TC

Auto Added by WPeMatico

Auto Added by WPeMatico

Monzo, the U.K. challenger bank, has finally added Apple Pay to its mobile-only current account. The just over three year-old fintech says it has been one of the most requested features for its banking app, with over 2,000 mentions of Apple Pay on Monzo’s forum, whilst its customer support team have been asked about the functionality more than 13,000 times. In other words, the rollout can’t come soon enough. Noteworthy, Monzo was able to add Google Pay all the way back in October 2017.

Meanwhile, many of its passionate and vocal users will be wondering what took Monzo so long (as an aside, rival challenger Starling was able to add Apple Pay in July 2017). The upstart bank, which usually makes a virtue of its community-driven approach and transparency hasn’t been able to say (or even fully acknowledge that the feature was coming), likely because Apple imposes strict rules on the ways its partners communicate working with the tech giant. And when you sign an NDA with Apple it’s not atypical for it to stipulate that you don’t talk about said NDA.

What we do know is that — similar to Apple’s iOS App Store when submitting an app — the Apple Pay approval process for a new bank partner is not for the faint-hearted. Industry insiders tell me that Google Pay has fewer hurdles to jump in comparison.

Now that the feature is live, Monzo is talking up the security and privacy aspect of using Apple Pay, noting that when you use a credit or debit card with Apple Pay, the actual card numbers are not stored on the device, nor on Apple servers. Instead, “a unique Device Account Number is assigned, encrypted and securely stored in the Secure Element on your device… [and] each transaction is authorised with a one-time unique dynamic security code”.

Of course, most people simply like Apple Pay for its convenience, letting you use your phone to pay rather than fumbling for a debit or credit card, and when shopping online not having to repeatedly enter card details.

Cue Monzo’s Tom Blomfield waxing lyrical in a company statement about Apple’s design and UX. “Apple is famous for building beautiful products with simple, intuitive interfaces. Their design thinking has long been a source of inspiration for us. Monzo’s mission has alway been to make sure everyone can use and manage their money effortlessly, and with Apple Pay we are one step closer to achieving that,” says the challenger bank’s co-founder and CEO.

Powered by WPeMatico

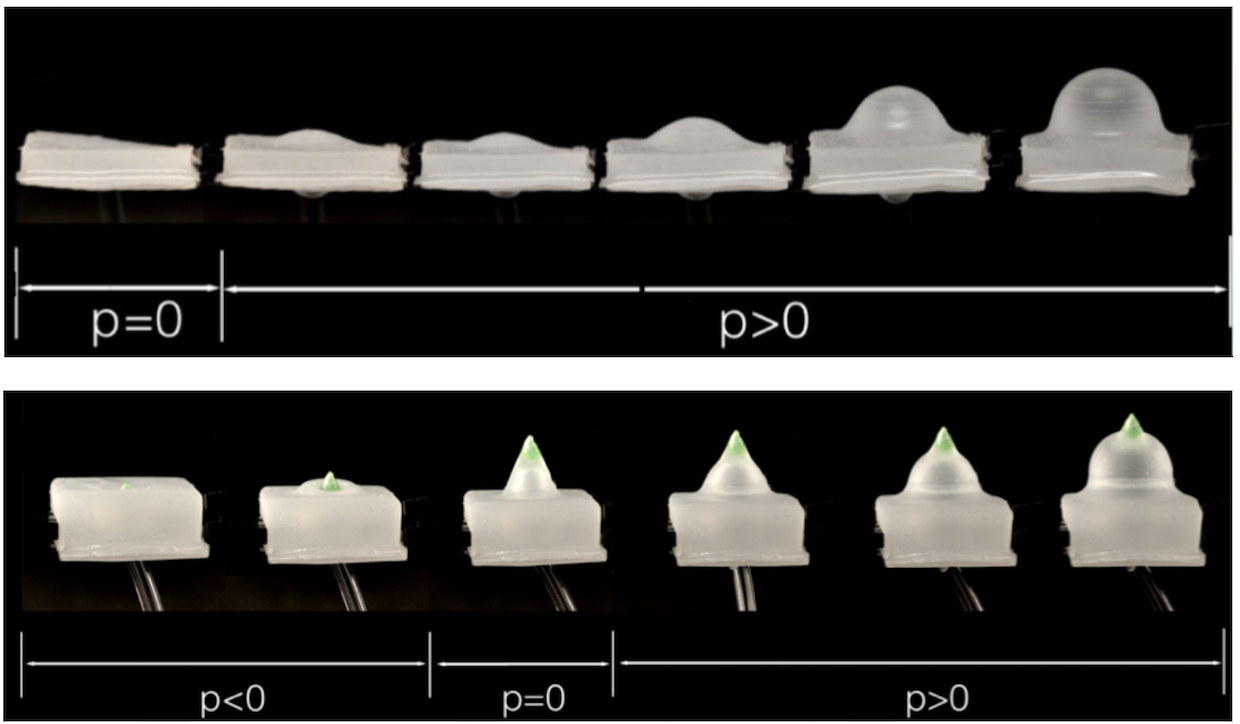

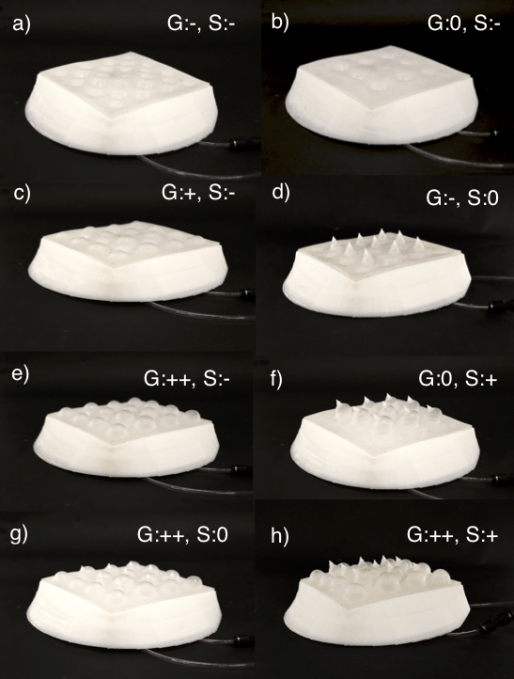

Cornell researchers have made a little robot that can express its emotions through touch, sending out little spikes when it’s scared or even getting goosebumps to express delight or excitement. The prototype, a cute smiling creature with rubber skin, is designed to test touch as an I/O system for robotic projects.

The robot mimics the skin of octopi which can turn spiky when threatened.

The researchers, Yuhan Hu, Zhengnan Zhao, Abheek Vimal and Guy Hoffman, created the robot to experiment with new methods for robot interaction. They compare the skin to “human goosebumps, cats’ neck fur raising, dogs’ back hair, the needles of a porcupine, spiking of a blowfish, or a bird’s ruffled feathers.”

“Research in human-robot interaction shows that a robot’s ability to use nonverbal behavior to communicate affects their potential to be useful to people, and can also have psychological effects. Other reasons include that having a robot use nonverbal behaviors can help make it be perceived as more familiar and less machine-like,” the researchers told IEEE Spectrum.

The skin has multiple configurations and is powered by a computer-controlled elastomer that can inflate and deflate on demand. The goosebumps pop up to match the expression on the robot’s face, allowing humans to better understand what the robot “means” when it raises its little hackles or gets bumpy. I, for one, welcome our bumpy robotic overlords.

Powered by WPeMatico

“Travel is expensive, but we are at the cusp of a revolution that will democratize travel and leisure for everyone,” reads the breathless whitepaper for HoweyCoins. “The Internet was the first part of the revolution. The other part is blockchain technology and cryptocurrencies.”

“I’m all about HoweyCoins – this thing is going to pop at the top!” writes @boxingchamp1934, an official celebrity backer of the token. The website is full of beautiful beaches, features a handsome team of international men and women and the technology is nowhere to be seen, buried under a sea of excitement. The whitepaper is complete and well-written, focusing on the upside that is to come. Riches await if you invest in HoweyCoin, the latest ICO opportunity from trusted folks.

Or do they?

They don’t. All that breathless optimism is a site created by US Securities Exchange Commission to warn investors of scams and issues associated with token sales. The site features all the trademarks of a scammy security token, including tiered pre-sale pricing and an urgent countdown clock.

The site features a number of red flags that the SEC encourages users to watch out for, including, most importantly, claims that tokens can only go up in value. They write:

Every investment carries some degree of risk, which is reflected in the rate of return you can expect to receive. High returns entail high risks, possibly including a total loss on the investments. Most fraudsters spend a lot of time trying to convince investors that extremely high returns are “guaranteed” or “can’t miss.”

The SEC also notes that “it is never a good idea to make an investment decision just because someone famous says a product or service is a good investment,” and that it is never a good idea to invest with a credit card.

They also warn against pump and dump language found on many ICO pages. “Our past two pumps have doubled value for the period immediately after the pump for returns of over 225%,” wrote the HoweyCoins “creators,” a giant no-no in the world of investing.

You can read the rest of the red flags here.

While the site is fairly comical, it is sufficiently complete and would fool the casual observer. The SEC also posted a real-looking whitepaper that makes it clear that anyone can string together a few buzzwords and write a passable investment prospectus. That this is now a service available to anyone — for a price — makes things even scarier.

The site is part of the SEC’s outreach efforts to help investors understand ICOs.

“Strong investor protection is part of what makes American markets so strong…and striking the balance, [between innovation and investor protection] is very important,” said Chief of the SEC Cyber Unit Robert Cohen at Consensus this week. During the same panel the SEC claimed its doors were always open for questions.

Ultimately there is little separating the scams from the real token sales. This is a problem. The SEC is framing this problem in their own way based on decades of dealing with pink sheet pump and dumps and bogus get-rich-quick schemes. While HoweyCoins may not be real, there are plenty of scammers out there, and at least something like this bogus website makes it easier to spot the warning signs.

Powered by WPeMatico

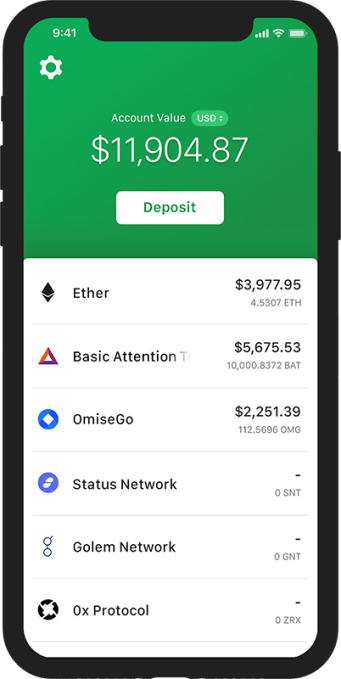

Compound wants to let you borrow cryptocurrency, or lend it and earn an interest rate. Most cryptocurrency is shoved in a wallet or metaphorically hidden under a mattress, failing to generate interest the way traditionally banked assets do. But Compound wants to create liquid money markets for cryptocurrency by algorithmically setting interest rates, and letting you gamble by borrowing and then short-selling coins you think will sink. It plans to launch its first five for Ether, a stable coin, and a few others, by October.

Today, Compound is announcing some ridiculously powerful allies for that quest. It’s just become the first-ever investment by crypto exchange juggernaut Coinbase’s new venture fund. It’s part of an $8.2 million seed round led by top-tier VC Andreessen Horowitz, crypto hedge fund Polychain Capital and Bain Capital Ventures — the startup arm of the big investment bank.

While right now Compound deals in cryptocurrency through the Ethereum blockchain, co-founder and CEO Robert Leshner says that eventually he wants to carry tokenized versions of real-world assets like the dollar, yen, euro or Google stock. That’s because Leshner tells me “My thesis is that almost every crypto asset is bullshit and not worth anything.”

Here’s how Compound tells me it’s going to work. It’s an “overnight” market that permits super-short-term lending. While it’s not a bank, it is centralized, so you loan to and borrow from it directly instead of through peers, alleviating you from negotiation. If you loan, you can earn interest. If you borrow, you have to put up 100 percent of the value of your borrow in an asset Compound supports. If prices fluctuate and your borrow becomes worth more than your collateral, some of your collateral is liquidated through a repo agreement so they’re equal.

To set the interest rate, Compound acts kind of like the Fed. It analyzes supply and demand for a particular crypto asset to set a fluctuating interest rate that adjusts as market conditions change. You’ll earn that on what you lend constantly, and can pull out your assets at any time with just a 15-second lag. You’ll pay that rate when you borrow. And Compound takes a 10 percent cut of what lenders earn in interest. For crypto-haters, it offers a way to short coins you’re convinced are doomed.

“Eventually our goal is to hand-off responsibility [for setting the interest rate] to the community. In the short-term we’re forced to be responsible. Long-term we want the community to elect the Fed,” says Leshner. If it gets the interest rate wrong, an influx of lenders or borrowers will drive it back to where it’s supposed to be. Compound already has a user interface prototyped internally, and it looked slick and solid to me.

“We think it’s a game changer. Ninety percent of assets are sitting in people’s cold storage, or wallets, or exchanges. They aren’t being used or traded,” says Leshner. Compound could let people interact with crypto in a whole new way.

Compound is actually the third company Leshner and his co-founder and CTO Geoff Hayes have started together. They’ve been teamed up for 11 years since going to college at UPenn. One of their last companies, Britches, created an index of CPG inventory at local stores and eventually got acquired by Postmates. But before that Leshner got into the banking and wealth management business, becoming a certified public accountant. A true economics nerd, he’s the chair of the SF bond oversight committee, and got into crypto five years ago.

Compound co-founder and CEO Robert Leshner

Sitting on coins, Leshner wondered, “Why can’t I realize the time value of the cryptocurrency I possess?” Compound was born in mid-2017, and came out of stealth in January.

Now with $8.2 million in funding that also came from Transmedia Capital, Compound Ventures, Abstract Ventures and Danhua Capital, Compound is pushing to build out its product and partnerships, and “hire like crazy” beyond its seven current team members based in San Francisco’s Mission District. Partners will be crucial to solve the chicken-and-egg problem of getting its first lenders and borrowers. “We are planning to launch with great partners — token projects, hedge funds and dedicated users,” says Leshner. Having hedge funds like Polychain should help.

“We shunned an ICO. We said, ‘let’s raise venture capital.’ I’m a very skeptical person and I think most ICOs are illegal,” Leshner notes. The round was just about to close when Coinbase announced Coinbase Ventures. So Leshner fired off an email asking if it wanted to join. “In 12 hours they researched us, met our team, diligenced it and evaluated it more than almost any investor had to date,” Leshner recalls. Asked if there’s any conflict of interest given Coinbase’s grand ambitions, he said, “They’re probably our favorite company in the world. I hope they survive for 100 years. It’s too early to tell they overlap.”

There are other crypto lending platforms, but none quite like Compound. Centralized exchanges like Bitfinex and Poloniex let people trade on margin and speculate more aggressively. But they’re off-chain, while Leshner says Compound is on-chain, transparent and can be built on top of. That could make it a more critical piece of the blockchain finance stack. There’s also a risk of these exchanges getting hacked and your coins getting stolen.

Meanwhile, there are plenty of peer-to-peer crypto lending protocols on the Ethereum blockchain, like ETHLend and Dharma. But interest rates, no need for slow matching, flexibility for withdrawing money and dealing with a centralized party could attract users to Compound.

Meanwhile, there are plenty of peer-to-peer crypto lending protocols on the Ethereum blockchain, like ETHLend and Dharma. But interest rates, no need for slow matching, flexibility for withdrawing money and dealing with a centralized party could attract users to Compound.

Still, the biggest looming threat for Compound is regulation. But to date, the SEC and regulators have focused on ICOs and how people fundraise, not on what people are building. People aren’t filing lawsuits against actual products. “All the operations have flown beneath the radar and I think that’s going to change in the next 12 months,” Leshner predicts. How exactly they’ll treat Compound is up in the air.

One source in the crypto hedge fund space told me about forthcoming regulation: “You’re either going to get annihilated and have to disgorge profits or dissolve. Or you pay a fine and you’re among the first legal funds in the space. This is the gamble you take before asset classes get baptized.” As Leshner confirmed, “That’s the number one risk, period.”

Money markets are just one piece of the financial infrastructure puzzle that still needs to emerge around blockchain. Custodians, auditors, administrators and banks are still largely missing. When those get hammered out to make the space safer, the big money hedge funds and investment banks could join in. For Compound, getting the logistics right will require some serious legal ballet.

Yet Leshner is happy to dream big despite all of the crypto world’s volatility. He concludes, “We want to be like Black Rock with a trillion under management, and we want to have 25 employees when we do that. They probably have [tens of thousands] of employees. Our goal is to be like them with a skeleton team.”

Powered by WPeMatico

Coinbase has come a long way since its launch in 2012. The company has raised more than $225 million and paved the way for cryptocurrencies to enter the mainstream by providing a digital currency exchange. Which is why we’re absolutely thrilled to have Coinbase co-founder and CEO Brian Armstrong join us on the main stage at TechCrunch Disrupt SF in September.

Armstrong worked as a developer for IBM and consultant at Deloitte before joining Airbnb as a software engineer in 2011. At Airbnb, Armstrong focused on fraud prevention, giving him the opportunity to learn about payment systems across the 190 countries Airbnb serves.

In 2012, Armstrong co-founded Coinbase and gave a budding demographic of cryptocurrency enthusiasts the opportunity to trade in their USD for bitcoins, and later the digital currency of their choice. Coinbase currently serves over 10 million customers across 32 countries, providing custody for more than $10 billion in digital assets.

In fact, Coinbase was valued at $1.6 billion following a $100 million funding round in August 2017.

In April, the company unveiled an early-stage fund for cryptocurrency startups, and acquired Earn.com for $100 million. As part of the acquisition, the company brought on Balaji Srinivasan as its first CTO.

There were also reports that Coinbase approached the SEC to become a licensed brokerage firm and electronic trading venue, which would allow the company to expand beyond the four coins (Bitcoin, Bitcoin Cash, Ethereum, Litecoin) that trade on the platform now.

Just yesterday, Coinbase announced that it would offer a new suite of services aimed at institutional investors, who are beginning to warm up to cryptocurrencies.

There is plenty to discuss with Armstrong come September, and we’re absolutely thrilled to have him join the stellar Disrupt SF agenda. You can head over here to buy yourself tickets. See you there!

Powered by WPeMatico

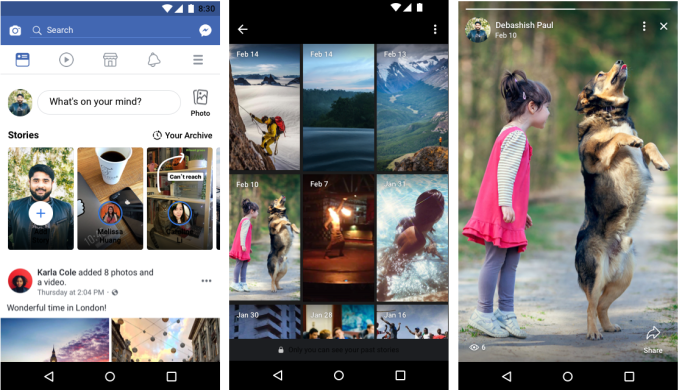

Facebook’s future rests on convincing the developing world to adopt Stories. But just because the slideshow format will soon surpass feed sharing doesn’t mean people use them the same way everywhere. So late last year, Facebook sent a team to India to learn what features they’d need to embrace Stories across a variety of local languages on phones without much storage.

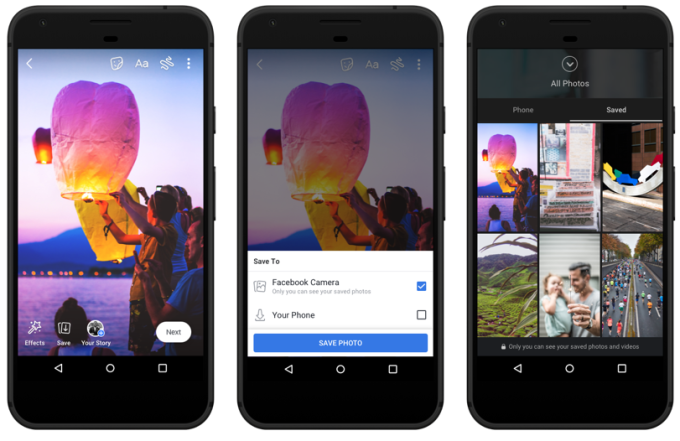

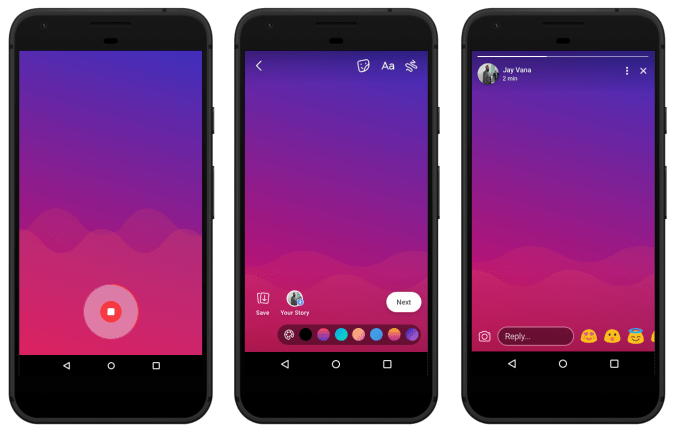

Today, Facebook will start rolling out three big Stories features in India, which will come to the rest of the world shortly after. First, to lure posts from users who don’t want to type or have a non-native language keyboard, as well as micropodcasters, Facebook Stories will allow audio posts combining a voice message with a colored background or photo.

Facebook Stories will get an Archive similar to Instagram Stories that automatically saves your clips privately after they expire so you can go back to check them out or re-share the content to the News Feed. And finally, Facebook will let Stories users privately Save their clips from the Facebook Camera directly to the social network instead of their phone in case they don’t have enough space.

Facebook Stories Archive

“We know that the performance and reliability of viewing and posting Stories is extremely important to people around the world, especially those with slower connections” Facebook’s director of Stories Connor Hayes tells me. “We are always working on ways to improve the experience of viewing Stories on all types of connections, and have been investing here — especially on our FB Lite app.”

Facebook has a big opportunity to capitalize on Snapchat’s failure to focus on the international market. Plagued by Android engineering problems and initial reluctance to court users beyond U.S. teens, Snapchat left the door open for Facebook’s Stories products to win the globe. Now Snapchat has sunk to its slowest growth rate ever, hitting 191 million daily users despite shrinking in March. Meanwhile, WhatsApp Status, its clone of Snapchat Stories has 450 million daily users, while Instagram Stories has over 300 million.

As for Facebook Stories, it was initially seen as a bit of a ghost town but more and more of my friends are posting there, in part thanks to the ability to syndicate you Instagram Stories there. Facebook Stories has never announced a user count, and Hayes says “We don’t have anything to share yet, but performance of Facebook Stories is encouraging, and we’ve learned a lot about how we can make the experience even better.” Facebook is hell-bent on making Stories work on its own app after launching the in mid-2017, and seems to believe users who find them needless or redundant will come around eventually.

My concern about the global rise of Stories is that instead of only recording the biggest highlights of our lives to capture with our phones, we’re increasingly interrupting all our activities and exiting the present to thrust our phone in the air.

That’s one thing Facebook hopes to fix here, Facebook’s director of Stories Connor Hayes tells me. “Saving photos and videos can be used to save what you might want to post later – So you don’t have to edit or post them while you’re out with your friends, and instead enjoy the moment at the concert and share them later.” You’re still injecting technology into your experience, though, so I hope we can all learn to record as subtly as possible without disturbing the memory for those around us.

Facebook Camera’s Save feature

The new Save to Facebook Camera feature creates a private tab in the Stories creation interface where you can access and post the imagery you’ve stored, and you’ll also find a Saved tab in your profile’s Photos section. Unlike Facebook’s discontinued Photo Sync feature, here you’ll choose to save imagery one at a time. It will be a big help to users lacking free space on their phone, as Facebook says many people around the world have to delete a photo just to save a new one.

Facebook wants to encourage people to invest more time decorating Stories, and learned that some people want to re-live or re-share their clips that expire after 24 hours. That’s why its built the Archive, a hedge against the potentially short-sighted trend of ephemerality.

On the team’s journey to India, they heard that photos and videos aren’t always the easiest way to share. If you’re camera-shy, have a low-quality camera, or don’t have cool scenes to capture, audio posts could get you sharing more. In fact, Facebook started testing voice clips as feed status updates in March. “With this week’s update, you will have options to add a voice message to a colorful background or a photo from your camera gallery or saved gallery. You can also add stickers, text, or doodles” says Hayes. With 22 official languages in India and over 100 spoken, recording voice can often be easier than typing.

Facebook Audio Stories

Some users will still hate Stories, which are getting more and more prominence atop Facebook’s feed. But Facebook can’t afford to retreat here. Stories are social media bedrock — the most full-screen and immersive content medium we can record and consume with just our phones. Facebook CEO Mark Zuckerberg himself said that Facebook must make sure that “ads are as good in Stories as they are in feeds. If we don’t do this well, then as more sharing shifts to Stories, that could hurt our business.” That means Facebook Stories needs India’s hundreds of millions of users.

There will always be room for text, yet if people want to achieve an emotional impact, they’ll eventually wade into Storytelling. But social networks must remember low-bandwidth users, or we’ll only get windows into the developed world.

For more on Facebook Stories, check out our recent coverage:

Powered by WPeMatico

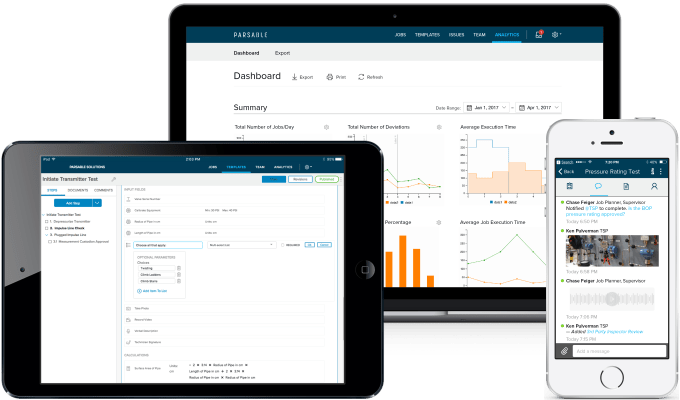

As we increasingly hear about automation, artificial intelligence and robots taking away industrial jobs, Parsable, a San Francisco-based startup sees a different reality, one with millions of workers who for the most part have been left behind when it comes to bringing digital transformation to their jobs.

Parsable has developed a Connected Worker platform to help bring high tech solutions to deskless industrial workers who have been working mostly with paper-based processes. Today, it announced a $40 million Series C cash injection to keep building on that idea.

The round was led by Future Fund with help from B37 and existing investors Lightspeed Venture Partners, Airbus Ventures and Aramco Ventures. Today’s investment brings the total to nearly $70 million.

The Parsable solution works on almost any smartphone or tablet and is designed to enter information while walking around in environments where a desktop PC or laptop simply wouldn’t be practical. That means being able to tap, swipe and select easily in a mobile context.

Photo: Parsable

The challenge the company faced was the perception these workers didn’t deal well with technology. Parsable CEO Lawrence Whittle says the company, which launched in 2013, took its time building its first product because it wanted to give industrial workers something they actually needed, not what engineers thought they needed. This meant a long period of primary research.

The company learned, it had to be dead simple to allow the industry vets who had been on the job for 25 or more years to feel comfortable using it out of the box, while also appealing to younger more tech-savvy workers. The goal was making it feel as familiar as Facebook or texting, common applications even older workers were used to using.

“What we are doing is getting rid of [paper] notebooks for quality, safety and maintenance and providing a digital guide on how to capture work with the objective of increasing efficiency, reducing safety incidents and increasing quality,” Whittle explained.

“What we are doing is getting rid of [paper] notebooks for quality, safety and maintenance and providing a digital guide on how to capture work with the objective of increasing efficiency, reducing safety incidents and increasing quality,” Whittle explained.

He likens this to the idea of putting a sensor on a machine, but instead they are putting that instrumentation into the hands of the human worker. “We are effectively putting a sensor on humans to give them connectivity and data to execute work in the same way as machines,” he says.

The company has also made the decision to make the platform flexible to add new technology over time. As an example they support smart glasses, which Whittle says accounts for about 10 percent of its business today. But the founders recognized that reality could change and they wanted to make the platform open enough to take on new technologies as they become available.

Today the company has 30 enterprise customers with 30,000 registered users on the platform. Customers include Ecolab, Schlumberger, Silgan and Shell. They have around 80 employees, but expect to hit 100 by the end of Q3 this year, Whittle says.

Powered by WPeMatico

Teatime Games, a new Icelandic “social games” startup from the same team behind the hugely popular QuizUp (acquired in by Glu Mobile), is disclosing $9 million in funding, made up of seed and Series A rounds.

Index Ventures led both, but have been joined by Atomico, the European VC fund founded by Skype’s Niklas Zennström, for the $7.5 million Series A round. I understand this is the first time the two VC firms have done a Series A deal together in over a decade.

Both VCs have a decent track record in gaming. Index counts King, Roblox and Supercell as previous gaming investments, whilst Atomico also backed Supercell, along with Rovio, and most recently Bossa Studios.

As part of the round, Guzman Diaz of Index Ventures, Mattias Ljungman of Atomico, and David Helgason, founder of Unity, have joined the Teatime Games board of directors.

Meanwhile, Teatime Games is keeping shtum publicly on exactly what the stealthy startup is working on, except that it plays broadly in the social and mobile gaming space. In a call with co-founder and CEO Thor Fridriksson yesterday, he said a little more off the record and on condition that I don’t write about it yet.

What he was willing to describe publicly, however, is the general problem the company has set out to solve, which is how to make mobile games more social and personalised. Specifically, in a way that any social features — including communicating with friends and other players in real-time — enhances the gameplay rather than gets in its way or is simply bolted on as an adjunct to the game itself.

The company’s macro thesis is that games have always been inherently social throughout different eras (e.g. card games, board games, arcades, and consoles), and that most games truly come to life “through the interaction between people, opponents, and the audience”. However, in many respects this has been lost in the age of mobile gaming, which can feel like quite a solitary experience. That’s either because they are single player games or turn-based and played against invisible opponents.

Teatime plans to use the newly disclosed investment to double the size of its team in Iceland, with a particular focus on software engineers, and to further develop its social gaming offering for third party developers. Yes, that’s right, this is clearly a developer platform play, as much as anything else.

On that note, Atomico Partner Mattias Ljungman says the next “breakout opportunity” in games will see a move beyond individual studios and titles to what he describes as fundamental enabling technologies. Linked to this he argues that the next generation of games companies being developed will “become ever more mass market and socially connected”. You can read much more on Ljungman and Atomico’s gaming thesis in a blog post recently published by the VC firm.

Powered by WPeMatico

In an effort to tie the top gamers and streamers more directly with their fans, a new company called Quarterback has just raised $2.5 million to create and manage fan-based leagues for the superstars of the esports and streaming world.

The company raked in its seed round from investors led by Bitkraft Esports, which is quickly building one of the most complete portfolios of gaming-related startups in the industry. Additional investors include Crest Capital Ventures, Deep Space Ventures, UpWest Labs and angel investors.

Essentially, it’s a platform for creating gaming leagues and content driven not by game publishers, leagues, or existing streaming sites like Twitch, but by the gamers themselves. It gives streamers and players a new way to reach their audience, the company claims.

Founded by serial entrepreneur Jonathan Weinberg, who acted as the chief executive for Round Robin and held a leadership role in the mobile game studio Spartonix, Quarterback is the latest attempt to get more revenue into the hands of gamers.

Leagues created on Quarterback can host daily challenges, give away prizes and compete against fan clubs devoted to other top players.

Esports streamers and gamers are among the most bankable influencers, pitching to a new generation of consumers that don’t track traditional media sources. The ability to host and own their own channels gives these streamers an ability to create their own game libraries, cultivate a next generation of talent and encourage one-to-one interactions on platforms they control.

“Most streamers and pros struggle to monetize their fan-base and lose touch with their audience when the fans break away to play their own games,” says Jens Hilgers, a founding partner of Bitkraft Esports Ventures. “Quarterback solves this problem in a unique way by helping streamers become an integral part of their fan’s game-play.”

Powered by WPeMatico

Auth0, a startup based in Seattle, has been helping developers with a set of APIs to build authentication into their applications for the last five years. It’s raised a fair bit of money along the way to help extend that mission, and today the company announced a $55 million Series D.

This round was led by led by Sapphire Ventures with help from World Innovation Lab, and existing investors Bessemer Venture Partners, Trinity Ventures, Meritech Capital and K9 Ventures. Today’s investment brings the total raised to $110 million. The company did not want to share its valuation.

CEO Eugenio Pace said the investment should help them expand further internationally. In fact, one of the investors, World Innovation Lab, is based in Japan and should help with their presence there. “Japan is an important market for us and they should help explain to us how the market works there,” he said.

The company offers an easy way for developers to build in authentication services into their applications, also known as Identification as a Service (IDaaS). It’s a lot like Stripe for payments or Twilio for messaging. Instead of building the authentication layer from scratch, they simply add a few lines of code and can take advantage of the services available on the Auth0 platform.

That platform includes a range of service such as single-sign on, two-factor identification, passwordless log-on and breached password detection.

They have a free tier, which doesn’t even require a credit card, and pay tiers based on the types of users — regular versus enterprise — along with the number of users. They also charge based on machine-to-machine authentication. Pace reports they have 3500 paying customers and tens of thousands of users on the free tier.

All of that has added up to a pretty decent business. While Pace would not share specific numbers, he did indicate the company doubled its revenue last year and expected to do so again this year.

With a cadence of getting funding every year for the last three years, Pace says this round may mark the end of that fundraising cycle for a time. He wasn’t ready to commit to the idea of an IPO, saying that is likely a couple of years away, but he says the company is close to profitability.

With the new influx of money, the company does plan to expand its workforce as moves into markets across the world . They currently have 300 employees, but within a year he expects to be between 400 and 450 worldwide.

The company’s last round was a $30 million Series C last June led by Meritech Capital Partners.

Powered by WPeMatico