TC

Auto Added by WPeMatico

Auto Added by WPeMatico

Orbital imagery is in demand, and if you think having daily images of everywhere on Earth is going to be enough in a few years, you need a lesson in ambition. Alba Orbital is here to provide it with its intention to provide Earth observation at intervals of 15 minutes rather than hours or days — and it just raised $3.4 million to get its next set of satellites into orbit.

Alba attracted our attention at Y Combinator’s latest demo day; I was impressed with the startup’s accomplishment of already having six satellites in orbit, which is more than most companies with space ambition ever get. But it’s only the start for the company, which will need hundreds more to begin to offer its planned high-frequency imagery.

The Scottish company has spent the last few years in prep and R&D, pursuing the goal, which some must have thought laughable, of creating a solar-powered Earth observation satellite that weighs in at less than one kilogram. The joke’s on the skeptics, however — Alba has launched a proof of concept and is ready to send the real thing up as well.

Little more than a flying camera with a minimum of storage, communication, power and movement, the sub-kilogram Unicorn-2 is about the size of a soda can, with paperback-size solar panel wings, and costs in the neighborhood of $10,000. It should be able to capture up to 10-meter resolution, good enough to see things like buildings, ships, crops, even planes.

“People thought we were idiots. Now they’re taking it seriously,” said Tom Walkinshaw, founder and CEO of Alba. “They can see it for what it is: a unique platform for capturing data sets.”

Indeed, although the idea of daily orbital imagery like Planet’s once seemed excessive, in some situations it’s quite clearly not enough.

“The California case is probably wildfires,” said Walkinshaw (and it always helps to have a California case). “Having an image once a day of a wildfire is a bit like having a chocolate teapot… not very useful. And natural disasters like hurricanes, flooding is a big one, transportation as well.”

Walkinshaw noted that they company was bootstrapped and profitable before taking on the task of launching dozens more satellites, something the seed round will enable.

“It gets these birds in the air, gets them finished and shipped out,” he said. “Then we just need to crank up the production rate.”

When I talked to Walkinshaw via video call, 10 or so completed satellites in their launch shells were sitting on a rack behind him in the clean room, and more are in the process of assembly. Aiding in the scaling effort is new investor James Park, founder and CEO of Fitbit — definitely someone who knows a little bit about bringing hardware to market.

Interestingly, the next batch to go to orbit (perhaps as soon as in a month or two, depending on the machinations of the launch provider) will be focusing on nighttime imagery, an area Walkinshaw suggested was undervalued. But as orbital thermal imaging startup Satellite Vu has shown, there’s immense appetite for things like energy and activity monitoring, and nighttime observation is a big part of that.

The seed round will get the next few rounds of satellites into space, and after that Alba will be working on scaling manufacturing to produce hundreds more. Once those start going up it can demonstrate the high-cadence imaging it is aiming to produce — for now it’s impossible to do so, though Alba already has customers lined up to buy the imagery it does get.

The round was led by Metaplanet Holdings, with participation by Y Combinator, Liquid2, Soma, Uncommon Denominator, Zillionize and numerous angels.

As for competition, Walkinshaw welcomes it, but feels secure that he and his company have more time and work invested in this class of satellite than anyone in the world — a major obstacle for anyone who wants to do battle. It’s more likely companies will, as Alba has done, pursue a distinct product complementary to those already or in the process of being offered.

“Space is a good place to be right now,” he concluded.

Powered by WPeMatico

As an entrepreneur, you started your business to create value, both in what you deliver to your customers and what you build for yourself. You have a lot going on, but if building personal wealth matters to you, the assets you’re creating deserve your attention.

You can implement numerous advanced planning strategies to minimize capital gains tax, reduce future estate tax and increase asset protection from creditors and lawsuits. Capital gains tax can reduce your gains by up to 35%, and estate taxes can cost up to 50% on assets you leave to your heirs. Careful planning can minimize your exposure and actually save you millions.

Smart founders and early employees should closely examine their equity ownership, even in the early stages of their company’s life cycle. Different strategies should be used at different times and for different reasons. The following are a few key considerations when determining what, if any, advanced strategies you might consider:

Some additional items to consider include issues related to qualified small business stock (QSBS), gift and estate taxes, state and local income taxes, liquidity, asset protection, and whether you and your family will retain control and manage the assets over time.

Smart founders and early employees should closely examine their equity ownership, even in the early stages of their company’s life cycle.

Here are some advanced equity planning strategies that you can implement at different stages of your company life cycle to reduce tax and optimize wealth for you and your family.

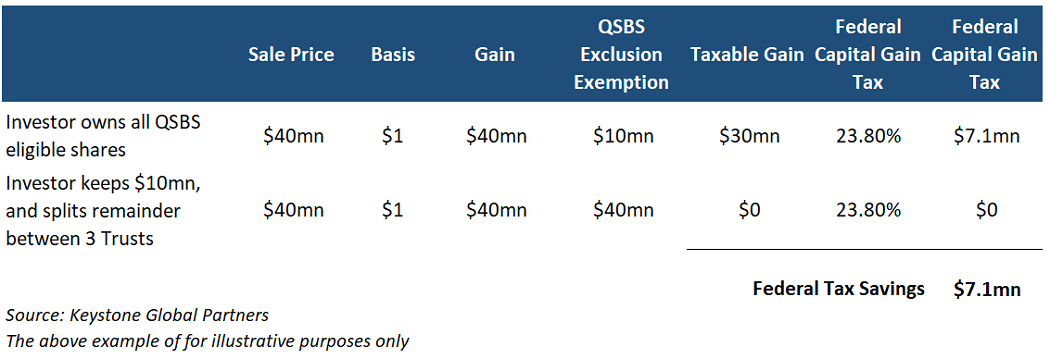

QSBS allows you to exclude tax on $10 million of capital gains (tax of up to 35%) upon an exit/sale. This is a benefit every individual and some trusts have. There is significant opportunity to multiply the QSBS tax exclusion well beyond $10 million.

The founder can gift QSBS eligible stock to an irrevocable nongrantor trust, let’s say for the benefit of a child, so that the trust will qualify for its own $10 million exclusion. The founder owning the shares would be the grantor in this case. Typically, these trusts are set up for children or unborn children. It is important to note that the founder/grantor will have to gift the shares to accomplish this, because gifted shares will retain the QSBS eligibility. If the shares are sold into the trust, the shares lose QSBS status.

Image Credits: Peyton Carr

In addition to the savings on federal taxes, founders may also save on state taxes. State tax can be avoided if the trust is structured properly and set up in a tax-exempt state like Delaware or Nevada. Otherwise, even if the trust is subject to state tax, some states, like New York, conform and follow the federal tax treatment of the QSBS rules, while others, like California, do not. For example, if you are a New York state resident, you will also avoid the 8.82% state tax, which amounts to another $2.6 million in tax savings if applied to the example above.

This brings the total tax savings to almost $10 million, which is material in the context of a $40 million gain. Notably, California does not conform, but California residents can still capture the state tax savings if their trust is structured properly and in a state like Delaware or Nevada.

Currently, each person has a limited lifetime gift tax exemption, and any gifted amount beyond this will generate up to a 40% gift tax that has to be paid. Because of this, there is a trade-off between gifting the shares early while the company valuation is low and using less of your gift tax exemption versus gifting the shares later and using more of the lifetime gift exemption.

The reason to wait is that it takes time, energy and money to set up these trusts, so ideally, you are using your lifetime gift exemption and trust creation costs to capture a benefit that will be realized. However, not every company has a successful exit, so it is sometimes better to wait until there is a certain degree of confidence that the benefit will be realized.

One way for the founder to plan for future generations while minimizing estate taxes and high state taxes is through a parent-seeded trust. This trust is created by the founder’s parents, with the founder as the beneficiary. Then the founder can sell the shares to this trust — it doesn’t involve the use of any lifetime gift exemption and eliminates any gift tax, but it also disqualifies the ability to claim QSBS.

The benefit is that all the future appreciation of the asset is transferred out of the founder’s and the parent’s estate and is not subject to potential estate taxes in the future. The trust can be located in a tax-exempt state such as Delaware or Nevada to also eliminate home state-level taxes. This can translate up to 10% in state-level tax savings. The trustee, an individual selected by the founder, can make distributions to the founder as a beneficiary if desired.

Further, this trust can be used for the benefit of multiple generations. Distributions can be made at the discretion of the trustee, and this skips the estate tax liability as assets are passed from generation to generation.

This strategy enables the founder to minimize their estate tax exposure by transferring wealth outside of their estate, specifically without using any lifetime gift exemption or being subject to gift tax. It’s particularly helpful when an individual has used up all their lifetime gift tax exemption. This is a powerful strategy for very large “unicorn” positions to reduce a founder’s future gift/estate tax exposure.

For the GRAT, the founder (grantor) transfers assets into the GRAT and gets back a stream of annuity payments. The IRS 7520 rate, currently very low, is a factor in calculating these annuity payments. If the assets transferred into the trust grow faster than the IRS 7520 rate, there will be an excess remainder amount in GRAT after all the annuity payments are paid back to the founder (grantor).

This remainder amount will be excluded from the founder’s estate and can transfer to beneficiaries or remain in the trust estate tax-free. Over time, this remainder amount can be multiples of the initial contributed value. If you have company stock that you expect will pop in value, it can be very beneficial to transfer those shares into a GRAT and have the pop occur inside the trust.

This way, you can transfer all the upside gift and estate tax-free out of your estate and to your beneficiaries. Additionally, because this trust is structured as a grantor trust, the founder can pay the taxes incurred by the trust, making the strategy even more powerful.

One thing to note is that the grantor must survive the GRAT’s term for the strategy to work. If the grantor dies before the end of the term, the strategy unravels and some or all the assets remain in his estate as if the strategy never existed.

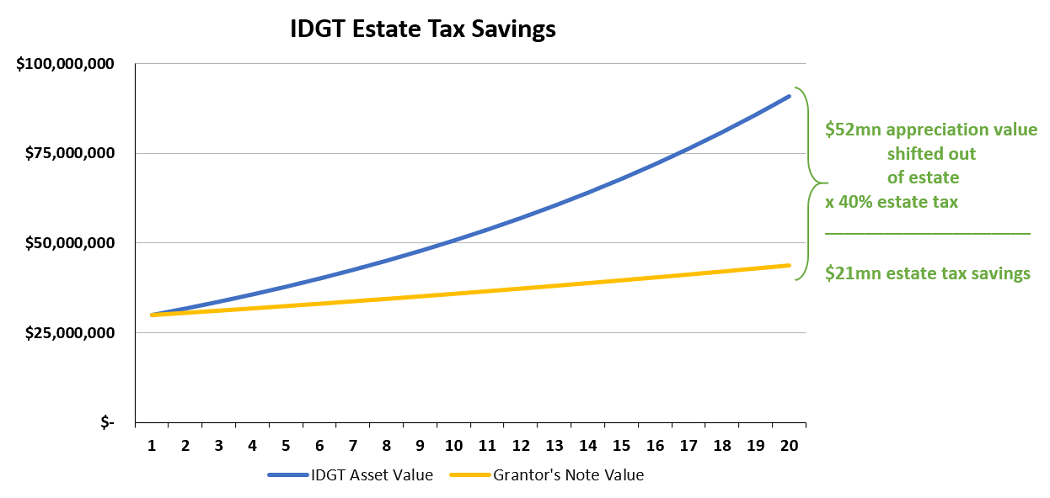

This is similar to the GRAT in that it also enables the founder to minimize their estate tax exposure by transferring wealth outside of their estate, but has some key differences. The grantor must “seed” the trust by gifting 10% of the asset value intended to be transferred, so this approach requires the use of some lifetime gift exemption or gift tax.

The remaining 90% of the value to be transferred is sold to the trust in exchange for a promissory note. This sale is not taxable for income tax or QSBS purposes. The main benefits are that instead of receiving annuity payments back, which requires larger payments, the grantor transfers assets into the trust and can receive an interest-only note. The payments received are far lower because it is interest-only (rather than an annuity).

Image Credits: Peyton Carr

Another key distinction is that the IDGT strategy has more flexibility than the GRAT and can be generation-skipping.

If the goal is to avoid generation-skipping transfer tax (GSTT), the IDGT is superior to the GRAT, because assets are measured for GSTT purposes when they are contributed to the trust prior to appreciation rather than being measured at the end of the term for a GRAT after the assets have appreciated.

Depending on a founder’s situation and goals, we may use some combination of the above strategies or others altogether. Many of these strategies are most effective when planning in advance; waiting until after the fact will limit the benefits you can extract.

When considering strategies for protecting wealth and minimizing taxes as it relates to your company stock, there’s a lot to take into account — the above is only a summary. We recommend you seek proper counsel and choose wealth transfer and tax savings strategies based on your unique situation and individual appetite for complexity.

Powered by WPeMatico

At the market close this afternoon ahead of its earnings report, New Relic, an applications performance monitoring company, announced that founder Lew Cirne would be stepping down as CEO and moving into the executive chairman role.

At the same time, the company announced that Bill Staples, a software industry vet, would be taking over as CEO. Staples joined the company last year as chief product officer before being quickly promoted to president and chief product officer in January. Today’s promotion marks a rapid rise through the ranks to lead the company.

Cirne said when he began thinking about stepping into that executive chairman role, he was looking for a trusted partner to take his place as CEO, and he found that in Staples. “Every founder’s dream is for the company to have a long-lasting impact, and then when the time is right for them to step into a different role. To do that, you need a trusted partner that will lead with the right core values and bring to the table what the company needs as an active partner. And so I’m really excited to move to the executive chairman role [and to have Bill be that person],” Cirne told me.

For Staples, who has worked at large organizations throughout his career, this opportunity to lead the company as CEO is the pinnacle of his long career arc. He called the promotion humbling, but one he believes he is ready to take on.

“This is a new chapter for me, a new experience to be a CEO of a public company with a billion-dollar-plus value valuation, but I think the experience I have in the seat of our customers, as well as the experience I’ve had at Microsoft and Adobe, very large companies with very large stakes running large organizations has really prepared me well for this next phase,” Staples said.

Cirne says he plans to take some time off this summer to give Staples the space to grow as the leader of the company without being in the shadow of the founder and long-time CEO, but he plans to come back and work with him as the executive chairman moving forward come the fall.

As he steps into this new role, Staples will be taking over. “Certainly I have a lot to learn about what it takes to be a great CEO, but I also come in with a lot of confidence that I’ve managed organizations at scale. You know I’ve been part of P&Ls that were many times larger than New Relic, and I have confidence that I can help New Relic grow as a company.”

Hope Cochran, managing director at Madrona Ventures, who is also the chairman of the New Relic Board, said that the board fully backs of the decision to pass the CEO torch from Cirne to Staples. “With the foundation that Lew built and Bill’s leadership, New Relic has a very bright future ahead and a clear path to accelerate growth as the leader in observability,” she said in a statement.

The official transition is scheduled to take place on July 1st.

Powered by WPeMatico

They say for every door that opens another closes, and the executive shuffle at VMware is certainly proving that old chestnut true. Four months after Pat Gelsinger stepped down as CEO to return to run Intel, the virtual machine pioneer announced yesterday that long-time exec Raghu Raghuram was taking over that role.

That set in motion another change when COO Sanjay Poonen, whom some had speculated might get the CEO job, announced yesterday afternoon on Twitter that he was leaving the company after seven years.

Coincidence? We think not.

Holger Mueller, an analyst at Constellation Research, says that he was surprised that Poonen didn’t get the job, but perhaps the VMware board valued Raghuram’s product focus more highly. “At 50, he [would have been] a long-term solution, and he did a great job on the End User Computing (EUC) side of the product before becoming COO. I guess that it is still not VMware’s core business,” he said.

Regardless, Mueller still liked the choice of Raghuram as CEO, saying that he brought stability and reliability to the position, but he sees him likely as a solid interim solution for several years as the company spins out from Dell and becomes a fully independent organization again.

“Obviously the board wanted to have someone who knows product, and has been there a long time, and is associated with the VMware core success — so that creates relatability [and stability].” He added, “At 57 he is the transitional candidate, and a good choice, a veteran who is happy to run this two-three or maybe five years and won’t go anywhere [in the interim]. And the board has time to find a long-term solution,” Mueller told me.

Mark Lockwood, lead analyst on VMware at Gartner, sees Raghuram as the right man for the job, with no reservations, one who will continue to implement the current strategy while putting his own stamp on the position.

“That the VMware board chose someone in Raghu Raghuram who has been the technical strategy executive inside the company for years speaks volumes about the board’s comfort level with the existing strategy trajectory of the company. Mr. Raghuram will most certainly steer the company slightly differently than Mr. Gelsinger did, but at least from the outside, the CEO appointment appears to be a stamp of approval on the company’s broad portfolio,” Lockwood said.

As for Poonen, he says that the writing was on the wall when he didn’t get the promotion. “Although Sanjay Poonen has indeed been a valuable executive for VMware, it was always unlikely that he would remain if not chosen for the CEO role,” Lockwood said.

Stephen Elliot, an analyst at IDC, was also bullish on the Raghuram appointment, saying he brings a broad understanding of the company, and that’s important to VMware right now. “He understands VMware customers, the technologies, M&A, and the importance of execution and its impact on profitable growth. He has been central to almost every successful strategy the company has created, and been a leader for product strategy and execution. He has a very good balance of making tactical and strategic moves to anticipate the value VMware can deliver for customers in a one-three year horizon,” Elliot said.

Elliot thinks Poonen will be just fine and will find a landing spot pretty quickly. “He is another very talented executive; he will become a CEO elsewhere, and another company will be very lucky,” he said. He says that it will take time to see if there is any impact from that, but he believes that VMware shouldn’t have trouble attracting other executive talent to fill in any gaps.

For every executive move, there are choices for replacements, and subsequent fallout from those choices. We saw a full-fledged example of that yesterday on display at VMware. If these industry experts are right, the company chose stability and reliability and a deep understanding of product. That would seem to be solid enough reasoning on the part of the board, even though Poonen leaving seems to be collateral damage from the decision, and a big loss for the company.

Powered by WPeMatico

BluBracket, an early-stage startup that focuses on keeping source code repositories secure, even in distributed environments, announced a $12 million Series A today.

Evolution Equity Partners led the round, with help from existing investors Unusual Ventures, Point72 Ventures, SignalFire and Firebolt Ventures. When combined with the $6.5 million seed round we reported on last year, the company has raised $19.5 million so far.

As you might imagine, being able to secure code in distributed environments came in quite handy when much of the technology world moved to work from home last year. BluBracket co-founder and COO Ajay Arora says that the pandemic forced many organizations to look carefully at how they secured their code base.

“So the anxiety organizations had about making sure their source code was secure and that it wasn’t leaking, from that standpoint that was a big tailwind for us. [With companies moving to a] completely remote development workforce, and with code being so important to their business as intellectual property, they needed to get that visibility into what vulnerabilities were there,” Arora explained.

Even prior to the pandemic, the company was finding they were gaining traction with developers and security pros by using a bottom up approach offering a free community version of the software. Having that free version as a top of the funnel for their sales motion was also helpful once COVID hit full force.

Today, Arora says the company has multiple thousands of developers, DevOps and SecOps users across dozens of organizations using the company’s suite of products. The big reference company right now is Priceline, but he says there are other big names that would prefer not to be public about it.

The company currently has 30 employees, with plans to double that by the end of the year, and he says that building diversity and inclusion into the hiring process is part of the company’s core values, and part of how the executive team gets measured.

“We’re big believers in putting our money where our mouth is and one of the OKRs for me and my co-founder [CEO Prakash Linga], or one of the things that we’re actually compensated for, is how well we are doing in building diversity and inclusion on the team,” he said. He adds that the recruiters that they are using are also being held to the same standard when it comes to providing a diverse set of candidates for open positions.

The company launched in 2018 and the founding team came from Vera, a startup that helped secure documents in motion. That company was sold to HelpSystems in December 2020 after Arora and Linga had left to start BluBracket.

Powered by WPeMatico

AWS announced today that it’s releasing a tool called AWS SaaS Boost as open source distributed under the Apache 2.0 license. The tool, which was first announced at the AWS re:Invent conference last year, is designed to help companies transform their on-prem software into cloud-based software as a service.

In the charter for the software, the company describes its mission this way: “Our mission is to create a community-driven suite of extensible building blocks for Software-as-a-Service (SaaS) builders. Our goal is to foster an open environment for developing and sharing reusable code that accelerates the ability to deliver and operate multi-tenant SaaS solutions on AWS.”

What it effectively does is provide the tools to turn the application into one that lets you sign up users and let them use the app in a multi-tenant cloud context. Even though it’s open source, it is designed to get you to move your application into the AWS system where you can access a number of AWS services such as AWS CloudFormation, AWS Identity and Access Management (IAM), Amazon Route 53, Elastic Load Balancing, AWS Lambda (Amazon’s serverless tool), and Amazon Elastic Container Service (Amazon’s Kubernetes Service). Although presumably you could use alternative services, if you were so inclined.

By making it open source, it gives companies that would need this kind of service access to the source code, giving them a comfort level and an ability to contribute to the project to expand upon the base product and give back to the community. That makes it a win for users who get flexibility and the benefit of a community behind the tool, and a win for AWS, which gets that community working on the tool to improve and enhance it over time.

“Our objective with AWS SaaS Boost is to get great quality software based on years of experience in the hands of as many developers and companies as possible. Because SaaS Boost is open source software, anyone can help improve it. Through a community of builders, our hope is to develop features faster, integrate with a wide range of SaaS software, and to provide a high quality solution for our customers regardless of company size or location,” Amazon’s Adrian De Luca wrote in a blog post announcing the intent to open source SaaS Boost.

This announcement comes just a couple of weeks after the company open-sourced its Deep Racer device software, which runs its machine-learning fueled mini race cars. That said, Amazon has had a complex relationship with the open source in the past couple of years, where companies like MongoDB, Elastic and CockroachDB have altered their open-source licenses to prevent Amazon from making their own hosted versions of these software packages.

Powered by WPeMatico

Do you and your early-stage startup have what it takes to be a modern-day gladiator and compete in Startup Battlefield at TechCrunch Disrupt 2021? You won’t know unless you apply, and time is running out. You have only 48 hours left to throw your helmet into the ring.

If you want to compete for glory, global exposure and $100,000 in equity-free prize money, apply to Startup Battlefield here before May 13 at 11:59 p.m. (PT).

Not familiar with Startup Battlefield? It has launched 922 companies — including the likes of Dropbox, Vurb, Mint and a bunch more — that have collectively raised $9.5 billion and produced 117 exits.

We can tell you what it’s like to compete in Startup Battlefield and about the benefits and opportunities that come from it. But Stacey Hronowski — co-founder and CEO of Canix, the winner of Startup Battlefield at Disrupt 2020 — describes it best.

“Our experience in Startup Battlefield was excellent. The rigorous training was specific and tailored to our individual business and presentation. I was particularly impressed with the Q&A training. I’ve fundraised numerous times and the practice questions were some of the most insightful and specific questions I’ve faced. I feel extremely well prepared for future fundraises.

“Post Startup Battlefield, we received significant press coverage and reach outs from notable investors. The experience was one of the most special of my life; I never thought I’d get the chance to share the story of Canix with investors and media across the globe.”

And guess what?! It won’t cost you a thing to apply or to compete. You can be from anywhere in the world and in any industry — but you should have an MVP. Are you detail-oriented? Read more about how Startup Battlefield works.

We’re tapping top VC talent to judge the Battlefield. Here are just a few of the experts you’ll need to impress:

TechCrunch Disrupt 2021 takes place on September 22-23, and if you want a shot at massive exposure and $100,000, you need to apply to Startup Battlefield before the deadline expires — in just 48 hours — on May 13 at 11:59 p.m. (PT). Go, gladiators, go!

Is your company interested in sponsoring or exhibiting at Disrupt 2021? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico

As the famous phrase goes, “software is eating the world” — and now software is eating dentistry. Or, perhaps more accurately, the arena of orthodontics — the specialty of dentistry that deals with things like braces — is slowly but surely being digitalized.

To whit, Impress, a Southern European player in direct-to-consumer orthodontics, has raised a $50 million Series A funding round led by CareCapital (a dental division of Hillhouse Capital in Asia), along with Nickleby Capital, UNIQA Ventures and investors including Michael Linse, Valentin Pitarque, Peter Schiff, Elliot Dornbusch and others. All existing shareholders, such as TA Ventures and Bynd VC, also participated.

Impress is an homage to the direct-to-consumer startups in this area in the U.S., such as SmileDirect, and now plans to scale across Europe from its existing bases in Spain, Italy, Portugal, the U.K. and France.

The company was founded in 2019 in Barcelona by orthodontist Dr. Khaled Kasem and serial entrepreneurs Diliara and Vladimir Lupenko.

Speaking from Barcelona, Lupenko told me that the idea was to “combine the best orthodontic tradition with the most innovative technology in the sector.”

As things stand, most of the time, consumers can usually only access cosmetic teeth alignment treatments or orthodontic medical treatments in conventional clinics. The new wave of clinics employs 3D scans and panoramic X-rays to check nerve and bone health.

Impress’s model is to offer these high-quality medical treatments directly to consumers, by developing its own chain of orthodontic clinics, which also put an emphasis on design and a “modern” patient experience, it says.

As Diliara Lupenko says: “We didn’t copy what other companies in the space were doing and approached the market from a different angle from the get-go. We doubled down on the doctor-led digital model which brought us way better conversion rates and treatment quality even though on paper it looked complex in the beginning. It’s still very complex but we were able to crack it and scale exponentially.”

Impress now has 75 clinics in Spain, Italy, the U.K., France and Portugal, which optimize costs and automate key parts of the value chain.

It now says it’s approaching €50 million in annual run-rate and is projected to grow to €150 million of revenue in 12 months.

Andreas Nemeth, managing partner of UNIQA Ventures GmbH commented: “Impress’s customer-centric focus, as well as its demonstrated ability to blitzscale, attracted us to the business. Vladimir and his team leverage technology to create a seamless customer journey for invisible orthodontics and optimized their cost structure in a unique way using software.”

Powered by WPeMatico

Planck co-founders (from left to right): David Schapiro, CEO Elad Tsur and CTO Amir Cohen. Image Credits: Planck

Planck, the AI-based data platform for commercial insurance underwriting, announced today it has raised a $20 million growth round. The funding came from 3L Capital and Greenfield Partners, along with returning investors Team8, Viola Fintech, Arbor Ventures and Eight Roads.

This brings the New York-based startup’s total raised to $48 million, including a $16 million Series B it announced in June 2020. Planck said it currently works with “dozens of commercial insurance companies in the U.S.,” including more than half of the top-30 insurers. It will use its new funding to build its U.S. team, expand into global markets and add products for new business segments. Ernie Feirer has also joined Planck as its head of U.S. business. He previously held leadership roles at LexisNexis Risk Solutions, building data analytics solutions for property and casualty insurance carriers.

Planck’s database, which includes online images, text, videos, reviews and public records, allows it to give insurance providers real-time information that helps them determine premiums, process claims and give SMEs faster quotes. It covers more than 50 business segments, including restaurants, construction, retail and manufacturing, and can deliver analytics by simply entering a business’ name and address.

For example, if a healthcare business is seeking to buy or renew an insurance policy, Planck can give underwriters information such as the type of equipment used, what kind of drugs it prescribes and the type of surgeries it performs.

In a statement, 3L Capital principal Paige Thacher said, “Commercial carriers and brokers can no longer afford to rely upon traditional data sources as they prospect, assess risk and monitor a small business insured’s changing exposure during the policy life cycle. The new imperative is to leverage AI and machine learning technologies to dynamically harvest business insights from the insured’s digital footprint.”

Powered by WPeMatico

As far as I can tell, low-code and no-code services are rapidly proving that prior models for products as broad as enterprise app creation and AI-powered data analytics were lackluster. My evidence? A mix of public- and private-market low- and no-code companies are putting up impressive results.

The Exchange caught up with Appian CEO Matt Calkins after his enterprise app software company reported its first-quarter performance to discuss the low-code market and what he’s hearing in customer meetings. To round out our general thesis — and shore up our somewhat bratty headline — we’ve compiled a list of recent low-code and no-code venture capital rounds, of which there are many.

As we’ll show, the pace at which venture capitalists are putting funds into companies that fall into our two categories is pretty damn rapid, which implies that they are doing well as a cohort. We can infer as much because it has become clear in recent quarters that while today’s private capital market is stupendous for some startups, it’s harder than you’d think for others.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

The dividing factor? Signs of impressive present-day traction: Startups that are growing very fast have nearly unlimited access to capital, while those that are growing at merely fast rates are often finding it difficult to find a dance partner.

So if we can show that a huge, diverse set of no-code and low-code startups are raising oodles of capital, we can infer something relatively sturdy about market demand for their products. (It also doesn’t hurt that no-code automation service Zapier is growing like a weed and has reached IPO scale. In other news, Appian just dropped a new version of its low-code automation platform, for whatever that is worth.)

So if we can show that a huge, diverse set of no-code and low-code startups are raising oodles of capital, we can infer something relatively sturdy about market demand for their products. (It also doesn’t hurt that no-code automation service Zapier is growing like a weed and has reached IPO scale. In other news, Appian just dropped a new version of its low-code automation platform, for whatever that is worth.)

First Appian’s CEO, then a venture capital roundup. This should be fun.

Briefly, Appian reported $88.9 million in Q1 2021 revenue, of which $39.1 million came from its cloud subscription business. The latter figure rose 38% in the quarter compared to the year-ago period. Appian also swung to adjusted EBITDA profit in the period. Investors responded by hammering the company’s stock in the wake of the results. From an April share-price range in the mid-$130s, Appian is now trading in the mid-$80s, though only some of those declines came post-earnings.

But the company’s stock price is only so important. Precisely how conservative any one public company’s guidance is for the current year and how those forecasts play with investor expectations during a period of generally excessive valuations is not our game. What does matter is what the company’s CEO had to say about the low-code space itself.

Powered by WPeMatico