Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Club Factory, a Chinese e-commerce platform that sells fashion and beauty items and electronics accessories, has raised $100 million in a new financing round as it looks to expand its footprint in India.

The new financing round — Series D — was led by Qiming Venture Partners, Bertelsmann, IDG Capital “and other Fortune 500 companies from the U.S. and Asia,” the five-year-old Hangzhou-headquartered startup said. Club Factory, which raised $100 million in its previous financing round early last year, has raised about $220 million to date.

Club Factory has amassed more than 70 million users on its platform, of which about 40 million live in India. The startup cited figures from app analytics firm App Annie to claim that Club Factory is now the third-largest e-commerce platform in India, surpassing once a market-leader Snapdeal.

Club Factory does not charge local sellers any commission fee, incentivizing them to cut down the cost of their items and expand offerings. The number of sellers on its platform in India has grown by 10X in the last six months, the startup claimed. Club Factory, which has about 5,000 sellers in India, plans to double that figure by year-end, it said.

A screenshot of Club Factory’s homepage

“At the same time, we have also pioneered to strengthen the ‘store-within-platform’ concept in India’s e-commerce industry, allowing direct contact between buyers and sellers through our application,” said Vincent Lou, co-founder and chief executive of Club Factory, in a statement.

He added, “We have changed the status of the Indian e-commerce industry that monopolized information of buyers and sellers, allowing SMEs to own their customers and run their business better. All this, combined with our strategy to reduce the transaction costs of buyers and sellers and allow more local players to enter the ecosystem, has worked very well for us in India.”

The startup said in the coming months it will also bulk up more items on its platform and introduce new product categories.

Powered by WPeMatico

Satellite imagery holds a wealth of information that could be useful for industries, science and humanitarian causes, but one big and persistent challenge with it has been a lack of effective ways to tap that disparate data for specific ends.

That’s created a demand for better analytics, and now, one of the startups that has been building solutions to do just that is announcing a round of funding as it gears up for expansion. Descartes Labs, a geospatial imagery analytics startup out of Santa Fe, New Mexico, is today announcing that it has closed a $20 million round of funding, money that CEO and founder Mark Johnson described to me as a bridge round ahead of the startup closing and announcing a larger growth round.

The funding is being led by Union Grove Venture Partners, with Ajax Strategies, Crosslink Capital, and March Capital Partners (which led its previous round) also participating. It brings the total raised by Descartes Labs to $60 million, and while Johnson said the startup would not be disclosing its valuation, PitchBook notes that it is $220 million ($200 million pre-money in this round).

As a point of comparison, another startup in the area of geospatial analytics, Orbital Insight, is reportedly now raising money at a $430 million valuation (that data is from January of this year, and we’ve contacted the company to see if it ever closed).

Santa Fe — a city popular with retirees that counts tourism as its biggest industry — is an unlikely place to find a tech startup. Descartes Labs’ presence there is a result of that fact that it is a spinoff from the Los Alamos National Laboratory near the city.

Johnson — who had lived in San Francisco before coming to Santa Fe to help create Descartes Labs (his previous experience building Zite for media, he said, led the Los Alamos scientists to first conceive of the Descartes Labs IP as the basis of a kind of search engine) — admitted that he never thought the company would stay headquartered there beyond a short initial phase of growth of six months.

However, it turned out that the trends around more distributed workforces (and cloud computing to enable that), engineers looking for employment alternatives to living in pricey San Francisco, plus the heated competition for talent you get in the Valley all came together in a perfect storm that helped Descartes Labs establish and thrive on its home turf.

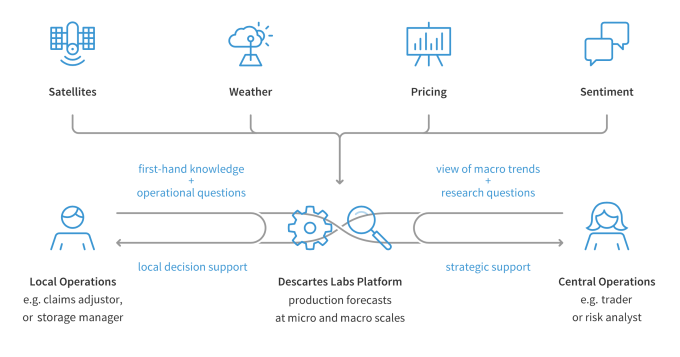

Descartes Labs — named after the seminal philosopher/mathematician Rene Descartes — describes itself as a “data refinery”. By this, it means it injests a lot of imagery and unstructured data related to the earth that is picked up primarily by satellites but also other sensors (Johnson notes that its sources include data from publicly available satellites; data from NASA and the European space agency, and data from the companies themselves); applies AI-based techniques including computer vision analysis and machine learning to make sense of the sometimes-grainy imagery; and distills and orders it to create insights into what is going on down below, and how that is likely to evolve.

This includes not just what is happening on the surface of the earth, but also in the air above it: Descartes Labs has worked on projects to detect levels of methane gas in oil fields, the spread of wildfires, and how crops might grow in a particular area, and the impact of weather patterns on it all.

It has produced work for a range of clients that have included governments (the methane detection, pictured above, was commissioned as part of New Mexico’s effort to reduce greenhouse gas emissions), energy giants and industrial agribusiness, and traders.

“The idea is to help them take advantage of all the new data going online,” Johnson said, noting that this can help, for example, bankers forecast how much a commodity will trade for, or the effect of a change in soil composition on a crop.

The fact that Descartes Labs’ work has connected it with the energy industry gives an interesting twist to the use of the phrase “data refinery”. But in case you were wondering, Johnson said that the company goes through a process of vetting potential customers to determine if the data Descartes Labs provides to them is for a positive end, or not.

“We have a deep belief that we can help them become more efficient,” he said. “Those looking at earth data are doing so because they care about the planet and are working to try to become more sustainable.”

Johnson also said (in answer to my question about it) that so far, there haven’t been any instances where the startup has been prohibited to work with any customers or countries, but you could imagine how — in this day of data being ‘the new oil’ and the fulcrum of power — that could potentially be an issue. (Related to this: Orbital Insight counts In-Q-Tel, the CIA’s venture arm, as one of its backers.)

Looking ahead, the company is building what it describes as a “digital twin” of the earth, the idea being that in doing so it can better model the imagery that it injests and link up data from different regions more seamlessly (since, after all, a climatic event in one part of the world inevitably impacts another). Notably, “digital twinning” is a common concept that we see applied in other AI-based enterprises to better predict activity: this is the approach that, for example, Forward Networks takes when building models of an enterprise’s network to determine how apps will behave and identify the reasons behind an outage.

In addition to the funding round, Descartes Labs named Phil Fraher its new CFO, and is announcing Veery Maxwell, Director for Energy Innovation and Patrick Cairns, who co-founded UGVP, as new board observers.

Powered by WPeMatico

Einride, the Swedish autonomous vehicle startup known for its futuristic pods designed to haul freight, has raised $25 million in a Series A round that will be used to fund its expansion into the United States.

The round was co-led by EQT Ventures and NordicNinja VC, a fund backed by Panasonic, Honda, Omron and the Japan Bank for International Cooperation. Other investors joining the round include Ericsson Ventures, Norrsken Foundation, Plum Alley Investments and Plug and Play Ventures. The startup has raised $32 million to date.

Einride’s self-driving vehicle isn’t quite a truck, although it’s meant to perform the same freight-hauling tasks. The company’s T-Pod electric vehicle, which was unveiled in 2017, has been running on public roads since May of this year.

Einride, which was founded in 2016, has landed several customer contracts, including logistics provider DB Schenker and supermarket chain Lidl. Einride has a commercial pilot with DB Schenker. The startup said it has also signed on “large U.S.-based retail companies,” without naming them.

The funds will be used to hire more people, invest in its software platform and expand internationally, notably the U.S., according to the company. Einride plans to open a U.S. office next year.

“Our ambition is to disrupt the transport industry and closing our series A brings us one step closer to that goal,” Einride co-founder and CEO Robert Falck. “The funding will allow us to start expanding in the U.S., deliver on our technology road map and to meet rapidly increasing customer demand.”

Powered by WPeMatico

Clari uses AI to help companies find key information like the customers most likely to convert, the state of orders in the sales process or the next big sources of revenue. As its revenue management system continues to flourish, the company announced a $60 million Series D investment today.

Sapphire Ventures led the round with help from newcomer Madrona Venture Group and existing investors Sequoia Capital, Bain Capital Ventures and Tenaya Capital. Today’s investment brings the total raised to $135 million, according to the company.

The valuation, which CEO and co-founder Andy Byrne pegged at around a half a billion, appears to be a hefty raise from what the company was likely valued at in 2018 after its $35 million Series C. As TechCrunch’s Ingrid Lunden wrote at the time:

For some context, Clari, according to Pitchbook, had a relatively modest post-money valuation of $83.5 million in its last round in 2014, so my guess is that it’s now comfortably into hundred-million territory, once you add in this latest $35 million.

Byrne says the company wasn’t even really looking for a new round, but when investors came knocking, he couldn’t refuse. “On the fundraise side, what’s really interesting is how this whole thing went down. We weren’t out looking, but we had a massive amount of interest from a lot of firms. We decided to engage, and we got it done in less than three weeks, which the board was kind of blown away by,” Byrne told TechCrunch.

What’s motivating these companies to invest is that Clari is helping to define this revenue operations category, and has attracted companies like Okta, Zoom and Qualtrics as customers. What they are providing is this AI-fueled way to see where the best sales opportunities are to drive revenue, and that’s what every company is looking for. At the same time, Byrne says that he’s moving companies away from a spreadsheet-driven record keeping system, enabling them to see all of the data in one place.

“Clari is allowing a rep to really understand where they should spend time, automating a lot of things for them to close deals faster, while giving managers new insights they’ve never had before to allow them to drive more revenue. And then we’re getting them out of ‘Excel hell.’ They’re no longer in these spreadsheets. They’re in Clari, and have more predictability in their forecasting,” he said.

Clari was founded in 2012 and is headquartered in Sunnyvale, Calif. It has more than 300 customers and just passed the 200 employee mark, a number that should increase as the company uses this money to begin to accelerate growth and expand the product’s capabilities.

Powered by WPeMatico

The reMarkable tablet is a strange device in this era of ultra-smart gadgets: A black and white screen meant for reading, writing, and sketching — and nothing more. Yet the company has sold 100,000 of the devices and now has attracted $15 million in series A funding from Spark Capital.

It’s an unusual trajectory for a hardware startup exploring a nearly unoccupied market, but CEO Magnus Wanberg is confident that’s because this category of device is destined to grow in response to increasingly invasive tech. Sometimes an anti-technology trend is the tech opportunity of a lifetime.

I reviewed the reMarkable last year and compared it with its only real competition, the Sony Digital Paper Tablet. It was launched not on Kickstarter or Indiegogo but with its own independent crowdfunding campaign — and considering we’ve seen devices like this attempt such a thing and either let down or rip off their backers, that alone was a significant risk.

The device has been a runaway success, though, selling over 100,000 units — and attracting investment in the process. When I talked with Wanberg and co-founder Gerst about their new A round, the conversation was so interesting that I decided to publish it in full (or at least slightly edited).

How did they get here? What would they have done differently? Is the threat of the “smart” world really a thing? Why fight tech with more tech?

Devin: So you guys raised some money, that’s great! But it’s been a while since we talked. I think it’s important to hear about the progress of unique companies that are doing interesting things. So first can you tell me a little about what the company’s been busy with?

Magnus: Well, we’ve created this wonderful product, the reMarkable paper tablet. We’ve been very focused on that effort, based on a love for paper and a love for technology, to see if we can find some ways to join these two together to help people think better. That’s sort of the the whole ethos of the company.

So for the last six years, we’ve just been grinding away… you know, we’re a small player up against the big guys on this. So we’ve been sort of fighting guerrilla warfare trying to trying to establish ourselves.

And we were successful, fortunately, when we did our pre-order campaign, because as we found out, we weren’t the only ones who who love this notion of thinking better with the paper tablet, seeing paper as a powerful tool for thinking and for creating.

Powered by WPeMatico

Security breaches and other activities that cause network surges and outages are all on the rise in the enterprise, and today, a startup called Forward Networks, which has built a clever way to help businesses monitor their network traffic to identify when things are going wrong, has raised a round of $35 million to continue expanding its business to meet that demand.

The money, a Series C, is being led by Goldman Sachs, which in this case is both a strategic and financial investor. David Erickson, the startup’s co-founder and CEO, said the investment bank started out as a customer, and Joshua Matheus, MD for technology at Goldman Sachs, was so pleased with the results that he recommended the bank also invest in the company. Others participating in this round include Andreessen Horowitz, Threshold Ventures (previously DFJ Venture) and A. Capital, the three investors that were behind Forward Networks’ previous round of $16 million in 2017.

Erickson, along with other co-founders Nikhil Handigol, Brandon Heller and Peyman Kazemian, were all Stanford PhDs, and the company’s technology is based around work they did there around mathematical modeling. Here, that concept is applied to a company’s network to create essentially a replica of a company’s network architecture, which is in turn used to simulate individual processes and apps running on the network to figure out how they interact and what would represent “normal” versus “abnormal” behavior, which in turn is applied in real time to monitor the network and predict what might happen on it. This is not a fixing platform per se, but in developer operations, there is a fundamental need and gap in the market for products that help engineers identify what is not working in order to know what to try to fix.

If you are familiar with Honeycomb.io — a DevOps platform for running apps to determine when and where bugs or conflicts might arise (which itself recently raised funding) — this seems to be taking a similar approach, but on a network scale.

Considered together, it seems that we’re starting to see a new wave of services and platforms designed to provide more granular and intelligent pictures of how apps and networks behave in our modern technology landscapes.

Erickson tells me that today, the vast majority of Forward Networks’ customers are using the product to monitor on-premises rather than cloud architectures.

“We launched a public cloud product for AWS towards the end of last year, which today is in use by customers, but the dominant use case for us is on-prem,” Erickson said, who said that while the media (ahem) loves to talk about cloud, in many cases large enterprises have actually been slower to migrate processes in cases where legacy services still work well, and they still harbour distrust of public cloud security and reliability. “We see growth towards the cloud but it’s baby steps.”

The company has been growing steadily; today its network monitoring covers some 75,000 devices. In that context, Goldman Sachs is a significant client, with some 15,000 devices in its network alone.

Looking ahead, Erickson said that the funding would be used in part for R&D and in part to continue its business development. There are a number of other solutions and services out there that have identified the opportunity of providing better network management as a route to identifying security threats and other risks, so that also presents an opportunity for M&A for Forward, although Erickson declined to comment further on that.

“We continue to see the value that Forward Networks’ platform brings to large enterprises running complex networks,” said Bill Krause, board partner at Andreessen Horowitz. “They have solved a critical business problem, which presents a real growth opportunity.”

Powered by WPeMatico

Missing out on a month’s rent because you can’t find a tenant is a huge loss. Searching for someone to fill a home takes work, while property managers are incentivized to price your place too high, leading to costly vacancies.

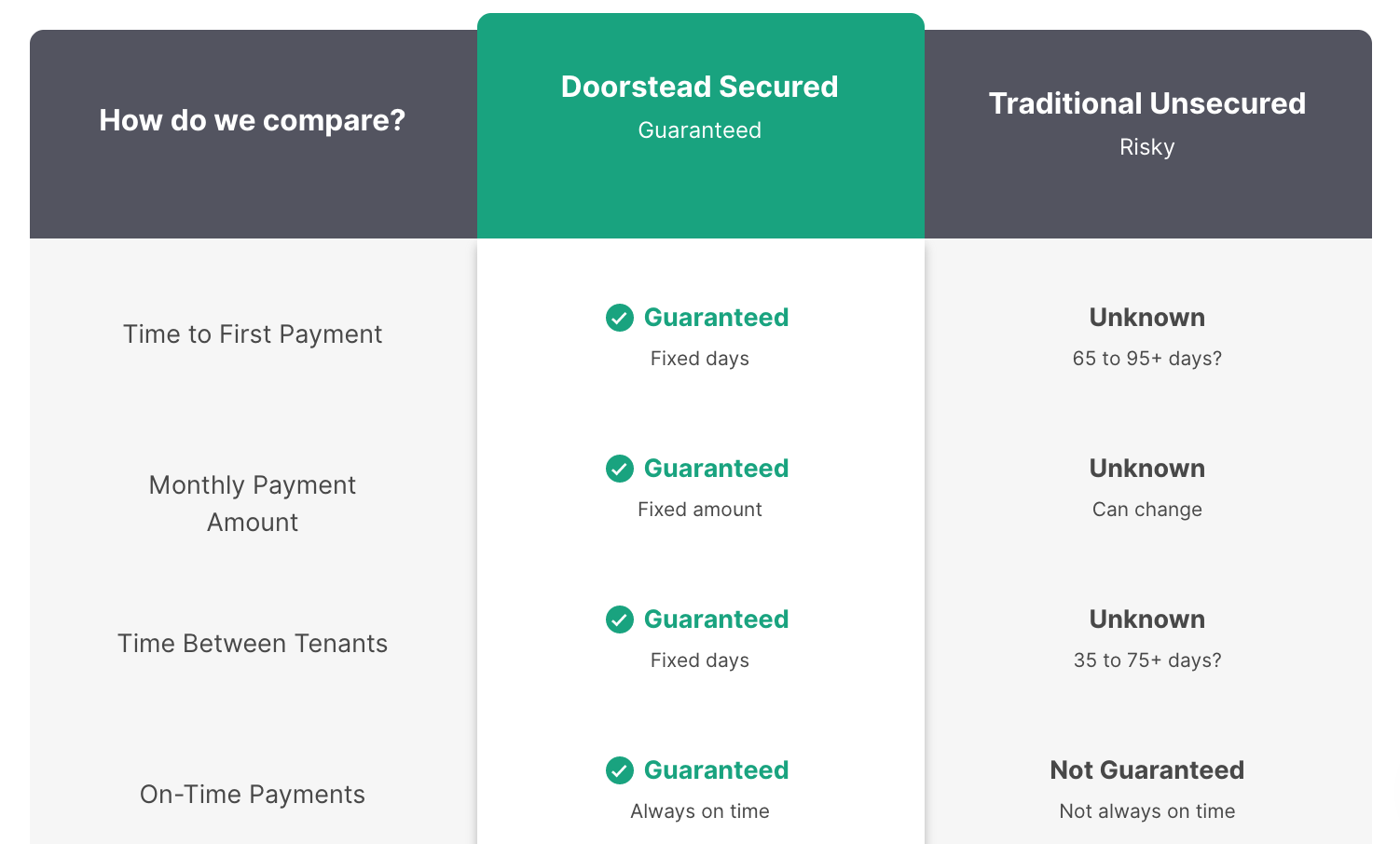

But new startup Doorstead wants to take on the risk and the work for you. It acts as a property manager for single-family homes, but guarantees you rent at a specific rate starting in a certain number of days, even if it can’t fill the house or apartment. It also handles all the algorithmic pricing, advertising, tenant interviews, repairs, maintenance, leases and online payments in exchange for 8% of rent. Owners just sit back and receive the money, making it much easier to profit off of distant real estate. The startup claims to earn users 3% to 9% more than other property management models.

Doorstead’s approach to the hot sector of “iRenting” has attracted a $3.3 million seed round co-led by M13 and Silicon Valley Data Capital, and joined by Venture Reality Fund and SOMA Capital. They’re betting on co-founders Jennifer Bronzo, whose parents ran a construction and property management firm, and Ryan Waliany, who worked in product at Uber after his recipe platform Kitchenbowl was acqui-hired.

Doorstead co-founders (from left): Jennifer Bronzo and Ryan Waliany

“I grew up going to job sites and learning about construction,” Bronzo says. “In the recent decade, my family purchased a lot of properties in the Bay and they needed help filling capacity. I saw so many opportunities in property management because of how antiquated the industry is.” Doorstead is now operating in five cities around the San Francisco Bay Area.

As consumers grow accustomed to zero-friction services, that approach is branching into bigger and bigger sectors like the trillions paid for long-term rentals. Waliany, Doorstead’s CEO, tells me, “We’re in the process of Uber’izing each step of the property management life cycle.” The startup is hoping to become the OpenDoor of rentals.

First, property owners contact Doorstead and provide some basic information on the home they want to rent out. They receive a preliminary offer before the startup does an inspection and takes professional marketing photos while digging through reams of data on local pricing, availability and demand to pick a rate its algorithm believes it can fill the home for quickly. Owners then receive a final offer agreement saying they’ll be paid $X per month starting in Y number of days (typically 21 to 45 days), with Doorstead absorbing all the risk if it can’t find a tenant.

First, property owners contact Doorstead and provide some basic information on the home they want to rent out. They receive a preliminary offer before the startup does an inspection and takes professional marketing photos while digging through reams of data on local pricing, availability and demand to pick a rate its algorithm believes it can fill the home for quickly. Owners then receive a final offer agreement saying they’ll be paid $X per month starting in Y number of days (typically 21 to 45 days), with Doorstead absorbing all the risk if it can’t find a tenant.

From there, the startup does approved maintenance and cleaning as necessary, and then methodically lists the home on all the top rental platforms. It handles open house walk-throughs and runs background checks on potential tenants to find who will most reliably pay rent. Doorstead prepares a lease and gets it signed by a tenant, but even if it doesn’t, owners still get their guaranteed payments. Rent is collected online, and if a move-out or eviction is necessary, Doorstead takes care of the transition to finding a new tenant.

There’s plenty of margin for Doorstead to earn if it can consistently fill homes faster. Most property managers charge at least 50% of the first month’s rent, but instead, Doorstead keeps all the rent of any extra days if it fills the spot before the guaranteed due date. From there, it charges 8% of monthly rent with no tenant placement fee, which is close to or under the common 10% fee on single-family home property management. And if it manages to secure a higher rate from tenants than its guarantee, it gives 70% to the owner.

Doorstead claims to be less risky than alternatives

“Property management incumbents have a 43-day vacancy average which leads to $86 billion in economic waste in the U.S. alone,” Waliany tells TechCrunch. “This means that landlords could earn the same money and lower rents by 12% for tenants with an efficient market.”

With Doorstead, even if the owner lives far away, the turn-key service lets them efficiently rent their home. That’s not only important to them, but to overcrowded cities like San Francisco that often see apartments left vacant by overseas owners because they’re too much effort to rent out. To date, Doorstead’s algorithm has allowed it to recoup 100% of its guarantees and it’s shooting to stay above 90%, while maintaining its NPS of 80.

But if the startup is working that well, it’s only a matter of time until incumbents try to barge in.

“It would be a no brainer for Airbnb to enter this market and Zillow to open this,” Waliany admits, given their existing pricing algorithms and popularity as rental destinations. But Bronzo says “the biggest barrier is the operations piece that an Airbnb and Zillow haven’t stepped into.” It would be a big departure from their lean software-based marketplaces. Other property management startups like Mynd, OneRent and BelongHome only offer guaranteed rent once tenants are found, absolving themselves of most of the risk. They’d have to take on a more precarious business model.

What about Zeus, Sonder and Lyric, which offer property management of homes they then use for corporate housing or as boutique hotels? “An owner of ours considered Zeus versus Doorstead and went with Doorstead because: 1) our offer was ~12% higher, and 2) they didn’t want the wear-and-tear that comes with having people move in and out of the property every few days or few months,” Waliany explains. “Sonder and Lyric have 300 move-in and move-outs over a six-year period. Doorstead has ~4 move ins/outs and that results in significantly less wear-and-tear and a much easier operations to manage. Not only that, the long-term rental market is 42x larger and has 12x more addressable revenue.” Doorstead will have to build a brand and product moat to defend against inevitable direct competition.

As iRenting is still a fresh concept, Waliany warns that “with any new business model, there will inevitably be ‘unknown unknowns’ that we cannot predict, black swan events and things that we might only be able to learn through calculated bets.” Luckily, because it doesn’t hold the leases for very long, and home rentals typically increase in an economic downturn, Doorstead’s liability is manageable in the event of a recession or other crisis.

“There are three large trillion-dollar industries — food, transportation and housing. At Doorstead, we have an opportunity to completely redefine the housing value chain by creating a new class of property management that eliminates unnecessary vacancies. In the end, this redefinition of the value chain allows ourselves to become the Blackstone of the future,” Waliany concludes. “It seems like we’re giving everyone free money.” That will prove either the startup’s downfall or a powerful growth tactic.

Powered by WPeMatico

Next Insurance, a three-year-old U.S.-based firm that sells insurance products to small businesses, has become the latest unicorn in the nation after bagging $250 million in a new financing round, the startup said today.

Germany-based Munich Re, one of the world’s largest reinsurers, alone funded Next Insurance’s Series C round, the two said in a statement. The new financing round valued the three-year-old startup, which has raised $381 million to date, at more than $1 billion, the startup said.

Guy Goldstein, co-founder and chief executive of Next Insurance, said the startup will use the fresh capital to build new products and expand its customer initiatives. Next Insurance offers a wide-range of insurance coverage to more than 1,000 unique types of business. It has amassed over 70,000 customers in the U.S., the only market where it currently operates.

Next Insurance aims to become a one-stop insurance shop for micro and small business insurance needs. Its insurance plans and products are designed to cater to the business sectors that are often overlooked by more general insurers.

The startup offers a number of insurance products, including general liability, which covers a number of accidents at work, including property damage and physical injury; professional liability, which covers business owners from accusations of professional mistakes; and commercial auto, which pays for damage caused by or to your business vehicle.

As TechCrunch’s Steve O’Hear explained earlier, small business owners often rely on price comparison websites to figure out what kind of coverage they need and where to buy it, though that means the plans they get don’t always cover all their needs. The other option is to use a broker, but that also adds another middle person.

In a statement, Joachim Wenning, chairman of the Board of Management at Munich Re, said the new investment will help Munich Re expand its footprint in the U.S.’s insurance market of small and medium-sized commercial customers.

“Next Insurance will benefit from our expertise in primary insurance and reinsurance. This investment emphasizes Munich Re’s commitment to be the leading provider of digital insurance solutions,” added Wenning.

Next Insurance, of course, isn’t the only player attempting to address the insurance needs of small and micro-sized businesses. It competes with a handful of startups, including Lemonade, which raised $300 million in April this year, and Root Insurance, which sells car insurance and raised $100 million last year.

Powered by WPeMatico

On the heels of Bird closing a $275 million round to help put itself in pole position in the electric scooter market, a smaller European rival has also raised some money to grow its own business. Tier Mobility, a Berlin-based startup that operates a fleet of 20,000 scooters across 40 cities in 12 countries, has raised $60 million, funding that Tier’s co-founder and CEO Lawrence Leuschner said it would invest in further geographical expansion and its technology.

Tier earlier this year started to describe itself as a “micro mobility” player, with plans to augment scooters with other transportation options, but in an interview Leuschner declined to say what those might be, or when they will come online. In the meantime, it’s been upgrading its fleet to a more robust hardware to cut down on maintenance costs (which has typically been one of the biggest strains on scooter startups): these newer scooters have lifespans of around 18 months and now make up some 80% of Tier’s current fleet, Leuschner said.

This latest funding, a Series B, is being co-led by Mubadala Capital and Goodwater Capital. Mubadala, for background, is the state fund for Abu Dhabi, which is currently the only non-European market where Tier operates. Mubadala made some headlines earlier this year when it was revealed that SoftBank was backing its $400 million fund for European investments. (Indirectly, this also means that SoftBank is backing Tier.)

“We firmly believe that micro-mobility as a form of transportation is here to stay, especially in Europe,” said Amer Alaily from Mubadala Capital in a statement. “We are confident that Tier Mobility is best positioned to become the leading player in Europe and globally. We are excited and look forward to building a global category leading company out of Europe.”

Others in this round include insurance giant Axa Germany, Evli Growth Partners, White Star Capital, Northzone, Speedinvest, Point9, Indico, Kibo Ventures, Market One Capital and — an ironic twist when you consider the reputation of scooter users being somewhat on the reckless side — Formula One racing champion Nico Rosberg. The valuation is not being disclosed.

The scooter market is a crowded one, but Tier’s rapid growth points both to the opportunity for those building services in it, and Tier’s own success.

Since raising its Series A (initially €25 million, but expanded to €32 million in February of this year), Tier has grown to 10 million rides, adding 8 million in the last four months both through its direct services and by way of partnerships with others, such as car rental company Sixt. That growth has led Tier to claim that it is currently the fastest-growing mobility company “in the world.” Leuschner — who co-founded the company with Matthias Laug (now CTO) — said the aggressive goal now is to hit between 3 million and 5 million rides weekly.

That’s impressive growth, but it comes with challenges. The funding today takes the total raised by Tier to around $95 million. However, relatively speaking, that is actually a modest amount when you consider the hundreds of millions raised by the likes of Bird (capital that it’s using in part to grow in Europe in direct competition with Tier) and Lime.

Tier has taken the view, so far, that big money isn’t the only way to build a big service.

“With our Series A funding of €32 million, we built the fastest-growing mobility company,” Leuschner said. “We achieved that with a fraction of the capital of Bird and Lime. That shows how efficiently we are operating. With this round we will now accelerate the growth based on our scalable infrastructure and positive unit economics.”

With the scooter market’s unit economics unlike that of car-based on-demand transportation (the vehicles are owned, and there are not drivers to pay out, for starters), he said that Tier is already profitable in some of its markets.

One of the other big sticking points that has hindered the growth of more scooter services has been regulation, and specifically safety concerns, with reports of faulty software and human error / reckless driving both contributing to a number of accidents.

Leuschner noted that Tier has had around 250 accidents to date across its 10 million rides, with “the vast majority minor accidents.”

“We continue to educate users, but I can’t see a significant safety issue compared to other vehicles,” he added. “I think Tier has taken a leadership role in safety with the safest scooter on the market, permanent education of our users and insurance for every driver in every city.”

In this regard, having an insurance company — Axa — now on board as a strategic investor will potentially see both more safety initiatives rolled out by Tier, but also potentially the emergence of insurance policies provided to customers as part of the service.

All told, the strong growth on the back of conservative capital, combined with the experience of the founders (Laug had also been the co-founder of Lieferando, one of the first big food delivery startups in Europe), and that interesting backing from big industry players, has all contributed to an optimistic outlook from investors.

“Tier Mobility is not only the fastest-growing mobility company in the world, but one of the fastest-growing companies in consumer tech history,” noted Chi-Hua Chien, the star investor and Goodwater Capital co-founder who had previously been at Kleiner Perkins and before that Accel.

“With phenomenal execution they have emerged as the leading micromobility provider in Europe on only a fraction of the invested capital of their competitors. This is a true testament to the uniquely capital efficient and profitable model the team chose to deploy from the outset. Tier’s unique approach to operations and partnerships yields superior unit economics and defensibility.”

Powered by WPeMatico

Fyle, a Bangalore-headquartered startup that operates an expense management platform, has extended its previous financing round to add $4.5 million of new investment as it looks to court more clients in overseas markets.

The additional $4.5 million tranche of investment was led by U.S.-based hedge fund Steadview Capital, the startup said. Tiger Global, Freshworks and Pravega Ventures also participated in the round. The new tranche of investment, dubbed Series A1, means that the three-and-a-half-year-old startup has raised $8.7 million as part of its Series A financing round, and $10.5 million to date.

The SaaS startup offers an expense management platform that makes it easier for employees of a firm to report their business expenses. The eponymous service supports a range of popular email providers, including G Suite and Office 365, and uses a proprietary technology to scan and fetch details from emails, Yash Madhusudhan, co-founder and CEO of Fyle, demonstrated to TechCrunch last week.

A user, for instance, could open a flight ticket email and click on Fyle’s Chrome extension to fetch all details and report the expense in a single click in real-time. As part of today’s announcement, Madhusudhan unveiled an integration with WhatsApp . Users will now be able to take pictures of their tickets and other things and forward it to Fyle, which will quickly scan and report expense filings for them.

These integrations come in handy to users. “Eighty percent to ninety percent of a user’s spending patterns land on their email and messaging clients. And traditionally it has been a pain point for them to get done with their expense filings. So we built a platform that looks at the challenges faced by them. At the same time, our platform understands frauds and works with a company’s compliances and policies to ensure that the filings are legitimate,” he said.

“Every company today could make use of an intelligent expense platform like Fyle. Major giants already subscribe to ERP services that offer similar capabilities as part of their offerings. But as a company or startup grows beyond 50 to 100 people, it becomes tedious to manage expense filings,” he added.

Fyle maintains a web application and a mobile app, and users are free to use them. But the rationale behind introducing integrations with popular services is to make it easier than ever for them to report filings. The startup retains its algorithms each month to improve their scanning abilities. “The idea is to extend expense filing to a service that people already use,” he said.

Until late last year, Fyle was serving customers in India. Earlier this year, it began searching for clients outside the nation. “Our philosophy was if we are able to sell in India remotely and get people to use the product without any training, we should be able to replicate this in any part of the world,” he said.

And that bet has worked. Fyle has amassed more than 300 clients, more than 250 of which are from outside of India. Today, the startup says it has customers in 17 nations, including the U.S. and the U.K. Furthermore, Fyle’s revenue has grown by five times in the last five months, said Madhusudhan, without disclosing the exact figures.

To accelerate its momentum, the startup is today also launching an enterprise version of Fyle that will serve the needs of major companies. The enterprise version supports a range of additional security features, such as IP restriction and a single sign-in option.

Fyle will use the new capital to develop more product solutions and integrations and expand its footprint in international markets, Madhusudhan said. The startup, which just recently set up its sales and marketing team, will also expand the headcount, he said.

Moving forward, Madhusudhan said the startup would also explore tie-ups with ERP providers and other ways to extend the reach of Fyle.

In a statement, Ravi Mehta, MD at Steadview Capital, said, “intelligent and automated systems will empower businesses to be more efficient in the coming decade. We are excited to partner with Fyle to transform one of the core business processes of expense management through intelligence and automation.”

Powered by WPeMatico