TC

Auto Added by WPeMatico

Auto Added by WPeMatico

Lordstown Motors released its Q1 earnings yesterday, and the electric vehicle manufacturer is facing a few challenges.

Expenses were higher than expected, it plans to slash production by about 50%, and the company reported zero revenue and a net loss of $125 million. Oh, it also needs more capital.

“But there’s more to the Lordstown mess than merely a single bad quarter,” writes Alex Wilhelm. “Lordstown’s earnings mess and the resulting dissonance with its own predictions are notable on their own, but they also point to what could be shifting sentiment regarding SPAC combinations.”

In light of the company’s lackluster earnings report (and a pending SEC investigation), Alex unpacks the company’s Q1, “but don’t think that we’re only singling out one company; others fit the bill, and more will in time.”

Image Credits: TechCrunch

Join TechCrunch reporter Ron Miller and Patrik Liu Tran, co-founder and CEO of automated real-time data validation and quality monitoring platform Validio, on Thursday, May 27 at 9 a.m. PDT/noon EDT for a Clubhouse chat about ensuring data quality in the era of Big Data.

The world produces 2.5 quintillion bytes of data daily, but modern data infrastructure still lacks solutions for monitoring data quality and data validation.

Among other topics, they’ll discuss the build versus buy debate, how to better understand data failures, and why traditional methods for identifying data failures are no longer operational.

Click here to join the conversation.

Thanks very much for reading Extra Crunch; have a great week!

Walter Thompson

Senior Editor, TechCrunch

@yourprotagonist

Full Extra Crunch articles are only available to members.

Use discount code ECFriday to save 20% off a one- or two-year subscription.

Image Credits: Nigel Sussman

Expensify may be the most ambitious software company ever to mostly abandon the Bay Area as the center of its operations.

The startup’s history is tied to places representative of San Francisco: The founding team worked out of Peet’s Coffee on Mission Street for a few months, then crashed at a penthouse lounge near the 4th and King Caltrain station, followed by a tiny office and then a slightly bigger one in the Flatiron building near Market Street.

Thirteen years later, Expensify still has an office a few blocks away on Kearny Street, but it’s no longer a San Francisco company or even a Silicon Valley firm. The company is truly global with employees across the world — and it did that before COVID-19 made remote working cool.

It makes sense that a company founded by internet pirates would let its workforce live anywhere they please and however they want to. Yet, how does it manage to make it all work well enough to reach $100 million in annual revenue with just a tad more than 100 employees?

As I described in Part 2 of this EC-1, that staffing efficiency is partly due to its culture and who it hires. It’s also because it has attracted top talent from across the world by giving them benefits like the option to work remotely all year as well as paying SF-level salaries even to those not based in the tech hub. It’s also got annual fully paid month-long “workcations” for every employee, their partner and kids.

Image Credits: TechCrunch

Managing Editor Jordan Crook interviewed Airbnb co-founder and CEO Brian Chesky to discuss the future of travel and what it was like leading the world’s biggest hospitality startup during a global pandemic.

“Our business initially dropped 80% in eight weeks. I say it’s like driving a car. You can’t go 80 miles an hour, slam on the brakes, and expect nothing really bad to happen.

Now imagine you’re going 80 miles an hour, slam on the brakes, then rebuild the car kind of while still moving, and then try to accelerate into an IPO, all on Zoom.”

Image Credits: alexsl (opens in a new window)/ Getty Images

There’s latent demand for life insurance currently unaddressed by much of the financial services industry, and embedded finance can be the solution.

It’s imperative for companies to consider product lines and partnerships to expand markets, create new revenue streams and provide added value to their customers.

Connecting consumers with products they need through channels they already know and trust is both a massive revenue opportunity and a social good, providing financial resilience to families at a time when they need it most.

Image Credits: Nigel Sussman (opens in a new window)

Zeta Global raised north of $600 million in private capital in the form of both equity financing and debt, making it a unicorn worth understanding.

The gist is that Zeta ingests and crunches lots of data, helping its users market to their customers on a targeted basis throughout their individual buying lifecycles. In simpler terms, Zeta helps companies pitch customers in varied manners depending on their own characteristics.

You can imagine that, as the digital economy has grown, the sort of work Zeta Global supports has only expanded. So, has Zeta itself grown quickly? And does it have an attractive business profile? We want to know.

Image Credits: Busakorn Pongparnit (opens in a new window) / Getty Images

In 2016, more than 20 years after Amazon’s founding and 10 years since Shopify launched, it would have been easy to assume e-commerce penetration (the percentage of total retail spend where the goods were bought and sold online) would be over 50%.

But what we found was shocking: The U.S. was only approximately 8% penetrated — only 8% for arguably the most advanced economy in the world!

Despite e-commerce growth skyrocketing over the past year, the reality is the U.S. has still only reached an e-commerce penetration rate of around 17%. During the last 18 months, we’ve closed the gap to South Korea and China’s e-commerce penetration of more than 25%, but there is still much progress to be made.

Here are five key predictions for what this road to further penetration will hold.

Image Credits: Nora Carol Photography (opens in a new window) / Getty Images

Every company wants to be innovative, but innovation comes with its share of difficulties. One key challenge for early-stage companies that are disrupting a particular space or creating a new category is figuring out how to sell a unique product to customers who have never bought such a solution.

This is especially the case when a solution doesn’t have many reference points and its significance may not be obvious.

Some buyers could use a walkthrough of the buying process. If you are building a singular product in a nascent market that necessitates forward-looking customers and want to drastically shorten sales cycles, create a buyer’s guide.

Image Credits: cruphoto (opens in a new window) / Getty Images

Pay attention to red flags when meeting with VCs: If they cancel late or leave you waiting, it’s a sign, just like being asked generic questions that demonstrate little or no understanding of the proposition. If they critique you or your business, that’s fine (obviously), but make sure you find out what’s behind their assertions to judge how well informed they are.

If you’re going to face these people each month and debate the direction of your business, the least you can expect is a robust argument outlining precisely why you may not have all the right answers.

If you fail to spot the warning signs, you’ll live to regret it. But do your due diligence and work constructively with them and, together, you might actually build a sustainable future.

Image via Getty Images / Westend61

This column aims to collect some of the most relevant recent discoveries and papers — particularly in, but not limited to, artificial intelligence — and explain why they matter.

In this edition, we have a lot of items concerned with the interface between AI or robotics and the real world. Of course, most applications of this type of technology have real-world applications, but specifically, this research is about the inevitable difficulties that occur due to limitations on either side of the real-virtual divide.

Image Credits: PeopleImages (opens in a new window) / Getty Images

Netflix has two CEOs: Co-founder Reed Hastings oversees the streaming side of the company, while Ted Sarandos guides Netflix’s content.

Warby Parker has co-CEOs as well — its co-founders went to college together. Other companies like the tech giant Oracle and luggage maker Away have shifted from having co-CEOs in recent years, sparking a wave of headlines suggesting that the model is broken.

While there isn’t a lot of research on companies with multiple CEOs, the data is more promising than the headlines would suggest. One study on public companies with co-CEOs revealed that the average tenure for co-CEOs, about 4.5 years, was comparable to solitary CEOs, “suggesting that this arrangement is more stable than previously believed.”

Furthermore, it’s impossible to be in two places at once or clone yourself. With co-CEOs, you can effectively do just that.

Powered by WPeMatico

The spinout of video platform Vimeo from IAC completed today, with the smaller company now trading as an independent entity under the ticker symbol VMEO.

If you missed the news that the internet conglomerate was spinning out the video service, don’t feel bad; it slipped past many radars. But with the company now trading, with our access to its historical results, and with our minds still enthralled by YouTube’s recent financial performance for Alphabet, it’s worth taking a moment to digest the company’s health.

Let’s answer a few questions: How quickly is Vimeo growing, how profitable is its business, and what can its spinout tell us about the larger video market? Recall that Kaltura, another video-powering company, recently put its IPO back into the pipeline after a small delay during what felt like a snap-freeze of the public markets toward the start of the second quarter.

So the Vimeo debut could impact a possible forthcoming unicorn IPO. With that in mind, let’s dig into the numbers.

From Q1 2020 to Q1 2021, Vimeo’s revenues expanded from $57 million to $89.4 million, a gain of around 57%. That’s a solid pace of expansion, but not a surprising one considering how much digital video the world consumed during the COVID-19 pandemic, a fact that could have bolstered the company’s recent performance.

Over the same time frame, Vimeo’s gross profit grew from $38.6 million to $64.5 million, a gain of around 67%. As you can infer from faster-rising gross profit than revenue, Vimeo’s gross margins improved during Q1 2021 compared to the first quarter of 2020, from 68% to 72%.

Powered by WPeMatico

Earlier this year, Turntable.fm’s founder Billy Chasen dusted off the old site and resurrected it for the pandemic age. I know I wasn’t the only one feeling a wistful pang of nostalgia for the service during the long, dull days of sheltering in place. And while March 2020 would have been the best time for a relaunch, March 2021 was pretty good, too.

Today Chasen announced that the service has received a nice little slice of VC backing to help the service (which has thus far been invite/password only) take the next step. Andreessen Horowitz led the $7.5 million round a decade after the site’s original launch. Funding had thus far been limited to fans through services like Patreon and Venmo. He notes that he will be turning off the service’s Patreon.

Chasen is staying mum as far as where the funding will go, stating, “And now with the new fundraising, we can continue to innovate and truly explore the cross section of social + music. I have a lot of ideas for the space and I’m excited to start building them.”

Though, a blog post does note that the company is hiring engineers and designers. Understandable, though as someone who’s been enjoying the site these last few months, I’m actually pretty surprised at how fresh the whole thing feels.

The team found a clever loophole around music rights in the form of YouTube videos, but perhaps a future version of the service will involve more direct music licensing or ties to popular apps like Spotify. A mobile app would be nice, if I’m just spitballing here.

Turntable.fm initially shut down back in 2013, stating at the time, “It was a tough decision to make because we love this community so much, but the cost of running a music service has been too expensive and we can’t outpace it with our efforts to monetize it and cut costs.” The service added that it was focusing on a live events platform instead.

Notably, Turntable.fm is not the only Turntable service looking to relaunch in 2021. There’s also Turntable.org (confusingly located at TT.fm), which is seeking fan funding, as well as looking toward a subscription fee. It announced that it had raised $500,000 in March and was aiming for an April launch for a mobile and desktop version. The site currently reads, “We’re building a new version just as much fun as the original.”

The two Turntables are not affiliated.

Powered by WPeMatico

What’s it like raising a round in 2021? How has it changed over the last few months, as some glimmer of normalcy seems, at least, within reach? What do early-stage founders (and investors!) need to know about the current state of the industry?

Few are in a better place to outline this than Avlok Kohli, the CEO of AngelList Venture who will let you know at TC Early Stage on July 8-9. With more than $2.2 billion in assets under management and over 5,000 startups funded on the platform, AngelList has data-driven insights that just about no one else could offer. Kohli joined AngelList Venture as CEO in mid-2019, giving him a remarkably unique view of the industry through a particularly wild time.

Kohli also knows what it’s like to be a founder, having been in that seat multiple times. In 2014 he founded Fastbite, a low-cost meal delivery service; in 2015, he sold it to Square. He dove back in with a daily house cleaning service called Fairy in 2017, and sold it to Postmates at the beginning of 2019.

We’re super excited to announce that Avlok Kohli will join us at TC Early Stage on July 8-9 to get us all up to speed on the state of play in early-stage investing.

TC Early Stage is our event series all about startups that are… well, early stage. From raising money to marketing the right way to just getting people to care, we go deep on the topics that matter most to founders.

We’ll kick this session off with a presentation from Kohli on the state of early-stage investing, then we’ll get right into audience Q&A and try to get your most burning questions answered live.

TC Early Stage: Marketing & Fundraising goes down on July 8th and 9th — and because it’s virtual, you can attend right from the comfort of your couch. Or office chair. Or a hammock. We don’t care, just come watch. Get your tickets here!

Powered by WPeMatico

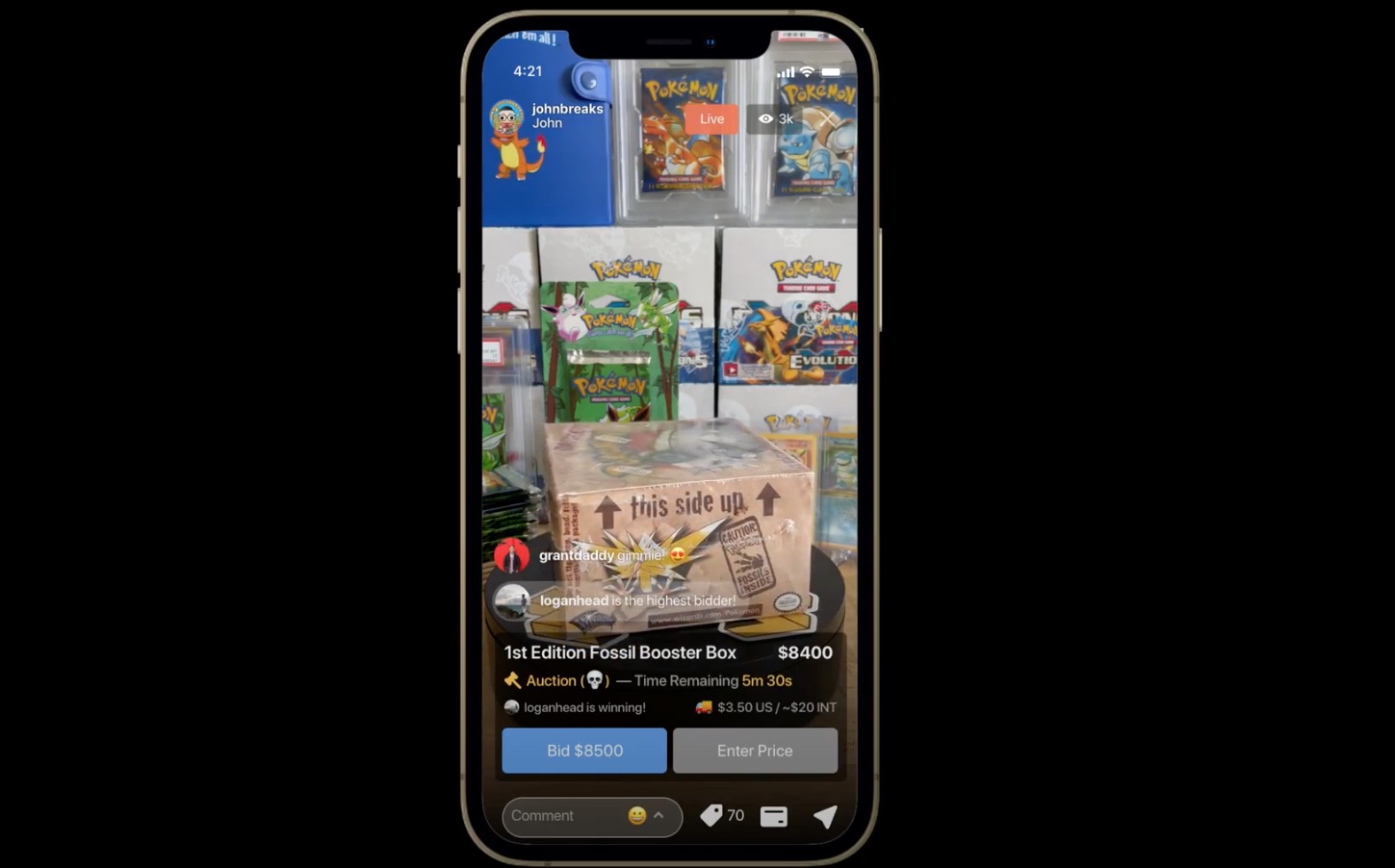

Whatnot exists with one primary goal in mind: to give people a place to buy and sell collectibles (like Pokémon cards, sports cards, pins, etc.) in a safe, authenticated way.

The company started out with intentions of being a GOAT/StockX-style resale marketplace, where the products up for sale lived on neat little pages with row after row of static images. As they started experimenting with other formats, they found one that really seemed to catch on: livestream sales. Think QVC or the Home Shopping Network… but instead of hosts in huge studios selling jewelry and patio furniture, it’s users with smartphones selling Charizard cards and Yoda figurines.

Image Credits: Whatnot

I first wrote about Whatnot last year. In the short time since, the company has raised three increasingly large rounds: $4 million in December, $20 million in March and, as of this morning, another $50 million.

While Whatnot still offers the more standard product pages to give sellers a 24/7 presence on the site, the livestreaming side of things has become the primary driver — by far. Co-founder Grant LaFontaine tells me that livestreaming is currently “95% of the focus”; it’s where most of their sales are happening, and what users seem to care most about.

Another thing users seem to care about? Sports cards. Whatnot opened up the site to sports card sellers in January, and it almost immediately took over as the site’s best-selling category. The one category now accounts for “millions of dollars” in sales each month, the company says.

The Whatnot team itself is growing quickly as well. When I first spoke to them, it was just a handful of employees; by January of this year, they were up to 10. Today it’s 45 full-timers. By the end of the year, says Grant, they expect to be nearing 100.

While anyone can sell on Whatnot’s marketplace, only users that have been vetted/invited can sell via livestream. This helps to keep fraud low; sellers know that if they try to sneak in fake cards or rip anyone off, their access to livestreaming — and thus their audience — could vanish.

The company tells me that this Series B round was led by Anu Hariharan of Y Combinator Continuity fund, and backed by Andreessen Horowitz, Animal Capital and a number of angels.

Powered by WPeMatico

Expensify may be the most ambitious software company ever to mostly abandon the Bay Area as the center of its operations.

Expensify may be the most ambitious software company ever to mostly abandon the Bay Area as the center of its operations.

The startup’s history is tied to places representative of San Francisco: The founding team worked out of Peet’s Coffee on Mission Street for a few months, then crashed at a penthouse lounge near the 4th and King Caltrain station, followed by a tiny office and then a slightly bigger one in the Flatiron building near Market Street.

Thirteen years later, Expensify still has an office a few blocks away on Kearny Street, but it’s no longer a San Francisco company or even a Silicon Valley firm. The company is truly global with employees across the world — and it did that before COVID-19 made remote working cool.

“Things got so much better when we stopped viewing ourselves as a Silicon Valley company. We basically said, no, we’re just a global company,” CEO David Barrett told TechCrunch. That globalism led to it opening a major office in — of all places —a small town in rural Michigan. That Ironwood expansion would eventually lead to a cultural makeover that would see the company broadly abandon its focus on the Bay Area, expanding from a headquarters in Portland to offices around the globe.

It makes sense that a company founded by internet pirates would let its workforce live anywhere they please and however they want to. Yet, how does it manage to make it all work well enough to reach $100 million in annual revenue with just a tad more than 100 employees?

As I described in Part 2 of this EC-1, that staffing efficiency is partly due to its culture and who it hires. It’s also because it has attracted top talent from across the world by giving them benefits like the option to work remotely all year as well as paying SF-level salaries even to those not based in the tech hub. It’s also got annual fully paid month-long “workcations” for every employee, their partner and kids.

Yet the real story is how a company can become untethered from its original geography, willing to adapt to new places and new cultures, and ultimately, give up the past while building the future.

Powered by WPeMatico

Hyro, formerly Airbud, is today announcing the close of a $10.5 million Series A financing round led by Spero Ventures, with participation from Twilio and Mindset Ventures. Existing investors Hanaco Ventures, Spider Capital and Entrepreneurs Roundtable Accelerator also participated in the round.

Hyro is an enterprise application, currently aimed at the healthcare sector but with eyes on new verticals, that adds an intelligent layer of voice chat or text chat to any application or website.

The company calls itself an adaptive communications platform, which essentially means that customers use plug-and-play tools to get information to end-users in a conversational way, whether that be voice or chat. It can integrate with contact centers, chatbots, SMS and other forms of communication. Essentially, Hyro targets information-heavy industries that often have to communicate with end-users.

This type of scenario, in the words of co-founder Israel Krush, usually leads to a terrible experience for the end user and a costly, inefficient process for the organization. The problem was no more apparent than in the healthcare sector during the pandemic. End users would flood platforms for information regarding the virus, the vaccine, testing, etc., but ask those redundant questions in myriad ways. On the enterprise side, the answers to those questions were changing over time.

Hyro allows these organizations to easily edit and change that information and deliver it to end users in an efficient way. But perhaps most importantly, Hyro scrapes information from the website to set up its own conversational tree, so the client doesn’t have to do a lot of heavy lifting up front.

Krush says that the problem is big, which means that the space is crowded. He views Twilio’s participation in this round of fundraising as a differentiator.

“The market is crowded so it’s really hard to differentiate yourself from the crowd,” said Krush. “Even though we have great technology, everyone says they have great technology. Twilio coming into this round and the partnership we’re trying to develop around contact centers really attests to the differentiation of our approach, to the scalability and the modularity of our approach.”

He added that Hyro is not a healthcare company — “it’s really about serving any enterprise.”

Hyro healthcare customers include Carroll, Wheelpros, Mercy Health, University of Rochester Medical Center and Weill Cornell Medicine, but the company plans to use this new funding to scale into more verticals, with an aim toward real estate, government and other information-heavy industries.

This latest round brings Hyro’s total funding to $15 million.

Powered by WPeMatico

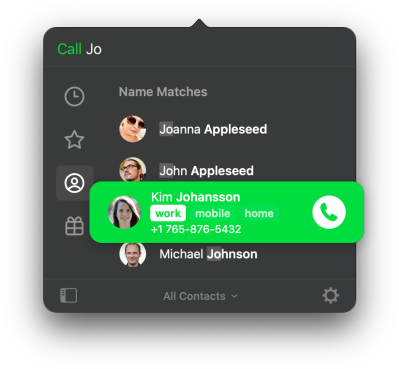

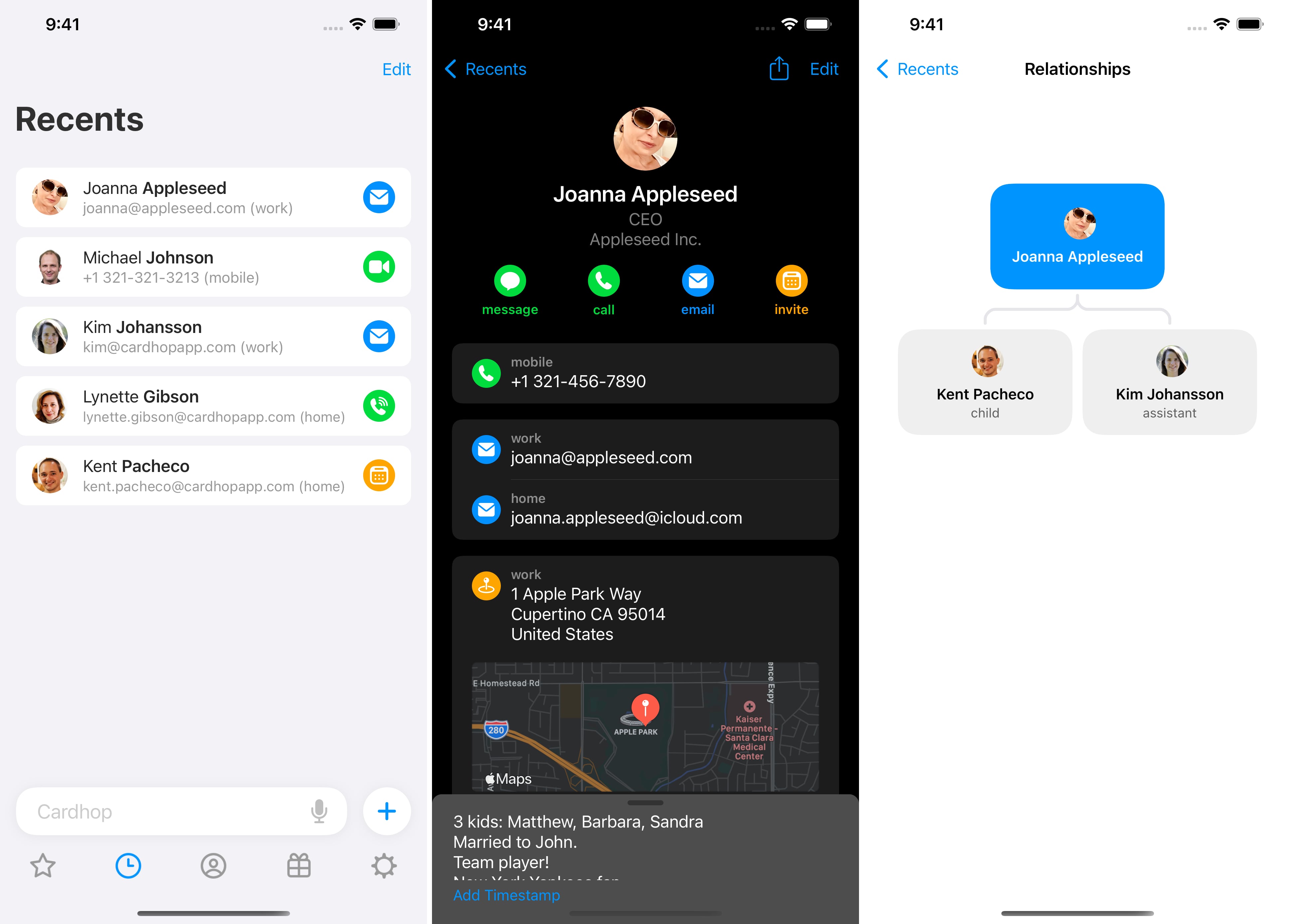

Flexibits, the company behind productivity apps Fantastical and Cardhop, is releasing a new version of Cardhop for both macOS and iOS. This is the second major version of the app and it adds new features, such as business card scanning, widgets, organizational charts and a deeper integration with Fantastical.

Cardhop is a clever take on contact management. It uses the same address book as the default Contacts app on your Mac, iPhone and iPad. But it lets you search, add and edit contacts much more efficiently.

On the Mac, Cardhop sits in the menu bar. When you click on the icon or hit a keyboard shortcut, you can see your contacts but you can also start typing. This is when it gets interesting.

As expected, you can find a contact card by typing a few letters. But you can also add information to an existing contact this way.

Image Credits: Flexibits

For instance, if you type a name followed by a phone number, Cardhop automatically figures out that the phone number doesn’t exist in the existing contact entry — hit enter and the number is saved. If the person isn’t even in your address book, you can create a new contact just by dumping information in the search field.

The app truly shines if you think about Cardhop as a sort of command-line interface to interact with your contacts. You can type “call Jane”, “email Tom” or “whatsapp Natasha” — Cardhop parses the action for you. It can be particularly handy to initiate calls on your iPhone from your Mac.

With Cardhop 2, the design has been updated and there are a handful of new features. You can now create widgets with your favorite actions. On iOS, you can add it to your home screen. On macOS, you can access it from the Notification Center. Widgets have been a popular feature of iOS 14 and many users will like that new feature.

If you’re also using Fantastical, you can send a calendar invite to someone else from Cardhop. And if you tend to invite the same group of people to your events, you can create a group in Cardhop. The next time you want to send an invitation, you can create an event with everyone in the group from Cardhop. This is going to be a good alternative to email aliases.

Cardhop can now also generate organizational charts and family trees based on relationships in your contacts. And if you work for a big company with a contact directory, you could easily find the right person to talk with using this new feature.

On iOS, Flexibits has also added a business card scanning feature. You can add contacts just by pointing your phone at a business card. There are many apps that offer that feature already, but now it’s integrated.

Image Credits: Flexibits

Flexibits has been around for 10 years. Originally, the company released new major updates and users had to pay to download the new version. That’s how independent development companies used to charge for apps.

Last year, the company launched a new version of Fantastical with a freemium model. New users could download the app for free and would have to pay a subscription of $4.99 per month or $39.99 per year to unlock all features. Existing users could keep using the app for free as all existing features had been unlocked for them.

After switching to this new model, Flexibits released quite a few updates to Fantastical. For instance, you can now join conference calls quickly with shortcuts in the menu bar and in the app. Fantastical now also supports Zoom, Google Meet and Microsoft Teams.

Flexibits wants to go one step further and create an ecosystem of productivity apps. Cardhop 2 is a free app with a few free features. If you want to unlock everything, you have to subscribe to the same Flexibits Premium subscription.

In other words, the company is bundling premium versions of Fantastical and Cardhop in a single subscription — and the price isn’t changing. Existing Cardhop users who don’t want to subscribe will also keep everything that was available in Cardhop 1 for free.

And if you’re already using Cardhop, it’s nice to see an update. It means that the app is going to be supported going forward. When you rely on an app for your work, it’s better when it’s regularly updated and keeps working as expected year after year. And I suspect many Fantastical users will try out Cardhop thanks to the new Flexibits Premium subscription.

Powered by WPeMatico

E-commerce is on the rise, but that also means the risk, and occurrence, of e-commerce fraud is, too. Now, Forter, one of the startups building a business to tackle that malicious activity, has closed $300 million in funding — a sign both of the size of the issue and its success in tackling it to date.

The new funding, a Series F, values Forter at $3 billion — notable not least because the funding is coming only about six months since Forter’s previous round, a $125 million Series E that valued it at over $1.3 billion.

Tiger Global Management is leading this latest equity infusion, with new backers Third Point Ventures and Adage Capital Management, and existing investors Bessemer Venture Partners, Sequoia Capital, March Capital, NewView Capital, Salesforce Ventures and Scale Venture Partners, also involved.

The plan will be to use to the money to expand Forter — founded in Tel Aviv and now based in New York — geographically, bring more functionality into its product and explore adjacent areas where Forter might expand its capabilities, either organically or by way of acquisition.

Forter today focuses mainly on identifying fraud at the point of transaction and building an AI-based platform that “learns” more behaviors to improve its accuracy; it also builds models that keep more people transacting and helps bring down the number of “false positives” where activity that appears suspicious actually is not.

One area on its roadmap for expansion is remediation after the fraud occurs, said Liron Damri, Forter’s co-founder and president.

“Our vision is to serve the merchant as the go-to trusted partner for everything, so remediation is definitely on our roadmap,” he said of potential acquisition targets.

Damri, who co-founded the company with Michael Reitblat, CEO, and Alon Shemesh, chief analyst, said in an interview that the startup — which works with some 350 large customers like Priceline and Instacart and a growing number of service providers like FreedomPay and Flutterwave, altogether seeing some $250 billion worth of transactions globally last year — wasn’t proactively looking for more money.

“All we wanted to do was go back to run the company,” he said. “But in the past six months we’ve seen such a great momentum, doubling revenue and ARR, and seeing our customer volumes grow.”

That led to a lot of investors proactively reaching out and asking questions, he continued. He described Tiger as a “kingmaker” in the category of e-commerce, so it was an easy decision to make, and gave it the “gas” it needed to take its next growth steps.

E-commerce has been one of the major technology growth stories of the last year, fueled by a rush of consumers and businesses playing out their lives online at a time when it has been harder, and in some cases impossible, to transact in person.

While we have definitely seen a lot of growth, and growing sophistication, in the number of tools on the market to combat cybercrime, it’s in some ways an ouroboros of a problem: The more transactions that are made, the more there are that need to be monitored for suspicious activity. And in any case, fraud in e-commerce is not exactly going away. It’s estimated that it will cost retailers some $20 billion in 2021 and is always on the rise.

Forter got its start in 2013 focusing first on monitoring activity on sites wherever customers happened to be to identify suspicious behavior — a sign that it might be a bot or someone on an illicit spending spree racking up a lot of items in quick succession — with the bigger concept being to build a network of activity from which to learn and help make more informed decisions over time.

In more recent years, the essence of the issue has expanded somewhat, and also grown more sophisticated. As companies have grown their businesses to reach beyond early adopters and core audiences, and into a more “omnichannel” environment beyond basic check-outs on their own sites, so too have the kinds of consumers coming to shop.

This has meant that traditional “signals” of legitimate buyers no longer were the same as before — a predicament that really rose in profile in the last year, as many newcomers came to e-commerce for the first time during the pandemic. In fact, Damri told me that in 2020 there were seven times more “newcomers” to sites than in 2019.

So with most of the flagging of suspicious activity coming up at the point of transaction, Forter expanded to analyzing activity there.

As with a recent acquisition of Stripe’s, Bouncer, to build out its own anti-fraud product, a large part of Forter’s attention these days is on providing tools to companies to identify suspicious purchasing, but even more than that, to make sure that the many occasions that might look suspicious are not, to help reduce the amount of “cart abandonment” and increase conversions.

The old way of doing things, Damri said, involved “thousands of rules and applying suspicion on everyone. You were guilty unless proved otherwise.”

Using its AI engine and some risk analysis (not unlike the kind that, say, an insurance or loan provider might apply in their businesses), Forter turned the proposition on its head.

“We wanted to approve as much as possible. We wanted to gradually increase the trust you have of your own customers. We changed the sentiment and approach… especially in areas that were neglected, such as those who saw significant changes in life,” Damri said. “This was extremely important as COVID-19 hit.”

Forter’s risk tolerance model, it seems, has so far proven out. Damri said that its algorithms applied reduce the total number of declines by 80%, but also reduce the number of chargebacks — one indicator of a mistake — by 60%.

This implies that it’s blocking more of the “wrong” kind of purchases, and letting through more of the legitimate ones. (That is, he pointed out, in addition to a few bad actors Forter intentionally lets buy things, just to learn how they operate. Damri referred to this as “paid-tuition.”)

Risk-based approvals, coupled with algorithms to learn what is truly bad, has resonated with customers, and investors.

“With the unprecedented rate of digital transformation and the fierce competition in creating the slickest user experience, superior fraud prevention plays an ever more critical role in e-commerce revenue growth” said John Curtius, a partner at Tiger Global Management, in a statement. “After we talked with dozens of customers of every relevant solution in this space, it was very clear to us that Forter is the clear leader in performance and scale.”

“As a longtime investor, it’s been incredible to see Forter’s ascent,” added Ravi Viswanathan, NewView Capital. “It’s a testament to the leadership team’s vision and execution in allowing merchants to provide the seamless experiences customers expect and to be able to accept as many transactions as possible, while still accurately identifying and blocking fraud.”

Powered by WPeMatico

In the wake of the news that U.K.-based AI startup Faculty has raised $42.5 million in a growth funding round, I teased out more from CEO and co-founder Marc Warner on what his plans are for the company.

Faculty seems to have an uncanny knack of winning U.K. government contracts, after helping Boris Johnson win his Vote Leave campaign and thus become prime minister. It’s even helping sort out the mess that Brexit has subsequently made of the fishing industry, problems with the NHS and telling global corporates like Red Bull and Virgin Media what to suggest to their customers. Meanwhile, it continues to hoover up PhD graduates at a rate of knots to work on its AI platform.

But, speaking to me over a call, Warner said the company no longer has plans to enter the political sphere again: “Never again. It’s very controversial. I don’t want to make out that I think politics is unethical. Trying to make the world better, in whatever dimension you can, is a good thing … But from our perspective, it was, you know, ‘noisy,’ and our goal as an organization, despite current appearances to the contrary, is not to spend tonnes of time talking about this stuff. We do believe this is an important technology that should be out there and should be in a broader set of hands than just the tech giants, who are already very good at it.”

On the investment, he said: “Fundamentally, the money is about doubling down on the U.K. first and then international expansion. Over the last seven years or so we have learned what it takes to do important AI, impactful AI, at scale. And we just don’t think that there’s actually much of it out there. Customers are rightly sometimes a bit skeptical, as there’s been hype around this stuff for years and years. We figured out a bunch of the real-world applications that go into making this work so that it actually delivers the value. And so, ultimately, the money is really just about being able to build out all of the pieces to do that incredibly well for our customers.”

He said Faculty would be staying firmly HQ’d in the U.K. to take advantage of the U.K.’s talent pool: “The U.K. is a wonderful place to do AI. It’s got brilliant universities, a very dynamic startup scene. It’s actually more diverse than San Francisco. There’s government, there’s finance, there are corporates, there’s less competition from the tech giants. There’s a bit more of a heterogeneous ecosystem. There’s no sense in which we’re thinking, ‘Right, that’s it, we’re up and out!’. We love working here, we want to make things better. We’ve put an enormous amount of effort into trying to help organizations like the government and the NHS, but also a bunch of U.K. corporates in trying to embrace this technology, so that’s still going to be a terrifically important part of our business.”

That said, Faculty plans to expand abroad: “We’re going to start looking further afield as well, and take all of the lessons we’ve learned to the U.S., and then later Europe.”

But does he think this funding round will help it get ahead of other potential rivals in the space? “We tend not to think too much in terms of rivals,” he says. “The next 20 years are going to be about building intelligence into the software that already exists. If you look at the global market cap of the software businesses out there, that’s enormous. If you start adding intelligence to that, the scale of the market is so large that it’s much more important to us that we can take this incredibly important technology and deploy it safely in ways that actually improve people’s lives. It could be making products cheaper or helping organizations make their services more efficient.”

If that’s the case, then does Faculty have any kind of ethics panel overseeing its work? “We have an internal ethics panel. We have a set of principles and if we think a project might violate those principles, it gets referred to that ethics panel. It’s randomly selected from across faculty. So we’re quite careful about the projects that we work on and don’t. But to be honest, the vast majority of stuff that’s going on is very vanilla. They are just clearly ‘good for the world’ projects. The vast majority of our work is doing good work for corporate clients to help them make their businesses that bit more efficient.”

I pressed him to expand on this issue of ethics and the potential for bias. He says Faculty “builds safety in from the start. Oddly enough, the reason I first got interested in AI was reading Nick Bostrom’s work about superintelligence and the importance of AI safety. And so from the very, very first fellowship [Faculty AI researchers are called Fellows] all the way back in 2014, we’ve taught the fellows about AI safety. Over time, as soon as we were able, we started contributing to the research field. So, we’ve published papers in all of the biggest computer science conferences Neurips, ICM, ICLR, on the topic of AI safety. How to make algorithms fair, private, robust and explainable. So these are a set of problems that we care a great deal about. And, I think, are generally ‘underdone’ in the wider ecosystem. Ultimately, there shouldn’t be a separation between performance and safety. There is a bit of a tendency in other companies to say, ‘Well, you can either have performance, or you can have safety.’ But of course, we know that’s not true. The cars today are faster and safer than the Model T Ford. So it’s a sort of a false dichotomy. We’ve invested a bunch of effort in both those capabilities, so we obviously want to be able to create a wonderful performance for the task at hand, but also to ensure that the algorithms are fair, private, robust and explainable wherever required.”

That also means, he says, that AI might not always be the “bogeyman” the phrase implies: “In some cases, it’s probably not a huge deal if you’re deciding whether to put a red jumper or a blue jumper at the top of your website. There are probably not huge ethical implications in that. But in other circumstances, of course, it’s critically important that the algorithms are safe and are known to be safe and are trusted by both the users and anyone else who encounters them. In a medical context, obviously, they need to be trusted by the doctors and the patients need to make sure they actually work. So we’re really at the forefront of deploying that stuff.”

Last year the Guardian reported that Faculty had won seven government contracts in 18 months. To what does he attribute this success? “Well, I mean, we lost an enormous number more! We are a tiny supplier to government. We do our best to do work that is valuable to them. We’ve worked for many, many years with people at the home office,” he tells me.

“Without wanting to go into too much detail, that 18 months stretches over multiple prime ministers. I was appointed to the AI Council under Theresa May. Any sort of insinuations on this are just obviously nonsense. But, at least historically, most of our work was in the private sector and that continues to be critically important for us as an organization. Over the last year, we’ve tried to step up and do our bit wherever we could for the public sector. It’s facing such a big, difficult situation around COVID, and we’re very proud of the things we’ve managed to accomplish with the NHS and the impact that we had on the decisions that senior people were able to undertake.”

Returning to the issue of politics I asked him if he thought — in the wake of events such as Brexit and the election of Donald Trump, which were both affected by AI-driven political campaigning — AI is too dangerous to be applied to that arena? He laughed: “It’s a funny old funny question… It’s a really odd way to phrase a question. AI is just a technology. Fundamentally, AI is just maths.”

I asked him if he thought the application of AI in politics had had an outsized or undue influence on the way that political parties have operated in the last few years: “I’m afraid that is beyond my knowledge,” he says. But does Faculty have regrets about working in the political sphere?

“I think we’re just focused on our work. It’s not that we have strong feelings, either way, it’s just that from our perspective, it’s much, much more interesting to be able to do the things that we care about, which is deploying AI in the real world. It’s a bit of a boring answer! But it is truly how we feel. It’s much more about doing the things we think are important, rather than judging what everyone else is doing.”

Lastly, we touched on the data science capabilities of the U.K. and what the new fundraising will allow the company to do.

He said: “We started an education program. We have roughly 10% of the U.K.’s PhDs in physics, maths, engineering, applying to the program. Roughly 400 or so people have been through that program and we plan to expand that further so that more and more people get the opportunity to start a career in data science. And then inside Faculty specifically, we think we’ll be able to create 400 new jobs in areas like software engineering, data science, product management. These are very exciting new possibilities for people to really become part of the technology revolution. I think there’s going to be a wonderful new energy in Faculty, and hopefully a positive small part in increasing the U.K. tech ecosystem.”

Warner comes across as sincere in his thoughts about the future of AI and is clearly enthusiastic about where Faculty can take the whole field next, both philosophically and practically. Will Faculty soon be challenging that other AI leviathan, DeepMind, for access to all those PhDs? There’s no doubt it will.

Powered by WPeMatico