TC

Auto Added by WPeMatico

Auto Added by WPeMatico

Hangry, an Indonesian cloud kitchen startup that wants to become a global food and beverage company, has raised a $13 million Series A. The round was led by returning investor Alpha JWC Ventures and included participation from Atlas Pacific Capital, Salt Ventures and Heyokha Brothers. It will be used to increase the number of Hangry’s outlets in Indonesia, including launching its first dine-in restaurants, over the next two years before it enters other countries.

Along with a previous round of $3 million from Alpha JWC and Sequoia Capital’s Surge program, Hangry’s Series A brings its total funding to $16 million. It currently operates about 40 cloud kitchens in Greater Jakarta and Bandung, 34 of which launched in 2020. Hangry plans to expand its total outlets to more than 120 this year, including dine-in restaurants.

Founded in 2019 by Abraham Viktor, Robin Tan and Andreas Resha, Hangry is part of Indonesia’s burgeoning cloud kitchen industry. Tech giants Grab and Gojek both operate networks of cloud kitchens that are integrated with their food delivery services, while other startups in the space include Everplate and Yummy.

One of the main ways Hangry sets itself apart is by focusing on its own brands, instead of providing kitchen facilities and services to restaurants and other third-party clients. Hangry currently has four brands, including Indonesian chicken dishes (Ayam Koplo) and Japanese food (San Gyu), that cost about 15,000 to 70,000 IDR per portion (or about $1 to $6 USD). Its food can be ordered through Hangry’s own app, plus GrabFood, GoFood and ShopeeFood.

“Given that Hangry has developed an extensive cloud kitchen network across Indonesia, we naturally would have interest from other brands to leverage our networks,” chief executive officer Viktor told TechCrunch. “However, our focus is to grow our brands since our brands are rapidly growing in popularity in Indonesia and require all kitchen resources that they need to realize their full potential.”

Providing food deliveries helped Hangry grow during COVID-19 lockdowns and social distancing, but in order to become a global brand within a decade, it needs to operate in multiple channels, he added.

“We knew that we will one day have to serve customers in all channels, including dine in,” said Viktor. “We started the hard way, doing delivery-first business, where we faced the challenges surrounding making sure our food still tastes good when it reaches customers’ homes. Now we feel ready to serve our customers in our restaurant premises. Our dine-in concept is an expansion of everything we’ve done in delivery channels.”

In a press statement, Alpha JWC Ventures partner Eko Kurniadi said, “In the span of 1.5 years, [Hangry] launched multiple brands across myriad tastes and categories, and almost all of them are amongst the best sellers list with superior ratings in multiple platforms, tangible examples of product-market fit. This is only the beginning and we can already foresee their growth to be a top local F&B brand in the country.”

Powered by WPeMatico

Four months after leading a $30 million growth round in Bibit, Sequoia Capital India has doubled down on its investment in the Indonesian robo-advisor app. Bibit announced today that the firm led a new $65 million growth round that also included participation from Prosus Ventures, Tencent, Harvard Management Company and returning investors AC Ventures and East Ventures.

This brings Bibit’s total funding to $110 million, including a Series A announced in May 2019. Its latest round will be used on developing and launching new products, hiring and increasing Bibit’s financial education services.

Bibit was launched in 2019 by Stockbit, a stock investing platform and community, and is part of a crop of Indonesian investment apps focused on new investors. Others include SoftBank Ventures-backed Ajaib, Bareksa, Pluang and FUNDtastic. Bibit runs robo-advisor services for mutual funds, investing users’ money based on their risk profiles, and claims that 90% of its users are millennials and first-time investors.

According to Indonesia’s Financial Services Authority (Otoritas Jasa Keuangan), the number of retail investors grew 56% year-over-year in 2020. For mutual funds in particular, Bibit said investors grew 78% year-over-year to 3.2 million, based on data from the Indonesia Stock Exchange and Central Securities Custodian.

Despite the economic impact of COVID-19, interest in stock investing grew as people took advantage of market dips (the Jakarta Composite Index fell in the first quarter of 2020, but is now recovering steadily). Apps like Bibit and its competitors want to make capital investing more accessible with lower fees and minimum investment amounts than traditional brokerages like Mandiri Sekuritas, which also saw an increase in new retail investors and average transaction value last year.

But the percentage of retail investors in Indonesia is still very low, especially compared to markets like Singapore or Malaysia, presenting growth opportunities for investment services.

Apps like Bibit focus on content that helps make capital investing less intimidating to first-time investors. For example, Ajaib also presents its financial educational features as a selling point.

In a press statement, Sequoia Capital India vice president Rohit Agarwal said, “Indonesian mutual fund customers have grown almost 10x in the past five years. Savings via mutual funds is the first step towards investing and Bibit has helped millions of consumers start their investing journey in a responsible manner. Sequoia Capital India is excited to double down on the partnership as the company brings the same customer focus to stock investing with Stockbit.”

Powered by WPeMatico

My mom cuts to the chase when she is describing my beat to others. In her words, I cover companies like Uber before they become companies like Uber. And honestly? I can’t exactly disagree with the description. The best feeling in tech journalism is telling a story about a startup before it becomes a household name. As an early-stage reporter, I honestly bet a lot on the potential of a savvy edtech founder or creative marketplace play. And when I’m doing my job right, I point to the unique insight that will make the startup successful or challenged in the future.

On that note, one of my favorite renewed series at TechCrunch is an EC-1 (Extra Crunch subscription required), a story series that goes through the nitty-gritty of a startup’s story, from its original days to its pivots along the way. I’ve spent the past few months on one of these projects — and mine is coming out next week! In the meantime, you’ve read packages about StockX and Tonal, and our latest just came out: the Klaviyo EC-1:

Image Credits: Nigel Sussman

Enjoy this long-form read and big thanks to Danny Crichton, my Equity co-host and managing editor here at TechCrunch, who has been managing and editing all of these projects.

In the rest of this newsletter we’ll get into All Raise data, the new Miami and a new lineup you don’t want to miss. Follow me on Twitter @nmasc_ for updates throughout the week.

All Raise, a nonprofit dedicated to increasing the footprint of women founders and funders, has released its annual report for 2020. The whole thing is honestly worth a read, but we especially paid attention to how funding has dropped for female founders:

Here’s what to know: On Equity, we talked about how these abysmal metrics were both a predicted but still surprising effect of Zoom investing. This disconnect is the conversation no one has during an upmarket — and metrics are one way we can benchmark progress.

To quote Winnie CEO and co-founder Sara Mauskopf, “Internet is the new Miami.” The networks made online — either through the rise of meme culture or Substack spice — can be a competitive advantage in the world of investment, as two new funds this week showed us.

Here’s what to know: Ryan Hoover and Vedika Jain announced Weekend Fund 3, which will include a $1 million community raise. And Chief Meme Officer Turner Novak finally debuted Banana Capital’s debut fund launched with $9.99 million in funding.

Novak explained how being internet-first impacts his investments:

“It just kind of happens where [my investments] are people who understand the culture of the internet, to understand memes and understand wit and humor and appreciate that a little bit more,” he said. “Those are probably the people that are more naturally intuitive investments, so it definitely does skew that direction.”

While Novak didn’t share explicit targets or mandates around investment in diverse founders, he pointed to his track record at Gelt VC, in which 41% of capital went to woman CEOs. To date, 65% of Banana Capital’s portfolio founding teams include non-white founders and 50% of the teams include more than one gender.

Seen on TechCrunch

Atlassian launches a Jira for every team

CES will return to Las Vegas in 2022

Microsoft’s new default font options, rated

Seen on Extra Crunch

Hacking my way into analytics: A creative’s journey to design with data

How Brex more than doubled its valuation in a year

India is in crisis. It is devastating and heartbreaking to watch this unfold and impact our family and friends and colleagues and people. My colleague Manish Singh, who is based there, wrote up the different ways you can donate to help out.

I’ll end by quoting Singh:

With several major industries, including film and sports, going about their lives pretending there is no crisis, entrepreneurs and startups have emerged as a rare beam of hope in recent days, springing to action to help the nation navigate its darkest hours.

It’s a refreshing change from last year, when thousands of Indian startups themselves were struggling to survive. And while some startups are still severely disrupted, offering a helping hand to the nation has become the priority for most.

Until next week,

Powered by WPeMatico

Tech companies in Silicon Valley, the geography, have had an incredible year. But one indicator points to longer-term changes. The internal rate of return (IRR) for companies in other startup hub cities has been even better. A big new analysis by AngelList showed aggregate IRR of 19.4% per year on syndicated deals elsewhere versus 17.5% locally. A separate measure, of total value of paid-in investment, revealed 1.67x returns for other hubs versus 1.60x in the main Silicon Valley and Bay Area tech cities.

The data is based on a sample of 2,500 companies that have used AngelList to syndicate deals from 2013 through 2020. Which is just one snapshot, but a relevant one given how hard it can be to produce accurate early-stage startup market analysis at this scale. I believe we’ll see more and more data confirming the trends in the coming years, especially as more of the startup world acclimates to remote-first and distributed offices. You can increasingly do a startup from anywhere and make it a success. Not that Silicon Valley is lacking optimism, as you’ll see in a number of the other stories in the roundup below!

Eric Eldon

Managing Editor, Extra Crunch

(Subbing in for Walter today as he’s enjoying a well-deserved break and definitely not still checking the site.)

Image Credits: Nigel Sussman (opens in a new window)

With the Coinbase direct listing behind us and the Robinhood IPO ahead, it’s a heady time for consumer-focused trading apps.

Mix in the impending SPAC-led debut of eToro, general bullishness in the cryptocurrency space, record highs for some equities markets, and recent rounds from Public.com, M1 Finance and U.K.-based Freetrade, and you could be excused for expecting the boom in consumer asset trading to keep going up and to the right.

But will it? There are data in both directions.

Image Credits: Nigel Sussman (opens in a new window)

A short meditation on value, or, more precisely, how assets are valued in today’s markets.

Long story short: This is why I only buy index funds. No one knows what anything (interesting) is worth.

Image Credits: Matthias Kulka (opens in a new window) / Getty Images

Raising capital for a new fund is always hard.

But should you give preferential economics or other benefits to a seed anchor investor who makes a material commitment to the fund? Let’s break down the pros and cons.

Image Credits: TEK IMAGE/SCIENCE PHOTO LIBRARY / Getty Images

Last year was a record 12 months for venture-backed biotech and pharma companies, with deal activity rising to $28.5 billion from $17.8 billion in 2019.

As vaccines roll out, drug development pipelines return to normal, and next-generation therapies continue to hold investor interest, 2021 is on pace to be another blockbuster year.

But founder missteps early in the fundraising journey can result in severe consequences.

In this exciting moment, when younger founders will likely receive more attention, capital and control than ever, it’s crucial to avoid certain pitfalls.

Image Credits: Maxime Robeyns/EyeEm (opens in a new window) / Getty Images

The fundamental thing to remember about the SPAC process is that the result is a publicly traded company open to the regulatory environment of the SEC and the scrutiny of public shareholders.

In today’s fast-paced IPO world, going public can seem like simply a marker of success, a box to check.

But are you ready to be a public company?

Image Credits: Westend61 (opens in a new window) / Getty Images

Those of us who read a lot of tech and business publications have heard for years about the cybersecurity skills gap. Studies often claim that millions of jobs are going unfilled because there aren’t enough qualified candidates available for hire.

Don’t buy it.

The basic laws of supply and demand mean there will always be people in the workforce willing to move into well-paid security jobs. The problem is not that these folks don’t exist. It’s that CIOs or CISOs typically look right past them if their resumes don’t have a very specific list of qualifications.

In many cases, hiring managers expect applicants to be fully trained on all the technologies their organization currently uses. That not only makes it harder to find qualified candidates, but it also reduces the diversity of experience within security teams — which, ultimately, may weaken the company’s security capabilities and its talent pool.

Image Credits: Nigel Sussman (opens in a new window)

We do not know how to value Honest Company.

It’s outside our normal remit, but that the company is getting out the door at what appears to be a workable price gain to its final private round implies that investors earlier in its cap table are set to do just fine in its debut. Snowflake it is not, but at its current IPO price interval, it is hard to not call Honest a success of sorts — though we also anticipate that its investors had higher hopes.

Returning to our question, do we expect the company to reprice higher? No, but if it did, The Exchange crew would not fall over in shock.

Image Credits: TechCrunch

Brex, a fintech company that provides corporate cards and spend-management software to businesses, announced Monday that it closed a $425 million Series D round of capital at a valuation of around $7.4 billion.

The new capital came less than a year after Brex raised $150 million at a $2.9 billion pre-money valuation.

So, how did the company manage to so rapidly boost its valuation and raise its largest round to date?

TechCrunch spoke with Brex CEO Henrique Dubugras after his company’s news broke. We dug into the how and why of its new investment and riffed on what going remote-first has done for the company, as well as its ability to attract culture-aligned and more diverse talent.

Image Credits: Flashpop (opens in a new window) / Getty Images

There’s a disconnect between reality and the added value investors are promising entrepreneurs. Three in five founders who were promised added value by their VCs felt duped by their negative experience.

While this feels like a letdown by investors, in reality, it shows fault on both sides. Due diligence isn’t a one-way street, and founders must do their homework to make sure they’re not jumping into deals with VCs who are only paying lip service to their value-add.

Looking into an investor’s past, reputation and connections isn’t about finding the perfect VC, it’s about knowing what shaking certain hands will entail — and either being ready for it or walking away.

Image Credits: Jeff Newton / Hippo

What is the biggest opportunity for proptech founders? How should they think about competition, strategic investment versus top-tier VC firms and how to build their board? What about navigating regulation?

We sat down with Brendan Wallace, co-founder and general manager of Fifth Wall, and Hippo CEO Assaf Wand for an episode of Extra Crunch Live to discuss all of the above.

Image Credits: emyerson (opens in a new window) / Getty Images

Software as a service (SaaS) has perhaps become a bit too interchangeable with subscription models.

Every software company now looks to sell by subscription ASAP, but the model itself might not fit all industries or, more importantly, align with customer needs, especially early on.

In the never-ending stream of venture capital funding rounds, from time to time, a group of startups working on the same problem will raise money nearly in unison. So it was with OKR-focused startups toward the start of 2020.

How were so many OKR-focused tech upstarts able to raise capital at the same time? And was there really space in the market for so many different startups building software to help other companies manage their goal-setting? OKRs, or “objectives and key results,” a corporate planning method, are no longer a niche concept. But surely, over time, there would be M&A in the group, right?

Image Credits: Nigel Sussman (opens in a new window)

Image Credits: petdcat (opens in a new window) / Getty Images

Tech innovation is becoming more widely distributed across the United States.

Among the five startups launched in 2020 that raised the most financing, four were based outside the Bay Area. The number of syndicated deals on AngelList in emerging markets from Austin to Seattle to Pittsburgh has increased 144% over the last five years.

And the number of startups in these emerging markets is growing fast — and increasingly getting a bigger piece of the VC pie.

Image Credits: Guido Mieth (opens in a new window)/ Getty Images

Almost two centuries ago, gold prospectors in California set off one of the greatest rushes for wealth in history. Proponents of socially conscious investing claim fund managers will start a similar stampede when they discover that environmental, social and governance (ESG) insights can yield treasure in the form of alternative data that promise big payoffs — if only they knew how to mine it.

ESG data is everywhere. Learning how to understand it promises big payoffs.

Image Credits: Bryce Durbin/TechCrunch

Dear Sophie,

My company is looking to hire a very talented data infrastructure engineer who is undocumented. She has never applied for DACA before.

What is the latest on DACA? What can we do to support her?

—Multicultural in Milpitas

Image Credits: Nigel Sussman (opens in a new window)

The IPO parade continued this week as India-based food-delivery unicorn Zomato filed to go public.

The Zomato IPO is incredibly important. As our own Manish Singh reported when the company’s numbers became public, a “successful listing [could be] poised to encourage nearly a dozen other unicorn Indian startups to accelerate their efforts to tap the public markets.”

So, Zomato’s debut is not only notable because its impending listing gives us a look into its economics, but because it could lead to a liquidity rush in the country if its flotation goes well.

Image Credits: Donald Iain Smith (opens in a new window) / Getty Images

With the United States moving all-in on massive infrastructure investment, much of the discussion has focused on jobs and building new green industries for the 21st century.

While the Biden administration’s plan will certainly expand the workforce, it also provides a massive opportunity for the adoption of automation technologies within the construction industry.

Despite the common narrative of automating away human jobs, the two are not nearly as much in conflict, especially with new investments creating space for new roles and work.

In fact, one of the greatest problems facing the construction industry remains a lack of labor, making automation a necessity for moving forward with these ambitious projects.

Image Credits: fourSage (opens in a new window)/ Getty Images

Even though in-person drinks and coffee walks are on the horizon, virtual fundraising isn’t going away.

Now, it’s imperative to ensure your virtual pitch is as effective as your IRL one.

Not only is it more efficient — no expensive trips to San Francisco or trouble fitting investor meetings into one day — virtual fundraising helps democratize access to venture capital.

Image Credits: Xuanyu Han (opens in a new window) / Getty Images

There’s a growing need for basic data literacy in the tech industry, and it’s only getting more taxing by the year.

Words like “data-driven,” “data-informed” and “data-powered” increasingly litter every tech organization’s product briefs. But where does this data come from?

Who has access to it? How might I start digging into it myself? How might I leverage this data in my day-to-day design once I get my hands on it?

Image Credits: Nigel Sussman (opens in a new window)

The first three months of the year were the most valuable period for fintech investing, ever.

Where did the fintech venture capital market push the most money in Q1, and why? Let’s dig in.

Image Credits: PM Images (opens in a new window)/ Getty Images

Why can we see all our bank, credit card and brokerage data on our phones instantaneously in one app, yet walk into a doctor’s office blind to our healthcare records, diagnoses and prescriptions?

Our health status should be as accessible as our checking account balance.

The liberation of healthcare data is beginning to happen, and it will have a profound impact on society — it will save and extend lives.

Image Credits: cnythzl (opens in a new window) / Getty Images

The red-hot market for special purpose acquisition companies, or SPACs, has “screeched to a halt.”

As the SPAC market grew in the past six months, it seemed that everyone was getting into the game. But shareholder lawsuits, huge value fluctuations and warnings from the U.S. Securities and Exchange Commission have all thrown the brakes on the SPAC market, at least temporarily.

So what do privately held tech companies that are considering going public need to know about the SPAC process and market?

Image Credits: Image Source (opens in a new window) / Getty Images

Once the uncool sibling of a flourishing fintech sector, insurtech is now one of the hottest areas of a buoyant venture market. Zego’s $150 million round at unicorn valuation in March, a rumored giant incoming round for WeFox, and a slew of IPOs and SPACs in the U.S. are all testament to this.

It’s not difficult to see why. The insurance market is enormous, but the sector has suffered from notoriously poor customer experience, and major incumbents have been slow to adapt. Fintech has set a precedent for the explosive growth that can be achieved with superior customer experience underpinned by modern technology. And the pandemic has cast the spotlight on high-potential categories, including health, mobility and cybersecurity.

This has begun to brew a perfect storm of conditions for big European insurtech exits.

Image Credits: Busakorn Pongparnit (opens in a new window) / Getty Images

The recent movement toward data transparency is bringing about a new era of innovation and startups.

Those who follow the space closely may have noticed that there are twin struggles taking place: a push for more transparency on provider and payer data, including anonymous patient data, and another for strict privacy protection for personal patient data.

What’s the main difference, and how can startups solve these problems?

Powered by WPeMatico

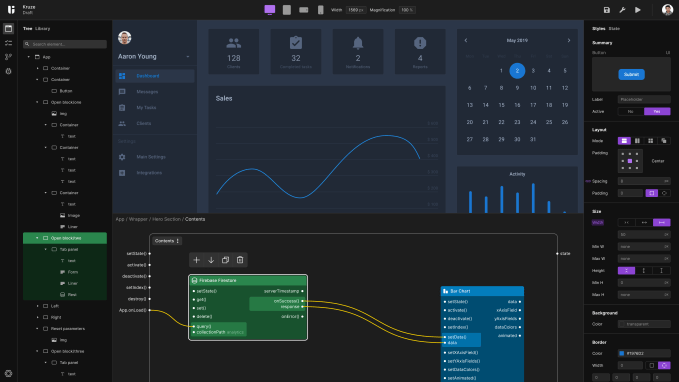

TechCrunch recently caught up with recent Y Combinator graduate Uiflow, a startup that is building a no-code enterprise app creation service.

If you are thinking wait, don’t a number of companies already do that?, the answer is yes. But what Quickbase, Smartsheet and others are working on isn’t quite the same thing, at least from the startup’s perspective.

Uiflow, a Bay Area-based concern that has been alive for far less than a year, has built an app creation tool that works with whatever backend a large company currently employs, and helps its development team build apps collaboratively. As the startup explained in a public posting, customer developers can import Figma files while their engineers can use existing UI libraries, and product managers can quickly vet an app’s logic.

The service is akin to a “cross between Unity and Figma,” Uiflow says.

Here’s what its own user interface looks like, per a screenshot the company provided to TechCrunch after an interview:

Per Y Combinator, the company has closed a pre-seed round of more than $500,000. The company told TechCrunch that it has been talking to investors lately — as essentially every Y Combinator-backed startup does after their public unveiling — but appears to be holding off raising more capital until it fully launches self-service of its product; the company may also accelerate its hiring efforts once its self-serve GTM motion is more broadly available.

The startup told TechCrunch that after its Product Hunt launch it picked up around 1,200 signups. It’s vetting the group and letting in some as pilot customers. Those customers currently pay the company, so it has revenue, although the startup is more product-focused at the moment than centered around boosting its short-term revenues.

Uiflow thinks that its target customers are companies with 250 or more workers, the scale at which a company begins to start thinking about its own UI elements. However, Uiflow is talking to companies with 100 to 1,000 customers, it said.

The five-person team is building a service in a market that is more than active at the moment. As TechCrunch has explored, private-market investors are bullish on the no-code space, especially after the COVID-19 pandemic bolstered the pace at which companies large and small moved toward digital solutions. No-code and low-code services came into greater demand as accelerating digital transformation efforts met the market’s general dearth of available developer talent.

TechCrunch has covered the no-code space extensively in recent quarters, given both rising market demand for its products and what seemed to be growing investor demand for shares in startups pursuing the model. All that’s to say that there’s a reasonable chance that we’ll hear from Uiflow soon regarding a fresh capital raise. Let’s see how long that takes.

In the meantime, here’s a photo of the Uiflow team. In 2021-style, it’s a Zoom shot:

From upper left, clockwise: Michael Tildahl, Eric Rowell (CTO and co-founder), Brian Lichliter, Rocco Cataldo and D. Sol Eun (CEO and co-founder). Via the company.

Powered by WPeMatico

Anyone who has played a video game with voice chat in the past decade knows that there is some risk involved. You might be greeted by friendly teammates, but you may also hear some of the most toxic language you’ve ever heard in your life.

Riot Games, the game developer behind ultra popular titles like League of Legends and Valorant, is thinking hard about this. And taking action.

The developer is today announcing changes to its privacy notice that allow for it to capture and evaluate voice comms when a report is submitted around disruptive behavior. The changes to the policy are Riot-wide, meaning that all players across all games will need to accept those changes. However, the only game that is scheduled to utilize these new abilities is Valorant, as it is the most voice chat-heavy game from Riot.

The plan here is to store relevant audio data in the account’s registered region and evaluate it to see if the behavior agreement was violated. This process is triggered by a report being submitted, and is not an always-on system. If a violation has occurred, the data will be made available to the player in violation and will ultimately be deleted once there is no further need for it following reviews. If no violation is detected, the data will be deleted.

Before we go any further, let me just say that this is a big fucking deal. Publishers and developers have long known that toxicity in gaming is not only a terrible user experience, but it’s actively preventing large swaths of potential gamers from dedicating themselves to it.

“Players are experiencing a lot of pain in voice comms and that pain takes the form of all kinds of different disruption in behavior and it can be pretty harmful,” said Head of Players Dynamics Weszt Hart. “We recognize that, and we have made a promise to players that we will do everything that we could in this space.”

Voice chat often makes games much richer and more fun. Particularly during the pandemic, people are craving more human connection. But in a tense environment like competitive games, that connection can turn sour.

As a gamer myself, I can safely say that some of the most hurtful experiences of my life have been while playing video games with strangers.

To be clear, Riot isn’t getting specific with how exactly this voice chat moderation will work. The first step is the update to its privacy notice, which gives players a heads up and gives the company the right to start evaluating voice comms.

It’s incredibly difficult to police voice comms. Not only do you need to be transparent with users and update any legal documents (which is arguably the easiest step, and the one Riot is taking today), but you must develop the right technology to do this, all while protecting player privacy.

I spoke with Hart and Data Protection Officer and CISO Chris Hymes about the changes. The duo said that the actual system for detecting behavior violations within voice comms is still under development. It may focus on automated voice-to-text transcription, and go through the same system as text chat moderation, or it may rely more heavily on machine learning to actually detect an infringement via voice alone.

“We’re looking at the technologies and we’re trying to land on the one that we want to launch with,” said Hart. “We’ve been putting a lot of time and effort into space and we have a pretty good idea of the direction that we’re going to take. But what we want to do is to have some audio to work with, to better understand if any other approaches that we’re looking at are going to be the best. To do this, we need to be able to process something real, and not just make a good guess.”

To get to that answer as quickly as possible, he added, the first step of updating the privacy notice had to go into effect.

Hart and Hymes also said that some layer of human moderation will be involved to ensure that whatever system is being developed is working properly and can ultimately be rolled out to other languages and other titles, as the system is initially being developed for Valorant in North America.

Advances in machine learning and natural language processing are making that development easier than it was 10, or even two, years ago. But even in a world where a machine learning algorithm could accurately detect hate speech, with all its nuances, there is yet another hurdle.

Gamers, even from one title to the next, have their own language. There is a whole lexicon of words and terms used by gamers that aren’t used in every day life. This adds yet another complication to the process of developing this system.

Still, this is a critical step in ensuring that Riot Games titles, and hopefully other titles as well, become an inclusive environment where anyone who wants to game feels safe and able to do so.

And Riot is careful to understand that developing games is a holistic endeavor. Everything from game design to anti-cheating measures to behavior guidelines and moderation have an effect on the overall experience of the player.

Alongside this announcement, the company is also introducing an update to its terms of service with an updated global refund policy and new language around anti-cheat software for current and future Riot titles.

Powered by WPeMatico

TC Early Stage is back in July and we have a fantastic lineup in store that’s laser-focused on marketing and fundraising. That includes, but is not limited to, Sequoia’s Mike Vernal, whose portfolio companies include Citizen, PicsArt, Whisper, Threads, Houseparty and more.

Vernal will be leading a discussion on tempo and product-market fit. The chat stems from Vernal’s experience as an investor, sharing the lesser-known keys to success to not only secure early investment, but to use it to secure a later-stage investment.

In essence, tempo is everything. At the earliest stage, investors are looking more at the team than the product, knowing that the likelihood of the product changing and evolving is high. That means that the ability to adapt — including the systems in place to collect feedback and willingness to continue iterating — are incredibly important factors.

Vernal will not only stress the importance of tempo and product iteration (and how it relates to fundraising success), he’ll also share how both enterprise and consumer companies should go about creating these feedback loops with customers and how to iterate quickly.

Vernal joined Sequoia as a partner in 2016. He currently sits on the boards of Citizen, Jumpstart, rideOS, PicsArt, Rockset, Threads and Whisper. Before Sequoia, Mike was VP at Facebook, where he led a variety of product and engineering teams. He co-created Facebook Login and the Graph API.

In other words, he’s seen and participated in success, and has done the work of product iteration himself.

Vernal joins a stellar lineup of speakers at TC Early Stage in July, including Norwest Venture Partners’ Lisa Wu, Greylock’s Mike Duboe and Cleo Capital’s Sarah Kunst, among many others that are soon to be announced.

One of the great things about TC Early Stage is that the show is designed around breakout sessions, with each speaker leading a chat around a specific startup core competency (like fundraising, designing a brand, mastering the art of PR and more). Moreover, there is plenty of time for audience Q&A in each session.

Pick up your ticket for the event, which goes down July 8 and 9, right here. And if you do it before the end of the day today, you’ll save a cool $100 off of your registration.

Powered by WPeMatico

Platforms like Shopify, Stripe and WordPress have done a lot to make essential business-building tools — like running storefronts, accepting payments and building websites — accessible to businesses with even the most modest budgets. But some very key aspects of setting up a company remain expensive, time-consuming affairs that can be cost-prohibitive for small businesses — but that, if ignored, can result in the failure of a business before it even really gets started.

Trademark registration is one such concern, and Toronto-based startup Heirlume just raised $1.7 million CAD (~$1.38 million) to address the problem with a machine-powered trademark registration platform that turns the process into a self-serve affair that won’t break the budget. Its AI-based trademark search will flag if terms might run afoul of existing trademarks in the U.S. and Canada, even when official government trademark search tools, and even top-tier legal firms, might not.

Heirlume’s core focus is on leveling the playing field for small business owners, who have typically been significantly out-matched when it comes to any trademark conflicts.

“I’m a senior-level IP lawyer focused in trademarks, and had practiced in a traditional model, boutique firm of my own for over a decade serving big clients, and small clients,” explained Heirlume co-founder Julie MacDonell in an interview. “So providing big multinationals with a lot of brand strategy, and in-house legal, and then mainly serving small business clients when they were dealing with a cease-and-desist, or an infringement issue. It’s really those clients that have my heart: It’s incredibly difficult to have a small business owner literally crying tears on the phone with you, because they just lost their brand or their business overnight. And there was nothing I could do to help because the law just simply wasn’t on their side, because they had neglected to register their trademarks to own them.”

In part, there’s a lack of awareness around what it takes to actually register and own a trademark, MacDonell says. Many entrepreneurs just starting out seek out a domain name as a first step, for instance, and some will fork over significant sums to register these domains. What they don’t realize, however, is that this is essentially a rental, and if you don’t have the trademark to protect that domain, the actual trademark owner can potentially take it away down the road. But even if business owners do realize that a trademark should be their first stop, the barriers to actually securing one are steep.

“There was an an enormous, insurmountable barrier, when it came to brand protection for those business owners,” she said. “And it just isn’t fair. Every other business service, generally a small business owner can access. Incorporating a company or even insurance, for example, owning and buying insurance for your business is somewhat affordable and accessible. But brand ownership is not.”

Heirlume brings the cost of trademark registration down from many thousands of dollars to just under $600 for the first, and only $200 for each additional after that. The startup is also offering a very small business-friendly “buy now, pay later” option supported by Clearbanc, which means that even businesses starting on a shoestring can take the step of protecting their brand at the outset.

In its early days, Heirlume is also offering its core trademark search feature for free. That provides a trademark search engine that works across both U.S. and Canadian government databases, which can not only tell you if your desired trademark is available or already held, but also reveal whether it’s likely to be able to be successfully obtained, given other conflicts that might arise that are totally ignored by native trademark database search portals.

Heirlume uses machine learning to identify these potential conflicts, which not only helps users searching for their trademarks, but also greatly decreases the workload behind the scenes, helping them lower costs and pass on the benefits of those improved margins to its clients. That’s how it can achieve better results than even hand-tailored applications from traditional firms, while doing so at scale and at reduced costs.

Another advantage of using machine-powered data processing and filing is that on the government trademark office side, the systems are looking for highly organized, curated data sets that are difficult for even trained people to get consistently right. Human error in just data entry can cause massive backlogs, MacDonell notes, even resulting in entire applications having to be tossed and started over from scratch.

“There are all sorts of data sets for those [trademark requirement] parameters,” she said. “Essentially, we synthesize all of that, and the goal through machine learning is to make sure that applications are utterly compliant with government rules. We actually have a senior-level trademark examiner that came to work for us, very excited that we were solving the problems causing backlogs within the government. She said that if Heirlume can get to a point where the applications submitted are perfect, there will be no backlog with the government.”

Improving efficiency within the trademark registration bodies means one less point of friction for small business owners when they set out to establish their company, which means more economic activity and upside overall. MacDonell ultimately hopes that Heirlume can help reduce friction to the point where trademark ownership is at the forefront of the business process, even before domain registration. Heirlume has a partnership with Google Domains to that end, which will eventually see indication of whether a domain name is likely to be trademarkable included in Google Domain search results.

This initial seed funding includes participation from Backbone Angels, as well as the Future Capital collective, Angels of Many and MaRS IAF, along with angel investors including Daniel Debow, Sid Lee’s Bertrand Cesvet and more. MacDonell notes that just as their goal was to bring more access and equity to small business owners when it comes to trademark protection, the startup was also very intentional in building its team and its cap table. MacDonell, along with co-founders CTO Sarah Ruest and Dave McDonell, aim to build the largest tech company with a majority female-identifying technology team. Its investor make-up includes 65% female-identifying or underrepresented investors, and MacDonnell says that was a very intentional choice that extended the time of the raise, and even led to turning down interest from some leading Silicon Valley firms.

“We want underrepresented founders to be to be funded, and the best way to ensure that change is to empower underrepresented investors,” she said. “I think that we all have a responsibility to actually do something. We’re all using hashtags right now, and hashtags are not enough […] Our CTO is female, and she’s often been the only female person in the room. We’ve committed to ensuring that women in tech are no longer the only woman in the room.”

Powered by WPeMatico

Last call, founders. Today is your last chance to save $100 on a pass to TC Early Stage 2021: Marketing & Fundraising. Our last founder bootcamp event of the year takes place July 8-9, and it’s time to call on Saint Expeditus — the patron saint of procrastinators and programmers alike. He’ll help you kick procrastination to the curb, save some cash and gain access to a bevy of top-tier investors, famous founders, marketing magicians, financial wizards and other startup savants. And they all want to help you build a better startup. But you need to buy your pass by 11:59 p.m. (PT) today, April 30.

This TC Early Stage experience goes deep on fundraising and marketing fundamentals. On day one, you’ll choose from a range of presentations and breakout sessions — all interactive, with plenty of time for Q&As. Plus video on demand, available after the event ends, means you don’t have to worry about schedule conflicts.

Speakers at Early Stage bring a wealth of experience, coupled with authenticity. You’ll walk away with actionable advice for immediate use and an unvarnished look at what it takes to build a startup. No sugar-coating here.

Vlad Magdalin, founder of Webflow, was very candid about the challenges he faced on his journey to success. “You always hear about startups that raise millions of dollars, but you don’t necessarily hear about the ups and downs it takes to get to that point. It’s important for early founders to see that side, too.”

We recently added Lisa Wu, a partner at Norwest Venture Partners, to our speaker roster, and we can’t wait to hear why she thinks founders should think like a VC. We’re adding more amazing speakers every week, and the full agenda is coming soon!

On day two, get ready for the Early Stage Pitch-off. Applications open next week! Throw your hat in the ring and maybe you’ll be one of the 10 early-stage startup founders chosen to pitch live in front of a panel of VC judges and all the Early Stage attendees around the world. Valuable exposure and pitch feedback for all competitors and special prizes for the winner. Stay tuned!

Read about Nalagenetics, the April TC Early Stage Pitch-off winner right here.

You procrastinated, dragged your feet and delayed taking action on this one simple, opportunity-filled task. For the love of Saint Expeditus, buy your pass to TC Early Stage 2021: Marketing & Fundraising before 11:59 pm (PT) tonight, save $100 and build a better startup.

Is your company interested in sponsoring or exhibiting at Early Stage 2021 – Marketing & Fundraising? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico

A U.S./Israeli startup, Sorbet — which is tackling what companies do with the financial risks as employees accrue paid time off (PTO) — has raised $6 million in a seed funding round led by Viola Ventures, with participation by Global Founders Capital and Meron Capital.

The economics of paid time off is relatively hidden in the business world, but essentially, Sorbet takes on the burden of this PTO from employers and then allows employees to spend it. This gives the employers far more control over the whole process and the ability to forecast its impact on the business.

Sorbet says that in the U.S., employees use only 72% of PTO balances, even though it’s the most sought-after benefit. But this, effectively, comes out at 768 million unused days off a year, worth around $224 billion. This creates a difficult problem for CFOs and accountants because its creates balance sheet liabilities on the company’s books, says Sorbet. If the employee doesn’t use all of their PTO, the employer can end up owing them a lot of money, which creates a cash flow liability on the company’s books. So Sorbet buys out these PTO liabilities from employees, then loads the cash value of the PTO on prepaid credit cards for the employees.

Speaking to me on a call, CEO and co-founder Veetahl Eilat-Raichel, said: “We researched this whole idea of paid time off and found this huge, massive market failure and inefficiency around the way that PTO is constructed. It’s kind of one of those things where, on the face of it, there’s this boring bureaucratic payroll item that turns into a boring balance sheet item. But under it is a $224 billion problem for U.S. businesses… If you think about it, employers are borrowing money from their employees at the worst terms possible and employees aren’t benefitting either. So everyone’s hurting here.”

She said: “Sorbet assumes the liability on ourselves and so then we can allow the company to control their cash flow and decide when they want to pay us back. They gain a lot of financial value because we are able to be very, very attractive on our funding. So it saves costs, it provides them with complete control of their cash flow and it allows them to give out amazing financial benefits to employees at a time where we can all use some extra cash right now.”

The platform Sorbet has built will, it says, sync with calendars, HR and payroll systems, identify habits and then proactively suggest personalized, pre-approved 3-6 hour “Micro Breaks”, 1-4 day “Micro Vacations” and +1 week Vacations. This, says the startup, increases PTO used by as much as 15%.

Employers can constantly renegotiate the terms of the loan with Sorbet, thus matching future cash flow, insulating themselves against salary raises (wage inflation), and take advantage of other benefits.

The co-founders are Eilat-Raichel, who previously worked at L’Oréal, Lockheed Martin and a fintech entrepreneur; Eliaz Shapira, co-founder and CPO; and Rami Kasterstein, co-founder and board member.

Powered by WPeMatico