TC

Auto Added by WPeMatico

Auto Added by WPeMatico

TechCrunch just hosted its first pitch-off in Detroit and we’re pleased to announce Diet ID won the event. The company, based in Detroit and founded in 2016 by Dr. David Katz, gives users a clinically tested approach to dietary assessment and management.

Diet ID competed against other Detroit-area startups, including Rivet Work, Plain Sight and FixMyCar. Local investors acted as judges: Jim Tenzillo, VP at Invest Michigan; Dawn Batts, Capital Strategist at TechTown and co-founder of Commune Angels; and Ben Bernstein, principal at Invest Detroit Ventures.

The entire pitch-off is embedded above.

The event also featured talks from local VCs on fundraising in Detroit, where Jonathon Triest from Ludlow Ventures and Patti Glaza from Invest Detroit Ventures spoke extensively on the growing startup scene. Ryan Landau, founder of Purpose Jobs, also spoke on startup hiring practices and trends in the Midwest. That video is found below.

This event is part of TechCrunch’s City Spotlight series, where we dive into the culture of growing startup ecosystems found throughout the United States. We’re going to Pittsburgh next and hope you can join us.

Powered by WPeMatico

TechCrunch just hosted a small virtual meetup with Detroit startups and venture capitals. Like the one we held last month in Miami, the event was a blast and featured a talk with two local VCs on which startups work in Detroit and how to raise money from local investors.

In case you missed it, the video of this talk is below. Jonathon Triest from Ludlow Ventures and Patti Glaza from Invest Detroit Ventures spoke extensively on the wide-ranging types of startups that call Detroit home. They point to Bloomscape (houseplants) and StockX (sneakers) and the numerous medical and security startups in Detroit, nearby Ann Arbor and the surrounding metro area. Both firms invest in early-stage startups, but do so in radically different ways.

The 20-minute conversation covers the types of founders who can find success in Detroit and other Midwestern areas.

This event was part of TechCrunch’s growing series of City Spotlights, where we focus on a growing startup ecosystem and highlight what makes the area attractive for startups. We’re going to Pittsburgh next and hope you can join us.

Powered by WPeMatico

When Zoom launched Zoom Apps and the Marketplace as a place to sell them last year, it was a big signal that the company wanted to be more than just a popular video conferencing application. It wanted to be a platform, which developers could use to build applications on top of Zoom.

Today the company announced a $100 million investment fund to encourage the most promising startups using the Zoom toolset to launch a business by giving them funding, while using that as a springboard to encourage other developers to take advantage of the tooling on the platform.

“We’re looking for companies with a viable product and early market traction, and a commitment to developing on and investing in the Zoom ecosystem,” Zoom’s Colin Born wrote in a blog post announcing the new program.

The company’s corporate development team, with heavy involvement from the Zoom executive team, will be in charge of selecting and managing the portfolio companies. The company plans to invest between $250,000 and $2.5 million in each startup in the portfolio.

“A big part of this is helping facilitate those early companies and giving them the access to resources and connections within Zoom, so that they can grow and succeed,” Zoom CTO Brendan Ittelson told me.

While the company wants to invest successfully, a big part of this is using the fund to encourage developers to take advantage of the platform offerings from Zoom. “We feel we’ll help [these startups] build these valuable and engaging experiences and by having that and by investing, we’re helping bring solutions and further expand the ecosystem and our customers should benefit from that,” he said.

Zoom has a number of developer tools that budding entrepreneurs can use to build applications that take advantage of Zoom functionality. In March the company introduced an SDK (software development kit) designed to help programmers embed Zoom functionality inside other applications.

The company also provides tools for embedding an application inside of Zoom, such as one designed for a specific purpose, like education or healthcare, and it has created a centralized place to learn about all of them at developer.zoom.us.

Zoom is not alone in investing in companies building applications on its platform. Firms like Sequoia, Maven Ventures and Emergence Capital have already started investing in startups building companies on top of Zoom, including Mmhmm, Docket and ClassEdu.

The fund gives startup founders one more option to get some funding to get their idea off the ground. Ittelson says all of the investments will be seed-level investments for starters, and they will be providing developer and business resources to help the young startups build and distribute their products.

While he says the company will be on the lookout for promising startups to bring into the portfolio, interested entrepreneurs can apply directly at zoom.com/fund.

Powered by WPeMatico

General Motors is joining the list of big automakers picking their horses in the race to develop better batteries for electric vehicles with its lead of a $139 million investment into the lithium-metal battery developer, SES.

Volkswagen has QuantumScape; Ford has invested in SolidPower (along with Hyundai and BMW); and now with SES’ big backing from General Motors, most of the big American and European automakers have placed their bets.

“We are beyond R&D development,” said SES chief executive Hu Qichao in an interview with TechCrunch. “The main purposes of this funding is to, one, improve the key material, this lithium metal electrolyte on the anode side and the cathode side, and, two, to improve the scale of the current cell from the iPhone battery size to the size that can be used in cars.”

There’s a third component to the financing as well, Hu said, which is to increase the company’s algorithmic capabilities to monitor and manage cell performance. “It’s something that we and our OEM partners care about,” said Hu.

The investment from GM is the culmination of nearly six years of work with the big automaker, said Hu. “We started working with them in 2015. For the next three years we will go through the standard automation approval processes. Going from ‘A’ sample to ‘B’ sample all the way through ‘D’ sample,” which is the final testing phase before commercial availability of SES’ batteries in cars.

While Tesla, the current leader in electric vehicle sales in America, is looking to improve the form factors of its batteries to make them more powerful and more efficient, Hu said that the chemistry isn’t that different. Solid state batteries represent a step change in battery technology that makes batteries more powerful, easier to recycle and potentially more stable.

As Mark Harris wrote in TechCrunch earlier this year:

There are many different kinds of SSB but they all lack a liquid electrolyte for moving electrons (electricity) between the battery’s positive (cathode) and negative (anode) electrodes. The liquid electrolytes in lithium-ion batteries limit the materials the electrodes can be made from, and the shape and size of the battery. Because liquid electrolytes are usually flammable, lithium-ion batteries are also prone to runaway heating and even explosion. SSBs are much less flammable and can use metal electrodes or complex internal designs to store more energy and move it faster — giving higher power and faster charging.

What SES is doing has brought the company attention not just from General Motors, but from previous investors, including the battery giant SK Innovation; the Singapore-based, government-backed investment firm, Temasek; the venture capital arm of semiconductor manufacturer, Applied Materials, Applied Ventures; the Chinese automaking giant, Shanghai Auto; and investment firm, Vertex.

“GM has been rapidly driving down battery cell costs and improving energy density, and our work with SES technology has incredible potential to deliver even better EV performance for customers who want more range at a lower cost,” said Matt Tsien, GM executive vice president and chief technology officer and president, GM Ventures. “This investment by GM and others will allow SES to accelerate their work and scale up their business.”

Powered by WPeMatico

The pandemic-induced lockdowns halted many a home decoration project, but the irony was that our homes became even more important. But where to get ideas to decorate? Home décor experts could no longer visit. Now an LA-based startup is addressing this digitization of the interior design market, but kicking off with a typically LA-oriented, high-end clientele.

The LA-based The Expert — a platform for video consultations with interior designers — has raised a $3 million seed funding round led by Forerunner Ventures, with participation from Sweet Capital, Promus Ventures, Golden Ventures, Jeffrey Katzenberg’s WndrCo, AD 100 designer Brigette Romanek and CEO/founder of goop, Gwyneth Paltrow.

The Expert offers 1:1 video consultations with leading interior designers, it says.

The founders consist of Jake Arnold, a celebrity interior designer (who has worked with John Legend and Rashida Jones and Chrissy Teigen, among others) and YC-alumni, Leo Seigal, who previously founded and sold Represent.com to CustomInk for $100 million in 2015.

After being “inundated” with DMs during lockdown asking for his advice, Arnold says he realized he didn’t have the business model to help non-retainer clients. So he joined Seigal to create The Expert.

The Expert features 85 designers, so far. Clients click on designers’ profiles to see rates and availability, then click to book. Clients can upload any relevant floor plans, images of the home, inspiration ideas, etc. for the designer to review ahead of time. They then join a Zoom link (the platform uses the Zoom API) to meet with an interior designer, and can leave a review afterward.

The company claims it has 700 designers on its waitlist and will hit $1 million of bookings after its first quarter, after launching in early February this year.

The startup has some competition in the form of Modsy and Havenly, but The Expert says it is going for a more high-end experience, where clients are willing to pay $300-$2,500 for an hour of a designers’ time. The startup takes a 20% cut of the transaction.

Co-founder Leo Seigal said: “We were able to attract a crazy roster of designers partly thanks to co-founder Jake who is so highly regarded in the industry, and partly due to a timeliness of offering which is far above anything that has been tried in the home space.”

In a statement, Gwyneth Paltrow said: “I’ve always felt that access to great design – and those who create it – is too rare of a commodity. It’s a game-changer for someone without the budget for a full-time designer to have this roster of talent on speed dial.”

Nicole Johnson, partner at Forerunner, said: “We’ve been thinking through new models for the interior design sector for years at Forerunner, observing room for improvement for the trade and consumers alike. Interior design is arguably the ultimate, best-suited source of home inspiration and commerce enablement for consumers, but the trade is a famously walled garden. The Expert solves for this, connecting anyone, anywhere with the world’s leading interior designers via video consultation—allowing Experts to broaden their reach and monetization in a predictable, rewarding, and low-friction way.”

Pippa Lamb, partner at Sweet Capital, which led their pre-seed investment round last summer said: “The Expert is democratizing access to top creators in the $150B global interior design industry. By partnering with leading talents like Amber Lewis and Leanne Ford, it’s solving both upstream discovery and downstream services: bringing Instagram feeds to life. Leo and his team are visionaries and Sweet Capital has been proud to back them since Day 1.”

Powered by WPeMatico

The online grocery market is poised to get a little more crowded in the next several months, with the launch of a startup led by a veteran founder who has taken big hits from Amazon in the past, but now hopes to come back swinging with the help of an army of robots.

Home Delivery Services, a delivery startup founded by Louis Borders that plans to sell groceries and general merchandise online using a massive, automated system to power the fulfillment and logistics, is today announcing funding of $3 million to finalize the finishing touches on an AI-based robotic demonstration center outside of Indianapolis.

The plan is for the center to showcase the technology that HDS Global has been building over the last several years (plans first emerged as long ago as 2014), robots and other automation under the name RoboFS, that will power a wide fulfillment system extending from stocking, sorting and picking items that will then be delivered, mostly by humans, to consumers, to take on what Borders describes as a $1 trillion grocery market in the U.S.

“The $1 trillion grocery in the U.S. is not well penetrated,” he said, comparing the opportunity to the one that Walmart seized 20 years ago in physical stores. “We want to offer a complete selection of groceries and general merchandise in one order.” The idea is to build warehouses that cover some 150,000 square feet to do $200 million in revenue over millions of SKUs for one-hour deliveries.

A funding round of $3 million — which is coming from Bob DiRumualdo, the chairman of Ulta and CEO of Naples Ventures — might sound a little modest, especially considering the hundreds of millions of dollars that have been collectively raised by online grocery players in the last several months — all of them racing to scale up their businesses in the wake of huge consumer demand for online shopping alternatives to visiting stores in person in the wake of the COVID-19 pandemic.

Borders said in an interview that this small round is primarily to kick off the demo center to show off RoboFS to help bring on new investors and new partners with the proof of concept. It already has a few investor partners (Ingram Micro and Toyota), and the idea will be to add more.

And he confirmed that HDS — which will unveil a different name when it launches commercially, he added — is also working on a much bigger round of funding, likely to close in the next 15 months, to fuel that wider commercial launch. It has raised $38 million to date, he said.

Borders’ name will ring a bell to many in the worlds of retail and technology: He was the founder and head of the Borders book superstores and later started Webvan, a very early mover in the world of online grocery ordering and delivery. Both companies crashed hard in their times and became case studies, and more specifically cautionary tales, around how to build businesses in the digital era: Beware the specter of Amazon, of innovating too early or too late, of being less agile, too inefficient and of not correctly identifying where the puck was going and skating to it.

This time around, the idea is that he’s focusing first and foremost on technology to try to head off those problems in ways that his previous ventures did not. This is one reason why HDS has spent so many years on building the technology: automation, specifically in areas like picking groceries, is one area that has foxed a lot of companies to date — Amazon continues to work on this, and Ocado, a leader in the space, has yet to launch robotic picking, although it says this is coming soon. Borders estimates that bringing in automation can bring down the cost of labor by two-thirds, with people instead focused on delivering and selling at people’s doors.

“When we went out to buy the tech we didn’t see what we wanted,” Borders said. “We’re trying to be smart about technology but the tech was just not there when we decided to build this five years ago. So we started with building that system. This became our opportunity.”

The interesting opportunity is not just to build services that don’t quite exist yet, but to provide a set of infrastructure that can be a viable alternative and supply chain to Amazon — a common goal that brings together players from a lot of disparate yet interconnected areas in the grocery value chain. This is one reason why companies like Toyota and Ingram have come on board to work with the startup.

Given that it’s been so many years in the making and has yet to see the proof of concept, there will continue to be a lot of factors that could not come together, but it’s a play that HDS, Borders and their partners are willing to make.

“Ecommerce has become an essential component in people’s daily lives but what many don’t realize is that it can be exponentially better than what is offered today,” said DiRumualdo in a statement. “I was attracted to working with Louis again and to the company’s big idea approach – an all-new robotic fulfillment system purpose-built for ecommerce – which can deliver a vastly improved experience at lower cost. I am excited to be a part of bringing this vision to life.”

Powered by WPeMatico

Buzzy “social audio” app Clubhouse has raised a Series C funding round, reportedly valuing the company at $4 billion. Clubhouse said the new round of financing was led by Andrew Chen of Andreessen Horowitz, with participation from DST Global, Tiger Global and Elad Gil. This round means Clubhouse has tripled the valuation it attained in January when Andreessen Horowitz led its Series B funding round.

The funding comes as Twitter, Spotify, Facebook, Telegram, Discord and LinkedIn are all prepping similar features to Clubhouse’s live audio streaming rooms, which has attracted attention for hosting live chats with the likes of Elon Musk and Mark Zuckerberg. Indeed, Vox reported that Facebook will announce a series of “social audio” products only today.

But, unusually for such a late stage of funding, the company has not revealed the amount raised. Industry sources say that this is probably because the Series C funding round is “multi-stage” and therefore not officially closed. Alternatively, the company is “hyping” itself ahead of a sale, as is often the case with “hot” startups. Twitter reportedly broke off talks to acquire the startup at a $4 billion valuation, according to Bloomberg.

And despite appearances that this funding round has been timed to coincide with the launch this week of Facebook’s Clubhouse clone, one well-placed source told me “this funding round has been in the works for the last 1.5 months” and that some offers have been “above 2x” the $4 billion valuation. In other words, there are some investors out there who think Clubhouse is worth more than $8 billion.

So far Clubhouse is demurring on all this, and declining to comment more directly to the media. The company disclosed the news about the funding during its weekly “town hall” chat last Sunday night and in a blog post, the company said the fundraising will support a fresh burst of growth for the app.

“While we’ve quadrupled the size of our team this year, stabilized our infrastructure, launched Payments in beta to help creators monetize, and readied Android for launch, there is so much more to do as we work to bring Clubhouse to more people around the world. It’s no secret that our servers have struggled a bit these past few months, and that our growth has outpaced the early discovery algorithms our small team originally built,” said the post.

Noting that “it’s important to us to be building all of this with people who are invested in the community and who represent a diverse set of backgrounds and voices,” Clubhouse has, however, been struck by a wave of problems in the last few days, when anti-Semitic audio rooms seemed to proliferate on the platform. Clubhouse has previously been criticized for its seeming inability to moderate extremism on the app.

The year-old platform, which has reported 10 million weekly active users, has thrived during the pandemic while people were locked down and therefore unable to chat easily in person.

Tech news site The Information first reported details on the Clubhouse funding on Friday.

Powered by WPeMatico

More than a year after the pandemic began, remote work shows no signs of going away. While it has its cons, it remains top of mind for potential employees around the world before joining a new company.

But while most people in Africa still go to physical offices despite the pandemic, a few companies have nevertheless embraced this concept. Andela, a New York-based startup that helps tech companies build remote engineering teams from Africa, was one of the first to publicly announce it was going remote on the continent.

Today, it is doubling down on this effort by announcing the global expansion of its engineering talent. Over the past six months, the company has seen a 750% increase in applicants outside Africa. More than 30% of Andela’s inbound engineer applications also came from outside the continent in March alone. Half this number came from Latin America while Africa saw a 500% increase in applications as well.

When Andela launched in 2014, it built hubs in Nigeria, Kenya, Rwanda and Uganda to source, vet and train engineers to be part of remote teams for international companies. It also tested satellite models in Egypt and Ghana as substitutes to physical hubs.

The company would issue a call for applications, select a few (less than 1%), pay them a salary for the first six months and provide them with housing and food. It also helped developers improve their skills via training and mentorship. Over 100,000 engineers have taken part in the company’s learning network and community, and, as of 2019, Andela had more than 1,500 engineers on its payroll.

However, after noticing that this model wasn’t sustainable, it began to make changes.

In September 2019, it let go of 420 junior engineers across Kenya, Uganda and Nigeria. Nine months later, citing the pandemic, it laid off 135 employees while introducing salary cuts for senior staff. But despite the layoffs, the pandemic provided some form of clarity to how Andela wanted to operate — which was remote, judging by the success of the satellite models.

“In the very beginning, a developer had to be in Lagos to work with Andela. Then it became living in Nigeria. Then Kenya. Then Uganda, Rwanda,” CEO Jeremy Johnson told TechCrunch. “Before the pandemic, Andela was opening applications in country after country. The pandemic came and changed that as we opened up to the entire continent.”

Shutting down its existing physical campuses and going remote also helped the company focus on getting engineers with more experience to meet its clients’ requirements. That experiment, which the company conducted in less than a year, is also part of its mission to be a global company.

“That went so well and we thought ‘what if we accelerated it now that we’re remote and just enable applicants from anywhere?’ because it was always the plan to become a global company. That was clear, but the timing was the question. We did that and it’s been an amazing experiment,” Johnson added.

Now with its global expansion, its clients can tap into regional expertise to support international growth.

According to a statement released by the firm, it currently has engineers from 37 countries across Africa, Asia, Latin America, North America and Europe.

Johnson didn’t go into details about how many of these engineers are getting jobs from Andela or even its total developer count. He’s more interested in helping its clients solve the diversity issues that have plagued many Western corporations.

Andela is currently working with eight companies that have hired its engineers in Latin America and Africa. In addition to the diversity play, the CEO says that means Andela engineers get to prove themselves on a global playing field in a way the company has “always wanted to see.”

Andela serves more than 200 customers, including GitHub, ViacomCBS, Pluralsight, Seismic, Cloudflare, Coursera and InVision. GitHub is one company that seems to be benefitting from Andela’s new offerings. The company’s VP of Engineering, Dana Lawson, in a statement said, “As a business in the developer tool space, a lot of us are trying to enter those areas of the world (Southeast Asia, Latin America and Africa) where the emergent developers are coming so we can better understand their needs. Having a local presence there with amazing talent is super valuable to building a global product.”

Image Credits: Andela

In its quest to become a global company, going up against competition is unavoidable for the seven-year-old company. But since most of these companies are horizontal marketplaces (providing a wide range of expertise), whereas Andela is vertical, Johnson believes there’s enough market share to be acquired by the company.

“We are focused on building digital products, and because of that, we’re able to do more, essentially, for our customers… That’s where our focus is — [building long-term relationships] and around building great digital products,” the CEO said.

The company was founded by Jeremy Johnson, Christina Sass, Nadayar Enegesi, Ian Carnevale, Brice Nkengsa and Iyinoluwa Aboyeji. It has raised more than $180 million (up to Series D) from firms like Chan Zuckerberg Initiative, Generation Investment Management, Google Ventures and Spark Capital, at a valuation of about $700 million.

While announcing the layoffs last year, Andela said it was on an annual revenue run rate of $50 million. But when asked how this number has changed over the past year, Johnson said the company is “growing at a healthier pace as we’ve ever had.”

The future of remote work is global and Johnson believes Andela provides the vital link to talent wherever it is found. The company’s head of talent operations, Martin Chikilian, echoed similar sentiments regarding the expansion.

“We’ve seen exponential growth and interest from engineers from across Africa who want to work with some of the world’s most exciting technology-focused companies,” he said. “Growing our network of talent from Africa to include more markets is a unique proposition and we continue to match talent with opportunity beyond geographical boundaries.”

Powered by WPeMatico

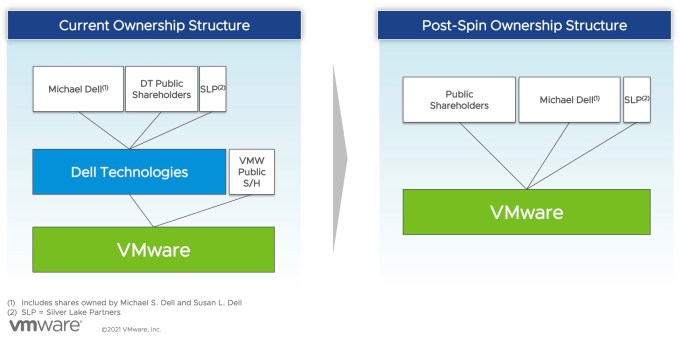

TechCrunch has spilled much digital ink tracking the fate of VMware since it was brought to Dell’s orbit thanks to the latter company’s epic purchase of EMC in 2016 for $58 billion. That transaction saddled the well-known Texas tech company with heavy debts. Because the deal left VMware a public company, albeit one controlled by Dell, how it might be used to pay down some of its parent company’s arrears was a constant question.

Dell made its move earlier this week, agreeing to spin out VMware in exchange for a huge one-time dividend, a five-year commercial partnership agreement, lots of stock for existing Dell shareholders and Michael Dell retaining his role as chairman of its board.

So, where does the deal leave VMware in terms of independence, and in terms of Dell influence? Dell no longer will hold formal control over VMware as part of the deal, though its shareholders will retain a large stake in the virtualization giant. And with Michael Dell staying on VMware’s board, it will retain influence.

Here’s how VMware described it to shareholders in a presentation this week. The graphic shows that under the new agreement, VMware is no longer a subsidiary of Dell and will now be an independent company.

Image Credits: VMware

But with VMware tipped to become independent once again, it could become something of a takeover target. When Dell controlled VMware thanks to majority ownership, a hostile takeover felt out of the question. Now, VMware is a more possible target to the right company with the right offer — provided that the Dell spinout works as planned.

Buying VMware would be an expensive effort, however. It’s worth around $67 billion today. Presuming a large premium would be needed to take this particular technology chess piece off the competitive board, it could cost $100 billion or more to snag VMware from the public markets.

So VMware will soon be more free to pursue a transaction that might be favorable to its shareholders — which will still include every Dell shareholder, because they are receiving stock in VMware as part of its spinout — without worrying about its parent company simply saying no.

Powered by WPeMatico

Say it louder for the people in the back: As tech grows bigger by the minute and venture capital adds dollar signs by the day, a startup hub’s success is not an either/or situation. The next Silicon Valley is a tired narrative, when in reality startups look, innovate and create differently all over the world.

On that note, my colleagues spent the past few months digging into the market in Detroit, Michigan:

While StockX is the startup darling that may have put the region in the generalist spotlight, I soon learned that the sneaker marketplace company wasn’t at all where the city’s story started and ended. Instead, it started a little more at ground level.

Detroit techies consistently point to billionaire Dan Gilbert, the co-founder of Quicken Loans and the owner of the Cleveland Cavaliers, as the reason behind the region’s startup growth. It made me immediately wonder if all it takes to create a startup ecosystem is deep pockets.

Turns out it’s a little more complicated than that.

Gilbert has poured at least $2.5 billion into rehabilitating buildings in the core of Detroit. Then he invested in the companies that took office space in those buildings, the restaurants that would feed those new families in the area and the retailers that would fill up the side blocks. It wasn’t one check by one billionaire, but instead a measured and consistent approach to try to reestablish Detroit as a city of innovation within the United States.

I think one founder put it best: “there are a lot of people who hate him, but the reality is that, while he wasn’t the only billionaire in town, he’s the only one who heavily invested in Detroit.”

Beyond Gilbert, the vitalization is spread throughout different sectors. There’s a 12-year-old early-stage venture firm that was one of the first to ever bet on mobility as an investment thesis; there’s a thriving garden startup; and there’s a hardware company that, despite remote work, is finding space to scale:

We’ll continue exploring emerging tech hubs, so throw us suggestions as we virtually (and one day physically) road trip across the country.

In the rest of this newsletter, we’ll talk about Tiger Global, IPOs and a few exciting upcoming events. Make sure to follow me on Twitter @nmasc_ to hang during the week.

This week on Equity, we talked about Tiger Global’s aggressive investment approach and what it could mean for early-stage firms and founders.

Here’s what to know: One of the reasons Tiger Global is feeling spendy is that it just closed one of the biggest venture funds ever. In 2020, the firm closed $3.75 billion in capital commitments. In 2021, it nearly doubled its own record, with $6.7 billion raised for its latest fund.

And if you don’t believe me, below is a list of just some of the New York-based firms’ recent activity:

Cryptocurrency trading giant Coinbase went public this week. The company opened at $381 per share, valuing the exchange at nearly $100 billion. It was a massive exit for the company, which underwent scrutiny last year when it banned politics at work.

Here’s what to know: It’s fairly obvious that Coinbase’s successful IPO was a big moment for fintech and crypto startups, as well as the decentralized finance movement. My colleagues Alex Wilhelm and Anna Heim dug into how the crypto ripple effect could look from the perspective of a few venture capitalists. There are too many good bits for me to choose an excerpt, so read it for yourself here, and a take sneak peek below:

So while there is an ocean of bullish sentiment that the Coinbase listing will lead to rising venture capital investment into crypto startups, there’s also some caution to be had; how much of the growing market that Coinbase can capture and control is not yet clear, though IVP’s Loverro was very bullish during our interview about the company’s expanding feature set — things like staking Tezos, or buying Uniswap. Its backers think that Coinbase is well-positioned to absorb future market upside in its niche.

As always, we have a ton of exciting events coming up. Here’s just a taste:

Seen on TechCrunch

Pakistan temporarily blocks social media

Republican antitrust bill would block all Big Tech acquisitions

Can the tech trade show return in 2021?

Garry Kasparov launches a community-first chess platform

Seen on Extra Crunch

Billion-dollar B2B: cloud-first enterprise tech behemoths have massive potential

For startups choosing a platform, a decision looms: build or buy?

Building customer-first relationships in a privacy-first world is critical

The IPO market is sending us mixed messages

Best,

Powered by WPeMatico