TC

Auto Added by WPeMatico

Auto Added by WPeMatico

Sensor data from smartphones and wearables can meaningfully predict an individual’s ‘biological age’ and resilience to stress, according to Gero AI.

The ‘longevity’ startup — which condenses its mission to the pithy goal of “hacking complex diseases and aging with Gero AI” — has developed an AI model to predict morbidity risk using ‘digital biomarkers’ that are based on identifying patterns in step-counter sensor data which tracks mobile users’ physical activity.

A simple measure of ‘steps’ isn’t nuanced enough on its own to predict individual health, is the contention. Gero’s AI has been trained on large amounts of biological data to spots patterns that can be linked to morbidity risk. It also measures how quickly a personal recovers from a biological stress — another biomarker that’s been linked to lifespan; i.e. the faster the body recovers from stress, the better the individual’s overall health prognosis.

A research paper Gero has had published in the peer-reviewed biomedical journal Aging explains how it trained deep neural networks to predict morbidity risk from mobile device sensor data — and was able to demonstrate that its biological age acceleration model was comparable to models based on blood test results.

Another paper, due to be published in the journal Nature Communications later this month, will go into detail on its device-derived measurement of biological resilience.

The Singapore-based startup, which has research roots in Russia — founded back in 2015 by a Russian scientist with a background in theoretical physics — has raised a total of $5 million in seed funding to date (in two tranches).

Backers come from both the biotech and the AI fields, per co-founder Peter Fedichev. Its investors include Belarus-based AI-focused early stage fund, Bulba Ventures (Yury Melnichek). On the pharma side, it has backing from some (unnamed) private individuals with links to Russian drug development firm, Valenta. (The pharma company itself is not an investor).

Fedichev is a theoretical physicist by training who, after his PhD and some ten years in academia, moved into biotech to work on molecular modelling and machine learning for drug discovery — where he got interested in the problem of ageing and decided to start the company.

As well as conducting its own biological research into longevity (studying mice and nematodes), it’s focused on developing an AI model for predicting the biological age and resilience to stress of humans — via sensor data captured by mobile devices.

“Health of course is much more than one number,” emphasizes Fedichev. “We should not have illusions about that. But if you are going to condense human health to one number then, for a lot of people, the biological age is the best number. It tells you — essentially — how toxic is your lifestyle… The more biological age you have relative to your chronological age years — that’s called biological acceleration — the more are your chances to get chronic disease, to get seasonal infectious diseases or also develop complications from those seasonal diseases.”

Gero has recently launched a (paid, for now) API, called GeroSense, that’s aimed at health and fitness apps so they can tap up its AI modelling to offer their users an individual assessment of biological age and resilience (aka recovery rate from stress back to that individual’s baseline).

Early partners are other longevity-focused companies, AgelessRx and Humanity Inc. But the idea is to get the model widely embedded into fitness apps where it will be able to send a steady stream of longitudinal activity data back to Gero, to further feed its AI’s predictive capabilities and support the wider research mission — where it hopes to progress anti-ageing drug discovery, working in partnerships with pharmaceutical companies.

The carrot for the fitness providers to embed the API is to offer their users a fun and potentially valuable feature: A personalized health measurement so they can track positive (or negative) biological changes — helping them quantify the value of whatever fitness service they’re using.

“Every health and wellness provider — maybe even a gym — can put into their app for example… and this thing can rank all their classes in the gym, all their systems in the gym, for their value for different kinds of users,” explains Fedichev.

“We developed these capabilities because we need to understand how ageing works in humans, not in mice. Once we developed it we’re using it in our sophisticated genetic research in order to find genes — we are testing them in the laboratory — but, this technology, the measurement of ageing from continuous signals like wearable devices, is a good trick on its own. So that’s why we announced this GeroSense project,” he goes on.

“Ageing is this gradual decline of your functional abilities which is bad but you can go to the gym and potentially improve them. But the problem is you’re losing this resilience. Which means that when you’re [biologically] stressed you cannot get back to the norm as quickly as possible. So we report this resilience. So when people start losing this resilience it means that they’re not robust anymore and the same level of stress as in their 20s would get them [knocked off] the rails.

“We believe this loss of resilience is one of the key ageing phenotypes because it tells you that you’re vulnerable for future diseases even before those diseases set in.”

“In-house everything is ageing. We are totally committed to ageing: Measurement and intervention,” adds Fedichev. “We want to building something like an operating system for longevity and wellness.”

Gero is also generating some revenue from two pilots with “top range” insurance companies — which Fedichev says it’s essentially running as a proof of business model at this stage. He also mentions an early pilot with Pepsi Co.

He sketches a link between how it hopes to work with insurance companies in the area of health outcomes with how Elon Musk is offering insurance products to owners of its sensor-laden Teslas, based on what it knows about how they drive — because both are putting sensor data in the driving seat, if you’ll pardon the pun. (“Essentially we are trying to do to humans what Elon Musk is trying to do to cars,” is how he puts it.)

But the nearer term plan is to raise more funding — and potentially switch to offering the API for free to really scale up the data capture potential.

Zooming out for a little context, it’s been almost a decade since Google-backed Calico launched with the moonshot mission of ‘fixing death’. Since then a small but growing field of ‘longevity’ startups has sprung up, conducting research into extending (in the first instance) human lifespan. (Ending death is, clearly, the moonshot atop the moonshot.)

Death is still with us, of course, but the business of identifying possible drugs and therapeutics to stave off the grim reaper’s knock continues picking up pace — attracting a growing volume of investor dollars.

The trend is being fuelled by health and biological data becoming ever more plentiful and accessible, thanks to open research data initiatives and the proliferation of digital devices and services for tracking health, set alongside promising developments in the fast-evolving field of machine learning in areas like predictive healthcare and drug discovery.

Longevity has also seen a bit of an upsurge in interest in recent times as the coronavirus pandemic has concentrated minds on health and wellness, generally — and, well, mortality specifically.

Nonetheless, it remains a complex, multi-disciplinary business. Some of these biotech moonshots are focused on bioengineering and gene-editing — pushing for disease diagnosis and/or drug discovery.

Plenty are also — like Gero — trying to use AI and big data analysis to better understand and counteract biological ageing, bringing together experts in physics, maths and biological science to hunt for biomarkers to further research aimed at combating age-related disease and deterioration.

Another recent example is AI startup Deep Longevity, which came out of stealth last summer — as a spinout from AI drug discovery startup Insilico Medicine — touting an AI ‘longevity as a service’ system which it claims can predict an individual’s biological age “significantly more accurately than conventional methods” (and which it also hopes will help scientists to unpick which “biological culprits drive aging-related diseases”, as it put it).

Gero AI is taking a different tack toward the same overarching goal — by honing in on data generated by activity sensors embedded into the everyday mobile devices people carry with them (or wear) as a proxy signal for studying their biology.

The advantage being that it doesn’t require a person to undergo regular (invasive) blood tests to get an ongoing measure of their own health. Instead our personal device can generate proxy signals for biological study passively — at vast scale and low cost. So the promise of Gero’s ‘digital biomarkers’ is they could democratize access to individual health prediction.

And while billionaires like Peter Thiel can afford to shell out for bespoke medical monitoring and interventions to try to stay one step ahead of death, such high end services simply won’t scale to the rest of us.

If its digital biomarkers live up to Gero’s claims, its approach could, at the least, help steer millions towards healthier lifestyles, while also generating rich data for longevity R&D — and to support the development of drugs that could extend human lifespan (albeit what such life-extending pills might cost is a whole other matter).

The insurance industry is naturally interested — with the potential for such tools to be used to nudge individuals towards healthier lifestyles and thereby reduce payout costs.

For individuals who are motivated to improve their health themselves, Fedichev says the issue now is it’s extremely hard for people to know exactly which lifestyle changes or interventions are best suited to their particular biology.

For example fasting has been shown in some studies to help combat biological ageing. But he notes that the approach may not be effective for everyone. The same may be true of other activities that are accepted to be generally beneficial for health (like exercise or eating or avoiding certain foods).

Again those rules of thumb may have a lot of nuance, depending on an individual’s particular biology. And scientific research is, inevitably, limited by access to funding. (Research can thus tend to focus on certain groups to the exclusion of others — e.g. men rather than women; or the young rather than middle aged.)

This is why Fedichev believes there’s a lot of value in creating a measure than can address health-related knowledge gaps at essentially no individual cost.

Gero has used longitudinal data from the UK’s biobank, one of its research partners, to verify its model’s measurements of biological age and resilience. But of course it hopes to go further — as it ingests more data.

“Technically it’s not properly different what we are doing — it just happens that we can do it now because there are such efforts like UK biobank. Government money and also some industry sponsors money, maybe for the first time in the history of humanity, we have this situation where we have electronic medical records, genetics, wearable devices from hundreds of thousands of people, so it just became possible. It’s the convergence of several developments — technological but also what I would call ‘social technologies’ [like the UK biobank],” he tells TechCrunch.

“Imagine that for every diet, for every training routine, meditation… in order to make sure that we can actually optimize lifestyles — understand which things work, which do not [for each person] or maybe some experimental drugs which are already proved [to] extend lifespan in animals are working, maybe we can do something different.”

“When we will have 1M tracks [half a year’s worth of data on 1M individuals] we will combine that with genetics and solve ageing,” he adds, with entrepreneurial flourish. “The ambitious version of this plan is we’ll get this million tracks by the end of the year.”

Fitness and health apps are an obvious target partner for data-loving longevity researchers — but you can imagine it’ll be a mutual attraction. One side can bring the users, the other a halo of credibility comprised of deep tech and hard science.

“We expect that these [apps] will get lots of people and we will be able to analyze those people for them as a fun feature first, for their users. But in the background we will build the best model of human ageing,” Fedichev continues, predicting that scoring the effect of different fitness and wellness treatments will be “the next frontier” for wellness and health (Or, more pithily: “Wellness and health has to become digital and quantitive.”)

“What we are doing is we are bringing physicists into the analysis of human data. Since recently we have lots of biobanks, we have lots of signals — including from available devices which produce something like a few years’ long windows on the human ageing process. So it’s a dynamical system — like weather prediction or financial market predictions,” he also tells us.

“We cannot own the treatments because we cannot patent them but maybe we can own the personalization — the AI that personalized those treatments for you.”

From a startup perspective, one thing looks crystal clear: Personalization is here for the long haul.

Powered by WPeMatico

Income-share agreements, or ISAs, are a way to bring flexibility to the often steep financial costs of higher education. The financial model allows a student to learn at zero upfront cost, and then pay any costs through a percentage of future income over time.

While the model has caught fire from a variety of trade schools and bootcamps, it’s a hard service to offer at scale. It required underwriting a risky group of people — and that costs money. Just last week, a leader in the ISA space Lambda School laid off 65 employees amid a broader restructuring.

It’s here that a startup like Blair, which graduated Y Combinator in 2019, could be of use. The startup today helps universities finance and offer income-share agreements, or ISAs, to students. The startup has two services: a capital arm (Blair Capital) for which it secured a $100 million debt facility, and a services arm (Blair Servicing) that helps manage the flow of money, which just got a new tranche of capital to expand

The company told TechCrunch that it has raised a $6.3 million round led by Tiger Global. Other investors include Rainfall and 468 Capital, along with angels such as Teachable’s Ankur Nagpal and Vouch’s Sam Hodges. The raise came on top of a $1.1 million pre-seed round, bringing Blair’s total capital raised to date at $7.4 million.

A big portion of the venture capital money will go toward doubling or tripling Blair’s San Francisco team, said CEO Mike Mahlkow. It is especially investing in engineering and product, as well as a few senior hires in finance, compliance and the service side.

The Blair founding team. Image Credits: Blair

Notably, Blair’s eight person team is fully male. The lack of gender diversity, even as an early-stage startup with a handful of employees, could hurt its competitive advantage, recruiting prospects, and performance over time. About 25 percent of the employees are LGBT and 37.5% identify as non-white.

Blair started as a tool to underwrite students with loans that would pay for college, a sum that would eventually be repaid through an income-share agreement. It was similar to an Affirm for Education, where it could help students get access with low or nonexistent upfront costs.

“The model worked very well until March last year,” Mahlkow said. “And then the debt market was fairly dead, so we needed to shift our focus to a more software-like approach.” Now, Blair focuses on building ISA-based programs for schools, and underwrites loans based on certain programs at certain schools that have historical returns.

Most companies use its servicing piece — aka an operating system for offering ISAs — but a number of companies turn to Blair to help finance the costs of offering an ISA. Either colleges and bootcamps finance the ISA themselves and put it on the balance sheet, or they sell it to a company like Blair to get the money upfront and get repaid eventually.

Blair Servicing takes a percent of money from an ISA once a student is employed post-graduation, and Blair Capital takes a base fee plus a portion for the ISA as well.

While the company did not share exact numbers, it did say it has doubled its customers since February, tripling revenue during the same time period. Of course, a bet from the ever-ravenous Tiger Global is a statement. And, unlike his new investor, Mahlkow plans to keep growth sustainable and lean. Long-term, Blair is betting that outcome-based financing could get traction in more than just a savvy startup bootcamp but in how recruiting and placement works in various industries. The startup is in talks with a sports association and large companies that are working on upskilling and reskilling their workforces. Incentives are key in edtech, and Blair speaking that language as an early-stage startup is key as the sector moves more into the spotlight.

Powered by WPeMatico

Robotic process automation (RPA) has certainly been getting a lot of attention in the last year, with startups, acquisitions and IPOs all coming together in a flurry of market activity. It all seemed to culminate with UiPath’s IPO last month. The company that appeared to come out of nowhere in 2017 eventually had a final private valuation of $35 billion. It then had the audacity to match that at its IPO. A few weeks later, it still has a market cap of over $38 billion in spite of the stock price fluctuating at points.

Was this some kind of peak for the technology or a flash in the pan? Probably not. While it all seemed to come together in the last year with a big increase in attention to automation in general during the pandemic, it’s a market category that has been around for some time.

RPA allows companies to automate a group of highly mundane tasks and have a machine do the work instead of a human. Think of finding an invoice amount in an email, placing the figure in a spreadsheet and sending a Slack message to Accounts Payable. You could have humans do that, or you could do it more quickly and efficiently with a machine. We’re talking mind-numbing work that is well suited to automation.

In 2019, Gartner found RPA was the fastest-growing category in enterprise software. In spite of that, the market is still surprisingly small, with IDC estimates finding it will reach just $2 billion in 2021. That’s pretty tiny for the enterprise, but it shows that there’s plenty of room for this space to grow.

We spoke to five investors to find out more about RPA, and the general consensus was that we are just getting started. While we will continue to see the players at the top of the market — like UiPath, Automation Anywhere and Blue Prism — jockeying for position with the big enterprise vendors and startups, the size and scope of the market has a lot of potential and is likely to keep growing for some time to come.

To learn about all of this, we queried the following investors:

We have seen a range of RPA startups emerge in recent years, with companies like UiPath, Blue Prism and Automation Anywhere leading the way. As the space matures, where do the biggest opportunities remain?

Mallun Yen: One of the fastest-growing categories of software, RPA has been growing at over 60% in recent years, versus 13% for enterprise software generally. But we’ve barely scratched the surface. The COVID-19 pandemic forced companies to shift how they run their business, how they hire and allocate staff.

Given that the workforce will remain at least partially permanently remote, companies recognize that this shift is also permanent, and so they need to make fundamental changes to how they run their businesses. It’s simply suboptimal to hire, train and deploy remote employees to run routine processes, which are prone to, among other things, human error and boredom.

Jai Das: All the companies that you have listed are focused on automating simple repetitive tasks that are performed by humans. These are mostly data entry and data validation jobs. Most of these tasks will be automated in the next couple of years. The new opportunity lies in automating business processes that involve multiple humans and machines within complicated workflow using AI/ML.

Sometimes this is also called process mining. There have been BPM companies in the past that have tried to automate these business processes, but they required a lot of services to implement and maintain these automated processes. AI/ML is providing a way for software to replace all these services.

Soma Somasegar: For all the progress that we have seen in RPA, I think it is still early days. The global demand for RPA market size in terms of revenue was more than $2 billion this past year and is expected to cross $20 billion in the coming decade, growing at a CAGR of more than 30% over the next seven to eight years, according to analysts such as Gartner.

That’s an astounding growth rate in the coming years and is a reflection of how early we are in the RPA journey and how much more is ahead of us. A recent study by Deloitte indicates that up to 50% of the tasks in businesses performed by employees are considered mundane, administrative and labor-intensive. That is just a recipe for a ton of process automation.

There are a lot of opportunities that I see here, including process discovery and mining; process analytics; application of AI to drive effective, more complex workflow automation; and using low code/no code as a way to enable a broader set of people to be able to automate tasks, processes and workflows, to name a few.

Laela Sturdy: We’re a long way from needing to think about the space maturing. In fact, RPA adoption is still in its early infancy when you consider its immense potential. Most companies are only now just beginning to explore the numerous use cases that exist across industries. The more enterprises dip their toes into RPA, the more use cases they envision.

I expect to see market leaders like UiPath continue to innovate rapidly while expanding the breadth and depth of their end-to-end automation platforms. As the technology continues to evolve, we should expect RPA to penetrate even more deeply into the enterprise and to automate increasingly more — and more critical — business processes.

Ed Sim: Most large-scale automation projects require a significant amount of professional services to deliver on the promises, and two areas where I still see opportunity include startups that can bring more intelligence and faster time to value. Examples include process discovery, which can help companies quickly and accurately understand how their business processes work and prioritize what to automate versus just rearchitecting an existing workflow.

Powered by WPeMatico

As expected, Bill.com is buying Divvy, the Utah-based corporate spend management startup that competes with Brex, Ramp and Airbase. The total purchase price of around $2.5 billion is substantially above the company’s roughly $1.6 billion post-money valuation that Divvy set during its $165 million, January 2021 funding round.

Divvy’s growth rate tells us that the company did not sell due to performance weakness.

Per Bill.com, the transaction includes $625 million in cash, with the rest of the consideration coming in the form of stock in Divvy’s new parent company.

Bill.com also reported its quarterly results today: Its Q1 included revenues of $59.7 million, above expectations of $54.63 million. The company’s adjusted loss per share of $0.02 also exceeded expectations, with the street expecting a sharper $0.07 per share deficit.

The better-than-anticipated results and the acquisition news combined to boost the value of Bill.com by more than 13% in after-hours trading.

Luckily for us, Bill.com released a deck that provides a number of financial metrics relating to its purchase of Divvy. This will not only allow us to better understand the value of the unicorn at exit, but also its competitors, against which we now have a set of metrics to bring to bear. So, this afternoon, let’s unpack the deal to gain a better understanding of the huge exit and the value of Divvy’s richly funded competitors.

The following numbers come from the Bill.com deck on the deal, which you can read here. Here are the core figures we care about:

This lets us price the company somewhat. Divvy sold for around 25x its current revenue rate. That’s a software-level multiple, implying that the company has either incredibly strong gross margins, or Bill.com had to pay a multiples-premium to buy the company’s future growth today. I suspect the latter more than the former, but we’ll have to scout for more data when Divvy shows up in Bill.com results after the deal closes; that data is a few quarters away.

Powered by WPeMatico

TechCrunch’s Startup Battlefield is one of the most popular parts of our annual TechCrunch Disrupt conference which is happening on September 21-23 this year. Now we’re very excited to reveal one of the fine people who will be judging Startup Battlefield at this year’s all-virtual event in September: Shauntel Garvey, a general partner at Reach Capital, a VC specializing in the world of education technology.

Startup Battlefield sees startups applying far and wide for a chance to pitch their ideas to a panel, and to all of us in the audience, giving the finalists a lot of exposure and a shot at winning the grand prize of $50,000. Startups: You can apply to be a part of the action here.

Edtech has seen a huge surge of interest in the last year of pandemic living, and that’s led to a pretty notable rise in education startups, more funding for education technology and a lot more attention paid to voices in edtech.

That’s because not only is edtech of huge importance to society and our economy, but those in the field have picked up a lot of learnings that apply well outside of edtech.

They know firsthand about engagement and how to get it; connecting with larger ecosystems of stakeholders; learning to work with public and private bodies; and the ins and outs of tapping into the latest innovations in areas like streaming, artificial intelligence and graphics to get the most out of a concept.

All of this makes Garvey a great person to have as a judge, someone with specific-area knowledge but very aware of how it relates to the wider challenges and opportunities in tech.

Garvey is a co-founder and general partner at Reach Capital, a Silicon Valley VC focused on the wider opportunity within the educational spectrum, backing the likes of ClassDojo, Springboard, Outschool, Handshake, Winnie and many more. Garvey herself currently sits on the boards of Riipen, FourthRev, Holberton School and Ellevation Education.

Her experience in edtech extends back years. Before Reach, she was a partner at the NewSchools Seed Fund and she has invested in more than 40 early-stage edtech companies, including Newsela, Nearpod and SchoolMint. She is also not all about edtech: Before turning to education and startups, Garvey trained and worked as a chemical engineer. We’re really looking forward to her input as a Startup Battlefield judge.

If you haven’t gotten your tickets yet, TechCrunch Disrupt is coming up around the corner, September 21-23. This will be our second year of having the conference in an all-virtual format, and we have a lot of great speakers, networking opportunities and other things planned — free of physical constraints, we can fly! — and we really hope you’ll join us.

Powered by WPeMatico

If you ask Nik Bonaddio why he wanted to build a new mobile trivia app, his answer is simple.

“In my life, I’ve got very few true passions: I love trivia and I love sports,” Bonaddio told me. “I’ve already started a sports company, so I’ve got to start a trivia company.”

He isn’t kidding about either part of the equation. Bonaddio actually won $100,000 on “Who Wants To Be A Millionaire?”, which he used to start the sports analytics company numberFire (acquired by FanDuel in 2014).

And today, after a period of beta testing, Bonaddio is launching BigBrain. He’s also announcing that the startup has raised $4.5 million in seed funding from FirstRound Capital, Box Group, Ludlow Ventures, Golden Ventures and others.

Of course, you can’t mention mobile trivia without thinking of HQ Trivia, the trivia app that shut down last year after some high-profile drama and a spectacular final episode.

Image Credits: BigBrain

But Bonaddio said BigBrain is approaching things differently than HQ in a few key ways. For starters, although there will be a handful of free games, the majority will require users to pay to enter, with the cash rewards coming from the entry fees. (From a legal perspective, Bonaddio said this is distinct from gambling because trivia is recognized as a game of skill.)

“The free-to-play model doesn’t really work for trivia,” he argued.

In addition, there will be no live video with a live host — Bonaddio said this would be “very, very difficult from a technical perspective and very cost ineffective.” Instead, he claimed the company has found a middle ground: “We have photos, we have different interactive elements, it’s not just a straight multiple choice quiz. We do try to keep it interactive.”

Plus, the simpler production means that where HQ was only hosting two quizzes a day, BigBrain will be hosting 20, with quizzes every 15 minutes at peak times.

Topics will range from old-school hip hop to college football to ’90s movies, and Bonaddio said different quizzes will have different prize structures — some might be winner take all, while others might award prizes to the top 50% of participants. The average quiz will cost $2 to $3 to enter, but prices will range from free to “$20 or even $50.”

What kind of quiz might cost that much money to enter? As an example, Bonaddio said that in a survey of potential users, he found, “There are no casual ‘Rick and Morty’ fans … They’re almost completely price sensitive, and since they’ve seen every episode, they can’t fathom a world where someone knows more about ‘Rick and Morty’ than they do.”

Powered by WPeMatico

This morning Metafy, a distributed startup building a marketplace to match gamers with instructors, announced that it has closed an additional $5.5 million to its $3.15 million seed round. Call it a seed-2, seed-extension or merely a baby Series A; Forerunner Ventures, DCM and Seven Seven Six led the round as a trio.

Metafy’s model is catching on with its market. According to its CEO Josh Fabian, the company has grown from incorporation to gross merchandise volume (GMV) of $76,000 in around nine months. That’s quick.

The startup is building in public, so we have its raw data to share. Via Fabian, here’s how Metafy has grown since its birth:

From the company. As a small tip, if you want the media to care about your startup’s growth rate, share like this!

When TechCrunch first caught wind of Metafy via prior seed investor M25, we presumed that it was a marketplace that was built to allow esports pros and other highly capable gamers teach esports-hopefuls get better at their chosen title. That’s not the case.

Don’t think of Metafy as a marketplace where you can hire a former professional League of Legends player to help improve your laning-phase AD carry mechanics. Though that might come in time. Today a full 0% of the company’s current GMV comes from esports titles. Instead, the company is pursuing games with strong niche followings, what Fabian described as “vibrant, loyal communities.” Like Super Smash Brothers, its leading game today in terms of GMV generated.

Why pursue those titles instead of the most competitive games? Metafy’s CEO explained that his startup has a particular take on its market — that it focuses on coaches as its core customer, over trainees. This allows the startup to focus on its mission of making coaching a full-time gig, or at least one that pays well enough to matter. By doing so, Metafy has cut its need for marketing spend, because the coaches that it onboards bring their own audience. This is where the company is targeting games with super-dedicated user bases, like Smash. They fit well into its build for coaches, onboard coaches, coaches bring their fans, GMV is generated model.

Metafy has big plans, which brings us back to its recent raise. Fabian told TechCrunch any game with a skill curve could wind up on Metafy. Think chess, poker or other games that can be played digitally. To build toward that future, Metafy decided to take on more capital so that it could grow its team.

So what does its $5.5 million unlock for the startup? Per its CEO, Metafy is currently a team of 18 with a monthly burn rate of around $80,000. He wants it to grow to 30 folks, with nearly all of its new hires going into its product org, broadly.

TechCrunch’s perspective is that gaming is not becoming mainstream, but that it has already done so. Building for the gaming world, then, makes good sense, as tools like Metafy won’t suffer from the same boom/bust cycles that can plague game developers. Especially as the startup becomes more diversified in its title base.

Normally we’d close by noting that we’ll get back in touch with the company in a few quarters to see how it’s getting on in growth terms. But because it’s sharing that data publicly, we’ll simply keep reading. More when we have a few months’ more data to chew on.

Powered by WPeMatico

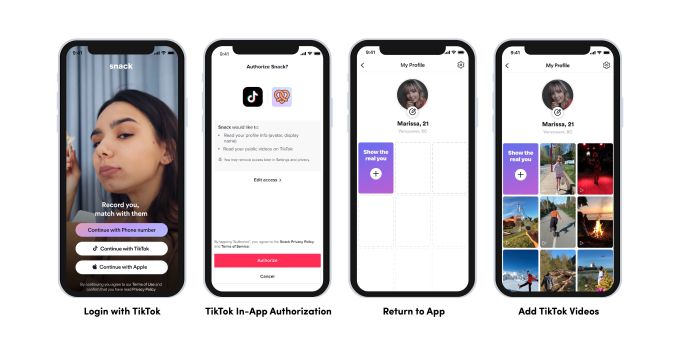

TikTok is expanding its integrations with third-party apps. The company today announced the launch of two new tool sets for app developers, the TikTok Login Kit and Sound Kit, that will allow apps on mobile, web and consoles to authenticate users via their TikTok credentials, build experiences that leverage users’ TikTok videos and share music and sounds back to TikTok from their own apps.

The company already offers tools that allow app developers to share content, including both pictures and videos, back to TikTok. But the new kits — or, SDKs (software development kits) — expand upon that functionality to make TikTok not just a destination for sharing, but a more deeply integrated part of the third-party app experience.

For starters, the new Login Kit allows an app’s users to sign in quickly using their TikTok log-in credentials, similar to other social log-ins offered by Facebook or Snap. Once signed in, users can then access their TikTok videos in the third-party app, potentially fueling entire new app ecosystems with TikTok content.

Image Credits: TikTok

For example, a video dating app called Snack is using the Login Kit to allow users to share their TikTok videos on their dating profiles to help them find new matches. The game recording app Medal will allow users to share their TikTok videos with their fellow gamers. And Singapore-based Burpple lets users share their food and dining reviews with a community.

Other early adopters of the Login Kit include gaming clips app Allstar, anti-anxiety app Breathwrk, social app IRL, as well as dating and friend-making apps Lolly, MeetMe, Monet, Swipehouse and EME Hive. Creator tool provider Streamlabs is also using Login Kit, as is video game PUBG, which is only using the login functionality. A forthcoming NFT platform Neon will use Login Kit, too.

When users log in to these apps via their TikTok credentials, they’ll then be presented with an additional permissions box that asks them if the app in question can read their profile information and access their public videos, which they then have to also agree to in order to take advantage of the additional video sharing options inside the app itself.

For the time being, these are the only permissions that Login Kit asks for — and it doesn’t give the app access to further information, like who the TikTok user’s friends are, for example. If TikTok expands beyond these permissions in the future, it says it will be transparent with users about any changes or new additions. For the time being, however, the focus is more on allowing apps to better integrate TikTok content into their own experiences.

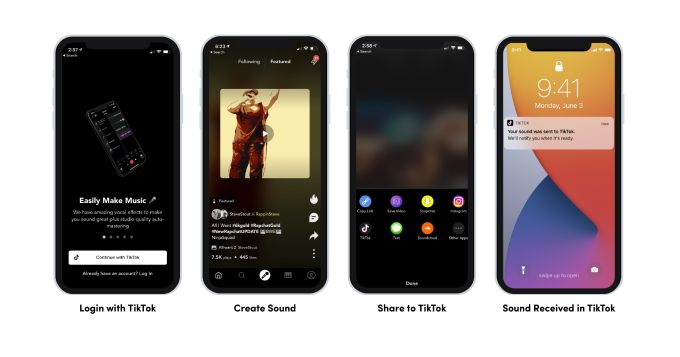

Image Credits: TikTok/Rapchat

The other new SDK launching today is the Sound Kit, which allows artists and creators to bring their original sounds and music from a third-party app into TikTok. This kit, which also requires Login Kit to work, will help TikTok seed its sounds database with more original content it doesn’t have to license from major labels. Instead, whatever licensing rights to the music and other sounds that exist within the original app will still apply to whatever is shared out to TikTok. But by sharing the music more broadly, creators can gain interest from potential fans and even see their sounds used as the backing for new TikTok videos.

Early adopters on this front include mobile multi-track recording studio Audiobridge, music creation and collaboration suite LANDR, hip hop music creation app Rapchat and upcoming audio recording and remix app Yourdio.

TikTok says some of the apps selected as early partners for the SDKs were those that already adopted its Share to TikTok SDK, which launched in 2019. Others, however, were chosen based on a specific set of criteria, including the ability to move quickly to integrate the new features and the strength of their specific use cases. TikTok was looking for a diversity of use cases and those that were particularly novel — like building out a dating network based on videos, for instance.

More information on the new tools and developer documentation will be added to TikTok’s developer website, but TikTok says it will be vetting and reviewing developers who request access. And as most of the current developer partners are U.S.-based, with just a few exceptions, the company says it is looking to diversify the list of companies going forward, as this is a global initiative.

“As TikTok becomes increasingly ingrained in culture, more third-party apps across a variety of categories and use cases are looking to tap into our community on their own platforms,” said Isaac Bess, TikTok’s Global Head of Distribution Partnerships, in a statement about the launch. “Through the Sound Kit and Login Kit for TikTok, we’re providing seamless integration solutions that help developers expand their reach, increase exposure for creators, and empower our community to showcase their content on other platforms,” he added.

Powered by WPeMatico

Ace Games, a Turkish mobile gaming company founded by a former Peak Games co-founder, has raised a $7 million seed funding round led by Actera Group. Co-investment has come from San Francisco’s NFX. Former gaming entrepreneurs Kristian Segerstrale, Alexis Bonte and Kaan Gunay also participated. Firat Ileri is a previous investor from the pre-seed round.

The company runs two studios, one focused on casual and one on “hyper-casual” games.

Co-founded by CEO Hakan Bas, the former co-founder and COO at Peak Games, Ace Games has had some success on the U.S. iOS Store with its hyper-casual title, “Mix and Drink.”

In a statement, Bas said: “Ace’s main focus is actually the casual ‘hybrid puzzle’ game that we have been working on for a while now. However, our hyper-casual studio assists the main studio in many aspects like training talent, coming up with creative game mechanics and marketing ideas, generating cash, and creating user base.” Ace’s casual title is to be released late-summer this year and the global launch is expected in early 2022.

Peak Games, Gram Games and Rollic Games were all acquired by Zynga, showing that Turkey is capable of producing decent exits for gaming startups.

VCs such as Index, Balderton, Makers and Griffin have all made M&A deals with Dream Games, Bigger Games and Spyke Games.

Powered by WPeMatico

Una Brands’ co-founders (from left to right): Tobias Heusch, Kiren Tanna and Kushal Patel. Image Credits: Una Brands

One of the biggest funding trends of the past year is companies that consolidate small e-commerce brands. Many of the most notable startups in the space, like Thrasio, Berlin Brands Group and Branded Group, focus on consolidating Amazon Marketplace sellers. But the e-commerce landscape is more fragmented in the Asia-Pacific region, where sellers use platforms like Tokopedia, Lazada, Shopee, Rakuten or eBay, depending on where they are. That is where Una Brands comes in. Co-founder Kiren Tanna, former chief executive officer of Rocket Internet Asia, said the startup is “platform agnostic,” searching across marketplaces (and platforms like Shopify, Magento or WooCommerce) for potential acquisitions.

Una announced today that it has raised a $40 million equity and debt round. Investors include 500 Startups, Kingsway Capital, 468 Capital, Presight Capital, Global Founders Capital and Maximilian Bitner, the former CEO of Lazada who currently holds the same role at secondhand fashion platform Vestiaire Collective.

Una did not disclose the ratio of equity and debt in the round. Like many other e-commerce aggregators, including Thrasio, Una raised debt financing to buy brands because it is non-dilutive. The round will also be used to hire aggressively in order to evaluate brands in its pipeline. Una currently has teams in Singapore, Malaysia and Australia and plans to expand in Southeast Asia before entering Taiwan, Japan and South Korea.

Tanna, who also founded Foodpanda and ZEN Rooms, launched Una along with Adrian Johnston, Kushal Patel, Tobias Heusch and Srinivasan Shridharan. He estimates that there are more than 10 million third-party sellers spread across different platforms in the Asia-Pacific.

“Every single seller in Asia is looking at multiple platforms and not just Amazon,” Tanna told TechCrunch. “We saw a big gap in the market where e-commerce is growing very quickly, but players in the West are not able to look at every platform, so that is why we decided to focus on APAC, launch the business there and acquire sellers who are selling on multiple platforms.”

Una looks for brands with annual revenue between $300,000 to $20 million and is open to many categories, as long as they have strong SKUs and low seasonality (for example, it avoids fast fashion). Its offering prices range from about $600,000 to $3 million.

Tanna said Una will maintain acquisitions as individual brands “because what’s working, we don’t change it.” How it adds value is by doing things that are difficult for small brands to execute, especially those run by just one or two people, like expanding into more distribution channels and countries.

“For example, in Indonesia there are at least five or six important platforms that you should be on, and many times the sellers aren’t doing that, so that’s something we do,” Tanna explained. “The second is cross-border in Southeast Asia, which sellers often can’t do themselves because of regulations around customs, import restrictions and duties. That’s something our team has experience in and want to bring to all brands.”

Amazon FBA roll-up players have the advantage of Amazon Marketplace analytics that allow them to quickly measure the performance of brands in their pipeline of potential acquisitions. Since it deals with different marketplaces and platforms, Una works with much more fragmented sources of data for revenue, costs, rankings and customer reviews. To scale up, the company is currently building technology to automate its valuation process and will also have local teams in each of its markets. Despite working with multiple e-commerce platforms, Tanna said Una is able to complete a deal within five weeks, with an offer usually happening within two or three days.

In countries where Amazon is the dominant e-commerce player, like the United States, many entrepreneurs launch FBA brands with the goal of flipping them for a profit within a few years, a trend that Thrasio and other Amazon roll-up startups are tapping into. But that concept is less common in Una’s markets, so it offers different team deals to appeal to potential sellers. Though Una acquires 100% of brands, it also does profit-sharing models with sellers, so they get a lump sum payment for the majority of their business first, then collect more money as Una scales up the brand. Tanna said Una usually continues working with sellers on a consulting basis for about three to six months after a sale.

“Something that Amazon players know very well is that they can find a product, sell it for four to five years, and then ideally make a multi-million deal exit and build another product or go on holiday,” said Tanna. “That’s something Asian sellers are not as familiar with, so we see this as an education phase to explain how the process works, and why it makes sense to sell to us.”

Powered by WPeMatico