, like who you’re chatting with and for how long, Rune co-founder Sanjay Guruprasad tells me that they don’t store or analyze the actual voice communication in any way.)

The company says that players have collectively spent around 50,000 hours chatting through the app since launching in March of 2019.

Rune’s matchmaking and voice chat systems are currently limited to two players. Since Brawl Stars (and plenty of other Battle Royale/arena style games) have game modes that support up to three players per team, Sanjay tells me that three-player matchmaking and voice chat are “both in the pipeline and will come out soon.”

Rune plans to support other games beyond Brawl Stars in the future — in fact, driving traffic to other games is part of their plan to monetize the free app. Once you’ve befriended someone, you’re free to use Rune for voice chat with whatever game you want; it just runs in the background, so what you’re playing doesn’t matter too much.

Rune is available for free on iOS here, and on Android here.

Powered by WPeMatico

Books on tape were the lifeblood of self-help. But e-learning startups like Khan Academy and Coursera demanded our eyes, not just our ears. Then came podcasts that make knowledge accessible, yet rarely focus on you retaining and applying what they teach.

Today, a new startup called Knowable is launching to provide gaze-free audio education at $100 per eight-hour course on topics like how to launch a startup or how to sleep better. The idea is that by layering chapter summaries and eventually interactive activities atop premium, long-form, ad-free lessons, it can become the trusted name in learning anywhere. With always-in Bluetooth earbuds and smart speakers becoming ubiquitous, we can imbibe content in smaller chunks in new environments. Knowable wants to fill that time with self-improvement.

The big question is whether Knowable can differentiate its content from free alternatives and build a moat against copycats through savvy voice-responsive learning exercises so you don’t forget everything.

To evolve beyond the podcast, Knowable has raised a $3.75 million seed round led by Andreessen Horowitz’s partner Connie Chan, and joined by Upfront, First Round and Initialized. “The market is ready for a company like Knowable. Their timing is right and their team possesses the rare combination of product expertise and creative media experience necessary to win. That’s why I’m not just hosting Knowable’s first course, Launch a Startup, we’re also one of the earliest investors in the company,” says Initialized’s Alexis Ohanian.

There’s certainly a market opportunity, as 32% of Americans listen to podcasts monthly, up from 26% in 2018, with 74% of those citing the desire to learn. Half of Americans have listened to an audio book. The e-learning market is $190 billion today, but projected to grow to $300 billion as bloated and expensive higher education succumbs to cheaper and more focused options.

But to score consistent revenue, Knowable must build up its library and execute on plans to offer a subscription service with access to updates on prior lessons. A major challenge will be bundling classes on the right topics that don’t exhaust users so they keep listening and paying.

“My first-generation immigrant parents came here without college degrees. Great teachers let me move up the socioeconomic ladder pretty quickly,” says Knowable co-founder Warren Shaeffer. “The genesis of the idea came from our shared interest in education and the value of great teachers.”

Shaeffer and his co-founder Alex Benzer have already been through the struggles of startup life together. After meeting at MuckerLab in LA and splitting from their respective co-founders, in 2007 they created SocialEngine, a community website builder that sold to Room 214. Next they built up a video platform for independent creators called Vidme that raised $9 million but never became sustainable before selling to Giphy in 2018.

Shaeffer and his co-founder Alex Benzer have already been through the struggles of startup life together. After meeting at MuckerLab in LA and splitting from their respective co-founders, in 2007 they created SocialEngine, a community website builder that sold to Room 214. Next they built up a video platform for independent creators called Vidme that raised $9 million but never became sustainable before selling to Giphy in 2018.

The pair had glimpsed how great content could rope in an audience, but felt like the true potential of the podcast hadn’t been explored. Why did they have to be produced on the cheap, distributed on generic platforms and supported by ads? Knowable emerged as a way to create luxury audio, delivered through a purpose-built app and paid for with direct sales or subscriptions. Instead of recording unscripted discussions as episodes, they mapped out course curriculum and filled them with structured advice from experts.

I’m a few hours into the Ohanian-hosted Launch a Startup. It’s certainly a lot more efficient than trying to learn the basics just through storytelling from podcasts like Reid Hoffman’s Masters of Scale or NPR’s How I Built This. One chapter breaks down the top ways startups die and the traits you’ll need to persevere. From optimism and resilience operating in unstructured environments to a refusal to make excuses why you can’t succeed, Ohanian cooly recaps the learnings at the end of the chapter. Open the app and you’ll get a written summary plus suggested blog posts and books for diving deeper. An accompanying 95-page PDF workbook collects all the key learnings for rapid review later.

The topic is huge, though, and Knowable is at its best when it’s distilling knowledge into neatly packaged lists and frameworks. The course’s weakest moments are when it feels most like a podcast, with somewhat meandering conversations with random founders discussing how they dealt with problems. Meanwhile, it currently lacks some basic tools like in-app notetaking and sharing, or as wide a range of playback speeds and rewind options as you’ll get on Audible. “We don’t think of ourselves as a podcast company,” Shaeffer says, but that’s still who he’s competing against.

— Alexis Ohanian Sr.

(@alexisohanian) May 28, 2019

What’s also missing is any true interactivity. The downside of audio learning is that if you’re not paying full attention, it’s easy to zone out. Knowable needs to develop voice and touch-controlled exercises to help users apply and retain the lessons. There are plans to launch learning communities where students can confer about the classes, akin to Y Combinator’s “Bookface” forum.

However, Shaeffer says that “we’re on a mission to make education more accessible and quizzes might be an impediment to that,” which leaves questions about what the learning activities will look like, even though they’re crucial to users coughing up $100 per class. It’s easy to imagine Spotify/Anchor, Gimlet Media or other major podcast players developing their own interactive features and classes if Knowable doesn’t get there first.

The startup’s bid for virality is the ability to give a friend a code to take the class with you. Knowable is also hoping big-name experts and quality driven by a team cobbled together from NPR, The Washington Post, William Morris Endeavor, Masterclass and Vice will set it apart. They’ve got a lot of work ahead to grow beyond the six courses currently available on topics like climate change activism and real estate, especially because there’s a 100% money-back guarantee if classes fall short.

For the moment, Knowable feels a bit late with its homework. It has the potential and demand to reinvent audio learning but currently sounds too similar to what’s already everywhere. I was hoping for a Bandersnatch for education that made a broadcast experience feel more like a game.

But the opportunity will only continue to grow as we spend more of our lives in earshot of AirPods and Echoes. With a broad enough library and clever editing, one day you might tell Knowable “teach me something about venture capital in eight minutes” as you walk to the coffee shop. That’s going to have a much better impact on your life than just scrolling through another feed.

Powered by WPeMatico

Rhino, the insurtech startup incubated by Kairos and co-founded by Kairos CEO Ankur Jain, has today announced the close of a $21 million Series A round led by Kairos and Lakestar.

Rhino was founded in 2017 with the goal of getting back to renters the billions of dollars that are locked up in cash security deposits, all while protecting landlords and their property. As it stands now, landlords usually take one month’s rent to cover any damage that might be done to the apartment during the lease. This is piled on top of first and sometimes last month’s rent, and even at times a broker’s fee of one month’s rent, which adds up to an incredibly steep cost of moving.

Because of certain regulations, this money is held in an individual escrow account and can’t really generate interest, which results in billions of dollars zapped out of the economy and instead sitting dead in some account.

Rhino is looking to give renters the option to pay a small monthly fee (as low as $3) to cover an insurance policy for the landlord. Rhino is itself a managing general agent, allowing the company to both sell and create policy plans for landlords through partnerships with carriers.

Thus far the startup has saved renters upwards of $60 million in 2019, with users in more than 300,000 rental units across the country.

“The greatest challenge is working against legacy and industry norms,” said Rhino CEO and co-founder Paraag Sarva. “That start has begun, but there is a huge amount of inertia behind the status quo and that is far and away what we are most challenged by day in and day out.”

To help speed up the process, Rhino is working alongside policymakers to enact change on a federal level.

Alongside the funding announcement, the company is announcing its new policy proposal that was created in collaboration with federal, state and local government officials. The policy essentially allows for renters to be given a choice when it comes to cash deposits, including allowing residents to cover security deposits in installments or use insurtech products like Rhino to cover deposits.

Rhino says it will be sharing the policy proposal with 2020 presidential candidates on both sides of the aisle.

Rhino is one of a handful of companies that has been incubated by Kairos, a startup studio led by Ankur Jain with the goal of solving the biggest problems faced by everyday Americans. The studio focuses on housing and healthcare, with companies such as Rhino, June Homes, Little Spoon, Cera and a couple of startups still in stealth.

Powered by WPeMatico

Two years after the Los Angeles-based fintech startup Dave launched with a suite of money management tools to save consumers from overdraft fees, the company is now worth $1 billion thanks to a nascent banking practice that had investors lining up.

The company used its overdraft protection service and money management display to shift customers’ focus away from the total balance that their account would show by giving them a sense of how much was actually left in their accounts once debits were included in their statements.

“What was cool about our financial management product was that we were trying to use Dave as a replacement for their current bank,” says Jason Wilk, Dave’s co-founder and chief executive.

Dave now counts over 4 million users for its financial management app and has roughly 800,000 people on the waiting list to use its banking services, Wilk says.

The company has taken a methodical approach to opening its doors as a digital bank, in part because it wants to have the necessary support infrastructure in place to service the demand that Wilk expects to see for its service.

“It’s one thing to help people with budgeting. It’s another to actually manage their money,” says Wilk.

Dave will use the $50 million raised from Norwest to significantly expand its product and engineering team within the next 12 months, in order to double down on the core business and ensure the success of the banking product.

“We can prove that Dave can be helpful by showing how we can help you manage your current account, and then Dave banking is the marketing lever from there,” says Wilk.

For now, customers need to have the financial management app installed to be able to access the company’s banking service.

Dave charges $1 per month for access to its financial management tools and that also gives customers the ability to use a cushion of between $50 to $75 to avoid being hit with overdraft fees from their current bank account. Dave asks for a tip every time a customer uses that cushion to cover expenses — something that Wilk says is still cheaper than having to worry about overdraft fees.

And, to add a bit of environmental spin, for every tip that Dave receives, the company plants a tree. “We plant millions and millions of trees,” says Wilk.

The company is FDIC insured through a partner bank, the Memphis-based Evolve Bank and Trust, which acts as a backstop for the company’s financial management activities.

“We already had a relationship with them for some payment processing stuff,” says Wilk. “We liked the team and liked the terms and went with them.”

Terms between financial services firms can vary, and, Wilk says, Evolve Bank was willing to give the company a good deal on splitting the interchange fee, which is a big source of revenue for upstart banks.

It’s possible that Dave could have received a bigger check at a potentially higher valuation, but Wilk says the startup is trying to stay lean.

“The company is growing so quickly, we didn’t want to get too diluted on this round,” he says. “We think the company is quite a bit more valuable than [$1 billion]. You don’t want to raise too much money too quickly if you really think the valuation is going to climb… Since we signed the term sheet the company has already grown another 40%.”

It was only four months ago that Dave was announcing a $110 million credit financing with Victory Park Capital and the launch of its banking product.

Dave’s products and services have a few advantages for customers that are just getting started on the path to financial security. The company monitors everyday monthly payments and reports them to credit agencies to improve customers’ credit ratings. The company also provides up to $100, interest-free, overdraft protection.

“Banks have failed their customers by building products that put their own interests ahead of the humans who use them. People don’t need predatory fees, they need tools that actually solve their challenges around credit building, finding work and getting access to their own money to cover immediate expenses. Dave is the banking product that works with its customers, not against them,” said Wilk, in a June statement announcing the funding and banking product launch.

While Dave is getting some hefty firepower and a generous valuation from Norwest, it’s also operating in a market where its core services that were a point of differentiation are quickly becoming table stakes.

Earlier in September, the new startup banking company Chime announced that it had hit 5 million banking customers and was offering its own overdraft protection service.

The San Francisco-based bank has also raised a lot more capital for a potential piggy bank to raid if it needs to acquire or spend on engineering talent to build out new products and services. Earlier this year, the company announced a $200 million round and said it had hit roughly 3 million customers. Clearly Chime is adding new banking customers at a torrid pace.

And they’re facing global competition as well. N26, the European startup bank with a $3.6 billion valuation and hundreds of millions in financing launched in the U.S. a few months ago as well.

The company sees a global opportunity to create new digital banking services in a world where large amounts of capital and an elite set of consumers move easily between international markets.

“We have an opportunity that we build a bank that has more than 50 million users around the globe. Today, we only have 3.5 million users but we’re accelerating,” said N26 chief executive, Valentin Self, in an interview with TechCrunch. “From a country perspective, we have agreed already that we go to Brazil. There’s no plan after Brazil yet. Now let’s focus on the U.S., then on Brazil, then next year we’ll find out what’s the feedback from these two markets.”

Powered by WPeMatico

Amboss, the Berlin-based “medtech” startup that originally offered a learning app for students but has since pivoted to a knowledge platform for medical professionals, has raised €30 million in Series B funding.

The round is led by Partech’s growth fund, with Target Global acting as a co-investor. Existing investors Cherry Ventures, Wellington Partners and Holtzbrinck Digital, also participated.

Launched in 2014 as a study platform for medical students, Amboss has since evolved to offer what it claims is the “most comprehensive and technologically-advanced” knowledge platform for medical professionals. It has been developed by a group of 70 doctors and 40 software engineers who work together in small cross-functional teams.

“Medical Knowledge does not find its way into practice efficiently,” argues Amboss co-CEO Benedikt Hochkirchen. “This has two main root causes: the way we educate doctors is outdated, and the way doctors access knowledge is inefficient.”

Specifically, he says that medical students are still taught to memorize facts, which become outdated quickly, and there isn’t enough emphasis on understanding and application. In contract, Amboss’ “smart learning” technology claims to not only help students achieve higher scores in their medical exams but furthers their contextual understanding and therefore lays the foundation “to be better prepared for clinical practice.”

“In clinical practice, doctors would adapt 50% of their decisions if they had the latest and precise knowledge at hand,” says Hochkirchen. “In real life on the wards, doctors lack the time to research and find the relevant knowledge. For them, Amboss’ smart guidance app is there to provide instant, convenient and reliable medical knowledge to carry out the best possible care.”

The end result, says the Amboss co-CEO, is that the startup’s app reduces the average research time needed for doctors to make a clinical decision from 30 minutes to 30 seconds. Crucially, its knowledge base contains the most recent medical facts and guidelines “in every single case.”

“Young doctors have to take over a lot of responsibility early in their career,” adds Hochkirchen. “Career starters are regularly the first touch point with a doctor when a patient enters a hospital. Often young doctors do not feel properly prepared for the real-life challenges in those situations. Amboss is the source of choice to master those decisions, e.g. with emergency algorithms and lead symptoms.”

Likewise, more experienced and specialised doctors can also find utility in Amboss, as guidelines and therapies of choice are constantly changing. “It is almost impossible for the doctor to stay up to date for every possible indication,” he says. “Amboss provides them with precise knowledge based on latest guidelines to ensure doctors choose the best therapy possible.”

Or, put a another way, Amboss is attempting to build a “Google for medicine.” “They are tackling a very exciting space which will have a positive impact on society, bringing knowledge levels and skillsets of medical doctors to a higher level,” Cherry Ventures’ Christian Meermann tells me.

Meanwhile, armed with new capital, Amboss says it will accelerate the global rollout of its product with a focus on the U.S. In addition, the startup will further develop its product, for both generalist and specialist doctors, “to help improve their daily clinical decision-making.”

Powered by WPeMatico

DeadHappy, a U.K.-based insurtech startup that wants to offer more flexible life insurance and remove the taboo surrounding death, has raised £4 million in Series A funding. Backing comes from e.ventures, alongside the company’s seed investor Octopus Ventures.

Founded in 2017, DeadHappy claims to be the U.K.’s “first fully digital pay-as-you-go life insurance provider.” It offers flexible life insurance policies that are designed to be “cheaper, easier and better” than existing traditional providers. This includes pricing insurance based on your current circumstances and the option to add (or remove) further coverage on a rolling basis.

More broadly, the startup is developing what it calls its “Deathwish” platform, which is something akin to a will. The idea is that you can specify how you wish any future insurance payout to be used, such as paying off your mortgage. And there are also plans to incorporate other wishes not related to finances.

“Our vision is to change attitudes to death and we are tackling that in a number of ways,” DeadHappy co-founder Phil Zeidler tells me. “Despite death being the one certainty humans face, it remains for many a taboo subject, and the failure to talk about it and plan for it is both counterintuitive and leads to significant further trauma at the most difficult of times for family and loved ones.”

Currently the Deathwish platform offers financially motivated Deathwishes, but the longer-term plan is to enable practical Deathwishes, such as making sure your funeral is the way you want it, and what Zeidler calls emotionally motivated Deathwishes.

The idea is to help offer a way to help loved ones “achieve something meaningful in their lives, whether that’s learning how to play the drums or funding an expedition to the Amazon,” he explains.

“Crucially, customers can share these Deathwishes as they choose, which is a practical tool to ensure their wishes are clear and understood. Our platform acts as a catalyst for opening a conversation with loved ones and a place to share recorded video messages and stories.”

Meanwhile, DeadHappy says it will use the new funding for future growth by further building the technology and capabilities of its Deathwish platform. It also plans to expand its product and partnership offerings to major financial service distributors.

Powered by WPeMatico

StrongSalt, then known as OverNest, appeared at the TechCrunch Disrupt NYC Battlefield in 2016, and announced a product for searching encrypted code, which remains unusual to this day. Today, the company announced a $3 million seed round led by Valley Capital Partners.

StrongSalt founder and CEO Ed Yu says encryption remains a difficult proposition, and that when you look at the majority of breaches, encryption wasn’t used. He said that his company wants to simplify adding encryption to applications, and came up with a new service to let developers add encryption in the form of an API. “We decided to come up with what we call an API platform. It’s like infrastructure that allows you to integrate our solution into any existing or any new applications,” he said.

The company’s original idea was to create a product to search encrypted code, but Yu says the tech has much more utility as an API that’s applicable across applications, and that’s why they decided to package it as a service. It’s not unlike Twilio for communications or Stripe for payments, except in this case you can build in searchable encryption.

The searchable part is actually a pretty big deal because, as Yu points out, when you encrypt data it is no longer searchable. “If you encrypt all your data, you cannot search within it, and if you cannot search within it, you cannot find the data you’re looking for, and obviously you can’t really use the data. So we actually solved that problem,” he said.

Developers can add searchable encryption as part of their applications. For customers already using a commercial product, the company’s API actually integrates with popular services, enabling customers to encrypt the data stored there, while keeping it searchable.

“We will offer a storage API on top of Box, AWS S3, Google Cloud, Azure — depending on what the customer has or wants. If the customer already has AWS S3 storage, for example, then when they use our API, and after encrypting the data, it will be stored in their AWS repository,” Yu explained.

For those companies that don’t have a storage service, the company is offering one. What’s more, they are using the blockchain to provide a mechanism for sharing, auditing and managing encrypted data. “We also use the blockchain for sharing data by recording the authorization by the sender, so the receiver can retrieve the information needed to reconstruct the keys in order to retrieve the data. This simplifies key management in the case of sharing and ensures auditability and revocability of the sharing by the sender,” Yu said.

If you’re wondering how the company has been surviving since 2016, while only getting its seed round today, it had a couple of small seed rounds prior to this, and a contract with the U.S. Department of Defense, which replaced the need for substantial earlier funding.

“The DOD was looking for a solution to have secure communication between computers, and they needed to have a way to securely store data, and so we were providing a solution for them,” he said. In fact, this work was what led them to build the commercial API platform they are offering today.

The company, which was founded in 2015, currently has 12 employees spread across the globe.

Powered by WPeMatico