Auto Added by WPeMatico

Playbyte’s new app aims to become the ‘TikTok for games’

A startup called Playbyte wants to become the TikTok for games. The company’s newly launched iOS app offers tools that allow users to make and share simple games on their phone, as well as a vertically scrollable, fullscreen feed where you can play the games created by others. Also like TikTok, the feed becomes more personalized over time to serve up more of the kinds of games you like to play.

While typically, game creation involves some aspect of coding, Playbyte’s games are created using simple building blocks, emoji and even images from your Camera Roll on your iPhone. The idea is to make building games just another form of self-expression, rather than some introductory, educational experience that’s trying to teach users the basics of coding.

At its core, Playbyte’s game creation is powered by its lightweight 2D game engine built on web frameworks, which lets users create games that can be quickly loaded and played even on slow connections and older devices. After you play a game, you can like and comment using buttons on the right-side of the screen, which also greatly resembles the TikTok look-and-feel. Over time, Playbyte’s feed shows you more of the games you enjoyed as the app leverages its understanding of in-game imagery, tags and descriptions, and other engagement analytics to serve up more games it believes you’ll find compelling.

At launch, users have already made a variety of games using Playbyte’s tools — including simulators, tower defense games, combat challenges, obbys, murder mystery games, and more.

According to Playbyte founder and CEO Kyle Russell — previously of Skydio, Andreessen Horowitz, and (disclosure!) TechCrunch — Playbyte is meant to be a social media app, not just a games app.

“We have this model in our minds for what is required to build a new social media platform,” he says.

What Twitter did for text, Instagram did for photos and TikTok did for video was to combine a constraint with a personalized feed, Russell explains. “Typically. [they started] with a focus on making these experiences really brief…So a short, constrained format and dedicated tools that set you up for success to work within that constrained format,” he adds.

Similarly, Playbyte games have their own set of limitations. In addition to their simplistic nature, the games are limited to five scenes. Thanks to this constraint, a format has emerged where people are making games that have an intro screen where you hit “play,” a story intro, a challenging gameplay section, and then a story outro.

In addition to its easy-to-use game building tools, Playbyte also allows game assets to be reused by other game creators. That means if someone who has more expertise makes a game asset using custom logic or which pieced together multiple components, the rest of the user base can benefit from that work.

“Basically, we want to make it really easy for people who aren’t as ambitious to still feel like productive, creative game makers,” says Russell. “The key to that is going to be if you have an idea — like an image of a game in your mind — you should be able to very quickly search for new assets or piece together other ones you’ve previously saved. And then just drop them in and mix-and-match — almost like Legos — and construct something that’s 90% of what you imagined, without any further configuration on your part,” he says.

In time, Playbyte plans to monetize its feed with brand advertising, perhaps by allowing creators to drop sponsored assets into their games, for instance. It also wants to establish some sort of patronage model at a later point. This could involve either subscriptions or even NFTs of the games, but this would be further down the road.

The startup had originally began as a web app in 2019, but at the end of last year, the team scrapped that plan and rewrote everything as a native iOS app with its own game engine. That app launched on the App Store this week, after previously maxing out TestFlight’s cap of 10,000 users.

Currently, it’s finding traction with younger teenagers who are active on TikTok and other collaborative games, like Roblox, Minecraft, or Fortnite.

“These are young people who feel inspired to build their own games but have been intimidated by the need to learn to code or use other advanced tools, or who simply don’t have a computer at home that would let them access those tools,” notes Russell.

Playbyte is backed by $4 million in pre-seed and seed funding from investors including FirstMark (Rick Heitzmann), Ludlow Ventures (Jonathon Triest and Blake Robbins), Dream Machine (former Editor-in-Chief at TechCrunch, Alexia Bonatsos), and angels such as Fred Ehrsam, co-founder of Coinbase; Nate Mitchell, co-founder of Oculus; Ashita Achuthan, previously of Twitter; and others.

The app is a free download on the App Store.

Powered by WPeMatico

Today’s real story: The Facebook monopoly

Facebook is a monopoly. Right?

Mark Zuckerberg appeared on national TV today to make a “special announcement.” The timing could not be more curious: Today is the day Lina Khan’s FTC refiled its case to dismantle Facebook’s monopoly.

To the average person, Facebook’s monopoly seems obvious. “After all,” as James E. Boasberg of the U.S. District Court for the District of Columbia put it in his recent decision, “No one who hears the title of the 2010 film ‘The Social Network’ wonders which company it is about.” But obviousness is not an antitrust standard. Monopoly has a clear legal meaning, and thus far Lina Khan’s FTC has failed to meet it. Today’s refiling is much more substantive than the FTC’s first foray. But it’s still lacking some critical arguments. Here are some ideas from the front lines.

To the average person, Facebook’s monopoly seems obvious. But obviousness is not an antitrust standard.

First, the FTC must define the market correctly: personal social networking, which includes messaging. Second, the FTC must establish that Facebook controls over 60% of the market — the correct metric to establish this is revenue.

Though consumer harm is a well-known test of monopoly determination, our courts do not require the FTC to prove that Facebook harms consumers to win the case. As an alternative pleading, though, the government can present a compelling case that Facebook harms consumers by suppressing wages in the creator economy. If the creator economy is real, then the value of ads on Facebook’s services is generated through the fruits of creators’ labor; no one would watch the ads before videos or in between posts if the user-generated content was not there. Facebook has harmed consumers by suppressing creator wages.

A note: This is the first of a series on the Facebook monopoly. I am inspired by Cloudflare’s recent post explaining the impact of Amazon’s monopoly in their industry. Perhaps it was a competitive tactic, but I genuinely believe it more a patriotic duty: guideposts for legislators and regulators on a complex issue. My generation has watched with a combination of sadness and trepidation as legislators who barely use email question the leading technologists of our time about products that have long pervaded our lives in ways we don’t yet understand. I, personally, and my company both stand to gain little from this — but as a participant in the latest generation of social media upstarts, and as an American concerned for the future of our democracy, I feel a duty to try.

The problem

According to the court, the FTC must meet a two-part test: First, the FTC must define the market in which Facebook has monopoly power, established by the D.C. Circuit in Neumann v. Reinforced Earth Co. (1986). This is the market for personal social networking services, which includes messaging.

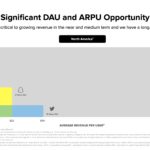

Second, the FTC must establish that Facebook controls a dominant share of that market, which courts have defined as 60% or above, established by the 3rd U.S. Circuit Court of Appeals in FTC v. AbbVie (2020). The right metric for this market share analysis is unequivocally revenue — daily active users (DAU) x average revenue per user (ARPU). And Facebook controls over 90%.

The answer to the FTC’s problem is hiding in plain sight: Snapchat’s investor presentations:

Snapchat July 2021 investor presentation: Significant DAU and ARPU Opportunity. Image Credits: Snapchat

This is a chart of Facebook’s monopoly — 91% of the personal social networking market. The gray blob looks awfully like a vast oil deposit, successfully drilled by Facebook’s Standard Oil operations. Snapchat and Twitter are the small wildcatters, nearly irrelevant compared to Facebook’s scale. It should not be lost on any market observers that Facebook once tried to acquire both companies.

The market Includes messaging

The FTC initially claimed that Facebook has a monopoly of the “personal social networking services” market. The complaint excluded “mobile messaging” from Facebook’s market “because [messaging apps] (i) lack a ‘shared social space’ for interaction and (ii) do not employ a social graph to facilitate users’ finding and ‘friending’ other users they may know.”

This is incorrect because messaging is inextricable from Facebook’s power. Facebook demonstrated this with its WhatsApp acquisition, promotion of Messenger and prior attempts to buy Snapchat and Twitter. Any personal social networking service can expand its features — and Facebook’s moat is contingent on its control of messaging.

The more time in an ecosystem the more valuable it becomes. Value in social networks is calculated, depending on whom you ask, algorithmically (Metcalfe’s law) or logarithmically (Zipf’s law). Either way, in social networks, 1+1 is much more than 2.

Social networks become valuable based on the ever-increasing number of nodes, upon which companies can build more features. Zuckerberg coined the “social graph” to describe this relationship. The monopolies of Line, Kakao and WeChat in Japan, Korea and China prove this clearly. They began with messaging and expanded outward to become dominant personal social networking behemoths.

In today’s refiling, the FTC explains that Facebook, Instagram and Snapchat are all personal social networking services built on three key features:

- “First, personal social networking services are built on a social graph that maps the connections between users and their friends, family, and other personal connections.”

- “Second, personal social networking services include features that many users regularly employ to interact with personal connections and share their personal experiences in a shared social space, including in a one-to-many ‘broadcast’ format.”

- “Third, personal social networking services include features that allow users to find and connect with other users, to make it easier for each user to build and expand their set of personal connections.”

Unfortunately, this is only partially right. In social media’s treacherous waters, as the FTC has struggled to articulate, feature sets are routinely copied and cross-promoted. How can we forget Instagram’s copying of Snapchat’s stories? Facebook has ruthlessly copied features from the most successful apps on the market from inception. Its launch of a Clubhouse competitor called Live Audio Rooms is only the most recent example. Twitter and Snapchat are absolutely competitors to Facebook.

Messaging must be included to demonstrate Facebook’s breadth and voracious appetite to copy and destroy. WhatsApp and Messenger have over 2 billion and 1.3 billion users respectively. Given the ease of feature copying, a messaging service of WhatsApp’s scale could become a full-scale social network in a matter of months. This is precisely why Facebook acquired the company. Facebook’s breadth in social media services is remarkable. But the FTC needs to understand that messaging is a part of the market. And this acknowledgement would not hurt their case.

The metric: Revenue shows Facebook’s monopoly

Boasberg believes revenue is not an apt metric to calculate personal networking: “The overall revenues earned by PSN services cannot be the right metric for measuring market share here, as those revenues are all earned in a separate market — viz., the market for advertising.” He is confusing business model with market. Not all advertising is cut from the same cloth. In today’s refiling, the FTC correctly identifies “social advertising” as distinct from the “display advertising.”

But it goes off the deep end trying to avoid naming revenue as the distinguishing market share metric. Instead the FTC cites “time spent, daily active users (DAU), and monthly active users (MAU).” In a world where Facebook Blue and Instagram compete only with Snapchat, these metrics might bring Facebook Blue and Instagram combined over the 60% monopoly hurdle. But the FTC does not make a sufficiently convincing market definition argument to justify the choice of these metrics. Facebook should be compared to other personal social networking services such as Discord and Twitter — and their correct inclusion in the market would undermine the FTC’s choice of time spent or DAU/MAU.

Ultimately, cash is king. Revenue is what counts and what the FTC should emphasize. As Snapchat shows above, revenue in the personal social media industry is calculated by ARPU x DAU. The personal social media market is a different market from the entertainment social media market (where Facebook competes with YouTube, TikTok and Pinterest, among others). And this too is a separate market from the display search advertising market (Google). Not all advertising-based consumer technology is built the same. Again, advertising is a business model, not a market.

In the media world, for example, Netflix’s subscription revenue clearly competes in the same market as CBS’ advertising model. News Corp.’s acquisition of Facebook’s early competitor MySpace spoke volumes on the internet’s potential to disrupt and destroy traditional media advertising markets. Snapchat has chosen to pursue advertising, but incipient competitors like Discord are successfully growing using subscriptions. But their market share remains a pittance compared to Facebook.

An alternative pleading: Facebook’s market power suppresses wages in the creator economy

The FTC has correctly argued for the smallest possible market for their monopoly definition. Personal social networking, of which Facebook controls at least 80%, should not (in their strongest argument) include entertainment. This is the narrowest argument to make with the highest chance of success.

But they could choose to make a broader argument in the alternative, one that takes a bigger swing. As Lina Khan famously noted about Amazon in her 2017 note that began the New Brandeis movement, the traditional economic consumer harm test does not adequately address the harms posed by Big Tech. The harms are too abstract. As White House advisor Tim Wu argues in “The Curse of Bigness,” and Judge Boasberg acknowledges in his opinion, antitrust law does not hinge solely upon price effects. Facebook can be broken up without proving the negative impact of price effects.

However, Facebook has hurt consumers. Consumers are the workers whose labor constitutes Facebook’s value, and they’ve been underpaid. If you define personal networking to include entertainment, then YouTube is an instructive example. On both YouTube and Facebook properties, influencers can capture value by charging brands directly. That’s not what we’re talking about here; what matters is the percent of advertising revenue that is paid out to creators.

YouTube’s traditional percentage is 55%. YouTube announced it has paid $30 billion to creators and rights holders over the last three years. Let’s conservatively say that half of the money goes to rights holders; that means creators on average have earned $15 billion, which would mean $5 billion annually, a meaningful slice of YouTube’s $46 billion in revenue over that time. So in other words, YouTube paid creators a third of its revenue (this admittedly ignores YouTube’s non-advertising revenue).

Facebook, by comparison, announced just weeks ago a paltry $1 billion program over a year and change. Sure, creators may make some money from interstitial ads, but Facebook does not announce the percentage of revenue they hand to creators because it would be insulting. Over the equivalent three-year period of YouTube’s declaration, Facebook has generated $210 billion in revenue. one-third of this revenue paid to creators would represent $70 billion, or $23 billion a year.

Why hasn’t Facebook paid creators before? Because it hasn’t needed to do so. Facebook’s social graph is so large that creators must post there anyway — the scale afforded by success on Facebook Blue and Instagram allows creators to monetize through directly selling to brands. Facebooks ads have value because of creators’ labor; if the users did not generate content, the social graph would not exist. Creators deserve more than the scraps they generate on their own. Facebook suppresses creators’ wages because it can. This is what monopolies do.

Facebook’s Standard Oil ethos

Facebook has long been the Standard Oil of social media, using its core monopoly to begin its march upstream and down. Zuckerberg announced in July and renewed his focus today on the metaverse, a market Roblox has pioneered. After achieving a monopoly in personal social media and competing ably in entertainment social media and virtual reality, Facebook’s drilling continues. Yes, Facebook may be free, but its monopoly harms Americans by stifling creator wages. The antitrust laws dictate that consumer harm is not a necessary condition for proving a monopoly under the Sherman Act; monopolies in and of themselves are illegal. By refiling the correct market definition and marketshare, the FTC stands more than a chance. It should win.

A prior version of this article originally appeared on Substack.

Powered by WPeMatico

Cent, the platform that Jack Dorsey used to sell his first tweet as an NFT, raises $3M

Cent was founded in 2017 as an ad-free creator network that allows users to offer each other crypto rewards for good posts and comments — it’s like gifting awards on Reddit, but with Ethereum. But in late 2020, Cent’s small, San Francisco-based team created Valuables, an NFT market for tweets, and by March, the small blockchain startup was thrown a serendipitous curveball.

“We just wrapped up for the day, and I was about to go eat dinner, and all these people started texting me,” remembers CEO Cameron Hejazi. Then, he realized that Twitter CEO Jack Dorsey had minted Twitter’s first-ever Tweet through Cent’s Valuables application. “I was basically like, mildly shivering for the rest of the night. The whole team, we were like, ‘Okay, battle stations, prepare to get hacked!’ ”

Dorsey ended up selling his NFT for $2.9 million, and he donated the proceeds to Give Directly’s Africa Response fund for COVID-19 relief. But for Cent, it was as if the small company had just been handed a free marketing campaign. Now, about five months later, Cent is announcing a $3 million round of seed funding with investors like Galaxy Interactive, former Disney chairman Jeffrey Katzenberg, will.i.am and Zynga founder Mark Pincus.

On Valuables, anyone on the internet can place an offer on any tweet, which then makes it possible for someone else to make a counter-offer. If the author of the tweet accepts an offer (logging into Valuables requires you to validate your Twitter account), then Cent will mint the tweet on the blockchain and create a 1-of-1 NFT.

The NFT itself contains the text of the tweet, the username of the creator, the time it was minted and the creator’s digital signature. The NFT also includes a link to the tweet, though the linked content lives outside the blockchain.

Image Credits: Cent (opens in a new window)

There’s nothing proprietary about minting tweets as NFTs — another company could do the same thing that Cent is doing. Even Twitter itself has recently dabbled in giving away free NFT art, though it hasn’t tried to sell actual tweets as NFTs like Cent. Still, Hejazi sees Dorsey’s use of Cent like an endorsement — he thinks it would be difficult for Twitter to shut them down, since Dorsey made $2.9 million on the platform himself. After all, Dorsey chose Cent instead of taking a screenshot of his first tweet, minting the .JPG as an NFT and posting it on a larger NFT platform, like OpenSea.

“We’ve spoken with people at Twitter. I’m positive that we have a healthy relationship going,” Hejazi said (Twitter declined to comment on or confirm whether that’s true). “We thought about applying this approach to other social platforms, like Instagram and TikTok, but we hypothesized that this is particularly suited for Twitter, because it’s a conversation platform, and it’s where all of the crypto people are actually living.”

With Cent’s seed funding Hejazi hopes to continue building the platform. The company’s goal is to enable anyone creative to make an income through the use of NFTs — that means developing tools to make it simpler for its users to mint NFTs, but also, building out its existing creator-focused social network. The content people post on Cent is usually creative work, like art and writing, rather than short posts — it’s closer to DeviantArt than it is to Reddit. These are lofty goals for a $3 million seed funding round, but there are aspects of Cent’s Beta platform that make it promising.

“There’s already value in what we post on social media. It’s just being proxied through ad dollars, and it doesn’t have to be the case that there’s so much wealth concentration in a single entity. We can work toward a system that decentralizes that wealth,” said Hejazi. “These networks as they exist have monopolies on distribution — you can’t take your Twitter audience, download it as a .CSV and send them all an email.”

A screenshot of Cent’s social platform.

In addition to independent distribution lists, Hejazi wants to move away from the ad-supported internet. He references Substack as an example of a company where the creator has control of their list, and at the same time, the platform can remain ad-free, since the money that propels it comes from the users who pay to subscribe to newsletters (and also, venture capital helps).

But Cent does something different by allowing users to essentially invest in creators who they think have the potential to take off on their platform.

Users can “seed” a post, which is how you subscribe to a creator participating on the creatives side of Cent’s platform. As the seeder, you pay a set fee of at least one dollar per month. There’s an incentive to support up-and-coming creators on the platform, because seeders get a portion of the creators’ future profit — it’s like making a bet on them that they will continue to make great content in the future. Five percent of profits go toward Cent, but the remaining 95% is split 50/50 between the creator and all of their past seeders. Participating on this platform would allow creators to network and show support for one another, but doesn’t prevent them from more directly monetizing their work on other creator platforms, like Patreon.

In addition to seeding posts, users can also “spot” other people’s posts — Cent’s version of a “like” button. Each “spot” is the equivalent of one cent from the user’s crypto wallet. Cent’s argument is that getting 1,000 likes on a post on other platforms yields nothing but a vague sensation of social clout. But on Cent, if a user gets 1,000 “spots,” that’s $10. Still, a project like this can only work if enough people use the platform.

“When we started Cent, we chose cryptocurrencies because we loved the idea of someone being able to earn money with nothing more than their creativity and a crypto address,” Hejazi said. “Over time, we’ve found it to be limiting as a payment type — very few people actually own it and have it ready to spend. We’re working on ways to make payments to creators using Cent easier, and are exploring both crypto-native and non-crypto options.”

This mindset echoes other NFT startups like Yat, which allows payments via credit card as part of its “progressive decentralization” model. So much of these companies’ success depends on public buy-in toward an eventual decentralized, blockchain-based internet. But until then, companies like Cent will continue to experiment in reimagining how creatives can get paid online.

Powered by WPeMatico

Yat thinks emoji ‘identities’ can be a thing, and it has $20M in sales to back it up

I learned about Yat in April, when a friend sent our group chat a link to a story about how the key emoji sold as an “internet identity” for $425,000. “I hate the universe,” she texted.

Sure, the universe would be better if people with a spare $425,000 spent it on mutual aid or something, but minutes later, we were trying to figure out what this whole Yat thing was all about. And few more minutes later, I spent $5 (in U.S. dollars, not crypto) to buy

, an emoji string that I think tells a moving story about my caffeine dependency and sensitive stomach. I didn’t think I would be writing about this when I made that choice.

, an emoji string that I think tells a moving story about my caffeine dependency and sensitive stomach. I didn’t think I would be writing about this when I made that choice.

Kesha’s Yat URL on Twitter

On the surface, Yat is a platform that lets you buy a URL with emojis in it — even Kesha (y.at/

), Lil Wayne (y.at/

), Lil Wayne (y.at/

), and Disclosure (y.at/

), and Disclosure (y.at/

) are using them in their Twitter bios. Like any URL on the internet, Yats can redirect to another website, or they can function like a more eye-catching Linktree. While users could purchase their own domain name that supports emojis and use it instead of a Yat, many people don’t have the technical expertise or time to do so. Instead, they can make a one-time purchase from Yat, which owns the Y.at domain, and the company will provide you with your own y.at link for you.

) are using them in their Twitter bios. Like any URL on the internet, Yats can redirect to another website, or they can function like a more eye-catching Linktree. While users could purchase their own domain name that supports emojis and use it instead of a Yat, many people don’t have the technical expertise or time to do so. Instead, they can make a one-time purchase from Yat, which owns the Y.at domain, and the company will provide you with your own y.at link for you.

This convenience, however, comes at a premium. Yat uses an algorithm to determine your Yat’s “rhythm score,” its metric for determining how to price your emoji combo based on its rarity. Yats with one or two emojis are so expensive that you have to contact the company directly to buy them, but you can easily find a four- or five-emoji identity that’ll only put you out $4.

Beyond that, CEO Naveen Jain — a Y Combinator alumnus, founder of digital marketing company Sparkart and angel investor — thinks that Yat is ultimately an internet privacy product. Jain wants people to be able to use their Yats in any way they’re able to use an online identity now, whether that’s to make payments, send messages, host a website or log in to a platform.

“Objectively, it’s a strange norm. You go on the internet, you register accounts with ad-supported platforms, and your username isn’t universal. You have many accounts, many usernames,” Jain said. “And you don’t control them. If an account wants to shut you down, they shut you down. How many stories are there of people trying to email some social network, and they don’t respond because they don’t have to?”

Image Credits: Yat (opens in a new window)

Yat doesn’t plan to fuel itself with ad money, since users pay for the product when they purchase their Yat, whether they get it for $4 or $400,000.

In the long run, Yat’s CEO says the company plans to use blockchain technology as a way to become self-sovereign. Yats would become assets issued on decentralized, distributed databases. Today, there are several projects working to create a decentralized alternative to the current domain name system (DNS), which is managed by internet regulatory authority ICANN. DNS is how you find things on the internet, but uses a centralized, hierarchical system. A blockchain domain name system would have no central authority, and some believe this could be the foundation of a next-gen web, or “Web 3.0.”

Today, words like “blockchain” and “cryptocurrency” don’t appear on the Yat website. Jain doesn’t think that’s compelling to average consumers — he believes in progressive decentralization, which explains why Yats are currently purchased with dollars, not ethereum.

“Something we think is really funny about the cryptocurrency world is that anyone who’s a part of it spends a lot of time talking about databases,” Jain said. “People don’t care about databases. When’s the last time you went to a website and it said ‘powered by MySQL’?”

Y.at, however, was registered at a traditional internet registrar, not on the blockchain.

“This is laying the foundation — there are certain elements of the vision that are certainly more of a social contract than actual implementation at this point in time,” says Jain. “But this is the vision that we’ve set forth, and we’re working continuously towards that goal.”

Still, until Yat becomes more decentralized, it can’t yet give users the complete control it aspires to. At present, the Terms & Conditions give Yat the authority to terminate or suspend users at its discretion, but the company claims it hasn’t yet booted anyone from the system.

“As Yat becomes more decentralized, our terms and conditions won’t be important,” Jain said. “This is the nature of pursuing a progressive decentralization strategy.”

In its “generation zero” phase (an open beta), Yat claims to have sold almost $20 million worth of emoji identities. Now, as the waitlist to get a Yat ends, Yat is posting some rare emoji identities on OpenSea, the NFT marketplace that recently reached a valuation of $1.5 billion.

A still image of a Yat visualizer creation

“For the first time ever, we’re going to be auctioning some Yats on OpenSea, and we’re going to be launching minting of Yats on Ethereum,” Jain said. Before minting Yats as NFTs, users can create a digital art landscape for their Yats through a Visualizer. These features, as well as new emojis in the Yat emoji set, will launch this evening at a virtual event called Yat Horizon.

“Yat Creators will now have more rights,” Jain said about the new ability to mint Yats as NFTs. “We are going to continue to pursue progressive decentralization until we achieve our ultimate goal: making Yat the best self-directed, self-sovereign identity system for all.”

Consumers have a demonstrated interest in retaining greater privacy on the internet — data shows that in iOS 14.5, 96% of users opted out of ad tracking. But the decentralization movement hasn’t yet been able to market its privacy advantages to the mainstream. Yat helps solve this problem because even if you don’t understand what blockchain means, you understand that having a personal string of emojis is pretty fun. But, before you spend $425,000 on a single-emoji username, keep in mind that Yat’s vision will only completely materialize with the advent of Web 3.0, and we don’t yet know when or if that will happen.

Powered by WPeMatico

Twitter launches US e-commerce pilot that lets users shop from profiles

Twitter this morning will launch a pilot in the U.S. aimed at testing the potential for e-commerce on its platform. The company is introducing a new “Shop Module” that offers brands, businesses and other retailers the ability to showcase their products to Twitter users directly on the business’ profile. Users will then be able to scroll through a carousel of product images in the module and tap through on a product they’re interested in purchasing. This opens up the business’s website inside the Twitter app itself, where the customer can learn more about the product in question and opt to make a purchase.

The Shop Module will appear in a new, dedicated space at the top of a supported Twitter profile, which can be seen by U.S. users in English on iOS devices.

The company told TechCrunch that only businesses with a Professional Profile will be able to use the feature at this time.

Professional Profiles, which began testing in April, give businesses, nonprofits, publishers and creators the ability to display specific information about their business directly on their profile, including things like their address, phone number, operating hours and more. Essentially, it’s the Twitter equivalent to something like a Facebook Page for a business.

At launch, the new Shop Module will be made available to only a small group of pilot testers. In addition to gaming retailer @GameStop and travel brand @ArdenCove, Twitter says there will only be approximately 10 other brands across the lifestyle, traditional retail, gaming, media and entertainment, tech and telco industries who will gain access to the new feature.

At present, Twitter isn’t offering a way for interested businesses to sign up for the pilot because the company is only in the initial phases of testing this feature, it said.

Image Credits: Twitter

While Twitter users often discuss products on the app and even reach out to companies directly for help with purchases, it’s unclear whether users will come to view Twitter as a shopping platform.

With the pilot, Twitter aims to better understand what could help it make that shift by tracking which types of products drive traffic to online retailers. For example, it wants to determine whether people are inspired by online conversations in the heat of the moment — like sports fans buying team apparel — or whether Twitter users could be encouraged to make purchases of a more lasting impact, like products for a new skincare routine. Having a diverse lineup of early pilot testers will help the company to compare data across verticals to learn what works best.

Twitter says it will also work directly with businesses to better understand their needs through the creation of a new Merchant Advisory Board, which will consist of “best-in-class examples” of merchants on Twitter.

The company earlier this year mentioned its plans to expand into e-commerce. At Twitter’s Analyst Day presentation in February, where it first announced its Super Follow platform for creators, the company also briefly spoke about its e-commerce investments.

“We’re … starting to explore ways to better support commerce on Twitter,” Twitter revenue lead Bruce Falck said during the event. “We know people come to Twitter to interact with brands and discuss their favorite products. In fact, you may have even noticed some businesses already developing creative ways to enable sales on our platform.

“This demand gives us confidence in the power of combining real-time conversation with an engaged and intentional audience. Imagine easily discovering, and quickly purchasing, a new skincare product or trendy sneaker from a brand you follow with only a few clicks,” Falck added.

Since then, Twitter has tested a new e-commerce feature for tweets, which allowed businesses to link out to online product pages — like those on a Shopify store, for instance.

Twitter CFO Ned Segal also touted the potential to shop on Twitter when speaking to investors at the J.P. Morgan Technology, Media and Communications conference in May, noting that people “do a lot of research on Twitter before they buy something.”

Twitter’s entry into online shopping comes at a time when major tech companies and social platforms are ramping up their investments in e-commerce. Facebook has made significant moves into e-commerce with shopping features across Facebook, Instagram and WhatsApp, including with initiatives like online storefronts, integrated checkout, product drops, video shopping and more.

Shopify has also partnered with a number of tech platforms, including Facebook, TikTok and Google, to make it easier for consumers to connect with products sold by its merchants.

It’s worth noting that Twitter previously attempted to run a commerce operation and failed. In 2017, the company began to wind down its “Buy” button product, which had allowed Twitter users to click to make purchases, and the retailer partnerships associated with that effort due to lack of traction. Clearly, the company believes the time is now right to try again.

Powered by WPeMatico

Twitter ‘acqui-hires’ the team from subscription news app, Brief

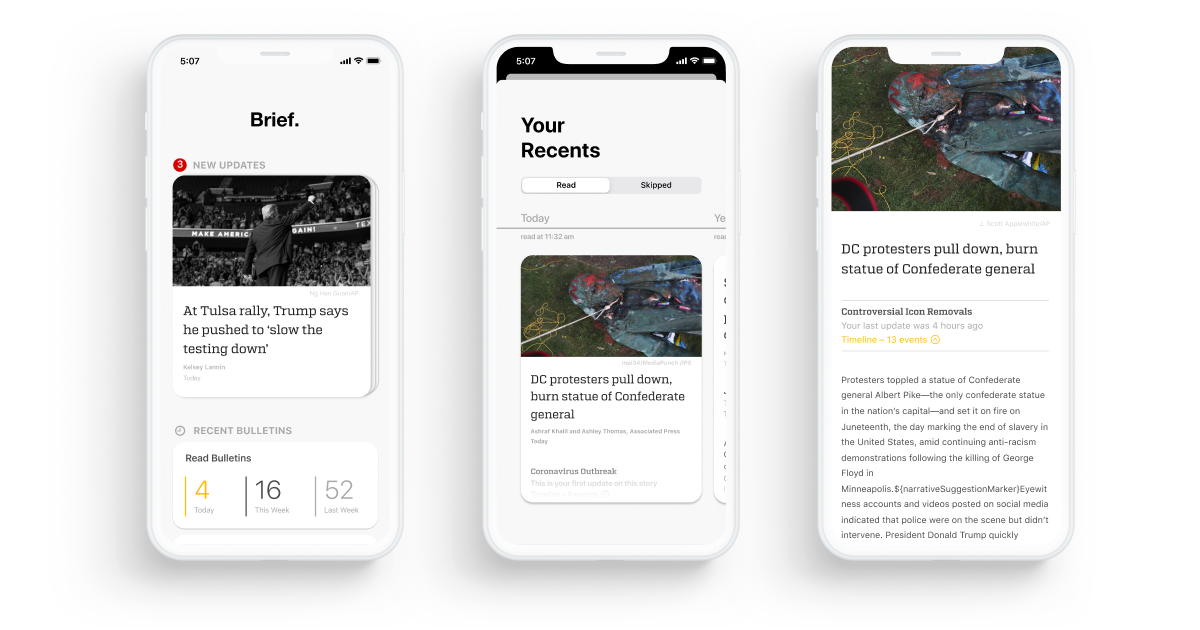

Twitter’s recent acquisition spree continues today as the company announces it has acqui-hired the team from news aggregator and summary app Brief. The startup from former Google engineers launched last year to offer a subscription-based news summary app that aimed to tackle many of the problems with today’s news cycle, including information overload, burnout, media bias and algorithms that promoted engagement over news accuracy.

Twitter declined to share deal terms.

Before starting Brief, co-founder and CEO Nick Hobbs was a Google product manager who had worked on AR, Google Assistant, Google’s mobile app, and self-driving cars, among other things. Co-founder and CTO Andrea Huey, meanwhile, was a Google senior software engineer, who worked on the Google iOS app and had a prior stint at Microsoft.

Image Credits: Brief

While Brief’s ambitious project to fix news consumption showed a lot of promise, its growth may have been hampered by the subscription model it had adopted. The app required a $4.99 per month commitment, despite not having the brand-name draw of a more traditional news outlet. For comparison, The New York Times’ basic digital subscription is currently just $4 per week for the first year of service, thanks to a promotion.

Twitter says the startup’s team, which also includes two other Brief employees, will join Twitter’s Experience.org group where they’ll work on areas that support the public conversation on Twitter, including Twitter Spaces and Explore.

While Twitter wouldn’t get into specifics as to what those tasks may involve, the company did tell TechCrunch it hopes to leverage the founders’ expertise with Brief to build out and accelerate projects in both those areas.

Explore, of course, is Twitter’s “news” section, where top stories across categories are aggregated alongside trending topics. But what it currently lacks is a comprehensive approach to distilling the news down to the basic facts and presenting balance, as Brief’s app had offered. Instead, Twitter’s news items include a headline and a short description of the story, followed by notable tweets. There’s certainly room for improvement there.

It’s also possible to imagine some sort of news-focused product built into Twitter’s own subscription service, Twitter Blue — but that’s just speculation at this point.

Twitter says it proactively reached out to Brief with its offer. As part of its current M&A strategy, the company is on the hunt for acquiring talent that will complement its existing teams and help to accelerate its product developments.

Over the past year, Twitter has made similar acqui-hires, including those for distraction-free reading service Scroll, social podcasting app Breaker, social screen-sharing app Squad, and API integration platform Reshuffle. It also bought products, like newsletter platform Revue, which it directly integrated. The company even held acquisition talks with Clubhouse and India’s ShareChat, which would have been much larger M&A deals.

“We’re really glad we ended up at Twitter,” Hobbs told TechCrunch.

“Andrea and I founded Brief to build news that fostered a healthy discourse, and Twitter’s genuine commitment to improve the public conversation is deeply inspiring,” he said. “While we can’t discuss specifics on future plans, we’re confident our experience at Brief will help accelerate the many exciting things happening at Twitter today,” he added.

Hobbs said the team remains optimistic about the future of paid journalism, too, as Brief demonstrated that some customers would pay for a new and improved news experience.

“Brief pioneered a fresh vision for journalism, focused on getting you just the news you need rather than as much as you could withstand,” remarked Ilya Kirnos, founding partner and CTO at SignalFire, who backed Brief at the seed stage. “That respect for its readers made SignalFire proud to support founders Nick Hobbs and Andrea Huey, who are now bringing that philosophy to the top source of breaking news — Twitter.”

To date, Brief had raised a million in seed funding from SignalFire and handful of angel investors, including Sequoia Scouts like David Lieb, Maia Bittner and Matt Macinnis.

As a result of today’s deal, Brief will wind down its subscription app on July 31. The company says it will alert its current user base today via a notification about its forthcoming shutdown but the app will remain on the App Store offering new features that allow users to explore its archives.

Powered by WPeMatico

Duolingo’s bellwether IPO

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

We were a smaller team this week, with Natasha and Alex together with Chris to sort through yet another summer frenzy of a week.

This time around we actually recorded live on Twitter Spaces, which was a first for the podcast. If you missed it, it’s probably because we didn’t promote the taping since it was just an experiment. Good news, though, is that it went well, and we’re going to do some more live tapings of the show with the entire crew on the mics. Make sure to follow the show on the Big Tweet to ensure that you can come hang with us next week. We’ll also do some Q&A at the end, if we’re in good moods.

Until then, let’s live in the present. Here’s what we got into in today’s show:

- The blisteringly hot EU startup market: You can raise money anywhere, but you might want to do it in Europe, where VCs are putting acre-feet of capital to work this year. Hours before the taping, Index Ventures announced a $3 billion trio of funds (and TikTok strategy?), basically solidifying our earlier reporting.

- The huge round for crypto trading house FTX, and OpenSea raising again: Regardless of whether or not you are paying attention to the crypto market today, investors are still firing capital at startups in the space at an eye-catching pace.

- Duolingo’s first IPO price range: It’s a good-news week for consumer-focused, edtech startups, since the public markets will finally get a taste of a non-enterprise sector startup. Plus, Duolingo’s upcoming finance event could lead to them finally bolstering areas like speech, cultural norms and fluency.

- From the world of funding rounds, we had notes on Sololearn, Numerade, NewCampus, Mural, Spreadsheet.com and Bolt. The conversation ran into some fresh corners, such as how a company raised less than its preceding round but 4x’d its valuation and if we should bite-size all learning.

- And we chatted about Clubhouse leaving beta. Live on Twitter spaces. What can you do?

Powered by WPeMatico

Didi gets hit by Chinese government, and Pleo raises $150M

Hello and welcome back to Equity, TechCrunch’s venture-capital-focused podcast where we unpack the numbers behind the headlines.

This is Equity Monday Tuesday, our weekly kickoff that tracks the latest private market news, talks about the coming week, digs into some recent funding rounds and mulls over a larger theme or narrative from the private markets. You can follow the show on Twitter here and myself here.

What a busy weekend we missed while mostly hearing distant explosions and hugging our dogs close. Here’s a sampling of what we tried to recap on the show:

- Didi vs. China: The Chinese government’s crackdown on Didi continued over the weekend, after announcing a cybersecurity review of the company on Friday. That decision blocked new user signups. Now Didi has had its app removed from pertinent app marketplaces. That’s going to hit revenue. Shares of the company are sharply lower in pre-marketing trading here in the United States. The company went public last week.

- Twitter vs. India: India’s attempts to cow Twitter into not enacting its own content moderation policies continues. Now India has taken away legal protections from the well-known American company. It’s not great news for India’s growing technology sector or the investors backing the upstarts.

- Funding rounds: Lots of companies raised money, including Byrd, with $19 million in a Series B, Pleo with a huge $150 million unicorn round, and Obviously AI, which just extended its seed round.

It’s going to be a busy week! Chat tomorrow.

Equity drops every Monday at 7:00 a.m. PST, Wednesday, and Friday at 6:00 a.m. PST, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts!

Powered by WPeMatico

3 guiding principles for CEOs who post on Twitter

A CEO’s fiduciary duties to their company and its shareholders do not end when they are off the clock — they must always act in good faith. However, navigating the boundaries between a company’s official communications and a personal voice can be difficult in today’s social-media-connected environment.

What a CEO posts on Twitter can raise not only serious reputational issues for themselves and their companies but posting the wrong things at the wrong time can also cause breach of fiduciary duties and may even run afoul of securities laws.

Reputation and goodwill take a long time to build and are difficult to maintain, but it only takes one tweet to destroy it all.

Fiduciary duties can be divided into three buckets: (1) duty of care — CEOs must act in good faith with the care of a reasonable person in a like position with a reasonable belief that their decisions are in furtherance of their company’s best interest; (2) duty of loyalty — CEOs must put the interest of shareholders and the company above their own self-interest; and (3) duty of good faith — CEOs must act with honesty and fairness to shareholders and the company.

There is no denying that Twitter can be leveraged as a powerful tool. Used appropriately, it can fortify the reputation of a company and its CEO, forge stronger consumer relationships and drive business profits. For example, Tim Cook’s habit of tweeting about his interactions with Apple customers demonstrates his customer-service values and effort to connect with consumers, which can potentially lead to a bigger and more loyal following.

Lately, more and more CEOs are communicating their stance on issues that are important to their consumer base to exhibit authenticity, relatability and demonstrate their personal and corporate values through social media. Following last year’s murder of George Floyd and rise of the Black Lives Matter movement, nearly 60% of all S&P 100 tech CEOs, unicorn CEOs, and Fortune 500 CEOs tweeted, “Black Lives Matter.” This was the first time CEOs active on Twitter overwhelmingly voiced their position on racial and social justice issues.

Twitter can also be an opportunity to show transparency in policy. CEOs can use social media to announce new management initiatives, capability expansions and new investments in employees (diversity initiatives, new roles for women, organizational changes) that are positive in tone and speak about the future direction of the company. These can have a positive correlation with stock prices.

It wasn’t that long ago that the world was fixated on Donald Trump’s Twitter posts and their correlation with the stock market. Words have permanence and their impact can be catastrophic. Given their elevated role as a leader and representative of the company and the fiduciary duties they owe, CEOs must watch what they say and when they say it. What it all boils down to is awareness, common sense and the law.

Don’t break the law and stick to the facts

For U.S. publicly traded companies, SEC Regulation Fair Disclosure (Reg FD) says that “an issuer may not disclose material nonpublic information to certain groups, either intentionally or unintentionally, without disclosing the same information to the entire marketplace.” If companies use social media to announce key information, to comply, they must alert investors that social media will be used to disseminate such information.

Regardless of whether it is a public or private company, CEOs are corporate officers and owe fiduciary duties to their companies and their shareholders. Fiduciary duty requires CEOs to act in good faith, apply their best business judgment and to act in the best interest of the company. This is true whether they are in the boardroom or on Twitter.

Powered by WPeMatico

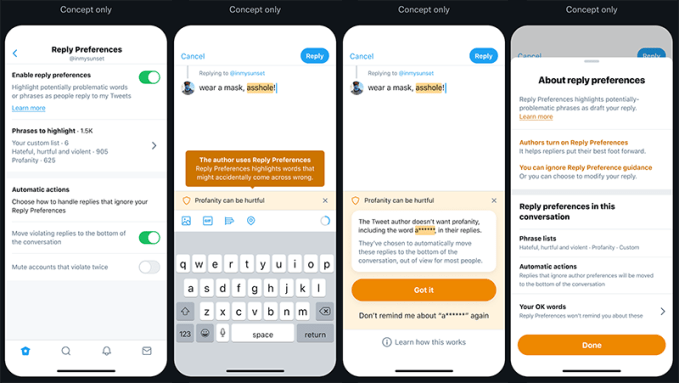

Twitter considers new features for tweeting only to friends, under different personas and more

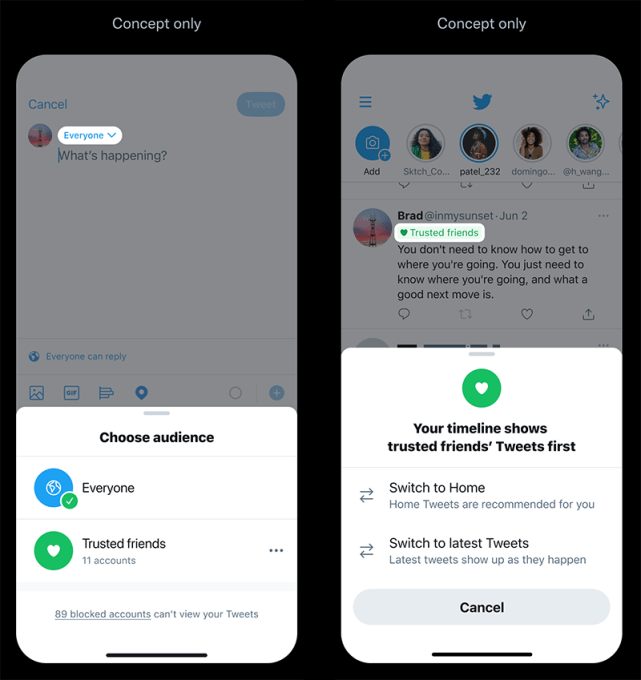

Twitter has a history of sharing feature and design ideas it’s considering at very early stages of development. Earlier this month, for example, it showed off concepts around a potential “unmention” feature that would let users untag themselves from others’ tweets. Today, the company is sharing a few more of its design explorations that would allow users to better control who can see their tweets and who ends up in their replies. The new concepts include a way to tweet only to a group of trusted friends, new prompts that would ask people to reconsider the language they’re using when posting a reply, and a “personas” feature that would allow you to tweet based on your different contexts — like tweets about your work life, your hobbies and interests, and so on.

The company says it’s thinking through these concepts and is looking to now gather feedback to inform what it may later develop.

The first of the new ideas builds on work that began last year with the release of a feature that allows an original poster to choose who’s allowed to reply to their tweet. Today, users can choose to limit replies to only people mentioned in the tweet, only people they follow, or they can leave it defaulted to “everyone.” But even though this allows users to limit who can respond, everyone can see the tweet itself. And they can like, retweet or quote tweet the post.

With the proposed Trusted Friends feature, users could tweet to a group of their own choosing. This could be a way to use Twitter with real-life friends, or some other small network of people you know more personally. Perhaps you could post a tweet that only your New York friends could see when you wanted to let them know you were in town. Or maybe you could post only to those who share your love of a particular TV show, sporting event or hobby.

Image Credits: Twitter

This ability to have private conversations alongside public ones could boost people’s Twitter usage and even encourage some people to try tweeting for the first time. But it also could be disruptive to Twitter, as it would chip away at the company’s original idea of a platform that’s a sort of public message board where everyone is invited into the conversation. Users may begin to think about whether their post is worthy of being shared in public and decide to hold more of their content back from the wider Twitter audience, which could impact Twitter engagement metrics. It also pushes Twitter closer to Facebook territory where only some posts are meant for the world, while more are shared with just friends.

Twitter says the benefit of this private, “friends only” format is that it could save people from the workarounds they’re currently using — like juggling multiple alt accounts or toggling between public to protected tweets.

Another new feature under consideration is Reply Language Prompts. This feature would allow Twitter users to choose phrases they don’t want to see in their replies. When someone is writing back to the original poster, these words and phrases would be highlighted and a prompt would explain why the original poster doesn’t want to see that sort of language. For instance, users could configure prompts to appear if someone is using profanity in their reply.

Image Credits: Twitter

The feature wouldn’t stop the poster from tweeting their reply — it’s more a gentle nudge that asks them to be more considerate.

These “nudges” can have impact. For example, when Twitter launched a nudge that suggested users read an article before they amplify it with a retweet, it found that users opened articles before sharing them 40% more often. But in the case of someone determined to troll, it may not do that much good.

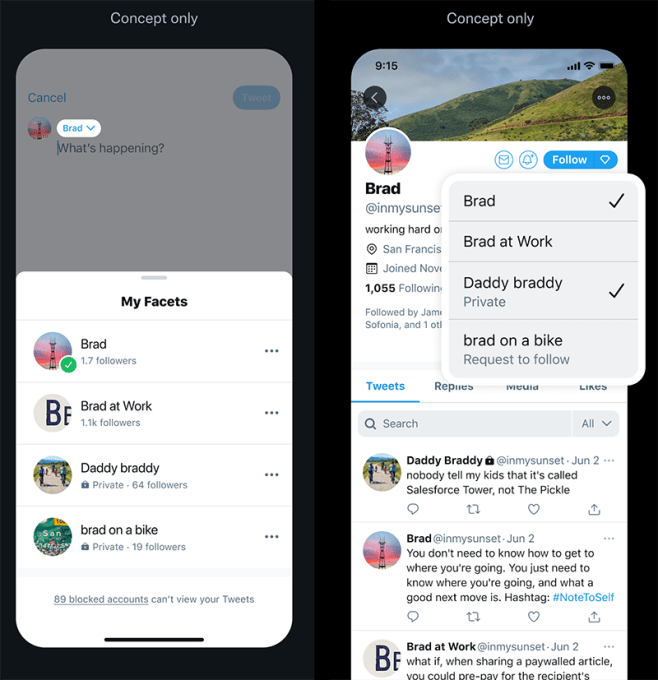

The third, and perhaps most complicated, feature is something Twitter is calling “Facets.”

This is an early idea about tweeting from different personas from one account. The feature would make sense for those who often tweet about different aspects of their lives, including their work life, their side hustles, their personal life or family, their passions and more.

Image Credits: Twitter

Unlike Trusted Friends, which would let you restrict some tweets to a more personal network, Facets would give other users the ability to choose whether they wanted to follow all your tweets, or only those about the “facet” they’re interested in. This way, you could follow someone’s tweets about tech, but ignore their stream of reactions they post when watching their favorite team play. Or you could follow your friend’s personal tweets, but ignore their work-related content. And so on.

This is an interesting idea, as Twitter users have always worried about alienating some of their followers by posting “off-topic” so to speak. But this also puts the problem of determining what tweets to show which users on the end user themselves. Users may be better served by the algorithmic timeline that understands which content they engage with, and which they tend to ignore. (Also: “facets‽”)

Twitter says none of the three features are in the process of being built just yet. These are only design mockups that showcase ideas the company has been considering. It also hasn’t yet made the decision whether any of the three will go under development — that’s what the user feedback it’s hoping to receive will help to determine.

Powered by WPeMatico