TC

Auto Added by WPeMatico

Auto Added by WPeMatico

Startups are a gamble, but it’s possible to better understand why some thrive and many more die by looking at the ecosystems in which they operate. Such is the mission of eight-year-old Startup Genome, composed of a group of researchers and entrepreneurs who, every year, interview thousands of founders and investors around the world to get a better handle on what’s changing in the regions where they operate, and what remains stubbornly the same.

The larger objective is to figure out how to help more startups succeed, and the outfit — which this year surveyed 10,000 founders with the help of partners like Crunchbase and Dealroom — produced some data that should perhaps concern those in the U.S. To wit, China looks positioned to overtake U.S. dominance when it comes to numerous tech sectors. Consider: In 2014, just 14 percent of so-called unicorns were based in China. Between the start of last year through today, that percentage has shot up to 35 percent, while in the U.S., the number of homegrown unicorns has fallen from 61 percent to 41 percent of the overall global number.

You could argue that investors are simply assigning China-based startups overly lofty valuations, as happened here in the U.S., and we partly believe that to be true. But China is also clearly “in it to win it,” based on a look at patents, with four times as many AI-related applications and three times as many crypto- and blockchain-related patents registered in China last year. With so much of the tech industry now focused on deep tech, it’s worth noting. In fact, though we loathed the January Financial Times column penned by famed VC Michael Moritz, who suggested U.S. companies follow China’s lead, his underlying call to arms was probably, gulp, prescient in its own way.

What else should startups know? According to Startup Genome’s findings, in addition to the rise of AI, blockchain and robotics manufacturing, there are clearly declining sub sectors, too, including, least surprisingly, adtech, which has seen a roughly 35 percent drop in funding over the last five years. No doubt that ties directly to the growing dominance of Facebook and Google, which accounted for 73 percent of all U.S. digital advertising last year, according to the equity research firm Pivotal.

That doesn’t mean adtech startups are cooked, notes the study’s authors. Rather, declining sub-sectors are often “mature” but can be revived by new technologies. In this case, while funding for adtech has dropped, virtual reality and augmented reality could well inject some new growth into the industry at some point. Maybe.

Either way, to us, the most interesting facets of this report — and it really is worth poring over — are the connections it’s able to make by talking with so many people around the world. It addresses, for example, how Stockholm, a relatively small startup ecosystem, is able to produce sizable startups at a meaningful rate, versus Chicago, whose ecosystem is ostensibly three times bigger. (The answer: Stockholm’s startup founders are apparently better connected to the world’s top seven ecosystems.)

Also quite interesting is the report’s findings about women founders, who build more relationships with regional founders and are more locally connected than their male counterparts — except with investors. That’s bad news for both women founders and investors, as local connectedness is associated with better startup performance.

To read the report in full, click over here. You have to fork over your email address, but with 240 pages filled with fascinating nuggets and other useful information, you’ll likely find it well worth it.

Powered by WPeMatico

Containers are eating the software world — and Kubernetes is the king of containers. So if you are working on any major software project, especially in the enterprise, you will run into it sooner or later. Cloud Foundry, which hosted its semi-annual developer conference in Boston this week, is an interesting example for this.

Outside of the world of enterprise developers, Cloud Foundry remains a bit of an unknown entity, despite having users in at least half of the Fortune 500 companies (though in the startup world, it has almost no traction). If you are unfamiliar with Cloud Foundry, you can think of it as somewhat similar to Heroku, but as an open-source project with a large commercial ecosystem and the ability to run it at scale on any cloud or on-premises installation. Developers write their code (following the twelve-factor methodology), define what it needs to run and Cloud Foundry handles all of the underlying infrastructure and — if necessary — scaling. Ideally, that frees up the developer from having to think about where their applications will run and lets them work more efficiently.

To enable all of this, the Cloud Foundry Foundation made a very early bet on containers, even before Docker was a thing. Since Kubernetes wasn’t around at the time, the various companies involved in Cloud Foundry came together to build their own container orchestration system, which still underpins much of the service today. As it took off, though, the pressure to bring support for Kubernetes grew inside of the Cloud Foundry ecosystem. Last year, the Foundation announced its first major move in this direction by launching its Kubernetes-based Container Runtime for managing containers, which sits next to the existing Application Runtime. With this, developers can use Cloud Foundry to run and manage their new (and existing) monolithic apps and run them in parallel with the new services they develop.

But remember how Cloud Foundry also still uses its own container service for the Application Runtime? There is really no reason to do that now that Kubernetes (and the various other projects in its ecosystem) have become the default of handling containers. It’s maybe no surprise then that there is now a Cloud Foundry project that aims to rip out the old container management systems and replace them with Kubernetes. The container management piece isn’t what differentiates Cloud Foundry, after all. Instead, it’s the developer experience — and at the end of the day, the whole point of Cloud Foundry is that developers shouldn’t have to care about the internal plumbing of the infrastructure.

There is another aspect to how the Cloud Foundry ecosystem is embracing Kubernetes, too. Since Cloud Foundry is also just software, there’s nothing stopping you from running it on top of Kubernetes, too. And with that, it’s no surprise that some of the largest Cloud Foundry vendors, including SUSE and IBM, are doing exactly that.

The SUSE Cloud Application Platform, which is a certified Cloud Foundry distribution, can run on any public cloud Kubernetes infrastructure, including the Microsoft Azure Container service. As the SUSE team told me, that means it’s not just easier to deploy, but also far less resource-intensive to run.

Similarly, IBM is now offering Cloud Foundry on top of Kubernetes for its customers, though it’s only calling this an experimental product for now. IBM’s GM of Cloud Developer Services Don Boulia stressed that IBM’s customers were mostly looking for ways to run their workloads in an isolated environment that isn’t shared with other IBM customers.

Boulia also stressed that for most customers, it’s not about Kubernetes versus Cloud Foundry. For most of his customers, using Kubernetes by itself is very much about moving their existing applications to the cloud. And for new applications, those customers are then opting to run Cloud Foundry.

That’s something the SUSE team also stressed. One pattern SUSE has seen is that potential customers come to it with the idea of setting up a container environment and then, over the course of the conversation, decide to implement Cloud Foundry as well.

Indeed, the message of this week’s event was very much that Kubernetes and Cloud Foundry are complementary technologies. That’s something Chen Goldberg, Google’s Director of Engineering for Container Engine and Kubernetes, also stressed during a panel discussion at the event.

Both the Cloud Foundry Foundation and the Cloud Native Computing Foundation (CNCF), the home of Kubernetes, are under the umbrella of the Linux Foundation. They take somewhat different approaches to their communities, with Cloud Foundry stressing enterprise users far more than the CNCF. There are probably some politics at play here, but for the most part, the two organizations seem friendly enough — and they do share a number of members. “We are part of CNCF and part of Cloud Foundry foundation,” Pivotal CEO Rob Mee told our own Ron Miller. “Those communities are increasingly sharing tech back and forth and evolving together. Not entirely independent and not competitive either. Lot of complexity and subtlety. CNCF and Cloud Foundry are part of a larger ecosystem with complimentary and converging tech.”

We’ll likely see more of this technology sharing — and maybe collaboration — between the CNCF and Cloud Foundry going forward. The CNCF is, after all, the home of a number of very interesting projects for building cloud-native applications that do have their fair share of use cases in Cloud Foundry, too.

Powered by WPeMatico

There are two kinds of people in the world: those who hate building IKEA furniture and madmen. Now, thanks to IkeaBot, the madmen can be replaced.

IkeaBot is a project built at Control Robotics Intelligence (CRI) group at NTU in Singapore. The team began by teaching robots to insert pins and manipulate IKEA parts, then, slowly, they began to figure out how to pit the robots against the furniture. The results, if you’ve ever fought with someone trying to put together a Billy, are heartening.

From Spectrum:

The assembly process from CRI is not quite that autonomous; “although all the steps were automatically planned and controlled, their sequence was hard-coded through a considerable engineering effort.” The researchers mention that they can “envision such a sequence being automatically determined from the assembly manual, through natural-language interaction with a human supervisor or, ultimately, from an image of the chair,” although we feel like they should have a chat with Ross Knepper, whose IkeaBot seemed to do just fine without any of that stuff.

In other words the robots are semi-autonomous but never get frustrated and can use basic heuristics to figure out next steps. The robots can now essentially assemble chairs in about 20 minutes, a feat that I doubt many of us can emulate. You can watch the finished dance here, in all its robotic glory.

The best part? Even robots get frustrated and fling parts around:

I, for one, welcome our IKEA chair manufacturing robotic overlords.

Powered by WPeMatico

Everyone seems to be insisting on installing cameras all over their homes these days, which seems incongruous with the ongoing privacy crisis — but that’s a post for another time. Today, we’re talking about enabling those cameras to send high-definition video signals wirelessly without killing their little batteries. A new technique makes beaming video out more than 99 percent more efficient, possibly making batteries unnecessary altogether.

Cameras found in smart homes or wearables need to transmit HD video, but it takes a lot of power to process that video and then transmit the encoded data over Wi-Fi. Small devices leave little room for batteries, and they’ll have to be recharged frequently if they’re constantly streaming. Who’s got time for that?

The idea behind this new system, created by a University of Washington team led by prolific researcher Shyam Gollakota, isn’t fundamentally different from some others that are out there right now. Devices with low data rates, like a digital thermometer or motion sensor, can something called backscatter to send a low-power signal consisting of a couple of bytes.

Backscatter is a way of sending a signal that requires very little power, because what’s actually transmitting the power is not the device that’s transmitting the data. A signal is sent out from one source, say a router or phone, and another antenna essentially reflects that signal, but modifies it. By having it blink on and off you could indicate 1s and 0s, for instance.

UW’s system attaches the camera’s output directly to the output of the antenna, so the brightness of a pixel directly correlates to the length of the signal reflected. A short pulse means a dark pixel, a longer one is lighter, and the longest length indicates white.

Some clever manipulation of the video data by the team reduced the number of pulses necessary to send a full video frame, from sharing some data between pixels to using a “zigzag” scan (left to right, then right to left) pattern. To get color, each pixel needs to have its color channels sent in succession, but this too can be optimized.

Assembly and rendering of the video is accomplished on the receiving end, for example on a phone or monitor, where power is more plentiful.

In the end, a full-color HD signal at 60FPS can be sent with less than a watt of power, and a more modest but still very useful signal — say, 720p at 10FPS — can be sent for under 80 microwatts. That’s a huge reduction in power draw, mainly achieved by eliminating the entire analog to digital converter and on-chip compression. At those levels, you can essentially pull all the power you need straight out of the air.

They put together a demonstration device with off-the-shelf components, though without custom chips it won’t reach those

A frame sent during one of the tests. This transmission was going at about 10FPS.

microwatt power levels; still, the technique works as described. The prototype helped them determine what type of sensor and chip package would be necessary in a dedicated device.

Of course, it would be a bad idea to just blast video frames into the ether without any compression; luckily, the way the data is coded and transmitted can easily be modified to be meaningless to an observer. Essentially you’d just add an interfering signal known to both devices before transmission, and the receiver can subtract it.

Video is the first application the team thought of, but there’s no reason their technique for efficient, quick backscatter transmission couldn’t be used for non-video data.

The tech is already licensed to Jeeva Wireless, a startup founded by UW researchers (including Gollakota) a while back that’s already working on commercializing another low-power wireless device. You can read the details about the new system in their paper, presented last week at the Symposium on Networked Systems Design and Implementation.

Powered by WPeMatico

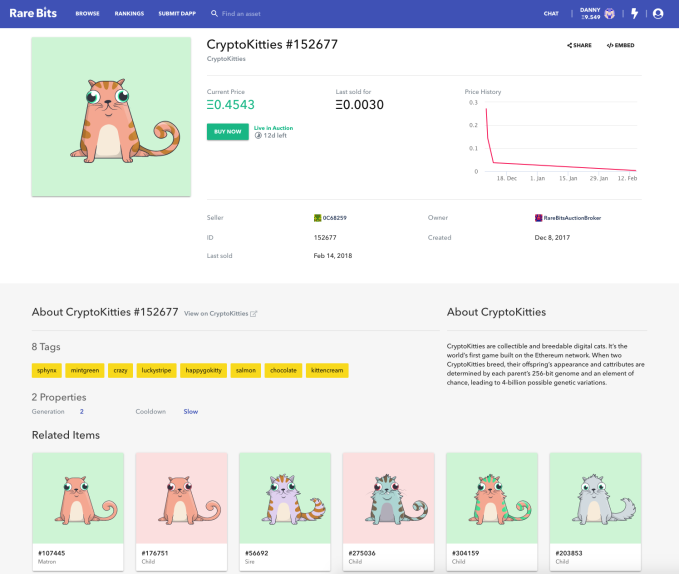

Rare Bits wants to be eBay for the blockchain, where you buy, sell and trade non-fungible crypto-goods. After CryptoKitties raised $12 million from Andreessen Horowitz last month for its digital collectibles game, there’s been an explosion of interest in the space. But without a popular marketplace, it’s hard to find the goods you want at the right price. Now a team of former Zynga staffers is building out the Rare Bits crypto-collectible auction and commerce site with a $6 million round led by Nabeel Hyatt at Spark Capital, and joined by First Round Capital, David Sacks’ Craft Ventures and SV Angel.

“Because of the Ethereum ledger, for the first time, users can truly own their digital items,” says co-founder Amitt Mahajan. “Previously in mobile or social games, virtual items earned through play or by spending money were actually owned by the company operating the game. If they shut down their servers, the items would go away and users would be out of luck. We believe this new asset class represents a paradigm shift in digital property whereby centralized assets will be moved onto decentralized systems.”  For now, Rare Bits isn’t slapping any extra fees on its marketplace, compared to paying up to 1 percent on other marketplaces like Open Sea, or even more elsewhere. Instead, if a crypto-item developer charges a fee on secondary sales, say 5 percent, they’ll split that with Rare Bits for arranging the transaction.

For now, Rare Bits isn’t slapping any extra fees on its marketplace, compared to paying up to 1 percent on other marketplaces like Open Sea, or even more elsewhere. Instead, if a crypto-item developer charges a fee on secondary sales, say 5 percent, they’ll split that with Rare Bits for arranging the transaction.

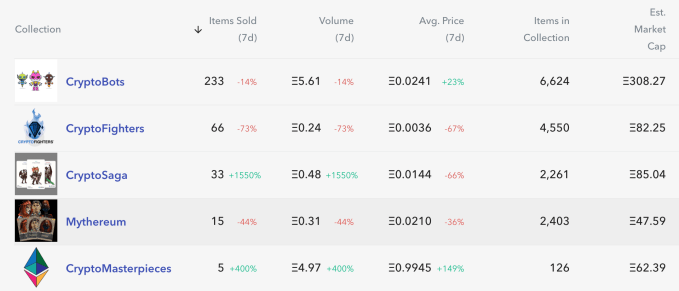

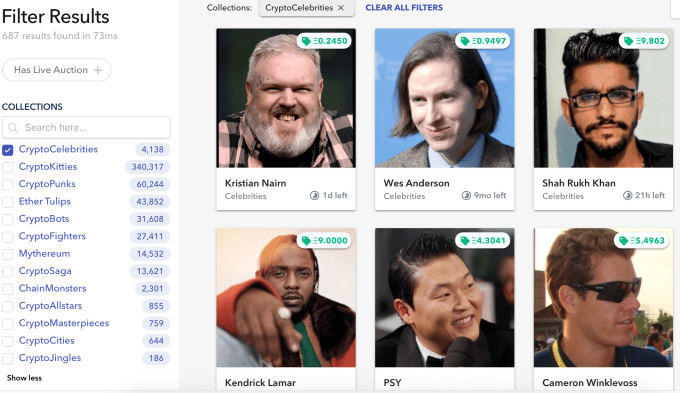

Rare Bits lists more than 500,000 items from a dozen games, including CryptoPunks, Ether Tulips, CryptoBots, CryptoFighters, Mythereum and CryptoCelebrities. Users get the benefit of having all their crypto-collectibles in a single wallet. They can see historical pricing before they buy anything thanks to the transparency of the Ethereum ledger, whether they want to “Buy Now” or win an auction. The collectors can also see related items rather than transacting in a vacuum. One item sold for more than $10,000, and sales in the 5-10ETH range ($555 each today) aren’t uncommon.

Rare Bits founders from left: Danny Lee, Payom Dousti, Dave Pekar and Amitt Mahajan

Mahajan, Danny Lee and Dave Pekar all met after selling their gaming startups to Zynga . [Disclosure: I know Pekar from college.] Their fourth co-founder, Payom Dousti, worked at fintech VC fund 1/0 Capital and sold his sports analytics startup numberFire to FanDuel. With experience across the gaming, virtual goods and crypto space, Mahajan tells me, “We thought long and hard about potentially building blockchain-based games ourselves, but ultimately decided that there was a larger opportunity in focusing on crypto-based property as a whole.” The Rare Bits exchange launched in February and did more than $100,000 in transactions in its first month.

With some CryptoKitties selling elsewhere for as much as $200,000, investors liked the idea of taking a cut of everyone’s transactions rather than just launching another digital trading card. That led Rare Bits to raise a $1 million seed from Macro Ventures and angels like Steve Jang and Robin Chan. As scaling issues threaten to prevent the Bitcoin and Ethereum blockchains from supporting micropayments and mainstream commerce, new use cases like crypto-collectibles are taking the spotlight.

Now with the $6 million Series A, Rare Bits is bringing in some heavyweight angels from the world of gaming. That includes Emmet Shear and Justin Kan, the co-founders of Twitch. Former Dropbox execs and married couple Ruchi Sanghvi and Aditya Agrawal are also in the round, alongside Greenoaks Captial MD Neil Mehta and Channel Factory CEO Tony Chen.

The team hopes the runway will help it secure partnerships with developers and creatives to publish new collectibles for the blockchain that have a home on Rare Bits. Mahajan says, “People are viewing these items as assets that can be invested in instead of liabilities that are one way transfers of value towards the developer, it’s one of the major changes in this ecosystem versus traditional virtual items.”

Rare Bits will have to deal with the inherent scaling troubles of the Ethereum blockchain it operates on. For now, it’s refunding users the “gas” it costs to execute purchases and sales on its marketplace in a timely manner. Those range from a few cents to a few dollars, depending on network congestion. But Rare Bits could be looking at a steep bill or be forced to push those fees onto users if it gets popular enough.

There’s always the danger that CryptoKitties and the like are just the new Beanie Babies — valued today, but worthless when the fad dies. Rare Bits benefits from getting to follow the trend to whatever crypto-collectible is in vogue, and just has to hope the whole concept doesn’t fade.

But Rare Bits has a hedge against that. “While today most of these items are items from games and collectibles, we envision that we will see licenses, tickets, rights, even tokenized physical goods represented as digital assets,” Mahajan tells us. It’s now building a Fan Bits feature that will let YouTube creators, Twitch streamers and Instagram celebrities create crypto-based collectibles “to engage with their audience and let their fans support them,” he explains. You might one day be able to buy and resell a meet-and-greet pass for your favorite band.

“Our ultimate goal is to convince millions of new people to begin owning and transacting crypto-based property,” says Mahajan. But the founders will probably be okay regardless. “Like anyone crazy enough to start a crypto app company this early, we started buying and HODLing BTC and ETH years ago.”

Powered by WPeMatico

mParticle, which helps companies like Airbnb and Spotify manage their customer data, has hired four new executives — including John Sedlak, most recently a vice president at Adobe, who’s joining the company as chief revenue officer.

In addition, Kiran Hebbar (formerly CFO of Social Tables) is joining as chief financial officer, Will Rogers (previously an engineer at Etsy) has been named chief information security officer and Aurélie Pols (who worked as data governance and privacy advocate at Krux Digital) is the new data protection officer.

Sedlak told me that in his roles at Adobe and Oracle (which he joined through the acquisition of BlueKai), he saw how the big marketing software players are trying to build comprehensive marketing clouds, often created through multiple startup acquisitions.

“They would constantly go to market and tout the benefits of the end-to-end stack, when I began to notice that there were many best-of-breed point solutions out there,” he said. “I got to see the power of standalone companies who are innovating ahead of what the big guys were doing. I’d put mParticle on that list.”

In the years since I first wrote about mParticle in 2014, a handy acronym has emerged to describe what the company does — CDP, short for customer data platform. Basically, CDPs like mParticle allow companies to unify all their first-party data, creating a single view of the customer.

Sedlak contrasted mParticle’s approach with older data management platforms, which he said weren’t built to connect customer data across all their interactions on different devices.

“They were originally built to ingest first-party cookie data coupled with third-party data,” he said. “They never fully contemplated the notion of a true cross-device world and I think [co-founders Michael Katz and Andrew Katz] knew that in 2013 and said, ‘You know we’re going to start solving for that now.’”

As for what hiring Sedlak will do for the company, he said one of his goals is to bring on even bigger customers: “I think mParticle can drive incremental or discrete value … to Fortune 50 marketers who I personally have done business with in the past, where I see an opportunity for us to significantly augment their current investments in the marketing cloud platforms.”

CEO Michael Katz, meanwhile, pointed out that two of these hires are focused on security. With the recent Facebook scandals discussions and Europe’s adoption of GDPR protections, there’s “a really healthy conversation around the importance of data control and governance,” and he said these hires will help mParticle build the tools that allow businesses to “put customer privacy and data security at the forefront of their business practice.”

Powered by WPeMatico

As renewable energy continues to gobble up more and more of the new energy capacity coming online, the solar project lending company Wunder Capital has raised $112 million in primarily debt financing to boost its business.

The 90 percent debt and 10 percent equity commitment came from the multi-strategy investment firm Cyrus Investments, which has backed renewable energy projects for years through its investment in RePower Group.

“The debt component is going to blow out the lending opportunity,” says Wunder chief executive Bryan Birsic.

Wunder chose to consolidate the debt and equity round with a single lead investor to simplify the negotiation process on both sides of the table, Birsic said. “Since Cyrus is an equity holder in the company we can come to better terms,” on debt facilities and repayment, he said.

Wunder lends money to commercial solar energy development projects throughout the U.S. and its business has been buoyed by a flood of demand for new solar energy projects coming online.

Since its launch in 2016, the company has financed more than 180 projects throughout the U.S., which are generating somewhere in the range of 50 megawatts (or enough electricity to power roughly 32,500 homes).

The Boulder, Colo.-based company makes money in three ways: It charges closing fees, a servicing fee and annual interest rate on the debt it provides — typically Wunder will pull in between 4 percent and 5 percent off of each loan it provides to a project.

And business… for renewable energy… is booming.

For instance, the industry appears to have shaken off concerns over price increases stemming from the tariffs imposed on solar panels as part of broad punitive measures President Trump has taken against China (which supplies most of the world’s solar panels).

“It was really pleasant to see that folks were less reactionary and more responsive to the data,” says Birsic. The headlines, Birsic explains, were worse than the reality for the industry. The headlines in January predicted a 30 percent tariff on solar panels, but banks thought those increases would ultimately result in a 3 percent price increase for residential solar installations and a 4 percent price increase for commercial solar.

Those price increases would only bring costs in line with what they were at the end of 2017, since over the course of the year prices on installations declined 10 percent, Birsic says.

“We’re very cool with the economics as it existed in 2017,” he said.

Powered by WPeMatico

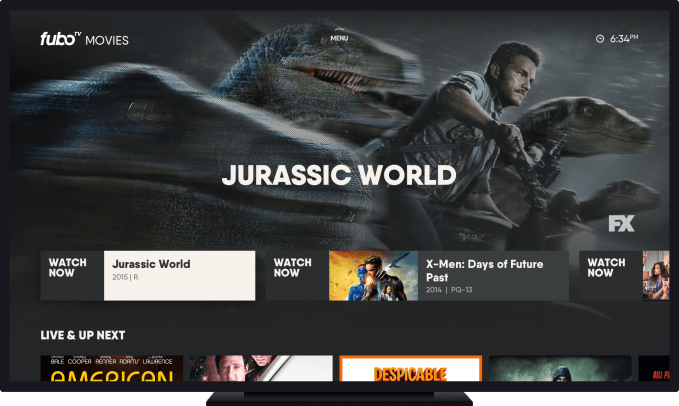

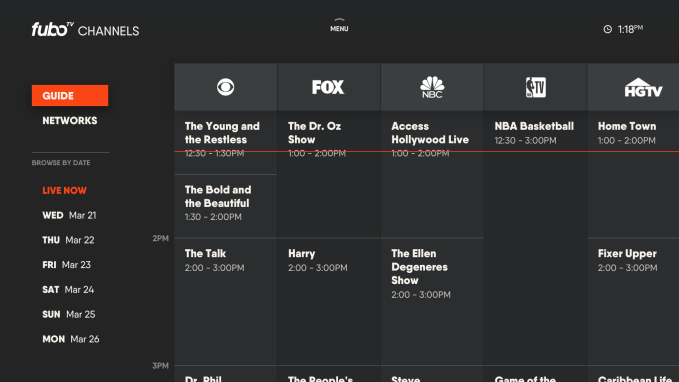

Days after Disney-owned ESPN launched its new streaming service, ESPN+, a three-year old streaming TV service for sports fans, fuboTV, is announcing the close of $75 million in Series D funding. The round included new investor AMC Networks, and existing investors 21st Century Fox, Luminari Capital, Northzone, Sky, and the former Scripps Networks Interactive, which was recently acquired by Discovery, Inc.

FuboTV has been working to carve out a niche for itself in the streaming TV market, where a number of competitors are delivering television programming to cord cutters by way of the internet.

In terms of subscribers, that space today is led by Dish’s Sling TV and AT&T’s newer DirecTV Now. But the market has also seen a lot of newcomers over the past year or so, with launches from Hulu’s Live TV, YouTube TV, and Philo. PlayStation Vue is a competitor as well, while CBS runs its own over-the-top streaming TV service with just its content, CBS All Access.

While many streaming TV services offer some sports content in their base packages, or sell additional access through add-ons, fuboTV’s core focus has been on serving the sports fan.

The service provides access to live games from the NBA, NHL, UFC, and more soccer than other streaming providers –

including matches from Bundesliga, EPL and La Liga to Liga MX, MLS, FIFA World Cup qualifiers, UEFA

Champions League matches and more.

That access doesn’t come cheap, however. FuboTV’s basic package with 70-plus channels, Fubo Premier, is $19.99 for the first month, which then becomes $44.99 per month after.

Customers can then customize their package with other options, like a “Sports Plus,” “Adventure Plus,” or “International Sports Plus” upgrade; a DVR with 500 hours of storage instead of just 30; or the option to add a third stream.

Even though the entry-level package is more than a full subscription to a mainstream service like Sling TV or YouTube TV, fuboTV managed to reach over 100,000 paid subscribers as of September 2017, and is continuing to see double-digit growth, it says.

Since the last funding round ten months ago, the company has streamed its first MLB All Star Game, Playoffs and World Series; Tour de France; NFL regular season, playoffs and Super Bowl; college football; and the Winter Olympic Games. And it has exited beta on Apple TV, Chromecast, Roku, iOS and Android; revamped its user interface; and debuted new features like “Lookback” and “Startover.”

The lineup it offers has begun to broaden beyond sports in recent months, as well.

While it has added several new sports additions in the last ten months, it has added entertainment networks, too – including those from its strategic investors. These include AMC, BBC AMERICA, CBS, CBS Sports Network, CBSN, Food Network, FUSION TV, HGTV, IFC, MSG, MSG+, NESN, NFL Network, Pac-12 Network, Pop, SNY, SundanceTV, The Olympic Channel, Travel Channel and WE tv.

Combined, fuboTV offers viewers over 30,000 sporting events per year, 10,000+ titles in its video-on-demand library.

In addition, fuboTV has been adding broadcast affiliates and now offers Fox in 87 percent of U.S. households, and NBC and CBS in 72 percent and 68 percent, respectively. In total, it has 257 local broadcast affiliates and owned-and-operated stations on the service.

FuboTV doesn’t just generate revenue from subscriptions, however – it also sells advertising.

The company tells TechCrunch it’s forecasting a revenue run rate of over $100 million by this time next year.

“We are very bullish from an ad perspective, even though we only launched server-side ad insertion in January,” notes fuboTV co-founder and CEO David Gandler. “One quarter in, advertising represents low single-digit percentage of our overall revenue, but it is growing quickly. As a benchmark, we are already experiencing ad revenue per subscriber above Spotify’s recently published ad revenue per user data,” he says.

With the new investment, fuboTV plans to double its office space and engineers and product team, and open a second headquarters. The funding will also be used to develop new products and content offerings, and for marketing.

Correction, 4/18/18, 4 PM ET: AMC participated and is a new investor; AMC did not lead the round. The article has been updated to reflect.

Powered by WPeMatico

Yesterday brought some interesting news in the cryptocurrency space. In a move that is at once sleazy and ridiculous, PornHub and its tech arm MindGeek announced a partnership with the creators of VergeCoin (XVG), an anonymized cryptocurrency in the vein of Monero that is currently trading at 7 cents, down from an all-time high of about 26 cents during a recent pump.

XVG is an epitome of a coin driven by mania. Originally billed as DogecoinDark in 2014, the currency has had some ups and downs but has always displayed the “move fast and break things” mentality that gives cryptocurrencies a bad name. The product is so hapless it can’t even get their Wikipedia entry right.

The currency developers recently beseeched its rabid fans — many of whom have been waxing confused on Reddit — to raise $2 million to build a secret partnership. Weeks of speculation followed as Vergins speculated about partners, including eBay and Amazon. The price went up and down and has settled below 10 cents, placing it at position 23 on the CoinMarketCap list. It’s doing well, but not great.

Yesterday the big announcement came, as it were. I received a few emails from PornHub PR announcing a crypto partnership but they refused to announce the currency. Now that the currency is officially announced, I’m sure there are some folks who are upset they bought a load of Titcoin.

Verge has partnered with PornHub to allow users to pay with the currency. Why? And why would you want to? This is unclear. Presumably the currency allows you to pay completely anonymously but you still have to acquire Verge to pay with Verge and associating a currency with porn pretty much gives the game away as to why you’d spend it. Further, the extensive marketing efforts make PornHub look far more interesting than Verge, especially since Verge shares the same name with the Verge tech site, something that is bound to confuse average buyers. Finally, you get no real benefit from paying with Verge and, in fact, you can’t get your Verge refunded if you decide you no longer want to pay $9.99 a month for premium PR()N.

Ultimately this is better for porn than it is for cryptocurrency. PornHub gets a little bit of a media boost and cryptocurrencies — including Bitcoin, Ether and ICO tokens — look like the only source for porn. While VHS and the internet grew out of porn, cryptocurrencies are already well-established and they don’t need any more “sin” associated with them. You can also pay for a number of services with crypto, including Flirt4Free, a cam girl site associated with LiveJasmin. Given that a series of stars in big trucks will be rolling through the U.S. over the next few months promoting cryptocurrencies — that $2 million had to go somewhere — it could be positive for crypto uptake but very bad for crypto perception.

While I agree that crypto needs a shot in the arm and a sense of mission, I doubt making it easier to see naked people is quite it. I’d like to see real remittances, real real estate transactions and even real voting systems put in place. Until then, however, stunts like this do little to help.

Powered by WPeMatico

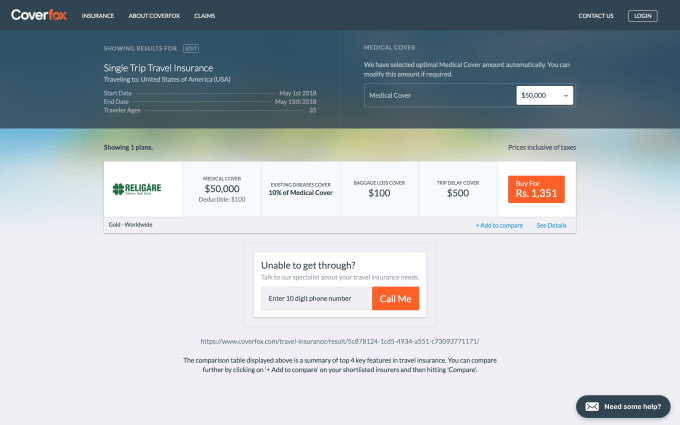

Coverfox, one of a handful of companies aiming to digitize insurance in India, has landed fresh funding via a $22 million Series C round that will be used to push into more rural parts of the country.

The investment is led by IFC, a sister organization of World Bank, and U.S. insurance firm Transamerica, with participation from existing investors SAIF Partners, Accel and Catamaran Ventures, the fund from Infosys co-founder Narayana Murthy. The company confirmed the round was actually closed in two phases, which explains why media reports around the Transamerica investment surfaced last June.

Based in Mumbai, Coverfox is a digital platform that aggregates insurance options. Currently, it works with 35 partners to offer some 150-plus packages that span health, car, bike, life and travel insurance policies in India.

Today’s announcement takes Coverfox, which was founded in 2013, to $39 million raised from investors.

Many of those same Coverfox backers have also funded digital insurance firm Acko, which was started by Coverfox co-founder Varun Dua last year. Acko and Dua made headlines when, nearly a year ago, the startup announced a $30 million seed investment round that came in before a product had even hit the market.

Acko got its license from the Insurance Regulatory & Development Authority of India (IRDAI) in September to go into business, and it again attracted headlines for its relationship with Amazon. The e-commerce firm was said to be in talks to invest (no deal has been announced) while Dua himself said the company was planning to develop products for the e-commerce giant, and potentially others of that scale too.

To date, though, Coverfox isn’t working with Acko, according to its CEO Premanshu Singh.

“We don’t work with Acko at all, and we don’t plan to work for next three to six months at least,” he said in an interview with TechCrunch, explaining that the company is going after larger insurance providers initially.

He also dismissed the potential for consolidation between the two despite the common investor base.

“Both entities are very different, with separate teams and different office locations. We can’t visualize anything strategic coming up,” Singh added.

Coverfox itself said it has seen “impressive momentum and scale” lately, which Singh clarified as four-fold revenue growth over the past year, although he declined to give specific figures. The company plans to double down on growth and use the new money to expand into India’s tier-two and tier-three cities, where it said that insurance coverage is 35 percent lower than in urban areas, while coverage among women is lower still at 40 percent below that of men.

The company also plans to put additional capital behind its Coverdrive app for Android, which is designed to equip insurance sales staff, who previously worked almost entirely offline, with digital-first materials to help grow their business using the Coverfox platform.

Coverdrive is a smart addition because it helps the company tackle the long tail of rural India without initial investment upfront. Instead, insurers use its service to boost their own business, thereby growing Coverfox sales at the same time.

Singh said Coverdrive accounts for around one-quarter of Coverfox sales. But that isn’t its only focus in tier-two and tier-three markets, where the company will roll out its own staff and focus on listing related policies.

Citing the growth of mobile data usage in rural India and a growth in digital as internet banking chips away at the bank assurance model used by most insurance brands, Singh said that rural India is better positioned for expansion than in previous years.

Coverfox isn’t yet looking at overseas options despite Singh explaining that there has been a considerable volume of inbound requests.

“It’s going to happen for sure [but] we haven’t decided where to go first,” he said.

Likewise, the model isn’t decided on either. Beyond a straight-up expansion, Coverfox could move into new markets via partnership or franchise.

Powered by WPeMatico