TC

Auto Added by WPeMatico

Auto Added by WPeMatico

Historically, we haven’t been great about digital security. In 2016 (not long enough ago to feel OK about it), the top passwords were “123456” and “password.”

Awareness has certainly grown, but some folks could still use a nudge in the right direction. Luckily, Fortnite Battle Royale maker Epic Games has a solution.

The company has introduced a new emote to the game — emotes are just one type of cosmetic upgrade that helped Epic rake in $1 billion in revenue. However, this new Boogie Down emote is only available to folks who enable two-factor authentication on their Epic Games account.

As you can expect, hackers and other malicious actors are well aware of both the popularity of Fortnite and users’ willingness to spend money on the game. Obviously, these accounts are attractive targets for “the bad guys.”

Two-factor authentication — which asks for two separate verifications that you are you (usually a password and then an SMS confirmation) — has its shortcomings, but it’s most certainly an upgrade to a single password.

Incentivizing better security practices is an interesting take, and may very well be the first time a game maker has used the technique.

The Boogie Down emote (above) is the prize for enabling 2FA, and it was introduced as part of a competition by Epic Games. In March, the company asked its community to submit dance moves, with the winner making it into the game.

For what it’s worth, the actual dance seems way cooler than the emote in the game.

[via Kotaku]

Powered by WPeMatico

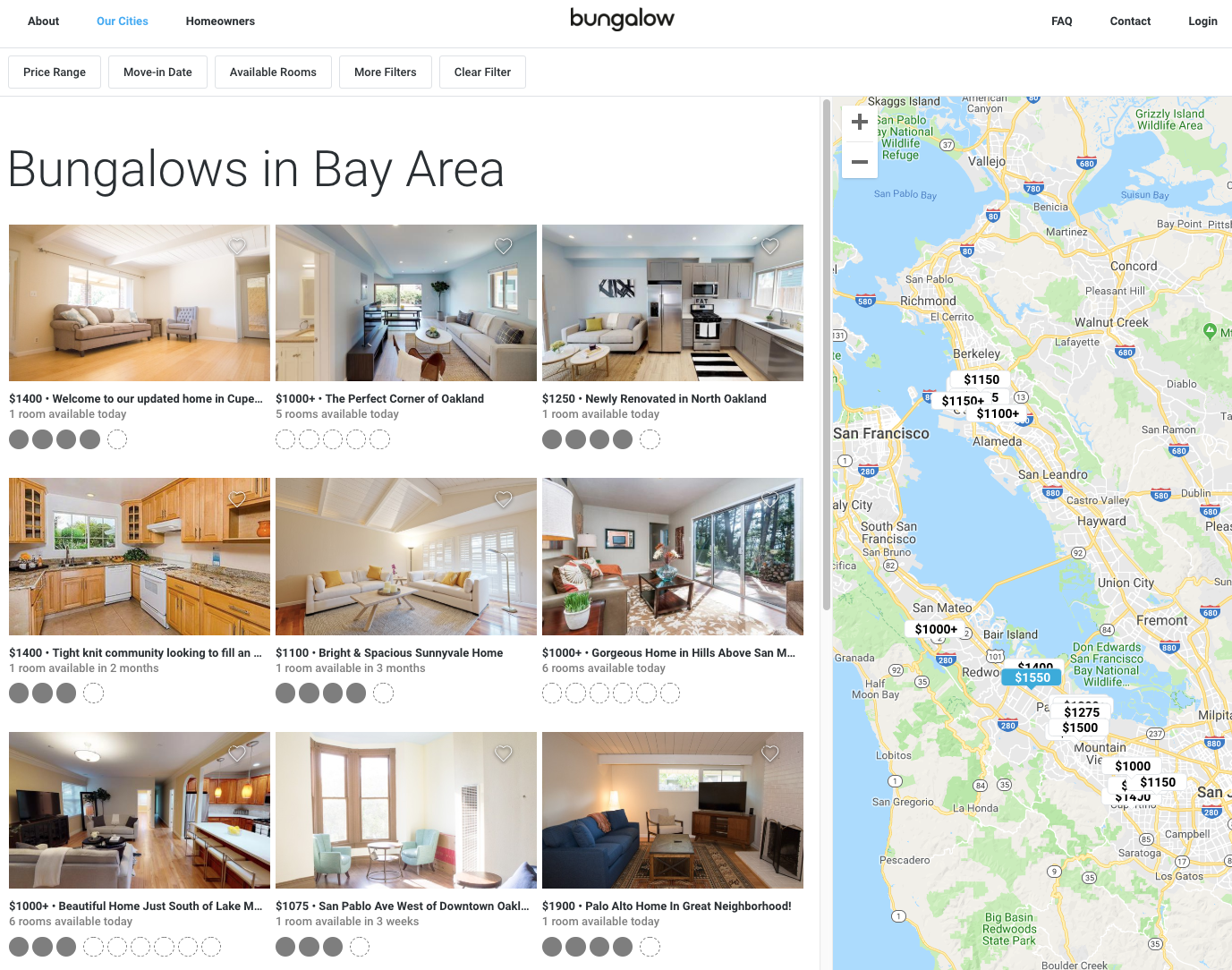

Moving to a new city can be tough for a number of reasons, but what’s arguably hardest about moving is a competitive and expensive housing market, and lack of a pre-existing social support network. That’s the problem startup Bungalow is trying to solve.

Bungalow, which just raised a $14 million Series A round led by Khosla Ventures with participation from Founders Fund, Atomic VC, Cherubic Ventures and Wing Ventures, offers people relatively affordable places to live with others who have been vetted by Bungalow’s platform. As part of the round, Keith Rabois of Khosla will join Bungalow’s board of directors. Bungalow also raised a $50 million debt facility to fuel its home growth costs. Bungalow had previously raised a $7 million seed round.

Bungalow, which joins the likes of WeLive, OpenDoor, Common, Roam and so many others, aims to be cheaper than getting your own studio or one-bedroom apartment, and offer a better experience than finding a roommate via Craigslist. Bungalow works with homeowners to lease their homes as the master tenant for three years at time. From there, Bungalow rents out the property on a room-by-room basis while guaranteeing occupancy to the homeowners.

“There aren’t as many families that are looking for these four, five, six-bedroom homes and so the incremental additional cost for those additional bedrooms is not commensurate with the individual rate at which we can lease out those individual bedrooms,” Bungalow co-founder and CEO Andrew Collins told me. “And so we were able to therefore basically create value out of that and then with scale that margin that we’re able to create within those given homes in an incredibly profitable and exciting coupling.”

For the renter, Bungalow says it’s about 30-40 percent cheaper than a studio. Depending on the market, of course, the prices can vary. Bungalow also furnishes shared common spaces, provides utilities, Wi-Fi and housekeeping in the monthly rental cost. In addition to what’s provided inside the space, Bungalow hosts monthly events for members in its properties to meet each other within a given market.

Bungalow currently operates 200 properties across seven markets, including the San Francisco Bay Area, Los Angeles, New York City, Portland, San Diego, Seattle and Washington, D.C. In total, there are 750 people residing in a Bungalow-leased property. All residents first must go through credit and background checks, as well as interviews with any existing residents before moving in. But that process can happen very fast, the company said. Some people have moved in same-day, but on average people look about 10 to 20 days ahead of when they’re trying to move.

While Bungalow’s current model is leasing assets from homeowners, it’s set up to operate any type of asset, Collins said, whether that’s a joint-venture or independently owned by Bungalow. Within the next six to 12 months, Bungalow is looking to launch in up to 12 new markets in the U.S. Next year, Bungalow hopes to expand its offering outside of the U.S.

Powered by WPeMatico

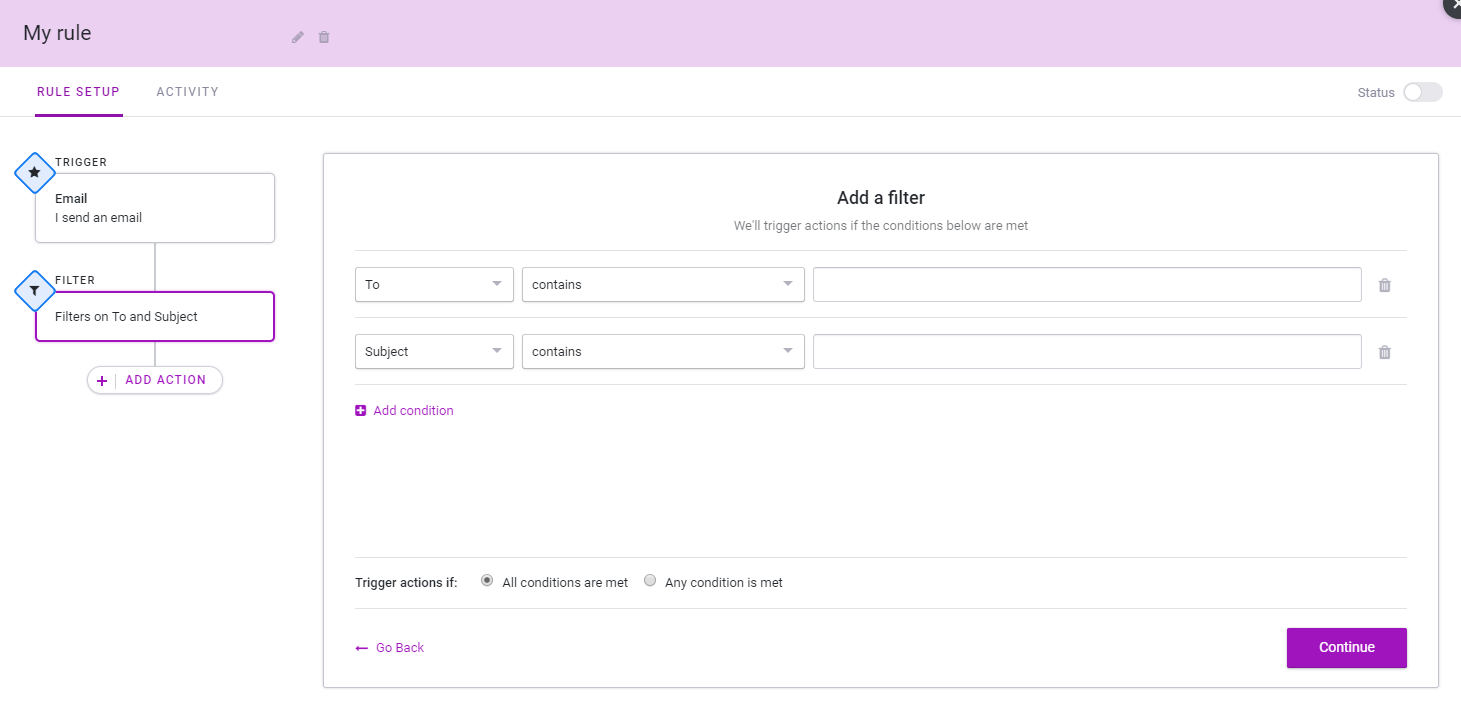

Mixmax, a service that aims to make email and other outbound communications more usable and effective, today announced the official launch of its new IFTTT-like rules for automating many of the most repetitive aspects of your daily email workflow.

On the one hand, this new feature is a bit like your standard email filter on steroids (and with connections to third-party tools like Slack, Salesforce, DocuSign, Greenhouse and Pipedrive). Thanks to this, you can now receive an SMS when a customer who spends more than $5,000 a month emails you, for example.

But rules also can be triggered by any of the third-party services the company currently supports. Maybe you want to send out a meeting reminder based on your calendar entries, for example. You can then set up a rule that always emails a reminder a day before the meeting, together with all the standard info you’d want to send in that email.

“One way we think about Mixmax is that we want to do for externally facing teams and people who talk a lot of customers what GitHub did for engineering and what Slack did for internal team communication,” Mixmax co-founder and CEO Olof Mathé told me. “That’s what we do for external communication.”

While the service started out as a basic Chrome extension for Gmail, it’s now a full-blown email automation system that offers everything from easy calendar sharing to tracking when recipients open an email and, now, building rules around that. Mathé likened it to an executive assistant, but he stressed that he doesn’t think Mixmax is taking anybody’s jobs away. “We’re not here to replace other people,” he said. “We amplify what you are able to do as an individual and give you superpowers so you can become your own personal chief of staff so you get more time.”

The new rules feature takes this to the next level and Mathé and his team plan to build this out more over time. He teased a new feature called “beast mode” that’s coming in the near future and that will see Mixmax propose actions you can take across different applications, for example.

Many of the new rules and connectors will be available to all paying users, though some features, like access to your Salesforce account, will only be available to those on higher-tier plans.

Powered by WPeMatico

Armory, a startup that has built a CI/CD platform on top the open source Spinnaker project, announced a $10 million Series A today led by Crosslink Capital. Other investors included Bain Capital Ventures, Javelin Venture Partners, Y Combinator and Robin Vasan.

Software development certainly has changed over the last several years, going from long cycles between updates to a continuous delivery model. The concept is actually called CI/CD or continuous integration/continuous delivery. Armory’s product is designed to eliminate some of the complexity associated with deploying this kind of solution.

When they started the company, the founders made a decision to hitch their wagon to Spinnaker, a project that had the backing of industry heavyweights like Google and Netflix. “Spinnaker would become an emerging standard for enabling truly multi-cloud deployments at scale. Instead of re-creating the wheel and building another in-house continuous delivery platform, we made a big bet on having Spinnaker at the core of Armory’s Platform,” company CEO and co-founder Daniel R. Odio wrote in a blog post announcing the funding.

The bet apparently paid off and the company’s version of Spinnaker is widely deployed enterprise solution (at least according to them). The startup’s ultimate goal is to help Fortune 2000 companies deploy software much faster — and accessing and understanding CI/CD is a big part of that.

As every company out there becomes a software company, they find themselves outside their comfort zones. While Google and Netflix and other hyper-scale organizations have learned to deploy software at startling speed using state of the art methodologies, it’s not so easy for most companies with much smaller engineering teams to pull off.

That’s where a company like Armory could come into play. It takes this open source project and it packages it in such a way that it simplifies (to an extent) the complex world that these larger companies operate in on a regular basis, putting Spinnaker and CI/CD concepts in reach of organizations whose core competency might not involve sophisticated software deployment.

All of this relates to multi-cloud and cloud-native approaches to software development, which lets you manage your applications and infrastructure wherever they live across any cloud vendor or even on-prem in consistent way. Being able to manage continuous deployment is part of that.

Armory launched in 2016 and is based in the Bay area. It has raised a total of $14 million with a $4 million seed round coming last year. They were also a member of the Y Combinator Winter 2017 class and count Y Combinator as an investor in this round.

Powered by WPeMatico

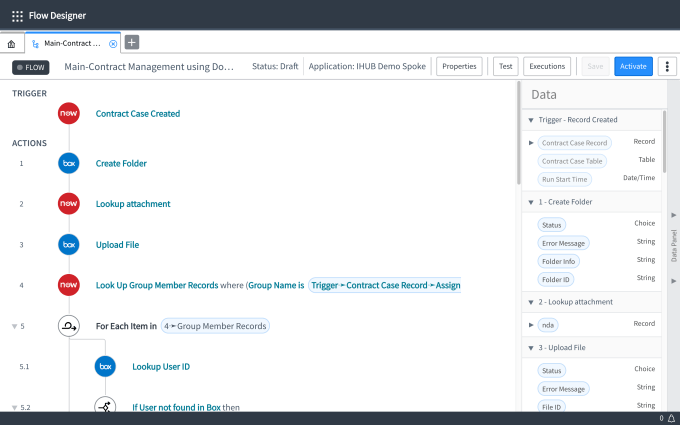

It used to be a one-vendor, stack-driven world in the enterprise. Today, the cloud has changed that and best of breed and interoperability are the watchwords of the day. Two enterprise cloud stalwarts have announced a new integration that brings Box content directly into ServiceNow.

For ServiceNow customers, it means that they can access Box content without leaving a ServiceNow application and changing focus. Company CTO Allan Leinwand says the two share a lot of common customers, and it made sense to bring them together.

“When you’re inside of a ServiceNow record, for example, you’re looking at an incident or problem or a knowledge base article, you are going to link to directly with a Box document or save files directly to Box from ServiceNow. There’s a lot of very practical things that help people get their work done faster,” he explained.

Jeetu Patel, Box’s Chief Strategy and Chief Product officer says the two companies are working to drive innovation inside organizations and that means working with multiple products to solve organizational issues.

“Our goal has been to be a neutral central content layer for every business process. Part of that ambition is to be able to plug into best of breed applications like ServiceNow. Companies already use these tools, and use Box, and they want to be sure they work seamlessly with each other,” Patel said.

On a practical level, customers can grab the Box plug-in from the ServiceNow Store. It comes with some prebuilt workflows for typical ServiceNow product usage scenarios, but the integration is flexible and allows customization. As an example, in an HR scenario, the ServiceNow administrator might build a workflow for onboarding a new employee in ServiceNow’s HR application. Using the company’s Flow Designer workflow-building tool, they can pull in all the documents a new employee needs to sign with other tasks into a single workflow.

Contract workflow with Box content in ServiceNow Flow Designer. Screenshot: ServiceNow

It comes down to helping customers work more efficiently. “We’re both cloud companies, and we’re both driving digital transformation for our customers. And we’ve really seen a lot of synergy between the way people work in Box, and how people are working in ServiceNow. We think we can integrate together and make work get done better,” Leinwand said.

Powered by WPeMatico

The vast majority of environmental experts say that avoiding meat and dairy is the single most important, and most impactful action, you can take to reduce your personal impact on Earth. Why? Because of the sheer amount of carbon pumped into the atmosphere from the process of meat production. Many would agree it’s also pretty good for your health. But when most of us have been brought up with animal protein in the middle of our plates, it often feels pretty hard to achieve. At the same time, fast food delivery has been taking off, but we’re still eating the same thing: meat.

So a Danish startup has come along to try to solve this. Simple Feast delivers sustainable food to people’s homes in biodegradable boxes, and it’s now raised a $12 million series A funding round led by Balderton Capital in London, with participation from 14W in New York. Existing investors Sweet Capital and ByFounders are also re-investing the round.

Simple Feast offers what it describes as ready-to-eat plant-based food that is “sustainably produced, organic, and delivered straight to the doorstep” in biodegradable boxes every week. The meal solution delivers weekly boxes with three prepared plant-based and 100 percent organic meals ready to serve in 10 minutes.

In this respect it’s not unlike other startups, such as HelloFresh, with the main difference being that all the food is plant-based.

Jakob Jønck, CEO and co-founder of Simple Feast, says: “Climate change is real. There is no Planet B and we are facing what is arguably the biggest challenge in human history. This is a big investment for a small company, but it’s a drop in the ocean considering the challenge at hand, the politicians and industries we are up against.”

He and Thomas Ambus, co-founder/CTO, started thinking more deeply about Simple Feast when Under Armour acquired Endomondo and MyFitnessPal, their previous startups, in the spring of 2015 and got serious about it in 2016. “Ever since founding Endomondo and heading up International Operations for MyFitnessPal, I always felt a missing link when trying to move towards a healthy, sustainable diet — an actual product that didn’t compromise on taste, nor convenience, but solved the huge challenges involved with embarking on this journey towards eating plants first and foremost,” says Jønck.

Daniel Waterhouse, a partner at Balderton Capital, says: “With a global transition towards plant-based food, we believe Simple Feast is uniquely positioned to change the way we eat and create awareness about the impact of our food choices.”

The main target is families, with the parents in their 30s and 40s. “We find that women are still predominantly the decision maker when it comes to food for the family. Our most typical customers are women in a relationship in their 30s with one or two kids. Our customers are also politically interested, above the average,” says Jønck.

They are competing with restaurants, meal kits and take-away. “We are disrupting both the restaurant and the meal kit industry. Nobody has ever taken the challenge of creating climate-friendly, plant-based food seriously while serving it directly to consumers. We don´t make compromises on taste, nor convenience, and we don´t believe that we have seen that before,” he told me.

Powered by WPeMatico

Root Insurance, an Ohio-based car insurance startup with a tech twist, said Wednesday it has raised $100 million in a Series D funding round led by Tiger Global Management, pushing the company’s valuation to $1 billion.

Redpoint Ventures, Ribbit Capital and Scale Venture Partners all participated as follow-on investors in this latest round.

The car insurance company, founded in 2015, plans to use the funds to expand into existing markets and make inroads into new states, as well as hire more employees such as engineers, actuaries, claims and customer service to support increased scale.

Root provides car insurance to drivers. Not exactly a new concept. But it establishes the premium customers based on their driving along with other factors. Drivers download the app and take a test drive that typically lasts two or three weeks. Then Root provides a quote that rewards good driving behavior and allows customers to switch their insurance policy. Customers can purchase and manage their policy through the mobile phone Root app.

Root says its approach allows good drivers to save more than 50 percent on their policies compared to traditional insurance carriers.

The company uses AI algorithms to adjust risk and sometimes provide discounts. For example, a vehicle with an advanced driver assistance system that it deems improves safety might receive further discounts.

“Root Insurance is leading digital innovation in U.S. auto insurance,” Lee Fixel, a partner at Tiger Global Management said in a statement. “This industry is ripe for change, and we are excited to invest in a team that has the expertise, vision, and momentum to deliver real results. We look forward to growing our partnership with Root and helping them expand their footprint across the United States.”

The company has grown from its home market of Ohio into 20 other states in the past two years. The company plans to expand to all 50 states and Washington, D.C., by the end of 2019.

Drive Capital and Silicon Valley Bank are also investors in the company.

Powered by WPeMatico

2018 has been the year that AR promises came face-to-face with reality. While Apple’s ARKit and Google’s ARCore sparked a ravenous response from developers that had grown worried about VR’s near-term market and the fate of AR headsets from Microsoft and Magic Leap, little seemed to resonate deeply with consumers.

That realization is part of the reason AR startups working on backend services and more base level development pipelines have seen so much success. Onstage at Disrupt SF 2018, we’ll be chatting with Anjney Midha, the CEO of an AR startup called Ubiquity6.

The startup was founded just a year ago but has already raised more than $37 million to solve some of the hardest augmented reality problems that companies like Google and Apple are working hard to solve, as well. Its backers include Google’s Gradient Ventures, First Round, Benchmark and KPCB, where Midha previously ran a small fund.

The company is tackling problems like multiplayer interactions and world mapping as well as issues key to more immersive gameplay like making sure that virtual objects stay tied to physical markers in-between gaming sessions. Ultimately, the company’s work is aiming to promote the Ubiquity6 app to be a hub for AR experiences that will have a development backbone that enables much deeper AR interactions for users.

Ubiquity6 is ambitious about the scale of their AR capabilities. While so many companies are focusing their efforts on how to capture AR interactions taking place in the living room, Ubiquity6 is actively working to map entire cities so it can deliver massive AR experiences that can turn heads (or at least phones).

We’re looking forward to chatting with Midha and hearing about how his startup is planning to compete with some of the world’s biggest tech companies in building out a digital reality that’s projected onto our own.

The full agenda is here. Passes for the show are available here.

Powered by WPeMatico

Fifty-nine startups took the stage at Y Combinator’s Demo Day 2, and among the highlights were a company that helps developers manage in-app subscriptions; a service that lets you create animojis from real photos; and a surplus medical equipment-reselling platform. Oh… and there was also a company that’s developed an entirely new kind of life form using e coli bacteria. So yeah, that’s happening.

Based on some investor buzz and what caught TechCrunch’s eye, these are our top picks from the second day of Y Combinator’s presentations.

You can find the full list of companies that presented on Day 1 here, and our top picks from Day 1 here.

With a founding team including some of the leading luminaries in the field of biologically inspired engineering (including George Church, Pamela Silver and Jeffrey Way from Harvard’s Wyss Institute), 64-x is engineering organisms to function in otherwise inaccessible environments. Chief executive Alexis Rovner, herself a post-doctoral fellow at the Wyss Institute, and chief operating officer Ryan Gallagher, a former BCG Consultant, are looking to commercialize research from the Institute around accelerating and expanding the ability to produce functionalized proteins and sequence-defined polymers with diverse chemistries. Basically they’ve engineered a new life form that they want to use for novel kinds of bio-manufacturing.

Why we liked it: These geniuses invented a new life form.

Sher Butt, a former lab directory at Steep Hill, saw that cannabinoids were as close to a miracle cure for pain, epilepsy and other chronic conditions as medicine was going to get. But plant-based cannabinoids were costly and produced inconsistent results. Alongside Jacob Vogan, Butt realized that biosynthesizing cannabinoids would reduce production costs by a factor of 10 and boost production 24 times current yields. With a deep experience commercializing drugs for Novartis and as the founder of the cannabis testing company SB Labs, Butt and his technical co-founder are uniquely positioned to bring this new therapy to market.

Why we liked it: Using manufacturing processes to make industrial quantities of what looks like nature’s best painkiller at scale is not a bad idea.

RevenueCat helps developers manage their in-app subscriptions. It offers an API that developers can use to support in-app subscriptions on iOS and Android, which means they don’t have to worry about all the nuances, bugs and updates on each platform.

The API also allows developers to bring all the data about their subscription business together in one place. It might be on to something, though it isn’t clear how big that something is quite yet. The nine-month-old company says it’s currently seeing $350,000 in transaction volume every month; it’s making some undisclosed percentage of money off that amount.

Read more about RevenueCat here.

Why we liked it: Write code. Release app. Use RevenueCat. Get paid. That sounds like a good formula for a pretty compelling business.

Indonesia is a country in transition, with a growing class of individuals with assets to invest yet who, financially, don’t meet the bar set by many wealth managers. Enter Ajaib, a newly minted startup with the very bold ambition of becoming the “Ant Financial of wealth management for Indonesia.” Why the comparison? Because China was in the same boat not long ago — a country whose middle class had little access to wealth management advice. With the founding of Ant Financial nearly four years ago, that changed. In fact, Ant now boasts more than 400 million users.

China is home to nearly 1.4 billion, compared with Indonesia, whose population of 261 million is tiny in comparison. Still, if its plans work out to charge 1.4 percent for every dollar managed, with an estimated $370 billion in savings in the country to chase after, it could be facing a meaningful opportunity in its backyard if it gains some momentum.

Why we liked it: If Ajaib’s wealth management plans (to charge 1.4 percent for every dollar it manages) work out — and with a total market of $370 billion in savings in Indonesia — the company could be facing a meaningful opportunity in its backyard.

The scooter craze is hitting Latin America and Grin is greasing the wheels. The Mexico City-based company was launched by co-founder Sergio Romo after he and his partner realized they weren’t going to be able to get a cut of the big “birds” on the scooter block in the U.S. (as Axios reported). Romo and his co-founder have already lined up a slew of investors for what may be the hottest new deal in Latin America. Backers include Sinai Ventures, Liquid2 Ventures, 500 Startups, Monashees and Base10 Partners.

Why we liked it: Scooters are so 2018. But there’s a lot of money to be made in mobility, and as the challenge from Bird and Lime to Uber and Lyft in hyperlocal transit has revealed, there’s no dominant player that’s taken over the market… yet.

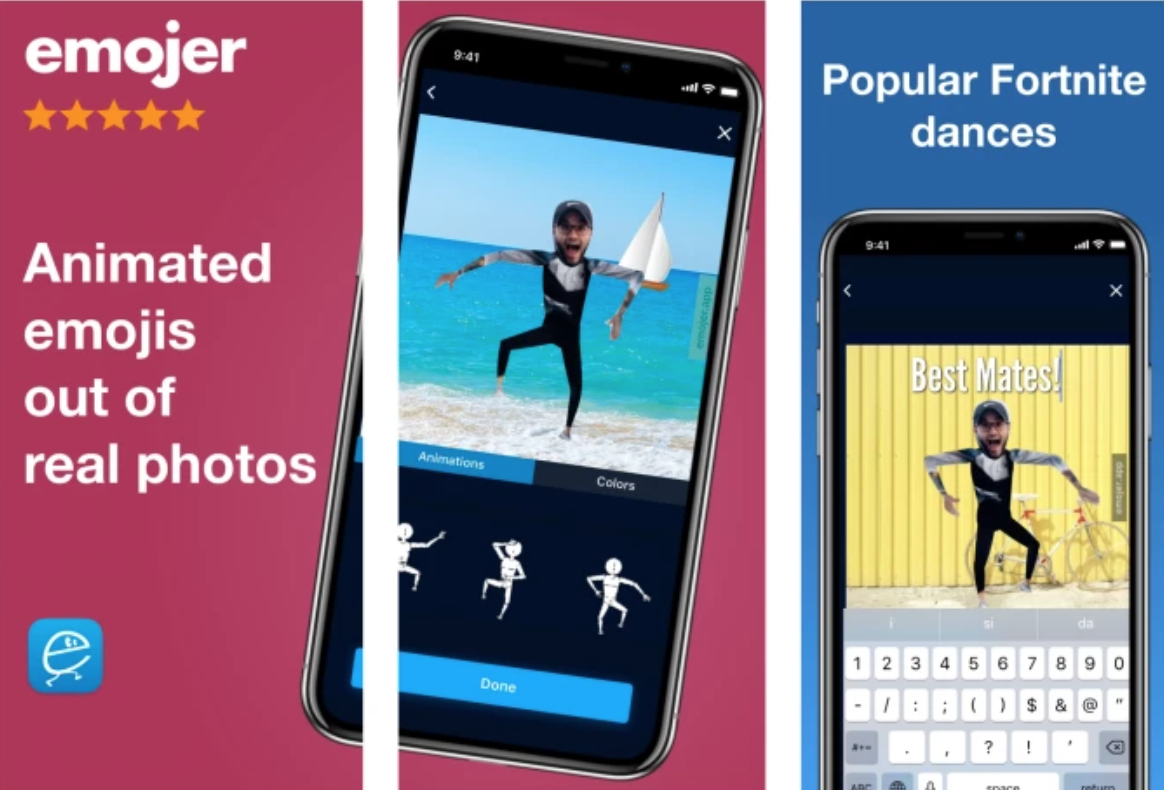

Creating animated emojis made from real photos, Emojer just might be the most fun you can have with a camera. The company’s software uses deep learning algorithms to detect body parts and guides users in creating their own avatars with just a simple photo take from a mobile phone. It’s replacing deep Photoshop expertise and animation skills with a super simple interface. The avatars look very similar to Elf Yourself, a popular site that let you paste your friends’ faces on dancing Christmas elves goes viral every year at Christmastime. Founders have PhDs in machine learning and computer vision.

Why we liked it: As the company’s chief executive said, Snap was for sexting, and Facebook was hot or not, so who says the next big consumer platform couldn’t be the Trojan horse of easily generated selfiemojis (akin to Elf Yourself)?

Osh’s Affordable Pharmaceuticals is a public benefit corporation connecting doctors and patients with sources of low-cost, compounded pharmaceuticals. The company is looking to decrease barriers to entry for drugs for rare diseases. Three weeks ago the company introduced a drug to treat Wilson’s Disease. There was no access to the drug that treats the disease before in Brazil, India or Canada. It slashes the cost of drugs from $30,000 a month to $120 per month. The company estimates it has a total addressable market of $17 billion. “Generic drug pricing is a crisis, people are dying because they can’t get access to the medicine they need,” says chief executive Alex Oshmyansky. Osh’s might have a solution.

Why we liked it: Selling lower-cost medications for rare diseases in countries that previously hadn’t had access to them is a good business that’s good for the world.

Tackling a $75 billion problem of healthcare waste, Medinas Health is giving hospitals an easy way to resell their used supplies. The company has already raised $1 million for its marketplace to help healthcare organizations buy and sell equipment. With a seed round led by Ashton Kutcher and Guy Oseary’s Sound Ventures, and General Catalyst’s Rough Draft Ventures fund, the company is also working to lower costs for cash-strapped rural healthcare centers.

Why we liked it: Finding uses for hospital equipment that’s been lying fallow in corners is a big business. A $75 billion business if Medinas’ estimates are correct. Add helping cut costs for rural medical facilities and Medinas is a business we can get behind.

Plus-size women have limited clothing options even at the largest retailers like Nordstrom and Macy’s. While a majority of American women fall into the plus-size clothing category, 100 million women are constrained to shopping for a very small percentage of options. And Comfort wants to solve the supply problem. To do this, the founders, two former Harvard classmates, are building a direct-to-consumer fashion brand with stylish, minimalist offerings for plus-size women, including tunic shirts and an apron dress. It’s very early days for the brand, but since launching in recent weeks, they’ve seen $25,000 in sales.

Why we liked it: This direct-to-consumer fashion brand is bringing higher quality, better-designed clothing options to a market that’s underserved and growing quickly. What’s not to like?

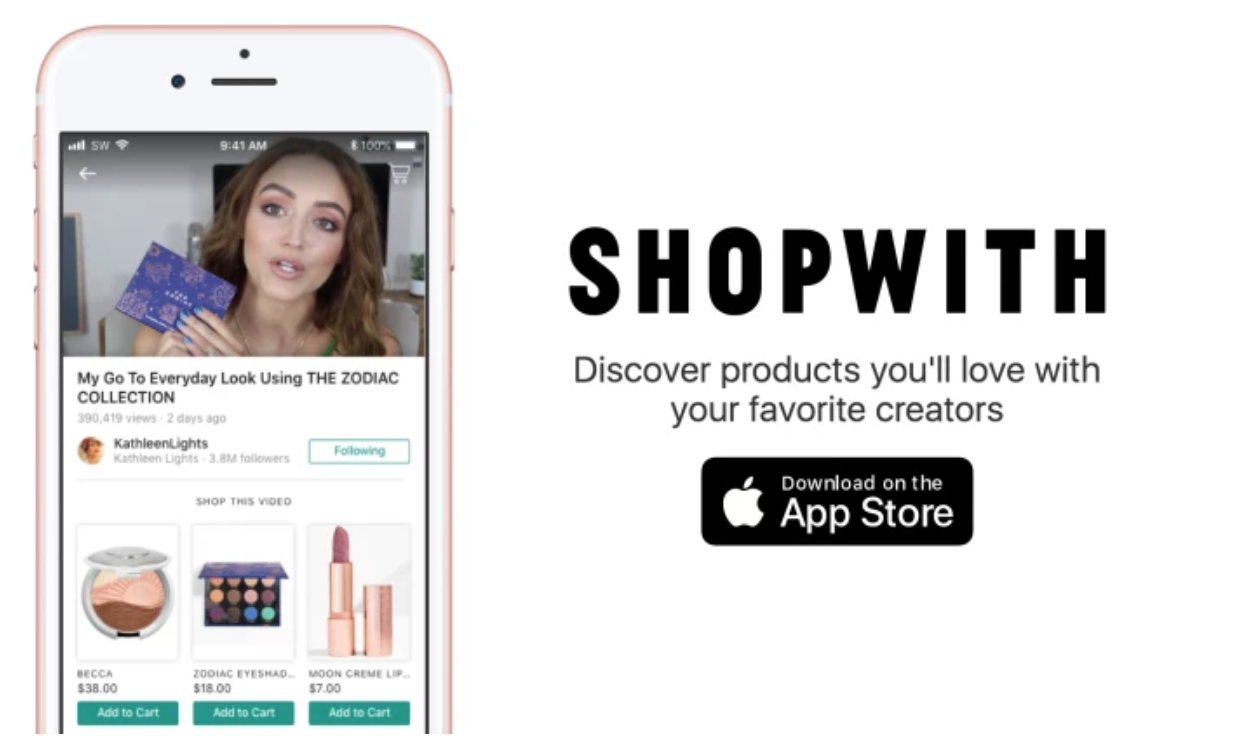

Influencers of the world are uniting on mobile app, ShopWith, which allows shoppers to browse virtual storefronts and aisles alongside their favorite fashion and beauty creators and YouTubers. Users can see exactly what products those influencers have featured and can buy them without ever leaving the app. It’s a free download and hours of commercially consumptive fun.

It’s like the QVC model, but for GenZ shoppers whose buying habits are influenced by social video content on YouTube, Instagram and Snapchat. The company revealed that one beauty influencer made $10,000 within five hours using the ShopWith platform. The founders are former product managers with experience building social commerce products at Facebook and Amazon.

Why we liked it: The QVC for GenZ not only has a nice ring to it, it’s a recipe for making cash registers hum. A mobile-first, influencer-based shopping company is something that we’d definitely not call an impulse purchase.

Powered by WPeMatico

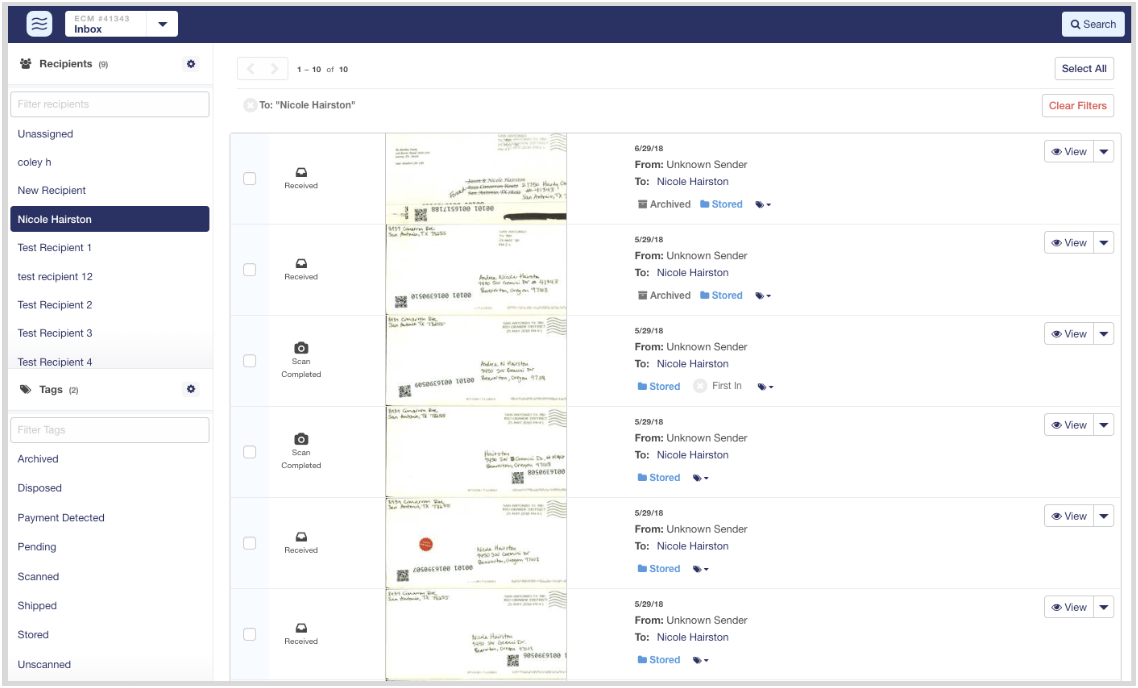

Earth Class Mail, a company that digitizes your physical mail so you don’t have to go to the mailbox every day, today announced that it has acquired receipt scanning and expense tracking service Shoeboxed.

The reason Earth Class Mail would be interested in Shoeboxed is pretty obvious, given that both companies focus on taking the pain out of dealing with paper. Both services will continue to operate as usual, though we’ll likely see some deep integrations between the two over time.

Shoeboxed, which launched 11 years ago, currently digitizes over five million documents per year for its more than 1 million customers in 90 countries. Its main market is small businesses in the U.S., which make up 500,000 of its users.

“When we started in 2008 and put the first iPhone app in the app store to scan receipts, there was one other powerhouse around helping small business go digital — Earth Class Mail,” the company’s CEO and co-founder Tobias Walter tells us. “The combined power of our two companies will be a massive shift for small businesses to finally become paperless and say goodbye to old workflows that cost them hours of their productivity. I could not be happier with the new home we found for the company, the team and our customers!”

What sets Earth Class Mail apart from the United States Postal Service’s Informed Delivery service is that it not only scans the outside of the envelopes that you are about to receive but that you can also give the company permission to scan all the documents inside, too (and the price you pay for the service depends mostly on how many of these full scans you want per month). While Oregon-based Earth Class Mail had to file for bankruptcy protection in 2015, its new leadership team turned the company around. The company says that its annual run rate is now $10 million, up 20 percent since Jess Garza become its new CEO last December.

Walter also notes that users would occasionally send unopened envelopes, too, but the company wasn’t allowed to open them. These customers can now easily become Earth Class Mail users.

Over the course of its existence, Shoeboxed only raised a moderate amount of funding, with a $580,000 Series A round led by Novak Biddle Venture Partners in 2008 (when Series A rounds were still much smaller than today) and a $1.4 million Series B round in 2011. The financial details of today’s acquisition were not disclosed.

Powered by WPeMatico