TC

Auto Added by WPeMatico

Auto Added by WPeMatico

Pokémon GO just got a little surprise update, complete with a curious new feature: “Lucky” Pokémon.

Most things in Pokémon GO are adapted from things that already exist in the Pokémon universe. Items like incense, lucky eggs and the like all exist in the main Pokémon series (though what these items actually do tends to be a bit different in GO).

Lucky Pokémon, as far as I know, is a new concept altogether.

So what are they? And how are they different from existing Shiny Pokémon?

Shiny Pokémon are rare variations of existing Pokémon with colors that differ from the standard. You might tap on your 398th Dratini, for example, only to find that it’s bright pink instead of the standard blue. You might randomly tap a Minun to find that it has green ears instead of blue, or an Aron with red eyes instead of blue. It’s a fun way to keep players tapping on Pokémon even after their Pokédex is technically complete. The differences are only skin deep, though; beyond the visual shift, Shiny Pokémon are generally functionally the same as their non-shiny version.

The new “Lucky” Pokémon, meanwhile, don’t look much different (save for a sparkly background when you look at them in your collection). They do, however, have a little functional advantage: powering them up requires less stardust. In other words, you’ll be able to make them stronger faster and with less work.

How do you get ’em? By trading. While folks are still working out the exact mechanics, it looks like non-Lucky Pokémon have a chance to become Lucky Pokémon when traded from one player to another. According to Niantic, the odds of a Pokémon becoming “lucky” after a trade increase based on how long ago it was originally caught.

And for the collectors out there: yes, for better or worse, “Lucky” Pokémon are now a category in the Pokédex. Niantic just added trading to Pokémon GO a month ago, and this is a clever way to get players to care about trading even after they’ve already caught everything there is to catch.

This update also brings a few other small changes, mostly just polishing up the way the friend/trading system works:

Powered by WPeMatico

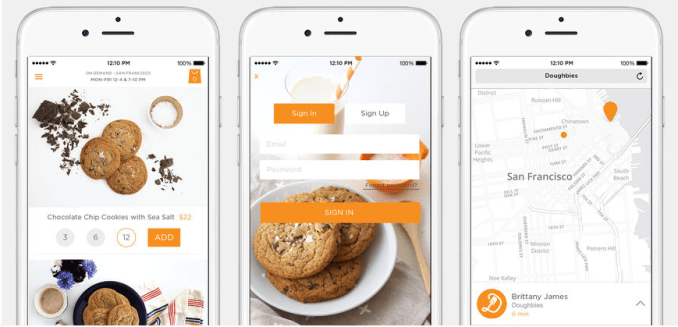

Doughbies should have been a bakery, not a venture-backed startup. Founded in the frothy days of 2013 and funded with $670,000 by investors, including 500 Startups, Doughbies built a same-day cookie delivery service. But it was never destined to be capable of delivering the returns required by the VC model that depends on massive successes to cover the majority of bets that fail. The startup became the butt of jokes about how anything could get funding.

This weekend, Doughbies announced it was shutting down immediately. Surprisingly, it didn’t run out of money. Doughbies was profitable, with 36 percent gross margins and 12 percent net profit, co-founder and CEO Daniel Conway told TechCrunch. “The reason we were able to succeed, at this level and thus far, is because we focused on unit economics and customer feedback (NPS scoring). That’s it.”

Many other startups in the on-demand space missed that memo and vaporized. Shyp mailed stuff for you and Washio dry cleaned your clothes, until they both died sudden deaths. Food delivery has become a particularly crowded cemetery, with Sprig, Maple, Juicero and more biting the dust. Asked his advice for others in the space, Conway said to “Make sure your business makes sense — that you’re making money, and make sure your customers are happy.”

Doughbies certainly did that latter. They made one of the most consistently delicious chocolate chip cookies in the Bay Area. I had them cater our engagement party. At roughly $3 per cookie plus $5 for delivery, it was pricey compared to baking at home, but not outrageous given SF restaurant rates. From its launch at 500 Startups Demo Day with an “Oprah” moment where investors looked beneath their seats to find Doughbies waiting for them, it cared a lot about the experience.

But did it make sense for a bakery to have an app and deliver on-demand? Probably not. There was just no way to maintain a healthy Doughbies habit. You were either gunning for the graveyard yourself by ordering every week, or like most people you just bought a few for special occasions. Startups like Uber succeed by getting people to routinely drop $30 per day, not twice a year. And with the push for nutritious and efficient offices, it was surely hard for enterprise customers to justify keeping cookies stocked.

Flanked by Instacart and Uber Eats, there weren’t many ripe adjacent markets for Doughbies to conquer. It was stuck delivering baked goods to customers who were deterred from growing their cart size by a sense of gluttony.

Without stellar growth or massive sales volumes, there aren’t a lot of exciting challenges to face for people like Conway and his co-founder Mariam Khan. “Ultimately we shut down because our team is ready to move on to something new,” Conway says.

The startup just emailed customers explaining that “We’re currently working on finding a new home for Doughbies, but we can’t make any promises at this time.” Perhaps a grocery store or broader food company will want its logistics technology or customer base. But delivery is a brutal market to break into, dominated by those like Uber who’ve built economies of scale through massive fleets of drivers to maximize routing efficiency.

In the end, Doughbies was a lifestyle business. That’s not a dirty word. A few co-founders with a dream can earn a respectable living doing what they care about. But they have to do it lean, without the advantage of deep-pocketed investors.

As soon as a company takes venture funding, it’s under pressure to deliver adequate returns. Not 2X or 5X, but 10X, 100X, even 1,000X what they raise. That can lead to investors breathing down their neck, encouraging big risks that could tank the business just for a shot at those outcomes. Two years ago we saw a correction hit the ecosystem, writing down the value of many startups, and we continue to see the ripple effect as companies funded before hit the end of their runway.

Desperate for cash, founders can accept dirty funding terms that screw over not just themselves, but their early employees and investors. FanDuel raised more than $416 million at a peak valuation of $1.3 billion. But when it sold for $465 million, the founders and employees received zero as the returns all flowed to the late-stage investors who’d secured non-standard liquidation preferences. After nearly 10 years of hard work, the original team got nothing.

Not every business is a startup. Not every startup is a rocket ship. It takes more than just building a great product to succeed. It can require suddenly cutting costs to become profitable before you run out of funding. Or cutting ambitions and taking less cash at a lower valuation so you can realistically hit milestones. Or accepting a low-ball acquisition offer because it’s better than nothing. Or not raising in the first place, and building up revenues the old-fashioned way so even modest growth is an accomplishment.

Investors are often rightfully blamed for inflating the bubble, pushing up raises and valuations to lure startups to take their money instead of someone else’s. But when it comes to deciding what could be a fast-growing business, sometimes its the founders who need the adjustment.

Powered by WPeMatico

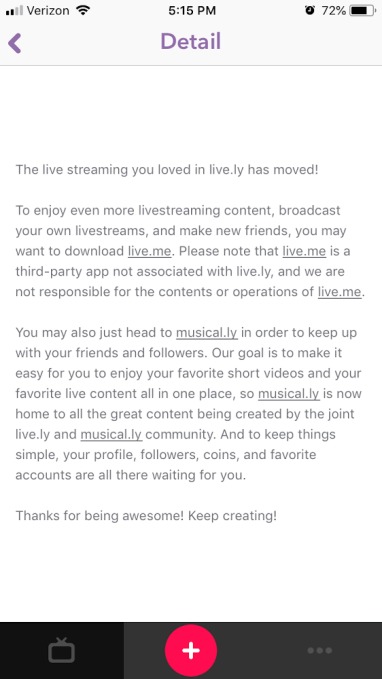

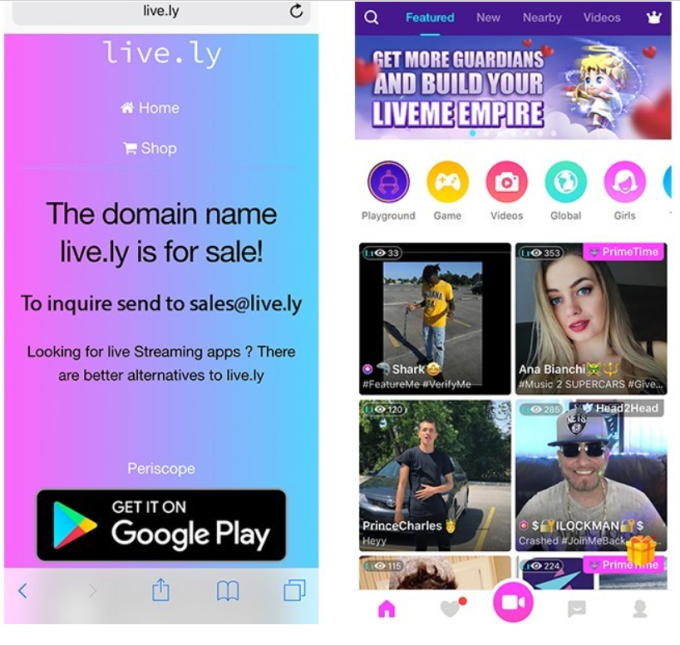

Musical.ly has begun redirecting users of its Live.ly app, which it decided to kill off last month, to a competing app called LiveMe. Existing Live.ly users are being pointed to LiveMe through an in-app message, it says. While it’s a fairly common industry practice for companies to direct users to similar apps or services when a product of theirs is being sunsetted, in this case, Musical.ly’s decision to close down Live.ly and send users to LiveMe was actually a contractually obligated part of Musical.ly’s nearly $1 billion acquisition by Chinese technology company Bytedance last year.

A clause in Bytedance’s agreement to acquire Musical.ly stated that, if the deal went through, Musical.ly would have to close Live.ly within six months, according to a source with knowledge of the deal.

The agreement also said that Live.ly would have to point users to LiveMe for at least 30 days following its closure, we learned, when verifying the information.

The issue at hand was a competing investment – right around the time of the Musical.ly acquisition, Bytedance had also put $50 million into the live-streaming app LiveMe. Apparently, it didn’t want to operate two rival properties.

Clearly, this request was not a deal-breaker for Musical.ly – in fact, it’s integrating Live.ly’s feature set into its own app. That means it will still be something of a competitor to LiveMe, though now no longer a direct one. Musical.ly’s main app, after all, is not known today for its live streaming, but rather for lip syncing videos that are recorded and edited using the app’s included visual effects and editing tools.

In addition, Live.ly had not been able to attract the viewership numbers that Musical.ly had. The company said, when confirming Live.ly’s closure last month, the majority of live stream views were taking place in Musical.ly itself, not in its spinoff.

That said, Live.ly had a fair number of users. Though nowhere near as big as Musical.ly’s 200+ million registered users or 60 million actives, its live stream app had 26 million installs, around 70 percent in the U.S., according to Sensor Tower’s data.

But LiveMe is bigger – it has more than 60 million users and has paid out over $30 million to its broadcasters through its direct virtual gifting program, the company claims.

LiveMe is also not the only app operated by the company. Other LiveMe portfolio apps include the social short video app Cheez, and mobile gaming and esports live streaming app Fluxr. To date, it has raised a total of $110 million.

Live.ly isn’t only redirecting users to LiveMe, however. In its own announcement about the news today, it shows a screenshot that’s pointing Live.ly users to Twitter’s Periscope, for instance. The message also notes that the Live.ly domain name is for sale, and provides an email for sales inquiries.

Musical.ly hasn’t yet responded to a request for comment.

Powered by WPeMatico

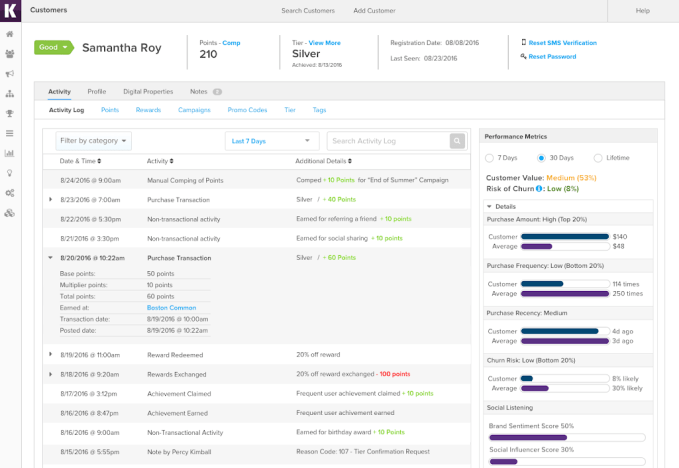

SessionM announced a $23.8 million Series E investment led by Salesforce Ventures. A bushel of existing investors including Causeway Media Partners, CRV, General Atlantic, Highland Capital and Kleiner Perkins Caufield & Byers also contributed to the round. The company has now raised over $97 million.

At its core, SessionM aggregates loyalty data for brands to help them understand their customer better, says company co-founder and CEO Lars Albright. “We are a customer data and engagement platform that helps companies build more loyal and profitable relationships with their consumers,” he explained.

Essentially that means, they are pulling data from a variety of sources and helping brands offer customers more targeted incentives, offers and product recommendations “We give [our users] a holistic view of that customer and what motivates them,” he said.

Screenshot: SessionM (cropped)

To achieve this, SessionM takes advantage of machine learning to analyze the data stream and integrates with partner platforms like Salesforce, Adobe and others. This certainly fits in with Adobe’s goal to build a customer service experience system of record and Salesforce’s acquisition of Mulesoft in March to integrate data from across an organization, all in the interest of better understanding the customer.

When it comes to using data like this, especially with the advent of GDPR in the EU in May, Albright recognizes that companies need to be more careful with data, and that it has really enhanced the sensitivity around stewardship for all data-driven businesses like his.

“We’ve been at the forefront of adopting the right product requirements and features that allow our clients and businesses to give their consumers the necessary control to be sure we’re complying with all the GDPR regulations,” he explained.

The company was not discussing valuation or revenue. Their most recent round prior to today’s announcement, was a Series D in 2016 for $35 million also led by Salesforce Ventures.

SessionM, which was founded in 2011, has around 200 employees with headquarters in downtown Boston. Customers include Coca-Cola, L’Oreal and Barney’s.

Powered by WPeMatico

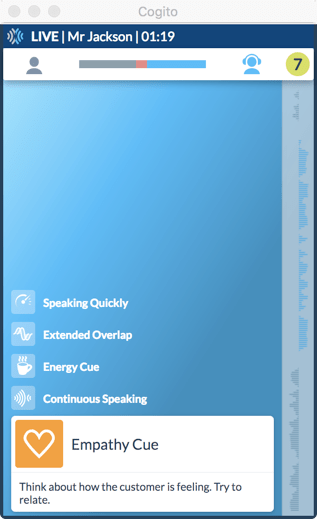

Cogito announced a $37 million Series C investment today led by Goldman Sachs Growth Equity. Previous investors Salesforce Ventures and OpenView also chipped in. Mark Midle of Goldman Sachs’ Merchant Banking Division, has joined Cogito’s Board of Directors

The company has raised over $64 million since it emerged from the MIT Human Dynamics Lab back in 2007 trying to use the artificial intelligence technology available at the time to understand sentiment and apply it in a business context.

While it took some time for the technology to catch up with the vision, and find the right use case, company CEO and founder Joshua Feast says today they are helping customer service representatives understand the sentiment and emotional context of the person on the line and give them behavioral cues on how to proceed.

“We sell software to very large software, premium brands with many thousands of people in contact centers. The purpose of our solution is to help provide a really wonderful service experience in moments of truth,” he explained. Anyone who deals with a large company’s customer service has likely felt there is sometimes a disconnect between the person on the phone and their ability to understand your predicament and solve your problem.

Cogito in action giving customer service reps real-time feedback.

He says using his company’s solution, which analyzes the contents of the call in real time, and provides relevant feedback, the goal is to not just complete the service call, but to leave the customer feeling good about the brand and the experience. Certainly a bad experience can have the opposite effect.

He wants to use technology to make the experience a more human interaction and he recognizes that as an organization grows, layers of business process make it harder for the customer service representative to convey that humanity. Feast believes that technology has helped create this problem and it can help solve it too.

While the company is not talking about valuation or specific revenue at this point, Feast reports that revenue has grown 3X over the last year. Among their customers are Humana and Metlife, two large insurance companies, each with thousands of customer service agents.

Cogito is based in downtown Boston with 117 employees at last count, and of course they hope to use the money to add on to that number and help scale this vision further.

“This is about scaling our organization to meet client’s needs. It’s also about deepening what we do. In a lot of ways, we are only scratching the surface [of the underlying technology] in terms of how we can use AI to support emotional connections and help organizations be more human,” Feast said.

Powered by WPeMatico

For the nearly 20 percent of Americans who experience severe online harassment, there’s a new company launching in the latest batch of Y Combinator called Tall Poppy that’s giving them the tools to fight back.

Co-founded by Leigh Honeywell and Logan Dean, Tall Poppy grew out of the work that Honeywell, a security specialist, had been doing to hunt down trolls in online communities since at least 2008.

That was the year that Honeywell first went after a particularly noxious specimen who spent his time sending death threats to women in various Linux communities. Honeywell cooperated with law enforcement to try and track down the troll and eventually pushed the commenter into hiding after he was visited by investigators.

That early success led Honeywell to assume a not-so-secret identity as a security expert by day for companies like Microsoft, Salesforce, and Slack, and a defender against online harassment when she wasn’t at work.

“It was an accidental thing that I got into this work,” says Honeywell. “It’s sort of an occupational hazard of being an internet feminist.”

Honeywell started working one-on-one with victims of online harassment that would be referred to her directly.

“As people were coming forward with #metoo… I was working with a number of high profile folks to essentially batten down the hatches,” says Honeywell. “It’s been satisfying work helping people get back a sense of safety when they feel like they have lost it.”

As those referrals began to climb (eventually numbering in the low hundreds of cases), Honeywell began to think about ways to systematize her approach so it could reach the widest number of people possible.

“The reason we’re doing it that way is to help scale up,” says Honeywell. “As with everything in computer security it’s an arms race… As you learn to combat abuse the abusive people adopt technologies and learn new tactics and ways to get around it.”

Primarily, Tall Poppy will provide an educational toolkit to help people lock down their own presence and do incident response properly, says Honeywell. The company will work with customers to gain an understanding of how to protect themselves, but also to be aware of the laws in each state that they can use to protect themselves and punish their attackers.

The scope of the problem

Based on research conducted by the Pew Foundation, there are millions of people in the U.S. alone, who could benefit from the type of service that Tall Poppy aims to provide.

According to a 2017 study, “nearly one-in-five Americans (18%) have been subjected to particularly severe forms of harassment online, such as physical threats, harassment over a sustained period, sexual harassment or stalking.”

The women and minorities that bear the brunt of these assaults (and, let’s be clear, it is primarily women and minorities who bear the brunt of these assaults), face very real consequences from these virtual assaults.

Take the case of the New York principal who lost her job when an ex-boyfriend sent stolen photographs of her to the New York Post and her boss. In a powerful piece for Jezebel she wrote about the consequences of her harassment.

As a result, city investigators escorted me out of my school pending an investigation. The subsequent investigation quickly showed that I was set up by my abuser. Still, Mayor Bill de Blasio’s administration demoted me from principal to teacher, slashed my pay in half, and sent me to a rubber room, the DOE’s notorious reassignment centers where hundreds of unwanted employees languish until they are fired or forgotten.

In 2016, I took a yearlong medical leave from the DOE to treat extreme post-traumatic stress and anxiety. Since the leave was almost entirely unpaid, I took loans against my pension to get by. I ran out of money in early 2017 and reported back to the department, where I was quickly sent to an administrative trial. There the city tried to terminate me. I was charged with eight counts of misconduct despite the conclusion by all parties that my ex-partner uploaded the photos to the computer and that there was no evidence to back up his salacious story. I was accused of bringing “widespread negative publicity, ridicule and notoriety” to the school system, as well as “failing to safeguard a Department of Education computer” from my abusive ex.

Her story isn’t unique. Victims of online harassment regularly face serious consequences from online harassment.

According to a 2013 Science Daily study, cyber stalking victims routinely need to take time off from work, or change or quit their job or school. And the stalking costs the victims $1200 on average to even attempt to address the harassment, the study said.

“It’s this widespread problem and the platforms have in many ways have dropped the ball on this,” Honeywell says.

Tall Poppy’s co-founders

Creating Tall Poppy

As Honeywell heard more and more stories of online intimidation and assault, she started laying the groundwork for the service that would eventually become Tall Poppy. Through a mutual friend she reached out to Dean, a talented coder who had been working at Ticketfly before its Eventbrite acquisition and was looking for a new opportunity.

That was in early 2015. But, afraid that striking out on her own would affect her citizenship status (Honeywell is Canadian), she and Dean waited before making the move to finally start the company.

What ultimately convinced them was the election of Donald Trump.

“After the election I had a heart-to-heart with myself… And I decided that I could move back to Canada, but I wanted to stay and fight,” Honeywell says.

Initially, Honeywell took on a year-long fellowship with the American Civil Liberties Union to pick up on work around privacy and security that had been handled by Chris Soghoian who had left to take a position with Senator Ron Wyden’s office.

But the idea for Tall Poppy remained, and once Honeywell received her green card, she was “chomping at the bit to start this company.”

A few months in the company already has businesses that have signed up for the services and tools it provides to help companies protect their employees.

Some platforms have taken small steps against online harassment. Facebook, for instance, launched an initiative to get people to upload their nude pictures so that the social network can monitor when similar images are distributed online and contact a user to see if the distribution is consensual.

Meanwhile, Twitter has made a series of changes to its algorithm to combat online abuse.

“People were shocked and horrified that people were trying this,” Honeywell says. “[But] what is the way [harassers] can do the most damage? Sharing them to Facebook is one of the ways where they can do the most damage. It was a worthwhile experiment.”

To underscore how pervasive a problem online harassment is, out of the four companies where the company is doing business or could do business in the first month and a half there is already an issue that the company is addressing.

“It is an important problem to work on,” says Honeywell. “My recurring realization is that the cavalry is not coming.”

Powered by WPeMatico

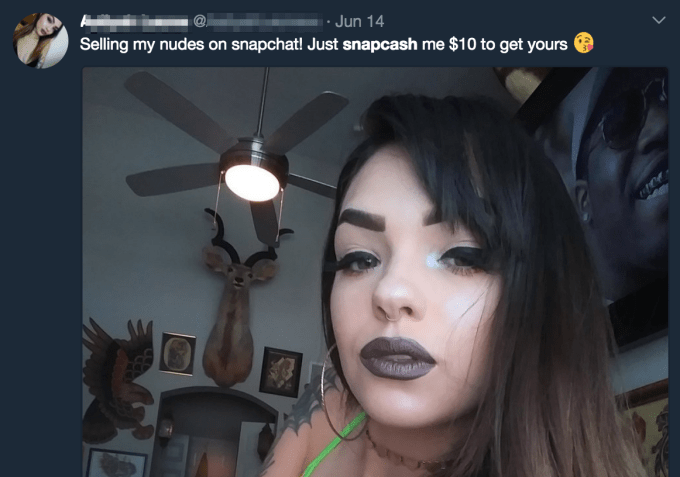

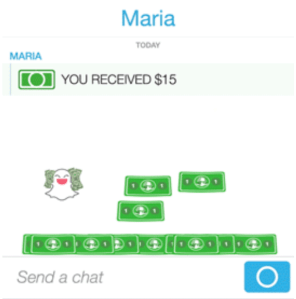

Snapcash ended up as a way to pay adult performers for private content over Snapchat, not just a way to split bills with friends. But Snapchat will abandon the peer-to-peer payment space on August 30th. Code buried in Snapchat’s Android app includes a “Snapcash deprecation message” that displays “Snapcash will no longer be available after %s [date]”. Shutting down the feature will bring an end to Snapchat’s four-year partnership with Square to power the feature for sending people money.

Snapcash may have become more of a liability than a utility. With apps like Venmo, PayPal, Zelle, and Square Cash itself, there were plenty of other ways to pay back friends for drinks or Ubers, so Snapcash may have seen low legitimate usage. Meanwhile, a quick Twitter search for “Snapcash” surfaced plenty of offers of erotic content in exchange for payments through the feature. It may have been safer for Snapchat to ditch Snapcash than risk PR problems over its misuse.

TechCrunch tipster Ishan Agarwal provided the below screenshot of Snapchat’s code to TechCrunch. When presented with the code and asked if Snapcash would shut down, a Snapchat spokesperson confirmed to TechCrunch that it would, explaining: “Yes, we’re discontinuing the Snapcash feature as of August 30, 2018. Snapcash was our first product created in partnership with another company – Square. We’re thankful for all the Snapchatters who used Snapcash for the last four years and for Square’s partnership!” The spokesperson noted that users would be notified in-app and through the support site soon.

Snapcash gave Snapchat a way to get users to connect payment methods to the app. That’s increasingly important as the company aims to become a commerce platforms where you can shop without leaving the app. Having payment info on file is what makes buying things through Snapchat easier than the web and draws brands to use Snapchat storefronts.

We’ll see how Snapchat plans evolve its commerce strategy without this driver. Earlier this month, TechCrunch revealed that Snapchat’s code contained mentions of a project codenamed “eagle” that’s a camera search feature. It was designed to allow users to scan an object or barcode with their Snapchat camera and see product results in Amazon. But since our report, mentions of Amazon have disappeared from the code. It’s unclear what will happen in the future, but camera search could give Snapchat new utility and monetization options.

We’ll see how Snapchat plans evolve its commerce strategy without this driver. Earlier this month, TechCrunch revealed that Snapchat’s code contained mentions of a project codenamed “eagle” that’s a camera search feature. It was designed to allow users to scan an object or barcode with their Snapchat camera and see product results in Amazon. But since our report, mentions of Amazon have disappeared from the code. It’s unclear what will happen in the future, but camera search could give Snapchat new utility and monetization options.

Snapcash won’t be a part of that future, though. Given Snapchat’s cost-cutting efforts including layoffs, its desperate need to attract and retain advertisers to hit revenue estimates its missed, and its persistent bad rap as a sexting app, it couldn’t afford to support unnecessary features or another scandal.

Powered by WPeMatico

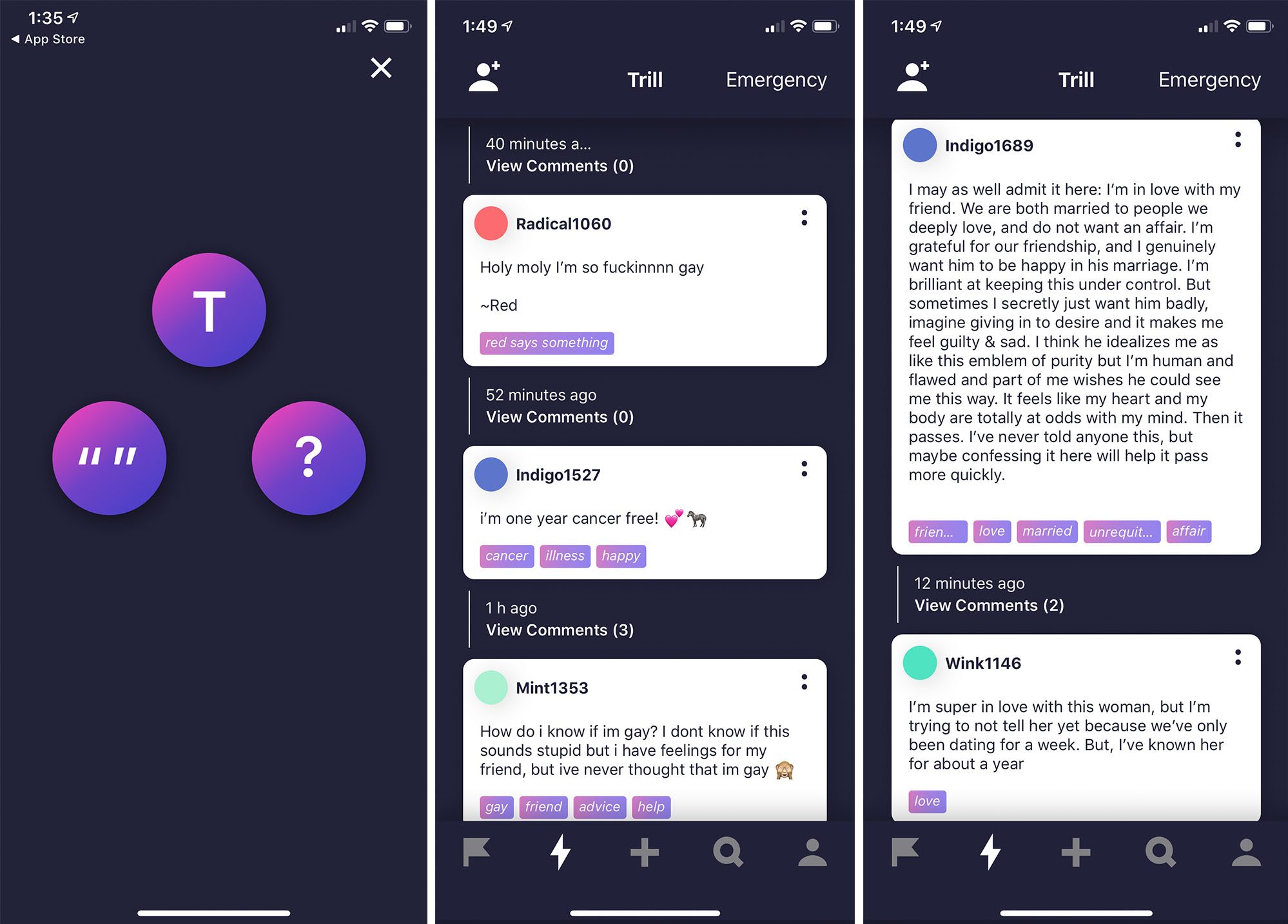

Trill Project, founded by three high school girls, recently launched out of private beta to help people safely express themselves online. For those unfamiliar with the word “trill,” it’s a combination of “true” and “real.” An investor described it to me as a positive Yik Yak .

Trill Project began as a community for teenagers, especially for transgender teens who felt like they didn’t have a safe space to be themselves. It has since expanded it to a platform for everyone to express anything from their struggles with addiction, mental illnesses to workplace issues.

“We’re reinventing the narrative of social networking and we kind of elevate social media by being private and anonymous,” Trill Project co-founder Georgia Messinger told TechCrunch over the phone.

On Trill Project, everything is anonymous (there are no usernames) and monitored by 50 moderators around the clock. Trill Project also has machine learning algorithms as work to learn from reported posts to be able to recognize problematic posts in the future. And if someone feels unsafe or thinks someone has figured out their trill identity, they can always just change it.

In addition to wanting to prevent bullying and harassment, Trill Project wants to be helpful to those suggesting they want to harm themselves or those reporting being hurt by others. That’s why Trill Project has partnered with non-profit organizations that specifically support people experiencing mental health crises.

Trill Project will always be free to the users, but the idea is to possibly license its machine learning algorithms, sell ad space and sponsorships for communities, Trill Project co-founder Ari Sokolov told TechCrunch.

Anonymous social networks, of course, are nothing new. Startups like Whisper, Secret and Yik Yak have all tried and arguably failed.

“People have tried before but as teenagers in particular, we really are closer to our users,” Messinger said. “It gives us access and insight those companies have been lacking.”

Trill Project is currently participating in Founders Bootcamp, an accelerator for high schoolers. Through the accelerator, Trill Project has received $50,000 in funding. Next month, Trill Project intends to start raising a seed round.

Powered by WPeMatico

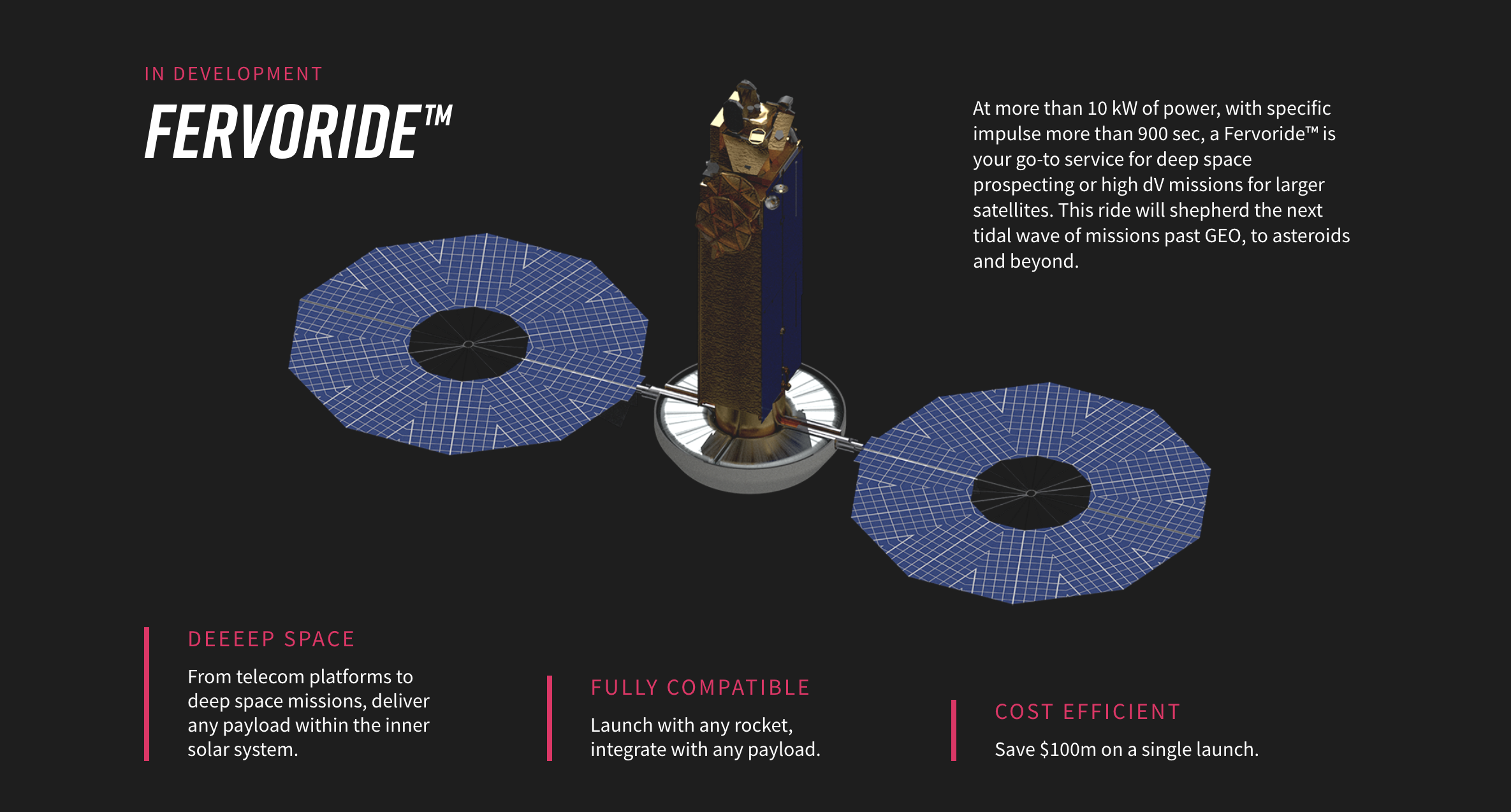

Mikhail Kokorich, the founder of Momentus, a new Y Combinator-backed propulsion technology developer for space flight, hadn’t always dreamed of going to the moon.

A physicist who graduated from Russia’s top-ranked Novosibirsk University, Kokorich was a serial entrepreneur in who grew up in Siberia and made his name and his first fortunes in the years after the fall of the Soviet Union.

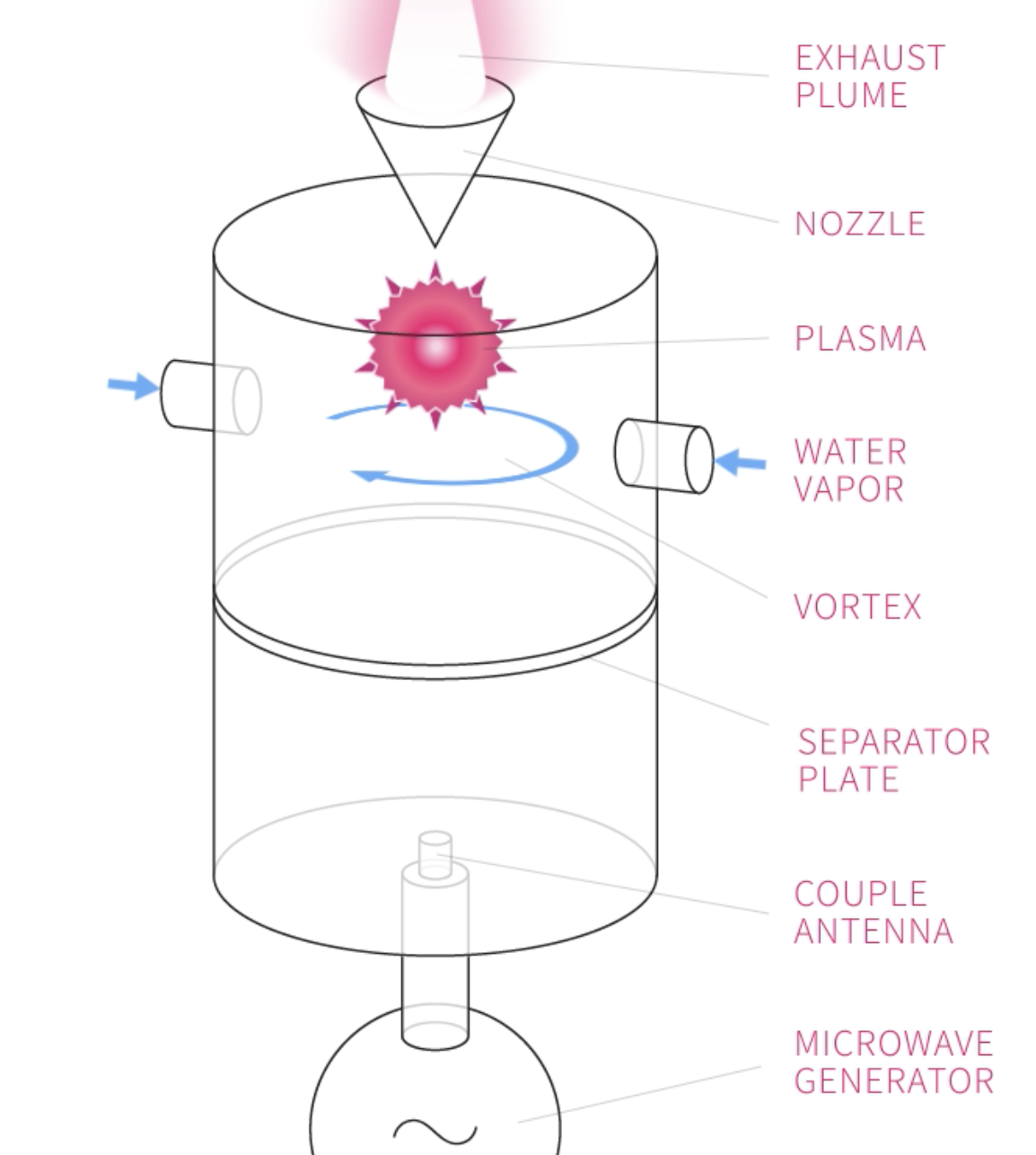

The heart of Momentus’ technology is a new propulsion system that uses water as a propellant instead of chemicals.

Image courtesy Momentus

Using water has several benefits, Kokorich says. One, it’s a fuel source that’s abundant in outer space, and it’s ultimately better and more efficient fuel for flight beyond low earth orbit. “If you move something with a chemical booster stage to the moon. Chemical propulsion is good when you need to have a very high thrust,” according to Kokorich. Once a ship gets beyond gravity’s pull, water simply works better, he says.

Some companies are trying to guide micro-satellites with technologies like Phase 4 which use ionized gases like Xenon, but according to Kokorich those are more expensive and slower. “When ionized propulsion is used for geostationary satellites to orbit, it takes months,” says Kokorich, using water can half the time.

“We can carry ten tons to geostationary orbit and it’s much faster,” says Kokorich.

The company has already signed an agreement with ECM Space, a European launch services provider, which will provide the initial trip for the company’s first test of its propulsion system on a micro-satellite — slated for early 2019.

That first product, “Zeal,” has specific impulses of 150 to 180 seconds and power up to 30 watts.

Kokorich started his first business, Dauria, in the mid-90s amid the collapse of the Soviet Union, selling explosives and engineering services to mining companies in Siberia. Kokorich sold that business and went into retail, eventually building a network of stores that sold home goods and housewares across Russia.

That raked in more millions for Kokorich, who then said he diversified into electronics by buying Russia’s BestBuy chain out bankruptcy. But space was never far from his mind, and, eventually he returned to it.

“In 2011 I hit my middle-aged crisis,” Korkorich says. “So I founded the first private Russian aerospace company.”

That company, Dauria Aerospace, was initially feted by the government, garnering the entrepreneur a place in Skolkovo, and its inaugural cohort of space companies. In an announcement of the successes the space program had achieved in 2014 Kokorich co-authored a piece with the Russian cosmonaut Sergey Zhukov, who remains the executive director of the networking and aerospace programs at the multi-billion-dollar boondoggle startup incubator.

Utilis detects water leaks underground using satellite imagery.

A few months later Kokorich would be in the U.S. working to back the first of what’s now a triumvirate of startups focused on space.

“With all the problems with Russia in the Western world, I moved to the U.S.,” says Kokorich. Dauria had quickly raised $30 million for its work, but as this Moscow Times article notes, stiff competition from U.S. firms and the sanctions leveled against Russia in the wake of its invasion and annexation of Crimea were taking their toll on the entrepreneur’s business. “It was a purely political immigration,” Korkorich says. “I don’t have purely business opportunities, because you have to work with the government [and] because the government would not like me.”

For all of his protestations, Kokorich has maintained several economic ties with partners in Russia. It’s through an investment firm called Oden Holdings Ltd. that Kokorich took an investment stake in the Canadian company Helios Wire, which was one of his first forays into space entrepreneurship outside of Russia. That company makes cryptographically secured applications for the transmission and reception of data from internet-enabled devices.

The second space company that the co-founder has built since moving to the U.S. is the satellite company Astra Digital, which processes data from satellites to make that information more accessible.

Now, with Momentus, Kokorich is turning to the problem of propulsion. “When transportation costs decrease, many business models emerge” Kokorich says. And Kokorich sees Momentus’ propulsion technology driving down the costs of traveling further into space — opening up opportunities for new businesses like asteroid mining and lunar transit.

The Momentus team is already thinking well beyond the initial launch. The company’s eyes are on a prize well beyond geostationary orbit.

Indeed, with water as a power source, the company says it will lay the groundwork for future cislunar and interplanetary rides. The company envisions a future where it will power water prospecting and delivery throughout the solar system, solar power stations, in-space manufacturing and space tourism.

Powered by WPeMatico

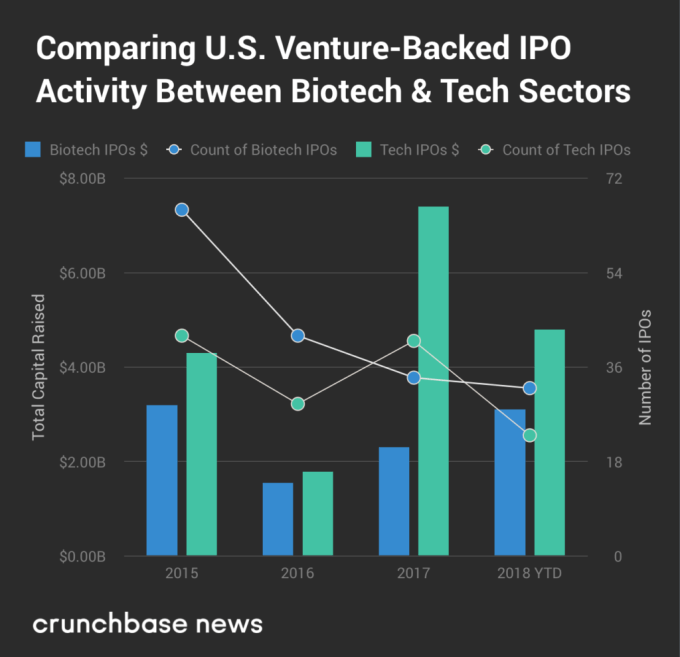

For people who make investment decisions based on revenues and projected earnings, biotech IPOs are kind of a non-starter. Not only are new market entrants universally unprofitable, most have zero revenue. Going public is mostly a means to raise money for clinical trials, with red ink expected for years to come.

That pattern may be one reason the venture capital press, Crunchbase News included, tends to devote a disproportionately small portion of coverage to biotech IPOs. It’s more exciting to watch a big-name internet company pop in first-day trading or poke fun at an underperforming dud.

But with our fixation on all things tech, we’re missing out on the big picture. There are actually a lot more biotech and healthcare startup IPOs than tech offerings. In the second quarter of this year, for instance, at least 16 U.S. venture-backed biotech and healthcare companies went public, compared to just 11 tech startups. In three of the past four years, bio offerings outnumbered tech IPOs, according to Crunchbase data.

In the following analysis, we attempt to get up to speed on the pace of biotech offerings, assess where we are in the cycle and spotlight some of the rising stars.

As mentioned above, U.S. bio IPOs outnumber tech offerings in most years. However, the bio cohort raises less total capital, partly because the largest technology IPOs tend to be much bigger than the largest bio IPOs. In the chart below, we compare the two sectors over the past four years.

Globally, the numbers are much higher. Using Crunchbase data, we’ve put together a chart looking at global VC-backed biotech and healthcare IPOs over the past four years. While we’re just over halfway through 2018, biotech and health IPOs have already raised more money than in any of the prior three full calendar years.

It’s pretty clear we’re in an upcycle for all things startup-related. VCs are flush with cash, late-stage rounds are ballooning in size and IPO and M&A action is picking up, too.

So what does that mean for bio IPOs? Is the uptick in the pace and size of offerings mostly a result of bullish market conditions? Or is the current slate of pre-IPO candidates more compelling than in the past?

We turned to Bob Nelsen, co-founder of ARCH Venture Partners, one of the top-performing biotech investors, for his take, which is that it’s a “fundamentals driven, cycle amplified” IPO boomlet.

More companies are launching well-received IPOs because the pace of startup innovation is faster than in the past. Nelson calls it “the result of the previous 30 years of investment and innovation in biotech that has finally led to essentially data-driven innovation.” That’s leading to more curative treatments, disease-modifying therapies and preventative technologies.

Yet we’re also in a bullish segment of the market cycle for biotech. That’s prompting companies that might have stayed private under other conditions to give going public a shot. It’s also providing bigger outcomes for emerging companies that were already on the IPO track.

The latest example of a big outcome IPO is Rubius Therapeutics, which develops drugs based on genetically engineered red blood cells. This week, the five-year-old company raised $241 million at an initial valuation of over $2 billion, making it the largest bio offering of 2018. The Cambridge, Mass. company, which previously raised nearly a quarter-billion-dollars in venture funding, is still in the pre-clinical trial phase.

This year has delivered several other good-sized offerings as well, including drug developers Eidos Therapeutics and Homology Medicines, recently valued around $800 million each, along with Tricida, valued around $1.2 billion. (See the full list of 2018 global bio and health offerings here.)

As for aftermarket performance, that’s been up and down, but includes some big ups. Last year, biotech led the pack for best-performing IPOs on U.S. exchanges. The sector accounted for four of the six top spots, according to Renaissance Capital, led by drug developers AnaptysBio, Argenx and UroGen, along with Calyxt, an agbio startup.

While things are already up, bio VCs, generally an optimistic bunch, see several reasons why bio IPOs could go higher.

Nelson points to what he sees as the lagging pace of in-house innovation at big pharma and biotech players. Increasingly, they need to acquire startups and recently public companies to stay competitive and build out new product pipelines.

There is also tons of fresh capital earmarked for healthcare startups. In the U.S. in 2017, healthcare-focused venture capitalists raised $9.1 billion. That figure was up 26 percent from 2016, per Silicon Valley Bank.

More dollars also are flowing from venture firms that invest in a mix of tech and life sciences through a single fund. That list includes well-established VCs with dry powder to invest, including Polaris Partners, Founders Fund, Kleiner Perkins and Sequoia Capital.

Still, Nelson observes, deep into an IPO bull market, the average quality of offerings does tend to decline. That said, he’s been through similar inflection points in previous cycles and “for the same point in the cycle, the quality is markedly higher.”

Powered by WPeMatico