TC

Auto Added by WPeMatico

Auto Added by WPeMatico

For years, marketers have been trying to optimize the online shopping experience to better understand their customers and deliver more customized interactions that ultimately drive more sales. Artificial intelligence was supposed to accelerate that, and today Adobe announced enhancements to Adobe Target and Adobe Experience Manager that attempt to deliver at least partly on that promise.

Adobe has been trying to lift the enterprise side of its business for some time, and even though they are well on their way to becoming a $10 billion company, the potential for even more revenue from the enterprise side of the business remains tantalizing. They are counting on AI to help push that along.

Adobe’s Loni Stark says companies are looking for more sophisticated solutions around customization and optimization. Part of that involves using Adobe’s intelligence layer, which they call Sensei, to help marketers as they tweak these programs to drive better experiences.

For starters, the company wants to help users choose the best algorithms for any given set of tasks. Adobe is bringing AI in to assist with a tool it released last year called Auto-Target. “One of the challenges marketers face has been which algorithms do you use, and how do you map them to your personalization strategy. We are enabling Adobe Sensei to choose the best algorithm for them.” She says giving them a smart assistant to help choose should make this task much less daunting for marketers.

Adobe is also bringing some smarts to layout design with a new tool called Smart Layouts, first introduced in March at Adobe Summit. The idea here is to deliver the right layout at any given time to allow marketing teams to scale personalization and increase the likelihood of action, which in marketing speak means buying something.

Once again the company is letting AI guide the process to generate different layouts automatically for different segments, depending on visitor behavior at any given moment. That means a retailer should be able to deliver ever more granular pages based on what it knows about visitors as they move through the shopping process. The more customized the experience, the more likely the shopper turns into a buyer.

Adobe is also looking at new delivery channels, particularly voice, as devices like the Amazon Alexa become increasingly popular. As with the web, mobile, print and other delivery approaches, marketers need to be able apply basic tasks like A/B testing on different voices or workflows, and the company is building these into their tools.

All of these new features are part of Adobe’s ongoing attempt to streamline its marketing tools to make life easier for its customers. By using artificial intelligence to help guide the workflow, they hope to drive more revenue from the digital experience side of the house. While these tools should help, Adobe still makes the vast majority of its money from Creative Cloud. The Digital segment still lags at $586 million (up 18 percent YoY) out of total quarterly revenue of 2.20 billion in the most recent report in June.

The company spent a hefty $1.68 billion in May to snag Magento. They are due to report their next quarterly report on September 18th, and it will be interesting to see if the Magento acquisition and increasing use of artificial intelligence can help continue to grow this side of the business.

Powered by WPeMatico

In what looks like an undeniably good strategic fit, U.K.-based business reporting software startup Supdate has been acquired by equity crowdfunding platform Crowdcube. Terms of the deal remain undisclosed, although I’m told it was an all-cash acquisition.

I understand that Crowdcube is essentially buying the Supdate user base and tech/IP, and that Supdate founder Duane Jackson is not joining Crowdcube but will be helping on the technical side during the handover. The idea is that Supdate will become part of part of the existing suite of “post-funding benefits” available to businesses that raise on Crowdcube, such as access to Amazon’s Launchpad Programme.

Founded out of Jackson’s own frustration as an angel investor, whereby startups he’d backed didn’t always keep him updated regularly, Supdate offers SaaS for businesses to create and share company news and metrics with shareholders. The premise was that well-designed software could help streamline and to some degree automate these updates, helping investors stay in the loop without a founder using up too much bandwidth writing reports.

Jackson — who previously founded and sold online accounting software company KashFlow — says that partnering with a crowdfunding platform was “an obvious route to market” for Supdate, which is why he approached Crowdcube. Those conversations quickly progressed to the possibility of Crowdcube acquiring Supdate. The timing was good, too, since Jackson has already begun working on a new venture in the accounting space. Here we go again, you might well say.

Adds Darren Westlake, co-founder and CEO of Crowdcube: “Crowdcube has funded over 600 companies, averaging 350 investors each and so ensuring businesses can easily connect with their shareholders to keep them updated is really valuable to our investor community. We’ve been fans of Supdate for a long time, and when we recently began talking with Duane in more detail, it quickly became obvious that Supdate would be a natural fit for Crowdcube and our growing Funded Club”.

Meanwhile, Crowdcube is giving its alumni of over 600 funded businesses access to Supdate, as well as providing ongoing access to Supdate’s existing customer base.

Powered by WPeMatico

OneDegree, a Hong Kong-based insurance technology startup, announced today that it has closed a Series A totaling HKD $200 million (about $25.5 million). Half of that amount was pledged by investors to OneDegree pending regulatory approval through the Hong Kong Insurance Authority’s new fast-track licensing program for online-only insurers. The company, which participated in Cyberport, the Hong Kong government’s startup incubator, claims this is the largest ever fundraising round for a pre-revenue insurance tech startup in Hong Kong.

OneDegree is currently not disclosing its list of investors because its new shareholders are being vetted by the Insurance Authority, founder and CEO Alvin Kwock tells TechCrunch, but it includes institutional investors and family offices. The South China Morning Post reports that speculation among brokers peg Tencent and Alibaba as probable backers.

OneDegree has developed an online insurance platform that lets consumers purchase personal lines and health insurance products without needing to consult with an agent. Instead, they find and buy policies through an app that is connected to a backend that automates claims processing, policy management and customer service.

The startup will initially sell medical insurance plans for pets. While there are more than 500,000 pet dogs and cats in Hong Kong, only about 2% to 3% are covered by insurance, compared to 42% in the United Kingdom, says OneDegree. The startup blames this on ineffective distribution, since pet insurance has relatively low premiums and is therefore overlooked by insurance agents, even though the number of pet dogs and cats in Hong Kong is increasing at an average annual growth rate of 3.5% and their owners are a relatively affluent demographic.

OneDegree plans to use its Series A to on tech development, launching new products and marketing. The funding will also serve as risk capital once it launches its insurance business.

In a press statement, Cyberport chairman George Lam said “As a key driver of digital technology development in Hong Kong, we are definitely excited to see local fintech start-ups like OneDegree successfully securing recognition from renowned institutional investors and attracting sizable funding that will enable faster growth.”

Powered by WPeMatico

Perlego, which has been dubbed the ‘Spotify for textbooks,’ has closed $4.8 million in finding. Leading the round is ADV, with participation from existing angel investors, including Simon Franks (co-founder of Lovefilm), Alex Chesterman (founder of Zoopla), and Peter Hinssen.

Founded by Gauthier Van Malderen and Matthew Davis, Perlego provides students and professionals unlimited access to hundreds of thousands of academic and professional eBook titles for £12 a month.

To be able to do this, it works with 650 publishers, including big names like Oxford University Press, Princeton University Press, Macmillan Higher Education, and Cengage Learning. Publishers receive 65 percent of each subscription on a consumption basis.

“Textbook prices have increased more than fifteen-fold since 1970, or three times the rate of inflation,” Perlego co-founder and CEO Van Malderen tells TechCrunch. “In the U.K., the average university student spends £439 a year on textbooks. This is only exacerbating the cost of higher education and the debt burden on students, which is set to rise again this year in the U.K.”.

In turn, Perlego says it helps publishers monetise their content to a large segment of price-sensitive students that would otherwise buy their books from the used-books market or download pirated copies. It also supplies publishers with detailed data on the consumption of titles.

“We are true subscription model,” adds Van Malderen. “For £12 per month you get unlimited access to the best textbooks. We do not operate a complex leasing model and publishers benefit [through] data collection, reduced piracy, no cannibalization from second-hand print sales”.

Meanwhile, Perlego says it will use the new funding to grow the team and support the company’s growth across the U.K. and Europe. It will also further invest in developing its product for students and professionals.

In addition, Perlego has joined Founders Factory this month as part of its edtech accelerator programme, which is backed by Holtzbrinck Macmillan one of the world’s leading academic publishers.

Powered by WPeMatico

“Unmortgage enables everyone to live in the home they want to, that’s our mission,” Unmortgage co-founder and CEO Ray Rafiq-Omar tells me. “We do that by allowing people to buy as little as five percent of a home and rent the rest. So there’s no mortgage involved, hence the name Unmortgage”.

The burgeoning London startup, which aims to launch next year having just closed a hefty £10 million seed round, calls its model “part-own, part-rent”. However, unlike traditional shared ownership schemes, Unmortgage doesn’t want you to have to take out a mortgage to buy the first portion of your own, and it isn’t targeting new-builds.

Like a number of other fintech/proptech companies, such as Strideup and Proportunity, it is the latest attempt to solve the increasing difficulty first time buyers face trying to get on the housing ladder as rising house prices typically outstrip wages. If people rent, they often cannot save the large deposit required for a mortgage. It is this “vicious circle” that Unmortgage want to break: by helping families that can afford to rent gradually buy a home.

“The way we like to think about it is the security of home ownership with the flexibility of renting,” says Rafiq-Omar. “You find a home. If we like it too, we’ll but it together in partnership. You’ll own your bit and you’ll pay rent on our bit. Then you have the option to buy more of your home from as little as a pound at any time”.

To keeps things fair — Rafiq-Omar stresses that fairness is “our core value” — Unmortgage will revalue the property on a monthly basis so you’ll always have an up-to-date valuation when increasing your stake. And at any point you are free to either buy out Unmortgage with a mortgage or an inheritance or to give the company three month’s notice for it to buy you out so you can take your cash at market price and move on to your next home.

Likewise, the rent you pay on the part of the property you don’t own is pegged to rises to inflation. But in case inflation outpaces market rate rents, Rafiq-Omar says Unmortgage will allow the customer to ask for a rent review. “They have the ability to not have to worry about their rent but if they are worried they can have it reviewed,” he says.

Unmortgage will use institutional funding to finance its part of the homes it purchases, who Rafiq-Omar says would like to own residential property, and the secure income stream it brings, but don’t want to be landlords or end up in the media for behaving like a landlord. “Unmortgage gives them a way to invest in residential property while solving societal need, which is [that] people want to own their own homes and have security over their housing situation”.

Meanwhile, investors in Unmortgage’s seed round are fintech venture capital firms Anthemis Exponential Ventures, and Augmentum Fintech plc. “”We’re grateful to our investors for believing in us and our social mission and excited to be working with them – especially Tee Pruitt [of Anthemis], who was instrumental through much of this process,” adds Rafiq-Omar.

Powered by WPeMatico

Brian Armstrong, the CEO of cryptocurrency trading platform Coinbase, wants to take his company public — maybe on the blockchain.

Onstage at TechCrunch Disrupt SF 2018, Armstrong dished on his ambitions for the future of Coinbase.

“We are self-sustaining,” Armstrong said. “You know, we’ve been profitable for quite a while. We don’t have any plans to raise additional capital at this point, but never say never … Someday I’d love to run a public company.”

Armstrong didn’t rule out going public on the blockchain. He said he’s even considered going public on his own platform.

“I think it would be very on mission for us to do that because, of course, we are creating an open financial system,” he said. “Companies could list their stock, which are really tokens, and instead of a cap table, you tokenize the cap table. But I don’t have any decisions on that to share at the moment.”

An innovative exit would be very on-brand for Coinbase. As one of the earliest players in crypto-mania, the company has certainly had to make things up as it goes. It’s worked, as Armstrong said; the company is profitable and was the first-ever cryptocurrency startup to garner a billion-dollar valuation.

Founded in 2012, Coinbase is backed by IVP, Spark Capital, Greylock Partners, Battery Ventures, Section 32, Draper Associates and more. The company was valued at $1.6 billion in August 2017 with a $100 million Series D last year. The financing was reportedly the largest-ever for a crypto startup.

Watch the full interview with Brian Armstrong below.

Powered by WPeMatico

Branch, the deep-linking startup backed by Andy Rubin’s Playground Ventures, will enter the unicorn club with an upcoming funding round.

Branch, the deep-linking startup backed by Andy Rubin’s Playground Ventures, will enter the unicorn club with an upcoming funding round.

The four-year-old company, which helps brands create links between websites and mobile apps, has authorized the sale of $129 million in Series D shares, according to sources and confirmed by PitchBook, which tracks venture capital deals. The infusion of capital values the company at roughly $1 billion.

In an e-mail this morning, Branch CEO Alex Austin declined to comment.

The Redwood City-based startup closed a $60 million Series C led by Playground in April 2017, bringing its total equity raised to $113 million. It’s also backed by NEA, Pear Ventures, Cowboy Ventures and Madrona Ventures. Rubin, for his part, is a co-founder of Android, as well as the founder of Essential, a smartphone company that, though highly valued, has had less success.

Branch’s deep-linking platform helps brands drive app growth, conversions, user engagement and retention.

Deep links are links that take you to a specific piece of web content, rather than a website’s homepage. This, for example, is a deep link. This is not.

Deep links are used to connect web or e-mail content with apps. That way, when you’re doing some online shopping using your phone and you click on a link to an item on Jet.com, you’re taken to the Jet app installed on your phone, instead of Jet’s desktop site, which would provide a much poorer mobile experience.

Branch supports 40,000 apps with roughly 3 billion monthly users. The company counts Airbnb, Amazon, Bing, Pinterest, Reddit, Slack, Tinder and several others as customers.

Following its previous round of venture capital funding, Austin told TechCrunch that the company had seen “tremendous growth” ahead of the raise.

“[We] have been fortunate enough to become the clear market leader,” he said. “There’s so much more we can accomplish in deep linking and this money will be used to fund Branch’s continued platform growth.”

Powered by WPeMatico

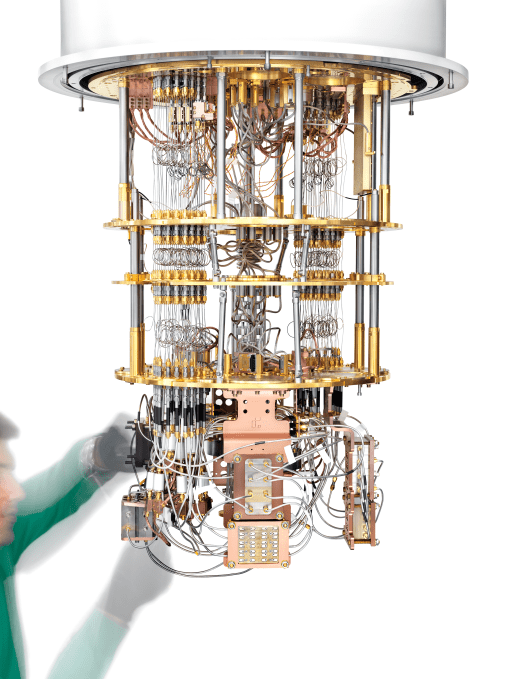

Rigetti, a quantum computing startup that is challenging the likes of IBM, Microsoft and Google in this nascent space, today at our TechCrunch Disrupt SF 2018 event announced the launch of its new hybrid quantum computing platform.

While Rigetti already offered API access to its quantum computing platform, this new service, dubbed Quantum Cloud Services (QCS), offers a combination of a cloud-based classical computer, its Forest development platform and access to Rigetti’s quantum backends. Thanks to this, developers will be able to write and test their algorithms significantly faster than with the company’s previous approach.

In addition to the new platform, which is now in private testing, Rigetti also announced a $1 million prize for the first team that manages to show quantum advantage on this hybrid platform. Quantum advantage, at least according to Rigetti’s definition, is the milestone where a quantum system will be able to solve a real problem that is beyond the reach of classical computers. The company plans to announce more details around this prize at the end of October.

In addition to the new platform, which is now in private testing, Rigetti also announced a $1 million prize for the first team that manages to show quantum advantage on this hybrid platform. Quantum advantage, at least according to Rigetti’s definition, is the milestone where a quantum system will be able to solve a real problem that is beyond the reach of classical computers. The company plans to announce more details around this prize at the end of October.

As Rigetti founder and CEO Chad Rigetti told me, the reason the hybrid approach is faster is simply because the two systems are closely integrated — and you will likely always need a classical computer in parallel with a quantum computer for solving virtually any problem. And the company expects that this hybrid approach — and likely the 128-qubit machine that Rigetti plans to launch next year — will allow for running an algorithm that demonstrates quantum advantage. The current API Rigetti makes available to developers features 8-qubit and 19-qubit machines. Those machines are nowhere near powerful enough to show quantum advantage, but they do give developers the ability to start experimenting with using quantum computers.

On the old platform, Rigetti also noted, the kind of loops you need to run to use the quantum machine for machine learning, for example, had a latency on the order of a second or more. “A lot of these algorithms require thousands and tens of thousands of iterations,” Rigetti said. “And now we have reduced this down to the order of milliseconds.”

Rigetti also today announced that it is partnering with a number of leading quantum computing startups (the kind that work on the software, not the hardware side of this ecosystem). These startups, including Entropica Labs, Horizon Quantum Computing, OTI Lumionics, ProteinQure, QC Ware and Riverlane Research, will build and distribute the applications through the Rigetti QCS platform.

Powered by WPeMatico

The music business is littered with stories about songwriters or studio contributors and session musicians who never get the credit — or money — they’re often due for their work on hit songs.

And for every storied session musician in “The Wrecking Crew” there are perhaps hundreds of other contributors who aren’t getting their just desserts.

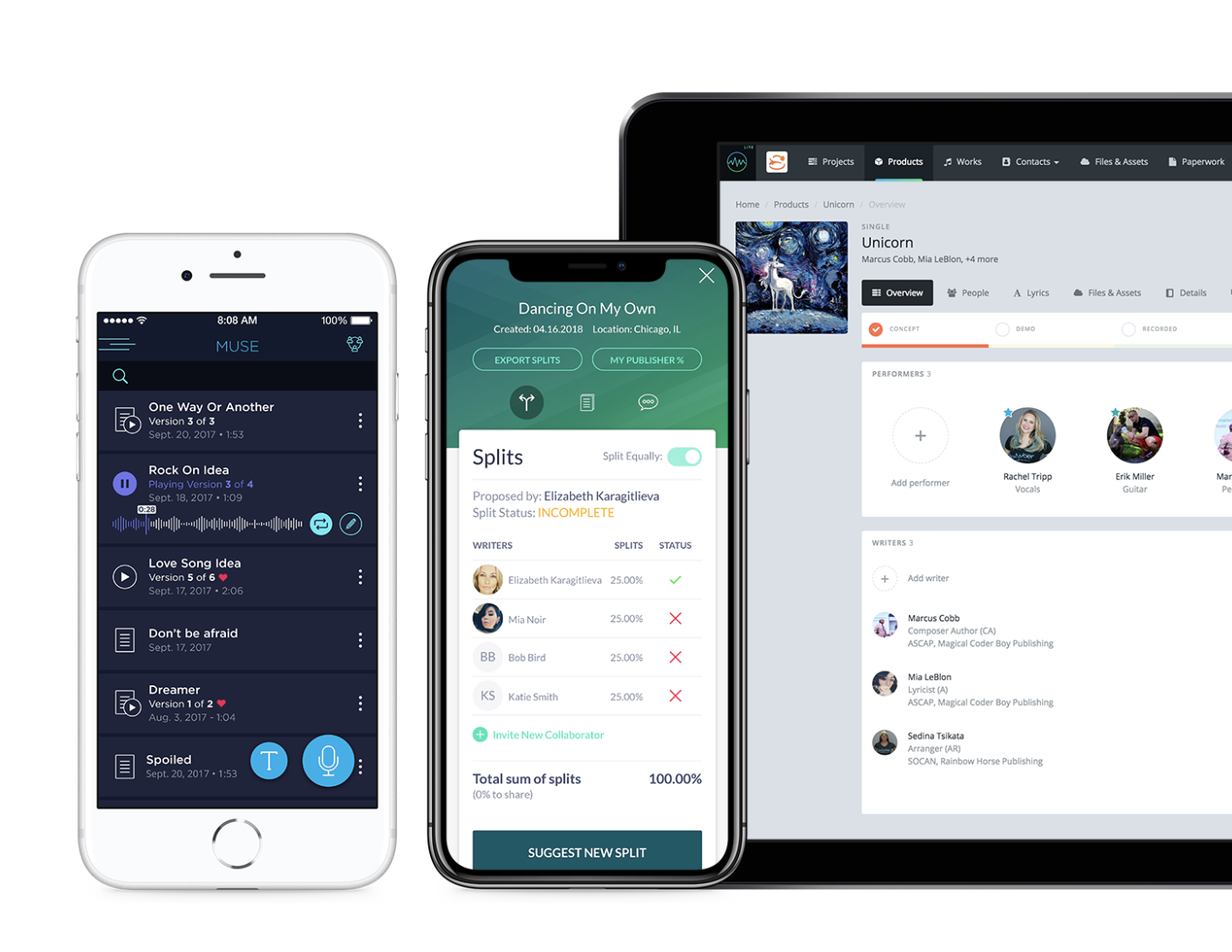

That’s where Jammber comes in. The five-year-old company co-founded by serial entrepreneur Marcus Cobb has developed a suite of tools to manage everything from songwriting credits and rights management to ticketing and touring all from a group of apps on a mobile phone. And has just raised $2.4 million in funding to take those tools to a broader market.

Jammber “Muse” gives collaborators a single platform to exchange lyrics and song ideas, while the company’s “Splits” app tracks ownership and credits of any eventual product from a collaboration. The company’s nStudio tracks songwriting credits to assist with chart and Grammy submission — through a partnership with Nielsen Music — and its “PinPoint” helps organize touring. The recording applications even have a presence feature so session musicians, songwriters and artists can actually be tagged in the studio while they’re working.

“I think we need to get attribution and monetization closer to the creators,” Cobb has said. “Why aren’t we doing that? The industry is growing and thriving. Are we making sure that performers and creators of all different tiers are being equally compensated?”

The answer, sadly, for many in the music industry is no. In fact, while Cobb had originally set out to make a networking tool for creatives with Jammber he wound up shifting the service to the management toolkit after visiting the offices of a music label.

Jammber chief executive Marcus Cobb

“I saw stacks and stacks of payroll checks that were returned to sender,” Cobb, told Crain’s Chicago Business. “These checks were taking three months to two years to print, and they were wrong addresses, or there were stage names instead of legal names.”

That experience convinced Cobb of the demand, but it was Nashville that gave the serial entrepreneur the crucible within which to develop the full suite of tools that now make up Jammber’s soup-to-nuts platform.

Cobb likes to say that Jammber was conceived in Chicago (where the company spun up from the city’s massively influential 1871 entrepreneurship center) and born in Nashville — the home of the multi-billion-dollar American country music industry. All of the tools in Jammber, Cobb says, were created with input from a local musician, producer, artist and repertoire person or a label executive.

In 2015, the company came down to Nashville as part of the first batch of companies in Project Music, a joint venture between the Country Music Association and the Nashville Entrepreneur Center meant to encourage the development of technology for the music industry.

For the 41-year-old Cobb, programming and entrepreneurship has literally been a life saver. Growing up in Texas and Nevada with an abusive, drug-addicted stepfather took a toll on Cobb and programming became an outlet — thanks to a particularly well-equipped computer lab at his high school. “I had moved 24 times,” Cobb said in an interview. “My stepfather was a full-blown crack addict. He would disappear with money; we got evicted a lot.”

But the experience with computers led to an early job out of high school, which launched Cobb’s tech career. He sold his first company, Eido Software in 2007 a year after launching it and has used that money to pursue other endeavors.

And while Cobb is a gifted programmer, that’s not his only interest. His next big foray into business was as the owner and lead designer of Marc Wayne Intimates, a boutique lingerie company that also provided the business-savvy Cobb with his first window into the music business — outfitting dancers in music videos for artists like Pitbull.

Cobb has invested $300,000 of his own money into Jammber and raised roughly $400,000 in early seed funding. The $2.3 million that the company raised in its most recent round came from a who’s who of music executives, including former Sony Nashville chief executive Joe Galante; Hootie and the Blowfish manager Clarence Spalding; and Kings of Leon manager Ken Levitan.

These investors know the tension at the heart of the music business better than anyone, Cobb says — which is that the creative act of making music can often be at odds with the mundanity of organizing and running an effective business to ensure that the music getting made is actually heard by an audience that then pays the musician for their work.

“The irony about making a living in a copyright industry like the music industry is you have to be very organized to make money in a timely manner or even get credit for your work,” said Cobb. “Over 40 percent of the money creators are owed is tied up by bad or wrong data because it’s very difficult to be organized while you create. These tools finally change that.”

Jammber’s services are currently in a closed, invite-only beta that will be capped at 10,000 users. There’s a basic set of services that will be available for free, with pricing for “unlimited” access to the toolkit starting at $10 per month. In addition to the applications, the company also has an online platform that integrates with the mobile suite. Pricing for that service starts at $25 per month.

“This is an ecosystem play for us. I’ve been in software for a long time and the realization for me is that it’s not just mobile-first or cloud-first anymore, it’s simplicity-first. Independent artists and record labels generated $5.2 billion in revenues last year and the sector continues to grow — all while largely using paper and spreadsheets for their back office tools,” said Cobb. “This is a massive, underserved market and we believe we’ve figured out how to provide the value they’ve been waiting for.”

Powered by WPeMatico

Knowing what’s going on in your warehouses and facilities is of course critical to many industries, but regular inspections take time, money, and personnel. Why not use drones? Vtrus uses computer vision to let a compact drone not just safely navigate indoor environments but create detailed 3D maps of them for inspectors and workers to consult, autonomously and in real time.

Vtrus showed off its hardware platform — currently a prototype — and its proprietary SLAM (simultaneous location and mapping) software at TechCrunch Disrupt SF as a Startup Battlefield Wildcard company.

There are already some drone-based services for the likes of security and exterior imaging, but Vtrus CTO Jonathan Lenoff told me that those are only practical because they operate with a large margin for error. If you’re searching for open doors or intruders beyond the fence, it doesn’t matter if you’re at 25 feet up or 26. But inside a warehouse or production line every inch counts and imaging has to be carried out at a much finer scale.

As a result, dangerous and tedious inspections, such as checking the wiring on lighting or looking for rust under an elevated walkway, have to be done by people. Vtrus wouldn’t put those people out of work, but it might take them out of danger.

The drone, called the ABI Zero for now, is equipped with a suite of sensors, from ordinary RGB cameras to 360 ones and a structured-light depth sensor. As soon as it takes off, it begins mapping its environment in great detail: it takes in 300,000 depth points 30 times per second, combining that with its other cameras to produce a detailed map of its surroundings.

It uses this information to get around, of course, but the data is also streamed over wi-fi in real time to the base station and Vtrus’s own cloud service, through which operators and inspectors can access it.

The SLAM technique they use was developed in-house; CEO Renato Moreno built and sold a company (to Facebook/Oculus) using some of the principles, but improvements to imaging and processing power have made it possible to do it faster and in greater detail than before. Not to mention on a drone that’s flying around an indoor space full of people and valuable inventory.

On a full charge, ABI can fly for about 10 minutes. That doesn’t sound very impressive, but the important thing isn’t staying aloft for a long time — few drones can do that to begin with — but how quickly it can get back up there. That’s where the special docking and charging mechanism comes in.

The Vtrus drone lives on and returns to a little box, which when a tapped-out craft touches down, sets off a patented high-speed charging process. It’s contact-based, not wireless, and happens automatically. The drone can then get back in the air perhaps half an hour or so later, meaning the craft can actually be in the air for as much as six hours a day total.

Probably anyone who has had to inspect or maintain any kind of building or space bigger than a studio apartment can see the value in getting frequent, high-precision updates on everything in that space, from storage shelving to heavy machinery. You’d put in an ABI for every X square feet depending on what you need it to do; they can access each other’s data and combine it as well.

This frequency and the detail which which the drone can inspect and navigate means maintenance can become proactive rather than reactive — you see rust on a pipe or a hot spot on a machine during the drone’s hourly pass rather than days later when the part fails. And if you don’t have an expert on site, the full 3D map and even manual drone control can be handed over to your HVAC guy or union rep.

You can see lots more examples of ABI in action at the Vtrus website. Way too many to embed here.

Lenoff, Moreno, and third co-founder Carlos Sanchez, who brings the industrial expertise to the mix, explained that their secret sauce is really the software — the drone itself is pretty much off the shelf stuff right now, tweaked to their requirements. (The base is an original creation, of course.)

But the software is all custom built to handle not just high-resolution 3D mapping in real time but the means to stream and record it as well. They’ve hired experts to build those systems as well — the 6-person team already sounds like a powerhouse.

The whole operation is self-funded right now, and the team is seeking investment. But that doesn’t mean they’re idle: they’re working with major companies already and operating a “pilotless” program (get it?). The team has been traveling the country visiting facilities, showing how the system works, and collecting feedback and requests. It’s hard to imagine they won’t have big clients soon.

Powered by WPeMatico