TC

Auto Added by WPeMatico

Auto Added by WPeMatico

This week, we welcome guest Hana Mohan to our podcast Found. Hana is the co-founder and CEO of MagicBell, a new startup she created with Josue Montano that recently graduated from Y Combinator’s Winter 2021 cohort. MagicBell is a full-featured plug-and-play notifications inbox aimed at developers who want to build one into their own product, but don’t want to have to build one from scratch.

Hana’s experience as an entrepreneur spans multiple companies, including her last one, which she grew to significant success in terms of annual revenue. She’s also a proud transgender woman, who underwent her transition mid-way through her existing history as a founder and entrepreneur. Hana talks to us about the challenges she faced taking on her transition in an industry where the focus is often exclusively on how hard you’re hustling and what you’re building next, and about her origin story as a founder coming from an environment where there weren’t necessarily many examples with similar life experience to look to for inspiration.

During our chat, Hana also shared lots of insight into YC, and what it provides founders, as well as perspective on what it was like going through the program during a global pandemic in a remote context. Finally, she offers some great context on finding your first investors and customers as a distributed team.

We loved talking to Hana, and we hope you love the episode. You can subscribe to Found in Apple Podcasts, on Spotify, on Google Podcasts or in your podcast app of choice. Definitely leave us a review and let us know what you think, or send us direct feedback either on Twitter or via email. Come back next week for yet another great conversation with a founder all about their own one-of-a-kind startup journey.

Powered by WPeMatico

A Solid Power manufacturing engineer holds two 20 ampere hour (Ah) all solid state battery cells for the BMW Group and Ford Motor Company. The 20 ampere hour (Ah) all solid state battery cells were produced on Solid Power’s Colorado-based pilot production line. Source: Solid Power.

Solid state battery systems have long been considered the next breakthrough in battery technology, with multiple startups vying to be the first to commercialization. Automakers have been some of the top investors in the technology, each of them seeking the edge that will make their electric vehicles safer, faster and with increased range.

Ford Motor Company and BMW Group have put their money on battery technology company Solid Power.

The Louisville, Colorado-based SSB developer said Monday its latest $130 million Series B funding round was led by Ford and BMW, the latest signal that the two OEMs see SSBs powering the future of transportation. Under the investment, Ford and BMW are equal equity owners, and company representatives will join Solid Power’s board.

Solid Power received additional investment in the round from Volta Energy Technologies, the venture capital firm spun out of the U.S. Department of Energy’s Argonne National Laboratory.

Solid state batteries are so named because they lack a liquid electrolyte, as Mark Harris explained in an Extra Crunch article earlier this year. Liquid electrolyte solutions are usually flammable and at risk of overheating, so SSBs are considered to be generally safer. The real value of SSBs versus their lithium-ion counterparts is the energy density. Solid Power says its batteries can provide as much as a 50% to 100% increase in energy density compared to rechargeable batteries. Theoretically, electric vehicles with more energy-dense batteries can travel longer distances on a single charge.

This latest round of investment will help Solid Power boost its manufacturing to produce battery cells with the company’s highest ampere hour (Ah) output yet. Under separate joint development agreements with Ford and BMW, it will deliver to the OEMs 100 Ah cells for testing and vehicle integration from 2022.

Until this point, the company has been manufacturing cells with 2 Ah and 20 Ah output. “Hundreds” of 2 Ah battery cells were validated by Ford and BMW late last year, Solid Power said in a statement. Meanwhile, it is currently producing 20 Ah solid state batteries on a pilot basis with standard lithium-ion equipment.

As opposed to the 20 Ah pilot-scale cells — which are composed of 22-layers at 9×20 cm — these 100 Ah cells will have a larger footprint and even more layers, Solid Power spokesman Will McKenna told TechCrunch. (“Layers” refers to the number of double-sided cathodes, McKenna explained — so the 20 Ah cell has 22 cathodes and 22 anodes, with an all-solid electrolyte separator in between each, all in a single cell.)

Unlike Solid Power’s manufacturing, traditional lithium-ion batteries must undergo electrolyte filling and cycling in their production processes. Solid Power says these additional steps account for 5% and 30% of capital expenditure in a typical GWh-scale lithium-ion facility.

This isn’t the first time Solid Power has landed investments from the automakers. The company’s $20 million Series A in 2018 attracted capital from BMW and Ford, as well as Samsung, Hyundai, Volta and others. It’s part of a new wave of companies that have attracted the attention of OEMs. Other notable examples include Volkswagen-backed QuantumScape and General Motors, which has put its money on SES.

Ford is also independently researching advanced battery technologies and is planning to open a $185 million R&D battery lab, the company said last week.

Powered by WPeMatico

Sony and Discord have announced a partnership that will integrate the latter’s popular gaming-focused chat app with PlayStation’s own built-in social tools. It’s a big move and a fairly surprising one given how recently acquisition talks were in the air — Sony appears to have offered a better deal than Microsoft, taking an undisclosed minority stake in the company ahead of a rumored IPO.

The exact nature of the partnership is not expressed in the brief announcement post. The closest we come to hearing what will actually happen is that the two companies plan to “bring the Discord and PlayStation experiences closer together on console and mobile starting early next year,” which at least is easy enough to imagine.

Discord has partnered with console platforms before, though its deal with Microsoft was not a particularly deep integration. This is almost certainly more than a “friends can see what you’re playing on PS5” and more of a “this is an alternative chat infrastructure for anyone on a Sony system.” Chances are it’ll be a deep, system-wide but clearly Discord-branded option — such as “Start a voice chat with Discord” option when you invite a friend to your game or join theirs.

The timeline of early 2022 also suggests that this is a major product change, probably coinciding with a big platform update on Sony’s long-term PS5 roadmap.

While the new PlayStation is better than the old one when it comes to voice chat, the old one wasn’t great to begin with, and Discord is not just easier to use but something millions of gamers already do use daily. And these days, if a game isn’t an exclusive, being robustly cross-platform is the next best option — so PS5 players being able to seamlessly join and chat with PC players will reduce a pain point there.

Of course Microsoft has its own advantages, running both the Xbox and Windows ecosystems, but it has repeatedly fumbled this opportunity and the acquisition of Discord might have been the missing piece that tied it all together. That bird has flown, of course, and while Microsoft’s acquisition talks reportedly valued Discord at some $10 billion, it seems the growing chat app decided it would rather fly free with an IPO and attempt to become the dominant voice platform everywhere rather than become a prized pet.

Sony has done its part, financially speaking, by taking part in Discord’s recent $100 million H round. The amount they contributed is unknown, but perforce it can’t be more than a small minority stake, given how much the company has taken on and its total valuation.

Powered by WPeMatico

Competitors Volvo AB and Daimler Trucks are teaming up to produce hydrogen fuel cells for long-haul trucks, which the companies say will lower development costs and boost production volumes. The joint venture, which is called cellcentric, aims to bring large-scale “gigafactory” production levels of hydrogen fuel cells to Europe by 2025.

While the two companies are teaming up to produce the fuel cells via the cellcentric venture, all other aspects of truck production will remain separate. The location of the forthcoming gigafactory will be announced next year. The companies also did not specify the production capacity of the forthcoming factory.

Even as Volvo AB and Daimler Trucks used ambition-signaling terms like “gigafactory” — a term popularized by Tesla due to the giga capacity of its factories — executives added a few cautionary caveats to their goal. Europe’s hydrogen economy will depend in part on whether the European Union can produce a policy framework that further drives down costs and invests in refueling stations and other infrastructure, executives noted in a media briefing. In other words, manufacturers like Daimler and Volvo that are looking to invest in hydrogen face a “chicken and the egg” problem: boosting fuel cell production only makes sense if it occurs in tandem with the buildout of a hydrogen network, including refueling stations, pipelines to transport hydrogen and renewable energy resources to produce it.

“In the long run, I mean, this must be a business-driven activity as everything else,” Volvo CTO Lars Stenqvist told TechCrunch. “But in the first wave, there must be support from our politicians.”

Together with other European truck manufacturers, the two companies are calling for a buildout of hydrogen refueling stations around Europe of around 300 by 2025 and around 1,000 by 2030.

The Swedish and German automakers suggested policies such as a tax on carbon, incentives for CO2-neutral technologies or an emissions trading system could all help ensure cost-competitiveness against fossil fuels. Heavy-duty trucking will only compose a fraction of hydrogen demand, around 10%, Stenqvist pointed out, with the rest being used by industries such as steel manufacturing and the chemical industry. That means the push for hydrogen-supportive policies will likely be heard from other sectors, as well.

One of the biggest challenges for the new venture will be working to decrease inefficiencies associated with converting hydrogen to electricity. “That’s the core of engineering in trucking, to improve the energy efficiency of the vehicle,” Stenqvist said. “That has always been in the DNA of engineers in our industry … energy efficiency will be even more important in an electrified world.” He estimated that the cost of hydrogen would need to be in the range of $3-4 per kilogram to make it a cost-effective alternative to diesel.

Volvo is also making investments in battery electric technologies and Stenqvist said he sees potential use cases for internal combustion engines (ICE) run on renewable biofuels. He is in agreement with Bosch executives who said earlier this month that they see a place for ICE in the future. “I’m also convinced that there is a place for the combustion engines for a long period of time, I don’t see any end, I don’t see any retirement date for the combustion engines,” he said.

“From a political side, I think it would be completely wrong to ban a technology. Politicians should not ban — should not approve technologies — they should point out the direction, they should talk about what they want to achieve. And then it’s up to us as engineers to come up with the technical solutions.”

Powered by WPeMatico

Education may well be the most important activity we conduct as a society — and it may also be the hardest space to build a startup in. Selling to school districts and universities is notoriously difficult, but enticing consumers is even harder. Learning takes focus, patience, tenacity and resources, and most consumers would prefer to watch some lip-sync videos on TikTok than stare at math equations (not to mention that such entertainment is free). Engagement and education feel aggressively at odds, which limits the way that startups can scale and succeed.

Yet, the revulsion VCs have traditionally had for the space has slowly dissipated over the past 10 years. Consumer and enterprise startups in edtech are increasingly attracting funding, and there is a growing crop of edtech-focused investors who are betting big on the future here. What’s changed isn’t the market or its potential, but rather the perception that ambitious and sustainable companies can truly be built in education.

One of the companies that has led the charge in transforming those perceptions is Pittsburgh-based Duolingo. It’s a language-learning app that has caught fire. From humble origins a decade ago as a translation platform for news agencies, it’s now used by 500 million people across the world to learn Spanish, English, French and more, all while generating bookings of $190 million in 2020. It’s a smashing success, but a success that was hard earned after a years-long effort of product and revenue experimentation to find its current niche.

TechCrunch’s writer and analyst for this EC-1 is Natasha Mascarenhas. Mascarenhas has been covering edtech from the very first day she joined TechCrunch as a venture capital and startups writer, and she has built up a reputation as a fearless chronicler of this increasingly vital ecosystem. The lead editor of this package was Danny Crichton, the copy editor was Richard Dal Porto, and illustrations were created by Nigel Sussman.

Duolingo had no say in the content of this analysis and did not get advance access to it. Mascarenhas has no financial ties to Duolingo or other conflicts of interest to disclose.

The Duolingo EC-1 comprises four main articles numbering 12,200 words and a reading time of 48 minutes. Here’s what’s in store:

And finally, note that Duolingo CEO and co-founder Luis von Ahn is coming to Disrupt, so make sure to grab your tickets because the conversation will continue there.

We’re always iterating on the EC-1 format. If you have questions, comments or ideas, please send an email to TechCrunch Managing Editor Danny Crichton at danny@techcrunch.com.

Powered by WPeMatico

Luis von Ahn, an entrepreneur who has dedicated his career to scaling free education, has probably annoyed you more than once. In fact, you’ve likely been annoyed by his work dozens and maybe hundreds of times over the years.

A decade before he co-founded the whimsical and language-learning app Duolingo, one of the most popular education apps in the world with over 500 million downloads and 40 million active users, he was building the technology that would become CAPTCHA, those human-annoying but bot-preventing little tests that pop up when registering or logging in to popular internet services like email.

It may seem like a radical pivot, but in fact, the lessons of how to create useful security tests at scale for consumers would one day offer the core DNA for building one of the most successful edtech companies in the world. The immigrant entrepreneur would soon learn himself that crowdsourcing, language and a willingness to adapt and ignore critics could change the face of an industry forever.

Von Ahn grew up in Guatemala City, where he saw firsthand the wretched state of public schools in impoverished countries. His mother spent most of her income sending him to “fancy private school” as he puts it, and he estimates she spent over $1 million on his education over his lifetime. The price tag weighed on him, and he knew he wanted to broaden access to education in the future.

After attending Duke as an undergrad, von Ahn was an enterprising first-year computer science Ph.D. student at top-ranked Carnegie Mellon University when he attended a talk by Yahoo’s chief scientist about 10 of Yahoo’s biggest headaches. One issue stood out: hackers were creating bots that register thousands of email addresses to send spam.

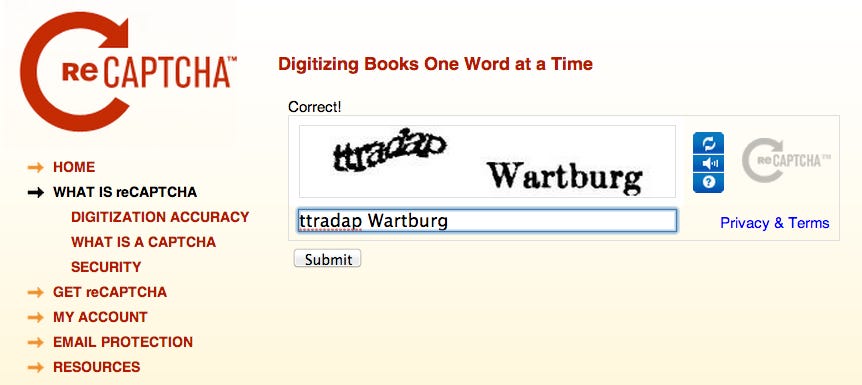

Inspired and full of immigrant grit, von Ahn and a team led by his then-adviser Manuel Blum created a nifty little test that could distinguish between bots and humans. The test, called a CAPTCHA, presented squiggly, ink-blotted words whenever a user tried to log in. Computer vision at the time couldn’t read the obscured text, but humans easily could — creating a useful signal. The deceptively simple test worked, so von Ahn, then a 20-something student, gave it to Yahoo for free, not understanding the value it would one day have.

Luis von Ahn, the inventor of CAPTCHA and reCAPTCHA, and co-founder of Duolingo. Image Credits: Duolingo

A fire was lit. With Yahoo as a distribution channel, CAPTCHA tests exploded in popularity, becoming an almost universally recognizable security checkpoint feature. At their peak, people spent 500,000 hours a day typing up to 200 million CAPTCHAs around the world. About 10% of the world’s population had recognized at least one word, von Ahn estimates.

For all the technology’s success, though, there was a downside. “During those 10 seconds while you’re typing in a CAPTCHA, your brain is doing something that computers can’t do, which is amazing,” von Ahn said. But the tests were annoying and pointless, so he wondered, “Could we get those 500,000 hours a day to do something useful for humanity?”

So in 2005, he launched reCAPTCHA. These new tests would have the same goal of CAPTCHA, but with a twist: the prompts would all be scans of books. Users would complete the security test while also helping to digitize books for the Internet Archive.

The early design of reCAPTCHA. Image Credits: Duolingo

This time, von Ahn knew his nifty idea was worth something. In 2009, he sold reCAPTCHA to Google, a transaction conducted just a year after the internet giant had purchased a license to one of his other research projects, a game focused on image labeling.

Luis von Ahn presenting about reCAPTCHA and CAPTCHA, two of his iconic inventions. Image Credits: Duolingo

The acquisition offered not just a monetary award (exact terms of the deal were not disclosed), but also suddenly garnered von Ahn serious clout in the industry just a few years after acquiring his Ph.D. Yet, instead of taking up tenure at the tech company, he stayed local in Pittsburgh and became a computer science professor at his alma mater.

Entering the world of education as a professor felt like an answer to his original dream of expanding access to education. What von Ahn didn’t know, though, was that his iconic work was simply foreshadowing. Carnegie Mellon, crowdsourced translation and even Google would all play a role in his next project as well, albeit in wildly different ways: incubation, failure and investment. For him, the success of two tools that used language as a barrier was the beginning of a long journey into discovering if, and how, language could instead be a bridge. It was an insight that would grow into a startup valued at $2.4 billion with the goal of making language learning fun: Duolingo.

In 2011, edtech startups such as Coursera and Codecademy were popping up — companies that today are valued as multibillion-dollar businesses. The rise of iPads and tablets in classrooms gave permission to founders who believed the future of education was on the internet. Enthusiasm was boiling, and virtual instruction felt like a nascent, but ambitious, place to bet on.

Powered by WPeMatico

Duolingo CEO and co-founder Luis von Ahn was tired of the gray and dreary design aesthetic edtech companies used to emulate universities. Instead, he and the company’s early team sought inspiration from games like Angry Birds and Clash Royale, looking to build a class that screamed more cartoon anarchy than lecture hall. From that frenetic creativity came the company’s distinctive mascot: a childish and rebellious evergreen-colored owl named Duo.

Duolingo didn’t just throw out the old colors though — it wanted to completely rethink language learning from the bottom up for mobile. So it replaced top-down curriculums with analytics-driven growth strategies, becoming consumed by an ethos that has more recently been dubbed product-led growth.

Used by companies such as Calendly, Slack and Dropbox, product-led growth is a strategy in which a company iterates its product to create loyal fans-turned-customers who popularize the product with others, creating a viral growth loop. It’s an attractive route because it vastly lowers the cost of acquiring users while also increasing engagement and thus retention. Duolingo, for example, has taken this model and found ways to embed engagement hooks, pockets of joy and addictive education features within its core app.

With early venture capital in its pocket, Duolingo could afford to focus on product over profits.

In part one of this EC-1, we explored how von Ahn’s previous products around CAPTCHA led to Duolingo’s launch, the rise and fall of crowdsourced translation as a way to disrupt language learning, and the accidental iteration of a top education app by a pair of interns. The startups’ early signs of success gave it energy to focus on growth to accomplish two things: know what they’re doing works, and garner a lot of user data so it continued iterating the product into something that was ever more addicting to use.

Now, we’ll analyze how Duolingo used product-led growth as a lever to expand its consumer base, and how a company built on gamification tries to balance its whimsy with education outcomes.

Duo, Duolingo’s mascot, flying around. Image Credits: Duolingo

Tyler Murphy, having graduated from his intern position at Duolingo launching the company’s iOS app, noticed that the gaming world was rapidly innovating around him in the mid-2010s. Angry Birds was no longer the only popular game on mobile, and video games generally were getting more engaging, with in-app currencies, progress bars and an experience that felt creatively addictive. He suddenly saw connections between the entertainment that games provided and the patient learning required for languages.

“Wouldn’t it be cool if the skill got harder and harder, kind of like how a character in a game gets more powerful and powerful?” he remembers asking. Duolingo had taken early inspiration from Angry Birds as well as Clash Royale later, following that game’s launch in 2016. “Half the people at Duolingo were playing Clash Royale, at some point,” he said. “And I think that shaped our product roadmap a lot and our design language a lot.”

Games solved a problem that was acutely personal for Murphy. The employee, who would go on to become chief designer at Duolingo, had gone to college to teach Spanish to students, but ultimately left the field after struggling to inspire kids in a classroom setting. The realization that Duolingo could borrow from gaming instead of monotonous edtech companies gave an adrenaline rush — and permission — to the team to experiment with new approaches to learning.

Every game needs some form of experience points and leveling up, and for Duolingo learners, that progress comes in the form of skill trees.

These trees, which were conceived by a design agency during the company’s early development, are Duolingo’s core experience, a visual representation of language skills that are interconnected and get progressively more difficult and refined over time. Each skill is a prerequisite for another. Sometimes it’s just logic: in order to be able to speak about restaurants, you probably should be able to introduce yourself first. Sometimes, however, it’s a necessary building block: in order to speak about your routine, you should be able to speak about basic everyday activities.

In Duolingo, each unit has its own suite of skills, each of which is broken down into five lessons. Once you complete all five lessons, you can move to the next skill. Complete all skills and you can move to the next unit. Depending on the language, a user might encounter an average of 60 skills across nine different units within a course.

Duolingo Skill Tree UX in 2012. Image Credits: Duolingo

Duolingo Skill Tree UX in 2021. Image Credits: Duolingo

Duolingo had its “leveling up” model figured out, but now it had to integrate gamification into every nook and cranny of its app. One of its first challenges was rebuilding the sort of teacher-student emotional bond that can help students stay motivated to learn. No one likes to fail, and Duolingo stumbled upon a scalable approach through its cartoon owl mascot Duo — also thought of by the design agency behind the skill trees.

Whenever users succeed or fail at their lessons today, they are likely to be encouraged or admonished by Duo’s presence. Designers sprinkled Duo throughout the product, looking at Super Mario Brothers as an example of how to use iconic art to create a friendly gaming experience. In early iterations of the app, Duo was present but static, more of an icon than a personality. That changed as the company increasingly pushed harder on engagement.

Powered by WPeMatico

As its meandering route to monetization will demonstrate, Duolingo isn’t mission-oriented, it’s mission-obsessed.

Co-founders Luis von Ahn and Severin Hacker never wanted to charge consumers for access to Duolingo content, a purpose imbued throughout the company’s culture. For years in order to work at Duolingo, you had to be comfortable with joining a company in Pittsburgh that was in no rush to make money. The startup, filled with education enthusiasts and mission-driven employees, became “very college pizza vibes,” Gina Gotthilf, former VP of Marketing at Duolingo, described. Everyone was against making money and having structure — some employees even threatened to quit if Duolingo ever charged a cent to users.

“One thing that recruited me was this brilliance that we can kill two birds with one stone,” she said, referring to Duolingo’s original translation-service business model we talked about in part one of this EC-1. “It was obviously tied to Luis’ thinking and reCAPTCHA and it was magical and brilliant.”

Free may not have paid the bills, but it did come with a valuable upside: growth. By 2017, Duolingo would boast having 200 million users, which was double von Ahn’s goal when he first launched to the public on the TechCrunch Disrupt stage.

Duolingo launched saying it would never do advertisements, subscriptions or in-app purchases — approaches that now all exist on the platform. Today, Duolingo has a simple freemium business model that is remarkably unconventional. It has a free version with all of its learning content, and it charges a subscription of $6.99 per month for paywalled features such as unlimited hearts, no advertisements and progress tracking. It also has a number of other revenue streams it’s developing, such as language proficiency tests.

As we’ll explore, Duolingo’s route from anti-business rebel to conventional consumer subscription is complex, full of twists and turns. While Duolingo never wanted to look like other edtech companies, as we saw with its product strategy in part two, it turns out that evolving from college pizza vibes meant that it would have to take a page from its peers.

Duocon, Duolingo’s new conference to celebrate education and language. Image Credits: Duolingo

“They had users and in Silicon Valley, there was this notion that if you have users, you can turn anything into money,” said Bing Gordon, the Kleiner Perkins Caufield & Byers (KPCB) partner who led Duolingo’s $20 million Series C in 2014.

“This was not very controversial back then, at least with investors,” von Ahn said. “This became controversial for us once we raised a ton of money, and we still weren’t making more money.”

While the company’s investors were relatively lenient in the early years, patience was starting to run thin. In June 2015, Duolingo raised a $45 million Series D round led by Laela Sturdy of Google Capital (later rebranded CapitalG), valuing the company at $470 million. She invested because of Duolingo’s growth and engagement numbers, but confronted von Ahn with some direct advice.

“She said to me, ‘Look, it worked for you to continue getting bigger and bigger checks from venture capital,’” von Ahn said. “‘But this is the last time it works for you … if you’re trying to con people, you cannot con anybody bigger than us [at Google].’” Duolingo’s valuation wouldn’t just be at stake next time it went fundraising on Sand Hill Road — its very survival would be as well.

Looking back, Sturdy said that she always “had confidence that they would come up with a revenue model” because of Duolingo’s passionate and organic users.

When a startup chooses to raise venture capital, it sets itself on a heavily-prescribed course. Suddenly, success isn’t defined merely as cash-flow breakeven with a long-term sustainable business. It has to be an exit of some sorts, and a big one at that. While Duolingo used venture as a lifeline to fund its product development, venture also came with pressure to become a billion-dollar company, or more. And that meant making revenue, not just growing engagement.

Von Ahn says his conversation with Sturdy is what really changed his mindset about money. After the Google check hit Duolingo’s bank account, he and Hacker began thinking about ways to make Duolingo as much a monetary success as it had been an educational one.

Duolingo’s Pittsburgh HQ. Image Credits: Duolingo

“It was clear that Luis didn’t have commercial instincts, he had cultural instincts and a deep focus on learning,” said Gordon. “[When we invested] Duolingo predicted it was on the verge of revenue growth, and it turned out it was not on the verge of revenue growth.”

What Gordon is alluding to was a litany of monetization attempts in Duolingo’s past. Translation, which helped von Ahn’s previous two startups, didn’t work when applied to language-learning services, and the company only secured two customers before ending the service. Business partnerships, such as a relationship with Uber to certify and train drivers in Brazil to speak English, didn’t catch fire.

Powered by WPeMatico

Duolingo has been wildly successful. It has pulled in 500 million total registered learners, 40 million active users, 1.5 million premium subscribers and $190 million in booked revenues in 2020. It has a popular and meme-ified mascot in the form of the owl Duo, a creative and engaging product, and ambitious plans for expansion.There’s just one key question in the midst of all those milestones: Does anyone actually learn a language using Duolingo?

“Language is first and foremost a social, relational phenomenon,” said Sébastien Dubreil, a teaching professor at Carnegie Mellon University. “It is something that allows people to make meaning and talk to each other and conduct the business of living — and when you do this, you use a tone of different kinds of resources that are not packaged in the vocabulary and grammar.”

Duolingo CEO and co-founder Luis von Ahn estimates that Duolingo’s upcoming product developments will get users from zero to a knowledge job in a different language within the next two to three years. But for now, he is honest about the limits of the platform today.

“I won’t say that with Duolingo, you can start from zero and make your English as good as mine,” he said. “That’s not true. But that’s also not true with learning a language in a university, that’s not true with buying books, that’s not true with any other app.”

Luis von Ahn, the co-founder of Duolingo, visiting President Obama in 2015. Image Credits: Duolingo

While Dubreil doesn’t think Duolingo can teach someone to speak a language, he does think it has taught consistency — a hard nut to crack in edtech. “What Duolingo does is to potentially entice students to do things you cannot pay them enough time to actually do, which is to spend time in that textbook and reinforce vocabulary and the grammar,” he said.

That’s been the key focus for the company since the beginning. “I said this when we started Duolingo and I still really strongly believe it: The hardest thing about learning a language is staying motivated,” von Ahn said, comparing it to how people approach exercise: it’s hard to stay motivated, but a little motion a day goes a long way.

With an enviable lead in its category, Duolingo wants to bring the quality and effectiveness of its curriculum on par with the quality of its product and branding. With growth and monetization secured, Duolingo is no longer in survival mode. Instead, it’s in study mode.

In this final part, we will explore how Duolingo is using a variety of strategies, from rewriting its courses to what it dubs Operation Birdbrain, to become a more effective learning tool, all while balancing the need to keep the growth and monetization engines stoked while en route to an IPO.

Duolingo’s office decor. Image Credits: Duolingo

Duolingo’s competitors see the app’s massive gamification and solitary experience as inherently contradictory with high-quality language education. Busuu and Babbel, two subscription-based competitors in the market, both focus on users talking in real time to native speakers.

Bernhard Niesner, the co-founder and CEO of Busuu, which was founded in 2008, sees Duolingo as an entry-level tool that can help users migrate to its human-interactive service. “If you want to be fluent, Duolingo needs innovation,” Niesner said. “And that’s where we come in: We all believe that you should not be learning a language just by yourself, but [ … ] together, which is our vision.” Busuu has more than 90 million users worldwide.

Duolingo has been the subject of a number of efficacy studies over the years. One of its most positive reports, from September 2020, showed that its Spanish and French courses teach the equivalent of four U.S. university semesters in half the time.

Babbel, which has sold over 10 million subscriptions to its language-learning service, cast doubt on the power of these findings. Christian Hillemeyer, who heads PR for the startup, pointed out that Duolingo only tested for reading and writing efficacy — not for speaking proficiency, even though that is a key part of language learning. He described Duolingo as “just a funny game that is maybe not as bad as Candy Crush.”

One of the ironic legacies of Duolingo’s evolution is that for years it outsourced much of the creation of its education curriculum to volunteers. It’s a legacy the company is still trying to rectify.

The year after its founding, Duolingo launched its Language Incubator in 2013. Similar to its original translation service, the company wanted to leverage crowdsourcing to invent and refine new language courses. Volunteers — at least at first — were seen as a scrappy way to bring new material to the growing Duolingo community and more than 1,000 volunteers have helped bring new language courses to the app.

Powered by WPeMatico

It’s widely known that Dell has a debt problem left over from its massive acquisition of EMC in 2016, and it seems to be moving this year to eliminate part of it in multi-billion-dollar chunks. The first step was spinning out VMware as a separate company last month, a move expected to net close to $10 billion.

The second step, long expected, finally dropped last night when the company announced it was selling Boomi to a couple of private equity firms for $4 billion. Francisco Partners is joining forces with TPG to make the deal to buy the integration platform.

Boomi is not unlike MuleSoft, a company that Salesforce purchased in 2018 for $6.5 billion, although a bit longer in the tooth. They both help companies with integration problems by creating connections between disparate systems. With so many pieces in place from various acquisitions over the years, it seems like a highly useful asset for Dell to help pull these pieces together and make them work, but the cash is trumping that need.

Providing integration services is a growing requirement as companies look for ways to make better use of data locked in siloed systems. Boomi could help, and that’s one of the primary reasons for the acquisition, according to Francisco executives.

“The ability to integrate and connect data and workflows across any combination of applications or domains is a critical business capability, and we strongly believe that Boomi is well positioned to help companies of all sizes turn data into their most valuable asset,” Francisco CEO Dipanjan Deb and partner Brian Decker said in a statement.

As you would expect, Boomi’s CEO Chris McNabb put a positive spin on the deal about how his new bosses were going to fuel growth for his company. “By partnering with two tier-one investment firms like Francisco Partners and TPG, we can accelerate our ability for our customers to use data to drive competitive advantage. In this next phase of growth, Boomi will be in a position of strength to further advance our innovation and market trajectory while delivering even more value to our customers,” McNabb said in a statement.

All of this may have some truth to it, but the company goes from being part of a large amorphous corporation to getting absorbed in the machinery of two private equity firms. What happens next is hard to say.

The company was founded in 2000, and sold to Dell in 2010. Today, it has 15,000 customer, but Dell’s debt has been well documented, and when you string together a couple of multi-billion-dollar deals as Dell has recently, pretty soon you’re talking real money. While the company has not stated it will explicitly use the proceeds of this deal to pay off debt as it did with the VMware announcement, it stands to reason that this will be the case.

The deal is expected to close later this year, although it will have to pass the typical regulatory scrutiny prior to that.

Powered by WPeMatico