TC

Auto Added by WPeMatico

Auto Added by WPeMatico

The American Midwest has a long history of making stuff. During the 20th century, it was the manufacturing center for the nation, and indeed much of the world. It’s still where a surpassing majority of agricultural commodities are grown and processed. But is it also a major producer of technology startups? Maybe not as much as the coasts, but the Midwest’s bustling metropoli and vast expanses of rural land prove to be fertile ground for quite a bit of startup activity.

And that’s what we’re going to take a look at here. In a similar vein to our recent analysis of startup fundraising in the South, we’ll break down the region into its constituent parts, assessing deal and dollar volume trends in the Midwest’s two primary sub-regions, some of its individual states and the most active metropolitan areas in the U.S.’s midsection.

And, to be clear, this is not Crunchbase News’s first foray into the region. We’ve covered the region’s seed-stage interest in AI and hard tech, a few notable rounds and have always included the Midwest in all manner of data-spelunking expeditions. And to this, we’ll add a deep dive into the numbers.

Borders and boundaries are a deep well of disputes. To preempt debate, we use the U.S. Census Bureau’s definition of the Midwest region which, unlike its definition of the South, shouldn’t be too controversial. If you have something against Kansas or Ohio being included in this group, take it up with the Feds.

The good folks at the Census Bureau split the Midwest into two distinct — and rather unimaginatively named — sub-regions: the West North Central and East North Central states, which are separated by the Mississippi River. We’ve included the map below.

By splitting the Midwest into two distinct parts, we’ll be able to see where most of the startup and funding activity is concentrated. Spoiler alert: The farther west you go, the startup population (and the population itself) grows more scattered.

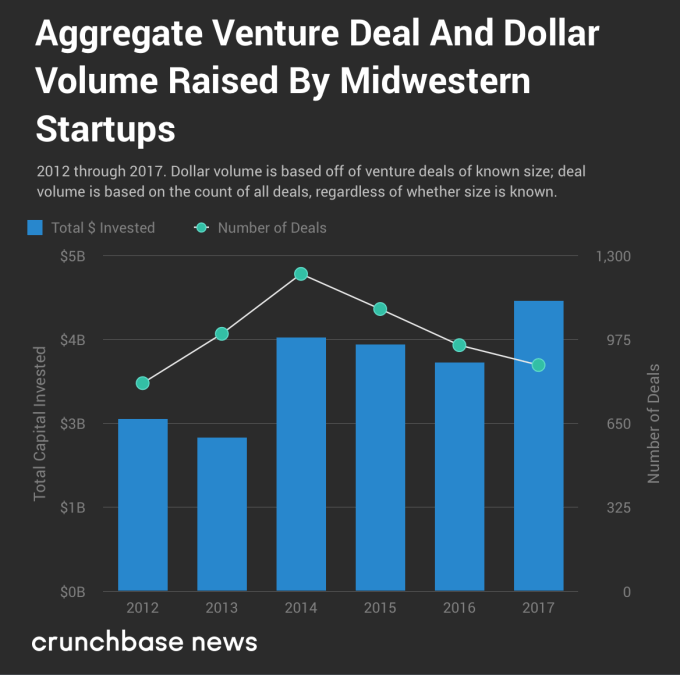

Based only on reported data in Crunchbase, the Midwest appears to be affected by the same phenomenon as the rest of the country. Crunchbase News has previously found that the number of seed and early-stage deals has gone off a cliff in the U.S., resulting in a top-heavy market featuring many large, late-stage deals. And this wouldn’t be a problem if it weren’t for a shortfall in new startups to fill the next cycle of early-stage funding. The “hollowing out” of the Midwestern venture deal pipeline becomes readily apparent when you look at funding data for the past several years, which you can find in the chart below.

To wit, deal volume is down markedly since 2014, as Crunchbase News reported in its Q4 2017 report of startup funding activity in the U.S. and Canada. But somewhat counterintuitively, the amount of money being invested into startups is on the rise in the Midwest and throughout many other parts of the country, reaching fresh multi-year highs in 2017. Almost one full quarter into 2018, the trend appears to continue unabated.

But this chart abstracts away a lot of nuance, so let’s take a closer look at the region and its states.

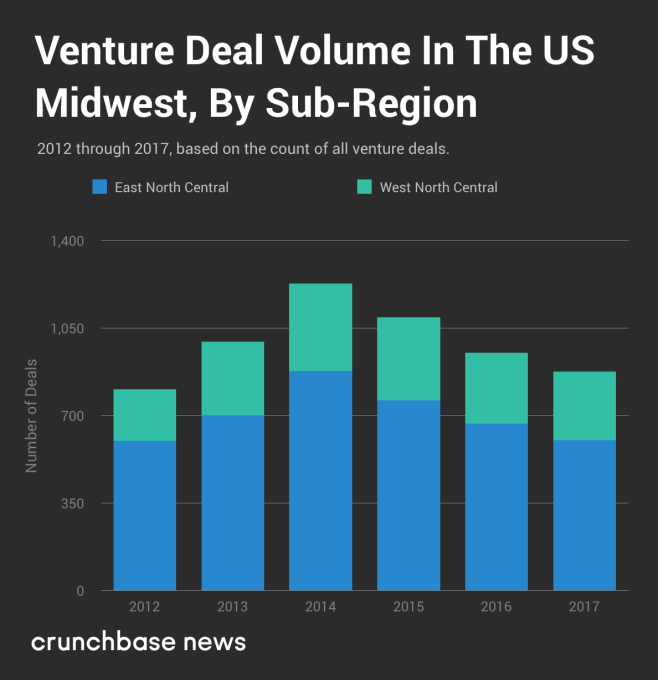

We’ll start first with deal volume, because that’s a fairly decent indicator of a geographic region’s level of startup activity. Below, we’ve plotted venture deal volume, divided by sub-region.

Again, based on the reported data from Crunchbase, we found that deal counts have been on a downward trend for several years. And though some of this may be attributable to reporting delays, projected deal volume data for the whole of the U.S. and Canada (fourth chart down in the Q4 quarterly report) shows a years’-long downtrend. There’s no reason to believe that startup activity in the Midwest is materially different from the rest of the U.S. and Canada.

But what about the relative “balance of power” between the two sub-regions? At least when it comes to deal volume, has one sub-region waxed while the other waned? To a limited extent, the answer is yes. Between 2012 and 2017, the percentage share of all Midwestern dealflow going to West North Central states like the Dakotas, Minnesota and Missouri has grown from 25.4 percent to 31.2 percent, up by nearly one-fifth in relative terms.

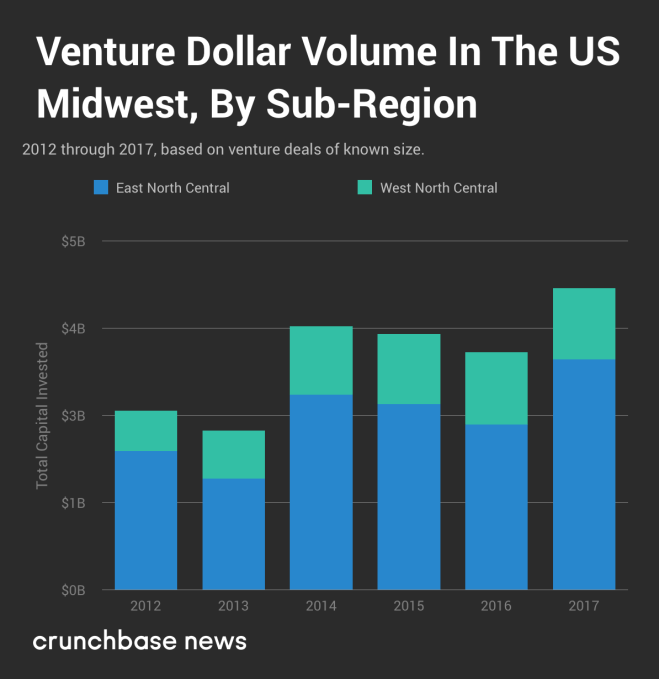

Now let’s check out dollar volume. The chart below displays aggregate reported venture capital dollar volume raised by startups in the Midwest.

As far as the amount of money Midwestern startups have raised over time, the trendline is generally up and to the right. But that’s not the only way this differs from the deal volume data we looked at earlier. For dollar volume, there appears to be no appreciable change in the “balance of power” between the two sub-regions since 2012. Depending on the year, East North Central states like Illinois, Michigan and Ohio raked in between 70 and 78 percent of total dollar volume, but that variance doesn’t appear in an orderly trend.

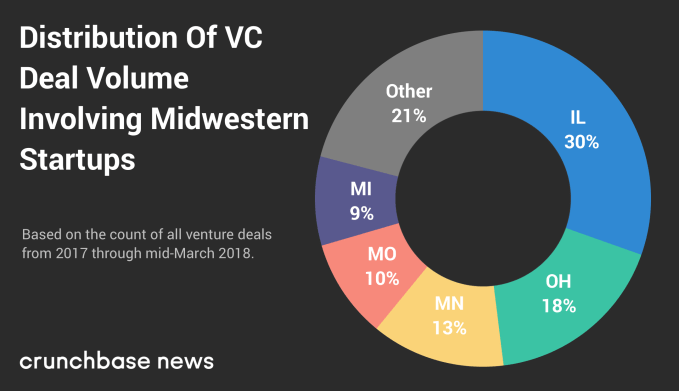

We started first at the regional level, then compared smaller groupings of states. Now, let’s see how deal and dollar volume is distributed on a state-by-state level. Doing so will point to the states that lead the region in venture-backed startup activity. Below, you’ll find a chart of how deal volume is split between the top five Midwestern states.

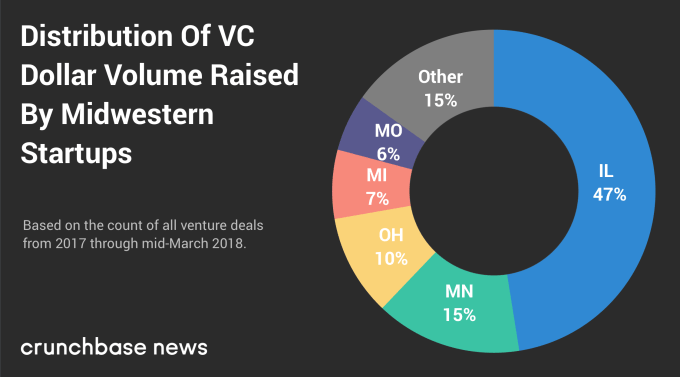

And here is how dollar volume is distributed.

As we saw with our analysis of the South, the top five Midwestern states for deal volume are the same five top-ranked states for dollar volume. But there is some notable variation in how these states rank among each other and the amount of deal and dollar volume they account for.

Considering that Illinois is home to Chicago and a number of downstate universities with deep tech startup roots, the fact that it places first for both metrics shouldn’t come as much of a surprise.

What might be more of a head-scratcher is Minnesota, which ranks third in deal volume but second in dollar volume. Why does it switch places with Ohio? The answer could lie in the industrial mix which, in the case of Minnesota, includes a disproportionately high number of medical device and other life sciences companies, which typically take a lot of capital to get off the ground.

Longtime readers of Crunchbase News may remember a ranking of Midwestern startup cities we wrote back in August 2017. However, here we’re just focusing on deal and dollar volume over the past 15 months, since the start of 2017.

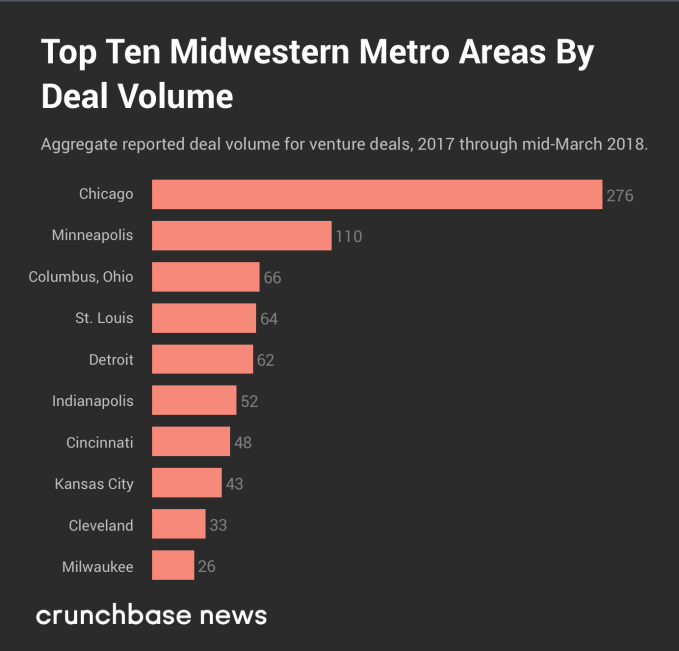

Let’s start first with the top 10 Midwestern cities as measured by number of startup funding rounds.

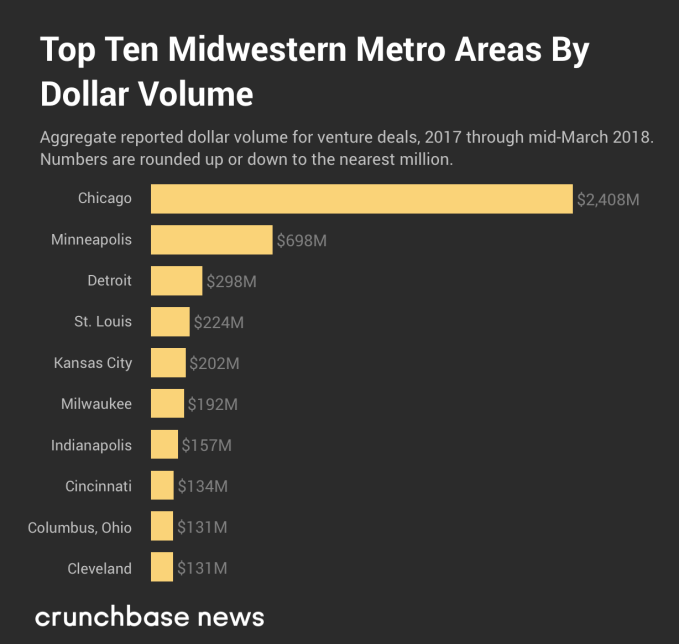

And in the chart below, you can see the top cities, as ranked by venture dollar volume, from the same period of time.

In both rankings, four of the top five cities are the same, but the odd one out appears to be Columbus, Ohio. Although there were a fairly large number of rounds raised by startups in that metro area, most of the rounds were fairly small by national standards. And one of the main reasons why Kansas City, Missouri jumped so much in the dollar volume rankings was a $100 million Series F round raised by C2FO.

But, again, as far as the Midwest goes, everything pales in comparison to Chicago alone.

For many, the Midwest is in a kind of Goldilocks zone. The East and West coasts seem to hold more or less equal sway over the culture and economy and most of its cities are neither too big nor too small. The only extreme it seems to occupy is its winter weather.

Powered by WPeMatico

Facebook chief Mark Zuckerberg has taken out a full page ad in the Washington Post, the New York Times, the Wall Street Journal and six UK papers today to apologize Cambridge Analytica scandal, according to CNN’s Brian Stelter.

The ad starts in bold letters, saying:

“We have a responsibility to protect your information. If we can’t, we don’t deserve it.”

Facebook took out full page ads in the NYT, WSJ, WashPost, and 6 UK papers today https://t.co/kMA822kTpU pic.twitter.com/CUEYwyWuTT

— Brian Stelter (@brianstelter) March 25, 2018

The ad was published on Sunday, following Zuck’s first public acknowledgement of the issue on Facebook and a subsequent media tour earlier this week.

Congress has also put Mark Zuckerberg on notice to potentially come speak with them, with Senator Kennedy of Louisiana encouraging Zuck to “do the common sense thing and roll up his sleeves and take a meaningful amount of time talking to [them].”

For those of you still unsure what’s going on with Facebook and Cambridge Analytica, you can see a full play-by-play here.

Here’s the full transcript from the print ad:

We have a responsibility to protect your information. If we can’t, we don’t deserve it.

You may have heard about a quiz app built by a university researcher that leaked Facebook data of millions of people in 2014. This was a breach of trust, and I’m sorry we didn’t do more at the time. We’re now taking steps to make sure this doesn’t happen again.

We’ve already stopped apps like this from getting so much information. Now we’re limiting the data apps get when you sign in using Facebook.

We’re also investigating every single app that had access to large amounts of data before we fixed this. We expect there are others. And when we find them, we will ban them and tell everyone affected.

Finally, we’ll remind you of which apps you’ve given access to your information — so you can shut off the ones you don’t want anymore.

Thank you for believing in this community. I promise to do better for you.

Mark Zuckerberg

Powered by WPeMatico

Hip hop stars are taking their reputations to Wall Street and Sand Hill road.

Unlike their rock star brethren, who’ve historically been disinterested in dabbling with startups, quite a few hip hop artists have amassed good-sized portfolios. They’ve seen a few big hits too, most recently including a massive up round for zero-commission stock trading platform Robinhood, which counted Jay-Z, Nas and Snoop Dogg among its earlier backers.

But just how deep does the hip hop-startup relationship go and where is it headed? To shed some light on that question, we put together a review of Crunchbase data on the startup investment activity of famous musicians. We looked at both hip hop and pop stars, culling a list of 21 artists who are either active investors or have joined one or more rounds in recent years.

The general conclusion: Artists are doing more deals, raising more funds and backing more companies that graduate to up rounds and exits. Here are a few examples:

That’s not to say everything a star touches turns multi-platinum. We found quite a few flops in their portfolios and assembled a list here of 10 startups now shuttered that counted a hip hop or pop star among their backers.

Becoming and remaining famous requires many of the same skills and qualities as running an entrepreneurial venture, including an exceptional degree of tenacity.

Of course, flops are part of life for early-stage investors, so there’s no reason we’d expect celebrities to be an exception. Moreover, most of the now-shuttered companies were not heavily capitalized by venture standards.

However, there are some higher-profile or more heavily funded companies on the flop list. One is Washio, a laundry delivery service, which raised $17 million from Nas and 20 other investors before hanging itself out to dry in 2016. Another is Viddy, an app for shooting and sharing video clips backed by Roc Nation.

A number of venture pundits and pop culture mavens have previously pontificated why celebrities, and hip hop stars in particular, are drawn to startups.

One possibility is that rap music and startups resemble each other at the earliest stages, postulates Cam Houser, CEO of the 3 Day Startup Program. Rap music starts with a rapper and a producer. This duality, he says, is similar to the beginning stages of a startup, which commonly also brings together two people, a business and a technical co-founder.

Rap and startup entrepreneurship are also both longshot career tracks that celebrate raw ambition and unabashed self-promotion. To make it, however, both require an excellent grasp of what sells in the real world.

Branding is perhaps the most common rationale provided for the celebrity-startup connection. With their massive fan bases, swooning coverage and millions of social media followers, celebrities can certainly help get the word out about a new product or app. That said, the attention usually works only if said product also has compelling attributes of its own.

One of the less controversial explanations is that becoming and remaining famous requires many of the same skills and qualities as running an entrepreneurial venture, including an exceptional degree of tenacity.

It’s also true that in venture capital and the music business, it’s the hits that matter. It helps that we’re seeing plenty of those.

Powered by WPeMatico

Dropbox went public this morning to great fanfare, with the stock shooting up more than 40% in the initial moments of trading as the enterprise-slash-consumer company looked to convince investors that it could be a viable publicly-traded company.

And for one that Steve Jobs famously called a feature, and not a company, it certainly was an uphill battle to convince the world that it was worth even the $10 billion its last private financing round set. It’s now worth more than that, but that follows a long series of events, including an increased focus on enterprise customers and finding ways to make its business more efficient — like installing their own infrastructure. Dropbox CEO Drew Houston acknowledged a lot of this, as well as the fact that it’s going to continue to face the challenge of ensuring that its users and enterprises will trust Dropbox with some of their most sensitive files.

We spoke with Houston on the day of the IPO to talk a little bit about what it took to get here during the road show and even prior. Here’s a lightly-edited transcript of the conversation:

TC: In light of the problems that Facebook has had surrounding user data and user trust, how has that changed how you think about security and privacy as a priority?

DH: Our business is built on our customers’ trust. Whether we’re private or public, that’s super important to us. I think, to our customers, whether we’re private or public doesn’t change their view. I wouldn’t say that our philosophy changes as we get to bigger and bigger scale. As you can imagine we make big investments here. We have an awesome security team, our first cultural principle is be worthy of trust. This is existential for us.

TC: How’s the vibe now that longtime employees are going to have an opportunity to get rewarded for their work now that you’re a public company?

DH: I think everyone’s just really excited. This is the culmination of a lot of hard work by a lot of people. We’re really proud of the business we’ve built. I mean, building a great company or doing anything important takes time.

TC: Was there something that changed that convinced you to go public after more than a decade of going private, and how do you feel about the pop?

DH: We felt that we were ready. Our business was in great shape. We had a good balance of scale and profitability and growth. As a private company, there are a lot of reasons why it’s been easier to stay private for longer. We’re all proud of the business we’ve built. We see the numbers. We think we’re on to not just a great business, but pioneering a whole new model. We’re taking the best of our consumer roots, combining them with the best parts of software as a service, and it was really gratifying to see investors be excited about it and for the rest of the world to catch on.

TC: As you were on your road show, what were some of the big questions investors were asking?

DH: We don’t fit neatly into any one mold. We’re not a consumer company, and we’re not a traditional enterprise company. We’re basically taking that consumer internet playbook and applying it to business software, combining the virality and scale. Over the last couple years, as we’ve been building that engine, investors are starting to understand that we don’t fit into a traditional mold. The numbers speak to themselves, they can appreciate the unusual combination.

TC: What did you tell them to convince them?

DH: We’re just able to get adoption. Just the fact that we have hundreds of millions of users and we’ve found Dropbox is adopted in millions of companies [was enough evidence]. More than 300,000 of those users are Dropbox Business companies. We spend about half on sales of marketing as a percentage of revenue of a typical software as a service company. Efficiency and scale are the distinctive elements, and investors zero in on that. To be able to acquire customers at that scale and also really efficiently, that’s what makes us stand out. They’ve seen Atlassian be successful with self-serve products, but you can layer on top of that leveraging our freemium and viral elements and our focus on design and building great products.

TC: How do you think about deploying the capital you’ve picked up from the IPO?

DH: So, we’re public because they wanted us to be a public company. But our approach is still the same. First, it’s about getting the best talent in the building and making sure we build the best products, and if you do those things, make sure customers are happy, that’s what works.

TC: What about recruiting?

DH: It’s a big day for dropbox. We’re all really excited about it and hopefully a lot of other people are too.

TC: When you look at your customer acquisition ramp, what does that look like?

DH: I mean, we’ve been making a lot of progress in the past couple of years if you look at growth in subscribers. That will continue. We look at numbers, we have 11 million subscribers, 80% use dropbox for work. But at the same time, we look at the world, there’s 1 billion knowledge workers and growing. We’re not gonna run out of people who need Dropbox.

TC: What about convincing investors about the consumer part of the business? How did you do that?

DH: I think, when you explain that our consumer and cloud storage roots have really become a way for us to efficiently acquire business customers at scale, that helps them understand. Second, it’s easy to focus on how in the consumer realm that the business has been commoditized. There’s all this free space and all this competition. On the other hand, we’ve never lowered prices, we’ve never even given more free space, we know that what our customers really value is the sharing and collaboration, not just the storage. It’s been good to move investors beyond the 2010 understanding of our business.

TC: How did creating your own infrastructure play into your readiness to go public?

DH: When I say that today is the culmination of a lot of events, that’s a great example. We made a many-year investment to migrate off the public cloud. Certainly that was one of the more eye-popping investors watching our gross margins literally double over the last couple of years from burning cash to being cash flow positive. We’ll continue reaching larger and larger scale, and those investments will.

TC: Getting a new guitar any time soon?

DH: I probably should.

Powered by WPeMatico

Dropbox made its public debut today, with the stock soaring nearly 40% on its first day of trading — meaning the company will now be beholden to the same shareholders that sent the company’s valuation well north of $10 billion.

As a file-sharing and collaboration service, Dropbox’s first principle is going to be user trust, CEO Drew Houston told TechCrunch after the company made its debut. This comes amid a tidal wave of information throughout the week indicating that data on 50 million Facebook users ended up in the hands of Cambridge Analytica several years ago through access gained via an app that was on the Facebook platform. While not a direct breach in the core sense of the word, the leaked data was a considerable breach of trust among Facebook’s users — and as Dropbox looks to crack into the enterprise and also continue to win over consumers, it’ll likely continue to have to increasingly emphasize security and privacy going forward.

“Our business is built on our customers’ trust,” Houston said, asked of its security. “Whether we’re private or public, that’s super important to us. I think, to our customers, whether we’re private or public doesn’t change their view. I wouldn’t say that our philosophy changes as we get to bigger and bigger scale. As you can imagine we make big investments here. We have an awesome security team, our first cultural principle is be worthy of trust. This is existential for us.”

Houston, and Dropbox, aren’t unfamiliar with some of the challenges that come into securing a service that has more than 500 million registered users. Dropbox in 2016 disclosed that it discovered a chunk of user credentials obtained in 2012 had been circulating on the Internet after an employee’s password was acquired and used to access user information. Dropbox, clearly, has recovered from that stumble and has pulled off a successful IPO, but it does underscore the challenges of not only maintaining security, but also user trust and political capital to actually get the business going.

In the end, that may come down to the trust of individual users. A large portion of Dropbox’s 11 million paying customers are, or started off as, the typical consumer. Dropbox’s playbook is a familiar one, first getting consumer adoption and using that to slowly creep into teams that use the tool because it’s easier than existing ones. Those teams adopt it, leading to further adoption, to the point that Dropbox in theory locks in a customer without having to pick up those direct partnerships or spend a ton of money on marketing. Should it stumble at step one, it would have a much steeper ramp to start acquiring the kind of enterprise companies that will help it build a much more robust business.

“We have this set of stated values in the company, and the number one value is literally, be worthy of trust,” Dropbox SVP of engineering, product, and design Quentin Clark said. I have observed and experienced that the protection of our users is very deeply woven in to the DNA of our company. This is why we encrypt the data at rest, in transit, and it’s why our user experience is designed to keep people down the path of keeping things secure by default. You see it in the tools we give admins and the events they look through. We’re very deeply committed to their privacy and security. We’ve never sold data, it’s not in our business model, it’s about the value people get in software.”

While Dropbox at its heart was born as a consumer company — and there are, indeed, hundreds of millions of consumers — it’s also morphed over time into one with an arm looking to crack big businesses. And now that it’s a public company, it will have more intense oversight from public investors who will be scrutinizing its every move and calibrating its valuation as a result of those moves. Dropbox, too, is moving onto its own infrastructure in order to improve its margins and show it can be an operationally efficient business. All this means that, if it’s going to be a successful company, it has to ensure the kinds of snafus like Cambridge Analytica, which sent Facebook’s stock off a cliff, don’t happen.

Powered by WPeMatico

The swipe is where the similarity ends. Raya is less like Tinder and more like a secret society. You need a member’s recommendations or a lot of friends inside to join, and you have to apply with an essay question. It costs a flat $7.99 for everyone, women and celebrities included. You show yourself off with a video slideshow set to music of your choice. And it’s for professional networking as well as dating, with parallel profiles for each.

Launched in March 2015, Raya has purposefully flown under the radar. No interviews. Little info about the founders. Not even a profile on Crunchbase’s startup index. In fact, in late 2016 it quietly acquired video messaging startup Chime, led by early Facebooker Jared Morgenstern, without anyone noticing. He’d become Raya’s first investor a year earlier. But Chime was fizzling out after raising $1.2 million. “I learned that not everyone who leaves Facebook, their next thing turns to gold,” Morgenstern laughs. So he sold it to Raya for equity and brought four of his employees to build new experiences for the app.

Now the startup’s COO, Morgenstern has agreed to give TechCrunch the deepest look yet at Raya, where the pretty, popular and powerful meet each other.

Raya COO Jared Morgenstern

“Raya is a utility for introducing you to people who can change your life. Soho House uses physical space, we’re trying to use software,” says Morgenstern, referencing the global network of members-only venues.

We’re chatting in a coffee shop in San Francisco. It’s an odd place to discuss Raya, given the company has largely shunned Silicon Valley in favor of building a less nerdy community in LA, New York, London and Paris. The exclusivity might feel discriminatory for some, even if you’re chosen based on your connections rather than your wealth or race. Though people already self-segregate based on where they go to socialize. You could argue Raya just does the same digitally.

Morgenstern refuses to tell me how much Raya has raised, how it started or anything about its founding team beyond that they’re a “Humble, focused group that prefers not to be part of the story.” But he did reveal some of the core tenets that have reportedly attracted celebrities like DJs Diplo and Skrillex, actors Elijah Wood and Amy Schumer and musicians Demi Lovato and John Mayer, plus scores of Instagram models and tattooed creative directors.

R aya’s iOS-only app isn’t a swiping game for fun and personal validation. Its interface and curated community are designed to get you from discovering someone to texting if you’re both interested to actually meeting in person as soon as possible. Like at a top-tier university or night club, there’s supposed to be an in-group sense of camaraderie that makes people more open to each other.

aya’s iOS-only app isn’t a swiping game for fun and personal validation. Its interface and curated community are designed to get you from discovering someone to texting if you’re both interested to actually meeting in person as soon as possible. Like at a top-tier university or night club, there’s supposed to be an in-group sense of camaraderie that makes people more open to each other.

Then there are the rules.

“This is an intimate community with zero-tolerance for disrespect or mean-spirited behavior. Be nice to each other. Say hello like adults,” says an interstitial screen that blocks use until you confirm you understand and agree every time you open the app. That means no sleazy pick-up lines or objectifying language. You’re also not allowed to screenshot, and you’ll be chastized with a numbered and filed warning if you do.

It all makes Raya feel consequential. You’re not swiping through infinite anybodies and sorting through reams of annoying messages. People act right because they don’t want to lose access. Raya recreates the feel of dating or networking in a small town, where your reputation follows you. And that sense of trust has opened a big opportunity where competitors like Tinder or LinkedIn can’t follow.

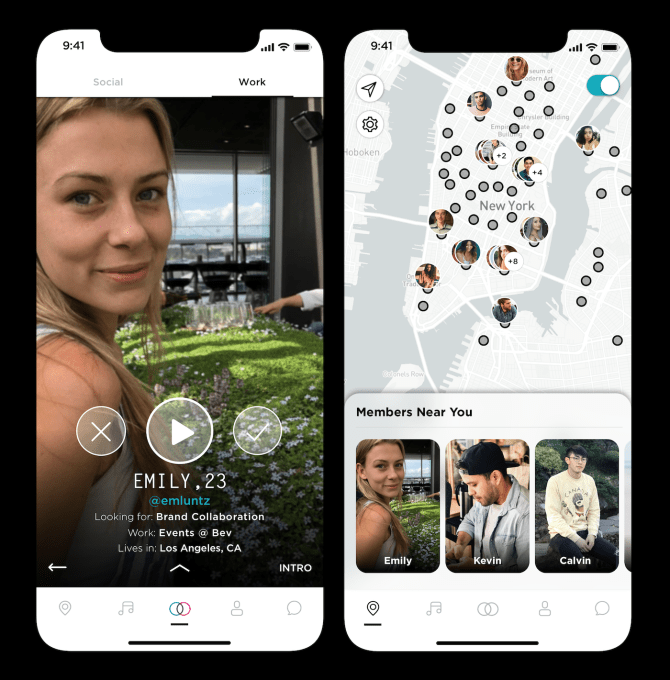

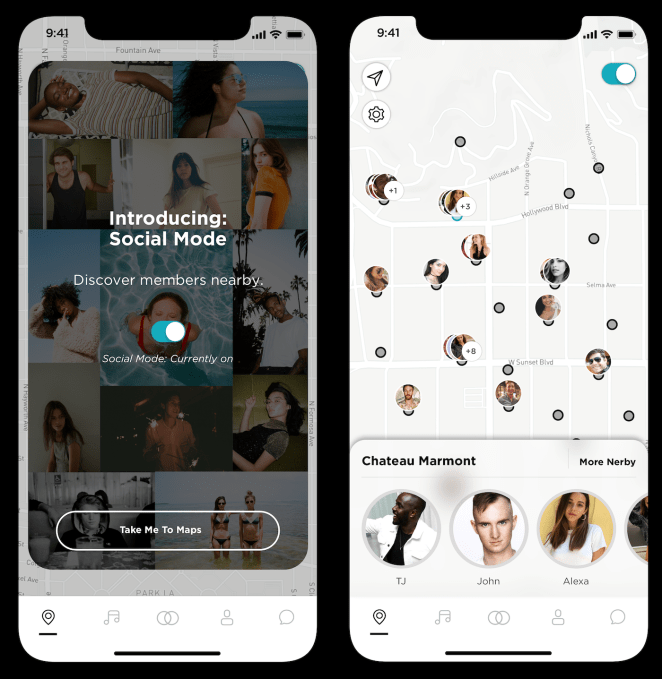

Until now, Raya showed you people in your city as well as around the world — which is a bit weird since it would be hard to ever run into each other. But to achieve its mission of getting you offline to meet people in-person, it’s now letting you see nearby people on a map when GPS says they’re at hot spots like bars, dance halls and cafes. The idea is that if you both swipe right, you could skip the texting and just walk up to each other.

“I’m not sure why Tinder and the other big meeting-people apps aren’t doing this,” says Morgenstern. But the answer seems obvious. It would be creepy on a big public dating app. Even other exclusive dating apps like The League that induct people due to their resume more than their personality might feel too unsavory for a map, since having gone to an Ivy League college doesn’t mean you’re not a jerk. Hell, it might make that more likely.

But this startup is betting that its vetted, interconnected, “cool” community will be excited to pick fellow Raya members out of the crowd to see if they have a spark or business synergy.

That brings Raya closer to the Holy Grail of networking apps where you can discover who you’re compatible with in the same room without risking the crash-and-burn failed come-ons. You can filter by age and gender when browsing social connections, or by “Entertainment & Culture,” “Art & Design,” and “Business & Tech” buckets for work. And through their bio and extended slideshows of photos set to their favorite song, you get a better understanding of someone than from just a few profile pics on other apps.

Users can always report people they’ve connected with if they act sketchy, though with the new map feature I was dismayed to learn they can’t yet report people they haven’t seen or rejected in the app. That could lower the consequences for finding someone you want to meet, learning a bit about them, but then approaching without prior consent. However, Morgenstern insists, “The real risk is the density challenge.”

Raya’s map doesn’t help much if there are no other members for 100 miles. The company doesn’t restrict the app to certain cities, or schools like Facebook originally did to beat the density problem. Instead, it relies on the fact that if you’re in the middle of nowhere you probably don’t have friends on it to pull you in. Still, that makes it tough for Raya to break into new locales.

But the beauty of the business is that since all users pay $7.99 per month, it doesn’t need that many to earn plenty of money. And at less than the price of a cocktail, the subscription deters trolls without being unaffordable. Morgenstern says, “The most common reason to stop your subscription: I found somebody.” That “success = churn” equation drags on most dating apps. Since Raya has professional networking as well, though, he says some people still continue the subscription even after they find their sweetheart.

“I’m happily in a relationship and I’m excited to use maps,” Morgenstern declares. In that sense, Raya wants to expand those moments in life when you’re eager and open to meet people, like the first days of college. “At Raya we don’t think that’s something that should only happen when you’re single or when you’re 20 or when you move to a new city.”

The bottomless pits of Tinder and LinkedIn can make meeting people online feel haphazard to the point of exhaustion. We’re tribal creatures who haven’t evolved ways to deal with the decision paralysis and the anxiety caused by the paradox of choice. When there’s infinite people to choose from, we freeze up, or always wonder if the next one would have been better than the one we picked. Maybe we need Raya-like apps for all sorts of different subcultures beyond the hipsters that dominate its community, as I wrote in my 2015 piece, “Rise Of The Micro-Tinders”. But if Raya’s price and exclusivity lets people be both vulnerable and accountable, it could forge a more civil way to make a connection.

Powered by WPeMatico

Tapas Media has its own platform for digital comics — but like a lot of publishers, CEO Chang Kim has ambitions beyond the comics world.

Comixology is the big name in digital comics. The company, which was acquired by Amazon in 2014, is focused on selling print comics from major publishers in web- and mobile-friendly formats. (It’s also working with publishers like Marvel to create exclusively digital content.)

That’s a very different approach from Tapas, which Kim compared to YouTube — it allows individual creators to publish their work and (hopefully) reach an audience. And unlike the superhero-dominated world of American comics, the most popular titles on Tapas seem to be more romance and fantasy themed, and are usually drawn in a style that’s closer to Japanese manga.

Tapas was founded in 2013, and it now says the platform has more than 32,000 creators who have created more than 48,000 titles. And it’s reaching an audience of 2.1 million monthly visitors.

The comics themselves are monetized through micropayments. Usually, the first few chapters of a title are free, then you have to pay to keep going.

Chang said his team is also working with some of the most popular creators on the platform to develop new intellectual property, which could be translated into movies or TV or other media. Eventually, he said he’s hoping that Tapas could launch the next Harry Potter.

That level of success is a long way off, but Tapas is already exploring ways to adapt its IP. For example, it’s announcing a partnership with Red Kraken Apps to develop a mobile puzzle game based on its Dungeon Construction Co. comic.

In addition, the company has partnered with Hachette Book Group and Ten Speed Press on titles, and it’s signed distribution deals with Tencent and Kakao.

Tapas announced earlier this month that it has raised $5 million in additional Series A funding. (The company has raised $10.8 million total.) Now it’s revealing more details about the round, which comes from ID Ventures, SBI Investment Korea, Medici Investment and EN Investment. Sean Park of ID Ventures is joining the board of directors.

“ID Ventures invested in Tapas Media because we believe in the impact their platform has on the digital and mobile publishing industries,” Park said in a statement. “Their remarkable extension into licensed content and co-development will see their continued dominance, as ID Ventures’ investment looks to help Tapas Media capitalize on their platform’s adoption and innovation as well.”

Powered by WPeMatico

Despite being a necessity for life, clean, drinkable water can be extremely hard to come by in some places where war has destroyed infrastructure or climate change has dried up rivers and aquifers. The Water Abundance XPRIZE is up for grabs to teams that can suck fresh water straight out of the air, and it just announced its five finalists.

The requirements for the program are steep enough to sound almost like science fiction: the device must extract “a minimum of 2,000 liters of water per day from the atmosphere using 100 percent renewable energy, at a cost of no more than 2 cents per liter.” Is that even possible?!

For a million bucks, people will try anything. But only five teams have made it to the finals, taking equal shares of a $250,000 “milestone prize” to further their work. There isn’t a lot of technical info on them yet, but here they are, in alphabetical order:

Hydro Harvest: This Australian team based out of the University of Newcastle is “going back to basics,” probably smart if you want to keep costs down. The team has worked together before on an emission-free engine that turns waste heat into electricity.

Hydro Harvest: This Australian team based out of the University of Newcastle is “going back to basics,” probably smart if you want to keep costs down. The team has worked together before on an emission-free engine that turns waste heat into electricity.

JMCC Wing: This Hawaiian team’s leader has been working on solar and wind power for many years, so it’s no surprise their solution involves the “marriage” of a super-high-efficiency, scalable wind energy harvester with a commercial water condenser. The bigger the generator, the cheaper the energy.

JMCC Wing: This Hawaiian team’s leader has been working on solar and wind power for many years, so it’s no surprise their solution involves the “marriage” of a super-high-efficiency, scalable wind energy harvester with a commercial water condenser. The bigger the generator, the cheaper the energy.

Skydra: Very little information is available for this Chicago team, except that they have created “a hybrid solution that utilizes both natural and engineered systems.”

The Veragon & Thinair: Alphabetically this collaboration comes on both sides of U, but I’m putting it here. U.K. collaboration has developed a material that “rapidly enhances the process of water condensation,” and are planning not only to produce fresh water but also to pack it with minerals.

The Veragon & Thinair: Alphabetically this collaboration comes on both sides of U, but I’m putting it here. U.K. collaboration has developed a material that “rapidly enhances the process of water condensation,” and are planning not only to produce fresh water but also to pack it with minerals.

Uravu: Out of Hyderabad in India, this team is also going back to basics with a solar-powered solution that doesn’t appear to actually use solar cells — the rays of the sun and design of the device do it all. The water probably comes out pretty warm, though.

Uravu: Out of Hyderabad in India, this team is also going back to basics with a solar-powered solution that doesn’t appear to actually use solar cells — the rays of the sun and design of the device do it all. The water probably comes out pretty warm, though.

The first round of testing took place in January, and round 2 comes in July, at which point the teams’ business plans are also due. In August there should be an announcement of the $1 million grand prize winner. Good luck to all involved and regardless of who takes home the prize, here’s hoping this tech gets deployed to good purpose where it’s needed.

Powered by WPeMatico

Instagram isn’t quite bringing back the chronological feed, but it will show more new posts and stop suddenly bumping you to the top of the feed while you’re scrolling. “With these changes, your feed will feel more fresh, and you won’t miss the moments you care about” Instagram writes. It should be more coherent to browse the app now that you won’t lose your place because your feed randomly refreshes, and there shouldn’t be as many disparate time stamps to juggle. Instead, you’ll be able to manually push a “New Posts” button when you want to refresh the feed.

Instagram switched from a reverse chronological feed to a relevancy-sorted feed in June 2016, leading to lots of grumbling from hardcore users. While it made sure you wouldn’t miss the most popular posts from your close friends, showing days-old posts made Instagram feel stale.

And for certain types of professional content creators and merchants, cutting their less likeable posts out of the feed — like their calls to buy their products or follow their other social accounts — was detrimental to their business. Instagram and Facebook moved to hide these posts over time because they can feel spammy.

“Based on your feedback, we’re also making changes to ensure that newer posts are more likely to appear first in feed” the company writes. Instagram’s VP of product Kevin Weil’s tweet indicates Instagram really is listening to all the complaints about the algorithmic feed:

We’re working every day to improve your Instagram feed—with your feedback top of mind! We want to start talking more about what we’re changing and why. Today is our first step, focused on making the feed fresher, with newer posts closer to the top. https://t.co/EqoBiszIde

— Kevin Weil (@kevinweil) March 22, 2018

Interestingly, despite all the anger about Facebook’s Cambridge Analytica scandal and the #DeleteFacebook movement, we haven’t seen nearly as many calls to #DeleteInstagram. In fact, the #DeleteFacebook trend seems to overlook the corporate parent company that owns Instagram, WhatsApp, and Oculus. Instead it focuses on just Facebook’s app, indicating that the scandal blowback might not be as much of an existential crisis.

If anything, the shift to the algorithmic feed caused much more of an uproar than any political issue or privacy scandal. While Facebook has become a core utility by bringing your real world identity to the Internet, Instagram is the pleasurable escape from that real world. And people get a lot more angry when you mess with their behavior patterns than when you highlight some abstract threat like misused personal data.

Powered by WPeMatico

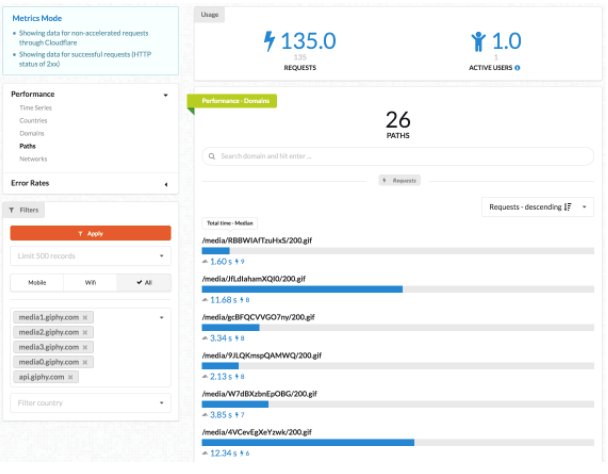

When Cloudflare acquired Neumob, a mobile performance startup last fall, it was a sign that the company wanted to move beyond web performance into helping mobile app developers understand what’s happening at the network level. Today, the company introduced Cloudflare Mobile SDK, a free tool which could help developers understand network-level performance problems.

Cloudflare’s co-founder and CEO Matthew Prince says developers have had tools at their disposal to understand why apps crash on the device itself, but they have lacked visibility into the network, which can be a major contributor to app instability.

Developers access the monitoring capability by adding a couple of lines of code to their iOS or Android apps. After that, they can log into a web console to see network performance metrics. The tool is designed to surface problems like dropping packets because of a poor signal or moving from WiFi to a mobile a network, each of which can cause an app to hang or otherwise misbehave.

Screenshot: Cloudflare

The tool gives you the ability to see how the network is performing in various parts of the world and where you are seeing issues and as it gathers and display information, it should help correlate performance issues with a flaky network and the impact that could be having on app performance.

Over time, he says they will be partnering with other monitoring tools to give developers a single place to check their performance issues. “Our goal is how can we get networks to perform better and give app developers better insight about network behavior.” Prince said.

Prince says, for starters they are providing some basic suggestions on how to improve performance, but in the future, they plan to integrate the network monitoring tool more deeply with the rest of the Cloudflare toolkit to make it easier to tweak performance problems.

Cloudflare also sees this as a way to build a better understanding of how networks are performing in general, and as they pull this data together, they plan to publish a mobile network reliability report. “We expect as this gets built into [more apps], and gives us visibility into mobile network providers, we will able to see who is providing the highest level of service and who has spotty or bad data services,” he explained.

Powered by WPeMatico