TC

Auto Added by WPeMatico

Auto Added by WPeMatico

Conventional wisdom over the last year has suggested that the pandemic has driven companies to the cloud much faster than they ever would have gone without that forcing event, with some suggesting it has compressed years of transformation into months. This quarter’s cloud infrastructure revenue numbers appear to be proving that thesis correct.

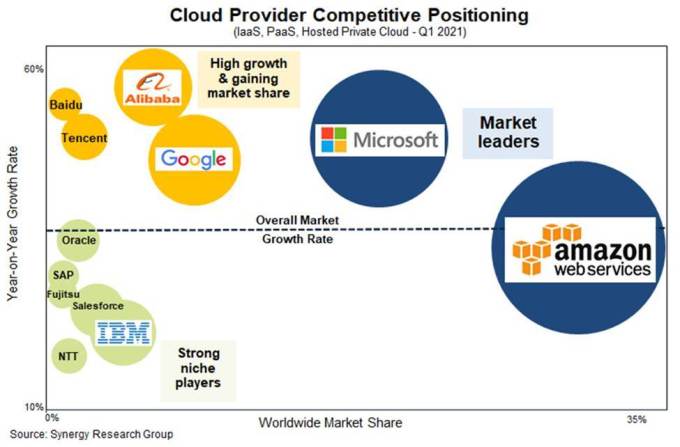

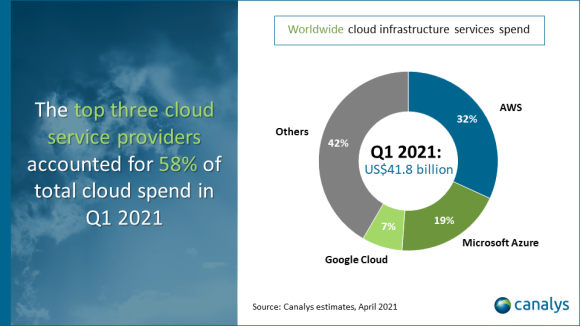

With The Big Three — Amazon, Microsoft and Google — all reporting this week, the market generated almost $40 billion in revenue, according to Synergy Research data. That’s up $2 billion from last quarter and up 37% over the same period last year. Canalys’s numbers were slightly higher at $42 billion.

As you might expect if you follow this market, AWS led the way with $13.5 billion for the quarter, up 32% year over year. That’s a run rate of $54 billion. While that is an eye-popping number, what’s really remarkable is the yearly revenue growth, especially for a company the size and maturity of Amazon. The law of large numbers would suggest this isn’t sustainable, but the pie keeps growing and Amazon continues to take a substantial chunk.

Overall AWS held steady with 32% market share. While the revenue numbers keep going up, Amazon’s market share has remained firm for years at around this number. It’s the other companies down market that are gaining share over time, most notably Microsoft, which is now at around 20% share — good for about $7.8 billion this quarter.

Google continues to show signs of promise under Thomas Kurian, hitting $3.5 billion, good for 9% as it makes a steady march toward double digits. Even IBM had a positive quarter, led by Red Hat and cloud revenue, good for 5% or about $2 billion overall.

Image Credits: Synergy Research

John Dinsdale, chief analyst at Synergy, says that even though AWS and Microsoft have firm control of the market, that doesn’t mean there isn’t money to be made by the companies playing behind them.

“These two don’t have to spend too much time looking in their rearview mirrors and worrying about the competition. However, that is not to say that there aren’t some excellent opportunities for other players. Taking Amazon and Microsoft out of the picture, the remaining market is generating over $18 billion in quarterly revenues and growing at over 30% per year. Cloud providers that focus on specific regions, services or user groups can target several years of strong growth,” Dinsdale said in a statement.

Canalys, another firm that watches the same market as Synergy, had similar findings with slight variations, certainly close enough to confirm one another’s findings. They have AWS with 32%, Microsoft 19% and Google with 7%.

Image Credits: Canalys

Canalys analyst Blake Murray says that there is still plenty of room for growth, and we will likely continue to see big numbers in this market for several years. “Though 2020 saw large-scale cloud infrastructure spending, most enterprise workloads have not yet transitioned to the cloud. Migration and cloud spend will continue as customer confidence rises during 2021. Large projects that were postponed last year will resurface, while new use cases will expand the addressable market,” he said.

The numbers we see are hardly a surprise anymore, and as companies push more workloads into the cloud, the numbers will continue to impress. The only question now is if Microsoft can continue to close the market share gap with Amazon.

Powered by WPeMatico

Tapping the geothermal energy stored beneath the Earth’s surface as a way to generate renewable power is one of the new visions for the future that’s captured the attention of environmentalists and oil and gas engineers alike.

That’s because it’s not only a way to generate power that doesn’t rely on greenhouse gas emitting hydrocarbons, but because it uses the same skillsets and expertise that the oil and gas industry has been honing and refining for years.

At least that’s what drew the former completion engineer (it’s not what it sounds like) Tim Latimer to the industry and to launch Fervo Energy, the Houston-based geothermal tech developer that’s picked up funding from none other than Bill Gates’ Breakthrough Energy Ventures (that fund… is so busy) and former eBay executive, Jeff Skoll’s Capricorn Investment Group.

With the new $28 million cash in hand, Fervo’s planning on ramping up its projects, which Latimer said would “bring on hundreds of megawatts of power in the next few years.”

Latimer got his first exposure to the environmental impact of power generation as a kid growing up in a small town outside of Waco, Texas near the Sandy Creek coal power plant, one of the last coal-powered plants to be built in the U.S.

Like many Texas kids, Latimer came from an oil family, and got his first jobs in the oil and gas industry before realizing that the world was going to be switching to renewables and the oil industry — along with the friends and family he knew — could be left high and dry.

It’s one reason he started working on Fervo, the entrepreneur said.

“What’s most important, from my perspective, since I started my career in the oil and gas industry, is providing folks that are part of the energy transition on the fossil fuel side to work in the clean energy future,” Latimer said. “I’ve been able to go in and hire contractors and support folks that have been out of work or challenged because of the oil price crash… And I put them to work on our rigs.”

Fervo Energy chief executive, Tim Latimer, pictured in a hardhat at one of the company’s development sites. Image Credits: Fervo Energy

When the Biden administration talks about finding jobs for employees in the hydrocarbon industry as part of the energy transition, this is exactly what they’re talking about.

And geothermal power is no longer as constrained by geography, so there are a lot of abundant resources to tap and the potential for high-paying jobs in areas that are already dependent on geological services work, Latimer said (late last year, Vox published a good overview of the history and opportunity presented by the technology).

“A large percentage of the world’s population actually lives next to good geothermal resources,” Latimer said. “[There are] 25 countries today that have geothermal installed and producing and another 25 where geothermal is going to grow.”

Geothermal power production actually has a long history in the Western U.S. and in parts of Africa where naturally occurring geysers and steam jets pouring from the earth have been obvious indicators of good geothermal resources, Latimer said.

“Fervo’s technology unlocks a new class of geothermal resource that is ready for large-scale deployment. Fervo’s geothermal systems use novel techniques, including horizontal drilling, distributed fiber optic sensing and advanced computational modelling, to deliver more repeatable and cost effective geothermal electricity,” Latimer wrote in an email. “Fervo’s technology combines with the latest advancements in Organic Rankine Cycle generation systems to deliver flexible, 24/7 carbon-free electricity.”

Initially developed with a grant from the TomKat Center at Stanford University and a fellowship funded by Activate.org at the Lawrence Berkeley National Lab’s Cyclotron Road division, Fervo has gone on to score funding from the DOE’s Geothermal Technology Office and ARPA-E to continue work with partners like Schlumberger, Rice University and the Berkeley Lab.

The combination of new and old technology is opening vast geographies to the company to potentially develop new projects.

Other companies are also looking to tap geothermal power to drive a renewable power-generation development business. Those are startups like Eavor, which has the backing of energy majors like bp Ventures, Chevron Technology Ventures, Temasek, BDC Capital, Eversource and Vickers Venture Partners; and other players including GreenFire Energy and Sage Geosystems.

Demand for geothermal projects is skyrocketing, opening up big markets for startups that can nail the cost issue for geothermal development. As Latimer noted, from 2016 to 2019 there was only one major geothermal contract, but in 2020 there were 10 new major power purchase agreements signed by the industry.

For all of these projects, cost remains a factor. Contracts that are being signed for geothermal that are in the $65 to $75 per megawatt range, according to Latimer. By comparison, solar plants are now coming in somewhere between $35 and $55 per megawatt, as The Verge reported last year.

But Latimer said the stability and predictability of geothermal power made the cost differential palatable for utilities and businesses that need the assurance of uninterruptible power supplies. As a current Houston resident, the issue is something that Latimer has an intimate experience with from this year’s winter freeze, which left him without power for five days.

Indeed, geothermal’s ability to provide always-on clean power makes it an incredibly attractive option. In a recent Department of Energy study, geothermal could meet as much as 16% of the U.S. electricity demand, and other estimates put geothermal’s contribution at nearly 20% of a fully decarbonized grid.

“We’ve long been believers in geothermal energy but have waited until we’ve seen the right technology and team to drive innovation in the sector,” said Ion Yadigaroglu of Capricorn Investment Group, in a statement. “Fervo’s technology capabilities and the partnerships they’ve created with leading research organizations make them the clear leader in the new wave of geothermal.”

Fervo Energy drilling site. Image Credits: Fervo Energy

Powered by WPeMatico

Barely more than eight months after announcing a $37 million funding round, Mux has another $105 million.

The Series D was led by Coatue and values the company at more than $1 billion (Mux isn’t disclosing the specific valuation). Existing investors Accel, Andreessen Horowitz and Cobalt also participated, as did new investor Dragoneer.

Co-founder and CEO Jon Dahl told me that Mux didn’t need to raise more funding. But after last year’s Series C, the company’s leadership kept in touch with Coatue and other investors who’d expressed interest, and they ultimately decided that more money could help fuel faster growth during “this inflection moment in video.”

Building on the thesis popularized by a16z co-founder Marc Andreessen, Dahl said, “I think video’s eating software, the same way software was eating the world 10 years ago.” In other words, where video was once something we watched at our desks and on our sofas, it’s now everywhere, whether we’re scrolling through our social media feeds or exercising on our Pelotons.

“We’re at the early days of a five- or 10-year major transition, where video is moving into being a first-class part of every software project,” he said.

Dahl argued that Mux is well-suited for this transition because it’s “a video platform for developers,” with an API-centric approach that results in faster publishing and reliable streaming for viewers. Its first product was a monitoring and analytics tool called Mux Data, followed by its streaming video product Mux Video.

“If you’re going to build a video platform and do it data-first, you need heavy data and monitoring and analytics,” Dahl explained. “We built the data layer [and then] we built the streaming platform.”

Customers include Robinhood, PBS, ViacomCBS, Equinox Media and VSCO — Dahl said that while Mux works with digital media companies, “our core market is software.” He suggested that back when the company was founded in 2015, video was largely seen as a “niche,” or “something you needed if you were ESPN or Netflix.” But the last few years have illustrated that “video is a fundamental part of how we communicate” and that “every software company should have video as a core part of its products.”

Mux founders Adam Brown, Steven Heffernan, Matt McClure and Jon Dahl. Image Credits: Mux

Not surprisingly, demand increased dramatically during the pandemic. During the past year, on-demand streaming via the Mux platform grew by 300%, while live video streaming grew 3,700% and revenue quadrupled.

“Which is a lot of work,” Dahl said with a laugh. “We definitely spent a lot of the last year ramping and scaling and investing in the platform.”

This new funding will allow Mux (which has now raised a total of $175 million) to continue that investment. Dahl said he plans to grow the team from 80 to 200 employees and to explore potential acquisitions.

“We were impressed by Mux’s laser focus on the developer community, and saw impressive customer retention and expansion indicative of the strong value their solutions provide,” said Coatue General Partner David Schneider in a statement. “This funding will enable Mux to continue to build on their customer-centric platform and we are proud to partner with Mux as it leads the way to this hybrid future.”

Powered by WPeMatico

Restoring and preserving the world’s forests has long been considered one of the easiest, lowest-cost and simplest ways to reduce the amount of greenhouse gases in the atmosphere.

It’s by far the most popular method for corporations looking to take an easy first step on the long road to decarbonizing or offsetting their industrial operations. But in recent months the efficacy, validity and reliability of a number of forest offsets have been called into question thanks to some blockbuster reporting from Bloomberg.

It’s against this uncertain backdrop that investors are coming in to shore up financing for Pachama, a company building a marketplace for forest carbon credits that it says is more transparent and verifiable thanks to its use of satellite imagery and machine learning technologies.

That pitch has brought in $15 million in new financing for the company, which co-founder and chief executive Diego Saez Gil said would be used for product development and the continued expansion of the company’s marketplace.

Launched only one year ago, Pachama has managed to land some impressive customers and backers. No less an authority on things environmental than Jeff Bezos (given how much of a negative impact Amazon operations have on the planet), gave the company a shoutout in his last letter to shareholders as Amazon’s outgoing chief executive. And the largest e-commerce company in Latin America, Mercado Libre, tapped the company to manage an $8 million offset project that’s part of a broader commitment to sustainability by the retailing giant.

Amazon’s Climate Pledge Fund is an investor in the latest round, which was led by Bill Gates’ investment firm Breakthrough Energy Ventures. Other investors included Lowercarbon Capital (the climate-focused fund from über-successful angel investor, Chris Sacca), former Uber executive Ryan Graves’ Saltwater, the MCJ Collective, and new backers like Tim O’Reilly’s OATV, Ram Fhiram, Joe Gebbia, Marcos Galperin, NBA All-star Manu Ginobili, James Beshara, Fabrice Grinda, Sahil Lavignia and Tomi Pierucci.

That’s not even the full list of the company’s backers. What’s made Pachama so successful, and given the company the ability to attract top talent from companies like Google, Facebook, SpaceX, Tesla, OpenAI, Microsoft, Impossible Foods and Orbital Insights, is the combination of its climate mission applied to the well-understood forest offset market, said Saez Gil.

“Restoring nature is one of the most important solutions to climate change. Forests, oceans and other ecosystems not only sequester enormous amounts of CO2 from the atmosphere, but they also provide critical habitat for biodiversity and are sources of livelihood for communities worldwide. We are building the technology stack required to be able to drive funding to the restoration and conservation of these ecosystems with integrity, transparency and efficiency” said Saez Gil. “We feel honored and excited to have the support of such an incredible group of investors who believe in our mission and are demonstrating their willingness to support our growth for the long term.”

Customers outside of Latin America are also clamoring for access to Pachama’s offset marketplace. Microsoft, Shopify and SoftBank are also among the company’s paying buyers.

It’s another reason that investors like Y Combinator, Social Capital, Tobi Lutke, Serena Williams, Aglaé Ventures (LVMH’s tech investment arm), Paul Graham, AirAngels, Global Founders, ThirdKind Ventures, Sweet Capital, Xplorer Capital, Scott Belsky, Tim Schumacher, Gustaf Alstromer, Facundo Garreton and Terrence Rohan were able to commit to backing the company’s nearly $24 million haul since its 2020 launch.

“Pachama is working on unlocking the full potential of nature to remove CO2 from the atmosphere,” said Carmichael Roberts from BEV, in a statement. “Their technology-based approach will have an enormous multiplier effect by using machine learning models for forest analysis to validate, monitor and measure impactful carbon neutrality initiatives. We are impressed by the progress that the team has made in a short period of time and look forward to working with them to scale their unique solution globally.”

Powered by WPeMatico

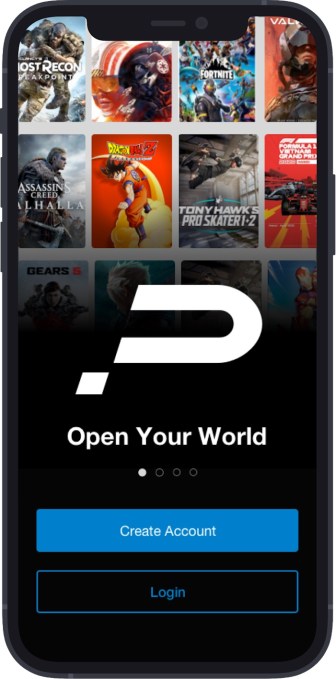

PreShow Interactive is giving gamers a new way to earn in-game currency in exchange for watching ads — a concept that’s become familiar in mobile games but hasn’t really made much headway on PCs or consoles.

The startup is led by MoviePass’ founding CEO Stacy Spikes. When I spoke to Spikes about PreShow two years ago, he was beta testing an app that provided users with free movie tickets in exchange for watching ads. But obviously, theatrical moviegoing has taken a big hit in the past year.

Spikes told me yesterday that he’d always hoped to bring the PreShow concept to four categories — theatrical movies, gaming, subscription streaming and video on demand — but the pandemic forced the startup to shift focus more quickly than expected and explore what a gaming experience might look like.

The current plan is to launch a new PreShow Interactive app this summer, where viewers can connect their in-game accounts and identify how much virtual currency they want to earn. Then they watch a package of ads and PreShow will automatically transfer the currency to their account — in other words, it’s buying the currency for them.

Users will have to download a separate app to watch the ads and get the benefits, but Spikes said this is actually better than trying to integrate advertising or branded content into the game itself, which can be a slow process for the developer and the advertiser, while also being distracting for the players. And this means PreShow Interactive should be able to support 20,000 games at launch, across PCs, consoles and virtual reality.

Image Credits: PreShow Interactive

“We just didn’t see the purpose of spending the time on integrations when it’s not really necessary,” he added. “Our deal is only with the consumer for their time. We’re saying, ‘This is your time. It has value.’ ”

One of the key elements to Preshow’s approach is technology that can detect when the viewer is actually looking at their phone screen — the ads will stop playing if you turn away. This has been criticized as “creepy surveillance tech,” but Spikes claimed that early PreShow users have embraced it. He also argued that it’s more transparent than the data collection and targeting currently driving online advertising.

“We used to think data was the new oil, but now our feeling is that permission and engagement and attention is the new oil,” he said.

In addition to revealing its new strategy, PreShow is announcing that it has raised $3 million in seed funding led by Harlem Capital, with participation by Canaan Partners, Wavemaker Partners, Front Row Fund, ROC Fund, BK Fulton and Monroe Harris.

And to be clear, Spikes said PreShow isn’t abandoning theatrical movies. He said that the PreShow app will eventually offer both movie and gaming deals “under one roof,” but brands aren’t currently eager to advertise to moviegoers.

“We’re ready to go when the marketplace is ready to go,” he said.

Powered by WPeMatico

Taking on Amazon S3 in the cloud storage game would seem to be a fool-hearty proposition, but Wasabi has found a way to build storage cheaply and pass the savings onto customers. Today the Boston-based startup announced a $112 million Series C investment on a $700 million valuation.

Fidelity Management & Research Company led the round with participation from previous investors. It reports that it has now raised $219 million in equity so far, along with additional debt financing, but it takes a lot of money to build a storage business.

CEO David Friend says that business is booming and he needed the money to keep it going. “The business has just been exploding. We achieved a roughly $700 million valuation on this round, so you can imagine that business is doing well. We’ve tripled in each of the last three years and we’re ahead of plan for this year,” Friend told me.

He says that demand continues to grow and he’s been getting requests internationally. That was one of the primary reasons he went looking for more capital. What’s more, data sovereignty laws require that certain types of sensitive data like financial and healthcare be stored in-country, so the company needs to build more capacity where it’s needed.

He says they have nailed down the process of building storage, typically inside co-location facilities, and during the pandemic they actually became more efficient as they hired a firm to put together the hardware for them onsite. They also put channel partners like managed service providers (MSPs) and value added resellers (VARs) to work by incentivizing them to sell Wasabi to their customers.

Wasabi storage starts at $5.99 per terabyte per month. That’s a heck of a lot cheaper than Amazon S3, which starts at 0.23 per gigabyte for the first 50 terabytes or $23.00 a terabyte, considerably more than Wasabi’s offering.

But Friend admits that Wasabi still faces headwinds as a startup. No matter how cheap it is, companies want to be sure it’s going to be there for the long haul and a round this size from an investor with the pedigree of Fidelity will give the company more credibility with large enterprise buyers without the same demands of venture capital firms.

“Fidelity to me was the ideal investor. […] They don’t want a board seat. They don’t want to come in and tell us how to run the company. They are obviously looking toward an IPO or something like that, and they are just interested in being an investor in this business because cloud storage is a virtually unlimited market opportunity,” he said.

He sees his company as the typical kind of market irritant. He says that his company has run away from competitors in his part of the market and the hyperscalers are out there not paying attention because his business remains a fraction of theirs for the time being. While an IPO is far off, he took on an institutional investor this early because he believes it’s possible eventually.

“I think this is a big enough market we’re in, and we were lucky to get in at just the right time with the right kind of technology. There’s no doubt in my mind that Wasabi could grow to be a fairly substantial public company doing cloud infrastructure. I think we have a nice niche cut out for ourselves, and I don’t see any reason why we can’t continue to grow,” he said.

Powered by WPeMatico

The last year of pandemic living has been real-world, and sometimes harrowing, proof of how important it can be to have efficient and well-equipped emergency response services in place. They can help people remotely if need be, and when they cannot, they make sure that in-person help can be dispatched quickly in medical and other situations. Today, a company that’s building cloud-based tools to help with this process is announcing a round of funding as it continues to grow.

RapidDeploy, which provides computer-aided dispatch technology as a cloud-based service for 911 centers, has closed a round of $29 million, a Series B round of funding that will be used both to grow its business and continue expanding the SaaS tools that it provides to its customers. In the startup’s point of view, the cloud is essential to running emergency response in the most efficient manner.

“911 response would have been called out on a walkie talkie in the early days,” said Steve Raucher, the co-founder and CEO of RapidDeploy, in an interview. “Now the cloud has become the nexus of signals.”

Austin-based RapidDeploy provides data and analytics to 911 centers — the critical link between people calling for help and connecting those calls with the nearest medical, police or fire assistance — and today it has about 700 customers using its RadiusPlus, Eclipse Analytics and Nimbus CAD products.

That works out to about 10% of all 911 centers in the U.S. (7,000 in total), and covering 35% of the population (there are more centers in cities and other dense areas). Its footprint includes state coverage in Arizona, California and Kansas. It also has operations in South Africa, where it was originally founded.

The funding is coming from an interesting mix of financial and strategic investors. Led by Morpheus Ventures, the round also had participation from GreatPoint Ventures, Ericsson Ventures, Samsung Next Ventures, Tao Capital Partners and Tau Ventures, among others. It looks like the company had raised about $30 million before this latest round, according to PitchBook data. Valuation is not being disclosed.

Ericsson and Samsung, as major players in the communication industry, have a big stake in seeing through what will be the next generation of communications technology and how it is used for critical services. (And indeed, one of the big leaders in legacy and current 911 communications is Motorola, a would-be competitor of both.) AT&T is also a strategic go-to-market (distribution and sales) partner of RapidDeploy’s, and it also has integrations with Apple, Google, Microsoft and OnStar to feed data into its system.

The business of emergency response technology is a fragmented market. Raucher describes them as “mom-and-pop” businesses, with some 80% of them occupying four seats or less (a testament to the fact that a lot of the U.S. is actually significantly less urban than its outsized cities might have you think it is), and in many cases a lot of these are operating on legacy equipment.

However, in the U.S. in the last several years — buffered by innovations like the Jedi project and FirstNet, a next-generation public safety network — things have been shifting. RapidDeploy’s technology sits alongside (and in some areas competes with) companies like Carbyne and RapidSOS, which have been tapping into the innovations of cell phone technology both to help pinpoint people and improve how to help them.

RapidDeploy’s tech is based around its RadiusPlus mapping platform, which uses data from smart phones, vehicles, home security systems and other connected devices and channels it to its data stream, which can help a center determine not just location but potentially other aspects of the condition of the caller. Its Eclipse Analytics services, meanwhile, are meant to act as a kind of assistant to those centers to help triage situations and provide insights into how to respond. The Nimbus CAD then helps figure out who to call out and routing for response.

Longer term, the plan will be to leverage cloud architecture to bring in new data sources and ways of communicating between callers, centers and emergency care providers.

“It’s about being more of a triage service rather than a message switch,” Raucher said. “As we see it, the platform will evolve with customers’ needs. Tactical mapping ultimately is not big enough to cover this. We’re thinking about unified communications.” Indeed, that is the direction that many of these services seem to be going, which can only be a good thing for us consumers.

“The future of emergency services is in data, which creates a faster, more responsive 9-1-1 center,” said Mark Dyne, founding partner at Morpheus Ventures, in a statement. “We believe that the platform RapidDeploy has built provides the necessary breadth of capabilities that make the dream of Next-Gen 9-1-1 service a reality for rural and metropolitan communities across the nation and are excited to be investing in this future with Steve and his team.” Dyne has joined the RapidDeploy board with this round.

Powered by WPeMatico

In Indonesia, daily necessities often cost more in smaller cities and rural areas. Super co-founder and chief executive officer Steven Wongsoredjo said the price difference can vary from about 10% to 20% in Tier 2 and Tier 3 cities, to nearly 200% in eastern provinces. Super uses social commerce and a streamlined logistics chain to lower the cost of goods. The startup announced today it has raised an oversubscribed $28 million Series B led by SoftBank Ventures Asia.

Other participants included returning backers Amasia, Insignia Ventures Partners, Y-Combinator Continuity Fund and Bain Capital co-chairman Stephen Pagliuca, while partners from DST Global and TNB Aura invested for the first time in this round.

The funding brings Super’s total raised so far to more than $36 million, which the company says is the most funding an Indonesian social commerce startup has raised so far.

Super, which took part in Y Combinator’s winter 2018 batch, focuses mainly on cities or towns with a gross domestic product per capita of $5,000 USD or lower. It currently operates in 17 cities in East Java, and has a network of thousands of agents, or resellers, and hundreds of thousands of end buyers. The company will use its new funding to double its presence in the region and launch in other Indonesian provinces this year. It will also expand its product categories beyond fast-moving consumer goods (FMCG) and develop its recently-launched white label brand, SuperEats.

Wongsoredjo told TechCrunch that Super’s ultimate goal is to “build the Walmart Group of Indonesia without having a retail store and utilizing the social commerce aspect to build a sustainable model,” similar to the way Pinduoduo became one of China’s biggest e-commerce companies by focusing on smaller cities.

Prices for consumer goods are higher in small cities and rural areas because of two reasons, Wongsoredjo said. The first is that orders from smaller cities cost more to fulfill, with supply chain costs adding up, than larger orders, and the second is infrastructure that makes it harder for manufacturers and FMCG brands to truck goods into rural areas, so supply does not meet demand.

Super operates a central warehouse, along with smaller hubs closer to buyers. Most of Super’s products are supplied by regional FMCG brands, and group orders are delivered to agents, who in turn perform last-mile deliveries to their buyers. This keeps prices down by making its supply chain more efficient and enabling it to fulfill orders within 24 hours without relying on third-party logistics providers.

Other social commerce companies in Indonesia include KitaBeli, ChiliBeli and Woobiz. Wongsoredjo said Super had a headstart to serve smaller cities and rural areas because it does not focus on Jabodetabek, or the greater Jakarta region. Its headquarters and core operations teams are also all outside of major cities.

“We believe that by not having Jabodetabek’s presence in our DNA, we can build unique social commerce products with the hyperlocal touch to serve rural communities much better,” Wongsoredjo added. “We want to go after the rest of 90% of the market that is still under-penetrated.”

In statement, SoftBank Ventures Asia partner Cindy Jin said, “We have been impressed by the Super team’s deep knowledge and commitment to Indonesia’s underserved regions, and believe that a truly local team like theirs will be well equipped to navigate and build out a platform in this hyperlocal market.”

Powered by WPeMatico

If businesses are going to meet their increasingly aggressive targets for reducing the greenhouse gas emissions associated with their operations, they’re going to have to have an accurate picture of just what those emissions look like. To get that picture, companies are increasingly turning to businesses like Sweep, which announced its commercial launch today.

The Parisian company boasts a founding team with an impeccable pedigree in enterprise software. Co-founders Rachel Delacour and Nicolas Raspal were the co-founders of BIME Analytics, which was acquired by Zendesk. And together with Zendesk colleagues Raphael Güller and Yannick Chaze, and the founder of the Net Zero Initiative, Renaud Bettin, they’ve created a software toolkit that gives companies a visually elegant view into not just a company’s own carbon emissions, but those of their suppliers as well.

It’s the background of the team that first attracted investors like Pia d’Iribarne, co-founder and managing partner, New Wave, which made their first climate-focused investment into the software developer.

“We decided to invest before we even closed the fund,” d’Iribarne said of the investment in Sweep. “We officially invested in December or January.”

New Wave wasn’t the only investor wowed by the company’s prospects. The new European climate-focused investment firm 2050, and La Famiglia, a fund with strong ties to big European industrial companies, also participated alongside several undisclosed angel investors from the Bay Area. In all Sweep raked in $5 million for its product before it had even launched a beta.

Sweep offers users the ability to visualize each location of a company’s business by brand, location, product or division and see how those different granular operations contribute to a company’s overall carbon footprint. Users can also link those nodes to external suppliers and distributors to share carbon data.

The effects of climate change are increasing, and companies across industries are motivated to do their part. But today’s carbon reduction efforts are being stalled by complex tools and resources that can’t match the urgency of the threat. By putting automation, connectivity and collaboration at the heart of the platform, Sweep is the first to offer companies an efficient mechanism to tackle their indirect Scope 3 emissions, and turn net zero from a buzzword into a reality.

Like the other companies that have come on the market with carbon monitoring and management solutions, Sweep also offers the ability to finance offset projects directly from its platform. And, like those other companies, Sweep’s offsets are primarily in the forestry space.

“Around the world, companies are under pressure from customers, investors and regulators to take action to reduce their emissions,” said Pia d’Iribarne in a statement. “As a result, we’re seeing unprecedented growth in the climate technology market and we expect it to continue to explode. What used to be an issue confined to a company’s sustainability team is now a front-and-center business objective that has the commitment of the CEO. We invested in Sweep because of their world-class expertise in sustainability and their success in developing state-of-the-art, end-to-end SaaS platforms. It’s the right team and the right product at the right time.”

Powered by WPeMatico

Every company wants to maintain that initial spark it had when it was an early-stage startup, but keeping that going as you scale into a public company isn’t always easy. Atlassian is taking a unique approach by opening up product ideas to an internal competition, and actually funding and building the best ones with the goal of bringing them to market.

Steve Goldsmith, who is heading up the project for Atlassian, says that it’s an in-house startup incubator called Point A. The company wants to encourage employees to be constantly thinking about new ways to improve the products. And every employee is encouraged to participate, not just engineers or product managers, as many might think.

“Point A is our internal framework for turning ideas into products. It’s our way of finding the innovation that’s happening all over the company, and giving a process and framework for those ideas to reach the maturity of actually becoming products that we offer to our customers,” Goldsmith told me.

He says that like many companies they hold internal hackathons and other events where many times employees come up with creative concepts for products, but they tend to get put on a shelf after the event is over and never get looked at again. With Point A, they can actually compete to put their experiments to work and see if they are actually viable.

“So we think of Point A as a way of finding all those different ideas and prototypes and concepts that people have in their brains or on the side of their desk kind of thing, and giving a process and a structure for those ideas to get out the door, and really invest in the ones that have some traction,” Goldsmith said.

He says by providing an official internal process to vet and maybe fund some of them, people inside the organization know that their proposals are being heard and they have a mechanism for submitting them, and the company has a way of seeing them.

The company launched Point A in 2019 looking at 35 possible projects, and testing them as possible products. Last January, they chose nine that made the final cut and four turned into actual products and made it out the door this week, including the Jira Work Management tool, which is being released today.

The next program is ready to roll with employees ready to present their ideas in a pitch day competition to get things going. “Our first class is graduating out of this program, and […] we start the process again. We actually just went through our big list of all the ideas to do it a second time, and we are doing a pitch day. It’s going to be a fun Shark Tank, The Voice kind of inspired [competition],” he said.

Company co-founders and co-CEOs Mike Cannon-Brookes and Scott Farquhar both participate in judging the competition, so it has executive buy-in, giving more clout to the program and sending a message to employees that their ideas are being taken seriously.

The company provides funding, time away from your regular job and executive coaches, and combines that with customer collaboration and early founder involvement with the goal of finding a scalable, repeatable process with defined phases that helps teams take the most innovative ideas from concept to customer.

Some make it. Some don’t, as you might expect, but so far the plan seems to be working and is successfully encouraging innovation from within, something every company should be trying to do.

Powered by WPeMatico