Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

“We want to change the way freight moves,” says Oren Zaslansky, the chief executive and founder of Flock Freight.

His company, which has been operating in stealth mode for the last two years, has finally emerged with a new solution for freight shipping that purports to bring in more money to shippers, remove inefficiencies in the current hub-and-spoke model for freight and offer better deals to shipping customers.

He’s also got $50 million in financing in the bank in what is one of the largest recent investments in a San Diego-based company.

For Zaslansky, the shipping business is a family affair. “My parents grew up in the moving business… I grew up around both entrepreneurship and freight,” he says.

Those twin passions led him to start his own trucking business out of college in the San Diego area. He also launched a brokerage business to support supply chain logistics. The exposure to both is what led Zaslansky to launch Flock Freight and its big new financing round, which closed earlier this week.

The company raised its cash to change the way shippers move small amounts of goods — those less-than-a-truckload-sized amounts that have to move through hub-and-spoke operations which increase the time goods are on the road and the possibility for breakage as they’re unloaded and reloaded onto different delivery vehicles.

“We want to disintermediate the infrastructure of hub and spoke,” says Zaslansky. “We want to carpool. We use our technology to change the way freight moves.”

Zaslansky isn’t talking about very small orders that can be delivered through a service like Roadie — the delivery company that raised $39 million from investors led by Home Depot back in February 2019.

This is still trucking — it’s a carpool in a 70-foot-long tractor trailer. Flock Freight works by reaching out to small and mid-size trucking companies and integrating their orders onto the shipments that these firms are already making. “We go to the carriers that are much more used to working with a third party to fill up empty trucks,” Zaslansky says.

Right now, that’s about 15% of the $110 billion freight and logistics trucking market, Zaslansky says.

The new investments into Flock Freight came from SignalFire and GLP Capital Partners in mid-February and they were likely drawn to the company’s claims that its service can eliminate damage claims, collect freight from multiple shippers and optimize route delivery for a 40% savings in fuel emissions, and the guaranteed delivery rate of 97.5%.

Companies like Tuft & Needle and Titan Supply Group are already using the company’s services, according to a statement from Flock Freight.

Flock Freight makes its market by having a window into the spare capacity of trucks and charging shippers for the exact amount of capacity that they’re using. “We want to go to a shipper and say — that [cargo] is 75% of the truck and we’ll charge you 75% of the truck,” said Zaslansky. For carriers, they can say that the price they’ve charged is for 100% of the truck and Flock Freight will add another 10 feet of freight and an additional $1,000 into a carrier’s pocket, Zaslansky said.

Powered by WPeMatico

Coding and other computer science expertise remain some of the more important skills that a person can have in the working world today, but in the last few years, we have also seen a big rise in a new generation of tools providing an alternative way of reaping the fruits of technology: “no-code” software, which lets anyone — technical or non-technical — build apps, games, AI-based chatbots, and other products that used to be the exclusive terrain of engineers and computer scientists.

Today, one of the newer startups in the category — London-based Gyana, which lets non-technical people run data science analytics on any structured dataset — is announcing a round of £3 million to fuel its next stage of growth.

Led by U.K. firm Fuel Ventures, other investors in this round include Biz Stone of Twitter, Green Shores Capital and U+I , and it brings the total raised by the startup to $6.8 million since being founded in 2015.

Gyana (Sanskrit for “knowledge”) was co-founded by Joyeeta Das and David Kell, who were both pursuing post-graduate degrees at Oxford: Das, a former engineer, was getting an MBA, and Kell was doing a Ph. D. in physics.

Das said the idea of building this tool came out of the fact that the pair could see a big disconnect emerging not just in their studies, but also in the world at large — not so much a digital divide, as a digital light year in terms of the distance between the groups of who and who doesn’t know how to work in the realm of data science.

“Everyone talks about using data to inform decision making, and the world becoming data-driven, but actually that proposition is available to less than one percent of the world,” she said.

Out of that, the pair decided to work on building a platform that Das describes as a way to empower “citizen data scientists,” by letting users upload any structured data set (for example, a .CSV file) and running a series of queries on it to be able to visualise trends and other insights more easily.

While the longer term goal may be for any person to be able to produce an analytical insight out of a long list of numbers, the more practical and immediate application has been in enterprise services and building tools for non-technical knowledge workers to make better, data-driven decisions.

To prove out its software, the startup first built an app based on the platform that it calls Neera (Sanskrit for “water”), which specifically parses footfall and other “human movement” metrics, useful for applications in retail, real estate and civic planning — for example to determine well certain retail locations are performing, footfall in popular locations, decisions on where to place or remove stores, or how to price a piece of property.

Starting out with the aim of mid-market and smaller companies — those most likely not to have in-house data scientists to meet their business needs — startup has already picked up a series of customers that are actually quite a lot bigger than that. They include Vodafone, Barclays, EY, Pret a Manger, Knight Frank and the UK Ministry of Defense. It says it has some £1 million in contracts with these firms currently.

That, in turn, has served as the trigger to raise this latest round of funding and to launch Vayu (Sanskrit for “air”) — a more general purpose app that covers a wider set of parameters that can be applied to a dataset. So far, it has been adopted by academic researchers, financial services employees, and others that use analysis in their work, Das said.

With both Vayu and Neera, the aim — refreshingly — is to make the whole experience as privacy-friendly as possible, Das noted. Currently, you download an app if you want to use Gyana, and you keep your data local as you work on it. Gyana has no “anonymization” and no retention of data in its processes, except things like analytics around where your cursor hovers, so that Gyana knows how it can improve its product.

“There are always ways to reverse engineer these things,” Das said of anonymization. “We just wanted to make sure that we are not accidentally creating a situation where, despite learning from anaonyised materials, you can’t reverse engineer what people are analysing. We are just not convinced.”

While there is something commendable about building and shipping a tool with a lot of potential to it, Gyana runs the risk of facing what I think of as the “water, water everywhere” problem. Sometimes if a person really has no experience or specific aim, it can be hard to think of how to get started when you can do anything. Das said they have also identified this, and so while currently Gyana already offers some tutorials and helper tools within the app to nudge the user along, the plan is to eventually bring in a large variety of datasets for people to get started with, and also to develop a more intuitive way to “read” the basics of the files in order to figure out what kinds of data inquiries a person is most likely to want to make.

The rise of “no-code” software has been a swift one in the world of tech spanning the proliferation of startups, big acquisitions, and large funding rounds. Companies like Airtable and DashDash are aimed at building analytics leaning on interfaces that follow the basic design of a spreadsheet; AppSheet, which is a no-code mobile app building platform, was recently acquired by Google; and Roblox (for building games without needing to code) and Uncorq (for app development) have both raised significant funding just this week. In the area of no-code data analytics and visualisation, there are biggies like Tableau, as well as Trifacta, RapidMiner and more.

Gartner predicts that by 2024, some 65% of all app development will be made on low- or no-code platforms, and Forrester estimates that the no- and low-code market will be worth some $10 billion this year, rising to $21.2 billion by 2024.

That represents a big business opportunity for the likes of Gyana, which has been unique in using the no-code approach specifically to tackle the area of data science.

However, in the spirit of citizen data scientists, the intention is to keep a consumer version of the apps free to use as it works on signing up enterprise users with more enhanced paid products, which will be priced on an annual license basis (currently clients are paying between $6,000 and $12,000 depending on usage, she said).

“We want to do free for as long as we can,” Das said, both in relation to the data tools and the datasets that it will offer to users. “The biggest value add is not about accessing premium data that is hard to get. We are not a data marketplace but we want to provide data that makes sense to access,” adding that even with business users, “we’d like you to do 90% of what you want to do without paying for anything.”

Powered by WPeMatico

Made Renovation, a new, San Francisco-based company, thinks it has found a profitable way to help homeowners get done something that busy general contractors in the Bay Area won’t otherwise make time for, which is bathroom remodels.

Why they typically pass on these: they have too many entire homes, or, at least, entire floors, to build for affluent regional homeowners who’ve kept the construction industry buzzing for years.

It’s a problem that founders Roger Dickey, who previously co-founded Gigster, and Sagar Shah, who previously founded Quad, think they can solve through technology, naturally. Their big idea: create bathroom templates that customers can customize but whose scope and costs are generally understood, line up these customers, then hire general contractors who are willing to focus only on these bathrooms.

It’s an idea that’s picking up traction with these GCs, says Dickey, who explains it this way: “General contractors generally see net margin of 3%” no matter the size of the job, owing to unforeseen hurdles, like pipes that suddenly need to be rebuilt, drains that need to be dug and materials that don’t ship on schedule.

In addition to timing issues, GCs are also often dealing with frustrated building owners who might underestimate a project’s costs, particularly in California, where construction bills often cause sticker shock.

Made Renovation sees an opportunity to make both the lives of GCs and homeowners easier. Through pre-negotiated pricing, volume and materials handling (it right now rents part of a warehouse where it receives goods), it’s promising GCs a “reasonable margin” so they can not only pay their crews but live a higher quality of life themselves.

Meanwhile, per the plan, customers need only choose from the company’s “modern” collection, its more traditional “heritage”design or its “artisan” collection — all of which can be customized — then sit back while their long-neglected bathrooms are remade.

Whether Made Renovation can pull off its grand vision is a giant question mark. The construction industry is nothing if not messy, and in addition to convincing GCs of its merits, Made Renovation — like any marketplace company — has to strike the right balance between customer demand and supply as it gets off the ground.

In the meantime, investors clearly think it has promise. Led by Base10 Partners and with participation from Felicis Ventures, Founders Fund and some individual investors, the company has already raised $9 million in seed funding across two tranches.

Part of that capital is on display right now in San Francisco, where Made Renovation today opened its doors to customers who want to check out its design ideas and, if all goes as planned, will begin lining up their own home improvement projects. Customers simply pick a collection, Made Renovation then puts together a “mood board” of materials from that collection, sends out a 3D rendering of what to expect, then goes into build mode with its GC partners.

As for what happens when that build goes awry, Dickey says Made Renovation has it covered. Most notably, while it guarantees the work to its own customers, the GCs with whom it works guarantee their work to Made Renovation.

Dickey also notes that while the startup “may lose money on some projects,” he stresses there are caveats that customers agree to at the outset. Among these, he says, “We can’t X-ray their walls and see if they don’t have wiring up to code. We don’t cover dry rot in walls.” Technology, suggests Dickey, can only do so much.

If you’re in the Bay Area and want to check out its new storefront, it’s on Chestnut Street in SF, in the city’s Marina district. The company hopes to perfect its model in the Bay Area, says Dickey, then expand into other regions. As for why Made Renovation decided to tackle one of the most challenging U.S. markets first, he suggests it’s the best way to test its mettle. “I like the idea of starting a company here, because if we can make it work here, I think we can succeed anywhere.”

Powered by WPeMatico

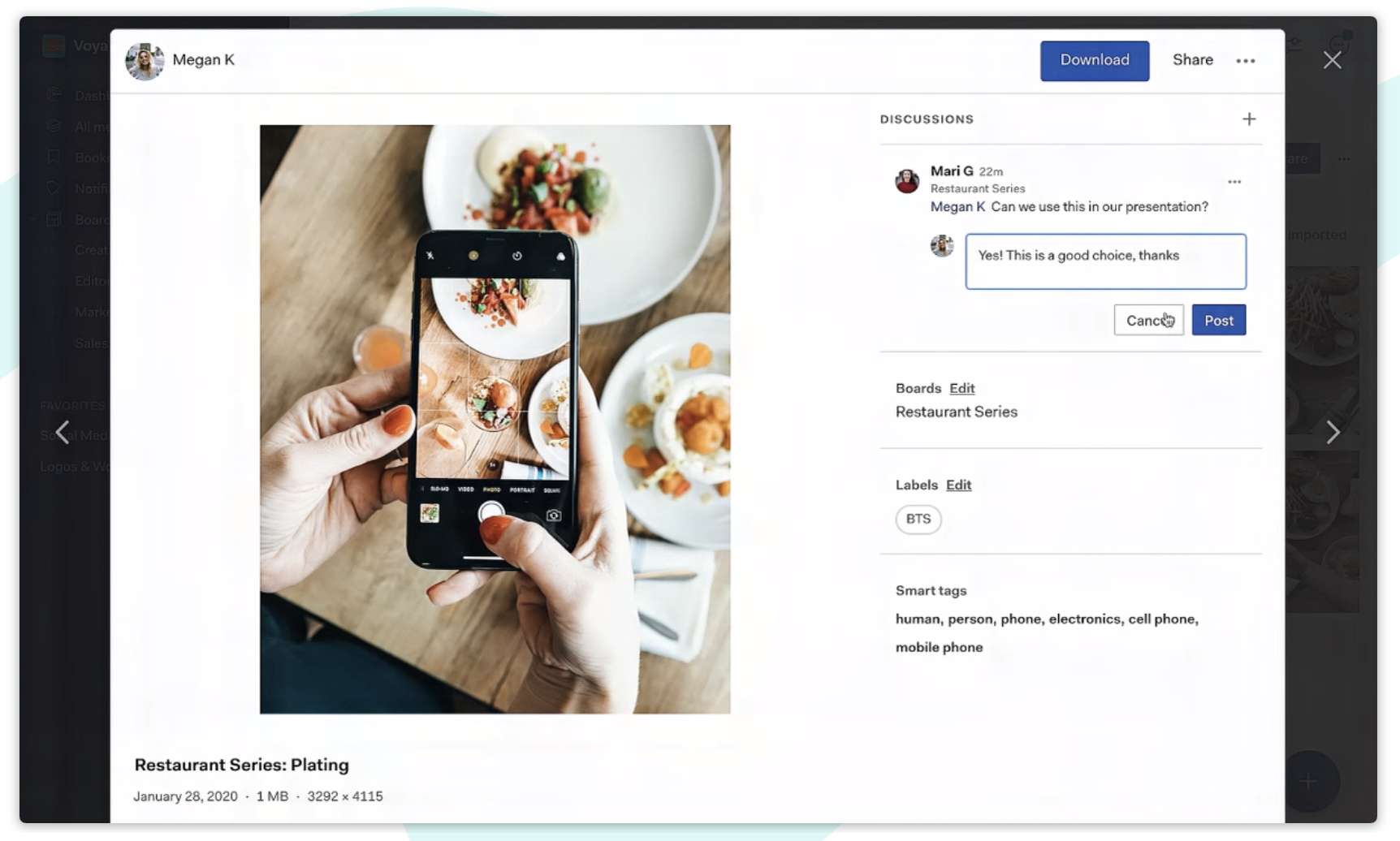

When it comes to the so-called “consumerization of the enterprise,” a workplace tool that looks an awful lot like Pinterest seems like it would be the trend’s final form. Brooklyn-based Air is building a digital asset manager for communications teams that aren’t satisfied with more general cloud storage options and want something that can show off visual files with a bit more pizzazz.

The startup tells TechCrunch that they have closed $6 million in funding led by Lerer Hippeau . RedSea Ventures, Advancit Capital and WndrCo also participated.

General-purpose cloud storage options from Google or Dropbox don’t always handle digital assets well — especially when it comes to previewing items, and Air’s more focused digital asset management competitors often require dedicated managers inside the org, the company says. Air has a pretty straightforward interface that looks more like a desktop site from Facebook or Pinterest, with a focus on thumbnails and video previews that’s simple and sleek.

Air is trying to capitalize on the trend toward greater à la carte software spend for teams looking to phase in products with very specific toolsets. The team is generally charging $10 per user per month, with 100GB of storage included.

“Adobe is an amazing suite of products, but with the idea that companies are mandating the tools that their employees use versus letting their employees choose — it makes a lot of sense that teams are going to ultimately end up having more autonomy and creating better work when they’re using tools that they care about,” Lerer Hippeau managing partner Ben Lerer tells TechCrunch.

Air lets customers migrate files from Dropbox or Google Drive to its AWS-hosted storage platform, which displays files like photos, videos, PDFs, fonts and other visual assets as Pinterest-esque boards. The app is a way to view and store files, but Air’s platform play focuses pretty heavily on giving co-workers the ability to comment and tag assets. Collaborating around files is a pretty easy sell; a couple of users discussing which photo they like best for a particular marketing campaign doesn’t require too much imagination.

The team has been focusing largely on attracting users in roles like brand marketing managers, content coordinators and social media managers as a way of infiltrating and scaling vertically inside marketing departments.

“What Airtable did to spreadsheets and what Notion did to docs, we’re doing for visual work,” CEO Shane Hegde told TechCrunch in an interview. “As we think about how we differentiate, it’s really that we’re a workspace collaboration tool, we’re not just cloud storage or digital asset management…”

Powered by WPeMatico

The student loan crisis in the U.S. has left venture capitalists searching for novel approaches to financing higher education, but can the same systems designed for helping coders in Silicon Valley get jobs at Google help underserved students in developing countries become part of a global work force?

Similar to the buzzy San Francisco startup Lambda School, Microverse is a coding school that utilizes ISAs, or Income Share Agreements, as a means of allowing students to learn now and pay later with a fixed percentage of their future salary. Microverse isn’t aiming to compete heavily with Lambda School for U.S. students, however, they are looking more heavily at courting students in developing countries. The startup currently has students in 96 countries, with Mexico, Brazil, Kenya, Nigeria, Cameroon and India among their most represented, CEO Ariel Camus tells TechCrunch.

The pitch of bringing the ISA model worldwide has attracted investor interest. The startup tells TechCrunch it has just closed $3.2 million in seed funding from venture capitalists including General Catalyst and Y Combinator.

Lambda School and its ilk have excited plenty of investors. There has also been plenty of scrutiny and some questions on whether quickly scaling to venture-sized returns or building revenue by selling off securitized ISAs ends up pushing these startups towards cutting corners.

Microverse, for its part, is already built quite lean. The program has no full-time instructors. The entire curriculum is a self-guided English-only lesson plan that relies on students that are just months ahead in the program serving as “mentors.” Students are expected to spend eight hours per day pushing through the curriculum with assigned study partners and peer groups, graduating in about eight months on average, Camus says.

“The average starting salary for us — it’s of course lower and that’s expected,” said Camus. “The only way we can offer as good or better learning experience as Lambda or any other campus-based education in the US — with salaries that will usually be lower — is if our costs are lower, and that’s why we have designed the entire system to allow us to scale faster. We don’t have to hire teachers, we don’t have to create content and that allows us to adjust to changes in the market and new technologies much much faster.”

While Lambda School’s ISA terms require students to pay 17% of their monthly salary for 24 months once they begin earning above $50,000 annually — up to a maximum of $30,000, Microverse requires that graduates pay 15% of their salary once they begin making more than just $1,000 per month, though there is no cap on time so students continue payments until they have repaid $15,000 in full. In both startup’s cases, students only repay if they are employed in a field related to what they studied, but with Microverse, ISAs never expire so if you ever enter a job adjacent to your area of study, you are on the hook for repayments. Lambda School’s ISA taps out after five years of deferred repayments.

Without much of the nuance in how Lambda School or Holberton School have structured their ISA terms, Microverse structure seems less amenable, but Camus defends the terms as a necessary means to getting around under-reporting.

“When you use a cap, you’re using using a perverse incentive for under-reporting,” Camus says. “In the U.S. where you can enforce tax reviews, there’s no need to worry about that and I think it’s better if you can cap it, but in most of the developing countries where there is not a strong tax system, it isn’t a possibility.”

For students that qualify terms for repaying this ISA, they are, again, on the hook for $15,000. Charging such a hefty fee for an online course without full-time instructors geared towards students in developing countries could be controversial for a venture-backed startup, but it will also put a heavy burden on the school to keep their students satisfied and help them find employment via its network of career counselors.

The CEO acknowledges the high price of Microverse’s instruction, “It is huge,” but says that the premium is necessary to build a business around getting students in developing countries careers in the global workforce. Microverse is keeping its total number of admitted students small early on so that it can ensure it’s meeting their needs, Camus says, noting that Microverse accepts just 1% of applicants, adding 70-80 students to the program per month.

“This conversation around the ISA in the U.S. that is so hot, you have to frame it in such a different way when you’re talking about students in developing and emerging countries. Like, there are no alternatives,” Camus says. “…if you can find a value proposition that aligns with their goals and gives them some international and professional exposure, that gives them a world-class education… that’s a very compelling proposition.”

Powered by WPeMatico

Fintech startup Revolut is raising a large Series D round of funding. TCV is leading the $500 million round, valuing the company at $5.5 billion. Over the past few years, Revolut has raised $836 million in total.

Some existing investors are also participating in today’s funding round, but Revolut isn’t sharing names. Previous investors include DST Global, Index Ventures, Balderton Capital and many others.

If you’re not familiar with Revolut, the company is building a financial service to replace traditional bank accounts. You can open an account from an app in just a few minutes. You can then receive, send and spend money from the app or using a debit card.

On top of that, Revolut has added a ton of features that it has built in-house or through partnerships. You can insure your phone, get a travel medical insurance package, buy cryptocurrencies, buy shares, donate to charities, save money and more.

Revolut currently has more than 10 million customers, mostly in Europe and the U.K. The company doesn’t share specific numbers when it comes to transaction volume and monthly active customers, but here are some percentage-based metrics:

With the new influx of cash, the company says that it’ll focus on improving its product for existing users as well as revenue. It’s all about making Revolut more useful and stickier going forward.

In particular, you can expect new lending services for both retail customers as well as companies using Revolut for Business. While Revolut provides a ton of services in the U.K., customers in other markets don’t have the same feature set. For instance, Revolut recently launched savings vaults in the U.K. — customers in other markets will be able to open savings sub-accounts in the future, as well.

Other than that, Revolut wants to double down on the core features. The company will improve its two subscription tiers (Premium and Metal) and improve banking operations across Europe — you can expect full bank accounts in Europe in the future.

There are currently 2,000 people working for Revolut. “We’re on a mission to build a global financial platform — a single app where our customers can manage all of their daily finances, and this investment demonstrates investor confidence in our business model. Going forward, our focus is on rolling-out banking operations in Europe, increasing the number of people who use Revolut as their daily account, and striving towards profitability,” Revolut co-founder and CEO Nik Storonsky said in the release.

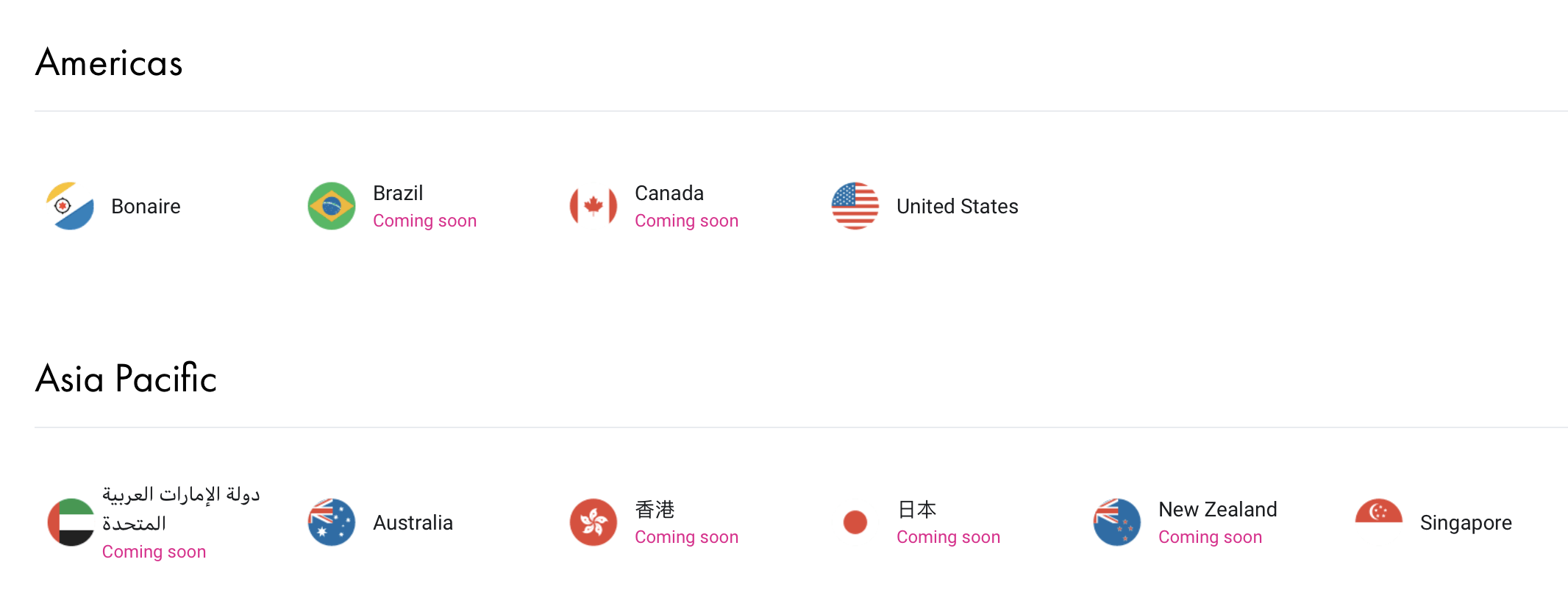

Revolut is currently live in the U.K., Europe, Singapore and Australia (in beta). While the company has announced plans to expand to a handful of countries, the main focus is on launching in the U.S. and Japan in the coming months.

Powered by WPeMatico

David Renteln, the Los Angeles-based co-founder of Soylent and the co-founder and chief executive of new nicotine gum manufacturer Lucy Goods, thinks there should be a better-tasting, less-medicinal offering for people looking to quit smoking.

That’s why he founded Lucy Goods, and that’s why investors, including RRE Ventures, Vice Ventures and FundRX joined previous investors YCombinator and Greycroft in backing the company with $10 million in new funding.

“We reformulated nicotine gum and the improvements that we made were to the taste, the texture and the nicotine release speed,” said Renteln.

These days, any startup that’s working on smoking cessation or working with tobacco products can’t avoid comparisons to Juul — the multi-billion-dollar startup that’s at the center of the surge in teen nicotine consumption.

“The Juul comparison is something that’s obviously top of people’s minds,” Renteln said. “It’s important to note that there’s a huge difference in nicotine products.”

Renteln points to statements from former Food and Drug Administration chief, Scott Gottlieb (who’s now a partner at the venture firm New Enterprise Associates), which drew a distinction between combustible tobacco products on one end and nicotine gums and patches on the other.

“Nicotine isn’t the principle agent of harm associated with these tobacco products,” said Rentlen. “It’s addictive but not inherently bad for you.”

Lucy Goods also doesn’t release its nicotine dosage in a concentrated burst like vapes, which are designed to replicate the head rush associated with smoking a cigarette, said Renteln.

“It is a stimulant and they will get a sensation, but it’s not as intense as taking a very deep drag of a cigarette,” Renteln said.

The company’s website also doesn’t skew to young, lifestyle marketing images. Instead, there are testimonials from older, ex-smokers hawking the Lucy gum.

“I don’t want anyone underage using any nicotine product or any drug in general… [and] the flavors have been around for a long time.”

Joining Renteln in the quest to create a better nicotine gum is Samy Hamdouche, a former business development executive at several Southern California biotech startups and the previous vice president of research at Soylent.

For both men, the idea is to get a new product to market that can help people quit smoking — without a social stigma — Renteln said.

“Smoking is the leading cause of preventable death in the United States claiming over 480,000 lives every year and costing the U.S. an estimated $300 billion in direct health costs and lost productivity. Lucy is committed to bringing innovative nicotine products to the market to eliminate tobacco related harm and we’re proud to be part of their journey,” said RRE investor, Jason Black in a statement.

Powered by WPeMatico

Some of Latin America’s leading venture capital investors are now backing hotel chains.

In fact, Ayenda, the largest hotel chain in Colombia, has raised $8.7 million in a new round of funding, according to the company.

Led by Kaszek Ventures, the round will support the continued expansion of Ayenda’s chain of hotels in Colombia and beyond. The hotel operator already has 150 hotels operating under its flag in Colombia and has recently expanded to Peru, according to a statement.

Financing came from Kaszek Ventures and strategic investors like Irelandia Aviation, Kairos, Altabix and BWG Ventures.

The company, which was founded in 2018, now has more than 4,500 rooms under its brand in Colombia and has become the biggest hotel chain in the country.

Investments in brick and mortar chains by venture firms are far more common in emerging markets than they are in North America. The investment in Ayenda mirrors big bets that SoftBank Group has made in the Indian hotel chain Oyo and an investment made by Tencent, Sequoia China, Baidu Capital and Goldman Sachs, in LvYue Group late last year, amounting to “several hundred million dollars”, according to a company statement.

“We’re seeking to invest in companies that are redefining the big industries and we found Ayenda, a team that is changing the hotel’s industry in an unprecedented way for the region”, said Nicolas Berman, Kaszek Ventures partner.

Ayenda works with independent hotels through a franchise system to help them increase their occupancy and services. The hotels have to apply to be part of the chain and go through an up to 30-day inspection process before they’re approved to open for business.

“With a broad supply of hotels with the best cost-benefit relationship, guests can travel more frequently, accelerating the economy,” says Declan Ryan, managing partner at Irelandia Aviation.

The company hopes to have more than 1 million guests in 2020 in their hotels. Rooms list at $20 per-night, including amenities and an around the clock customer support team.

Oyo’s story may be a cautionary tale for companies looking at expanding via venture investment for hotel chains. The once high-flying company has been the subject of some scathing criticism. As we wrote:

The New York Times published an in-depth report on Oyo, a tech-enabled budget hotel chain and rising star in the Indian tech community. The NYT wrote that Oyo offers unlicensed rooms and has bribed police officials to deter trouble, among other toxic practices.

Whether Oyo, backed by billions from the SoftBank Vision Fund, will become India’s WeWork is the real cause for concern. India’s startup ecosystem is likely to face a number of barriers as it grows to compete with the likes of Silicon Valley.

Powered by WPeMatico

DSP Concepts — a startup whose Audio Weaver software is used by companies as varied as Tesla, Porsche, GoPro and Braun Audio — is announcing that it has raised $14.5 million in Series B funding.

The startup goal, as explained to me by CEO Chin Beckmann and CTO Paul Beckmann (yep, they’re a husband-and-wife founding team), is to create the standard framework that companies use to develop their audio processing software.

To that end, Chin told me they were “picky about who we wanted on the B round, we wanted it to represent the support and endorsement of the industry.”

So the round was led by Taiwania Capital, but it also includes investments from the strategic arms of DSP Concepts’ industry partners — BMW i Ventures (which led the Series A), the Sony Innovation Growth Fund by Innovation Growth Ventures, MediaTek Ventures, Porsche Ventures and the ARM IoT Fund.

Paul said Audio Weaver started out as the “secret weapon” of the Beckmanns’ consulting business, which he could use to “whip out” the results of an audio engineering project. At a certain point, consulting customers started asking him, “Hey, how about you teach me how to use that?,” so they decided to launch a startup focused on the Audio Weaver platform.

Paul described the software as a “graphical block diagram editor.” Basically, it provides a way for audio engineers to combine and customize different software modules for audio processing.

“Audio is still in the Stone Ages compared to other industries,” he said. “Suppose you’re building a product with a touchscreen — are you going write the graphics from scratch or use a framework like Qt?”

Similarly, he suggested that while many audio engineers are still “down in the weeds writing code,” they can take advantage of Audio Weaver’s graphical interface to piece everything together, as well as the company’s “hundreds of different modules — pre-written, pre-tested, pre-optimized functions to build up your system.”

For example, Paul said that by using the Audio Weaver platform, DSP Concepts engineers could test out “hundreds of ideas” for algorithms for reducing wind noise in the footage captured by GoPro cameras, then ultimately “hand the algorithms over to GoPro,” whose team could them plug the algorithms into their software and modify it themselves.

The Beckmanns said the company also works closely with chip manufacturers to ensure that audio software will work properly on any device powered by a given chipset.

Other modules include TalkTo, which is designed to give voice assistants like Alexa “super-hearing,” so that they can still isolate voice commands and cancel out all the other noise in loud environments, even rock concerts. (You can watch a TalkTo demo in the video below.)

DSP Concepts has now raised more than $25 million in total funding.

Powered by WPeMatico

Electriphi, a provider of charging management and fleet monitoring software for electric vehicles, has joined the scrum of startups looking to provide services to the growing number of electric vehicle fleets in the U.S.

The San Francisco-based company has just raised $3.5 million in seed funding from investors, including Wireframe Ventures, the Urban Innovation Fund and Blackhorn Ventures. Lemnos Labs and Acario Innovation also participated in the round.

Electriphi’s pitch has resonated with school districts. It counts the Twin Rivers Unified School District in Sacramento, Calif. as one of its benchmark customers.

“Twin Rivers Unified School District has the largest fleet of electric school buses in North America, and our ambition is to transition to a fully electric fleet in the coming years,” said Tim Shannon, transportation services director, Twin Rivers Unified School District, in a statement. “This is a significant undertaking, and we needed a trusted partner that could provide us state-of-the-art charging management and help us with data collection and monitoring.”

There are several companies pursuing this market — all with either a bit of a head start, significant corporate backers or more capital. Existing offerings from EVConnect, GreenLots, GreenFlux, AmplyPower all compete with Electriphi.

The company is betting that the experience of co-founder Muffi Ghadiali, a former senior director at ChargePoint who led hardware and software development for fast charging infrastructure, can sway customers. Joining Ghadiali is Sanjay Dayal, who previously worked at Agralogics, Tibco, Xamplify, Versata and Sybase .

There’s also the sheer scale of the opportunity, which is likely to see multiple companies emerge as winners.

“There are millions of public and commercial fleet vehicles in the U.S. alone that we rely on daily for transportation, delivery and services,” said Paul Straub, managing partner, Wireframe Ventures. “Many of these are beginning to consider electrification and the opportunity is tremendous.”

Powered by WPeMatico