Thrive Capital

Auto Added by WPeMatico

Auto Added by WPeMatico

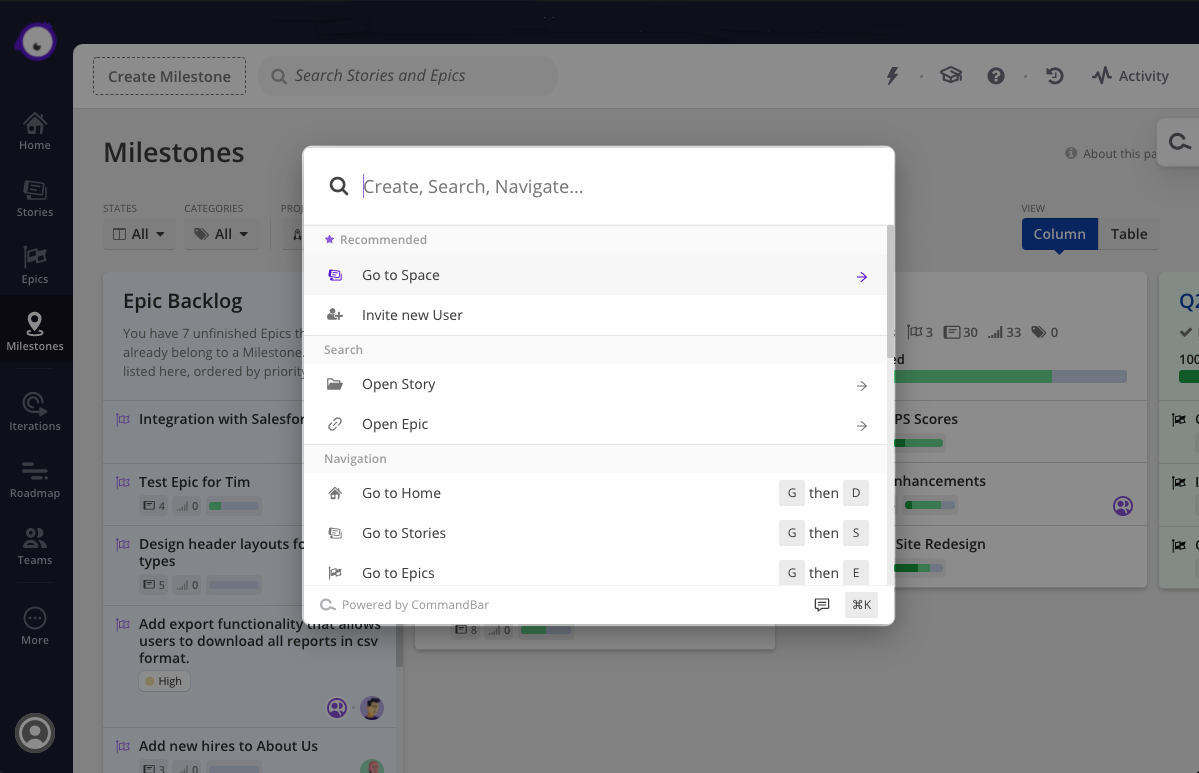

James Evans, Richard Freling and Vinay Ayyala, co-founders at CommandBar, were working on a software product when they hit a wall while trying to access certain functionalities within the software.

That’s when the lightbulb moment happened and, in 2020, the team shifted to building an embeddable search widget to make software easier to use.

“We thought this paradigm feels like it could be useful, but it is hard to build well, so we built it,” Evans told TechCrunch.

On Monday, CommandBar emerged from beta and announced its $4.8 million seed round, led by Thrive Capital, with participation from Y Combinator, BoxGroup and a group of angel investors including, AngelList’s Naval Ravikant, Worklife Ventures’ Brianne Kimmel, StitchFix president Mike Smith and others.

CommandBar’s business-to-business tool, referred to as “command k,” was designed to make software simpler and faster to use. The technology is a search interface that sits on top of web-based apps so that users can access functionalities by searching simple keywords. It can also be used to boost new users with recommended prompts like referrals.

CommandBar in Clubhouse. Image Credits: CommandBar

Companies integrate CommandBar by pasting in a line of code and using configuration tools to quickly add commands relevant to their apps. The product was purposefully designed as low-code so that product and customer success teams can add configurations without relying on engineering support, Evans said.

Initially, it was a difficult sell: One of the more challenging parts in the early days of the company was helping customers and investors understand what CommandBar was doing.

“It was hard to describe over the phone, we had to try to get people on Zoom so they could see it,” he said. “It is easier now to sell the product because they can see it being used in an app. That is where many new users come from.”

CommandBar is already being used by companies like Clubhouse.io, Canix and Stacker that are serving hundreds of thousands of users. The most common use case for CommandBar so far is onboarding new software users.

He intends to use the new funding to grow the team, hiring across engineering, sales and marketing. The beta testing was successful in receiving good feedback from the early customers, and Evans wants to reflect that in new products and functionalities that will come out later this year.

Vince Hankes, an investor at Thrive Capital, was introduced to CommandBar through one of its pre-seed investors.

His interest is in B2B software companies and applications, and one of the things that became obvious to him while looking into the space was the natural tension between the simplicity and functionality of apps.

Apps are sometimes hard for even a power user to navigate, he said, but CommandBar makes something as simple as resetting a password easier by being able to search for that term and go right to that page if it is configured that way by the company.

“The types of companies interested in their product are impressive,” Hankes said. “We began to see demand from a broad range of companies that weren’t obvious. In fact, they are using CommandBar as a tool for deeper customer engagement.”

Powered by WPeMatico

Maisonette, a four-year-old, New York-based company, has aimed from the outset to become a one-stop curated shop for everything a family might need for their young children.

That plan appears to be working. Today, the company — which launched with preppy young children’s apparel and has steadily built out categories that include home décor, home furniture, toys, gear and accessories — says it doubled its number of customers last year and tripled its revenue. Indeed, even as COVID could have crimped its style — sales of children’s dress-up clothes slowed for a time — its DIY and STEM toy sales shot up 1,400%.

Though the company keeps its sales numbers private, its growth is interesting, particularly given the unabated growth of Amazon, which became the nation’s leading apparel retailer somewhere around the end of 2018.

Seemingly, much of Maisonette’s traction owes to the trust it has built with customers, who see its offerings as high-end yet accessible relative to the many luxury fashion brands that are also increasingly focused on the children’s market, like Gucci and Burberry.

Specifically, the 75-person company has a merchandising team that prides itself on working with independent brands and surfacing items that are hard to find elsewhere.

Maisonette also launched its own apparel line roughly 30 months ago, called Maison Me. Focused around “elevated basics” at a more reasonable price point, the line, made in China, is seeing brisk sales to families who buy items time and again as their kids outgrow or wear holes in them, says the company.

It helps that Maisonette’s founders have an eye for what’s chic. Co-founders Sylvana Ward Durrett and Luisana Mendoza de Roccia met at Vogue magazine, where Durrett spent 15 years, joining the staff straight from Princeton and becoming its director of events (work that earned her a high profile in fashion circles). Roccia joined straight from Georgetown the same year, 2003, and left as the magazine’s accessories editor in 2008.

For those who might be curious, their former boss, Anna Wintour, is a champion of theirs. Yet they also have some other powerful advocates, including NEA investor Tony Florence, a kind of e-commerce whisperer who on behalf of his firm has also led previous investments in Jet, Goop, and Casper.

NEA is an investor in Maisonette, as is Thrive Capital and the growth-stage venture firm G Squared, which just today announced it led a $30 million round in the company that brings its total funding to $50 million.

Another ally is Marissa Mayer, who first met Durrett back in 2009 when Mayer was still known as Google’s first female engineer and its most fashionable executive. Not only has their friendship endured — Mayer says she named one of her twin daughters Sylvana because she adored the name — but Mayer is on the board of Maisonette, where she has presumably helped refine its data strategy, including around an inherent advantage that the company enjoys: its very young customers.

“One of the things that’s really helpful when it comes to data and e-commerce is when you can capture people at a particular life stage,” Mayer explains. “It’s why people liked wedding registries. You get married, then you have children and [the retailer] can follow the children’s ages and start anticipating that customer’s needs and what they’re going to want two years from now.”

In terms of “predictable supply chain, for inventory selection, for just being able to meet that moment, having insight into those stages is really important and helpful,” she says. It can also be very lucrative for Maisonette as it continues to build out its business, notes Mayer.

Certainly, much is working in the company’s favor already. To Mayer’s point, Roccia says that more than half of Maisonette’s sales last year came from repeat customers. More, it already has an audience of more than 800,000 people who either receive emails from the company or follow its social media channels. (Maisonette also features a healthy dose of content at its site.)

Unlike some e-commerce businesses, Maisonette is asset-lite, too. Though it has opened a handful of pop-up stores previously and was contemplating a bigger move into retail (“that’s now on pause,” says Durrett), the company doesn’t have warehouses to manage. Instead, items are shipped directly to customers from the various retailers featured at its site.

Perhaps most meaningful of all, the company is competing in what is a massive and growing market. In the U.S. alone, the children’s apparel market is estimated to be $34 billion. Meanwhile, the children’s market is $630 billion globally. While Maisonette is selling to U.S. customers alone right now, it plans to use some of that new funding to move into international markets, says Roccia, who has been living in Milan with her own four children during the pandemic, while Durrett began working out of Maisonette’s mostly empty Brooklyn headquarters in January to create a bit of space from her three.

Indeed, on a Zoom call from their far-flung locations, they talk at length about parents needing to create new space to work from home right now, as well as to update rooms for kids attending virtual school. While no one asked for a global shutdown, home décor is a “category that has picked up due to the COVID effect,” notes Roccia.

Asked what other trends the two are tracking — for example, Maisonette features the mommy-and-me clothing pairings that have become big business in recent years — Roccia says that even with the world shut down, it remains a “huge” trend. “It started with holiday pajamas — that was kind of the catalyst to this whole movement — and now swimwear and just casual dressing has become a pretty big piece of the business, too.”

As for what Durrett has noticed, she laughs. “Llamas are big. We sell a llama music player that we had to bring back on the site several times over the holidays.” Also “rainbows and unicorns. As cliché as it sounds, we literally can’t keep them in stock.”

Unicorns, she adds, “are a thing.”

Powered by WPeMatico

Cityblock Health, a company that provides healthcare services to low-income communities, is now commanding a high-priced valuation of over $1 billion after venture capitalists poured $160 million into the company.

The round was led by new investor General Catalyst with participation from crossover investor Wellington Management and support from major existing investors, including Kinnevik AB, Maverick Ventures, Thrive Capital, Redpoint Ventures and more, according to a statement from the company.

Cityblock works with community caregivers to work with residents to provide primary care, behavioral health and other services to address social determinants of health, in person and… increasingly… through virtual consultations.

The company first spun out of Alphabet’s Sidewalk Labs in 2017 and initially partnered with EmblemHealth. By relying primarily on licensed clinical social workers, community health partners and a network of specialized practice clinicians and doctors to provide basic primary care and supporting health services, Cityblock believes it can drive down the costs of healthcare.

Some 70,000 patients use Cityblock services in four major U.S. cities, the company said.

To date, Cityblock has raised $300 million.

The company said in a statement that the new funding will be used to support Cityblock’s national expansion in caring for Medicaid and dually-eligible communities, to attract and onboard talent across its product, engineering, data science, clinical and business operations, to launch new service lines and to continue investing in its proprietary technology platform, Commons.

Powered by WPeMatico

The spreadsheet-centric database and no-code platform Airtable today announced that it has raised a $185 million Series D funding round, putting the company at a $2.585 billion post-money valuation.

Thrive Capital led the round, with additional funding by existing investors Benchmark, Coatue, Caffeinated Capital and CRV, as well as new investor D1 Capital. With this, Airtable, which says it now has 200,000 companies using its service, has raised a total of about $350 million. Current customers include Netflix, HBO, Condé Nast Entertainment, TIME, City of Los Angeles, MIT Media Lab and IBM.

In addition, the company is also launching one of its largest feature updates today, which starts to execute on the company’s overall platform vision that goes beyond its current no-code capabilities and brings tools to the service more low-code features, as well new automation (think IFTTT for Airtable) and data management.

As Airtable founder and CEO Howie Liu told me, a number of investors approached the company since it raised its Series C round in 2018, in part because the market clearly realized the potential size of the low-code/no-code market.

“I think there’s this increasing market recognition that the space is real, and the space is very large […],” he told me. “While we didn’t strictly need the funding, it allowed us to continue to invest aggressively into furthering our platform, vision and really executing aggressively, […] without having to worry about, ‘well, what happens with COVID?’ There’s a lot of uncertainty, right? And I think even today there’s still a lot of uncertainty about what the next year will bear.”

The company started opening the round a couple of months after the first shelter in place orders in California, and for most investors, this was a purely digital process.

Liu has always been open about the fact that he wants to build this company for the long haul — especially after he sold his last company to Salesforce at an early stage. As a founder, that likely means he is trying to keep his stake in the company high, even as Airtable continues to raise more money. He argues, though, that more so than the legal and structural controls, being aligned with his investors is what matters most.

“I think actually, what’s more important in my view, is having philosophical alignment and expectations alignment with the investors,” he said. “Because I don’t want to be in a position where it comes down to a legal right or structural debate over the future of the company. That almost feels to me like the last resort where it’s already gotten to a place where things are ugly. I’d much rather be in a position where all the investors around the table, whether they have legal say or not, are fully aligned with what we’re trying to do with this business.”

Just as important as the new funding though, are the various new features the company is launching today. Maybe the most important of these is Airtable Apps. Previously, Airtable users could use pre-built blocks to add maps, Gantt charts and other features to their tables. But while being a no-code service surely helped Airtable’s users get started, there’s always an inevitable point where the pre-built functionality just isn’t enough and users need more custom tools (Liu calls this an escape valve). So with Airtable Apps, more sophisticated users can now build additional functionality in JavaScript — and if they choose to do so, they can then share those new capabilities with other users in the new Airtable Marketplace.

“You may or may not need an escape valve and obviously, we’ve gotten this far with 200,000 organizations using Airtable without that kind of escape valve,” he noted. “But I think that we open up a lot more use cases when you can say, well, Airtable by itself is 99% there, but that last 1% is make or break. You need it. And then, just having that outlet and making it much more leveraged to build that use case on Airtable with 1% effort, rather than building the full-stack application as a custom built application is all the difference.”

The other major new feature is Airtable Automations. With this, you can build custom, automated workflows to generate reports or perform other repetitive steps. You can do a lot of that through the service’s graphical interface or use JavaScript to build your own custom flows and integrations, too. For now, this feature is available for free, but the team is looking into how to charge for it over time, given that these automated flows may become costly if you run them often.

The last new feature is Airtable Sync. With this, teams can more easily share data across an organization, while also providing controls for who can see what. “The goal is to enable people who built software with Airtable to make that software interconnected and to be able to share a source of truth table between different instances of our tables,” Liu explained.

Powered by WPeMatico

Dutchie, a nearly three-year-old, Bend, Oregon-based software company focused on connecting consumers with cannabis dispensaries that pay it a monthly subscription fee to create and maintain their websites, process their orders and track what needs to be ready for pickup, has raised $35 million in Series B funding. The capital came both new investors Thrive Capital and Starbucks founder Howard Schultz, along with earlier backers, including Kevin Durant’s Thirty Five Ventures and the cannabis-focused fund Casa Verde Capital.

The money comes hot on the heels of Dutchie’s first major round of funding — $15 million that it closed last September — and suggests that the cannabis industry has fared better during the COVID-19 pandemic than people outside the industry might imagine.

We had a fast chat yesterday with the company’s co-founder and CEO, Ross Lipson, about the year that Dutchie is having.

TC: I’d seen recently that Dutchie has added contactless payments.

RL: Yes, when the pandemic hit, virtually all of our dispensaries shifted to a curbside pickup model. We built a solution that allows customers to select curbside at checkout, and also includes a way to notify the dispensary when they arrive and provides them information on how to locate their vehicle.

TC: A year ago, there were more than 30 states where cannabis was either medically legal or that had legalized the recreational use of marijuana. How has that changed?

RL: We now work with over 1,300 dispensaries in 32 markets. By comparison, a year ago we were only operating in 9 markets. Nationwide, 47 out of 50 states now allow some form of legal cannabis, and 2020 could bring full legalization in major markets such as New Jersey and Arizona.

TC. Can you put that into context? How many dispensaries are there in the U.S.?

RL: Dutchie processes 10% of all legal cannabis sales worldwide and powers over 25% of dispensaries. That’s more than 75,000 orders a day.

TC: You had 36 employees the last time we talked. What’s that number now?

RL: We currently have 102 employees and we aim to double our team by the end of 2021.

TC: Aside from helping dispensaries shift to a curbside model, how has the pandemic impacted your business?

RL: Virtually all states deemed cannabis dispensaries as essential businesses [once COVID took hold]. Many still had to comply with state laws and close their physical stores, though, leaving only one option for sales — online ordering. We saw dispensaries shift from about 30% of overall sales coming from Dutchie to upwards of 100%, and our business grew 600% in roughly one month.

Overall, we’ve seen a 700% surge in sales volume during the pandemic. We had to scale quickly to deal with six times the load on our technology.

TC: Think those numbers will shift around as some parts of the country open up?

RL: Dispensaries are poised to keep online ordering and e-commerce options available because it is part of what their customers now expect.

Pictured, left to right, above: Ross and Zach Lipson (Zach, Ross’s brother, is the company’s co-founder and chief product officer).

Powered by WPeMatico

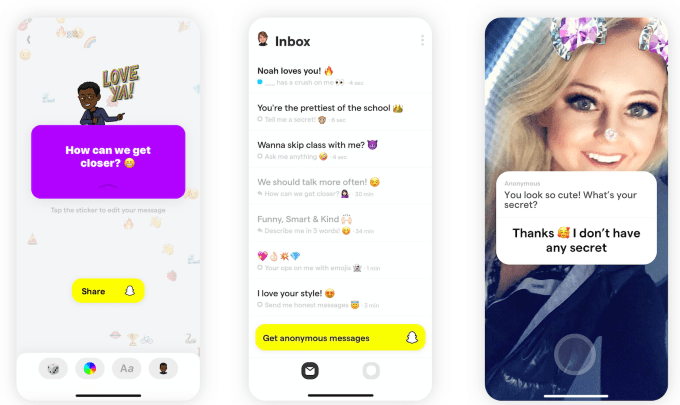

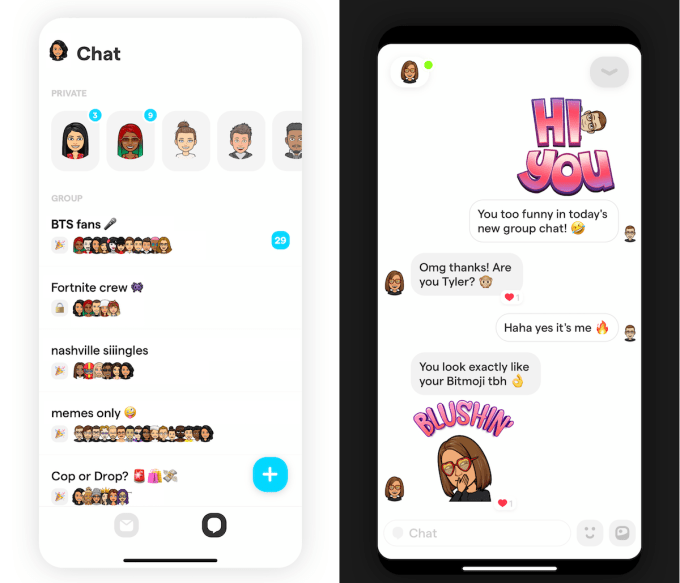

It wasn’t a fad. Yolo became the country’s No. 1 app just a week after launch by letting teens ask for anonymous replies to questions they posted on Snapchat. But nine months later, Yolo is still in the top 100 iOS apps and has 10 million active users. Now it’s safeguarding the app from predators while revealing a smart new feature for spinning up anonymous group chats, powered by $8 million in fresh funding.

“What we are trying to build is a new kind of network where there’s a fluidity to identity,” Yolo co-founder Greg Henrion tells me. “We weren’t sure if Yolo was here to stay, but we’re still ranking well and there seems to be a real opportunity in anonymity starting with Snapchat Q&A.”

Yolo is the first big win for Snapchat’s Snap Kit platform that lets developers piggyback on its login, Bitmoji avatars, stickers and Stories. This lets tiny development teams build apps that hundreds of millions of people, teens in particular, can instantly sign up for in just a few taps. Another Snap Kit app for meeting new people called Hoop recently spiked to No. 2 on the charts

We haven’t seen this kind of social platform success since Zynga’s empire rose atop Facebook. Spawning more blockbusters like Yolo could ensure that a Snapchat account is a must-have utility for the next generation.

“For two weeks we basically didn’t sleep,” Henrion recalls about the chaos he and co-founder Clément Raffenoux endured after Yolo shot to No. 1 last May. “You’re trying to stay afloat. It was very, very wild.”

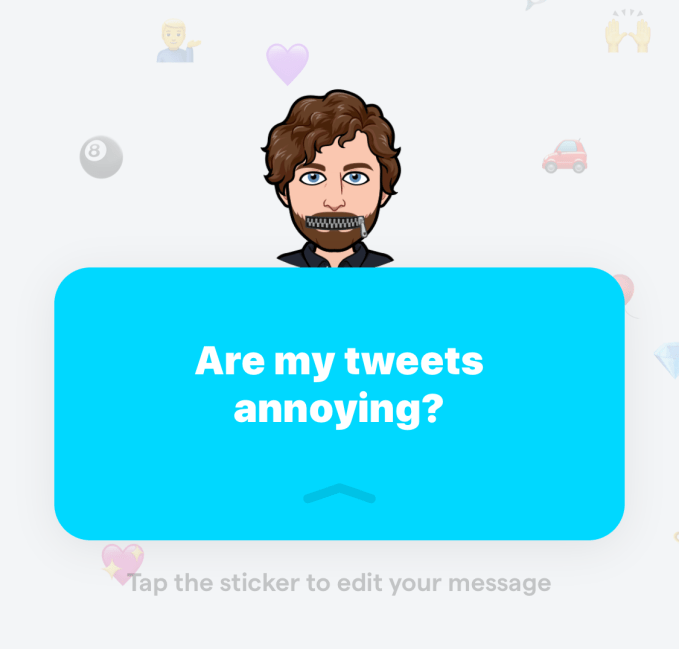

The basic premise of Yolo is that you write a question like, “Who’s my celebrity look alike?”, “What do people really think of me?” or “How could I be nicer?” You’re then switched over to Snapchat, where you can post the question in your Story or messages with a link back to Yolo. There, people can anonymously leave a response; you can post that and your reply with another post on Snapchat.

Yolo co-founder and CEO Greg Henrion, in real life and Bitmoji

The result is that friends and followers feel comfortable giving you real talk. They don’t have to sugarcoat their answers. And that makes people race to open Yolo each time they get a message. Yolo has seen 26 million downloads across iOS and Android globally, with nearly 70% in the U.S, according to Sensor Tower.

Other anonymous apps like tbh (acquired by Facebook) and Sarahah (kicked off the app stores) quickly faded, and others eventually imploded due to bullying, like Secret and YikYak. Although tbh hit No. 1 in September 2017, it was out of the top 500 by November. It seems a combination of inherent virality via Snapchat, easy user acquisition via Snap Kit and sharp product design has given Yolo some staying power. It still managed 2.2 million downloads last month versus a peak of 5.5 million in its first month back in May 2019.

That June, Yolo quietly raised a $2 million seed round thanks to its sudden success. The team had been grinding since 2017 on a video reactions app called Popshow funded by a small pre-seed round from SV Angel, Shrug Capital and Product Hunt’s Ryan Hoover. They’d previously built music video-making app Mindie that eventually sold to influencer collective Shots Studios. Popshow never caught on, so the team began experimenting on Snap Kit, building a more official Q&A feature for Snapchat than predecessors like Sarahah and Polly. Then, boom. Days after launch, Yolo’s usage exploded.

That June, Yolo quietly raised a $2 million seed round thanks to its sudden success. The team had been grinding since 2017 on a video reactions app called Popshow funded by a small pre-seed round from SV Angel, Shrug Capital and Product Hunt’s Ryan Hoover. They’d previously built music video-making app Mindie that eventually sold to influencer collective Shots Studios. Popshow never caught on, so the team began experimenting on Snap Kit, building a more official Q&A feature for Snapchat than predecessors like Sarahah and Polly. Then, boom. Days after launch, Yolo’s usage exploded.

But to keep users interested, Yolo needed to evolve. That would require more funding for the eight-person team split between Snapchat’s home of Los Angeles and Henrion’s home of Paris.

The concept of a social app where users could shift between full anonymity and representation via avatar attracted its $8 million Series A to invest in product and engineering. The round was led by Thrive Capital, Ron Conway’s A.Capital, former TechCrunch editor Alexia Tsotsis’ Dream Machine (also in the seed round), Shrug, Day One, Goodwater, Knight VC, ex-Facebooker Bobby Goodlatte, Twitter co-founder Biz Stone and SV Angel’s Brian Pokorny.

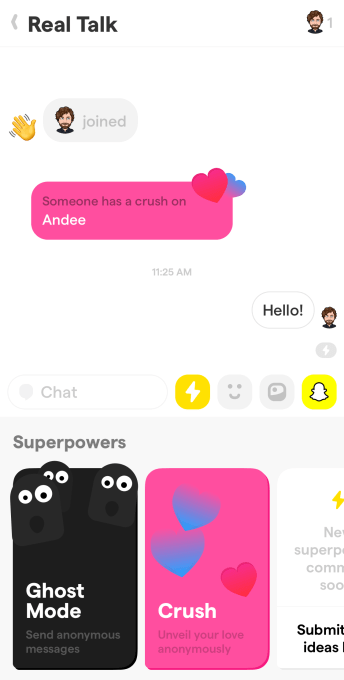

That cash fueled the release of Yolo’s new group chat feature. You can set up a chat room, give it a name and generate an invite URL or sticker you can post on Snapchat, just like its previous question feature. Friends or friends of friends that are already in can join the group chat, represented by their Bitmoji instead of their name. Yolo suggests people join the more open “party mode” chats where their friends are active.

That cash fueled the release of Yolo’s new group chat feature. You can set up a chat room, give it a name and generate an invite URL or sticker you can post on Snapchat, just like its previous question feature. Friends or friends of friends that are already in can join the group chat, represented by their Bitmoji instead of their name. Yolo suggests people join the more open “party mode” chats where their friends are active.

What makes this special is that once an hour, users can tap the Yolo Superpowers button to send a totally anonymous message to the group. More Superpowers are coming, but there’s also an anonymous “Someone has a crush on [name]” message so you can secretly profess your affection to anyone or someone else in the chat.

“The limits of Q&A is that it doesn’t generate real conversation. It’s an ice breaker, but we also want conversations to happen,” Henrion stresses. “‘What do you think about this dress?’ The group chat is more about ‘let’s talk about the dress.’” The chats could be focused on people you actually know offline, or those you share interests with. The option to restrict group chats to either just your contacts or friends of friends “limits the amount of meeting strangers,” Henrion explains. “This is very different from the public communities like Reddit or the dating apps.”

Still, anonymous apps have consistently proven to be havens for cyberbullying and unsafe behavior. Without the accountability of having your name attached, people are free to say awful things. That can be even worse amongst teenagers who might get in trouble for being mean at school but not on an app.

Yolo first focused on messages blocking 10% of overall messages that contained offensive content. That meant blatant hate speech and trolling couldn’t spread through the app. “We’re strict on moderation. When looking at the reviews about bullying, it’s like nothing compared to any other anonymous app. I think we solved 90% of the problem.”

Now it’s working with Snapchat to safeguard the group chats feature. The goal is to ensure Yolo doesn’t actively recommend chat amongst adults to minors and vice-versa. Henrion says this update should roll out soon.

“It’s 2020 and we need to be very responsible” Henrion tells me. “Moderation and growth are the most difficult things to balance. It’s moderation first for sure. We don’t care about growth if it’s not healthy or sustainable.” The new funding also gives Yolo the luxury of pushing back monetization while it focuses on safely adding more users.

By making anonymity more private, Yolo has a chance to sidestep some of the worst elements of human behavior. Making fun of someone has less appeal if there’s no wider audience like trolls exploited in the feeds and comment reels of Secret and YikYak.

That could let the brighter side of anonymity shine through: vulnerability, honesty and deep connections that are enhanced by the absence of embarrassment. With all the change, uncertainty and anxiety that’s part of growing up, teens deserve a place where they can be open with each other and speak their minds. After all, you only live once.

Powered by WPeMatico

With roughly one million customers across Brazil and a new round of financing, the mobile phone insurance provider Pitzi now finds itself with a $100 million valuation.

The size of its latest round, which was led by QED Investors and included commitments from existing investors like Thrive Capital and Valiant Partners, was undisclosed.

PItzi acts as a reseller for insurance companies to offer products around mobile phone insurance across Brazil. Founded in 2012, the company’s mobile handset insurance offerings were a service that was in the right place at the right time, as low-cost handsets caused the market in Latin America’s most populous country to explode.

Pitzi previously raised $20 million from investors, including Thrive, Kaszek Ventures, Flybridge and DCM. Even with the company’s success, cell phone insurance in Brazil stands at 4%, compared with global standards of more than 40%. This despite the fact that there are more than 200 million phones in Brazil alone.

“Today, only 4% of smartphones here are protected but we’re driving that towards 90% in the coming years and using those phones to unlock even more transformation in the space,” said Daniel Hatkoff, founder and CEO of Pitzi, in a statement.

The investment by QED Investors puts Pitzi in some pretty good company when it comes to Latin American financial technology startups. Other Latin American investments in the firm’s portfolio include the multibillion-dollar credit card startup, Nubank; the personal finance lender, Creditas; the business lender, Konfio; and the rental financing company Quinto Andar.

As a result of the investment, Bill Cilluffo, a former president of Capital One International and a general partner with QED, will take a seat on the company’s board of directors, according to a statement.

For Hatkoff, the cell phone is a window into other products and services in the insurance industry thanks to the ways the device has transformed so many experiences for the emerging Brazilian middle class.

“The smartphone will be profoundly transformational in Brazil, allowing the emerging middle class to finally emerge and do things it never imagined possible,” said Hatkoff. “As market leaders, we at Pitzi are obsessed with unlocking the Brazilian consumer’s ability to use their phones in ever more powerful ways. Cell phone protection is just the beginning.”

Powered by WPeMatico

Another consumer finance business is lining up investors for its largest cash infusion yet.

Affirm, founded by PayPal’s Max Levchin, is said to be raising as much as $1.5 billion in a combination of debt and equity, according to people with knowledge of the company’s fundraising activities. Josh Kushner’s New York venture capital firm Thrive Capital is said to be leading the financing, with participation from the San Francisco outfit Spark Capital.

Sources familiar with Affirm, which gives consumers an alternative to personal loans and credit by financing online purchases at point-of-sale, presume the round will be made up largely of a line of credit from a large financial institution, known as a warehouse facility.

Affirm recently raised a $300 million Thrive-led Series F round in April at a valuation of $3 billion. Fintech companies focused on payments and lending, however, require a vast amount of capital to sustain operations. Those capital requirements coupled with the frothiness of the venture capital market justify this additional cash infusion.

To date, Affirm has raised $1.03 billion in funding from Ribbit Capital, Founders Fund, Andreessen Horowitz, Khosla Ventures, Lightspeed Venture Partners and more, according to PitchBook. Fellow fintech ‘unicorns’ Brex, Stripe, SoFi and Kabbage, for context, have collectively raised roughly $5 billion in debt and equity to date.

Affirm offers installment plans to online shoppers, a method of delayed payment historically reserved for large purchase like vehicles or luxury electronics. Using Affirm, consumers can create personalized installment plans for purchases as small as a pair of sneakers sold by StockX or as large as a diamond engagement ring from Diamond Nexus, for example.

Affirm, serving as an alternative to a credit card charge, requires no paperwork, minimum credit score or income. The company, however, makes money the same way as a credit card provider, with interest rates for Affirm’s loans falling between 10% and 30%.

Affirm’s fundraising efforts come as more and more companies are devoting ample resources to consumer and B2B lending. Affirm, doubling down on the opportunity in B2B, spun out a new financial services business focused entirely on business lending earlier this year. The company, Resolve, provides a “buy now, pay later” option tailored to B2B sales flow.

“Traditional B2B financing is slow, inaccurate and limits a business’s potential for growth because of an over reliance on email, call centers, faxes and manual invoicing processes,” Resolve wrote in an April press release. “Today, many companies offer a standard net 30-day payment plan only to their best and longest tenured customers, leaving others in need of financing to rely on credit cards or installment loans.”

Meanwhile, companies like Stripe and Square are making a concerted effort to explore other financial frontiers, with the former launching a lending tool as well as a corporate credit card this month. Square, for its part, recently introduced a new debit card, called the Square Card, allowing businesses to withdraw and spend money they’ve collected through Square payments.

Venture investment in fintech companies headquartered in the U.S. is poised to reach new highs this year. In the first eight months of 2019, $10.5 billion was funneled into the sector, following a record high of $11.6 billion in 2018. Globally, fintech investment is increasing, too, with nearly $20 billion deployed this year, per PitchBook.

Competition in the fintech space has accelerated growth and innovation, as consumer-friendly, frictionless tools permeate the conservative and highly-regulated finance industry.

Following a year of fintech mega-rounds, we expect to seem a series of fintech initial public offerings as soon as next year. Affirm, Robinhood, Stripe, SoFi, Coinbase, we’re looking at you.

Powered by WPeMatico

Sex, despite being one of the most fundamental human experiences, is still one of those businesses that some advertisers reject, banks are hesitant to financially support and some investors don’t want to fund.

Given how sex is such a huge part of our lives, it’s no surprise founders are looking to capitalize on the space. But the idea of pleasure versus function, plus the stigma still associated with all-things sex, is at the root of the barriers some startup founders face.

Just last month, Samsung was forced to apologize to sextech startup Lioness after it wrongfully asked the company to take down its booth at an event it was co-hosting. Lioness is a smart vibrator that aims to improve orgasms through biofeedback data.

Sextech companies that relate to the ability to reproduce or, the ability to not reproduce, don’t always face the same problems when it comes to everything from social acceptance to advertising to raising venture funding. It seems to come down to the distinction between pleasure and function, stigma and the patriarchy.

This is where the trajectories for sextech startups can diverge. Some startups have raised hundreds of millions from traditional investors in Silicon Valley while others have struggled to raise any funding at all. As one startup founder tells me, “Sand Hill Road was a big no.”

Powered by WPeMatico

Welcome back to this week’s transcribed edition of Equity.

This week, TechCrunch’s Danny Crichton filled in for co-host Alex Wilhelm – who was out in preparation for his wedding this weekend – joining Kate to cover the big news of the week.

Kate and Danny dive straight into Slack’s IPO and the implications of its direct listing strategy, before shifting gears to discuss the launch of Facebook’s new ‘Libra’ cryptocurrency and the VCs backing the initiative.

The duo then took a look at Lime’s latest fundraising efforts and the potential headwinds facing scooter companies with an appetite for capital. Lastly, Kate and Danny talk about underappreciated tensions for founders, including getting pushed out of their own companies and handling their own salaries.

Crichton: Talking about founders and compensation, our correspondent, Ron Miller, talked to a bunch of VCs to ask how are founders paying themselves today? Obviously, the cost of living in the Bay Area, in New York and other startup hubs has increased dramatically. So VCs have had to become acutely aware of their founders’ financial means.

One of the things that really came out of this survey though, from my perspective, was just how high the numbers are. We surveyed small number. We put it out in the interviews. It came out to post-Series A people are starting to get paid around 200K. But the numbers, even a couple of years ago, I seem to recall was like $120 was the magic number around the Series A, $90K if you had a serious seed fund and like $60 to $80 if you are just getting started.

But the numbers that we saw out of this were significantly higher. I think that shows a lot about how the cost of living has just continued to creep up in San Francisco and in New York.

Clark: Yeah. I think the point is made in the story. If you live in San Francisco and you’re paying a mortgage and you have kids, of course, you need to make six figures really to get by, which is just an unfortunate reality. I can’t say I was surprised by how those salaries looked. Seeing $125K for a founder, if anything, I thought was maybe a little low.

But it reminded me of, nearly a year ago at this point, when I wrote something on how much VCs are paid. I had written it based off data that was provided to me from a consulting firm. People were just up in arms at what I had written because, and I understand looking back, I think it grouped VCs together as VCs who work at really big funds who are getting the 2% carry out of a multi-billion dollar fund and who are paid a lot more.

And there are of course VCs who run seed funds or any kind of fund. There are many different sizes of VC funds. Some VCs actually don’t have a salary at all and are up against the same challenges, if not even more difficult challenges, of a startup founder.

Want more Extra Crunch? Need to read this entire transcript? Then become a member. You can learn more and try it for free.

Kate Clark: Hello, and welcome back to Equity, TechCrunch’s venture capital-focused podcast. My co-host, Alex, is getting married this weekend so he’s not with us today, unfortunately. But we’ve got TechCrunch editor, Danny Crichton on the line. Danny, how are you?

Powered by WPeMatico