TC

Auto Added by WPeMatico

Auto Added by WPeMatico

Oracle today announced that it has made another acquisition, this time to enhance both the kind of data that it can provide to its business customers, and its artificial intelligence capabilities: it is buying DataFox, a startup that has amassed a huge company database — currently covering 2.8 million public and private businesses, adding 1.2 million each year — and uses AI to analyse that to make larger business predictions. The business intelligence resulting from that service can in turn be used for a range of CRM-related services: prioritising sales accounts, finding leads, and so on.

“The combination of Oracle and DataFox will enhance Oracle Cloud Applications with an extensive set of AI-derived company-level data and signals, enabling customers to reach even better decisions and business outcomes,” noted Steve Miranda, EVP of applications development at Oracle, in a note to DataFox customers announcing the deal. He said that DataFox will sit among Oracle’s existing portfolio of business planning services like ERP, CX, HCM and SCM. “Together, Oracle and DataFox will enrich cloud applications with AI-driven company-level data, powering recommendations to elevate business performance across the enterprise.”

Terms of the deal do not appear to have been disclosed but we are trying to find out. DataFox — which launched in 2014 as a contender in the TC Battlefield at Disrupt — had raised just under $19 million and was last valued at $33 million back in January 2017, according to PitchBook. Investors in the company included Slack, GV, Howard Linzon, and strategic investor Goldman Sachs among others.

Oracle said that it is not committing to a specific product roadmap for DataFox longer term, but for now it will be keeping the product going as is for those who are already customers. The startup counted Goldman Sachs, Bain & Company and Twilio among those using its services.

The deal is interesting for a couple of reasons. First, it shows that larger platform providers are on the hunt for more AI-driven tools to provide an increasingly sophisticated level of service to customers. Second, in this case, it’s a sign of how content remains a compelling proposition, when it is presented and able to be manipulated for specific ends. Many customer databases can get old and out of date, so the idea of constantly trawling information sources in order to create the most accurate record of businesses possible is a very compelling idea to anyone who has faced the alternative, and that goes even more so in sales environments when people are trying to look their sharpest.

It also shows that, although both companies have evolved quite a lot, and there are many other alternatives on the market, Oracle remains in hot competition with Salesforce for customers and are hoping to woo and keep more of them with the better, integrated innovations. That also points to Oracle potentially cross and up-selling people who come to them by way of DataFox, which is an SaaS that pitches itself very much as something anyone can subscribe to online.

Powered by WPeMatico

Cowboy, the Belgian startup that designed and sells a smarter electronic bicycle, has raised €10 million in Series A funding.

Leading the round is Tiger Global Management, with participation from previous backers Index Ventures and Hardware Club. The new capital will be used to scale operations and expand beyond Belgium into Germany, U.K., Netherlands and France.

Founded in January 2017 by Adrien Roose and Karim Slaoui, who both previously co-founded Take Eat Easy (an early Deliveroo competitor), and Tanguy Goretti, who previously co-founded ridesharing startup Djump, Cowboy set out to build and sell direct a better designed e-bike.

This included making the Cowboy bike lighter in weight and more stylish than models from incumbents, and adding automatic motor assistance. The latter utilizes built-in sensor technology that measures speed and torque, and adjusts to pedaling style and force to deliver an added boost of motor-assisted speed at key moments, e.g. when you start pedaling, accelerate or go uphill.

In addition, Cowboy’s “smart” features powered by the Cowboy app enables the device to be switched on and off, track location, provide “ride stats” and support remote troubleshooting and software updates. A theft detection feature is also promised soon.

“We designed the Cowboy bike to appeal specifically to people who are yet to be convinced that electric bikes are a practical and mainstream mode of transport,” says Adrien Roose, Cowboy’s CEO, in a statement.

“We focused our attention on the three main reasons people are reluctant to purchase electric bikes: high cost, poor design and redundant technology — or a combination of the above — and we set about fixing them all.”

Powered by WPeMatico

How can Lime differentiate its scooters and bikes from the piles of Birds and Spins filling Los Angeles sidewalks? Apparently with a physical storefront where it can convince customers of the wonders of on-demand mobility. According to a job listing from Lime seeking a “Retail Store Manager,” the startup plans to open a “lifestyle brand store in Santa Monica”.

[Update: Following the publication of this article, Lime responded to our inquiry, telling TechCrunch “In the coming year, Lime will be opening brick & mortar storefronts in major US and international markets, starting with Santa Monica, California. Locations will place heavy importance on community engagement, rider education, and brand experience.”]

Lime will rent vehicles directly from the store as well as charge them, with the full-time manager’s role including “monitoring inventory levels” as well as daily operations, and employee recruiting. They’ll also be throwing live events to build Lime’s hype. Given the company is calling this a lifestyle store, the focus will likely be on showing how Lime’s scooters and bikes can become part of people’s lives and enhance their happiness, rather than on maximizing rental volume.

A rendering of Lime’s new office it’s building in San Francisco. The design could hint at what Lime wants to do with its retail store branding.

TechCrunch has confirmed Lime’s plans for the store, and that the deal to build it came through Lime’s investor Fifth Wall Ventures that arranges partnerships between tech companies and real estate developers. As for what will happen at the store, Fifth Wall’s Adam Demuyakor tells me “There will be deployment of scooters, charging of scooters, and some sales of apparel and accessories that are related. There will be demos, tutorials, and presentations on how to be safe.” Growing Lime’s traction is critical to Fifth Wall, which led the startup’s $70 million Series B extension in February, and joined its $335 million Series C in July.

The big motive here is for Lime to repair relationships with the local community. Demuyakor tells me “when e-mobility companies appeared, some people really loved it, but some people said ‘you dropped a bunch of scooters on my sidewalk’” in what he called a “really irresponsible manner”. But with a physical store front, Lime will have human faces to push its side of the story. “Lime would have an opportunity to control the narrative, engage with the local community, and invest in Santa Monica. They can make it clear that they care about the constituency there . . . Educate them on the benefits, educate them on safety, and provide helmets.” That could counter the idea that scooters just get in the way and are an urban eye sore. “The narrative took on legs of its own” Demuyakor explains.

Fifth Wall worked on the Lime retail store deal with one of its core LPs, Macerich, the third-largest owner of shopping malls in the US. Lime will become the exclusive distributor of scooters at the Macerich-owned open-air mall Santa Monica place. The idea is that by linking up with Macerich, Lime will be able to deploy and charge scooters “where people are coming and going from the mall” Fifth Wall co-founder and managing partner Brendan Wallace tells TechCrunch. He explains that scooter companies have thought about expansion too purely from the standpoint of acheiving market saturation. “You have to partner with local organizations both public and private, and real estate organizations because real estate developers are typically the most politically influential.”]

The listing was first spotted by Nathan Pope, a transportation researcher for consultancy Steer, and later by Cheddar’s Alex Heath. We’ve reached out to Lime and will update if we hear back from the company. Glassdoor shows that the store manager job was posted more than 30 days ago, and the site estimates the potential salary at $41,000 to $74,000.

The sheer number of Lime scooters in Santa Monica where the store will arise is already staggering. Supply doesn’t seem to be bottlenecking as it is in some other cities. Instead, it’s the fierce competition from hometown startups like local favorite Bird that Lime wants to overcome through brick-and-mortar marketing. Often you’ll see scooters from Lime and Bird lined up right next to each other. And with similarly cheap pricing, the decision of which to use comes down to brand affinity. According to Apptopia, Bird’s monthly U.S. downloads surpassed Lime’s in July for the first time ever, despite Lime offering bikes as well as scooters.

The sheer number of Lime scooters in Santa Monica where the store will arise is already staggering. Supply doesn’t seem to be bottlenecking as it is in some other cities. Instead, it’s the fierce competition from hometown startups like local favorite Bird that Lime wants to overcome through brick-and-mortar marketing. Often you’ll see scooters from Lime and Bird lined up right next to each other. And with similarly cheap pricing, the decision of which to use comes down to brand affinity. According to Apptopia, Bird’s monthly U.S. downloads surpassed Lime’s in July for the first time ever, despite Lime offering bikes as well as scooters.

There are plenty of people who still have never tried an on-demand electric scooter, and going through the process of renting, unlocking and riding them might be daunting to some. If employees at a physical store can teach people that it’s not too difficult to jump aboard, Lime could become their default scooter. This, of course, comes with risks too, as electric scooters can be dangerous to the novice or uncoordinated. More aggressive in-person marketing might pull in users who were apprehensive about scooting for the right reason — concerns about safety. And there’s also the issue of overhead costs. Beyond charging and repair facilities near its major markets, brick-and-mortar stores could crank up the burn rate on Lime’s $467 million in funding.

As cities figure out how to best regulate scooters, I hope we see a focus on uptime, aka how often the scooters actually function properly. It’s common in LA to rent a scooter, then discover the handlebar is loose or the acceleration is sluggish, end the ride and rent another scooter from the same brand or a competitor in hopes of getting one that works right. I ditched several Lime scooters like this while in LA last week.

Regulators should inquire about what percentage of scooter company fleets are broken and what percentage of rides end within 90 seconds of starting, which is typically due to a malfunctioning vehicle. Cities could then award permits to companies that keep their fleets running, rather than that litter the streets with massive paper weights, or worse, vehicles that could crash and hurt people. Scooters are fun, cheap and therefore accessible to more people than Ubers, and reduce traffic. But unless startups like Lime put a bigger focus on helmets and cautious riding behavior, we could trade congestion on the roads for congestion in the emergency room. Hopefully the retail store will drive closer ties between Lime and city governments to prioritize safety.

This article has been updated to include Lime’s statement as well as comments from Fifth Wall Ventures.

Powered by WPeMatico

Minds, a decentralized social network, has raised $6 million in Series A funding from Medici Ventures, Overstock.com’s venture arm. Overstock CEO Patrick Byrne will join the Minds Board of Directors.

What is a decentralized social network? The creators, who originally crowdfunded their product, see it as an anti-surveillance, anti-censorship, and anti-“big tech” platform that ensures that no one party controls your online presence. And Minds is already seeing solid movement.

“In June 2018, Minds saw an enormous uptick in new Vietnamese of hundreds of thousands users as a direct response to new laws in the country implementing an invasive ‘cybersecurity’ law which included uninhibited access to user data on social networks like Facebook and Google (who are complying so far) and the ability to censor user content,” said Minds founder Bill Ottman.

“There has been increasing excitement in recent years over the power of blockchain technology to liberate individuals and organizations,” said Byrne. “Minds’ work employing blockchain technology as a social media application is the next great innovation toward the mainstream use of this world-changing technology.”

Interestingly, Minds is a model for the future of hybrid investing, a process of raising some cash via token and raising further cash via VC. This model ensures a level of independence from investors but also allows expertise and experience to presumably flow into the company.

Ottman, for his part, just wants to build something revolutionary.

“The rise of an open source, encrypted and decentralized social network is crucial to combat the big-tech monopolies that have abused and ignored users for years. With systemic data breaches, shadow-banning and censorship, people over the world are demanding a digital revolution. User-safety, fair economies, and global freedom of expression depend on it – we are all in this battle together,” said Ottman.

Powered by WPeMatico

When I bought the Nintendo Switch a few months ago, my friends told me to buy Super Mario Odyssey, The Legend of Zelda: Breath of the Wild and Mario Kart 8 Deluxe. That’s precisely what I did, but none of those games were enough to get me hooked, which is probably for the best.

But then came Super Mario Party, which Nintendo released earlier this month for the Switch. I grew up gaming, but somehow never played Super Mario Party. Well, it seems as if I’ve been missing out my whole life.

Super Mario Party for Nintendo Switch is a quick, pick-up-and-play kind of game. You set the difficulty level, tell the game how much you want to party (ten, fifteen or twenty turns) and that’s how long you’ll party. But be careful playing with your friends or significant others — because it’s bound to stir up people’s competitive nature.

For those who are unfamiliar with Super Mario Party, it’s a digital board game. The name of the game (well, not literally) is to collect the most stars.

This is my character, Bowser Jr., collecting a star like a boss

To collect these stars, you roll one of two dice — a standard one or one that’s unique to your character. Some characters have dice that roll up to ten (like Donkey Kong and Bowser), but that also comes with the risk of not moving at all or losing coins, which you need to buy stars.

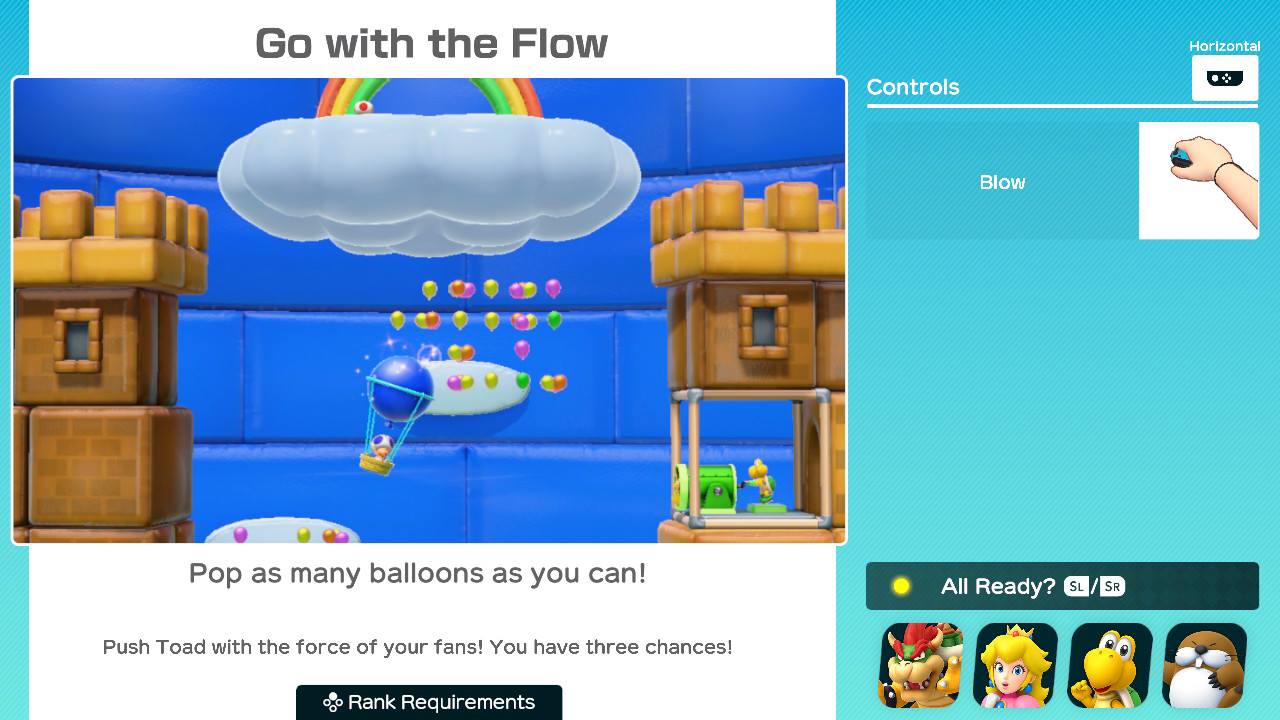

After each round, you play a mini-game, where you’re able to earn some more coins. Depending on the game, you’ll need to put your memory, hand-eye coordination or even sense of touch to work. Thankfully, there’s an opportunity to practice before each mini-game.

Throughout the game, there are opportunities to steal coins and stars from people. During my last party, Luigi stole a star from Yoshi (played by my girlfriend) and it wasn’t pretty. Let’s just say profanities were exclaimed.

There are more than 80 minigames available to play — some of which make great use of the Joy Con, the name for the Switch’s detachable controllers.

The party mode has four game boards. My favorite board (that is, the board on which I tend to perform the best, is Megafruit Paradise. Down the road, maybe through a software update of sorts, it’d be great to have more boards to choose from.

Super Mario Party also features a couple of other modes — river survival, where you control a boat with the Joy-Con paddles, a Sound Stage that reminds me of Dance Dance Revolution and mini-game mode, where you just play mini-games.

But in my experience, its the most fun to play the standard party mode. I’ve heard the best way to play the game is with four humans, but I’ve only ever played it with my girlfriend. We’re already both pretty intense about it so I could only imagine what it’d be like to play with two other people. Consider this my open invitation to holler at me to get a party started.

But in my experience, its the most fun to play the standard party mode. I’ve heard the best way to play the game is with four humans, but I’ve only ever played it with my girlfriend. We’re already both pretty intense about it so I could only imagine what it’d be like to play with two other people. Consider this my open invitation to holler at me to get a party started.

Powered by WPeMatico

Silicon Valley is in the midst of a health craze, and it is being driven by “Eastern” medicine.

It’s been a record year for US medical investing, but investors in Beijing and Shanghai are now increasingly leading the largest deals for US life science and biotech companies. In fact, Chinese venture firms have invested more this year into life science and biotech in the US than they have back home, providing financing for over 300 US-based companies, per Pitchbook. That’s the story at Viela Bio, a Maryland-based company exploring treatments for inflammation and autoimmune diseases, which raised a $250 million Series A led by three Chinese firms.

Chinese capital’s newfound appetite also flows into the mainland. Business is booming for Chinese medical startups, who are also seeing the strongest year of venture investment ever, with over one hundred companies receiving $4 billion in investment.

As Chinese investors continue to shift their strategies towards life science and biotech, China is emphatically positioning itself to be a leader in medical investing with a growing influence on the world’s future major health institutions.

We like to talk about things we can interact with or be entertained by. And so as nine-figure checks flow in and out of China with stunning regularity, we fixate on the internet giants, the gaming leaders or the latest media platform backed by Tencent or Alibaba.

However, if we follow the money, it’s clear that the top venture firms in China have actually been turning their focus towards the country’s deficient health system.

A clear leader in China’s strategy shift has been Sequoia Capital China, one of the country’s most heralded venture firms tied to multiple billion-dollar IPOs just this year.

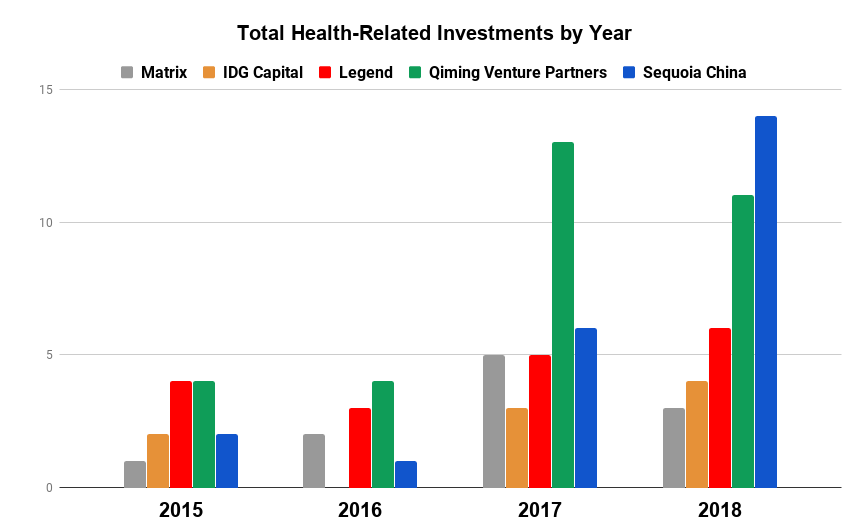

Historically, Sequoia didn’t have much interest in the medical sector. Health was one of the firm’s smallest investment categories, and it participated in only three health-related deals from 2015-16, making up just 4% of its total investing activity.

Recently, however, life sciences have piqued Sequoia’s fascination, confirms a spokesperson with the firm. Sequoia dove into six health-related deals in 2017 and has already participated in 14 in 2018 so far. The firm now sits among the most active health investors in China and the medical sector has become its second biggest investment area, with life science and biotech companies accounting for nearly 30% of its investing activity in recent years.

Health-related investment data for 2015-18 compiled from Pitchbook, Crunchbase, and SEC Edgar

There’s no shortage of areas in need of transformation within Chinese medical care, and a wide range of strategies are being employed by China’s VCs. While some investors hope to address influenza, others are focused on innovative treatments for hypertension, diabetes and other chronic diseases.

For instance, according to the Chinese Journal of Cancer, in 2015, 36% of world’s lung cancer diagnoses came from China, yet the country’s cancer survival rate was 17% below the global average. Sequoia has set its sights on tackling China’s high rate of cancer and its low survival rate, with roughly 70% of its deals in the past two years focusing on cancer detection and treatment.

That is driven in part by investments like the firm’s $90 million Series A investment into Shanghai-based JW Therapeutics, a company developing innovative immunotherapy cancer treatments. The company is a quintessential example of how Chinese VCs are building the country’s next set of health startups using their international footprints and learnings from across the globe.

Founded as a joint-venture offshoot between US-based Juno Therapeutics and China’s WuXi AppTec, JW benefits from Juno’s experience as a top developer of cancer immunotherapy drugs, as well as WuXi’s expertise as one of the world’s leading contract research organizations, focusing on all aspects of the drug R&D and development cycle.

Specifically, JW is focused on the next-generation of cell-based immunotherapy cancer treatments using chimeric antigen receptor T-cell (CAR-T) technologies. (Yeah…I know…) For the WebMD warriors and the rest of us with a medical background that stopped at tenth-grade chemistry, CAR-T essentially looks to attack cancer cells by utilizing the body’s own immune system.

Past waves of biotech startups often focused on other immunologic treatments that used genetically-modified antibodies created in animals. The antibodies would effectively act as “police,” identifying and attaching to “bad guy” targets in order to turn off or quiet down malignant cells. CAR-T looks instead to modify the body’s native immune cells to attack and kill the bad guys directly.

Chinese VCs are investing in a wide range of innovative life science and biotech startups. (Photo by Eugeneonline via Getty Images)

The international and interdisciplinary pedigree of China’s new medical leaders not only applies to the organizations themselves but also to those running the show.

At the helm of JW sits James Li. In a past life, the co-founder and CEO held stints as an executive heading up operations in China for the world’s biggest biopharmaceutical companies including Amgen and Merck. Li was also once a partner at the Silicon Valley brand-name investor, Kleiner Perkins.

JW embodies the benefits that can come from importing insights and expertise, a practice that will come to define the companies leading the medical future as the country’s smartest capital increasingly finds its way overseas.

Despite heavy investment by China’s leading VCs, Silicon Valley is doubling down in the US health sector. (AFP PHOTO / POOL / JASON LEE)

Innovation in medicine transcends borders. Sickness and death are unfortunately universal, and groundbreaking discoveries in one country can save lives in the rest.

The boom in China’s life science industry has left valuations lofty and cross-border investment and import regulations in China have improved.

As such, Chinese venture firms are now increasingly searching for innovation abroad, looking to capitalize on expanding opportunities in the more mature US medical industry that can offer innovative technologies and advanced processes that can be brought back to the East.

In April, Qiming Venture Partners, another Chinese venture titan, closed a $120 million fund focused on early-stage US healthcare. Qiming has been ramping up its participation in the medical space, investing in 24 companies over the 2017-18 period.

New firms diving into the space hasn’t frightened the Bay Area’s notable investors, who have doubled down in the US medical space alongside their Chinese counterparts.

Partner directories for America’s most influential firms are increasingly populated with former doctors and medically-versed VCs who can find the best medical startups and have a growing influence on the flow of venture dollars in the US.

At the top of the list is Krishna Yeshwant, the GV (formerly Google Ventures) general partner leading the firm’s aggressive push into the medical industry.

Krishna Yeshwant (GV) at TechCrunch Disrupt NY 2017

A doctor by trade, Yeshwant’s interest runs the gamut of the medical spectrum, leading investments focusing on anything from real-time patient care insights to antibody and therapeutic technologies for cancer and neurodegenerative disorders.

Per data from Pitchbook and Crunchbase, Krishna has been GV’s most active partner over the past two years, participating in deals that total over a billion dollars in aggregate funding.

Backed by the efforts of Yeshwant and select others, the medical industry has become one of the most prominent investment areas for Google’s venture capital arm, driving roughly 30% of its investments in 2017 compared to just under 15% in 2015.

GV’s affinity for medical-investing has found renewed life, but life science is also part of the firm’s DNA. Like many brand-name Valley investors, GV founder Bill Maris has long held a passion for the health startups. After leaving GV in 2016, Maris launched his own fund, Section 32, focused specifically on biotech, healthcare and life sciences.

In the same vein, life science and health investing has been part of the lifeblood for some major US funds including Founders Fund, which has consistently dedicated over 25% of its deployed capital to the space since at least 2015.

The tides may be changing, however, as the recent expansion of oversight for the Committee on Foreign Investment in the United States (CFIUS) may severely impact the flow of Chinese capital into areas of the US health sector.

Under its extended purview, CFIUS will review – and possibly block – any investment or transaction involving a foreign entity related to the production, design or testing of technology that falls under a list of 27 critical industries, including biotech research and development.

The true implications of the expanded rules will depend on how aggressively and how often CFIUS exercises its power. But a lengthy review process and the threat of regulatory blocks may significantly increase the burden on Chinese investors, effectively shutting off the Chinese money spigot.

Regardless of CFIUS, while China’s active presence in the US health markets hasn’t deterred Valley mainstays, with a severely broken health system and an improved investment environment backed by government support, China’s commitment to medical innovation is only getting stronger.

Deficiencies in China’s health sector has historically led to troublesome outcomes. Now the government is jump-starting investment through supportive policy. (Photo by Alexander Tessmer / EyeEm via Getty Images)

They say successful startups identify real problems that need solving. Marred with inefficiencies, poor results, and compounding consumer frustration, China’s health industry has many.

Outside of a wealthy few, citizens are forced to make often lengthy treks to overcrowded and understaffed hospitals in urban centers. Reception areas exist only in concept, as any open space is quickly filled by hordes of the concerned, sick, and fearful settling in for wait times that can last multiple days.

If and when patients are finally seen, they are frequently met by overworked or inexperienced medical staff, rushing to get people in and out in hopes of servicing the endless line behind them.

Historically, when patients were diagnosed, treatment options were limited and ineffective, as import laws and affordability issues made many globally approved drugs unavailable.

As one would assume, poor detection and treatment have led to problematic outcomes. Heart disease, stroke, diabetes and chronic lung disease accounts for 80% of deaths in China, according to a recent report from the World Bank.

Recurring issues of misconduct, deception and dishonesty have amplified the population’s mounting frustration.

After past cases of widespread sickness caused by improperly handled vaccinations, China’s vaccine crisis reached a breaking point earlier this year. It was revealed that 250,000 children had been given defective and fallacious rabies vaccinations, a fact that inspectors had discovered months prior and swept under the rug.

Fracturing public trust around medical treatment has serious, potentially destabilizing effects. And with deficiencies permeating nearly all aspects of China’s health and medical infrastructure, there is a gaping set of opportunities for disruptive change.

In response to these issues, China’s government placed more emphasis on the search for medical innovation by rolling out policies that improve the chances of success for health startups, while reducing costs and risk for investors.

Billions of public investment flooded into the life science sector, and easier approval processes for patents, research grants, and generic drugs, suddenly made the prospect of building a life science or biotech company in China less daunting.

For Chinese venture capitalists, on top of financial incentives and a higher-growth local medical sector, loosening of drug import laws opened up opportunities to improve China’s medical system through innovation abroad.

Liquidity has also improved due to swelling global interest in healthcare. Plus, the Hong Kong Stock Exchange recently announced changes to allow the listing of pre-revenue biotech companies.

The changes implemented across China’s major institutions have effectively provided Chinese health investors with a much broader opportunity set, faster growth companies, faster liquidity, and increased certainty, all at lower cost.

However, while the structural and regulatory changes in China’s healthcare system has led to more medical startups with more growth, it hasn’t necessarily driven quality.

US and Western investors haven’t taken the same cross-border approach as their peers in Beijing. From talking with those in the industry, the laxity of the Chinese system, and others, have made many US investors weary of investing in life science companies overseas.

And with the Valley similarly stepping up its focus on startups that sprout from the strong American university system, bubbling valuations have started to raise concern.

But with China dedicating more and more billions across the globe, the country is determined to patch the massive holes in its medical system and establish itself as the next leader in international health innovation.

Powered by WPeMatico

Hotels can be pricey, and travelers are often forced to leave their rooms for basic things, like food that doesn’t come from the minibar. Yet Airbnb accommodations, which have become the go-to alternative for travelers, can be highly inconsistent.

Domio, a two-year-old, New York-based outfit, thinks there’s a third way: apartment hotels, or “apart hotels,” as the company is calling them.

The idea is to build a brand that travelers recognize as upscale yet affordable, more tech friendly than boutique hotels and features plenty of square footage, which it expects will appeal to both families as well as companies that send teams of employees to cities and want to do it more economically.

Domio has a host of competitors, if you’ll forgive the pun. Marriott International earlier this year introduced a branded home-sharing business called Tribute Portfolio Homes wherein it says it vets, outfits and maintains to hotel standards homes of its choosing. And Marriott is among a growing number of hotels to recognize that customers who stay in a hotel for a business trip or a family vacation might prefer a multi-bedroom apartment with hotel-like amenities.

Property management companies have been raising funding left and right for the same reason. Among them: Sonder, a four-year-old, San Francisco-based startup offering “spaces built for travel and life” that, according to Crunchbase, has raised $135 million from investors, much of it this year; TurnKey, a six-year-old, Austin, Tex.-based home rental management company that has raised $72 million from investors, including via a Series D round that closed back in March; and Vacasa, a nine-year-old, Portland, Ore.-based vacation rental management company that manages more than 10,000 properties and which just this week closed on $64 million in fresh financing that brings its total funding to $207.5 million.

That’s saying nothing of Airbnb itself, which has begun opening hotel-like branded apartment complexes that lease units to both long-term renters and short-term visitors in partnership with development partner Niido.

Whether Domio can stand out from competitors remains to be seen, but investors are happy to provide it the financing to try. The company is today announcing it has raised $12 million in Series A equity funding led by Tribeca Venture Partners, with participation from SoftBank Capital NY and Loric Ventures. The round comes on the heels of Domio announcing a $50 million joint venture last month with the private equity firm Upper 90 to exclusively fund the leasing and operations of as many as 25 apartment-style hotels for group travelers.

Indeed, Domio thinks one advantage it may have over other home-share companies is that rather than manage the far-flung properties of different owners, it can shave costs and improve the quality of its offerings by entering five- to 10-year leases with developers and then branding, furnishing and operating entire “apart hotel” properties. (It even has partners in China making its furniture.)

As CEO and former real estate banker Jay Roberts told us earlier this week, the plan is to open 25 of these buildings across the U.S. over the next couple of years. The units will average 1,500 square feet and feature two to three bedrooms, and, if all goes as planned, they’ll cost 10 to 25 percent below hotel prices, too.

And if the go-go property management market turns? Roberts insists that Domio can “slow down growth if necessary.” He also notes that “Airbnb was founded out of the recession, supported by people who were interested in saving money. We’re starting to see companies that want to be more cost-effective, too.”

Domio had earlier raised $5 million in equity and convertible debt from angel investors in the real estate industry; altogether it has now amassed funding of $67 million.

Powered by WPeMatico

In another example of VR bleeding into real life, Cornell University food scientists found that cheese eaten in pleasant VR surroundings tasted better than the same cheese eaten in a drab sensory booth.

About 50 panelists who used virtual reality headsets as they ate were given three identical samples of blue cheese. The study participants were virtually placed in a standard sensory booth, a pleasant park bench and the Cornell cow barn to see custom-recorded 360-degree videos.

The panelists were unaware that the cheese samples were identical, and rated the pungency of the blue cheese significantly higher in the cow barn setting than in the sensory booth or the virtual park bench.

That’s right: cheese tastes better on a virtual farm versus inside a blank, empty cyberia.

“When we eat, we perceive not only just the taste and aroma of foods, we get sensory input from our surroundings – our eyes, ears, even our memories about surroundings,” said researcher Robin Dando.

To be clear, this research wasn’t designed to confirm whether VR could make food taste better but whether or not VR could be used as a sort of taste testbed, allowing manufacturers to let people try foods in different places without, say, putting them on an airplane or inside a real cow barn. Because food tastes differently in different surroundings, the ability to simulate those surroundings in VR is very useful.

“This research validates that virtual reality can be used, as it provides an immersive environment for testing,” said Dando. “Visually, virtual reality imparts qualities of the environment itself to the food being consumed – making this kind of testing cost-efficient.”

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

This week we had the Three Excellent Friends (Connie Loizos, Danny Chrichton, and Alex Wilhelm) on hand to kick things about with Scale Venture Partner’s own Rory O’Driscoll.

As I’ve written the last few weeks, what a pile of news we’ve had recently. And like the last few episodes, we had to pick and choose what to drill into. This week: Twilio-Sendgrid, Palantir, Uber, Lyft, and Tencent Music IPOs, Instacart, and Saudi Arabia.

In order, I think? First, we tackled the week’s biggest venture-themed M&A: Twilio buying SendGrid. Keep in mind that they are both recent IPOs; Twilio went out in 2016, and SendGrid in 2017.

The $2 billion-ish all-stock transaction is effectively Twilio using its rich market cap (rich in terms of its revenue and profit multiples) to snag an obvious (though intelligent) extension of API-powered communications toolset.

Next up we dug into the chance that Palantir is worth $41 billion. Spoiler: It isn’t. Then we chatted the two other recently-floated IPO valuations for Uber ($120 billion) and Lyft ($15 billion). They probably make more sense, depending a little on how you add and then divide.

All that and we also touched on the recent delay in the Tencent Music IPO, a profitable company.

Then we riffed through the Instacart round ($600 million more at a $7.6 billion valuation; wow), and re-touched on Silicon Valley’s currently least popular dinner party topic: how much Saudi money has recently gone to work powering tech startups.

A big thanks to you for not only sticking with Equity for so long, but also for making it quite literally as popular as it has ever been. It’s super fun to have the biggest crew with us every week that we’ve ever had.

You, yes you, are a delight.

Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Pocket Casts, Downcast and all the casts.

Powered by WPeMatico

When TrackR raised $50 million from investors that included Amazon a year ago, the Santa Barbara startup made a big splash in the growing market for small connected dongles that you could attach to “dumb” objects like keys to keep tabs on their location. But times for the company have been challenging since then. It’s weathered layoffs; a succession of natural disasters; and its co-founders stepping away from exec roles as CEO and president. Those events took their toll: we discovered that TrackR quietly closed an additional, small amount of funding earlier this year — but on a valuation of $40 million, a 73 percent drop compared to less than a year before.

Now it looks like the startup is about to enter another new phase. TrackR is launching a new brand, Adero, and sources say it is widening its focus to other uses for its tracking technology, taking TrackR beyond the circular Bluetooth fobs that form the core of its service today.

TechCrunch first learned of the brand change from an anonymous tipster, who said he’d noticed a legal name change for the company on Carta, from TrackR to Adero, “to match their new focus on home solutions.” Another source said that TrackR had been talking to retailers to sell what sounds like a larger connected home solution, although the outcome of those discussions is not clear.

We have also noticed that TrackR has been discounting its existing stock, a sign that it could be trying to clear the decks for whatever is coming next. Contacted for this story, a spokesperson did not comment on whether it would continue to sell products like the TrackR Bravo and Pixel — only that it would continue to support them.

“TrackR will continue to support all products we’ve sold into the market,” he said. “Both the battery replacement program and the Crowd Locate network are both active.”

Christian Smith, who had been the company’s president but quietly left his executive role at the startup at the end of last year, had once described a bigger vision of targeting enterprises in an IoT play, although it’s also not clear if this is part of TrackR’s plan now, or if it ever will be.

Whatever the pivot will entail, it is happening at a critical time. The company quietly raised $10 million in July, at a $40 million valuation according to Pitchbook. It was a clear downround: TrackR was valued at $150 million when it raised $50 million a recently as August 2017. Investors were not disclosed in the most recent funding, but previous backers of the company, in addition to Amazon, include Foundry Group, NTT, and Revolution.

“As our valuation reflects, at the start of this year, we made a conscious decision with the support of our board to build a new future instead of chasing incremental growth,” a spokesperson said of the reduced valuation. “The future we’re building revolves around helping our users proactively manage the chaos of life. We’re excited to reveal the first chapter of our new story in a few weeks.”

TrackR is expected to make an official announcement of its plans towards the end of November, we understand. It declined to comment on the new brand or direction for this article.

But we found a trail of records connecting TrackR to Adero dating from the middle of this year — an indication that the startup has been working on this strategy for at least six months.

Starting in May 2018, Trackr registered three trademarks for Adero. One filed in May of this year describes Adero in fairly generic terms: “Telecommunications services, namely, electronic transmission of data, messages, graphics, images, audio, video and information among users relating to locating, managing, organizing, and tracking assets, devices, and objects.”

Another trademark application details “cloud based software for tracking, organizing, and managing assets, objects, and devices; providing an interactive website featuring non-downloadable software that allows for the tracking, organizing, and managing of assets, objects, and devices; providing temporary use of non-downloadable cloud-based software for sharing information about, organizing, and managing networked wireless devices; providing temporary use of online non-downloadable software that shares information and data between electronic devices within a community of users; providing an on-line network environment that features technology for sharing, organizing, and managing data between wireless devices.”

A third describes hardware to manage such a service.

Trackr also registered separate trademarks around the same time is for a brand called “Activefield,” which might be one of the components of the Adero solution. (Its descriptions match those of the Adero trademarks.)

In addition to that, a Twitter profile for Adero features a picture of Santa Barbara — the homebase of Trackr. And ownership of the Adero.com domain, meanwhile, was transferred in May 2018, although the owner is not listed publicly (not unusual with domain applications). (An older Adero that some might remember was a telecoms company that had raised nearly $97 million in the first dot-com wave but then — like so many other startups of the time — shut down.)

Trackr’s shift speaks to some of the challenges that have hung over the market for IoT when it comes to consumer services.

There is a lot of exciting potential in having all of the physical things in your world able to “speak” and for you to be able to control them by way of data, but there are also hurdles.

To name just two, the market is full of competition, not just between lookalike dongles, but also between a wide range of products that are all getting connectivity built into them, removing the need for the dongle to begin with. This all makes for difficult margins.

Second, although we have seen a flood of products hit the market, it’s still early days when it comes to understanding just how strong demand is for these products, and what it is that consumers ultimately will want to invest in. “Issues around interoperability, security and privacy concerns, and the cost of devices will continue to be leading inhibitors to the market’s growth,” IDC analyst Adam Wright noted in a recent report.

As it happens, both TrackR and its closest competitor Tile have reportedly had disappointing sales in key periods like the holidays, and tellingly Tile has also seen a series of recent changes.

In September, the company appointed a new CEO, CJ Prober, as it took on a new strategic investment from Comcast that points to its own efforts to widen its business beyond its square trackers. It also moved into subscription services, with the launch of a new device with a battery that can be replaced by way of a subscription.

Powered by WPeMatico