TC

Auto Added by WPeMatico

Auto Added by WPeMatico

Origin stories are satisfying because we already know the hero will overcome the odds — and in doing so, they’ll reveal their core strengths.

This week, we published a four-part series about how Klaviyo co-founders Andrew Bialecki and Ed Hallen bootstrapped their startup into an e-commerce marketing automation platform now valued at $4.15 billion.

Neither founder was bitten by a radioactive spider or received a serum that enhanced their entrepreneurial skills; instead, they focused on outreach to prospective customers to find out what they were willing to pay for and largely ignored the competition.

“Bootstrapping Klaviyo, it came out of this: ‘Hey, if we are super disciplined about finding a problem that someone will pay us to solve, we have a real company,’” said Hallen.

Full Extra Crunch articles are only available to members.

Use discount code ECFriday to save 20% off a one- or two-year subscription.

Even though millions of us respond every day to the personalized, automated emails sent through its platform, Klaviyo still isn’t a well-known brand. Our ongoing series of EC-1s offers entrepreneurs real insight into growing and scaling successful companies, but they’re also extremely useful for consumers who want to understand how the internet really works.

Thanks very much for reading Extra Crunch; I hope you have a great weekend.

Walter Thompson

Senior Editor, TechCrunch

@yourprotagonist

Image Credits: Nigel Sussman

Image Credits: slowcentury (opens in a new window) / Getty Images

Several micromobility companies once operated in my city, but consolidation has reduced that to a small handful.

Now that many consumers are buying their own e-bikes and e-scooters, shared dockless micromobility “just hasn’t proven itself to be a profitable line of business,” Puneeth Meruva, an associate at Trucks Venture Capital, told TechCrunch.

There’s only one dockless electric moped provider in my town, so price is no longer a consideration. Instead, my first priority is to find a vehicle with the best-charged battery. (San Francisco has a lot of hills, and you never know where the day might take you.)

Larger players like Lime and Bird have vertically integrated tech stacks for fleet management features like this, but there are also opportunities for startups — imagine a “phantom scooter” that drives itself to a neighborhood with high demand or a moped that alerts drivers if there’s traffic ahead.

This in-depth industry analysis shows how increased regulation on the local level and changing consumer habits are pushing micromobility providers to adapt and innovate.

“Whether you want to stack regulatory compliance on the vehicles, do safety features like ADAS or add mapping content, you kind of need this platform where you can actively develop and launch new apps on the vehicle without having to bring it back to the factory,” Meruva said.

Image Credits: TechCrunch/Bryce Durbin

If the definition of insanity is doing the same thing over and over and expecting a different outcome, then one might say the cybersecurity industry is insane.

Criminals continue to innovate with highly sophisticated attack methods, but many security organizations still use the same technological approaches they did 10 years ago. The world has changed, but cybersecurity hasn’t kept pace.

Image Credits: ra2studio (opens in a new window) / Getty Images

By 2025, 463 exabytes of data will be created each day, according to some estimates. It’s now easier than ever to translate physical and digital actions into data, and businesses of all types have raced to amass as much data as possible in order to gain a competitive edge.

However, in our collective infatuation with data (and obtaining more of it), what’s often overlooked is the role that storytelling plays in extracting real value from data.

The reality is that data by itself is insufficient to really influence human behavior. Whether the goal is to improve a business’ bottom line or convince people to stay home amid a pandemic, it’s the narrative that compels action, not the numbers alone.

As more data is collected and analyzed, communication and storytelling will become even more integral in the data science discipline because of their role in separating the signal from the noise.

Image Credits: Raquel Segato/EyeEm (opens in a new window) / Getty Images

We all need to be taking precautionary measures, not just in light of COVID, but to ensure our firms can continue to thrive when faced with unexpected tragedy.

So ask yourself this question: “What would happen if I or my partner(s) checked into the hospital tomorrow and had no phone and/or was too sick to call anyone, and that went on for two or three weeks (or longer)?”

If the answer is “I’m really not sure,” then you don’t have a business continuity plan.

Image Credits: rubberball (opens in a new window) / Getty Images

After years of sustained growth, the pandemic supercharged the outdoor recreation industry. Startups that provide services like camper vans, private campsites and trail-finding apps became relevant to millions of new users when COVID-19 shut down indoor recreation, building on an existing boom in outdoor recreation.

Startups like Outdoorsy, AllTrails, Cabana, Hipcamp, Kibbo and Lowergear Outdoors have seen significant growth, but to keep it going, consumers who discovered a fondness for the great outdoors during the pandemic must turn it into a lifelong interest.

Image Credits: MaboHH / Getty Images

Dell last week agreed to spin out VMware in exchange for a huge one-time dividend, a five-year commercial partnership agreement, lots of stock for existing Dell shareholders and Michael Dell retaining his role as chairman of its board.

So, where does the deal leave VMware in terms of independence and in terms of Dell influence?

Image Credits: Westend61 (opens in a new window) / Getty Images

Many emerging and mature organizations survive or die based on their ability to scale. Scale quicker. Scale cheaper. Scale right.

Typically the IT team bears that burden — on top of countless other demands. IT teams move mountains for their organizations while scaling the tech platform as fast as possible, putting out the latest infrastructure fire and responding to countless day-to-day requests.

The most helpful gift any chief information officer or chief technology officer can give their IT teams is more time. Many people think that means adding another team member. But it could be as simple as introducing a low-code integration platform.

Image Credits: Nigel Sussman (opens in a new window)

A stunning first quarter in venture capital funding was not restricted to the United States; Europe also had one hell of a start to the year.

The venture capital world kicked off its 2021 European investing cycle with enough activity to set the continent on the path that would crush yearly records.

Inside the data, there’s lots to unpack, including which sectors of European startups stood out in terms of capital raised, rising seed and late-stage deals, and dollar volume. We’ll also need to discuss exits — the Deliveroo IPO and its various woes was not the only transaction from the period worth understanding.

We’ll keep in mind that all venture capital data lags reality somewhat, as many deals from a particular period are not disclosed or discovered until long after they actually occurred.

In this case, it makes the numbers all the more impressive.

Image Credits: Zastrozhnov (opens in a new window) / Getty Images

Robotic process automation unicorn UiPath went public this week, concentrating our focus on its value.

UiPath raised its last private round when the markets were most interested in public offerings and is now going public in a slightly altered climate.

In numerical terms, UiPath raised its IPO range from $43 to $50 per share to $52 to $54 per share. That’s a 21% jump in the value of the lower end of its range and an 8% gain to the value of the upper end of its per-share IPO price interval.

UiPath is also selling more shares than before, which should make its total valuation slightly larger at the top end than a mere 8% gain. So let’s go through the math one more time.

Image Credits: Nigel Sussman (opens in a new window)

The investment landscape for insurtech startups is off to a hot start in Q2 2021. Since the end of the first quarter, we’ve seen several players in the broad startup category announce new capital.

But, as anyone who’s familiar with startups that offer insurance-related products and services knows, the sector is enough of a mixed bag that one needs to segment down to get clarity on how constituent companies are performing.

Let’s discuss insurtech’s 2020 as a whole, peek at some preliminary 2021 venture data and then dive deep into what we’ve collected regarding growth among insurtech marketplace players.

Covering longitudinal progress of specific startup categories is one of our favorite things to do. So, please, walk with us!

Image Credits: Kehan Chen / Getty Images

Research papers come out far too frequently for anyone to read them all. That’s especially true in the field of machine learning, which now affects (and produces papers in) practically every industry and company.

This column aims to collect some of the most relevant recent discoveries and papers — particularly in, but not limited to, artificial intelligence — and explain why they matter.

This week, we dove into “introspective failure prediction,” using ML to identify dangerous moles, and spotting cows from space.

Image Credits: Gearstd (opens in a new window) / Getty Images

With strict privacy laws such as GDPR and CCPA already listing big-ticket penalties — and a growing number of countries following suit — businesses have little option but to comply.

It’s not just bigger, established businesses offering privacy and compliance tech; brand-new startups are filling in the gaps in this emerging and growing space.

Privacy isn’t dead, as many would have you believe. New regulations, stricter cross-border data transfer rules and increasing calls for data sovereignty have helped the privacy startup space grow thanks to an uptick in investor support.

This is how we got here, and where investors are spending.

Image Credits: Nigel Sussman (opens in a new window)

UiPath is not worth $36 billion, as we might have expected, but at a figure below $30 billion.

At $29.1 billion, UiPath has a roughly 35x run-rate multiple. That just about ties it for eighth-best overall. Among all public cloud companies. That means that UiPath is insanely valuable, just not that insanely valuable.

So what went wrong with the company’s final private round? The Exchange’s hunch is that UiPath’s final private investors expected the market to stay as hot as it once was, but it has cooled since the first two months of the year. So, instead of UiPath coming to the market in the expected climate, the company instead had to price where it did because the weather predicted by its final private price had already chilled.

Those investors gambled, in other words, hoping that a last-minute, pre-IPO round could snag them a rapid return on a company going public in a hot market. That didn’t work out.

And how bad is that? Not very! UiPath’s IPO is more a meeting of private-market exuberance and modestly more conservative public markets. It’s nothing to cry about.

Image Credits: d3sign (opens in a new window) / Getty Images

The second half of 2021 will bring incredible growth, the likes of which we haven’t seen in a long time.

Here’s how marketing in tech will shift — and what you need to know to reach more customers and accelerate growth this year.

First and foremost, differentiation is going to be imperative. It’s already hard enough to stand out and get noticed, and it’s about to get much more difficult as new companies emerge and investments and budgets balloon in the latter half of the year.

Additionally, tech companies need to be mindful not to ignore the most important part of the ecosystem: people. Technology will only take you so far, and it’s not going to be enough to survive the competition.

Tactically, the most successful tech companies will embrace video and experimentation in their marketing — two components that will catapult them ahead of the competition.

Ignoring these predictions, backed by empirical evidence, will be detrimental and devastating. Fasten your seatbelts: 2021 is going to be a turbocharged year of growth opportunities for marketing in tech.

Image Credits: Bryce Durbin/TechCrunch

Dear Sophie,

I’m a female entrepreneur who created my first startup a few months ago.

Once my startup gets off the ground — and as COVID-19 gets under control — I’d like to visit the United States to test the market and meet with investors. Which visas would allow me to do that?

—Noteworthy in Nairobi

Despite a somewhat circuitous route, UiPath closed its first day as a public company worth more than it was in its Series F round — when it sold 12,043,202 shares at $62.27576 apiece, per SEC filings. More simply, UiPath closed on Wednesday worth more per-share than it was in February.

How you might value the company, whether you prefer a simple or fully diluted share count, is somewhat immaterial at this juncture. UiPath had a good day.

TechCrunch spoke with UiPath CFO Ashim Gupta, curious about the company’s choice of a traditional IPO, its general avoidance of adjusted metrics in its SEC filings and the IPO market’s current temperature.

Image Credits: Nigel Sussman (opens in a new window)

The global venture capital market had a cracking start to the year. Coming off a 2020 high, VC totals in the United States, in Europe, and among competitive verticals like insurtech and AI are on pace to set new records in 2021.

The rapid-fire deal-making and trend of larger venture checks at higher valuations that The Exchange has tracked for some time require private-market investors to make decisions faster than ever. For venture capitalists, the timeline for reaching conviction around a startup’s thesis and executing due diligence has become compressed.

Some venture capitalists are turning to data to move more quickly. Some are spending more time preparing to be vetted themselves. And some investors are simply doing the work beforehand.

We were tipped off to the concept of pre-diligence during the reporting process for a look into recent fundraising trends in the AI/ML space. Sapphire investor Jai Das, when asked about how he was handling a competitive and swiftly moving market for AI startup investments, said that “most firms are completing their due diligence way before the financing actually happens.”

How does that work in practice?

Image Credits: MartinvBarraud (opens in a new window) / Getty Images

Your clients might not demand 24/7 customer service yet, but they’re certainly hoping for it.

But how can a startup with a lean staff provide round-the-clock customer care? There are several options available, but more than ever, outsourcing is one of them.

When should your startup consider outsourcing its customer care? And what should you look for in a provider?

Here are some insights on what customer care as a service (CCaaS) can do for you, and how fast-growing startups have been leveraging this new class of partners to boost customer satisfaction.

Image Credits: Erik Isakson / Getty Images

Productivity infrastructure is on the rise and will continue to be front and center as companies evaluate what their future of work entails and how to maintain productivity, rapid software development and innovation with distributed teams.

Understanding the benefits, use cases and steps to consider can propel organizations into the next phase of digital transformation.

Image Credits: Klaus Vedfelt (opens in a new window) / Getty Images

The clock begins ticking on a startup the day the doors open. Regardless of a young company’s struggles or success, sooner or later the question of when, how or whether to sell the enterprise presents itself. It’s possibly the biggest question an entrepreneur will face.

For founders who self-funded (bootstrapped) their startup, a boardroom full of additional factors comes into play. Some are the same as for investor-funded firms, but many are unique.

After 18 years of bootstrapping a BI software firm into a business that now serves 28,000 companies and 3 million users in 75 countries, here’s what I’ve learned about myself, my company, about entrepreneurship and about when to grab for that brass ring.

Put happiness at the center of the decision, and let your intuition — the instincts that made you the person you are today — be your guide.

Powered by WPeMatico

Ever since I read this Bloomberg story about how songs are engineered to go viral on TikTok, I’ve had one thought in my head, if you can call it that — it’s more of a noise, or impression:

AHHHHHHHHHHHHHHH

Yes, it’s the sound of internally screaming. Just when I thought I understood how deeply social media algorithms have hijacked our desires, tastes and preferences — WHAM! Another jab straight to the nose. I have to admit, I was blindsided by this one. It knocked me out.

Now, I understand that I work for a website called TechCrunch, emphasis on the tech, but if this story doesn’t make you feel at least a teensy bit like a Luddite, well, I don’t know what to tell you. You’re probably like that character in the Matrix, Cypher, who wants to be plugged in.

Is that harsh? I mean, companies are going to company, and partnerships with major record labels is a common sense move for a social media app all about honing the art of short, clever combinations of sound and video. And fair dues to the creators, many of them in college or high school, for jumping at the chance to make some money and get a little bit of fame.

But it’s probably not too harsh when you consider what else is possible when catchiness is weaponized. Here’s what we know: whether it’s internet memes or political slogans or Megan Thee Stallion’s Savage, what drives information dissemination is not the truthfulness of the content or the credibility of the speaker but 1) how easy it is to remember and 2) how quickly it sparks conversations.

And would you look at that! Those are exactly the variables music producers optimize for today. What the Bloomberg story highlights, inadvertently or not, is how a No. 1 pop hit and a piece of political disinformation are not all that different, aesthetically. Everyone’s an entertainer.

Now read to the end of the Bloomberg story. Get to the part where it’s revealed that ByteDance (the Chinese company that owns TikTok), in response to threats of a U.S. ban on the app, recruited creators to orchestrate a seemingly grassroots lawsuit against the proposed ban. And I think: damn. Attention really is the most precious commodity in the world. And we’re just…giving it away.

(Cue the internal screams.)

Powered by WPeMatico

A biotech company that has spent 11 years researching supplements to increase human longevity plans to launch its supplements later this year. Longevica says it has attracted a total of $13 million from investors, including Alexander Chikunov, a longevity investor, who is also president of the company.

Longevica says it created a biotechnology platform for longevity after researching the life-span of laboratory mice. It now aims to produce medicines, dietary supplements and food products.

The longevity space is a growing sector for tech startups. Google backed the launch of Calico in the space. Late last year Humanity Inc. raised $2.5 million in a round led by Boston fund One Way Ventures for its longevity company that will leverage AI to maximize people’s health span.

Longevica’s CEO Aynar Abdrakhmanov, backing up his company’s aim to tap the desire for people to live longer, said: “According to the WHO, by 2050, 2 billion people will be 60+ years old. By 2026, the sales of services and products for this audience will be around $27 trillion… By comparison, it was only $17 trillion in 2019.”

According to CB Insights, life-extension startups raised a record total of $800 million in 2018 alone. And there are some high-profile investors in the space.

PayPal co-founder Peter Thiel invested in Unity Biotechnology, which is developing drugs to treat diseases that accompany aging. And Ethereum founder Vitalik Buterin invested $2.4 million worth of Ether into the nonprofit SENS Research foundation, where famed longevity research Aubrey de Grey is chief science officer, to develop rejuvenation biotechnologies.

Longevica is basing its platform on the work of scientist Alexey Ryazanov, who holds 10 U.S. patents in the space, and is a longtime researcher into the regulation of protein biosynthesis cells.

Chikunov said: “I gathered scientists known in this field to discuss their approaches to the problem. Then Alexey Ryazanov proposed the innovative idea of large-scale screening of all known pharmacological substances on long-lived mice in order to find those that prolong life.”

Under the leadership of Ryazanov, Longevica says it used 20,000 long-lived female mice and 1,033 drugs representing compounds from 62 pharmacological classes to find five substances that statistically significantly increased longevity by 16-22%: Inulin, Pentetic Acid, Clofibrate, Proscillaridin A, D-Valine.

From this work, they formed a view about the elimination of certain heavy metals from the body and improved the body’s ability to remove toxins.

Powered by WPeMatico

Don’t let procrastination slow your roll. Yeah, we’re looking at you, early-stage founders. At TechCrunch, we love to reward action with savings. Want to save a cool $100? Buy your Early Stage 2021: Marketing & Fundraising pass before April 30, at 11:59 p.m. (PT), and you’ll keep a cool $100 in your pocket.

Take action, reap savings and get ready to join your community of early-inning startup founders for a two-day bootcamp (July 8-9) dedicated to helping you build a firm foundation for entrepreneurial success. We’re talking a day packed with highly interactive presentations, breakout sessions and plenty of time for Q&As with top-tier industry leaders and experts — plus a thrilling day-long pitch competition.

Part one of TC Early Stage 2021, which took place in April, featured folks like entrepreneur and VC Melissa Bradley, who delivered advice on nailing a virtual pitch meeting; Alexa von Tobel lead a discussion on finance for founders; and Fuel Capital’s Leah Solivan revealed 10 things not to do when you start a company.

Here’s just one example of the quality topics and guidance you can expect at TC Early Stage 2021 in July.

Plenty of founders struggle to find, or even define, product-market fit. And let’s face it, without the proper product-market fit, you basically have two chances of raising a unicorn: slim and fat. That’s why you won’t want to miss out on what Superhuman founder, CEO and product-market fit master Rahul Vohra has to say on the subject. Bring your questions and take advantage of his invaluable advice.

Pro Tip: We’re building our July agenda and announcing new speakers every week (like Mike Duboe and Sarah Kunst) — stay tuned!

Wondering whether attending TC Early Stage 2021: Marketing & Fundraising is worth your time and money? Here’s what two founders shared about their experience at last year’s event.

Early Stage 2020 provided a rich, bootcamp experience with premier founders, VCs and startup community experts. If you’re beginning to build a startup, it’s an efficient way to advance your knowledge across key startup topics. — Katia Paramonova, founder and CEO of Centrly.

Sequoia Capital’s session, Start with Your Customer, looked at the benefits of storytelling and creating customer personas. I took the idea to my team and we identified seven different user types for our product, and we’ve implemented storytelling to help onboard new customers. That one session alone has transformed my business. — Chloe Leaaetoa, founder, Socicraft.

TC Early Stage 2021: Marketing & Fundraising takes place on July 8-9, and you have just one week left to save $100 on the price of admission. Kick procrastination to the curb and keep more money in your wallet. Buy your TC Early Stage 2021 pass before April 30, at 11:59 p.m. (PT).

Is your company interested in sponsoring or exhibiting at Early Stage 2021 – Marketing & Fundraising? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico

While there’s been plenty of attention and money lavished on virtual event platforms over the past year, Introvoke co-founder and CEO Oana Manolache predicted that we’re only at the beginning of a “third wave of digital transformation.”

In her framing, the first wave came at the beginning of the pandemic, when everyone was using video conferencing tools like Zoom for their virtual events. Next came conference platforms like Hopin (which has been raising money at a mind-boggling clip). But Manolache argued that even Hopin represents a “Band-Aid” that customers are hoping will tide them over until in-person events can resume — particularly when organizers have to point attendees to a third-party platform.

“One size does not fit all,” she said. “The Band-Aid solution that was only supposed to last for a couple months has had big benefits as companies grew their customer base and revenue targets. Now we’ve reached the third wave, as organizations want to bring solutions to their own universe and own their relationship with the audience.”

San Francisco-based Introvoke is a Techstars Accelerator graduate aiming to provide this third-wave solution. It’s announcing today that it has raised $2.7 million in funding led by Struck Capital, while Comcast, Social Leverage, Great Oaks, V1vc, Time CTO Bharat Krish and Resy co-founder Mike Montero also participated.

The startup offers components like virtual stages, chat rooms and networking hubs, all customizable and embeddable on a customer’s website. Manolache said Introvoke (the name comes from the idea of “thought-provoking introductions”) is designed for a hybrid future, which will take multiple forms: “Hybrid is going to mean virtual-only events, in-person only events and events that have in-person and virtual elements.”

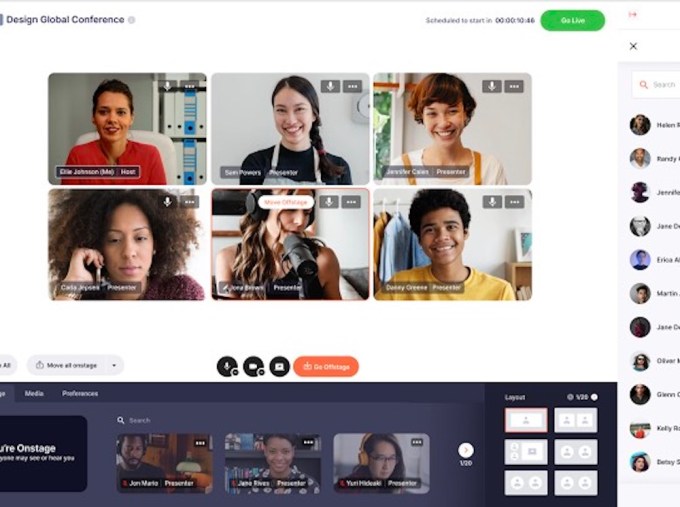

Image Credits: Introvoke

Introvoke charges customers based on live event minutes, a model that it says is accessible to companies large and small. Its components can be embedded on websites built with WordPress, Squarespace, Wix, Splash and other platforms, but also on a customer’s internal intranet.

“We’ve been so impressed by the way customers are using the technology — conferences, career fairs, employee engagements,” Manolache said.

She added that as customers like Comcast, Wharton and Ritual Motion have used the platform in private preview mode, they’re beginning to break free of the in-person model. For example, Introvoke events can allow for attendees to chat with each other over weeks or months, not just a few days.

In a statement, Struck Capital founder and Managing Partner Adam B. Struck suggested that virtual events “will continue far beyond the COVID-19 pandemic.”

“Right now, virtual experiences, from conferences and concerts to company all-hands, are generally hosted on third party platforms, which creates a disjointed experience for the brand or organization hosting the event,” he continued. “Virtual enablement should be native to the website and platform of the enterprise itself, and it’s the role of technologists like the Introvoke team to make these experiences as seamless as any in-person event.”

Powered by WPeMatico

After spending much of his career in mission-critical environments, including the Israeli Air Force, Israeli Intelligence and leading development of a cybersecurity product at Microsoft, Amit Rosenzweig turned his attention to autonomous vehicles.

It was a technology that he soon recognized would need what every other mission-critical system requires: humans.

“I understood that there are so many edge cases that will not be solved purely by AI and machine learning, and there must be some kind of human-in-the-loop intervention,” Rosenzweig said in a recent interview. “You don’t have any mission-critical system on the planet — not nuclear power plants, not airplanes — without human supervision. A human must be in the loop or present in some way for autonomous mobility to exist, even in 10 or probably 20 years from now.”

That “human in the loop” conclusion led Rosenzweig to found teleoperations startup Ottopia in 2018. (His brother, Oren Rosenzweig is also in the autonomous vehicle business via the lidar company he co-founded, Innoviz.) Ottopia’s first product is a universal teleoperation platform that allows a human operator to monitor and control any type of vehicle from thousands of miles away. Ottopia’s software is combined with off-the-shelf hardware components like monitors and cameras to create a teleoperations center. The company’s software also includes assistive features, which provide “path” instructions to the AV without having to remotely control the vehicle.

Since launching, the small 25-person company has racked up investors and partners such as BMW, fixed-route AV startup May Mobility and Bestmile. Ottopia said Friday that it has raised $9 million from Hyundai Motor Group as well as Maven and IN Venture, the Israel-focused venture capital arm of Sumitomo Corporation. Existing investors MizMaa and Israeli firm NextGear also participated.

Hyundai and IN Venture also gained board seats. Woongjun Jang, who heads up Hyundai’s autonomous driving center, and IN Venture managing partner Eyal Rosner, are now on Ottopia’s board.

Ottopia has raised a total of $12 million to date, and Rosenzweig has already set his sights on a larger round to help fund the company’s growth.

For now, Rosenzweig is focused on doubling his workforce to 50 people by the end of the year and opening an office in the United States. Rosenzweig said the company is also expanding into other applications of its teleoperations software, including defense, mining and logistics. However, most of Ottopia’s resources will continue to be dedicated to automotive, and specifically the deployment of autonomous cars, trucks and shuttles.

“The motivation is really simple — it’s simple but it’s hard to do — and that’s to make affordable autonomous transportation closer to reality,” Rosenzweig said. “The problem of course is that when an AV does not have any kind of backup or any kind of safety net in the form of teleoperations and it gets stuck, passengers are going to get anxious, ‘what’s going on, why, why is this not moving’.”

The other problem, Rosenzweig noted, is that AVs need to be combined with an efficient transit service. That’s where he sees his newest partner, on-demand shuttle and transit software company Via, coming in.

Under the partnership, which was also announced this week, Via will offer autonomous vehicle fleets that combine its fleet management software with Ottopia’s teleoperations platform. Via is not developing its own self-driving software system. In November 2020, Via announced it had partnered with May Mobility to launch an autonomous vehicle platform that integrates on-demand shared rides, public transportation and transit options for passengers with accessibility needs.

Powered by WPeMatico

TechCrunch is embarking on a major new project to survey European founders and investors in cities outside the larger European capitals.

Over the next few weeks, we will ask entrepreneurs in these cities to talk about their ecosystems, in their own words.

This is your chance to put Hamburg, Munich, Cologne, Bielefeld and Frankfurt on the TechCrunch Map!

If you are a tech startup founder or investor in these cities please fill out the survey form here.

We are particularly interested in hearing from women founders and investors.

This is the follow-up to the huge survey of investors we’ve done over the last six or more months, largely in capital cities.

These formed part of a broader series of surveys we’re doing regularly for Extra Crunch, our subscription service that unpacks key issues for startups and investors.

In the first wave of surveys, the cities we wrote about were largely capitals. You can see them listed here.

This time, we will be surveying founders and investors in Europe’s other cities to capture how European hubs are growing, from the perspective of the people on the ground.

We’d like to know how your city’s startup scene is evolving, how the tech sector is being impacted by COVID-19 and generally how your city will evolve.

We leave submissions mostly unedited and are generally looking for at least one or two paragraphs in answer to the questions.

So if you are a tech startup founder or investor in one of these cities please fill out our survey form here.

Thank you for participating. If you have questions you can email mike@techcrunch.com and/or reply on Twitter to @mikebutcher.

Powered by WPeMatico

With the increase of digital transacting over the past year, cybercriminals have been having a field day.

In 2020, complaints of suspected internet crime surged by 61%, to 791,790, according to the FBI’s 2020 Internet Crime Report. Those crimes — ranging from personal and corporate data breaches to credit card fraud, phishing and identity theft — cost victims more than $4.2 billion.

For companies like Sift — which aims to predict and prevent fraud online even more quickly than cybercriminals adopt new tactics — that increase in crime also led to an increase in business.

Last year, the San Francisco-based company assessed risk on more than $250 billion in transactions, double from what it did in 2019. The company has over several hundred customers, including Twitter, Airbnb, Twilio, DoorDash, Wayfair and McDonald’s, as well a global data network of 70 billion events per month.

To meet the surge in demand, Sift said today it has raised $50 million in a funding round that values the company at over $1 billion. Insight Partners led the financing, which included participation from Union Square Ventures and Stripes.

While the company would not reveal hard revenue figures, President and CEO Marc Olesen said that business has tripled since he joined the company in June 2018. Sift was founded out of Y Combinator in 2011, and has raised a total of $157 million over its lifetime.

The company’s “Digital Trust & Safety” platform aims to help merchants not only fight all types of internet fraud and abuse, but to also “reduce friction” for legitimate customers. There’s a fine line apparently between looking out for a merchant and upsetting a customer who is legitimately trying to conduct a transaction.

Sift uses machine learning and artificial intelligence to automatically surmise whether an attempted transaction or interaction with a business online is authentic or potentially problematic.

Image Credits: Sift

One of the things the company has discovered is that fraudsters are often not working alone.

“Fraud vectors are no longer siloed. They are highly innovative and often working in concert,” Olesen said. “We’ve uncovered a number of fraud rings.”

Olesen shared a couple of examples of how the company thwarted fraud incidents last year. One recently involved money laundering through donation sites where fraudsters tested stolen debit and credit cards through fake donation sites at guest checkout.

“By making small donations to themselves, they laundered that money and at the same tested the validity of the stolen cards so they could use it on another site with significantly higher purchases,” he said.

In another case, the company uncovered fraudsters using Telegram, a social media site, to make services available, such as food delivery, with stolen credentials.

The data that Sift has accumulated since its inception helps the company “act as the central nervous system for fraud teams.” Sift says that its models become more intelligent with every customer that it integrates.

Insight Partners Managing Director Jeff Lieberman, who is a Sift board member, said his firm initially invested in Sift in 2016 because even at that time, it was clear that online fraud was “rapidly growing.” It was growing not just in dollar amounts, he said, but in the number of methods cybercriminals used to steal from consumers and businesses.

“Sift has a novel approach to fighting fraud that combines massive data sets with machine learning, and it has a track record of proving its value for hundreds of online businesses,” he wrote via email.

When Olesen and the Sift team started the recent process of fundraising, Insight actually approached them before they started talking to outside investors “because both the product and business fundamentals are so strong, and the growth opportunity is massive,” Lieberman added.

“With more businesses heavily investing in online channels, nearly every one of them needs a solution that can intelligently weed out fraud while ensuring a seamless experience for the 99% of transactions or actions that are legitimate,” he wrote.

The company plans to use its new capital primarily to expand its product portfolio and to scale its product, engineering and sales teams.

Sift also recently tapped Eu-Gene Sung — who has worked in financial leadership roles at Integral Ad Science, BSE Global and McCann — to serve as its CFO.

As to whether or not that meant an IPO is in Sift’s future, Olesen said that Sung’s experience of taking companies through a growth phase such as what Sift is experiencing would be valuable. The company is also for the first time looking to potentially do some M&A.

“When we think about expanding our portfolio, it’s really a buy/build partner approach,” Olesen said.

Powered by WPeMatico

Alexa von Tobel, co-founder and managing partner of Inspired Capital, will be joining TechCrunch Disrupt 2021 taking place September 21-23 to help judge the startups competing in Startup Battlefield. NOTE: Applications are now open to don’t hesitate to throw your hat in the ring here!

Prior to Inspired Capital, Alexa founded LearnVest in 2008 with the goal of helping women in particular make better investments and learn financial planning. After raising $75 million in venture capital and growing the service to 1.5 million users, LearnVest was acquired by Northwestern Mutual in May 2015 for $250 million.

Following the acquisition, Alexa joined the management team of Northwestern Mutual as the company’s first chief digital officer. She later assumed the role of chief innovation officer, a position in which which she oversaw Northwestern Mutual’s venture arm.

Alexa, who holds a Certified Financial Planner designation, is also The New York Times-bestselling author of “Financially Fearless,” which debuted in December 2013, and its follow-up, “Financially Forward,” which arrived in May 2019. She is also the host of “The Founders Project with Alexa von Tobel,” a weekly podcast with Inc. that highlights entrepreneurs.

Alexa is a member of the 2016 Class of Henry Crown Fellows and an inaugural member of President Obama’s Ambassadors for Global Entrepreneurship. She has been honored with numerous recognitions, including: a Forbes Magazine cover story, Fortune’s 40 Under 40, Fortune’s Most Powerful Women, Inc. Magazine’s 30 Under 30 and World Economic Forum’s Young Global Leader.

Alexa recently joined us at TechCrunch Early Stage, where she led a breakout session on financial planning targeted specifically at startups. Join us at Disrupt this September and get your ticket for under $100 for a limited time!

Powered by WPeMatico

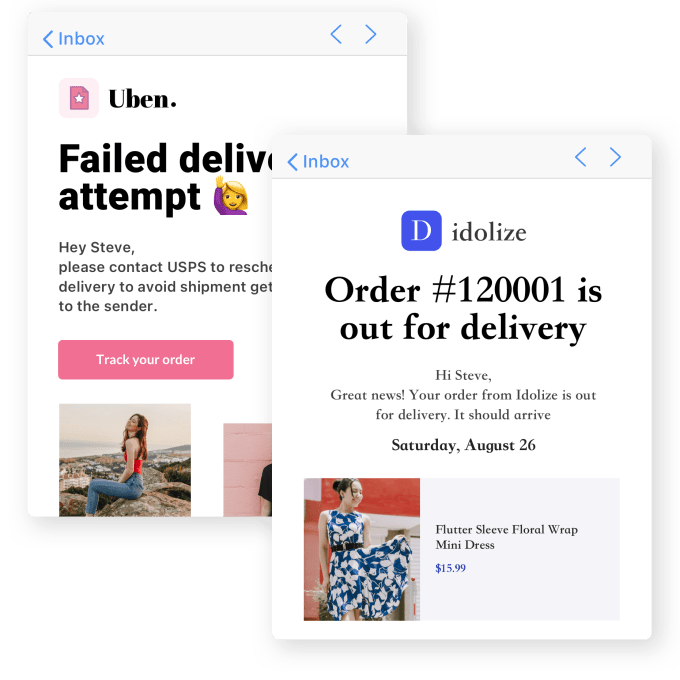

AfterShip launched in 2012 to help online sellers track packages across different carriers, but since then it has built a suite of data analytics tools covering almost every step of the shopping experience, from email marketing to customer retention. The Hong Kong-headquartered startup announced today it has raised a $66 million Series B led by Tiger Global, with participation from Hillhouse Capital’s GL Ventures.

AfterShip’s last round of funding was a $1 million Series A in 2014. Co-founder Andrew Chan told TechCrunch that the company has been profitable since its launch and grew mainly through word-of-mouth referrals and partnerships, like a Shopify integration, that boosted its profile. But the company recently added a sales team and will use its latest capital on international hiring for sales and customer support. It also plans to launch new products and expand further in the United States, where about 70% of AfterShip’s customers are located.

The company’s software enables sellers to track shipments made through more than 740 carriers and handles more than 6 billion shipments each year. AfterShip’s partners with about 10,000 companies, including some of the biggest names in e-commerce: Shopify (where it is used by 50,000 merchants), Magento, Squarespace, Amazon, eBay, Etsy, Groupon, Rakuten, Wish and retail brands like Dyson and Inditex.

A branded shipment tracking page and email created with AfterShip’s software. Image Credits: AfterShip

AfterShip’s core product is its shipment tracking platform, but it also makes apps for shoppers, including self-service returns and package tracking, and sales and marketing tools for merchants that let them get more use out of data from shipments. Chan explained that package tracking is also a user engagement tool for sellers that lets them show more product recommendations and promotions to shoppers. AfterShip’s tools enables merchants to create their own branded tracking pages and notifications. Other features allow them to track the performance of different carriers, create email marketing campaigns and increase customer retention.

Its CRM capabilities help AfterShip differentiate from other shipment tracking aggregator providers.

“When we think of our vision, we look at what Salesforce is doing, but is there an e-commerce Salesforce that can cover more topics for sales people to use,” Chan said.

In press statement, Pengfei Wang, global partner at Tiger Global, said, “AfterShip leads the charge in making the shipping process more transparent and reliable for consumers and companies alike. As growth in e-commerce spirals ever upward, we are excited to partner with AfterShip and its leadership team as they continue to advance technology in this critical and expanding industry.”

Powered by WPeMatico