TC

Auto Added by WPeMatico

Auto Added by WPeMatico

The Pentagon is going to make one cloud vendor exceedingly happy when it chooses the winner of the $10 billion, ten-year enterprise cloud project dubbed the Joint Enterprise Defense Infrastructure (or JEDI for short). The contract is designed to establish the cloud technology strategy for the military over the next 10 years as it begins to take advantage of current trends like Internet of Things, artificial intelligence and big data.

Ten billion dollars spread out over ten years may not entirely alter a market that’s expected to reach $100 billion a year very soon, but it is substantial enough give a lesser vendor much greater visibility, and possibly deeper entree into other government and private sector business. The cloud companies certainly recognize that.

Photo: Glowimages/Getty Images

That could explain why they are tripping over themselves to change the contract dynamics, insisting, maybe rightly, that a multi-vendor approach would make more sense.

One look at the Request for Proposal (RFP) itself, which has dozens of documents outlining various criteria from security to training to the specification of the single award itself, shows the sheer complexity of this proposal. At the heart of it is a package of classified and unclassified infrastructure, platform and support services with other components around portability. Each of the main cloud vendors we’ll explore here offers these services. They are not unusual in themselves, but they do each bring a different set of skills and experiences to bear on a project like this.

It’s worth noting that it’s not just interested in technical chops, the DOD is also looking closely at pricing and has explicitly asked for specific discounts that would be applied to each component. The RFP process closes on October 12th and the winner is expected to be chosen next April.

What can you say about Amazon? They are by far the dominant cloud infrastructure vendor. They have the advantage of having scored a large government contract in the past when they built the CIA’s private cloud in 2013, earning $600 million for their troubles. It offers GovCloud, which is the product that came out of this project designed to host sensitive data.

Jeff Bezos, Chairman and founder of Amazon.com. Photo: Drew Angerer/Getty Images

Many of the other vendors worry that gives them a leg up on this deal. While five years is a long time, especially in technology terms, if anything, Amazon has tightened control of the market. Heck, most of the other players were just beginning to establish their cloud business in 2013. Amazon, which launched in 2006, has maturity the others lack and they are still innovating, introducing dozens of new features every year. That makes them difficult to compete with, but even the biggest player can be taken down with the right game plan.

If anyone can take Amazon on, it’s Microsoft. While they were somewhat late the cloud they have more than made up for it over the last several years. They are growing fast, yet are still far behind Amazon in terms of pure market share. Still, they have a lot to offer the Pentagon including a combination of Azure, their cloud platform and Office 365, the popular business suite that includes Word, PowerPoint, Excel and Outlook email. What’s more they have a fat contract with the DOD for $900 million, signed in 2016 for Windows and related hardware.

Microsoft CEO, Satya Nadella Photo: David Paul Morris/Bloomberg via Getty Images

Azure Stack is particularly well suited to a military scenario. It’s a private cloud you can stand up and have a mini private version of the Azure public cloud. It’s fully compatible with Azure’s public cloud in terms of APIs and tools. The company also has Azure Government Cloud, which is certified for use by many of the U.S. government’s branches, including DOD Level 5. Microsoft brings a lot of experience working inside large enterprises and government clients over the years, meaning it knows how to manage a large contract like this.

When we talk about the cloud, we tend to think of the Big Three. The third member of that group is Google. They have been working hard to establish their enterprise cloud business since 2015 when they brought in Diane Greene to reorganize the cloud unit and give them some enterprise cred. They still have a relatively small share of the market, but they are taking the long view, knowing that there is plenty of market left to conquer.

Head of Google Cloud, Diane Greene Photo: TechCrunch

They have taken an approach of open sourcing a lot of the tools they used in-house, then offering cloud versions of those same services, arguing that who knows better how to manage large-scale operations than they do. They have a point, and that could play well in a bid for this contract, but they also stepped away from an artificial intelligence contract with DOD called Project Maven when a group of their employees objected. It’s not clear if that would be held against them or not in the bidding process here.

IBM has been using its checkbook to build a broad platform of cloud services since 2013 when it bought Softlayer to give it infrastructure services, while adding software and development tools over the years, and emphasizing AI, big data, security, blockchain and other services. All the while, it has been trying to take full advantage of their artificial intelligence engine, Watson.

IBM Chairman, President and CEO Ginni Romett Photo: Ethan Miller/Getty Images

As one of the primary technology brands of the 20th century, the company has vast experience working with contracts of this scope and with large enterprise clients and governments. It’s not clear if this translates to its more recently developed cloud services, or if it has the cloud maturity of the others, especially Microsoft and Amazon. In that light, it would have its work cut out for it to win a contract like this.

Oracle has been complaining since last spring to anyone who will listen, including reportedly the president, that the JEDI RFP is unfairly written to favor Amazon, a charge that DOD firmly denies. They have even filed a formal protest against the process itself.

That could be a smoke screen because the company was late to the cloud, took years to take it seriously as a concept, and barely registers today in terms of market share. What it does bring to the table is broad enterprise experience over decades and one of the most popular enterprise databases in the last 40 years.

Larry Ellison, chairman of Oracle. Photo: David Paul Morris/Bloomberg via Getty Images

It recently began offering a self-repairing database in the cloud that could prove attractive to DOD, but whether its other offerings are enough to help it win this contract remains to be to be seen.

Powered by WPeMatico

To keep up with the growing sizes of early-stage funding rounds, Y Combinator announced this morning that it will increase the size of its investments to $150,000 for 7 percent equity starting with its winter 2019 batch.

Based in Mountain View, Calif., YC funds and mentors hundreds of startups per year through its 12-week program that culminates in a demo day, where founders pitch their companies to an audience of Silicon Valley’s top investors. Airbnb, Dropbox and Instacart are among its greatest successes.

Since 2014, YC has invested $120,000 for 7 percent equity in its companies. It has increased the size of its investment before — in 2007, a YC “standard deal” was just $20,000 — but the amount of equity the accelerator takes in exchange for the capital has been consistent.

“We thought a $30K increase was necessary to help companies stay focused on building their product without worrying about fundraising too soon,” Y Combinator chief executive officer Michael Seibel wrote in a blog post this morning. “Capital for startups has never been more abundant, and we’ll continue to focus on the things that remain hard to come by — community, simplicity, advice that’s systematic and personal, and above all, a great founder experience.”

Seibel was named CEO in 2016. Co-founder Sam Altman serves as YC’s president.

YC is also changing the way it crafts its investments. It will now invest in startups on a post-money safe basis rather than on a pre-money safe. YC invented the fundraising mechanism, safe, in 2013. A safe, or a simple agreement for future equity, means an investor makes an investment in a company and receives the company stock at a later date — an alternative to a convertible note. A safe is a quicker and simpler way to get early money into a company and the idea was, according to YC, that holders of those safes would be early investors in the startup’s Series A or later priced equity rounds.

In recent years, YC noticed that startups were raising much larger seed rounds than before and those safes were “really better considered as wholly separate financings, rather than ‘bridges’ into later priced rounds.” Founders, in the meantime, were struggling to determine how much they were being diluted.

YC’s latest change, in short, will make it easier for founders to know exactly how much of their company they are selling off and will make capitalization table math, which can be extremely grueling for founders, a whole lot easier.

The pre-money safe has been criticized by founders and investors alike.

Last year, a pair of venture capitalists who’d worked with YC companies, Dolby Family Partners’ Pascal Levensohn and Andrew Krowne, wrote that the safe method was screwing over founders.

“Entrepreneurs who don’t do the capitalization table math end up owning less of their company’s equity than they thought they did. And when an equity round is inevitably priced, entrepreneurs don’t like the founder dilution numbers at all. But they can’t blame the VC, they can’t blame the angels, so that means they can only blame… oops!”

A transition to a post-money safe will eliminate that cap table math headache while still being simple and efficient. The trade-off, YC says, “is that each incremental dollar raised on post-money safes dilutes just the current stockholders, which is often the founders and early employees.” So it’s not perfect, but it’s an improvement.

Recent YC grad Deepak Chhugani, the founder of The Lobby, which announced a $1.2 million investment this week, had a positive response to the changes and said either way, most of the resources provided by YC are priceless to a first-time founder, like himself.

YC is also tweaking its policy around pro-rata follow-ons. You can read about that here.

Powered by WPeMatico

Urban-X, the urban-tech startup accelerator backed by BMW MINI and early-stage urban-tech fund Urban.Us, hosted a demo day today for its fourth cohort of companies at its Brooklyn HQ. The seven presenting companies offered solutions to issues plaguing modern cities, including toll-road pricing, energy and construction management, and even the inefficiencies of modern cycling helmets.

In a day that offered an impressive display of entrepreneurial talent, here are a few of the companies that really stood out to us:

In hopes of improving landlord transparency, Rentlogic uses years of city government data to create objective algorithmic letter ratings for apartment buildings. As CEO Yale Fox pointed out, despite city-dwellers spending half our paychecks on rent, urban housing hasn’t seen the same rating systems that we use to guide decisions on where we eat, what car we buy, or what shows we binge. Rentlogic allows apartment hunters to screen buildings before signing a lease and avoid committing to unhealthy conditions or an absentee landlord.

Rentlogic partners with landlords looking to obtain a stamp of quality for potential renters, offering an added inspection feature that allows them to hang a letter rating outside their building. The company’s roster of customers already includes Blackstone and Phipps Houses, the largest for-profit and non-profit landlords in the world, respectively.

What stands out with Rentlogic is its ability to scale. Though currently only in New York City, the same data used in New York presumably exists across all major US markets and Rentlogic has minimized the cost of entering new cities by building out the back-end infrastructure required to ingest and analyze the data. From a demand perspective, as renters defer to Rentlogic for quality assurance and more competitors hang “A” ratings outside their buildings, landlords will face more pressure to maintain the same offering.

The idea hit home for a born-and-bred New Yorker with my own set of landlord horror stories, and the first thing I did when I left was look up my building on Rentlogic.

Most companies wish they had mega-campuses or “motherships” where they could offer employees access to sprawling outdoor working areas. For companies based in urban areas, offering outdoor space can be tough, with many parks often privatized, far from city centers, or void of the amenities needed to be productive.

Campsyte transforms underutilized urban outdoor spaces into productive and fun spaces that customers can book for co-working purposes, corporate off-sites, or events. Similar to WeWork’s approach with buildings, Campsyte takes a parking lot, and adds value by filling it with greenery, furniture, electricity, WiFi, and other services. With its services driving nearly 10x the annual revenue per square foot seen by traditional parking lots, the value proposition for lot owners is convincing.

Given the competition companies are facing when it comes to attracting and retaining talent, providing the same amenities as competitors based outside city centers seems invaluable, with Campsyte boasting an extremely impressive roster of partner companies, including LinkedIn, PayPal, Salesforce, and Airbnb.

As anyone who has driven in a city knows, car crashes or accidents can often be caused by the built environment around you. Yet insurers, who focus on personal characteristics like credit scores when underwriting a policy, lack the measurement tools to assess the risk of someone’s external environment.

Founded by an MIT-trained city planner, ODN builds risk models using machine learning and public data records to help insurers evaluate risk and mitigate accidents. The resulting analytics eases the selection process for insurers, allowing them to drive more sales with less cost and risk. ODN is already partnered up with some of the world’s largest insurers including Zurich, Travelers, and Hanover insurance.

The potential use cases for ODN’s technology go far beyond the massive existing insurance market, with the eventual rollout of autonomous cars forcing insurers to ask how they construct policies when human behavior plays no role in accidents. ODN is working with carriers to help answer this question while helping create a more efficient and fair underwriting process today.

Avvir: “Avvir automates quality assurance for the construction industry, providing real-time insights into the progress and potential defects on a project.”

ClearRoad: “ClearRoad helps government agencies automate toll road pricing for any section of road without the need for traditional proprietary hardware infrastructure.”

Park & Diamond: “Park & Diamond makes biking better by reinventing the bike helmet, using next-generation materials to build a safer, more portable helmet that can roll up into the shape of a water bottle for easier carrying, while looking like a regular hat, cap, or beanie.”

Sapient Industries: “Sapient Industries has developed an autonomous energy management system that senses and learns human behavior in order to eliminate wasted energy in buildings.”

Powered by WPeMatico

This December a set of autonomous vehicles will start roaming the streets of Columbus, Ohio, in an effort to turn this bustling Midwestern community into the first smart city. The project, which is part of the Smart Columbus and DriveOhio initiatives, is the first step in launching a fully autonomous shuttle route in the city.

“We’re proud to have the first self-driving shuttle in Ohio being tested on the streets of Columbus,” said Mayor Andrew J. Ginther. “This pilot will shape future uses of this emerging technology in Columbus and the nation. Residents win when we add more mobility options to our transportation ecosystem – making it easier to get to work, school or local attractions.”

Michigan-based May Mobility provided the shuttles and the team is training the autonomous vehicles to navigate Columbus streets. May Mobility already launched their vehicles in Detroit and this is the second full implementation of the tech.

The six-seater electric shuttles will follow a 3 mile route through downtown Columbus and the vehicles will start picking up passengers on December 1. Rides are free. May Mobility has already performed over 10,000 successful trips in Detroit. In Columbus the shuttles will drive the Scioto Mile loop, a scenic route through the city and by the Ohio River. A large digital display will show system information and there will be a single operator to oversee the trip and take control in case of emergency.

Founder Edwin Olson is a robotics professor at the University of Michigan and his team won the original DARPA challenge in 2007.

“Cities are seeking cost-effective transportation services that will improve congestion in urban cores, and self-driving shuttles can offer a huge relief,” he said. “As we work toward a future where people can drive less and live more, we’re thrilled to be working with partners from Columbus to provide a new transportation experience that will make traveling through Columbus safe, reliable and personal.”

Columbus won the $40 million Smart City Challenge in June 2016 to test and implement smart city tech.

Powered by WPeMatico

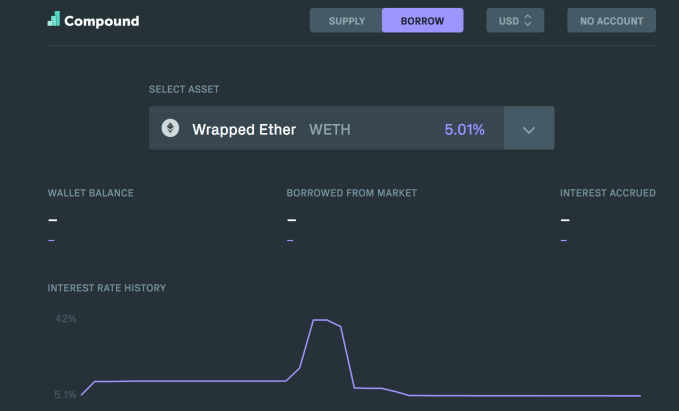

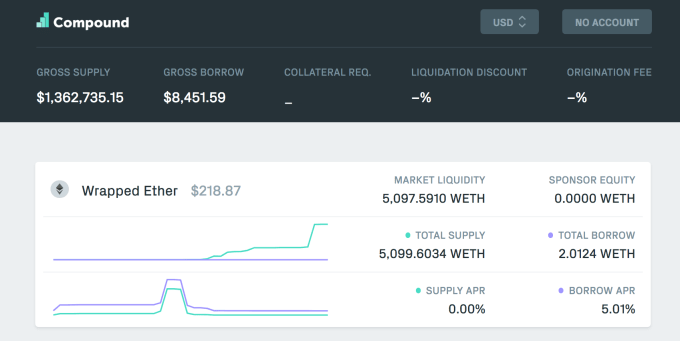

Think Ethereum and other crypto coins are overvalued? Now you can make money when their prices fall via Compound, which is launching its money market protocol for shorting cryptocurrencies today. The Coinbase and Andreessen Horowitz-funded startup today opens its simple web interface allowing users to borrow and short Ethereum, 0x’s ZRX, Brave’s BAT, and Augur’s REP token, or lend them through Compound to earn interest.

Compound’s protocol isn’t just useful for crypto haters, or HODLers who want to generate interest instead of just having their coins gathering dust in a wallet. “If/when Compound scales, this will lead to some really interesting improvements in market structure, namely, fairer prices” Compound CEO Robert Leshner tells me.

The startup spent the summer completing a security audit by Trail Of Bits and adding 26 hedge fund partners who will trade with Compound, offering liquidity to independent investors looking to be matched with borrowers or lenders. Next, the startup wants to offer a stablecoin on its protocol, bring in big financial institutions to add even more liquidity, and partner with a wallet provider to make signup faster.

Compound users visit its site through a Web3 browser such as MetaMask or Coinbase Wallet and enter their Ethereum price. They can then view the interest rates for borrowing and shorting or lending and earning interest for each of the supported tokens. Compound’s secret sauce is that those interest rates are set algorithmically based on demand, though eventually it wants a community governance body to oversee this process. “It ranges from 5 percent to 45 percent APR depending on how scarce liquidity is . . . in general, we expect supply to outnumber borrowing about 5-1, and borrowing rates to be about 10 percent”.

To make sure no one thinks they’re getting scammed, Compound is also releasing a transparency dashboard users can view to check up on all the assets moving through the protocol and see what Compound is earning. It charges 10 percent of what borrowers pay in interest, with the rest going to the lender. That margin is what attracted the $8.2 seed round for Compound that also included Polychain Capital and Bain Capital Ventures.

It could also make crypto exchanges like Coinbase or Robinhood less attractive to users because leaving their coins there comes with the opportunity cost of not lending them for profit. Meanwhile, shorts could pop the volatile crypto bubble and push prices to more sensible and stable levels. That’s market health is a critical precursor to big banks and traditional investors diving into crypto.

[Disclosure: The author owns small positions in Bitcoin and Ethereum, but has no financial motive for writing this article, did not make trades in the week prior to this article, and doesn not plan to make trades in the 72 hours following publication.]

Powered by WPeMatico

WndrCo, the consumer tech investment and holding company founded by longtime Hollywood executive Jeffrey Katzenberg, has invested $30 million in The Infatuation, a restaurant discovery platform.

The Infatuation made waves earlier this year when it purchased Zagat from Google, which had paid $151 million for the 40-year-old company in 2011. Despite efforts to makeover the Zagat app, the search giant ultimately decided to unload the perennial restaurant review and recommendation service and focus on expanding its database of restaurant recommendations organically.

New York-based The Infatuation was founded by music industry vets Chris Stang and Andrew Steinthal in 2009. It has previously raised $3.5 million for its mobile app, events, newsletter and personalized SMS-based recommendation tool.

Stang told TechCrunch this morning that they plan to use a good chunk of the funds to develop the new Zagat platform, which will be kept separate from The Infatuation.

“The first thing we want to do before we build anything is spend a lot of time researching how people have used Zagat in the past, how they want to use it in the future, what a community-driven platform could look like and how to apply community reviews and ratings to the brand,” said Stang, The Infatuation’s chief executive officer. “Zagat’s roots are in user-generated content. … What we are doing now is thinking through what that looks like with new tech applied to it. What it looks like in the digital age. How [we can] take our domain expertise and that legendary brand and make something new with it.”

The Infatuation will also expand to new cities beginning this fall with launches in Boston and Philadelphia. It’s already active in a dozen or so U.S. cities including Los Angeles, Seattle and San Francisco. The startup’s first and only international location is London.

Katzenberg, who began his Hollywood career at Paramount Pictures, began raising up to $2 billion for WndrCo about a year ago. Since then, he’s unveiled WndrCo’s new mobile video startup NewTV, which has raised $1 billion and hired Meg Whitman, the former president and CEO of Hewlett Packard, as CEO.

On top of that, WndrCo has invested in Mixcloud, Axios, Node, Flowspace, Whistle Sports, TYT Network and others.

Given The Infatuation founders’ experience in the entertainment industry, a partnership with Katzenberg was natural.

“We really felt like between content and technology they had … expertise on both sides,” Stang said. “The Infatuation is at its best when great content intersects with great technology, to find a fund that was perfectly suited to that was exciting.”

Powered by WPeMatico

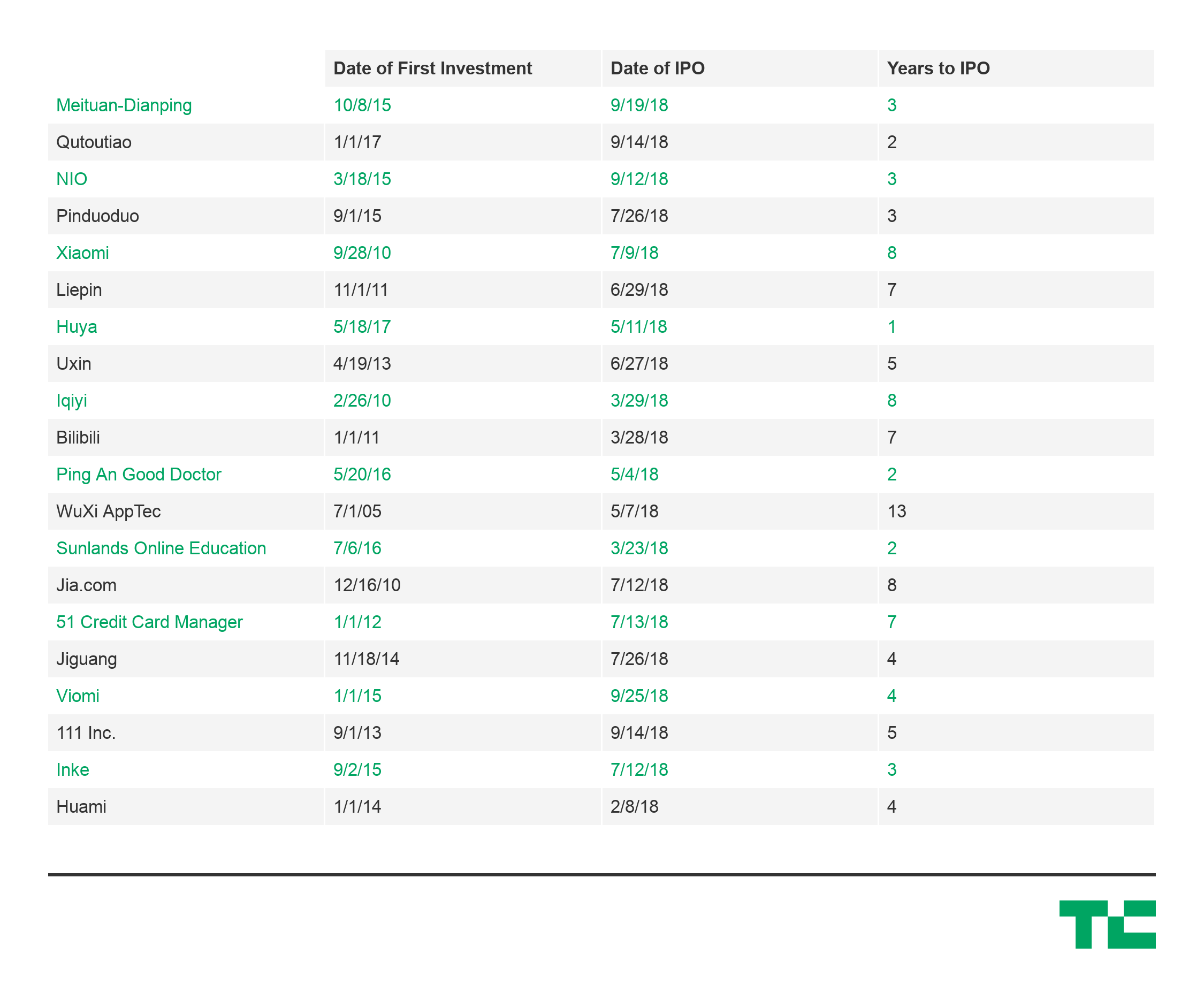

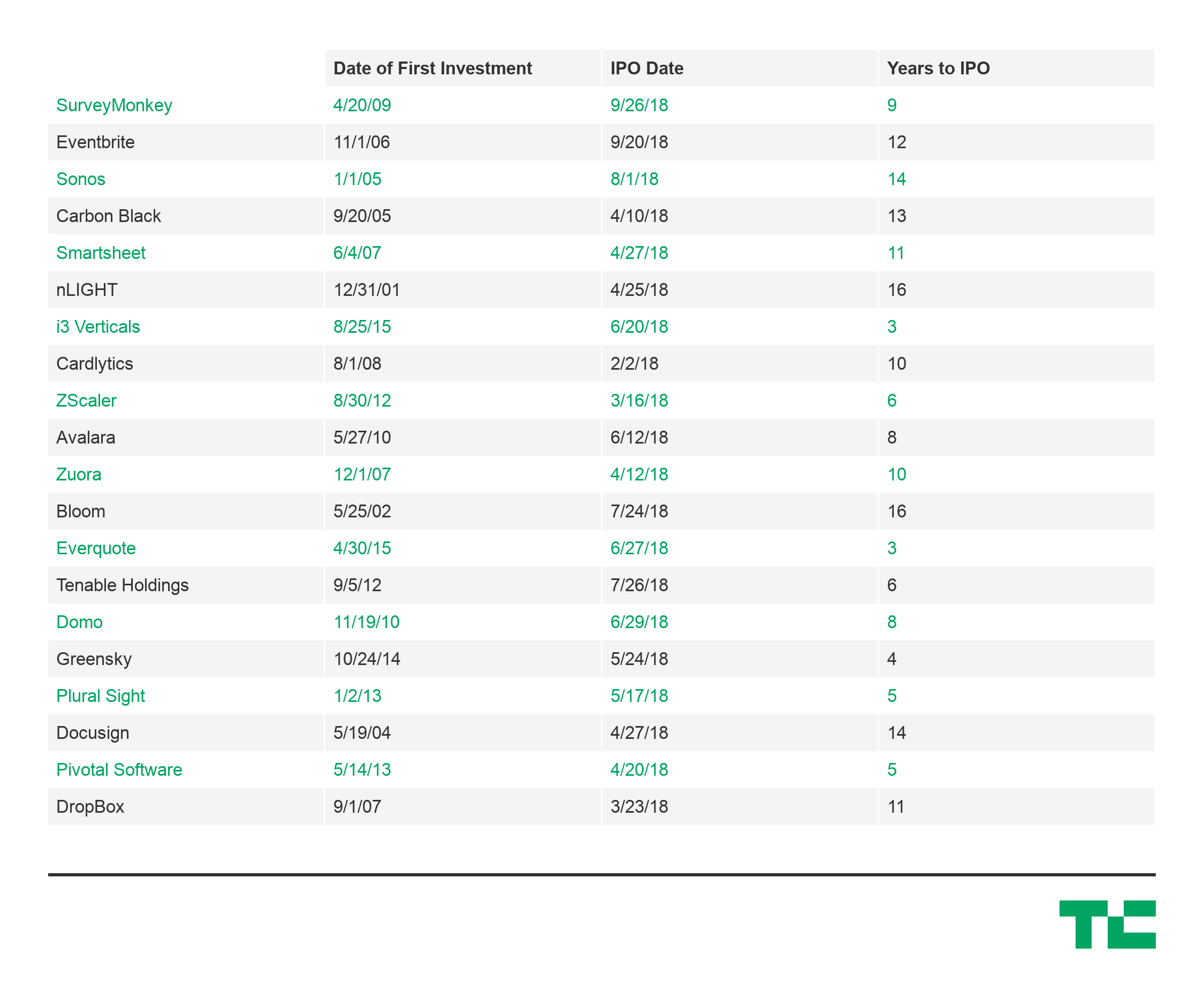

This year’s rush of IPOs from Chinese tech companies has dominated headlines, but what’s more interesting is how quickly they got there.

Traditionally, “going public” represented the gratifying culmination of sleepless nights and missed birthdays that went into building a company. The peak of a lengthy climb, where founders and VCs would finally see the fruits of their labor.

However, Chinese companies appear to be reaching that peak much quicker than their American peers, heading to the public markets only a few years after initial venture investments, and often with little operating history.

Analyzing twenty of the most high profile Chinese tech IPOs this year, the average time from first venture investment to IPO was only around three to five years. Take e-commerce platform Pinduoduo, which pulled in $1.6 billion less than three years after its Series A. Or the recent IPO of EV-manufacturer NIO, which raised a billion dollars just three-and-a-half years after its Series A and having just delivered its first car in June.

China IPO data for 2018 compiled from NASDAQ, Pitchbook, and Crunchbase

That’s less than half the average 10-year timeline for venture-backed US tech companies that went public in 2018, including Dropbox, Eventbrite, and DocuSign, which all IPO’d more than a decade after their initial investments.

Differences in market maturity, government involvement, and support from large tech incumbents all undoubtedly play a factor, but the speed to liquidity for the Chinese companies is still astounding.

Speed to liquidity is a critical metric for the health of a startup ecosystem. It creates a positive cycle where faster liquidity can drive faster fundraising, faster reinvestment, faster startup building, and faster public liquidity again. An accelerated cycle could be especially appealing for funds with LPs that require faster returns due to cash commitments or otherwise.

It’s important to note that venture returns are a function of capital and time, so quicker exits will also drive higher returns for the same amount invested. For example, a $1 million investment with a $5 million exit after ten years would generate an Internal Rate of Return (a commonly used metric to evaluate VC performance) of 20%. If the same exit occurred after five years, the IRR would be 50%.

Liquidity is a key consideration as China’s influence on the flow of global venture capital intensifies. As China’s tech ecosystem sees more of its darlings mature and more consistently deliver smashing exits, investments in China will have to be a more serious consideration for VCs, even if only to minimize the sheer amount of time, resources, and painstaking energy needed to build a company in the U.S.

Powered by WPeMatico

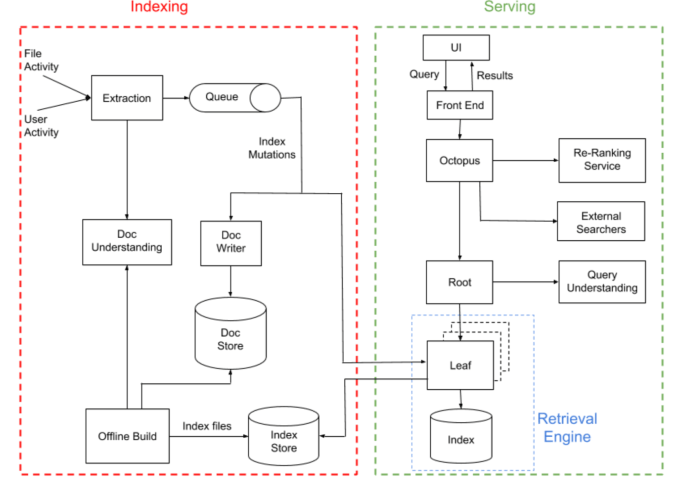

Over the last several months, Dropbox has been undertaking an overhaul of its internal search engine for the first time since 2015. Today, the company announced that the new version, dubbed Nautilus, is ready for the world. The latest search tool takes advantage of a new architecture powered by machine learning to help pinpoint the exact piece of content a user is looking for.

While an individual user may have a much smaller body of documents to search across than the World Wide Web, the paradox of enterprise search says that the fewer documents you have, the harder it is to locate the correct one. Yet Dropbox faces of a host of additional challenges when it comes to search. It has more than 500 million users and hundreds of billions of documents, making finding the correct piece for a particular user even more difficult. The company had to take all of this into consideration when it was rebuilding its internal search engine.

One way for the search team to attack a problem of this scale was to put machine learning to bear on it, but it required more than an underlying level of intelligence to make this work. It also required completely rethinking the entire search tool from an architectural level.

That meant separating two main pieces of the system, indexing and serving. The indexing piece is crucial of course in any search engine. A system of this size and scope needs a fast indexing engine to cover the number of documents in a whirl of changing content. This is the piece that’s hidden behind the scenes. The serving side of the equation is what end users see when they query the search engine, and the system generates a set of results.

Nautilus Architecture Diagram: Dropbox

Dropbox described the indexing system in a blog post announcing the new search engine: “The role of the indexing pipeline is to process file and user activity, extract content and metadata out of it, and create a search index.” They added that the easiest way to index a corpus of documents would be to just keep checking and iterating, but that couldn’t keep up with a system this large and complex, especially one that is focused on a unique set of content for each user (or group of users in the business tool).

They account for that in a couple of ways. They create offline builds every few days, but they also watch as users interact with their content and try to learn from that. As that happens, Dropbox creates what it calls “index mutations,” which they merge with the running indexes from the offline builds to help provide ever more accurate results.

The indexing process has to take into account the textual content assuming it’s a document, but it also has to look at the underlying metadata as a clue to the content. They use this information to feed a retrieval engine, whose job is to find as many documents as it can, as fast it can and worry about accuracy later.

It has to make sure it checks all of the repositories. For instance, Dropbox Paper is a separate repository, so the answer could be found there. It also has to take into account the access-level security, only displaying content that the person querying has the right to access.

Once it has a set of possible results, it uses machine learning to pinpoint the correct content. “The ranking engine is powered by a [machine learning] model that outputs a score for each document based on a variety of signals. Some signals measure the relevance of the document to the query (e.g., BM25), while others measure the relevance of the document to the user at the current moment in time,” they explained in the blog post.

After the system has a list of potential candidates, it ranks them and displays the results for the end user in the search interface, but a lot of work goes into that from the moment the user types the query until it displays a set of potential files. This new system is designed to make that process as fast and accurate as possible.

Powered by WPeMatico

Entrepreneur First (EF), the company builder and “talent first” investor, held its tenth London Demo Day this afternoon. This time around the even had a decidedly more international bent as it combined pitches from the London and recently launched Berlin programs.

Once again, the pitches took place in front of a nearly overcapacity crowd at King’s Place in London’s King Cross area, and saw a 24 startups pitch their wares to investors, press and other actors in the European tech scene.

EF stands out from the many other demo days that the U.K. capital city hosts because of the way the investor backs individuals “pre-team, pre-idea” — meaning that the companies pitching only came into existence over the last 6 months and perhaps may never have done so without the founders bashing heads during the program.

Unusually, aside from the upstarts presenting on stage, there were no other EF announcements today, which is in stark contrast to most previous demo days. However, I’m hearing there could be some big EF news coming quite shortly and this is likely a case of EF lining up its PR ducks in a row and choosing to shoot them down one news opportunity at a time. Besides, the company builder has had more than its fair share of announcements over the last twelve months.

In addition to existing programs in London and Singapore, this year saw EF expand to Hong Kong and Paris, as well as Berlin. And almost exactly a year ago, EF announced a $12.4 million funding round led by Silicon Valley’s Greylock Partners, and that Greylock’s Reid Hoffman had joined the company builder’s board. The capital — to be used for operational purposes and separate from EF’s multiple investment funds — was raised to enable EF to scale its program in multiple tech startup/academic hubs around the world, and where it deemed the EF “secret sauce” can bring the most value.

Meanwhile, the themes for EF’s tenth London Demo Day continued to reflect the company builder’s focus on recruiting the best technical and domain expert talent — both recent graduates and also people already working at tech companies. They spanned AR headsets, “massive simulations,” genome sequencing, machine intelligence, and cryptocurrencies.

After tuning in to the live stream and enduring 24 rounds of ‘pitchlash’, my cursory 3 picks this time around are as follows:

With a mission to “empower people to build a new relationship with food, myLevels uses data from Continuous Glucose Monitors combined with its own Bayesian-based machine learning models to measure the impact that food has on an individual’s body and metabolism. This is because the effect different food has on a person’s blood sugar levels — and the sometimes horrible spike followed by craving — varies person by person, and until now it has been difficult to build a personalised understanding of this. Once you have that understanding it becomes easier to lose weight and increase higher energy levels and even concentration.

There’s gold in those microbiome, apparently. Juno Bio is “unlocking the potential of the microbiome” (bacteria that lives in our guts and other places, such as animals and soil), which the startup says has unprecedented potential to disrupt various industries such as the $195 billion fertiliser industry. More broadly, Juno Bio says there is an arms race for understanding and harnessing the information that microbiome hold. To that end, Juno Bio uses machine learning and state of the art bioinformatics to analyse and predict how best to manipulate microbiomes, significantly reducing the time and resources needed to improve their functionality.

Circuit Mind wants to use AI to automate the design of electronic circuits. The startup reckons that every year £40bn and 1.5bn hours are spent globally in “tedious and repetitive circuit board design” work, making building hardware even harder than it needs to be. To fix this, the company is building artificial intelligence that takes in the requirements for a circuit board and outputs the circuit board final design, ready for manufacture. “This means better circuits, designed orders of magnitude faster, at a fraction of the cost,” says Circuit Mind. Chalk this one up as another industry 4.0 play, of which EF already has a promising track record.

● Nodes & Links is taming the complexity of modern projects.

● CodeREG makes regulatory change in finance as simple as a software update.

● QFlow enables construction teams to track, analyse and respond to environmental

risks.

● Moonsift is the first platform for shoppers to create their own digital twin for product

discovery.

● Homewards is the next generation of home ownership.

● Popsure gives personalised insurance advice.

● Metomic is data privacy made simple.

● Teamflow unlocks the power of human intelligence in organisations to improve

productivity

● myLevels empowers people to build a new relationship with food.

● Phantasma Labs is helping self-driving cars understand humans better.

● Juno Bio is unlocking the potential of the microbiome.

● Magic Sandbox produces world class software engineers at scale.

● Faultless AI eliminates human error in manufacturing.

● Janus Genomics builds AI tools to enable biomedical data sharing while preserving

data privacy.

● Lumenora is the world’s first compact, high field-of-view Augmented Reality

headset.

● Donut enables increased crypto adoption through personalised portfolios. Fully

regulated.

● Juniper uses hybrid deep learning to empower oncologists.

● WILD AI empowers humans to reach their personal best through datalogy.

● Holotron unleashes the true potential of VR & humanoid robots.

● Data Hygge helps companies spot, prioritise and solve experience issues.

● Yo-Da is the personal data management platform making consumer data protection

quick, easy, and profitable.

● Insurami is removing friction in office space onboarding.

● Atlas ML is a development platform for machine learning.

● Circuit Mind is using AI to completely automate the design of electronic circuits.

Powered by WPeMatico

Fast, healthy food is one of those concepts that just seems too good to be true. But Farmer’s Fridge, a Chicago-based startup that recently closed a $30 million Series C round led by former Google CEO Eric Schmidt’s Innovation Endeavors, aims to make that a reality.

Farmer’s Fridge retrofits vending machines to serve up healthy foods — salads, sandwiches, granola, etc. — for people on the go, for anywhere from $5 to about $8. In order to ensure restaurant-quality food, Farmer’s Fridge has a chef on board who receives feedback from customers to constantly tweak the menu and the food. There’s also a large workforce in place to restock the food, which is prepared daily in Farmer’s Fridge’s kitchen, every morning. I tried the food while I was in Chicago, and I must admit that it was good. And this is coming from someone who generally dislikes salad.

While the amount of waste is low (about 5 percent left over) — thanks to its allocation algorithm that determines how much of each type of food to stock in each vending machine location — Farmer’s Fridge has a system in place to deliver leftover food to the Greater Chicago Food Depository, a food bank that works in partnership with 700 agencies, including soup kitchens, shelters and pantries.

“The hypothesis for the business is that it’s been done for ATMs, it’s been done for movies, and those things have nothing to do with each other. So the only connection would be that consumers generally want things that are faster and cheaper and more convenient, as long as they don’t have to sacrifice any quality from the experience,” Farmer’s Fridge founder and CEO Luke Saunders told me at the startup’s headquarters in Chicago.

Farmer’s Fridge founder and CEO Luke Saunders at the startup’s Chicago-based HQ

“So, renting a movie from a kiosk — there’s no difference,” he added. “It’s the same movie when you get home. With food, though, it was interesting because there’s a lot of businesses where the experience is supposedly the most important part, so ‘if you have really good service at a restaurant, could technology actually replace that experience’ was the core question of the business. Or is that an important sustained advantage for a restaurant versus our business model?”

So far, it’s been working. Since launching in 2013, Farmer’s Fridge has deployed 200 vending machines throughout Chicago and Milwaukee. Farmer’s Fridge vending machines can be found in airports, hospitals and in traditional retailers, like pharmacies, convenience stores and even the Amazon Go store in Chicago. Each location gets stocked at least five days a week, while the airport gets stocked seven days a week. Depending on the business partner, Farmer’s Fridge has a revenue model that ranges from subsidized accounts to revenue shares.

“Each vertical behaves really differently,” Saunders said. “In a hospital, they care more about having an amenity overnight for employees who don’t have access to a cafeteria than they do about profitability. At O’Hare International Airport, it’s a revenue share because of the traffic generated. For some retailers, it’s about the traffic Farmer’s Fridge brings to those places.”

The app is probably the least technologically interesting part about Farmer’s Fridge, but what it offers is an easy way to see where you can find a fridge, the inventory of said fridge and the ability to reserve food from that fridge ahead of time. The fridge itself is the real technological achievement. It’s an internet-connected device that runs firmware and features a graphical user interface and cloud infrastructure.

Next year, the plan is to expand regionally and launch in an additional region. In the nearer term, Farmer’s Fridge is expecting to grow from 130 employees today to about 200 by the end of next year.

Powered by WPeMatico