TC

Auto Added by WPeMatico

Auto Added by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast where we unpack the numbers behind the headlines.

This week we were back in the studio with Connie Loizos and myself hanging out with Jai Das, a managing director at Sapphire Ventures. Our beloved Matthew Lynley was off this week, but he’ll be back for the next episode.

This week we had an excellent list of things to get to, first of which was Lyft’s latest shopping run. This time Lyft accreted to itself Motivate, a bike-sharing company that operates various programs in cities like New York City and San Francisco.

The context for the transaction is threefold. First, Lyft just raised a bundle of money for effectively diddly dilution. Second, Uber bought Jump and there is no FOMO in the market today like ridesharing FOMO. And third, scooters now lurk in the background of any and every ridesharing conversation, so the big shops are on a bit of defense.

The sum is that Uber and Lyft now own bike companies, which feels a bit 2017.

But moving along Unicorn Row we quickly found ourselves at the door of Airbnb, which is prepping for a 2019-2020 IPO and a change to its personnel comp cadence, the latter due to its age and a market trend that Das noted concerned employee comp and shareholder dilution.

In other news, Airbnb needs a CFO, so if you are in the market, that’s who to call.

Next up was Automation Anywhere’s epic $250 million Series A, which brought the software process-automation company to a valuation of $1.8 billion. The firm helps companies execute repetitive software tasks at a fraction of the cost of having humans click the buttons.

And we wrapped with Juul, everyone’s favorite e-cigarette company that has simply beautiful financials. Whether it’s ethical is something that we spent a moment talking about.

So fire up your vape or just hit play and we’ll be right back in seven days.

Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Pocket Casts, Downcast and all the casts.

Powered by WPeMatico

Booksy, a Poland-based booking application for the beauty business, has raised $13.2 million in a Series B effort to drive global growth. The company, founded in 2014 by Stefan Batory and Konrad Howard, is currently seeing 2.5 million bookings per month.

The company raised from Piton Capital, OpenOcean, Kulczyk Investments, and Zach Coelius.

Batory, an ultramarathoner, also co-founded iTaxi, Poland’s popular taxi hailing app. Booksy came about when he was trying to schedule physiotherapy appointments after long runs. He would come home sore and plan on calling his physiotherapist but it was always too late.

“I didn’t want to bother him after I was done with my workout late night, and it was virtually impossible to contact him during day time as his hands were busy massaging people and he did not answer my calls,” he said.

Booksy launched in the US in 2017 and “rapidly become the number one booking app in the world,” said Batory.

“We will use the funding to drive global growth, recruit high profile talent and develop proprietary technologies that will further support beauty businesses,” he said. “That includes the implementation of one-click booking, a feature that uses machine learning and AI technologies, to determine each user’s buying pattern and offer them the best dates with their favorite stylists, thus simplifying user experience for both merchants and their customers.”

Powered by WPeMatico

There is perhaps no firm that has done as much to promote the adoption of Ethereum as the dominant cryptocurrency platform for actual product development as Consensys.

Founded by Ethereum Foundation co-founder Joe Lubin, Consensys has emerged as an investor, accelerator, educator and product developer in its own right in little more than three years that it has been in existence.

A Princeton-educated roboticist and autonomous vehicle researcher, Lubin has become a billionaire through his bet on Ethereum as the cryptocurrency that would win the hearts and minds of developers.

And with Consensys he’s built an empire that spans the globe. From its headquarters in Brooklyn, Consensys now has operations, offices and partnerships in Ireland, Israel, and Singapore, and the global expansion shows no sign of slowing down.

That’s why we’re absolutely thrilled to have Joe Lubin, Chief Marketing Officer Amanda Gutterman, and Chief Strategy Officer Sam Cassatt join us on the Disrupt SF stage.

Nothing summarizes Lubin’s ambitions for Ethereum better than this comment on the transformative power that he sees in the cryptocurrency.

“We are all passionately building the decentralized world wide web on which economic, social, and political systems will be built going forward.” A short and sweet overview of the @ConsenSys organism from @EtherealSummit at the @knockdowncenter in May. https://t.co/8DGdiyu29E

— Joseph Lubin (@ethereumJoseph) June 19, 2018

Lubin, Gutterman and Cassatt join a world-class agenda, with speakers like Brian Armstrong, Kirsten Green, Reid Hoffman, and Marty Chavez. Tickets to the show, which runs September 5-7, are available here.

Powered by WPeMatico

When Mitra Raman went off to college, all she wanted was a bowl of her mother’s homemade rasam. The daughter of Indian immigrants, Raman grew up eating traditional South Indian cuisine almost every day, but didn’t quite know how to make it just like mom when she left home.

On her next visit back home, she told her mom she missed her cooking. And, being a mom, Mrs. Raman simply packed all the ingredients for rasam in a plastic bag and told her daughter to heat up some water and add it in. It’s that simple.

That’s how Buttermilk was born.

The YC-backed company offers a variety of Indian dishes at a low price that can be cooked up by simply adding hot water.

Based in Seattle, Buttermilk launched in 2017 to the local market and has since expanded to serve their products across the country.

Buttermilk dishes include Sambar, Daal, Khichdi, Rasam, and Upma, all of which cost $6 each. Buttermilk also sells Basmati Rice for $1.50.

While users can buy Buttermilk meals individually, they can also purchase one of Buttermilk’s “suites,” which pack a handful of meals into one shipment. The suites, including the High Protein Pack, Buttermilk Suite, North Indian Favorites and South Indian Favorites, cost $39.

Last week, Buttermilk introduced an option called Subscribe and Save, which offers the chance to buy monthly subscriptions of pre-set packs for 10 percent off. The company is also launching new meals, including Chana Masala, Coconut Chutney, and Quina and Brown Rice options, starting on July 12. Pre-orders for the new meals start tomorrow.

Buttermilk has plans to add other cuisines to the platform eventually, with the same idea of bringing mom’s home cooking to people who don’t have the money or time to recreate those meals from scratch. The company is also interested in potentially selling their products in grocery stores or coffee shops beyond the existing online channel.

Powered by WPeMatico

Tinder Loops, the recently announced video feature from Tinder, is today rolling out globally.

Tinder has been testing this feature in Canada and Sweden since April, when it was first announced, and has rolled out to a few other markets since then.

Today, Loops are available to Tinder users across the following markets: Japan, United Kingdom, United States, France, Korea, Canada, Australia, Germany, Italy, Netherlands, Russia, Sweden, Belgium, Denmark, Iceland, Ireland, Kuwait, New Zealand, Norway, Qatar, Saudi Arabia, Singapore, Switzerland, Taiwan, Thailand and United Arab Emirates.

Loops are two-second, looping videos that can be posted to users’ profiles. Users can’t shoot Tinder Loops from within the app, but rather have to upload and edit existing videos in their camera roll or upload a Live Photo from an iOS device.

Tinder is also expanding the number of images you can post to your profile to nine, in order to make room for Loops without displacing existing photos.

Given that Tinder has been testing the feature since early April, the company now has more data around how Tinder Loops have been working out for users. For example, users who added a Loop to their profile saw that their average conversation length went up by 20 percent. The feature seems to be particularly effective in Japan — Loops launched there in June — with users receiving an average of 10 percent more right swipes if they had a Loop in their profile.

In the age of Instagram and Tinder, people have used photos to represent themselves online. But, with all the editing tools out there, that also means that photos aren’t always the most accurate portrayal of personality or appearance. Videos on Tinder offer a new way to get to know someone for who they are.

Powered by WPeMatico

Mobike made a roster of announcements about its bikesharing program today, including the end of customer deposits in China and full integration into Meituan Diaping’s app. The developments, its first since its acquisition by Meituan for $2.7 billion in April, are meant to help Mobike become a stronger competitor against Ofo, its biggest rival, and a slew of smaller startups in China’s heated bikesharing wars.

Mobike, which claims 200 million users, will have the chance to reach more customers thanks to its integration into Meituan’s platform. Meituan has ambitious growth plans (filed for an IPO in Hong Kong last month) and describes itself as a “one-stop super app” because of the large range of services, including dining, salon, entertainment and travel bookings, it offers. Meituan’s 310 million users were already able to pay for Mobike on the platform and will now also be able to rent a bike through the app.

Mobike also upped the ante for competitors by announcing that it will stop requiring users in China to pay 299 RMB (about $45) deposits and will refund all deposits already paid. Mobike says it is getting rid of deposits to “establish a no-threshold, zero-burden and zero-condition deposit-free standard for the entire bikesharing industry.” (Since the new policy only applies to users in China, instead of all 200 million Mobike users, TechCrunch has contacted the company for more information about how much money it is refunding).

Deposits are a contentious issue among bikesharing users. Though Mobike and Ofo claim they do not use customer deposits to fund operations, some bikesharing startups have been accused of spending deposits on operational expenses, with users complaining that it is very difficult to get their money back, even if they stop using a service or it goes out of business. The issue has resulted in Chinese lawmakers drafting regulations that require bikesharing companies to store deposits in a separate bank account so the funds are still available to return to customers even if a company goes out of business.

Another controversial issue is the large number of trashed or abandoned bikes created by bikesharing companies, with photos of “bikesharing graveyards” becoming symbolic of the sector’s excesses and unsustainable growth. To address environmental concerns, Mobike says it is launching a bike components recycling program in partnership with several companies, including Dow, China Recycling Resources and Tianjin Xinneng Recycling Resources. Called Mobike Life Cycle, the program will recycle bike components into new parts or raw materials. Mobike says it has already recycled and reused over 300,000 Mobike tires.

Mobike will also add a new e-bike that can reach a top speed of 20 km/hour and travel up to 70 km on a single charge. The company hopes that the e-bike, which will be available in China and Mobike’s international markets, will increase trip lengths. In its press statement, Mobike says most of its bikes are used for trips up to 3 km, but the e-bikes will hopefully increase that to 5 km.

Powered by WPeMatico

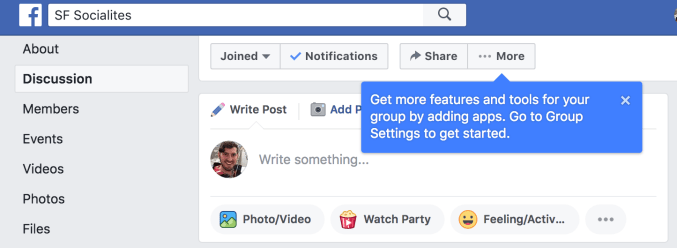

Facebook is becoming a marketplace for enterprise apps that help Group admins manage their communities.

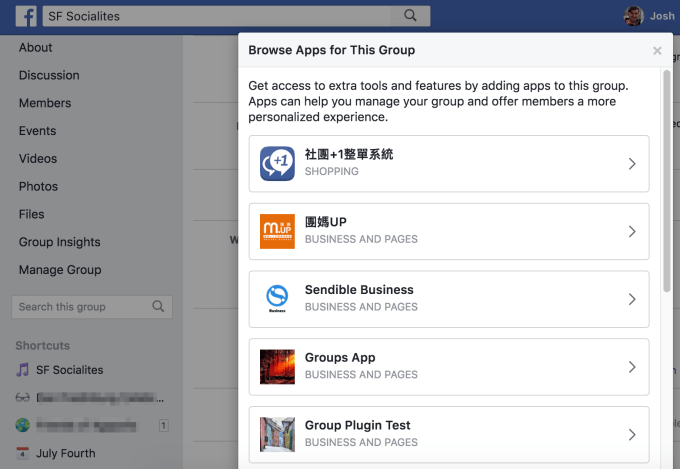

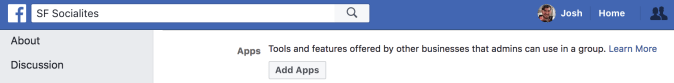

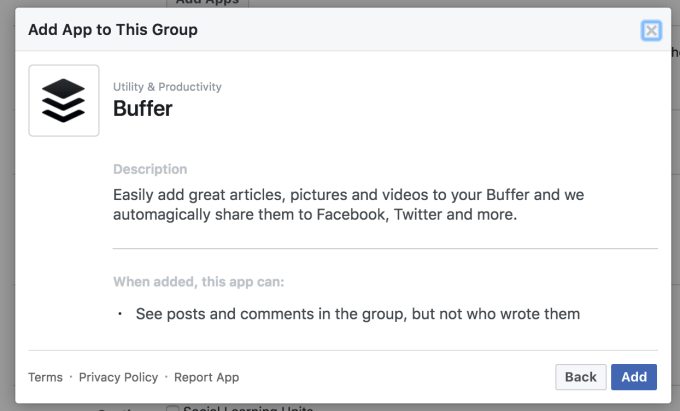

To protect itself and its users in the wake of the Cambridge Analytica scandal, Facebook locked down the Groups API for building apps for Groups. These apps had to go through a human-reviewed approval process, and lost access to Group member lists, plus the names and profile pics of people who posted. Now, approved Groups apps are reemerging on Facebook, accessible to admins through a new in-Facebook Groups apps browser that gives the platform control over discoverability.

Facebook confirmed the new Groups apps browser after our inquiry, telling TechCrunch, “What you’re seeing today is related to changes we announced in April that require developers to go through an updated app review process in order to use the Groups API. As part of this, some developers who have gone through the review process are now able to access the Groups API.”

Facebook wouldn’t comment further, but this Help Center article details how Groups can now add apps. Matt Navarra first spotted the new Groups apps option and tipped us off. Previously, admins would have to find Group management tools outside of Facebook and then use their logged-in Facebook account to give the app permissions to access their Group’s data.

Groups are often a labor of love for admins, but generate tons of engagement for the social network. That’s why the company recently began testing Facebook subscription Groups that allow admins to charge a monthly fee. With the right set of approved partners, the platform offers Group admins some of the capabilities usually reserved for big brands and businesses that pay for enterprise tools to manage their online presences.

Becoming a gateway to enterprise tool sets could make Facebook Groups more engaging, generating more time on site and ad views from users. This also positions Facebook as a natural home for ad campaigns promoting different enterprise tools. And one day, Facebook could potentially try to act more formally as a Groups App Store and try to take a cut of software-as-a-service subscription fees the tool makers charge.

Facebook can’t build every tool that admins might need, so in 2010 it launched the Groups API to enlist some outside help. Moderating comments, gathering analytics and posting pre-composed content were some of the popular capabilities of Facebook Groups apps. But in April, it halted use of the API, announcing that “there is information about people and conversations in groups that we want to make sure is better protected. Going forward, all third-party apps using the Groups API will need approval from Facebook and an admin to ensure they benefit the group.”

Now apps that have received the necessary approval are appearing in this Groups apps browser. It’s available to admins through their Group Settings page. The apps browser lets them pick from a selection of tools like Buffer and Sendible for scheduling posts to their Group, and others for handling commerce messages.

Facebook is still trying to bar the windows of its platform, ensuring there are no more easy ways to slurp up massive amounts of sensitive user data. Yesterday it shut down more APIs and standalone apps in what appears to be an attempt to streamline the platform so there are fewer points of risk and more staff to concentrate on safeguarding the most popular and powerful parts of its developer offering.

The Cambridge Analytica scandal has subsided to some degree, with Facebook’s share price recovering and user growth maintaining at standard levels. However, a new report from The Washington Post says the FBI, FTC and SEC will be investigating Facebook, Cambridge Analytica and the social network’s executives’ testimony to Congress. Facebook surely wants to get back to concentrating on product, not politics, but must take it slow and steady. There are too many eyes on it to move fast or break anything.

Powered by WPeMatico

Planck Re, a startup that wants to simplify insurance underwriting with artificial intelligence, announced today that it has raised a $12 million Series A. The funding was led by Arbor Ventures, with participation from Viola FinTech and Eight Roads. Co-founder and CEO Elad Tsur tells TechCrunch that the capital will be used to expand Planck Re’s product line into more segments, including retail, contractors, IT and manufacturing, and grow its research and development team in Israel and North American sales team.

The Tel Aviv and New York-based startup plans to focus first on its business in the United States, where it has already launched pilot programs with several insurance carriers. Tsur says that Planck Re’s clients generally use it to help underwrite insurance for small to medium-sized businesses, including business owner policies, which cover property and liability risks, and workers’ compensation.

Founded in 2016 by Tsur, Amir Cohen and David Schapiro, Planck Re poses its technology as a more efficient and accurate alternative to the lengthy risk assessment questionnaire insurers ask clients to fill out. Its platform crawls the internet for publicly available data, including images, text, videos, social media profiles and public records, to build profiles of SMBs seeking insurance coverage. Then it analyzes that data to help carriers figure out their potential risk.

Before launching Planck Re, Tsur and Cohen founded Bluetail, a data mining startup that was acquired by Salesforce in 2012, where it served as the base technology for Salesforce Einstein. Schapiro was previously CEO of financial analytics company Earnix.

There are already a handful of startups, including SoftBank-backed Lemonade, Trōv, Cover, Hippo and Swyfft, that use algorithms to make picking and buying insurance policies easier for consumers, but AI-based underwriting is still a nascent category. One example is Flyreel, which focuses on underwriting property insurance and recently signed a deal with Microsoft to accelerate its go-to-market strategy.

Tsur says Planck Re is developing more dedicated algorithms to meet the evolving needs of insurance providers. For example, many underwriters now want to know if clients in photography use aerial imaging equipment, so Planck Re’s imaging process capabilities automatically check images for that information.

He adds that being able to automate underwriting enables carriers to find new distribution channels, including allowing customers to apply for insurance online without needing to fill out any forms. Planck Re also continues to monitor and underwrite policies, which means if a customer’s risk profile changes, insurers can react quickly.

In a statement, Arbor Ventures vice president and head of Israel Lior Simon said, “We are excited to partner with Planck Re and the driven, entrepreneurial team. Insurance companies are thirsty for actionable data, to assess risk, gain real time insights and enhance customer understanding. Planck Re aims to empower them through a streamlined digital approach, which we believe will truly alter the insurance industry.”

Powered by WPeMatico

Airbnb is testing a new payments feature for hosts, letting them get partially paid out at the time of booking.

This feature isn’t rolling out to everyone just yet, as Airbnb says that this is just a preliminary test to gauge interest. Invited hosts simply opt in to payout splitting to check out the feature.

Here’s how it works:

Normally, Airbnb hosts are paid 24 hours after their guest’s scheduled check-in time. With the new payouts test, hosts who have been invited and opt in will receive 50 percent of their cash three days after the guest has booked their stay, and the other half will be received 24 hours after check-in time.

For their trouble, Airbnb is taking a 1 percent fee of the booking subtotal for early payouts.

As per usual, hosts can opt out of early payouts at any time by making the change in their Payout Preferences.

If a booking is cancelled after an early payout has been received, the amount will be deducted from the host’s next booking.

This comes on the heels of Airbnb’s announcement in February to add new tiers and types of lodging to the platform, including boutique hotels and B&Bs. Airbnb classifies hosts with more than six listings on the platform as Professional Hosts, and early payouts are one way that Airbnb can help these hosts grow their business.

However, in certain housing-constrained markets like NYC, professional hosts aren’t necessarily welcome. In May, NYC Comptroller Scott Stringer released a report saying that Airbnb’s presence in NYC is driving up the cost of rent for full-time residents. The company and the Comptroller’s office went back and forth over the veracity of the report, but NYC isn’t the only market worried about the folks who make Airbnb their full-time job.

In 2017, the WSJ reported on a study surveying 100 of the largest metro areas in the U.S. that found that a 10 percent increase in Airbnb listings leads to a 0.39 percent increase in rent and a 0.64 percent increase in housing prices. That may sound small, but rental prices typically climbed by 2.2 percent per year without Airbnb, according to one of the survey’s authors. So Airbnb is accelerating the rate at which rental prices rise.

This very argument and the ensuing spats have led Airbnb to cut SF listings (almost in half) following the city’s kick-off of new short-term rental laws. And new, stricter laws may be coming to NYC.

Airbnb says that it works with its communities to stay on the right side of the law, but that professionally managed properties are integral in markets where tourism is a huge part of the economy.

“For decades, vacation rentals and professionally managed properties have been the backbone of the economy in vacation destinations like beach and ski towns and we welcome these types of listings in these types of communities,” said an Airbnb spokesperson. “Trials like these are one way we work to support our community. In some places, usually urban destinations, there can be rules around hosting multiple listings. We always want Airbnb to be a positive force in local communities and we make it clear to hosts that they need to follow these rules.”

The payouts test is geared toward professional hosts, but is being spread via an invite basis to both pro hosts and regular hosts.

Powered by WPeMatico

Airwallex, a three-year-old fintech startup focused on international payments for SMEs and businesses, is putting itself on the map after it raised an $80 million Series B round.

Based out of Melbourne, but with six offices in Asia and other parts of the world, Airwallex’s new funding round is the second-largest financing deal for an Australian startup in history. The round was led by existing investors Tencent, the $500 billion Chinese internet giant, and Sequoia China. Other participants included China’s Hillhouse, Horizons Ventures — the fund from Hong Kong’s richest man, Li Ka-Shing — Indonesia-based Central Capital Ventura (BCA) and Australia’s Square Peg, a firm from Paul Bassat, who took recruitment firm Seek to IPO and is one of Australia’s highest-profile founders.

The financing takes Airwallex to $102 million raised. Tencent led a $13 million Series A in May 2017, while Square Peg added $6 million more via a Series A+ in December. Mastercard is also a backer; the finance giant uses Airwallex to handle its “Send” product, while Tencent uses the service to power an overseas remittance service for its WeChat app.

Airwallex handles cross-border transactions for companies that do business in multiple countries using international currencies. So it’s not unlike a TransferWise-style service for SMEs that lack the capital to develop a sophisticated (and expensive) international banking system of their own.

The service uses wholesale FX rates to route overseas payments back to a client’s domestic bank and is capable of processing “thousands of transactions per second,” according to the company. A use case example might include helping a China-based seller return money earned in the U.S. or Europe via Amazon or other e-commerce services, or route sales revenue back directly from their own website.

Airwallex CEO Jack Zhang (far right) onstage at TechCrunch Shenzhen in 2017

China is a key market for Airwallex — which was started by four Australian-Chinese founders — as well as the wider Asian region, and in particular Australia, Hong Kong and Southeast Asia. With this new capital, Airwallex co-founder and CEO Jack Zhang said the company will increase its focus on Hong Kong and Southeast Asia, whilst also extending its business in Europe (where it has a London-based office) and pushing into North America.

Product R&D is shared across Melbourne and Shanghai, while Hong Kong accounts for business development, compliance and more, Zhang explained. However, Airwallex’s locations in London and San Francisco are likely to account for most of the upcoming headcount growth planned following this funding. Right now, Airwallex has around 100 staff, according to Zhang.

The company is also aiming to expand its product range.

The firm is in the process of applying for a virtual banking license in Hong Kong, a third-party payment license in mainland China and a cross-border Chinese yuan license. One goal, Zhang revealed, is to offer working capital loans to SMEs to help them scale their businesses to the next level. Airwallex is working with an undisclosed partner to underwrite deals in the future. Zhang explained that the company sees a gap in the market since banks don’t have access to critical data on clients for loan assessments.

More generally, he’s bullish for the future, despite Brexit and the ongoing trade war between the U.S. and China.

“The trade war gives the Chinese yuan a lot of vitality, and we’ve seen more demand in the market. China’s belt road initiative has really taken off, too, and we’re seeing the impact in many, many of our payment corridors,” he explained. “Business has been booming, especially as traditional offline SMEs start to move online and go from domestic to global.”

“We want to be the backbone to support these new opportunities for businesses,” Zhang added.

Powered by WPeMatico