TC

Auto Added by WPeMatico

Auto Added by WPeMatico

MotoRefi has raised another $45 million in a round led by Goldman Sachs just five months after investors poured $10 million into the fintech startup to help turbocharge its auto refinancing business.

The startup developed an auto refinancing platform that handles the entire loan process, including finding the best rates, paying off the old lender and re-titling the vehicle. MotoRefi says using its platform saves consumers an average of $100 a month on their car payments, a goal achieved partly because it works directly with lending institutions. The company’s refinancing tools had seen steady growth until the COVID-19 pandemic popped into in higher gear. CEO Kevin Bennett said MotoRefi is on track to issue $1 billion in loans by the end of the year, a fivefold increase from the same period last year.

Bennett said the short timeline between rounds was driven by investor confidence in its metrics, which have continued on to grow at a fast pace, and the basic economics around the business.

“We candidly weren’t planning on raising yet, but they (Goldman Sachs) were comfortable given the relationship we have built and the track record and success of the business, to preempt the round and move that calendar up,” Bennett said.

MotoRefi’s platform is available in 46 states and Washington, DC, with plans to be live in all 50 states by the end of the year. The startup has ramped up hiring to help support that growth. By the first quarter of 2021, it had more than doubled its headcount to 187 employees from the same period last year. Its workforce has now popped to 250 employees. The company has hired several senior-level executives, opened a new headquarters and partnered with SoFi. Goldman Sach’s VP of venture capital and growth equity Jade Mandel has joined MotoRefi’s board.

And Bennett sees plenty of room to grow as consumers seek ways to rebalance their debts. The auto refinance market in the United States is $40 billion. However, overall auto loan debt is $1.3 trillion. With 40 million auto loans originated every year, MotoRefi is promised a consistent flow of potential new customers.

The fresh injection of capital, which included investor IA Capital as well as returning backers Moderne Ventures, Accomplice, Link Ventures, Motley Fool Ventures and CMFG Ventures, will be used to continue to build out its products and services and hire more people. MotoRefi has raised $60 million since its inception in 2016.

Bennett believes the company is now in self-sustaining position.

“Thankfully, we moved beyond the world where we are raising capital and then raising more capital as we run out of capital,” he said. “I think we have a great sustainable business and so we, in some sense runway is infinite, and we are building a great profitable business. That’s not to say that we won’t ever raise again, but it will be based on strategic considerations, as opposed to out of necessity.”

Powered by WPeMatico

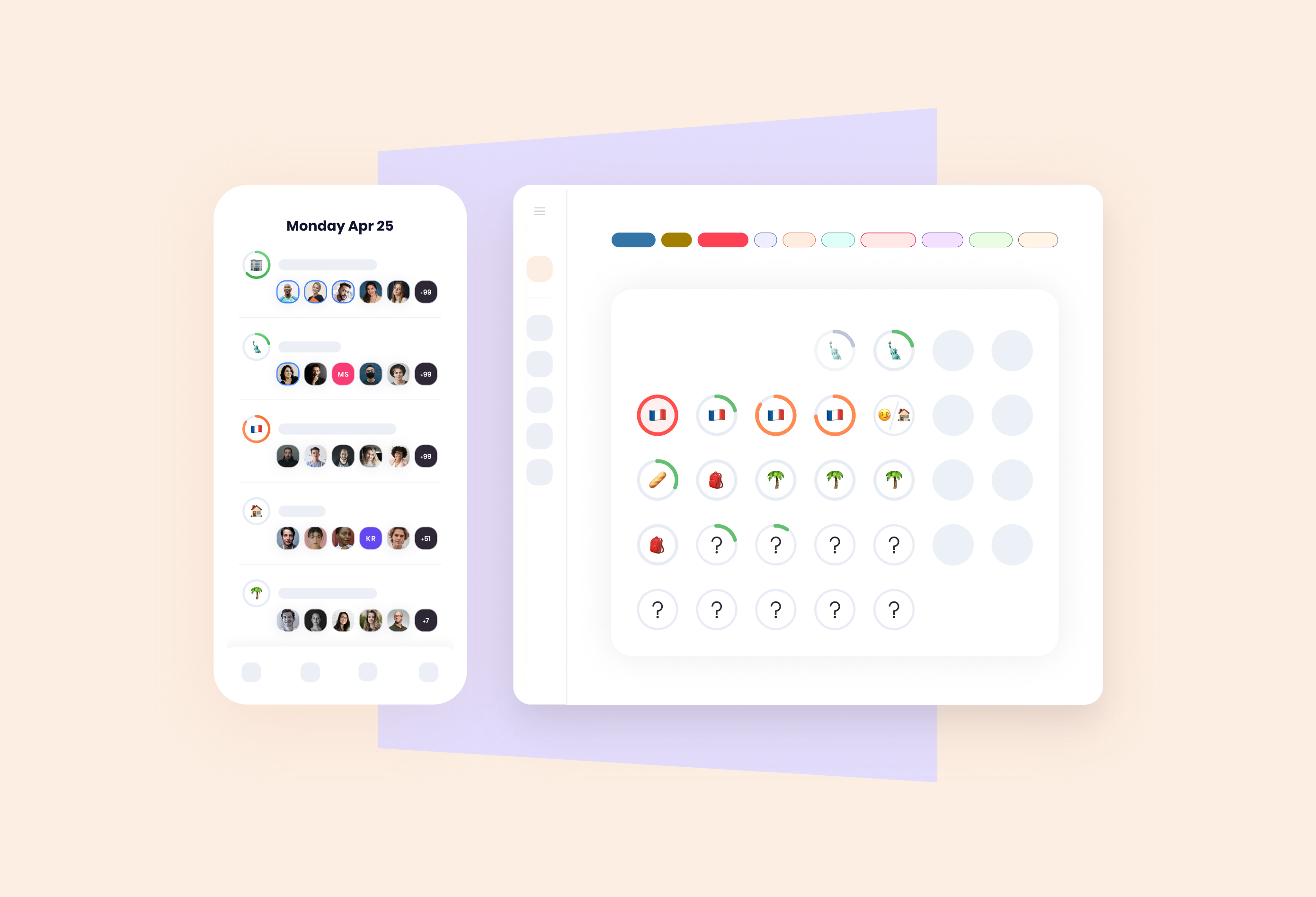

Meet Café, a new French startup founded by two brothers that wants to help companies switch to a hybrid remote-and-office workplace model. Café isn’t a traditional desk-booking tool. Instead, the company helps you see when people in your team are coming to the office so that you can plan when you should go to the office as well.

Instead of focusing on workspace, Café focuses on people first. “We decided that we wouldn’t let you book a desk directly,” co-founder and CTO Arthur Lorotte de Banes told me.

When you open the app, you get a simplified calendar view. For each day, you can see your team members divided by groups — people coming to the office, people working from home, etc.

In just a few taps, you can tell your other co-workers what you plan to do. This way, it becomes much easier to schedule meetings, have in-person conversation and more generally hang out with your co-workers. It also makes it easier to find a common day with a specific co-worker if you’re working on the same project.

“We interviewed 150 companies and we realized companies faced the same issue after interviewing the first five companies. They all use spreadsheets,” co-founder and CEO Tom Nguyen told me.

Image Credits: Café

Using a tool like Café also gives you insights about your office. For instance, you can see the average number of persons in your office depending on the day of the week or the day of the month. Admins can configure a weekly reminder to make sure that everybody fills out information.

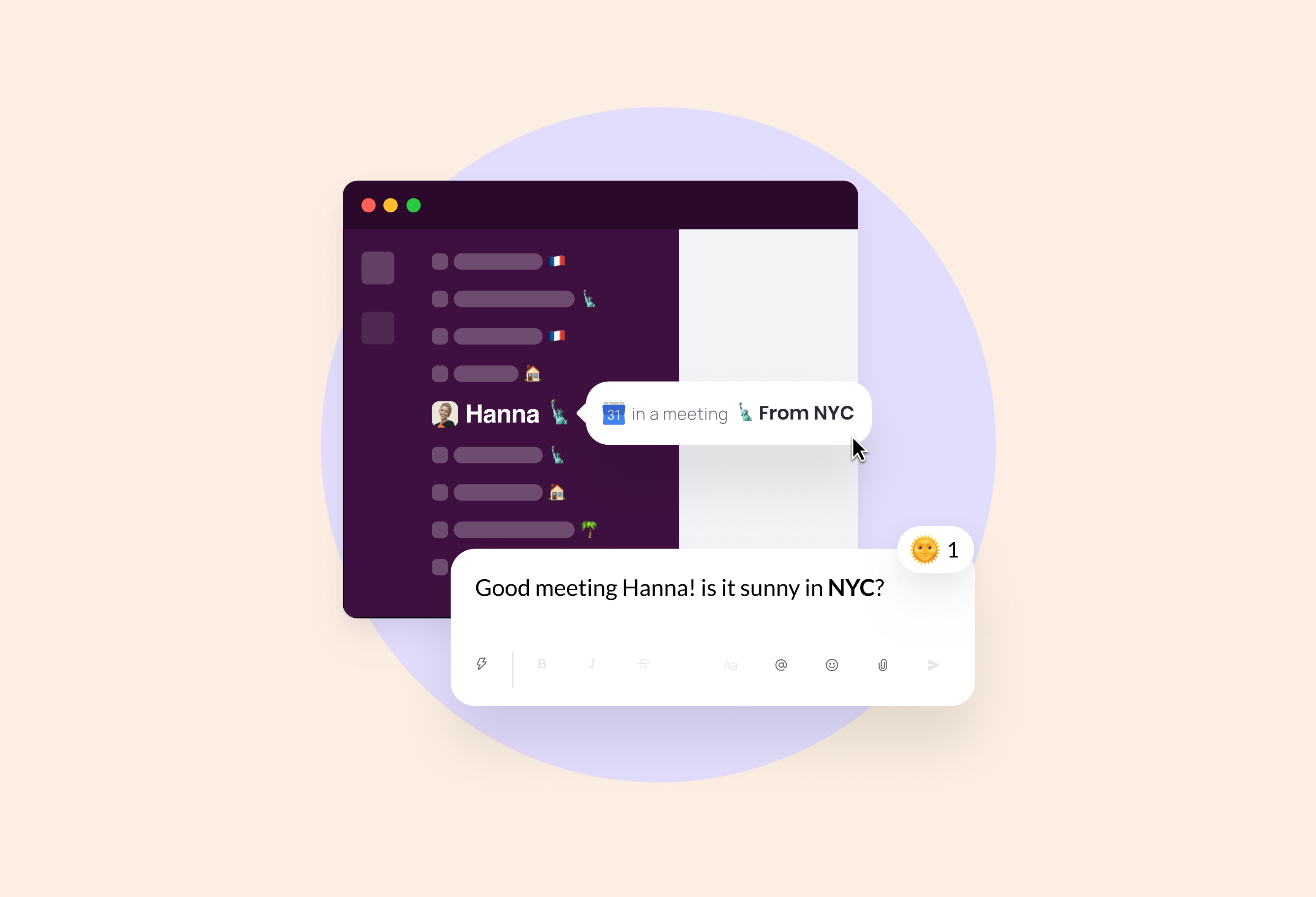

In addition to its mobile app and web app, Café integrates with your existing tools. For instance, you can connect your Café account with Slack so that your status on Slack reflects your status in Café. Teammates can hover over your name to know that you’re in the office or you’re at home.

The company is also working on integrations with human resource information systems, such as PayFit, so that your vacation is automatically synchronized with Café.

Image Credits: Café

As companies start hashing out a plan to return to the office, Café arrives on the market at the right time. Companies can create custom statuses to fit their specific needs. For instance, a Café customer has created a status so that they know who has the office keys to make sure that the office remains open.

The company raised a $1 million seed round from 122West, Kima Ventures, Jonathan Widawski, Guillaume Lestrade, Jacques-Edouard Sabatier and various business angels who work or have worked for WeWork, Dropbox, Github, Snapchat, Intercom, Stripe, Alan and PayFit.

Like Typeform, Doodle or Slido, Café has chosen a freemium strategy. Teams can sign up for free and start using the product with their immediate co-workers. You don’t need to enter card information to sign up.

If you want to roll it out across the organization with more users, you have to start paying — existing clients include Livestorm, Jellysmack and Yubo. The startup believes employees will become product advocates for the entire organization. And it seems like the right strategy for a product that is supposed to make employees happier at work.

Powered by WPeMatico

As startups and venture capital grow in tandem, fundraising has gone from a formal affair on Sand Hill Road to a process that can happen anywhere from Twitter to Zoom.

While fundraising may no longer require a trip to California, it might depend on whether you got an invite to a private audio app. And while you may not need to be an insider, second-time founders — largely male and white — still have a competitive advantage.

If your intention is to build a company that you want to own and run indefinitely, and/or to grow more slowly and take fewer risks, traditional venture capital is not right for what you want to build.

The growing complexity of fundraising has the opportunity to make tech either inclusive or exclusive. For new founders looking to raise money, let’s dismantle the myths about raising your first check and instead focus on how investors and other successful founders describe the nuance needed to secure money.

This question is existential, but it should be at the forefront throughout your journey as a founder. Elizabeth Yin, founding partner of Hustle Fund, says startups should be able to hit one of two goals: Reach $100 million ARR by its fifth year or get to $1 billion in valuation in the same time period.

“This is hard to do. And most businesses will never get there — not for a lack of trying — but there’s a lot of luck whether your idea has that much demand that quickly,” she added.

“I think you will know in the first year or two how ‘easy’ or ‘hard’ it is to get customers and whether you think on that trajectory you can get to $100 million a year in a few years,” Yin said. “And if it’s really hard, it doesn’t mean you throw in the towel. … There are many great companies that are not VC-backable where the founders will make a lot of money, but it just means you need to think through where to get your financing. Perhaps it’s from angels. Perhaps it’s from revenue-based financing funds. Perhaps it’s from customer crowdfunding.”

While VC is the flashy gold medal, the rapid growth of emerging fund managers means that a first check can be piecemealed together from a variety of different sources. The options for financing are seemingly endless: syndicates, public crowdfunding, VC firms, accelerators, debt financing, rolling funds, and, for the profitable few, bootstrapping.

“When people go around saying, ‘Do you want to run a VC-backable company?’ that feels weird — you don’t necessarily get to pick how fast you can grow — the market just may or may not be there,” Yin said. “There’s a lot of luck with that.”

Leslie Feinzaig, founder of Female Founders Collective, said that beyond economics, the hardest part of knowing whether your startup makes sense as a VC-backed business is understanding your own goals as an entrepreneur.

Powered by WPeMatico

Box executives have been dealing with activist investor Starboard Value over the last year, along with fighting through the pandemic like the rest of us. Today the company reported earnings for the first quarter of its fiscal 2022. Overall, it was a good quarter for the cloud content management company.

The firm reported revenue of $202.4 million, up 10% compared to its year-ago result, numbers that beat Box projections of between $200 million to $201 million. Yahoo Finance reports the analyst consensus was $200.5 million, so the company also bested street expectations.

The company has faced strong headwinds the past year, in spite of a climate that has been generally favorable to cloud companies like Box. A report like this was badly needed by the company as it faces a board fight with Starboard over its direction and leadership.

Company co-founder and CEO Aaron Levie is hoping this report will mark the beginning of a positive trend. “I think you’ve got a better economic climate right now for IT investment. And then secondarily, I think the trends of hybrid work, and the sort of long-term trends of digital transformation are very much supportive of our strategy,” he told TechCrunch in a post-earnings interview.

While Box acquired e-signature startup SignRequest in February, it won’t actually be incorporating that functionality into the platform until this summer. Levie said that what’s been driving the modest revenue growth is Box Shield, the company’s content security product and the platform tools, which enable customers to customize workflows and build applications on top of Box.

The company is also seeing success with large accounts. Levie says that he saw the number of customers spending more than $100,000 with it grow by nearly 50% compared to the year-ago quarter. One of Box’s growth strategies has been to expand the platform and then upsell additional platform services over time, and those numbers suggest that the effort is working.

While Levie was keeping his M&A cards close to the vest, he did say if the right opportunity came along to fuel additional growth through acquisition, he would definitely give strong consideration to further inorganic growth. “We’re going to continue to be very thoughtful on M&A. So we will only do M&A that we think is attractive in terms of price and the ability to accelerate our roadmap, or the ability to get into a part of a market that we’re not currently in,” Levie said.

Box managed modest growth acceleration for the quarter, existing only if we consider the company’s results on a sequential basis. In simpler terms, Box’s newly reported 10% growth in the first quarter of its fiscal 2022 was better than the 8% growth it earned during the fourth quarter of its fiscal 2021, but worse than the 13% growth it managed in its year-ago Q1.

With Box, however, instead of judging it by normal rules, we’re hunting in its numbers each quarter for signs of promised acceleration. By that standard, Box met its own goals.

How did investors react? Shares of the company were mixed after-hours, including a sharp dip and recovery in the value of its equity. The street appears to be confused by the results, weighing the report and working out whether its moderately accelerating growth is sufficiently enticing to warrant holding onto its equity, or more perversely if its growth is not expansive enough to fend off external parties hunting for more dramatic changes at the firm.

Sticking to a high-level view of Box’s results, apart from its growth numbers Box has done a good job shaking fluff out of its operations. The company’s operating margins (GAAP and not) improved, and cash generation also picked up.

Perhaps most importantly, Box raised its guidance from “the range of $840 million to $848 million” to “$845 to $853 million.” Is that a lot? No. It’s +$5 million to both the lower and upper-bounds of its targets. But if you squint, the company’s Q4 to Q1 revenue acceleration, and upgraded guidance, could be an early indicator of a return to form.

Levie admitted that 2020 was a tough year for Box. “Obviously, last year was a complicated year in terms of the macro environment, the pandemic, just lots of different variables to deal with…” he said. But the CEO continues to think that his organization is set up for future growth.

Will Box manage to perform well enough to keep activist shareholders content? Levie thinks if he can string together more quarters like this one, he can keep Starboard at bay. “I think when you look at the next three quarters, the ability to guide up on revenue, the ability to guide up on profitability. We think it’s a very very strong earnings report and we think it shows a lot of the momentum in the business that we have right now.”

Powered by WPeMatico

On-demand grocery startups like Gorillas are invading Europe right now, but although on-demand-everything is kinda old-hat in the Bay Area, a new startup thinks it might just be able to do something new.

Food Rocket says it has raised a $2 million investment round from AltaIR Capital, Baring Vostok fund and the Angelsdeck group of business angels, including Philipp Bashyan, of Russia’s Yonder, who has joined as an investor and advisor.

Yes, admittedly, this tiny startup is competing with DoorDash, GoPuff, InstaCart and Amazon Fresh. Maybe let’s not get into that…

Using the company’s mobile app, users can order fresh groceries, ready-to-eat meals and household goods that will be delivered within 10-15 minutes, says the startup, which will be servicing SoMa, South Park, Mission Bay, Japantown, Hayes Valley and other areas. The company hopes to open 150 “dark stores” on the West Coast as part of its infrastructure.

Vitaly Aleksandrov, CEO, and co-founder of Food Rocket, said: “The level of competition in this market in the U.S. is still manageable, which is why we have the opportunity to become leaders in the sphere of fast delivery of basic products and household goods. We aim to replace brick-and-mortar supermarkets and to change consumers’ current habits in regards to grocery shopping.”

What can we say? Good luck?

Powered by WPeMatico

Orbiit, a startup that automates the interactions within an online community, has raised a $2.7 million round led by Bread and Butter Ventures, with participation from new investors High Alpha Capital, LAUNCHub Ventures and Company Ventures. Existing investors Founders Fund, which led Orbiit’s $1 million pre-seed round, Acceleprise and other angels also participated. The capital will be used to build out the Orbiit product and engineering team.

Orbiit says its platform handles the communications, matching, scheduling, feedback collection and analytics for people connecting with each other in an online community. The idea is that the communities therefore learn and network better, engage more and share more knowledge.

CEO and co-founder Bilyana Freye said: “Tailored 1:1 connections allow members to discuss difficult topics, be vulnerable and share learnings with one another. Those 1:1 connections are the hardest to execute, but when you start investing in them, with the help of Orbiit, you see engagement feeding into all other initiatives and a vibrant, active community that truly delivers on the promise to its members.”

Bread and Butter Ventures Managing Partner Mary Grove added: “This age-old question of how to leverage technology at scale to drive meaningful connections across communities both internal to an organization and across the globe is a problem we’ve been actively seeking a solution to for a decade. Orbiit brings the perfect blend of tech-enabled software with human curation to create strong connections and provide insights back to community managers.”

The platform is being used by startup communities at True Ventures, GGV and Lerer Hippeau; private networking groups such as Dreamers & Doers; and customer communities, like the CFO community run by fintech leader Spendesk.

Founders Fund Principal Delian Asparouhov said: “We see Orbiit as a key platform for peer learning within companies and communities, unlocking untapped knowledge through curated matchmaking.”

LAUNCHub Ventures participated in the round, following the recent first close of its new $70 million fund.

Powered by WPeMatico

CorrActions, a noninvasive neuroscience startup that uses sensor data to evaluate a user’s cognitive state due to drowsiness, alcohol, fatigue and other issues, today announced that it has raised a $2.7 million seed round. Early-stage fund VentureIsrael, seed fund Operator Partners and the Israeli Innovation Authority are backing the company, which is based out of OurCrowd’s Labs/02 incubator.

The idea here is to use touch sensors wherever humans may interact with machines, be that in a fighter jet’s cockpit, a car or anywhere else where knowing a user’s cognitive state could prevent potentially catastrophic errors. CorrActions promises that its proprietary algorithms can identify the user’s cognitive state and detect errors 150 milliseconds before they occur by “decoding unconscious brain signals through body motion monitoring.” For the most part, the system is use-case agnostic since it’s basically a generic platform that is independent of where it is implemented.

“Using sensors that already exist in nearly every electronic device like smartwatches, smartphones and even steering wheels and joysticks, CorrActions is the first in the world to be able to read a person’s cognitive state at any given moment by analyzing micro changes in their muscular activity,” explained Eldad Hochman, the company’s co-founder and CSO. “It is enough for the person to come in contact with an electronic device for two minutes and we can accurately quantify cognitive state and even predict a rapid deterioration, which may lead to failure or accidents. We can see this coming seconds before it occurs. This means that we can quantify the level of fatigue, intoxication, exhaustion or lack of concentration at any given moment.”

A lot of modern cars already feature sensors that can monitor your alertness, of course, and so it’s maybe no surprise that CorrActions is already working on proofs of concept with a few players in the automotive industry. In addition, it is also working on projects with the defense industry to show that its systems can assess a pilot’s performance, for example. But Hochman also believes that the company’s algorithms may be able to alert athletes or the elderly when they may be at risk of injury and falls.

The company says it will use the new funding to further develop its algorithms and support its current deployment partners, especially in the automotive industry.

“We are developing, and already seeing significant results for a technology which has the potential to save companies man-hours and money by preventing basic operational errors,” said CorrActions co-founder and CEO Zvi Ginosar. “Moreover, the application of our platform can be used to save lives, and prevent thousands of accidents and errors. In the next months we hope to be able to report more ground-breaking results and proof of concept trials, and this funding will greatly help us reach this goal.”

Powered by WPeMatico

We’ve been urging you to apply to Startup Battlefield at TechCrunch Disrupt 2021 for weeks now, and you have just over 12 hours left before the application window slams shut on May 27 at 11:59 p.m. (PT). Don’t procrastinate — the experience alone, whether you win the $100,000 prize or not, can improve the trajectory of your business.

Case in point: Mollie Breen started out as a mathematician at the National Security Agency before co-founding an IoT/OT security startup called Perygee. She and her team competed in Startup Battlefield last year at Disrupt 2020. Although they didn’t reach the finals, Breen has plenty to say about the experience. Here’s what she shared with us in a quick Q&A.

TC: Why did you apply to Startup Battlefield?

Breen: I admired the leadership and growth of other companies that, at one point, were Startup Battlefield contestants. I noticed they had similar traction to us when they applied, and their products resembled ours in their ability to disrupt the respective industry.

TC: What was the training process like?

Breen: It was incredibly valuable both in the short term and long term. Every team gets a weekly session with the Battlefield editor. Together you rehearse and go over every iteration of the pitch line-by-line and slide-by-slide. After each session, I walked away with constructive feedback on everything — the content, the speaking style and even the font color on a particular slide.

This was a unique opportunity, and we put in extra hours to be ahead of schedule, sent drafts for review in the off hours and even doubled down on additional practice with Q&As. As a result, we couldn’t have been more prepared for pitch day. And the training has stayed with Perygee well past the sessions and the competition.

TC: What did it feel like to pitch at Disrupt?

Breen: Pitching at Disrupt was, in some ways, like other pitches except that you have an international audience. Since, at that point, we had practiced our pitch dozens of times, the real unknown during the competition was the Q&A with the VC judges.

There was additional pressure to answer succinctly and convincingly within a time constraint that you wouldn’t have during a normal one-on-one pitch. But with the prep help from the TechCrunch team, I felt ready to speak in front of such a large audience. I encourage anyone who might be nervous about the big stage to go for it and trust you’ll have more than enough preparation when you get there.

TC: What was the post-pitch impact? Did you meet investors, press or other key partners?

Breen: It helped accelerate our progress. Following Battlefield, we closed an oversubscribed fundraising round. We acquired additional beta users, including our first beta user who messaged us after reading about Perygee on TechCrunch. We also gained numerous press opportunities to share our story.

It’s almost a year since Startup Battlefield, and I’m still impressed by how many people start the conversation saying they watched the pitch while reading our company’s background. It’s a reminder that the opportunities created by being a TechCrunch Battlefield company continue.

TC: Do you have any great news to share since your pitch?

Breen: At TechCrunch Battlefield we were a small team doing MVP testing and just about to start raising. Since the pitch, we have scaled on all fronts. We grew the founding team and the engineering team, and we deployed the product to enterprise networks. Some of those deployments include contacts who reached out because of TechCrunch — and we raised our seed round!

TC: Is there anything else you’d like to share?

Breen: I’m grateful for the camaraderie and relationships we developed with the other teams. What you didn’t see on stage during the pitches was all of us cheering one another on from the group chat or social media feed. Even now, we continue to support one another through navigating business questions or promoting product launches. If it weren’t for Startup Battlefield, I would never have met this awesome group of startups.

You have just 24 hours left to channel your inner Mollie Breen. Apply to Startup Battlefield before the deadline expires on May 27 at 11:59 p.m. (PT). Get moving!

Powered by WPeMatico

Breinify is a startup working to apply data science to personalization, and do it in a way that makes it accessible to nontechnical marketing employees to build more meaningful customer experiences. Today the company announced a funding round totaling $11 million.

The investment was led by Gutbrain Ventures and PBJ Capital with participation from Streamlined Ventures, CXO Fund, Amino Capital, Startup Capital Ventures and Sterling Road.

Breinify co-founder and CEO Diane Keng says that she and co-founder and CTO Philipp Meisen started the company to bring predictive personalization based on data science to marketers with the goal of helping them improve a customer’s experience by personalizing messages tailored to individual tastes.

“We’re big believers that the world, especially consumer brands, really need strong predictive personalization. But when you think about consumer big brands or the retailers that you buy from, most of them aren’t data scientists, nor do they really know how to activate [machine learning] at scale,” Keng told TechCrunch.

She says that she wanted to make this type of technology more accessible by hiding the complexity behind the algorithms powering the platform. “Instead of telling you how powerful the algorithms are, we show you [what that means for the] consumer experience, and in the end what that means for both the consumer and you as a marketer individually,” she said.

That involves the kind of customizations you might expect around website messaging, emails, texts or whatever channel a marketer might be using to communicate with the buyer. “So the AI decides you should be shown these products, this offer, this specific promotion at this time, [whether it’s] the web, email or SMS. So you’re not getting the same content across different channels, and we do all that automatically for you, and that’s [driven by the algorithms],” she said.

Breinify launched in 2016 and participated in the TechCrunch Disrupt Startup Battlefield competition in San Francisco that year. She said it was early days for the company, but it helped them focus their approach. “I think it gave us a huge stage presence. It gave us a chance to test out the idea just to see where the market was in regards to needing a solution like this. We definitely learned a lot. I think it showed us that people were interested in personalization,” she said. And although the company didn’t win the competition, it ended up walking away with a funding deal.

Today the startup is growing fast and has 24 employees, up from 10 last year. Keng, who is an Asian woman, places a high premium on diversity.

“We partner with about four different kinds of diversity groups right now to source candidates, but at the end of the day, I think if you are someone that’s eager to learn, and you might not have all the skills yet, and you’re [part of an under-represented] group we encourage everyone to apply as much as possible. We put a lot of work into trying to create a really well-rounded group,” she said.

Powered by WPeMatico

Most marketers today know how to send targeted communications to customers, and there are many tools to help, but when it comes to sending personalized in-house messages, there aren’t nearly as many options. Pyn, an early-stage startup based in Australia, wants to change that, and today it announced an $8 million seed round.

Andreessen Horowitz led the investment with help from Accel and Ryan Sanders (the co-founder of BambooHR) and Scott Farquhar (co-founder and co-CEO at Atlassian).

That last one isn’t a coincidence, as Pyn co-founder and CEO Joris Luijke used to run HR at the company and later at Squarespace and other companies, and he saw a common problem trying to provide more targeted messages when communicating internally.

“I’ve been trying to do this my entire professional life, trying to personalize the communication that we’re sending to our people. So that’s what Pyn does. In a nutshell, we radically personalize employee communications,” Luijke explained. His co-founder Jon Williams was previously a co-founder at Culture Amp, an employee experience management platform he helped launch in 2011 (and which raised more than $150 million), so the two of them have been immersed in this idea.

They bring personalization to Pyn by tracking information in existing systems that companies already use, such as Workday, BambooHR, Salesforce or Zendesk, and they can use this data much in the same way a marketer uses various types of information to send more personalized messages to customers.

That means you can cut down on the company-wide emails that might not be relevant to everyone and send messages that should matter more to the people receiving them. And as with a marketing communications tool, you can track how many people have opened the emails and how successful you were in hitting the mark.

David Ulevitch, general partner at a16z and lead investor in this deal, points out that Pyn also provides a library of customizable communications materials to help build culture and set policy across an organization. “It also treats employee communication channels as the rails upon which to orchestrate management practices across an organization [by delivering] a library of management playbooks,” Ulevitch wrote in a blog post announcing the investment.

The startup, which launched in 2019, currently has 10 employees, with teams working in Australia and the Bay Area in California. Williams says that already half the team is female and the plan is to continue putting diversity front and center as they build the company.

“Joris has mentioned ‘radical personalization’ as this specific mantra that we have, and I think if you translate that into an organization, that is all about inclusion in reality, and if we want to be able to cater for all the specific needs of people, we need to understand them. So [diversity is essential] to us,” Williams said.

While the company isn’t ready to discuss specifics in terms of customer numbers, it cites Shopify, Rubrik and Carta as early customers, and the founders say there was a lot of interest when the pandemic hit last year and the need for more frequent and meaningful types of communication became even more paramount.

Powered by WPeMatico