TC

Auto Added by WPeMatico

Auto Added by WPeMatico

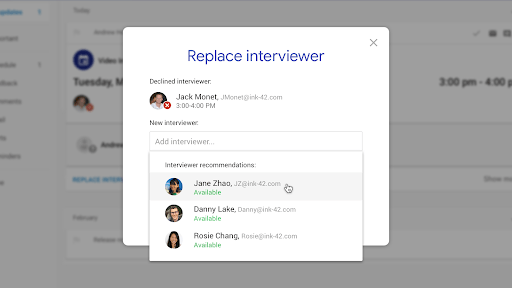

Since Google Hire launched last year it has been trying to make it easier for hiring managers to manage the data and tasks associated with the hiring process, while maybe tweaking LinkedIn while they’re at it. Today the company announced some AI-infused enhancements that they say will help save time and energy spent on manual processes.

“By incorporating Google AI, Hire now reduces repetitive, time-consuming tasks, like scheduling interviews into one-click interactions. This means hiring teams can spend less time with logistics and more time connecting with people,” Google’s Berit Hoffmann, Hire product manager wrote in a blog post announcing the new features.

The first piece involves making it easier and faster to schedule interviews with candidates. This is a multi-step activity that involves scheduling appropriate interviewers, choosing a time and date that works for all parties involved in the interview and scheduling a room in which to conduct the interview. Organizing these kind of logistics tend to eat up a lot of time.

“To streamline this process, Hire now uses AI to automatically suggest interviewers and ideal time slots, reducing interview scheduling to a few clicks,” Hoffmann wrote.

Photo: Google

Another common hiring chore is finding keywords in a resume. Hire’s AI now finds these words for a recruiter automatically by analysing terms in a job description or search query and highlighting relevant words including synonyms and acronyms in a resume to save time spent manually searching for them.

Photo: Google

Finally, another standard part of the hiring process is making phone calls, lots of phone calls. To make this easier, the latest version of Google Hire has a new click-to-call function. Simply click the phone number and it dials automatically and registers the call in call a log for easy recall or auditing.

While Microsoft has LinkedIn and Office 365, Google has G Suite and Google Hire. The strategy behind Hire is to allow hiring personnel to work in the G Suite tools they are immersed in every day and incorporate Hire functionality within those tools.

It’s not unlike CRM tools that integrate with Outlook or GMail because that’s where sales people spend a good deal of their time anyway. The idea is to reduce the time spent switching between tools and make the process a more integrated experience.

While none of these features individually will necessarily wow you, they are making use of Google AI to simplify common tasks to reduce some of the tedium associated with every-day hiring tasks.

Powered by WPeMatico

The CRM industry is now estimated to be worth some $4 billion annually, and today a startup has announced a round of funding that it hopes will help it take on one aspect of that lucrative pie, customer support. Kustomer, a startup out of New York that integrates a number of sources to give support staff a complete picture of a customer when he or she contacts the company, has raised $26 million.

The funding, a series B, was led by Redpoint Ventures (notably, an early investor in Zendesk, which Kustomer cites as a key competitor), with existing investors Canaan Partners, Boldstart Ventures, and Social Leverage also participating.

Cisco Investments was also a part of this round as a strategic investor: Cisco (along with Avaya) is one of the world’s biggest PBX equipment vendors, and customer support is one of the biggest users of this equipment, but the segment is also under pressure as more companies move these services to the cloud (and consider alternative options). Potentially, you could see how Cisco might want to partner with Kustomer to provide more services on top of its existing equipment, and potentially as a standalone service — although for now the two have yet to announce any actual partnerships.

Given that Kustomer has been approached already for potential acquisitions, you could see how the Ciscos of the world might be one possible category of buyers.

Kustomer is not discussing valuation but it has raised a total of $38.5 million. Kustomer’s customers include brands in fashion, e-commerce and other sectors that provide customer support on products on a regular basis, such as Ring, Modsy, Glossier, Smug Mug and more.

When we last wrote about Kustomer, when it raised $12.5 million in 2016, the company’s mission was to effectively turn anyone at a company into a customer service rep — the idea being that some issues are better answered by specific people, and a CRM platform for all employees to engage could help them fill that need.

Today, Brad Birnbaum, the co-founder and CEO, says that this concept has evolved. He said that “half of its business model still involves the idea of everyone being on the platform.” For example, an internal sales rep can collaborate with someone in a company’s shipping department — “but the only person who can communicate with the customer is the full-fledged agent,” he said. “That is what the customers wanted so that they could better control the messaging.”

The collaboration, meanwhile, has taken an interesting turn: it’s not just related to employees communicating better to develop a more complete picture of a customer and his/her history with the company; but it’s about a company’s systems integrating better to give a more complete view to the reps. Integrations include data from e-commerce platforms like Shopify and Magento; voice and messaging platforms like Twilio, TalkDesk, Twitter and Facebook Messenger; feedback tools like Nicereply; analytics services like Looker, Snowflake, Jira and Redshift; and Slack.

Birnbaum previously founded and sold Assistly to Salesforce, which turned it into Desk.com — (his co-founder in Kustomer, Jeremy Suriel, was Assistly’s chief architect), and between that and Kustomer he also had a go at building out Airtime, Sean Parker’s social startup. Kustomer, he says, is not only competing against Salesforce but perhaps even more specifically Zendesk, in offering a new take on customer support.

Zendesk, he said, had really figured out how to make customer support ticketing work efficiently, “but they don’t understand the customer at all.”

“We are a much more modern solution in how we see the world,” he continued. “No one does omni-channel customer service properly, where you can see a single threaded conversation speaking to all of a customer’s points.”

(In actual fact, Zendesk has now started to respond: in May the company launched a new omnichannel product called The Suite, which bundles Zendesk Support, Guide, Chat, and Talk to give a unified view of a customer to the support agent. One more reason Kustomer needs to keep expanding what it does.)

Going forward, Kustomer will be using the funding to expand its platform with more capabilities, and some of its own automations and insights (rather than those provided by way of integrations). This will also see the company expand into other kinds of services adjacent to taking inbound customer requests, such as reaching out to the customers, potentially to seel to them. “We plan to go broadly with engagement as an example,” Birnbaum said. “We already know everything about you so if we see you on a website, we can proactively reach out to you and engage you.”

“It is time for disruption in customer support industry, and Kustomer is leading the way,” said Tomasz Tunguz, partner at Redpoint Ventures, in a statement. “Kustomer has had impressive traction to date, and we are confident the world’s best B2C and B2B companies will be able to utilize the platform in order to develop meaningful relationships, experiences, and lifetime value for their customers. This is an exciting and forward-thinking platform for companies as well as their customers.”

Powered by WPeMatico

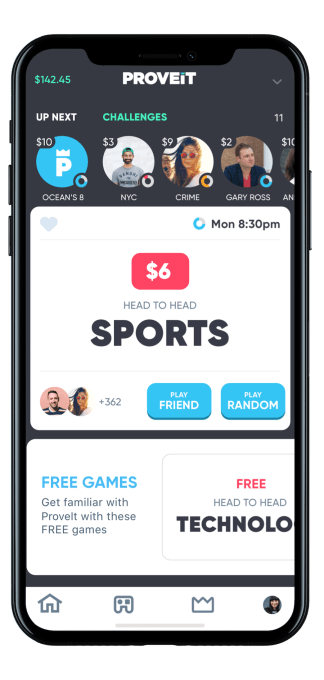

Pick a category, wager a few dollars and double your money in 60 seconds if you’re smarter and faster than your opponent. Proveit offers a fresh take on trivia and game show apps by letting you win or lose cash on quick 10-question, multiple choice quizzes. Sick of waiting to battle a million people on HQ for a chance at a fraction of the jackpot? Play one-on-one anytime you want or enter into scheduled tournaments with $1,000 or more in prize money, while Proveit takes around 10 percent to 15 percent of the stakes.

“I’d play Jeopardy all the time with my family and wondered ‘why can’t I do this for money?’ ” says co-founder Prem Thomas.

Remarkably, it’s all legal. The Proveit team spent two years getting approved as “skill-based gaming” that exempts it from some laws that have hindered fantasy sports betting apps. And for those at risk of addiction, Proveit offers players and their loved ones a way to cut them off.

The scrappy Florida-based startup has raised $2.3 million so far. With fun games and a snackable format, Proveit lets you enjoy the thrill of betting at a moment’s notice. That could make it a favorite amongst players and investors in a world of mobile games without consequences.

“I could spend $50 for a three-hour experience in a movie theater, or I could spend $2 to enter a Proveit Movies tournament that gives me the opportunity to compete for several thousand dollars in prize money,” says co-founder Nathan Lehoux. “That could pay for a lot of movies tickets!”

St. Petersburg, Fla. isn’t exactly known as an innovation hub. But outside Tampa Bay, far from the distractions, copycatting and astronomical rent of Silicon Valley, the founders of Proveit built something different. “What if people could play trivia for money just like fantasy sports?” Thomas asked his friend Lehoux.

St. Petersburg, Fla. isn’t exactly known as an innovation hub. But outside Tampa Bay, far from the distractions, copycatting and astronomical rent of Silicon Valley, the founders of Proveit built something different. “What if people could play trivia for money just like fantasy sports?” Thomas asked his friend Lehoux.

That’s the same pitch that got me interested when Lehoux tracked me down at TechCrunch’s SXSW party earlier this year. Lehoux is a jolly, outgoing fella who became interested in startups while managing some angel investments for a family office. Thomas had worked in banking and health before starting a yoga-inspired sandals brand. Neither had computer science backgrounds, and they’d raised just a $300,000 seed round from childhood friend Hilt Tatum who’d co-founded beleaguered real money gambling site Absolute Poker.

Yet when he Lehoux thrust the Proveit app into my hand, even on a clogged mobile network at SXSW, it ran smoothly and I immediately felt the adrenaline rush of matching wits for money. They’d initially outsourced development to an NYC firm that burned much of their initial $300,000 seed funding without delivering. Luckily, the Ukrainian they’d hired to help review that shop’s code helped them spin up a whole team there that built an impressive v1 of Proveit.

Meanwhile, the founders worked with a gaming lawyer to secure approvals in 33 states including California, New York, and Texas. “This is a highly regulated and highly controversial space due to all the negative press that fantasy sports drummed up,” says Lehoux. “We talked to 100 banks and processors before finding one who’d work with us.”

Proveit founders (from left): Nathan Lehoux, Prem Thomas

Proveit was finally legal for the three-fourths of the U.S. population, and had a regulatory moat to deter competitors. To raise launch capital, the duo tapped their Florida connections to find John Morgan, a high-profile lawyer and medical marijuana advocate, who footed a $2 million angel round. A team of grad students in Tampa Bay was assembled to concoct the trivia questions, while a third-party AI company assists with weeding out fraud.

Proveit launched early this year, but beyond a SXSW promotion, it has stayed under the radar as it tinkers with tournaments and retention tactics. The app has now reached 80,000 registered users, 6,000 multi-deposit hardcore loyalists and has paid out $750,000 total. But watching HQ trivia climb to more than 1 million players per game has proven a bigger market for Proveit.

“We’re actually fans of HQ. We play. We think they’ve revolutionized the game show,” Lehoux tells me. “What we want to do is provide something very different. With HQ, you can’t pick your category. You can’t pick the time you want to play. We want to offer a much more customized experience.”

To play Proveit, you download its iOS-only app and fund your account with a buy-in of $20 to $100, earning more bonus cash with bigger packages (no minors allowed). Then you play a practice round to get the hang of it — something HQ sorely lacks. Once you’re ready, you pick from a list of game categories, each with a fixed wager of about $1 to $5 to play (choose your own bet is in the works). You can test your knowledge of superheroes, the ’90s, quotes, current events, rock ‘n roll, Seinfeld, tech and a rotating selection of other topics.

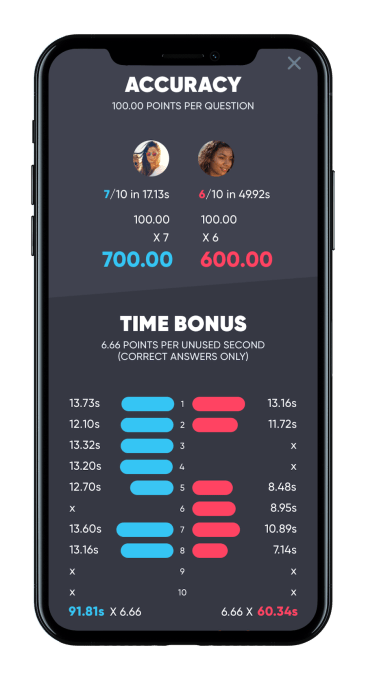

In each Proveit game you get 10 questions, 1 at a time, with up to 15 seconds to answer each. Most games are head-to-head, with options to be matched with a stranger, or a friend via phone contacts. You score more for quick answers, discouraging cheating via Google, and get penalized for errors. At the end, your score is tallied up and compared to your opponent, with the winner keeping both player’s wagers minus Proveit’s cut. In a minute or so, you could lose $3 or win $5.28. Afterwards you can demand a rematch, go double-or-nothing, head back to the category list or cash out if you have more than $20.

The speed element creates intense, white-knuckled urgency. You can get every question right and still lose if your opponent is faster. So instead of second-guessing until locking in your choice just before the buzzer like on HQ, where one error knocks you out, you race to convert your instincts into answers on Proveit. The near instant gratification of a win or humiliation of a defeat nudge you to play again rather than having to wait for tomorrow’s game.

The speed element creates intense, white-knuckled urgency. You can get every question right and still lose if your opponent is faster. So instead of second-guessing until locking in your choice just before the buzzer like on HQ, where one error knocks you out, you race to convert your instincts into answers on Proveit. The near instant gratification of a win or humiliation of a defeat nudge you to play again rather than having to wait for tomorrow’s game.

Proveit will have to compete with free apps like Trivia Crack, prize games like student loan repayer Givling and virtual currency-based Fleetwit, and the juggernaut HQ.

“The large tournaments are the big draw,” Lehoux believes. Instead of playing one-on-one, you can register and ante up for a scheduled tournament where you compete in a single round against hundreds of players for a grand prize. Right now, the players with the top 20 percent of scores win at least their entry fee back or more, with a few geniuses collecting the cash of the rest of the losers.

Just like how DraftKings and FanDuel built their user base with big jackpot tournaments, Proveit hopes to do the same… then get people playing little one-on-one games in-between as they wait for their coffee or commute home from work.

Thankfully, Proveit understands just how addictive it can be. The startup offers a “self-exclusion” option. “If you feel that you need to take greater control of your life as it relates to skill-gaming,” users can email it to say they shouldn’t play any more, and it will freeze or close their account. Family members and others can also request you be frozen if you share a bank account, they’re your dependant, they’re obligated for your debts or you owe unpaid child support.

“We want Proveit to be a fun, intelligent entertainment option for our players. It’s impossible for us to know who might have an issue with real-money gaming,” Lehoux tells me. “Every responsible real-money game provides this type of option for its users.

That isn’t necessarily enough to thwart addiction, because dopamine can turn people into dopes. Just because the outcome is determined by your answers rather than someone else’s touchdown pass doesn’t change that.

Skill-based betting from home could be much more ripe for abuse than having to drag yourself to a casino, while giving people an excuse that they’re not gambling on chance. Zynga’s titles like Farmville have been turning people into micro-transaction zombies for a decade, and you can’t even win money from them. Simultaneously, sharks could study up on a category and let Proveit’s random matching deliver them willing rookies to strip cash from all day. “This is actually one of the few forms of entertainment that rewards players financially for using their brain,” Lehoux defends.

With so much content to consume and consequence-free games to play, there’s an edgy appeal to the danger of Proveit and apps like it. Its moral stance hinges on how much autonomy you think adults should be afforded. From Coca-Cola to Harley-Davidson to Caesar’s Palace, society has allowed businesses to profit off questionably safe products that some enjoy.

For better and worse, Proveit is one of the most exciting mobile games I’ve ever played.

Powered by WPeMatico

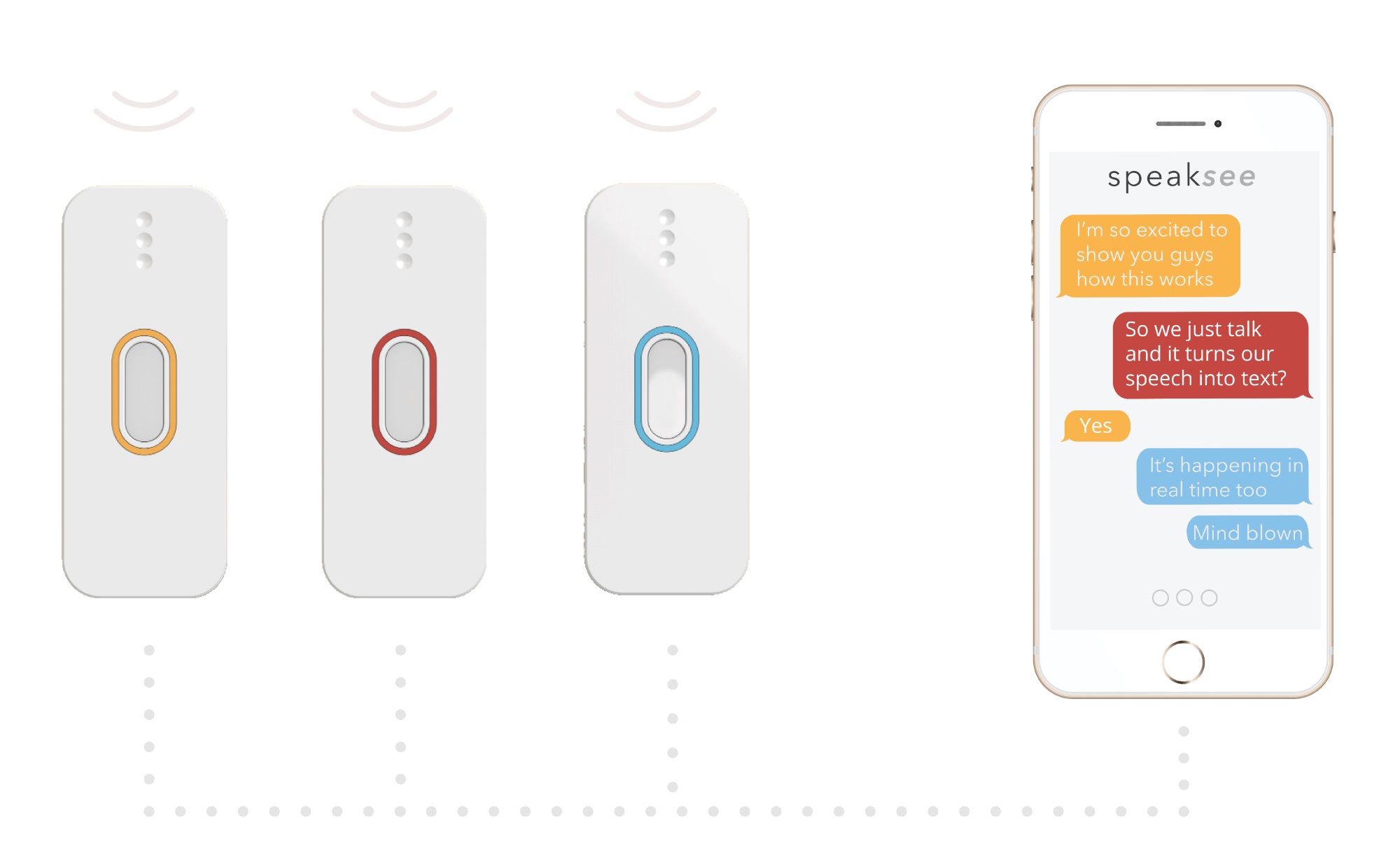

There’s a great deal of activity in the fields of speech recognition and the “Internet of Things,” but one natural application of the two has gone relatively unpursued: helping the deaf and hard of hearing take part in everyday conversations. SpeakSee aims to do this (after crowdfunding, naturally) with a clever hardware design that minimizes setup friction and lets everyone communicate naturally.

It’s meant to be used in situations where someone hard of hearing needs to talk with a handful of others — a meeting, a chat at dinner, asking directions and so on. There are speech-to-text apps out there that can transcribe what someone is saying, but they’re not really suited to the purpose.

“Many deaf people experienced a huge barrier in asking people to download the app and hold the phone close to their mouth. These limitations in the interface meant no one kept using it,” explained SpeakSee CEO and co-founder Jari Hazelebach. “But because we designed our own hardware, we were able to customize it towards the situations it will be used in.”

SpeakSee is simple to use: A set of clip-on microphones live in a little charger case, and when the user wants to have a conversation, they hand those microphones out to whoever will be talking. The case acts as a wireless hub for the mics and relays the audio to the smartphone with which it’s paired. This audio is sent off, transcribed quickly somewhere in the cloud, and displayed on the deaf user’s phone.

Critically, though, each microphone also intelligently and locally accounts for its speaker and background noise.

Critically, though, each microphone also intelligently and locally accounts for its speaker and background noise.

“Naturally the microphones pick up speech from multiple people,” said Hazelebach. “So we included sensors that tell the microphone what direction the sound is coming from, and the microphones exchange these values. So we can determine which microphone should pick up which person’s speech.”

The result is quickly transcribed speech divided by speaker, delivered quickly and with decent accuracy (there’s always a trade-off between turnaround time and how the process is). And no one has to do anything but wear a mic. (They have a patent pending for this multi-microphone system.)

Hazelebach’s parents are deaf, and he grew up seeing how their ability to interact in ordinary circumstances was being limited.

The mics aren’t exactly small… but that’s how you know they’re real working hardware and not imaginary.

“As you can imagine my parents were the first to test this out,” he said. “At first we had a lot of issues but soon we started engaging with others. We wrote a post on a deaf blog and out of nowhere 200 people signed up. So we’ve been testing in the field with groups in the U.S., and also in the U.K. and the Netherlands.”

Right now English speech recognition is considerably ahead of Dutch and other languages, so the transcriptions will be better for the former, but even so the devices should work with any of 120 languages supported by the cloud service. Transcription is free for up to 5 hours of audio monthly, after which it’s a $10/month subscription. But if it works, it may be more than worth the money.

The team has a finished prototype but is seeking crowdfunding to get production off the ground. “We need to improve the electronics to meet specifications, battery life for example. We expect to ship in February of 2019,” Hazelebach said. Pre-orders are set at $350 for a dock and three mics.

The usual caveats (primarily “emptor”) apply when backing an Indiegogo type campaign — but at the very least, having spoken to the creator, I feel pretty sure this is a real, working product that just needs a boost to get to market.

Powered by WPeMatico

By placing all the information about services or complex manufacturing and assembly processes on a private, permissioned blockchain, the idea is that a company can create an “immutable” audit trail of data. When you think about it, currently this involves a labor-intensive combination of paper and networks. But initial trials with private blockchains in the last couple of years have shown there is potential to reduce the identification process of a data trail from several days to minutes.

Indications that this is becoming a hot issue amongst startups arrives today in two pieces of news.

Firstly, London-based “Gospel”(yes, that really is their name…) has raised £1.4m in seed funding from investors led by European-focused LocalGlobe.

The blockchain startup says it has been working with an unnamed “aerospace and defence manufacturer” to develop a proof of concept to improve record keeping for its supply chain. What’s the betting it’s British Aerospace? They aren’t saying.

At any rate, Gospel says it has developed a way of securely distributing data across decentralised infrastructures, offering companies the potential to automate records for complex products that usually require significant manual management. The idea is that is shares only the information it needs to, securely, with other partners in its supply chain, potentially leading to improved efficiency and lower costs of information recall.

Founded in December 2016 by entrepreneur Ian Smith, Gospel uses a private blockchain that requires users to set up a network of “nodes” within their ecosystem. Each party controls their own node and all the nodes must agree before any transaction can be processed and put on the blockchain. The node network acts as a consensus and provides a mechanism of trust.

Smith says: “For manufacturers and other businesses dealing with critical data there is a problem of trust in data systems, particularly when there is a need to share that data outside the organization. With Gospel technology we can provide an immutable record store so that trust can be fully automated between systems of forward-thinking businesses.”

Prior to this seed round, Gospel was backed by a number of angel investors including Gumtree co-founder Michael Pennington and Vivek Kundra, the Chief Information Officer for the US Government during Barack Obama’s administration.

Secondly, Russia-based startup Waves, which has issued its own cryptocurrency, is getting into the space with the launch of Vostok, a universal blockchain solution for scalable digital infrastructure.

The idea is that public institutions and large enterprises can use the platform to enhance security, data storage, transparency and stability of their systems.

Vostok, which is named after the craft that carried Yuri Gagarin into space, claims to be significantly faster and cheaper than existing blockchain solutions, claiming 10,000 transactions per second (TPS) at only $0.000001 per a transaction. This is compared to Bitcoin which has transactional processing capacity of 3-6TPS and costs $0.951 per transaction. Vostok also uses a closed operational node set and Proof-of-Stake.

Sasha Ivanov, CEO and Founder of Vostok and Waves Platform, said: “Vostok is a multi- purpose solution, quite simple, but at the same time non-trivial. It will allow any large organisation to gain the benefits of blockchain without having to create new systems from scratch or retrain their staff.”

Powered by WPeMatico

Here is what your daily menu might look like if recently funded startups have their way.

You’ll start the day with a nice, lightly caffeinated cup of cheese tea. Chase away your hangover with a cold bottle of liver-boosting supplement. Then slice up a few strawberries, fresh-picked from the corner shipping container.

Lunch is full of options. Perhaps a tuna sandwich made with a plant-based, tuna-free fish. Or, if you’re feeling more carnivorous, grab a grilled chicken breast fresh from the lab that cultured its cells, while crunching on a side of mushroom chips. And for extra protein, how about a brownie?

Dinner might be a pizza so good you send your compliments to the chef — only to discover the chef is a robot. For dessert, have some gummy bears. They’re high in fiber with almost no sugar.

Sound terrifying? Tasty? Intriguing? If you checked tasty and intriguing, then here is some good news: The concoctions highlighted above are all products available (or under development) at food and beverage startups that have raised venture and seed funding this past year.

These aren’t small servings of capital, either. A Crunchbase News analysis of venture funding for the food and beverage category found that startups in the space gobbled up more than $3 billion globally in disclosed investment over the past 12 months. That includes a broad mix of supersize deals, tiny seed rounds and everything in-between.

Spending several hours looking at all these funding rounds leaves one with a distinct sense that eating habits are undergoing a great deal of flux. And while we can’t predict what the menu of the future will really hold, we can highlight some of the trends. For this initial installment in our two-part series, we’ll start with foods. Next week, we’ll zero in on beverages.

For protein lovers disenchanted with commercial livestock farming, the future looks good. At least eight startups developing plant-based and alternative proteins closed rounds in the past year, focused on everything from lab meat to fishless fish to fast-food nuggets.

New investments add momentum to what was already a pretty hot space. To date, more than $600 million in known funding has gone to what we’ve dubbed the “alt-meat” sector, according to Crunchbase data. Actual investment levels may be quite a bit higher since strategic investors don’t always reveal round size.

In recent months, we’ve seen particularly strong interest in the lab-grown meat space. At least three startups in this area — Memphis Meats, SuperMeat and Wild Type — raised multi-million dollar rounds this year. That could be a signal that investors have grown comfortable with the concept, and now it’s more a matter of who will be early to market with a tasty and affordable finished product.

Makers of meatless versions of common meat dishes are also attracting capital. Two of the top funding recipients in our data set include Seattle Food Tech, which is working to cost-effectively mass-produce meatless chicken nuggets, and Good Catch, which wants to hook consumers on fishless seafoods. While we haven’t sampled their wares, it does seem like they have chosen some suitable dishes to riff on. After all, in terms of taste, both chicken nuggets and tuna salad are somewhat removed from their original animal protein sources, making it seemingly easier to sneak in a veggie substitute.

Another trend we saw catching on with investors is robot chefs. Modern cooking is already a gadget-driven process, so it’s not surprising investors see this as an area ripe for broad adoption.

Pizza, the perennial takeout favorite, seems to be a popular area for future takeover by robots, with at least two companies securing rounds in recent months. Silicon Valley-based Zume, which raised $48 million last year, uses robots for tasks like spreading sauce and moving pies in and out of the oven. France’s EKIM, meanwhile, recently opened what it describes as a fully autonomous restaurant staffed by pizza robots cooking as customers watch.

Salad, pizza’s healthier companion side dish, is also getting roboticized. Just this week, Chowbotics, a developer of robots for food service whose lineup includes Sally the salad robot, announced an $11 million Series A round.

Those aren’t the only players. We’ve put together a more complete list of recently launched or funded robot food startups here.

Sugar substitutes aren’t exactly a new area of innovation. Diet Rite, often credited as the original diet soda, hit the market in 1958. Since then, we’ve had 60 years of mass-marketing for low-calorie sweeteners, from aspartame to stevia.

It’s not over. In recent quarters, we’ve seen a raft of funding rounds for startups developing new ways to reduce or eliminate sugar in many of the foods we’ve come to love. On the dessert and candy front, Siren Snacks and SmartSweets are looking to turn favorite indulgences like brownies and gummy bears into healthy snack options.

The quest for good-for-you sugar also continues. The latest funding recipient in this space appears to be Bonumuse, which is working to commercialize two rare sugars, Tagatose and Allulose, as lower-calorie and potentially healthier substitutes for table sugar. We’ve compiled a list of more sugar-reduction-related startups here.

It’s tough to tell which early-stage food startups will take off and which will wind up in the scrap bin. But looking in aggregate at what they’re cooking up, it looks like the meal of the future will be high in protein, low in sugar and prepared by a robot.

Powered by WPeMatico

Lemonade, the insurance platform based out of NYC, has filed a lawsuit against German company ONE Insurance, its parent company wefox, and founder Julian Teicke.

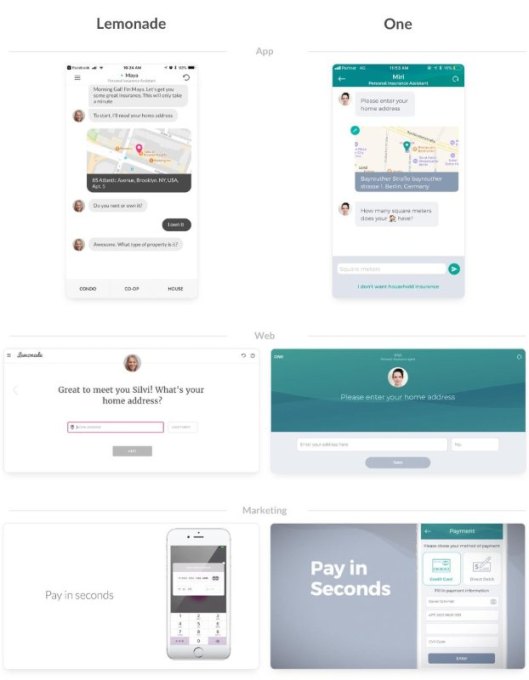

The complaint, filed in the U.S. District Court Southern District of NY, alleges that wefox reverse engineered Lemonade to create ONE, infringing Lemonade’s intellectual property, violating the Computer Fraud and Abuse Act, and breaching its contractual obligations to Lemonade not to “copy content… to provide any service that is competitive…or to…create derivative works.”

In the filing (which you can see on Pacer or here), Lemonade alleges that Teicke repeatedly registered for insurance on Lemonade under various names and for various addresses, some of which do not exist. Teicke also allegedly filed claims in what appeared to be an attempt to assess and copy the arrangement of those flows.

Lemonade’s counsel says Teicke started seven claims over the course of 20 days, prompting Lemonade to cancel his policy.

Alongside Teicke, a number of other executives and members of leadership at wefox also filed fake claims, says the complaint, despite having opted in to Lemonade’s user agreement and taking an honesty pledge, which is required of all Lemonade users.

This, according to Lemonade, violates the Computer Fraud and Abuse act. Lemonade also alleges that the ONE app infringes Lemonade’s IP, and that in assessing the Lemonade app and building a competitor, Teicke also violated Lemonade’s TOS.

Lemonade has changed the insurance business in two key ways: First, it made the process of actually buying insurance as easy as a few clicks on your smartphone. Digitizing the process makes the issue of getting home or renters insurance far less daunting and more approachable to consumers. Secondly, Lemonade rethought the business model of insurance.

Normally, insurance providers charge you a certain monthly rate based on the value of the property/items looking to be insured. But at the end of the year, the money remaining in that policy becomes profit, putting the insurance company in direct opposition to the consumer any time a claim is filed.

Lemonade takes its profit directly out of each payment, and if a file isn’t claimed, it sends the rest of the leftover money to the charity of your choice, ensuring that Lemonade and the consumer are on the same page when a claim is filed.

In keeping with that thesis, any proceeds generated from this lawsuit will go directly to Code.org.

“We’re not trying to enrich ourselves by poking another startup,” said Lemonade CEO Daniel Schreiber . “We’re not anti-competition. We’re just saying ‘Play by the rules, play fair and square.’”

Update: A wefox spokesperson offered up the following statement:

At wefox Group, we have 160 talented people whose hard work has created a unique business that is challenging the status quo every day. These allegations have no merit and ultimately appear to be an attempt to disrupt our business rather than a serious dispute. Lemonade actually raised these questions with us nine months ago, and – as we explained at the time – the concerns are meritless and we further received no answer. We have not been served any paper from Lemonade: if we are, we intend to defend ourselves vigorously. This lawsuit appears to be an attempt to bait the media into covering a non-issue.

Powered by WPeMatico

About one year ago, a note from a CEO thanking his employee for using sick days to take care of her mental health went viral. It was a reminder to Alyson Friedensohn of what she wants to accomplish with Modern Health, the emotional health benefits startup she founded last year with neuroscientist Erica Johnson.

“We want that to be normal. We want the email she sent to be normal, to be able to be that open,” Friedensohn tells TechCrunch.

Modern Health, a Y Combinator alum, announced today that it has raised $2.26 million in seed funding for hiring, accelerating the development of its healthcare platform and growing its network of therapists, coaches and other providers. Offered as a benefit by companies, Modern Health’s services are meant to improve employee well-being and retention rates. The round was led by Afore, with participation from Social Capital, Precursor Ventures, Merus Capital, Maschmeyer Group Ventures, Y Combinator and angel investors.

Friedensohn, Modern Health’s chief executive officer, says several employers have already signed up for its platform, which includes services like counseling and career and financial coaching. One of its newest customers, human resources startup Gusto, hit a 43% utilization rate of its services, including connecting employees to coaches and therapists, among registered users just four days after it began offering the platform.

The startup is especially proud of the fact that Modern Health’s team is currently all female and Friedensohn wants to parlay their points of view into services that address issues affecting women. For example, the platform already works with providers who specialize in postpartum depression and infertility.

“People don’t talk about what working moms are dealing with and countless things like that,” says Friedensohn, who previously worked at health tech companies Keas and Collective Health. “People don’t want to talk about it because they are worried it will jeopardize their careers, but it makes a difference.”

Several other tech startups are working on mental health care platforms for employers to offer as a benefit, including Ginger.io, Lyra Health and Quartet, which have all have received significant amounts of funding from prominent investors. The space is especially important, given the alarming rise in the United States’ suicide rate and the fact that about 6.7% of all adults in the U.S. have experienced at least one major depressive episode.

One of Modern Health’s priorities is to reach employees before they hit a crisis point. Since many people are daunted by the idea of therapy, the platform connects them to coaches instead to focus on specific issues, like their careers, or overall emotional wellbeing. This helps referrals, Friedensohn notes, because it makes the service feel more approachable.

“They can say to friends, I have this awesome Modern Health coach, versus saying I have a therapist, so it’s way easier for people to engage,” she says.

Modern Health also makes its services more accessible by offering several ways to use the platform: texting, video calls or, for people who don’t want to talk to a therapist or coach yet, meditation apps and other digital tools created by the company. Friedensohn adds that it’s not uncommon for people to write essays on their sign-up forms when registering because it’s the first time they’ve been able to unload their problems.

“People like that it’s coaching,” she says. “What we found is that by focusing on that point, the biggest thing is lowering the barrier to entry, so that people who are depressed are also comfortable reaching out.”

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast where we unpack the numbers behind the headlines.

This week was something of a first for the crew, twice. First, we had two guests on the show, and, also, we only made it through two and a half topics. The former is good, the latter is, well, we’ll see.

So, this week Matthew Lynley and I were joined by David Chao, co-founder and general partner at DCM, and Steve Vassallo, a general partner at Foundation Capital. Points to both for being guinea pigs.

Heading into our first topic I’m sorry to inform you that, at least in terms of Equity, scooters are the new Uber. So, we wound up talking about both this week. We started with the fact that Bird is raising new capital at an even more staggering valuation than before ($2 billion!), and that Lime is working to raise a truckload of capital itself. (Reports vary, but it’s probably a $250 million equity round at around a $750 million valuation. There may also be some debt in the mix for Lime. More when we lock that down.)

And, as Chao’s firm is an investor in the space, we had even more to chew on.

Next up we dug into the massive new Opendoor round. The firm’s new $325 million puts it into a solid position to help people sell their houses. Which markets are the best fit was something for us to unspool, along with public market comps, such as they are. But most critical, at least in my view, was the idea of risk. On that point Vassallo made a reasonable argument regarding stress testing. We’ll see.

And finally, we touched on Meituan’s impending IPO, and how it came to be.

Thanks for sticking with Equity after all this time. We’ll be back next week with another round of chatter about the latest, greatest and dumbest that tech has to offer.

Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Pocket Casts, Downcast and all the casts.

Powered by WPeMatico

While brand safety and fraud prevention have been big topics in the online ad industry over the past couple years, Cheq CEO Guy Tytunovich argued that “first generation solutions for ad verification” aren’t good enough.

The problem, Tytunovich said, is that existing products use sampling to alert advertisers to issues “after the fact.” Compare this to credit card fraud — if the credit card company only alerted you long after the fraud had occurred, “You’re not going to be happy with that kind of answer.”

At Cheq, Tytunovich and his team have developed an approach that uses artificial intelligence to deliver what he calls “autonomous brand safety” — the idea is that when an ad is being served, Cheq can detect whether it might be a fraudulent impression that will only be seen by bots, or if it might show up next to content that a brand doesn’t want to be associated with. If there’s an issue, Tytunovich said, “We block [the ad] from being served in real time.”

Beforehand, advertisers set up their own ad placement guidelines, and afterwards, they can see the reason why individual ads didn’t get served.

Cheq is announcing that it has raised $5 million in Series A funding led by Battery Ventures . Tytunovich said that 80 percent of the Cheq team consists of developers, and that most of the funding will go towards further product development.

If the Cheq approach really is so much better, why aren’t bigger, better-funded companies doing the same thing? Tytunovich pointed to his experience, and his team’s experience, in the Israel Defense Forces, where he said “they teach you to compensate for a lack of scale, of manpower, by focusing on automation and speed.”

Similarly, Tytunovich said that at Cheq, “the name of the game is speed.”

“A lot about our underlying technology lies around the speed of the data crunching,” he added. “We look at around 700 data parameters per impression … We need to be able to take all that data, analyze it and do it in real time.”

Cheq has offices in Tokyo, New York and Tel Aviv. Tytunovich said it’s currently focused on the American and Japanese markets — customers listed on the Cheq website include Coca Cola, Turner and Mercedes-Benz. Update: A spokesperson clarified that those companies are listed on the Cheq website because Cheq participated with them in The Bridge program.

Powered by WPeMatico