TC

Auto Added by WPeMatico

Auto Added by WPeMatico

In a world where nothing can be trusted and fake news abounds, ICO and crypto teams are further muddying the waters by trying – and often failing – to pay for posts. While bribes for blogs is nothing new, sadly the current crop of ICO creators and crypto projects are particularly interested in scaling fast and many ICO CEOs are far happier with scammy multi-level marketing tricks than real media relations.

The worst part of this spammy, scammy ecosystem is the service providers. A new group of media organizations are appearing where pay-to-post is the norm rather than the rare exception. I’ve been looking at these groups for a while now and recently found a few egregious examples.

But first some background.

Say you’re trying to publicize a startup. You’ve emailed all the big names in the industry and the emails have gone unanswered. Your product is about to flounder on the market without users and you can’t get any because, in perfect chicken-or-egg fashion, you can’t get funding without users and you can’t get users without funding. So isn’t it a good idea to pay a few dollars for a little press?

No.

And isn’t most PR just pay-for-post anyway?

No.

PR people are consummate networkers and are paid to reach out to media on your behalf and their particular set of skills, honed over long careers, are dedicated to breaking down the forcefield between the journalist and the outside world. They are your surrogate hustlers, dedicated to getting you more exposure. A good PR person is worth their weight in gold. They can call up a popular journalist and make a simple pitch: “This cool new thing is happening. Can I put you in touch?”

If a journalist’s mission is to afflict the comfortable and comfort the afflicted, a good PR person makes the comfortable look slightly afflicted in order to give the journalist a better story. Also, like velociraptors, they are tenacious and will follow up multiple times on your behalf.

A bad PR person, on the other hand, will cold-call hundreds of journalists and read a script that is half the length of Moby Dick. They produce little more than spam and their efforts begin and end with pressing the “Send” button. It’s also interesting to note that many bad PR people, of late, have found new life as ICO specialists.

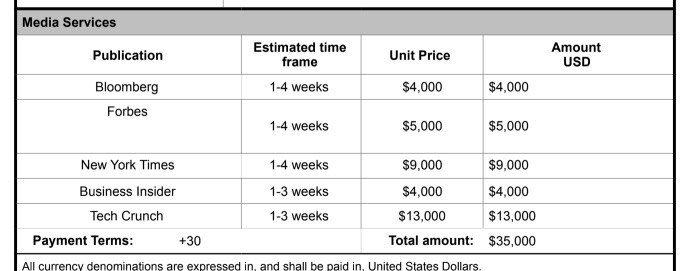

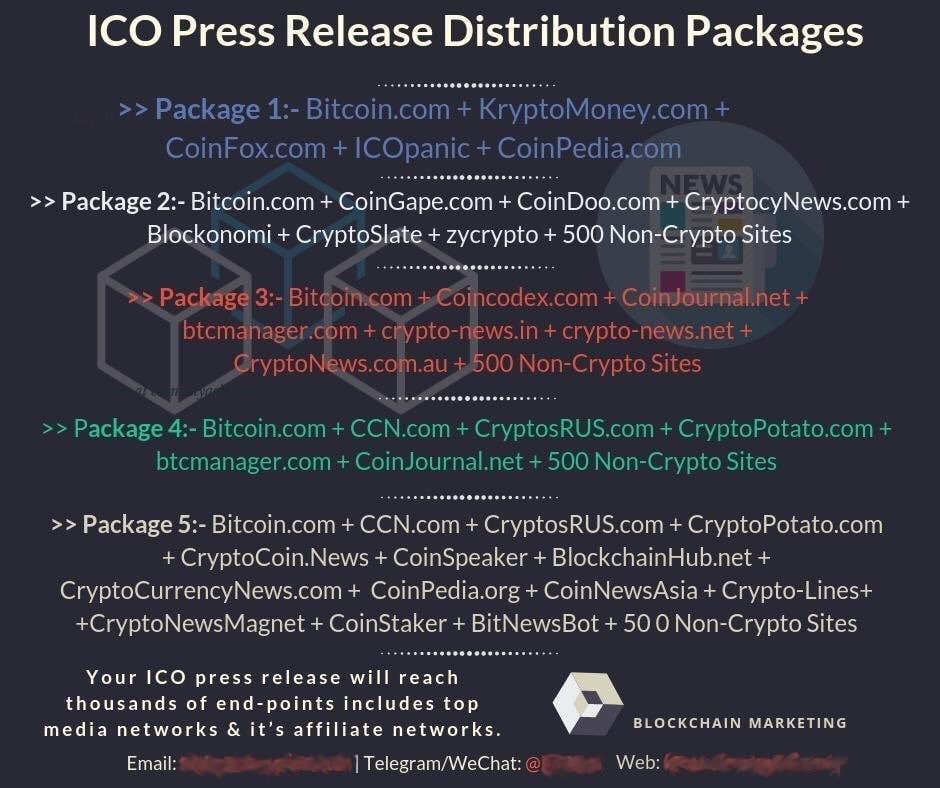

Now meet the pay-for-post hucksters. As I wrote before, there is now a subset of the PR world that offers to get your press release or story on the top of various websites for the low, low price of between $500 and $13,000. For example, one set of hucksters created a small business selling posts on Harvard.edu by creating garbage WordPress blogs and posting press releases to increase SEO coverage. Further, I received a document that outlined the prices for placement in various blogs including this one. While it is impossible to buy a post on TechCrunch this way, it doesn’t stop many from trying.

What’s the difference between that price list and the job a PR person will do for you? The difference is trust. A pay-for-post huckster is dependent on convincing poorly paid freelance writers to add links and other dross to their posts in order to get a “placement.” I get requests like this almost every day and almost all the journalists I talked to reported the same.

Some entrepreneurs are savvy enough to avoid these scams. Even more aren’t.

“I’ve never paid since I think it’s almost always a waste of money but I’ve been offered this type of coverage many times,” said Rick Ramos, of HealthJoy.com. “The last offer was for Kathy Ireland’s Worldwide Business… A TV show that I’ve never heard of in my life. I’ve also been approached by niche publications like InsuranceOutlook and HealthCareTechOutlook that want $3,000 for a ‘reprint branding package.’ A quick Alexa.com search shows their rank as 1,725,207 and 1,054,501 globally. I think I get pitched at least every six months for one of these types of packages.

Unfortunately, many of these organizations hide their request for payment until the last minute. That said, how do you know when it’s someone selling pay-for-play vs. a real editor? It’s usually obvious.

“It’s usually pretty easy to sniff out based on their email blast. It’s pretty untargeted with no reference to what your company does or how it related to a story. Some people are up front about the payment but others want a ’15 min call to discuss.’ A quick LinkedIn search always shows them as a sales person versus a reporter or editor,” said Ramos.

This is a document I received from a company attempting an ICO. This sort of menu was quite uncommon until fairly recently when the “on-demand” economy melded with PR scammers. The completeness of the document is unique – you could feasibly plan your own PR efforts just by reaching out to journalists who work at all of these places. But you’ll also note that each spot has its own price, often in the low hundreds of dollars, which means that those spots are mostly pay-for-play anyway.

ICOLists by on Scribd

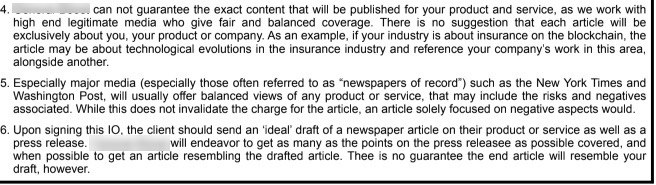

No PR company can promise coverage. In fact, many pay-for-play folks mention this in their communications, hiding it in plain sight. This snippet of text appeared in a contract for work from one of the pay-for-play providers. In short, you’re paying for something they cannot guarantee to get. Interestingly, the PR company below calls their product an IO – an insertion order – which is language used in ad sales. Further, they take great pains in explaining that it is almost impossible to achieve what they promise.

None of the pay-for-post folks I mentioned here would respond to my requests for comment.

Journalists should never expect money for coverage.

Yet many do.

“Lately I have worked on a number of blockchain technology pieces and I have encountered a wide variety of these asks,” said Brittany Whitmore, CEO at Exvera Communications. “A lot of the new, smaller blockchain-focused outlets seem to do a lot of pay-to-play, likely trying to capitalize on the ICO gold rush. The strangest request that I received was that the outlet would do a an article about the news for free but only if we paid them over $1,000 to promote the article with ads. I did not proceed.”

In one very detailed article on The Outline, Jon Christian explored this world and found that many writers received small sums for a single brand mention in a story, a sort of SEO flogging that rarely helps. He wrote:

An unpaid contributor to the Huffington Post, also speaking on condition of anonymity because, in his words, “I would be pretty fucked if my name got out there,” said that he has included sponsored references to brands in his articles for years, in articles on the Huffington Post and other sites, on behalf of six separate agencies. Some agencies pay him directly, he said, in amounts that can be as small as $50 or $175, but others pay him through an employee’s personal PayPal account in order to obfuscate the source of the funds. In a statement, Huffington Post said “Using the HuffPost Contributors Network to self-publish paid content violates our terms of use. Anyone we discover to be engaging in such abuse has their post removed from the site and is banned from future publication.”

The Huffington Post writer also described specific brands he’d written about on behalf of one of the agencies, which ranged from a popular ride-hailing app, to a publicly-traded site for booking flights and hotels, to a large American cell phone service provider.

“This is a classic example of payola,” he said of the brand mentions, invoking a term that’s been used to describe radio DJs who accept payments from record companies in order to play certain artists on the air.

Further, many influencers – folks who sell their Internet fame to the highest bidder – masquerade as journalists, asking for outrageous sums to flog an ICO on their YouTube channel or Instagram page. Pay-for-play services can also put out organic content like this in hopes of appearing in the news.

The rule of thumb? Paid posts and native advertising are not journalism. Ultimately, journalists who charge for coverage are marketers. No one at any reputable news organization will ask for cash but, sadly, there are a number of disreputable news organizations making the rounds.

All this still doesn’t answer the question: Should you pay-to-post?

“The short answer is no,” said Kevin Bourke of BourkePR. “I get asked all the time, and in fact, turned down another request just today. And I advise my clients to decline these offers as well.”

Pay-for-post disrupts journalism in a way that should be familiar and desirable to any modern-day entrepreneur. Middlemen are being knocked out everywhere and brands are approaching consumers from every angle including native ads in Instagram and Twitter. But the value of coverage – real coverage – from a journalists perspective is the opportunity to explain complex ideas to a ready audience. While posting a picture of a blockchain on Facebook and hoping for clicks is one strategy, explaining your views, opinions, and insights is far more important even if you approach it from a mercenary position.

“When you start paying for placement, you remove objectivity and credibility, and in my opinion, this is the reason you look for coverage of your company/products in the first place. That’s what influences readers/viewers. But I understand the temptation for startups. You come to believe that ‘all visibility is good visibility.’ I just can’t agree with that,” said Bourke. “I see the trend toward paid placements (now called sponsored content), paid awards and I can’t stand it – especially with the trade show awards in high tech. They’ve completely devalued the Best of Show awards in so many cases. Typically, only the big companies with budgets can afford them, so many of the smaller guys with no money but amazing products get left out. I understand that the publishing industry needs to figure out new revenue streams – these are very difficult times for them. But they need to figure out smarter business models and maintain the integrity of editorialized content, built on the opinions and perspectives of journalists and influencers.”

Powered by WPeMatico

Facebook is getting ready to purposefully influence the U.S. mid-term elections after spending two years trying to safeguard against foreign interference. Instagram plans to run ads in Stories and feed powered by TurboVote that will target all US users over 18 and point them towards information on how to get properly registered and abide by voting rules. Then when election day arrives, users will be able to add an “I Voted” sticker to their photos and videos that link to voting info like which polling place to go to.

Combined, these efforts could boost voter turnout, especially amongst Instagram’s core audience of millennials. If one political party’s base skews younger, they could receive an advantage. “Ahead of National Voter Registration Day, we are helping our community register to vote and get to the polls on November 6th” Instagram writes. “From today, Instagram will connect US voters with the information they need to get registered.”

In 2010, a non-partisan “Get out the vote” message atop the Facebook News Feed was estimated to have driven 340,000 additional votes. The study by Nature suggested that “more of the 0.6% growth in turnout between 2006 and 2010 might have been caused by a single message on Facebook”. That’s significant considering the 2000 election had a margin of just 0.1 percent of voters.

In 2010, a non-partisan “Get out the vote” message atop the Facebook News Feed was estimated to have driven 340,000 additional votes. The study by Nature suggested that “more of the 0.6% growth in turnout between 2006 and 2010 might have been caused by a single message on Facebook”. That’s significant considering the 2000 election had a margin of just 0.1 percent of voters.

You can watch Instagram’s video ads for voting below, which feature a cartoony purple Grimace character and are clearly aimed at a younger audience. They purposefully avoid any Democratic or Republican imagery, but also stick to a polished and American style that could ensure the clips aren’t mistaken for Russian propaganda.

Earlier this year, the company admitted that 120,000 Instagram posts by the Russian military intelligence group the Internet Research Agency reached 20 million Americans in an attempt to sow discord surrounding the 2016 presidential election. They used a variety of image memes about polarizing social issues to try to divide the country. Facebook has since doubled its security staff to 20,000, required identity verification for political advertisers, and has stepped up its effort to delete scores of fake accounts associated with election interference.

The Russian disinformation attacks could still make users weary to learn about voting from social media. But more turnout means a more democratic society, so it’s easy to see the positive impact of Instagram efforts here. The question remains whether this voter drive will end up the subject of congressional scrutiny at another inevitable hearing on social media and political bias.

Powered by WPeMatico

Rent the Runway, the fashion startup that began as a rental service for special occasions and has since evolved into a service for people also looking to spice up their everyday wear, just opened up its fifth physical, standalone location. The new location, in downtown San Francisco, enables Rent the Runway members to try on clothes, rent and return them.

Rent the Runway’s launch of a standalone brick-and-mortar location in San Francisco comes after it first opened up a location inside Neiman Marcus. With a standalone location, the company is able to offer longer hours for its members. Instead of opening at 10 a.m. and closing at 7 p.m., Rent the Runway can now stay open from 9 a.m. – 8 p.m. Monday through Friday. It also, of course, has weekend hours.

Thanks to some technology Rent the Runway developed within the last year, it has essentially “legalized shoplifting” for its members, Rent the Runway COO Maureen Sullivan told me yesterday ahead of the store’s launch. Toward the front of the store, there’s a self-return process that enables anyone to quickly return their items. A little farther back in the store, there’s a handful of self-checkout kiosks that let members quickly scan their items and leave.

Photo by Miha Matei Photography

Since its launch about nine years ago, Rent the Runway has launched two additional product offerings. In addition to its standard Reserve product, a one-time rental, Rent the Runway now offers two subscription products. The first is called Unlimited, which lets members rent four items at a time on a constant rotation (meaning you can swap them out as much as you want) for $159 a month.

The second is called Update, which lets you rent just four items for the whole month for $89 per month. In the event someone really likes what they’ve rented, they always have the option to purchase the item at anywhere from 10 percent to 75 percent off. Today, the subscription products make up 50 percent of Rent the Runway’s revenue, with San Francisco as the third largest subscription market.

Photo by Miha Matei Photography

In the nine years or so Rent the Runway has been around, a number of other services have cropped up around fashion. Stitch Fix, which went public last November, and Trunk Club by Nordstrom are two of the big ones. But what differentiates Rent the Runway from the likes of Stitch Fix is that, “they’re trying to get you to buy stuff,” Sullivan said. “You’re still buying things that accumulate in your closet.”

The vision with Rent the runway is to get to the point where 50 percent of your closet is rented, and therefore less cluttered. Rent the Runway, for example, has some customers who wear rented clothes 120 days out of the year.

Rent the Runway currently partners with over 500 brands, and operates as a new type of distribution channel for them. What Rent the Runway offers for brands is marketing and discovery, and customer data.

Down the road, Rent the Runway does envision getting into men’s clothing Sullivan said, but right now, there’s “unprecedented growth” in women’s clothing, so that’s where the focus will be for now.

Back in August, Rent the Runway partnered with Temasek for a $200 million credit facility. Before that deal, Rent the Runway had raised more than $200 million from traditional investors like KPCBC, Highland Capital, Bain Capital, TCV and others.

Powered by WPeMatico

Spire’s Health Tags, the dark and tiny devices you stick on your clothes to gather all sorts of health data from your steps, heartbeat and stress levels is now available at your local Apple Store.

The company started out with a breath tracking device to detect when you are feeling tense and help calm you down. But four years in and its now all about the wearable “tags” you stick on items of clothing like your pants or sports bra.

Yes, yes, there are lots of gadgets out there to gather similar information — the Apple Watch will now even detect if you have a fall or if something is wrong with your heart — but the Spire health tag is nothing like a Fitbit or Apple Watch, according to the company. For one, there’s zero need to charge the device. One tag’s battery will last a year and a half before dying out. They’re also machine washable. You just pick a few outfits and stick a tag on each of them.

Of course a few other startups out there are working on making smart, washable, data-gathering clothes. Enflux makes the clothing and then sews in the motion sensor to tell you if you are lifting correctly. Vitali is a “smart” bra with a built-in sensor to detect stress. Then there’s OmSignal, which makes body-hugging workout clothes that gather “medical-grade biometric data to achieve optimal health.” But these tiny health tags are different in that they allow you to choose the clothes you want to adhere the monitor to.

Like Spire’s first product, the Stone, which earned more than $8 million in sales, according to the company, the tags will also pick up on times of stress and help calm you down through a series of breaths and focus on the app.

“Continuous health data will revolutionize health and wellness globally, but early incarnations have been hampered by poor user experiences and a focus on the hardware over the outcomes that the hardware can create,” Spire’s founder Jonathan Palley said. “By making the device ‘disappear’, we believe Health Tag is the first product to unlock the potential.”

Spire’s Health Tags will be sold in Apple Stores as a three-pack for $130, six-pack for $230 and an eight-pack for $300, with additional pack sizes available on the company’s website.

Powered by WPeMatico

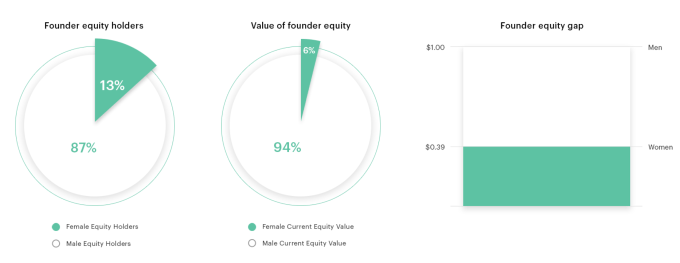

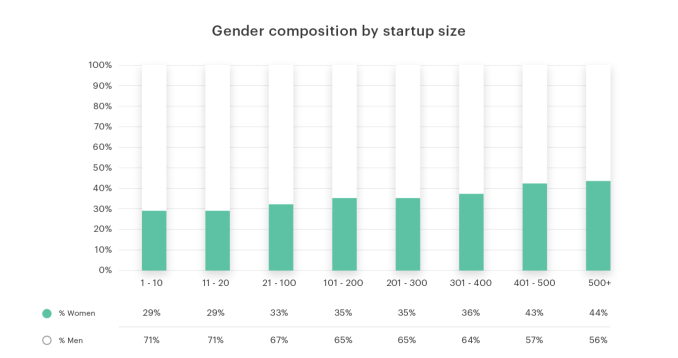

Even bigger than the salary gap that sees women earn $.82 on the dollar is the equity gap. A new study from Carta and the ex-Twitter female investor group #Angels reveals that women make up 35 percent of startup equity-holding employees, yet own just 20 percent of the equity. That means they own just $0.47 for every $1 that men own. Even worse, women account for 13 percent of startup founders but just 6 percent of founder equity — or merely $0.39 on the dollar.

Combined, that means only 9 percent of founder and employee startup equity is owned by women.

“This is not just about wealth” says #Angels’ Chloe Sladden. “Wealth from successful exits goes on to shape the entire industry. It’s about who has power and who gets to decide what gets funded.” #Angels’ Jessica Verrilli notes that “Having this data is going to be a watershed moment and catalyze more urgency to address this underrepresentation.”

The study by cap table management tool Carta (formerly eShares) looked at a subset of its privately held company customers including roughly 180,000 employees, 15,000 founders, and 6,000 companies encompassing $45 billion in equity value.

Amongst the hypothesized causes of the gap are that female-led startups get valued lower and diluted more, there’s less total capital allocated to women due to investor and industry bias, the underrepresentation of women as investors, challenges facing women during negotiations, and that they often team-up with more co-founders that have to split the equity pool.

#Angels’ Jana Messerschmidt explains that the gap table spotlights how women aren’t being hired for early engineering and leadership positions. These roles often get the lion’s share of equity, and when women are hired for sales, marketing, and HR jobs, “those folks are getting less equity because they are joining later and we have a hypothesis of how those roles are valued differently.” Sladden reminds founders to focus on diversity from day one. “Don’t push this off as something you’ll fix down the road as you’re facing all the other challenges.”

Once a successful startup gets acquired or IPOs and paper money turns into cash, tech workers often reinvest their winnings into more startups as angels, fund LPs, or by starting their own venture firm. If only men are getting enough equity to make those downstream investments, their biases could further unbalance the gender breakdown of the tech industry. The #Angels say they’ve found this translates into fewer fundraising term sheets and bargaining power for female founders when they come to the Sand Hill Road boy’s club for venture capital.

Beyond more diverse hiring, the #Angels believe it’s critical that the industry demystify equity so more women know how to exercise stock options and score tax advantages for maximum gain. “You shouldn’t need to have an MBA to know the importance of equity and how to negotiate for it” says Sladden. Better financing avenues for those women who need up-front capital to exercise their stock options could also ensure it’s not just those who already have money who can make money through equity.

Sladden concludes, “We hope this is going to start a movement. We hope that CEOs will start to measure it and talk about it.”

Powered by WPeMatico

Today marks a big milestone for Lyft — one billion rides. That’s a milestone Uber hit in December 2015. Uber has since grown to 10 billion trips completed — including Eats deliveries — as of this past July. Uber, of course, had a bit of head start given it launched in 2009 while Lyft first launched in 2012.

This milestone for Lyft comes about a year after it announced it was completing one million rides a day. To celebrate it, Lyft employees are surprising 3,500 drives with a free tank of gas.

Earlier this month, Lyft officially entered the scooter sharing space when it launched electric scooters in Denver, Colo. Lyft has since deployed its scooters in Santa Monica, Calif. as part of the city’s pilot program. Lyft’s entrance into scooters came close after its acquisition of bike-share company Motivate. We’ll be watching closely to see how Lyft’s additional modes of transportation impacts number of trips completed.

Powered by WPeMatico

Design tools are becoming increasingly important to just about every brand out there. Today, a new entrant joins the race.

Framer X, a revamped version of three-year-old Framer, was founded by Koen Bok and Jorn van Dijk after the duo sold design software Sofa to Facebook in 2011. Framer X is a rich, React-based design tool that lets any designer draw out their interface components and instantly send them over to the engineering team for collaboration.

The key here is reusability and fidelity. With Framer X, engineers can send over existing components that are in production and let designers move forward from there. Conversely, designers aren’t sending developers a facsimile of a button or icon but the actual SVG code behind that component.

Framer X also allows users to collect components and other design items as a package within the Framer X store, so that they’re easily accessible during the design process. Framer X offers a public Framer X Store where casual designers can build off of the experience of advanced designers who’ve uploaded components to the store.

The company also allows enterprises to launch their own private store for use within the organization.

Framer costs $15/month for users, and private Framer X stores for the enterprise are priced flexibly based on the size of the organization.

Framer now joins a competitive landscape, which includes the likes of InVision, Adobe, and Sketch.

The company says it has around 50,000 monthly active users, with 200 companies (including Google, Facebook and Dropbox) using the product. Framer has raised $9 million to date from Greylock, Foundation Capital, Designer Fund, and Accel Europe.

Powered by WPeMatico

UiPath is bringing automation to repetitive processes inside large organizations and it seems to have landed on a huge pain point. Today it announced a massive $225 million Series C on a $3 billion valuation.

The round was led by CapitalG and Sequoia Capital. Accel, which invested in the companies A and B rounds also participated. Today’s investment brings the total raised to $408 million, according to Crunchbase, and comes just months after a $153 million Series B we reported on last March. At that time, it had a valuation of over $1 billion, meaning the valuation has tripled in less than six months.

There’s a reason this company you might have never heard of is garnering this level of investment so quickly. For starters, it’s growing in leaps in bounds. Consider that it went from $1 million to $100 million in annual recurring revenue in under 21 months, according to the company. It currently has 1800 enterprise customers and claims to be adding 6 new ones a day, an astonishing rate of customer acquisition.

The company is part of the growing field of robotic process automation or RPA. While the robotics part of the name could be considered a bit of a misnomer, the software helps automate a series of mundane tasks that were typically handled by humans. It allows companies to bring a level of automation to legacy processes like accounts payable, employee onboarding, procurement and reconciliation without actually having to replace legacy systems.

Phil Fersht, CEO and chief analyst at HfS, a firm that watches the RPA market, says RPA isn’t actually that intelligent. “It’s about taking manual work, work-arounds and integrated processes built on legacy technology and finding way to stitch them together,” he told TechCrunch in an interview earlier this year.

It isn’t quite as simple as the old macro recorders that used to record a series of tasks and execute them with a keystroke, but it is somewhat analogous to that approach. Today, it’s more akin to a bot that may help you complete a task in Slack. RPA is a bit more sophisticated moving through a workflow in an automated fashion.

Ian Barkin from Symphony Ventures, a firm that used to do outsourcing, has embraced RPA. He says while most organizations have a hard time getting a handle on AI, RPA allows them to institute fundamental change around desktop routines without having to understand AI.

If you’re worrying about this technology replacing humans, it is somewhat valid, but Barkin says the technology is replacing jobs that most humans don’t enjoy doing. “The work people enjoy doing is exceptions and judgment based, which isn’t the sweet spot of RPA. It frees them from mundaneness of routine,” he said in an interview last year.

Whatever it is, it’s resonating inside large organizations and UiPath, is benefiting from the growing need by offering its own flavor of RPA. Today its customers include the likes of Autodesk, BMW Group and Huawei.

As it has grown over the last year, the number of employees has increased 3x and the company expects to reach 1700 employees by the end of the year.

Powered by WPeMatico

Late last week, Congress moved one step closer to passing the American Innovation Act of 2018, a bill that would make accounting and tax changes that would likely increase the valuation of startups in an acquisition.

The House Ways and Means committee approved a bill containing text that would improve the treatment of Net Operating Losses (NOLs) for startups. While many startup founders would probably rather watch paint dry (or build their companies) than dive into complex tax code changes, the provisions in the bill could greatly improve the ability of startups to invest in growth activity, and could drive meaningfully positive impacts to valuations, acquisition prices, capital markets participation and venture returns.

First, though, what are NOLs? Each year, if a company loses money, it can claim the losses as a deduction off of its future taxes. Traditionally, the U.S. tax code has allowed companies to cumulatively track and carry forward NOLs to offset taxable income in future years, reducing the amount of cash required to pay taxes. These NOLs are essentially a cash-like asset, and they can be exchanged in the event that a company is acquired.

However, a long-standing IRS provision, Section 382, which was originally implemented to prevent companies with large tax appetites from acquiring those with large operating losses exclusively to reduce taxes, limits the use of NOL carry-forwards in instances of ownership change.

Currently, in cases of an ownership change, specified as a more than 50 percent change in the ownership of shareholders who own at least 5 percent of a company’s stock, the amount of taxable income for the “post-change” company that can be offset by existing NOLs cannot exceed the value of the “pre-change” company, multiplied by the long-term tax exempt rate set by the IRS.

(Yes, this is why you hire a tax attorney.)

The net-net is that this provision has been particularly challenging for startups, which often trigger this limiting condition, given they frequently operate in the red through growth stages and often see frequent, sizable changes in their ownership structure due to fundraising, public offerings and acquisitions.

The House bill would alleviate this complication by protecting these tax offsets and creating an exception to the section 382 provision for startups, allowing the application of NOLs and R&D tax credits realized in the first three years of operations regardless of ownership change limitations.

These changes have a number of benefits for startups. It would provide increased flexibility around early-stage financing activities and remove potential issues that could arise with capital markets activity. Additionally, with startups more easily maintaining tax offsets to reduce their cash taxes, startups would have larger cash balances to invest in growth efforts.

The protection of the NOL from ownership change limitations could also have serious impacts to company valuations and the attractiveness of startups as acquisition candidates. With acquirers better able to utilize existing tax offsets, startups should benefit from higher purchase prices from the inclusion of NOL balances in valuations, helping founder and VC returns.

The bill passed through committee through a voice vote with no objections and is now expected to be voted on by the rest of the House later this month before advancing to the Senate. The bill has 23 co-sponsors, all Republican.

Powered by WPeMatico

WHILL, the startup known for creating sleek, high-tech personal mobility devices, announced today that it has closed a $45 million Series C. The funding will be used for expanding into new international markets, as well as developing new products for large venues, including airports and “last-mile” sidewalk transportation. The round’s lead investors were SBI Investment, Daiwa Securities Group and WHIZ Partners, with participation from returning investors INCJ, Eight Road Ventures, MSIVC, Nippon Venture Capital, DG Incubation and Mizuho Capital.

This brings WHILL’s total funding so far to about $80 million. Founded in Tokyo in 2012, WHILL plans to open a branch in the European Union and enter 10 new European countries. It also plans to start working with partners on developing autonomous capabilities for its mobility devices, senior marketing manager Jeff Yoshioka told TechCrunch. The company will build its own sensors and cameras to use in its “mobility as a service” program, which allows users to control vehicles and call customer service through a mobile app.

One of WHILL’s biggest projects is developing an autonomous personal mobility device system for airports. Yoshioka says that an estimated 20 million people request wheelchairs in U.S. airports each year. This means they need to wait for an airline employee to bring a wheelchair to them and then push them from check-in to their gates. At the same time, it doesn’t give users a lot of flexibility.

The system that WHILL has in mind, on the other hand, would allow individuals to use an app to summon a mobility device over to them. Then they can go wherever they want — coffee shops, restrooms, shops — before heading to the gate without an assistant. Once they are done with the device, it will return to a docking station on its own. WHILL has already begun testing a similar program at Tokyo International Airport in partnership with Panasonic.

Yoshioka says WHILL will most likely pursue distribution partnerships with U.S. airlines, which are responsible for supplying and maintaining the wheelchair systems in American airports, and airports to build the necessary infrastructure.

Along with airports, WHILL wants to bring its technology to other large venues, including shopping malls and sports arenas, as well as create a system for last-mile transportation. Yoshioka notes that “there are already a lot of companies out there like LimeBike and MoBike that offer bikes and electric scooters, but there’s nothing out there for people with disabilities who can’t use those devices.”

Instead, many rely on Ubers or public transportation even for short distances. Like the airport system, WHILL’s last-mile sidewalk system will use autonomous electric vehicles that can be called to users with an app. It faces unique challenges, however, because WHILL’s devices are larger and more expensive than bikes or electric scooters, so the company needs to find safe places to dock them that are still accessible to people with limited mobility. Yoshioka says WHILL likely will focus on partnering with commercial properties to create indoor docking stations.

WHILL’s largest market is still Japan, where it has between 4,000 to 5,000 resellers. In its home market, WHILL’s devices are subsidized by the government and also available for rent. In the U.S., however, many customers need to purchase devices out-of-pocket. To make their products more accessible, WHILL launched the less expensive Model Ci (called the Model C in Europe and Japan) earlier this year. While there is still plenty of room for innovation in the wheelchair market, the Model Ci and other WHILL products compete with devices like the iBot, which can climb stairs, and the Trackchair, designed for off-road use. WHILL’s current products can’t climb stairs, but they do have the advantage of being designed for both indoor and outdoor use, giving users more flexibility, says Yoshioka.

The company also expects demand for its products to grow thanks to a rapidly aging world population, citing statistics that show there are expected to be more than 2.1 billion people over the age of 60 by 2050, up from about 900 million last year.

“We don’t necessarily see [the other companies] as direct competitors. They definitely do impact sales, because people might want something that climbs stairs instead of having better outdoor capabilities, but I think overall it’s very beneficial for the industry,” Yoshioka adds. “As a company that’s trying to disrupt the industry, it’s nice to have them around because it pushes the industry forward and opens eyes for other manufacturers.”

Powered by WPeMatico