TC

Auto Added by WPeMatico

Auto Added by WPeMatico

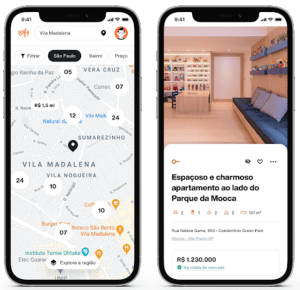

Nearly exactly one month ago, digital real estate platform Loft announced it had closed on $425 million in Series D funding led by New York-based D1 Capital Partners. The round included participation from a mix of new and existing investors such as DST, Tiger Global, Andreessen Horowitz, Fifth Wall and QED, among many others.

At the time, Loft was valued at $2.2 billion, a huge jump from its being just near unicorn territory in January 2020. The round marked one of the largest ever for a Brazilian startup.

Now, today, São Paulo-based Loft has announced an extension to that round with the closing of $100 million in additional funding that values the company at $2.9 billion. This means that the 3-year-old startup has increased its valuation by $700 million in a matter of weeks.

Baillie Gifford led the Series D-2 round, which also included participation from Tarsadia, Flight Deck, Caffeinated and others. Individuals also put money in the extension, including the founders of Better (Zach Frenkel), GoPuff, Instacart, Kavak and Sweetgreen.

Loft has seen great success in its efforts to serve as a “one-stop shop” for Brazilians to help them manage the home buying and selling process.

Image Credits: Loft

In 2020, Loft saw the number of listings on its site increase “10 to 15 times,” according to co-founder and co-CEO Mate Pencz. Today, the company actively maintains more than 13,000 property listings in approximately 130 regions across São Paulo and Rio de Janeiro, partnering with more than 30,000 brokers. Not only are more people open to transacting digitally, more people are looking to buy versus rent in the country.

“We did more than 6x YoY growth with many thousands of transactions over the course of 2020,” Pencz told TechCrunch at the time of the company’s last raise. “We’re now growing into the many tens of thousands, and soon hundreds of thousands, of active listings.”

The decision to raise more capital so soon was due to a variety of factors. For one, Loft has received “overwhelming investor interest” even after “a very, very oversubscribed main round,” Pencz said.

“We have seen a continued acceleration in our market share growth, especially in São Paulo and Rio de Janeiro, the two markets we currently operate in,” he added. “We saw an opportunity to grow even faster with additional capital.”

Pencz also pointed out that Baillie Gifford has relatively large minimum check size requirements, which led to the extension being conducted at a higher price and increased the total round size “by quite a bit to be able to accommodate them.”

While the company was less forthcoming about its financials as of late, it told me last year that it had notched “over $150 million in annualized revenues in its first full year of operation” via more than 1,000 transactions.

The company’s revenues and GMV (gross merchandise value) “increased significantly” in 2020, according to Pencz, who declined to provide more specifics. He did say those figures are “multiples higher from where they were,” and that Loft has “a very clear horizon to profitability.”

Pencz and Florian Hagenbuch founded Loft in early 2018 and today serve as its co-CEOs. The aim of the platform, in the company’s words, is “bringing Latin American real estate into the e-commerce age by developing online alternatives to analogue legacy processes and leveraging data to create transparency in highly opaque markets.” The U.S. real estate tech company with the closest model to Loft’s is probably Zillow, according to Pencz.

In the United States, prospective buyers and sellers have the benefit of MLSs, which in the words of the National Association of Realtors, are private databases that are created, maintained and paid for by real estate professionals to help their clients buy and sell property. Loft itself spent years and many dollars in creating its own such databases for the Brazilian market. Besides helping people buy and sell homes, it offers services around insurance, renovations and rentals.

In 2020, Loft also entered the mortgage business by acquiring one of the largest mortgage brokerage businesses in Brazil. The startup now ranks among the top-three mortgage originators in the country, according to Pencz. When it comes to helping people apply for mortgages, he likened Loft to U.S.-based Better.com.

This latest financing brings Loft’s total funding raised to an impressive $800 million. Other backers include Brazil’s Canary and a group of high-profile angel investors such as Max Levchin of Affirm and PayPal, Palantir co-founder Joe Lonsdale, Instagram co-founder Mike Krieger and David Vélez, CEO and founder of Brazilian fintech Nubank. In addition, Loft has also raised more than $100 million in debt financing through a series of publicly listed real estate funds.

Loft plans to use its new capital in part to expand across Brazil and eventually in Latin America and beyond. The company is also planning to explore more M&A opportunities.

This article was updated post-publication to reflect accurate investor information.

Powered by WPeMatico

The race to decarbonize aviation got a boost this Earth Day with the announcement of a $20.5 million Series A round by Universal Hydrogen, a Los Angeles-based startup aiming to develop hydrogen storage solutions and conversion kits for commercial aircraft.

“Hydrogen is the only viable path for aviation to reach Paris Agreement targets and help limit global warming,” said founder and CEO Paul Eremenko in an interview with TechCrunch. “We are going to build an end-to-end hydrogen value chain for aviation by 2025.”

The round was led by Playground Global, with an investor syndicate including Fortescue Future Industries, Coatue, Global Founders Capital, Plug Power, Airbus Ventures, Toyota AI Ventures, Sojitz Corporation and Future Shape.

The company’s first product will be lightweight modular capsules to transport “green hydrogen,” produced using renewable power to aircraft equipped with hydrogen fuel cells. The capsules will ultimately be available in different sizes for aircraft ranging from VTOL air taxis to long-distance, single-aisle planes.

“We want them to be interchangeable within each class of aircraft, a bit like consumer batteries today,” says Eremenko.

To help kickstart the market for its capsules, Universal Hydrogen is developing one such plane itself, a modified 40-60-seat turboprop capable of regional flights of up to 700 miles. The effort is a collaboration with seed investor Plug Power, which will supply the hydrogen and fuel cells, and magniX, which develops motors for electric aircraft.

Eremenko hopes to have the plane flying paying passengers in a larger, 50-plus seater aircraft by 2025 and ultimately to produce kits for regional airlines to retrofit their own aircraft.

“We want to have a couple of years of service to de-risk hydrogen certification and passenger acceptance before Boeing and Airbus decide on the airplanes they are going to build in the early 2030s,” says Eremenko. “It’s imperative that at least one of them build a hydrogen airplane or aviation is not going to hit its climate goals.”

Universal Hydrogen is not alone in betting on hydrogen. ZeroAvia in the U.K. is developing its own regional fuel cell aircraft on an even more ambitious timeline, and Airbus in particular has been working on hydrogen aircraft concepts.

Eremenko hopes that producing a simple and safe hydrogen logistics network will soon attract new entrants.

“It’s like the Nespresso system. We have to make the first coffee maker or nobody cares about our capsule technology, but we don’t want to be in the coffee maker business. We want other people to build coffee with our capsules.”

Universal Hydrogen will use the Series A funds to grow its current 12-person team to around 40 and accelerate its technology development.

30kW sub-scale demonstration of Universal Hydrogen’s aviation powertrain, with Plug Power’s hydrogen fuel cell and a magniX motor.

Powered by WPeMatico

Brazilian mobile payments app PicPay filed on Wednesday an F-1 with the Securities and Exchange Commission (SEC) for an IPO valued at up to $100 million. The company plans to list on the Nasdaq under the ticker symbol PICS.

PicPay operates largely as a financial services platform that includes a credit card, a digital wallet similar to that of Apple Pay, a Venmo-style P2P payments element, e-commerce and social networking features.

“We want to transform the way people and companies interact, make transactions, and communicate in an intelligent, connected, and simple experience,” said José Antonio Batista, CEO of PicPay, in a statement.

While the company is based in São Paulo now and operates across Brazil, PicPay originally launched in Vitoria in 2012, a coastal city north of Rio. In 2015 the company was acquired by the group J&F Investimentos SA, a holding company owned by Brazilian billionaire brothers Wesley and Joesley Batista, which also own the gigantic meatpacker JBS SA.

According to the company’s registration statement, J&F was involved in the biggest corruption scandal in Brazil’s history, known as The Car Wash, and in 2017 entered into a plea deal with the Brazilian Federal Prosecutor. In December 2020 the company agreed to pay a fine of $1.5 billion and contribute an extra $442.6 million to social projects in Brazil. That being said, J&F continues to be a powerful conglomerate in the country, positioning itself as a strong backer for PicPay.

2020 was an explosive year for PicPay as the company saw its active userbase grow from 28.4 million to 36 million as of March 2021. According to the company’s 2020 financial report, which PicPay shared with TechCrunch, the company’s revenues also grew drastically from $15.5 million in 2019, to $71 million in 2020. The company is not yet profitable, however, and PicPay shelled out $146 million in 2020 to fuel its growth.

“We believe that the growth of our base and user engagement in our ecosystem demonstrates the scalability of our business model and reveals a great opportunity to generate more value for these customers,” Batista added.

Fintech is one of the most popular sectors in Brazil today, because there’s a lot of room for improvement in the region. The country has traditionally been controlled by four major banks, which have been slow to adapt to technology and also charge very high fees.

PicPay’s IPO is being led by Banco Bradesco BBI, Banco BTG Pactual, Santander Investment Securities Inc., and Barclays Capital Inc.

*The Brazilian Real was valued at 5.50 to $1 USD on the date of publication.

Powered by WPeMatico

The global venture capital market had a cracking start to the year. Coming off a 2020 high, VC totals in the United States, in Europe, and among competitive verticals like insurtech and AI are on pace to set new records in 2021.

The rapid-fire deal-making and trend of larger venture checks at higher valuations that The Exchange has tracked for some time require private-market investors to make decisions faster than ever. For venture capitalists, the timeline for reaching conviction around a startup’s thesis and executing due diligence has become compressed.

Some venture capitalists are turning to data to move more quickly. Some are spending more time preparing to be vetted themselves. And some investors are simply doing the work beforehand.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

We were tipped off to the concept of pre-diligence during the reporting process for a look into recent fundraising trends in the AI/ML space. Sapphire investor Jai Das, when asked about how he was handling a competitive and swiftly moving market for AI startup investments, said that “most firms are completing their due diligence way before the financing actually happens.”

How does that work in practice? Per Das, startups that raise quick Series A and B rounds are “tracked by [early-stage] investors as soon as they raise their seed financings. So there is no need to do any due diligence during the financing and hence most of these financings are pre-emptive.”

How does that work in practice? Per Das, startups that raise quick Series A and B rounds are “tracked by [early-stage] investors as soon as they raise their seed financings. So there is no need to do any due diligence during the financing and hence most of these financings are pre-emptive.”

Venture capital: Now more about sales than ever before!

This morning, The Exchange is digging into the question of how VCs are handling diligence in a world where the most attractive deals can open and close faster than ever, and old models of deep diligence and paced deal-making are outmoded.

One way that investors are betting on themselves in a bid to speed their diligence and decision-making is by investing in their own tech. That may sound obvious, given that venture capital dollars often land in the accounts of tech-focused companies, but in a business that was previously known for its relationship focus — more on that shortly — the trend is worth considering.

Powered by WPeMatico

While most startups today are creating software, not every upstart enterprise is taking a code-only approach to building a business. Some of today’s most ambitious startups are aiming quite a bit higher.

Albedo is one such company. The recent Y Combinator graduate wants to build a constellation of low-orbit satellites that can provide higher-resolution Earth imaging than what is generally available today. And it just closed a $10 million seed round.

Initialized Capital led the investment, which also saw participation from Jetstream, Liquid2 Ventures and Soma Capital.

TechCrunch has had its eye on Albedo since its Y Combinator run, discussing the firm’s approach to providing what it describes as “aerial-quality” images — though they are taken from space instead of a drone or aircraft. In more technical parlance, Albedo wants to provide 10-centimeter visual imagery and 2-meter thermal imagery.

According to Topher Haddad, Albedo’s co-founder and CEO, the company aims to launch its first satellite in 2024 and bring its full constellation to orbit by 2027. With eight satellites, the company can provide daily image revisits; with 24, it can do that three times each day, though the eight-satellite fleet will be an early milestone for the startup, according to its CEO.

Why hasn’t someone already tried to build what Albedo is working on? The company, Haddad explained, has been made possible in part due to advances in the larger space economy, and the fact that major cloud providers AWS and Azure have both built out services to handle satellite data — “AWS Ground Station” in the case of the former and “Azure Orbital” in the latter. Mix in cheaper launches and more modular satellite construction, and what Albedo wants to do is becoming possible.

Albedo CEO and co-founder Topher Haddad. Image Credits: Albedo

There’s some tech risk to what Albedo aims to do, however. Haddad explained to TechCrunch how his company hopes to employ in-orbit refueling for its satellites’ electric propulsion so that they can stay afloat longer; if that effort fails, or drag winds up being worse than anticipated, Albedo’s satellites might have to opt for slightly higher orbits and lower-res photos in the 12- to 15-centimeter range.

For fun, what does that resolution mean in more practical terms? A 10-centimeter-resolution image from a satellite is one in which each pixel is 10 centimeters on each side. So, a 15-centimeter-resolution image would have pixels that were more than twice the surface area of a 10-centimeter shot.

Resolution matters, as does the regularity of new pictures being taken. On the latter front, the company’s eventual fleet of satellites should keep its photos fresh.

Albedo intends to target companies of all sizes as customers. The imaging world is a big market, with Haddad expecting to find customers among property insurance companies, mapping concerns, utility firms and other large companies. And now it has more capital than ever to pursue its goals.

It takes more money to get a space startup off the ground than it takes to iterate on an early software product. So, what does the $10 million it just raised get Albedo? The first thing is staff. When TechCrunch last spoke with Haddad, the company was still a team of three. That’s about to change, however; a number of new hires recently accepted offers, and the company expects to add another four or five people to its staff in addition to those already planning to join.

Albedo said it anticipates a staff of 10 to 12 by the end of the year.

The $10 million will also allow the company to fund a down payment on rocket space and payments to suppliers that should allow Albedo to wrap up its satellite design. Per its CEO, the startup expects to raise a larger Series A in around a year to help finance getting its first satellite into orbit. That moment will allow the startup to better prove its technology, and, if all goes well, help it to raise even more capital to keep its launch schedule packed.

Let’s see how far the company can get with its new capital, and if it finds sufficient, ahem, lift to reach the next funding milestone. If it does, we could wind up covering the launch of its first satellite. That would be fun.

Powered by WPeMatico

Holoride, the company that’s building an immersive XR in-vehicle media platform, today announced it raised €10 million (approximately $12 million) in its Series A investing round, earning the company a €30 million ($36 million) valuation.

The Swedish ADAS software development company Terranet led the round with €3.2 million (~$3.9 million), followed by a group of Chinese financial and automotive technology investors, organized by investment professional Jingjing Xu, and educational and entertainment game development company Schell Games, which has partnered with holoride in the past to create content.

Holoride will use the fresh funds to search for new developers and other talent both as it prepares to expand into global markets like Europe, the United States and Asia, and in advance of its summer 2022 launch for private passenger cars.

“This goes hand-in-hand with putting more emphasis on the content creator community, and as of summer this year, releasing a lot of tools to help them build content for cars on our platform,” Nils Wollny, holoride’s CEO and founder, told TechCrunch.

The Munich-based company launched at CES in 2019. TechCrunch got to test out its in-car virtual reality system. Our team was surprised, and delighted, to find that holoride had figured out how to quell the motion sickness caused both by being a passenger in a vehicle, and by using a VR headset. The key? Matching the experience users have within the headset to the movement of the vehicle. Once holoride launches, users will be able to download the holoride app to their phones or other personal devices like VR headsets, which will connect wirelessly to the car itself, and extend their reality.

“Our technology has two sides,” said Wollny. “One is the localization, or positioning software, that takes data points from the car and performs real-time synchronization. The other part is what we call our Elastic Software Development Kit. Content creators can build elastic content, which adapts to your travel time and routes. The collaboration with Terranet means their sensors and software stack that allow for a more precise capture and interpretation of the environment at an even faster speed with higher accuracy will enable us in the future for even more possibilities.”

Terranet’s VoxelFlow software, which was originally designed for ADAS applications, will help holoride advance its real-time, in-vehicle XR entertainment. Terranet’s CEO Par-Olof Johannesson, describes VoxelFlow

software, which was originally designed for ADAS applications, will help holoride advance its real-time, in-vehicle XR entertainment. Terranet’s CEO Par-Olof Johannesson, describes VoxelFlow as a new paradigm within computer vision and object identification, wherein a combination of sensors, event cameras and a laser scanner are integrated into a car’s windshield and headlamps in order to calculate the distance, direction and speed of an object.

as a new paradigm within computer vision and object identification, wherein a combination of sensors, event cameras and a laser scanner are integrated into a car’s windshield and headlamps in order to calculate the distance, direction and speed of an object.

Terranet’s VoxelFlow uses computer vision and object identification via a combination of sensors, event cameras and a laser scanner, which are integrated into a car’s windshield and headlamps, in order to calculate the distance, direction and speed of an object. Image Credits: Terranet

uses computer vision and object identification via a combination of sensors, event cameras and a laser scanner, which are integrated into a car’s windshield and headlamps, in order to calculate the distance, direction and speed of an object. Image Credits: Terranet

Holoride, which is manufacturer-agnostic, will be able to use the data points calculated by VoxelFlow in real time if holoride were being used in a vehicle that was built integrated with Terranet’s software. But more important is the ability for holoride to reuse 3D event data for XR applications, giving it to creators so they can create the most interactive experience. Terranet is also looking forward to opening up a new vertical for VoxelFlow

in real time if holoride were being used in a vehicle that was built integrated with Terranet’s software. But more important is the ability for holoride to reuse 3D event data for XR applications, giving it to creators so they can create the most interactive experience. Terranet is also looking forward to opening up a new vertical for VoxelFlow .

.

“We are of course very eager to access holoride’s wide pipeline, as well,” said Johannesson. “This deal is very much about expanding the addressable market and tapping into the heart of the automotive industry, where lead times and turnaround times are usually pretty long.”

Holoride is on a mission to revolutionize the passenger experience by turning dead car time into interactive experiences that can run the gamut of gaming, education, productivity, mindfulness and more. For example, around Halloween 2019, holoride teamed up with Ford and Universal Pictures to immerse riders into the frightening world of the Bride of Frankenstein, replete with monsters jumping out and tasks for riders to perform.

Wollny said holoride always has an eye toward the next step, even though its first product hasn’t gone to market yet. He understands that the future is in autonomous vehicles, and wants to build an essential element of the future tech stack of future cars, cars in which everyone is a passenger.

“Car manufacturers always focus on the buyer of the car or the driver, but not so much on the passenger,” said Wollny. “The passenger is who holoride really focuses on. We want to turn every vehicle into a moving theme park.”

Powered by WPeMatico

Earlier this week, ExxonMobil, a company among the largest producers of greenhouse gas emissions and a longtime leader in the corporate fight against climate change regulations, called for a massive $100 billion project (backed in part by the government) to sequester hundreds of millions of metric tons of carbon dioxide in geologic formations off the Gulf of Mexico.

The gall of Exxon’s flag-planting request is matched only by the grit from startup companies that are already working on carbon capture and storage or carbon utilization projects and have announced significant milestones along their own path to commercialization even as Exxon was asking for handouts.

These are companies like Charm Industrial, which just completed the first pilot test of its technology through a contract with Stripe. That pilot project saw the company remove 416 tons of carbon dioxide equivalent from the atmosphere. That’s a small fraction of the hundred million tons Exxon thinks could be captured in its hypothetical sequestration project located off the Gulf Coast, but the difference between Exxon’s proposal and Charm’s sequestration project is that Charm has actually managed to already sequester the carbon.

The company’s technology, verified by outside observers like Shopify, Microsoft, CarbonPlan, CarbonDirect and others, converts biomass into an oil-like substance and then injects that goop underground — permanently sequestering the carbon dioxide, the company said.

Eventually, Charm would use its bio-based oil equivalent to produce “green hydrogen” and replace pumped or fracked hydrocarbons in industries that may still require combustible fuel for their operations.

While Charm is converting biomass into an oil-equivalent and pumping it back underground, other companies like CarbonCure, Blue Planet, Solidia, Forterra, CarbiCrete and Brimstone Energy are capturing carbon dioxide and fixing it in building materials.

“The easy way to think about CarbonCure is we have a mission to reduce 500 million tons per year by 2030. On the innovation side of things we really pioneered this area of science using CO2 in a value-added, hyper low-cost way in the value chain,” said CarbonCure founder and chief executive Rob Niven. “We look at CO2 as a value-added input into making concrete production. It has to raise profits.”

Niven stresses that CarbonCure, which recently won one half of the $20 million carbon capture XPrize alongside CarbonBuilt, is not a hypothetical solution for carbon dioxide removal. The company already has 330 plants operating around the world capturing carbon dioxide emissions and sequestering them in building materials.

Applications for carbon utilization are important to reduce the emissions footprints of industry, but for nations to achieve their climate objectives, the world needs to move to dramatically reduce its reliance on emissions spewing energy sources and simultaneously permanently draw down massive amounts of greenhouse gases that are already in the atmosphere.

It’s why the ExxonMobil call for a massive project to explore the permanent sequestration of carbon dioxide isn’t wrong, necessarily, just questionable coming from the source.

The U.S. Department of Energy does think that the Gulf Coast has geological formations that can store 500 billion metric tons of carbon dioxide (which the company says is more than 130 years of the country’s total industrial and power generation emissions). But in ExxonMobil’s calculation that’s a reason to continue with business-as-usual (actually with more government subsidies for its business).

Here’s how the company’s top executives explained it in the pages of The Wall Street Journal:

The Houston CCS Innovation Zone concept would require the “whole of government” approach to the climate challenge that President Biden has championed. Based on our experience with projects of this scale, we estimate the approach could generate tens of thousands of new jobs needed to make and install the equipment to capture the CO2 and transport it via a pipeline for storage. Such a project would also protect thousands of existing jobs in industries seeking to reduce emissions. In short, large-scale CCS would reduce emissions while protecting the economy.

These oil industry executives are playing into a false narrative that the switch to renewable energy and a greener economy will cost the U.S. jobs. It’s a fact that oil industry jobs will be erased, but those jobs will be replaced by other opportunities, according to research published in Scientific American.

“With the more aggressive $60 carbon tax, U.S. employment would still exceed the reference-case forecast, but the increase would be less than that of the $25 tax,” write authors Marilyn Brown and Majid Ahmadi. “The higher tax causes much larger supply-side job losses, but they are still smaller than the gains in energy-efficiency jobs motivated by higher energy prices. Overall, 35 million job years would be created between 2020 and 2050, with net job increases in almost all regions.”

ExxonMobil and the other oil majors definitely have a role to play in the new energy economy that’s being built worldwide, but the leading American oil companies are not going to be able to rest on their laurels or continue operating with a business-as-usual mindset. These companies run the risk of going the way of big coal — slowly sliding into obsolescence and potentially taking thousands of jobs and local economies down with them.

To avoid that, carbon sequestration is a part of the solution, but it’s one of many arrows in the quiver that oil companies need to deploy if they’re going to continue operating and adding value to shareholders. In other words, it’s not the last 130 years of emissions that ExxonMobil should be focused on, it’s the next 130 years that aim to be increasingly zero-emission.

Powered by WPeMatico

In Hefei, a Chinese city known for its relics from the Three Kingdoms period and its manufacturing industry today, Maxim Rate was thrilled to find a small studio crafting a Western role-playing game, a genre that attracts lovers of gritty aesthetics and dark storylines.

“The design and computer graphics are really good. You can’t tell they are a Chinese team,” said Rate.

Rate’s mission is to find Chinese studios like the bootstrapped Hefei team and help them woo international players. As Chinese regulators tighten rules on game publishing and make licenses hard to obtain, small studios find themselves struggling. Since last year, Apple has pulled thousands of unlicensed games from its Chinese App Store at the behest of local authorities. Small-time developers began to look beyond their home turf.

“The problem is these startups have no experience in overseas expansion,” said Rate.

An avid gamer himself, Rate quit his job at a Chinese cross-border payment firm last year and launched a part-incubator, part-investment vehicle to take Chinese games abroad. The firm, called Westward Gaming Ventures, took inspiration from Zheng He, a Chinese diplomat and explorer who embarked on state-sponsored naval expeditions to the “Western Oceans” during the Ming Dynasty.

Westward plans to raise 200 million yuan ($30 million) for its debut fund, Rate told TechCrunch in an interview. It plans to deploy the capital over the next three years with an intended check size of 2-4 million yuan per studio. It’s currently in talks with 20-30 teams that span a wide range of genres.

The Chinese fund being established is a so-called Qualified Foreign Limited Partners Fund, which, Rate said, for the first time will enable foreign investors (USD and EUR) to invest directly in Chinese gaming firms. Only a few institutions own a license for QFLP, and while Westward itself doesn’t hold one, it gained legitimacy for direct foreign investment by partnering with the private equity arm of a major Chinese financial conglomerate, which declined to be named at this stage.

To navigate such regulatory complications, Westward also seeks help from its advisors, including one that oversaw the legal and financial process of one of the largest joint ventures established between Chinese and foreign gaming firms in recent years. The partnership, which can’t be named, was also the first time a foreign entity has become the majority shareholder in a gaming joint venture in China.

China limits foreign investments in areas it considers sensitive, such as value-added services, so many companies resort to setting up elaborate offshore entities to receive overseas funding. The restriction makes it difficult for resource-strapped studios to land foreign investors, who could help them venture into global markets. They are left with the option of getting backed or bought by Chinese giants like Tencent or ByteDance.

The idea of Westward is not just to lower the barriers for independent Chinese games to secure foreign capital but also to better prepare them for overseas expansion.

“Chinese gaming studios, big or small, used to rely heavily on ads for user acquisition when they went abroad,” said Rate. “Sometimes a game would take off, but the team had no idea why, so they continued to test. Those who failed may just give up.”

But taking a game abroad is not as simple as translating it, hitting the publish button and launching an ad campaign on Facebook.

Westward’s plan is to get involved in a game’s early development phase and help them position: Is it an RPG? Is the targeted user a casual or serious player? What’s the graphic style? In addition, the firm also plans to supply developers with workspace, technical assistance, marketing and localization expertise, connection to publishers and overseas operation help.

Image Credits: Westward Gaming Ventures

To provide post-investment support, Westward has partnered up with V+ Gaming Society, an incubator for games headquartered in Shenzhen, which Westward also calls home.

Chinese tech companies are facing mounting challenges in the West as geopolitical tensions rise. Many now prefer calling themselves “global firms” and even deny their Chinese roots outright.

But for Westward, the games it helps create don’t need to pretend they are non-Chinese. “Most players don’t consider where a game is from if it is a really good game,” said Rate.

“We actually hope to see elements of Chinese culture in these games that can be understood by overseas players.”

Amy Ho, a partner at Westward along with Rate and Edward He, said one of the few Chinese games that have managed to be both “Chinese” and transcend cultural boundaries is “Chinese Parents.” The simulation game became a global hit by letting users experience what it is like to raise a child in China.

The benchmark Rate gave was the generation of Japanese games that began exporting 20-30 years ago, which he described as “Japanese” in spirit but “globalized” in graphics and game design.

There have already been globally successful titles from Chinese makers like Tencent and rising studios Lilith and Mihoyo. In the past, many Chinese users on Steam would be asking foreign titles to rush out Chinese versions. Now, it’s not uncommon to see Western users demanding English editions of Chinese games, Rate observed.

Rather than politics, the bigger challenge, especially for small studios, is how to “collect key data for product iteration while complying with local privacy laws,” said Ho.

Westward expects 50-70% of its capital to come from Chinese institutions. The presence of Chinese investments inevitably leads to questions around censorship. Ho said while Westward provides resources and capital to studios, it will work to ensure their independence from investor influence.

If things go well, Westward could help facilitate cultural exchange between China and the rest of the world. Beijing has been trying to export the country’s soft power, and games may be a suitable conduit, suggested Rate. Amid the ongoing trade war, having foreign funding in Chinese companies may also do good to China’s “brand”, he said.

Powered by WPeMatico

When we last heard from BigID at the end of 2020, the company was announcing a $70 million Series D at a $1 billion valuation. Today, it announced a $30 million extension on that deal valuing the company at $1.25 billion just four months later.

This chunk of money comes from private equity firm Advent International, and brings the total raised to more than $200 million across four rounds, according to the company. The late-stage startup is attracting all of this capital by building a security and privacy platform. When I spoke to CEO Dimitri Sirota in September 2019 at the time of the $50 million Series C, he described the company’s direction this way:

We’ve separated the product into some constituent parts. While it’s still sold as a broad-based [privacy and security] solution, it’s much more of a platform now in the sense that there’s a core set of capabilities that we heard over and over that customers want.

Sirota says he has been putting the money to work, and as the economy improves he is seeing more traction for the product set. “Since December, we’ve added employees as we’ve seen broader economic recovery and increased demand. In tandem, we have been busy building a whole host of new products and offerings that we will announce over the coming weeks that will be transformational for BigID,” he said.

He also said that as with previous rounds, he didn’t go looking for the additional money, but decided to take advantage of the new funds at a higher valuation with a firm that he believes can add value overall. What’s more, the funds should allow the company to expand in ways it might have held off on.

“It was important to us that this wouldn’t be a distraction and that we could balance any funding without the need to over-capitalize, which is becoming a bigger issue in today’s environment. In the end, we took what we thought could bring forward some additional product modules and add a sales team focused on smaller commercial accounts,” Sirota said.

Ashwin Krishnan, a principal on Advent’s technology team in New York, says that BigID was clearly aligned with two trends his firm has been following. That includes the explosion of data being collected and the increasing focus on managing and securing that data with the goal of ultimately using it to make better decisions.

“When we met with Dimitri and the BigID team, we immediately knew we had found a company with a powerful platform that solves the most challenging problem at the center of these trends and the data question,” Krishnan said.

Past investors in the company include Boldstart Ventures, Bessemer Venture Partners and Tiger Global. Strategic investors include Comcast Ventures, Salesforce Ventures and SAP.io.

Powered by WPeMatico

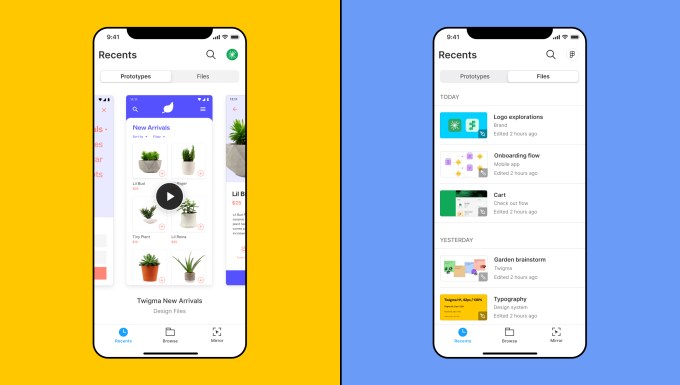

Figma spent years in stealth before launching its web-based collaborative design tool. Since coming into the light, the company has been iterating quickly. Today, Figma launches its biggest product update to date.

Meet FigJam, Figma’s new whiteboarding tool.

The entire concept of Figma stemmed from the fact that designers were taking up much more space at the figurative table and needed a place to collaborate efficiently. That is only more true today, especially during the last year of working from home, which is why Figma is extending itself throughout the workflow of designers with whiteboarding.

Not only does FigJam give designers a place to come up with ideas together, but it also gives nondesigners a place to participate in the brainstorm.

FigJam functionality includes sticky notes, emojis and drawing tools, as well as shapes, pre-built lines and connectors, stamps and cursor chats. As expected, FigJam works with Figma so components or other design objects breathed into life on FigJam can easily be moved into Figma.

“Our point of view here was focusing on how to make FigJam work as the first step in the design process, before you go into actually doing design work,” said Figma founder and CEO Dylan Field. “We see people looking for a better, more fluid experience, but we also wanted to make it simple enough to bring other people into the tool.”

To take that a step further, Figma is also introducing voice chat into all of its products. That means users who are designing alongside one another in Figma or brainstorming in FigJam don’t need to hop into a separate Zoom call or Google Meet, but can just toggle on chat in Figma to use audio.

Figma didn’t build its voice chat from scratch, but rather worked with a partner to bring this to market. Figma did not specify which partner/tech it’s working with on voice chat.

Alongside the release of FigJam and voice chat, Figma is also releasing a more full-featured mobile app, which will be in beta through TestFlight at launch.

Image Credits: Figma

One final update that Figma is announcing today is branching and merging in Figma. This allows designers who are updating the design system, for example, to branch out and do their work and then merge that work with the existing design system, rather than updating a shared component or resource and affecting everyone else’s workflow.

Powered by WPeMatico