TC

Auto Added by WPeMatico

Auto Added by WPeMatico

Facebook wants you to look and move like you in VR, even if you’ve got a headset strapped to your face in the real world. That’s why it’s building a new technology that uses a photo to map someone’s face into VR, and sensors to detect facial expressions and movements to animate that avatar so it looks like you without an Oculus on your head.

CTO Mike Schroepfer previewed the technology during his day 2 keynote at Facebook’s F8 conference. Eventually, this technology could let you bring your real-world identity into VR so you’re recognizable by friends. That’s critical to VR’s potential to let us eradicate the barriers of distance and spend time in the same “room” with someone on the other side of the world. These social VR experiences will fall flat without emotion that’s obscured by headsets or left out of static avatars. But if Facebook can port your facial expressions alongside your mug, VR could elicit similar emotions to being with someone in person.

![]()

Facebook has been making steady progress on the avatar front over the years. What began as a generic blue face eventually got personalized features, skin tones and life-like features, and became a polished and evocative digital representation of a real person. Still, they’re not quite photo-realistic.

![]()

Facebook is inching closer, though, by using hand-labeled characteristics on portraits of people’s faces to train its artificial intelligence how to turn a photo into an accurate avatar.

![]()

Meanwhile, Facebook has tried to come up with new ways to translate emotion into avatars. Back in late 2016, Facebook showed off its “VR emoji gestures,” which let users shake their fists to turn their avatar’s face mad, or shrug their shoulders to adopt a confused expression.

Still, the biggest problem with Facebook’s avatars is that they’re trapped in its worlds of Oculus and social VR. In October, I called on Facebook to build a competitor to Snapchat’s wildly popular Bitmoji avatars, and we’re still waiting.

VR headsets haven’t seen the explosive user adoption some expected, in large part because they lack enough compelling experiences inside. There are zombie shooters and puzzle rooms and shipwrecks to explore, but most tire of them quickly. Games and media lose their novelty in a way social networking doesn’t. Imagine what you were playing or watching 14 years ago, yet we’re still using Facebook.

That’s why the company needs to nail emotion within VR. It’s the key to making the medium impactful and addictive.

Powered by WPeMatico

The Handmaid’s Tale, America’s favorite dystopian drama, will return for a third season.

Hulu announced the news this morning on the heels of revealing it has hit 20 million subscribers for its streaming service.

The second season of The Handmaid’s Tale is currently airing on Hulu, with the third episode to available today.

The series is based on Margaret Atwood’s 1985 novel by the same name. In it, humanity has become mostly infertile, leading a conservative militia to overtake the country and enslave the remaining fertile women as childbearers for the “upstanding” families of the regime.

In Season One, the story was focused on exposition of the new world as well as our main character, Offred (June) and her life as a Handmaid. Season 2 seems to be expanding on that world and our main character, showing both the good and the bad of her character’s personality.

The Handmaid’s Tale is far and away Hulu’s most popular and critically acclaimed original series, winning five Emmys last year, including one for Best Drama series.

If you want to learn more about The Handmaid’s Tale, make sure to check out the latest episode of TC’s Original Content podcast.

Powered by WPeMatico

The massage-on-demand service Soothe seems to be rubbing investors the right way with the close of a new $31 million round of funding.

The Series C round from late-stage and growth capital investment firm, The Riverside Company, caps a busy first quarter for the massage service. It also relocated from Los Angeles to Las Vegas; named a new chief executive; and announced new geographies where its massage booking platform is now available.

As part of the new round, chief executive and founder Merlin Kauffman is stepping down from the role and assuming the mantle of executive chairman. Current chief financial officer Simon Heyrick is stepping into the chief executive role.

The former CFO of MarketShare, Heyrick has helped the company expand to more than 11,000 massage therapists in its network.

The company said the new round would help keep massage therapists in its network with pricing that can be up to three times more than those therapists would make in their local markets.

Beyond the new financing and a new boss, Soothe also is heading to new markets, launching services in Manchester, U.K.; Australia’s Gold Coast, Pittsburgh and Hartford, Conn. (some of those places are not like the others).

Soothe isn’t the only player in the massage marketplace. New York-based Zeel also has an offering for folks who want to book massages on the fly. Zeel claims a geographic reach of 85 U.S. cities, while Soothe claims roughly 60 cities worldwide.

Powered by WPeMatico

Google is betting big on the Assistant ecosystem and it’s now putting its money where its mouth is. The company announced today it’s launching a new program that will provide investment capital and other resources to early-stage startups that build applications in the Google Assistant ecosystem.

Typically, companies announce these kinds of programs to kickstart an ecosystem around a new product. While developers have already launched plenty of services for the Google Assistant, the company says that it is launching this new program to “promote more of this creativity.”

Google VP for search and the Google Assistant Nick Fox echoed this. “With the Google Assistant, we’re focused on fostering an open ecosystem for developers, device makers, and content partners to build new experiences,” he told me. “We’re already seeing a lot of creativity from developers with the Google Assistant, and to help promote this, we’re opening a new investment program for early-stage startups.”

Investments are one part of this program, but Google will also work with these startups directly to provide them with mentorship and advice from engineers, product managers and design experts. The startups in the program will also get early access to new features and tools, as well as access to the Google Cloud Platform and promotional support. That sounds a bit like an accelerator program, though that’s not quite what Google is calling it.

Fox tells me that Google won’t put a cap on the investments. “We’ll invest as much as we see fit, and are focused on helping startups succeed in this emerging space,” he said. “And we’re not just offering investment capital. We’re eager to partner with these startups and leverage our company’s strengths to help these products come to market poised for success.”

The first startups in this program include GoMoment, a concierge service for hotels and Edwin, a personal English tutor, as well as the developer tools BotSociety and Pulse Labs.

These startups are good representatives of what Google is after. Fox tells me that Google is looking for startups that are “pursuing an interesting space for Assistants, such as vertical industries like travel or gaming.” In addition, Google is also looking to deepen some of its partnerships, but for the most part, it’s simply looking for startups that are pushing technologies like the Assistant forward.

Powered by WPeMatico

The venture investment arm of massive meat manufacturer Tyson Foods is continuing its push into potential alternative methods of poultry production with a new investment in the Israeli startup Future Meat Technologies.

The backer of companies like the plant-based protein-maker Beyond Meat, and cultured-meat company Memphis Meats, Tyson Ventures’ latest investment is also tackling technology development to create mass-produced meat in a lab — instead of on the farm.

Future Meat Technologies is working to commercialize a manufacturing technology for fat and muscle cells that was first developed in the laboratories of the Hebrew University of Jerusalem.

“It is difficult to imagine cultured meat becoming a reality with a current production price of about $10,000 per kilogram,” said Yaakov Nahmias, the company’s founder and chief scientist, in a statement. “We redesigned the manufacturing process until we brought it down to $800 per kilogram today, with a clear roadmap to $5-10 per kg by 2020.”

The deal marks Tyson’s first investment in an Israeli startup and gives the company another potential horse in the race to develop substitutes for the factory slaughterhouses that provide most of America’s meat.

“This is definitely in the Memphis Meats… in the lab-based meat world,” says Justin Whitmore, executive vice president of corporate strategy and chief sustainability officer of Tyson Foods.

Whitmore takes pains to emphasize that Tyson is continuing to invest in its traditional business lines, but acknowledges that the company believes “in exploring additional opportunities for growth that give consumers more choices,” according to a statement.

While startups like Impossible Foods are focused on developing plant-based alternatives to the proteins that give meat its flavor, Future Meat Technologies and Memphis Meats are trying to use animal cells themselves to grow meat, rather than basically harvesting it from dead animals.

Chef Uri Navon mixing ingredients with FMT’s cultured meat

According to Nahmias, animal fat produces the flavors and aromas that stimulate taste buds, and he says that his company can produce the fat without harvesting animals and without genetic modification.

For Whitmore, what separates Future Meat Technologies and Memphis Meats is the scale of the bioreactors that the companies are using to make their meat. Both companies — indeed all companies on the hunt for a meat replacement — are looking for a way around relying on fetal bovine serum, which is now a crucial component for any lab-cultured meats.

“I want my children to eat meat that is delicious, sustainable and safe,” said Nahmias, in a statement, “this is our commitment to future generations.”

The breadth of backgrounds among the investors that have come together to finance the $2.2 million seed round for Future Meat Technologies speak to the market opportunity that exists for getting a meat manufacturing replacement right.

“Global demand for protein and meat is growing at a rapid pace, with an estimated worldwide market of more than a trillion dollars, including explosive growth in China. We believe that making a healthy, non-GMO product that can meet this demand is an essential part of our mission,” said Rom Kshuk, the chief executive of Future Meat Technologies, in a statement.

One of the company’s first pilot products is lab-grown chicken meat that chefs have already used in some recipes.

FMT’s first cultured chicken kebab on grilled eggplant with tahini sauce

In addition to Tyson Ventures, investors in the Future Meat Technologies seed round included the Neto Group, an Israeli food conglomerate; Seed2Growth Ventures, a Chicago-based fund backed by Walmart wealth; BitsXBites, a Chinese food technology fund; and Agrinnovation, an Israeli investment fund founded by Yissum, the Technology Transfer Company of The Hebrew University,

“Hebrew University, home to Israel’s only Faculty of Agriculture, specializes in incubating applied research in such fields as animal-free meat sources. Future Meat Technologies’ innovations are revolutionizing the sector and leading the way in creating sustainable alternative protein sources,” said Dr. Yaron Daniely, president and CEO of Yissum.

Powered by WPeMatico

Dish’s Sling TV service is expanding its Cloud DVR to a wide variety of new devices.

Chrome browser, Chromecast, Xbox One, LG Smart TVs, and more recent models of Samsung Smart TVs (2016 and 2017 models) will all now support Sling TV’s Cloud DVR service.

For those of you who don’t know, Sling TV DVR is a digital DVR service that lets users record up to 50 hours of content, with an unlimited amount of time for storing those devices. In other words, recorded content in the digital DVR will never expire.

Of note: Sling TV’s DVR service costs an extra $5/month on top of the base package, which starts at $20/month.

The company recently announced that it has 2.2 million users on the service, making Sling TV the biggest internet-based live TV service.

By comparison, Hulu Live has 450,000 users and YouTube TV has 300,000 users, according to a report from January, while AT&T’s DirecTV Now has 1 million users.

To check out the full list of Sling TV’s DVR-supported devices, check out this information page.

Powered by WPeMatico

Startup life is nothing if not full of ups and downs. On the up this week is Cera, the London-based homecare startup advised by former Deputy Prime Minister Sir Nick Clegg, which today is announcing $17 million in Series A funding. Investing in the round is Guinness Asset Management (via its EIS fund), Yabeo (which is also the lead investor in Germany’s biggest care supply company Pflegebox), and Kairos. In addition, a number of Cera’s seed backers have followed on.

Contrast that with last week when a Bloomberg report alleged that fake reviews of Cera had been posted to third-party websites, such as TrustPilot — allegedly written by “Cera Care employees or people close to them” — and that at the time of its report some non-existent or expired NHS partnerships were incorrectly listed on Cera’s website.

The same report also revealed that Cera — which makes a virtue of its ability to collect and take actions on client data — wasn’t registered with the U.K. data regulator, the Information Commissioner’s Office (ICO), before February this year, although the company tells TechCrunch it began the process a year earlier. Either way, the startup launched as early as November 2016 and therefore was likely operating for a period without the proper data regulation.

Addressing the alleged fake reviews, and alleged misrepresentation of some NHS partnerships, Cera issued TechCrunch with the following statement:

“We have looked into this, and TrustPilot have removed unverified reviews. We pride ourselves on delivering outstanding, high-quality care, which is demonstrated through our platform’s automated customer feedback, which remains at a 95% satisfaction rate.

“Contrary to certain statements in recent press articles, we have partnered with several NHS organisations over the past year, successfully delivering NHS-funded and referred care services. In 2018 we have delivered NHS CCG funded care with the following CCGs: Lambeth, Tower Hamlets, Haringey, Enfield, and previously had partnered with CCGs including Brent, Harrow and Hillingdon, and East London Foundation Trust, in addition to marketing in NHS hospitals including: Central Middlesex, West Middlesex, Northwick Park, Royal Marsden, Whittington and Barnet & Chase Farm. We note that at the time the articles were written, our website was not fully up to date with these materials and have since rectified it – this was in part due to variable contractual expiry dates”.

Meanwhile, Cera says it will use its Series A funding — which is made up of both equity and debt — to expand its services further across the U.K., launching in an additional three cities beyond London, namely Manchester, Leeds and Birmingham, via what it is calling a “buy and build” strategy. This will see Cera buy struggling homecare agencies across the U.K. — many of which it says lack the technology to scale and grow independently — as a more rapid means of expanding.

“In a fragmented market of over 8,000 homecare providers, Cera has built the technology to quickly aggregate U.K. homecare businesses in a scalable manner, in what will be a U.K.-first from a startup in this space. This model will also be used to drive Cera’s expansion to Germany,” says the company.

The injection of capital will also support Cera’s continued investment in “AI”. It has been prototyping a chatbot-styled assistant it calls “Martha,” which it claims can successfully foresee deterioration in patient health, based on carer feedback, such as whether a patient hasn’t been eating, has a fever, or isn’t walking normally. The aim is to pre-empt more serious illnesses and avoid unnecessary admissions to hospital.

Related to this, I understand from Cera’s latest investor email report that Cera has grown its data set to “over 1 million data points” — a 90 percent quarter-on-quarter increase — which it intends to feed into its machine learning-powered predictive analytics tool to help improve health outcomes and reduce preventable hospital admissions. “We are taking active steps to ensure GDPR compliance,” says the company, which is just as well.

The same email details a number of business development updates by Cera, including that it is working on a collaboration with NHS 111 that — if it goes ahead — would permit integration of data records between Cera and the NHS 111 service. The startup is also working on Amazon Alexa integration, and has formed an exclusive partnership with the Daily Mail Group, to offer home care to Daily Mail readers and users.

To that end, the U.K. homecare startup space is pretty crowded already and therefore media partnerships and other more direct ways to market could be quite important beyond simply becoming a partner provider to local health and social care authorities. Cera’s direct U.K. competitors include HomeTouch (backed by Rocket Internet’s GFC, Passion Capital, Bupa, and 500 Startups), and SuperCarers.

Powered by WPeMatico

Nearly every aspect of the current ICO market is pay-for-play or otherwise tainted. I do not paint the industry with such a broad brush lightly but this sort of chicanery hasn’t existed since the heyday of print media when journalists – myself included – took long, convoluted trips to distant headquarters where they enjoyed, as I wrote back in 2007, “suckling on the sweet teat of junket whoredom.”

As I said in this post on payola that briefly made waves a few months ago, payola is stupid and everybody should be able to see through it. But many can’t and that’s a big problem.

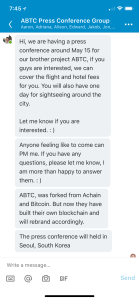

The ICO market is hot right now and there is money flowing from hand to hand in a torrent. One litigious company I spoke to took $10,000 to write a white paper and then returned a two page squib, refusing ultimately to refund a founder’s money. Another company, below, is sponsoring an all-inclusive trip to Seoul for a press conference. Other companies take $400,000 or more to manage your ICO, offering PR and services look to have been cobbled together in a rush yet promise millions in returns.

Any time there is a gold rush there are carpet baggers. Any time there is a bubble there are those who would take advantage of it. And anywhere there is a new, unregulated way to make – or raise – millions of dollars you’d better believe there is someone skimming.

Arguably not everyone knows the rules. They are, quite simply: don’t take free stuff in exchange for positive coverage and don’t take trips. Most tech journalists have a closet full of junk that needs to go back to manufacturers but they should never expect cash from a manufacturer to smooth things along. Junkets are dangerous primarily because they cloud a journalist’s judgment. You can imagine Syria sponsoring a fancy junket into its war zone to understand the extreme chilling effect and bias this would introduce.

Arguably not everyone knows the rules. They are, quite simply: don’t take free stuff in exchange for positive coverage and don’t take trips. Most tech journalists have a closet full of junk that needs to go back to manufacturers but they should never expect cash from a manufacturer to smooth things along. Junkets are dangerous primarily because they cloud a journalist’s judgment. You can imagine Syria sponsoring a fancy junket into its war zone to understand the extreme chilling effect and bias this would introduce.

Further, the other services – legal, PR, social media – that are cropping up in the market are taking a huge cut and often stand unchallenged. ICOs are hard work and very confusing. Instructions, to say the least, are unclear and anyone who has done one successfully – including this team that simulated and exit scam to send people to their ICO consultancy – is considered a global expert. It’s as if someone discovered a working Bloomberg terminal an abandoned building and then began telling everyone they could make them millions. It’s not that easy.

Ultimately these barnacles will be shaken off. TechCrunch was born out of the confusion of the second startup boom and, in turn, this created the modern VC industry, the modern pitch-off, and the accelerator. The good guys, so to speak, outnumbered the pay-for-play “incubators” and the rapacious investors and created what you see today: a tame but useful system for unlocking wealth. Now that that system has been supplanted – and make no mistake: VC is over – the new organism has its own parasites and none of them are particularly new.

This does not mean the current system is perfect. Angel funding is almost impossible to find outside of major cities. Team and a dream has been replaced by team and multi-million dollar revenue. VC has become a spectator sport and its practitioners are – or feel like – rock stars. There is plenty of nastiness in that business.

But crypto is a different beast entirely.

“Everyone I talk to in this space is corrupt,” railed one founder to me last week. He didn’t know where to turn so he did it all himself. It worked, but not without much trial and error.

Another founder is handing out legal documents his legal team produced for him because he was sick they cost so much. Given that the average equity investment in a startup requires one document and a handshake, to spend upwards of $100,000 for documentation galls. Add in an opaque, hype-filled market and a secretive investment class and you get an explosive mixture.

This will not lost. The barnacles will fall off. But until then it’s sad that such a promising technology will be tainted by the behavior of a few growth marketers who are using the techniques they learned selling penis pills to sell securities. Don’t expect financial authorities to cut these cheaters down, either. That can only be done by the market, a market that knows when enough is enough and that it shouldn’t cost dumb money to raise smart money.

You can’t pay for coverage. You shouldn’t charge to pitch. You shouldn’t make profit on wild inequity. But people will do these things and more and things will not change until the entire industry – from the founders to the service companies to the investors to the media – agrees to scrape them off.

Photo by Thomas Kelley on Unsplash

Powered by WPeMatico

Poq, the London-based startup that offers a SaaS to make it easier for retailers to launch and maintain a consumer-facing shopping app, has raised £9.5 million in Series B funding. Leading the round is Smedvig Capital, with participation from previous backers Beringea, and Revolt Ventures. It brings the total amount raised by Poq to £16.5 million since the company was founded in 2011.

A fairly early entrant into the so-called ‘apps-as-a-service’ space, Poq’s pitch is that it enables retailers — with a particular focus on ‘pureplay’ or multichannel brands — to create their own e-commerce app at a fraction of the price of using a traditional app development agency or doing it all in-house. The company counts the likes of House of Fraser, Missguided, Prettylittlething, Holland & Barrett, Hotel Chocolat, Fragrance Direct, and Made.com as clients.

“Our platform is the result of years of focus on retail apps and is proven to increase conversion rates and revenue,” Øyvind Henriksen, CEO and co-founder at Poq, tells TechCrunch. “New code is rolled out every week and major releases delivered every quarter”.

This, he says, is often in contrast to the way retailers engage with a traditional app agency, which typically sees a lot of work and investment go into a version one, only for the app to be left unloved as each update can be costly and has unnecessary friction.

The other option is to not bother with an app and just have a mobile website, but Poq claims these don’t perform well in retail and that apps are proven to provide a better shopping experience, which leads to much better engagement, retention and conversion.

“While everyone would love to have an app, the reality is that apps are typically hard to build and maintain. By using Poq’s SaaS approach, retailers get the product faster to market, keep it up to date easier, [and] have the ability to plug into an ecosystem of pre-built integrations to technology providers,” says Henriksen.

The Poq CEO describes Poq’s typical customer as a large pureplay or multichannel retailer. “Our first major customer was House of Fraser,” he says, “and that’s when we proved ourselves as an enterprise-ready software provider. From then we’ve seen multichannel customers such as Holland and Barrett and House of Fraser use apps as a new digital channel, the apps also power their loyalty programs in the stores”.

Meanwhile, Poq says the new funding will help the company drive growth in the U.K. and Europe, as well as in the U.S., where it plans to open offices. I’m told the U.S. currently makes up 20 percent of Poq’s revenue.

Powered by WPeMatico

Zinc, the London-based company builder tackling various societal problems, has picked up £3 million in seed investment as it readies its second cohort and mission. Backing the round is LocalGlobe, Niklas Zennström’s Atomico, U.K. university LSE, and a number of angel investors.

Launched late last year, Zinc helps build startups almost from scratch. Somewhat similar to Entrepreneur First, it focuses on recruiting potential founders — in this instance, experts in social science, technology, design and business — who through the 9-month programme form new companies.

Each Zinc cohort is tasked with tackling a specific mission around a broader theme. The debut programme, which was used to prove the model and is currently drawing to a close, set out to create startups that can tackle the problem of women’s mental and emotional health. This saw 55 prospective founders and entrepreneurs participate, resulting in 17 new companies being formed.

They span tech-enabled businesses working on problems as diverse as perinatal mental health, loneliness amongst the elderly, young women discovering sexual pleasure, stress-related physical conditions like IBS, women walking safely in cities, new talking therapies, and more. One criteria of Zinc-founded companies is that the resulting solution needs to be applicable globally, and that the problem being tackled affects a large enough number of people in the developed world ie ~100 million or more.

“We try to solve huge societal issues by mobilising talent, ideas and capital, and by taking a mission-led approach,” Ella Goldner, co-founder and GM of Zinc, tells TechCrunch. “Our programme does so by finding the best talent, surrounding them with smarts experts to help them build new tech-enabled scalable businesses, and help them develop products and services that tackle the issues in the context of the mission”.

Zinc’s second mission, which the company builder is currently recruiting for, will see it focus on the 150 million people living in places that have been hit hard by automation and globalisation over the last 20 or 30 years, as traditional industries in those areas have declined (e.g. coal, manufacturing, textiles, shipbuilding, ports and tourism).

“The founders on the programme are a diverse group of entrepreneurial creative individuals who are driven by the mission, and are keen to set up a new business. They have background in tech, the mission’s focus area, or in ops and marketing. The average age is 34 and they are truly diverse in terms of nationalities… We believe in people’s ability to take control over those issues and solve them, rather than relying on public sector to do that,” explains Goldner.

Suzanne Ashman Blair, partner at LocalGlobe, echoes that sentiment and says that Zinc has got off to a great start with its first mission. “To have an impact on society’s deepest challenges, we need to bring together entrepreneurial talent and capital. Zinc has demonstrated that its approach to addressing social problems through technology is a powerful combination”.

LSE’s investment in Zinc also sees it effectively become a founder of the burgeoning company builder. The London university is leading a new consortium of U.K. universities (Oxford, Manchester, Sussex and Sheffield) who will work with the Zinc programme to “turn research insight into new businesses that have commercial and social impact”.

To that end, in addition to Goldner, Zinc lists it founders as Paul Kirby (a former Head of the No 10 Policy Unit and previously a senior partner at KPMG), Saul Klein (co-founder of LocalGlobe and a serial tech entrepreneur), and Professor Julia Black (Pro-Director for Research at the London School of Economics and Political Science and a Board Member of U.K. Research & Innovation).

Meanwhile, Zinc says the new £3 million funding will enable it to plan future missions and replicate the success of its launch programme.

Powered by WPeMatico