TC

Auto Added by WPeMatico

Auto Added by WPeMatico

With the Windows 10 April 2018 Update, Microsoft is launching a number of new features for its desktop operating system today. Most of those apply to all users, but in addition to all the regular feature updates, the company also today announced a couple of new features and tools specifically designed for its business users with Microsoft 365 subscriptions that combine a license for Windows 10 with an Office 365 subscription and device management tools.

According to Brad Anderson, Microsoft’s corporate VP for its enterprise and mobility services, the overall thinking behind all of these new features is make it easier for businesses to give their employees access to a “modern desktop.” In Microsoft’s parlance, that’s basically a desktop that’s part of a Microsoft 365 subscription. But in many ways, this so much about the employees but the IT departments that support them. For them, these updates will likely simplify their day-to-day lives.

The most headline-grabbing feature of today’s update is probably the addition of an S-mode to Windows 10. As the name implies, this allows admins to switch a Windows 10 Enterprise device into the more restricted and secure Windows 10 S mode, where users can only install applications from a centrally managed Microsoft Store. Until now, the only way to do this was to buy a Windows 10 S device, but now, admins can automatically configure any device that run Windows 10 Enterprise to go into S mode.

It’s no secret that Windows 10 S as a stand-alone operating system wasn’t exactly a hit (and launching itat an education-focused event with the Surface Laptop probably didn’t help). The overall idea is sound, though, and probably quite attractive to many an IT department.

“We built S mode as a way to enable IT to ensure what’s installed on a device,” Anderson told me. “It’s the most secure way to provision Windows.”

The main surprise here is actually that S mode is already available now, since it was only in March that Microsoft’s Joe Belfiore said that it would launch next year.

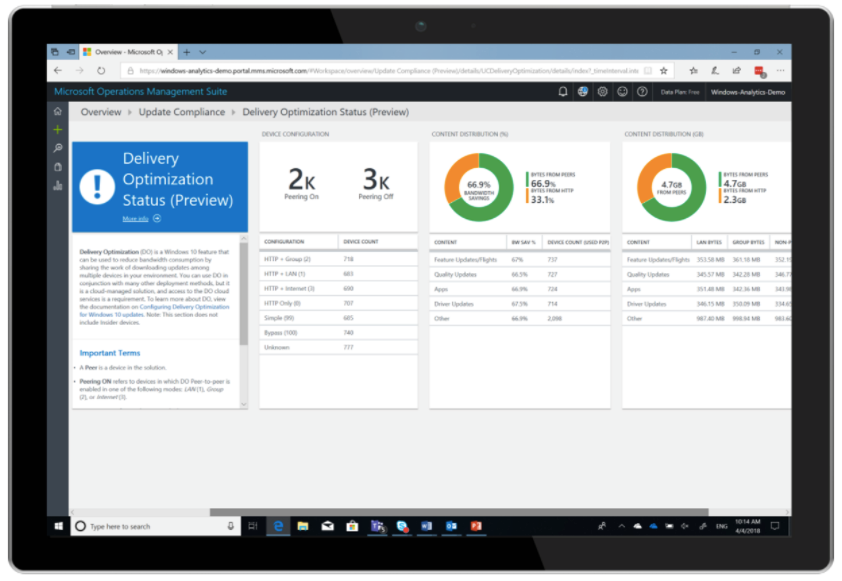

Another part of this update is what Microsoft calls ‘delivery optimization” for updates. With this, a single device can download an update and the distribute it to other Windows 10 devices over the local network. Downloads take a while and eat up a lot of bandwidth, after all. And to monitor those deployments, the Windows Analytics dashboard now includes a tab for keeping tabs on them.

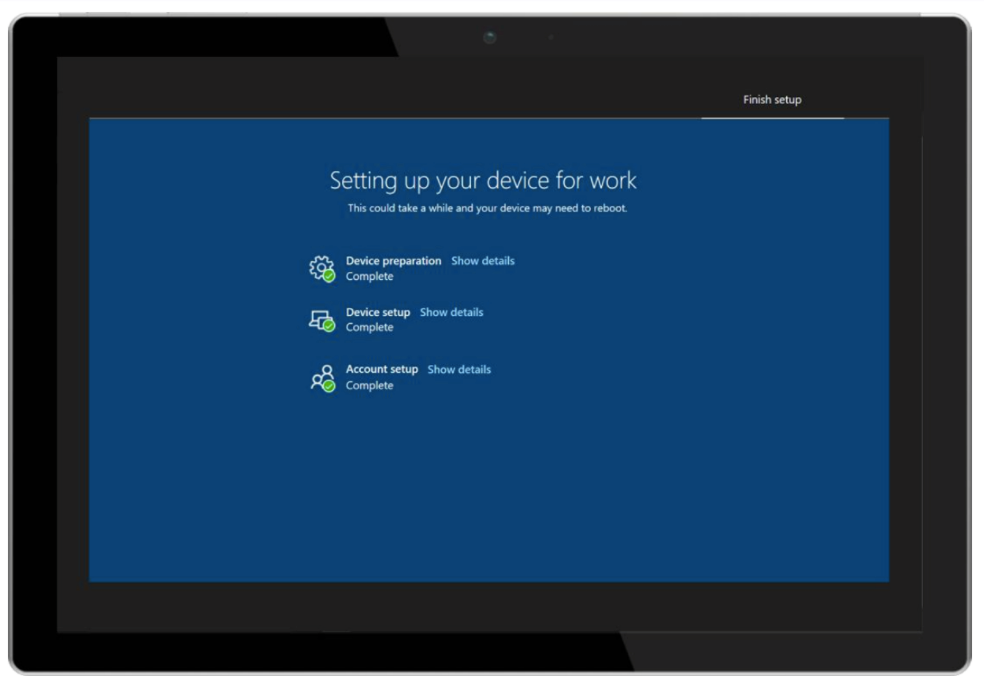

Another new deployment feature Microsoft is launching today is an improvement to the AutoPilot service. AutoPilot allows IT to distribute laptops to employees without first setting them up to a company’s specifications. Once a user logs in, the system will check what needs to be done and then applies those settings, provisions policies and installs apps as necessary. With this update, AutoPilot now includes an enrollment status page that does all of this before the user ever gets to the desktop. That way, users can’t get in the way of the set-up process and IT knows that everything is up to spec.

A number of PC vendors are now also supporting AutoPilot out of the box, including Lenovo and Dell, with HP, Toshiba and Fujitsu planning to launch their AutoPilot-enabled PCs later this year.

To manage all of this, Microsoft is also launching a new Microsoft 365 admin center today that brings all the previously disparate configurations and monitoring tools of Office 365 and Microsoft 365 under a single roof.

One other aspect of this launch is an addition to Microsoft 365 for firstline workers. Windows 10 in S mode is one part of this, but the company is also updating the Office mobile apps licensing terms to add the company’s iOS and Android apps to the Office 365 E1, F1 and Business Essential licenses. For now, though, only access to Outlook for iOS and Android is available under these licenses. Support for Word, PowerPoint, Excel and OneNote will launch in the next few months.

Powered by WPeMatico

DocuSign priced its IPO Thursday evening at $29 per share, netting the company $629 million.

It was a better price than the e-signature company had been expecting. The initially proposed price range was $24 to $26 and then that was raised to $26 to $28.

The price gives the company a valuation of $4.4 billion on the eve of its public debut, above the $3 billion the company had raised for its last private round.

The IPO has been a long-time coming. Founded in 2003, DocuSign had raised over $500 million over the course of 15 years.

The company brought in $518.5 million in revenue for its fiscal year ending in 2018. This is up from $381.5 million last year and $250.5 million the year before. Losses for this year were $52.3 million, down from $115.4 million last year and, $122.6 million for 2016.

“We have a history of operating losses and may not achieve or sustain profitability in the future,” the company warned in the requisite “risk factors” section of the prospectus.

The filing reveals that Sigma Partners is the largest shareholder, owning 12.9% of the company. Ignition Partners owns 11.7% and Frazier Technology Ventures owns 7.2%.

DocuSign, competes HelloSign and Adobe Sign, among others, but has managed to sign up many of the largest enterprises. T-Mobile, Salesforce, Morgan Stanley and Bank of America are amongst its clients. It has a tiered business model, with companies paying more for added services.

HelloSign COO Whitney Bouck said that “this space is changing the way business is done at its foundation — we are finally realizing the future of digital business and exactly how much more profitable it can be by removing the friction caused by outdated technology and processes.” But she said that DocuSign should be wary of competitive “more nimble vendors that can provide more innovative, faster, and more user-friendly solutions at a cheaper price.”

DocuSign has gone through several management changes over the years. Dan Springer took over as CEO in early 2017, after running Responsys, which went public and then was later bought by Oracle for $1.5 billion. Chairman Keith Krach had been running the company since 2011. He was previously CEO of Ariba, which was acquired by SAP for $4.3 billion.

Powered by WPeMatico

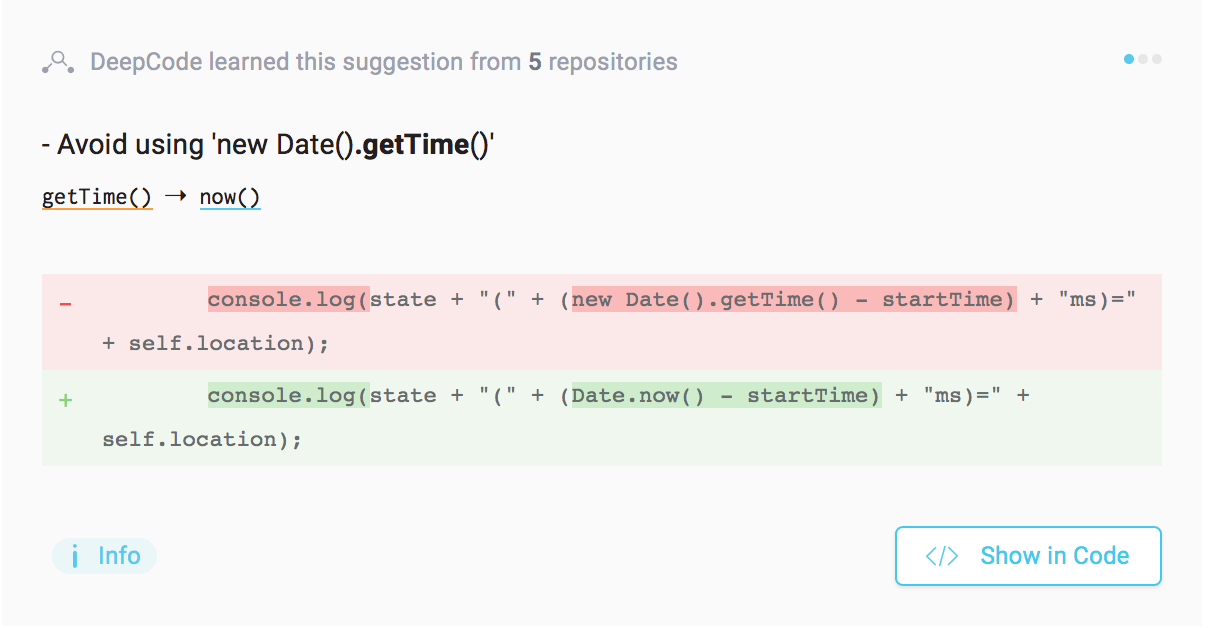

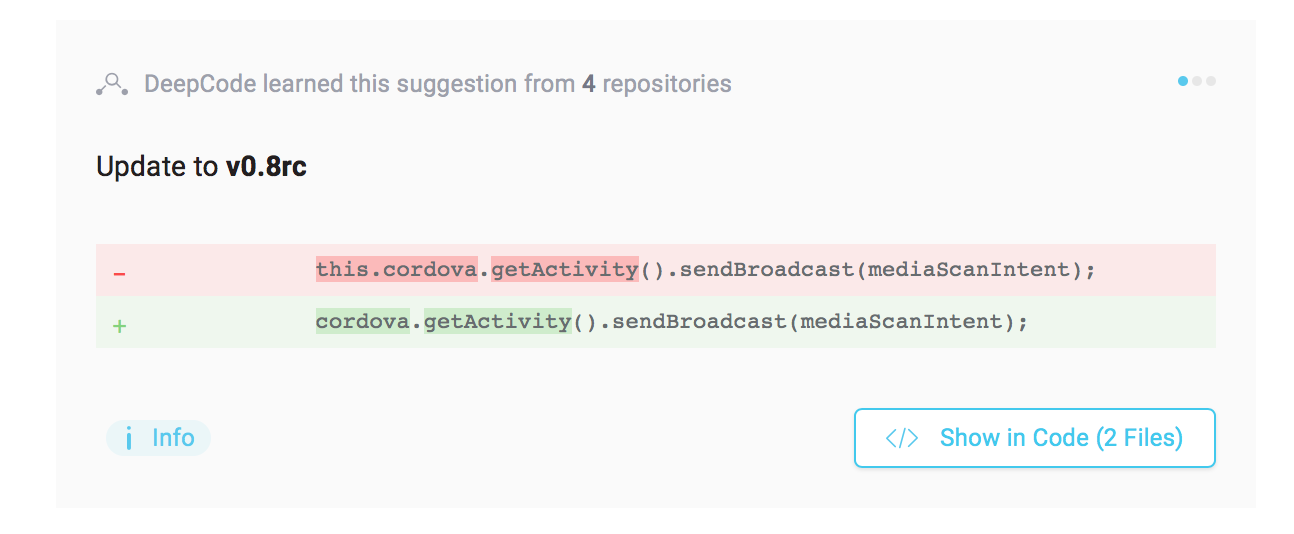

Zurich-based DeepCode claims that their system — essentially a tool for analyzing and improving code — is like Grammarly for programmers. The system, which uses a corpus of 250,000 rules, reads your public and private GitHub repositories and tells you how to fix problems, remain compatible and generally improve your programs.

Founded by Veselin Raychev, advisor Martin Vechev and Boris Paskalev, the team has extensive experience in machine learning and AI research. This project is a spin-off from ETH in Switzerland and is a standalone research project turned programming utility.

How does it work? Pretty well. I ran one of my public repositories through the system and received 49 suggestions in 449 files. The fixes range from literal code changes — changing name: String, to name: {type: String}, — to suggestions for code that might be actually missing in function calls. It’s an interesting tool, especially if you need help finding hidden bugs in your code. The advice this tool gives is also surprisingly precise. Because it can build its own recommendations based on large amounts of code it finds things humans might miss.

“We built a platform that understands the intent of the code,” said Paskalev. “We autonomously understand millions of repositories and note the changes developers are making. Then we train our AI engine with those changes and can provide unique suggestions to every single line of code analyzed by our platform.”

“Today we have more than 250K rules and growing daily,” said Paskalev. “Our competition has to manually create rules and the biggest competitor has 3-4,000 rules and they’ve been working for years.

The company is self-funded and recently raised $1.1 million from btov. The founders are serial entrepreneurs. Paskalev worked at VistaPrint and PPAG and Raychev worked for Google and is a researcher in the field of machine learning in programming language semantics.

More than a simple debugger, DeepCode “reads” and tries to compare code to other implementations, giving you best-of-class performance from every line. Now the team just has to get programmers to use it.

“We have a unique platform that understands software code the same way Grammarly understands written language,” Paskalev said. “This unique proposition is positioned us save billions of dollars within the software development community with our first service and then to be on the front end of transforming the industry towards fully autonomous code synthesis.”

Powered by WPeMatico

Today, 11 new companies launch out of the Entrepreneurs Roundtable Accelerator based in NYC. This is the 14th cohort of startups to launch out of ERA, and each company has received $100,000 in seed funding from the accelerator.

These startups span a wide variety of industries, from hospitality to new retail to healthcare. So without any further ado, here are the 11 companies launching out of ERA:

Butler wants to handle room service and amenities for hotels, partnering with hotels to provide room service, catering and other food-based amenities from Butler’s various hubs across the city. Using SMS as a means of communication with guests, Butler can serve a larger number of hotels. Right now, Butler serves 5,000 rooms in Manhattan.

Leveraging machine learning algorithms that scour social media, Choosy quickly whips up fashion designs, sends them to China for manufacturing and offers flash-fashion items via Instagram. As brands like H&M and Top Shop continue to speed up their operations and offerings, Choosy looks to use tech to keep up the pace.

Flume Health works with self-insured employers and healthcare providers to ensure that employees are best utilizing their healthcare benefits. The company says that 78 percent of employees don’t understand how their benefits program works, costing companies up to 26 percent more for healthcare. Flume Health uses concierges to connect employees with the best healthcare at the lowest price based on their benefits plan, reducing healthcare costs by 20 percent to 60 percent.

HealNow wants to bridge the gap between healthcare professionals, pharmacies and patients, offering an ordering and payments platform for pharmacies. Patients can pay, schedule deliveries and enter medical information online to receive their prescription or equipment, while doctors and hospitals can offer on-demand delivery of the prescriptions they write.

Deodorant stops being optional around the age of 13, but many deodorants are made with potentially harmful chemicals and toxins. Myro offers an all-natural formula in a refillable container, letting users feel good about what they’re putting on their body as well as reducing plastic waste. Plus, they smell good. Myro launches later this summer.

Orcadex is a business intelligence platform focused on the blockchain and cryptocurrency verticals, collecting data via machine learning and natural language processing to offer analysis and insights to customers. The platform helps professionals create models and identify trends as the blockchain space continues to rapidly evolve. Orcadex launches to a closed group of institutional investors in June.

Spin Analytics is a fintech company focused on offering credit risk modeling for financial institutions. The company works with banks to offer actionable insights for meeting regulatory compliance and reporting requirements, reducing the time and cost of maintaining compliance.

Spryfit is where HQ meets the gym. Users connect their fitness trackers and try to achieve their fitness goals with the hopes of winning a cash prize. The idea is to use underutilized health data from wearables and smartphones to motivate users to get fit for the cash prize. The company currently has 50,000 users.

Hourly workers like waiters tend to churn in and out of positions often. StellarEmploy uses deep learning algorithms to match employee performance to job fundamentals, letting companies recruit hourly workers that will enjoy the job, do a great job, and stay put. Some of StellarEmploy’s customers include Home Chef and IBEX Global.

Big companies understand that healthy employees are both more effective and more cost efficient, which is why many companies have implemented a wellness program for their workers. But Welnys wants to do the heavy lifting for those companies, offering a marketplace for workplace wellness vendors such as yoga and meditation instructors, nutritionists and more.

Young Alfred wants to make buying home insurance as simple as possible. The platform lets users identify their needs, while a machine learning algorithm identifies customer risk and makes custom recommendations for home insurance that fit the users needs. Young Alfred has relationships with Progressive and Hippo, and users can check-out online direct from the Young Alfred website.

Powered by WPeMatico

Photos, not just video. No yellow ring alerting people to the camera. Underwater-capable. Classier colors with lighter lenses. Prescription options. Faster syncing. And a much slimmer frame and charging case. Snapchat fixed the biggest pain points of its Spectacles camera sunglasses with V2, which launch today for $150. The company only sold 220,000 pairs of V1, with their limited functionality, tricky exports and goofy hues. But V2 is stylish, convenient and useful enough to keep handy. They’re not revolutionary. They’re a wearable camera for everybody.

You can check out our snazzy hands-on demo video below:

The new Spectacles go on sale today in the U.S., Canada, U.K. and France, then in 13 more European countries on May 3. The $150 V2s are $20 more than the old version and only available on Snap’s app and site — no Amazon, pop-up stores or vending SnapBots. And V1 owners will get a firmware update that lets them take photos.

After two days of use, I think Spectacles V2 cross the threshold from clumsy novelty to creative tool accessible to the mainstream. And amidst user growth struggles, that’s what Snap needs right now.

What Snap doesn’t need is a privacy scandal, and that risk is the trade-off it’s making with its more discreet Spectacles design. They still display a little circle of white lights while recording, but with the permanent yellow ring on the corner removed, you might not notice there’s a camera lens there. That could make people a little nervous and creeped out.

What Snap doesn’t need is a privacy scandal, and that risk is the trade-off it’s making with its more discreet Spectacles design. They still display a little circle of white lights while recording, but with the permanent yellow ring on the corner removed, you might not notice there’s a camera lens there. That could make people a little nervous and creeped out.

But the company’s VP of hardware Mark Randall tells me he thinks the true purpose of V1 was to get people comfortable wearing and being recorded by a face computer. It certainly wasn’t a consumer success, with less than half of owners using them after the first month. He said he feels pretty good about shipping 220,000 pairs. Yet Snapchat was roundly mocked for taking a $40 million write-off after making hundreds of thousands too many. Randall attributes that to having fragmented sales channels, which Snap is fixing by only selling V2 itself so it can better predict demand.

Snap did learn that users wanted to take photos, get them in less flashy coral colors, bring Spectacles to the beach, pair them quicker with better resolution exports and hear less wind noise when moving. And most importantly, they wanted something they didn’t feel weird wearing. So Randall’s team essentially scrapped the yellow warning ring, style, architecture, chipset and electronics to build a better V2 from the ground up. The result rises high above its predecessor.

Snapchat isn’t making a spectacle out of the Spectacles V2 launch. There’s no hidden vending machines with cryptic clues leading to long lines. They’re openly for sale today in Snap’s four top markets, with IE, BE, NL, SE, NO, DK, FI, DE, AT, CH, PL, ES and IT coming next week. This might make sure everyone who wants them can have them before they inevitably stop being trendy and will have to rely on their true value.

As soon as you slide them out of their tennis ball tube package, you’ll notice a higher build quality in Spectacles V2. The yellow case is about 1/3 smaller, so you could squeeze it in some pants pockets or easily throw it in a jacket or purse. The old version basically required a backpack. The charging port has also been moved to the side so it doesn’t fall out so easily. Even with the better hardware, Spectacles are supposed to have enough battery and memory to record and transfer 70 videos over a week on a normal charge, plus carry four extra charges in the case.

The Spectacles themselves feel sleeker and less like chunky plastic. They come in onyx black, ruby red and sapphire blue and you can choose between a more mirrored or natural lens color too. Users in the U.S. can order them with prescription lenses through Lensabl. Those colors are a lot more mature than the childish coral pink and teal of V1. More transparent lenses make them easier to use in lower light, so you won’t be restricted to just the sunniest days, though they’re still UVA and UVB rated. I could even get by inside to some degree, whereas I was bumping into things indoors with V1.

The box holding the hardware on the hinges is now much smaller, making them lighter and shallower overall. An extra microphone helps Spectacles reduce wind noise and balance out conversations so the wearer doesn’t sound way louder.

It’s easy to long-press for a photo or tap for 10-second video, with extra taps extending the clip up to 30 seconds. Either fires up the light ring to let people know you’re recording, but this is much more subtle than the permanent yellow ring that was there on V1. You can only add stickers and drawings after you shoot and export your Spectacles Snaps, so that means there’s no adding augmented reality face filters or dancing hot dogs to what you see first-person.

Syncing goes much faster with Spectacles V2

Snap Inc. actually reduced the field of vision for Spectacles from 115 to 105 degrees to cut off some of the fish-eye warping that happened to the edges of clips shot on V1. Videos now record in 1216 x 1216 pixels, while photos are 1642 x 1642. What’s fun is that Spectacles can record under water. Randall doesn’t recommend diving to 200 feet with them, but jumping in the pool or getting caught in the rain will be no problem. In fact, it can make for some pretty trippy visuals. Cheddar’s Alex Heath nailed most of these features in a scoop about V2 last month.

Syncing to your phone now just requires Bluetooth and a seven-second press of the shutter button, rather than a shoddy QR code scan. Exports always happens in HD over Specs’ internal Wi-Fi now, and transfers go four times quicker than the old process that required you to sync standard definition (low-quality) versions of videos first, then pick your favorites, then download them in HD. Randall says that led lots of people to accidentally or impatiently settle for SD content, which made Spectacles’ capture resolution seem much lower than its potential.

Unfortunately, Snapchat is what’s holding Spectacles back. You can only sync your Spectacles to Snapchat Memories first before exporting videos individually or as one big Story to your camera roll. That makes it a pain to share them elsewhere. If Snap wants to be a hardware giant, it can’t just build accompaniments to its own app. It needs to catch the attention of all kinds of photographers, not just those who already love Snapchat. I do wish they could share directly to Instagram, and barring that is a weighty strategy choice.

What really matters, though, is the how the incremental improvements all add up to something much more livable.

Snapchat may have finally found a way to make Spectacles carryable and wearable enough that people use them as their default sunglasses. That could lead to way more content being produced from Spectacles, which in turn could make Snapchat more interesting at a time when it’s desperate to differentiate from Instagram with something tough to copy.

Randall says Snap is just starting to reach out to professional creators, who could prove to people how fun Spectacles could be. Snap neglected them last time around and ended up with few pieces of flagship Spectacles content. This time, though, Snap will focus on showing off what Spectacles can shoot rather than just how they look on your face. It’s even going to run its own in-app ads promoting Spectacles that will let you swipe up to buy them instantly.

Randall says Snap is just starting to reach out to professional creators, who could prove to people how fun Spectacles could be. Snap neglected them last time around and ended up with few pieces of flagship Spectacles content. This time, though, Snap will focus on showing off what Spectacles can shoot rather than just how they look on your face. It’s even going to run its own in-app ads promoting Spectacles that will let you swipe up to buy them instantly.

Snap Inc. calls itself a camera company, but beyond software, that wasn’t really true until now. It could be a half-decade before we have AR goggles for the masses, and Snap can’t wait around for that. V2 is a solid step forward, and Randall says Snap is committed to a long road of hardware releases.

Getting tons of its cash-strapped teens to buy the gadget may prove difficult again, but I at least expect V2s won’t end up dying alone in a drawer as often. These glasses aren’t going to turn around Snapchat’s business, which lost $443 million last quarter. And they probably won’t win over any Instagram loyalists. But Spectacles V2 could rekindle the interest of lapsed users while producing unique points of view to entertain those who never left. And if they don’t sell well, Snap at least is working the kinks out of its hardware iteration process that could pave the way for a killer product in the future.

The startup was always about communicating visually, and what better way than to lend someone your perspective of the world. Snap may have broken the Google Glass curse.

Powered by WPeMatico

Revolut, the London-based fintech that offers a digital banking account and sprawling set of other financial services, is disclosing that it has raised a whopping $250 million in Series C funding, less than three years since launching.

The new round, which gives the company a $1.7 billion post-money valuation — a five-fold increase in under a year, we’re told — was led by Hong Kong based DST Global, along with a group of new and existing investors that includes Index Ventures, and Ribbit Capital. In case you aren’t keeping up, it brings the total amount raised by Revolut to $340 million in less than 36 months.

To put this into context, TransferWise — London’s undisputed fintech darling and on some features a direct competitor to Revolut — recently announced $280 million in Series D investment, giving the company a reported post-money valuation of $1.6 billion. The difference? It took TransferWise seven years compared to Revolut’s three.

That’s testament to how much value investors are now placing on bank-disrupting fintech or perhaps signs of a fintech bubble. Or both. It is also worth remembering that these are private valuations with neither company yet to float on the public markets, even if TranserWise looks increasingly a candidate to do so.

Meanwhile, Revolut says the new round of funding and surge in valuation follows “incredible growth figures to date,” with the fintech now processing $1.8 billion through the platform each month and signing up between 6,000 and 8,000 new customers every day.

It claims nearly 2 million customers in total, of which 250,000 are daily active users, roughly 400,000 are weekly active users and 900,000 are monthly active users. The company says the target is 100 million customers in the next five years.

For a little more context, TransferWise has 3 million customers. I’m also told U.K. challenger bank Monzo now has 630,000 current account customers, of which 200,000 are daily active users, 360,000 are weekly active users and 500,000 are monthly active users. (In both Revolut and Monzo’s case, active users are defined as making at least one financial transaction.)

With the aim of persuading both consumers and businesses to ditch their traditional bank, Revolut offers most of the features you’d expect of a current account, including physical and virtual debit cards, direct debits and money transfer. Its “attack vector” (to borrow Monzo’s Tom Blomfield’s phrase) was originally low exchange fees when spending in a foreign currency, which undoubtedly fuelled much of the startup’s early growth and mindshare, but new features and products are being added at an increasingly fast pace.

Many of these are through partnerships with other fintech companies, and include travel insurance, phone insurance, credit, savings, and cryptocurrency. The latter looks like riding the hype cycle almost perfectly. Revolut is also applying for a European banking license, which would enable it to begin balance sheet lending, too.

To that end, Revolut says the Series C funding will be used to go beyond Europe and expand worldwide, starting with the U.S., Canada, Singapore, Hong Kong, and Australia this year. The company also expects to increase its workforce from 350 to around 800 employees in 2018.

Powered by WPeMatico

Artificial intelligence and the application of it across nearly every aspect of our lives is shaping up to be one of the major step changes of our modern society. Today, a startup that wants to help other companies capitalise on AI’s advances is announcing funding and emerging from stealth mode.

Allegro.AI, which has built a deep learning platform that companies can use to build and train computer-vision-based technologies — from self-driving car systems through to security, medical and any other services that require a system to read and parse visual data — is today announcing that it has raised $11 million in funding, as it prepares for a full-scale launch of its commercial services later this year after running pilots and working with early users in a closed beta.

The round may not be huge by today’s startup standards, but the presence of strategic investors speaks to the interest that the startup has sparked and the gap in the market for what it is offering. It includes MizMaa Ventures — a Chinese fund that is focused on investing in Israeli startups, along with participation from Robert Bosch Venture Capital GmbH (RBVC), Samsung Catalyst Fund and Israeli fund Dynamic Loop Capital. Other investors (the $11 million actually covers more than one round) are not being disclosed.

Nir Bar-Lev, the CEO and cofounder (Moses Guttmann, another cofounder, is the company’s CTO), started Allegro.AI first as Seematics in 2016 after he left Google, where he had worked in various senior roles for over 10 years. It was partly that experience that led him to the idea that with the rise of AI, there would be an opportunity for companies that could build a platform to help other less AI-savvy companies build AI-based products.

“We’re addressing a gap in the industry,” he said in an interview. Although there are a number of services, for example Rekognition from Amazon’s AWS, which allow a developer to ping a database by way of an API to provide analytics and some identification of a video or image, these are relatively basic and couldn’t be used to build and “teach” full-scale navigation systems, for example.

“An ecosystem doesn’t exist for anything deep-learning based.” Every company that wants to build something would have to invest 80-90 percent of their total R&D resources on infrastructure, before getting to the many other apsects of building a product, he said, which might also include the hardware and applications themselves. “We’re providing this so that the companies don’t need to build it.”

Instead, the research scientists that will buy in the Allegro.AI platform — it’s not intended for non-technical users (not now at least) — can concentrate on overseeing projects and considering strategic applications and other aspects of the projects. He says that currently, its direct target customers are tech companies and others that rely heavily on tech, “but are not the Googles and Amazons of the world.”

Indeed, companies like Google, AWS, Microsoft, Apple and Facebook have all made major inroads into AI, and in one way or another each has a strong interest in enterprise services and may already be hosting a lot of data in their clouds. But Bar-Lev believes that companies ultimately will be wary to work with them on large-scale AI projects:

“A lot of the data that’s already on their cloud is data from before the AI revolution, before companies realized that the asset today is data,” he said. “If it’s there, it’s there and a lot of it is transactional and relational data.

“But what’s not there is all the signal-based data, all of the data coming from computer vision. That is not on these clouds. We haven’t spoken to a single automotive who is sharing that with these cloud providers. They are not even sharing it with their OEMs. I’ve worked at Google, and I know how companies are afraid of them. These companies are terrified of tech companies like Amazon and so on eating them up, so if they can now stop and control their assets they will do that.”

Customers have the option of working with Allegro either as a cloud or on-premise product, or a combination of the two, and this brings up the third reason that Allegro believes it has a strong opportunity. The quantity of data that is collected for image-based neural networks is massive, and in some regards it’s not practical to rely on cloud systems to process that. Allegro’s emphasis is on building computing at the edge to work with the data more efficiently, which is one of the reasons investors were also interested.

“AI and machine learning will transform the way we interact with all the devices in our lives, by enabling them to process what they’re seeing in real time,” said David Goldschmidt, VP and MD at Samsung Catalyst Fund, in a statement. “By advancing deep learning at the edge, Allegro.AI will help companies in a diverse range of fields—from robotics to mobility—develop devices that are more intelligent, robust, and responsive to their environment. We’re particularly excited about this investment because, like Samsung, Allegro.AI is committed not just to developing this foundational technology, but also to building the open, collaborative ecosystem that is necessary to bring it to consumers in a meaningful way.”

Allegro.AI is not the first company with hopes of providing AI and deep learning as a service to the enterprise world: Element.AI out of Canada is another startup that is being built on the premise that most companies know they will need to consider how to use AI in their businesses, but lack the in-house expertise or budget (or both) to do that. Until the wider field matures and AI know-how becomes something anyone can buy off-the-shelf, it’s going to present an interesting opportunity for the likes of Allegro and others to step in.

Powered by WPeMatico

Few people get into coding because they enjoy debugging, but since there’s no such thing as perfect code, issues inevitably pop up. Israeli startup Rookout is tackling one aspect of this by helping developers track down issues in production code without forcing developers to do any additional coding to write additional tests and re-deploy their apps. As the company announced today, it has raised $4.2 million in seed funding from TLV Partners and Emerge.

Rookout co-founders Or Weis and Liran Haimovitch told me that their own experience in writing code led them to starting this project. Weis, who has taken the CEO role, with Haimovitch being the CTO, noted that only a few years ago, your code would run in its own box and you’d have full control over it. These days, however, your code may run in multiple locations and it’s virtually impossible to get access to the entire state of an application. So when bugs pop up in production — as they often do, despite all of the testing that happens throughout the development process — debugging becomes a real pain point.

Rookout’s solution for this is to instrument the code with “breakpoints that don’t break.” To make this work, you connect Rookout’s online IDE with your code repository on GitHub, Bitbucket or another git hosting service (or with your local file system). The IDE will pull in the code and let you browse it. Developers typically have a hunch about where a bug may be, so when you get to the suspect file, you use Rookout’s visual rule editor to set your virtual breakpoint. Once the production code runs again, all of the data is automatically pushed into the IDE so that you can examine the entire stack trace up to where you set the breakpoint.

All of this works for code that was written in Python and Node.js, as well as for Java virtual machine (JVM) languages like Scala or Kotlin. As for environments, the service currently works for code that’s deployed on AWS, Azure, Google Cloud and local servers, where it can be used with both serverless and containerized applications, too.

While Rookout focuses on collecting data, the team was pretty clear about the fact that Rookout doesn’t want to be an application performance monitoring tool. You can, however, forward your Rookout data to these kind of tools.

Weis and Haimovitch tell me the company now has 14 employees and “dozens” of customers in the pipeline. Looking ahead, the team plans to add support for Go and other languages as the requests come in, and gradually add more IDE support, too.

Like at many a startup, the founders are still working out their pricing model. The current plan is to focus it around the number of hosts that a company is using, though that could still change.

Powered by WPeMatico

The FDA has its eye on Juul Labs, the e-cigarette company that has captured nearly half of the $2 billion e-cig market.

Yesterday, the U.S. Food and Drug Administration Commissioner Scott Gottlieb announced a new initiative called the Youth Tobacco Prevention Plan. While the agency is focused on making sure kids don’t have easy access to any e-cigs, the Juul vaporizer seems to be of particular concern to them.

As part of the initiative, the FDA has sent a request for information to Juul Labs in an effort to understand why young people are so attracted to the product.

Over the past year, a number of reports have suggested that teen vape use, especially with the Juul, is steeply on the rise.

The request is for documents related to “product marketing; research on the health, toxicological, behavioral or physiologic effects of the products, including youth initiation and use; whether certain product design features, ingredients or specifications appeal to different age groups; and youth-related adverse events and consumer complaints associated with the products.”

In response, Juul Labs issued a press release announcing its plan to combat underage use. The strategy includes an initial investment of $30 million over the next three years going towards independent research, youth and parent education and community engagement efforts. Juul Labs also said it will support federal and state initiatives to raise the legal minimum purchase age to 21+. The company website has required that purchasers be 21 or older since August 2017.

Here’s what Juul CEO Kevin Burns had to say about it:

Our company’s mission is to eliminate cigarettes and help the more than one billion smokers worldwide switch to a better alternative. We are already seeing success in our efforts to enable adult smokers to transition away from cigarettes and believe our products have the potential over the long-term to contribute meaningfully to public health in the U.S. and around the world. At the same time, we are committed to deterring young people, as well as adults who do not currently smoke, from using our products. We cannot be more emphatic on this point: No young person or non-nicotine user should ever try JUUL.

Juul Labs is not the only organization that the FDA is cracking down on. The agency said it had sent out 40 warning letters to retailers selling e-cigs, including the Juul, to minors. Some of those retailers were caught as the result of a ‘blitz’ that has been underway since the beginning of April.

The agency has also asked eBay to take down all listings of Juul vaporizers, which run the risk of being sold to minors.

Alongside the FDA’s request for information from Juul Labs, the agency is also sending out similar letters to other e-cig manufacturers.

Powered by WPeMatico

Amongst massive criticism over data privacy, Facebook showed the resiliency of its advertising machine by beating Wall Street’s $11.41 billion revenue estimate in its Q1 2018 earnings report by raking in $11.97 billion in revenue with $1.69 EPS compared to the $1.35 estimate.

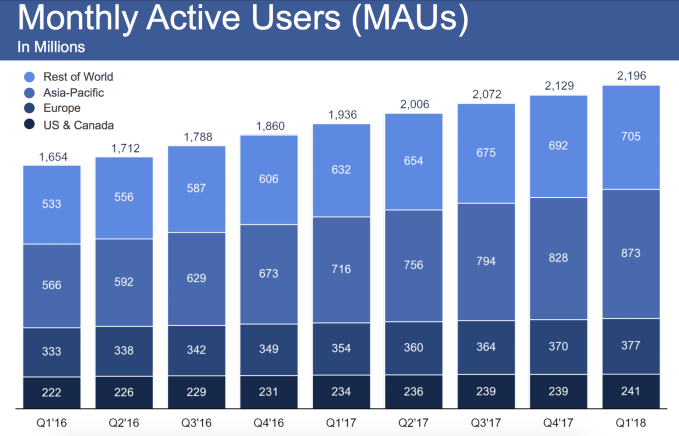

Facebook added 48 million daily active users to hit 1.449 billion, up 3.42 percent to revive Facebook’s growth after slower 2.18 percent growth last quarter. But Facebook only added 70 million monthly active users to reach 2.196 billion, a 3.14 percent growth rate that was a little slower than last quarter’s 3.39 percent growth. Both daily and monthly users are up 13 percent year-over-year, showing Facebook’s troubles haven’t paralyzed its growth.

This was perhaps the most tumultuous quarter since Facebook went public. Facebook faced intense criticism regarding the Cambridge Analytica scandal and its data privacy practices, leading a massive pull-back of developer capabilities as Zuckerberg headed to testify before Congress. Last quarter saw Facebook’s first-ever decline in users in a market, with a 700,000 user drop in the U.S. & Canada market following changes to promote well-being that reduced the prevalence of viral videos.

Facebook was able to revive its U.S. & Canada user growth this quarter, perking back up to 185 million, from 184 million last quarter — though that’s just a return to where it was in Q3 2017. Monthly active user count in the market went from 239 to 241 million. That shows that while people might disagree with Facebook’s approach to privacy, they aren’t about to give up their News Feeds.

Demonstrating Facebook’s declining web presence, mobile made up $10.7 billion, or 91 percent of all ad revenue, up from 89 percent last quarter. Facebook reached $4.98 billion in profit, up from a weak $4.26 billion last quarter. Average Revenue Per User reached $5.53, up 30 percent year-over-year thanks to strong gains this quarter in Europe and Asia-Pacific. Facebook’s headcount has swelled 48 percent year-over-year as it’s now half-way to its promise of doubling its security and content moderation staff from 10,000 to 20,000 in 2018.

The recent scandals have put a lot of downward pressure on its share price, but apparently the company thinks it’s a good buy. It’s increased the amount authorized under a share repurchase program by an additional $9 billion, on top of an original $6 billion plan, of which it’s spent $4 billion. It’s partly to offset big stock distributions for employees, but CFO David Wehner also said it was “opportunistic,” aka related to Facebook perceiving its price as too low. Wall Street apparently liked the earnings report as shares are up over 4.38 percent to $166.68 in after-hours trading.

The question is whether the new ads transparency requirements, developer platform crackdown and Facebook’s quest to make using it healthier will show up in next quarter’s earnings. These changes could deter advertisers, give users less functionality to play with and remove low-quality viral content that might make users feel bad but keeps them scrolling.

CEO Mark Zuckerberg wrote that, “Despite facing important challenges, our community and business are off to a strong start in 2018. We are taking a broader view of our responsibility and investing to make sure our services are used for good. But we also need to keep building new tools to help people connect, strengthen our communities, and bring the world closer together.” We’ll get to hear more from him at 2pm Pacific during the earnings call, so stay tuned here.

Updates from the earnings call:

Powered by WPeMatico