TC

Auto Added by WPeMatico

Auto Added by WPeMatico

As businesses continue to adopt new digital tools to get their names out into the world, a startup that’s built a sales and marketing platform specifically for small and medium businesses is announcing a big round of funding. ActiveCampaign, which has built what it describes as a “customer experience automation” platform — providing a way not just to run digital campaigns but to follow up aspects of them automatically to make sales and marketing work more efficiently — has closed a $240 million round of funding. The Series C values the Chicago startup at over $3 billion.

The round is being led by a new, big-name investor, Tiger Global, with participation from another new backer Dragoneer, along with Susquehanna Growth Equity and Silversmith Capital Partners, which had both invested previously.

This funding round represents a huge leap for ActiveCampaign. It was only in January 2020 that it raised $100 million, and before that, the company, which was founded in 2003, had only raised $20 million.

But as we have seen in many other ways, the pandemic resulted in a surge of interest among businesses to do more — a lot more — online than ever before, not least because so many people were spending more time at home, carrying out their consumer lives over the internet. That led to ActiveCampaign growing to a customer base of 145,000 customers, up from 90,000 16 months ago.

That points not just to the company already growing at a decent clip before the pandemic, but how it capitalized on that at a time when companies were looking for more tools to run their businesses in the new world.

The growth was not about ActiveCampaign throwing more money into business development, founder and CEO Jason VandeBoom said in an interview. “It was the network effect of people finding success. Even today, organic word of mouth is our primary driver.”

The company’s tools fit into a wider overall trend in the world of business: automation, built on the back of new, cloud-based technology, is being adopted to carry out some of the less interesting and repetitive aspects of running a business.

In the case of sales, an example of what ActiveCampaign might provide is a way for an e-commerce business to identify when a logged-in customer (that is, a user who has an account already and is signed in) might have ‘abandoned’ a visit to a site before buying a product that had already been searched for, or clicked on, or even added to a cart. In these cases, it sends an email to customers reminding them of those items, with options for other follow-ups, in the event that the choice was due to being distracted or having second thoughts that might be persuaded otherwise.

Users can opt-out of these, but they can be useful given the genuine distraction exercise that is browsing online — with all of the unrelated notifications, plus other options for considering a purchase. Tellingly, ActiveCampaign integrates with 850 different apps, a measure of just how fragmented the online landscape is, and also how many ways your attention might be distracted, or snagged depending on your perspective.

Abandoned carts can cost a company, in aggregate, a lot of lost revenue, yet chasing those down is not the kind of task that a company would typically assign to a valuable employee to carry out. And that’s where companies like ActiveCampaign come in.

This, plus some 500 other actions like it around sales and marketing campaigns — VandeBoom calls them “recipes” — some of which have been contributed by ActiveCampaign’s own users, form the basis of the company’s platform.

The marketing and sales automation market is estimated to be worth billions of dollars today, and, thanks to the rise of social media and simply more places to spend time online (and more time spent online) is expected to be worth more than $8 billion by 2027, so it’s going after a lucrative and much-used tool for doing business online. (And others are looking at it as well, of couse, including newer entrants like Shopify coming from a different angle to the same problem. Shopify today is a valued partner of the company, VandeBoom said when I asked him about it.)

That gives ActiveCampaign not just a big opportunity to continue targeting, but possibly also makes it a target itself, for an acquisition.

The other key aspect of ActiveCampaign’s growth that is worth watching is related to its customers. While the company has a client base that includes recognized names like the Museum of Science and Industry based out of ActiveCampaign’s hometown, it also has some 145,000 others across nearly 200 countries with a big emphasis on small and medium businesses.

SMBs form the vast majority of all businesses globally, collectively representing a huge win for tech companies that can capture them as customers. But traditionally, they have proven to be a challenging sector, given that they cover so many different verticals, are in many ways more price-sensitive than their enterprise-sized counterparts, among other factors.

So for ActiveCampaign to have found successful traction with SMBs — including with pricing that works for many of them (using it starts at $9 for accounts with less than 500 contacts) — is likely another reason why the startup has caught the eye of investors keen to back winning horses.

While the company did not need to raise money, VandeBoom said he “saw it as an opportunity to bring in more partners, saying that investors like how it purposely went after the idea of customer experience not on vertical or locale.”

“We’ve been lucky enough to have a front row seat on this journey from early on – and it’s been pretty breathtaking,” said Todd MacLean, managing partner, Silversmith Capital Partners, in a statement to TechCrunch. “Even compared to other great growth companies, the momentum and capital efficiency are rare. But Jason is a rare entrepreneur and has built a team in his image. While there’s lots left to do, we believe we’ve only scratched the surface of this market opportunity and are excited to double-down on Jason and his vision.”

Powered by WPeMatico

Class, an edtech startup that integrates exclusively with Zoom to make remote teaching more elegant, has raised $12.25 million in new financing. The round brings Salesforce Ventures, Sound Ventures and Super Bowl champion Tom Brady onto its capital table.

CEO and founder Michael Chasen said that Marc Benioff, the CEO of Salesforce, approached the company about investing in Class. Salesforce Ventures launched a $100 million Impact Fund in October 2020, a month after Class launched, to back edtech companies and cloud enterprises businesses with an impact lens.

As for Tom Brady entering the edtech world, Chasen said that the famous football player has made tech investments in the past and, “as the father of three is passionate about helping people through education.”

“Tom Brady and I are both fathers to three kids and like all parents, we get the need to add teaching and learning tools to Zoom,” Chasen added.

Class has now raised $58 million in less than a year, with a $30 million Series A in February 2021 and a $16 million seed round in September 2020. Today’s raise is less than its Series A round, which signals it was likely more done strategically to bring on investors than out of necessity.

The money will be used to help roll out Class to K-12 and higher-ed institutions across the world. The startup’s software publicly launched on the Mac a few months ago, and will exit beta for Windows, iPhone, Android and Chromebook in the next few weeks, Chasen said. The larger public launch will help scale the some 7,500 schools that have shown interest in adopting Class.

The big hurdle for Class, and any startup selling e-learning solutions to institutions, is post-pandemic utility. While institutions have traditionally been slow to adopt software due to red tape, Chasen says that both of Class’ customers, higher ed and K-12, are actively allocating budget for these tools. The price for Class ranges between $10,000 to $65,000 annually, depending on the number of students in the classes.

“We have not run into a budgeting problem in a single school,” Chasen said in February. “Higher ed has already been taking this step towards online learning, and they’re now taking the next step, whereas K-12, this is the first step they’re taking.” So far, Class has more than 125 paying clients with even-split between K-12 and higher ed, and 10% of customers using it for corporate teams.

It’s not the only startup that is trying to reinvent Zoom University. A number of companies are trying to serve the same market of students and teachers who are fatigued by current video conferencing solutions which — at best — often look like a gallery view with a chat bar. Three companies that are gaining traction include Engageli, Top Hat and InSpace.

While each startup has its own unique strategy and product, the founders behind them all need to answer the same question: Can they make digital learning a preferred mode of pedagogy and comprehension — and not merely a backup — after the pandemic is over?

As that question continues to get explored, today’s news shows that Class isn’t having any trouble recruiting people to believe the answer is yes. In just nine months, the company has gone from two to more than 150 employees and contractors.

Powered by WPeMatico

Software-as-a-service (SaaS) is now the default business model for most B2B and B2C software startups. And while it’s been around for a while now, its momentum keeps accelerating and the ecosystem continues to expand as technologists and marketers are getting more sophisticated about how to build and sell SaaS products. For all of them, we’re pleased to announced TechCrunch Sessions: SaaS 2021, a one-day virtual event that will examine the state of SaaS to help startup founders, developers and investors understand the state of play and what’s next.

The single-day event will take place 100% virtually on October 27 and will feature actionable advice, Q&A with some of SaaS’s biggest names and plenty of networking opportunities. Importantly, $75 Early Bird passes are now on sale. Book your passes today to save $100 before prices go up.

We’re not quite ready to disclose our agenda yet, but you can expect a mix of superstars from across the industry, ranging from some of the largest tech companies to up-and-coming startups that are pushing the limits of SaaS.

The plan is to look at a broad spectrum of what’s happening with B2B startups and give you actionable insights into how to build and/or improve your own product. If you’re just getting started, we want you to come away with new ideas for how to start your company, and if you’re already on your way, then our sessions on scaling both your technology and marketing organization will help you to get to that $100 million annual run rate faster.

In addition to other founders, you’ll also hear from enterprise leaders who decide what to buy — and the mistakes they see startups make when they try to sell to them.

But SaaS isn’t only about managing growth — though ideally, that’s a problem founders will face sooner or later. Some of the other specific topics we will look at are how to keep your services safe in an ever-growing threat environment, how to use open source to your advantage and how to smartly raise funding for your company.

We will also highlight how B2B and B2C companies can handle the glut of data they now produce and use it to build machine learning models in the process. We’ll talk about how SaaS startups can both do so themselves and help others in the process. There’s nary a startup that doesn’t want to use some form of AI these days, after all.

And because this is 2021, chances are we’ll also talk about building remote companies and the lessons SaaS startups can learn from the last year of working through the pandemic.

Don’t miss out. Book your $75 Early Bird pass today and save $100.

Powered by WPeMatico

Catch&Release founder and CEO Analisa Goodin told me that she wants to help brands break free from the limitations of stock photography — and that her startup has raised $14 million in Series A funding to achieve that goal.

Goodin explained that the company started out as an image research firm before becoming a product-focused, venture-backed startup in 2015. The Series A was led by Accel (with participation from Cervin Ventures and other existing investors), and it brings Catch&Release’s total funding to $26 million.

Stock media and video services are moving in this direction themselves, for example by introducing their own libraries of user-generated content. Goodin applauded this, and she said Catch&Release isn’t opposed to the use of stock photos — it integrates with these stock marketplaces. At the same time, she suggested that she has a much bigger vision.

“This isn’t just about UGC, this is about tapping into the creative potential of the internet,” she said.

After all, you can now find pretty much any kind of content you can imagine somewhere online, but “a lot of advertising agencies and brands have been trained that if a piece of content comes from the internet, avoid it,” because it’s just “too hard” to figure out how to license it. (And indeed, that’s why I went with a stock photo for the lead image of this post.)

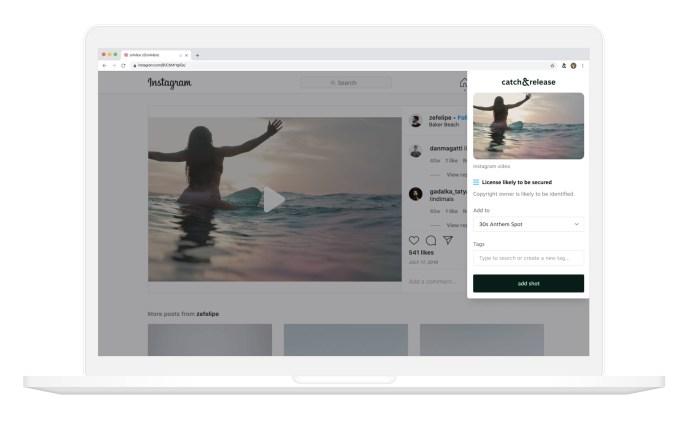

Image Credits: Catch&Release

Catch&Release aims to make that process as simple as possible, first with a browser extension that allows marketers to save any media that they find on the web, anytime they think they might want to use it in their own campaigns (this is the “catch” part of the process). It even presents a “licensability score,” which is a rating based on factors like the person who posted the content, the description and the comments, indicating how likely it is that a marketer will actually be able to license this content.

Then, when someone from a brand or advertising agency decides that they want to use a piece of content, they can send a licensing request with a push of a button (this is the “release”). Catch&Releases also analyzes the content for anything else that needs to be cleared or obscured, such as a company logo.

While we’ve written about other tools for licensing online content, Goodin emphasized that Catch&Release isn’t just about finding photos for a social media campaign. Part of the goal, she said, is to erase the “stigma” around UGC, which now “represents the entire spectrum of culturally relevant content.”

For example, she showed me a Red Lobster commercial that looks like a normal TV ad, but was in fact assembled entirely from footage found online — something that’s been even more useful in the past year, with pandemic-related safety concerns around large shoots. (Catch&Release has also been used to license content for ads promoting TechCrunch’s parent company Verizon.)

Goodin added that the new funding will allow Catch&Release to continue investing in product, engineering and marketing.

“No one has defined the commercial licensing layer for the web,” she said. “What’s got me really excited to build this product is being that layer for the internet, not just for photos and videos, but for writing, art, graphics and building the commercial licensing engine of the web.”

Powered by WPeMatico

For IBM, much of the last eight years simply posting positive revenue growth was a challenge. In fact, the company had a period between 2013 and 2018 when it experienced an astonishing 22 straight quarters of negative revenue growth. So when Big Blue reported yesterday that revenue was up slightly, I’m sure the company took that as a win. Investors appear to be happy with the results, with the stock up 4.73% this morning as of publication.

Consider that over the last eight quarters encompassing FY2019 and FY2020, the company had only one positive revenue quarter when it was up 0.1% in Q42019. It had had five losing quarters prior to that one. When you look at yesterday’s report in that light, and combine it with growth in the Cloud and Cognitive Services group, it adds up to a decent quarter for IBM, one it badly needed after another negative report in the prior quarter.

Looking back at the January report, the company reported Cloud and Cognitive Services revenues down 4.5% at $6.8 billion, which was a big blow, considering the company has been betting much of its future on those very areas, fueled in large part by the $34 billion Red Hat acquisition in 2018.

Its most recent quarterly report proved much better, with the company reporting Cloud and Cognitive Services revenues of $5.4 billion, up 3.8% YoY. Interestingly quarter-on-quarter revenue for the segment was down, but rose on a year-over-year basis. Perhaps a year-end enterprise revenue push could account for the difference between Q4 2020 and Q1 2021.

At any rate, IBM CEO Arvind Krishna saw today’s report as a positive sign that his attempts to push the company toward a future focused on hybrid computing and AI were starting to take root. He also saw enough in the report to predict some growth this year.

“In our last call, we shared our financial expectations for the year, revenue growth and $11 billion to $12 billion of adjusted free cash flow. While it’s still early in the year and a lot remains to be done, we are confident enough to say that we are on track,” Krishna said in the earnings call with analysts yesterday.

The company has made a number of smaller acquisitions over the last year, including a couple of consulting companies, which should help as they try to work with customers around the transition to hybrid computing and artificial intelligence, both of which tend to require a lot of hand-holding to get done.

At the same time, of course, the company is continuing apace with its spin out of the legacy infrastructure services division, which it announced last year. The plan at this point is to rename the company Kyndryl (an unfortunate choice) and complete the spin out by year’s end.

CFO Jim Kavanaugh also sees the modestly positive quarter as something the company can build on. “…in fact we are even more confident in the position we put in place with regards to our two most important measures, one, revenue growth, and second, adjusted free cash flow, which is going to provide the fuel for the investments needed for us to capture that hybrid cloud $1 trillion TAM,” Kavanaugh said in the earnings call with analysts.

All of this is being pushed by Red Hat, which grew revenue 15% in the most recent quarter, something the company is banking will continue to advance it deeper into positive territory throughout the rest of 2021.

Krishna is not looking for booming growth by any means. He just wants growth, and even sustained single-digit top line expansion will make him happy. “Our systems if I take a two-year to three-year view kind of flattish, but in any given year it might increase or decrease but not by a whole lot. It doesn’t impact the top line a lot and that’s how sort of we get to the mid-single-digit sustainably,” Krishna said in the call.

The CEO simply wants to bring some long-term stability back to the company it has been sadly lacking in recent years. Of course, it’s hard to know if this quarter was a temporary upward blip on IBM’s earnings chart, one of those fluctuations up or down he spoke of, or if it is the corner the company has been looking to turn for years. Only time will tell whether IBM can sustain the modest revenue goals Krishna has set for the organization, or if it will fall back into the revenue doldrums that have plagued the company for the last eight years.

Powered by WPeMatico

The investment landscape for insurtech startups is off to a hot start in Q2 2021. Since the end of the first quarter, we’ve seen several players in the broad startup category announce new capital, including Clearcover, Alan, Next Insurance and The Zebra.

But, as anyone who’s familiar with startups that offer insurance-related products and services knows, the sector is enough of a mixed bag that one needs to segment down to get clarity on how constituent companies are performing. So while Clearcover’s $200 million round from last week, Next Insurance’s $250 million round from the first of the month and Alan’s $220 million round from yesterday are interesting, this morning we’re going to focus a bit more on The Zebra’s side of the insurtech house.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

The Exchange divides insurtech startups into three categories: neoinsurance providers, insurtech marketplaces and insurtech enablers. (You can see why we need to segment the insurtech genre!)

Briefly, neoinsurance providers are companies like Root, Metromile and Next Insurance, which use technology to underwrite and sell insurance in an updated manner; these companies also often have optimized mobile experiences.

Marketplaces like The Zebra, Gabi, Insurify and others provide a way for consumers to better identify their insurance options. And, finally, there are companies like AgentSync, which fit neatly into our third category of firms that help other companies in the insurance business digitize their operations or otherwise modernize.

Insurtech marketplaces came back into our view when The Zebra put together a $150 million Series D earlier this month and released a host of metrics regarding its growth, and Insurify dropped the news that it is partnering with Toyota.

Insurtech marketplaces came back into our view when The Zebra put together a $150 million Series D earlier this month and released a host of metrics regarding its growth, and Insurify dropped the news that it is partnering with Toyota.

This morning, let’s discuss insurtech’s 2020 as a whole, peek at some preliminary 2021 venture data and then dive deep into what we’ve collected regarding growth among insurtech marketplace players. The Exchange has data and other details from The Zebra, Insurify, Wefox and more.

Covering longitudinal progress of specific startup categories is one of our favorite things to do. So, please, walk with us!

PitchBook data regarding the insurtech category in 2020 underscores how large the startup niche has grown. Per the data company, $18.3 billion was spent last year on insurtech startups across venture capital, private equity and M&A activity. That was a billion dollars under its 2019 result, but given the pandemic’s onset, 2020’s final result is somewhat impressive — who expected insurance investing to hold up during an unprecedented global catastrophe?

This year is proving lucrative for the insurtech market, at least from a venture capital perspective. Normally I’d make a joke about how unprofitable some neoinsurance providers are at this juncture, but because our focus is elsewhere, bringing up the fact that, say, Lemonade’s adjusted losses in the final quarter of 2020 were around 150% of its revenue is kind of irrelevant. So we won’t!

Powered by WPeMatico

WayUp started out as a platform to help college graduates find jobs and internships, but over time, it has increasingly focused on helping employers find diverse job candidates. And it recently introduced a new feature to help those employers see exactly where their diversity and inclusion efforts may be falling short.

Co-founder and CEO Liz Wessel explained that when companies aren’t hiring enough employees from diverse backgrounds, recruiters and executives often assume “we’re not getting enough of those candidates at the top of our funnel.” That idea, she suggested, is exemplified by Wells Fargo CEO Charles Schlarf’s controversial remarks last fall, when he said the company wasn’t reaching its diversity goals because there simply aren’t enough qualified candidates.

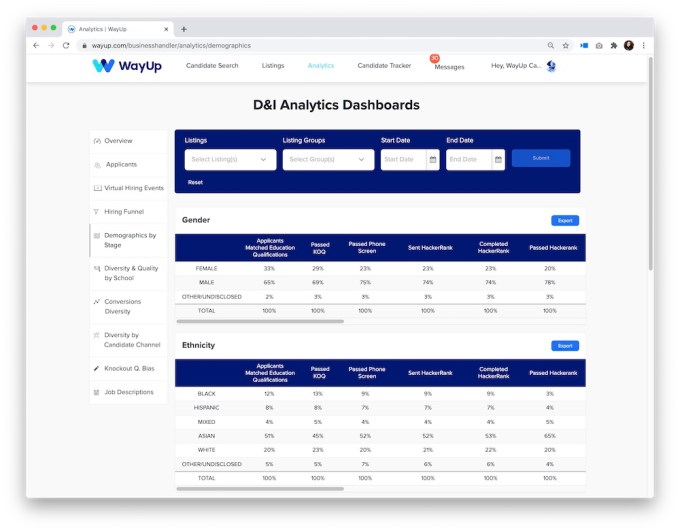

Wessel suggested that when you take a closer look at the data, you find that the initial outreach and recruiting is only part of the problem. WayUp’s new dashboard allows employers to track this, because it shows the demographic (race and gender) breakdown of the candidate pool at each part of the funnel.

For example, Wessel said that many employers hiring for technical roles discover that they’re reaching a relatively diverse candidate pool during their initial outreach, and that the pool stays diverse during the first interviews — only to become much more white and male after the technical assessments/programming tests.

Image Credits: WayUp

“Similar to the SATs, many technical assessments have high correlation to socioeconomics status,” she said.

Upon discovering this, some recruiters may choose to stop requiring these tests. Others may choose to keep them — but thanks to WayUp, at least they know where the breakdown is really happening.

After Wessel showed me the dashboard, I wondered why other hiring platforms didn’t offer something similar. In a follow-up email, she suggested that many platforms don’t realize that achieving these goals requires more than just getting a diverse pool of candidates. Plus, she said WayUp is “one of the only sourcing/job platforms that I know of that has candidates self-report their race/ethnicity, gender and veteran status (in an EEOC/OFCCP compliant way).”

She added, “We really are focusing on having our platform make it so your entire hiring process is equitable and optimizes for employers hiring a diverse workforce, [versus] putting a Band-Aid or quick fix on the issue by just sourcing more diverse candidates at the top of your funnel.”

Powered by WPeMatico

Farshad Yousefi and Masoud Jalali used to drive through Palo Alto neighborhoods and marvel at the outrageous home prices. But the drives sparked an idea. They were not in a financial position to purchase a home in those neighborhoods (to be clear, not many people are) either for investment or to live. But what if they could invest in homes in up and coming cities throughout the U.S.?

Then they realized that even that might be a challenge, considering that with all their student debt, affording a down payment would be impossible.

“There was nothing available out there besides a crowdfunding platform, which when we first signed up, took away $1,000 from our account that we didn’t have, and then our capital would be locked up for three to 10 years,” recalls Yousefi.

So the pair started doing research and spoke to 1,000 individuals under the age of 35. Eight out of 10 said they would like to invest in real estate but were deterred by all the barriers to entry.

“There is clearly a large demand for access to real estate,” Yousefi said. “And we wanted to give people a way to invest in it like they can in stocks, via a mobile app.”

And so the idea for Fintor was born.

Yousefi and Jalali founded the company in 2020 with the goal of purchasing homes via an LLC, and turning each into shares through an SEC-approved broker dealer. Individuals can then buy shares of the homes via Fintor’s platform. Its next step is to sign agreements with individual real estate investors or bigger real estate development firms to list their properties on the platform and give people the opportunity to buy shares.

And now Fintor has raised $2.5 million in seed money to continue building out its fractional real estate investing platform. The startup aims to “fractionalize” houses and other residential property, giving people in the U.S. access to investment opportunities “starting with as little as $5.” The company attracted the interest of investors such as 500 Startups, Hustle Fund, Graphene Ventures, Houston-based real estate investor Manny Khoshbin, Mana Ventures and other angel investors such as Cindy Bi, Skyler Fernandes, VU Venture Partners, Minal Hasan, Andrew Zalasin, Alluxo CEO and founder Safa Mahzari, SquareFoot CEO and founder Jonathan Wasserstrum and Teachable CEO and founder Ankur Nagpal.

Image Credits: Fintor

Fintor is eying markets such as Kansas City, South Carolina and Houston, where it already has some properties. It’s looking for homes in the $80,000 to $350,000 price range, and millennials and Gen Zers are its target demographic.

“Fintor can give the same return as the stock market, but at half the risk,” Yousefi said. “As two [Iranian] immigrants, we’ve seen how much this country has to offer and how real estate sits at the top of everything, yet is so inaccessible.”

The pair had originally set out to raise just $1 million but the round was quickly “way oversubscribed,” according to Yousefi, and they ended up raising $2.5 million at triple the original valuation.

Jalali said the company will use machine learning technology to filter and rate properties as it scales its business model.

“We’ll use ML to categorize neighborhoods and to come up with the price of properties to offer to potential sellers,” he added. “Our ultimate goal is to create indexes so that people can invest in multiple properties in a given city. That creates diversification right away.”

Elizabeth Yin, co-founder and general partner of Hustle Fund, believes that Fintor is solving a generational problem with real estate.

“Retail investors have almost no access to great real estate investments today and the best opportunities are reserved for the select few,” she told TechCrunch. “Not to mention that in addition to access, retail investors often need a lot of capital in order to have a diversified portfolio or be accredited to join funds.”

Fintor’s approach to securitize real estate assets will give millions of investors who are not accredited investors access they would otherwise not have had, Yin added.

“Simultaneously, it provides increased liquidity to property owners, while improving the user experience for both parties,” she said. “Effectively this becomes a new asset class, because it’s entirely turnkey and is fractionalized, which opens up many new pockets of investors.”

Powered by WPeMatico

Pragma is building what it calls a “backend as a service,” providing ready-made infrastructure to developers of online, live service games. And it’s announcing today that it has raised $12 million in Series A funding.

The round was led by David Thacker at Greylock, with participation from Zynga founder Mark Pincus, Oculus founder Nate Mitchell and Cloudera founder Amr Awadallah, along with previous investors Upfront Ventures and Advancit Capital. Amy Chang, who sold her business intelligence startup Accompany to Cisco, is joining Pragma’s board of directors.

Co-founder and CEO Eden Chen told me that where Unity and Unreal have built popular frontend game engines, he and his co-founder Chris Cobb (former engineering lead at Riot Games) are hoping Pragma will fill the void for a “de facto backend game engine.”

And while “many companies tried to do this” over the past decade, Chen suggested that this is the right time to launch the platform, thanks to the continued rise of live service games (like League of Legends) that have to be treated as “living, breathing products,” as well as improved tooling around infrastructure platforms like Amazon Web Services.

Image Credits: Pragma

Pragma is launching a starter kit today designed to allow developers to quickly set up and test game loops. Meanwhile, the broader platform is currently in private beta testing with studios including One More Game (started by started by Pat Wyatt, one of Blizzard’s first employees) and Mitchell’s Mountain Top Studios.

Chen said the platform’s features fall into three broad categories — player accounts/social, game loops (including lobbies and matchmaking) and player/game data. Pragma isn’t building all of this from scratch; in some cases, it’s “acting as the integrator” for other platforms like Discord. Chen also noted that while the team plans to build a fully managed solution in the future, the current version is on-premise: “We’re building an instance of Pragma on the studio’s own infrastructure, [so they can] so they can take our code base and customize it to their own preferences.”

Pragma is initially targeting game studios with about 10 to 50 team members. Eventually, Chen hopes the platform could serve larger studios while also supporting “the democratization of these tools, so that a one- to five-person team can really leverage [them] to launch a networked, online game.”

He added, “The vision for us long term is that we really want to be innovating on the social side, creating social features that improve the game and build stronger connections.”

Powered by WPeMatico

“Challenger” startups in banking and insurance have upended their industries, and picked up significant business, by building more customer-friendly tools and services — more personalized, easier to access and usually competitively priced — than those typically provided by their bigger, incumbent rivals. Now, a startup out of Romania that is building tools to help the incumbents respond with better services of their own is announcing a significant round of funding as its business grows.

FintechOS, which has built a low-code platform aimed at larger (older) banking and insurance companies to help them build new services and analytics on top of and around their existing infrastructure, has raised €51 million ($61.5 million at today’s rates, but $60 million at the time of the deal closing) in a Series B round of funding.

FintechOS’s opportunity has been to target the wave of incumbents in the insurance and banking industries that have been slowly watching as newer players like Lemonade (in insurance) and a huge plethora of challenger banks (Revolut, N26, Monzo and many others) are swooping in and picking up customers, especially among younger demographics, while they have been unable to respond mostly because their infrastructure is too old and big. Turning a huge ship around, as we have seen, is no small task — a situation that has become only more apparent in the last year of pandemic living and the big shift to digital interactions that resulted from it.

“When we launched FintechOS in 2017, we could already see existing solutions to digital transformation would struggle to deliver tangible results. By contrast, our unique approach has quickly inspired a sea-change in how financial institutions address digitization and engage with their customers,” said Teodor Blidarus, co-founder and CEO at FintechOS, in a statement. “Events over the last year have only increased pressure on our industry to evolve and as a result we’re seeing growing demand for our powerful platforms. Our latest round of funding will help us grow at the pace needed to improve outcomes for financial institutions and their customers globally.”

(It is not the only one. Others out of Europe in the space of bringing new tools to incumbent banks to help them make more modern and competitive products include 10x, Thought Machine, Temenos, Mambu and many more.)

The Series B round of funding is being led by Draper Esprit, with Earlybird, Gapminder Ventures, Launchub and OTB Ventures (which all participated in its Series A in December 2019) also participating. There are other backers in the round that are not being disclosed at this time, the startup added. FintechOS is also not disclosing its valuation. The company, based out of Bucharest, has raised just under $80 million to date.

FintechOS is active today in the U.K. and Europe — where it has been growing at a CAGR of 200% and says its services touch “millions” of people, with some of its key customers including the likes of banking giants Societe Generale and IdeaBank and international insurance brokers Howden. The plan will be to continue investing in those markets, as well as expanding internationally.

And it will be adding more services. Today, the banking platform is designed to help banks launch more retail services for consumers and small and medium business customers, and for insurance companies to build new health, life and general insurance products (there are a lot of synergies in how insurance and financial services companies have been built over the years, and so it’s a natural couplet when it comes to building tools for those industries).

In the financial sector, FintechOS lets banks build in new digital onboarding flows, credit cards and loan products, savings and mortgage products. Insurance products include new approaches to generating and handling quotes, customer onboarding and management and claims automation — which may well bring FintechOS into closer contact and collaboration with the most successful startup to come out of its home country to date, the RPA juggernaut UiPath. In all cases, it helps stitch together data from a bank’s own systems with more modern tooling, and to link that up with yet more modern tools to help process that data more easily.

This is “low code,” but it typically means that the company needs to work with third parties to enable all of this. Partners include the likes of integrators and other global services technicians, such as Microsoft, Deloitte, CapGemini, KPMG and so on. (And the founders of the startup themselves come from consulting backgrounds so they well understand the role these companies play in the process of bringing technology into big businesses.)

FintechOS is tapping into a couple of very big trends that have arguably been the biggest in the financial and related insurance industries.

The first of these is the fact that core services around things like credit/loans, current deposits and savings are not just very complex to build but actually have largely become commoditized — similar to digital payments — and so packaging them up and turning them into services that can be integrated by way of an API makes them more easily accessed without the heavy lifting needed to build them from scratch. This lets companies focus instead on customer service or building more interesting tools around those basic services to customise them (for example AI-based personalization). Disintermediating basic functions from the services built around them is arguably a bigger trend, but it has been especially prevalent in enterprise, which has long been a slow-moving space when it comes to innovation in the back-end, and the front-end.

The second of these is the big swing toward using no-code and low-code tools to empower more people within organizations to get stuck in when they can see something not working as efficiently as it could, and building the workflows themselves to improve that. This also applies to trying out and testing new products — again something that typically has not been done in financial and insurance services but can now be possible with low-code and no-code tools.

“Not only is our technology helping financial institutions become customer centric, but it’s also helping them provide products and services to more people and businesses,” said Sergiu Negut, the other co-founder who is FintechOS’s CFO and COO, in a separate statement. “With so many markets still underserved, the ability to tailor offerings to a segment of one offers the opportunity to increase financial inclusion and adheres to our ideal that easy access to financial services is essential. We’re delighted to be working with investors who share our views on how fintech should be transforming the financial services industry.”

Notably, Draper Esprit also has backed Thought Machine, another big player in the world of fintech that is taking some of the learnings and models that have helped new entrants disrupt incumbents, and is packaging them up as services for incumbents, too. It takes a different approach to doing this, not using low-code but smart contracts, which could be one reason why the VC doesn’t see the investments as conflict of interest. They are also tackling an enormous market, and so at least for now there is room for them, and many others in the space, such as 10x, Temenos, Mambu, Rapyd and many others.

“When we met Teo and Sergiu, we were immediately convinced of their vision: a data led, end-to-end platform, facilitated with a low-code/no-code infrastructure,” Vinoth Jayakumar, partner at Draper Esprit, said in a statement. “Incumbent financial services firms have cost-to-income ratios up to 90%, so we see a huge and increasing need for infrastructure software that allows digitisation at speed, ease and lower cost. Draper Esprit builds enduring partnerships; with the team at FintechOS we hope to build an enduring fintech company that will dramatically change financial services experiences for people all over the world.”

Powered by WPeMatico