TC

Auto Added by WPeMatico

Auto Added by WPeMatico

Titan could put an end to stock market FOMO. The app chooses the best 20 stocks by scraping top hedge fund data, adds some shorts based on your personal risk profile and puts your money to work. No worrying about market fluctuations or constantly rebalancing your portfolio. You don’t have to do anything, but can get smarter about stocks thanks to its in-app explanations and research reports. Titan wants to be the easiest way to invest in stocks for a mobile generation that wants an affordable coach to guide them through the market themselves.

“Our goal is to take things that aren’t accessible [in wealth management] and make them accessible, starting with hedge funds,” says Titan co-founder Joe Percoco. That potential to democratize one of the keys to financial mobility has won Titan a $2.5 million seed round from Y Combinator’s co-founder Paul Graham, president Sam Altman and partners including Gmail creator Paul Bucheit. The rest of the capital comes from Maverick Ventures, BoxGroup and Liquid2 Ventures.

“Titan is where investing meets virality,” says Graham. “Those are two very powerful forces.” Since TechCrunch broke the news of Titan’s launch in August, it’s doubled its assets under management to $20 million and hired its first non-founder engineer.

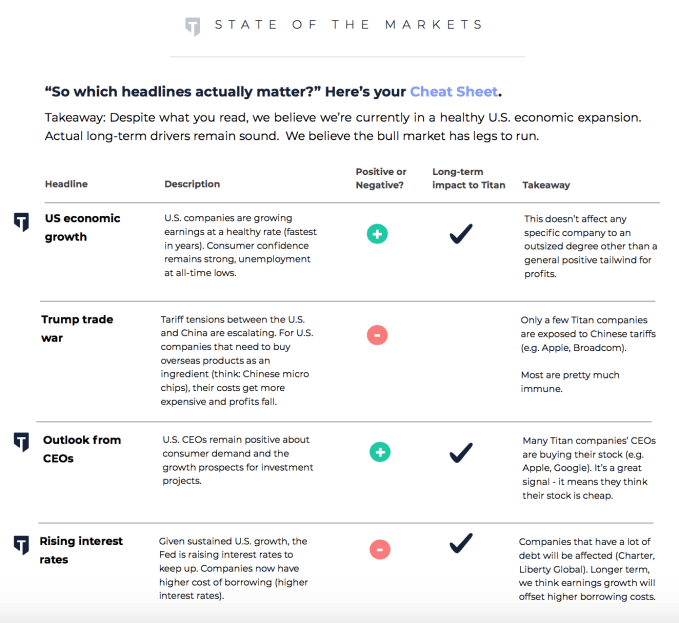

Now it’s launching in-app educational videos so stock market dummies can get up to speed if they want to understand where their money’s going amidst a swirling see of financial news. “There are so many different headlines telling so many different narratives,” Percoco tells me. “Everyone is searching for explanations in a voice they trust. An ‘ETF’ can’t talk back. Sometimes a human face is better than writing. A video can really help people make choices.” Here’s its two-minute video about Facebook’s Q2 earnings a few months ago, explaining why the share price crashed 25 percent:

Percoco and Clayton Gardner met on their first day of Wharton business school, while their third co-founder was earning a hedge fund patent and studying computer science at Stanford. They went on to work at hedge funds and private equity firms like Goldman Sachs, but got fed up just growing the fortunes of the already rich.

So they started Titan to invent a modern, mobile version of BlackRock, the investment giant founded in the 1980s. Titan uses the public disclosures of hedge funds to find consensus around the 20 best performing stocks. With as little as $1,000, users can let Titan robo-manage their investments for a 1 percent fee on assets. Users provide some info on how big they want to gamble, and Titan personalizes their portfolio with more or less conservative shorts to hedge their bets.

Titan’s simplicity combined with the sense of participation could help it grow quickly. It sits between do-it-yourself options like Robinhood or E*Trade, where you’re basically left to fend for yourself, and totally passive options like Wealthfront and Betterment, where you’re so divorced from your portfolio that you’re not learning. Managed hedge funds and fellow active investment vehicles like BlackRock with a human advisor can require a $100,000 minimum investment that’s too steep for millennials.

“Even the best hedge fund in the world is only going to send you a PDF every 90 days,” Percoco explains. But Titan doesn’t want you nervously checking your portfolio non-stop. “Our median user checks the app once per day.” That seems like a healthy balance between awareness and sanity. It thinks its education and informative push notifications make it worth a higher required investment and fees than Wealthfront charges.

“Even the best hedge fund in the world is only going to send you a PDF every 90 days,” Percoco explains. But Titan doesn’t want you nervously checking your portfolio non-stop. “Our median user checks the app once per day.” That seems like a healthy balance between awareness and sanity. It thinks its education and informative push notifications make it worth a higher required investment and fees than Wealthfront charges.

Essentially, Titan is a stock trading auto-pilot merged with a flight simulator so you improve your finance skills without having to fear a crash. Percoco tells me the sense of accomplishment that engenders is why clients say they’re telling friends about Titan. “When I invest, I look for companies that are growing quickly and making a huge positive impact on the world. Titan is one of those companies,” investor Altman says. “I think they could improve the financial well-being of an entire generation.”

Powered by WPeMatico

Messaging app firm Line has given up majority control of its Line Games business after it raised outside financing to expand its collection of titles and go after global opportunities.

The Line Games business was formed earlier this year when Line merged its existing gaming division from NextFloor, the Korea-based game publisher that it acquired in 2017. Now the business has taken on capital from Anchor Equity Partners, which has provided 125 billion KRW ($110 million) in financing via its Lungo Entertainment entity, according to a disclosure from Line.

A Line spokesperson clarified that the deal will see Anchor acquire 144,743 newly created shares to take a 27.55 percent stake in Line Games. That increase means Line Corp’s own shareholding is diluted from 57.6 percent to a minority 41.73 percent stake.

Korea-based Anchor is best known for a number of deals in its homeland, including investments in e-commerce giant Ticket Monster, Korean chat giant Kakao’s Podotree content business and fashion retail group E-Land.

Line operates its eponymous chat app, which is the most popular messaging platform in Japan, Thailand and Taiwan, and also significantly used in Indonesia, but gaming is a major source of income. This year to date, Line has made 28.5 billion JPY ($250 million) from its content division, which is primarily virtual goods and in-app purchases from its social games. That division accounts for 19 percent of Line’s total revenue, and it is a figure that is only better by its advertising unit, which has grossed 79.3 billion JPY, or $700 million, in 2018 to date.

The games business is currently focused on Japan, Korea, Thailand and Taiwan, but it said that the new capital will go toward finding new IP for future titles and identifying games with global potential. It is also open to more strategic deals to broaden its focus.

While Line has always been big on games, Line Games isn’t just building for its own service. The company said earlier this year that it plans to focus on non-mobile platforms, which will include the Nintendo Switch among others consoles.

That comes from the addition of NextFloor, which is best known for titles like Dragon Flight and Destiny Child. Dragon Flight has racked up 14 million users since its 2012 launch; at its peak it saw $1 million in daily revenue. Destiny Child, a newer release in 2016, topped the charts in Korea and has been popular in Japan, North America and beyond.

Line went public in 2016 via a dual U.S.-Japan IPO that raised more than $1 billion.

Note: The original version of this article was updated to clarify that Lungo Entertainment is buying newly issued shares.

Powered by WPeMatico

Brex, the corporate card built for startups, unveiled its new rewards program today.

The billion-dollar company, which announced its $125 million Series C three weeks ago, has partnered with Amazon Web Services, WeWork, Instacart, Google Ads, SendGrid, Salesforce Essentials, Twilio, Zendesk, Caviar, HubSpot, Orrick, Snap, Clerky and DoorDash to give entrepreneurs the ability to accrue and spend points on services and products they use regularly.

Brex is lead by a pair of 22-year-old serial entrepreneurs who are well aware of the costs associated with building a startup. They’ve been carefully crafting Brex’s list of partners over the last year and say their cardholders will earn roughly 20 percent more rewards on Brex than from any competitor program.

“We didn’t want it to be something that everyone else was doing so we thought, what’s different about startups compared to traditional small businesses?” Brex co-founder and chief executive officer Henrique Dubugras told TechCrunch. “The biggest difference is where they spend money. Most credit card reward systems are designed for personal spend but startups spend a lot more on business.”

Companies that use Brex exclusively will receive 7x points on rideshare, 3x on restaurants, 3x on travel, 2x on recurring software and 1x on all other expenses with no cap on points earned. Brex carriers still using other corporate cards will receive just 1x points on all expenses.

Most corporate cards offer similar benefits for travel and restaurant expenses, but Brex is in a league of its own with the rideshare benefits its offering and especially with the recurring software (SalesForce, HubSpot, etc.) benefits.

San Francisco-based Brex has raised about $200 million to date from investors including Greenoaks Capital, DST Global and IVP. At the time of its fundraise, the company told TechCrunch it planned to use its latest capital infusion to build out its rewards program, hire engineers and figure out how to grow the business’s client base beyond only tech startups.

“This is going to allow us to compete even more with Amex, Chase and the big banks,” Dubugras said.

Powered by WPeMatico

Monzo, the U.K. challenger bank that now boasts more than a million customers, has raised £85 million in Series E funding. The round is led by U.S. venture capital firm General Catalyst, and Accel. Existing backers Passion Capital, Goodwater, Thrive Capital, Orange Digital Ventures, and Stripe also participated.

The latest funding was at a pre-money valuation of £1 billion (~$1.27b), meaning that Monzo is now a bonafide member of the U.K. fintech unicorn club, joining recent entrant Revolut.

Meanwhile, the bank upstart is also planning to launch a large crowdfunding round later this year. Like a lot of other fintechs — and before it was fashionable — Monzo has historically opened up its fundraising to its passionate community and other armchair investors.

In a brief call earlier today with Monzo co-founder and CEO Tom Blomfield, he told me the new funding will be primarily used for increasing headcount to further develop the Monzo product line and to cover other operational costs now that the challenger bank has reached “contribution margin positive”.

In other words, on average each customer is generating more revenue than the cost of servicing their current account, which is undoubtedly evidence of how much progress Monzo has made over the last year. This includes bringing down costs, such as weaning customers off costly debit card “top ups” and imposing a cap on fee-free foreign ATM withdrawals — as well as starting to generate meaningful revenue.

On where that revenue is now coming from, Blomfield cited lending in the form of Monzo’s overdraft product, interest it earns on deposits (currently Monzo doesn’t share that interest with customers, even if it is very small in percentage terms), and interchange fees (the money Monzo makes any time you spend on your Monzo debit card).

Another revenue stream is the nascent Monzo marketplace, which he says will be the next focus going forward now that the Monzo current account, with the omission of savings accounts and cash deposits, is basically “done“.

That’s noteworthy given that Monzo embraced developers extremely early on in its existence, holding four very popular hackathons and conducting a few early partnership pilots, but has since mostly stalled on the roll out of marketplace banking and other partnership integrations, sometimes to the frustration of the wider U.K. fintech ecosystem and developers. The exception being the recent integration with TransferWise for sending money abroad.

Blomfield doesn’t dispute this framing but says it wasn’t that Monzo changed course on offering an open API or working on deeper integrations that will put partner products inside of the Monzo banking app, but that gaining a banking license and building out all of the features of the current account had to be the short-term priority. Now that heavy lifting is complete and armed with new operational capital, it is marketplace game on.

To that end, the Monzo CEO says headcount over the next year could double again, from around 450 now to 900. And in terms of customer growth, extrapolating stats from a recent Nationwide annual report (PDF link), the challenger bank says it now accounts for 15 percent of all new bank accounts opened each month in the U.K. It also says it has 800,000 monthly active users.

Account switching — that is customers ditching their existing bank — still makes up the bulk of customer acquisition, even if Monzo recently began targeting 16-18 year olds who would be opening their first ever bank account. Another key metric: the number of customers who deposit their salary each month with Monzo is now at around 26 percent, although I’m told that this isn’t as important for Monzo as it might be for traditional banks and isn’t the main correlation with engagement or those accessing a Monzo overdraft.

Asked what Monzo’s biggest challenge will be over the next year, its CEO doesn’t mince his words: “Increasing revenue,” he says. This means ensuring that its lending models are correct (ie avoiding too many defaults as it scales) and steadfastly growing the marketplace and third-party product partnerships that will bring in additional revenue.

I was also intrigued to see a U.S. venture capital firm once again back the U.K. challenger bank — many of its existing backers have a U.S. bent and Blomfield has made no secret of his ambitions to expand across the pond at some stage. In an email exchange a few hours before publication, General Catalyst’s Adam Valkin (who was previously at Accel in London where he invested in GoCardless, which Blomfield also co-founded), gave me the following statement:

We’re investing in Tom and his team because they are delivering a high-quality banking experience for consumers at scale that is sorely missing from the market. Today’s incumbent UK banks represent billions of market cap but suffer from low NPS scores, reflecting their inability to meet their customers’ needs. Monzo, in contrast, explicitly builds product and banking features in a community-driven approach based on customers’ feedback and requests. This has driven very high organic growth, strong retention and engagement, and unprecedented customer love for and trust in Monzo. Beyond this, Tom and the Monzo team have improved upon the traditional business model of banking, removing the traditional offline retail-based banking model in favor of a highly scalable and lower cost mobile-only experience. All of this creates the potential for Monzo to become a leading U.K. bank, launch a successful financial marketplace, and eventually expand internationally.

Powered by WPeMatico

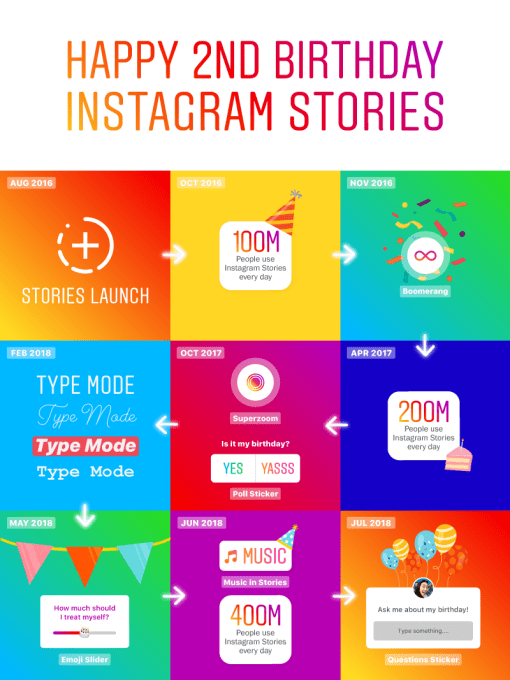

The News Feed won’t sustain Facebook forever, and that’s scaring investors. Today on Facebook’s earnings call, Mark Zuckerberg stressed that sharing is shifting to private chat, where people send 100 billion messages per day on Facebook’s family of apps, and Stories, where he says people share 1 billion of these slideshows per day (though it’s unclear if that includes third-party apps like Snapchat).

But that means Facebook will have to realign its business towards these mediums where monetization is more complex and it has less experience. The result of Zuckerberg’s comments was a reversal of Facebook’s initial 2 percent share price gain after earnings were announced that dragged it down to a 3.5 percent loss. That was only reversed when Zuckerberg said Facebook would reduce limits on video advertising, pushing shares up 3 percent in after-hours trading.

Facebook’s year-over-year revenue growth has already slowed from 59 percent in Q3 2016, to 49 percent a year ago, to 33 percent now as Zuckerberg admits it’s hitting saturation in developed markets, plus it’s running out of News Feed space. Now it will both have to deal with the sharing medium shift, and that the new users it’s adding in the Asia-Pacific and Rest Of World regions earn it 10X less than users in North America.

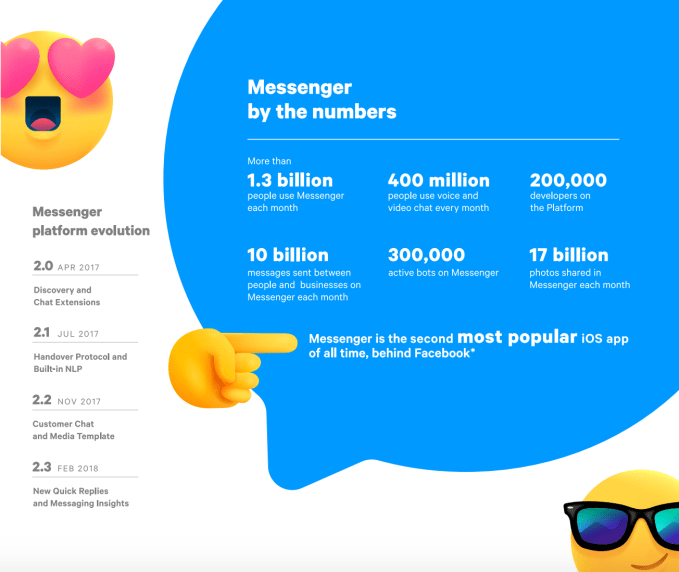

In messaging, Zuckerberg says “People share more photos, videos, and links on WhatsApp and Messenger than they do on social networks.” He sees Facebook’s position as strong, saying “We’re leading in most countries”, though that’s mostly in the developing world Android market where people choose their own default messaging app. “Our biggest competitor by far is iMessage. In important countries like the US where the iPhone is strong, Apple bundles iMesssage as the default texting app, and it’s still ahead” Zuckerberg notes.

The “bundled” language harkens back to to antitrust lawsuits against Microsoft for bundling computers with Internet Explorer. With Apple CEO Tim Cook constantly harping on the poor privacy practices of ad-supported companies like Facebook, Zuckerberg might be gunning to draw regulator attention to iMessage.

Facebook is starting to more aggressively monetize Messenger through inbox ads, and its now selling enterprise tools to brands on both Facebook and WhatsApp that let them pay to ping users. But Facebook risks its chat apps seeming annoying or intrusive if it packs in too many ads or allows too much Message spam. Users could stray to status quos like iMessage and Android Messages if it puts monetization above the user experience.

On Stories, Zuckerberg says Facebook is doing even better. Over 1 billion people use its Stories features across Facebook, Messenger, Instagram, and WhatsApp each day, compared to 186 million daily users on Stories inventor Snapchat as a whole. Stories are where the majority of Facebook sharing growth is happening, and Facebook Stories are gaining momentum after a slow and buggy start. That’s why Zuckerberg never mentioned Snapchat, and instead talk about YouTube as its primary competitor in video.

The problem is that creating attractive video ads, especially vertical full-screen ones for Stories, is beyond the capability of the long-tail on small businesses that have fueled Facebook’s News Feed ad revenue. Users often rapidly skip through Stories ads, and Facebook currently doesn’t offer unskippable ones like Snapchat. Many people don’t think to tap or swipe up to visit a link from a Story, or simply don’t want to lose their place in ways that didn’t happen on desktop or even mobile feed ads.

Beyond Stories, Facebook salvaged its after-hours share price by discussing how it plans to show more video, and therefore more of its lucrative video ads. Back in January, Facebook admitted its Q4 user count had declined and revenue might stumble in part because it had decided to show people fewer viral videos that they watch passively. This came as part of its drive for Time Well Spent. But now, Zuckerberg says that Facebook has cracked the code for how to make passive video consumption a positive experience, so Facebook will lift some limits:

“People really want to watch a lot of video. To a large degree we’ve had to rate limit its growth, and we need to do the things so we can stop limiting it. The things that have caused us to limit it are on the one hand, when we see passive consumption of video displacing social interactions . . . We needed to figure out a way that video can grow but people can also keep on interacting and doing what they tell us that they uniquely want from Facebook. And now I think we’re starting to work through what the formula is going to be so we can take some of those rate limits off and let video grow at the rate that it wants to. I feel that that’s a very exciting opportunity ahead.”

Across Facebook’s other products, Zuckerberg noted that 800 million people now use Marketplace, its Jobs feature have helped people find 1 million jobs, and its birthday fundraisers have raised $300 million alone this year. But it will be teaching advertisers how to effectively create sponsored messages and Stories ads that will define whether Facebook’s revenue keeps growing.

Powered by WPeMatico

Local advertising startup ZypMedia is announcing that it has raised $5.6 million in Series C funding.

That’s a relatively small amount of money for a Series C (the company had previously raised $6.9 million total, according to Crunchbase), but co-founder Aman Sareen said, “We had the opportunity to raise a lot more, but we chose not to.” In fact, Sareen said ZypMedia became profitable last year.

So the new funding round should allow the company to continue expanding its product lineup and its team — it has plans to double its headcount in the United States and India over the next year — while still leaving room for organic growth.

“We didn’t want to be a cautionary tale [like] other previous adtech companies,” Sareen said. “We are buckling down for the long haul … We didn’t want to necessarily raise money just for the sake of it.”

Sareen founded ZypMedia with his former college roommate Ramandeep Ahuja, as well as former Current TV executive Mark Goldman, with the aim of helping local broadcasters move into programmatic advertising.

The idea is to help those media companies offer campaigns that can reach advertisers’ desired audiences across traditional and digital channels, such as display, video (including over-the-top), social media and native advertising.

“Local digital advertising has been very neglected,” Sareen said. “It’s a huge market, and our goal was to be one of the leaders. I’ll be honest, it wasn’t an easy to task, but we have been decently successful in our mission.”

“Decently successful” means signing up partners like Sinclair Broadcast Group and Univision. It also means enlisting Archer Venture Capital as the lead investor in the new round. (Existing investors US Venture Partners and Sinclair also participated.)

“Not only have Aman and Ramandeep created a superior tech stack for delivering local advertising, they’ve also developed a really smart and defensible business model, partnering with local media companies to act as their direct sales force,” said Archer Managing Director John Hadl in the funding announcement.

And ultimately, the vision goes beyond bringing incremental revenue to traditional media companies. Sareen argued that ZypMedia’s model positions it right at the intersection of traditional and digital advertising.

“Within the next two-to-five years, digital or linear, over-the-top or over-the-air, it will jump through one platform,” he said. “Everything will use the same technology and currency.”

Powered by WPeMatico

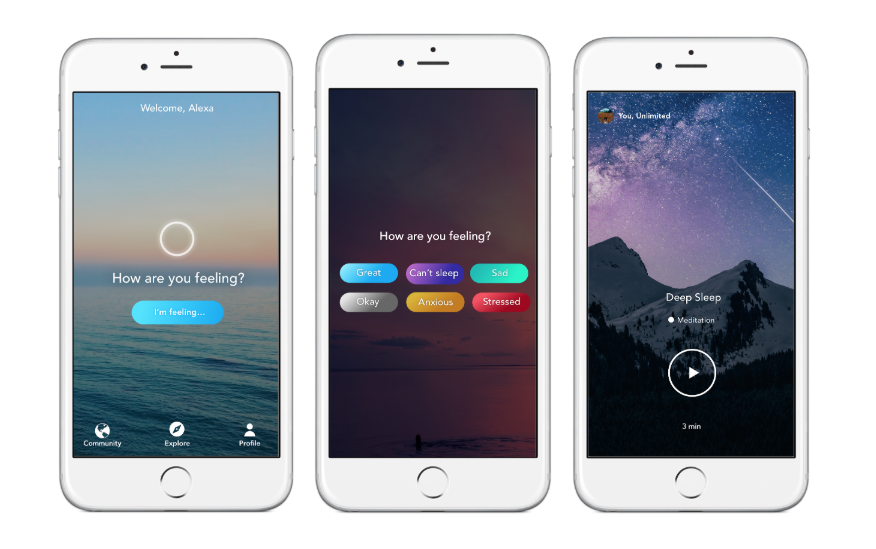

Aura, an app for emotional well-being, has raised a $2.7 million seed round co-led by Cowboy Ventures and Reach Capital, with participation from others.

When Aura first launched a couple of years ago, its bread and butter was short, three-to-seven-minute meditations based on your current mood — be that stressed, anxious, happy or sad. Since then, co-founders Steve and Daniel Lee say the company has grown to a few million users.

“We’ve since grown to become everyone’s emotional wellness assistant,” Steve told me. “We ask how people are feeling right now and then offer content to help them feel better.”

Aura works with therapists, coaches and meditation teachers to offer a variety of content to help people get the type of help they’re looking for. In addition to meditation, Aura offers life coaching, music and inspirational stories.

Premium users, who pay $60 per year, have unlimited access to content, while free users are limited to three minutes of wellness content once every two hours. Aura is not currently sharing how many paid customers it has.

“At Reach, we often ask how we can empower people to achieve at their fullest potential,” Reach Capital Partner Wayee Chu said in a statement. “We are thrilled to be supporting two founders who are not only deeply driven by their own personal narrative in living with a family member with a mental illness, but who have committed themselves in building a world-class technology and tool to empower others in building a regular mental health and wellness practice.”

With the funding in tow, Aura has plans to expand its base of content creators and grow its team — which currently consists just of the Lee brothers. Down the road, Aura envisions integrating the app with wearable devices and their respective sensors to detect mood automatically. That way, Aura would be able to serve up what you need before you know you need it. The company also plans to become more than just a content platform by building additional tools on top of the core service.

Powered by WPeMatico

Cockroach Lab’s open source SQL database, CockroachDB, has been making inroads since it launched last year, but as any open source technology matures, in order to move deeper into markets it has to move beyond technical early adopters to a more generalized audience. To help achieve that, the company announced a new CockroachDB managed service today.

The service has been designed to be cloud-agnostic, and for starters it’s going to be available on Amazon Web Services and Google Cloud Platform. Cockroach, which launched in 2015, has always positioned itself as modern cloud alternative to the likes of Oracle or even Amazon’s Aurora database.

As company co-founder and CEO Spencer Kimball told me in an interview in May, those companies involve too much vendor lock-in for his taste. His company launched as open alternative to all of that. “You can migrate a Cockroach cluster from one cloud to another with no down time,” Kimball told TechCrunch in May.

He believes having that kind of flexibility is a huge advantage over what other vendors are offering, and today’s announcement carries that a step further. Instead of doing all the heavy lifting of setting up and managing a database and the related infrastructure, Cockroach is now offering CockroachDB as a service to handle all of that for you.

Kimball certainly recognizes that by offering his company’s product in this format, it will help grow his market. “We’ve been seeing significant migration activity away from Oracle, AWS Aurora, and Cassandra, and we’re now able to get our customers to market faster with Managed CockroachDB,” Kimball said in a statement.

The database itself offers the advantage of being ultra-resilient, meaning it stays up and running under most circumstances and that’s a huge value proposition for any database product. It achieves up time through replication, so if one version of itself goes down, the next can take over.

As an open source tool, it has been making money up until now by offering an enterprise version, which includes backup, support and other premium pieces. With today’s announcement, the company can get a more direct revenue stream from customers subscribing to the database service.

A year ago, the company announced version 1.0 of CockroachDB and $27 million in Series B financing, which was led by Redpoint with participation from Benchmark, GV, Index Ventures and FirstMark. They’ve obviously been putting that money to good use developing this new managed service.

Powered by WPeMatico

There are few things more irritating than a canceled flight, whether it’s on your way to a friend’s wedding, a conference or to celebrate a holiday back home. Wouldn’t it be nifty if technology could put an end to our travel woes? Freebird, a travel rebooking service, has raised an $8 million Series A to do just that.

The startup charges a minimum of $19 per flight — more depending on distance, time of year, location and more — to independent travelers and companies that partner with the service to help travelers rebook flights after cancellations or other “disruption events.” Most of the time, flights are on-time and without issue, which means that most of the time, Freebird pockets all of its customer’s cash. But if there is a disruption event, Freebird guarantees it will rebook you with just three taps of your phone and without any additional charge.

American Express Ventures has led the round, with support from Citi Ventures, PAR Capital Ventures, General Catalyst and Accomplice. Freebird is currently in discussions with Amex and Citi, as well as other banks, to roll its travel benefits into their corporate card services. To date, the startup works with 100 corporate clients and 10 corporate travel agency partners, including BCD Travel. Freebird says it expects to support 250,000 travelers this year.

Founded in 2015 by Ethan Bernstein, Cambridge, Mass.-based Freebird aggregates data on flight patterns to predict the probability of a flight disruption. If the probability is high, Freebird charges more for access to its mobile rebooking tool.

“If you’re flying out of Buffalo in the winter, it’s going to be a higher-risk flight,” Freebird chief executive officer Bernstein told TechCrunch. “If you’re flying out of Phoenix in the summer, you’re at a very low risk of being disrupted. We understand those risks and we are able to price our product differently based on those factors.”

Freebird has raised a total of $16.5 million in funding to date. It’s one of many travel technology startups to bring in venture capital this year. IfOnly, a marketplace for experiences, secured $20 million in April; luggage startup Away brought in a $50 million in June; and travel activities platform Klook raised $200 million in August, to name a few.

Freebird, though focused specifically on flights, says its experiences are at the forefront of its business model.

“There are a million different products that will help you automate your life but one of the things we are focused on is transforming personal experiences,” Bernstein said. “Do they go through these disruption events tearing their hair out or do they go through it knowing that they have control, agency, support and information? It’s funny what happens when people deal with uncertainty; uncertainty is the worst. As soon you give people information, human support and technology to help them solve their problems, they experience the event so much differently.”

Powered by WPeMatico

To get an edge on the market, investors must look beyond traditional financial info like revenue and profits. Our every online activity generates data exhaust, like web traffic, Twitter mentions, app downloads and search trends. It’s the ability to overlay the old and new data sets to spot surprising trends that will set the best traders apart. Sentieo wants to be their tool.

Sentieo is an investment research software suite that uses AI to scan financial documents, analyze alternative data sets and create visualizations. The fintech SAAS startup now has 700 customers, including top hedge funds plus mutual funds, Fortune 500s and investment banks that pay around $500 to $1,000 per month per license. That’s a lot cheaper than a $21,000 yearly Bloomberg Terminal subscription. [Correction: Sentieo charges $500 to $1000 per month, not per year.]

Now Sentieo is ready to crank up its name recognition with a sales and marketing blitz fueled by a new $19 million Series A round led by Centana, a $250 million growth equity firm focused on fintech SAAS. Now with $30 million in total funding, the 160-person startup plans to “Educate [traders] that ‘hey, this product is built by people who sat in your seats,’” says CEO Alap Shah.

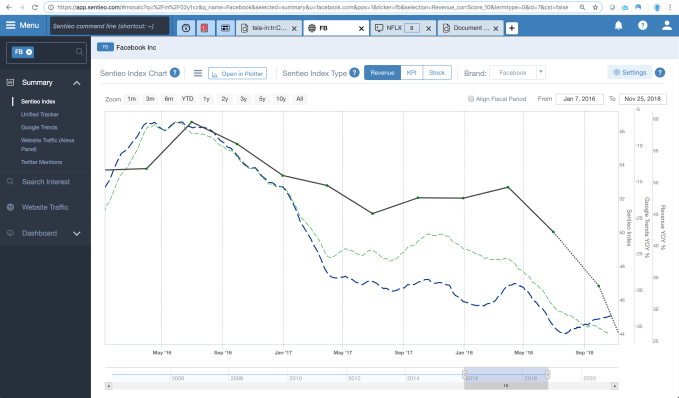

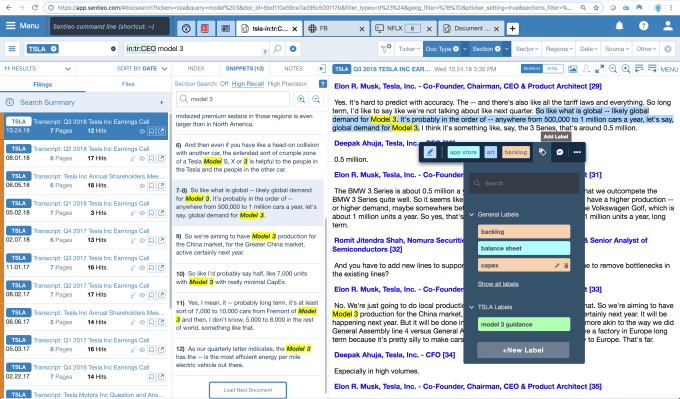

Sentieo charts Search Trends data and Sentieo Index data on Facebook versus the social network’s revenue.

Ten years ago, Shah was making the Wall Street rounds after graduating from Harvard in economics. He was an analyst in consulting at Novantas, private equity at Castanea, and worked for hedge funds Viking Global and Citadel. “It became clear that there were some really big holes in my process where software wasn’t meeting my needs. Importantly, there was a hole around search,” Shah tells me. “We’ve grown accustomed to going to Google. But unfortunately that’s just not the way the old-school financial data programs are structured.”

Sentieo co-founder and CEO Alap Shah

So he built his own. “I used all the financial tools out there: Capital IQ, FactSet, Bloomberg — each had their strengths and weaknesses. But they were all over 20 years old, so they pre-date the cloud, pre-date SAAS, pre-date mobile!” With Sentieo, he wanted to develop a tool that could understand the nuances of business momentum before it showed up in the balance sheets.

Sentieo does have a traditional financial equity data terminal with real-time pricing. But there’s also a machine learning and natural language processing-powered document search tool that can sort through SEC documents, earnings call transcripts, press releases and more. It taps Alexa web traffic data, Apptopia app download rates and Twitter chatter, as well as Thomson Reuters analyst estimates and fundamentals. Customers can annotate files, organize ideas, generate visualizations and share their insights through Sentieo’s Notebook.

For example, Sentieo could look through all of Tesla’s earnings calls and financial documents for mentions of guidance on Model 3 production volume. It could highlight them all, analyze the sentiment of those mentions and chart them against Tesla’s share price. Or you could search for all the companies starting to list President Trump as a risk factor for their business, which would surface how the medical cannabis companies are concerned about Attorney General Jeff Sessions’ stance on legalization.

Sentieo’s synonym library allows it to hunt down different ways of saying the same thing with the goal of not forcing investors — or their dutiful analysts — to read through 100-page 10-Q documents manually. “You can get the same information at 10x the speed with something like Sentieo,” Shah claims. It wants to a be a “research management system,” like a Salesforce CRM for tracking investment ideas.

But Sentieo’s 65-person India-based engineering must keep data from all 50 feeds, 25 million documents and 64,000 equities flowing to keep customers satisfied. There are a ton of moving parts, and Sentieo is competing with much bigger companies. Beyond Bloomberg, there are lots of alternative data providers out there. And Microsoft’s software suite also has plenty of info management tools.

Sentieo’s hope is to emerge as an aggregator of information sources and an annotation tool that benefits from being purposefully designed for what analysts need. If Robinhood is on one side of the spectrum making investing easy for novice traders, Sentieo is on the other end making investing smarter for experts. “It’s really at the bleeding edge of how you get the data today,” Shah concludes. “For every company driven by consumer demand, there are all these little breadcrumbs being left all over the internet.”

[Disclosure: I briefly rented a room in an apartment where Shah lived five years ago and I know him from the San Francisco social scene frequented by many Silicon Valley figures.]

Powered by WPeMatico