TC

Auto Added by WPeMatico

Auto Added by WPeMatico

At long last, the Monday.com crew dropped an F-1 filing to go public in the United States. TechCrunch has long known that the company, which sells corporate productivity and communications software, has scaled north of $100 million in annual recurring revenue (ARR).

The countdown to its IPO filing — an F-1, because the company is based in Israel, rather than the S-1s filed by domestic companies — has been ticking for several quarters, so seeing Monday.com drop the document on this Monday morning was just good fun.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

The Exchange has been riffling through the document since it came out, and we’ve picked up on a few things to explore. We’ll start by looking at the company’s revenue growth on a historical basis to see if it has accelerated in recent quarters thanks to the pandemic. Then, we’ll turn to profitability, cash burn, share-based compensation expenses and product vision.

We’ll wrap at the end with a summary of what we’ve learned and also make sure to check out the company’s marketing spend, because I’m sure you’ve seen its digital ads.

We’ll wrap at the end with a summary of what we’ve learned and also make sure to check out the company’s marketing spend, because I’m sure you’ve seen its digital ads.

It’s a lot to chew through, so no more dilly-dallying. Into the numbers!

As always, we’re starting with revenue growth because it’s still the single most important thing about any venture-backed company.

This is great news for the startup, its employees and its investors. From 2019 to 2020, Monday.com grew its revenues from $78.1 million to $161.1 million, or 106%.

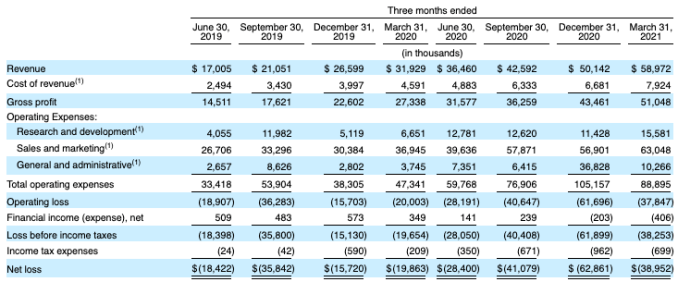

From Q1 2020 to Q1 2021, the company’s revenues grew from $31.9 million to $59 million. That’s about 85% growth. So, by what measure do we mean that the company’s revenue growth is accelerating? Its sequential-quarter revenue growth is picking up. Observe the following:

Image Credits: Monday.com F-1 filing

From Q2 2019 to Q3 2019, the company added around $4 million in revenue. From Q2 2020 to Q3 2020, that number was $6.1 million. More recently, the company’s revenue added $7.6 million from Q3 2020 to Q4 2020, which accelerated to $8.8 million from the final quarter of 2020 to the first quarter of 2021. Of course, from an ever-larger base, the company’s growth rate may decline. But the super clean and obvious expanding sequential revenue gains at the company are solid.

The fact that it added so much top line in recent quarters also helps explain why Monday.com is going public now. Sure, the markets are still near record highs and the pandemic is fading, but just look at that consistent growth! It’s investor catnip.

Powered by WPeMatico

As gaming platforms capitalize on pandemic-fueled traffic to their digital worlds, brands that drive culture in the physical world are fighting to ensure they don’t miss any new opportunities. A new partnership between Roblox and Gucci brings digital items from the fashion house into the platform’s metaverse alongside a new limited-run digital experience.

Gucci’s new experience teams a set of virtual spaces with a set of digital branded items in an effort to immerse Roblox users inside a world that feels unique to the Gucci brand and Roblox platform. The new space, called Gucci Garden, debuts today for a two-week run on the Roblox platform.

The environment takes advantage of recent advances in the game engine powering Roblox, bringing users a high-dynamic set of environments that they can traverse as blank mannequins, which evolve visually as users move through different spaces. Different rooms in the experience draw influence from different Gucci campaigns of the past several years. The digital event’s rollout accompanies a real-world multimedia event in Florence, Gucci Garden Archetypes.

The rollout follows an early pilot with creator Rook Vanguard in releasing Gucci-branded digital items to the platform this past December.

Image Credits: Roblox

In an interview with TechCrunch, Gucci CMO Robert Triefus details how the luxury fashion brand has been redefining its approachability as it extends its reach to digital platforms like Roblox — which the company sees as an opportunity that’s growing too quickly to ignore.

“Hats off to Roblox, scale came quickly,” Triefus tells TechCrunch. “Gucci is scale, though it’s taken us 100 years, and it took Roblox about 100 days.”

For high-fashion brands, the digital sphere has presented plenty of challenges when it comes to preserving exclusivity on a medium that begs for mass adoption. Triefus says Gucci has aimed to lean into the access offered by digital platforms as a way of promoting a more inclusive brand.

“There’s so much talk today about the metaverse,” Triefus says. “In the last six years, [Creative Director Alessandro Michele] has created a Gucci Metaverse but it’s not necessarily a digital manifestation, it’s a narrative.”

Luxury and authenticity have been some of the central sells of blockchain-based NFTs, something Triefus still sees opportunities for down the road. “It’s astonishing to me how fast the conversation around NFTs has exploded,” Triefus says. “We’ve been studying blockchain for a long time as you might imagine, authenticity of product and of experience is extremely important.”

In addition to experiments with Roblox, late last year Gucci partnered with startup Genies to outfit user avatars.

Virtual items from real-world retailers have been relatively slow to pop up inside digital worlds, though as user perceptions of paying for digital goods have shifted, platforms are moving to capitalize.

“We don’t partner with very many brands,” Roblox exec Christina Wootton tells TechCrunch. “One thing that was very special when we started speaking with Gucci is that they took the time to understand our platform and what works well for designers and creators in our community.”

Powered by WPeMatico

As the price of bitcoin hits record highs and cryptocurrencies become increasingly mainstream, the industry’s expanding carbon footprint becomes harder to ignore.

Just last week, Elon Musk announced that Tesla is suspending vehicle purchases using bitcoin due to the environmental impact of fossil fuels used in bitcoin mining. We applaud this decision, and it brings to light the severity of the situation — the industry needs to address crypto sustainability now or risk hindering crypto innovation and progress.

The market cap of bitcoin today is a whopping $1 trillion. As companies like PayPal, Visa and Square collectively invest billions in crypto, market participants need to lead in dramatically reducing the industry’s collective environmental impact.

As the price of bitcoin hits record highs and cryptocurrencies become increasingly mainstream, the industry’s expanding carbon footprint becomes harder to ignore.

The increasing demand for crypto means intensifying competition and higher energy use among mining operators. For example, during the second half of February, we saw the electricity consumption of BTC increase by more than 163% — from 265 TWh to 433 TWh — as the price skyrocketed.

Sustainability has become a topic of concern on the agendas of global and local leaders. The Biden administration rejoining the Paris climate accord was the first indication of this, and recently we’ve seen several federal and state agencies make statements that show how much of a priority it will be to address the global climate crisis.

A proposed New York bill aims to prohibit crypto mining centers from operating until the state can assess their full environmental impact. Earlier this year, the U.S. Securities and Exchange Commission put out a call for public comment on climate disclosures as shareholders increasingly want information on what companies are doing in this regard, while Treasury Secretary Janet Yellen warned that the amount of energy consumed in processing bitcoin is “staggering.” The United Kingdom announced plans to reduce greenhouse gas emissions by at least 68% by 2030, and the prime minister launched an ambitious plan last year for a green industrial revolution.

Crypto is here to stay — this point is no longer up for debate. It is creating real-world benefits for businesses and consumers alike — benefits like faster, more reliable and cheaper transactions with greater transparency than ever before. But as the industry matures, sustainability must be at the center. It’s easier to build a more sustainable ecosystem now than to “reverse engineer” it at a later growth stage. Those in the cryptocurrency markets should consider the auto industry a canary: Carmakers are now retrofitting lower-carbon and carbon-neutral solutions at great cost and inconvenience.

Market participants need to actively work together to realize a low-emissions future powered by clean, renewable energy. Last month, the Crypto Climate Accord (CCA) launched with over 40 supporters — including Ripple, World Economic Forum, Energy Web Foundation, Rocky Mountain Institute and ConsenSys — and the goal to enable all of the world’s blockchains to be powered by 100% renewables by 2025.

Some industry participants are exploring renewable energy solutions, but the larger industry still has a long way to go. While 76% of hashers claim they are using renewable energy to power their activities, only 39% of hashing’s total energy consumption comes from renewables.

To make a meaningful impact, the industry needs to come up with a standard that’s open and transparent to measure the use of renewables and make renewable energy accessible and cheap for miners. The CCA is already working on such a standard. In addition, companies can pay for high-quality carbon offsets for remaining emissions — and perhaps even historical ones.

While the industry works to become more sustainable long term, there are green choices that can be made now, and some industry players are jumping on board. Fintechs like Stripe have created carbon renewal programs to encourage its customers and partners to be more sustainable.

Companies can partner with organizations, like Energy Web Foundation and the Renewable Energy Business Alliance, to decarbonize any blockchain. There are resources for those who want to access renewable energy sources and high-quality carbon offsets. Other options include using inherently low-carbon technologies, like the XRP Ledger, that don’t rely on proof-of-work (which involves mining) to help significantly reduce emissions for blockchains and cryptofinance.

The XRP Ledger is carbon-neutral and uses a validation and security algorithm called Federated Consensus that is approximately 120,000 times more energy-efficient than proof-of-work. Ethereum, the second-largest blockchain, is transitioning off proof-of-work to a much less energy-intensive validation mechanism called proof-of-stake. Proof-of-work systems are inefficient by design and, as such, will always require more energy to maintain forward progress.

The devastating impact of climate change is moving at an alarming speed. Making aspirational commitments to sustainability — or worse, denying the problem — isn’t enough. As with the Paris agreement, the industry needs real targets, collective action, innovation and shared accountability.

The good news? Solutions can be practical, market-driven and create value and growth for all. Together with climate advocates, clean tech industry leaders and global finance decision-makers, crypto can unite to position blockchain as the most sustainable path forward in creating a green, digital financial future.

Powered by WPeMatico

Before Twilio had a market cap approaching $56 billion and more than 200,000 customers, the cloud-communications platform developed a secret sauce to fuel its growth: a developer-focused model that dispensed with traditional marketing rules.

Software companies that sell directly to end users share a simple framework for managing growth that leverages discoverability, desirability and do-ability — the “aha!” moment where a consumer is able to incorporate a new product into their workflow.

Data show that traditional marketing doesn’t work on developers, and it’s not because they’re impervious to a sales pitch. Builders just want reliable tools that are easy to use.

As a result, companies that are looking to create and sell software to developers at scale must toss their B2B playbooks and meet their customers where they are.

Attorney Sophie Alcorn, our in-house immigration law expert, submitted two columns: On Monday, she analyzed a decision by the U.S. Department of Homeland Security not to cancel the International Entrepreneur Parole program, which potentially allows founders from other countries to stay in the U.S. for as long as 60 months.

On Wednesday, she responded to a question from an entrepreneur who asked whether it made sense to sponsor visas for workers who are working remotely inside the U.S.

Thanks very much for reading Extra Crunch this week, and have a great weekend.

Walter Thompson

Senior Editor, TechCrunch

@yourprotagonist

Image Credits: Peter Finch (opens in a new window) / Getty Images

Can you imagine making 13 attempts at something before attaining a successful outcome?

Alex Circei, CEO and co-founder of Git analytics tool Waydev, applied 13 times to Y Combinator before his team was accepted. Each year, the accelerator admits only about 5% of the startups that seek to join.

“Competition may be fierce, but it’s not impossible,” says Circei. “Jumping through some hoops is not only worth the potential payoff but is ultimately a valuable learning curve for any startup.”

In an exclusive exposé for TechCrunch, he shares four key lessons he learned while steering his startup through YC’s stringent selection process.

The first? “Put your business value before your personal vanity.”

Image Credits: Illustration by Nigel Sussman, art design by Bryce Durbin

In March, TechCrunch Daily Reporter Anna Heim was interviewing executives at Expensify to learn more about the company’s history and operations when they unexpectedly made themselves less available.

Our suspicions about their change of heart were confirmed on May 3 when the expense report management company confidentially filed to go public.

With a founding team comprised mainly of P2P hackers, it’s perhaps inevitable that Expensify doesn’t look and feel like something an MBA might envision.

“We hire in a super different way. We have a very unusual internal management structure,” said founder and CEO David Barrett. “Our business model itself is very unusual. We don’t have any salespeople, for example.”

Similar to the way companies must file a Form S-1 that describes their operations and how they plan to spend capital, TechCrunch EC-1s are part origin story, part X-ray. We published the first article in a series on Expensify on Monday:

We’ll publish the remainder of Anna’s series on Expensify in the coming weeks, so stay tuned.

Image Credits: Nigel Sussman (opens in a new window)

Construction tech unicorn Procore Technologies this week set a price range for its impending public offering. The news comes after the company initially filed to go public in February of 2020, a move delayed by the pandemic.

In March 2021, Procore filed again for a public offering, but its second shot ran into a cooling IPO market. The company filed another S-1/A in April, and then another in early May. This week’s filing is the first that sets a price for the Carpinteria, California-based software upstart.

But Procore is not the only company that filed and later put on hold an IPO to get back to work on floating. Kaltura, a software company focused on video distribution, also recently got its IPO back on track. Are we seeing a reacceleration of the IPO market? Perhaps.

Image Credits: Patcharin Saenlakon/EyeEm (opens in a new window) / Getty Images

Family physician Bobbie Kumar lays out the golden rules to ensure your healthcare product, service or innovation is on the right track.

Rule 1: “It’s not enough to develop a ‘new tool’ to use in a health setting,” Dr. Kumar writes. “Maybe it has a purpose, but does it meaningfully address a need, or solve a problem, in a way that measurably improves outcomes? In other words: Does it have value?”

Image Credits: Bryce Durbin/TechCrunch

Dear Sophie,

I’m the founder of an early-stage, two-year-old fintech startup. We really want to move to San Francisco to be near our lead investor.

I heard International Entrepreneur Parole is back. What is it, and how can I apply?

— Joyous in Johannesburg

Image Credits: Nigel Sussman (opens in a new window)

If you have heard of Better.com but really had no idea what it does before this moment, welcome to the club. Mortgage tech is like pre-kindergarten applications — it applies to a very specific set of folks at a very particular moment. And they care a lot about it. But the rest of us aren’t really aware of its existence.

Better.com, a venture-backed digital mortgage lender, announced this week that it will combine with a SPAC, taking itself public in the second half of 2021. The unicorn’s news comes as the American IPO market is showing signs of fresh life after a modest April.

Image Credits: filadendron (opens in a new window) / Getty Images

The pandemic forced many employees to begin working from home, and, in doing so, may have changed the way we think about work. While some businesses have slowly returned to the office, depending on where you live and what you do, many information workers remain at home.

That could change in the coming months as more people get vaccinated and the infection rate begins to drop in the U.S.

Many companies have discovered that their employees work just fine at home. And some workers don’t want to waste time stuck on congested highways or public transportation now that they’ve learned to work remotely. But other employees suffered in small spaces or with constant interruptions from family. Those folks may long to go back to the office.

On balance, it seems clear that whatever happens, for many companies, we probably aren’t going back whole-cloth to the prior model of commuting into the office five days a week.

Image Credits: PM Images (opens in a new window) / Getty Images

On a recent episode of TechCrunch’s Equity podcast, hosts Natasha Mascarenhas and Alex Wilhelm invited Yext CFO Steve Cakebread and Latch CFO Garth Mitchell on to discuss when companies should go public, the costs and benefits of the process and when a SPAC can make sense. Yext pursued a traditional IPO a few years back; Latch is now going public via a blank-check company combination.

The chat was more than illustrative, as we got to hear two CFOs share their views on delayed public offerings and when different types of debuts can make the most sense. While the TechCrunch crew has, at times, made light of certain SPAC-led deals, the pair argued that the transactions can make good sense.

Undergirding the conversation was Cakebread’s recent IPO-focused book, which not only posited that companies going public earlier rather than later is good for their internal operations but also because it can provide the public with a chance to participate in a company’s success.

In today’s hypercharged private markets and frothy public domain, his argument is worth considering.

Image Credits: John Lund (opens in a new window) / Getty Images

Ken Harlan, the founder and CEO of Mobile Fuse, writes about the perks and pitfalls of software development kits.

“The digital media industry often talks about how much influence, dominance and power entities like Google and Facebook have,” Harlan writes. “Generally, the focus is on the vast troves of data and audience reach these companies tout. However, there’s more beneath the surface that strengthens the grip these companies have on both app developers and publishers alike.

“In reality, SDK integrations are a critical component of why these monolith companies have such a prominent presence.”

Image Credits: Nigel Sussman (opens in a new window)

The Exchange caught up with Appian CEO Matt Calkins after his enterprise app software company reported its first-quarter performance to discuss the low-code market and what he’s hearing in customer meetings. To round out our general thesis — and shore up our somewhat bratty headline — we’ve compiled a list of recent low-code and no-code venture capital rounds, of which there are many.

As we’ll show, the pace at which venture capitalists are putting funds into companies that fall into our two categories is pretty damn rapid, which implies that they are doing well as a cohort. We can infer as much because it has become clear in recent quarters that while today’s private capital market is stupendous for some startups, it’s harder than you’d think for others.

A pair of Bird e-scooters parked in Barcelona. Image Credits: Natasha Lomas/TechCrunch

Historically — and based on what we’re seeing in this fantastical filing — Bird proved to be a simply awful business. Its results from 2019 and 2020 describe a company with a huge cost structure and unprofitable revenue, per filings. After posting negative gross profit in both of the most recent full-year periods, Bird’s initial model appears to have been defeated by the market.

What drove the company’s hugely unprofitable revenues and resulting net losses? Unit economics that were nearly comically destructive.

Image Credits: Bryce Durbin/TechCrunch

Dear Sophie,

My startup is in big-time hiring mode. All of our employees are currently working remotely and will likely continue to do so for the foreseeable future — even after the pandemic ends. We are considering individuals who are living outside of the U.S. for a few of the positions we are looking to fill.

Does it make sense to sponsor them for a visa to work remotely from somewhere in the United States?

— Selective in Silicon Valley

Image Credits: ivan101 / Getty Images

“Today, we live in a world of product-led growth, where engineers (and the software they have built) are the biggest differentiator,” says Coatue Management general partner Caryn Marooney and investor David Cahn. “If your customers love what you’re building, you’re headed in the right direction. If they don’t, you’re not.

“However, even the most successful product-led growth companies will reach a tipping point, because no matter how good their product is, they’ll need to figure out how to expand their customer base and grow from a startup into a $1 billion+ revenue enterprise.

“The answer is the hamburger model. Why call it that? Because the best go-to-market (GTM) strategies for startups are like hamburgers:

Image Credits: belterz (opens in a new window) / Getty Images

Krish Subramanian, the co-founder and CEO of Chargebee, writes that while subscription business models are attractive, there are two major pitfalls: First, payment.

“Regardless of company size, there’s an ongoing need to convince customers to sign up long term,” Subramanian writes. “The second issue: How do businesses cover the funding gap between when customers sign up and when they pay?”

Image Credits: Aimee Blasee (opens in a new window)

Scott Lenet, the president of Touchdown Ventures, asks how deal-makers should think about how to handle themselves when counter-parties attempt to change an agreement. “When is it OK to modify terms, and when should deal-makers stand firm?” he asks.

“Entrepreneurs and investors should recognize that contracts are worth very little without the ongoing relationship management that keeps all parties aligned. Enforcement is so unusual in the world of startups that I consider it a mostly dead-end path. In my experience, good communication is the only reliable remedy. This is the way.”

Image Credits: Ray Massey / Getty Images

“Search engine optimization, PR, paid marketing, emails, social — marketing and communications is crowded with techniques, channels, solutions and acronyms,” writes Dominik Angerer, CEO and co-founder of Storyblok, which provides best practice guidance for startups on how to build a sustainable approach to marketing their content. “It’s little wonder that many startups strapped for time and money find defining and executing a sustainable marketing campaign a daunting prospect.

“The sheer number of options makes it difficult to determine an effective approach, and my view is that this complexity often obscures the obvious answer: A startup’s best marketing asset is its story.”

Powered by WPeMatico

For Bill Staples, the freshly appointed CEO at New Relic, who takes over on July 1, yesterday was a good day. After more than 20 years in the industry, he was given his own company to run. It’s quite an accomplishment, but now the hard work begins.

On the positive side of the equation, New Relic is one of the market leaders in the application performance monitoring space.

Lew Cirne, New Relic’s founder and CEO, who is stepping into the executive chairman role, spent the last several years rebuilding the company’s platform and changing its revenue model, aiming for what he hopes is long-term success.

“All the work we did in re-platforming our data tier and our user interface and the migration to consumption business model, that’s not so we can be a $1 billion New Relic — it’s so we can be a multibillion-dollar New Relic. And we are willing to forgo some short-term opportunity and take some short-term pain in order to set us up for long-term success,” Cirne told TechCrunch after yesterday’s announcement.

On the positive side of the equation, New Relic is one of the market leaders in the application performance monitoring space. Gartner has the company in third place behind Dynatrace and Cisco AppDynamics, and ahead of DataDog. While the Magic Quadrant might not be gospel, it does give you a sense of the relative market positions of each company in a given space.

New Relic competes in the application performance monitoring business, or APM for short. APM enables companies to keep tabs on the health of their applications. That allows them to cut off problems before they happen, or at least figure out why something is broken more quickly. In a world where users can grow frustrated quickly, APM is an important part of the customer experience infrastructure. If your application isn’t working well, customers won’t be happy with the experience and quickly find a rival service to use.

In addition to yesterday’s CEO announcement, New Relic reported earnings. TechCrunch decided to dig into the company’s financials to see just what challenges Staples may face as he moves into the corner office. The resulting picture is one that shows a company doing hard work for a more future-aligned product map and business model, albeit one that may not generate the sort of near-term growth that gives Staples ample breathing room with public investors.

Making long-term bets on a company’s product and business model future can be difficult for Wall Street to swallow in the near term. But such work can garner an incredibly lucrative result; Adobe is a good example of a company that went from license sales to subscription incomes. There are others in the midst of similar transitions, and they often take growth penalties as older revenues are recycled in favor of a new top line.

So when we observe New Relic’s recent result and guidance for the rest of the year, we’re more looking for future signs of life than quick gains.

Starting with the basics, New Relic had a better-than-anticipated quarter. An analysis showed the company’s profit and adjusted profit per share both beat expectations. And the company announced $173 million in total revenue, around $6 million more than the market expected.

So, did its shares rise? Yes, but just 5%, leaving them far under their 52-week high. Why such a modest bump after so strong a report? The company’s guidance, we reckon. Per New Relic, it expects its current quarter to bring 6% to 7% growth compared to the year-ago period. And it anticipates roughly 6% growth for its current fiscal year (its fiscal 2022, which will conclude at the end of calendar Q1 2022).

Powered by WPeMatico

No matter what slice of the mobility market you’ve claimed as your own — AVs, EVs, data mining, AI, dockless scooters, robotics or the batteries that will charge and change the world — you won’t find a better place to showcase your extraordinary tech and talent than TC Sessions: Mobility 2021.

Buy a Startup Exhibitor Package and virtually plant your early-stage mobility startup in front of a global audience that’s focused exclusively on one of the most complex, rapidly evolving industries. TC Sessions: Mobility, which takes place on June 9, features the top minds and makers, draws thousands of attendees, fosters collaborative community and creates a networking environment ripe with opportunities.

Pro tip: This package is for pre-Series A, early-stage startups only.

The Startup Exhibitor Package costs $380, and it comes with four all-access passes to the event. But wait (insert infomercial voice here), there’s more!

Your virtual expo booth features lead-generation capabilities. You can highlight your pitch deck, run a video loop and/or host live demos. Network with CrunchMatch, our AI-powered platform, to find and connect with the people who can help move your business forward. CrunchMatch lets you host private video meetings — pitch investors, recruit new talent or grow your customer base.

You’ll have access to all the presentations, panel discussions and breakout sessions, too. And video-on-demand means you won’t miss out.

Here’s a peek at just some of the agenda’s great programming you and, thanks to those extra passes, your team can attend — or catch later with VOD:

TC Sessions: Mobility 2021 takes place June 9. Buy a Startup Exhibitor Package and set yourself up for global exposure and networking success. Show us your extraordinary tech and talent!

Is your company interested in sponsoring or exhibiting at TC Sessions: Mobility 2021? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico

There’s a lot of noise out there. The ability to effectively communicate can make or break your launch. It will play a role in determining who wins a new space — you or a competitor.

Most people get that. I get emails every week from companies coming out of stealth mode, wanting to make a splash. Or from a Series B company that’s been around for a while and hopes to improve their branding/messaging/positioning so that a new upstart doesn’t eat their lunch.

You have to stop thinking that what you are up to is interesting.

How do you make a splash? How do you stay relevant?

Worth noting is that my area of expertise is in the DevOps space and that slant may crop up occasionally. But these five specific tips should be applicable to virtually any startup.

This is especially important if you are a small startup that not many people know about. Journalists don’t want to hear opinions from your head of marketing or product — they want to hear from the founders. What problems are they solving? What unique opinions do they have about the market? These are insights that mean the most coming from the people that started the company. So if you don’t have at least one founder that can dedicate time to being the face, then PR is going to be an uphill battle.

That doesn’t mean there isn’t plenty to do to support these efforts. Create a list of all the journalists that have written about your competitors. Read those articles. How can your founder add value to these conversations? Where should you be contributing thought leadership? What are the most interesting perspectives you can offer to those audiences?

This is legwork and research you can do before looping founders into the conversation. Getting your PR going can be like trying to push a broken-down car up the road: If the founders see you exerting effort to get things moving on your own, they’re more likely to get beside you and help.

Here’s an example: It may be unreasonable to ask a founder to sit down and write a 1,000-word thought leadership piece by the end of the week, but they very likely have 20 minutes to chat, especially if you make it clear that the contents of the conversation will make for great thought leadership pieces, social media posts, etc.

The flow looks like:

Powered by WPeMatico

When you’re head-down and nose to the grindstone — I’m looking at all you hard-working early-stage startup founders — it’s easy to miss a deadline for an outstanding opportunity. Case in point: competing in Startup Battlefield at TechCrunch Disrupt 2021 in September.

We want every game-changing, innovative startup — from anywhere around the world — to have a shot at massive exposure to investors, media and other influential unicorn-makers. The $100,000 in equity-free prizemoney would be nice, too, right? That’s why we’re extending our application deadline for another full week.

It won’t cost you a thing to apply or to participate, so don’t let this trajectory-changing opportunity slip past you. Apply to Startup Battlefield here before May 27 at 11:59 p.m. (PT).

The TechCrunch editorial team will vet every application and ultimately choose roughly 20 startups to go head-to-head. Each team receives weeks of free, rigorous coaching from our seasoned Battlefield team. Your pitch, presentation skills and business model will reach new heights of excellence. You’ll also be ready to deftly handle all the questions you’ll receive from our expert VC judges.

Startup Battlefield plays out over several rounds, with the field progressively narrowing. Each time you make the cut, you’ll repeat your pitch-and-answer session to a new set of judges. All that training, prep and focus leads to a final showdown and one last grab for the brass ring. And then it’s up to the judges to decide which stand-out startup wins the championship and that huge check.

While only one startup wins the money and the title, every team that competes benefits from standing in a global spotlight. Sean Huang, co-founder of Matidor, competed in Startup Battlefield at Disrupt 2020. His team was one of the five finalists. Here’s what he said about his experience:

“Going through Startup Battlefield helped us simplify and improve our pitch. It helped us not only with brand messaging, but also to win other pitch competitions after Battlefield. By pitching in the finals, we booked a demo with one of the final panelists. We received inbound investment interest from 12 Tier-1 investors, and eight potential key clients came to our website for a demo session. We also received an endorsement letter for our Y Combinator application from a fellow Battlefield participant, with whom we formed a great connection.”

You’re head down and focused — that’s why we’re giving you a one-week extension. So… stop, look up and grab this opportunity to take your startup to whole new levels. Get your nose off that grindstone and apply to Startup Battlefield here before May 27 at 11:59 p.m. (PT).

Is your company interested in sponsoring or exhibiting at Disrupt 2021? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico

Cisco has been busy on the acquisition front this week, and today the company announced it was buying threat assessment platform Kenna Security, the third company it has purchased this week. The two companies did not disclose the purchase price.

With Kenna, Cisco gets a startup that uses machine learning to sort through the massive pile of threat data that comes into a security system on a daily basis and prioritizes the threats most likely to do the most damage. That could be a very useful tool these days when threats abound and it’s not always easy to know where to put your limited security resources. Cisco plans to take that technology and integrate into its SecureX platform.

Gee Rittenhouse, senior vice president and general manager of Cisco’s Security Business Group, wrote in a blog post announcing the deal with Kenna that his company is getting a product that brings together Cisco’s existing threat management capabilities with Kenna’s risk-based vulnerability management skills.

“That is why we are pleased to announce our intent to acquire Kenna Security, Inc., a recognized leader in risk-based vulnerability prioritization with over 14 million assets protected and over 12.7 billion managed vulnerabilities. Using data science and real-world threat intelligence, it has a proven ability to bring data in from a multi-vendor environment and provide a comprehensive view of IT vulnerability risk,” Rittenhouse wrote in the blog post.

The security sphere has been complex for a long time, but with employees moving to work from home because of COVID, it became even more pronounced in the last year. In a world where the threat landscape changes quickly, having a tool that prioritizes what to look at first in its arsenal could be very useful.

Kenna Security CEO Karim Toubba gave a typical executive argument for being acquired: it gives him a much bigger market under Cisco than his company could have built alone.

“Now is our opportunity to change the industry: once the acquisition is complete, we will be one step closer to delivering Kenna’s pioneering Risk-Based Vulnerability Management (RBVM) platform to the more than 7,000 customers using Cisco SecureX today. This single action exponentially increases the impact Kenna’s technology will have on the way the world secures networks, endpoints and infrastructures,” he wrote in the company blog.

The company, which launched in 2010, claims to be the pioneer in the RBVM space. It raised over $98 million on a $320 million post-money valuation, according to PitchBook data. Customers include HSBC, Royal Bank of Canada, Mattel and Quest Diagnostics.

For those customers, the product will cease to be standalone at some point as the companies work together to integrate Kenna technology into the SecureX platform. When that is complete, the standalone customers will have to purchase the Cisco solution to continue using the Kenna tech.

Cisco has had a busy week on the acquisition front. It announced its intent to acquire Sedona Systems on Tuesday, Socio Labs on Wednesday and this announcement today. That’s a lot of activity for any company in a single week. The deal is expected to close in Cisco Q4 FY 2021. Kenna’s 170 employees will be joining the Security Business Group led by Rittenhouse.

Powered by WPeMatico

New media poster child Substack announced today that they’ve added a small community-building consultancy team to its ranks, acquiring the Brooklyn-based startup People & Company.

The small firm has been working with clients to build up their community efforts, and its team will now be tasked with building up some of the newsletter company’s upstart efforts for writers in its network.

In a blog post, Substack co-founder Hamish McKenzie said that the company had previously used the People & Co. team to consult on their fellowship and mentorship programs and that members of the team would now be working on a variety of new efforts, from scaling programs to help writers with legal support and health insurance to community-guided projects like workshops and meetups to help crowdsource insights.

“These people are the best in the world at what they do, and now they’re not only working for Substack, but they’re also working for you,” McKenzie wrote.

Beyond Substack, previous partners with People & Company include Porsche AG, Nike and Surfrider.

Substack has been blazing ahead in recent months, adding new partners and raising cash as it aims to bring on more and more subscribers to its network. The firm shared back in late March that it had raised a $65 million round at a reported valuation around $650 million, according to earlier reporting by Axios.

Powered by WPeMatico