TC

Auto Added by WPeMatico

Auto Added by WPeMatico

Medical and biotech had a strong showing at Y Combinator’s latest demo day, with nearly a dozen companies in the space catching my eye. The things a startup can accomplish in this space are astonishing these days, so don’t be surprised if a few of these companies are headline news in the next year.

Atom Bioworks has one of the shortest timelines and highest potential impacts; as I wrote in our second set of favorites from demo day, the company seems to be fairly close to one of the Holy Grails of biochemistry, a programmable DNA machine. These tools can essentially “code” a molecule so that it reliably sticks to a specific substance or cell type, which allows a variety of follow-up actions to be taken.

For instance, a DNA machine could lock onto COVID-19 viruses and then release a chemical signal indicating infection before killing the virus. The same principle applies to a cancer cell. Or a bacterium. You get the picture.

Atom’s founders have published the details of their techniques in Nature Chemistry, and the company says it’s working on a COVID-19 test as well as therapies for the virus and other conditions. It expects sales in the nine-figure range.

Another company along these lines is LiliumX. This company is going after “biospecific antibodies,” which are kind of like prefab DNA machines. Our own antibodies learn to target various pathogens, waste and other items the body doesn’t want, and customized, injected antibodies can do the same for cancer cells.

LiliumX is taking the algorithmic approach to generating potential antibody structures that could be effective, as many AI-informed biotech companies have before it. But the company is also using a robotic testing setup to thin the herd and get in vitro results for its more promising candidates. Going beyond lead generation is a difficult step, but one that makes the company that much more valuable.

Entelexo is one step further down the line, having committed to developing a promising class of therapeutics called exosomes that could help treat autoimmune diseases. These tiny vesicles (think packages for inter-cell commerce) can carry all kinds of materials, including customized mRNA that can modify another cell’s behavior.

Modifying cell behavior systematically could help mitigate conditions like multiple sclerosis, though the company did not elaborate on the exact mechanism — probably not something that can be explained in less than a minute. They’re already into animal testing, which is surprising for a startup.

One step further, at least mechanically, is Nuntius Therapeutics, which is working on ways to deliver cell-specific (i.e. to skeletal muscle, kidney cells, etc.) DNA, RNA and CRISPR-based therapies. This is an issue for cutting-edge treatments: while they can be sure of taking the correct action once in contact with the target cell type, they can’t be sure that the therapeutic agent will ever reach those cells. Like ambulance drivers without an address, they can’t do their jobs if they can’t get there.

Nuntius claims to have created a reliable way to deliver genetic therapy payloads to a variety of target cells, beyond what major pharma companies like Moderna have accomplished. The company also develops and licenses its own drugs, so it’s practically a one-stop shop for genetic therapies if its techniques pan out for human use.

Beyond providing therapeutics, there is the evolving field of artificial organs. These are still highly experimental, partly due to the risk of rejection even when using biocompatible materials. Trestle Biotherapeutics is taking on a specific problem — kidney failure — with implantable lab-grown kidney tissue that can help get these patients off dialysis.

While the plan is to eventually create full kidney replacements, the truth is that for people with this condition, every week and month counts. Not only does it improve their chances of finding a donor or moving up the list, but regular dialysis is a horrible process by all accounts. Anything that reduces the need to rely on it would be welcomed by millions.

This Yale-Harvard tie-up comes from a team with quite a bit of experience in stem cell science and tissue engineering, including 3D printing human tissues — which no doubt is part of the approach.

Moving beyond actual techniques for fighting various conditions, the YC batch had quite a few dedicated to improving the process of researching and understanding those conditions and techniques.

Many industries rely on cloud-based document platforms like Google Docs for sharing and collaboration, but while copywriters and sales folks probably find the standard office suite sufficient, that’s not necessarily the case for scientists whose disciplines demand special documentation and formatting.

Curvenote is a shared document platform built with these folks in mind; it integrates with Jupyter, SaturnCloud and Sagemaker, supports lots of import and export options, integrates visualization plug-ins like Plotly, and versions through Git. Now you just have to convince the head of your department it’s worth paying for.

A more specialized cloud tool can be found in Pipe | bio, which does hosted bioinformatics for developing antibody drugs like LiliumX. It’s hard to get into details here beyond that the computational and database needs of companies in biotech can be very specific and not everyone has a bioinformatics specialist on staff.

Having a tool you can just pay for instead of getting a data science grad student to moonlight for your lab is almost always preferable. (Also preferable is not using special characters in your company name — just saying, it’s going to come up.)

Special tools can be found on the benchtop as well as the laptop, though, and the remaining companies are firmly in meatspace.

Forcyte is another company I highlighted in our favorite demo day companies roundups: It’s less about chemistry and molecular biology than the actual physical phenomena experienced by cells. This is a difficult thing to observe systematically, but important for many reasons.

Forcyte is another company I highlighted in our favorite demo day companies roundups: It’s less about chemistry and molecular biology than the actual physical phenomena experienced by cells. This is a difficult thing to observe systematically, but important for many reasons.

The company uses a micropatterned surface to observe individual cells and watch specifically for contraction and other shape changes. Physical constriction or relaxation of cells is at the heart of several major diseases and their treatments, so being able to see and track it will be extremely helpful for researchers.

The company has positioned itself as a way to test drugs at scale that affect these properties and claims to have already found promising compounds for lung fibrosis. Forcyte’s team is published in Nature, and received a $2.5 million SBIR award from the NIH, a pretty rare endorsement.

Kilobaser is taking aim at the growing DNA synthesizing space; companies often contract with dedicated synthesizing labs to create batches of custom DNA molecules, but at a small scale this might be better done in-house.

Kilobaser’s benchtop machine makes the process as simple as using a copier, even for people with no technical know-how. As long as it has some argon, a reagent supply and microfluidic chip (sold by the company, naturally), it can replicate DNA you submit digitally in less than two hours. This could accelerate testing in many a small lab that’s held back by its reliance on a separate facility. The company has already sold 15 machines at €15,000 each — but like razor blades, the real money is in the refills.

Reshape Biotech is perhaps the most straightforward of the bunch. Its approach to automating common lab tasks is to create custom robots for each one. That’s it! Of course, that’s easier said than done, but given the similarity of many lab layouts and equipment, a custom robotic sampler or autoclave could be adopted by thousands as (again) an alternative to hiring another part-time grad student.

There were several other companies in the biotech and medical space worth looking at in the batch, but not enough space here to highlight them individually. Suffice it to say that the space is increasingly welcoming to startups as advances in tech and software are brought to bear where insuperable barriers to entry once left such possibilities remote.

Powered by WPeMatico

Investor FOMO following Roblox’s blockbuster public debut is pushing venture capitalists who missed out on that gaming giant to invest in competing platforms.

Today, Rec Room announced it has raised $100 million from Sequoia and Index, with participation from Madrona Venture Group. The deal is a huge influx of capital for Rec Room, which had raised less than $50 million before this round, including a $20 million Series C that closed in December. In 2019, we reported that the company had raised its Series B at a $126 million valuation, this latest deal values the company at $1.25 billion, showcasing how investor sentiment for the gaming space has shifted in the wake of Roblox’s monster growth.

Rec Room launched as a VR-only platform, but as headset sales creeped along slowly, the company embraced traditional game consoles, PC and mobile to expand its reach.

In a press release accompanying today’s funding announcement, Rec Room detailed it has surpassed 15 million “lifetime users” and had shown 566% year-over-year revenue growth. In December, CEO Nick Fajt told TechCrunch that the company has tripled its player base in the past 12 months.

The company has been following in Roblox’s footsteps in many ways as it build out its creator tools and seeks to build out an on-platform economy for game creators. The company says that 2 million players have created content on the platform and that Rec Room is on track to pay out more than $1 million to them this year.

Powered by WPeMatico

Next week, TechCrunch is hosting Early Stage — a virtual bootcamp for founders to gain the critical insight needed to launch and scale their companies. Day one is all about how-to’s. What about day two? April 2 is the inaugural TC Early Stage Pitch-Off featuring 10 exceptional early-stage startups.

The Pitch-Off is split into two segments. For the semifinals, each company will pitch for five minutes followed by a Q&A with our expert panel of judges. Check them out here, you might see some names you recognize. Three startups will make it into the final round — same pitch but a new batch of judges with a deeper Q&A.

We know you are excited to see who has made it. Tune in on April 2 to watch TC’s first Early Stage Pitch-Off event. Without further ado:

Session 1: 9:00 a.m. – 9:50 a.m. PDT

Clocr (Austin, Texas) — Clocr provides an all-in-one digital legacy planning and disbursement platform backed by patent-pending security.

Crispify (Tel Aviv, Israel) — Crispify provides air-quality monitoring and management solutions for mobility-as-a-service fleets like Uber, Avis and Zipcar.

Fitted (Philadelphia, Pennsylvania) — Fitted is the ultimate closet management service. [Fitted] combines a subscription laundry service with integrated technology that assists urban dwellers discover, clean and donate their clothes.

hi.health (Vienna, Austria) — hi.health provides zero friction financing for out-of-pocket health expenses, currently in Germany. The offering enables direct reimbursement solutions for pharmacies, medical product and service providers — where previously the insured person had to spend their own money and then file for reimbursement.

Pivot Market (Miami, Florida) — Pivot Market is a B2B marketplace where consumer brands gain immediate distribution in physical stores. Brand rent spaces inside B&M stores and stores earn money by managing those spaces on behalf of the brands.

Session 2: 10:00 a.m. – 10:45 a.m. PDT

Soon (Salt Lake City, Utah) — Soon’s patent-pending cash flow algorithm automates investing from start to finish, with the best combination of simplicity and wealth generation in a personal finance solution. Soon functions across all assets from your checking account to your savings and more.

Nalagenetics (Singapore City, Singapore) — Nalagenetics designs and develops preemptive genetic tests for developing markets. By combining genetic, clinical and behavioral data from patients, Nalagenetics builds localized risk-prediction models for minorities, starting with Asian populations

The Last Gameboard (Boulder, Colorado) — Gameboard is a gaming device and platform that unleashes the power of digital media with tactile movements of physical game pieces, creating a new genre of phygital gaming for tabletop fans.

Attention Quotient by Mindwell Labs (New York, New York) — Mindwell Labs is a precision healthcare technology startup. Its first consumer product is AQ — the first personalized mental fitness tracking and training app that uses our unique biomarkers to measure and improve attention.

— the first personalized mental fitness tracking and training app that uses our unique biomarkers to measure and improve attention.

FLX Solutions (Bethlehem, Pennsylvania) — FLX Solutions is pioneering functional applications for robotics with highly intelligent robots that are miniaturized to operate in spaces that humans and traditional robots cannot easily access. Our first product, The FLX BOT, is a patented 1″ diameter snake-like robot that is able to fit into these spaces to inspect, map, and then autonomously perform any required maintenance.

Finals: 11:00 a.m. – 11:30 a.m. PDT

Powered by WPeMatico

The pandemic has clearly had an impact on the way we work, and this is especially true for salespeople. Salesforce introduced a number of updates to Sales Cloud this morning, including Salesforce Meetings, a smart overlay for Zoom meetings that gives information and advice to the sales team as they interact with potential customers in online meetings.

Bill Patterson, EVP and general manager of CRM applications at Salesforce says that the company wanted to help sales teams manage these types of interactions better and take advantage of the fact they are digital.

“There’s a broad recognition, not just from Salesforce, but really from every sales organization that selling is forever changed, and I think that there’s been a broad understanding, and maybe a surprise in learning how effective we can be in the from anywhere kind of times, whether that’s in office or not in office or whatever,” Patterson explained.

Salesforce Meetings gives that overlay of information, whether it’s advice to slow down the pace of your speech or information about the person speaking. It also can compile action items and present a To Do list to participants at the end of each meeting to make sure that tasks don’t fall through the cracks.

This is made possible in part through the Einstein intelligence layer that is built across the entire Salesforce platform. In this case, it takes advantage of a new tool called Einstein Conversation Insights, which the company is also exposing as a feature for developers to build their own solutions using this tool.

For sales people who might find the tool a bit too invasive, you can dial the confidence level of the information up or down on an individual basis, so that you can get a lot of information or a little depending on your needs.

For now, it works with Zoom and the company has been working closely with the Zoom development team to provide the API and SDK tooling it needs to pull off something like this, according to Patterson. He notes that plans are in the works to make it compatible with WebEx and Microsoft Teams in the future.

While the idea was in the works prior to the pandemic, COVID created a sense of urgency for this kind of feature, as well as other features announced today like Pipeline Inspection, which uses AI to analyze the sales pipeline. It searches for changes to deals over time with the goal of finding the ones that could benefit most from coaching or managerial support to get them over the finish line.

Brent Leary, founder and principal analyst at CRM Essentials says that this ability to capture information in online meetings is changing the way we think about CRM.

“The thing the caught my attention is how tightly integrated video meetings/collaboration is now into sales process. This is really compelling because meeting interactions that may not find their way into the CRM system are now automatically captured,” Leary told me.

Salesforce Meetings is available today, while Pipeline Inspection is expected to be available this summer.

Powered by WPeMatico

Plaid, the fintech giant, has announced the inaugural cohort of startups in its new accelerator program, FinRise.

The equity-free and capital-free program has chosen five early-stage fintech startups out of 100 applications to join its cohort, working on issues central to the financial services industry such as simplifying payments and access to credit. The accelerator, announced two months ago, is explicitly focused on backing underrepresented founders in tech.

Last week, The Information reported that Plaid is nearing a new financing deal that would value the company at between $10 billion to $15 billion. Beyond a high valuation, Plaid sports a key characteristic that positions it well to help early-stage startups: it has gone through regulatory hurdles. Months ago, Plaid announced it would not merge with Visa in what would have been a $5.3 billion acquisition. This event, as well as advice on how private fintech startups can deal with policy issues, will be part of FinRise programming.

While participants don’t get funding, FinRise has collated a number of “capital access partners,” which basically means investors who are committed to meeting with these companies and potentially writing a check. This network includes Accion, Acrew, Amex Ventures, Flourish, Harlem Capital, Kapor, Matrix, Village Capital, Visible Hands and First Round.

Powered by WPeMatico

Leveraging networks of “experts” online started out as a very manual online business. But it’s rapidly becoming more efficient as machine learning is applied to the whole business model. Indeed, in the U.K. alone $60 billion is spent a year on using outside expertise. Large players in this space include GLG, Third Bridge, Guidepoint and AlphaSights. And we saw recently that proSapient has raised $18 million for its SaaS platform for managing expert networks.

Now Barcelona-based Arbolus has raised a $6 million funding round led by early-stage U.K. VC Fuel Ventures, in addition to Plug and Play Ventures, better known in Silicon Valley.

The three-year old startup claims it has seen a 7x growth YoY and now has offices in Barcelona and New York. It’s also appointed Pau Beltran at CTO, who was formerly of Disney, eDreams, OneMind and others.

Arbolus’ approach to “enterprise knowledge,” as it’s known, is employing natural language processing and an AI backbone to its platform.

Whereas proSapient uses technology to make expert sourcing more efficient, Arbolus captures recordings of expert interviews, transcribes them on its platform and then shares that knowledge within companies’ networks that subscribe to the platform.

Companies using the platform pay fees to actually use the software, and use all of the toolsets that are on there. It also makes transaction fees when companies pay independent experts on its platform.

Sam Glasswell, CEO and co-founder of Arbolus, said in a statement: “Having the right information gives you a competitive edge but the typical means of engaging with experts through one-hour calls alone is failing to deliver value. These interviews are usually held by a single department and their findings end up lost in PowerPoint presentations or reports. Therefore, companies are only building up a short-term view. We are bringing innovation to the ways companies are working with external experts by using groundbreaking technology to, not just build expertise within organizations, but deliver it in ways that are digestible, searchable and, most importantly, usable for the months and years ahead across different departments.”

Mark Pearson, managing partner from Fuel Ventures, added: “Arbolus have done amazing things in its first 24 months and it’s a testament to the entrepreneurial ambition of Sam and Will backed up by their experience of helping to scale a $1 billion company in their former lives.”

Arbolus says it is working with more than 80 customers, including Big Four firms such as KPMG, and startups like UiPath.

Founders Sam Glasswell and Will Leeming scaled an expert agency before this startup and realized a lot of knowledge was being lost in these expert networks because it simply wasn’t being captured in the right way. And they decided to base the company in Barcelona because it was able to attract talent and had all the advantages of being in the EU.

Glasswell told me: “In Barcelona we have an awesome office, our own space, a great team it’s certainly a beautiful city, and we’re able to attract really really top talent. I mean, people will move from anywhere in the world to go to Barcelona. It’s probably been one of the biggest success factors for us so far. Does the EU factor, help? Yes, I mean the fact that is in the EU in the trading bloc of the union does help… and we thought we’d just be able to build a much more culturally diverse team in the long run.”

Certainly, the future of work looks like it is shifting toward one where outside experts are used more and more by companies. If the gig economy has affected your pizza delivery, it’s also affecting the knowledge economy.

Powered by WPeMatico

Ketch, a startup aiming to help businesses navigate the increasingly complex world of online privacy regulation and data compliance, is announcing that it has raised $23 million in Series A funding.

The company is also officially coming out of stealth. I actually wrote about Ketch’s free PrivacyGrader tool last year, but now it’s revealing the broader vision, as well as the products that businesses will actually be paying for.

The startup was founded by CEO Tom Chavez and CTO Vivek Vaidya. The pair previously founded Krux, a data management platform acquired by Salesforce in 2016, and Vaidya told me that Ketch is the answer to a question that they’d begun to ask themselves: “What kind of infrastructure can we build that will make our former selves better?”

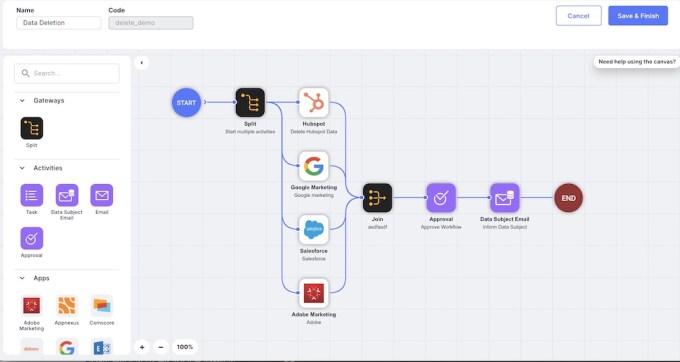

Chavez said that Ketch is designed to help businesses automate the process of remaining compliant with data regulations, wherever their visitors and customers are. He suggested that with geographically specific regulations like Europe’s GDPR in place, there’s a temptation to comply globally with the most stringent rules, but that’s not necessary or desirable.

“It’s possible to use data to grow and to comply with the regulations,” Chavez said. “One of our customers turned off digital marketing completely in order to comply. This has got to stop […] They are a very responsible customer, but they didn’t know there are tools to navigate this complexity.”

Image Credits: Ketch

The pair also suggested that things are even more complex than you might think, because true compliance means going beyond the “Hollywood façade” of a privacy banner — it requires actually implementing a customer’s requests across multiple platforms. For example, Vaidya said that when someone unsubscribes to your email list, there’s “a complex workflow that needs to be executed to ensure that the email is not going to continue … and make sure the customer’s choices are respected in a timely manner.”

After all, Chavez noted, if a customer tells you, “I want to delete my data,” and yet they keep getting marketing emails or targeted ads, they’re not going to be satisfied if you say, “Well, I’ve handled that in the four walls of my own business, that’s an issue with my marketing and email partners.”

Chavez also said that Ketch isn’t designed to replace any of a business’ existing marketing and customer data tools, but rather to “allow our customers to configure how they want to comply vis-à-vis what jurisdiction they’re operating in.” For example, the funding announcement includes a statement from Patreon’s legal counsel Priya Sanger describing Ketch as “an easily configurable consent management and orchestration system that was able to be deployed internationally” that “required minimal engineering time to integrate into our systems.”

As for the Series A, it comes from CRV, super{set} (the startup studio founded by Chavez and Vaidya), Ridge Ventures, Acrew Capital and Silicon Valley Bank. CRV’s Izhar Armony and Acrew’s Theresia Gouw are joining Ketch’s board of directors.

And if you’d like to learn more about the product, Ketch is hosting a webinar at 11am Pacific today.

Powered by WPeMatico

As the Ubers of the world continue to scale, a smaller on-demand transportation startup has raised some funding in Germany, underscoring the opportunities that remain for startups in the space targeting specific service niches. Blacklane — the Berlin startup that provides on-demand black-car chauffeur services in Berlin, London, Dubai, Los Angeles, New York, Paris, Singapore and 16 other cities — has closed a round of €22 million ($26 million at current rates). After taking a majority stake in Havn, the Jaguar-hatched electric car service in London, in February, Blacklane said that it will be using this latest round of funding to continue expanding sustainable travel initiatives, and to continue expanding its existing business with more flexible options for riding.

The funding, which is being made at an up round valuation, is a sign of how the company is showing signs of growth after a year in which monthly revenues dropped 99% in the wake of the COVID-19 pandemic and the resulting drop in travel, and specifically people willing to be in small spaces that are shared with others.

“The global travel and mobility industries have suffered, with several players struggling between drastic cuts, hibernation or ceasing operations. Blacklane has taken the opportunity to cater to travelers’ emerging needs,” said Dr. Jens Wohltorf, CEO and co-founder of Blacklane, in a statement. “Thanks to this financing, we will continue to fast-track our innovation, with zero layoffs.”

The company said that the investment is coming from existing investors German automotive giant Daimler, the UAE’s ALFAHIM Group and btov Partners. And while it is coming at an up round, Blacklane is not disclosing any figures, nor has it ever disclosed valuation. Previous backers of the company also include the strategic investment arm of Recruit Holdings, the Japanese HR giant, and it has raised around $100 million to date, including a round of about $45 million in 2018.

The funding is coming after what has been an extremely rough year for travel and transportation startups due to the COVID-19 pandemic, with Blacklane itself seeing monthly revenues drop 99% after the pandemic hit last year, the company tells me.

Some others in the space that diversified into other areas like food delivery or other kinds of transport (e.g. bikes or scooters) were able to offset declines in their more core ride-hailing services, which in the meantime were repositioned as a safer alternative to public transportation. Blacklane, however, had never positioned itself as a ride for “everyman” — its core use case were higher-end rides and airport trips (which had also died a death) — so when movement shut down, Blacklane’s business nosedived.

It was particularly bad timing for Blacklane, considering that in the lead up to the pandemic, it looked to be on course to turn a profit on its focused model. (While financials for 2020 will take a while to be posted, the most recent results for the company showed a net loss of about $18 million in 2018.)

The reason that Blacklane has managed to raise at an up round tells another side of the story, however.

As companies in transport and travel gingerly started to show the smaller signs of recovery last summer, so too did Blacklane. It coupled that with the first steps of diversification itself.

Earlier this month, it added “chauffeur hailing” in 22 cities, an on-demand service that reduced the lead time for an order to under 30 minutes (its previous service was based on more advanced bookings). It also changed its pricing structure to get more competitive on shorter distances, since so many of the airport rides that were the basis of its revenues have yet to return.

In addition to that, Blacklane took a majority stake in Havn, an electric-based car service hatched by Jaguar, for an undisclosed sum, to spearhead a move into more sustainable travel options alongside the fleet of Teslas already operated by Blacklane.

“Worldwide travel restrictions give us a one-time chance to reset our expectations for safe and sustainable trips,” said Wohltorf in a statement. “Blacklane will recover responsibly and continue to grow while caring for both people and the planet.”

Powered by WPeMatico

On the heels of Jumio announcing a $150 million injection this week to continue building out its AI-based ID verification and anti-money laundering platform, another startup in the space is levelling up. Feedzai, which provides banks, others in the financial sector, and any company managing payments online with AI tools to spot and fight fraud — its cornerstone service involves super-quick (3 millisecond) checks happening in the background while transactions are being made — has announced a Series D of $200 million. It said that the new financing is being made at a valuation of over $1 billion.

The round is being led by KKR, with Sapphire Ventures and strategic backer Citi Ventures — both past investors — also participating. Feedzai said it will be using the funds for further R&D and product development, to expand into more markets outside the U.S. — it was originally founded in Portugal but now is based out of San Mateo — and towards business development, specifically via partnerships to integrate and sell its tools.

One of those partners looks to be Citi itself:

“Citi is committed to advancing global payments anchored on transparency, efficiency, and control, and our partnership with Feedzai is allowing us to provide customers with technology that seamlessly balances agility and security,” said Manish Kohli, global head of Payments and Receivables, with Citi’s Treasury and Trade Solutions, in a statement.

This latest round comes nearly four years after Feedzai raised its Series C, a $50 million round led by an unnamed investor and with an undisclosed valuation. Sapphire also participated in that round. It has now raised some $182 million to date.

Feedzai’s funding is happening at a time when the need for fraud protection for those managing transactions online has reached a high watermark, leading to a rush of customers for companies in the field.

Feedzai says that its customers include four of the five largest banks in North America, 80% of the world’s Fortune 500 companies, 154 million individual and business taxpayers in the U.S., and has processed $9 billion in online transactions for two of the world’s most valuable athletic brands. In total its reach covers some 800 million customers of businesses that use its services.

In addition to Citibank, its customers include Fiserv, Santander, SoFi and Standard Chartered’s Mox.

While money laundering, fraud and other kinds of illicit financial activity were already problems then, in the interim, the problem has only compounded, not least because of how much activity has shifted online, accelerating especially in the last year of pandemic-driven lockdowns. That’s been exacerbated also by a general rise in cybercrime — of which financial fraud remains the biggest component and motivator.

Within that bigger trend, solutions based on artificial intelligence have really emerged as critical to the task of identifying and fighting those illicit activities. Not only is that because AI solutions are able to make calculations and take actions and simply process more than non-AI based tools, or humans for that matter, but they are then able to go head to head with much of the fraud taking place, which itself is being built out on AI-based platforms and requires more sophistication to identify and combat.

For banking customers, Feedzai’s approach has been disruptive in part because of how it has conceived of the problem: It has built solutions that can be used across different scenarios, making them more powerful since the AI system is subsequently “learning” from more data. This is in contrast to how many financial service providers had conceived and tackled the issue in the past.

“Until now banks have used solutions based on verticals,” Nuno Sebastiao, co-founder and CEO of Feedzai, said in the past to TechCrunch. “The fraud solution you have for an ATM wouldn’t be the same fraud solution you would use for online banking which wouldn’t be the same fraud solution you would have for a voice call center.” As these companies have refreshed their systems, many have taken a more agnostic approach like the kind Feedzai has built.

The scale of the issue is clear, and unfortunately also something many of us have experienced firsthand. Feedzai says its data indicates that the last quarter of 2020 shows consumers saw a 650% increase in account takeover scams, a 600% in impersonation scams and a 250% increase in online banking fraud attacks versus the first quarter of 2020. (Those periods are, essentially, before-pandemic and during-pandemic comparisons.)

“The past 12 months have accelerated the world’s dependency on electronic financial services – from online banking to mobile payments, and in turn have increased fraud and money laundering activity. Our services are in more demand than ever,” said Sebastiao in a statement today.

Indeed, yesterday, when I covered Jumio’s $150 million round, I said I wouldn’t consider its funding to be an outlier (even though Jumio made clear it was the largest funding to date in its space): the fast follow from Feedzai, with an even higher amount of financing, really does underscore the trend at the moment.

In addition to these two, one of Feedzai’s biggest competitors, Kount, was acquired by credit ratings giant Equifax earlier this year for $640 million to move deeper into the space. (And related to that field, in the area of identity management, which goes hand-in-hand with tools for laundering and fraud, Okta acquired Auth0 for $6.5 billion.)

Other big rounds for startups in the wider space have included ForgeRock ($96 million round), Onfido ($100 million), Payfone ($100 million), ComplyAdvantage ($50 million), Ripjar ($36.8 million) Truework ($30 million), Zeotap ($18 million) and Persona ($17.5 million).

KKR’s involvement in this round is notable as another example of a private equity firm getting in earlier with venture rounds with fast-scaling startups, similar to Great Hill’s investment in Jumio yesterday and a number of other examples. The firm says it’s making this investment out of its Next Generation Technology Growth Fund II, which is focused on making growth equity investment opportunities in the technology space.

“Feedzai offers a powerful solution to one of the biggest challenges we are facing today: financial crime in the digital age. Global commerce depends on future-proof technologies capable of dealing with a rapidly evolving threat landscape. At the same time, consumers rightfully demand a great customer experience, in addition to strong security layers when using banking or payments services,” said Stephen Shanley, managing director at KKR, in a statement

“We believe Feedzai’s platform uniquely meets these expectations and more, and we are looking forward to working with Nuno and the rest of the team to expand their offering even further,” added Spencer Chavez, principal at KKR.

Powered by WPeMatico

We’ve reached the end of Y Combinator’s biggest Demo Day, which saw more than 300 companies pitching back-to-back over eight hours.

Earlier, we highlighted some of the companies that caught our eye in the first half of the day. Now we’re back with our favorite companies from the second half. From a marketplace to help you resell formalwear to a startup that offers self-driving street cleaners, it’s quite the mix.

If you’d like to browse all of the companies from this batch YC has a catalog of publicly-launched W21 companies here.

Heading into this particular demo day, I had my eyes peeled for startups focused on delivering services via an API instead of offering managed software. Happily, there have been a number to dig into, including Pitbit.ai, Bimaplan, Enode and Terra.

Terra stood out to me because it solves a problem I care deeply about, namely fitness data siloization. My running data is stuck in one app, biking data in another, and my weight-lifting data is stuck in my head, though I doubt Terra has an API for that interface quite yet.

What Terra does is permit fitness app developers to better connect their services, which permits the sharing of data back and forth. Presenters likened their startup to Plaid — a popular thing to do in recent quarters — saying that what the fintech startup did for banking data, Terra would do for fitness and health information.

Getting developers to sign on will be tricky, as I presume all of the apps I use in an exercise context would prefer to be my main workout home. But I don’t want that, so here’s hoping Terra realizes its vision.

— Alex

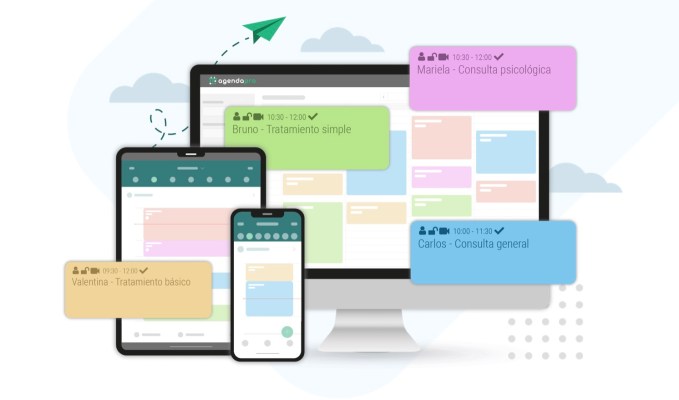

Calling itself “Shopify for beauty and wellness” in Latin America, AgendaPro wants to help small businesses in the region book customers online and collect payments.

The company’s idea isn’t as radical as some companies that we heard from today — Carbon capture! Faster drug discovery! — but the company did share several metrics that made us sit up. First, AgendaPro has reached $152,000 in MRR, or just over $1.8 million in ARR. And representatives shared that its gross margins are 89%. As far as software margins goes, that’s pretty damn good.

The startup has more than 3,000 merchants using its service at the moment, and it claims that there are more than four million businesses that it could service. If AgendaPro can get software and payments revenues from even a respectable fraction of those companies, it will be a big, big business. And who doesn’t love vertical SaaS?

— Alex

One of the holy grails of biochemistry is a programmable DNA machine. These tools can essentially “code” a molecule so that it reliably sticks to a specific substance or cell type, which allows a variety of follow-up actions to be taken.

For instance, a DNA machine could lock onto COVID-19 viruses and then release a chemical signal indicating infection before killing the virus. The same principle applies to a cancer cell. Or a bacterium. You get the picture — and it looks like Atom Bioworks has something a lot like this.

Powered by WPeMatico