TC

Auto Added by WPeMatico

Auto Added by WPeMatico

Last week the Canadian Supreme Court ruled that the national government’s plan to tax carbon emissions was legal in a decision that could have significant implications for the nation’s climate-focused startup companies.

The ruling put an end to roughly two years of legal challenges and could set the stage for a boom in funding and commercial support for Canadian startup companies developing technologies to curb greenhouse gas emissions, according to investors and entrepreneurs representing some of the world’s largest utilities and petrochemical companies.

“The high price on carbon has the potential to make Canada a powerhouse for scaling up breakthrough decarbonization technologies and for deploying solutions like carbon capture, industrial electrification, and hydrogen electrolysis,” said one investor who works with a fund that backs startups on behalf of large energy businesses.

This 2018 Greenhouse Gas Pricing Act is the cornerstone of the Canadian climate policy pushed through by Prime Minister Justin Trudeau. It establishes minimum pricing standards that all provinces have to meet but gives the provinces the ability to set higher prices. So far, seven of the nation’s 13 provinces are currently paying the “backstop” rate set by the national government.

That price is C$30 per tonne of carbon dioxide released, but is set to rise to C$170 per tonne by 2030. That figure is just a bit higher than the current prices that Californians are charged under the state’s carbon pricing plan and roughly four times the price on carbon set by the Northeastern Regional Greenhouse Gas Initiative.

Under the plan, much of the money raised through the tax levied by the Canadian government would be used to support projects and technologies that reduce greenhouse gas emissions or create more sustainable approaches to industry.

“Climate change is real. It is caused by greenhouse gas emissions resulting from human activities, and it poses a grave threat to humanity’s future,” Chief Justice Richard Wagner wrote, on behalf of the majority, in the Supreme Court ruling.

Three provinces — Alberta, Ontario and Saskatchewan challenged the legality of the greenhouse gas policy, and Alberta’s challenge was allowed to proceed to the high court — holding up the national implementation of the pricing scheme.

With the roadblocks removed, entrepreneurs and investors around the world expect the carbon scheme to quickly boost the prospects of Canadian startups.

“This represents underlying government support and a huge pot of money. If you wanted macro support for an underlying shift in sectoral developments that could substantiate and support tech companies working on climate change mitigation what better then when the government has told you that we care about this and money is free?” said BeZero Carbon founder, Tommy Ricketts. “There couldn’t be a better condition for startups in Canada.”

Companies that stand to directly benefit from a carbon tax in Canada include businesses like Kanin Energy, which develops decarbonization projects, including waste heat to power; CERT, which is currently competing in the carbon Xprize and is working on a way to convert carbon dioxide to ethylene; and SeeO2, a company also working on carbon dioxide conversion technologies.

Geothermal technologies like Quaise and Eavor could also see a boost, as will companies that focus on the electrification of the transportation industry in Canada.

Farther afield are the companies like Planetary Hydrogen, which combines hydrogen production and carbon capture in a way that also contributes to ocean de-acidification.

“Think about the gas at the pump. That is going to get charged extra,” said one investor who works for the venture arm of one of the largest oil and gas companies in the world, who was not authorized to speak to the press. “For cleaner energy the price will definitely be reduced. And think about where this tax is going. Most of the tax is going to go to government funding into cleantech or climate-tech companies. So you have a double boost for startups in the carbon footprint reduction area.”

Early Stage is the premier “how-to” event for startup entrepreneurs and investors. You’ll hear firsthand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company building: Fundraising, recruiting, sales, product-market fit, PR, marketing and brand building. Each session also has audience participation built-in — there’s ample time included for audience questions and discussion. Use code “TCARTICLE” at checkout to get 20% off tickets right here.

Powered by WPeMatico

Mayfield partner Navin Chaddha and Poshmark founder and CEO Manish Chandra met all the way back in 2003, well before Poshmark was even a glimmer in his eye. They stayed connected over the years, through Chandra’s sale of his startup Kaboodle to Hearst and after he left.

At a breakfast one morning, Chandra told Chaddha he was going to try to do everything from his iPhone for the next six months.

Over the course of that time, the idea for Poshmark started to percolate into something more concrete. Chandra, following Kaboodle, knew he wanted to do several things differently. The first was create an engagement and revenue model that was symbiotic, rather than starting with engagement and having to build out a business model later. He also knew he wanted to start with people first, and build a founding team that had deep DNA in the fashion world to pair with his technical background.

He met Tracy Sun, brought her on, and got to work.

This was back in 2011, and Chandra was absolutely adamant that he wanted Poshmark to be an app, not a website. So adamant, in fact, that during beta he actually provided 100 users with video iPods. (He recalled that he only got 20% of them back.)

“Lead with love, and the money comes.” It’s one of the cornerstone values at Poshmark. The company practiced that early on by holding IRL, and then virtual, parties, allowing users to show each other their wares and create an engagement cycle that offered instant gratification. The user base grew from 100 to 150 to 1,000 and so on.

“We still to this day use a similar kind of strategy in a much more compressed timeframe as we go to different countries,” said Chandra. “We focus on building the community first and then scale that community.”

Chaddha and Mayfield led the company’s Series A deal a decade ago. On the latest episode of Extra Crunch Live, Chandra and Chaddha sat down with us and walked us through that original Series A pitch deck (which you can check out below). They also participated in the Pitch Deck Teardown, giving their expert feedback on decks submitted by the audience. If you’d like your deck to be featured on a future episode of Extra Crunch Live, hit up this link.

Time stamp — 11:00

Poshmark was built on a couple fundamental premises. The first was that the iPhone would transform the way we do just about everything. The second was more pointed: That fashion, at the time underserved by technology, was a discovery process over a direct search process. A decade ago, Chandra envisioned a fashion marketplace that mimicked shopping in the real world — walk into a shop and let natural attraction do its thing — without holding any inventory.

Powered by WPeMatico

Since the pandemic began, I have been pushing the limits of my imagination to try to picture what cities will look and feel like in the coming years.

If your town looks like San Francisco, where I live, it’s a pressing question: Our once-bustling financial district is a ghost town, but even in outer neighborhoods, the number of vacant storefronts is unsettling. People are starting to emerge after sheltering in place for a year, but we are a long way from fully restoring our shared spaces.

What’s going to happen to those semi-vacant office towers, some of which are still under construction? There’s been renewed talk of converting some skyscrapers into residential housing, but there are real economic/logistic hurdles to clear before that can be broadly applied. Scores of restaurants have closed in recent months; who will take over those spaces? I spend a lot of time walking around, and it’s been a long time since I’ve noticed a “Grand Opening” sign.

Seeking answers, Managing Editor Eric Eldon interviewed 10 VCs who are active in proptech and found that most were generally “optimistic.”

Several expressed genuine uncertainty about the future of offices, but most were bullish about prospects for remote work, the rebirth of physical retail and the emergence of “third spaces” that will fill the gap between work and home.

In a companion article on TechCrunch, Eric explores these broader shifts, concluding, “you can start to see a world emerging that sounds a lot more like the fantasies of a New Urbanist than the world before the pandemic.”

Here’s who he interviewed:

Thanks very much for reading Extra Crunch this week. Have a great weekend!

Walter Thompson

Senior Editor, TechCrunch

@yourprotagonist

Full Extra Crunch articles are only available to members.

Use discount code ECFriday to save 20% off a one- or two-year subscription.

Image Credits: Jon Feingersh Photography Inc / Getty Images

Ideally, BI transforms raw data into actionable information, but according to Charles Caldwell, VP of product management at Logi Analytics, “a gap exists between the functionalities provided by current BI and data discovery tools and what users want and need.”

Few BI tools actually integrate with existing workflows and most offer clunky user experiences, “leaving many individuals feeling like they need an advanced computer science degree to actually be able to pull insights out.”

Instead of requiring workers to abandon workflow applications to access data, embedded analytics are more efficient and easier to use, says Caldwell.

In short, “it’s time to abandon BI — at least as we currently know it.”

Image Credits: nadia_bormotova / Getty Images

Amid the pandemic, investors became laser-focused on sections of the pitch deck that address monetization and business viability — signs that founders need to come to the table with better-defined businesses in order to succeed.

Investors’ heightened expectations for monetization potential and a company’s positioning within its competitive landscape are unlikely to lessen in the years to come, even in a post-COVID economy.

Image Credits: Rafael Henrique/SOPA Images/LightRocket via Getty Images

Clubhouse’s hockey-stick growth is something most startups would kill for.

However, it also means that UX problems can only be addressed while in “full flight” — and that changes to the user experience will be felt at scale rather under the cover of a small, loyal and (usually) forgiving user base.

We’re not investors, so we’re not pretending to sort the unicorns from the goats.

But TechCrunch reporters spend a lot of time talking with startups, hearing pitches and telling their stories; if you’re curious about which companies stood out from Y Combinator’s W21 Demo Day, read on.

Image Credits: Nigel Sussman (opens in a new window)

There’s a lot going on: The venture capital market is redlining its engines while public markets remain sympathetic to growing, unprofitable companies.

Let’s round up IPO news from DigitalOcean, Kaltura, Robinhood and Zymergen, and big rounds for Lattice and goPuff.

Image Credits: Bryce Durbin/TechCrunch

Dear Sophie:

I’m a startup founder looking to expand in the U.S. I was originally looking at opening an office in Silicon Valley to be close to software engineers and investors, but then … COVID-19 🙂

A lot has changed over the last year — can I still come?

— Hopeful in Hungary

Image Credits: Aleksei Naumov / Getty Images

Aside from improved SEO, small business websites optimizing for Google’s new Core Web Vitals will reap the rewards of an improved user experience for their site visitors.

While many are looking at the Core Web Vitals as a big hoop to jump through to please the search powers that be, others are seeing — and seizing — the opportunities that come along with this change.

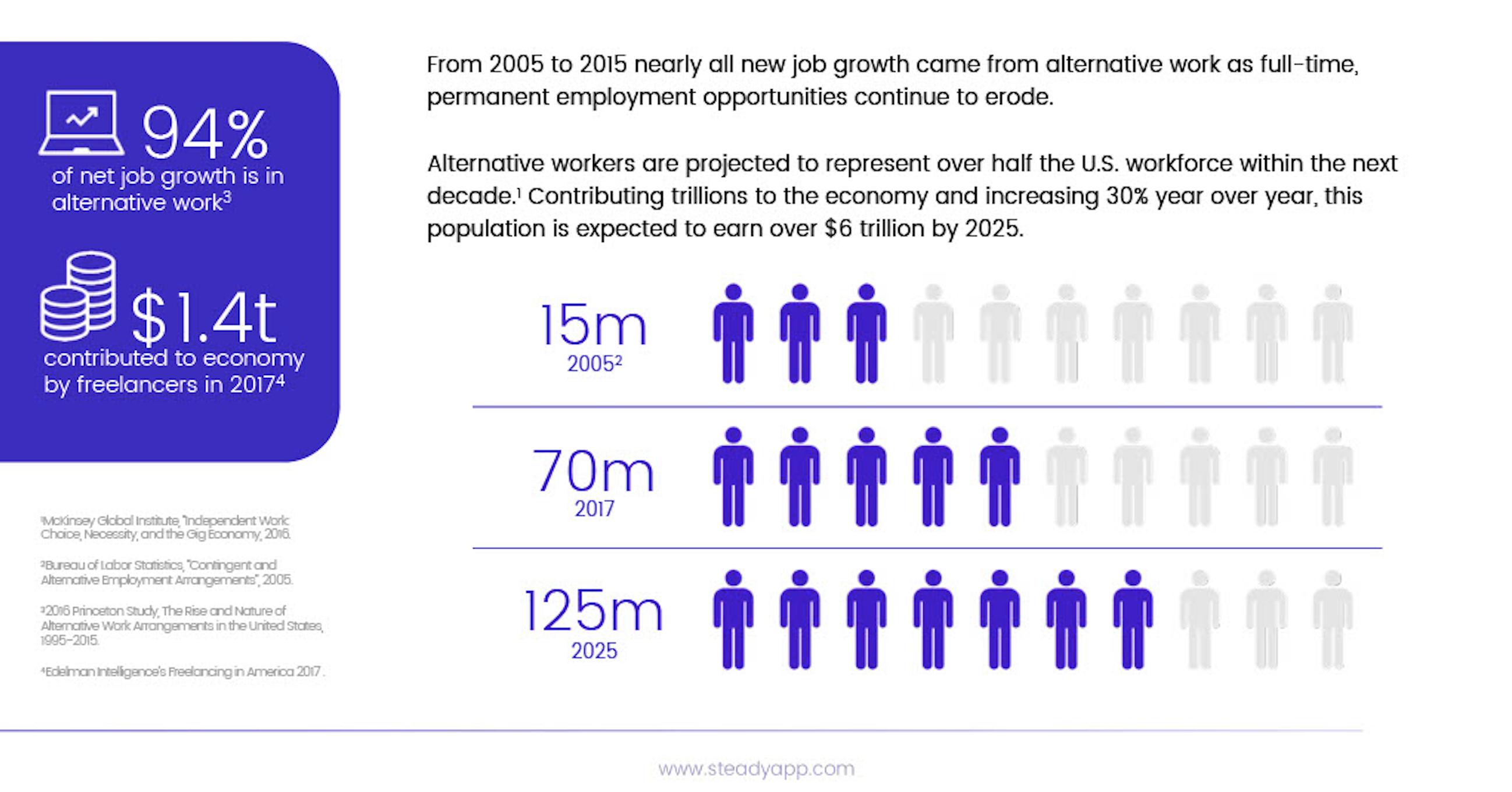

Image Credits: Steady

When it comes to Steady — the platform that helps hourly workers manage and maximize their income and access deals on things like benefits and financial services — the strengths of the business are clear.

But it took time for founder and CEO Adam Roseman to clearly define and communicate each of them in his quest for fundraising.

Image Credits: Nigel Sussman (opens in a new window)

Alex Wilhelm dug into Discord’s possible $10 billion exit to Microsoft and explored IPO price ranges for real estate tech company Compass and Intermedia Cloud Communications, a unified-communications-as-a-service company.

“It’s a lot,” he noted, “but if we don’t get through it all now, we’ll fall behind and feel silly later.”

Image Credits: Nigel Sussman (opens in a new window)

The consumer trading frenzy could be slowing.

What would happen to Robinhood and its cohorts if the apparent cooling in consumer trading demand continues?

Image Credits: Miguel Navarro (opens in a new window) / Getty Images (Image has been modified)

Almost every private equity and venture capital investor now advertises that they have a platform to support their portfolio companies, “however, most of us don’t have the budget of an Andreessen Horowitz to support almost every major need” for each startup they’ve bet on, says Versatile VC founder David Teten.

If you’re prioritizing a platform buildout for your firm, consider using the framework he’s outlined.

Image Credits: Bryce Durbin

Despite all of the pomp and promises about the potential for AR and VR, there isn’t a clear understanding of market demand for bringing the technology to cars, trucks and passenger vans.

Estimates of the global market range from $14 billion by 2027 to as much as $673 billion by 2025, showing just how nascent the market currently is and how much opportunity is present.

Image Credits: phototechno / Getty Images

The Middle East is a promising region with growing digital advertising solutions despite locals’ attachment to traditional means of advertising.

In recent years, there has been a shift to the active use of social media and online shopping, meaning the Middle East embodies great potential for adtech startups.

Image Credits: Getty Images

Social+ products are seeing mass adoption because they marry community with functionality.

This applies even to fintech companies as taboos around money fall away.

Image Credits: Mironov Konstantin / Getty Images

It took Christine Tao, founder of Sounding Board, just over three years to recognize the value of executive coaching and get her company to a Series A.

Here’s how she did it.

Image Credits: Amber J. Dickinson (opens in a new window)

Music companies, celebrities and fashion brands are some of the latest entities to dip a toe into the burgeoning NFT market.

In part two of a three-part series, we take a look at why NFTs are “the next chapter of digital art history.”

Image Credits: Charday Penn (opens in a new window) / Getty Images

The pandemic-induced growth of e-commerce is, by now, well documented.

What is happening in the app ecosystem that supports e-commerce? Is it growing, or are we more likely to see consolidations and IPOs?

Let’s explore.

Image Credits: Nigel Sussman (opens in a new window)

You’ll want to pay attention to this one: Israel’s ironSource, an app-monetization startup, is going public via a SPAC.

It’s the second SPAC-led debut from an Israeli company in recent weeks worth more than $10 billion, and ironSource is actually a pretty darn interesting company from a financial perspective.

Image Credits: Bryce Durbin / TechCrunch

The market views Coursera’s edtech business warmly ahead of its impending public offering.

Coursera is being valued as a software company, likely a breathe-easy moment for still-private edtech companies, since the debut could be an industry bellwether.

Powered by WPeMatico

Last October as Slack was preparing for its virtual Frontiers conference, the company began thinking about different ways people could communicate on the platform. While it had built its name on being able to integrate a lot of services in a single place to alleviate the dreaded task-switching phenomenon, it has been largely text-based up until now.

More recently, Slack has started developing a few new features that could bring different ways of interacting to the platform. CEO Stewart Butterfield discussed them on Thursday with former TechCrunch reporter Josh Constine, now a SignalFire investor, in a Clubhouse interview.

The talk was about the future of work, and Slack believes these new ways of communicating could help employees better connect online as we shift to a hybrid work world — one which has been hastened by the pandemic over the last year. There is a general consensus that many companies will continue to work in a hybrid fashion, even when the pandemic is over.

For starters, Slack aims to add a way to communicate by video. But instead of trying to compete with Zoom or Microsoft Teams, Slack is envisioning an experience that’s more like Instagram Stories.

Think about the CEO sharing an important announcement with the company, or the kind of information that might have gone out in a companywide email. Instead, you can skip the inbox and deliver the message directly by video. It’s taking a page from the consumer approach to social and trying to move it into the enterprise.

Writing in a company blog post earlier this week, Slack chief product officer Tamar Yehoshua was clear this was going to be an asynchronous approach, rather than a meeting kind of experience.

“To help with this, we are piloting ways to shift meetings toward an asynchronous video experience that feels native in Slack. It allows us to express nuance and enthusiasm without a meeting,” she wrote.

While it was at it, Slack decided to create a way of just chatting by voice. As Butterfield told Constine in his Clubhouse interview, this is essentially Clubhouse (or Twitter Spaces) being built for Slack.

Yeah, I’ve always believed the ‘good artists copy, great artists steal’ thing, so we’re just building Clubhouse into Slack, essentially. Like that idea that you can drop in, the conversation’s happening whether you’re there or not, you can enter and leave when you want, as opposed to a call that starts and stops, is an amazing model for encouraging that spontaneity and that serendipity and conversations that only need to be three minutes, but the only option for you to schedule them is 30 minutes. So look out for Clubhouse built into Slack.

Again, it’s taking a consumer social idea and applying it to a business setting with the idea of finding other ways to keep you in Slack when you could be using other tools to achieve the same thing, whether it be Zoom meetings, email or your phone.

Butterfield also hinted that another feature — asynchronous audio, allowing you to leave the equivalent of a voicemail — could be coming some time in the future. A Slack spokesperson confirmed that it was in the works, but wasn’t ready to share details yet.

It’s impossible to look at these features without thinking about them in the context of the $27 billion Salesforce acquisition of Slack at the end of last year. When you put them all together, you have this set of tools that let you communicate in whatever way makes the most sense to you.

When you combine that Slack Connect DM, a new feature to communicate outside the organization that was released this week to some controversy, as people wanted assurances that they could control spam and harassment, it takes the concept one step further — outside the organization itself.

As part of a larger entity like Salesforce, these tools could be useful across sales, service and even marketing as a way to communicate in a variety of ways inside and outside the organization. And they greatly expand the value prop of Slack as it becomes part of Salesforce sometime later this year.

While it began talking about the new audio and video features last fall, the company has been piloting them since the beginning of this year. So far Slack is not saying when the new features will be generally available.

Powered by WPeMatico

With Roblox’s massive IPO this month, game developers, brands and investors alike are wondering what factors cause the most successful games on this $47 billion platform to break out from the millions of user-generated passion projects.

According to Roblox’s S-1 filing, nearly 250 developers and creators earned $100,000 or more in Robux in the year through September 2020 out of nearly 1 million creators on the platform.

From Gamefam’s first game two years ago that topped out at only 25 concurrent players to our current portfolio with 2 million to 3 million daily visits, our team learned to develop on Roblox the hard way — by trial and error and by getting better at listening to the Roblox community’s unique gamer culture and vernacular.

Even the most experienced and talented game designers from the mobile F2P business usually fail to understand what features matter to Robloxians.

For those entrepreneurs just starting their journey in Roblox game development, these are the most common mistakes I have seen gaming professionals (myself included) make on Roblox:

In the F2P mobile games market, it’s all about layered game loops: play a match with the hero, level the hero up using resources from the match, buy more heroes to merge with the first hero, open up new matches with new rules to win more resources, and on and on. These require ongoing player tutorials across hours of play sessions. These mechanics tend to backfire on Roblox because players have no tolerance for anything but immediate, visceral fun.

Accordingly, in mobile F2P, a robust tutorial for new users is oftentimes one of the biggest investments during development. But in our Roblox game Speed Run Simulator (more than 400,000 daily visits), we saw a significant increase in D1 retention when we removed the tutorial entirely and just allowed existing players to guide new players’ understanding of the game. The differences between Roblox and mobile F2P are not only numerous but also sometimes profoundly counterintuitive.

Roblox players spend because they’re getting something they want. They won’t be cajoled or coerced into spending like in a mobile game where progress is restricted or slowed without making an in-app purchase (think Candy Crush).

Powered by WPeMatico

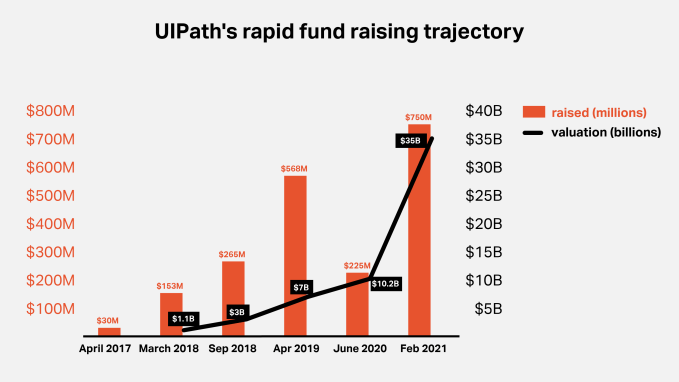

When TechCrunch covered UIPath’s Series A in 2017, it was a small startup out of Romania working in a little known area of enterprise software called robotic process automation (RPA).

Then the company took off with increasingly large multibillion dollar valuations. It progressed through its investment rounds, culminating with a $750 million round on an eye-popping $35 billion valuation last month.

This morning, the company took the next step on its rapid-fire evolutionary path when it filed its S-1 to go public. To illustrate just how fast the company’s rise has been, take a look at its funding history:

Image Credits: Bryce Durbin/TechCrunch

RPA is much better understood these days with larger enterprise software companies like SAP, Microsoft, IBM and ServiceNow getting involved. With RPA, companies can automate a mundane process like processing an insurance claim, moving work automatically, while bringing in humans only when absolutely necessary. For example, instead of having a person enter a number in a spreadsheet from an email, that can happen automatically.

In June 2019, Gartner reported that RPA was the fastest-growing area in enterprise software, growing at over 60% per year, and attracting investors and larger enterprise software vendors to the space. While RPA’s growth has slowed as it matures, a September 2020 Gartner report found it expanding at a more modest 19.5% with total revenue expected to reach $2 billion in 2021. Gartner found that stand-alone RPA vendors UIPath, Blue Prism and Automation Anywhere are the market leaders.

Although the market feels rather small given the size of the company’s valuation, it’s still a nascent space. In its S-1 filing this morning, the company painted a rosy picture, projecting a $60 billion addressable market. While TAM estimates tend to trend large, UIPath points out that the number encompasses far more than pure RPA into what they call “Intelligent Process Automation.” That could include not only RPA, but also process discovery, workflow, no-code development and other forms of automation.

Indeed, as we wrote earlier today on the soaring process automation market, the company is probably going to need to expand into these other areas to really grow, especially now that it’s competing with much bigger companies for enterprise automation dollars.

While UIPath is in the midst of its quiet period, it came up for air this week to announce that it had bought Cloud Elements, a company that gives it access to API integration, an important component of automation in the enterprise. Daniel Dines, the company co-founder and CEO said the acquisition was about building a larger platform of automation tools.

“The acquisition of Cloud Elements is just one example of how we are building a flexible and scalable enterprise-ready platform that helps customers become fully automated enterprises,” he said in a statement.

While there is a lot of CEO speak in that statement, there is also an element of truth in that the company is looking at the larger automation story. It can use some of the cash from its prodigious fundraising to begin expanding on its original vision with smaller acquisitions that can fill in missing pieces in the product road map.

The company will need to do that and more to compete in a rapidly moving market, where many vendors are fighting for different parts of the business. As it continues its journey to becoming a public company, it will need to continue finding new ways to increase revenue by tapping into different parts of the wider automation stack.

Powered by WPeMatico

We’ve seen a lot of trend lines moving throughout 2020 and into 2021 around automation, workflow, robotic process automation (RPA) and the movement to low-code and no-code application building. While all of these technologies can work on their own, they are deeply connected and we are starting to see some movement toward bringing them together.

While the definition of process automation is open to interpretation, and could include things like industrial automation, Statista estimates that the process automation market could be worth $74 billion in 2021. Those are numbers that are going to get the attention of both investors and enterprise software executives.

Just this week, Berlin-based Camunda announced a $98 million Series B to help act as a layer to orchestrate the flow of data between RPA bots, microservices and human employees. Meanwhile, UIPath, the pure-play RPA startup that’s going to IPO any minute now, acquired Cloud Elements, giving it a way to move beyond RPA into API automation.

Not enough proof for you? How about ServiceNow announcing this week that it is buying Indian startup Intellibot to give it — you guessed it — RPA capabilities. That acquisition is part of a broader strategy by the company to move into full-scale workflow and automation, which it discussed just a couple of weeks ago.

Meanwhile, at the end of last year, SAP bought a different Berlin process automation startup, Signavio, for $1.2 billion after announcing new automated workflow tools and an RPA tool at the beginning of December. Microsoft is in on it too, having acquired process automation startup Softmotive last May, which it then combined with its own automation tool PowerAutomate.

What we have here is a frothy mix of startups and large companies racing to provide a comprehensive spectrum of workflow automation tools to empower companies to spin up workflows quickly and move work involving both human and machine labor through an organization.

The result is hot startups getting prodigious funding, while other startups are exiting via acquisition to these larger companies looking to buy instead of build to gain a quick foothold in this market.

Cathy Tornbohm, Distinguished Research vice president at Gartner, says part of the reason for the rapidly growing interest is that these companies have stayed on the sidelines up until now, but they see an opportunity and are using their checkbooks to play catch-up.

“IBM, SAP, Pega, Appian, Microsoft, ServiceNow all bought into the RPA market because for years they didn’t focus on how data got into their systems when operating between organizations or without a human. [Instead] they focused more on what happens inside the client’s organization. The drive to be digitally more efficient necessitates optimizing data ingestion and data flows,” Tornbohm told me.

For all the bluster from the big vendors, they do not control the pure-play RPA market. In fact, Gartner found that the top three players in this space are UIPath, Automation Anywhere and Blue Prism.

But Tornbohm says that, even as the traditional enterprise vendors try to push their way into the space, these pure-play companies are not sitting still. They are expanding beyond their RPA roots into the broader automation space, which could explain why UIPath came up from its pre-IPO quiet period to make the Cloud Elements announcement this week.

Dharmesh Thakker, managing partner at Battery Ventures, agrees with Tornbohm, saying that the shift to the cloud, accelerated by COVID-19, has led to an expansion of what RPA vendors are doing.

“RPA has traditionally focused on automation-UI flow and user steps, but we believe a full automation suite requires that ability to automate processes across the stack. For larger companies, we see their interest in the category as a way to take action on data within their systems. And for standalone RPA vendors, we see this as validation of the category and an invitation to expand their offerings to other pillars of automation,” Thakker said.

The activity we have seen across the automation and workflow space over the last year could be just the beginning of what Thakker and Tornbohm are describing, as companies of all sizes fight to become the automation stack of choice in the coming years.

Early Stage is the premier “how-to” event for startup entrepreneurs and investors. You’ll hear firsthand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company building: Fundraising, recruiting, sales, product-market fit, PR, marketing and brand building. Each session also has audience participation built-in — there’s ample time included for audience questions and discussion. Use code “TCARTICLE” at checkout to get 20% off tickets right here.

Powered by WPeMatico

Ryu Games, a startup that helps developers add cash tournaments to their mobile games, announced this morning it has raised $2.3 million in a seed round. The funds came from a number of investors, including Side Door Ventures, MGV Capital, Velo Partners and Citta Ventures.

In addition, 500 Startups participated in the round. To see the accelerator take part in the funding round is not a surprise, as TechCrunch first caught wind of Ryu during its participation in the most recent 500 Startups demo day. At the time, we were enthused by the idea of gamers wagering money to go head-to-head with other players on mobile devices. Investors appear to back our first impression of the company.

The gist behind our bullishness on the company’s idea is that esports is cool. And though your humble servant is sufficiently ancient as to favor PC-based esports, younger folks are into mobile gaming esports. Fair enough. Now mix in the sports-betting frenzy that we’ve seen in the United States, and you have a potentially potent cocktail.

TechCrunch caught up with Ryu Games co-founder and CEO Ross Krasner to dig in a bit more. It turns out that the original esports-y model that we envisioned for Ryu was a bit off. Instead, players will often go toe-to-toe in an asynchronous fashion, betting high scores in a game against one another. So, competitive “StarCraft II” this is not. But “StarCraft” is famously difficult to be even mediocre at, while mobile games are simpler by nature, and thus more popular.

Perhaps your parents will square off against office friends in cash-fueled solitaire tournaments.

The money setup is simple, with Krasner likening it to a poker tournament. You wager a set amount, and then play. Ryu collects a fee for hosting, and then players get to it.

Ryu hopes to be present on a few dozen games this year. One matter that could slow adoption, however, is that games it partners with tend to relaunch a version of their title with Ryu’s SDK built in. The startup bites back against the work that partner-developers have to undertake by cross-promoting titles that use its system. So, if you sign up, you can do more than generate revenue. Your game might also find a new audience.

Like with most seed-stage startups, Ryu Games is more of a bet on the future than proof of a new trend. Let’s see how far it can get with this set of capital, especially as vaccines take larger and larger bites out of the pandemic that has kept us locked up for so very long.

Powered by WPeMatico

What happens to hot fintech startups that have benefited from a rise in consumer trading activity if regular folks lose interest in financial wagers?

That’s the question facing Robinhood, Coinbase and other trading platforms that have ridden an upward cycle. Each has performed well in recent quarters: Robinhood by securing huge payment-for-order-flow revenues, while Coinbase’s trading fees have proven incredibly lucrative, something we learned when it filed to go public.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

According to recent reporting, the consumer trading frenzy could be slowing: Bloomberg recently noted that options trading volume is slipping, Robinhood’s app store ranking is falling, and some alternative assets are also losing steam. Other reporting from the publication notes that many SPAC shares are underwater while Google trends data indicates falling consumer trading interest, perhaps limiting the inflow of new users for equities-focused apps.

There are other indications that the red-hot speculative consumer market is cooling. Bitcoin is off around 10% in the last week after a blistering rise in recent quarters. Hot stocks like Peloton, once a darling of traders, fell more than 10% yesterday alone.

But looking past price declines and other signals of market chop, volume itself at some well-known exchanges could be falling.

But looking past price declines and other signals of market chop, volume itself at some well-known exchanges could be falling.

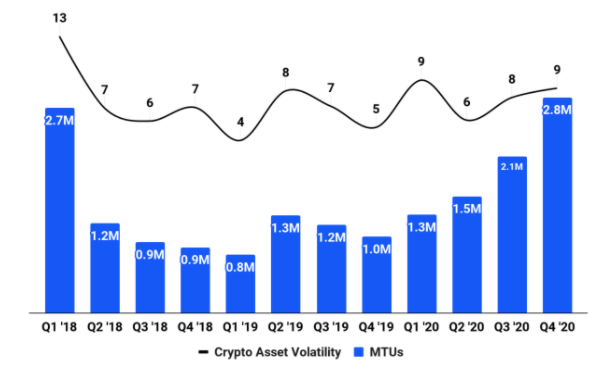

There’s a historical precedent for such declines. Coinbase’s historical revenues, to pick an example, have proved variable based on consumer interest in cryptocurrencies, with the company benefiting from rising demand and trading activity and seeing its top line decline in periods of restrained enthusiasm.

Robinhood and its fellow free trading apps have yet to undergo a similar rise-and-fall in trading volume, I’d reckon. At least of the sort of extreme up-and-down that Coinbase endured after the 2017-2018 bitcoin boom. Our question is, what would happen to Robinhood and its cohorts if the apparent cooling in consumer trading demand continues? Let’s talk about it.

Coinbase was a famously lucrative organization during the 2017-2018 bitcoin boom.

Indeed, we can see from the following chart from its S-1 filing that the company’s monthly transacting users (MTUs) dropped sharply into 2018. The percentage decline from 2.7 million to 800,000 is just over 70%.

Image Credits: Coinbase

And in case you think we’re being rude, we have a related chart from the same SEC filing that shows trading volume falling over the same period, not merely MTUs. We’re not picking a loose proxy to merely infer that trading revenue dipped at Coinbase. We can show it:

Powered by WPeMatico

Gorillas, the Berlin-HQ’d startup that promises to let you order groceries and other “every day” items for delivery in as little as 10 minutes, has raised $290 million in Series B funding, at a valuation that surpasses $1 billion.

The round — which was first reported by BI — is led by Coatue Management, DST Global and Tencent, with participation from Green Oaks, Fifth Wall and Dragoneer. Previous backer Atlantic Food Labs also followed on.

Noteworthy, Gorillas CEO and co-founder Kağan Sümer tells TechCrunch the round is “100% equity” (i.e. without a debt component). Asked if it includes any secondary funding — seeing existing shareholders liquidate a portion of their shares — Gorillas declined to comment.

Having become one of the fastest European startups to have achieved so-called “unicorn” status — a valuation of $1 billion or more — Gorillas says it will reward its rider crew and warehouse staff with $1 million in bonuses. However, the company isn’t disclosing how this one-off bonus breaks down per worker, and it isn’t clear if the bonus is cash or stock or a mixture of both. The move comes at a time when Gorillas riders in Germany are reportedly organising to unionise.

“In contrast to established gig economy models, we employ more than a thousand riders directly,” says Sümer. “Therefore, we invest in a strong career development program, rider security and a healthy working environment. Beyond that, all riders will receive a once-off payment”.

Founded last May by Kağan Sümer and Jörg Kattner in Berlin, Gorillas has already expanded to more than 12 cities, including Amsterdam, London and Munich. The company lets you order groceries and other household items on-demand with an average delivery time of 10 minutes.

To do this, it operates a vertical or “dark store” model, seeing it set up its own micro fulfillment centers, which currently total 40, spread across Germany, the U.K. and the Netherlands. Customers are charged just over $2 per delivery and can order from “more than 2,000 essential items at retail prices”.

“We believe that the weekly grocery run is outdated because people’s lives are increasingly spontaneous and shopping habits change accordingly,” says Sümer, noting that while access to supermarkets has increased, the space we have to store goods has decreased as people in cities are living in smaller spaces.

“Additionally, this pandemic has accelerated the need for grocery deliveries. If we can order clothes and trinkets and have them delivered to our door, the same should be said for our essential needs. Gorillas helps customers get what they need when they need it, whether this is their weekly grocery list or the tomatoes they forgot for tonight’s pasta recipe”.

Sümer says the service initially attracted typical early adopters because it was a radically new experience and the app was only available in English. He claims that Gorillas has since gained a “very broad” base of users that are “extremely loyal”. “With geographical expansion and the rapid increase of word-of-mouth, we now cater to pretty much anyone you’d meet in a supermarket,” he says.

Asked to share what a typical basket looks like, and therefore what kind of existing grocery habits Gorillas is displacing, Sümer says that users increase their basket size over time as they gain trust in the service and its products. “Simultaneously, customers are integrating an increasing share of their typical supermarket purchases within their Gorillas orders. This includes fresh goods like fruit and vegetables, as well as products of local suppliers”.

Meanwhile, dark store competition in cities like London — where Gorillas recently expanded and counts as a key market — continues to ramp up. This is seeing operators issue vouchers and offer sizeable discounts in a bid to acquire customers fast, while VCs are pumping huge amounts of early-stage cash into a space where unit economics aren’t yet definitively proven.

Earlier this month, Berlin-based Flink announced that it had raised $52 million in seed financing in a mixture of equity and debt. The company didn’t break out the equity-debt split, though one source told me the equity component was roughly half and half.

Others in the space include London’s Jiffy, Dija and Weezy, and France’s Cajoo. There’s also London-based Zapp, which remains in stealth, and heavily backed Getir, which started in Turkey but recently also came to London.

Meanwhile, U.S.-founded goPuff — which this week raised another $1.15 billion in funding at a whopping $8.9 billion valuation (compared to $3.9 billion in October) — is also looking to expand into Europe and has held talks to acquire or invest in the U.K.’s Fancy.

Powered by WPeMatico