TC

Auto Added by WPeMatico

Auto Added by WPeMatico

Robotic process automation unicorn UiPath is set to go public this week, concentrating our focus on its value.

The well-known company was last valued on the private markets at $35 billion in February when it closed a $750 million round. Living up to that price as a public company, however, at least when it comes to its formal IPO price, is proving to be challenging.

In a sense, that’s not too surprising given that the red-hot IPO market cooled as Q1 2021 came to a close. UiPath raised its last private round when the markets were most interested in public offerings and is now going public in a slightly altered climate.

In numerical terms, UiPath raised its IPO range from $43 to $50 per share, to $52 to $54 per share. That’s a 21% jump in the value of the lower end of its range, and an 8% gain to the value of the upper end of its per-share IPO price interval.

UiPath is also selling more shares than before, which should make its total valuation slightly larger at the top end than a mere 8% gain. So let’s go through the math one more time. Afterward, we’ll stack its new simple, fully diluted IPO valuations against its final private price, ask ourselves if our musings on the company’s recent profitability bore out, and close by asking where the company might finally price, and if we expect it to do so above its new price range.

Powered by WPeMatico

We’ve all heard the phrase “passive income” to describe how people can make money by owning rental properties. Many Americans would love to passively earn money, but the process of becoming a landlord can be intimidating and complicated.

I mean, how many people have looked back and wished they hadn’t sold a property after seeing its value rise years after selling it?

And those who are already landlords can get overwhelmed by the complexities of managing properties.

One startup out of Boston, Knox Financial, aims to help people identify and manage residential rentals with its algorithm-based platform, and it’s raised a $10 million Series A to help it further that goal. Boston-based G20 Ventures led the round, which included participation from Greycroft, Pillar VC, 2LVC, and Gaingels.

The investment brings Knox’s total raised since its inception in 2018 to $14.7 million. The company closed on a $3 million seed round in January 2020, led by Greycroft.

Knox co-founder and CEO David Friedman is no stranger to startups. He founded Boston Logic — an integrated marketing platform and online marketing services for real estate offices and agents — in 2004. He sold that company (now under the name Propertybase) to Providence Equity for an undisclosed amount in 2016.

Knox launched its platform in March of 2019, with the goal of offering homeowners who are ready to move “a completely hands-off way” of converting a home they’re moving out of into an investment property. It also claims to help landlords more easily and efficiently manage their rentals.

At the time of its seed round early last year, the company was only operating in the Boston market and had 50 units on its platform. It’s now operating in seven states, has “hundreds” of investment properties on its platform and is overseeing a portfolio of more than $100 million.

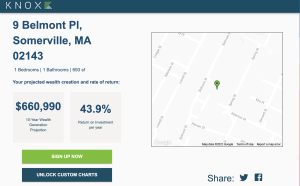

So how does it work? Once a property is enrolled on Knox’s “Frictionless Ownership Platform,” the company automates and oversees the property’s finances and taxes, insurance, leasing and legal, tenant and property care, banking and bill pay.

Knox also has developed a rental pricing and projection model for calculating the investment rate of return a property will produce over time.

Image Credits: Knox Financial

“We save investors a lot and almost always make their portfolios more profitable,” Friedman said. “If someone is moving or upsizing, we can turn properties into incredible ROI generators or cash flow.”

The company’s revenue model is simple.

“When a dollar of rent moves through our system, we keep a dime,” Friedman told TechCrunch. “We align our interests with our customers. If there’s no rent coming in, we’re not making money. Or if a tenant doesn’t pay rent, we don’t make money.”

Knox plans to use its new capital to continue expanding geographically and getting the word out to more people.

“We want to become the de facto platform for real estate investment acquisition and ownership,” Friedman said. “And we have to be coast to coast to really do that for everybody. So, we’re still very early in our growth trajectory.”

Bob Hower, co-founder and partner of G20 Ventures, shared that weeks after his college graduation, he had bought a fixer upper with his mother’s help. A week after finishing renovations, he put the house on the market. Over the subsequent five months, he gradually reduced the price as the market softened, and eventually the property sold at a small profit.

“That house now is worth a multiple of what I paid for it,” Hower recalls. “In hindsight, the mistake I made was deciding to sell the house at all.”

That experience helped Hower appreciate what he describes as a “clarity of thinking” in Knox’s business model.

“Had Knox existed decades ago, I’d likely still have that fixer-upper I bought after college,” he said. “Investing platforms such as Betterment have collapsed multiple advising and optimization activities into a simple single-sign-on service, and Knox is the first company to apply this type model to residential real estate investing.”

Powered by WPeMatico

Tyltgo wants to make it easier for restaurants and small businesses to compete with same-day delivery services offered by the likes of Amazon and HelloFresh. The Canadian company, which recently raised CAD $2.3 million (USD $1.8 million) in a seed round, is akin to a white label Uber Eats, providing businesses an on-demand delivery platform under their own branding that connects them to gig economy couriers.

“I think about us as a post-purchase experience company,” co-founder and CEO Jaden Pereira told TechCrunch. “The recipient goes directly onto the merchant’s platform and places orders through them, so it feels like they’re interacting with the brand they purchased from throughout the entire experience. Our messages, notifications, tracking pages and delivery are all customized under the merchant’s brand name, but it’s powered by Tyltgo.”

The necessity of having products delivered during the pandemic’s shelter-in-place orders combined with the massive reach of e-commerce giants like Amazon has created a society that expects same-day deliveries. Tyltgo recognized the exclusionary nature of that reality on smaller businesses with less time and fewer resources, and contrived to remedy the situation with some innovative tech and gig economy couriers.

In July 2018, Pereira, 22, co-founded the company with fellow student and developer Aaron Paul while studying at the University of Waterloo. Pereira originally did deliveries himself as a side hustle, while building up a consumer-facing service on Shopify. In October 2019, Pereira and Paul shifted focus to B2B, identifying the real problem as merchants struggling to offer quality same-day delivery at an affordable price.

From December 2019 to December 2020, Tyltgo’s revenue grew 2,000%, says Pereira. The company started 2020 with two staff members and ended with nine, including former head of Uber Eats Canada’s marketplace operations, Joe Rhew, and former director of engineering at Goldman Sachs-acquired fintech company Financeit, Adnan Ali.

Aided by funding from VC firm TI Platform Management, Y Combinator and angel investor Charles Songhurst, Tyltgo projects another 1,500% revenue growth for 2021. The company’s goal is to expand its team, develop an API and app-based platform and add 100 more merchants across Ontario.

Pereira said Tyltgo originally focused on florists, and occasionally pharmacies, but demand from the restaurant industry led to the company’s new target — meal kit deliveries.

Meal kit services that provide the culinarily challenged with perfectly portioned ingredients and cooking instructions were already gaining popularity in the before times. When the pandemic hit, services like HelloFresh and Blue Apron saw even more growth. As restaurants struggled to keep their businesses open, many started to get in on the action, delivering restaurant-quality meals with instructions for heating and serving.

The global meal kit delivery services market is expected to reach almost $20 billion by 2027, with heat-and-eat options taking a large share of that market. Tyltgo is counting on the success of this industry. It has already secured partnerships with restaurants like General Assembly Pizza and Crafty Ramen, as well as with more traditional meal kit delivery services from grocery stores and organic farms.

Pereira said working in the “quasi-perishable space” of flowers and meal kits is both a challenge and a differentiator for the company. Depending on the contents of the delivery, Tyltgo will determine its perishability window and make sure to match that window with a driver. It’s also got an advanced fleet management platform that assigns a number of deliveries to suit the size of a courier’s vehicle.

“In the earlier days, the hardest part was being able to match those perishability windows without causing damage to the products,” said Pereira. “We all know that in logistics, you have to account for traffic, weather conditions, all these other things, but you have an eight-hour delivery window to get out 35 deliveries.”

Another challenge is ensuring the top-quality service Tyltgo advertises while working in the gig economy. Selecting for reliable couriers has slowed the company down at points, but Tyltgo aims to grow capacity only if it can simultaneously maintain a low error threshold.

“We won’t bring on a merchant if we don’t think we have the capacity to handle their deliveries and meet those expectations,” said Pereira.

Whether or not Tyltgo’s meal kit focus will end up driving scalability in the long run, the platform itself has legs. Pereira’s goal is to see Tyltgo become a part of every post-purchase customer experience for all retail trade categories, and that includes expanding into customer service, branding and transactions on top of delivery.

“The main reason why we’re doing this is because a lot of these smaller, brick-and-mortar retailers don’t have the time and resources to be able to compete with the Amazons of the world,” said Pereira. “We want to be able to put that power in their hands.”

Powered by WPeMatico

E-commerce is booming as retailers race to transform their brick-and-mortar footprints into online storefronts. By some counts, the market grew an astonishing 42% in 2020 in the wake of the COVID-19 pandemic, and estimates show that online spending in the U.S. will surpass $1 trillion by 2022. It’s a bonanza, and everyone is figuring out this new terrain.

Consumers are likely familiar with the front-end brands for these storefronts — with companies like Amazon, Shopify, Square, and Stripe owning attention — but it’s the tooling behind the curtain that is increasingly determining the competitiveness of individual stores.

Klaviyo may not be a household name to consumers (at least, not yet), but in many ways, this startup has become the standard by which email marketers are judged today, triangulating against veterans Mailchimp and Constant Contact and riding the e-commerce wave to new heights.

Founded in 2012, this Boston-based company helps marketers personalize and automate their email messaging to customers. By now, most people are intimately familiar with these kinds of emails; if you’ve ever given your email address to an online store, the entreaties to come back to your abandoned cart or browse the latest sale are Klaviyo’s bread and butter.

It may seem obvious in retrospect that email would grow to become a premier platform for marketing, but this wasn’t the case even a few years ago when social ads and search engine marketing were the dominant paradigm. Today, owned marketing and customer experience management are white-hot trends, and Klaviyo has surged from a lifestyle business to a multi-billion dollar behemoth in just a few short years. Its story is at the heart of the internet economy today, and the future.

TechCrunch’s writer and analyst for this EC-1 is Chris Morrison. Morrison, who previously wrote our EC-1 on Roblox, has been a writer and independent game developer covering the video game industry and the marketing challenges that come with publishing. As an analyst and a potential user, he’s in a unique position to explain the Klaviyo story. The lead editor for this package was Danny Crichton, the assistant editor was Ram Iyer, the copy editor was Richard Dal Porto and illustrations were created by Nigel Sussman.

Klaviyo had no say in the content of this analysis and did not get advance access to it. Morrison has no financial ties to Klaviyo or other conflicts of interest to disclose.

The Klaviyo EC-1 comprises four main articles numbering 9,700 words and a reading time of 43 minutes. Let’s take a look:

We’re always iterating on the EC-1 format. If you have questions, comments or ideas, please send an email to TechCrunch Managing Editor Danny Crichton at danny@techcrunch.com.

Powered by WPeMatico

Startups are stories of feverish dreams and obsessive fears. Short of hearing it from the source, a glimpse into the inbox of a founder would be the best way to experience the travails they endure on the way to building a business. A customer finally makes a purchase, a VC invests or walks away, an employee signs their offer letter — all of the major and minor milestones of a startup are communicated via that now-ancient medium of email.

Current Klaviyo users may be surprised to hear that email was not a part of the initial product.

Email’s ubiquity is only part of the story, though. It’s also a symbol of freedom: The last social platform that remains relatively open and free from the clutches of a single monopoly owner. It’s a market rife with entrenched incumbents, but one that simultaneously continues to invite founders to find some new take on this venerable communications channel and make it better for everyone.

That was the mission that Andrew Bialecki and Ed Hallen undertook when they founded Klaviyo back in 2012. What they perhaps didn’t bank on was just how long of a route they were about to take — or how many rejections they might find in their own inboxes from accelerators and VCs who never thought a new generation of email service providers could make it.

So they bootstrapped, kept things lean. They debated canceling dinners to pay the bills when customers churned. And along the way, they built a special startup that is today valued at a whopping $4.15 billion. Klaviyo is the story of how two scrappy, inexperienced entrepreneurs set out to build a lifestyle business — and ended up creating an email titan.

Klaviyo’s origin story sounds a bit like the generic advice given by every book on entrepreneurship. Andrew Bialecki — he goes by AB — had a need that no existing company filled. So, he started a company to address that need.

It began with what he calls a side hustle: a website devoted to cataloging the dates and locations of running races. Bialecki had the technical chops to build it, but the data wasn’t already available online and he needed race organizers to provide it. That, in turn, meant he needed to let them know his site existed and constantly follow up to make sure they were using it.

“I realized I’m on the phone with people and it’s never going to scale. After a while, I was working on that while I was at another startup, and I said I have two options here. Either I can go all-in on road races, or all-in on the problem: ‘How do we help these businesses connect with the people using their software or products?’” recalls Bialecki.

By then, he already had a co-founder in mind. Bialecki had been a student together with Ed Hallen at MIT, but the pair actually met while working at Applied Predictive Technologies (APT), a Washington, D.C. tech consultancy.

“I’d read all those books on, hey, when you’re looking for someone to start a business with, you want someone with similar values who’s also complementary,” says Bialecki. “I’d known he was kind of interested in starting a company, and we had really complementary skillsets. I loved the engineering and design and product, and he was a big product guy too, but was used to working with customers and clients.”

Current Klaviyo users may be surprised to hear that email was not part of the product that emerged. Instead, Bialecki and Hallen built a database to collect all the e-commerce data that was falling through the cracks.

“Once we really talked to a lot of e-commerce people, it was clear there were long-standing problems,” says Hallen.

Bialecki adds, “There are facts you know, like their name, their email address, their favorite color or something they told you about their birthday. But some of the harder stuff was, jeez, how many times has this person visited my website, bought something from me, what products did they buy and how is that trending over time? Were they a really frequent customer that dropped off the face of the Earth?”

As they spoke to customers, the founders realized that handling customers’ data and making it useful to them was going to be critical to Klaviyo’s success. It just so happened that gathering data matched well with their experiences working at APT.

“We had a ton of experience stitching together data sources,” says Hallen. “We took that expertise and put it as our foundation. What’s the most broken, largest market, and let’s really tie data to it, not as an afterthought.”

Klaviyo’s two co-founders Andrew Bialecki and Ed Hallen in July 2012. Image Credits: Klaviyo

What that required, in practical terms, was spending the initial months building a custom database to store the disparate data types that come up during e-commerce transactions — events, documents and object data models. Conor O’Mahony, who joined the company in 2018 as chief product officer and departed this month to become an advisor, says that the company’s early time investment in its database laid the foundations for its later success in scaling up.

Powered by WPeMatico

Email is the communication medium that refuses to die.

“Eventually, every technology is trumped by something new and better. And I feel that email is ready to be trumped. But by what?” wrote the venture capitalist Fred Wilson in 2007. Three years later, he updated readers that other forms of messaging had outgrown email. “It looks like email’s reign as the king of communication is ending and social networking is now supreme,” he said. (To be fair to Wilson, his view was nuanced enough to continue investing in email tech.)

Despite the competition, Klaviyo didn’t just break into the market — it has also achieved an unusual level of excitement and loyalty among marketers despite its youthful history.

Investors weren’t alone — marketers have also spent years anticipating the next big thing.

“It was SMS, it was YouTube, it was Instagram. Before that it was Facebook, then it was Snapchat and TikTok. I kinda feel like individually all those things are fleeting. I think people found: You know what? Everyone still opens their emails every day,” says Darin Hager, a former sneaker entrepreneur who is now an email marketing manager at Adjust Media.

Email has an estimated four billion users today and continues to grow steadily even as mature social networks plateau. Estimates of the number of nonspam messages sent each day range from 25 billion to over 300 billion.

Unsurprisingly for a marketing channel with so much volume, there’s voluminous competition to send and program those emails. Yet, despite the competition, Klaviyo didn’t just break into the market — it has also achieved an unusual level of excitement and loyalty among marketers despite its youthful history.

“If you’re not using Klaviyo and you’re in e-commerce, then it’s not very professional. If you see ‘Sent by Constant Contact or Mailchimp’ at the bottom of an email by a brand, it makes it look like they’re not really there yet,” Hager said.

How did Klaviyo become the standard solution among email marketers?

In Klaviyo’s origin story, we delved into part of the answer: The company began life as an e-commerce analytics service. Once it matured to compete as an email service provider, Klaviyo benefited from the edge given by its deeper, more comprehensive focus on data.

However, that leaves several questions unanswered. Why is email so important to e-commerce? What are the substantive differences between Klaviyo’s feature set and those of its competitors? And why did several large, well-funded incumbents fail to capitalize on building an advantage in data first?

In this section, we’ll answer those questions — as well as laying out the significance of COVID-19 on the e-commerce market, and how newsletters and AI figure into the company’s future.

Email is one of the oldest tech verticals: Constant Contact, one of the most venerable email service providers (ESPs), was founded in 1995, went public in 2007 and was taken private in 2015 for $1 billion. By the time Klaviyo started in 2012, the space was well served by numerous incumbents.

Powered by WPeMatico

Brands are emotions made physical. The clothes we wear, the media we consume, the devices we use — all signal not only to others what we value and see in ourselves, they also are a way to construct our very identities. Experimenting to deepen that bond has been at the core of the marketing profession for a century; its origins rooted in Freudian psychoanalysis.

There had always been one critical limitation, though: Marketers had to appeal to the masses. Radio, television and print media allowed brands to deliver only one message to everyone, no matter if their product conferred luxury or smart cost-consciousness.

On the internet, the masses have been shattered into ever smaller shards, shifting that marketing calculus toward targeted audiences and social network interest groups. Today, niche brands, large corporations and every business in between are reaching ever-narrower audiences.

Marketers who become expert at personalization, especially for existing customers through owned marketing platforms like email, will hold an edge over their competitors.

Yet, advertising and social networks are competitive marketplaces. Over time, prices to reach niche audiences rise, and strategies that once worked become unviable. In 2021, these perpetual challenges are joined by two new factors: a fresh influx of new e-commerce brands and changing privacy policies on third-party platforms.

Klaviyo benefits from these secular trends. While the cost or difficulty of acquiring new customers may increase, as we looked at in the second part of this EC-1, the cost of emailing an existing one remains much the same. Marketers who become expert at personalization, especially for existing customers through owned marketing platforms like email, will hold an edge over their competitors. It’s no longer about marketing to narrow slices of audiences — it’s about building an emotional bond with an audience of one.

While 2020 was a banner year for e-commerce in the wake of the COVID-19 pandemic, the early months of 2021 have brought about a new problem: Customer acquisition costs are rising, sometimes to a worrying degree. For instance, one company interviewed by TechCrunch that did not wish to be named said it has seen its return on investment for Facebook ads fall by nearly half in the first months of 2021. Such inflation has also been predicted by firms like ECI Media Management.

There are two possible reasons for this increase. First, an unprecedented number of companies are moving online, spurred by COVID-19 and worldwide lockdowns.

Powered by WPeMatico

Many of the stories in our EC-1 series tell tales of startups in the wilderness hacking out green field opportunities. Klaviyo is a different breed of company: One that went into an established market and challenged powerful incumbents, ultimately finding success with a new, more data-oriented generation of email marketers.

As such, the lessons that it offers are, perhaps, more subtle; its insights bordering on common sense.

But as the saying goes, common sense to an uncommon degree becomes wisdom. Here are four pieces of wisdom I’ve gleaned from Klaviyo’s story:

Drama and sizzle help companies stand out, undoubtedly. But are they necessary for success? Klaviyo’s story suggests otherwise.

Silicon Valley has become a showcase for oddity. Ironically, we all enjoy “Silicon Valley” (the show) or “The Social Network.” Unironically, we toss around phrases like “the hustle” and “sweat equity.” Hot companies often stand out with stories of intense struggle and failure, a larger-than-life founder or a chaotic (and often toxic) management structure.

Drama and sizzle help companies stand out, undoubtedly. But are they necessary for success? Klaviyo’s story suggests otherwise.

Powered by WPeMatico

Cannabis financing company Bespoke Financial today announced it raised $8 million in a Series A financing round. Through this round, the company brought new, key investors into its corner as it fights to bring financing solutions to companies in the cannabis space.

Bespoke is a direct lender and provides several financing solutions to companies operating in cannabis. These short-term loans allow the companies to build credit with Bespoke, which then offers better terms on subsequent loans and products. The company says its loan origination volume has grown exponentially, outgrowing forecasts by 25% over the proceeding year. The company has deployed $120 million in gross merchandise volume over 2,000 cannabis license holders, with zero defaults to date.

With this new round of capital, Bespoke intends to launch new financing structures and expand its financing options across various distribution channels.

CEO and co-founder George Mancheil calls this round a pivotal moment for his company and stamp of validation on the direction and products offered by Bespoke Financial. As he tells TechCrunch, this round provides several key partners to the growing startup.

The financing round was co-led by Snoop Dogg’s Casa Verde Capital and Sweat Equity Ventures, along with Ceres Group Holdings, Greenhouse Capital Partners, DoubleLine Capital’s co-founder and former president Philip Barach, and Robert Stavis, an investor based in New York.

This is Sweat Equity Ventures’ (SEV) first investment into a cannabis company. SEV, backed and funded by LinkedIn founder Reid Hoffman, is led by Dan Portillo and works differently from traditional venture funds. SEV works with founders to provide top engineering and business talent to its portfolio companies. In exchange for these services, SEV takes equity from the companies instead of just writing checks.

“This is our firm’s first investment in the cannabis industry, and we are excited to partner with Bespoke as more and more states legalize cannabis use, and the Federal government contemplates nationwide legalization. This partnership combines Bespoke’s finance and cannabis acumen with our team’s expertise scaling innovative tech companies, and will provide cannabis companies greater access to streamlined financing while benefiting investors with increased transparency and enhanced risk surveillance,” says Dan Portillo, managing partner of Sweat Equity Ventures, in a released statement.

Karan Wadhera, managing partner at Casa Verde Capital, says Bespoke Financial addresses real needs in a growing industry. Casa Verde Capital previously invested in Bespoke Capital, including in a $7 million round in 2019.

Bespoke CEO Mancheil tells TechCrunch his company is focused on being more than just a lender; it wants to be a modern financing company that allows it to act as a true partner with the cannabis industry.

With this $8 million in financing, Bespoke Financial has raised $28 million to date. The company was founded in 2019 and, as of this announcement, has 12 employees.

Powered by WPeMatico

If you’ve spent any time on TikTok lately, then you’ve probably seen a number of Popl’s ads. The startup has been successfully leveraging social media to get its modern-day business card alternative in front of a wider audience. Packaged as either a phone sticker, keychain or wristband, Popl uses NFC technology to make sharing contact information as easy as using Apple Pay. To date, Popl has sold somewhere over 700,000 units and has generated $2.7 million in sales for its digital business card technology.

Popl co-founder and CEO Jason Alvarez-Cohen, a UCLA grad with a background in computer science, first realized the potential for NFC business cards through a different use case — a device he encountered in someone’s home while attending a party. But it sparked the idea to use NFC technology for sharing information person-to-person, which would be faster than alternatives, like AirDrop or manual entry. And so, Popl was born.

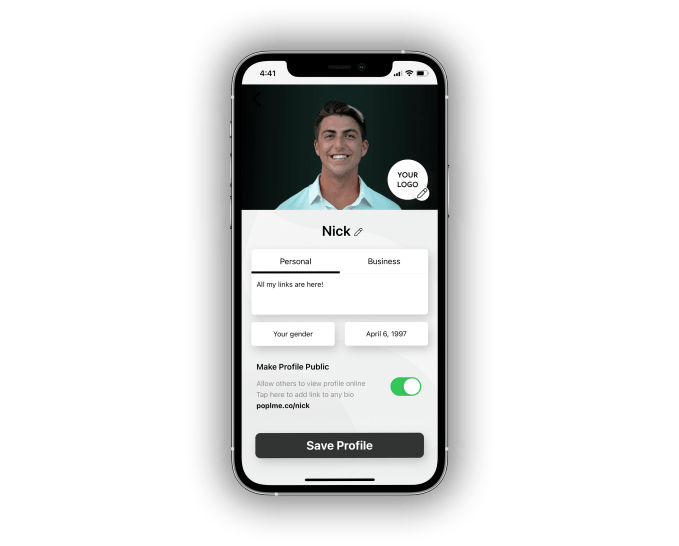

Image Credits: Popl

Though startup history is littered with would-be “business card killers” that eventually died, what makes Popl different from early contenders is that it combines both an app with a physical product — the Popl accessory. This accessory can be purchased in a variety of form factors, including the popular Popl phone sticker that you can apply right to the back of your phone case (or even the top of your PopSocket), and customized with a photo of your choosing.

“I knew that, in the past, people would tap phones and share information like that. But I learned quickly that you can’t do this just phone-to-phone with pure software,” says Alvarez-Cohen. “So I [wondered to myself], what’s the closest way we can get the phone tapping? And that’s how I came up with this back-of-the-phone product.”

Each Popl accessory is actually an NFC tag which enables the handoff of the user’s contact information. When the phones are close, the recipient will get a notification that alerts them to your shared Popl data.

There are, of course, other ways to quickly exchange contact information. You can easily enter in someone’s digits into your phone’s contacts app directly, for example, which may work better for more casual encounters — like meeting someone at a bar. But Popl lets you share a full business cards’ worth of contact data with just a tap, which makes it better for professional encounters, or any other time you want to share more than just your phone number.

While the Popl tags make for a nice gimmick, the Popl mobile app is what makes the overall service useful. And to be clear, the app is only necessary for the Popl’s owner — the recipient doesn’t need the app installed for Popl to work. They will, however, need to have a phone that can read NFC tags, which can leave out some older devices. Or, as a backup, they’ll need the ability to scan the QR code the app provides as a workaround.

Image Credits: Popl

In the Popl app, you can customize which data you want to share with others — including your contact info, social profiles, website links, etc. — all via an easy-to-use interface. Like some business card apps in the past, you can flip between a personal profile and a business profile in Popl in order to share the appropriate information when out networking. To actually make the exchange of contact information with another person, you simply hold up your phone to theirs and they’ll get a notification directing them to your Popl profile webpage. (The phones don’t have to physically touch or bump together, however. It’s more like Apple Pay, where they have to be near each other.)

From the Popl website, that’s shared via the notification that pops up, the recipient can tap on the various options to connect with the sender — for example, adding them on a social network like LinkedIn or Instagram, grabbing their phone number to send a quick text, or even downloading a full contact card to their phone’s address book, among other things.

Image Credits: Popl

The app’s more clever feature, however, is something Popl calls “Direct.”

This patented feature won’t send over the Popl website where the recipient then has to choose how they want to connect. Instead, it opens the destination app directly. For example, if you have LinkedIn Direct on, the recipient will be taken directly to your profile on LinkedIn when they tap the notification. Or if you put your Contact Card on Direct, it will just pop your address book entry onto the screen so the user can choose to save it to their phone.

For paid users, the app also lets you track your history of Popl connections on a map, so you can recall who you met, where and when, along with other analytics.

Image Credits: Popl

Work on Popl, which is co-founded by Alvarez-Cohen’s UCLA roommate, Nick Eischens, now Popl COO, began in late 2019. The startup then launched in February 2020 — just before the coronavirus lockdowns in the U.S. That could have been a disastrous time for a business designed to help people exchange information during in-person meetings when the world was now shifting to Zoom and remote work. But Alvarez-Cohen says they marketed Popl as a “contactless solution.”

“If I have this, and I have to meet someone for my business, I don’t even have to tap it — you can just hover, and it will still send that information,” Alvarez-Cohen says. “So I’m able to share my business card with you without handing you a business card, which is safe.”

But what really helped to sell Popl were its video demos. One TikTok ad, which I’m sure you’ve seen if you use TikTok at all, features the co-founders’ friend Arev sharing her TikTok profile with a new friend just as she’s leaving the gym.

In the video, the recipient — clearly dumbfounded by the technology after she taps his phone — responds “what? what? Whoa! What? How’d you do that?!”

It’s now been viewed over 80 million times.

Today, Popl’s TikTok videos get high tens of thousands, hundreds of thousands and sometimes still millions of views per video. The company also has an active presence on other social media. For instance, Popl posts regularly to Instagram, where it has over 100,000 followers. Today, the startup’s growth is about 60% driven by Facebook and Instagram marketing and 40% organic, Alvarez-Cohen says.

Now, the company is preparing new products for the post-pandemic era when in-person events return. Though it had before sold Popl’s in bulk for this purpose, it’s now readying an “event bracelet” that just slips on your wrist (and is reusable). The bracelet could be used at any big event — like music festivals or business conferences, where you’re meeting a lot of new people. And because Popl uses NFC, phones have to be close to make the contact info exchange — it won’t just randomly share your info with everyone as you pass by them.

Popl is also fleshing out the business networking side of its app with integrations for Salesforce, Oracle, HubSpot and CSV export, that come with its Popl Pro subscription ($4.99 per month). The in-app subscription is already at $450,000-plus in annual recurring revenue and growing 10% every week, as of early April.

A Y Combinator Winter 2021 participant, Popl is backed by Twitch co-founder Justin Kan (via Goat Capital), YC, Urban Innovation Fund, Cathexis Ventures and others angels, including Wish.com CEO Peter Szulczewski and PlanGrid co-founder Ralph Gootee.

The app is available on iOS and Android, and the Popl accessories are sold on its website and on Target.com.

Update, 4/19/21, 6:45 PM ET: Post updated with a more current revenue figure after publication.

Powered by WPeMatico