TC

Auto Added by WPeMatico

Auto Added by WPeMatico

Sometimes smart contracts can be pretty dumb.

All of the benefits of a cryptographically secured, publicly verified, anonymized transaction system can be erased by errant code, malicious actors or poorly defined parameters of an executable agreement.

Hoping to beat back the tide of bad contracts, bad code and bad actors, Sagewise, a new Los Angeles-based startup, has raised $1.25 million to bring to market a service that basically hits pause on the execution of a contract so it can be arbitrated in the event that something goes wrong.

Co-founded by a longtime lawyer, Amy Wan, whose experience runs the gamut from the U.S. Department of Commerce to serving as counsel for a peer-to-peer real estate investment platform in Los Angeles, and Dan Rice, a longtime entrepreneur working with blockchain, Sagewise works with both Ethereum and the Hedera Hashgraph (a newer distributed ledger technology, which purports to solve some of the issues around transaction processing speed and security which have bedeviled platforms like Ethereum and Bitcoin).

The company’s technology works as a middleware, including an SDK and a contract notification and monitoring service. “The SDK is analogous to an arbitration clause in code form — when the smart contract executes a function, that execution is delayed for a pre-set amount of time (i.e. 24 hours) and users receive a text/email notification regarding the execution,” Wan wrote to me in an email. “If the execution is not the intent of the parties, they can freeze execution of the smart contract, giving them the luxury of time to fix whatever is wrong.”

Sagewise approaches the contract resolution process as a marketplace where priority is given to larger deals. “Once frozen, parties can fix coding bugs, patch up security vulnerabilities, or amend/terminate the smart contract, or self-resolve a dispute. If a dispute cannot be self-resolved, parties then graduate to a dispute resolution marketplace of third party vendors,” Wan writes. “After all, a $5 bar bet would be resolved differently from a $5M enterprise dispute. Thus, we are dispute process agnostic.”

Wavemaker Genesis led the round, which also included strategic investments from affiliates of Ari Paul (Blocktower Capital), Miko Matsumura (Gumi Cryptos), Youbi Capital, Maja Vujinovic (Cipher Principles), Jordan Clifford (Scalar Capital), Terrence Yang (Yang Ventures) and James Sowers.

“Smart contracts are coded by developers and audited by security auditing firms, but the quality of smart contract coding and auditing varies drastically among service providers,” said Wan, the chief executive of Sagewise, in a statement. “Inevitably, this discrepancy becomes the basis for smart contract disputes, which is where Sagewise steps in to provide the infrastructure that allows the blockchain and smart contract industry to achieve transactional confidence.”

In an email, Wan elaborated on the thesis to me, writing that, “smart contracts may have coding errors, security vulnerabilities, or parties may need to amend or terminate their smart contracts due to changing situations.”

Contracts could also be disputed if their execution was triggered accidentally or due to the actions of attackers trying to hack a platform.

“Sagewise seeks to bring transactional confidence into the blockchain industry by building a smart contract safety net where smart contracts do not fulfill the original transactional intent,” Wan wrote.

Powered by WPeMatico

Crypto skeptics rejoice! A new way to short the cryptocurrency market is coming from dYdX, a decentralized financial derivatives startup. In two months it will launch its protocol for creating short and leverage positions for Ethereum and other ERC20 tokens that allow investors to amp up their bets for or against these currencies.

To get the startup there, dYdX recently closed a $2 million seed round led by Andreessen Horowitz and Polychain, and joined by Kindred and Abstract plus angels, including Coinbase CEO Brian Armstrong and co-founder Fred Ehrsam, and serial investor Elad Gil.

“The main use for cryptocurrency so far has been trading and speculation — buying and holding. That’s not how sophisticated financial institutions trade,” says dYdX founder Antonio Juliano. “The derivatives market is usually an order of magnitude bigger than the spot trading or buy/sell market. The cryptocurrency market is probably on the order of $5 billion to $10 billion in volume, so you’d expect the derivatives market would be 10X bigger. I think there’s a really big opportunity there.”

The idea is that you buy the short Ethereum token with ETH or a stable coin from an exchange or dYdX. The short Ethereum’s token price is inversely pegged to ETH, so it goes up in value when ETH goes down and vice versa. You can then sell the short Ethereum token for a profit if you correctly predicted an ETH price drop.

On the backend, lenders earn an interest rate by providing ETH as collateral locked into smart contracts that back up the short Ethereum tokens. Only a small number of actors have to work with the smart contract to mint or close the short Tokens. Meanwhile, dYdX also offers leveraged Ethereum tokens that let investors borrow to boost their profits if ETH’s price goes up.

The plan is to offer short and leveraged tokens for any ERC20 currency in the future. dYdX is building its own user-facing application for buying the tokens, but is also partnering with exchanges to offer the margin tokens “where people are already trading,” says Juliano.

“We think of it as more than just shorting your favorite shitcoin. We think of them as mature financial products.”

Coinbase has proven to be an incredible incubator for blockchain startup founders. Juliano was employed there as a software engineer after briefly working at Uber and graduating in computer science from Princeton in 2015. “The first thing I started was a search engine for decentralized apps. I worked for months on it full-time, but nobody was building decentralized apps so no one was searching for them. It was too early,” Juliano explains.

But along the way he noticed the lack of financial instruments for decentralized derivatives despite exploding consumer interest in buying and selling cryptocurrencies. He figured the big hedge funds would eventually come knocking if someone built them a bridge into the blockchain world.

But along the way he noticed the lack of financial instruments for decentralized derivatives despite exploding consumer interest in buying and selling cryptocurrencies. He figured the big hedge funds would eventually come knocking if someone built them a bridge into the blockchain world.

Juliano built dYdX to create a protocol to first begin offering margin tokens. It’s open source, so technically anyone can fork it to issue tokens themselves. But dYdX plans to be the standard-bearer, with its version offering the maximum liquidity to investors trying to buy or sell the margin tokens. His five-person team in San Francisco with experience from Google, Bloomberg, Goldman Sachs, NerdWallet and ConsenSys is working to find as many investors as possible to collateralize the tokens and exchanges to trade them. “It’s a race to build liquidity faster than anyone else,” says Juliano.

So how will dYdX make money? As is common in crypto, Juliano isn’t exactly sure, and just wants to build up usage first. “We plan to capture value at the protocol level in the future likely through a value adding token,” the founder says. “It would’ve been easy for us to rush into adding a questionable token as we’ve seen many other protocols do; however, we believe it’s worth thinking deeply about the best way to integrate a token in our ecosystem in a way that creates rather than destroys value for end users.”

“Antonio and his team are among the top engineers in the crypto ecosystem building a novel software system for peer-to-peer financial contracts. We believe this will be immensely valuable and used by millions of people,” says Polychain partner Olaf Carlson-Wee. “I am not concerned with short-term revenue models but rather the opportunity to permanently improve global financial markets.”

With the launch less than two months away, Juliano is also racing to safeguard the protocol from attacks. “You have to take smart contract security extremely seriously. We’re almost done with the second independent security audit,” he tells me.

The security provided by decentralization is one of dYdX’s selling points versus centralized competitors like Poloniex that offer margin trading opportunities. There, investors have to lock up ETH as collateral for extended periods of time, putting it at risk if the exchange gets hacked, and they don’t benefit from shared liquidity like dYdX will.

The security provided by decentralization is one of dYdX’s selling points versus centralized competitors like Poloniex that offer margin trading opportunities. There, investors have to lock up ETH as collateral for extended periods of time, putting it at risk if the exchange gets hacked, and they don’t benefit from shared liquidity like dYdX will.

It also could compete for crypto haters with the CBOE that now offers Bitcoin futures and margin trading, though it doesn’t handle Ethereum yet. Juliano hopes that since dYdX’s protocol can mint short tokens for other ERC20 tokens, you could bet for or against a certain cryptocurrency relative to the whole crypto market by mixing and matching. dYdX will have to nail the user experience and proper partnerships if it’s going to beat the convenience of centralized exchanges and the institutional futures market.

If all goes well, dYdX wants to move into offering options or swaps. “Those derivatives are more often traded by sophisticated traders. We don’t think there are too many traders like that in the market right now,” Juliano explains. “The other types of derivatives that we’ll move to in the future will be really big once the market matures.” That “once the market matures” refrain is one sung by plenty of blockchain projects. The question is who’ll survive long enough to see that future, if it ever arrives.

[Featured Image via Nuzu and Bryce Durbin]

Powered by WPeMatico

Lemonade, the New York-based insurance platform, looks set to drop the lawsuit it filed against German company ONE Insurance, its parent company Wefox, and Wefox founder Julian Teicke.

The complaint, filed in the U.S. District Court Southern District of NY, alleged that Wefox reverse engineered Lemonade to create ONE, infringed Lemonade’s intellectual property, violated the Computer Fraud and Abuse Act, and breached the contract in Lemonade’s terms of service.

At the time of the filing, a statement issued on behalf for Wefox said the allegations had no merit and “ultimately appear to be an attempt to disrupt our business rather than a serious dispute,” dubbing Lemonade’s concerns as meritless. “We intend to defend ourselves vigorously. This lawsuit appears to be an attempt to bait the media into covering a non-issue,” concluded the statement.

However, in a slightly bizarre turn of events, Wefox founder Teicke has taken to his personal LinkedIn profile to post what appears to be a mea culpa of sorts — also revealing that he and Lemonade founder Daniel Schreiber recently met in person to discuss Lemonade’s lawsuit against ONE Insurance (as adults are supposed to do).

Posted to LinkedIn on the 2nd of August, Teicke writes: “Here’s the bottom line: Lemonade created something truly revolutionary, and their innovation inspired many in our industry – including myself. There’s a fine line between inspiration and imitation, and we acknowledge that Lemonade’s perspective is that we crossed it in some parts”.

Continues Teicke:

“While ONE has many unique features, I’m committed to addressing this concern of Lemonade. To that end, ONE will immediately undertake a redesign of elements in the app, website and marketing material that are similar to Lemonade. I am looking forward to putting this conflict aside and to exploring possibilities for cooperation in the future”.

In response, Schreiber shared Teicke’s post on his own LinkedIn profile, and thanked him for a “very amicable and constructive meeting” and for committing to remedy the issues raised in the complaint. He also said he is “committed to dropping the lawsuit once all these changes are implemented”.

I have reached out Teicke, who said he was unable to comment, and to Schreiber, who declined to comment on record. If and when the lawsuit is dropped, which I understand could be within a matter of a couple of weeks, we’ll endeavour to update our reporting. As always, watch this space.

Powered by WPeMatico

Epic Games continues to spread the love… to consumers, at least.

Following the launches of Fortnite Battle Royale on iOS earlier this year and Fortnite for the Nintendo Switch earlier this summer, Epic Games is now confirming that the Android version of the game will be available exclusively through the Fortnite website.

Users can visit Fortnite.com and download the Fortnite Launcher, which will then allow them to load Fortnite Battle Royale onto their devices.

When asked why Epic would choose to distribute the game via their own website instead the more official channel of the Google Play Store, Epic Games CEO Tim Sweeney told TechCrunch in an email:

On open platforms like PC, Mac, and Android, Epic’s goal is to bring its games directly to customers. We believe gamers will benefit from competition among software sources on Android. Competition among services gives consumers lots of great choices and enables the best to succeed based on merit.

Of course, Sweeney didn’t mention the 30 percent fee that goes to Google each time a user makes an in-app purchase, but it’s hard to imagine that’s not a factor in the decision.

In-game purchases are a huge source of revenue for Epic. After all, Fortnite Battle Royale is still a free download across all platforms. That said, Epic Games has already made more than $1 billion on the game through in-game purchases alone. For context on that 30 percent fee, Epic Games is making approximately $2 million per day as of July, according to Sensor Tower.

Using a virtual currency called V-Bucks, players can buy skins, pick axes, gliders and emotes, none of which offer a competitive advantage. Epic declined to clarify if mobile users have the same purchasing behavior as PC and console players. But if they do on Android, Epic will make 100 percent of the revenue.

Epic Games also declined to give an exact date for the launch, still simply saying that the game will launch this “summer.”

That said, you can expect to see the same game, and the same cross-play compatibility, on the Android version of Fortnite Battle Royale when it launches.

One potential drawback to the launch will be security. As Android Police points out, loads of people will enable unknown sources in settings, forgetting to turn it off after, which could end up being a problem down the line.

We’ll be sure to let you know more specific information around the launch date and supported devices as soon as we hear more from Epic Games.

Powered by WPeMatico

Rent the Runway today announced that it has partnered with Temasek for a $200 million credit facility.

Founded in 2009, Rent the Runway lets users rent items of clothing for special events or occasions, bringing runway styles to folks without the cash to purchase the clothing outright.

Rent the Runway started out by letting users rent their wares for about 10 percent of the item’s price. But in 2017, RTR introduced a subscription model, giving users unlimited rentals for $89/month.

The model has already been proven by other businesses. RTR started giving users access to fashion in the same way that Netflix gives users access to video, Spotify gives access to music, or even the way ClassPass gives users access to studio fitness classes.

Since the subscription launch, RTR’s subscription business is up 150 percent year over year, and represents 50 percent of the company’s overall revenue.

According to the release, RTR will use the new funds to continue growing its subscription business, expand operations, and refinance its existing debt facility. As part of the deal, Temasek has received an observer seat on the board of directors.

In response to the question around why Rent The Runway chose a credit facility over traditional VC investment, CFO Scarlett O’Sullivan had this to say via email:

We are very pleased that the company has demonstrated the kind of business model, growth prospects and financial discipline that make it possible to access a credit facility of this size with an equity-minded long-term partner like Temasek – they have a proven track record of supporting disruptive high-growth companies.

We were specifically looking for debt for three key reasons:

1 – This facility gives us the ability to access more financing – we can draw capital as we need to, giving us flexibility to grow our subscription business more quickly

2 – We improved the terms of our prior facility which we refinanced with a portion of these funds — and debt for us is a lower cost option to finance the business

3 – It is less dilutive to our existing shareholders – we believe there will be significant value creation over the next several years as we continue to change consume behavior and help women put their closet in the cloud

Before this latest deal, Rent the Runway had raised more than $200 million in funding from investors such as Bain Capital, KPCB, Highland Capital, TCV, and more.

Powered by WPeMatico

Kinside founders Rob Bircher, Shadiah Sigala and Abe Han

The cost of childcare is one of the biggest financial burdens American families face. Even dependent care flexible spending accounts, pre-tax benefit accounts meant to reduce caregiving costs, can be an extra stressor because they involve filling out many forms. Kinside, a startup in Y Combinator’s current batch, wants to help by automating the claims process. It also serves as a childcare management tool, letting parents pay their care providers with a Venmo-like feature while making it simpler for companies to offer childcare benefits, like matching costs, that can help attract talented employees. Kinside is still in beta, but it’s already been adopted by several tech companies, including Le Tote.

Kinside’s three founders—CEO Shadiah Sigala, COO Rob Bircher and CTO Abe Han—were motivated to launch the startup after realizing that dependent care FSAs (which can also be used for other caregiving-related costs, like elder care) are vastly underutilized.

“Even though upwards of 70% of companies offer this FSA, we found in our conversations with numerous companies that maybe 10% of eligible parents are using this benefit,” Sigala says. “From an employee experience perspective, we are really taking on a very onerous, traditional FSA product and streamlining the payments process, not only for employers to offer this benefit very seamlessly, but also streamlining the process for parents to take advantage of this benefit.”

One reason eligible employees forgo their dependent care FSA benefits is the claims process, which can take weeks to process and involves collecting receipts and uploading them onto a website (snail mail and fax are other options). As parents, Kinside’s founders have experienced firsthand the headache of dealing with dependent care FSA forms at previous jobs.

“Some of the products we’ve seen already look a decade old, with multiple screens of input. They are really clumsy, so from a modern Web app and UX experience, Kinside brings it up to speed,” says Han.

Kinside also takes advantage of the trio’s past experience in the payments and benefits space. Before launching Kinside, Sigala co-founded HoneyBook, a CRM for entrepreneurs in creative fields. Han also worked at HoneyBook as lead software engineer, while Bircher was senior vice president of sales and marketing at healthcare benefits tech company Picwell.

The team’s goal is to not only encourage use of dependent care FSAs, but also relieve the mental load for harried parents. To sign up for Kinside, they enter their childcare provider’s information on its Web app and connect a bank account. Kinside then makes automated childcare payments with funds from their FSAs and bank accounts or sends payment reminders. It keeps receipts and at the end of the year provides parents with a tax form.

“This couldn’t be done five years ago because there wasn’t a modern payroll. There weren’t modern payments services that existed and we didn’t have APIs for payment and payroll services,” says Sigala. “A lot of employers offer dependent care FSAs already, but they are very receptive to our service because they are looking for products that will improve the experience.”

Kinside is targeting other tech companies first, since many are at the forefront of building family-friendly policies. Several, including Netflix, Facebook and Etsy, have made headlines for offering parental benefits that are considered very generous by American standards, like longer paid leave, flex time and childcare subsidies. This doesn’t just help parents. It also helps companies build diverse workforces by attracting more millennials and women (the high cost of childcare is a big reason why many new mothers leave the workforce, even if they don’t want to. They simply can’t afford to work).

“They know that you have to offer more than a trivial benefit like free lunch or a foosball table,” says Sigala. “Childcare is more expensive than healthcare, or as expensive as rent. Childcare is eating up to 20% of a Bay Area family’s income.”

One of Kinside’s selling points is enabling small to mid-sized businesses to offer competitive benefits, too. “You see solutions that cater to larger employers, like on-site daycare centers, that are very inaccessible to smaller to mid-sized companies,” says Bircher. “We want to fill a void that we thought existed for SMBs and this was one way to do it.”

As more companies turn to better family benefits to boost recruitment and retention, it’s conceivable that other startups will also look at ways to make using Dependent Care FSAs easier. Sigala says one advantage Kinside has is the founding team’s prior experience, which means they know the right distribution channels. The startup is looking at ways to help parents get more use out of the money they put in their FSAs by partnering with eligible childcare-related services. It also wants to work with companies that pre-screen providers, so Kinside can potentially address all steps of the childcare process, from finding a trustworthy carer and paying them on time to preparing year-end tax forms.

“Parents are going to pay an arm and a leg for childcare already,” says Sigala. “If we can help them get tax-free dollars toward childcare, that’s what we want to do.”

Powered by WPeMatico

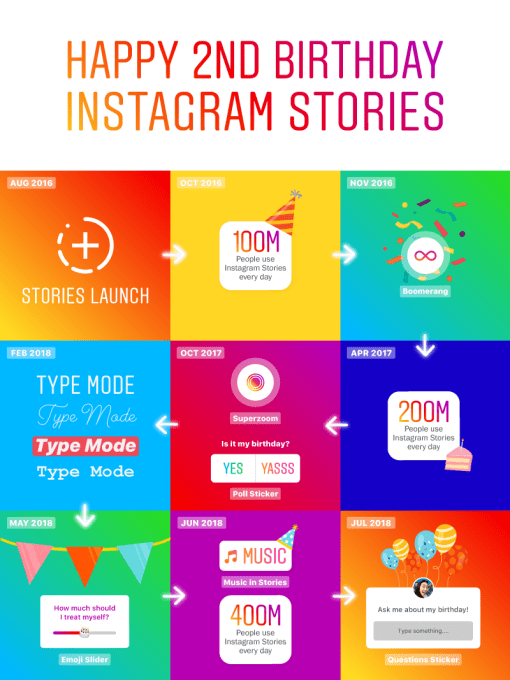

“I think the mistake everyone made was to think that Stories was a photography product,” says Instagram CEO Kevin Systrom. “If you look at all these interactivity features we’ve added, we’ve really made Stories something else. We’ve really innovated and made it our own.”

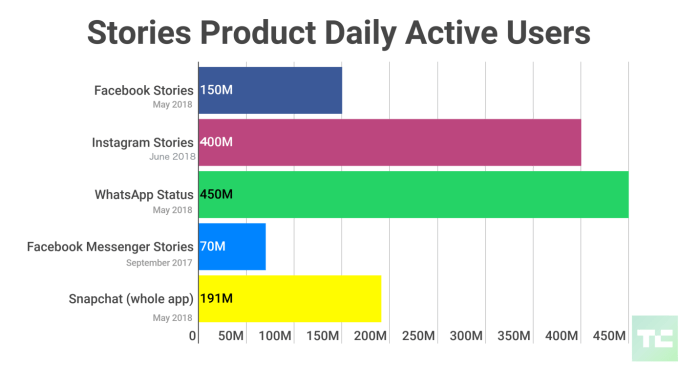

His version of the ephemeral slideshow format turns two years old today. By all accounts, it’s a wild success. Instagram Stories has 400 million daily users, compared to 191 million on Snapchat, which pioneered Stories. While the first year was about getting to parity with augmented reality filters and stickers, the two have since diverged. Instagram chose the viral path.

Snapchat has become more and more like Photoshop, with its magic eraser for removing objects, its green screen-style background changer, scissors for cut-and-pasting things and its fill-in paint bucket. These tools are remarkably powerful for living in a teen-centric consumer app. But many of these artistic concepts are too complicated for day-to-day Snapping. People don’t even think of using them when they could. And while what they produce is beautiful, the slides get tapped past and disappear just like any other photo or video.

Instagram could have become Photoshop. Its early photo-only feed’s editing filters and brightness sliders pointed in that direction. Instead, it chose to focus not on the “visual” but the “communication.” Instagram increasingly treats Stories as a two-way connection between creators and fans, or between friends. It’s not just one-to-many. It’s many-to-one, as well.

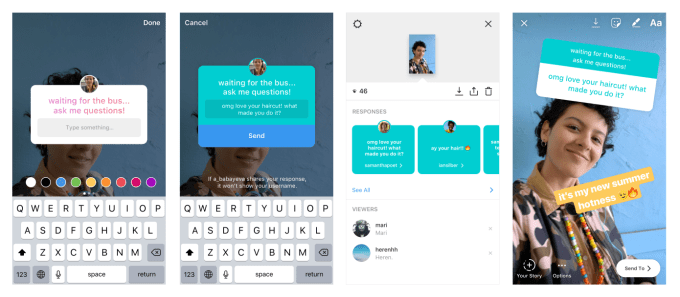

Instagram Stories arrived three years after Snapchat Stories, yet it was the first to let you tag friends so they’d get a notification. Now those friends can repost Stories you tag them in, or public posts on which they want to comment. You could finally dunk on other Instagrammers like you do with quote-tweets. It built polls with sliders friends can move to give you feedback about “how ridiculous is my outfit today?” Music stickers let you give a corny joke a corny soundtrack or share the epic song you heard in your head while looking out upon a beautiful landscape. And most recently, it launched the Question sticker so you can query friends through your Story and then share their answers there too. Suddenly, anyone could star in their own “Ask Me Anything.”

None of these Instagram tools require much “skill.” They’re designed not for designers, but for normal people trying to convey how they feel about the world around them. Since we’re social creatures, that perception is largely colored by someone’s friends or audience. Instagram lets you make them part of the Story. And the result is a product that grabs non-users or casual users and pulls them deeper into the Instagram universe, exposing people to the joy of creating something that lasts until tomorrow, not always forever.

Snap has been trying to get more interactive too, adding tagging for instance. It’s also got new multiplayer filter games called Snappables where you play with your face and can then post the footage to your Story. But again, they feel overly involved and therefore less accessible than where Instagram is going.

Mimicking Photoshop reinforces the idea that everything has to look polished. That’s the opposite of what Systrom was going for with the launch of Instagram Stories. “There will always be an element in any public broadcast system of trying to show off,” Systrom explains. “But what I see is it moving in the other direction. GIF stickers allow you to be way more informal than you used to be. Type mode means now people are just typing in thoughts rather than actually taking photos. Things like Superzoom with the TV effect or the beats — it’s anything but polished. If anything it’s a joke. Quantitatively people feel comfortable to post way more to Stories than to feed.”

Systrom is about to go on paternity leave, and has been using Stories from friends with kids to collect ideas about what to do with his own. When asked if he thinks Stories produces less of the dangerous envy inherent in the feeds of social media success theater we passively consume, Systrom tells me, “Just personally, it’s inspired me rather than it’s created any sense that I’m missing out.” Of course, that might be related to the fact that his life of attending the Met Gala and bicycling through Europe doesn’t leave much to envy.

AR filters have become table stakes for Stories. On the left, Instagram. On the right, Snapchat.

The sense of comfort powered by Instagram purposefully pushing Stories to diverge from its classy feed has contributed to its explosion in popularity — not just for Stories but Instagram as a whole. It now has more than 1 billion users, in part driven by it introducing Stories to developing countries Snapchat never penetrated.

“Remember how at the launch of Stories, I said it was a format and we want to make it original? And there was a bunch of criticism around us adopting this format?” Systrom chides, knowing a fair amount of that criticism came from me. “My response was this is a format and we’re going to innovate and make it our own. The whole idea there is to make it not just about photography but about expression. It’s a canvas for you to express yourself.”

At the time, Systrom also told me, regarding copying Snapchat, “They deserve all the credit.” But Stories has since emerged as how Instagram expressed itself too, allowing it to break away from the staid perfection of the feed, becoming something much more goofy.

That success has emboldened it to try something truly new. IGTV lets people share longer-form vertical videos up to an hour in length in an age when vertical is for 15-second Stories and lengthy clips only exist in landscape mode.

“What I’m most proud of is that Instagram took a stand and tried a brand new thing that is frankly hard to pull off. Full-screen vertical video that’s mobile only. That doesn’t exist anywhere else,” Systrom beams. “So the question is can we pull that off, and the early signs are really good.” We’ll see if that’s born out in the numbers. Stories benefited from early adopters immediately knowing what to post thanks to Snapchat. The price IGTV pays for originality is a steep learning curve.

Last week when Facebook announced its revenue was decelerating as users shifted attention from its lucrative News Feed to Stories where it’s still educating advertisers, its share price tanked, deleting $120 billion in market cap. Yet imagine how much further it would have dropped if Systrom hadn’t been willing to put his pride aside, take Snapchat Stories, and give it the Insta spin? Instead, it led the way to Facebook now having more than 1.1 billion (duplicated) daily Stories users across its apps. That poises Facebook and Instagram to earn a ton off of Stories.

“There was a long time that desktop advertising worked really, really well, but we knew the future was mobile and we’d have to go there. There was some short-term pain. Everyone was worried that we wouldn’t monetize as well,” Systrom remembers. “We believe the future is the combination of feed and Stories, and it just takes time for Stories to get to the same level or even exceed feed.”

So does he feel vindicated in that once-derided decision to think of Stories not as Evan Spiegel’s property but a medium meant for everyone? “I don’t wake up everyday trying to feel vindicated. I wake up everyday trying to make sure our billion users have amazing stuff to use. I just feel lucky that they love what we produce,” Systrom says with a laugh. “I don’t know if that fits your definition of vindicated.”

Powered by WPeMatico

Shedul, an online booking platform for salons and spas, has raised $5 million in funding. The round is led by Berlin’s Target Global, with participation from New York based FJ Labs. A number of individuals also invested personally, including Niklas Östberg (founder and CEO of Delivery Hero), and Hakan Koç (co-founder and co-CEO of Auto1 Group).

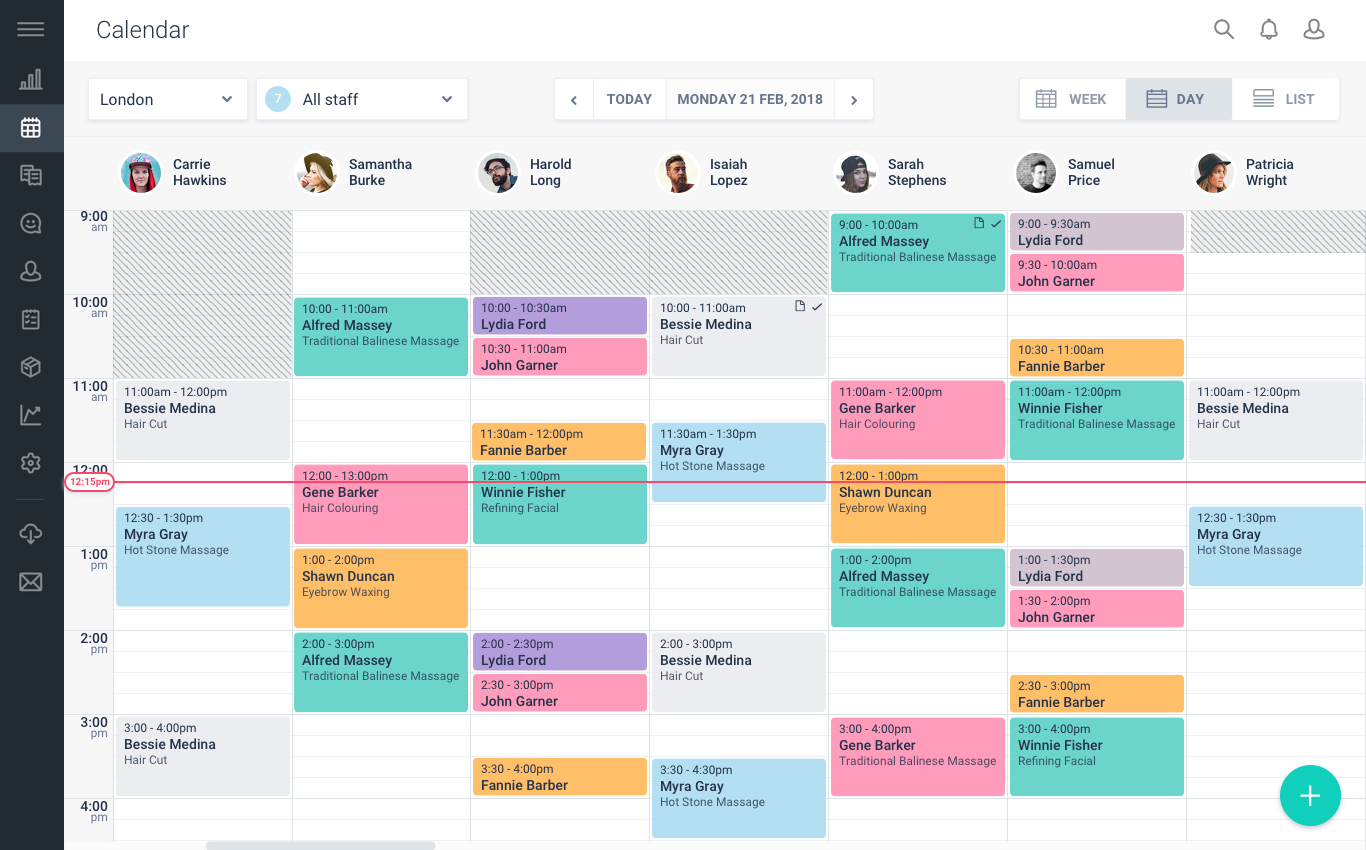

Launched in 2015, Shedul’s first product is a free SaaS designed to help salons and spas manage their day-to-day sales and operations. The platform’s features span managing appointment bookings, point-of-sale, customer records, inventory, and financial reporting. A second, more recent offering is the Fresha.com marketplace, and it here where the London-headquartered company generates revenue by charging merchants a small percentage fee on top of bookings.

“We’ve built the world’s best platform for beauty and wellness industry and given it to all businesses globally 100 percent subscription free,” says founder and CEO William Zeqiri. “Good free software has spread virally with users in the industry enabling us to acquire new merchants very fast”.

This has seen Shedul acquire salon and spa operator customers in more than 120 countries, primarily in the U.S., U.K., Australia, and Canada. Around 6 million appointments are booked each month, growing at an average rate of 20 percent month-on-month, while the platform is on track to process $3.5 billion worth of appointment bookings by the end of 2018.

“Leveraging our existing pool of global merchants allowed us to bootstrap the consumer marketplace with a lot of liquidity,” explains Zeqiri. “This created additional value proposition for both merchants and marketplace customers. With our Free SaaS-enabled marketplace business model we are leveraging the critical mass of merchants and marketplace users to scale the platform exponentially”.

Currently in the initial rollout phase, Zeqiri says Fresha.com provides mobile apps for customers and real-time booking integrations through Instagram, Facebook and Google, along with in-app payment processing. It also incorporates intelligent features to help merchants grow revenues. This includes displaying price and availability options based on a customer’s purchase history and the merchant’s projected occupancy.

“With our two-sided Marketplace platform, we’re automating many processes of running a business in the beauty industry with powerful online booking features, marketing tools and access to our consumer marketplace to attract new clients. This frees up merchants to do what they do best and spend more face time with customers,” adds the Shedul CEO.

“We have salons where 80 percent of their bookings are now made though our online marketplace Fresha.com. Our technology helps businesses optimize their schedule with real-time online availability; in some cases it has increased merchant revenues more than 30 percent”.

Shedul counts its main competitors in the U.S. as MindBody, Vagaro, and StyleSeat. In Europe, the startup competes most directly with marketplace TreatWell.

Meanwhile, Shedul says the new capital will be used for product development and to support the continued rollout of the new marketplace offering. It brings the total amount raised by the company to over $11 million to date and should see it through to an upcoming Series B round.

Powered by WPeMatico

Today WhatsApp launches its first revenue-generating enterprise product and the only way it currently makes money directly from its app. The WhatsApp Business API is launching to let businesses respond to messages from users for free for up to 24 hours, but will charge them a fixed rate by country per message sent after that.

Businesses will still only be able to message people who contacted them first, but the API will help them programatically send shipping confirmations, appointment reminders or event tickets. Clients also can use it to manually respond to customer service inquiries through their own tool or apps like Zendesk, MessageBird or Twilio. And small businesses that are one of the 3 million users of the WhatsApp For Business app can still use it to send late replies one-by-one for free.

After getting acquired by Facebook for $19 billion in 2014, it’s finally time for the 1.5 billion-user WhatsApp to pull its weight and contribute some revenue. If Facebook can pitch the WhatsApp Business API as a cheaper alternative to customer service call centers, the convenience of asynchronous chat could compel users to message companies instead of phoning.

Only charging for slow replies after 24 hours since a user’s last message is a genius way to create a growth feedback loop. If users get quick answers via WhatsApp, they’ll prefer it to other channels. Once businesses and their customers get addicted to it, WhatsApp could eventually charge for all replies or any that exceed a volume threshold, or cut down the free window. Meanwhile, businesses might be too optimistic about their response times and end up paying more often than they expect, especially when messages come in on weekends or holidays.

WhatsApp first announced it would eventually charge for enterprise service last September when it launched its free WhatsApp For Business app that now has 3 million users and remains free for all replies, even late ones.

Importantly, WhatsApp stresses that all messaging between users and businesses, even through the API, will be end-to-end encrypted. That contrasts with The Washington Post’s report that Facebook pushing to weaken encryption for WhatsApp For Business messages is partly what drove former CEO Jan Koum to quit WhatsApp and Facebook’s board in April. His co-founder, Brian Acton, had ditched Facebook back in September and donated $50 million to the foundation of encrypted messaging app Signal.

Today WhatsApp is also formally launching its new display ads product worldwide. But don’t worry, they won’t be crammed into your chat inbox like with Facebook Messenger. Instead, businesses will be able to buy ads on Facebook’s News Feed that launch WhatsApp conversations with them… thereby allowing them to use the new Business API to reply. TechCrunch scooped that this was coming last September, when code in Facebook’s ad manager revealed the click-to-WhatsApp ads option and the company confirmed the ads were in testing. Facebook launched similar click-to-Messenger ads back in 2015.

Finally, WhatsApp also tells TechCrunch it’s planning to run ads in its 450 million daily user Snapchat Stories clone called Status. “WhatsApp does not currently run ads in Status though this represents a future goal for us, starting in 2019. We will move slowly and carefully and provide more details before we place any Ads in Status,” a spokesperson told us. Given WhatsApp Status is more than twice the size of Snapchat, it could earn a ton on ads between Stories, especially if it’s willing to make some unskippable.

Together, the ads and API will replace the $1 per year subscription fee WhatsApp used to charge in some countries but dropped in 2016. With Facebook’s own revenue decelerating, triggering a 20 percent, $120 billion market cap drop in its share price, it needs to show it has new ways to make money — now more than ever.

Powered by WPeMatico

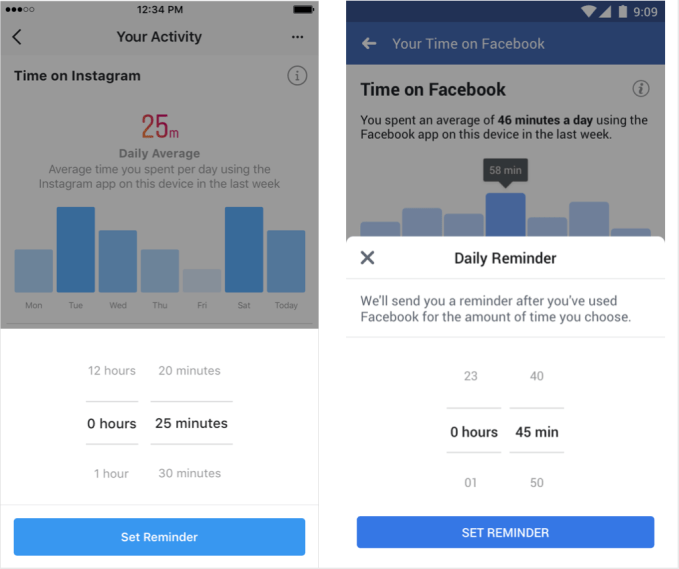

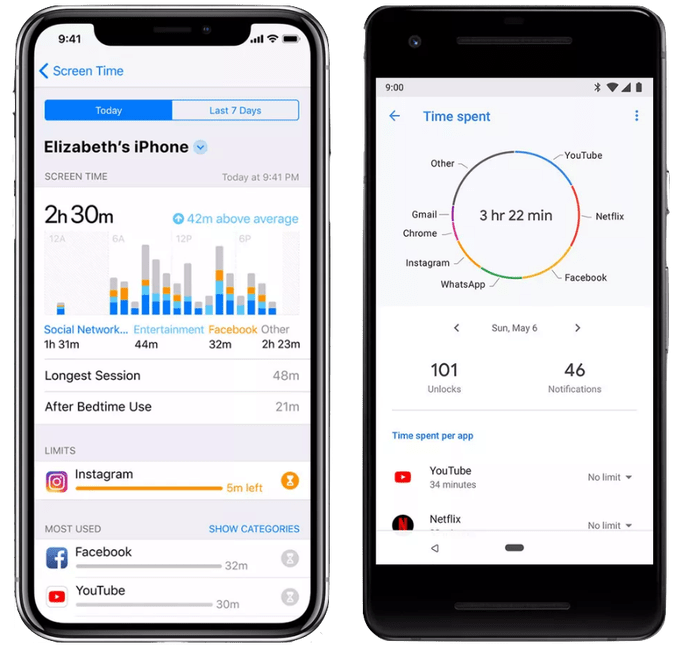

It’s passive zombie-feed scrolling, not active communication with friends, that hurts our health, according to studies Facebook has been pointing to for the last seven months. Yet it’s treating all our social networking the same with today’s launch of its digital well-being screen-time management dashboards for Facebook and Instagram in the U.S. before rolling them out to everyone in the coming weeks.

Giving users a raw count of the minutes they’ve spent in their apps each day in the last week plus their average across the week is a good start to making users more mindful. But by burying them largely out of sight, giving them no real way to compel less usage and not distinguishing between passive and active behavior, they seem destined to be ignored while missing the point the company itself stresses.

TechCrunch scooped the designs of the two separate but identical Instagram and Facebook tools over the past few months thanks to screenshots from the apps’ code generated by Jane Manchun Wong. What’s launching today is what we saw, with the dashboards located in Facebook’s “Settings” -> “Your Time On Facebook” and Instagram’s “Settings” -> “Your Activity.”

Unfortunately, you’ll only see info about your usage on the mobile app on that device. It won’t include your minutes spent on desktop, where these features don’t appear, what you do on your tablet or info about your usage across the Facebook family of apps. There are no benchmarks about how long other people your age or in your country spend in the apps. All of these would make nice improvements to the dashboards.

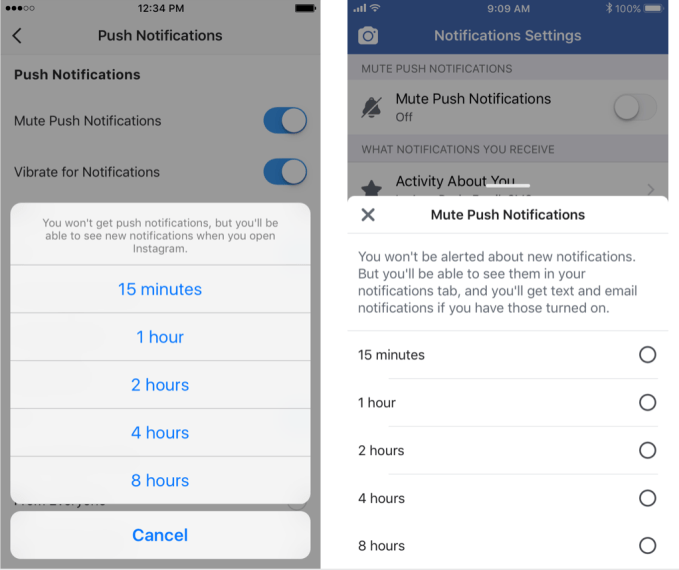

Beyond the daily and average minute counts, you can set a daily “limit” in minutes, after which either app will send you a reminder that you’ve crossed your self-imposed threshold. But they won’t stop you from browsing and liking, or force you to dig into the Settings menu to extend your limit. You’ll need the willpower to cut yourself off. The tools also let you mute push notifications (you’ll still see in-app alerts), but only for as much as 8 hours. If you want anything more permanent, you’ll have to dig into their separate push notification options menu or your phone’s settings.

The announcement follows Instagram CEO Kevin Systrom’s comments about our original scoop, where he tweeted “It’s true . . . We’re building tools that will help the IG community know more about the time they spend on Instagram – any time should be positive and intentional . . . Understanding how time online impacts people is important, and it’s the responsibility of all companies to be honest about this. We want to be part of the solution. I take that responsibility seriously.”

Users got their first taste of Instagram trying to curtail overuse with its “You’re All Caught Up” notices that show when you’ve seen all your feed posts from the past two days. Both apps will now provide callouts to users teaching them about the new activity-monitoring tools. Facebook says it has no plans to use whether you open the tools or set daily limits to target ads. It will track how people use the tools to tweak the designs, but it sounds like that’s more about what time increments to show in the Daily Reminder and Mute Notifications options than drastic strengthening of their muscle. Facebook will quietly keep a tiny fraction of users from getting the features to measure if the launch impacts behavior.

“It’s really important for people who use Instagram and Facebook that the time they spend with us is time well spent,” Ameet Ranadive, Instagram’s Product Director of Well-Being, told reporters on a conference call. “There may be some trade-off with other metrics for the company and that’s a trade-off we’re willing to live with, because in the longer term we think this is important to the community and we’re willing to invest in it.”

Facebook has already felt some of the brunt of that trade-off. It’s been trying to improve digital well-being by showing fewer low-quality viral videos and clickbait news stories, and more from your friends since a big algorithm change in January. That’s contributed to a flatlining of its growth in North America, and even a temporary drop of 700,000 users early this year, while it also lost 1 million users in Europe this past quarter. That led to Facebook’s slowest user growth rates in history, triggering a 20 percent, $120 billion market cap drop in its share price. “The changes to the News Feed back in January were one step . . . giving people a sense of their time so they’re more mindful of it is the second step,” says Ranadive.

The fact that Facebook is willing to put its finances on the line for digital well-being is a great step. It’s a smart long-term business decision, too. If we feel good about our overall usage, we won’t ditch the apps entirely and could keep seeing their ads for another decade. But it’s likely to be changes to the Facebook and Instagram feeds that prioritize content you’ll comment on rather than look at and silently scroll past that will contribute more to healthy social networking than today’s toothless tools.

While iOS 12’s Screen Time and Android’s new Digital Wellbeing features both count your minutes on different apps too, they offer more drastic ways to enforce your own good intentions. iOS will deliver a weekly usage report to remind you the features exist. Android’s is best-in-class because it grays out an app’s icon and requires you to open your settings to unlock an app after you exceed your daily limit.

iOS Screen Time (left) and Android Digital Wellbeing (right)

To live up to the responsibility Systrom promised, Facebook and Instagram will have to do more to actually keep us mindful of the time we spend in their apps and help us help ourselves. Let us actually lock ourselves out of the apps, turn them grayscale, fade their app icons or persistently show our minute count onscreen once we pass our limit. Anything to make being healthy on their apps something you can’t just ignore like any other push notification.

Or follow the research and have the dashboards actually divide our sharing, commenting and messaging time from our feed scrolling, Stories tapping, video watching and photo stalking. The whole point is that social networking isn’t all bad, but there are behaviors that hurt. Most of us aren’t going to give up Facebook and Instagram. Even just trying to spend less time on them is difficult. But by guiding us toward the activities that interconnect us rather than isolate us, Facebook could get us to shift our time in the right direction.

Powered by WPeMatico