TC

Auto Added by WPeMatico

Auto Added by WPeMatico

Elvie, a London-based startup known best for its connected Kegel trainer, is jumping into the breast pump business with a new $480 hands-free system you can slip into your bra.

Even with all the innovation in baby gear, breast pumps have mostly sucked (pun intended) for new moms for the past half a century. My first experience with a pump required me to stay near a wall socket and hunch over for a good 20 to 30 minutes for fear the milk collected might spill all over the place (which it did anyway, frequently). It was awful!

Next I tried the Willow Pump, an egg-shaped, connected pump meant to liberate women everywhere with its small and mobile design. It received glowing reviews, though my experience with it was less than stellar.

The proprietary bags were hard to fit in the device, filled up with air, cost 50 cents each (on top of the $500 pump that insurance did not cover), wasted many a golden drop of precious milk in the transfer and I had to reconfigure placement several times before it would start working. So I’ve been tentatively excited about the announcement of Elvie’s new cordless (and silent??) double breast pump.

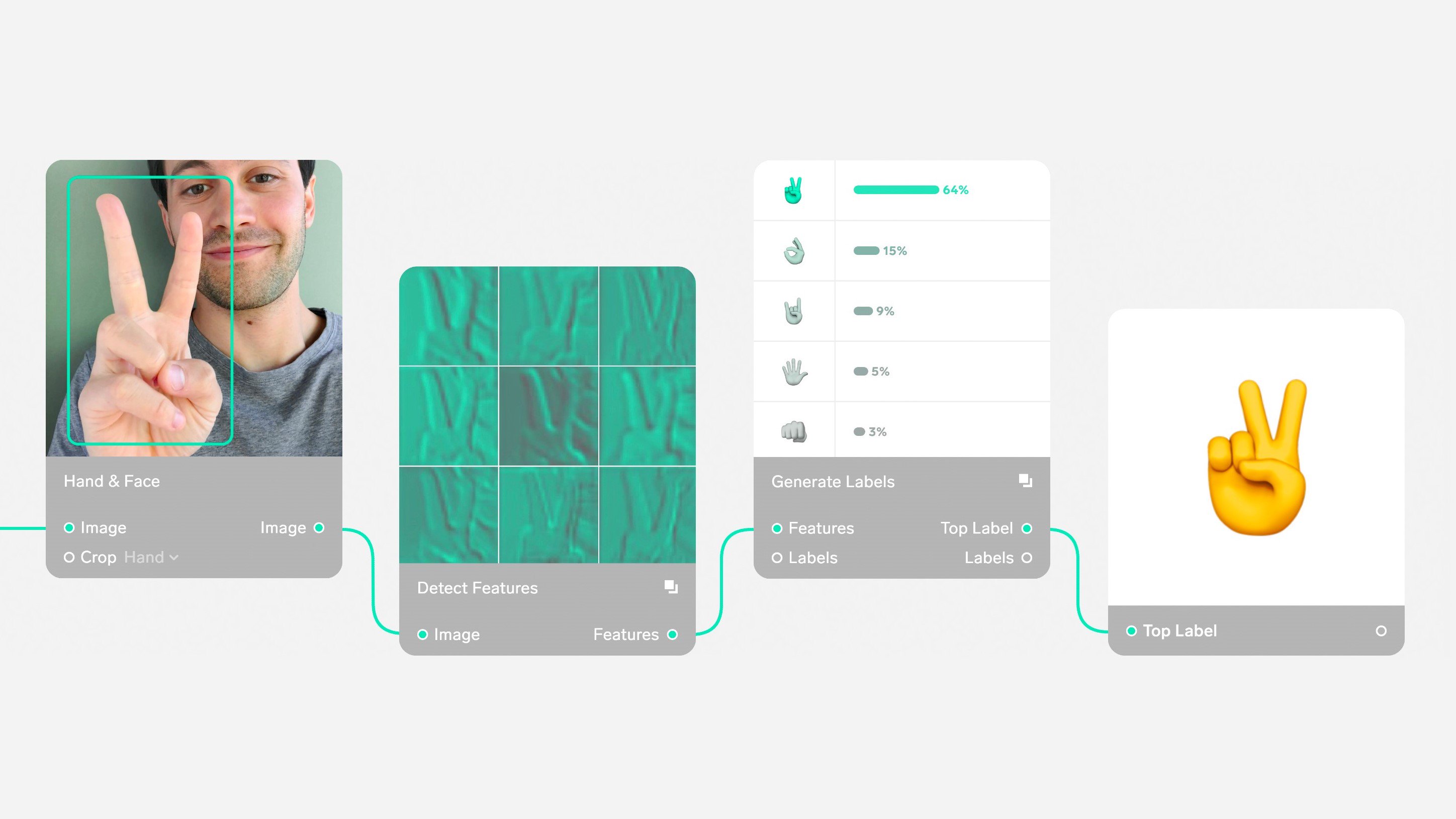

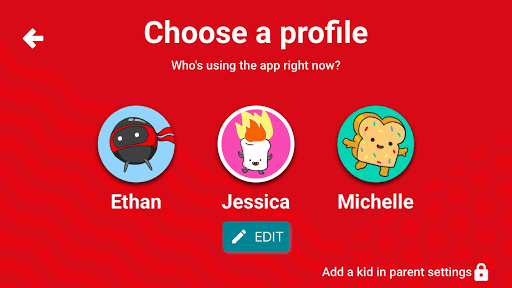

Displayed: a single Elvie pump with accompanying app

Elvie tells TechCrunch its aim all along has been to make health tech for women and that it has been working on this pump for the past three years.

The Elvie Pump is a cordless, hands-free, closed-system, rechargeable electric pump designed by former Dyson engineers. It can hold up to 5 oz. from each breast in a single use.

It’s most obvious and direct competition is the Willow pump, another “wearable” pump moms can put right in their bra and walk around in, hands-free. However, unlike the Willow, Elvie’s pump does not need proprietary bags. You just pump right into the device and the pump’s smartphone app will tell you when each side is full.

It’s also half the size and weight of a Willow and saves every precious drop it can by pumping right into the attached bottle so you just pump and feed (no more donut-shaped bags you have to cut open and awkwardly pour into a bottle).

On top of that, Elvie claims this pump is silent. No more loud suction noise off and on while trying to pump in a quiet room in the office or elsewhere. It’s small, easy to carry around and you can wear it under your clothes without it making a peep! While the Willow pump claims to be quiet — and it is, compared to other systems — you can still very much hear it while you are pumping.

Elvie’s connected breast pump app

All of these features sound fantastic to this new (and currently pumping) mom. I remember in the early days of my baby’s life wanting to go places but feeling stuck. I was chained to not just all the baby gear, hormonal shifts and worries about my newborn but to the pump and feed schedule itself, which made it next to impossible to leave the house for the first few months.

My baby was one of those “gourmet eaters” who just nursed and nursed all day. There were days I couldn’t leave the bed! Having a silent, no mess, hands-free device that fit right in my bra would have made a world of difference.

However, I mentioned the word “tentatively” above, as I have not had a chance to do a hands-on review of Elvie’s pump. The Willow pump also seemed to hold a lot of promise early on, yet left me disappointed.

To be fair, the company’s customer service team was top-notch and did try to address my concerns. I even went through two “coaching” sessions, but in the end it seemed the blame was put on me for not getting their device to work correctly. That’s a bad user experience if you are blaming others for your design flaws, especially new and struggling moms.

Both companies are founded by women and make products for women — and it’s about time. But it seems as if Elvie has taken note of the good and bad in their competitors and had time to improve upon it — and that’s what has me excited.

As my fellow TechCrunch writer Natasha put it in her initial review of Elvie as a company, “It’s not hyperbole to say Elvie is a new breed of connected device. It’s indicative of the lack of smart technology specifically — and intelligently — addressing women.”

So why the pump? “We recognized the opportunity [in the market] was smarter tech for women,” founder and CEO Tania Boler told TechCrunch on her company’s move into the breast pump space. “Our aim is to transform the way women think and feel about themselves by providing the tools to address the issues that matter most to them, and Elvie Pump does just that.”

The Elvie Pump comes in three sizes and shapes to fit the majority of breasts and, in case you want to check your latch or pump volume, also has transparent nipple shields with markings to help guide the nipple to the right spot.

The app connects to each device via Bluetooth and tracks your production, detects let down, will pause when full and is equipped to pump in seven different modes.

The pump retails for $480 and is currently available in the U.K. However, those in the U.S. will have to wait until closer to the end of the year to get their hands on one. According to the company, it will be available on Elvie.com and Amazon.com, as well in select physical retail stores nationally later this year, pending FDA approval.

Powered by WPeMatico

3D Hubs, like MakeXYZ, was a community-based 3D printing service that let anyone with a printer sell their prints online. Founded in the heyday of the 3D printing revolution, the service let thousands of makers gather a little cash for making and mailing prints on their home 3D printers.

Now, however, the company has moved to a model in which its high-end partners will be manufacturing plastic, metal, and injection molded parts for customers willing to pay extra for a professional print.

“Indeed, more focus on high end printers run by professional companies,” said founder Brian Garret. “So a smaller pool of manufacturing locations (still hundreds around the world), but with more control on standardized quality and repeatability. Our software takes care of the sourcing, so companies order with 3D Hubs directly.”

Not everyone is happy with the decision. 3DPrint.come editor Joris Peels saw the value in a solid, dedicated community of hobbyists in the 3D space. The decision to move away from hobbyist printers, wrote Peels, “has confused many.”

“The value of 3DHubs is in its community; the community gives it granular local presence and a barrier to entry. Now it is just like any 3D printing service upstart and will lose its community entirely. I’ve always liked 3DHubs, although I have been very skeptical of their Trends Report I like the company and what they’re doing. I liked the idealism coupled with business,” he wrote.

The community, for its part, is angry.

A big F you to @3DHubs today! Switching over from “Locally sourced 3D prints” to the “Closed manufacturing program” basically… This was a big reason for me to own a 3d printer… now it’s all gone!

— 2lol555 (@2lol555) September 12, 2018

Why? Don’t you plan on screwing over the 3d printing community due to greed?

— MikByte (@viperz28) September 12, 2018

Sad news! @3DHubs is closing normal hubs (non Manufacturing Partners/Fulfilled by 3D Hubs). I’ve been pushing for months to get into the Fulfilled by 3D Hubs program, hope they give me one last change to join

pic.twitter.com/R6W51rLEeH

— Diego Trapero (@diegotrap) September 12, 2018

The move will happen on October 1 when all prints will be completed by Fulfilled by 3D Hubs partners, dedicated merchants who will offer “source parts for larger, high value engineering projects.” The company wrote that during the early hobbyist days the “platform at that time was very much free-form, with the goal of serving as many, mostly one-off, custom maker projects as possible.”

This slow movement from hobbyist 3D printing to professional parts manufacturer is not surprising or unexpected, but it is jarring. The 3D printing community is small, vociferous, and dedicated to the technology. In the early days, when 3D printers were rare, it was tempting to buy a mid-price printer and become a small, one-person shop online. Now, with the availability of commodity printers that cost less than some paper printers, the novelty and utility of a low-resolution print has fallen considerably.

3D printing never fulfilled its promise in the home and small office. A one-off print can save some of us a trip to the machine shop or music store but in practice home 3D printing has been a bust.

Like most open source technologies that went commercial, the dedicated zealots will complain and the established players will pivot into profitability. It ruffles feathers, to be sure, but that’s how these things work. To paraphrase the White Stripes, “Well, you’re in your little room and you’re printing something good/ But if it’s really good, you’re gonna need a bigger room/ And when you’re in the bigger room, you might not know what to do/ You might have to think of how you got started sitting in your little room.”

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast where we unpack the numbers behind the headlines.

After a long run of having guests climb aboard each week, we took a pause on that front, bringing together three of our regular hosts instead: Connie Loizos, Danny Chrichton, and myself.

Despite the fact that there were just three of us instead of the usual four, we got through a mountain of stuff. Which was good as it was a surprisingly busy week, and we didn’t want to leave too much behind.

Up top we dug into the latest in the land of crypto, which Danny had politely summarized for us in an article. The gist of his argument is that the analogies relating crypto as an industry to the Internet may work, but most people have their timelines wrong: Crypto isn’t like the Internet in the 90s, perhaps. More like the 80s.

On the same topic, crypto companies formed a team lobbying effort, and a high-flying crypto fund is struggling to once again post strong profit figures.

Moving along, Juul is back in the news. Not, however, for raising more money or posting quick growth. Well, sort of the latter, as the government is after it. The Food and Drug Administration has put Juul on a countdown to get its act together regarding teens and smoking. That the financially impressive unicorn is in as much trouble as it is, is nearly surprising.

Finally, we ran through the three most recent Chinese IPOs that hit our radar. Here they are:

And that was the end of things. Thanks for sticking with us, as always. Speaking of which, our 100th episode is coming up. Who should we bring onto the show to celebrate?

Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Pocket Casts, Downcast and all the casts.

Powered by WPeMatico

Looking for funding as a startup in Latin America is a lot like looking for a watering hole in the middle of the desert. You know it’s out there, but finding it in time is a life or death situation.

Granted, venture capital investment in the region is at an all-time high, with leading firms like Andreessen Horowitz, Sequoia Capital and Accel Partners having made inaugural investments in markets like Colombia, Brazil and Mexico, respectively. But, at the same time, while startup founders might be tantalized by the news of big investments happening around them, as many of them get closer to the funding stage themselves, they often realize it’s nothing but a mirage.

And this isn’t just a problem in Latin America. All over the world, startups are struggling to find investment, as VCs are investing more money in fewer deals in the endless search for the next unicorn. Due to a dwindling number of VC deals in both the United States and Europe, even entrepreneurs in established ecosystems are having to look further afield for the resources they need to build their businesses, bringing many of them to emerging markets like Latin America.

Fortunately, whether you’re a local or foreign founder in an emerging market, there is a way to quench your thirst for the international investment that you need to scale your company. Here’s what we recommend to the startups that are part of our UTEC Ventures accelerator program in Peru, and what we’d recommend to you, too.

As a startup in an emerging market, the prospect of finding local investment can seem challenging. In fact, this is probably why you’re looking for international investment in the first place. But the truth is, finding local seed money to get started is really the first prerequisite for securing international funding later on.

Last year in Peru, for example, US$7.2 million of seed capital was invested in the country’s startups, with barely over US$1 million coming from international funds. This goes to show that international investors peeking into emerging markets are less active in seed rounds, and more interested in later-stage rounds once a company has better demonstrated its worth.

If you want to attract international investors, you need to be an international startup.

As such, we advise all startups to raise a first or second seed round locally in Peru, and then seek international investors. The same can go for other emerging markets, as well.

To raise these initial rounds, the most important thing is to show that you have a solid team, a business idea that works and has traction with clients chasing your product and that you’re better than any local competition. If you can demonstrate that you meet these requirements, finding local seed capital shouldn’t be too difficult; all you need is a good pitch deck and some patience when networking within local angel groups or at investor events.

If you want to attract international investors, you need to be an international startup. In other words, you need to demonstrate that you can sell your product in a bigger, more competitive market before turning the heads of international investors. For startups in Peru and other emerging markets in Latin America, that means successfully expanding to the region’s most developed markets in Mexico, Brazil or Argentina.

Consider, for example, the Colombian courier service Rappi. It wasn’t until after the company expanded its operations to Mexico at the beginning of 2016 that it secured its first major international investment, led by Andreessen Horowitz. The company then went on to close a Series B round just one month later, in addition to a US$130 million venture round at the beginning of this year, led by a German food delivery service with participation from a number of U.S.-based investors.

The same idea goes for emerging markets outside of Latin America, too. In Eastern Europe, which lags behind its western counterpart in terms of VC funding, many entrepreneurs will either set up their businesses in Western European countries from the get-go, or expand there as soon as they’ve achieved product/market fit and demonstrated success in their home countries.

This is a clear demonstration of the broader fact that if you want to start raising money from more developed markets, you generally need to be based in those markets, or at least a market of comparable size. Accordingly, your primary focus when seeking international funding should be to first succeed locally, and then replicate that success in a more developed market — whether that be in the United States, Mexico, Western Europe or anywhere else.

While it’s easy to be distracted by the glitz and glamour of securing a round from international VCs, startups have a number of other options at their disposal to secure international funding.

Foreign governments in emerging markets are increasingly stepping up their game with programs designed to bolster their local startup ecosystems as an engine for economic growth. As such, a number of foreign governmental programs have emerged, offering support in the form of equity-free cash to entrepreneurs who decide to set up shop in a given country.

Corporate capital has taken on a very important role in many emerging markets like Latin America.

There are plenty of examples in Latin America alone. Start-Up Chile, for example, offers entrepreneurs up to US$80,000 to launch their businesses in Chile as a launch pad to reach the rest of the world; Parallel18 in Puerto Rico offers entrepreneurs up to US$75,000 to do the same thing; and the Peruvian government plans to announce a similar program to help startups soft launch in Peru with up to US$40,000 at the upcoming Peru Venture Capital Conference.

Startups have another option, as well. Corporate capital, or startup investment from major corporations, has taken on a very important role in many emerging markets like Latin America. In fact, Qualcomm Ventures, the investment arm of U.S.-based tech giant Qualcomm, is the most active global corporate investor in Latin America. Naspers, American Express Ventures and other corporate funds have taken an active interest in the region’s startups, as well.

Together, the growing support of foreign governments and interest from international corporations highlights the fact that securing international funding is in fact possible, and not as hard as you’d expect. Knowing that there are options besides getting an international VC on board, you should take the time to find out which alternatives are available in the markets to which you’re hoping to expand.

So, no matter whether you’re a local or foreign entrepreneur in an emerging market, there’s no reason to give up hope on finding international funding. The key is to think globally and use technology to solve real-world challenges. Then, demonstrate success at home first, and duplicate it later in a bigger market. Resources are available to help you when taking your first step abroad, and if you do it well, you’ll find that the investment wells aren’t dry after all.

Powered by WPeMatico

Watching the current price madness is scary. Bitcoin is falling and rising in $500 increments with regularity and Ethereum and its attendant ICOs are in a seeming freefall with a few “dead cat bounces” to keep things lively. What this signals is not that crypto is dead, however. It signals that the early, elated period of trading whose milestones including the launch of Coinbase and the growth of a vibrant (if often shady) professional ecosystem is over.

Crypto still runs on hype. Gemini announcing a stablecoin, the World Economic Forum saying something hopeful, someone else saying something less hopeful – all of these things and more are helping define the current market. However, something else is happening behind the scenes that is far more important.

As I’ve written before, the socialization and general acceptance of entrepreneurs and entrepreneurial pursuits is a very recent thing. In the old days – circa 2000 – building your own business was considered somehow sordid. Chancers who gave it a go were considered get-rich-quick schemers and worth of little more than derision.

As the dot-com market exploded, however, building your own business wasn’t so wacky. But to do it required the imprimaturs and resources of major corporations – Microsoft, Sun, HP, Sybase, etc. – or a connection to academia – Google, Netscape, Yahoo, etc. You didn’t just quit school, buy a laptop, and start Snapchat.

It took a full decade of steady change to make the revolutionary thought that school wasn’t so great and that money was available for all good ideas to take hold. And take hold it did. We owe the success of TechCrunch and Disrupt to that idea and I’ve always said that TC was career pornography for the cubicle dweller, a guilty pleasure for folks who knew there was something better out there and, with the right prodding, they knew they could achieve it.

So in looking at the crypto markets currently we must look at the dot-com markets circa 1999. Massive infrastructure changes, some brought about by Y2K, had computerized nearly every industry. GenXers born in the late 70s and early 80s were in the marketplace of ideas with an understanding of the Internet the oldsters at the helm of media, research, and banking didn’t have. It was a massive wealth transfer from the middle managers who pushed paper since 1950 to the dot-com CEOs who pushed bits with native ease.

Fast forward to today and we see much of the same thing. Blockchain natives boast about having been interest in bitcoin since 2014. Oldsters at banks realize they should get in on things sooner than later and price manipulation is rampant simply because it is easy. The projects we see now are the Kozmo.com of the blockchain era, pie-in-the-sky dream projects that are sucking up millions in funding and will produce little in real terms. But for every hundred Kozmos there is one Amazon .

And that’s what you have to look for.

Will nearly every ICO launched in the last few years fail? Yes. Does it matter?

Not much.

The market is currently eating its young. Early investors made (and probably lost) millions on early ICOs but the resulting noise has created an environment where the best and brightest technical minds are faced with not only creating a technical product but also maintaining a monetary system. There is no need for a smart founder to have to worry about token price but here we are. Most technical CEOs step aside or call for outside help after their IPO, a fact that points to the complexity of managing shareholder expectations. But what happens when your shareholders are 16-year-olds with a lot of Ethereum in a Discord channel? What happens when little Malta becomes the de facto launching spot for token sales and you’re based in Nebraska? What happens when the SEC, FINRA, and Attorneys General from here to Beijing start investigating your hobby?

Basically your hobby stops becoming a hobby. Crypto and blockchain has weaponized nerds in an unprecedented way. In the past if you were a Linux developer or knew a few things about hardware you could build a business and make a little money. Now you can build an empire and make a lot of money.

Crypto is falling because the people in it for the short term are leaving. Long term players – the Amazons of the space – have yet to be identified. Ultimately we are going to face a compression in the ICO and, for a while, it’s going to be a lot harder to build an ICO. But give it a few years – once the various financial authorities get around to reading the Satoshi white paper – and you’ll see a sea change. Coverage will change. Services will change. And the way you raise money will change.

VC used to be about a team and a dream. Now it’s about a team, $1 million in monthly revenue, and a dream. The risk takers are gone. The dentists from Omaha who once visited accelerator demo days and wrote $25,000 checks for new apps are too shy to leave their offices. The flashy VCs from Sand Hill have to keep Uber and Airbnb’s plates spinning until they can cash out. VC is dead for the small entrepreneur.

Which is why the ICO is so important and this is why the ICO is such a mess right now. Because everybody sees the value but nobody – not the SEC, not the investors, not the founders – can understand how to do it right. There is no SAFE note for crypto. There are no serious accelerators. And all of the big names in crypto are either goldbugs, weirdos, or Redditors. No one has tamed the Wild West.

They will.

And when they do expect a whole new crop of Amazons, Ubers, and Oracles. Because the technology changes quickly when there’s money, talent, and a way to marry the two in which everyone wins.

Powered by WPeMatico

Microsoft today announced that is has acquired Lobe, a startup that lets you build machine learning models with the help of a simple drag-and-drop interface. Microsoft plans to use Lobe, which only launched into beta earlier this year, to build upon its own efforts to make building AI models easier, though, for the time being, Lobe will operate as before.

“As part of Microsoft, Lobe will be able to leverage world-class AI research, global infrastructure, and decades of experience building developer tools,” the team writes. “We plan to continue developing Lobe as a standalone service, supporting open source standards and multiple platforms.”

Lobe was co-founded by Mike Matas, who previously worked on the iPhone and iPad, as well as Facebook’s Paper and Instant Articles products. The other co-founders are Adam Menges and Markus Beissinger.

In addition to Lobe, Microsoft also recently bought Bonsai.ai, a deep reinforcement learning platform, and Semantic Machines, a conversational AI platform. Last year, it acquired Disrupt Battlefield participant Maluuba. It’s no secret that machine learning talent is hard to come by, so it’s no surprise that all of the major tech firms are acquiring as much talent and technology as they can.

“In many ways though, we’re only just beginning to tap into the full potential AI can provide,” Microsoft’s EVP and CTO Kevin Scott writes in today’s announcement. “This in large part is because AI development and building deep learning models are slow and complex processes even for experienced data scientists and developers. To date, many people have been at a disadvantage when it comes to accessing AI, and we’re committed to changing that.”

It’s worth noting that Lobe’s approach complements Microsoft’s existing Azure ML Studio platform, which also offers a drag-and-drop interface for building machine learning models, though with a more utilitarian design than the slick interface that the Lobe team built. Both Lobe and Azure ML Studio aim to make machine learning easy to use for anybody, without having to know the ins and outs of TensorFlow, Keras or PyTorch. Those approaches always come with some limitations, but just like low-code tools, they do serve a purpose and work well enough for many use cases.

Powered by WPeMatico

Shift Technologies, an online marketplace for used cars, has closed a Series D financing round of more than $140 million in equity and debt.

The round, which consists of about $70 million in debt and $71 million in equity, was led by automotive retailer Lithia Motors. Bryan DeBoer, CEO and president of Lithia, will join Shift’s board of directors.

Previous investors Alliance Ventures, BMW iVentures, DCM, DFJ, G2VP, Goldman Sachs Investment Partners and Highland Capital also participated. This new capital brings Shift’s total financing of equity and debt to $265 million.

Shift, which is based in San Francisco, serves car buyers and sellers. The company, founded in 2013, has built a software platform that lets customers shop for cars, get financing and schedule test drives. Car owners can use the platform to sell their vehicle, as well. Shift says any car it buys must pass a “rigorous” 150+ point inspection.

The company plans to invest in its technology platform and scale its engineering staff from 35 to more than 80 people by the end of 2019, CEO George Arison noted to TechCrunch in an email. Shift employs 380 people. The company’s platform has focused on scaling in California; it covers about 80 percent of that market. But the company has long had its sights set on expanding beyond the Golden State.

Shift is focused on, and is heavily investing in, its peer-to-peer business, in which the company acquires cars from individuals and then sells them. Buying, refurbishing and then selling cars online is a logistics-heavy business pursuit, and one that has seen a number of competitors come and go in the past several years. But Arison says the company has not just survived; it has grown.

Shift didn’t provide revenue numbers. But Arison cited the company’s more than 70 percent revenue growth in the past six months as an example of the company’s success.

The company did have a partnership with rental giant Hertz, but that has since ended. At the time, Shift was going to feature vehicles from Hertz’s fleet inventory. It was meant to be a win-win: Hertz gets access to a new retail sales channel and Shift benefits from the rental car company’s ready supply of lightly used cars.

The partnership ended after Hertz opened its own retail stores that competed against Shift

Powered by WPeMatico

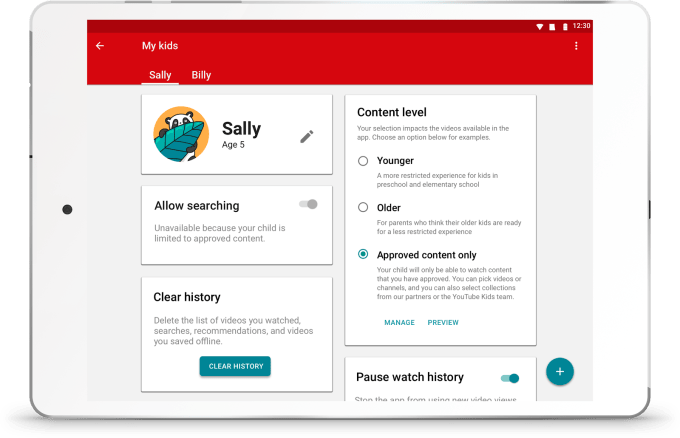

YouTube Kids’ latest update is giving parents more control over what their kids watch. Following a change earlier this year that allowed parents to limit viewing options to human-reviewed channels, YouTube today is adding another feature that will give parents the ability to explicitly whitelist every channel or video they want to be available to their children through the app.

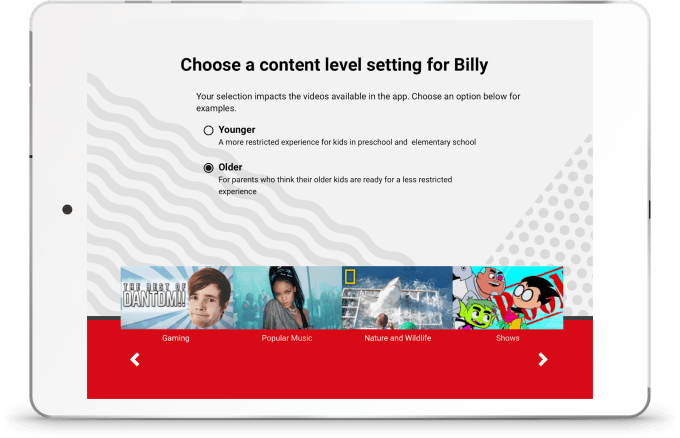

Additionally, YouTube Kids is launching an updated experience to serve the needs of a slightly older demographic: tween viewers ages 8 through 12. This mode adds new content, like popular music and gaming videos.

The company had promised in April these changes were in the works, but didn’t note when they’d be going live.

With the manual whitelisting feature, parents can visit the app’s Settings, go to their child’s profile, and toggle on an “Approved Content Only” option. They can then handpick the videos they want their kids to have access to watch through the YouTube Kids app.

Parents can opt to add any video, channel, or collection of channels they like by tapping the “+” button, or they can search for a specific creator or video through this interface.

Once this mode is enabled, kids will no longer be able to search for content on their own.

While this is a lot of manual labor on parents’ part, it does serve the needs of those with very young children who aren’t comfortable with YouTube Kids’ newer “human-reviewed channels” filtering option, as mistakes could still slip through.

A “human-reviewed” channel means that a YouTube moderator has watched several videos on the channel, to determine if the content is generally appropriate and kid-friendly, but it doesn’t mean every single video that is later added to the channel will be human-reviewed.

Instead, future uploads to the channel will only go through YouTube’s algorithmic layers of security, the company has said.

YouTube Kids expands to tweens

The other new feature now arriving will update YouTube Kids for an older audience who’s beginning to outgrow the preschool-ish look-and-feel of the app, and the way it sometimes pushes content that’s “for babies,” as my 8-year old would put it.

Instead, parents will be able to turn on the “Older” content level setting that opens up YouTube Kids to include less restricted content for kids ages 8 to 12.

According to the company, this includes music and gaming videos – which is basically something like 90% of kids’ YouTube watching at this age. (Not an official stat. Just what it feels like over here.)

The “Younger” option will continue to feature things like sing-alongs and other age-appropriate educational videos, but YouTube Kids’ “Older” mode will let kids watch different kinds of videos, like music videos, gaming video, shows, nature and wildlife videos, and more.

YouTube stresses to parents that its ability to filter content isn’t perfect – inappropriate content could still slip through. It needs parents to participate by blocking and flagging videos, as that comes up.

It’s best if kids continue to watch YouTube while in parents’ presence, of course, and without headphones, or on the big screen in the living room where you can moderate kids’ viewing yourself.

But there are times when you need to use YouTube as the babysitter or a distraction so you can get things done. The new whitelisting option could help parents feel more comfortable letting their kids loose on the app.

Meanwhile, older kids will appreciate the expanded freedom. (And you won’t be constantly begged for your own phone where “regular YouTube” is installed, as a result.)

YouTube says the parental controls are rolling today globally on Android and coming soon to iOS. The “Older” option is rolling out now in the U.S. and will expand globally in the future.

Correction: An earlier version of this post referenced the lack of a blacklisting feature. This was incorrect – blacklisting by channel or video is possible. This section was removed shortly after publishing. Apologies for the error.

Powered by WPeMatico

Tyler Cowen, who I interviewed here, is a fascinating economist. Part pragmatist and part dreamer, he has been researching and writing about the future for a long time in books and his blog, Marginal Revolution. Now he and his university, George Mason, are putting some money where his mouth is.

Cowen and the team at GMU are working on Emergent Ventures, a fellowship and grant program for moon shots. The goal is to give people with big ideas a little capital to help them build out their dreams.

“It has long been my view that risk-takers are not sufficiently rewarded in the world of ideas and that academic incentives are too conservative,” he said. “The intellectual scene should learn something from Silicon Valley and venture capital.”

Cowen is raising $4 million for the first fund. He announced the fund in a podcast on the Mercatus website.

“People such as Satoshi and Jordan Peterson have had huge impacts (regardless of one’s degree of enthusiasm for their ideas), and yet in terms of philanthropic funding the world just isn’t geared to seed their ambitions,” said Cowen.

The project is part of the GMU Mercatus Center, a “source for market-oriented ideas—bridging the gap between academic ideas and real-world problems.” The fund has just opened applications and the amounts granted depend on the project and creator.

Cowen, for his part, is optimistic about the prospects of the future-focused fund.

“I expect to produce a better and freer world, some degree of human self-realization, a better climate for public intellectuals and other creators of ideas, more innovation, and to bring the intellectual side of America more in touch with the entrepreneurial side,” said Cowen.

Powered by WPeMatico

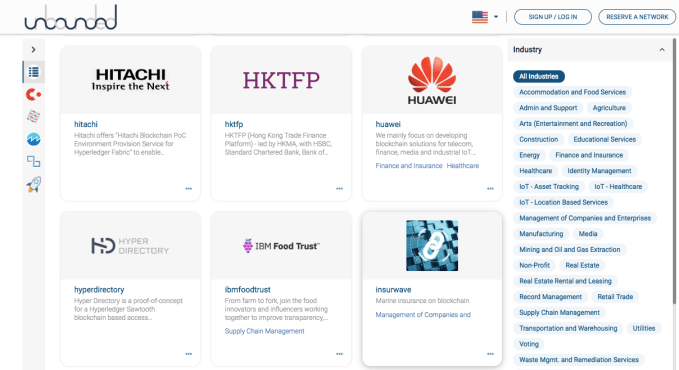

In the 1990s when the web was young, companies like Yahoo, created directories of web pages to help make them more discoverable. Hacera wants to bring that same idea to blockchain, and today it announced the launch of the Hacera Network Registry.

CEO Jonathan Levi says that blockchains being established today risk being isolated because people simply can’t find them. If you have a project like the IBM -Maersk supply chain blockchain announced last month, how does an interested party like a supplier or customs authority find it and ask to participate? Up until the creation of this registry, there was no easy way to search for projects.

Early participants include heavy hitters like Microsoft, Hitachi, Huawei, IBM, SAP and Oracle, who are linking to projects being created on their platforms. The registry supports projects based on major digital ledger communities including Hyperledger, Quorum, Cosmos, Ethereum and Corda. The Hacera Network Registry is built on Hyperledger Fabric, and the code is open source. (Levi was Risk Manager for Hyperledger Fabric 1.0.)

Hacera Network Registry page

While early sponsors of the project include IBM and Hyperledger Fabric, Levi stressed the network is open to all. Blockchain projects can create information pages, not unlike a personal LinkedIn page, and Hacera verifies the data before adding it to the registry. There are currently more than 70 networks in the registry, and Hacera is hoping this is just the beginning.

Jerry Cuomo, VP of blockchain technologies at IBM, says for blockchain to grow it will require a way to register, lookup, join and transact across a variety of blockchain solutions. “As the number of blockchain consortiums, networks and applications continues to grow we need a means to list them and make them known to the world, in order to unleash the power of blockchain,” Cuomo told TechCrunch. Hacera is solving that problem.

This is exactly the kind of underlying infrastructure that the blockchain requires to expand as a technology. Cuomo certainly recognizes this.”We realized from the start that you cannot do blockchain on your own; you need a vibrant community and ecosystem of like-minded innovators who share the vision of helping to transform the way companies conduct business in the global economy,” he said.

Hacera understands that every cloud vendor wants people using their blockchain service. Yet they also see that to move the technology forward, there need to be some standard ways of conducting business, and they want to provide that layer. Levi has a broader vision for the network beyond pure discoverability. He hopes eventually to provide the means to share data through the registry.

Powered by WPeMatico