TC

Auto Added by WPeMatico

Auto Added by WPeMatico

It appears that the slowdown in tech debuts is not a complete freeze; despite concerning news regarding the IPO pipeline, some deals are chugging ahead. This morning, we’re adding Alkami Technology to a list that includes Coinbase’s impending direct listing and Robinhood’s expected IPO.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

We are playing catch-up, so let’s learn about Alkami and its software, dig into its backers and final private valuation, and pick apart its numbers before checking out its impending IPO valuation. After all, if Kaltura and others are going to hit the brakes, we must turn our attention to companies that are still putting the hammer down.

We are playing catch-up, so let’s learn about Alkami and its software, dig into its backers and final private valuation, and pick apart its numbers before checking out its impending IPO valuation. After all, if Kaltura and others are going to hit the brakes, we must turn our attention to companies that are still putting the hammer down.

Frankly, we should have known about Alkami’s IPO sooner. One of a rising number of large tech companies based in nontraditional areas, the bank-focused software company is based in Texas, despite having roots in Oklahoma. The company raised $385.2 million during its life, per Crunchbase data. That sum includes a September 2020 round worth $140 million that valued the company at $1.44 billion on a post-money basis, PitchBook reports.

So, into the latest SEC filing from the software unicorn we go!

Alkami Technology is a software company that delivers its product to banks via the cloud, so it’s not a legacy player scraping together an IPO during boom times. Instead, it is the sort of company that we understand; it’s built on top of AWS and charges for its services on a recurring basis.

The company’s core market is all banks smaller than the largest, it appears, or what Alkami calls “community, regional and super-regional financial institutions.” Its service is a software layer that plugs into existing financial systems while also providing a number of user interface options.

In short, it takes a bank from its internal systems all the way to the end-user experience. Here’s how Alkami explained it in its S-1/A filing:

Image Credits: Alkami S-1

Simple enough!

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast where we unpack the numbers behind the headlines.

This is Equity Monday, our weekly kickoff that tracks the latest private market news, talks about the coming week, digs into some recent funding rounds and mulls over a larger theme or narrative from the private markets. You can follow the show on Twitter here and myself here.

This morning we took a global look at the news, trying to take in the latest from around our little planet:

It’s going to be a blast of a week. Talk to you Wednesday!

Equity drops every Monday at 7:00 a.m. PST, Wednesday, and Friday at 6:00 AM PST, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts!

Powered by WPeMatico

On a recent morning in downtown Shenzhen, Lingyu queued up to order her go-to McMuffin. As she waited in line with other commuters, the 50-year-old accountant noticed the new vegetarian options on the menu and decided to try the imitation spam and scrambled egg burger.

“I’ve never had fake meat,” she said of the burger — one of five new breakfast items that McDonald’s introduced last week in three major Chinese cities featuring luncheon meat substitutes produced by Green Monday.

Although some investors worry the sudden boom of meat-substitute startups could turn into a bubble, others believe the market is far from saturated.

Lingyu, who works in her family business in Shenzhen, is exactly the type of Chinese customer that imitation meat companies want to attract beyond the young, trendy, eco-conscious urbanites. Her yuan means potentially more to meat replacement companies because it advances their business and climate agendas both. Eating less meat is one of the simplest ways to reduce an individual’s carbon footprint and help fight climate change.

McDonald’s hopes that its pea- and soy-based, zero-cholesterol, luncheon meat substitutes will carve out a piece of China’s massive dining market. Longtime rival KFC, and local competitor Dicos introduced their own plant-based products last year. Partnering with fast food chains is a smart move for companies that want to promote alternative protein to the masses, because these products are often pricey and are usually aimed at wealthy urbanites.

2020 could well have been the dawn of alternative protein in China. More than 10 startups raised capital to make plant-based protein for a country with increasing meat demand. Of these, Starfield, Hey Maet, Vesta and Haofood have been around for about a year; ZhenMeat was founded three years ago; and the aforementioned Green Monday is a nine-year-old Hong Kong firm pushing into mainland China. The competition intensified further last year when American incumbents Beyond Meat and Eat Just entered China.

Although some investors worry the sudden boom of meat-substitute startups could turn into a bubble, others believe the market is far from saturated.

“Think about how much meat China consumes a year,” said an investor in a Chinese soy protein startup who requested anonymity. “Even if alternative protein replaces 0.01% of the consumption, it could be a market worth tens of billions of dollars.”

In many ways, China is the ideal testbed for alternative protein. The country has a long history of imitation meat rooted in Buddhist vegetarianism and an expanding middle class that is increasingly health-conscious and willing to experiment. The country also has a grip on the global supply chain for plant-based protein, which could give domestic startups an edge over foreign rivals.

“I believe, in five years, China will see a raft of domestic plant-based protein companies that could be on par with industry leaders from Europe and North America,” said Xie Zihan, who founded Vesta to develop soy-based meat suitable for Chinese cuisine.

Hey Maet’s imitation meat dumplings. Image Credits: Hey Maet

Lily Chen, a manager at the Chinese arm of alternative protein investor Lever VC, outlines three categories of meat analog companies in China: Western giants such as Beyond Meat and Eat Just; local players; and conglomerates such as Unilever and Nestlé that are developing vegan meat product lines as a defense strategy. Lever VC invested in Beyond Meat, Impossible Foods and Memphis Meats.

“They all have their product differentiation, but the industry is still very early stage,” said Chen.

Powered by WPeMatico

At the end of 2020, I argued that edtech needs to think bigger in order to stay relevant after the pandemic. I urged founders to think less about how to bundle and unbundle lecture experience, and more about how to replace outdated systems and methods with new, tech-powered solutions. In other words, don’t simply put engaging content on a screen, but innovate on what that screen looks like, tracks and offers.

A few months into 2021, the exit environment in edtech…feels like it’s doing exactly that. The same startups that hit billion and multi-billion valuations during the pandemic are scooping up new talent to broaden their service offerings.

Ruben Harris, the founder of Career Karma, a platform that matches aspiring coding professionals to bootcamps, put together a massive report recently with his team to talk about the pandemic’s impact on the bootcamp market.

James Gallagher, the author of the report, tells me:

It is important to note that the full potential of bootcamps has not yet been realised. We are now seeing more exploration of niches like technology sales which provide gateways into new careers in tech for people who otherwise may not have been able to acquire training. To scale such models, new businesses will need venture capital.

He went on to explain how a notable acquisition from 2020 was K12 scooping up Galvanize, “which would give K12 exposure into corporate training and the coding bootcamp space, a market outside of K12’s focus at the moment.”

To me this report signal two things: the financial interest in boot camps isn’t simply stemming from other bootcamps (although that is happening), but it’s surprising partnerships. Leaving this subsector, we see creative acquisitions such as a Roblox for edtech buying a language learning tool, and a startup known for flashcards scooping up a tech tutoring service.

Readers should know by this point that I love a nonobvious acquisition (except when this almost happened), so if you have any more tips on coming deals in edtech, please Signal me or direct message me on Twitter.

I’ll end with this: Successful startup founders are innately ambitious, finding opportunity in moonshots and convincing others that the odds are in their favor. However, the ceiling for what defines ambition heightens almost everyday. What used to be a win is now a nonnegotiable, and a feat is only a feat until your competitor hits the exact same milestone.

Acquisitions are one way to scoop up competition and synergistic talent, but it’s what happens next that matters the most.

In the rest of this newsletter, we will talk about Clubhouse competitors, how a homegrown experiment became one of the fastest growing companies in fitness tech and a cool-down in public markets (?!). As always, you can get this newsletter in your inbox each Saturday morning, so subscribe here to join the cool kids.

Remember when everyone was buzzing around about building Stories? That’s so pre-pandemic. A number of companies recently announced plans to build their own versions of Clubhouse, after the buzzy app unearthed the consumer love for audio.

Here’s what to know: It might be easier to start guessing who isn’t building a Clubhouse clone at this point. Our predictions are already starting, but jokes aside, the rise in clones could mean that Clubhouse might have to make a run for its pre-monetized money (cough, cough, Twitter spaces). It doesn’t matter if a startup is first in unlocking a key insight, all that matters is who executes that key insight the best.

Image Credits: Getty Images

Tonal, a fitness tech startup, became a unicorn this week after raising a new tranche of capital.

Here’s what to know: The new status underscores market growth for at-home fitness solutions. And while we don’t have a Tonal S-1 yet, we do have a Tonal EC-1. EC-1’s are TechCrunch’s riff on an S-1, and are essentially a deep dive into a company.

Reporter JP Mangalindan wrote thousands and thousands of words about Tonal, from its origin story to business model, its focus on communities and its biggest hurdles ahead.

Image Credits: Nigel Sussman

You’ve probably had a better week than Compass, Deliveroo and Kaltura. The three companies all had different events that illustrate a potential damper on the part that has been the public markets.

Here’s what to know: Compass cut its shares and lowered pricing of said shares, Deliveroo had a rough debut as a delivery company on the public markets, and Kaltura postponed its IPO after valuation demand didn’t hit expectations.

In other news, though:

Photo Taken In Arizona, United States. Image Credits: Jure Batagelj / 500px / Getty Images

Thanks to everyone who tuned in to TechCrunch Early Stage! If you enjoyed the event (or missed it), don’t worry: Disrupt is almost here.

Seen on TechCrunch

How startups can go passwordless, thanks to zero trust

Tips for founders thinking about doing a remote accelerator

US iPhone users spent an average of $138 on apps in 2020, will grow to $180 in 2021

Niantic CEO shares teaser image of AR glasses device

The Weeknd will sell an unreleased song and visual art via NFT auction

Seen on Extra Crunch

Embedded procurement will make every company its own marketplace

5 mistakes creators make building new games on Roblox

E-commerce roll-ups are the next wave of disruption in consumer packaged goods

How our SaaS startup improved net revenue retention by more than 30 points in two quarters

Powered by WPeMatico

For this morning’s column, Alex Wilhelm looked back on the last few months, “a busy season for technology exits” that followed a hot Q4 2020.

We’re seeing signs of an IPO market that may be cooling, but even so, “there are sufficient SPACs to take the entire recent Y Combinator class public,” he notes.

Once we factor in private equity firms with pockets full of money, it’s evident that late-stage companies have three solid choices for leveling up.

Seeking more insight into these liquidity options, Alex interviewed:

After recapping their deals, each executive explains how their company determined which flashing red “EXIT” sign to follow. As Alex observed, “choosing which option is best from a buffet’s worth of possibilities is an interesting task.”

Thanks very much for reading Extra Crunch! Have a great weekend.

Walter Thompson

Senior Editor, TechCrunch

@yourprotagonist

Full Extra Crunch articles are only available to members.

Use discount code ECFriday to save 20% off a one- or two-year subscription.

Image Credits: Nigel Sussman

On Tuesday, we published a four-part series on Tonal, a home fitness startup that has raised $200 million since it launched in 2018. The company’s patented hardware combines digital weights, coaching and AI in a wall-mounted system that sells for $2,995.

By any measure, it is poised for success — sales increased 800% between December 2019 and 2020, and by the end of this year, the company will have 60 retail locations. On Wednesday, Tonal reported a $250 million Series E that valued the company at $1.6 billion.

Our deep dive examines Tonal’s origins, product development timeline, its go-to-market strategy and other aspects that combined to spark investor interest and customer delight.

We call this format the “EC-1,” since these stories are as comprehensive and illuminating as the S-1 forms startups must file with the SEC before going public.

Here’s how the Tonal EC-1 breaks down:

We have more EC-1s in the works about other late-stage startups that are doing big things well and making news in the process.

Image Credits: Nigel Sussman (opens in a new window)

Why did Deliveroo struggle when it began to trade? Is it suffering from cultural dissonance between its high-growth model and more conservative European investors?

Let’s peek at the numbers and find out.

Image Credits: Nigel Sussman (opens in a new window)

The Exchange doubts many folks expected the IPO climate to get so chilly without warning. But we could be in for a Q2 pause in the formerly scorching climate for tech debuts.

Image Credits: Nigel Sussman (opens in a new window)

A $65 million Series B is remarkable, even by 2021 standards. But the fact that a16z is pouring more capital into the alt-media space is not a surprise.

Substack is a place where publications have bled some well-known talent, shifting the center of gravity in media. Let’s take a look at Substack’s historical growth.

Image Credits: Visual Generation / Getty Images

Robotic process automation came to the fore during the pandemic as companies took steps to digitally transform. When employees couldn’t be in the same office together, it became crucial to cobble together more automated workflows that required fewer people in the loop.

RPA has enabled executives to provide a level of automation that essentially buys them time to update systems to more modern approaches while reducing the large number of mundane manual tasks that are part of every industry’s workflow.

Image Credits: Javier Zayas Photography (opens in a new window) / Getty Images

This year is all about the roll-ups, the aggregation of smaller companies into larger firms, creating a potentially compelling path for equity value. The interest in creating value through e-commerce brands is particularly striking.

Just a year ago, digitally native brands had fallen out of favor with venture capitalists after so many failed to create venture-scale returns. So what’s the roll-up hype about?

Image Credits: TarikVision (opens in a new window) / Getty Images

The cyber world has entered a new era in which attacks are becoming more frequent and happening on a larger scale than ever before. Massive hacks affecting thousands of high-level American companies and agencies have dominated the news recently. Chief among these are the December SolarWinds/FireEye breach and the more recent Microsoft Exchange server breach.

Everyone wants to know: If you’ve been hit with the Exchange breach, what should you do?

Image Credits: David Malan (opens in a new window) / Getty Images

Machine learning has become the foundation of business and growth acceleration because of the incredible pace of change and development in this space.

But for engineering and team leaders without an ML background, this can also feel overwhelming and intimidating.

Here are best practices and must-know components broken down into five practical and easily applicable lessons.

Image Credits: Busakorn Pongparnit / Getty Images

Embedded procurement is the natural evolution of embedded fintech.

In this next wave, businesses will buy things they need through vertical B2B apps, rather than through sales reps, distributors or an individual merchant’s website.

Image Credits: twomeows / Getty Images

There’s a persistent fallacy swirling around that any startup growing pain or scaling problem can be solved with business development.

That’s frankly not true.

Image Credits: Bryce Durbin/TechCrunch

Dear Sophie:

I’m a founder of a startup on an E-2 investor visa and just got engaged! My soon-to-be spouse will sponsor me for a green card.

Are there any minimum salary requirements for her to sponsor me? Is there anything I should keep in mind before starting the green card process?

— Betrothed in Belmont

Image Credits: RichVintage / Getty Images

Many organizations perceive data management as being akin to data governance, where responsibilities are centered around establishing controls and audit procedures, and things are viewed from a defensive lens.

That defensiveness is admittedly justified, particularly given the potential financial and reputational damages caused by data mismanagement and leakage.

Nonetheless, there’s an element of myopia here, and being excessively cautious can prevent organizations from realizing the benefits of data-driven collaboration, particularly when it comes to software and product development.

Image Credits: Jetta Productions Inc (opens in a new window) / Getty Images

Cyber strategy and company strategy are inextricably linked. Consequently, chief information security officers in the C-suite will be just as common and influential as CFOs in maximizing shareholder value.

Image Credits: Tetra Images (opens in a new window) / Getty Images

Edtech unicorns have boatloads of cash to spend following the capital boost to the sector in 2020. As a result, edtech M&A activity has continued to swell.

The idea of a well-capitalized startup buying competitors to complement its core business is nothing new, but exits in this sector are notable because the money used to buy startups can be seen as an effect of the pandemic’s impact on remote education.

But in the past week, the consolidation environment made a clear statement: Pandemic-proven startups are scooping up talent — and fast.

Image Credits: Orbon Alija (opens in a new window)/ Getty Images

Knowledge transfer is not the only trend flowing in the U.S.-Asia-LatAm nexus. Competition is afoot as well.

Because of similar market conditions, Asian tech giants are directly expanding into Mexico and other LatAm countries.

Image Credits: Steven Puetzer (opens in a new window) / Getty Images

There’s certainly no shortage of SaaS performance metrics leaders focus on, but NRR (net revenue retention) is without question the most underrated metric out there.

NRR is simply total revenue minus any revenue churn plus any revenue expansion from upgrades, cross-sells or upsells. The greater the NRR, the quicker companies can scale.

Image Credits: SOPA Images (opens in a new window) / Getty Images

Even the most experienced and talented game designers from the mobile F2P business usually fail to understand what features matter to Robloxians.

For those just starting their journey in Roblox game development, these are the most common mistakes gaming professionals make on Roblox.

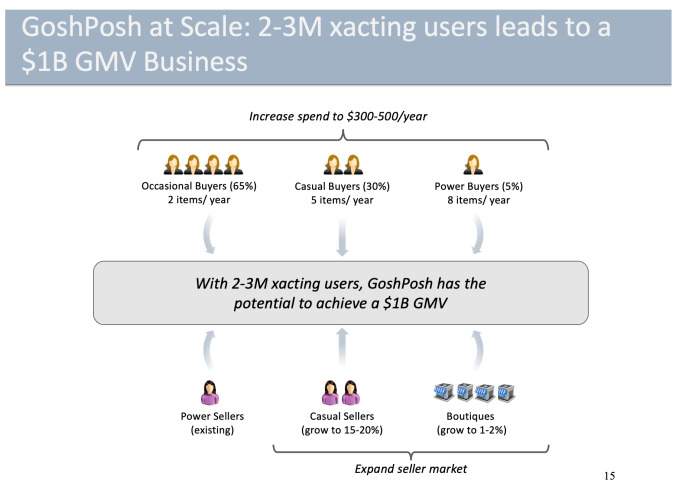

Image Credits: Poshmark

“Lead with love, and the money comes.” It’s one of the cornerstone values at Poshmark. On the latest episode of Extra Crunch Live, Chandra and Chaddha sat down with us and walked us through their original Series A pitch deck.

Image Credits: hopsalka (opens in a new window) / Getty Images

Cities are bustling hubs where people live, work and play. When the pandemic hit, some people fled major metropolitan markets for smaller towns — raising questions about the future validity of cities.

But those who predicted that COVID-19 would destroy major urban communities might want to stop shorting the resilience of these municipalities and start going long on what the post-pandemic future looks like.

Image Credits: Gearstd (opens in a new window) / Getty Images

There’s plenty of uncertainty surrounding copyright issues, fraud and adult content, and legal implications are the crux of the NFT trend.

Whether a court would protect the receipt-holder’s ownership over a given file depends on a variety of factors. All of these concerns mean artists may need to lawyer up.

Image Credits: Nigel Sussman (opens in a new window)

It’s a reasonable question: Why would anyone pay that much for Cazoo today if Carvana is more profitable and whatnot? Well, growth. That’s the argument anyway.

Powered by WPeMatico

Woody Sears has long been interested in storytelling. Following the debut in 2007 of the first iPhone, he founded a storytelling app called Zuuka that built up a library of narrated and illustrated kids’ books for the iPhone and iPad.

Sears later sold that company to a small New York-based outfit. But Sears, who is based in Santa Barbara, California, isn’t done with stories yet. Instead, he just raised $1.6 million in seed funding for his second and newest storytelling startup, HearHere, a subscription-based audio road-trip app that, with users’ permission, pushes information to them as they’re driving, giving them informational tidbits in three- to five-minute segments about their surroundings, including points of interest they might not have been aware of at all.

The idea is to surface the unknown or forgotten history of regions, which makes sense in a world where more people have returned to road trips and parents have grown desperate to pull their kids’ attention away from TikTok. In fact, Sears’s neighbor, Kevin Costner, liked the idea so much that he recently joined its five-person team as a co-founder and narrator and investor, along with Snap Inc., the law firm Cooley, Camping World CEO and reality TV star Marcus Lemonis, AAA and numerous other individual investors, including from NextGen Venture Partners.

Because we, too, like history and road trips (and okay, fine, Kevin Costner), we talked with Sears and Costner earlier today to learn why they think they’ll succeed with HearHere when other content-rich geo-location based apps have fallen short of meaningful adoption.

Excerpts from that chat follow, edited lightly for length.

TC: You’re creating an audio map of the U.S., so how many stories do you have banked as we speak?

WS: We’re up to 5,500 stories across 22 states, and we’ll be nationwide by summer. The mission is to connect people to the places that they’re traveling through, lending people stories about the history, the natural wonders and the colorful characters who’ve lived in that area. We also do stories about sports and music and provide local insights.

TC: That’s a lot of content to gather up, edit down, then record. What does the process look like?

WS: At the end of the day, the content is king, and we take great care with these stories, producing them with a team of 22 researchers, writers, editors and narrators, most whom come from a travel journalism background. We really feel like we get the best end result through that team approach.

Eventually, we’ll open up to third-party content contributors, where we’re hosting both professional content and also user-generated content.

TC: Is there an AI component or will there be?

WS: We more see this as augmented reality in that these stories really do overlay the landscape and give you a different perspective while traveling. But AI and machine learning are things that we’ll incorporate as we start to move into foreign languages and better tailor the content for the end user.

TC: How do you prioritize which stories to tell as you’re building up this content library?

WS: The major historical markers are a big inspiration, but we’re looking for those lesser-known gems, too, and we look at travel patterns — the way that people move when they’re on leisure trips, meaning what interstate highways they’re taking and which scenic routes are most popular.

TC: How does the subscription piece work?

WS: You get five free free stories each month; for unlimited streaming, it’s $35.99 per year.

TC: Kevin, you must be approached a lot with startup ideas and investment opportunities. Why get so involved with this one?

KC: Obviously I’m story-oriented; that doesn’t come as a shock to anybody. But you’re right, a lot of ideas come to me.

HearHere came through my wife, who said that Woody had something he wanted to talk about, and as she explained it to me, I got it, you know? That’s the shiny thing for me, storytelling and having the ability for a good story to come out, especially when it comes to our country.

So we had this meeting and he explained the concept to me, which is kind of equal to what I’d already been doing my whole life, which is stopping at the bronze plaques all over the country and reading about their historical significance — those [moments] that kind of interrupt everybody’s trip except mine. [Laughs.] You know, [it’s] getting out and stretching my legs and reading a little history and dreaming while the rest of the people in the car are kind of moaning because we stopped our progress.

This [product] is an extension of that for me, without getting out of the car, and with stories that can evolve and perhaps get longer. And I can become more involved in what I was driving past and the people in the car can maybe sense what it was that interested me enough to stop.

Image Credits: Hearhere

TC: You love history.

KC: HearHere is a lot more than history, but for me, it was the history [that I found so compelling]. And it’s how the foundation was set for me to become more involved in the company and understand it a lot better and then become somebody who wanted to be a part of the founding of it.

TC: AAA and Camping World are among the company’s strategic investors. How might they promote the app and what other partnerships have you struck to get HearHere in front of people at the right time?

WS: Camping World also owns Good Sam Club, which is the largest organization of RV owners in the world, and AAA is a giant with 57 million members in the U.S., and they all see this as a way to fulfill something they’re aren’t currently doing for their audience; it’s making that bridge to digital, and we’re really excited to get this in front of their members and customers.

We also have partnerships with [the RV marketplaces] Outdoorsy and RVshare [and the RV rental and sales company] Cruise America. It’s a very hot market.

TC: There have been similar ideas. Caterina Fake’s Findery was an early app that aimed to help users discover much more about locations. Detour, a startup that provided walking audio tours of cities that was founded by Groupon co-founder Andrew Mason, seemed interesting but failed to take off with users. What makes you think this startup will click?

WS: I loved Detour. I ate up both of those.

I guess where I think [Detour] missed product-market fit was the number of scenarios where you could use it and also, it was competing for people’s time. We chose to start with road trips because you have a captive audience; there’s only so much you can do when you’re driving in the car, unlike when you’re in a city, where there are all kinds of options to explore its history, including physical books and tour guides. You also had to carve out two hours of your time, and it’s easy to get distracted while you’re walking around.

We want to capture the places that are along the journey and lesser known and more untold and where people have the space to engage in it. Starting as short form helps. It’s also on-demand, so you don’t have to follow a pre-designated route. We’re not taking you on a specific tour, where you have to turn left or turn right. We’re going to surface stories for you no matter what route you take.

Powered by WPeMatico

When UIPath filed its S-1 last week, it was a watershed moment for the robotic process automation (RPA) market. The company, which first appeared on our radar for a $30 million Series A in 2017, has so far raised an astonishing $2 billion while still private. In February, it was valued at $35 billion when it raised $750 million in its latest round.

RPA and process automation came to the fore during the pandemic as companies took steps to digitally transform. When employees couldn’t be in the same office together, it became crucial to cobble together more automated workflows that required fewer people in the loop.

RPA has enabled executives to provide a level of workflow automation that essentially buys them time to update systems to more modern approaches while reducing the large number of mundane manual tasks that are part of every industry’s workflow.

When UIPath raised money in 2017, RPA was not well known in enterprise software circles even though it had already been around for several years. The category was gaining in popularity by that point because it addressed automation in a legacy context. That meant companies with deep legacy technology — practically everyone not born in the cloud — could automate across older platforms without ripping and replacing, an expensive and risky undertaking that most CEOs would rather not take.

RPA has enabled executives to provide a level of workflow automation, a taste of the modern. It essentially buys them time to update systems to more modern approaches while reducing the large number of mundane manual tasks that are part of just about every industry’s workflow.

While some people point to RPA as job-elimination software, it also provides a way to liberate people from some of the most mind-numbing and mundane chores in the organization. The argument goes that this frees up employees for higher level tasks.

As an example, RPA could take advantage of older workflow technologies like OCR (optical character recognition) to read a number from a form, enter the data in a spreadsheet, generate an invoice, send it for printing and mailing, and generate a Slack message to the accounting department that the task has been completed.

We’re going to take a deep dive into RPA and the larger process automation space — explore the market size and dynamics, look at the key players and the biggest investors, and finally, try to chart out where this market might go in the future.

UIPath is clearly an RPA star with a significant market share lead of 27.1%, according to IDC. Automation Anywhere is in second place with 19.4%, and Blue Prism is third with 10.3%, based on data from IDC’s July 2020 report, the last time the firm reported on the market.

Two other players with significant market share worth mentioning are WorkFusion with 6.8%, and NTT with 5%.

Powered by WPeMatico

Mike Barile spent two years and racked up nearly $20,000 in credit card debt to bring his first startup, Backflip, to life.

The former management consultant had spent years toiling in the startup grind, first at Uber, then, after taking a coding academy bootcamp through AppAcademy (where Barile met his co-founder, Adam Foosaner), at Google and at a failed cryptocurrency startup.

Burned by the crypto experience, Barile was casting about for his next thing, and trying to find a way to scrape up some rent money, when he hit on the idea for Backflip. The experience of selling electronics online was still shady and Barile and Foosaner thought there had to be a better way.

That way became Backflip. It offers customers cash on delivery for their used electronics — anything from Androids to Xboxes and Apple devices to Game Boys.

“When I first started working on backflip back in March 2019, I met this kid named Chris and he wanted to buy some of my old iPhones. He had been a student at USF and as a side hustle he started buying used devices and would refurbish them and then either sell them himself or sell them to an official reseller,” said Barile. “Chris started making so much money he dropped out of school. That was a ‘holy shit’ moment. He can make a lot of money doing this and he’s doing a really good thing.”

The problem, said Barile, was safety. “He’s got all these devices he’s acquiring paying cash for and he’s driving all around town… Everyone who works in the [refurbish and resell] industry has at least one story about getting robbed at gunpoint.”

Backflip solved that problem by being the intermediary between buyers and sellers and taking a small commission for managing the transaction.

The company raised its first money at the end of 2019, but before that, Foosaner and Barile lived off of credit and used electronics.

So far, Backflip has facilitated the exchange of roughly 3,000 devices. The company handles everything from wiping a device and ensuring its quality to finding a buyer for the electronics. The company pays out roughly $150 per device and has deposited a little over $500,000 with users of the service, according to data provided by the company.

“We did all sorts of stuff to get our first few users,” said Barile. We posted ads on Facebook Marketplace and Craigslist. We started experimenting at the end of the summer with the most bare-bones mobile app kind of thing. At that point it was just Adam and I,” Barile said.

Starting now, Backflip is working with UPS stores to provide in-person drop-off and packaging centers for the used electronics. Over time, Barile sees those services expanding to offer cash on delivery. “The experience will be similar to an Amazon return,” he said. “Except we’ll be paying you.”

Currently about half of the company’s inventory is used handsets and mobile devices, but Barile said that could drop to a third of inventory as word spreads about the hundred-odd pieces of electronics that Backflip is willing to accept.

“Unlike other resale options, Backflip prioritizes the user’s time and convenience,” said Foosaner in a statement. “Forget the back-and-forth of negotiating over price and scheduling a meetup. We’re here to do all the work for the seller and make sure they get paid fairly and quickly. Backflip users can know that they’re getting the most for their devices without having to do anything other than bring them to The UPS Store or box them up at home.”

The connection to the refurbishing community started early for Barile, whose mother had a side business called “Stone Cottage Workshop” where she was flipping refurbished furniture on eBay and at local thrift stores near Barile’s bucolic New Jersey hometown.

“We want to build the Amazon of making things disappear from your apartment,” Barile said.

Powered by WPeMatico

By now, all companies are fundamentally data driven. This is true regardless of whether they operate in the tech space. Therefore, it makes sense to examine the role data management plays in bolstering — and, for that matter, hampering — productivity and collaboration within organizations.

While the term “data management” inevitably conjures up mental images of vast server farms, the basic tenets predate the computer age. From censuses and elections to the dawn of banking, individuals and organizations have long grappled with the acquisition and analysis of data.

By understanding the needs of all stakeholders, organizations can start to figure out how to remove blockages.

One oft-quoted example is Florence Nightingale, a British nurse who, during the Crimean war, recorded and visualized patient records to highlight the dismal conditions in frontline hospitals. Over a century later, Nightingale is regarded not just as a humanitarian, but also as one of the world’s first data scientists.

As technology began to play a greater role, and the size of data sets began to swell, data management ultimately became codified in a number of formal roles, with names like “database analyst” and “chief data officer.” New challenges followed that formalization, particularly from the regulatory side of things, as legislators introduced tough new data protection rules — most notably the EU’s GDPR legislation.

This inevitably led many organizations to perceive data management as being akin to data governance, where responsibilities are centered around establishing controls and audit procedures, and things are viewed from a defensive lens.

That defensiveness is admittedly justified, particularly given the potential financial and reputational damages caused by data mismanagement and leakage. Nonetheless, there’s an element of myopia here, and being excessively cautious can prevent organizations from realizing the benefits of data-driven collaboration, particularly when it comes to software and product development.

Data defensiveness manifests itself in bureaucracy. You start creating roles like “data steward” and “data custodian” to handle internal requests. A “governance council” sits above them, whose members issue diktats and establish operating procedures — while not actually working in the trenches. Before long, blockages emerge.

Blockages are never good for business. The first sign of trouble comes in the form of “data breadlines.” Employees seeking crucial data find themselves having to make their case to whoever is responsible. Time gets wasted.

By itself, this is catastrophic. But the cultural impact is much worse. People are natural problem-solvers. That’s doubly true for software engineers. So, they start figuring out how to circumvent established procedures, hoarding data in their own “silos.” Collaboration falters. Inconsistencies creep in as teams inevitably find themselves working from different versions of the same data set.

Powered by WPeMatico

The Exchange just yesterday discussed a downward revision in the impending Compass IPO and the disappointing Deliveroo flotation as signals that market demand for high-growth, unprofitable tech shares could be slipping. Recent news underscores the possibly chilling conditions. This morning, Kaltura, a technology company that provides video streaming software and services, delayed its IPO. JioForMe reports that the postponement comes after Kaltura’s “valuation demand was lower than expected.”

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

TechCrunch noted yesterday that Kaltura had not released a second, higher IPO price range. The fact stood out given how hot the public markets had proven in recent months for new tech offerings. Kaltura’s S-1 filing detailed accelerating revenue growth, which at the time we thought would be more than enough to fetch the company an attractive initial public valuation.

It appears that Kaltura was also surprised that it was not trending toward a higher IPO price.

In another sign of how quickly the temperature for new tech flotations may have chilled, digital comms firm Intermedia Cloud Communications also delayed its IPO today. In a release, CEO Michael Gold said the decision is due “to challenging current conditions in the market for initial public offerings, especially for technology companies.”

In another sign of how quickly the temperature for new tech flotations may have chilled, digital comms firm Intermedia Cloud Communications also delayed its IPO today. In a release, CEO Michael Gold said the decision is due “to challenging current conditions in the market for initial public offerings, especially for technology companies.”

Challenging current conditions? For IPOs? For tech IPOs? That’s new.

Axios reporter Dan Primack noted this morning that SPAC formation appears to be slowing. Mix that into the delays and yesterday’s anemic-to-awful IPO news, and the market could be seeing a somewhat rapid retrenchment toward more historical valuations and demand levels for unprofitable equities.

Thinking out loud: We should expect SPAC formation and deal volume to fall the fastest of all the signals we’re tracking, including IPO pricing, the pace of S-1 filings and first-day trading performance. Why? Because it’s the most exotic of the various data points we’ve observed on the way up during the tech boom. Therefore, it should also be the thing most vulnerable to rising financial gravity.

Powered by WPeMatico