TC

Auto Added by WPeMatico

Auto Added by WPeMatico

E-commerce is booming, but among the biggest challenges for entrepreneurs of online businesses are finding a place to store the items they are selling and dealing with the logistics of operating.

Tyler Scriven, Maxwell Bonnie and Paul D’Arrigo co-founded Saltbox in an effort to solve that problem.

The trio came up with a unique “co-warehousing” model that provides space for small businesses and e-commerce merchants to operate as well as store and ship goods, all under one roof. Beyond the physical offering, Saltbox offers integrated logistics services as well as amenities such as the rental of equipment and packing stations and access to items such as forklifts. There are no leases and tenants have the flexibility to scale up or down based on their needs.

“We’re in that sweet spot between co-working and raw warehouse space,” said CEO Scriven, a former Palantir executive and Techstars managing director.

Saltbox opened its first facility — a 27,000-square-foot location — in its home base of Atlanta in late 2019, filling it within two months. It recently opened its second facility, a 66,000-square-foot location, in the Dallas-Fort Worth area that is currently about 40% occupied. The company plans to end 2021 with eight locations, in particular eyeing the Denver, Seattle and Los Angeles markets. Saltbox has locations slated to come online as large as 110,000 square feet, according to Scriven.

The startup was founded on the premise that the need for “co-warehousing and SMB-centric logistics enablement solutions” has become a major problem for many new businesses that rely on online retail platforms to sell their goods, noted Scriven. Many of those companies are limited to self-storage and mini-warehouse facilities for storing their inventory, which can be expensive and inconvenient.

Scriven personally met with challenges when starting his own e-commerce business, True Glory Brands, a retailer of multicultural hair and beauty products.

“We became aware of the lack of physical workspace for SMBs engaged in commerce,” Scriven told TechCrunch. “If you are in the market looking for 10,000 square feet of industrial warehouse space, you are effectively pushed to the fringes of the real estate ecosystem and then the entrepreneurial ecosystem at large. This is costing companies in significant but untold ways.”

Now, Saltbox has completed a $10.6 million Series A round of financing led by Palo Alto-based Playground Global that included participation from XYZ Venture Capital and proptech-focused Wilshire Lane Partners in addition to existing backers Village Global and MetaProp. The company plans to use its new capital primarily to expand into new markets.

The company’s customers are typically SMB e-commerce merchants “generating anywhere from $50,000 to $10 million a year in revenue,” according to Scriven.

He emphasizes that the company’s value prop is “quite different” from a traditional flex office/co-working space.

“Our members are reliant upon us to support critical workflows,” Scriven said.

Besides e-commerce occupants, many service-based businesses are users of Saltbox’s offering, he said, such as those providing janitorial services or that need space for physical equipment. The company offers all-inclusive pricing models that include access to loading docks and a photography studio, for example, in addition to utilities and Wi-Fi.

Image Credits: Saltbox

Image Credits: Saltbox

The company secures its properties with a mix of buying and leasing by partnering with institutional real estate investors.

“These partners are acquiring assets and in most cases, are funding the entirety of capital improvements by entering into management or revenue share agreements to operate those properties,” Scriven said. He said the model is intentionally different from that of “notable flex space operators.”

“We have obviously followed those stories very closely and done our best to learn from their experiences,” he added.

Investor Adam Demuyakor, co-founder and managing partner of Wilshire Lane Partners, said his firm was impressed with the company’s ability to “structure excellent real estate deals” to help them continue to expand nationally.

He also believes Saltbox is “extremely well-positioned to help power and enable the next generation of great direct to consumer brands.”

Playground Global General Partner Laurie Yoler said the startup provides a “purpose-built alternative” for small businesses that have been fulfilling orders out of garages and self-storage units.

Saltbox recently hired Zubin Canteenwalla to serve as its chief operating officer. He joined Saltbox from Industrious, an operator co-working spaces, where he was SVP of Real Estate. Prior to Industrious, he was EVP of Operations at Common, a flexible residential living brand, where he led the property management and community engagement teams.

Powered by WPeMatico

Four years ago, MasterClass, a platform that sells celebrity-taught classes, invited chess legend Garry Kasparov to teach a class. He said yes, but soon realized that creating a message that could satisfy a majority of players was a “struggle throughout the process.”

While the class did pretty well, Kasparov found it “a little bit annoying” that he had to downplay concepts and stick to a specific structure. So, now, Kasparov is launching a platform he says has been several years in the making: Kasparovchess.

Kasparovchess will be a platform in which legendary chess players will have free reign to share tips and tricks with players from various levels. Financed by private investors, and media conglomerate Vivendi, the company declined to disclose its total capital raised to date.

The platform, produced by Vivendi, includes documentaries, podcasts, articles and interviews between experts and known players in the chess community. Moe than 1,000 videos have been recorded to date, Kasparov said. Beyond content, Kasparovchess will have an exclusive Discord server attached to it and playing zones.

In many ways, it’s a vertical-specific version of the chess MasterClass he did years ago, with a big focus on community and variety. MasterClass, which is reportedly raising funding that would value it at $2.5 billion, has been a leader in the “edutainment” space, which monetizes off of documentary-style entertainment. One of the unicorn’s biggest characteristics, as Kasparov alluded to earlier, is that it has to appeal to a wide audience so subscribers can hop from one class to another. Within the same month, a user could go from a Kasparovchess class to general pontifications from RuPaul on self expression. The more classes that MasterClass can get you to take, the longer you’ll keep your subscription.

Image Credits: Kasparovchess

MasterClass might consider its broad view as a differentiator, but it’s clear that Kasparov views it as an opportunity.

Kasparovchess has a monthly or yearly subscription of $13.99 or $119.99, respectively. The majority of lessons from experts and retrospective analysis on games you’ve played sit behind the paywall. The premium product also grants users access to a database of 50,000 manually created puzzles that allows players to train certain skills. The product will be available to the public by the end of month.

A popular competitor already exists: Chess.com. It’s a chess server, forum and networking site that launched in 2005, with premium subscription that ranges between $5 a month or $29 a year. Kasparovchess is significantly more expensive.

Kasparov says his biggest differentiator will be a focus on community. The long-term goal of Kasparovchess is to connect global chess communities with each other, unearth prodigies that might not have access otherwise and give others access to his experiences. He thinks that remote education during the pandemic has shown the need to have more interactive solutions, beyond buzzy promises.

“It’s time to actually switch from what we’re teaching to how students can apply it,” he said. “And that helps us indirectly because chess has been recognized for centuries as a nexus for intelligence and creativity.”

Kasparov became the youngest world chess champion in 1985. He retired from public chess in 2005, and has since launched a foundation to help children have access to chess worldwide. Most recently, he helped advise for “Queen’s Gambit,” a show about a chess prodigy that became Netflix’s most-watched scripted limited series to date on the platform. The show was so ubiquitously popular that sales for chess boards soon skyrocketed.

“I was so happy because it was the first time where we could see chess as a positive factor,” he said. “We had so many years with chess being seen as potential destruction and something that could push kids to the dark area of psychological instability.”

The freshness of this message mixed with an uptick in remote education has given Kasparov confidence that his years-long project is finally ready to launch.

“It’s not just about teaching the game, or playing the game, or debating the game,” he said. Instead, he hopes people who come to the platform focus on the culture of chess, its survival and its seemingly timeless power.

Powered by WPeMatico

As companies create machine learning models, the operations team needs to ensure the data used for the model is of sufficient quality, a process that can be time-consuming. Bigeye (formerly Toro), an early-stage startup is helping by automating data quality.

Today the company announced a $17 million Series A led Sequoia Capital with participation from existing investor Costanoa Ventures. That brings the total raised to $21 million with the $4 million seed, the startup raised last May.

When we spoke to Bigeye CEO and co-founder Kyle Kirwan last May, he said the seed round was going to be focused on hiring a team — they are 11 now — and building more automation into the product, and he says they have achieved that goal.

“The product can now automatically tell users what data quality metrics they should collect from their data, so they can point us at a table in Snowflake or Amazon Redshift or whatever and we can analyze that table and recommend the metrics that they should collect from it to monitor the data quality — and we also automated the alerting,” Kirwan explained.

He says that the company is focusing on data operations issues when it comes to inputs to the model, such as the table isn’t updating when it’s supposed to, it’s missing rows or there are duplicate entries. They can automate alerts to those kinds of issues and speed up the process of getting model data ready for training and production.

Bogomil Balkansky, the partner at Sequoia who is leading today’s investment, sees the company attacking an important part of the machine learning pipeline. “Having spearheaded the data quality team at Uber, Kyle and Egor have a clear vision to provide always-on insight into the quality of data to all businesses,” Balkansky said in a statement.

As the founding team begins building the company, Kirwan says that building a diverse team is a key goal for them and something they are keenly aware of.

“It’s easy to hire a lot of other people that fit a certain mold, and we want to be really careful that we’re doing the extra work to [understand that just because] it’s easy to source people within our network, we need to push and make sure that we’re hiring a team that has different backgrounds and different viewpoints and different types of people on it because that’s how we’re going to build the strongest team,” he said.

Bigeye offers on-prem and SaaS solutions, and while it’s working with paying customers like Instacart, Crux Informatics and Lambda School, the product won’t be generally available until later in the year.

Powered by WPeMatico

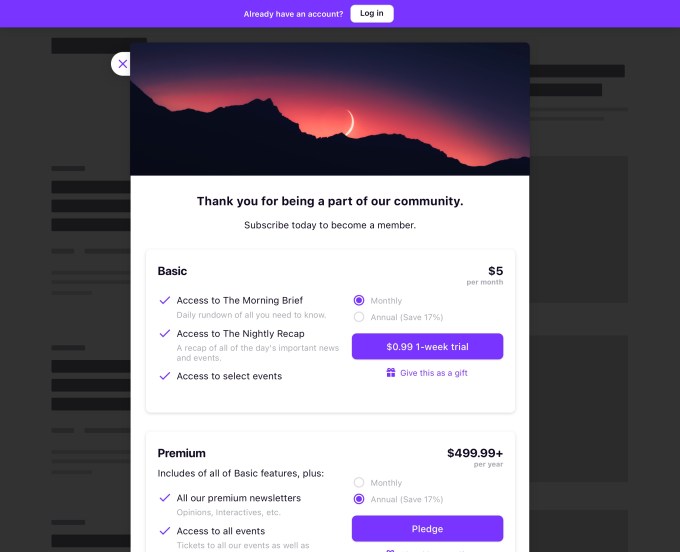

Pico, a New York startup that helps online creators and media companies make money and manage their customer data, announced today that it has launched an upgraded platform and raised $6.5 million in new funding.

In a statement, the startup’s co-founder and CEO Nick Chen said Pico helps creators with their two biggest problems — “how to make money more easily and how to get to know your audience better” — while also giving them control over their two most important assets, namely “your brand and the relationship to your audience.”

The company provides a long list of different tools, including landing pages, pop-ups to collect email addresses, paid newsletters, subscription paywalls, tiered membership programs, recurring and one-time donations and video revenue tools. With version 2.0, the company says it’s bringing all these features together with a unified data structure, so that customers can see “who is paying for what content and where they came from” in one dashboard.

Via email, co-founder and President Jason Bade (pictured above with Chen) pointed to “the power of our CRM to help creators understand their audience” as the most significant upgrade, suggesting that this “makes Pico the operating system for the creator economy.”

Image Credits: Pico

“A creator can’t scale a business without the proper tools,” Bade continued. “Take email capture, that is the first step in audience development. But what next? You need data and a CRM to handle it. 2.0 upgrades every part of Pico to rearchitect it for the scalability and extensibility that the creator economy demands.”

Pico also said it will be launching an API soon to support integrations with different parts of the platform.

Apparently, the company has seen its customer count increase nearly 5x in the past year, with customers including The Colorado Sun, Defector Media and The Generalist. And it recently recruited Rodolphe Ködderitzsch (who held a number of roles at YouTube, including global head of partner sales) as its chief revenue officer.

The new funding was led by Ann Lai at Bullpen Capital and brings Pico’s total funding to $10 million. Other investors include Precursor Ventures, Stripe, BloombergBeta and Village Global.

Powered by WPeMatico

Dell announced this afternoon that it’s spinning out VMware, a move that has been suspected for some time. Dell acquired VMware as part of the massive $58 billion EMC acquisition (announced as $67 billion) in 2015.

The way that the deal works is that Dell plans to offer VMware shareholders a special dividend of between $11.5 and $12 billion. As Dell owns approximately 81% of those shares that would work out to somewhere between $9.3 and $9.7 billion coming into Dell’s coffers when the deal closes later this year.

“By spinning off VMware, we expect to drive additional growth opportunities for Dell Technologies as well as VMware, and unlock significant value for stakeholders. Both companies will remain important partners, with a differentiated advantage in how we bring solutions to customers,” Dell CEO Michael Dell said in a statement.

While there is a fair amount of CEO speak in that statement, it appears to mean that the move is mostly administrative as the companies will continue to work closely together, even after the spin-off is official. Dell will remain as chairman of both companies.

In a presentation to investors, the companies indicated that the plan to work together is more than lip service. There is a five-year deal commercial agreement in place with plans to revisit that deal each year thereafter. In addition, there is a plan to sell VMware products through the Dell sales team and for VMware to continue to work with Dell Financial Services. Finally, there is a formalized governance process in place related to achieving the commercial goals under the agreement, so it’s pretty firm that these companies will continue to work closely together at least for another five years.

For its part, VMware said in a separate release that the deal will allow it “increased freedom to execute its strategy, a simplified capital structure and governance model and additional strategic, operational and financial flexibility, while maintaining the strength of the two companies’ strategic partnership.”

Dell shares are up more than 8% following the announcement. The company intends on using parts of its proceeds to deleverage, writing in a release that it will use “net proceeds to pay down debt, positioning the company well for Investment Grade ratings.” By that it means that Dell will reduce its net debt position and, it hopes, garner a stronger credit rating that will limit its future borrowing costs.

Even when it was part of EMC, VMware had a special status in that it operates as a separate entity with its own executive team and board of directors, and the stock has been sold separately as well.

The deal is expected to close at the end of this year, but it has to clear a number of regulatory hurdles first. That includes garnering a favorable ruling from the IRS that the deal qualifies for a tax-free spin-off, which could prove to be a considerable hurdle for a deal like this.

The transaction is not a surprise. The company has been open about its intention to shake up its broader corporate structure. And with Dell bloated in debt terms and, perhaps, in product scope as well, the VMware deal could be an intelligent way forward. Dell investors are more excited about the transaction than VMware shareholders, with the latter company’s stock is up a more modest 1.4%.

VMware’s most recent earnings release notes that it had $4.715 billion in “total cash, cash equivalents and short-term investments.” Perhaps its shareholders aren’t enthused at the prospect of levering VMware’s balance sheet to help Dell do the opposite.

Powered by WPeMatico

A few years ago, founder Sean Lane thought he’d achieved product-market fit.

Speaking to attendees at TechCrunch’s Early Stage virtual event, Lane said Queue, a secure digital check-in tablet for hospital waiting rooms that reduced wait times by uniting and correcting electronic medical records, was “selling like hotcakes.” But once Lane realized it would only ever address one piece of a much bigger market opportunity, he sold off the product, laid off two-thirds of the people affiliated with it and redirected the employees who were left.

Lane explained that what he really wanted to build is what his company — since renamed Olive — has now become, a robotic process automation (RPA) company that takes on hospital workers’ most tedious tasks so nurses and physicians can spend more time with patients.

Customers seem to like it. According to Lane, more than 600 hospitals use the service to assist employees with tasks like prior authorizations and patient verifications.

Investors clearly approve of what Olive is selling, too: Last year, the company raised three rounds of funding totaling roughly $380 million and valuing the company at $1.5 billion. According to Crunchbase, it’s raised a total of $456 million altogether.

In fact, VCs think so much of Lane that in February, they invested $50 million in another company that Lane runs simultaneously called Circulo, a startup that describes itself as building the “Medicaid insurance company of the future.”

Still, the path from point A to B was painful, and it might not have happened if Lane didn’t have a few things going for him, including a deeply personal reason to build something that could have greater impact on the U.S. healthcare system.

Powered by WPeMatico

Few people are more knowledgable on the topic of how founders should manage their finances than Alexa von Tobel. She is a certified financial planner, started her own company in the midst of the recession (which happened to be a wildly successful personal finance startup that sold for hundreds of millions of dollars) and is now a VC who invests and advises founders.

At Early Stage 2021, she gave a presentation on how founders should think about managing their own wealth. Startup founders can often put all their money into their venture and end up paying more attention to the finances of their company than their own bank account.

Von Tobel outlined the various steps you can take to stay out of debt, build credit and accumulate wealth through investments to ensure you have financial peace of mind as you take on the most stressful venture of your life: Starting a company.

The first step in getting organized and being proactive is often taking inventory. Von Tobel believes that knowing your numbers and getting organized digitally is the first step to having financial peace of mind.

Know all your numbers. Know your net worth. What are your assets? What’s your debt? What does your total financial picture look like? Get everything online. You should have all the mobile apps downloaded so that, in minutes, you can actually see your full financial life. And keep it simple. Fewer accounts are better. I always tell people, if you have seven credit cards, plus three savings accounts, that’s a lot. You’re never going to be as good at managing your finances. Simplify your accounts. (Time stamp — 2:50)

Powered by WPeMatico

Today shares of Coinbase began to trade after the company executed a direct listing. From a reference price of $250, Coinbase shares opened at $381 today, a change of around 52%. At its open Coinbase was valued at $99.6 billion on a fully diluted basis. As of the time of writing Coinbase has appreciated further to just over $400 per share, valuing the company at a touch more than $104 billion.

Coinbase was worth $65.3 billion at its reference price, on a fully diluted basis.

Coinbase’s debut has been hotly anticipated, thanks to its position inside the greater crypto economy and, from a purely startup perspective, its huge value unlock. Private investors poured capital into the company during its life as a private company, valuing it as high as $8 billion.

The company’s new valuation dwarfs that prior figure, implying strong returns for its long-term backers. Today even regular folks could get a scratch at the company’s equity, and they were willing to pay up for the privilege. TechCrunch asked its audience about the debut, pre-trading results that served as an anti-indicator of where the crypto-unicorn’s shares would trade:

For Coinbase the road ahead is interesting. The company is richly capitalized and posted monster profits in its most recent quarter. However, Coinbase has yet to chart a future sufficiently delinked from the impacts of cryptocurrency price levels and resulting trading volume to be immune to a potential setback in growth and income if the value of bitcoin, et al. dropped.

But for crypto believers, watching Coinbase list is a win; it is ironic that a traditional company listing on an old-fashioned exchange is a key moment for the crypto economy, but most things come in steps. Perhaps the next major crypto company trading debut will be on a decentralized exchange.

Powered by WPeMatico

A few weeks ago, we wrote about fintech Pilot raising a $100 million Series C that doubled the company’s valuation to $1.2 billion.

Bezos Expeditions — Amazon founder Jeff Bezos’ personal investment fund — and Whale Rock Capital joined the round, adding $40 million to a $60 million raise led by Sequoia about one month prior.

That raise came after a $40 million Series B in April 2019 co-led by Stripe and Index Ventures that valued the company at $355 million.

Both raises were notable and warranted coverage. But sometimes it’s fun to take a peek at the stories behind the raises and dig deeper into the numbers.

So here we go.

First off, San Francisco-based Pilot — which has a mission of affordably providing back-office services such as bookkeeping to startups and SMBs — apparently had term sheets that offered “2x the $40M” raised in its Series B. But it chose not to raise so much capital.

I also heard that the same investor that ended up leading a now defunct competitor’s $60 million raise first asked to invest $60 million in Pilot as a follow-on to that Series B prior to making the other investment. While I don’t know for sure, I can only presume that what is being referred to is ScaleFactor’s $60 million Series C raise in August 2019 that was led by Coatue Management. (ScaleFactor crashed and burned last year.)

According to CFO Paul Jun: “There were many periods when Pilot turned away new customers and growth capital instead of absolutely maximizing short-term growth…Pilot prioritized building the foundational investments needed for scalability, reliability and high velocity. When it was presented with the opportunity for additional funding towards further growth in 2019, it declined to do so.”

Co-founder and CEO Waseem Daher elaborates, pointing out that the first company that Pilot’s founding team ran, Ksplice, was bootstrapped before getting acquired by Oracle in 2011. (It’s also worth noting that the founding team are all MIT computer scientists.)

“Ultimately, the reason to raise money is you believe that you can deploy the capital, to grow the company or to basically cause the company to grow at the rate you’d like to grow. And it doesn’t make sense to raise money if you don’t need it, or don’t have a good plan for what to do with it,” Daher told TechCrunch. “Too much capital can be bad because it sort of leads you to bad habits…When you have the money, you spend the money.”

So despite what he describes as “a great deal of institutional interest” in 2019, Pilot opted to raise just $40 million, instead of $80 million to $100 million, because it was the amount of capital the company had confidence that it could deploy successfully.

Also, Jun shared some numbers beyond the recent raise amount and valuation.

Bottom line is companies don’t have to accept all the capital that’s offered to them. And maybe in some cases, they shouldn’t.

Powered by WPeMatico

School closures due to the pandemic have interrupted the learning processes of millions of kids, and without individual attention from teachers, reading skills in particular are taking a hit. Amira Learning aims to address this with an app that reads along with students, intelligently correcting errors in real time. Promising pilots and research mean the company is poised to go big as education changes, and it has raised $11 million to scale up with a new app and growing customer base.

In classrooms, a common exercise is to have students read aloud from a storybook or worksheet. The teacher listens carefully, stopping and correcting students on difficult words. This “guided reading” process is fundamental for both instruction and assessment: It not only helps the kids learn, but the teacher can break the class up into groups with similar reading levels so she can offer tailored lessons.

“Guided reading is needs-based, differentiated instruction and in COVID we couldn’t do it,” said Andrea Burkiett, director of Elementary Curriculum and Instruction at the Savannah-Chatham County Public School System. Breakout sessions are technically possible, “but when you’re talking about a kindergarten student who doesn’t even know how to use a mouse or touchpad, COVID basically made small groups nonexistent.”

Amira replicates the guided reading process by analyzing the child’s speech as they read through a story and identifying things like mispronunciations, skipped words and other common stumbles. It’s based on research going back 20 years that has tested whether learners using such an automated system actually see any gains (and they did, though generally in a lab setting).

In fact I was speaking to Burkiett out of skepticism — “AI” products are thick on the ground and while it does little harm if one recommends you a recipe you don’t like, it’s a serious matter if a kid’s education is impacted. I wanted to be sure this wasn’t a random app hawking old research to lend itself credibility, and after talking with Burkiett and CEO Mark Angel I feel it’s quite the opposite and could actually be a valuable tool for educators. But it needed to convince educators first.

“You have to start by truly identifying the reason for wanting to employ a tech tool,” said Burkiett. “There are a lot of tech tools out there that are exciting, fun for kids, etc., but we could use all of them and not impact growth or learning at all because we didn’t stop and say, this tool helps me with this need.”

Amira was decided on as one that addresses the particular need in the K-5 range of steadily improving reading level through constant practice and feedback.

“When COVID hit, every tech tool came out of the woodwork and was made free and available,” Burkiett recalled. “With Amira you’re looking at a 1:1 tutor at their specific level. She’s not a replacement for a teacher — though it has been that way in COVID — but beyond COVID she could become a force multiplier,” said Burkiett.

You can see the old version of Amira in action below, though it’s been updated since:

Testing Amira with her own district’s students, Burkiett replicated the results that have been obtained in more controlled settings: As much as twice or three times as much progress in reading level based on standard assessment tools, some of which are built into the teacher-side Amira app.

Naturally it isn’t possible to simply attribute all this improvement to Amira — there are other variables in play. But it appears to help and doesn’t hinder, and the effect correlates with frequency of use. The exact mechanism isn’t as important as the fact that kids learn faster when they use the app versus when they don’t, and furthermore this allows teachers to better allocate resources and time. A kid who can’t use it as often because their family shares a single computer is at a disadvantage that has nothing to do with their aptitude — but this problem can be detected and accounted for by the teacher, unlike a simple “read at home” assignment.

“Outside COVID we would always have students struggling with reading, and we would have parents with the money and knowledge to support their student,” Burkiett explained. “But now we can take this tool and offer it to students regardless of mom and dad’s time, mom and dad’s ability to pay. We can now give that tutor session to every single student.”

This is familiar territory for CEO Mark Angel, though the AI aspect, he admits, is new.

“A lot of the Amira team came from Renaissance Learning. bringing fairly conventional edtech software into elementary school classrooms at scale. The actual tech we used was very simple compared to Amira — the big challenge was trying to figure out how to make applications work with the teacher workflow, or make them friendly and resilient when 6-year-olds are your users,” he told me.

“Not to make it trite, but what we’ve learned is really just listen to teachers — they’re the superusers,” Angel continued. “And to design for radically sub-optimal conditions, like background noise, kids playing with the microphone, the myriad things that happen in real-life circumstances.”

Once they were confident in the ability of the app to reliably decode words, the system was given three fundamental tasks that fall under the broader umbrella of machine learning.

The first is telling the difference between a sentence being read correctly and incorrectly. This can be difficult due to the many normal differences between speakers. Singling out errors that matter, versus simply deviation from an imaginary norm (in speech recognition that is often, effectively, American English as spoken by white people) lets readers go at their own pace and in their own voice, with only actual issues like saying a silent k noted by the app.

On that note, considering the prevalence of English language learners with accents, I asked about the company’s performance and approach there. Angel said they and their research partners went to great lengths to make sure they had a representative dataset, and that the model only flags pronunciations that indicate a word was not read or understood correctly.

The second is knowing what action to take to correct an error. In the case of a silent k, it matters whether this is a first grader who is still learning spelling or a fourth grader who is proficient. And is this the first time they’ve made that mistake, or the tenth? Do they need an explanation of why the word is this way, or several examples of similar words? “It’s about helping a student at a moment in time,” Angel said, both in the moment of reading that word, and in the context of their current state as a learner.

Third is a data-based triage system that warns students and parents if a kid may potentially have a language learning disorder like dyslexia. The patterns are there in how they read — and while a system like Amira can’t actually diagnose, it can flag kids who may be high risk to receive a more thorough screening. (A note on privacy: Angel assured me that all information is totally private and by default is considered to belong to the district. “You’d have to be insane to take advantage of it. We’d be out of business in a nanosecond.”)

The $11 million in funding comes at what could be a hockey-stick moment for Amira’s adoption. The round was led by Authentic Ventures II, LP, with participation from Vertical Ventures, Owl Ventures and Rethink Education.

“COVID was a gigantic spotlight on the problem that Amira was created to solve,” Angel said. “We’ve always struggled in this country to help our children become fluent readers. The data is quite scary — more than two-thirds of our fourth graders aren’t proficient readers, and those two-thirds aren’t equally distributed by income or race. It’s a decades-long struggle.”

Having basically given the product away for a year, the company is now looking at how to convert those users into customers. It seems like, just like the rest of society, “going back to normal” doesn’t necessarily mean going back to 2019 entirely. The lessons of the pandemic era are sticking.

“They don’t have the intention to just go back to the old ways,” Angel explained. “They’re searching for a new synthesis — how to incorporate tech, but do it in a classroom with kids elbow to elbow and interacting with teachers. So we’re focused on making Amira the norm in a post-COVID classroom.”

Part of that is making sure the app works with language learners at more levels and grades, so the team is working to expand its capabilities upward to include middle-school students as well as elementary. Another is building out the management side so that success at the classroom and district levels can be more easily understood.

The company is also launching a new app aimed at parents rather than teachers. “A year ago 100% of our usage was in the classroom, then three weeks later 100% of our usage was at home. We had to learn a lot about how to adapt. Out of that learning we’re shipping Amira and the Story Craft that helps parents work with their children.”

Hundreds of districts are on board provisionally — aided by a distribution partnership with Houghton Mifflin Harcourt, also an investor — but decisions are still being kicked down the road as they deal with outbreaks, frustrated parents and every other chaotic aspect of getting back to “normal.”

Perhaps a bit of celebrity juice may help tip the balance in their favor. A new partnership with Miami Dolphins (former Houston Texans) linebacker Brennan Scarlett has the NFL player advising the board and covering the cost of 100 students at a Portland, OR school through his education charity, the Big Yard Foundation — and more to come. It may be a drop in the bucket in the scheme of things, with a year of schooling disrupted, but teachers know that every drop counts.

Powered by WPeMatico