TC

Auto Added by WPeMatico

Auto Added by WPeMatico

Vitamins are proving to be a lucrative industry in the United States. Just last year vitamin sales pulled in roughly $37 billion for the U.S. economy. That’s up from $28 billion in 2010. To cash in on this growing market, several startups have popped up in the last few years — including Nutrigene, a startup combining the vitamin business with another lucrative avenue of revenue in consumer DNA analysis.

Nutrigene believes your genes may hold the secret to what you might be missing in your diet. The company will send you tailor-made liquid vitamin supplements based on a lifestyle quiz and your DNA. You get your analysis by filling out an assessment on the startup’s website, choosing a recommended package such as “essentials,” “improve performance” or “optimize gut health.” After that you can also choose to upload your DNA profile from 23andMe, then Nutrigene will send you liquid supplements built just for you.

Founder Min FitzGerald launched the startup out of Singularity and later accepted a Google fellowship for the idea. Nutrigene then went on to Y Combinator’s winter 2018 class. FitzGerald’s co-founder and CTO Van Duesterberg comes from a biotech and epigenetics background and holds a PhD from Stanford.

PhDs and impressive resumes aside, the vitamin and genetics industries are not without controversy. For every study showing that those who eat a balanced diet don’t benefit from supplements, there are just as many highlighting the benefits of taking your vitamins. Also, coupling vitamin therapy with your DNA seems at a glance dubious. However, Dawn Barry, former VP at Illumina and now president of Luna DNA, a biotech company powered by the blockchain, says it could have some scientific underpinnings. But, she cautioned, nutrigenetics is still an early science.

Amir Trabelsi, founder of genetic analysis platform Genoox, agrees. We interviewed both Trabelsi and Barry previously when Nutrigene first came on our radar. Trabelsi pointed out these types of companies don’t need to provide any proof.

“That doesn’t mean it’s completely wrong,” he told TechCrunch. “But we don’t know enough to say this person should use Vitamin A, for example… There needs to be more trials and observation.”

Nutrigene acknowledges the best supplementation for performance goes beyond just a genetic profile. Our lifestyles, where we live, what we do and what we put in our bodies (or don’t) all can contribute to a deficiency. For better nutritional accuracy, Nutrigene will send you a blood test kit in the mail to test for things like Vitamin D deficiency (a common deficiency in Silicon Valley, according to my doctor). You also can choose to go to a blood testing center to find out what sort of nutritional supplements you’ll need for optimal performance.

One other twist — Nutrigene’s vitamins come in liquid form for what FitzGerald says is the optimum delivery method.

I tried out the program for myself earlier this year, though not for more than a few days as I was pregnant at the time and wanted to stick with the prenatal vitamins I’d been taking. Nothing I saw on the packaging from Nutrigene was dangerous for pregnant women, just run-of-the-mill stuff like vitamin B12, which my genetic analysis said I was prone to be deficient in. But I had already been taking some pretty good prenatal vitamins from New Chapter and a DHA supplement from Nordic Naturals for a year leading up to getting pregnant. I had a very healthy, nearly 9.5 pound baby boy in March. My own doctor, who tested my nutritional levels at the beginning of my pregnancy through a blood sample, did not tell me I had any deficiencies.

That’s not to say it wouldn’t be great for someone else looking for optimal nutrition and wanting a boost through supplementation. It’s also a great industry to get into if you know how to market your products. Though crowded, there’s plenty of room to grow and billions of dollars in the vitamin industry for those who can make their products stand out. DNA analysis and liquid supplementation might just be the thing.

FitzGerald tells TechCrunch that Nutrigene has already shipped 8,500 personalized dosages to customers since launching earlier this year.

For those interested in trying out Nutrigene, you can do so by ordering on the website. Package pricing varies and depends on nutritional needs, but starts at around $85 per month.

Powered by WPeMatico

Forethought, a 2018 TechCrunch Disrupt Battlefield participant, has a modern vision for enterprise search that uses AI to surface the content that matters most in the context of work. Its first use case involves customer service, but it has a broader ambition to work across the enterprise.

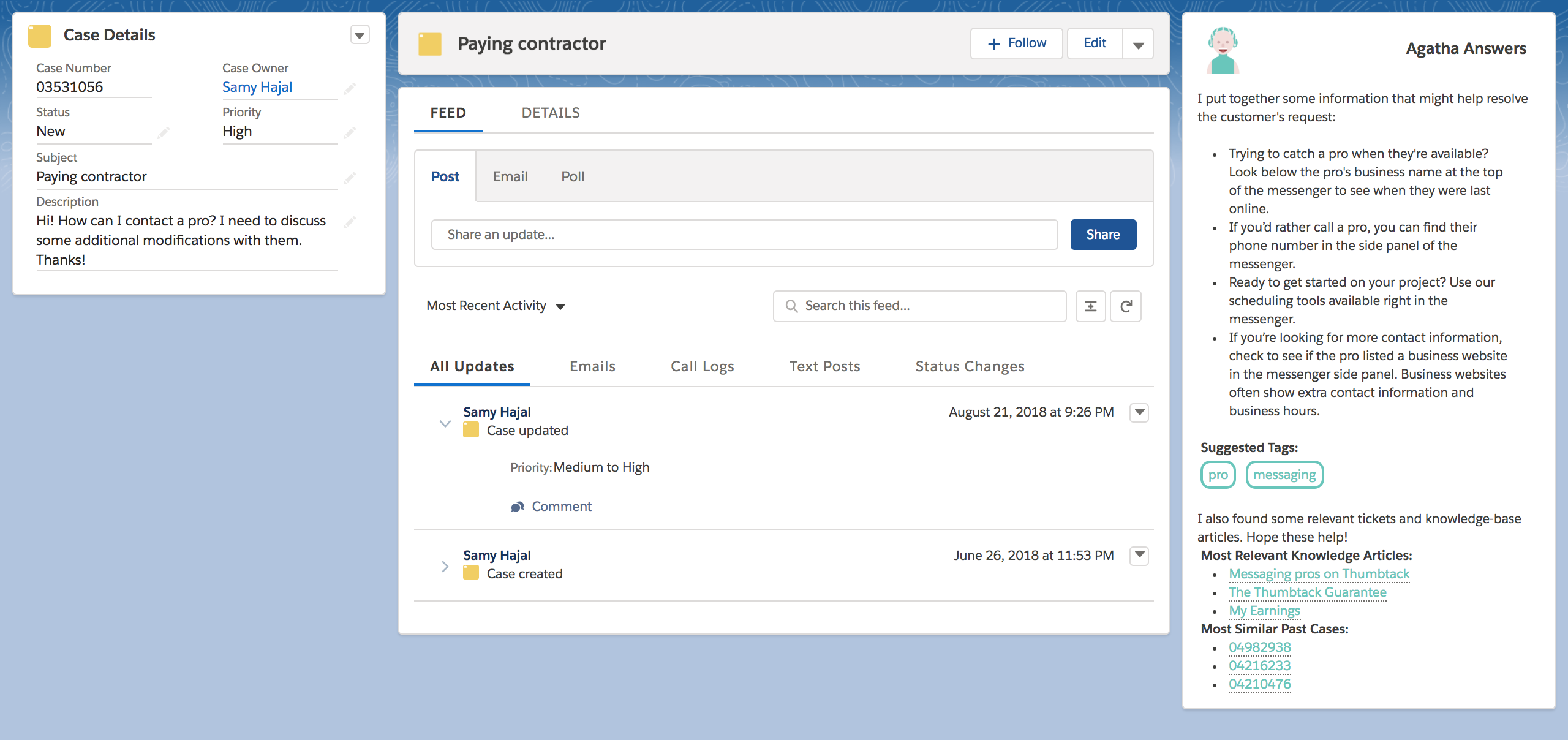

The startup takes a bit of an unusual approach to search. Instead of a keyword-driven experience we are used to with Google, Forethought uses an information retrieval model driven by artificial intelligence underpinnings that they then embed directly into the workflow, company co-founder and CEO Deon Nicholas told TechCrunch. They have dubbed their answer engine ‘Agatha.’

Much like any search product, it begins by indexing relevant content. Nicholas says they built the search engine to be able to index millions of documents at scale very quickly. It then uses natural language processing (NLP) and natural language understanding (NLU) to read the documents as a human would.

“We don’t work on keywords. You can ask questions without keywords and using synonyms to help understand what you actually mean, we can actually pull out the correct answer [from the content] and deliver it to you,” he said.

One of first use cases where they are seeing traction in is customer support. “Our AI, Agatha for Support, integrates into a company’s help desk software, either Zendesk, Salesforce Service Cloud, and then we [read] tickets and suggest answers and relevant knowledge base articles to help close tickets more efficiently,” Nicholas explained. He claims their approach has increased agent efficiency by 20-30 percent.

Forethought at work in Salesforce Service Cloud. Screenshot: Forethought

The plan is to eventually expand beyond the initial customer service use case into other areas of the enterprise and follow a similar path of indexing documents and embedding the solution into the tools that people are using to do their jobs.

When they reach Beta or general release, they will operate as a cloud service where customers sign up, enter their Zendesk or Salesforce credentials (or whatever other products happen to be supported at that point) and the product begins indexing the content.

Forethought in Zendesk. Screenshot: Forethought

The founding team, all in their mid-20s, have had a passion for artificial intelligence since high school. In fact, Nicholas built an AI program to read his notes and quiz him on history while still in high school. Later at the University of Waterloo he published a paper on machine learning and had internships at Palantir, Facebook and Dropbox. His first job out of school was at Pure Storage. All these positions had a common thread of working with data and AI.

The company launched last year and they debuted Agatha in private Beta 4 months ago. They currently have six companies participating, the first of which has been converted to a paying customer.

They have closed a pre-seed round of funding too, and although they weren’t prepared to share the amount, the investment was led by K9 Ventures. While Village Global, Original Capital and other unnamed investors also participated.

Powered by WPeMatico

Elastic, the provider of subscription-based data search software used by Dell, Netflix, The New York Times and others, has unveiled its IPO filing after confidentially submitting paperwork to the SEC in June. The company will be the latest in a line of enterprise SaaS businesses to hit the public markets in 2018.

Headquartered in Mountain View, Elastic plans to raise $100 million in its NYSE listing, though that’s likely a placeholder amount. The timing of the filing suggests the company will transition to the public markets this fall; we’ve reached out to the company for more details.

Elastic will trade under the symbol ESTC.

The business is known for its core product, an open-source search tool called ElasticSearch. It also offers a range of analytics and visualization tools meant to help businesses organize large data sets, competing directly with companies like Splunk and even Amazon — a name it mentions 14 times in the filing.

“Amazon offers some of our open source features as part of its Amazon Web Services offering. As such, Amazon competes with us for potential customers, and while Amazon cannot provide our proprietary software, the pricing of Amazon’s offerings may limit our ability to adjust,” the company wrote in the filing, which also lists Endeca, FAST, Autonomy and several others as key competitors.

This is our first look at Elastic’s financials. The company brought in $159.9 million in revenue in the 12 months ended July 30, 2018, up roughly 100 percent from $88.1 million the year prior. Losses are growing at about the same rate. Elastic reported a net loss of $18.5 million in the second quarter of 2018. That’s an increase from $9.9 million in the same period in 2017.

Founded in 2012, the company has raised about $100 million in venture capital funding, garnering a $700 million valuation the last time it raised VC, which was all the way back in 2014. Its investors include Benchmark, NEA and Future Fund, which each retain a 17.8 percent, 10.2 percent and 8.2 percent pre-IPO stake, respectively.

A flurry of business software companies have opted to go public this year. Domo, a business analytics company based in Utah, went public in June raising $193 million in the process. On top of that, subscription biller Zuora had a positive debut in April in what was a “clear sign post on the road to SaaS maturation,” according to TechCrunch’s Ron Miller. DocuSign and Smartsheet are also recent examples of both high-profile and successful SaaS IPOs.

Powered by WPeMatico

Rugged smartphones, the kind of devices that business can give to their employees who work in harsh environments, are a bit of a specialty market. Few consumers, after all, choose their smartphones based on how well they survive six-foot drops. But there is definitely a market there, and IDC currently expects that the market for Android -based rugged devices will grow at 23 percent annually over the next five years.

It’s maybe no surprise that Google is now expanding its Android Enterprise Recommended program to include rugged devices, too. Chances are you’ve never heard of many of the manufacturers in this first batch (or thought of them as smartphone manufacturers): Zebra, Honeywell, Sonim, Point Mobile, Datalogic. Panasonic, which has a long history of building rugged devices, will also soon become part of this program.

It’s maybe no surprise that Google is now expanding its Android Enterprise Recommended program to include rugged devices, too. Chances are you’ve never heard of many of the manufacturers in this first batch (or thought of them as smartphone manufacturers): Zebra, Honeywell, Sonim, Point Mobile, Datalogic. Panasonic, which has a long history of building rugged devices, will also soon become part of this program.

The minimum requirements for these devices are pretty straightforward: they have to support Android 7+, offer security updates within 90 days of release from Google and, because they are rugged devices, after all, be certified for ingress protection and rated for drop testing. They’ll also have to support at least one more major OS release.

“Today’s launch continues our commitment to improving the enterprise experience for customers,” Google writes in today’s announcement. “We hope these devices will serve existing use cases and also enable companies to pursue new mobility use cases to help them realize their goals.“

Powered by WPeMatico

Snapchat isn’t revealing sales numbers of version 2 of its Spectacles camera sunglasses, but at least they’re not getting left in a drawer as much as the V1s. The company tells me V2 owners are capturing 40 percent more Snaps than people with V1s.

And today, Snapchat is launching two new black-rimmed hipster styles of Spectacles V2 — a Wayfarer-esque Nico model and a glamorous big-lensed Veronica model. Both come with a slimmer semi-soft black carrying case instead of the chunky old triangular yellow one, and are polarized for the first time. They look a lot more like normal sunglasses, compared to the jokey, bubbly V1s, so they could appeal to a more mature and fashionable audience. They go on sale today for $199 in the US and Europe and will be sold in Neiman Marcus and Nordstrom later this year, while the old styles remain $149.

The new Spectacles styles (from left): Veronica and Nico

Spectacles V2 original style (left) and V1 (right)

Snap is also trying to get users to actually post what they capture, so it’s planning an automatically curated Highlight Story feature that will help you turn your best Specs content into great things to share. That could address the problem common amongst GoPro users of shooting a ton of cool footage but never editing it for display.

The problem is that V1 were pretty exceedingly unpopular, and those that did buy them. Snap only shipped 220,000 pairs and reportedly had hundreds of thousands more gathering dust in a warehouse. It took a $40 million write-off and its hardware “camera company” strategy was called into question. Business Insider reported that less than 50 percent of buyers kept using them after a month and a “sizeable” percentage stopped after just a week.

The new styles come with a slimmer semi-soft carry case

That means the bar was pretty low from which to score a 40 percent increase in usage, especially given the V2s take photos, work underwater, come in a slimmer charging case, and lack the V1s’ bright yellow ring around the camera lens that announces you’re wearing a mini computer on your face. Snap was smart to finally let you export in non-circular formats which are useful for sharing beyond Snapchat, and let you automatically save Snaps to your camera roll and not just its app’s Memories feature.

I’ve certainly been using my V2s much more than the V1s since they’re more discrete and versatile. And I haven’t encountered as much fear or anxiety from people worried about being filmed as privacy norms around technology continue to relax.

But even with the improved hardware, new styles, and upcoming features, Spectacles V2 don’t look like they’re moving the needle for Snapchat. After shrinking in user count last quarter, Snap’s share price has fallen to just a few cents above its all-time low. Given most of its users are cash-strapped teens who aren’t going to buy Spectacles even if they’re cool, the company needs to focus on how to make its app for everyone more useful and differentiated after the invasion of Instagram’s copy-cats of its Stories and ephemeral messaging.

Whether that means securing tentpole premium video content for Discover, redesigning Stories to ditch the interstitials for better lean-back viewing, or developing augmented reality games, Snap can’t stay the course. Despite its hardware ambitions, it’s fundamentally a software company. It has to figure out what makes that software special.

Powered by WPeMatico

Wunder Mobility, the Hamburg-based startup that provides a range of mobility services, from carpooling to electric scooter rentals, has raised $30 million in Series B funding. The round was led by KCK Group, with participation from previous backer Blumberg Capital and other non-disclosed investors.

The German company says the investment will be used to expand the company’s engineering team in its home country and to establish an international B2B sales organisation. Currently, Wunder Mobility has 70 employees working from four offices in Asia, Germany, and South America. The aim is to add another 100 employees over the next twelve months in the areas of product development and B2B sales.

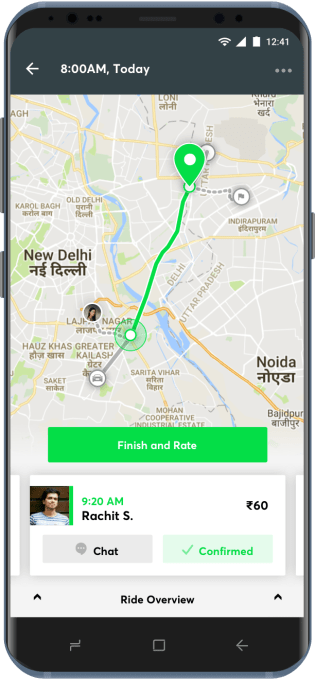

Founded in Hamburg in 2014, but now with an international focus, including emerging markets, Wunder Mobility supplies software, hardware, and operational services for various “future-oriented” mobility concepts. These span smart shuttles, fleet management and carpooling, reaching more than two million users in a dozen countries, including France, Germany, Spain, Brazil, India, and the Philippines.

“We are enabling communities on four continents to address the global traffic challenge and to deploy more sustainable mobility options faster by hosting a full-stack urban mobility tech platform,” explains founder and CEO Gunnar Froh.

“We are enabling communities on four continents to address the global traffic challenge and to deploy more sustainable mobility options faster by hosting a full-stack urban mobility tech platform,” explains founder and CEO Gunnar Froh.

“Our three product lines either allow private people to share empty seats with people headed in the same direction (Wunder Carpool), match professional drivers with passengers in 6-10 seater vans (Wunder Shuttle), or give travellers the option to rent vehicles (electric scooters, cars) by the minute (Wunder Fleet)”.

In recent months, transport companies as well as customers from the automotive industry in Japan, Europe and America have committed to using Wunder technology. The company is already processing around one million trips per month worldwide.

To that end, Froh describes Wunder Mobility’s typical B2C customers as the emerging middle class in mega cities such as Rio de Janeiro, Manila or Dehli.

“Many of these customers commute to work every day for several hours, are often first-time car owners and are open to sharing empty seats in their cars in order save on gas and car expenses,” he says.

On the B2B side, the startup’s customers are large OEMs, and public transit companies or suppliers, such as the Japanese conglomerate Marubeni. “We are working with Marubeni on ambitious new mobility services worldwide,” adds Froh.

Meanwhile, Wunder Mobility’s competitors are cited as Via in New York on the shuttle side. In Europe it perhaps competes most directly with Berlin’s Door2Door, and Vulog in Paris.

Powered by WPeMatico

Tizeti, the Nigerian internet service provider behind the brand Wifi.com.ng, has raised $3 million in a new round of funding as it expands its unlimited internet service into Ghana.

The new financing was led by 4DX Ventures, a new, Africa-focused fund that’s been deploying capital at an incredibly fast clip since its launch earlier this year. Its portfolio includes Sokowatch, a startup connecting local African retailers to international suppliers; the outsourced programmer placement and apprenticeship service, Andela; and the integrated pharmacy supplier and operator, mPharma.

For Walter Baddoo, one of 4DX Ventures co-founders and a new addition to the Tizeti board, the value in a company that operates as “the Comcast of Africa” was clear.

“If you take the efficiency of point to multipoint wireless technology and you add to that solar infrastructure, you leap-frog a generation of infrastructure. That makes getting cheap data to the hands of customers much easier,” Baddoo says.

Tizeti does exactly that. Using solar energy to power its wireless towers, the company provides residences, businesses, events and conferences with unlimited high-speed broadband internet access, which now covers more than 70 percent of Lagos. Since its launch from Y Combinator’s winter 2017 batch, the company has installed over 7,000 public Wi-Fi hotspots in Nigeria with 150,000 users.

Tizeti co-founders Ifeanyi Okonkwo and Kendall Ananyi

In November, the company partnered with Facebook to offer Express Wi-Fi and roll out hundreds of hotspots across the Nigerian capital of Abuja.

Now, with the new funding, Tizeti is expanding its operations outside of Nigeria, launching a new brand — Wifi.Africa — and pushing its service into Ghana.

“Tizeti was built to tackle poor internet connectivity not only in Nigeria, but on the continent as a whole, by developing a cost-effective solution from inception to delivery, for reliable and uncapped internet access for potentially millions of Africans,” said Kendall Ananyi, the co-founder and chief executive of Tizeti.

The company’s unlimited internet packages cost $30 per-month, a price it’s able to achieve through the use of cheap solar electricity to power its towers.

“Reducing the cost of data in Africa is a critical step in accelerating the pace of internet adoption across the continent,” Baddoo said in a statement. “Tizeti makes it easier and cheaper to connect Africa to the global digital economy and we are excited to partner with Kendall and his team on this mission.”

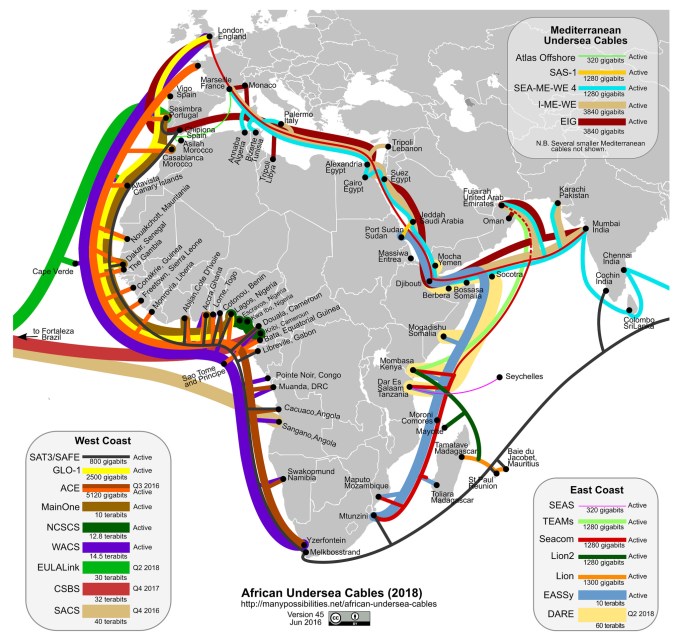

All of this is being powered by a network of new undersea cables stretching along the ocean floor that is bringing connectivity to the continent.

“There’s a ton of capacity going to 16 submarine cables [coming into Africa],” Ananyi told us back in 2017. “The problem is getting the internet to the customers. You have balloons and drones and that will work in the rural areas but it’s not effective in urban environments. We solve the internet problem in a dense area.”

It’s not a radical concept, and it’s one that has netted the company 3,000 subscribers already and nearly $1.2 million in annual recorded revenue in its first months of operations, Ananyi told us at the time.

“There are 1.2 billion people in Africa, but only 26 percent of them are online and most get internet over mobile phones,” says Ananyi. Perhaps only 6 percent of that population has an internet subscription, he said.

Photo courtesy of Flickr/Steve Song

Powered by WPeMatico

Apttus, a quote-to-cash vendor built on top of the Salesforce platform that looked to be heading toward an IPO in recent years has taken a different tack, instead being acquired by private equity firm Thoma Bravo today.

The company did not reveal the purchase price, but said it could be ready to share more details about the arrangement after the deal closes, probably next month. “What we can say is that Apttus views this development positively and believes Thoma Bravo can instill greater operational excellence, strengthen our market leadership and allow us to continue providing indispensable value to our customers,” a company spokesperson told TechCrunch.

They are describing this not as a full on acquisition, but as ‘taking a majority stake’. However you describe it, it probably wasn’t the ending the company envisioned after taking $404 million in investment since launching in 2006, one of the earliest startups to build a business on top of the Salesforce platform.

If the company believed that Salesforce would eventually buy it, that never happened. In fact, that dream probably went out the window when Salesforce bought SteelBrick, a similar company also built on Salesforce, at the end of 2015 for $360 million.

In spite of this, in an interview in 2016, CEO Kirk Krappe still was confident that an exit was coming, either by IPO or a possibly a Salesforce acquisition.

“We will be IPOing this year. That may be a function to figure what Salesforce wants to do and they may think about that [after purchasing SteelBrick at the end of last year]. There’s no reason they can’t buy us too. For me, I have to run the business, and we’re growing 100 percent year on year. If Salesforce came to the table, that would be great if the numbers work. If not, we have an amazingly strong business,” he said at the time.

That never came to pass of course, and the company tried to separate itself from Salesforce in April of 2016 when it released a version of Apttus that would work on Microsoft Dynamics. Krappe saw this as a way to show investors he wasn’t completely married to the Salesforce platform.

While Salesforce provided a system of record around the customer information and all that involved, once the salesperson actually closed in on a sale, that’s when software like Apttus came into play, allowing the company to generate a detailed proposal, a contract once the deal was agreed upon and finally collecting and recording the money from the sale.

Apttus took its last funding rounds in Sept 2017 for $55 million and later a debt financing round for another $75 million in February this year, according to data on Crunchbase.

Thoma Bravo has bought a number of enterprise software products over the years including Qlik, Sailpoint, Dynatrace, Solar Winds and others. Apttus should fit in well with that family of companies.

Powered by WPeMatico

It was May 2016 when Thomas Plantenga got the call.

He was living in New York and working on projects with Fabrice Grinda — the co-founder of classified juggernaut OLX and the founder of FJ Labs. Plantenga had worked with Grinda on expanding OLX and was ready for the next challenge — which came in the form of the used clothing marketplace, Vinted.

The invitation came from Insight Venture Partners and it was an offer to help work with one of their portfolio companies — a former high flyer that had fallen on hard times.

“They sold me on the story,” said Plantenga on a call from Vilnius, Lithuania, where he moved to take the reins at the used clothing startup.

“The business was completely burning down and I was hanging out with them,” said Plantenga. “In those five weeks I connected with both the co-founders and wrote a very aggressive plan of how to completely change things and really change the direction… I said ‘fuck it.’ If you’re going to be betting everything and everyone on this… let’s stick around.”

Plantenga proposed severe austerity measures for the used clothing exchange. The company shuttered its offices in San Francisco, London, Munich and Paris, and slashed headcount from 240 to 150 and automated the processes of content moderation.

There was a strategic shift in product development, as well. The company focused on trust and safety between buyers and sellers and concentrated on two core markets: Germany and France. And, as Milda Mitkute, the company’s co-founder, told Forbes in an article earlier this year, the company shifted from a mandatory sales fee to a free product with additional paid services (like promotional marketing on the platform for sellers). Between January and December 2017, Vinted processed $360 million in sales.

The turnaround not only saved the company but had investors come knocking at the door. Last week, Sprints Capital led the €50 million financing that also included Burda Media and Insight Venture Partners (along with Grinda’s FJ Labs).

“Insight and Accel had the investment written-off to zero and did not expect it to come back,” said Plantenga. What came next was the biggest investment round ever for a Lithuanian startup.

“We started this whole turnaround with something like $14 million in the bank account and we closed the round when we had $10 million of cash,” Plantenga said. Before the weekend the company saw $2 million in sales in a single day. “It was close to zero a little more than two years ago,” said Plantenga.

As a sign of the faith the company has in management, Plantenga said that even though the ownership stake of the founders and executive team has fallen below 50 percent, they still maintain control over the company and the board.

Used clothes may not sound like much of a business, but in Europe, Vinted thinks that roughly $500 billion worth of clothing changes hands across the continent every year.

With so much money on the table, it’s little wonder that Vinted has attracted competition. Companies like Depop, which raised $20 million in January to pursue its own expansion plans for global domination of the used clothing market, are putting their own spin on the marketplace for used clothes.

And the two companies have very different approaches to their market.

“Depop is very smart in branding and positioning themselves as a cool brand that sells cool clothing,” said Plantenga. “And we’re just selling everybody’s clothes. We don’t care whether it’s cool. We just want people to sell their clothes.”

But both companies are on the edge of what Plantenga sees as a massive shift in consumer behavior.

“If we see the super trends of people wanting not to waste and being careful of how they pressure the environment, and all these super trends are becoming a thing,” said Plantenga. “We are hooking in on those super trends. I came from the classified space where you build a horizontal and you monetize cars and real estate, and fashion was a thing that was kind of nice to have. I stuck around because of my own belief that this is something really big.”

Powered by WPeMatico

CRISPR, the gene-editing system that could one day change the course of humanity still has a long way to go before we seriously alter anything but it’s not too far-fetched to say it could happen. What’s real and what’s not and just how close are we to radically changing our food supply, medicine and life as we know it as human beings? We’re going to get into all that with Trevor Martin, the co-founder of Mammoth Biosciences and Rachel Haurwitz, the co-founder of Caribou bioscience this week at Disrupt SF 2018.

Trevor Martin is building what he refers to as the biological search engine for CRISPR through his company Mammoth Biosciences. That means using a guide RNA to direct a CRISPR protein to search for any specific DNA or RNA sequence and it could be used to shape the future of bio research. Martin holds a PhD in Biology from Stanford University and received his undergraduate education in biology from Princeton.

Rachel Haurwitz earned her undergraduate degree from Harvard and holds a Ph.D. in molecular and cell biology from the University of California, Berkeley. She is the CEO and president of gene editing company Caribou Biosciences, which she co-founded with CRISPR co-inventor Jennifer Doudna. Haurwitz also owns several patents covering multiple CRISPR-based technologies.

We’ll be chatting with both of these fascinating people on stage this Thursday at the Moscone Center in downtown San Francisco about CRISPR and the future of gene editing.

Disrupt SF will take place in San Francisco’s Moscone Center West from September 5 to 7. The full agenda is here, and you can still buy tickets right here.

Powered by WPeMatico