TC

Auto Added by WPeMatico

Auto Added by WPeMatico

Drug discovery is a large and growing field, encompassing both ambitious startups and billion-dollar Big Pharma incumbents. Engine Biosciences is one of the former, a Singaporean outfit with an expert founding crew and a different approach to the business of finding new therapeutics, and it just raised $43 million to keep growing.

Digital drug discovery in general means large-scale analysis of biological data like genes, gene expression, protein structures, binding sites, things like that. Where it has hit a wall in the past is not on the digital side, where any number of likely molecules or processes can be generated, but on the next step, when those notions need to be tested in vitro. So a new crop of biotech companies have worked to integrate these aspects.

Engine does so with a pair of tools it has dubbed NetMAPPR and CombiGEM. NetMAPPR is a huge sort of search engine for genes and gene interactions, taking special note of “errors” that could provide a foothold for a molecule or treatment. CombiGEM is like a mass genetic testing process that can look into thousands of gene combinations and edits on diseased cells simultaneously, providing quick experimental confirmation of the targets and effects proposed by the digital side. The company is focused on anti-cancer drugs but is looking into other fields as they become viable.

The focus on gene interactions sets their approach apart, said co-founder and CEO Jeffrey Lu.

“Gene interactions are relevant to all diseases, and in cancers, where we focus, a proven approach for effective precision medicines,” he explained. “For example, there are four approved drugs targeting the PARP enzyme in the context of mutation in the BRCA gene that is changing cancer treatment for millions of people. The fundamental principle of this precision medicine is based on understanding the gene interaction between BRCA and PARP.”

The company raised a $10 million seed in 2018 and has been doing its thing ever since — but it needs more money if it’s going to bring some of these things to market.

“We already have chemical compounds directed toward the novel biology we have uncovered,” said Lu. “These are effectively prototype drugs, which are showing anti-cancer effects in diseased cells. We need to refine and optimize these prototypes to a suitable candidate to enter the clinic for testing in humans.”

Right now they’re working with other companies to do the next step up from automated testing, which is to say animal testing, to clear the way for human trials.

The CombiGEM experiments — hundreds of thousands of them — produce a large amount of data as well, and they’re sharing and collaborating on that front with several medical centers throughout Asia. “We have built what we believe to be the largest data compendium related to gene interactions in the context of cancer disease relevance,” said Lu, adding that this is crucial to the success of the machine learning algorithms they employ to predict biological processes.

The $43 million round was led by Polaris Partners, with participation by newcomers Invus and a long list of existing investors. The money will go toward the requisite testing and paperwork involved in bringing a new drug to market based on promising leads.

“We have small molecule compounds for our lead cancer programs with data from in vitro (in cancer cells) experiments. We are refining the chemistry and expanding studies this year,” said Lu. “Next year, we anticipate having our first drug candidate enter the late preclinical phase of development and regulatory work for an IND (investigational new drug) filing with the FDA, and starting the clinical trials in 2023.”

It’s a long road to human trials, let alone widespread use, but that’s the risk any drug discovery startup takes. The carrot dangling in front of them is not just the possibility of a product that could generate billions in income, but perhaps save the lives of countless cancer patients awaiting novel therapies.

Powered by WPeMatico

Tesla has installed its 200,000th Powerwall, the company’s home battery storage product, the company said in a tweet on Wednesday. Tesla’s CFO Zachary Kirkhorn told investors during a first-quarter earnings call in April that Tesla is continuing to work through a “multi-quarter backlog on Powerwall,” suggesting that the volume of installations will continue to soar in coming months.

During that earnings call, Tesla CEO Elon Musk said the company will no longer sell its Solar Roof panel product without a Powerwall. He said widespread installation of solar panels plus home battery packs (Tesla built, of course) would turn every home into a distributed power plant.

“…Every solar Powerwall installation that the house or apartment or whatever the case may be, will be its own utility,” he said. “And so even if all the lights go out in the neighborhood, you will still have power. So that gives people energy security. And we can also, in working with the utilities, use the Powerwalls to stabilize the overall grid.”

He noted the unprecedented winter storm in Texas in February, which, combined with record-breaking demand for electricity, left millions without power in freezing temperatures. He suggested that under that scenario, utilities could work with customers who have Powerwalls to release stored electricity back on the grid to meet that demand.

“So if the grid needs more power, we can actually then with the consent, obviously, of the homeowner and the partnership with the utility, we can then actually release power on to the grid to take care of peak power demand,” he said.

Tesla hit the 100,000 milestone for Powerwall installations in April 2020, five years after it debuted the first-generation Powerwall. That means that sales numbers that took the company five years to achieve were doubled in a single year.

Powered by WPeMatico

In just a few short years, Vise has gone from launching on the Disrupt Battlefield stage to unicorn. Co-founders Samir Vasavada and Runik Mehrotra met Sequoia’s Shaun Maguire at an afterparty at the event, and Maguire ended up leading a seed and Series A round while Sequoia led the Series B. Last week, Vise raised its Series C of $65 million and was officially valued at $1 billion post-money.

A good pitch deck is short and simple, and covers the key points in less than 12 words a slide.

We sat down with Vasavada and Maguire to talk about the early fundraising process for Vise, specifically the seed round, and get a look at the startup’s first pitch deck. We discussed what Vasavada has learned about delivering a good fundraising pitch, and what stood out about the pitch and the product for Maguire.

Vasavada says he’s made dozens of pitch decks since starting Vise and that this early deck was not his best because it was trying to do too much.

“A good pitch deck is short and simple, and covers the key points in less than 12 words a slide,” said Vasavada, adding that many founders think they need to show investors every part of their business.

“The deck has to show that you’re solving an important problem, that you’ve got the path to an important solution, that there is a big market opportunity, and that your team is positioned to execute,” he said. “Those are the only four things that matter. Everything else can be discussed in the Q&A.”

The goal of a pitch meeting is not to get the “yes” instantly, and satisfy every curiosity, but rather to give the investor something to think about and a reason to want another conversation.

Vasavada explained to the audience that this early seed deck certainly went into too much detail and was too text-heavy. (You can check out the full deck below.)

Beyond the problem, solution, market and team, there is an additional X factor that makes a difference in pitching for fundraising.

Timing can make or break a startup. Incredible ideas, ones that have gone on to be some of the biggest businesses in the world, have fizzled out and died for being too early.

Powered by WPeMatico

If Instagram’s photo tagging feature was spun out into its own app, you’d have the viral sensation Poparazzi, now the No. 1 app on the App Store. The new social networking app, from the same folks behind TTYL and others, lets you create a social profile that only your friends can post photos to — in other words, making your friends your own “paparazzi.” To its credit, the new app has perfectly executed on a series of choices designed to fuel day-one growth — from its prelaunch TikTok hype cycle to drive App Store preorders to its postlaunch social buzz, including favorable tweets by its backers. But the app has also traded user privacy in some cases to amplify network effects in its bid for the Top Charts, which is a risky move in terms of its long-term staying power.

The company positions Poparazzi as a sort of anti-Instagram, rebelling against today’s social feeds filled with edited photos, too many selfies and “seemingly effortless perfection.” People’s real lives are made up of many unperfect moments that are worthy of being captured and shared, too, a company blog post explains.

This manifesto hits the right notes at the right time. User demand for less performative social media has been steadily growing for years — particularly as younger, Gen Z users wake up to the manipulations by tech giants. We’ve already seen a number of startups try to siphon users away from Instagram using similar rallying cries, including Minutiae, Vero, Dayflash, Oggl and, more recently, the once-buzzy Dispo and the under-the-radar Herd.

Even Facebook has woken up to consumer demand on this front, with its plan to roll out new features that allow Facebook and Instagram users to remove the Like counts from their posts and their feeds.

Poparazzi hasn’t necessarily innovated in terms of its core idea — after all, tagging users in photos has existed for years. In fact, it was one of the first viral effects introduced by Facebook in its earlier days.

Instead, Poparazzi hit the top of the charts by carefully executing on growth strategies that ensured a rocket ship-style launch.

@poparazziappcomment it! ##greenscreen ##poparazziapp ##positivity ##foryoupage♬ Milkshake – BBY Kodie

The company began gathering prelaunch buzz by driving demand via TikTok — a platform that’s already helped mint App Store hits like the mobile game High Heels. TikTok’s powers are still often underestimated, even though its potential to send apps up the Top Charts have successfully boosted downloads for a number of mobile businesses, including TikTok sister app CapCut and e-commerce app Shein, for example.

And Poparazzi didn’t just build demand on TikTok — it actually captured it by pointing users to its App Store preorders page via the link in its bio. By the time launch day rolled around, it had a gaggle of Gen Z users ready and willing to give Poparazzi a try.

The app launches with a clever onboarding screen that uses haptics to buzz and vibrate your phone while the intro video plays. This is unusual enough that users will talk and post about how cool it was — another potential means of generating organic growth through word-of-mouth.

After getting you riled up with excitement, Poparazzi eases you into its bigger data grab.

First, it signs up and authenticates users through a phone number. Despite Apple’s App Store policy, which requires it, there is no privacy-focused option to use “Sign In with Apple,” which allows users to protect their identity. That would have limited Poparazzi’s growth potential versus its phone number and address book access approach.

It then presents you with a screen where it asks for permission to access your Camera (an obvious necessity) and Contacts (wait, all of them?), and permission to send you Notifications. This is where things start to get more dicey. The app, like Clubhouse once did, demands a full address book upload. This is unnecessary in terms of an app’s usability, as there are plenty of other ways to add friends on social media — like by scanning each other’s QR code, typing in a username directly or performing a search.

But gaining access to someone’s full Contacts database lets Poparazzi skip having to build out features for the privacy-minded. It can simply match your stored phone numbers with those it has on file from user signups and create an instant friend graph.

As you complete each permission, Poparazzi rewards you with green checkmarks. In fact, even if you deny the permission being asked, the green check appears. This may confuse users as to whether they’ve accidently given the app access.

While you can “deny” the Address Book upload — a request met with a tsk tsk of a pop-up message — Poparazzi literally only works with friends, it warns you — you can’t avoid being found by other Poparazzi users who have your phone number stored in their phone.

When users sign up, the app matches their address book to the phone number it has on file and then — boom! — new users are instantly following the existing users. And if any other friends have signed up before you, they’ll be following you as soon as you log in the first time.

In other words, there’s no manual curation of a “friend graph” here. The expectation is that your address book is your friend graph, and Poparazzi is just duplicating it.

Of course, this isn’t always an accurate presentation of reality.

Many younger people, and particularly women, have the phone numbers of abusers, stalkers and exes stored in their phone’s Contacts. By doing so, they can leverage the phone’s built-in tools to block the unwanted calls and texts from that person. But because Poparazzi automatically matches people by phone number, abusers could gain immediate access to the user profiles of the people they’re trying to harass or hurt.

Sure, this is an edge case. But it’s a nontrivial one.

It’s a well-documented problem, too — and one that had plagued Clubhouse, which similarly required full address book uploads during its early growth phase. It’s a terrible strategy to become the norm, and one that does not appear to have created a lasting near-term lock-in for Clubhouse. It’s also not a new tactic. Mobile social network Path tried address book uploads nearly a decade ago and almost everyone at the time agreed this was not a good idea.

As carefully designed as Poparazzi is — (it’s even got a blue icon — a color that denotes trustworthiness!) — it’s likely the company intentionally chose the trade-off. It’s forgoing some aspects of user privacy and safety in favor of the network effects that come from having an instant friend graph.

The rest of the app then pushes you to grow that friend graph further and engage with other users. Your profile will remain bare unless you can convince someone to upload photos of you. A SnapKit integration lets you beg for photo tags over on Snapchat. And if you can’t get enough of your friends to tag you in photos, then you may find yourself drawn to the setting “Allow Pops from Everyone,” instead of just “People You Approve.”

There’s no world in which letting “everyone” upload photos to a social media profile doesn’t invite abuse at some point, but Poparazzi is clearly hedging its bets here. It likely knows it won’t have to deal with the fallout of these choices until further down the road — after it’s filled out its network with millions of disgruntled Instagram users, that is.

Dozens of other growth hacks are spread throughout the app, too, from multiple pushes to invite friends scattered throughout the app to a very Snapchatt-y “Top Poparazzi” section that will incentivize best friends to keep up their posting streaks.

It’s a clever bag of tricks. And though the app does not offer comments or followers counts, it isn’t being much of an “anti-Instagram” when it comes to chasing clout. The posts — which can turn into looping GIFs if you snap a few in a row — may be more “authentic” and unedited than those on Instagram; but Poparazzi users react to posts with a range of emojis and how many reactions a post receives is shown publicly.

For beta testers featured on the explore page, reactions can be in the hundreds or thousands — effectively establishing a bar for Pop influence.

Finally, users you follow have permission to post photos, but if you unfollow them — a sure sign that you no longer want them to be in your poparazzi squad — they can still post to your profile. As it turns out, your squad is managed under a separate setting under “Allow Pops From.” That could lead to trouble. At the very least, it would be nice to see the app asking users if they also want to remove the unfollowed account’s permission to post to your profile at the time of the unfollow.

Overall, the app can be fun — especially if you’re in the young, carefree demographic it caters to. Its friend-centric and ironically anti-glam stance is promising as well. But additional privacy controls and the ability to join the service in a way that offers far more granular control of your friend graph in order to boost anti-abuse protections would be welcome additions.

TechCrunch tried to reach Poparazzi’s team to gain their perspective on the app’s design and growth strategy, but did not hear back. (We understand they’re heads down for the time being.) We understand, per SignalFire’s Josh Constine and our own confirmation, that Floodgate has invested in the startup, as has former TechCrunch co-editor Alexia Bonatsos’ Dream Machine and Weekend Fund.

Powered by WPeMatico

Databricks launched its fifth open-source project today, a new tool called Delta Sharing designed to be a vendor-neutral way to share data with any cloud infrastructure or SaaS product, so long as you have the appropriate connector. It’s part of the broader Databricks open-source Delta Lake project.

As CEO Ali Ghodsi points out, data is exploding, and moving data from Point A to Point B is an increasingly difficult problem to solve with proprietary tooling. “The number one barrier for organizations to succeed with data is sharing data, sharing it between different views, sharing it across organizations — that’s the number one issue we’ve seen in organizations,” Ghodsi explained.

Delta Sharing is an open-source protocol designed to solve that problem. “This is the industry’s first-ever open protocol, an open standard for sharing a data set securely. […] They can standardize on Databricks or something else. For instance, they might have standardized on using AWS Data Exchange, Power BI or Tableau — and they can then access that data securely.”

The tool is designed to work with multiple cloud infrastructure and SaaS services and out of the gate there are multiple partners involved, including the Big Three cloud infrastructure vendors Amazon, Microsoft and Google, as well as data visualization and management vendors like Qlik, Starburst, Collibra and Alation and data providers like Nasdaq, S&P and Foursquare

Ghodsi said the key to making this work is the open nature of the project. By doing that and donating it to The Linux Foundation, he is trying to ensure that it can work across different environments. Another big aspect of this is the partnerships and the companies involved. When you can get big-name companies involved in a project like this, it’s more likely to succeed because it works across this broad set of popular services. In fact, there are a number of connectors available today, but Databricks expects that number to increase over time as contributors build more connectors to other services.

Databricks operates on a consumption pricing model much like Snowflake, meaning the more data you move through its software, the more money it’s going to make, but the Delta Sharing tool means you can share with anyone, not just another Databricks customer. Ghodsi says that the open-source nature of Delta Sharing means his company can still win, while giving customers more flexibility to move data between services.

The infrastructure vendors also love this model because the cloud data lake tools move massive amounts of data through their services and they make money too, which probably explains why they are all on board with this.

One of the big fears of modern cloud customers is being tied to a single vendor as they often were in the 1990s and early 2000s when most companies bought a stack of services from a single vendor like Microsoft, IBM or Oracle. On one hand, you had the veritable single throat to choke, but you were beholden to the vendor because the cost of moving to another one was prohibitively high. Companies don’t want to be locked in like that again and open source tooling is one way to prevent that.

Databricks was founded in 2013 and has raised almost $2 billion. The latest round was in February for $1 billion at a $28 billion valuation, an astonishing number for a private company. Snowflake, a primary competitor, went public last September. As of today, it has a market cap of over $66 billion.

Powered by WPeMatico

Facebook this week will begin to publicly roll out the option to hide Likes on posts across both Facebook and Instagram, following earlier tests beginning in 2019. The project, which puts the decision about Likes in the hands of the company’s global user base, had been in development for years, but was deprioritized due to the COVID-19 pandemic and the response work required on Facebook’s part, the company says.

Originally, the idea to hide Like counts on Facebook’s social networks was focused on depressurizing the experience for users. Often, users faced anxiety and embarrassment around their posts if they didn’t receive enough Likes to be considered “popular.” This problem was particularly difficult for younger users who highly value what peers think of them — so much so that they would take down posts that didn’t receive enough Likes.

Like-chasing on Instagram, especially, also helped create an environment where people posted to gain clout and notoriety, which can be a less authentic experience. On Facebook, gaining Likes or other forms of engagement could also be associated with posting polarizing content that required a reaction.

As a result of this pressure to perform, some users grew hungry for a “Like-free” safer space, where they could engage with friends or the wider public without trying to earn these popularity points. That, in turn, gave rise to a new crop of social networking and photo-sharing apps such as Minutiae, Vero, Dayflash, Oggl and, now, newcomers like Dispo and newly viral Poparazzi.

Though Facebook and Instagram could have chosen to remove Likes entirely and take its social networks in a new direction, the company soon found that the metric was too deeply integrated into the product experience to be fully removed. One key issue was how the influencer community today trades on Likes as a form of currency that allows them to exchange their online popularity for brand deals and job opportunities. Removing Likes, then, is not necessarily an option for these users.

Instagram realized that if it made a decision for its users, it would anger one side or the other — even if the move in either direction didn’t really impact other core metrics, like app usage.

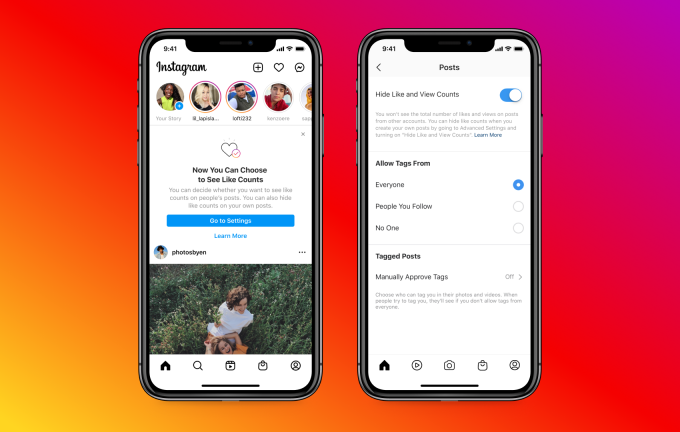

Image Credits: Instagram

“How many likes [users] got, or other people got — it turned out that it didn’t actually change nearly as much about the experience, in terms of how people felt or how much they use the experience, as we thought it would. But it did end up being pretty polarizing,” admitted Instagram head, Adam Mosseri. “Some people really liked it and some people really didn’t.”

“For those who liked it, it was mostly what we had hoped — which is that it depressurized the experience. And, for those who didn’t, they used Likes to get a sense for what was trending or was relevant on Instagram and on Facebook. And they were just super annoyed that we took it away,” he added. This latter group sometimes included smaller creators still working on establishing a presence across social media, though larger influencers were sometimes in favor of Like removals. (Mosseri name-checked Katy Perry as being pro Like removals, in fact.)

Ultimately, the company decided to split the difference. Instead of making a hard choice about the future of its online communities, it’s rolling out the “no Likes” option as a user-controlled setting on both platforms.

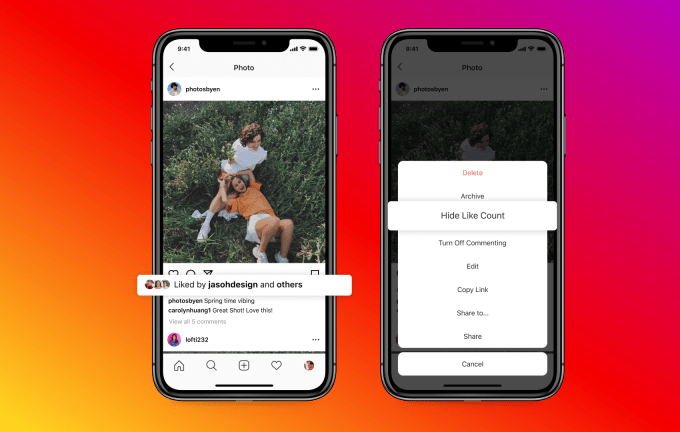

On Instagram, both content consumers and content producers can turn on or off Like and View counts on posts — which means you can choose to not see these metrics when scrolling your own Feed and you can choose whether to allow Likes to be viewed by others when you’re posting. These are configured as two different settings, which provides for more flexibility and control.

Image Credits: Instagram

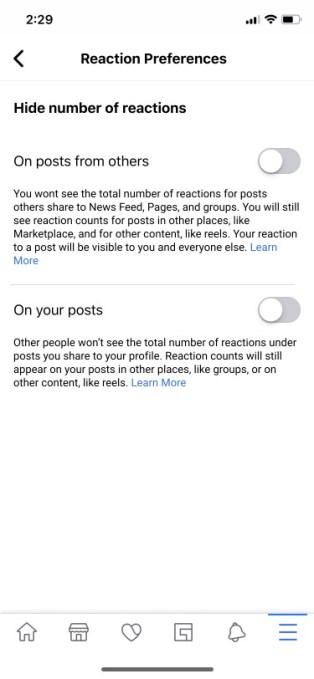

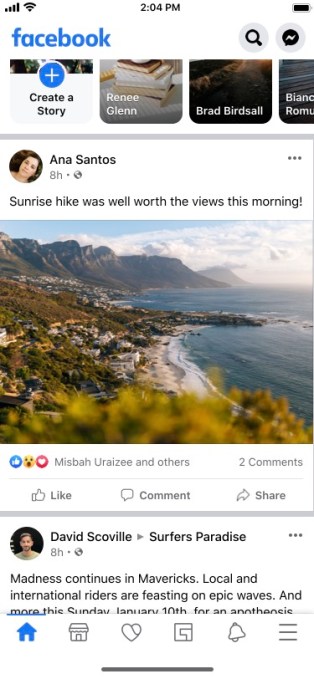

On Facebook, meanwhile, users access the new setting from the “Settings & Privacy” area under News Feed Settings (or News Feed Preferences on desktop). From here, you’ll find an option to “Hide number of reactions” to turn this setting off for both your own posts and for posts from others in News Feed, groups and Pages.

The feature will be made available to both public and private profiles, Facebook tells us, and will include posts you’ve published previously.

Image Credits: Facebook

Instagram last month restarted its tests on this feature in order to work out any final bugs before making the new settings live for global users, and said a Facebook test would come soon. But it’s now forging ahead with making the feature available publicly. When asked why such a short test, Instagram told TechCrunch it had been testing various iterations on this experience since 2019, so it felt it had enough data to proceed with a global launch.

Mosseri also pushed back at the idea that a decision on Likes would have majorly impacted the network. While removal of Likes on Instagram had some impact on user behavior, he said, it was not enough to be concerning. In some groups, users posted more — signaling that they felt less pressure to perform, perhaps. But others engaged less, Mosseri said.

Image Credits: Facebook

“Often people say, ‘oh, this has a bunch of Likes. I’m gonna go check it out,’ ” the exec explained. “Then they read the comments, or go deeper, or swipe to the carousel. There’s been some small effects — some positive, some negative — but they’ve all been small,” he noted. Instagram also believes users may toggle on and off the feature at various times, based on how they’re feeling.

In addition, Mosseri pointed out, “there’s no rigorous research that suggests Likes are bad for people’s well-being” — a statement that pushes back over the growing concerns that a gamified social media space is bad for users’ mental health. Instead, he argued that Instagram is still a small part of people’s day, so how Likes function doesn’t affect people’s overall well-being.

“As big as we are, we have to be careful not to overestimate our influence,” Mosseri said.

He also dismissed some of the current research pointing to negative impacts of social media use as being overly reliant on methodologies that ask users to self-report their use, rather than measure it directly.

In other words, this is not a company that feels motivated to remove Likes entirely due to the negative mental health outcomes attributed to its popularity metrics.

It’s worth mentioning that another factor that could have come into play here is Instagram’s plan to make a version of its app available to children under the age of 13, as competitor TikTok did following its FTC settlement. In that case, hiding Likes by default — or perhaps adding a parental control option — would necessitate such a setting. Instagram tells TechCrunch that, while it’s too soon to know what it would do with a kids app, it will “definitely explore” a no Likes by default option.

Facebook and Instagram both told TechCrunch the feature will roll out starting on Wednesday but will reach global users over time. On Instagram, that may take a matter of days.

Facebook, meanwhile, says a small percentage of users will have the feature Wednesday — notified through an alert on News Feed — but it will reach Facebook’s global audience “over the next few weeks.”

Powered by WPeMatico

Uptycs, a Boston-area startup that uses data to help understand and prevent security attacks, announced a $50 million Series C today, 11 months after announcing a $30 million Series B. Norwest Venture Partners led the round with participation from Sapphire Ventures and ServiceNow Ventures.

Company co-founder and CEO Ganesh Pai says that he was still well capitalized from last year’s investment, and wasn’t actually looking to raise funds, but the investors came looking for him and he saw a way to speed up some aspects of the company’s roadmap.

“It was one of those things where the round came in primarily as a function of execution and success to date, and we decided to capitalize on that because we know the partners and raised the capital so that we could use it meaningfully for a couple of different things, primarily sales and marketing acceleration,” Pai said.

He said that part of the reason for the company’s success over the last year was that the pandemic generated more customer interest as people moved to work from home, the SolarWinds hack happened and companies were moving to the cloud faster. “We provided a solution which was telemetric powered and very insightful when it came to solving their security problems and that’s what led to triple digit growth over the last year,” he said.

But Pai says that the company has not been sitting still in terms of the platform. While last year, he described it primarily as a forensic security data solution, helping customers figure out what happened after a security issue has happened, he says that the company has begun expanding on that vision to include all four main areas of security, including being proactive, reactive, predictive and protective.

The company started primarily in being reactive by figuring what happened in the past, but has begun to expand into these other areas over the last year, and the plan is to continue to build out that functionality.

“In the context of SolarWinds, what everyone is trying to figure out is how soon into the supply chain can you figure out what could be potentially wrong by looking at indications of behavior or indications of compromise, and our ability to ingest telemetry from a diverse set of sources, not as a bolt-on solution, but something which is built from the ground up, resonated really well,” Pai explained.

The company had 65 employees when we spoke last year for the Series B. Today, Pai says that number is approaching 140 and he is adding new people every week, with a goal to get to around 200 people by the end of the year. He says as the company grows, he keeps diversity top of mind.

“As we grow and as we raise capital diversity has been something which has been a high priority and very critical for us,” he said. In fact, he reports that more than 50% of his employees come from under-represented groups whether it’s Latinx, Black or Asian heritage.

Pai says that one of the reasons he has been able to build a diverse workforce is his commitment to a remote workplace, which means he can hire from anywhere, something he will continue to do even after the pandemic ends.

Powered by WPeMatico

APIs make the world go round in tech, but that also makes them a very key target for bad actors: As doorways into huge data troves and services, malicious hackers spent a lot of time looking for ways to pick their locks or just force them open when they’re closed, in order to access that information. And a lot of recent security breaches stemming from API vulnerabilities (see here, here and here for just a few) show just how real and current the problem is.

Today, a company that’s building a network of services to help those using and producing APIs to identify and eradicate those risks is announcing a round of funding to meet a growing demand for its services. Salt Security, which provides AI-based technology to identify issues and stop attacks across the whole of your API library, has closed $70 million in funding, money that it will be using both to meet current demand but also continue building out its technology for a wider set of services and use cases for API management.

The funding is being led by Advent International, by way of Advent Tech, with Alkeon Capital, DFJ Growth and previous backers Sequoia Capital, Tenaya Capital, S Capital VC and Y Combinator all also participating.

Salt, founded in Israel and now active globally, is not disclosing valuation, but I understand from a reliable source that it is in the region of $600-700 million.

As with many of the funding rounds that seem to be getting announced these days, this one is coming on the heels of both another recent round, as well as strong growth. Salt has raised $131 million since 2016, but nearly all of that — $120 million, to be exact — has been raised in the last year.

Part of the reason for that is Salt’s performance: In the last 12 months, it’s seen revenue grow 400% (with customers including a range of Fortune 500 and other large businesses in the financial services, retail and SaaS sectors like Equinix, Finastra, TripActions, Armis and DeinDeal); headcount grow 160%; and, perhaps most importantly, API traffic on its network grow 380%.

That growth in API traffic underscores the issue that Salt is tackling. Companies these days use a variety of APIs — some private, some public — in their tech stack as a way to interface with other businesses and run their services. APIs are a huge part of how the internet and digital services operate, with Akamai estimating that as much as 83% of all IP traffic is API traffic.

The problem, Roey Eliyahu, CEO and co-founder of Salt Security, told me, is that this usage has outpaced how well many manage those APIs.

“How APIs have evolved is very different to how developers used APIs years ago,” he said. “Before, there were very few, and you could say they were more manageable, and they contained less-sensitive data, and there were very few changes and updates made to them,” he said. “Today with the pace of development, not only are they always getting updated, but you have thousands of them now touching crown jewels of the company.”

This has made them a prime target for malicious hackers. Eliyahu notes Gartner stats that predict that by 2022, APIs will make up the largest attack vector in cybercrime.

Salt’s approach starts with taking stock of a whole network and doing a kind of spring clean to find all the APIs that might be used or abused.

“Companies don’t know how many APIs they even have,” Eliyahu said, noting that some 40%-80% of the APIs in existence for a typical company’s data are not even in active operation, lying there as “shadow APIs” for someone to pick up and misuse.

It then looks at what vulnerabilities might inadvertently be contained in this mix and makes suggestions for how to alter them to fix that. After this, it also monitors how they are used in order to stop attacks as they happen. The third of these also involves remediation “insights”, but carrying out the remediation is done by third parties at the moment, Eliyahu said. All of this is done through Salt’s automated, AI-based, flagship Salt Security API Protection Platform.

There are a number of competitors in the same space as Salt, including Ping, and newer players like Imvision and 42Crunch (which raised funding earlier this month), and the list is likely to grow as not just other API management companies get deeper into this huge space, but cybersecurity companies do, too.

“The rapid proliferation of APIs has dramatically altered the attack surface of applications, creating a major challenge for large enterprises since existing security mechanisms cannot protect against this new threat,” said Bryan Taylor, managing partner and head of Advent’s technology team, in a statement. “We continue to see API security incidents make the news headlines and cause significant reputational risk for companies. As we investigated the API security market, Salt stood out for its multi-year technical lead, significant customer traction and references, and talented team. We look forward to drawing on our deep experience in this sector to partner with Salt in this exciting new chapter.”

Powered by WPeMatico

Smart Eye, the publicly traded Swedish company that supplies driver monitoring systems for a dozen automakers, has acquired emotion-detection software startup Affectiva for $73.5 million in a cash-and-stock deal.

Affectiva, which spun out of the MIT Media Lab in 2009, has developed software that can detect and understand human emotion, which Smart Eye is keen to combine with its own AI-based eye-tracking technology. The companies’ founders see an opportunity to expand beyond driver monitoring systems — tech that is often used in conjunction with advanced driver assistance systems to track and measure awareness — and into the rest of the vehicle. Together, the technology could help them break into the emerging “interior sensing” market, which can be used to monitor the entire cabin of a vehicle and deliver services in response to the occupant’s emotional state.

Under the terms of the deal, $67.5 million will be paid with 2,354,668 new Smart Eye shares, of which 2,015,626 are to be issued upon closing of the transaction. The remaining 339,042 Smart Eye shares will be issued within two years of closing. About $6 million will be paid in cash once the deal closes in June 2021.

Affectiva and Smart Eye were competitors. A meeting at the technology trade show CES in 2020 put the two companies on a path to merge.

“Martin and I realized like, wow, we are on a path to compete with each other — and wouldn’t it be so much better if we joined forces?” Affective co-founder and CEO Dr. Rana el Kaliouby said in an interview Tuesday. “By joining forces, we kind of check all the boxes for what the OEMs are looking for with interior sensing, we leapfrog the competition and we have an opportunity to do this better and faster than we could have done it on our own.”

Boston-based Affectiva brings its emotion-detection software to the deal, which will allow Smart Eye to offer its existing automotive partners a variety of products. Smart Eye helps Affectiva move beyond the development and prototype work and into production contracts. Smart Eye has won 84 production contracts with 13 OEMs, including BMW and GM. Smart Eye, which has offices in Gothenburg, Detroit, Tokyo and Chongqing, China, also has a division that provides research organizations such as NASA with high-fidelity eye tracking systems for human factors research.

Smart Eye founder and CEO Martin Krantz said that European manufacturers building luxury and premium vehicles led the charge for driver monitoring systems.

“We see the same pattern repeating itself now for interior sensing,” Krantz said. “I think a large part of the early contracts will be European premium OEMs such as Mercedes, BMW, Audi, JLR, Porsche.” Krantz added that there are a number of other premium brands it will target in other regions, including Cadillac and Lexus.

The opportunity will initially be in passenger vehicles driven by humans and will eventually expand as greater levels of automated driving enter the market.

Affectiva, which employs 100 people at its offices in Boston and Cairo, also has another business unit that applies its emotio-detection software to media analytics. This division, which will be part of the deal and will operate separately, is profitable, Kaliouby said, noting the software is used by 70% of the world’s largest advertisers to measure and understand emotional responses to media content.

Powered by WPeMatico

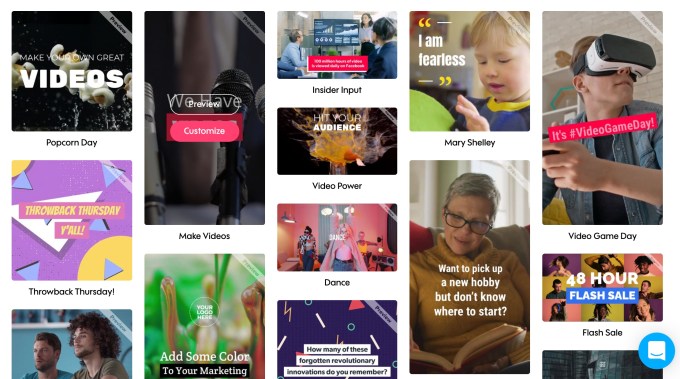

The social video tool Promo.com just raised $16 million in a Series B round led by Getty Images, the company synonymous with stock imagery.

Brands, creators or whoever else might need some quick and dirty video content can search Promo.com for what they need, just like they would use a stock photography service. Getty offers its own library of stock videos as well, but Promo.com provides both the video clips and the tools for non-editors to craft a basic edit with a little bit of customization.

Brands can select an existing professional video clip from a library, plug in their own message and add a logo or custom audio. All that’s left is downloading the customized video and whisking it off to their social channels.

Mizrahi-Tefahot Bank, one of the largest banks in Israel, also participated in the Series B round through debt financing. Promo.com’s existing “strategic partnership” with Getty Images will deepen as part of the deal, giving the former company access to the latter’s expansive existing pool of video clips.

Image Credits: Screenshot/Promo.com

Of course, Promo.com isn’t the only show in town. Video creation platform Biteable raised $7 million of its own in December, and similarly allows companies to make bright, bite-sized video content for social. The super streamlined graphic design platform Canva also supports video editing with its own library of stock images. Vimeo offers its own video template service too, known as Vimeo Create, which grew out of the company’s acquisition of the AI-powered video editor Magisto.

Powered by WPeMatico